Free Travel Invoice Template for Easy Billing

Managing business expenses and keeping track of payments can be a daunting task, especially when you’re constantly on the move. Having the right tools to streamline this process is essential for smooth operations. Whether you’re an entrepreneur, freelancer, or employee handling reimbursements, a well-organized document can save you time and reduce errors.

In this guide, we’ll explore how a structured document can simplify billing, helping you focus more on your core work. With customizable and easily accessible formats, you can quickly create professional records for any project or service. These solutions not only save time but also ensure clarity in communication with clients or employers.

Embracing the right tools can make all the difference when managing expenses. By using a well-organized format, you’ll ensure all necessary details are covered, from dates to amounts, while maintaining a professional look. Let’s dive into how these tools can make your financial record-keeping more efficient and stress-free.

Free Travel Invoice Template for Professionals

For professionals working in industries that require frequent client meetings or business-related travel, having a well-structured document for billing is crucial. A well-designed record-keeping system ensures that all necessary expenses are captured and properly reported, making the entire process more efficient and transparent. By utilizing a ready-made form, you can save time and effort, allowing you to focus on your work rather than worrying about the administrative side of things.

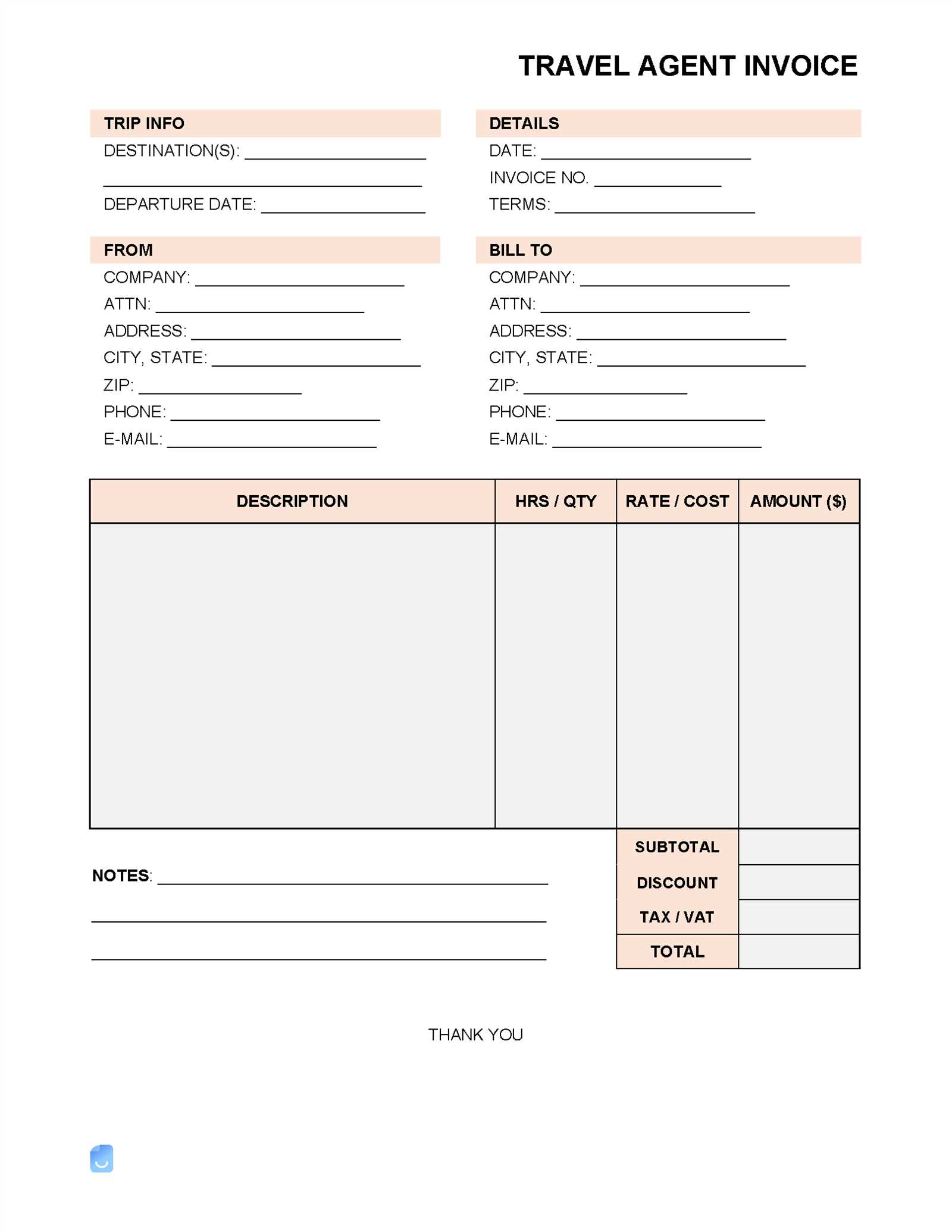

Essential Information to Include

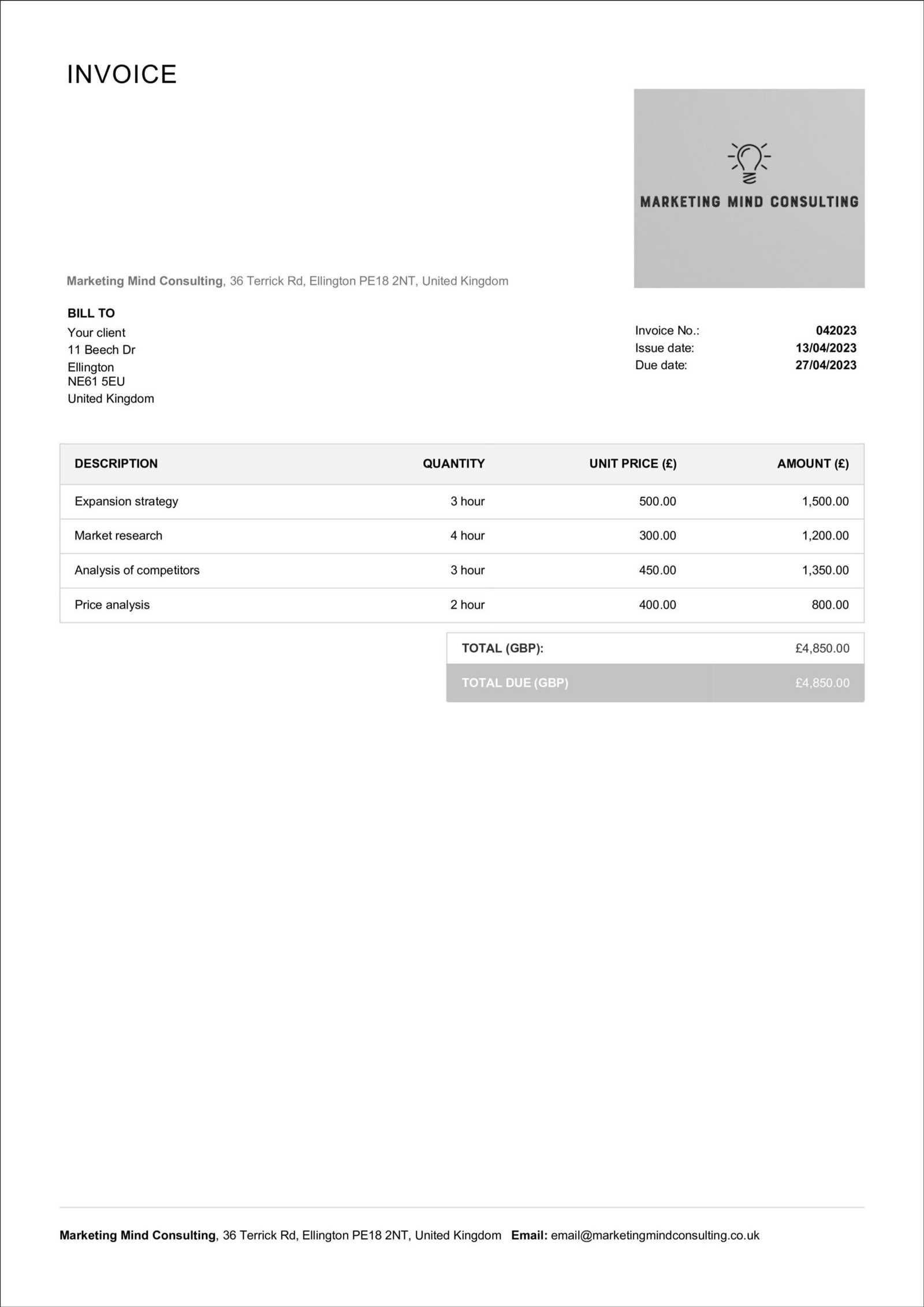

When creating a detailed payment request, it’s important to include all the relevant details that both you and your client can refer to easily. A clear and concise record should contain specific categories, such as services rendered, dates, amounts, and any associated costs. Ensuring these elements are properly listed will help avoid confusion and ensure timely payment.

| Category | Description |

|---|---|

| Date of Service | The date when the service was provided or the meeting took place. |

| Details | A brief description of the services or expenses incurred. |

| Amount | The cost associated with each service or expense item. |

| Total | The sum of all individual amounts. |

How a Structured Document Benefits Professionals

Using a structured, standardized document provides several advantages. It not only streamlines the billing process but also reduces errors, ensuring you capture every necessary expense. It also enhances the professional image you present to clients or employers, fostering trust and clear communication. Whether you’re submitting an expense report to your company or sending a payment request to a client, a well-organized form reflects your attention to detail and reliability.

How to Create a Travel Invoice

Creating an effective billing document involves more than just filling in a few details. It’s about ensuring clarity, accuracy, and completeness to make sure that both you and your client are on the same page regarding the services rendered or costs incurred. A well-structured record not only helps you track your payments, but it also facilitates smoother transactions and quicker processing of reimbursements or payments.

Start by gathering all relevant information: the dates, descriptions of services or expenses, and the corresponding amounts. Once these details are organized, it’s time to input them into your chosen format. A clean and professional layout ensures that the client can easily understand each item and the total sum due.

Make sure to include a clear breakdown of each cost, and don’t forget to list any terms regarding payment deadlines, methods, or late fees if applicable. Double-check the information for accuracy, and ensure that the document has your contact details and any legal requirements depending on your location or industry. Finally, saving and sending the document in a universally accepted format, like PDF, ensures compatibility across devices and maintains the professional appearance of your work.

Top Benefits of Using Templates

Utilizing pre-designed formats can significantly streamline your billing and documentation processes. Instead of starting from scratch each time, a structured design saves you time and reduces the risk of errors. With all necessary sections already laid out, you can focus on inputting the specific details, ensuring consistency and professionalism with every document.

Increased Efficiency

By using a ready-made structure, you eliminate the need to manually create the same sections over and over again. This not only saves time but also allows you to process payments faster, whether you’re submitting documents for reimbursement or providing clients with a breakdown of costs. The repetitive task of creating new forms is replaced by a more efficient method of customization, allowing for quicker turnarounds.

Improved Professionalism

A consistent format helps maintain a high level of professionalism, ensuring your documents are clear and visually appealing. When clients or employers receive a well-organized breakdown of expenses or services, it reflects your attention to detail and enhances the trust in your business practices.

| Benefit | Description |

|---|---|

| Time-Saving | Ready-made designs allow for quick customization and faster document creation. |

| Consistency | Standardized formats ensure uniformity in every document you produce. |

| Ease of Use | Simple to customize and fill in, even for those with minimal design or technical skills. |

| Professional Appearance | Clean layouts help present your information in a clear, well-organized manner. |

Best Free Templates for Travel Billing

When it comes to managing expenses and providing detailed payment breakdowns, choosing the right structure can make all the difference. The ideal format should not only help you record the necessary details but also present them in a professional and clear way. Fortunately, there are a variety of pre-designed formats available that cater specifically to professionals needing a streamlined solution for tracking costs and handling financial transactions.

The best available designs offer flexibility for customization while maintaining consistency across your documents. Whether you’re handling business reimbursements, client payments, or managing multiple projects, these formats help simplify the process and reduce the chances of mistakes. They are easy to use and ensure that all essential information is included in a clear, logical order.

Here are some of the top options that professionals can take advantage of to make billing more efficient:

- Simple and Clean Format – Ideal for those who need a straightforward way to list expenses without any unnecessary complexity. Perfect for clients or employers who prefer simplicity.

- Detailed Breakdown – For more complex billing needs, this layout offers sections for travel expenses, accommodation costs, meals, and other details, giving clients a comprehensive view of the charges.

- Professional Design – Designed with business professionals in mind, this option includes branding features such as company logos and contact details, offering a polished and consistent appearance for all documents.

- Mobile-Friendly Formats – With these options, you can access and customize your records on the go, ensuring you can stay on top of your billing even when traveling or working remotely.

Customizing Your Travel Invoice Template

Personalizing your billing structure allows you to tailor the document to your specific needs and ensure that all relevant information is clearly presented. Customization not only makes your documents unique but also ensures they are more effective in conveying all necessary details to your clients or employers. A well-modified layout can reflect your professional standards while making the document easier to understand and process.

When customizing a billing document, it’s important to adjust certain sections to match your workflow and the services you offer. Whether you’re adding extra fields for specific costs or changing the overall look, these adjustments help create a more professional and user-friendly record. In this section, we’ll cover the key areas where you can make changes to suit your requirements.

Key Customization Areas

| Customization Area | What to Modify |

|---|---|

| Header | Include your business name, logo, and contact details to give the document a personalized touch. |

| Service Description | Adjust the categories to reflect the exact services or products you’re providing, ensuring clarity for your client. |

| Payment Terms | Modify payment deadlines, methods, and any specific conditions that apply to the transaction. |

| Currency | Change the currency symbol or adjust the format if you’re working with international clients. |

Making these modifications will ensure that your document not only fits your needs but also stands out in terms of both clarity and professionalism. Whether you’re using it for local or international transactions, customization enhances the document’s usability and effectiveness, helping you get paid on time and avoiding any potential confusion.

Why Choose Free Invoice Templates

When managing billing and payments, having a ready-to-use structure can save both time and money. Instead of investing in expensive software or hiring a designer to create customized forms, you can easily access pre-designed formats that meet your needs. These options are not only cost-effective but also allow you to quickly start handling payments, helping to streamline your workflow without additional overhead.

Opting for readily available formats ensures you don’t have to spend valuable time creating documents from scratch. These pre-made designs provide all the essential sections you need, such as service details, costs, and contact information, allowing for quick and efficient record-keeping. Additionally, many of these designs are simple to edit, enabling you to add your unique business details or adjust the layout as needed.

Here are some advantages of using these accessible options:

- Cost Efficiency – There’s no need for expensive software or professional help to create a polished, effective record-keeping document.

- Time-Saving – With a ready-made structure, you can focus on entering relevant details instead of formatting and design.

- Easy Customization – Many options allow for quick modifications, ensuring the document suits your specific needs.

- Professional Appearance – Even though they’re accessible, these options still offer a professional, polished look for your records.

By choosing these accessible and customizable options, you can enhance your billing process without adding unnecessary costs or complexity. It’s a simple and effective way to maintain professionalism while keeping things efficient and streamlined.

Easy Steps to Download Travel Invoices

Downloading the right document for managing your expenses and payments is a simple and straightforward process. With the right resources, you can quickly find and access a structured format that meets your needs. These formats are often available on a variety of platforms, allowing you to easily download them to your computer or device in just a few steps.

Here’s how to quickly obtain the necessary documents to manage your billing tasks:

- Step 1: Choose a Reliable Platform – Start by selecting a trusted website or platform that offers customizable formats. Ensure the site provides easy access to download options and provides security for your data.

- Step 2: Select the Right Format – Browse through the available options and choose the design that best fits your needs. Look for one that allows for easy modifications to suit your business style.

- Step 3: Download the File – Once you’ve found your preferred format, simply click on the download button. The document will usually be available in a universally accepted format like PDF or Word, ensuring compatibility with most devices and software.

- Step 4: Save and Customize – After downloading, open the file on your device and start adding the relevant details. You can fill in your business name, service description, costs, and other important information as needed.

By following these simple steps, you can quickly download and start using the right documents for your billing process. Whether you need them for one-time use or ongoing projects, the convenience of downloading these pre-structured formats ensures you stay organized without the hassle of creating documents from scratch.

Key Elements of a Travel Invoice

When creating a document for billing purposes, it’s crucial to include specific information that helps both parties understand the details of the charges and payments. Each section should be clear, organized, and easy to read to avoid any confusion. A well-structured form ensures that all important aspects of the service or expenses are captured, leading to smoother transactions and faster payments.

The following are the essential components you should always include in your billing record to ensure transparency and completeness:

Essential Information to Include

- Business and Client Details: Include the name, address, and contact information of both parties. This ensures that the document is easily traceable and professional.

- Service Description: Clearly outline the services provided, including dates and a brief description of the work or expenses incurred. This section helps avoid misunderstandings by specifying exactly what was delivered.

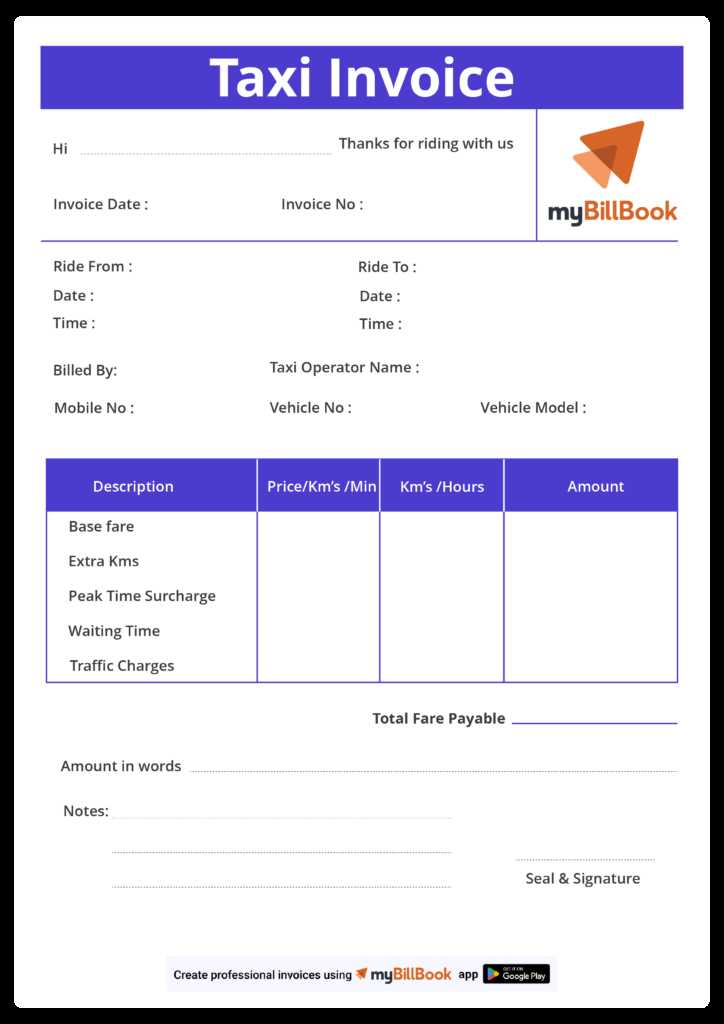

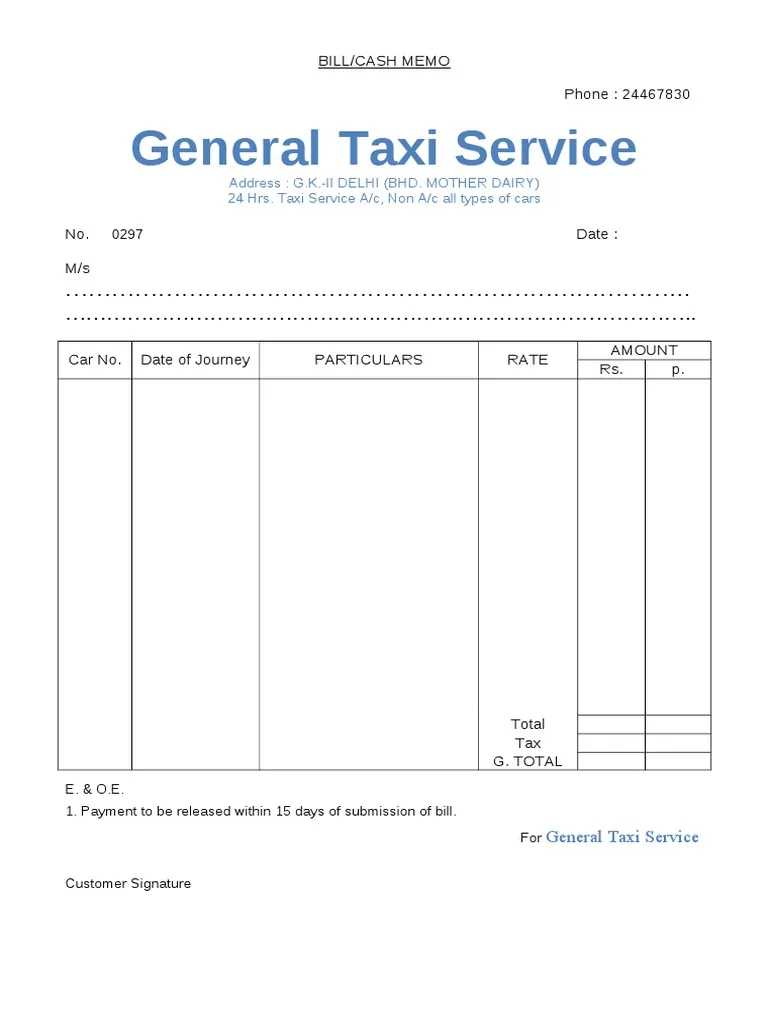

- Cost Breakdown: Detail the costs associated with each service or item. It’s important to break down charges into specific categories (e.g., accommodation, transportation, meals) for clarity.

- Total Amount Due: After listing individual charges, clearly state the total amount due to avoid any confusion. It should be prominently displayed at the end of the document.

Additional Important Elements

- Payment Terms: Include any relevant details such as payment deadlines, accepted payment methods, and late fees if applicable. This ensures both parties are aligned on when and how payments should be made.

- Unique Reference Number: Assign a unique identifier to each document to help with tracking and future reference. This is especially important for businesses managing multiple transactions.

- Legal Information: Depending on your industry or region, include any legal disclaimers, tax information, or other mandatory details that are required for compliance.

Including these key elements will ensure that your billing records are thorough, professional, and transparent. Properly structured documents not only speed up payment processing but also reflect your attention to detail, which helps build trust with your clients or employers.

Common Mistakes to Avoid in Invoices

Even a well-designed document can lead to confusion or delays if not filled out correctly. There are several common pitfalls that can result in miscommunication, errors in payment processing, or delays. Ensuring that each section is completed accurately and thoroughly can save you time and effort, and help maintain a professional relationship with your clients or employers.

Frequent Errors to Watch For

- Missing Contact Information: Failing to include both your and your client’s contact details can lead to delays or confusion, especially if the document needs to be followed up on or referenced in the future.

- Unclear Payment Terms: Not specifying the payment method, due date, or penalties for late payments can create misunderstandings and delay the payment process.

- Incorrect Amounts: Always double-check your calculations and itemized costs. Mistakes in pricing or totals are not only unprofessional but can also result in unpaid balances or disputes.

- Omitting Relevant Dates: Be sure to include both the service date and the issue date for the document. Without these, clients may not know when the charges were incurred or when payment is expected.

- Missing Unique Identifier: Failing to assign a reference number to the document can make it harder for you and your client to track the record in case of disputes or future reference.

How to Prevent These Mistakes

- Double-Check Your Details: Review all information before sending the document, ensuring that both your and your client’s contact information, as well as amounts, are accurate.

- Clarify Payment Terms: Be specific about payment deadlines, accepted methods, and penalties for late payments. This will prevent delays and ensure timely processing.

- Ensure Consistency: Keep your formatting consistent throughout the document. If you use a certain date format or pricing style, make sure it’s applied uniformly.

- Proofread Before Sending: A final review is crucial. Look for any overlooked mistakes or missing elements to avoid potential confusion and ensure your document is professionally presented.

By avoiding these common mistakes, you can create accurate, professional records that help ensure timely payment and prevent disputes. Properly completed billing documents not only facilitate smooth transactions but also reflect your commitment to detail and professionalism in every interaction.

How Templates Save Time for Travelers

For professionals on the go, managing finances efficiently is key to staying productive. Rather than spending time manually organizing expenses and calculating totals, having a pre-structured document allows travelers to focus on what really matters–getting the job done. These ready-made formats streamline the process of tracking and reporting costs, which means less time spent on administrative tasks and more time for actual work.

By using a ready-to-go format, travelers can quickly input details and avoid the hassle of formatting and layout. Whether it’s for business trips, client meetings, or conferences, a standardized approach simplifies the process and reduces the chances of mistakes, making it easier to stay organized while on the move.

Here’s how such structures help save valuable time:

- Quick Customization: Pre-designed formats allow travelers to quickly input specific details such as service descriptions and amounts, eliminating the need for extensive editing or designing from scratch.

- Consistency: Using a fixed layout ensures that all documents are uniform, which makes them easier to read and process, both for the traveler and for anyone receiving the record.

- Improved Accuracy: Reduces the chances of missing critical information or making mistakes in calculations, as the document already includes all essential fields and sections.

- Instant Access: Many online resources offer downloadable options, meaning travelers can access and use the document at any time, even from their mobile devices, ensuring they never miss a detail.

In a fast-paced, mobile environment, saving time with structured, pre-built formats helps travelers stay organized and focused, ensuring all financial matters are handled efficiently without disrupting their primary work tasks.

How to Include Travel Expenses Correctly

Accurately recording and documenting expenses is crucial for both reimbursement and accounting purposes. Whether you’re submitting a report for business trips or keeping track of personal spending for budgeting, ensuring that each charge is clearly itemized and justified is essential. Properly categorizing and calculating your expenses helps prevent confusion and ensures that you’re reimbursed promptly or that your records are accurate for tax purposes.

When detailing your expenses, it’s important to break them down into categories such as transportation, lodging, meals, and other relevant charges. Each category should clearly reflect the cost and the purpose of the expense. Additionally, including dates and receipts wherever possible will provide the necessary proof to validate the entries.

Steps to Properly Include Expenses

- Itemize Each Cost: List each expense separately with a brief description of the service or item. This ensures clarity for anyone reviewing the document.

- Include Dates: Always specify the dates when the expenses were incurred. This is important for validating the time frame of the charges.

- Provide Supporting Documents: Attach receipts or proof of payment where applicable. These documents validate the listed expenses and make the submission more transparent.

- Group Similar Costs: Group related expenses under specific categories like transportation, accommodation, meals, etc. This simplifies the review process and makes it easier to track your overall expenditure.

Tips for Accuracy

- Double-Check Amounts: Ensure all amounts are correctly calculated and that no charges are left out. Small errors can add up quickly.

- Be Consistent: Use the same format for each entry to avoid confusion. Consistency in how you list your expenses makes your document easier to follow.

- Round Numbers Correctly: Ensure that all rounding is done consistently. For instance, if you’re rounding meal costs, make sure to round them all to the nearest dollar or cent as needed.

By following these steps and maintaining careful records, you ensure that your documentation is accurate, transparent, and easy to process. This approach not only helps with reimbursement but also ensures your financial records are in order for future reference or audits.

Design Tips for Professional Invoices

The appearance of your billing documents plays a critical role in how your business is perceived. A well-designed form not only looks professional but also makes it easier for clients to understand the charges, terms, and payment instructions. Clear, organized, and aesthetically pleasing documents help build trust and reflect your attention to detail. A clean design can also expedite the payment process by ensuring all necessary information is easy to find.

When creating a billing document, there are several key design elements to consider that will elevate the professionalism and clarity of your record. From layout to typography, each choice impacts the readability and effectiveness of the document. Below are some practical tips to enhance the design of your billing forms.

Layout and Structure

- Keep It Simple: A cluttered design can confuse the reader and obscure key information. Use white space effectively to make the document easier to navigate.

- Use Clear Sections: Break your document into distinct sections–such as contact information, services provided, and total amount due–so clients can quickly find the relevant details.

- Logical Flow: Arrange the sections in a logical order, starting with basic details and ending with the total due. This allows for an intuitive reading experience.

Typography and Branding

- Choose Readable Fonts: Use clean, easy-to-read fonts for body text. Avoid overly stylized fonts that might distract from the content.

- Highlight Important Information: Use bold text or larger font sizes for key sections, like the total amount due or payment instructions, so they stand out.

- Maintain Consistency: If you use colors or fonts for branding, make sure they are consistent with your overall business style. This helps reinforce your professional image.

Incorporating these design tips into your billing records will not only enhance the visual appeal of your documents but will also make them more functional, ensuring that your clients can quickly and easily understand the charges and payment instructions. A well-designed document can set you apart from the competition and streamline your financial transactions.

Legal Requirements for Travel Invoices

When creating billing documents, it’s important to ensure that they comply with legal regulations. This ensures that both parties–whether it’s a business or individual–are protected and that the document holds up in case of disputes or audits. Different regions and industries may have specific rules about what needs to be included, so understanding these requirements is essential for maintaining professionalism and staying compliant with local laws.

Legal compliance involves more than just formatting; certain pieces of information must be included to make the document valid for tax or business purposes. Failing to provide these details could lead to delays, disputes, or even legal issues down the line.

Key Legal Elements to Include

- Business Details: Always include your company name, address, and contact information. This ensures that the document is clearly associated with your business.

- Client Information: Provide the recipient’s name or business name, along with their address and contact information. This identifies who the payment is due from.

- Unique Reference Number: Many jurisdictions require that each document has a unique reference or document number for tracking and record-keeping purposes.

- Service Description: Clearly state what was provided, including any dates of service. This helps clarify the purpose of the charges.

- Total Amount Due: The final amount due must be clearly stated, including a breakdown of costs. This ensures transparency and helps avoid misunderstandings.

- Tax Information: Depending on your region, it may be necessary to include tax information, such as sales tax, VAT, or any other applicable levies. Include your tax ID number if required.

- Payment Terms: Outline the due date and payment method. This ensures that the payer understands when and how to settle the balance.

Additional Considerations

- Currency: If you are doing business internationally, specify the currency in which the charges are to be paid to avoid confusion.

- Late Payment Fees: Clearly outline any penalties or late fees for overdue payments. This should be in line with your business policies and local laws.

- Legal Disclaimers: In some cases, including disclaimers regarding liability or service terms may be necessary, depending on your industry or location.

By including all the required legal elements, you help ensure that your billing records are clear, valid, and enforceable. Compliance with these regulations not only protects your business but also fosters a professional relationship with your clients. Understanding and meeting these requirements is essential for smooth financial operations and can help you avoid potential issues down the road.

How to Keep Track of Travel Costs

Managing expenses during trips is crucial for staying within budget and maintaining clear financial records. Keeping an accurate log of all expenditures ensures that nothing is overlooked and that reimbursements are processed smoothly. Whether you’re traveling for business or personal reasons, tracking costs efficiently allows for better planning and financial control. Proper record-keeping also helps when it comes time to report expenses or submit them for reimbursement.

To stay organized and ensure accuracy, it’s essential to categorize your costs and track each expense as it occurs. This will not only help you manage your spending but also provide you with a clear overview when it’s time to compile a report or settle accounts. The following steps can help streamline the process and ensure you capture every important detail.

Steps to Track Expenses Effectively

- Record Every Expense: Document each expenditure, no matter how small. It’s easy to forget minor purchases, but they can add up over time.

- Group Costs into Categories: Organize expenses into logical groups, such as transportation, lodging, meals, and other services. This simplifies the process when it’s time to calculate totals.

- Use Digital Tools: Consider using mobile apps or digital spreadsheets to track costs in real-time. These tools can help you stay organized and ensure that no expense is missed.

- Keep Receipts and Proofs: Save all receipts and documents related to your expenditures. This will provide you with the necessary proof if you need to justify your spending later.

- Review Regularly: Make it a habit to check your records frequently, especially while still on the trip. This allows you to catch any discrepancies early.

Organizing Your Records

Once you’ve gathered all your data, it’s time to organize your records in a clear and accessible format. The table below demonstrates how to structure your expenses for clarity and ease of reference:

| Date | Category | Details | Amount |

|---|---|---|---|

| 2024-11-01 | Transportation | Taxi from airport | $25.00 |

| 2024-11-02 | Lodging | Hotel room for 2 nights | $120.00 |

| 2024-11-03 | Meals | Lunch at restaurant | $15.00 |

| 2024-11-04 | Miscellaneous | Conference materials | $40.00 |

By using a clear format like the one shown abov

Free vs Paid Invoice Options

When it comes to preparing professional billing documents, there are two main paths to choose from: using no-cost options or opting for premium versions that come with additional features. Both choices have their pros and cons, depending on your needs, frequency of use, and the level of customization required. While free solutions can be sufficient for those with simple billing needs, paid options often offer greater flexibility, advanced features, and support for users who require more robust functionality.

For individuals or businesses just starting out or those with minimal requirements, no-cost resources can provide a quick and easy solution. On the other hand, paid services can offer premium designs, customer support, and integrations with accounting systems, which may be essential for larger operations or those with more complex needs. Understanding the key differences between these options can help you decide which is the best fit for your particular situation.

Advantages of Using No-Cost Options

- Cost-Efficiency: The most obvious benefit is that they come at no charge, making them an attractive choice for those on a tight budget or just starting out.

- Simplicity: Free options often come with basic features that are easy to understand and use, making them ideal for users who need something quick and straightforward.

- Instant Access: Many no-cost options are available for immediate download or online use, requiring little to no setup time.

Benefits of Premium Options

- Advanced Features: Paid solutions typically offer more advanced functionalities, such as automatic tax calculations, integration with payment gateways, and customizable fields.

- Professional Design: Premium options often provide access to more polished and modern designs, helping businesses present a more professional image to clients.

- Customer Support: With paid services, you often get access to dedicated support teams to help resolve any issues or questions, offering peace of mind in case something goes wrong.

- Regular Updates: Paid options are often updated regularly, offering the latest features, security improvements, and compliance with legal regulations.

Ultimately, the decision between using a no-cost or paid solution comes down to your specific needs. If you only need basic functionality and are looking to save money, free resources may be more than sufficient. However, if your needs are more complex, and you require additional support, customization, and features, investing in a paid option could be worth the expense.