Free Transport Invoice Template Excel for Easy Billing

Managing finances in the logistics industry can be complex, but having the right tools can significantly simplify the process. Accurate documentation and clear payment records are essential for smooth business operations. One of the most effective ways to handle this task is through structured billing systems that can be easily customized and tracked. With the right approach, managing client payments and service details becomes more streamlined and efficient.

Customizable billing formats provide flexibility, allowing businesses to tailor their documents to suit different needs and ensure all relevant data is included. Whether you’re handling freight services or fleet management, having a detailed and easy-to-edit file is crucial for both small companies and larger enterprises.

By using digital formats, companies can reduce human error, improve consistency, and save time on repetitive administrative tasks. Such solutions offer an accessible way to organize financial transactions while maintaining professional standards and accuracy in every document issued.

Understanding Billing Documents for Logistics Services

In the logistics industry, clear and efficient documentation is essential for managing payments, services, and customer expectations. A well-structured financial record helps businesses keep track of transactions and ensures transparency in their operations. Such documents not only provide an overview of services rendered but also ensure compliance with regulatory standards, making it easier to handle accounting and client communication.

Key Components of a Complete Billing Record

A comprehensive billing document typically includes several key elements to ensure both parties–service providers and clients–are on the same page. These components make the financial transaction clear and easily verifiable.

| Component | Description |

|---|---|

| Service Details | Describes the specific services provided, including type, quantity, and duration. |

| Client Information | Includes the client’s name, address, and contact details for clear identification. |

| Cost Breakdown | Itemizes the charges for each service, including taxes and additional fees, if applicable. |

| Payment Terms | Details on due dates, payment methods, and any discounts or late fees. |

| Unique Reference Number | A tracking number to ensure the document is easily identifiable in future correspondence. |

Why Such Documents Matter

Having a structured financial document helps avoid confusion and potential disputes with clients. It serves as an official record of the agreed-upon services and costs, which can be referenced at any time. Additionally, these documents make it easier for businesses to track payments, manage their cash flow, and prepare for audits or financial assessments.

Why Use Spreadsheets for Billing Documents?

Spreadsheets are one of the most popular tools for creating and managing financial documents, thanks to their versatility and user-friendly nature. They offer businesses the ability to customize their billing systems, track transactions, and organize payment data all in one place. Whether you’re managing small-scale operations or large client lists, spreadsheets provide an efficient solution to streamline administrative tasks.

Here are some reasons why using spreadsheets for billing is highly beneficial:

- Easy Customization: You can design a layout that suits your business needs, adding or removing fields as necessary.

- Cost-Effective: Most spreadsheet software is affordable or free, making it an accessible option for businesses of all sizes.

- Data Organization: You can easily organize financial data, track payments, and create a clear record of all transactions.

- Simple Calculation Tools: Built-in formulas allow for automatic calculations, reducing the risk of human error.

- Scalability: As your business grows, spreadsheets can handle an increasing amount of data without losing efficiency.

With such features, spreadsheets are an ideal solution for businesses looking to simplify their billing process while ensuring accuracy and consistency in their financial records. They are particularly useful for small to medium-sized companies that need to manage their billing without investing in more complex, costly software.

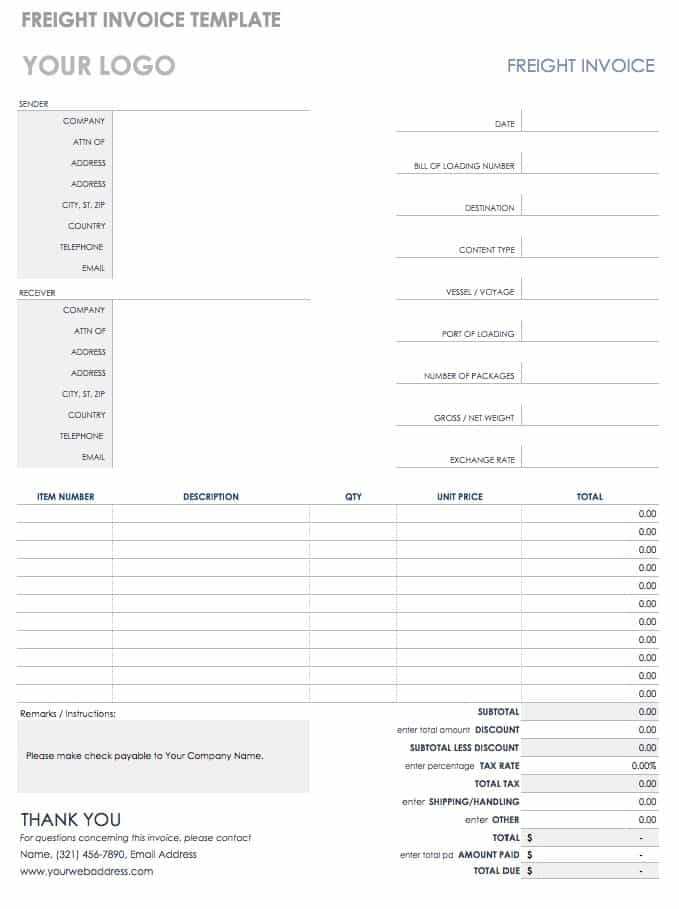

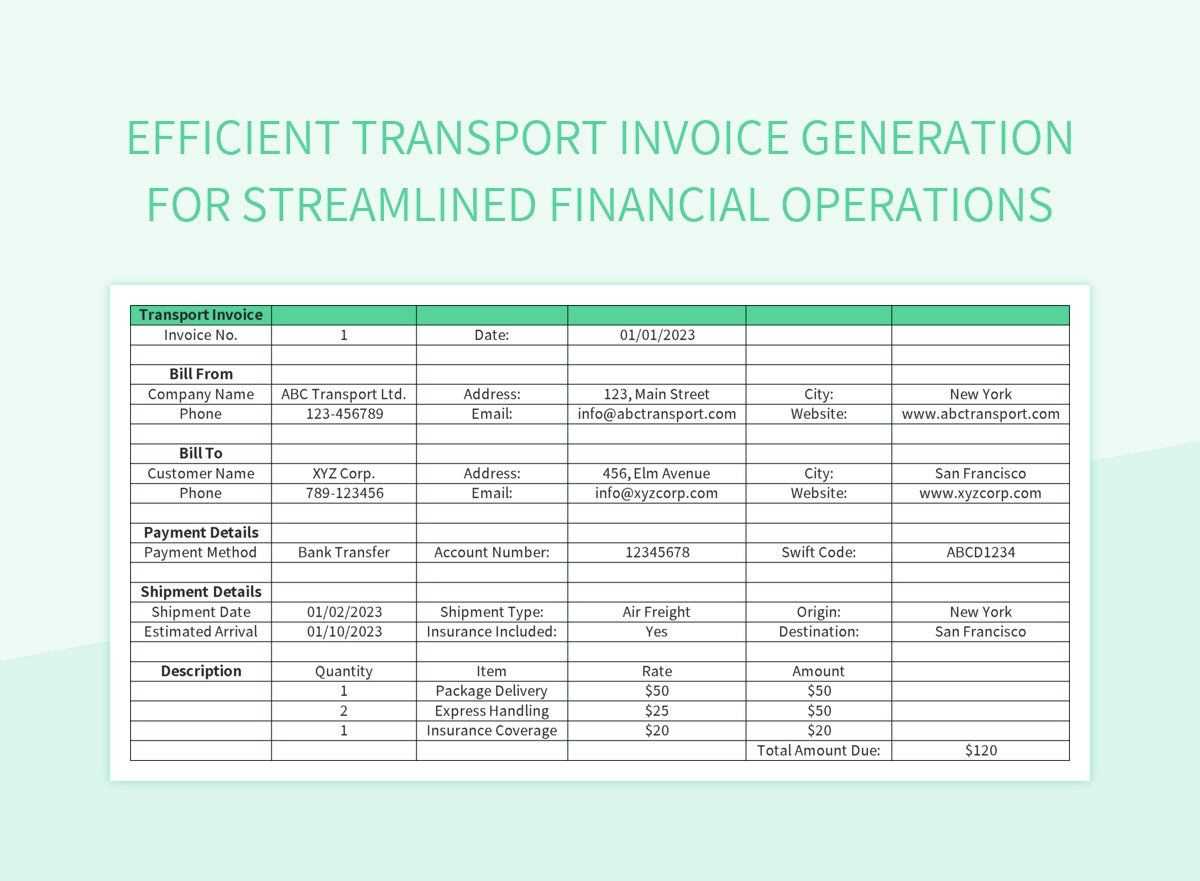

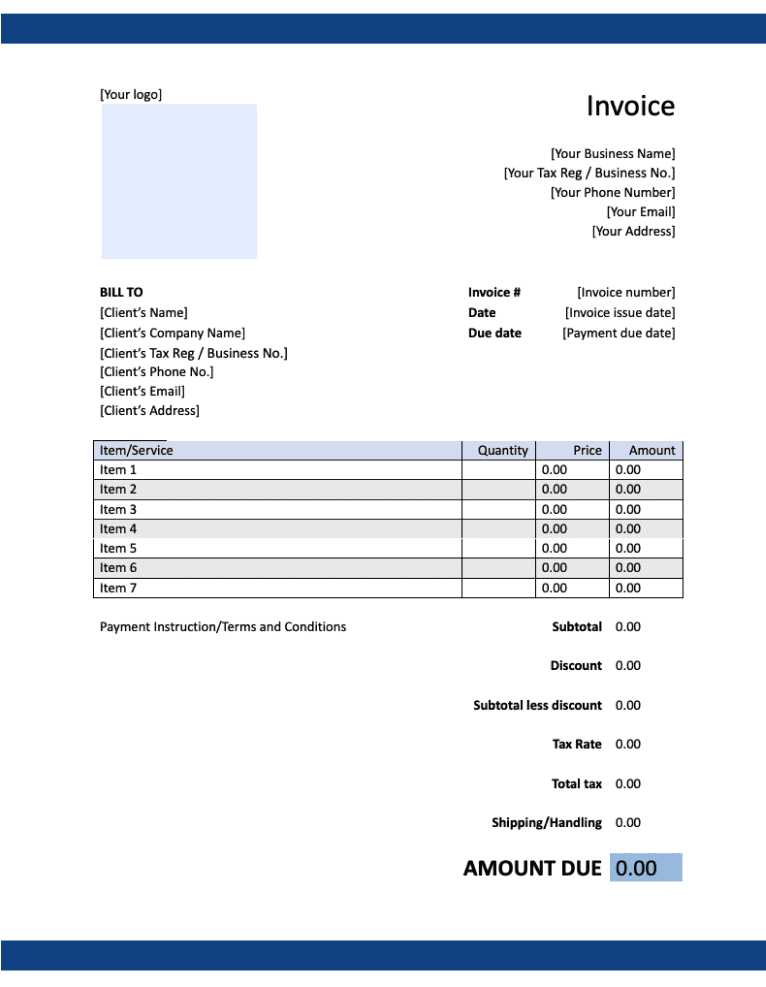

Key Features of a Billing Document for Logistics

When creating a financial record for logistics services, it is important to include specific details that ensure clarity and accuracy. A well-designed document not only outlines the charges but also includes necessary information to prevent misunderstandings and facilitate smooth transactions. These key elements make the document functional and ensure that both the service provider and client are aligned on the terms of the agreement.

Essential Information to Include

For a financial document to be comprehensive, it must contain several critical elements:

- Service Description: Clear details of the services provided, including type, quantity, and any additional specifications.

- Cost Breakdown: A detailed list of charges, including base rates, taxes, and any additional fees associated with the service.

- Client and Provider Information: Accurate details of both the client and service provider, including addresses and contact details.

- Payment Terms: Information regarding the due date, accepted payment methods, and any penalties for late payment.

- Reference Number: A unique identifier for the document, useful for tracking and future references.

Why These Features Matter

Including these elements ensures that all relevant details are easily accessible and clearly presented. It helps prevent confusion between parties, facilitates faster payment processing, and ensures compliance with any legal or regulatory requirements. A complete and professional document can also enhance the company’s image and build trust with clients by demonstrating attention to detail and professionalism.

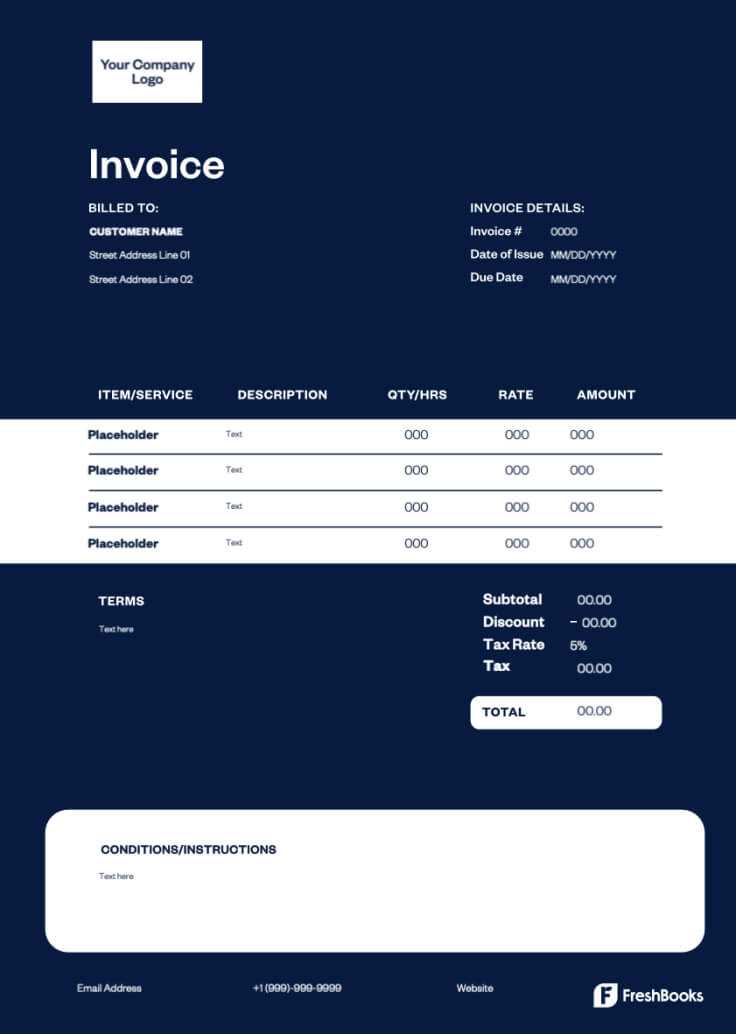

Benefits of Customizable Billing Documents

Having the ability to adjust financial documents to suit specific business needs offers numerous advantages. Customization allows companies to create documents that align with their brand, business model, and operational requirements. This flexibility enhances efficiency, reduces errors, and ensures that all necessary information is included in each transaction.

Tailored to Your Business Needs

Customizable documents allow businesses to modify various sections based on the services provided or the type of client they are dealing with. This flexibility ensures that every document is relevant and contains only the necessary details. For example, small businesses can use simple formats, while larger organizations may require more detailed records with additional fields.

- Brand Consistency: Customize the layout, colors, and logos to match your brand identity, improving professionalism.

- Specific Service Details: Add or remove fields that reflect your business offerings, ensuring no information is overlooked.

- Flexible Payment Terms: Easily adjust payment schedules, terms, or discounts based on client agreements.

Improved Efficiency and Accuracy

Customizable documents help streamline the billing process by making it easier to input relevant data and perform calculations. This reduces the chances of mistakes and speeds up the document creation process. In addition, having pre-built formats for regular use saves valuable time and effort, allowing staff to focus on other important tasks.

- Automated Calculations: Built-in formulas ensure accurate calculations for taxes, totals, and discounts, reducing human error.

- Consistency: Use the same format for every transaction, maintaining uniformity across all records.

- Faster Processing: Streamlined templates allow for quicker generation and distribution of documents, speeding up payment cycles.

By adopting customizable formats, businesses can optimize their financial documentation, improve client relations, and enhance operational efficiency.

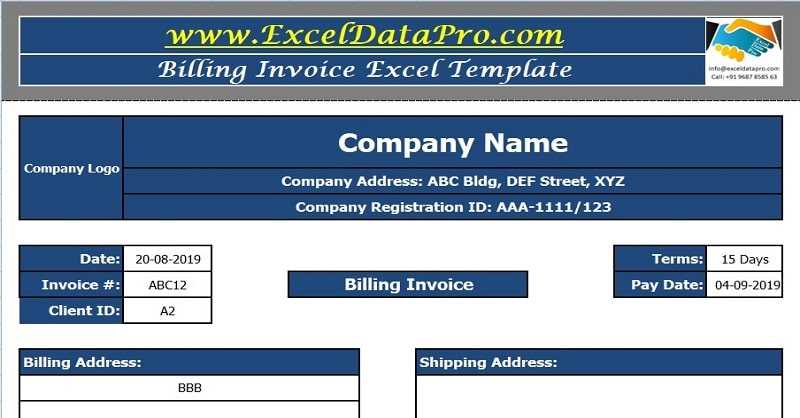

How to Create a Billing Document for Logistics Services

Creating a financial record for logistics services requires attention to detail and a structured approach to ensure that all necessary information is included. The process involves setting up a clear format, adding the appropriate fields, and ensuring that calculations are accurate. Once the document is set up, it becomes easy to generate for future transactions, saving time and reducing errors.

Step-by-Step Guide to Designing a Billing Record

Follow these steps to create an efficient and professional financial document:

- Choose a Platform: Select the software that best fits your needs, whether it’s a spreadsheet program or another tool.

- Set Up Your Layout: Start with a clean sheet and define sections such as client information, service details, and cost breakdown.

- Add Fields for Information: Include sections for the client’s name, address, payment terms, and a unique document reference number.

- Input Service Details: Add lines for describing the service, including the type, quantity, and any additional specifications related to the job.

- Calculate Charges: Include fields to list rates, taxes, and any discounts. Use formulas to calculate totals automatically.

- Finalize Payment Terms: Clearly define when payment is due, accepted methods, and any penalties for late payments.

- Double-Check Accuracy: Ensure all information is accurate, especially calculations, to avoid future disputes or confusion.

Additional Tips for a Professional Document

To create a polished and professional financial record, consider the following:

- Consistency: Use the same format for all documents to ensure uniformity and easy recognition.

- Branding: Incorporate your logo, business name, and colors to create a branded look that enhances professionalism.

- Clarity: Ensure all sections are clearly labeled, and the text is easy to read and understand, reducing the risk of confusion.

Once you’ve created the document, save it for future use. Customizing it for your needs and saving it in a reusable format will allow you to quickly generate new records as your business grows.

Essential Information for Logistics Billing Documents

To ensure clarity and transparency in financial records, it is crucial to include specific details that outline the services provided and the corresponding charges. These elements not only protect both parties involved but also streamline payment processing. A complete and well-organized document reduces the chance of errors and disputes, making it easier to track and manage financial transactions.

Key Details to Include in Each Record

For a comprehensive billing document, the following information should always be present:

- Client Information: Name, address, and contact details for accurate identification.

- Service Description: A clear breakdown of services provided, including quantities, dates, and relevant details.

- Cost Breakdown: Itemized charges for each service, along with applicable taxes and additional fees.

- Payment Terms: Payment due date, accepted methods, and penalties for late payments.

- Unique Reference Number: A unique code to help track and manage the record.

- Service Provider Information: Business name, address, and contact information to identify the party providing the service.

Why This Information Matters

Including these key components ensures that the document serves as an official and verifiable record of the transaction. Having all relevant details prevents misunderstandings, facilitates faster payments, and helps maintain strong business relationships. Moreover, these elements assist in bookkeeping and financial management, making it easier to reconcile accounts and maintain compliance with industry standards.

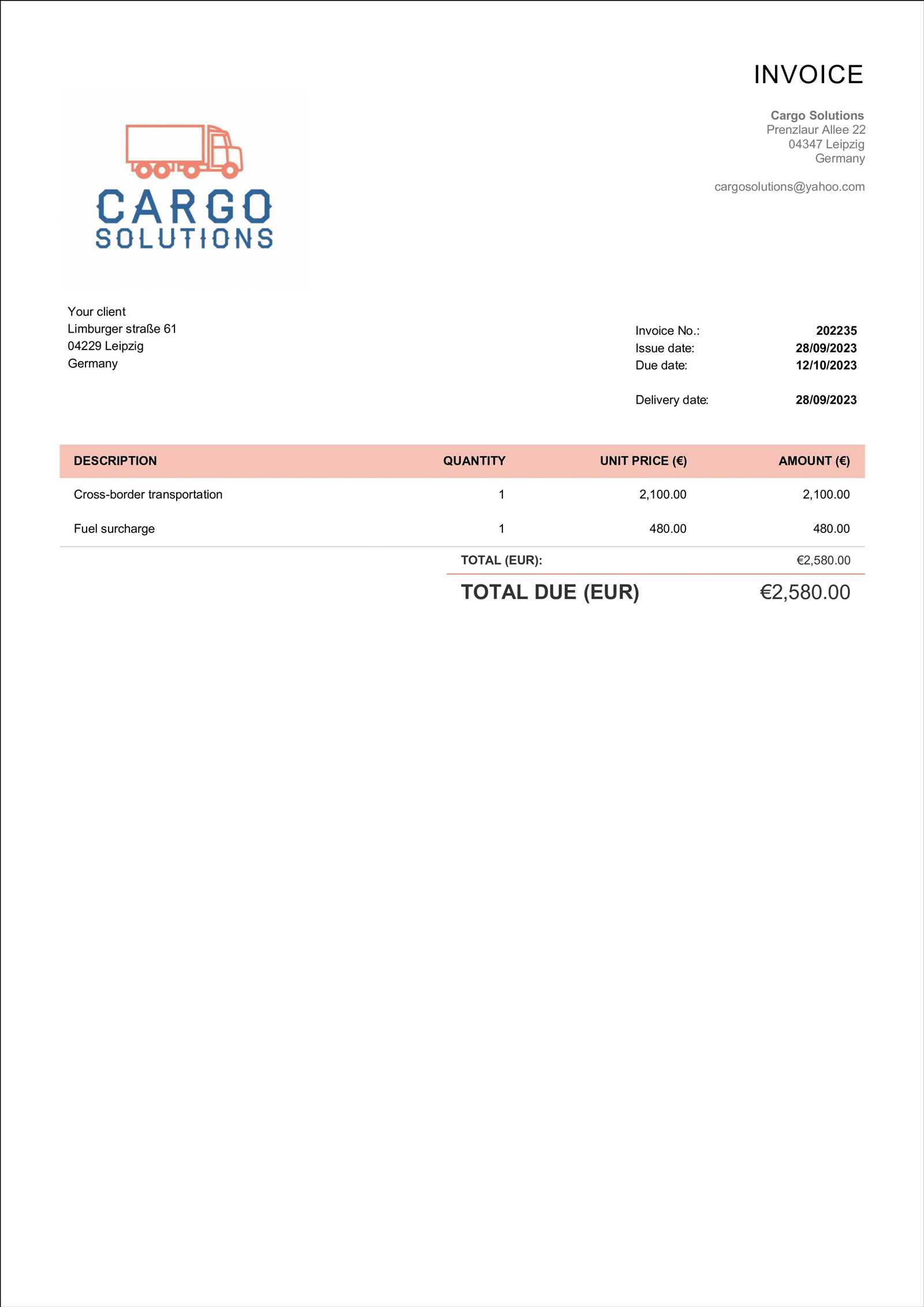

Common Mistakes to Avoid in Billing

Creating accurate financial documents is essential for maintaining good relationships with clients and ensuring timely payments. However, even small mistakes in the billing process can lead to confusion, delays, and potential disputes. By being aware of common errors, businesses can avoid costly mistakes and improve the overall efficiency of their financial operations.

Here are some of the most frequent billing mistakes to watch out for:

- Incorrect Contact Information: Failing to include accurate client details, such as the correct address or contact number, can delay payments or cause miscommunication.

- Omitting Service Details: Leaving out important descriptions of the services provided can lead to confusion about what was delivered and why specific charges were applied.

- Calculation Errors: Simple arithmetic mistakes in totals, taxes, or discounts can result in incorrect amounts being billed, which can undermine trust with clients.

- Not Including a Unique Reference Number: Without a reference number, both the client and service provider may find it difficult to track and reconcile the document in the future.

- Failure to Clarify Payment Terms: Not specifying payment deadlines, methods, and late fees can lead to misunderstandings and delayed payments.

- Inconsistent Formatting: Using inconsistent layouts or unclear labels can make it difficult for clients to understand the charges and details, potentially leading to errors in processing payments.

By carefully checking each financial record for these common mistakes, businesses can maintain a professional image, improve payment accuracy, and foster stronger relationships with clients.

Free Resources for Billing Document Templates

There are many free resources available online to help businesses create professional and accurate financial documents. Whether you’re a small business owner or a freelancer, you can find customizable files that suit your specific needs without having to invest in expensive software. These free resources provide a great starting point for designing professional records that ensure clarity and help streamline the billing process.

Where to Find Free Templates

Numerous websites offer free access to templates, allowing businesses to download and modify documents easily. Some sites provide basic versions, while others offer advanced features and customizable fields. Below are some reliable sources to consider:

| Resource | Features |

|---|---|

| Google Sheets | Free access to simple, editable billing formats that sync with your Google Drive for easy access. |

| Microsoft Office Online | Offers free, downloadable files that can be used with various spreadsheet programs and are customizable to suit your needs. |

| Template.net | Provides a wide variety of customizable formats for businesses in different industries, from simple to detailed designs. |

| Invoice Generator | Online tool that lets you create and download a simple, professional document quickly with no sign-up required. |

How to Make the Most of Free Resources

While free resources are a great starting point, it’s important to customize the documents to fit your business’s specific needs. Ensure that all relevant details are included, such as service descriptions, payment terms, and contact information. By tailoring the document to your operations, you can create more accurate and professional-looking records that improve efficiency and build trust with your clients.

How to Edit Your Billing Document

Editing a financial document to better suit your business needs can significantly improve its efficiency and accuracy. Customizing a pre-made record allows you to tailor it to the specific services you offer, include the most relevant fields, and streamline your processes. Whether you are adjusting it for a new client, a new service type, or a new pricing structure, editing your document is a crucial step in maintaining clarity and professionalism in your billing practices.

Steps to Edit Your Document

Follow these steps to effectively modify a financial record to meet your business needs:

- Open the Document: Start by opening the file you wish to edit, whether it’s a downloaded resource or a document you’ve previously created.

- Review the Existing Structure: Take a moment to review the layout and the sections that are already included. Determine if any sections need to be added, removed, or reorganized.

- Modify Client and Service Details: Adjust the client’s name, address, and service descriptions to reflect the current transaction. This may include updating itemized lists or altering quantities.

- Update Payment Terms: If there are changes to your payment terms, such as a new discount or different due dates, make sure these are clearly reflected in the document.

- Adjust Pricing and Calculations: Update the pricing, taxes, and any additional fees. Use formulas to ensure that totals and tax calculations are correct.

- Save the Document: Once you’ve made all the necessary changes, save the document with a new file name to avoid confusion with previous versions.

Tips for Efficient Editing

To ensure your document remains professional and error-free, here are some tips to keep in mind while editing:

- Consistency: Ensure that all formatting (font size, style, and layout) is consistent throughout the document for a polished look.

- Double-Check Calculations: Always double-check your calculations and ensure formulas are working correctly to avoid any discrepancies.

- Keep It Simple: Avoid overloading the document with too much information. Focus on the key details necessary for the transaction.

By following these steps and tips, you can easily modify your financial document to suit your needs and maintain a streamlined, professional billing process.

How Spreadsheet Software Simplifies Billing Management

Spreadsheet software provides businesses with a powerful and versatile tool for managing financial documents. By organizing and automating key aspects of the billing process, it helps companies save time, reduce errors, and increase overall efficiency. The flexibility and range of features in spreadsheet applications make it an ideal solution for tracking transactions, calculating totals, and generating accurate records without the need for complex software.

Here are some of the ways spreadsheet software simplifies billing management:

- Automation of Calculations: Built-in formulas allow businesses to quickly calculate totals, taxes, and discounts without manual intervention. This reduces human error and ensures accuracy.

- Data Organization: Spreadsheets allow users to easily organize information by sorting and filtering data. This makes it simple to track payments, service details, and client information in one place.

- Customizable Formats: Spreadsheet programs offer the ability to design documents according to your specific business needs. You can adjust the layout, add or remove fields, and create a format that suits your operations.

- Tracking and Reporting: Spreadsheets make it easy to generate reports based on specific criteria. For example, you can track outstanding payments, summarize monthly transactions, or identify trends in service usage.

- Cost-Effective Solution: Spreadsheet software is generally inexpensive or even free, making it an accessible tool for businesses of all sizes. There’s no need for expensive, specialized software to manage financial documents.

Overall, spreadsheet applications simplify the process of creating, organizing, and tracking financial documents, making them a vital tool for small and large businesses alike. With the right setup, you can streamline your billing workflow, ensure accuracy, and enhance your overall financial management.

Tracking Payments with Spreadsheet Templates

Efficiently tracking payments is essential for maintaining accurate financial records and ensuring that your business receives timely compensation. By using customizable documents, businesses can easily monitor paid and unpaid amounts, due dates, and outstanding balances. These tools simplify the process of tracking transactions and provide a clear overview of your cash flow, which is crucial for financial planning and decision-making.

Setting Up a Payment Tracking System

To track payments effectively, you need to set up a simple yet comprehensive system that includes the key details of each transaction. Below are the essential components to include:

- Client Information: Include the client’s name, contact details, and the reference number associated with the service provided.

- Service Details: List the services rendered, including dates and descriptions, to make it clear what each payment corresponds to.

- Payment Due Date: Clearly specify the due date for each payment, helping to manage deadlines and prevent delays.

- Amount Due and Paid: Track the total amount owed and the amount that has been paid. This ensures you can easily identify outstanding balances.

- Payment Status: Include a column for marking payment status (e.g., “Paid,” “Unpaid,” or “Pending”) for each record.

Why This Approach Works

Using a structured system to track payments has several benefits:

- Visibility: You can easily see which payments have been made and which are still pending, reducing the risk of missed or delayed payments.

- Accuracy: Automating calculations and using built-in formulas reduces errors, ensuring that totals and balances are correct.

- Organization: Storing all payment details in one organized file allows you to quickly access payment histories and generate reports for financial analysis.

- Time Efficiency: The ability to sort and filter data by date, client, or payment status saves time when reconciling accounts or preparing financial reports.

By implementing a payment tracking system using a customizable document, businesses can streamline their accounting processes, improve cash flow management, and reduce administrative overhead.

Tips for Accurate Billing in Logistics

Accurate billing is essential for maintaining clear financial records and ensuring timely payments in logistics. Small errors or inconsistencies in your records can lead to confusion, delayed payments, or even disputes with clients. By following a few best practices and tips, you can streamline the process, reduce mistakes, and improve the overall efficiency of your business operations.

Here are some important tips to keep in mind when creating billing documents for logistics services:

- Clearly Define Services: Ensure that each service provided is clearly described with details such as quantities, distances, or types of goods transported. This helps clients understand exactly what they are being charged for.

- Double-Check Calculations: Always verify that totals, taxes, and any discounts have been accurately calculated. Mistakes in math can lead to overcharging or undercharging clients.

- Set Payment Terms: Include clear terms for payment, including due dates, accepted payment methods, and any penalties for late payments. This helps manage expectations and reduces payment delays.

- Use Consistent Formatting: Consistency in formatting (e.g., fonts, layout, and structure) makes it easier for clients to read and understand the billing document. A professional presentation fosters trust.

- Incorporate Unique Reference Numbers: Assigning a unique number to each transaction helps both you and the client easily track and reference specific records. This is essential for future queries or audits.

- Keep a Record of Communications: Maintain a log of all communication with clients regarding billing. This can help resolve any issues that may arise and provide a clear history of negotiations or agreements.

By adhering to these tips, you can ensure that your billing process is smooth, accurate, and transparent. This leads to better financial management, improved client relationships, and timely payments, all of which contribute to the long-term success of your business.

Managing Multiple Clients with Billing Documents

Managing multiple clients and their corresponding records can quickly become overwhelming without a streamlined process. Using organized and reusable documents allows businesses to handle numerous clients efficiently, track individual transactions, and maintain consistency across all financial records. By customizing and managing each client’s details separately, you can ensure accuracy while minimizing the risk of errors or confusion.

Key Strategies for Efficient Client Management

Here are some strategies to effectively manage billing documents for multiple clients:

- Create Individual Records: Set up separate files or sections for each client. This ensures their information and transactions are kept distinct and easily accessible.

- Use Consistent Formatting: Use the same format for all client records to ensure consistency and easier tracking. This will help you quickly locate details and minimize confusion.

- Automate Calculations: Leverage formulas or pre-built functions to automate common calculations like totals, taxes, and discounts. This saves time and ensures accuracy for each client.

- Include Client-Specific Details: Customize each document to reflect unique information for the client, such as payment terms, service descriptions, and agreed rates.

- Track Due Dates: Keep track of payment due dates and any outstanding balances for each client. This will help you stay organized and prompt clients for payments on time.

Tools for Better Client Organization

To further improve client management, consider the following tools and tips:

- Use Filters and Sorting: If you’re working with a large number of clients, use the sorting and filtering features to group records by due date, payment status, or client name for easy access.

- Maintain a Master List: Create a master document or spreadsheet to track all clients, their payment status, and any important notes. This helps you stay on top of multiple accounts at once.

- Utilize Templates for Quick Setup: Save time by creating a standard structure for your documents, allowing you to quickly customize each one based on the client’s needs.

By following these strategies, you can effectively manage multiple clients without compromising on accuracy or efficiency. A well-organized system not only saves time but also helps foster better relationships with clients, as you can provide clear, timely, and professional records.

Automating Billing Document Creation

Automating the creation of financial records can save businesses significant time and effort. By setting up systems to generate billing documents automatically, you reduce manual work, minimize human error, and ensure consistency across all records. Automation tools, such as formulas, macros, and predefined structures, allow businesses to quickly generate accurate documents while focusing on other important tasks.

Here’s how you can automate the creation of billing documents:

Setting Up Automation for Billing Documents

There are several ways to automate different aspects of creating financial records:

- Use Formulas for Calculations: Automate the calculation of totals, taxes, and discounts by using formulas. These formulas will update automatically as you input new data, ensuring accuracy without needing to manually calculate each time.

- Predefined Fields: Set up predefined fields for standard client information, services, and payment terms. Once filled out, the document will be automatically populated with all the required details, reducing the need to enter the same information repeatedly.

- Utilize Macros: Macros can automate repetitive tasks such as formatting, adding rows, or applying specific calculations. Recording a macro once will allow you to apply the same actions with a simple click, saving time on future documents.

- Create Drop-Down Menus: For services or payment terms that are often repeated, create drop-down menus for easy selection. This will allow you to quickly insert the correct data without typing it out each time.

- Template Customization: Customize a document layout that fits your specific business needs, and use it as a starting point for each new record. By automating document creation, you eliminate the need to start from scratch each time.

Benefits of Automating Billing Documents

Automating your billing process offers several key advantages:

- Efficiency: Automation speeds up document creation, allowing you to generate records faster and process more transactions without extra effort.

- Consistency: With automated fields and calculations, every document follows the same structure and format, ensuring consistency across all your records.

- Reduced Errors: By automating calculations and data entry, you reduce the likelihood of human error, ensuring that all figures are correct and up to date.

- Time Savings: Automation frees up time by reducing the need for manual input, giving you more time to focus on other critical areas of your business.

By setting up automated processes for creating billing documents, you can streamline your operations, improve accuracy, and ensure your business runs smoothly and efficiently.

Security Considerations for Financial Documents

When handling sensitive financial data, it’s crucial to ensure that documents are protected from unauthorized access, tampering, or loss. Financial records, including those used for billing and payments, often contain personal information, payment details, and other private data. Safeguarding these documents is essential to prevent fraud, ensure compliance with regulations, and maintain the trust of clients and partners.

Here are some important security measures to consider when working with financial documents:

Protecting Documents with Passwords

One of the most effective ways to secure your documents is by setting up strong passwords to restrict access. Here’s how to implement password protection:

- Set a Strong Password: Use complex and unique passwords that include a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information, such as names or birthdates.

- Limit Access: Only share the password with individuals who absolutely need access to the document. Avoid sending passwords through unsecured channels like email.

- Use Encryption: In addition to password protection, consider encrypting the file to add an extra layer of security, ensuring that even if the file is accessed, its contents are unreadable without the proper decryption key.

Maintaining Data Integrity

Ensuring the integrity of your financial records is vital. Here are some ways to maintain the authenticity of your documents:

- Use Version Control: Keep track of document versions to ensure you are working with the latest data. This also allows you to revert to previous versions if needed.

- Limit Editing Rights: Grant editing access only to authorized individuals. You can use features like “view-only” mode or “read-only” permissions to prevent unauthorized changes.

- Enable Document Backups: Regularly back up your financial records to secure cloud storage or external drives to prevent data loss due to accidental deletion, corruption, or hardware failure.

Ensuring Secure Sharing

When sharing financial documents with clients, vendors, or team members, it’s essential to use secure methods:

- Use Secure Sharing Platforms: Share documents through trusted, encrypted platforms like secure cloud services rather than email, which can be vulnerable to interception.

- Set Expiry Dates: When sharing sensitive financial data, use features that allow you to set expiration dates for shared links. This ensures that access is time-limited and reduces the risk of unauthorized access later.

- Monitor Access Logs: Many document-sharing platforms provide logs that allow you to track who accessed the document and when. Monitoring these logs helps you detect any suspicious activity.

By implementing these security measures, businesses can protect their financial documents from unauthorized access, tampering, and loss. This helps ensure the confidentiality of sensitive information and the trustworthiness of

Where to Find Professional Document Layouts

For businesses looking to streamline their record-keeping processes, professional layouts can make the task significantly easier. Whether you’re looking for pre-designed structures for financial records or customizable options that suit your needs, there are various platforms offering these solutions. Using such resources not only saves time but also ensures consistency and accuracy in your financial documentation.

Here are some of the best places to find high-quality document layouts:

| Platform | Features | Cost |

|---|---|---|

| Microsoft Office Templates | Pre-designed layouts for various business needs, easy customization | Free |

| Google Docs & Sheets | Cloud-based templates with collaboration features, free to use | Free |

| Template Websites (e.g., Template.net, Templatemonster) | Wide variety of professional designs, industry-specific options | Paid (with free samples available) |

| Canva | Visually appealing designs with customization options, user-friendly | Free (Premium options available) |

| Envato Elements | Premium templates with extensive customization, regularly updated | Paid (Subscription required) |

These platforms provide a range of professional layouts that can be customized to fit specific business requirements. Whether you need something simple or complex, these resources can help you find the right design to enhance your documentation process.