How to Create a Transfer Invoice Template in QuickBooks

Managing financial records is a crucial aspect of any business. Ensuring that you can quickly create and customize key documents for your transactions helps streamline processes and maintain accurate records. Whether you’re sending statements, receipts, or payment confirmations, it’s important to have a reliable system in place that saves time and minimizes errors.

By leveraging automated solutions, you can create professional documents tailored to your needs. These tools allow you to easily customize the layout and content, ensuring that each record is accurate and aligned with your branding. With the right setup, generating important paperwork becomes a seamless task that integrates well into your overall financial management system.

In this guide, we’ll walk you through how to efficiently design and use custom documents for your business needs. From setting up to sending, you’ll learn how to take advantage of the available features that improve efficiency and keep your financial records in top shape.

Transfer Document Management System for Your Business

Efficiently handling business records is essential for maintaining organization and financial accuracy. Having a system that allows you to generate essential paperwork tailored to your specific needs can save time and reduce human error. With modern tools, creating customized transaction documents becomes a seamless task, ensuring everything is prepared professionally and ready for clients or internal use.

Why Customizing Documents Matters

Personalizing your transaction records ensures that they reflect your company’s identity and meet your specific requirements. Whether it’s adjusting layouts, adding logos, or modifying fields, customization options enable you to produce documents that are both functional and aligned with your business practices.

Key Features for Document Creation

- Easy Customization: Quickly adjust fields, text, and branding elements to match your needs.

- Automation: Generate documents automatically based on transaction data, reducing manual entry.

- Integration: Sync with payment systems for real-time updates and accurate information.

- Record Keeping: Keep all generated documents organized for easy retrieval and future reference.

By utilizing the right features in your document creation system, you can ensure that all records are professional, accurate, and delivered in a timely manner. Customization tools make it possible to tailor your transaction paperwork to suit various business models and financial needs.

Why Use a Document for Transaction Tracking

Properly documenting financial exchanges is essential for smooth business operations. By using the right tools to generate transaction records, you ensure that all the details are captured accurately and consistently. This not only helps with internal record-keeping but also makes it easier to manage payments and track outstanding balances.

Benefits of Using Customized Records

- Improved Accuracy: Automating the process reduces human error, ensuring all information is correctly recorded.

- Time Efficiency: Quickly generate standardized forms without having to manually input data each time.

- Professionalism: Create polished, branded documents that reflect your business’s image and credibility.

- Clear Communication: Provide your clients with easy-to-understand documents that detail all necessary transaction information.

How It Enhances Financial Management

- Real-Time Tracking: Automatically update and monitor payments as soon as they are made or received.

- Organization: Keep all your business records in one place for quick access and review when needed.

- Easy Auditing: Maintain well-organized documentation that simplifies financial reviews or tax filing.

Incorporating automated document generation into your workflow ensures that every transaction is properly recorded and that your business maintains full control over its financial data.

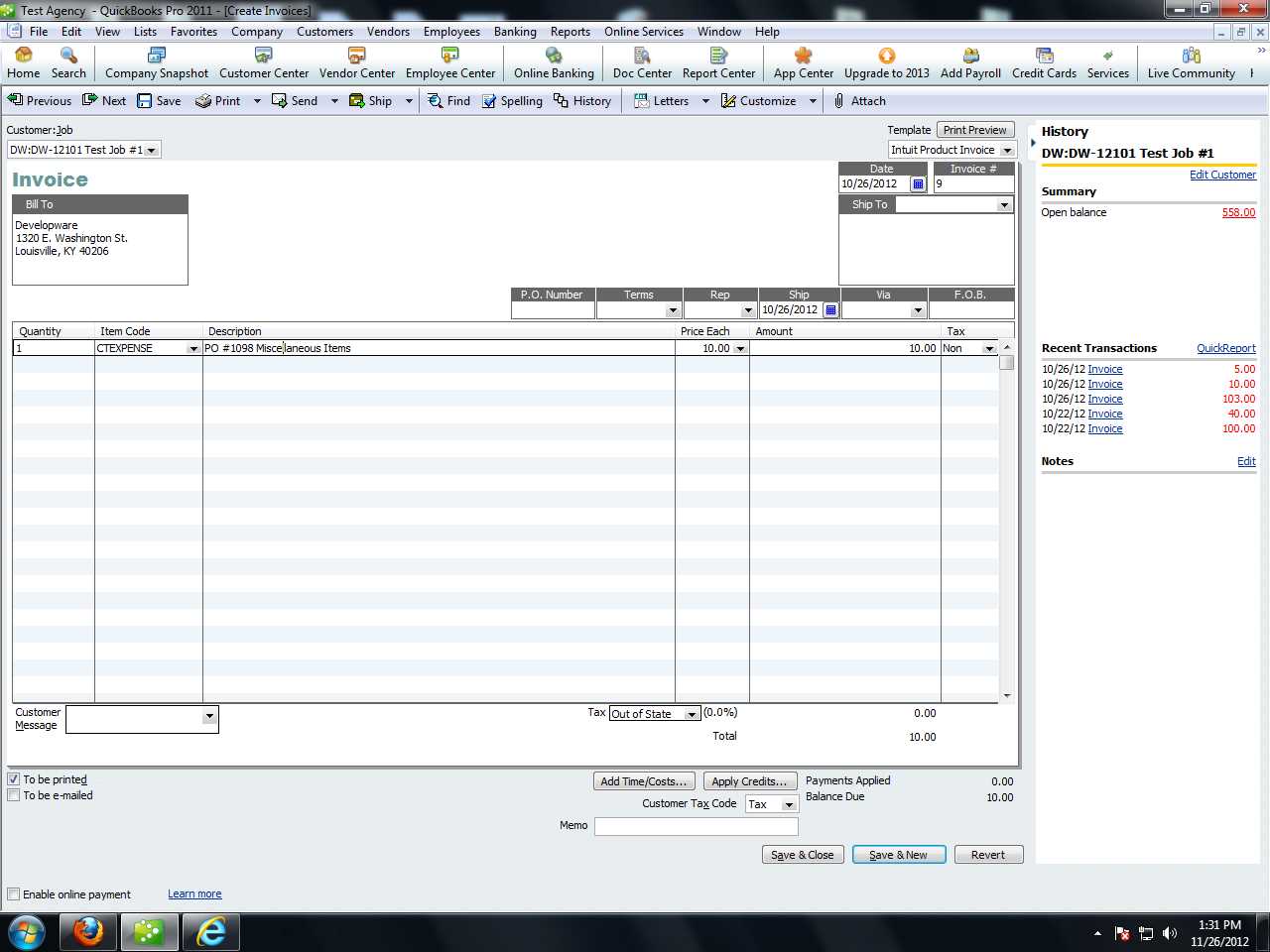

Understanding the Basics of QuickBooks Invoices

Creating professional transaction records is a key part of managing business finances. These documents are used to capture essential information about the goods or services provided, including pricing, dates, and payment terms. Understanding how to use the tools available for generating these records will help ensure your transactions are well-documented and easy to track.

Key Elements of Financial Documents

When generating transaction records, certain fields need to be filled out in order to provide a complete overview of the transaction. These elements typically include:

- Client Information: Name, contact details, and address.

- Transaction Details: List of items, quantities, and prices.

- Dates: Transaction date and payment due date.

- Payment Terms: Conditions on when and how payment should be made.

Automating Document Creation

Using a streamlined system to generate these records makes it possible to automate much of the data entry. This helps reduce errors, speed up the process, and ensures consistency in your documentation. Here’s how automation benefits you:

- Efficiency: Create and send multiple records with minimal effort.

- Accuracy: Automatically populate customer and item details from your database.

- Consistency: Maintain a standard format across all documents for a professional appearance.

By mastering the basics of creating financial records, you can simplify your workflow and stay organized. This foundational knowledge will make it easier to manage accounts, track payments, and ensure timely follow-up with clients.

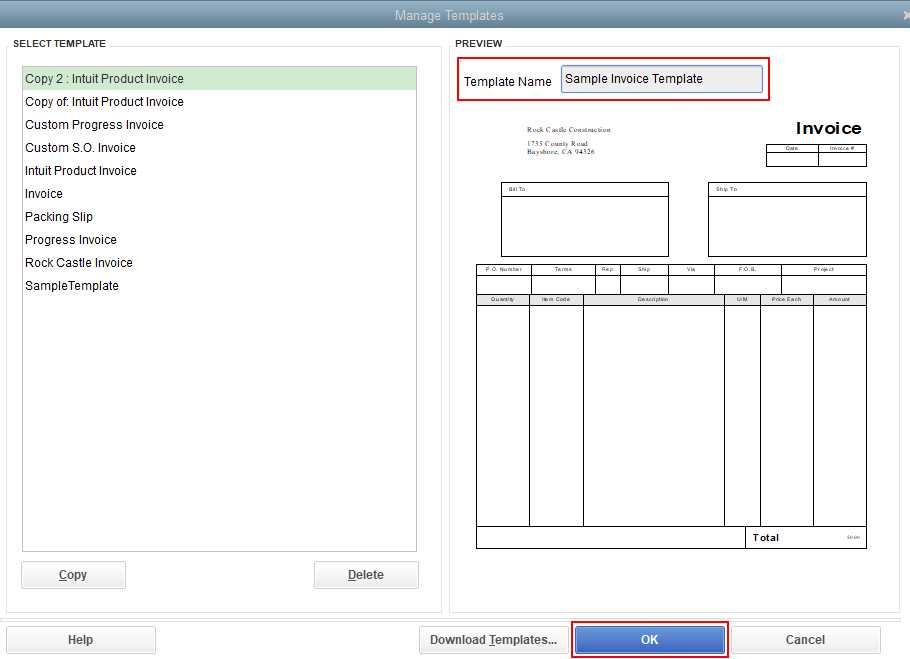

How to Create Custom Documents in Your Financial System

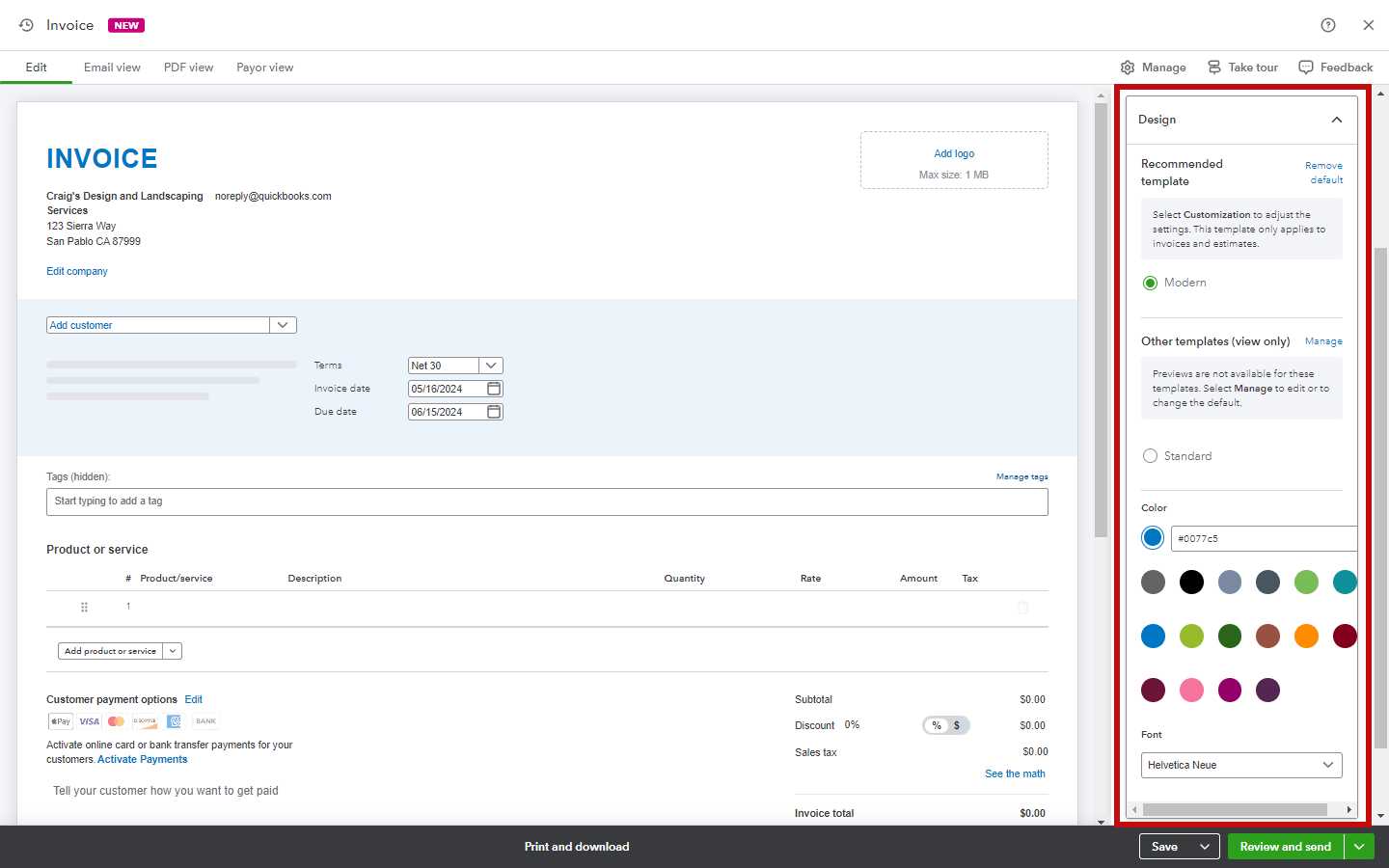

Customizing your transaction records allows you to tailor each document to your specific needs. With the right tools, you can adjust the format, include necessary fields, and even add branding elements to ensure that each record reflects your business identity. Creating custom forms also makes it easier to manage transactions in a way that suits your workflow and client interactions.

Steps to Personalize Your Transaction Records

Follow these simple steps to create and modify your documents for your business:

- Access Document Settings: Navigate to the document creation section of your system and choose to create a new record.

- Choose a Layout: Select from pre-designed layouts or start from scratch for more control over the design.

- Customize Fields: Modify sections such as client information, payment terms, and item descriptions based on your specific needs.

- Add Branding: Upload your logo and adjust fonts or colors to match your business branding.

- Save and Apply: Save your custom format and apply it to future transactions for consistency.

Tips for Effective Customization

- Keep It Simple: Ensure the layout is clear and easy to read to avoid confusion for your clients.

- Use Consistent Branding: Use the same logo, fonts, and colors across all documents for a professional appearance.

- Include All Necessary Information: Always ensure that essential details such as payment terms, dates, and transaction descriptions are clearly visible.

- Save Time: Once you’ve customized your form, save it as a default for future use, eliminating the need to adjust it every time.

Creating custom transaction records is a straightforward process that provides you with the flexibility to meet your unique business needs. By following these steps, you ensure that your documents are both functional and aligned with your brand’s image.

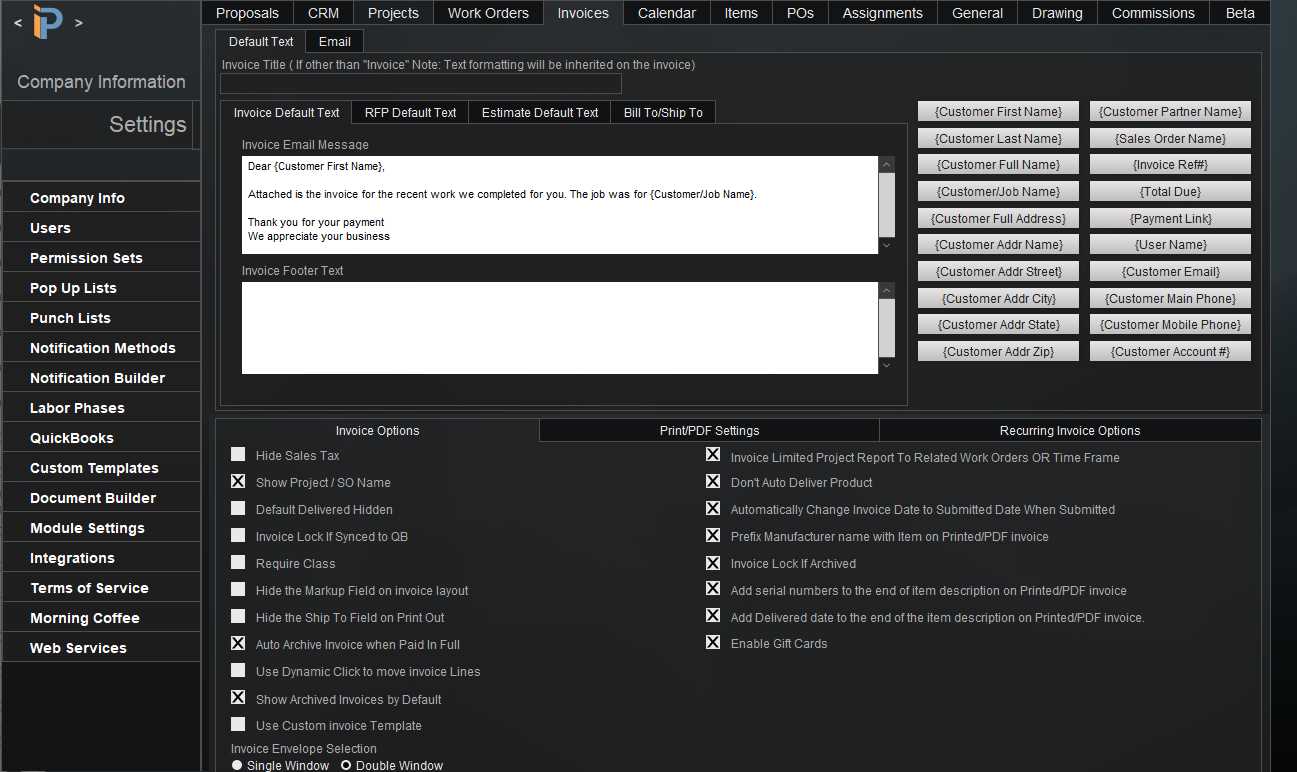

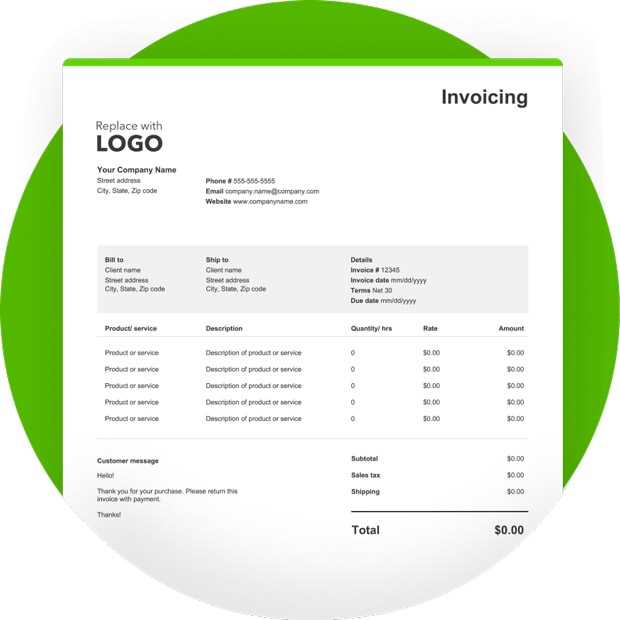

Setting Up Custom Document Formats for Transactions

Having a well-organized system to manage transaction records is essential for maintaining consistency and efficiency. By setting up a standardized structure for your business documents, you ensure that each transaction is documented in the same format, reducing errors and saving time. Customizing these records allows you to align the format with your business needs, making it easier to handle payments, manage orders, and communicate with clients.

Steps to Configure Your Document Structure

To create a custom format for your business documents, follow these steps:

- Access the Document Settings: Locate the section in your software where you can manage document layouts and create new formats.

- Select a Base Layout: Choose a default layout that fits your needs, or start with a blank layout for full customization.

- Customize the Layout: Add and remove fields as necessary. Include details such as client name, item description, quantities, prices, payment terms, and dates.

- Design for Clarity: Adjust fonts, text size, and colors to ensure that the document is both professional and easy to read.

- Save Your Custom Format: Once satisfied with the layout, save the format for future use, ensuring all generated documents follow the same structure.

Best Practices for Document Layouts

- Keep It Simple: A clean and organized document is more effective. Avoid overcomplicating the layout with unnecessary elements.

- Highlight Key Information: Make important details like payment due dates, amounts, and item descriptions stand out for quick reference.

- Consistency is Key: Ensure that all future documents follow the same format for easy recognition and improved professionalism.

- Test Before Use: Create a few sample records to verify that the layout works as intended and appears correctly when printed or sent electronically.

By setting up a customized structure for your transaction documents, you ensure a streamlined approach to handling payments and communications with clients. Once configured, this system saves valuable time and enhances your business’s professional image.

QuickBooks Features for Document Management

Managing transaction records efficiently is essential for any business. A robust financial system provides various tools that help automate the creation, tracking, and management of essential business documents. These features can save time, reduce errors, and improve the overall accuracy of your financial record-keeping process. Understanding the key functionalities available in your financial software can enhance your workflow and make it easier to keep track of important details.

Essential Tools for Managing Business Documents

There are several useful features built into your financial system to help you generate and track your documents with ease:

- Automatic Creation: The system can automatically generate documents based on your transaction data, reducing the need for manual entry.

- Customization: You can personalize the design and layout of your documents to fit your branding and business requirements.

- Template Storage: Save custom formats for future use, ensuring all documents are consistent and ready to be sent without reformatting.

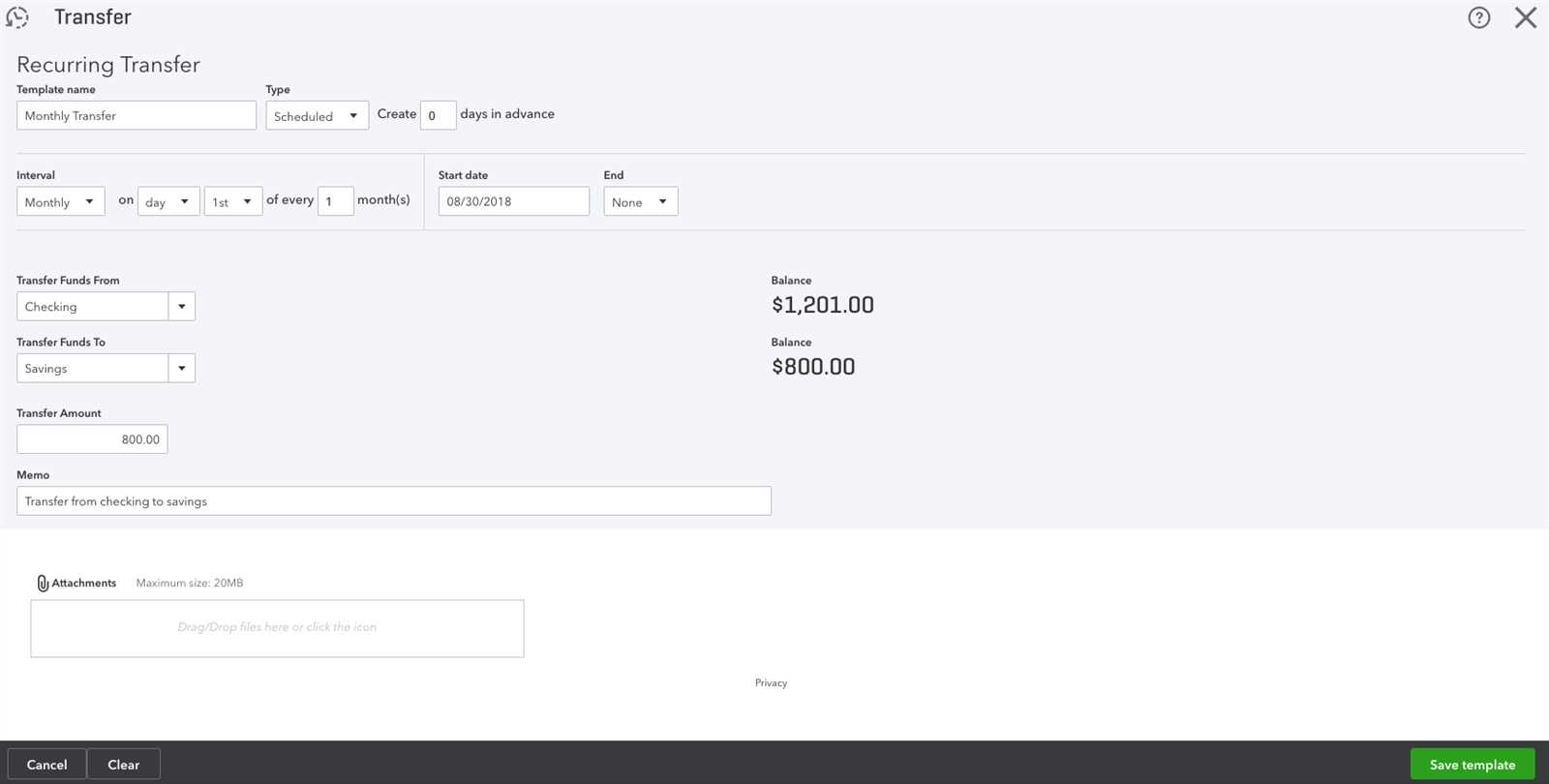

- Recurring Transactions: Automate the creation of documents for regular payments or orders, saving time and effort.

- Integration with Payment Systems: Seamlessly link your documents to payment gateways for easy tracking of transactions and balances.

Tracking and Reporting Features

In addition to document creation, the system offers features that make it easier to monitor and report on financial data:

- Real-Time Updates: Instantly track payments and document statuses, ensuring you always have the most up-to-date information.

- Payment Reminders: Automatically send reminders to clients about upcoming payments or overdue amounts.

- Comprehensive Reporting: Generate detailed reports on transaction activity, outstanding balances, and payment history to help with financial analysis.

By taking advantage of these features, you can streamline your document management process, maintain accurate records, and stay organized. These tools ensure that your business remains efficient, professional, and ready to handle any financial situation that arises.

Best Practices for Creating Transaction Records

Creating clear, accurate, and professional transaction documents is key to ensuring smooth business operations. By following best practices, you can ensure that all the necessary information is captured in a consistent format. This not only helps with internal tracking but also improves communication with clients, streamlining the overall process and minimizing errors.

Key Tips for Crafting Clear and Professional Documents

- Ensure Accurate Details: Double-check client information, dates, and amounts to ensure everything is correct before sending.

- Include Payment Terms: Clearly state when payments are due and the preferred method to avoid confusion.

- Use Simple, Clear Language: Avoid jargon or overly complex terms; keep the document easy to understand.

- Maintain a Clean Layout: Use a well-organized structure that makes it easy to locate key information quickly.

- Brand Consistency: Add your company’s logo and branding elements to ensure each document aligns with your professional image.

Efficiency Tips for Streamlining the Process

- Use Pre-Saved Formats: Create and save standardized layouts so you don’t need to re-enter information every time.

- Automate Recurring Documents: Set up automatic generation for regular transactions to save time and reduce manual entry.

- Track Document Status: Use tools that allow you to track when a document is viewed or paid to stay on top of your financials.

- Use Digital Signatures: Incorporate electronic signatures for faster approval and streamlined processing.

By following these best practices, you can ensure that your transaction documents are both efficient and professional. This not only helps with day-to-day operations but also fosters better relationships with clients and keeps your business running smoothly.

Editing and Customizing Transaction Documents

Customizing your business records ensures that they meet your specific needs and align with your brand identity. By adjusting the layout, content, and style of your documents, you can create a streamlined and professional format that suits both your business operations and client interactions. Editing these documents is a flexible process that helps you maintain consistency while adapting to different situations or requirements.

Steps to Edit and Customize Your Documents

Follow these steps to personalize your transaction records effectively:

- Select a Document: Choose the document you want to edit from your existing list or start a new one.

- Edit Text and Content: Modify fields such as client name, date, item descriptions, or payment terms as needed.

- Adjust Layout: Move sections around or resize fields to make the document more readable and better organized.

- Add Branding Elements: Insert your logo, adjust fonts, or change colors to match your business’s branding.

- Save and Apply Changes: Once you’re satisfied with the document, save the customized version for future use.

Organizing Your Documents with Tables

Tables are a great way to present transaction details clearly. They help break down complex information, making it easier for clients to understand the specifics of the transaction. Here’s how to structure your table:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Service B | 1 | $150 | $150 |

Tables like the one above help break down each element of the transaction in a clear and concise manner, ensuring that clients can easily see the quantities, prices, and totals for each item.

By carefully editing and customizing your documents, you can ensure that every transaction record is tailored to your specific business needs, enhances communication with clients, and main

Common Issues When Using Business Document Formats

While customizing and using pre-designed formats for business records can significantly improve efficiency, there are often common issues that arise in the process. These challenges can range from layout problems to data synchronization errors, and addressing them promptly ensures smoother operations. Understanding these typical issues allows you to troubleshoot and make necessary adjustments to improve your workflow.

Layout and Formatting Issues

One of the most frequent problems users face when working with document formats is issues related to the layout and presentation. These problems can make your records look unprofessional or difficult for clients to understand. Common layout challenges include:

- Misaligned Fields: Text, numbers, and other elements may not line up properly, making the document look disorganized.

- Inconsistent Font Styles: Variations in font size and style can create a visually jarring experience for recipients.

- Spacing Problems: Insufficient or excessive space between sections can make the document hard to read or cluttered.

Data Synchronization and Accuracy Errors

Another issue many users encounter involves the automatic population of data into their documents. When your system is not properly synced with the correct information, errors can occur, leading to discrepancies in financial records. Some common data-related problems include:

- Incorrect Client Information: When client names or contact details are not correctly updated, it can cause confusion and mistakes.

- Item Discrepancies: The wrong product descriptions, quantities, or pricing may be automatically inserted into the document.

- Missing or Overlapping Fields: Sometimes fields don’t populate as expected, or fields overlap with other sections of the document, making it unreadable.

By being aware of these common issues, you can take the necessary steps to prevent or fix them before sending out important business records. Regularly reviewing and testing your document formats ensures that your financial and transactional paperwork is both accurate and professional.

How to Save Custom Business Document Formats

Once you’ve created a customized layout for your business documents, it’s important to save them properly for future use. This allows you to quickly generate consistent and professional records without having to re-enter all the details each time. Saving your formats ensures that you can reuse them across different transactions, improving efficiency and maintaining consistency in your communications.

Steps to Save Your Custom Layout

Follow these simple steps to ensure your customized formats are saved and easily accessible for future use:

- Complete Your Customization: After adjusting the document’s layout, content, and style, ensure everything is accurate and ready to save.

- Access the Save Option: Most systems will have a “Save As” or “Save Template” option in the document creation menu. Click on this option to store your format.

- Name Your Format: Give your layout a unique and descriptive name so you can easily identify it later.

- Select a Storage Location: Choose where you want to store your saved format. Most systems allow you to save it in a central location or assign it to a specific folder for organization.

- Save and Confirm: Once the format is saved, confirm that it appears in your saved formats list, ensuring that it’s ready for use in the future.

Best Practices for Organizing Saved Formats

To maintain a streamlined and organized document storage system, consider the following tips:

- Group Similar Layouts: If you create multiple formats for different types of transactions, organize them into folders or categories for easy access.

- Update as Needed: If your business requirements change, regularly update and save new versions of your formats to keep them current.

- Label Clearly: Use clear and consistent naming conventions for each format to avoid confusion when selecting the appropriate layout.

By saving your customized formats and organizing them properly, you can reduce the time spent creating new documents and ensure that every transaction is consistently documented in the same professional manner.

How to Apply Custom Document Layouts in Your Financial System

Applying custom layouts to your transaction records streamlines the process of generating consistent and professional documents. Once you’ve created or saved a customized format, it’s essential to know how to apply it to new transactions. This ensures that every record, whether it’s for a sale, payment, or other business interaction, follows the same structure, making your process more efficient and reducing the chances of errors.

Here’s how to apply your customized formats when creating new records:

- Access Document Creation: Begin by opening the section where you create new business records within your system.

- Select Your Saved Layout: When prompted to choose a layout for your new document, select the custom format you previously saved. This is often available in a drop-down list or template selection screen.

- Customize Specific Details: After selecting the layout, ensure that the relevant information for the transaction–such as client details, products, or services–is correctly filled in.

- Review and Finalize: Once the document is populated with the necessary information, review it to ensure accuracy before saving or sending it to the client.

By applying your saved formats, you save time on each transaction and ensure consistency across all your records. The application process is simple and allows you to quickly generate documents that align with your business needs and branding requirements.

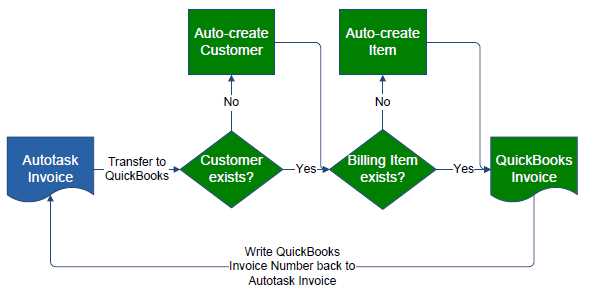

Integrating Business Documents with Payment Systems

Integrating your business records with payment processing systems can streamline financial transactions and improve cash flow management. By connecting your custom transaction formats to an integrated payment gateway, you can automate the payment process, track transactions in real-time, and reduce manual data entry. This seamless connection ensures that clients can make payments quickly, and you can easily track when payments are received or overdue.

Steps to Integrate Payment Systems with Your Documents

To integrate your payment processing system with your transaction records, follow these steps:

- Set Up Payment Gateway: First, ensure that your payment gateway is properly configured and linked to your system. This could involve entering API keys or linking your account details.

- Link Your Document Layouts: Choose the document format that you want to link with the payment system. This allows the system to pull payment information directly from your document fields.

- Enable Payment Options: Once your layout is linked, enable payment options such as credit card, debit card, or bank transfer on the document itself. This provides clients with easy ways to pay directly from the document.

- Track Payments Automatically: Once a payment is made, the system will automatically update the payment status in the transaction record, saving you time and reducing the chance of errors.

Benefits of Integrating Payment Systems

Integrating payment systems with your transaction records provides several key benefits:

- Improved Efficiency: By automating the payment process, you reduce manual effort and speed up the invoicing cycle.

- Real-Time Updates: Payments are tracked instantly, allowing you to stay on top of your financials without delays.

- Enhanced Client Experience: Clients appreciate the convenience of making payments directly from the document, improving satisfaction and reducing the risk of delayed payments.

- Accurate Record-Keeping: Integrating your payment system with your business documents ensures that all transactions are recorded correctly and consistently.

By integrating payment processing with your transaction documents, you create a

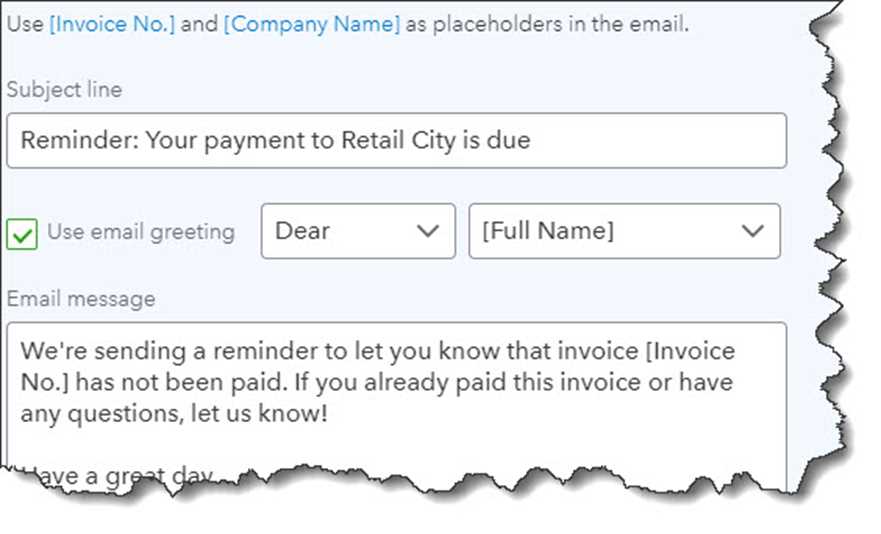

Tracking Payments with Business Documents

Effectively tracking payments is essential to managing your cash flow and ensuring that all transactions are recorded accurately. When you generate transaction documents, it’s crucial to incorporate features that allow you to monitor the status of each payment, from the moment it’s issued to the final payment confirmation. This process not only helps you stay organized but also enables you to follow up on overdue payments in a timely manner.

Steps to Track Payments Efficiently

To effectively track payments associated with your transaction records, follow these key steps:

- Record Payment Terms: Clearly state the payment due date and accepted methods of payment on each document to set clear expectations for your clients.

- Monitor Payment Status: Use a system that allows you to update the status of each transaction–whether it’s paid, partially paid, or overdue. This will give you real-time visibility into your receivables.

- Send Payment Reminders: For overdue payments, set up automated reminders or alerts to prompt clients to make payment.

- Mark Transactions as Paid: Once a payment is made, promptly mark the record as paid, and adjust the remaining balance accordingly.

Benefits of Tracking Payments

- Improved Cash Flow: By keeping an eye on payment statuses, you can quickly identify outstanding debts and follow up to avoid delays in receiving payments.

- Better Financial Reporting: Having accurate payment tracking helps generate detailed financial reports, making it easier to assess your company’s financial health.

- Reduced Risk of Errors: Tracking payments within your system reduces the likelihood of overlooking transactions and ensures accuracy in your records.

- Client Transparency: By keeping clients informed about the status of their payments, you build trust and foster a professional relationship.

Tracking payments within your transaction records simplifies financial management and reduces the potential for discrepancies. By staying on top of each transaction’s status, you can ensure timely follow-ups, maintain accurate records, and keep your cash flow healthy.

Exporting Transaction Records from Your Financial System

Exporting business records from your financial management system allows you to transfer data into other formats for further analysis, reporting, or sharing with clients and stakeholders. Whether you need to generate reports for tax purposes, share records with your accountant, or back up your transaction history, exporting these documents can help streamline your workflow and ensure that all necessary information is easily accessible outside of the system.

Here are the steps you can take to export your transaction records efficiently:

Steps to Export Your Documents

- Open the Record Section: Navigate to the section of your financial system where you store your transaction records.

- Select the Desired Records: Choose the specific documents you wish to export. This could be a single transaction or a batch of records.

- Choose Export Format: Most systems allow you to export data in various formats, such as PDF, Excel, or CSV. Select the format that best suits your needs.

- Confirm Export Settings: Before exporting, review any settings related to data formatting or the scope of the records you’re exporting (e.g., date range, transaction type).

- Export and Save: Click the export button, and choose where to save the file on your device or cloud storage for future access.

Why Exporting Business Records is Important

- Backup and Security: Exporting your records ensures you have a backup of critical financial information in case of system errors or data loss.

- Streamlined Reporting: Exporting allows you to easily create financial reports and share them with accountants or other stakeholders.

- Data Sharing: You can quickly send exported records to clients, vendors, or other parties who need the information for auditing or processing purposes.

- Better Analysis: Exporting data into formats like Excel allows you to analyze and manipulate the information more easily, such as creating custom charts or filtering data based on specific criteria.

By regularly exporting your transaction records, you can maintain better control over your financial data, simplify reporting processes, and ensure that your records are safely stored a

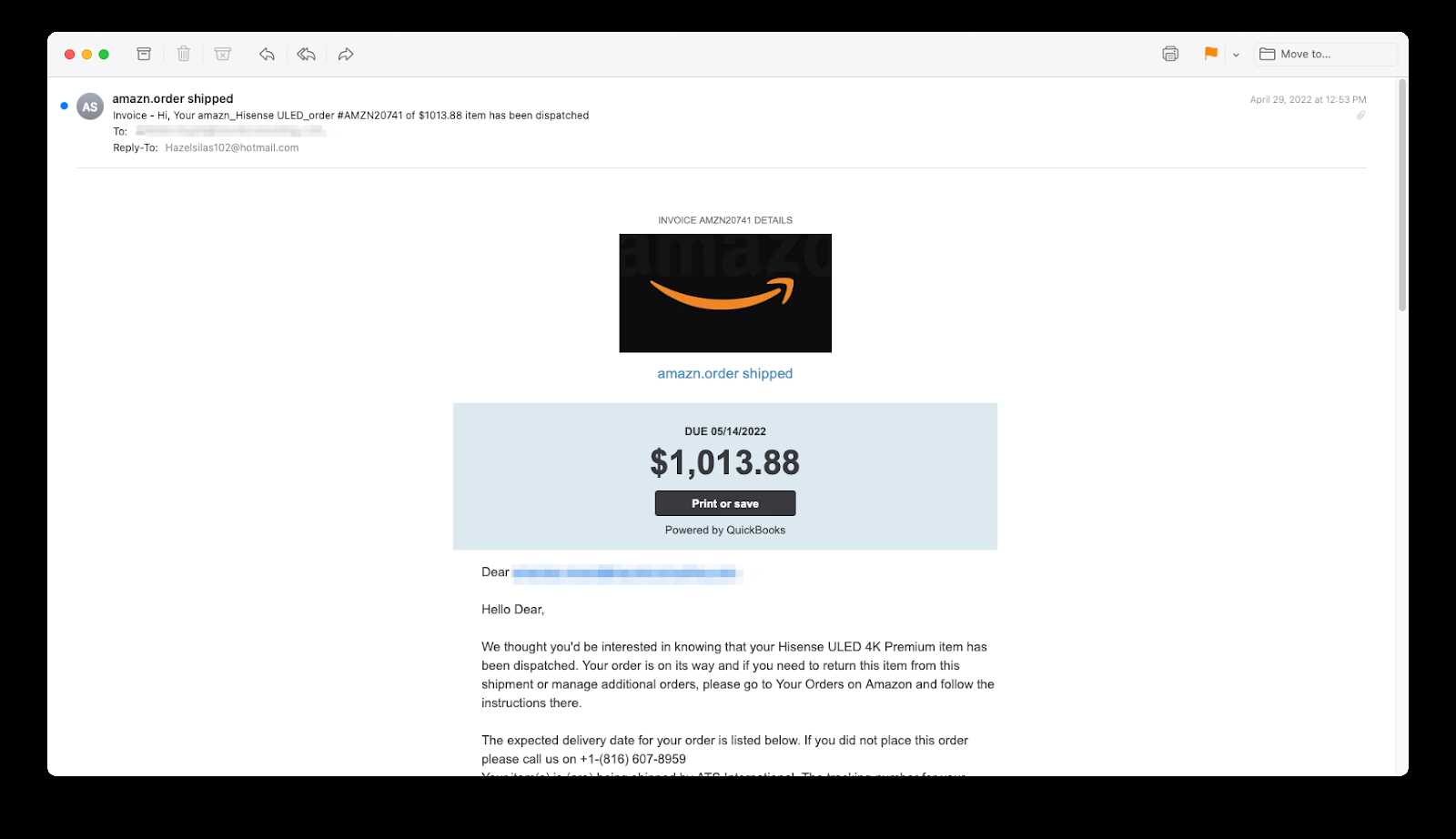

How to Share Transaction Records with Clients

Sharing your business documents with clients is an essential part of maintaining clear communication and ensuring that payment processes run smoothly. Whether you’re sending a completed record of a transaction or an updated document for review, it’s important to choose the right method to share the file efficiently. The ability to send these documents quickly and securely can improve your workflow and provide a professional experience for your clients.

Methods for Sharing Documents with Clients

There are several effective ways to share your business records with clients, depending on their preferences and your system capabilities:

- Email: The most common and simplest method is to send the document as an email attachment. Most systems allow you to directly email the file from within the platform in formats like PDF or Excel.

- Client Portal: If you use a client portal or online system, you can upload the document for clients to access securely at any time. This provides a centralized location for all records and transactions.

- Cloud Storage: Using cloud-based storage platforms like Google Drive or Dropbox allows you to upload the document and share a link with clients. This is a good option for larger files or when you need to share multiple documents at once.

- Fax or Postal Mail: Although less common in the digital age, some clients may still prefer to receive physical copies of their documents. If needed, you can print and mail documents or send them via fax.

Best Practices for Sharing Business Records

- Secure Formats: Always choose secure formats such as PDF to ensure that your document is not altered after sharing and can be easily opened by the client.

- Clear Instructions: When sending documents electronically, include clear instructions on how to access or review the file, especially if the client is not familiar with the platform.

- Confirm Receipt: It’s important to follow up with your clients to ensure that they have received the document and have all the information they need for payment processing or further action.

- Track Document Status: Some systems allow you to track when the document is viewed or downloaded, helping you keep tabs on client interaction and ensuring follow-ups when necessary.

By selecting the best method for sharing your transaction records, you ensure tha

Automation Tips for Document Creation

Automating the process of generating business documents can significantly improve efficiency, reduce human error, and save valuable time. By setting up automation features in your financial system, you can streamline the creation of these records, ensuring consistency and accuracy every time a transaction occurs. This also frees up resources for other important tasks in your business.

Key Automation Strategies for Business Records

To automate the creation of your business documents, consider implementing the following strategies:

- Recurring Transactions: Set up recurring templates for regular transactions such as subscriptions, retainer agreements, or monthly billing. This will automatically generate the required documents at the set intervals without any manual input.

- Pre-filled Client Data: Use your system to store client information such as contact details, payment preferences, and billing history. This allows the system to auto-populate these fields each time a document is created, reducing time spent entering repetitive information.

- Customizable Workflow Automation: Configure workflows so that documents are automatically sent once created, or that follow-up reminders are triggered if the client hasn’t responded within a specific timeframe.

- Automated Payment Integration: Link your document system with payment processors to automatically update the payment status once a client pays, removing the need to manually track or enter payment data.

Advantages of Automating Business Documents

- Increased Efficiency: Automation saves time and eliminates manual tasks, allowing you to focus on more complex aspects of your business.

- Consistency: Automated systems ensure that every document follows the same format and includes the correct details, reducing the chance of errors.

- Improved Client Experience: By automating document creation and delivery, clients receive prompt and professional communication, enhancing your reputation and streamlining their experience.

- Time Savings: Automation speeds up the document creation process, allowing you to process a larger volume of transactions without sacrificing quality or accuracy.

By implementing automation for creating business records, you can significantly reduce administrative workload, ensure consistency across documents, and improve your overall efficiency. These time-saving techniques allow you to focus on growing your business while the system handles the repetitive tasks.

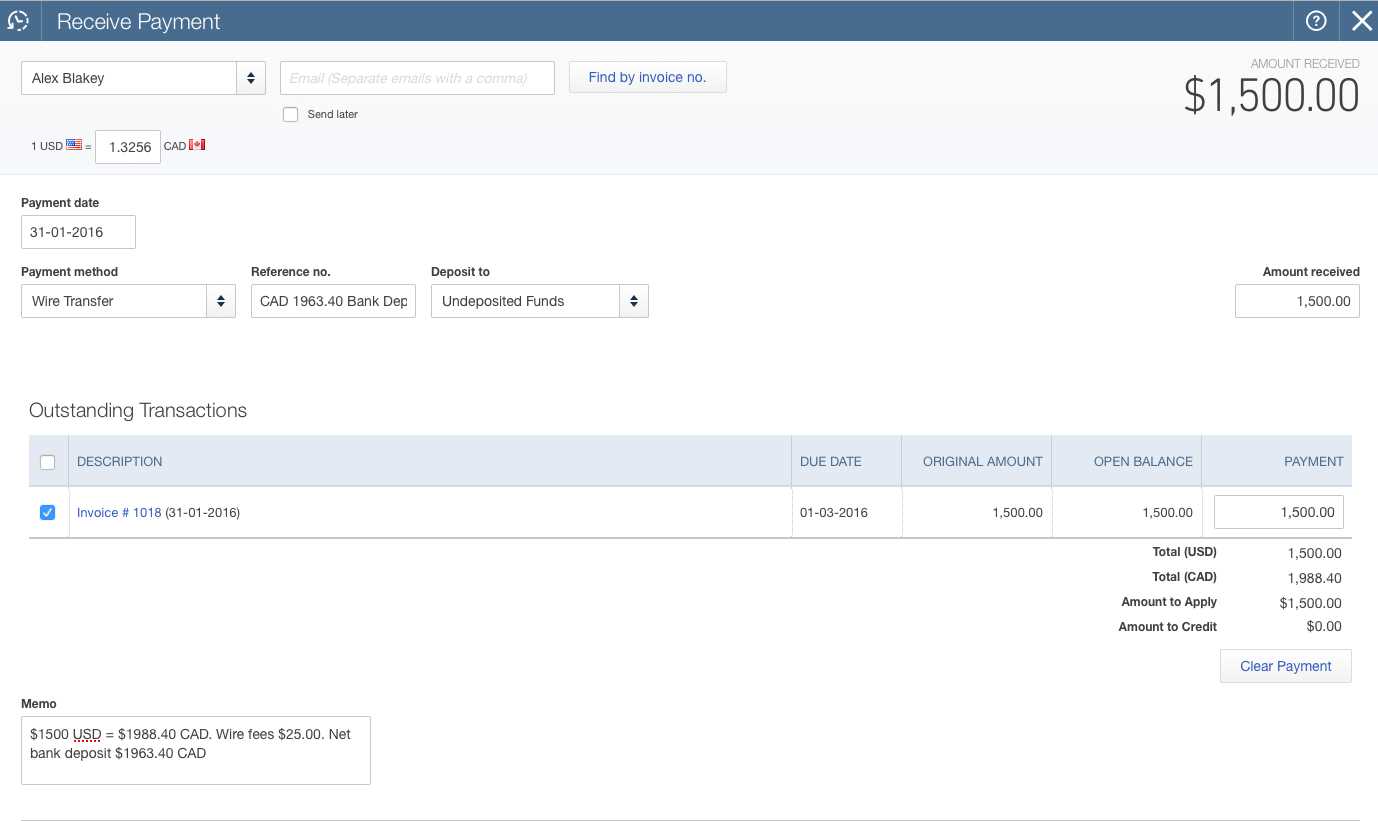

Managing Multi-Currency Transactions in Your Financial System

Handling multi-currency transactions is a common necessity for businesses that operate internationally or work with clients in various countries. A robust financial system can simplify the management of such transactions by allowing you to record and process payments in different currencies without the need for complex manual conversions. This feature is particularly useful for businesses looking to streamline their global operations and ensure that foreign transactions are accurately tracked and reported.

How to Manage Multi-Currency Transactions

When dealing with clients or suppliers from different countries, it’s essential to ensure that your system is set up to handle various currencies seamlessly. Here’s how you can manage these types of transactions:

- Enable Multi-Currency Feature: Ensure that your financial system has multi-currency support activated. This will allow you to create records in multiple currencies and handle exchange rate conversions automatically.

- Set Default Currency for Each Client: Assign a default currency to each of your clients based on their location or preference. This simplifies the process of generating and sending records, as the system will automatically use the correct currency for each transaction.

- Track Exchange Rates: Keep an eye on exchange rate fluctuations, as they can impact the final amounts. Some systems offer automatic updates for exchange rates, ensuring that your financial records remain accurate.

- Generate Multi-Currency Reports: With multi-currency transactions, it’s important to have the ability to generate comprehensive reports that reflect all currencies involved, providing an accurate view of your financial status across different regions.

Benefits of Managing Multi-Currency Transactions

- Accurate Financial Records: Automated currency conversion ensures that your records reflect the true value of international transactions, avoiding discrepancies or errors.

- Time Savings: Automating multi-currency management reduces the time spent manually converting and calculating exchange rates, speeding up your financial processes.

- Improved Global Operations: By handling multiple currencies seamlessly, your business can operate more effectively in international markets, offering a smoother experience for global clients and vendors.

- Better Reporting: Multi-currency support allows for more detailed financial reporting, giving you a clear picture of revenue and expenses in different currencies and helping with financial analysis and forecasting.

Integrating multi-currency capabilities into your system allows you to focus on growing your global busi

Using Transaction Record Formats for Reporting

Effective reporting is crucial for understanding your business’s financial health and making informed decisions. By using predefined record structures, businesses can quickly generate consistent, accurate reports that reflect their financial activity over a specific period. These formats allow you to track income, expenses, and other essential data, providing insights that help streamline your financial analysis.

How Record Structures Facilitate Reporting

Utilizing structured record formats for financial reports simplifies the process of gathering data and generating insights. Here are some key ways these tools can enhance your reporting capabilities:

- Consistency in Data Entry: Structured formats ensure that all required fields are filled out in a standardized way, preventing missing or inconsistent information that can complicate reporting.

- Easy Data Aggregation: Using consistent structures makes it easier to aggregate data across multiple periods or client interactions, allowing for more comprehensive financial reporting.

- Quick Financial Insights: Predefined formats allow you to generate reports instantly, helping you assess financial performance without the need for manual data entry or complex calculations.

- Customization for Specific Reports: Many systems allow for customized fields, enabling you to tailor your reports to specific business needs, such as tracking project costs, client payment statuses, or sales trends.

Advantages of Using Predefined Formats for Reports

- Time Efficiency: Automating the process of data collection through predefined structures saves time and reduces the likelihood of errors in reporting.

- Improved Accuracy: Consistent use of record formats ensures that all relevant data is captured correctly, providing more reliable reports for decision-making.

- Comprehensive Overview: With accurate and organized reports, you gain a better understanding of your business’s financial situation, allowing you to make informed strategic decisions.

- Streamlined Compliance: Structured formats help maintain compliance with tax regulations and accounting standards by ensuring that all necessary financial information is recorded and reported in the correct manner.

By utilizing structured record formats for reporting, businesses can improve their efficiency, accuracy, and decision-making capabilities. This approach provides a streamlined way to generate i