Travel Agent Invoice Template for Efficient Billing and Professionalism

Managing financial transactions smoothly is essential for any service-based business. Having a reliable document for outlining charges and payments can streamline communication with clients and ensure timely payments. A well-organized billing system not only saves time but also enhances your professionalism, allowing for transparent and accurate financial records.

Whether you are working with individuals or groups, having a consistent and structured way to present your charges is crucial. Customizing such documents to suit your needs provides flexibility while maintaining clarity for your clients. From including payment terms to detailing services provided, each element plays an important role in fostering trust and reducing misunderstandings.

In this guide, we’ll explore how you can create or adapt a billing form that suits your business, focusing on the features that make it effective, practical, and easy to use. With the right tools, managing finances becomes less of a task and more of a seamless part of your daily operations.

Travel Agent Invoice Template Essentials

For any business that provides services, having a structured way to bill clients is crucial. A comprehensive billing document not only ensures transparency but also helps maintain a professional image. When properly crafted, it clearly outlines the charges for services rendered, payment expectations, and other important details. In this section, we’ll discuss the fundamental elements that should be included in every billing document to ensure smooth transactions and client satisfaction.

Key Elements to Include

- Business Information – Always include the name, address, and contact details of your business to make it easy for clients to reach you with questions or concerns.

- Client Information – Clearly list the client’s name, address, and any other relevant contact information for easy identification.

- Description of Services – Provide a clear breakdown of the services offered, including the date of service and any additional notes necessary for the client to understand the charges.

- Pricing Details – Specify the cost for each service provided, along with any taxes or fees applicable. This helps clients understand the exact amount they owe.

- Payment Terms – Include the due date for payment and any late fees or penalties that may apply if the payment is not received on time.

- Payment Methods – List acceptable methods of payment (e.g., credit card, bank transfer, check), making it easier for clients to complete their transaction.

Why These Elements Matter

- Clarity and Transparency – A detailed and clear document helps prevent misunderstandings between you and your clients regarding what they are paying for.

- Professional Image – Well-designed billing forms enhance the perception of your business as professional and organized, which can lead to greater client trust and satisfaction.

- Efficient Record-Keeping – Having all essential details documented properly helps you maintain accurate financial records, which is important for tax purposes and future business planning.

By incorporating these essential elements, you can create a billing document that not only simplifies financial transactions but also enhances the overall client experience, fostering long-term business relationships.

Why Use an Invoice Template

Using a structured document for billing purposes offers several key advantages for businesses of all sizes. Rather than manually creating each financial statement from scratch, having a ready-made document can save time, reduce errors, and maintain consistency across all client transactions. This approach not only simplifies the process but also ensures that important details are never overlooked, contributing to smoother operations and stronger client relationships.

Time Efficiency

- Quick Setup – Pre-designed forms allow you to insert specific details quickly, making the process of billing faster and less cumbersome.

- Reusable Format – Once set up, the same document can be used for multiple clients, saving you the time of recreating the structure each time.

- Less Error-Prone – Standardized fields reduce the chances of forgetting key information, ensuring that all invoices are complete and accurate.

Professional Appearance

- Consistency – A consistent, well-organized layout for all your financial statements enhances your brand’s professionalism.

- Client Trust – Providing a clear and polished document reinforces your business’s credibility and builds trust with clients.

- Legal Protection – A formalized document helps prevent misunderstandings and provides clear evidence of agreed-upon services and fees if disputes arise.

By using a pre-made billing structure, you streamline your workflow, ensuring that every financial exchange is professional, accurate, and efficient, which in turn strengthens both your business operations and client satisfaction.

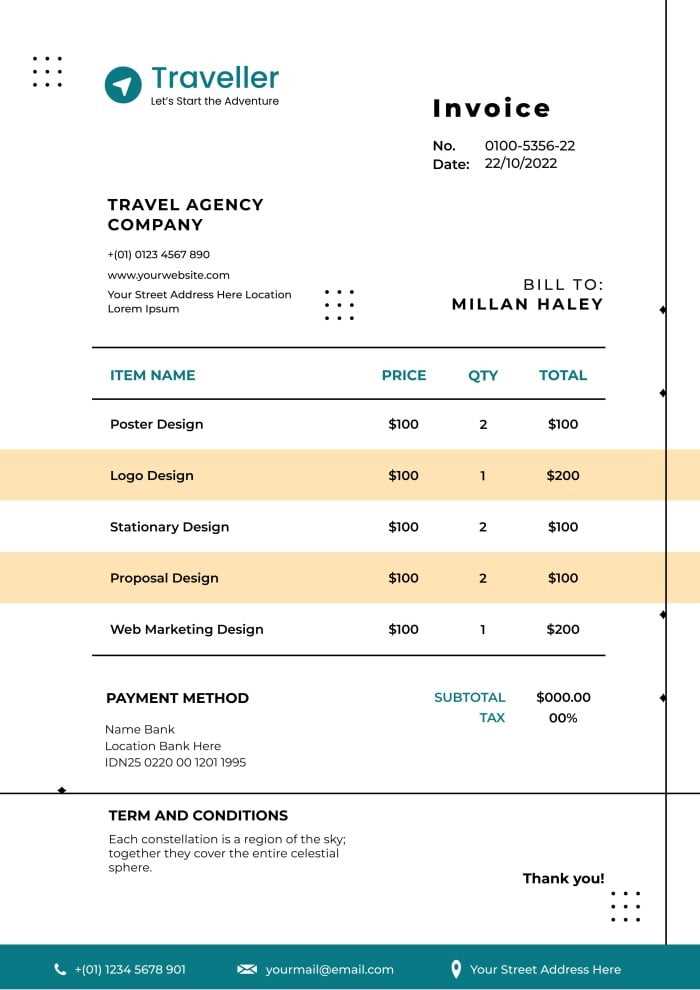

Key Components of a Travel Invoice

Creating a detailed and accurate billing document involves including essential elements that outline the charges for services provided. A well-organized document not only helps clients understand what they are being billed for but also ensures that all relevant information is captured for financial records. Below are the key components that should be included to make your billing clear, professional, and efficient.

Essential Information

- Business Details – The name, address, and contact information of your business should be listed clearly to make it easy for clients to reach out if needed.

- Client Information – Always include the client’s name, address, and contact details to ensure the document is properly associated with the correct party.

- Unique Identifier – Assigning a unique reference number to each document helps with tracking and ensures each billing record is easily distinguishable.

Billing Details

- Description of Services – A detailed list of services rendered, including dates, locations, and specific offerings, provides full transparency to the client.

- Pricing Breakdown – Each service should be itemized with its corresponding cost. This section may also include taxes, discounts, or additional charges if applicable.

- Total Amount Due – Clearly state the total amount owed, ensuring that clients can quickly see how much they need to pay.

- Payment Terms – Define when the payment is due and any conditions related to late payments, such as additional fees or interest rates.

By including these key components, you create a billing document that is easy to understand, complete, and professional, which helps build trust and facilitates smooth transactions with your clients.

How to Customize Your Invoice

Customizing your billing document is essential to ensure it fits the specific needs of your business. Tailoring the layout, design, and content can make the document more relevant to your services while reinforcing your brand identity. The following steps will guide you through the process of adapting your billing statement to better suit your business and client needs.

Adjusting the Layout and Design

- Choose a Clean and Professional Style – Select a layout that is easy to read and visually appealing. Use clean fonts, clear headings, and organized sections to improve readability.

- Incorporate Your Branding – Add your company logo, color scheme, and font style to match your business identity. This creates a cohesive experience for your clients.

- Make it Mobile-Friendly – Ensure your document is legible on both desktop and mobile devices, as many clients may view it on their phones or tablets.

Personalizing the Content

- Modify Service Descriptions – Adapt the descriptions of services to reflect the specific offerings your business provides, ensuring clarity for your clients.

- Adjust Payment Terms – Include payment terms that align with your business practices, such as due dates, late fees, or available discounts for early payment.

- Customize Additional Fields – If your services require unique information (such as booking references or travel dates), make sure those details are easy to add and update for each client.

Customizing your billing documents not only helps streamline your workflow but also gives a more personalized and professional touch to your communications, enhancing client satisfaction and trust.

Benefits of Using an Invoice Template

Utilizing a standardized billing document brings numerous advantages that can improve the efficiency and professionalism of your business. By relying on a ready-made format, you can simplify your administrative tasks, reduce the likelihood of errors, and enhance your overall workflow. Below are some of the key benefits of using a pre-designed billing form that can make a significant difference in your daily operations.

| Benefit | Description |

|---|---|

| Time-Saving | With a pre-structured document, you eliminate the need to create a new billing statement from scratch every time, saving valuable time and resources. |

| Consistency | Using the same format for every transaction ensures uniformity in your communication, leading to a more professional and organized image. |

| Reduced Errors | A standardized format minimizes the chances of forgetting key details or miscalculating charges, leading to fewer mistakes and disputes with clients. |

| Customization | You can easily adapt the form to reflect your unique offerings, pricing structure, and branding, ensuring that it meets the specific needs of your business. |

| Improved Client Trust | Delivering a professional, clear, and consistent document boosts your credibility and builds trust with clients, fostering long-term relationships. |

By using a pre-designed billing format, you gain greater control over your financial transactions while ensuring that each client interaction remains efficient and professional. These advantages not only save time but also help you maintain strong client relationships and ensure smooth business operations.

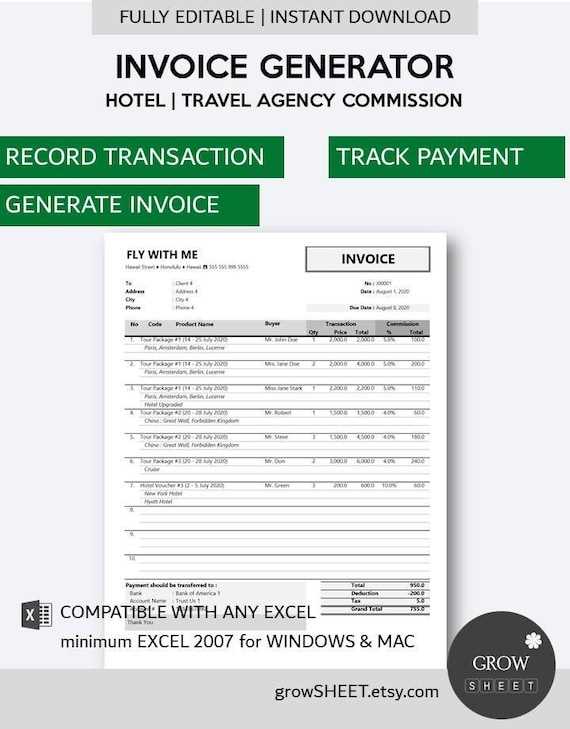

Free vs Paid Invoice Templates

When choosing a format for creating your billing documents, you have two main options: free or paid solutions. Both have their advantages, but understanding the differences can help you make the right decision for your business needs. While free options may be accessible and simple, paid alternatives often provide additional features and customization options that can better support more complex requirements.

Free Templates

- Cost-Effective – Free options are ideal for businesses on a tight budget, providing basic functionality without any upfront costs.

- Basic Functionality – These are usually simple documents that cover essential billing needs, such as service descriptions, pricing, and payment terms.

- Limited Customization – Free formats often have fewer customization options, which may limit your ability to tailor the design to your branding or specific business needs.

- Quick and Easy Access – Free formats are widely available and easy to download or use immediately, making them a fast solution for businesses that need to get started quickly.

Paid Templates

- Enhanced Features – Paid versions often come with more advanced features, such as automated calculations, multi-currency support, and integrated payment gateways.

- Greater Customization – These options allow for more flexibility in design and content, helping you create a more polished and personalized billing statement that reflects your brand identity.

- Professional Support – With paid solutions, you typically gain access to customer service or technical support, which can be invaluable if issues arise or you need assistance with customization.

- Time-Saving Automation – Many paid formats offer automated reminders, recurring billing, and other time-saving tools that streamline your invoicing process.

Choosing between free and paid formats ultimately depends on the size and needs of your business. If you’re just starting out or have minimal billing requirements, free options may suffice. However, for businesses that require more advanced features, better customization, and a more professional appearance, investing in a paid solution may be the best choice.

Choosing the Right Format for Your Invoice

Selecting the appropriate structure for your billing document is essential for both operational efficiency and professionalism. The right format should meet your business’s specific needs while ensuring that clients can easily understand the charges. Whether you choose a simple, straightforward document or a more detailed one with advanced features, the format you select will play a crucial role in how effectively you communicate with your clients and manage payments.

Factors to Consider

- Business Size and Complexity – Small businesses with straightforward services may require a simple format, while larger companies or those offering a variety of services may benefit from a more complex layout.

- Client Needs – Understand your clients’ preferences and needs. For instance, some clients may prefer detailed breakdowns, while others may appreciate a concise summary.

- Legal and Tax Requirements – Ensure the chosen format complies with any local legal or tax obligations, such as including VAT numbers, tax rates, or other legally required information.

- Branding – The document should reflect your company’s identity, including your logo, color scheme, and font style to present a consistent and professional image.

Format Comparison

| Format Type | Advantages | Considerations | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Basic Structure | Simple, easy to create, ideal for small businesses or basic services. | Limited customization options and less flexibility for complex services. | |||||||||||||||||||||||||

| Detailed Format | Allows for more customization, ideal for businesses offering multiple services or products. | Can be more time-consuming to set up and may overwhelm clients if too detailed. | |||||||||||||||||||||||||

| Automated Format | Time-saving features like automatic calculations, reminders, and

How to Include Payment TermsClearly defining payment terms in your billing documents is essential for maintaining transparency and avoiding misunderstandings with your clients. Payment terms outline the expectations regarding when payments are due, how they should be made, and any penalties for late payments. Including these details in every financial statement ensures that both parties are on the same page and helps you manage cash flow more effectively. When drafting your payment terms, it’s important to make them specific, clear, and easy to understand. Below are key aspects to consider when including payment terms in your documents. Key Elements of Payment Terms

Tips for Clear Payment Terms

By establishing clear payment terms and including them in each billing statement, you help set the right expectations with your clients, making the payment process smoother and reducing the risk of delayed payments. Best Practices for Professional InvoicesCreating a professional billing document is essential for building trust and ensuring smooth financial transactions with your clients. A well-designed statement not only reflects your business’s professionalism but also minimizes misunderstandings and helps you get paid on time. In this section, we’ll discuss key best practices to ensure your billing documents are clear, accurate, and professional. Key Elements of a Professional Billing Document

Table of Best Practices

By following these best practices, you ensure that your billing documents convey professionalism, accuracy, and clarity. Not only will this h Creating a Consistent Billing SystemEstablishing a reliable and organized method for managing billing is crucial for maintaining a smooth cash flow and fostering positive relationships with clients. A consistent system ensures that every transaction is recorded accurately, payments are tracked efficiently, and the overall process is streamlined. By setting up a standardized approach, you can reduce errors, improve client communication, and make the entire process more predictable and manageable. Steps to Build a Reliable Billing System

Benefits of Consistency

By creating a consistent billing system, you can ensure smoother operations, increase client satisfaction, and make financial management easier. The more predictable and transparent your process, the more likely you are to build a How to Calculate Travel Fees CorrectlyAccurately calculating service fees is crucial for ensuring that both your business and your clients are on the same page regarding payment expectations. Whether you are charging for bookings, transportation, or any other service, it’s essential to understand how to determine the correct costs to avoid misunderstandings or errors. Below are steps and key considerations for calculating fees that reflect both your service value and the needs of your clients. Steps for Calculating Service Fees

Common Fee Types to Consider

By understanding these basic principles and consistently applying them, you can ensure that your service fees are calculated fairly and transparently, helping you maintain profitability while kee What Information Should Be on Your InvoiceEnsuring that your billing document contains all the necessary details is essential for smooth transactions and clear communication with your clients. The right information helps avoid confusion, ensures legal compliance, and guarantees that payments are processed correctly. Below are the key elements you should include in every billing statement to ensure completeness and professionalism. Essential Information to Include

Additional Information to Consider

Including all relevant information in your billing statement not only ensures clarity and transparency but also helps prevent disputes and delays in payment. A well-detailed document reflects professionalism and can build stronger, trust-based relati Legal Requirements for Travel InvoicesWhen creating a billing document, it’s crucial to ensure that it complies with all relevant legal regulations. Properly formatted and accurate billing statements not only help you stay organized but also protect your business in case of disputes. Different jurisdictions may have varying requirements, but certain core elements are universally necessary for legal compliance. Below, we will explore the essential legal aspects of billing documents and the necessary information you must include to ensure compliance. Core Legal Elements of a Billing Document

Compliance Considerations

By including these critical elements in your billing documents, you not only comply with legal requirements but also maintain professionalism and clarity in your financial transactions. Each of these steps helps reduce potential conflicts and ensures that both your business and your clients Common Mistakes in Travel InvoicesBilling documents play a critical role in ensuring smooth transactions between businesses and clients. However, several common errors can occur when preparing these documents, potentially leading to confusion, delays in payment, or even legal issues. Being aware of these mistakes and learning how to avoid them is key to maintaining a professional and efficient billing process. Frequent Errors to Avoid

Consequences of Mistakes

By avoiding these common mistakes, you can ensure that your billing documents are clear, accurate, and legally compliant. Taking the time to review each document before sending it helps maintain professionalism and improves client satisfaction while also safeguarding your business’s reputation. How to Send an Invoice to ClientsSending a billing document to clients is more than just an administrative task; it’s an essential part of maintaining clear communication and ensuring timely payments. The way you send these documents can affect the client’s perception of your business and the efficiency of the transaction. Whether you choose to deliver it electronically or via physical mail, there are certain best practices to follow to ensure professionalism and avoid delays. Methods for Sending Billing Documents

Best Practices for Sending Billing Documents

By following these practices, you ensure that Managing Payment Due DatesEffectively managing payment due dates is a critical component of maintaining healthy cash flow and ensuring that payments are made on time. Setting clear deadlines for when payments are expected and establishing a system to monitor these deadlines can help you avoid late payments and minimize administrative headaches. Properly communicating payment due dates to clients, as well as setting realistic expectations, is essential for both parties to avoid confusion or disputes. Best Practices for Setting Payment Deadlines

Tracking Payment Deadlines

By establishing clear payment deadlines and using tools to track and remind clients of their obligations, you can create a more predictable and streamlined payment process. This reduces the risk of late payments and helps maintain your business’s financial stability. Tracking and Storing Invoices EfficientlyProperly tracking and storing financial documents is crucial for maintaining organization and ensuring that your business operations run smoothly. By implementing effective systems to monitor payments and securely store records, you can easily access important documents when needed, minimize errors, and stay compliant with tax regulations. An organized system for managing these documents can save time, reduce stress, and improve overall business efficiency. Methods for Tracking Financial Documents

Best Practices for Storing Financial Records

By implementing an efficient system for tracking and storing financial records, you can maintain order and have peace of mind knowing your important documents are easily accessible and secure. This approach not only saves time but also ensures your business can operate smoothly and remain compl Improving Client Relationships Through InvoicingHow you handle billing documents can significantly impact your relationship with clients. Clear, professional, and timely communication in your billing process fosters trust and strengthens client satisfaction. When clients feel confident that their financial transactions are handled smoothly and accurately, they are more likely to continue working with your business and recommend your services to others. Building Trust Through Transparency

Enhancing Communication and Responsiveness

By focusing on clarity, professionalism, and timely communication, you can turn the billing process into an opportunity to reinforce and enhance your relationship with clients. An efficient and respectful approach to financial dealings ensures that clients feel valued, which can lead to long-term partnerships and positive word-of-mouth for your business. |