Tree Removal Service Invoice Template for Efficient Billing

When running a business that involves outdoor labor, maintaining clear and professional communication with clients is essential. One of the most important aspects of this is the way you handle financial transactions. A well-structured document outlining costs and payment terms not only ensures accuracy but also enhances your credibility in the eyes of customers.

Creating a straightforward and customizable billing document can save you time and help streamline your operations. By having a reliable framework to work with, you can focus on delivering quality work while maintaining transparency with clients. A proper billing statement provides all necessary details regarding the work completed, the cost breakdown, and payment methods.

For businesses engaged in outdoor and landscaping tasks, it’s crucial to have a professional, easy-to-use solution for issuing financial documents. This tool simplifies the invoicing process, reduces errors, and can be adapted to suit different job scopes. Whether you are offering small tasks or large-scale projects, a well-prepared document ensures both you and your clients are on the same page regarding payment expectations.

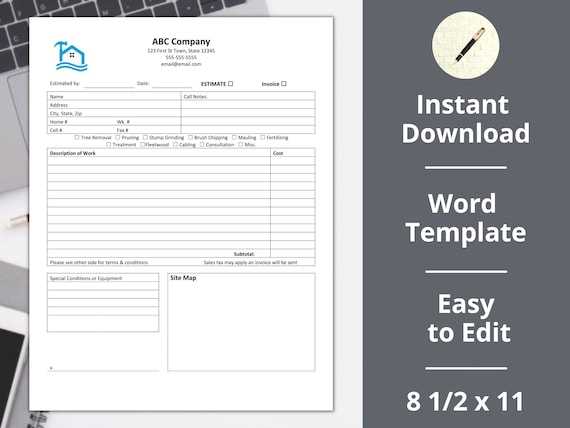

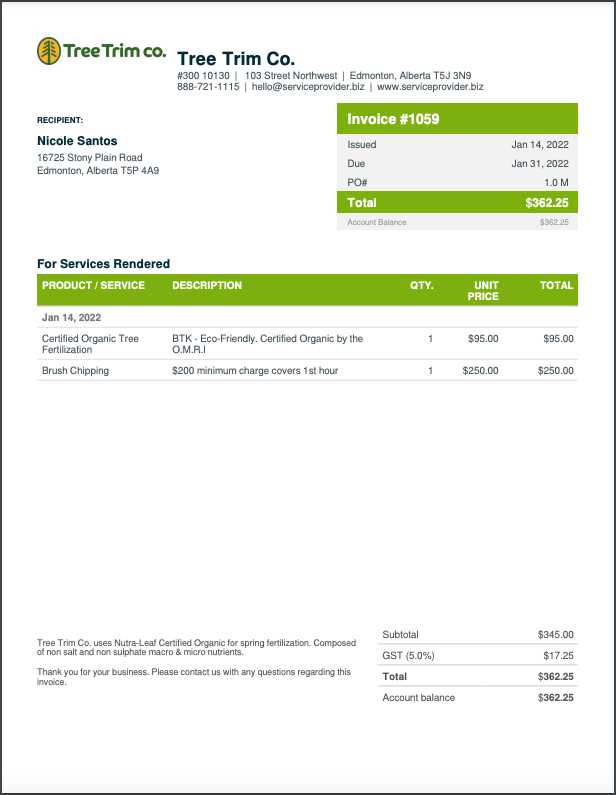

Tree Removal Service Invoice Template

Creating a professional document to outline costs and payment details for outdoor work is essential for maintaining transparency with clients. A customized billing document ensures accuracy and helps prevent misunderstandings. It serves as an official record of the work completed, the materials used, and the overall costs involved. By providing a clear breakdown, businesses can offer clients a comprehensive understanding of their charges.

To create an effective billing document, consider including the following key elements:

- Business Information: Include your company name, address, and contact details.

- Client Information: Ensure the client’s name, address, and contact information are clearly stated.

- Job Description: Provide a brief, detailed description of the work done, including labor, materials, and equipment used.

- Cost Breakdown: List individual charges for each part of the job, such as labor rates and material costs.

- Payment Terms: Outline payment methods, deadlines, and any discounts or late fees that may apply.

- Tax Information: Clearly specify any applicable taxes or fees, depending on local regulations.

By incorporating these components, the document will not only help with accurate billing but also project professionalism and enhance trust with clients. Additionally, a well-organized form can speed up the payment process and reduce potential disputes over charges.

Importance of Professional Invoice Templates

Having a standardized method for documenting the financial aspects of your work is essential for maintaining a professional image and ensuring clarity in transactions. Using a well-structured billing document helps avoid confusion, promotes timely payments, and establishes credibility with clients. A professional layout not only reflects your attention to detail but also fosters trust in your business practices.

When you use a consistent format for your financial records, both you and your clients can easily track and manage payments. This consistency minimizes errors, reduces misunderstandings, and streamlines the billing process. Moreover, an effective document provides a clear record for both parties, which can be invaluable for future reference or in case of disputes.

Key Benefits of Professional Billing Documents

| Benefit | Description |

|---|---|

| Improved Organization | A consistent format helps you stay organized, making it easier to track payments and job details. |

| Increased Credibility | A polished, professional document builds client confidence and showcases your commitment to quality. |

| Faster Payments | Clear and accurate billing documents speed up the payment process, as clients understand the charges upfront. |

| Legal Protection | Having a formal record helps protect both parties in case of any future disputes regarding the work performed. |

Why Consistency Matters

Maintaining a uniform approach to documenting charges provides a clear overview of your business transactions. Consistency is key to building trust and professionalism. When clients receive clear and understandable documents, they are more likely to return for future work and recommend your business to others.

How to Customize Your Invoice

Personalizing your billing document allows you to align it with your business’s specific needs and branding. Customization ensures that all essential details are clearly presented while reflecting the professionalism of your company. By tailoring the layout, you can create a document that is not only functional but also uniquely represents your brand identity.

Customizing a billing document involves adjusting several key elements. Here are some steps you can follow to ensure your document is both effective and professional:

Key Elements to Personalize

- Business Information: Include your company name, logo, address, and contact details to make the document easily recognizable and professional.

- Client Details: Ensure that the client’s name, address, and contact information are correctly entered to avoid any confusion during payment.

- Payment Terms: Clearly state the payment methods, deadlines, and any late fees or discounts. This helps manage client expectations and promotes timely payments.

- Job Descriptions: Customize the description of the work done, ensuring it is clear and matches the nature of the project. Include specifics like labor, materials, and equipment used.

- Tax Information: Add any applicable tax rates to the total charges to ensure compliance with local regulations.

Choosing the Right Layout

Beyond the content, you should also focus on the design and structure of your document. A clean, organized layout helps clients easily navigate the details. Ensure the sections are clearly labeled, and the font is easy to read. A simple yet professional design improves the overall experience for both you and your client.

By customizing your document in these ways, you create a tool that is both practical and aligned with your business goals. Not only does this streamline the billing process, but it also enhances your professional image and builds trust with clients.

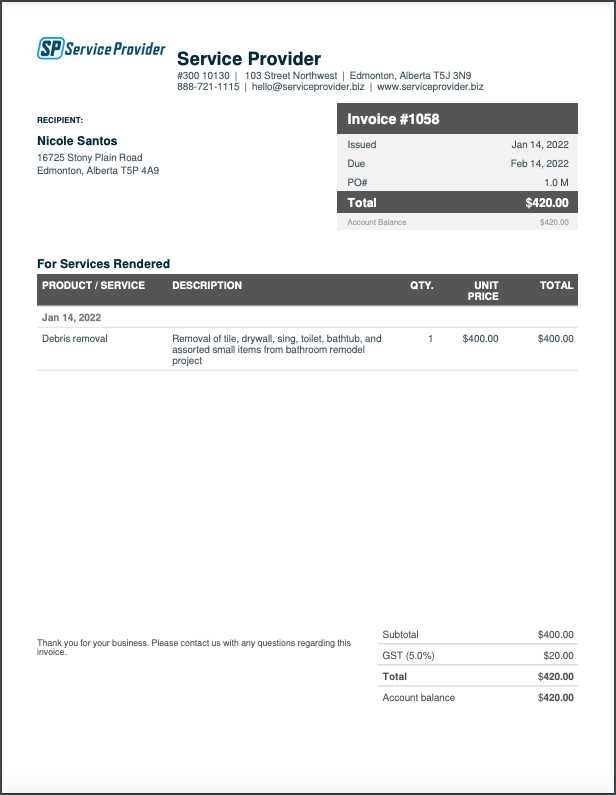

Key Information to Include in Invoices

For any business, a well-structured financial document should contain essential details that ensure clarity and accuracy in transactions. The key information not only helps you get paid on time but also builds trust with clients. Including all relevant elements guarantees that both parties understand the charges, payment terms, and expectations from the outset.

Here are the most important components to incorporate in your billing statement to avoid confusion and ensure professionalism:

Essential Elements to Add

- Business Information: Clearly display your company’s name, address, phone number, and email. Adding a logo is also a good way to reinforce your brand identity.

- Client Information: Include the client’s full name, address, and contact details to ensure the document is tailored to the specific recipient.

- Job Description: Provide a concise description of the work done, materials used, and any other relevant details to give the client a full understanding of the charges.

- Dates: Include the date the work was completed as well as the date the document is issued. This helps in tracking deadlines and payment schedules.

- Cost Breakdown: Clearly list individual charges for each aspect of the job, such as labor, materials, and equipment, to ensure full transparency.

- Payment Terms: Specify the payment method, due date, and any applicable late fees or discounts. Clear terms help manage expectations and ensure timely payments.

- Tax Information: If applicable, list the tax rates or fees associated with the charges to stay compliant with local regulations.

Why Each Detail Matters

Each of these details serves a purpose beyond just listing costs. Providing comprehensive information shows professionalism, prevents disputes, and makes the payment process smoother. Whether you’re dealing with a small job or a large-scale project, the accuracy and completeness of your billing documents play a crucial role in maintaining a positive business relationship with your clients.

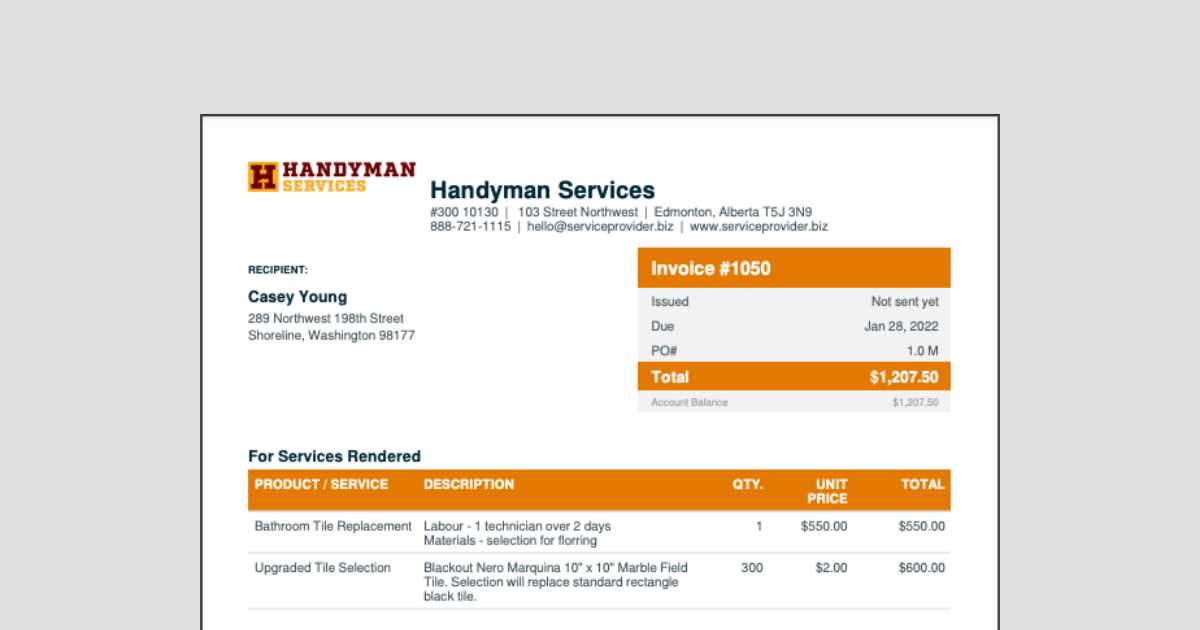

Benefits of Using Invoice Templates

Utilizing a pre-designed format for billing documents offers a range of advantages that can significantly improve the efficiency and professionalism of your business operations. By adopting a structured approach, you streamline the process of creating financial records, ensuring consistency and accuracy with every transaction. This method saves time, reduces errors, and ultimately leads to better business management.

Here are some key benefits of using a standardized format for your financial documentation:

Time-Saving and Efficiency

- Quick Setup: Pre-made formats allow you to fill in details quickly without having to design a new document each time.

- Consistency: A consistent format ensures that every document is uniform, saving time and effort for both you and your clients.

- Customization: Many formats are customizable, enabling you to adjust the design to fit your brand identity and business needs.

Improved Accuracy and Professionalism

- Minimized Errors: Using a structured approach minimizes human error in calculations, preventing costly mistakes.

- Clear Communication: A well-organized document ensures that all charges, payment terms, and work descriptions are easily understood, fostering trust with clients.

- Professional Image: A polished and consistent design reflects a high level of professionalism, helping to establish credibility with clients.

By leveraging a standardized billing format, you ensure that your business remains organized, efficient, and professional. This small investment in organization can lead to faster payments, better client relationships, and smoother business operations overall.

Best Practices for Clear Billing

Maintaining transparency in financial transactions is essential for fostering trust and ensuring smooth interactions with clients. Clear and well-organized billing documents prevent misunderstandings and make the payment process straightforward. By following best practices, businesses can ensure that clients fully understand what they are being charged for and feel confident in their dealings.

To achieve clear billing, consider these best practices:

Key Practices for Transparency

- Provide a Detailed Breakdown: List each charge separately, including labor, materials, and any additional fees. This allows clients to see exactly what they are paying for and prevents confusion.

- Be Clear About Payment Terms: Specify the due date, accepted payment methods, and any late fees or discounts. Clear terms help manage expectations and promote timely payments.

- Include Contact Information: Ensure your contact details are easy to find. This allows clients to reach out quickly in case of any questions or issues regarding the charges.

- Use Simple and Consistent Language: Avoid jargon or overly complex terminology. Use straightforward language to describe the work performed and charges, ensuring it’s easy for any client to understand.

- Include a Unique Reference Number: Assign a unique number to each financial document. This makes it easier for both you and the client to track and refer back to specific records.

Formatting Tips for Easy Navigation

- Use Clear Section Headers: Organize the document into logical sections such as job details, cost breakdown, and payment terms. This makes the information easier to find and understand.

- Highlight Important Information: Use bold or larger fonts for critical details like the total cost, due date, and contact information. This ensures the most important elements are immediately visible.

- Avoid Clutter: Keep the design simple and uncluttered. A clean layout makes it easier for clients to navigate and understand the information presented.

By adopting these best practices, you can ensure that your billing documents are clear, professional, and easy for clients to comprehend. This not only improves client satisfaction but also speeds up the payment process and minimizes potential disputes.

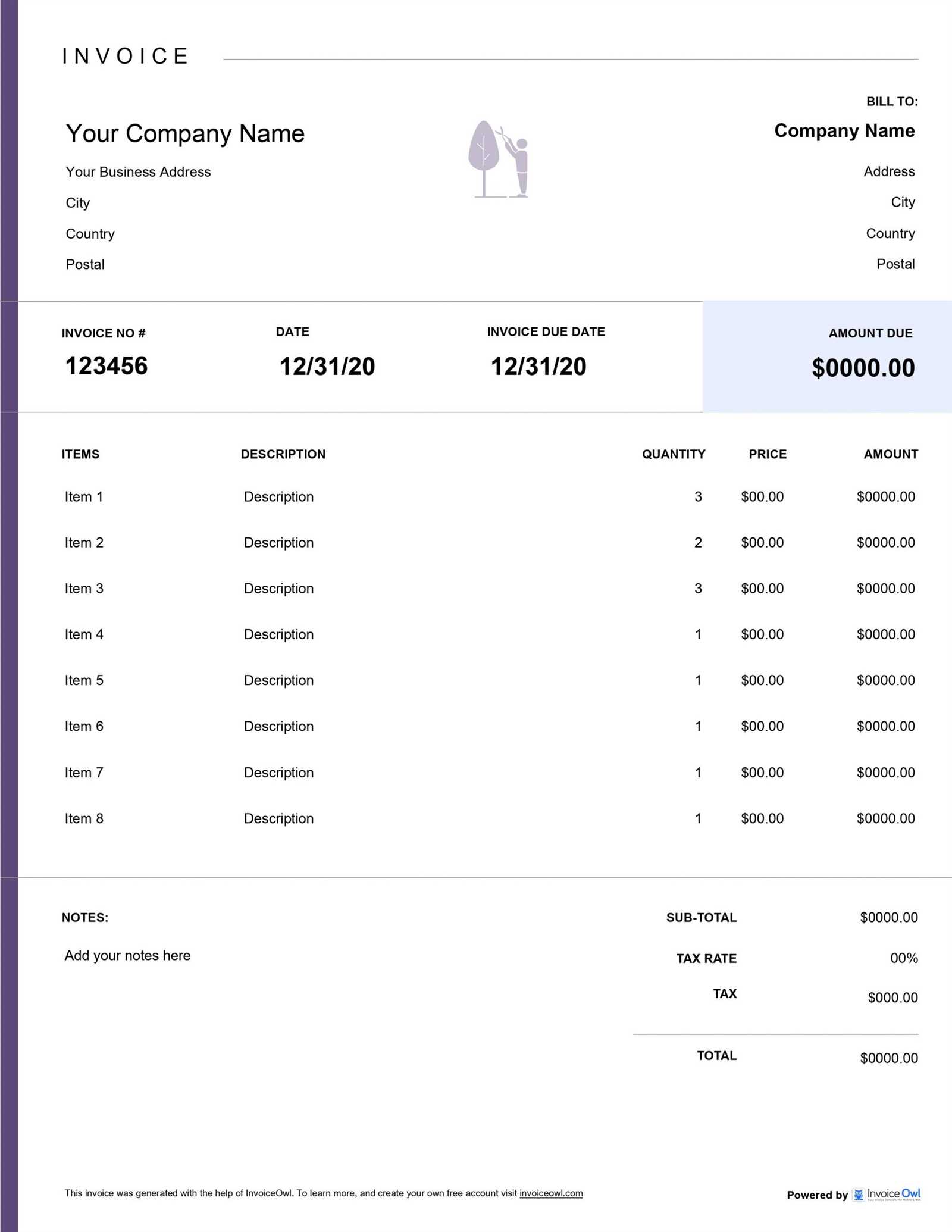

Creating a Simple Invoice Design

When designing a billing document, simplicity is key. A clean and straightforward layout ensures that all necessary details are presented in an organized and easy-to-read manner. The goal is to make it as simple as possible for both you and your client to understand the charges and payment terms, while maintaining a professional appearance. An uncomplicated design can enhance the clarity of your document, reduce confusion, and promote quicker payments.

To create an effective and simple billing document, focus on the following design elements:

Essential Design Elements

- Minimalist Layout: Keep the design free from unnecessary graphics or clutter. Stick to the basics: the company name, client details, job description, cost breakdown, and payment terms.

- Clear Section Headings: Organize the document into distinct sections. For example: “Client Information,” “Work Details,” “Cost Breakdown,” and “Payment Terms.” This structure helps guide the reader through the document.

- Consistent Fonts: Use one or two easy-to-read fonts for the entire document. This ensures the content is legible and professional without distracting the reader.

- Whitespace: Don’t crowd the page with text. Allow for enough space between sections, and keep margins clear. This makes the document feel more open and less overwhelming.

- Highlight Key Information: Bold or use a larger font size for critical details such as the total amount due or the payment due date. This draws attention to the most important aspects of the document.

Formatting Tips for a Professional Look

- Use a Simple Header: Place your business name, logo, and contact information at the top of the document in a simple, neat arrangement. This establishes your brand and makes the document look official.

- Include Clear Totals: Ensure that the total cost is prominently displayed at the bottom of the page. This makes it easy for the client to see what they owe at a glance.

- Align Text Properly: Ensure that all text is aligned in a clean, consistent manner. For example, left-align job des

Common Mistakes in Billing Documents

Creating accurate financial records is essential for maintaining a professional relationship with clients and ensuring timely payments. However, even minor errors in your billing documents can lead to confusion, delays, or disputes. By recognizing common mistakes and avoiding them, you can improve the quality of your documentation and foster better communication with clients.

Below are some of the most common mistakes found in financial documents and how to avoid them:

Mistake Consequence How to Avoid Missing or Incorrect Client Details Delays in payment and confusion about who the bill is for. Double-check client information before issuing a document. Unclear Job Descriptions Clients may question the charges or not understand what they are paying for. Provide a detailed and accurate description of the work done. Inaccurate Cost Breakdown Potential disputes over charges and payment delays. Ensure all costs are listed individually, including labor, materials, and other fees. Failure to Include Payment Terms Confusion about payment deadlines and methods. Clearly state payment due dates, accepted methods, and any late fees or discounts. Not Including a Unique Reference Number Difficulty tracking and referencing past documents. Assign a unique reference number to every document for easy identification. Omitting Tax Information Failure to comply with tax regulations and confusion about the total cost. Ensure that applicable taxes or fees are included in the final amount and specified clearly. By avoiding these common mistakes, you can create more effective billing documents that promote clarity, reduce the risk of disputes, and improve your overall professionalism. A well-organized, accurate document ensures both you and your clients are on the same page, leading to smoother transactions and stronger bus

Legal Requirements for Tree Service Billing

When it comes to billing for labor and materials, it’s essential for businesses to comply with local and federal regulations to avoid legal issues and ensure smooth financial transactions. The legal requirements for billing documents vary depending on the location and type of work, but there are several key elements that every document should include to meet general legal standards. Failure to adhere to these requirements can lead to disputes, penalties, or even legal action.

Here are the main legal considerations you should be aware of when creating your billing documents:

Key Legal Elements to Include

- Business Identification: Your company must include its legal name, business address, and tax identification number (TIN). This ensures that the transaction is properly recorded and can be traced back to your business for tax purposes.

- Client Information: Include the full name and address of the client receiving the work. This helps avoid confusion and ensures that you are billing the correct party.

- Detailed Description of Work: Provide a clear and specific description of the work completed, including any materials or equipment used. This transparency helps prevent disputes and ensures that the client understands what they are being charged for.

- Payment Terms and Conditions: Clearly state the payment due date, acceptable payment methods, and any late fees or interest charges that may apply if payments are delayed. Clearly outlining these terms is crucial for both parties’ understanding of expectations.

- Tax Information: If applicable, your billing document must include the appropriate sales tax, VAT, or any other regional tax rates. Failing to include taxes correctly can lead to non-compliance with tax laws.

- Legal Disclaimers: Depending on your location, there may be specific legal disclaimers or notices that need to be included on your financial documents, such as warranties or liability clauses. These are typically used to protect both the business and the client in the event of issues arising after the work is completed.

Why Legal Compliance Matters

Ensuring that your billing documents comply with legal requirements helps maintain your business’s integrity and prevents costly legal complications. Not only does it protect your business from potential fines or disputes, but it also demonstrates professionalism and builds trust with your clients. By

How to Calculate Tree Removal Costs

Accurately estimating the cost of a project is crucial for both the business and the client. Several factors contribute to the total cost, and understanding these variables ensures transparency and fairness in the pricing process. By considering the scope of the job, the resources required, and other external factors, you can calculate an appropriate price for the work.

Here are the key factors to consider when determining the cost of a job:

Factors Affecting Cost

- Size and Height of the Project: Larger or taller jobs typically require more time, equipment, and labor, which can increase the cost. The bigger and more complex the task, the higher the price.

- Location and Accessibility: If the job site is hard to reach or in a crowded area, additional logistics may be necessary. Difficult access can increase the overall cost due to the need for special equipment or additional safety measures.

- Type of Work: Certain projects may involve additional steps, such as cutting, hauling, or grinding. For instance, removing a large structure with deep roots or complicated positioning requires more labor and machinery, which impacts the price.

- Materials and Equipment: The tools and machinery required for the job, such as cranes, chippers, or specialized vehicles, are significant cost factors. If renting equipment is necessary, this should also be factored into the total price.

- Labor Costs: The skill level and number of workers needed for the job directly influence the price. If the work requires highly trained professionals or a large crew, the labor cost will be higher.

- Permitting and Insurance: Depending on the location and nature of the work, permits or insurance may be required. These additional expenses should be included in the final cost to ensure compliance and safety.

How to Estimate and Provide an Accurate Quote

- Conduct a Site Assessment: Visit the job site to assess the scope of work, access issues, and any potential complications. A thorough inspection helps provide a more accurate quote.

- Break Down the Costs: Itemize the cost of labor, equipment, materials, and other overheads to

Using Online Tools for Invoice Creation

Creating financial documents manually can be time-consuming and prone to errors. Online tools provide an efficient and user-friendly way to generate professional documents quickly. These platforms simplify the billing process, offering customizable options and automatic calculations to ensure accuracy. Whether you’re a small business owner or a freelancer, leveraging online tools can save time and enhance the professionalism of your financial records.

Here are some reasons why using online platforms for generating billing records is beneficial:

Advantages of Online Tools

- Time Efficiency: Online tools allow you to create and send documents in just a few clicks, eliminating the need for manual calculations and formatting. You can create multiple records quickly, saving you valuable time.

- Customizable Designs: Many online platforms offer customizable layouts that let you adjust the format, logo, color scheme, and text fields to match your business’s branding.

- Automatic Calculations: With online platforms, the calculation of totals, taxes, and discounts is automated, reducing the risk of human error and ensuring accurate billing every time.

- Cloud Storage and Accessibility: Most online tools store your documents in the cloud, allowing you to access and manage your records from anywhere. This ensures that your financial information is always secure and easily accessible.

- Professional Appearance: Online tools provide templates that give your documents a clean and consistent look, improving your company’s image and making your financial records look more polished and organized.

Popular Online Platforms

- QuickBooks: This widely used tool offers easy-to-use features for generating professional billing documents, managing finances, and tracking payments.

- Zoho Invoice: Zoho’s platform provides customizable options for billing, along with features for recurring billing, tax management, and payment tracking.

- Wave: A free option for small businesses and freelancers, Wave offers simple tools for creating, sending, and tracking billing documents online.

- FreshBooks: Known for its invoicing capabilities, FreshBooks also provides comprehensive accounting tools that allow for easy tracking of expenses and payments.

By using online tools, businesses can streamline the billing process, reduce the risk of errors, and improve their overall efficiency. With these platforms, you can focus more on growing your business and less on administrative tasks, while still ensuring your financial documents are professional, accurate, and easy to manage.

Why Clients Appreciate Detailed Invoices

Providing clear and thorough financial records fosters trust and transparency between businesses and their clients. When clients receive a detailed breakdown of costs, they are better equipped to understand what they are paying for, which can lead to a smoother transaction process. Detailed records help eliminate confusion, prevent disputes, and ensure that both parties are on the same page regarding the charges. Clients appreciate knowing exactly how their money is being allocated and what services or materials they are being billed for.

Here are several reasons why clients value detailed financial documents:

Benefits of Providing a Clear Breakdown

- Transparency: A detailed list of charges allows clients to see exactly where their money is going, which builds trust and prevents misunderstandings.

- Prevents Disputes: When all aspects of the work and associated costs are clearly outlined, there is less room for confusion or disagreement regarding the final amount due.

- Professionalism: Well-organized and detailed records reflect a high level of professionalism, reassuring clients that they are working with a reliable and credible business.

- Better Budgeting: Clients can better manage their finances when they have a comprehensive view of the costs. This helps them plan and make informed decisions about their future spending.

- Improved Payment Process: When clients fully understand the charges, they are more likely to make prompt payments, reducing delays and increasing cash flow for your business.

Key Components Clients Look for in Detailed Records

Component Why It Matters Clear Job Description Clients appreciate knowing exactly what work was completed, how it was done, and why it was necessary. Itemized Charges An itemized list helps clients see the cost for each specific task or material, reducing the risk of surprise charges. Accurate Tax Information Including tax details ensures compliance with local regulations and prevents confusion about the final amount due. Payment Terms Clearly stating payment methods, due dates, and any penalties for late payments helps avoid miscommunication and ensures time Incorporating Payment Terms in Billing Records

Clearly defined payment terms are essential to ensuring smooth transactions between businesses and their clients. By outlining when and how payments should be made, businesses can prevent misunderstandings and ensure that clients are aware of their financial obligations. Including specific payment guidelines in your billing documents not only helps with cash flow but also fosters a sense of professionalism and accountability.

Below are the key components that should be addressed when including payment terms in financial documents:

Payment Term Explanation Due Date Clearly state the exact date by which the payment must be made. This ensures there is no confusion about the deadline. Accepted Payment Methods List the types of payments you accept (e.g., credit card, bank transfer, online payment platforms) to avoid delays or inconvenience for the client. Late Payment Penalties If applicable, mention any late fees or interest charges that will be incurred if the payment is not made on time. This encourages timely payments. Early Payment Discounts Offer discounts for clients who pay before the due date as an incentive to speed up the payment process. Partial Payments If you accept partial payments, specify the terms of such arrangements, including the schedule for remaining balances. Payment Confirmation Make it clear whether the client will receive a confirmation upon payment, and the format (e.g., email receipt, online portal confirmation). By incorporating these elements into your billing records, you ensure that both parties have clear expectations regarding the payment process. This not only helps avoid disputes but also promotes a smoother workflow and encourages prompt payment, ultimately benefiting your business’s financial stability.

How to Handle Discounts on Tree Services

Offering discounts is an effective way to attract new clients and retain existing ones, especially in a competitive market. However, it is important to handle discounts carefully to ensure that they benefit both your business and your clients. Clearly communicating discount terms and applying them correctly in financial records can help maintain profitability while keeping clients satisfied.

Here are some important aspects to consider when incorporating discounts into your pricing structure:

Types of Discounts to Offer

- Seasonal Discounts: Offering discounts during off-peak seasons can encourage clients to book services when business may be slower. This can help maintain steady cash flow throughout the year.

- First-Time Customer Discounts: Providing an introductory discount to new clients can help entice them to choose your business over competitors and potentially lead to repeat business.

- Referral Discounts: Rewarding existing clients who refer new customers with a discount is a great way to incentivize word-of-mouth marketing and build a loyal client base.

- Volume or Package Discounts: Offering a discount for larger jobs or bundled services can make clients feel like they are getting more value for their money, while also encouraging larger projects.

- Early Payment Discounts: Encouraging clients to pay early by offering a small discount can speed up cash flow and reduce the time spent on collecting overdue payments.

How to Apply Discounts Effectively

- Be Transparent: Clearly explain the terms of the discount to your clients, including eligibility criteria and expiration dates. This helps avoid confusion and sets clear expectations.

- Apply Discounts to Specific Charges: If your discount applies to certain aspects of the work (e.g., labor, materials), make sure to indicate this on the billing record. This ensures transparency and accuracy in pricing.

- Limit Discount Usage: Set guidelines on how often discounts can be used, particularly for repeat clients. Offering discounts too frequently can erode profitability and lead to an unsustainable business model.

- Document All Discounts: Always document discounts provided in your financial records for clarity and to avoid potential conflicts with clients. This also helps with accounting and ensures that your pricing remains consistent.

By carefully managing and applying discounts, you can enhance customer satisfaction without compromising your business’s profitability. A well-structured discou

Integrating Tax Rates in Your Billing Records

Including accurate tax rates in your financial documents is a critical aspect of maintaining compliance and ensuring that both your business and your clients understand the full cost of a transaction. Properly calculating and displaying taxes on your records prevents misunderstandings, reduces errors, and helps you stay aligned with local regulations. It also improves the professionalism of your business and demonstrates transparency in your pricing structure.

Here are key considerations for effectively integrating tax rates into your financial documents:

Understanding Tax Calculation

- Sales Tax Rates: Different products or services may be subject to different tax rates based on the jurisdiction. Make sure to apply the correct rate according to the location of the transaction.

- Taxable vs. Non-Taxable Items: Not all items are taxable. Ensure that only eligible products or services are taxed, and clearly distinguish between taxable and non-taxable charges on your documents.

- Tax Jurisdictions: Some regions have multiple tax rates depending on local, state, or national laws. Be sure to research and apply the appropriate rate based on where the service is rendered or where the client resides.

- Compound vs. Simple Tax: In some cases, taxes are compounded, meaning they are calculated on the original price plus any other taxes. Understanding whether to apply a simple or compound tax rate is vital for accurate billing.

How to Display Tax Information

- Separate Tax Line: To avoid confusion, clearly list the tax amount as a separate line item on the billing record, showing both the tax rate and the total amount being charged for taxes.

- Include a Tax Breakdown: If your transaction is subject to multiple taxes (e.g., local and state taxes), provide a breakdown that shows how each tax was calculated. This increases transparency and helps the client understand the charges.

- Be Clear on Total Amount: Ensure that the final amount due includes the tax and is prominently displayed, so the client is aware of the total payment required without any hidden fees.

By integrating tax rates correctly, businesses can avoid issues with overcharging or undercharging clients. It also ensures that you comply with tax laws and regulations, which helps maintain your reputation and avoid potential legal issues. Clear communication of tax details in your financial records not only ensures accuracy but also builds trust with your clients.

How to Send and Track Billing Documents

Sending and monitoring financial records is an essential part of managing business transactions. Ensuring that these documents are delivered promptly and tracked effectively can improve cash flow, reduce overdue payments, and streamline your accounting process. By using efficient methods to send and track records, businesses can maintain a professional image and keep operations running smoothly.

Here are the key steps for effectively sending and tracking financial documents:

Steps for Sending Financial Records

- Choose a Delivery Method: Select a method that suits both your business and the client’s preferences. Options include traditional mail, email, or through an online payment platform or accounting software. Email is the fastest and most commonly used method today.

- Verify Client Details: Before sending, ensure that all client contact details, such as email address or postal address, are correct. This prevents delays and ensures that the document reaches the right recipient.

- Include Clear Instructions: When sending a record, include a brief message explaining the details of the charges and the due date. This can help the client understand the document more quickly and avoid confusion.

- Use Professional Formats: Whether you’re sending a digital or physical document, make sure the layout is clear and professional. This enhances credibility and shows that your business is well-organized.

Tracking Financial Records

- Utilize Online Tools: Many accounting platforms allow you to track when a document has been opened or viewed. Using these tools can provide valuable insight into your clients’ actions, helping you follow up as needed.

- Set Reminders: Schedule reminders for when a document is due or when a follow-up is necessary. This ensures you don’t miss any deadlines and helps maintain a consistent follow-up schedule.

- Record Payment Status: Keep track of whether payments have been received and mark them as paid in your records. If the payment is overdue, it’s essential to follow up promptly to avoid delays in cash flow.

- Send Payment Reminders: If a payment is approaching its due date or has passed, sending a polite reminder email can encourage the client to settle the balance. Include any late fees, if applicable, to reinforce the importance of timely payment.

Efficiently sending and tracking financial records helps ensure that your business runs smoothly and that you receive payments on time. By using reliable methods and tools for tracking, businesses can maintain better control over their cash flow and financial processes, ultimately contributing to their overall success.

Improving Your Business’s Professional Image

A strong professional image is essential for building trust with clients, standing out from competitors, and ensuring long-term success. The way your business communicates with clients–both visually and through documentation–can have a significant impact on how it is perceived. By focusing on the details and maintaining consistency across all client interactions, you can enhance your business’s reputation and make a lasting impression.

Here are several strategies to improve your business’s image through documentation and client interaction:

Key Aspects of Professionalism

- Clear Communication: Ensure that all communication with clients, whether through emails, phone calls, or physical documentation, is clear, concise, and polite. Providing accurate and timely information helps build trust.

- Consistent Branding: Consistency in your brand’s visual elements, such as logos, colors, and fonts, across all your communications reinforces your business identity and creates a cohesive look.

- Attention to Detail: Small details like the layout of your documents, correct spelling and grammar, and timely responses show that your business is detail-oriented and professional.

Using Documentation to Build Trust

Well-structured documents are an essential part of a professional image. They not only convey important information but also reflect the reliability and credibility of your business.

Document Element Importance Professional Layout A clean, organized layout improves readability and enhances your business’s credibility. Accurate Information Providing accurate and up-to-date information ensures clients can trust the data presented to them, fostering positive relationships. Personalization Tailoring documents to reflect the specific needs of each client demonstrates attention and care, making clients feel valued. Timely Delivery Delivering documents promptly shows respect for clients’ time and demonstrates your ab