Training Invoice Template DOC for Easy Professional Billing

Managing the financial side of educational or consulting services can often be a tedious task, especially when it comes to creating accurate and professional records for each session. A well-structured document that details services rendered, fees, and payment terms is essential for both the provider and the client. By utilizing a ready-made document, you can simplify this process and maintain a clear, organized billing system.

Professionals in various industries can benefit from customizable documents that allow for flexibility while ensuring all necessary details are captured. Whether you’re offering workshops, one-on-one lessons, or group training, these documents help streamline the process and reduce the chances of errors. By having a standardized format, you can save time and focus more on delivering quality content to your clients.

Efficiency is the key. A simple, well-organized document not only enhances the professionalism of your service but also ensures that all financial transactions are documented properly, making tracking payments and resolving discrepancies easier. In this article, we’ll explore how to create, modify, and use these essential tools for a smooth billing experience.

Training Invoice Template DOC Overview

When providing educational or professional services, it’s crucial to have a clear and organized way to document the details of each transaction. Having a structured document that outlines the services offered, payment terms, and other necessary details helps ensure smooth financial processes between you and your clients. This type of document can serve as a formal agreement and record for both parties, ensuring transparency and reducing the chance of misunderstandings.

Key Features of a Professional Billing Document

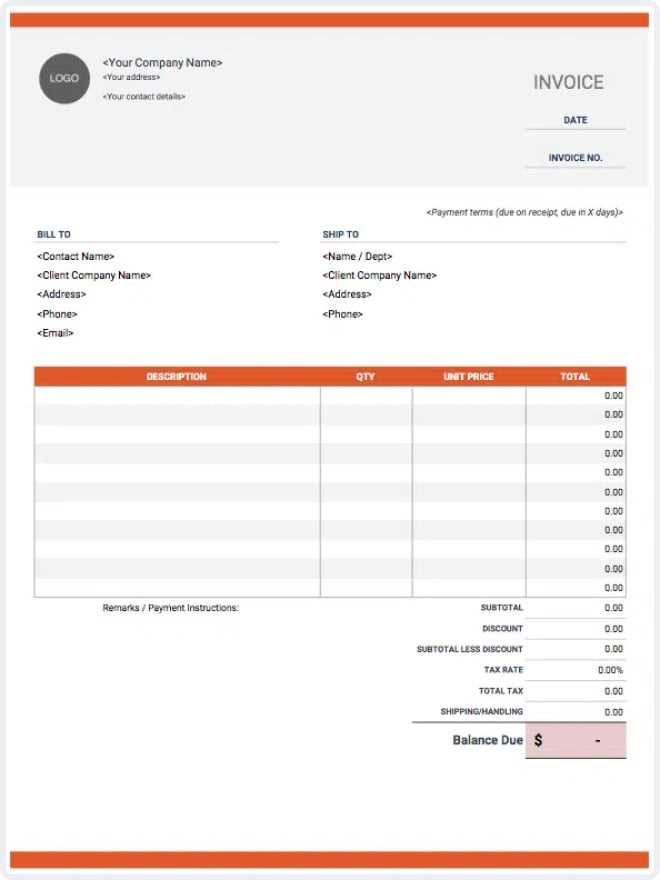

Creating a document to capture service details should focus on clarity and completeness. Some key components to include are:

- Client Information: Full name, address, and contact details.

- Service Description: A clear breakdown of what services were provided, including duration and specifics.

- Payment Terms: Clearly stated rates, payment deadlines, and any applicable taxes or discounts.

- Tracking Details: Reference numbers for easy tracking and future reference.

- Payment Instructions: How clients should remit payments, including payment methods and account details.

Advantages of Using a Ready-Made Document

Using a pre-designed document ensures consistency and saves time. Some of the advantages include:

- Consistency: A standardized format helps ensure that all important details are included every time.

- Time Efficiency: By modifying an existing document, you can quickly customize it for each client without starting from scratch.

- Professionalism: A polished, well-organized record can enhance your reputation and improve client trust.

- Accuracy: Using a structured format reduces the likelihood of errors, helping you avoid payment disputes.

Why Use a Training Invoice Template

Having a pre-designed document to manage financial transactions in service-based work offers numerous benefits. It simplifies the process of capturing key details, ensures consistency, and saves time. With a ready-to-use structure, you can focus on providing high-quality services without worrying about missing important information or creating complex billing documents from scratch.

Benefits of Using a Structured Billing Document

Using a pre-set format for billing comes with several advantages that make it a practical choice for professionals offering educational or consultative services:

- Time Savings: With a predefined structure, you can easily modify the document for each client, streamlining the billing process.

- Consistency: A standardized format ensures that no crucial details are overlooked, providing uniformity across all records.

- Accuracy: By following a template, you minimize the chances of mistakes in calculating fees, taxes, or payment terms.

- Professionalism: A clean, well-organized document enhances your image and assures clients that they are dealing with a serious, reliable professional.

Streamlining the Billing Process

A structured document ensures that you don’t have to start from scratch each time you need to prepare a record. Key details, such as rates, payment schedules, and service descriptions, are already outlined, which means you can easily customize the template for each client. This not only saves time but also provides clarity and reduces the chance of confusion or errors.

How to Customize a Training Invoice

Customizing a financial document to fit your specific needs is a straightforward process that enhances both functionality and professionalism. By adjusting the standard structure to suit your services, you ensure that all relevant details are included and that the document reflects the unique terms of each engagement. Whether you’re adjusting rates, adding payment schedules, or including specific terms, customization ensures clarity and accuracy for both you and your client.

The customization process typically involves modifying sections such as client information, service descriptions, and payment terms. You can also adjust the layout to match your branding or preferred style. This ensures that the final document is not only functional but also professional and aligned with your business image.

To make the most of your customized document, focus on the following elements:

- Personal Information: Ensure the correct contact details are listed for both parties to avoid any confusion.

- Service Breakdown: Provide a detailed description of what was delivered, including timeframes and specific tasks.

- Payment Schedule: Clearly outline the total amount due, payment deadlines, and any applicable discounts or taxes.

- Branding: Include your logo, company name, and other branding elements to make the document look professional.

- Terms and Conditions: Specify any special terms, such as late fees or cancellation policies, to avoid misunderstandings.

Essential Elements of a Training Invoice

A well-structured financial document is critical to ensure clear communication between service providers and clients. By including all the necessary details, you avoid misunderstandings and ensure both parties are on the same page regarding expectations, payment terms, and services provided. This section outlines the key components that should be present in any billing document related to educational or consulting services.

Key Components to Include

For a comprehensive and effective billing record, consider the following elements:

- Client Information: Full name, address, and contact details of the person or company being billed.

- Service Description: A clear breakdown of what services were provided, including the type of session, duration, and any specific deliverables.

- Dates: Dates when the services were delivered, which helps both parties track when the work was completed.

- Total Amount Due: The agreed-upon fee, including any discounts or additional charges, if applicable.

- Payment Terms: The payment schedule, including due dates, late fees, and any applicable taxes.

- Payment Instructions: Clear directions for how the payment should be made (bank transfer, check, online payment, etc.), including any necessary account details.

Additional Useful Details

While the essential elements provide the core structure, you may want to consider including additional information to make the document more informative:

- Reference Number: A unique number to help identify and track the record.

- Terms and Conditions: Any specific terms about refunds, cancellations, or additional fees.

- Notes Section: A space for any additional comments, questions, or clarifications that may be needed.

Creating Professional Training Invoices

When preparing a financial document for your services, professionalism is key. A well-crafted record not only reflects your business standards but also helps maintain trust and transparency with clients. By ensuring that all relevant details are clearly presented and formatted in a clean, organized manner, you show your clients that you are thorough and reliable. This section outlines how to create a polished document that will leave a lasting positive impression.

Important Tips for Professional Document Creation

To create a high-quality financial record, you need to pay attention to several aspects beyond just the information it contains. Here are some tips to enhance the document’s appearance and functionality:

- Clear Layout: Use a simple, organized structure with sections clearly labeled for easy reference.

- Legible Fonts: Choose professional fonts like Arial or Times New Roman that are easy to read and look formal.

- Branding: Include your business logo, name, and contact information at the top of the document for brand consistency.

- Consistency: Maintain a consistent style throughout the document, including font sizes, colors, and alignment.

- Whitespace: Ensure the document is not too crowded; use whitespace to separate sections and make it easier to read.

Formatting for Client Understanding

When creating a document, it’s not only about the aesthetics. The format must prioritize client understanding and clarity. Be sure to:

- Use Itemized Lists: Break down the services or charges in a clear, itemized format so clients can see exactly what they are being charged for.

- Highlight Key Information: Make the total amount due and payment deadlines stand out so that they are easily noticed.

- Include Payment Instructions: Provide simple, step-by-step instructions on how the client can make the payment.

Free Training Invoice Templates Available

There are many resources available online that offer free, pre-designed documents to help professionals manage their billing processes more efficiently. These documents come in various formats and styles, allowing you to easily find one that matches your needs. Using these ready-to-go solutions saves time, ensures accuracy, and helps maintain a professional appearance for your business.

These free resources are often customizable, so you can adjust them to suit the specific details of your services. Whether you are just starting out or looking for a quicker way to generate financial records, these tools provide a simple yet effective way to streamline your administrative tasks.

Some common places where you can find these free resources include:

- Online platforms: Websites offering free document creation tools with customizable features.

- Software solutions: Free or trial versions of software programs that include pre-built records.

- Template libraries: Various online collections with downloadable files in different formats like Word, Excel, and PDF.

By utilizing these resources, you can save time and effort, allowing you to focus more on delivering excellent services to your clients while keeping your financial records in order.

Benefits of Using DOC Format Templates

Using a word processing file format for creating business records offers several advantages over other document types. The flexibility and compatibility of this format make it an ideal choice for professionals looking to create organized, editable, and easy-to-share financial documents. Whether you are working with clients, colleagues, or collaborators, a word document provides an accessible and user-friendly solution for creating accurate and customizable records.

Key Advantages of Word Processing Formats

The word processing format offers a range of benefits, particularly when it comes to customizing and managing your business documentation:

- Ease of Customization: You can easily modify the layout, text, and structure, allowing you to tailor documents to your specific needs.

- Wide Compatibility: Word documents are widely supported across different devices and software, ensuring easy access and sharing with clients and partners.

- Professional Formatting: Pre-built styles and formatting options help maintain a clean, polished look without requiring advanced design skills.

- Collaboration Features: Many word processing tools offer collaboration features, allowing multiple users to edit and comment on a document in real-time.

Efficiency and Flexibility

Another key benefit is the ability to quickly edit, update, and save documents in various formats. Whether you need to adjust payment terms, update services rendered, or make other changes, a word processing file makes the process quick and straightforward. Additionally, the format allows for easy conversion to PDF or other formats, making it suitable for both print and digital sharing.

Common Mistakes in Training Invoices

Creating billing records can sometimes be a straightforward task, but it’s easy to overlook important details that can lead to misunderstandings or delays in payment. Small errors in these documents can have a significant impact on both the service provider and the client. In this section, we’ll discuss common mistakes that should be avoided to ensure accuracy and clarity in every transaction.

By carefully reviewing the following pitfalls, you can minimize errors and improve the professionalism of your business documents:

- Incorrect Client Information: Always double-check the name, address, and contact details of the client to ensure they are correct. Even small typos can cause confusion.

- Missing or Inaccurate Dates: Ensure that the dates of service or delivery are clearly stated and accurate. Omitting this information can lead to disputes over when services were rendered.

- Unclear Descriptions of Services: Vague or overly general descriptions of what was provided can create confusion. Be specific about the services offered and the duration or quantity if applicable.

- Incorrect Payment Details: Double-check the payment method, account details, and due date to avoid payment delays. Providing clear instructions ensures that clients know exactly how to proceed.

- Omitting Taxes and Fees: Forgetting to include applicable taxes or fees can result in a payment that doesn’t reflect the total amount due. Always list these clearly to avoid surprises.

- Not Including Payment Terms: Without clear terms outlining when and how payment should be made, you may face late payments or disputes. Always specify payment deadlines and any penalties for late payments.

Being aware of these common mistakes can help ensure that your billing documents are clear, accurate, and professional, leading to smoother transactions and stronger client relationships.

How to Calculate Training Fees

Determining the right price for services is crucial for both clients and service providers. Accurately calculating the cost of your offerings ensures that you are compensated fairly while also providing transparency for your clients. The process involves considering various factors, from the amount of time spent on the service to any additional expenses incurred along the way. This section explains the key steps to follow when calculating your fees to maintain consistency and fairness in your billing practices.

Key Factors to Consider

Several elements should be taken into account when determining the appropriate fee for your services:

- Hourly or Flat Rate: Decide whether you will charge an hourly rate or a fixed fee for your services. An hourly rate is ideal for services that vary in length, while a flat fee may be more suitable for structured, time-defined offerings.

- Materials and Resources: If your service involves providing materials or resources, such as training documents or software, be sure to include these costs in the final calculation.

- Location: Travel or location-based factors may also impact your pricing, particularly if your services are delivered off-site or require additional transportation costs.

- Duration: Calculate the total time spent delivering the service, including preparation, delivery, and follow-up time, and use this information to determine the final cost.

Additional Considerations for Accuracy

To ensure your fees are aligned with your business model and market standards, consider the following:

- Market Rates: Research what others in your field are charging to remain competitive while still ensuring that your services are appropriately valued.

- Overhead Costs: Factor in any indirect costs, such as administrative expenses, utilities, or equipment, that contribute to the overall cost of your service.

By carefully considering these factors, you can ensure that your pricing is fair, transparent, and sustainable, helping you to maintain healthy client relationships while securing a reasonable income.

Invoice Format for Training Services

When creating financial documents for services provided, clarity and organization are key. A well-structured document not only ensures proper payment but also promotes a professional image. The format should include all relevant details, from the description of services offered to the total amount due. In this section, we’ll discuss the key components that should be included when outlining the format for billing records related to services delivered.

Key Elements of a Service Billing Document

To create a comprehensive and accurate document, the following sections should be included:

- Header Information: The document should clearly display the provider’s and client’s contact details, including names, addresses, and contact numbers.

- Service Description: Provide a detailed description of the service or program, including the duration, goals, and any specific outcomes expected. Be sure to list any specific tasks completed or milestones reached.

- Dates of Service: Specify the start and end dates of the service, or include the specific dates when activities took place. This helps clarify the billing period.

- Payment Terms: Outline payment due dates, payment methods, and any late fees or penalties. This ensures both parties are aware of expectations.

- Total Amount Due: Clearly state the total cost for the services rendered, including any applicable taxes or fees. Break down the amount into categories (e.g., hourly rate, materials, etc.) to provide a transparent view of the charges.

Additional Considerations

In addition to the core components, consider including the following to enhance clarity:

- Discounts or Special Offers: If applicable, include any discounts or promotional rates that were applied to the total amount.

- Invoice Number: Assign a unique number to each document for tracking and reference purposes. This can help with bookkeeping and follow-up.

- Notes or Comments: Leave space for any additional notes or instructions. This can be used for clarification, thank-you messages, or any relevant details about the transaction.

By ensuring that all these elements are present and clearly defined, your billing documents will be accurate, professional, and easy for clients to understand, reducing the chance for disputes or confusion.

Best Practices for Invoice Layout

Creating a well-organized and visually appealing billing document is essential for clear communication and professionalism. A clean layout helps clients easily understand the details of the charges and ensures that the document is both functional and user-friendly. This section outlines best practices for structuring your document to achieve a polished and effective result.

Key Principles for a Professional Layout

When organizing the content of your billing document, it’s important to maintain consistency and clarity. Here are some key points to consider:

- Clear Structure: Divide the document into distinct sections such as header, service description, payment details, and totals. This helps ensure that each piece of information is easy to locate.

- Readable Font: Choose a clean, professional font that is easy to read, such as Arial or Times New Roman. Avoid using overly decorative fonts that may distract from the content.

- Logical Order: Present information in a logical sequence, beginning with your contact information, followed by the client’s details, service description, and total amount due.

- Whitespace: Ensure that there is enough space between sections to prevent the document from looking crowded. Adequate margins and padding around text blocks will improve readability.

Design Enhancements for Professionalism

To elevate the appearance of your billing document and make it more visually appealing, consider the following design tips:

- Use of Color: Limit the use of color to a few accents or highlights, such as for headings or totals. This adds a polished look without overwhelming the reader.

- Consistency: Maintain consistency in font sizes, line spacing, and layout elements. Consistency creates a cohesive and professional appearance throughout the document.

- Branding: Include your logo and use colors that align with your brand identity. This reinforces your business’s image and makes the document feel personalized.

- Tables for Breakdown: Use tables to break down complex information, such as itemized charges. This makes it easier for clients to review individual elements and ensure accuracy.

By following these best practices, you can create a clear, professional, and visually appealing billing document that not only meets the client’s needs but also strengthens your business reputation.

Adding Tax Information to Invoices

Incorporating tax details into a billing document is essential for both legal compliance and clarity. Accurately reflecting tax information ensures that clients understand the full cost of the services and products provided. It also helps maintain transparency and prevents future disputes. In this section, we will explore how to effectively add tax-related details to your financial documents.

When including tax information, it’s important to specify the applicable rates, the total tax amount, and the overall cost breakdown. Here’s how to do it:

| Description | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Service/Products Provided | $500.00 | 8% | $40.00 | $540.00 |

| Additional Fees | $50.00 | 8% | $4.00 | $54.00 |

| Total | $550.00 | – | $44.00 | $594.00 |

As shown above, you can break down the tax calculation into the base amounts and the tax amounts for each charge. It’s important to clarify whether the tax is included in the total price or if it is added separately. This ensures both clarity and compliance with tax regulations. Additionally, the tax rate should be indicated clearly for transparency, along with the total amount of tax applied.

Adding tax information not only keeps your documentation accurate but also ensures compliance with local tax laws, which may vary depending on the region or service type. Always check local tax regulations to ensure proper calculations and reporting.

Including Payment Terms in Invoices

Clear and concise payment terms are essential for any business transaction, as they establish the expectations for both parties. Specifying the agreed-upon terms helps ensure timely payments and minimizes misunderstandings. It also helps protect the service provider by outlining the consequences of delayed or non-payment. In this section, we’ll explore the importance of including payment terms and how to structure them effectively.

When detailing payment conditions, it is crucial to include several key elements to avoid confusion and to create a fair agreement between the business and client. Below are important aspects to consider:

- Due Date: Specify the exact date when payment is expected. This is essential to avoid ambiguity and to help the client understand the timeline for settlement.

- Late Fees: Include any penalties for overdue payments, such as a percentage-based fee or a fixed amount for each day the payment is delayed.

- Accepted Payment Methods: Clearly outline how payments should be made, whether via bank transfer, credit card, check, or another method.

- Discounts for Early Payment: Offer an incentive for clients who settle their balance ahead of the due date, such as a small percentage off the total amount.

- Installment Options: If the client requires flexibility, offer options for installment payments, specifying the amount and schedule for each installment.

It’s important to keep these terms straightforward and easy to understand. For example, instead of using complicated legal jargon, aim for simple and direct language. Providing clients with these details upfront can prevent payment delays and improve your cash flow.

Example: “Payment is due 30 days from the issue date. A late fee of 1.5% per month will be applied to overdue balances. Payments can be made via bank transfer or credit card.” This simple and clear approach ensures that both parties are aware of their obligations and expectations.

Tracking Payments with Invoice Templates

Effectively monitoring payments is essential for maintaining a healthy cash flow and ensuring that clients fulfill their financial obligations. Using structured billing documents can greatly simplify this process, providing both businesses and clients with a clear record of payments made and amounts outstanding. In this section, we’ll look at how to track payments efficiently and how well-designed billing forms can support this task.

When it comes to tracking payments, the most effective approach is to ensure that each financial document includes a detailed record of payment status. Below are some important features to include to streamline the tracking process:

- Payment Status: Indicate whether the amount has been paid, is partially paid, or is due. This helps provide clarity and ensures you have a record of the transaction history.

- Payment Dates: Including both the due date and the actual payment date allows you to track when a payment was made and whether it was received on time.

- Outstanding Amount: Clearly display any remaining balance, making it easy to see if additional payments are required.

- Reference Number: Include a unique reference number for each transaction. This helps both parties easily reference specific payments in the future.

- Payment Method: Record how the payment was made (e.g., bank transfer, credit card, check) so you can track any issues or discrepancies with specific payment channels.

By adding these elements, you ensure that the financial history of each transaction is fully documented. This simplifies the process of follow-ups and ensures that any missing or late payments are identified quickly. Additionally, it provides a professional image for your business and builds trust with clients by offering transparency in your billing practices.

Moreover, keeping a comprehensive log of payments helps with bookkeeping and financial planning. As you accumulate records, you’ll have an easier time preparing for tax season or auditing your accounts, as all relevant data is available in a single, organized format.

How to Save and Share DOC Templates

Once you’ve created a structured billing document, it’s important to know how to properly save and share it with others. This ensures that the form is accessible, editable, and can be easily distributed when needed. In this section, we’ll explore effective methods for storing and sharing your files in a way that ensures they are both secure and easy to use.

Saving Files is the first step in managing your document. Here are some key considerations for storing your forms securely:

- Choose the Right File Format: Saving your document in a widely accepted file format, such as Microsoft Word (.docx) or PDF, ensures that the document can be easily opened on various devices and platforms.

- Use Cloud Storage: Cloud services like Google Drive, Dropbox, or OneDrive allow for easy access and backup of your files. They also provide additional security measures, such as encryption, to protect your data.

- Organize with Folders: Keep your files organized by creating specific folders for different purposes (e.g., “Client Billing Forms” or “Financial Documents”). This makes it easier to locate specific forms when needed.

Sharing Files is just as important as saving them. Proper sharing methods ensure that your documents reach the right people securely and efficiently:

- Share via Email: Attach your saved file to an email when sending it to clients or colleagues. Make sure the subject and message are clear so recipients understand the content.

- Use File Sharing Links: Services like Google Drive or Dropbox allow you to create a link to your file that can be shared with anyone. You can set permissions to control whether others can only view or also edit the document.

- Collaborative Platforms: If you need to work on a document with others in real-time, consider using collaborative tools like Google Docs or Microsoft 365. These platforms allow multiple users to edit the document simultaneously.

By following these tips, you can ensure that your documents are well-organized, easy to find, and simple to share with clients or colleagues. Keeping files in a secure, accessible location helps ensure that you maintain control over your data while providing convenience for sharing and collaborating.

Ensuring Accurate Invoice Details

When preparing a financial document for services rendered, accuracy is crucial to avoid confusion and potential delays in payment. The details you include should be precise, clear, and up to date, as even small errors can lead to misunderstandings and affect the trust between you and your client. This section covers key strategies for ensuring that all necessary information is correctly reflected in your documents.

Key Elements to Double-Check

- Client Information: Ensure the correct name, address, and contact details of the recipient are included. This prevents the document from being misplaced or incorrectly directed.

- Dates: Include accurate dates for both service delivery and when the document is issued. Be sure to specify any due dates or payment terms clearly to avoid confusion.

- Itemized Charges: Break down the services or products provided. Include clear descriptions, unit prices, quantities, and totals. This helps the recipient understand exactly what they are being charged for.

- Payment Terms: Clearly state the agreed payment methods and deadlines. If there are any discounts or late fees associated with payment, these should be outlined as well.

Review and Verification Process

To ensure accuracy, consider implementing a review process before sending out the document. It’s often helpful to have a second pair of eyes check for errors or omissions. You can also use automated tools that flag common mistakes such as incorrect calculations or missing fields.

Incorporating these practices will help maintain professionalism and avoid potential issues with payment delays or disputes. Properly managing the details of your financial documents creates a seamless experience for both you and your clients.

Training Invoice Template for Different Services

Each service offered comes with its own set of unique requirements when documenting the charges and terms. The layout and content of a financial record should reflect these differences to ensure clarity and avoid misunderstandings. Customizing the structure based on the type of service provided ensures that all the necessary details are captured accurately and professionally.

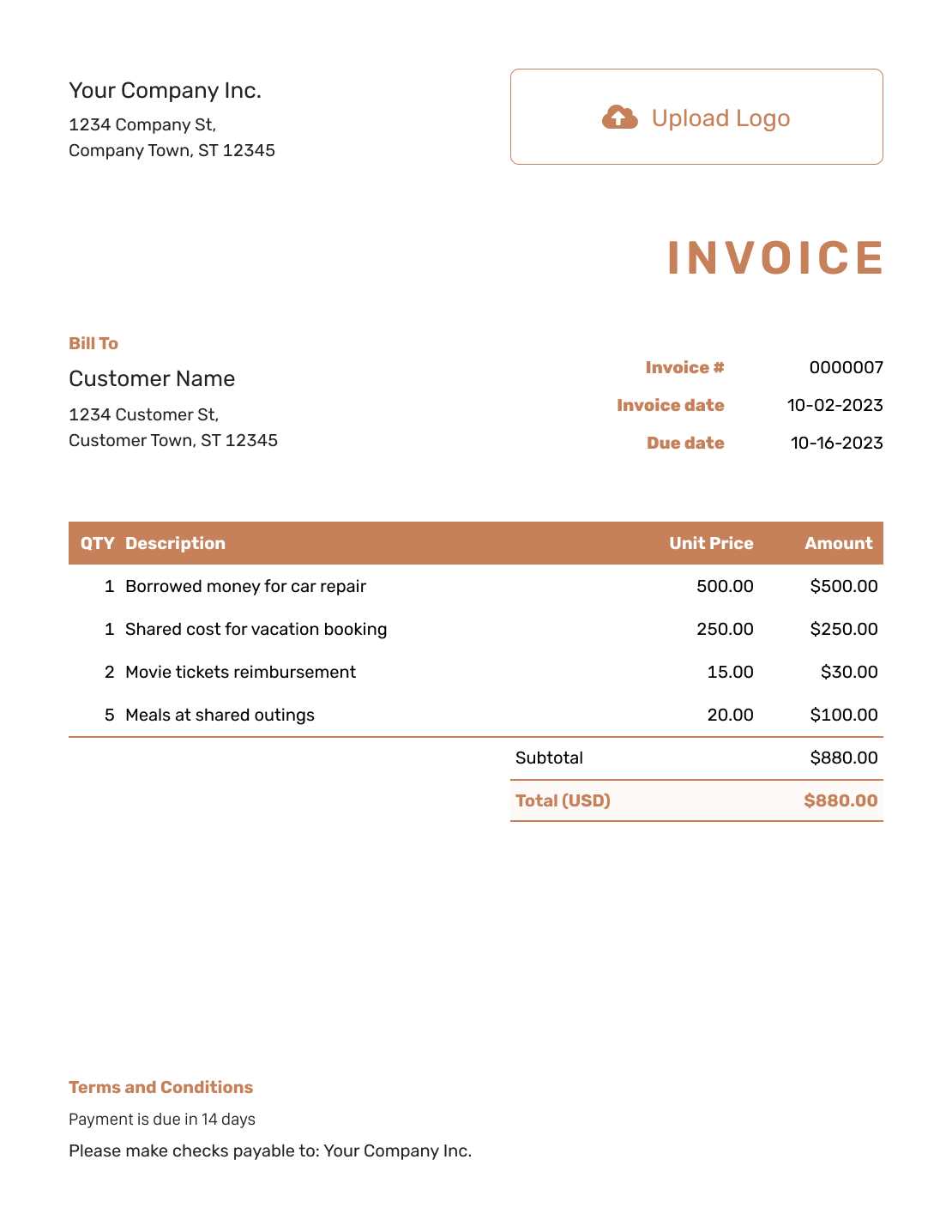

For example, when providing professional development or consulting services, it’s essential to itemize the time spent, hourly rates, and specific services delivered. On the other hand, for product-based offerings, a detailed list of products, quantities, and unit prices would be more relevant.

Customizing for Different Types of Services

- Consulting Services: Typically requires a breakdown of hours worked, specific tasks performed, and hourly rates. Include details of any initial consultation or follow-up sessions.

- Workshops and Seminars: Should feature details about the event, such as the date, duration, location, and number of participants. Charges might include a per-person rate or a flat fee.

- Freelance Services: A clear breakdown of the services rendered, along with the agreed-upon rates for each task, ensures transparency in the pricing structure.

- Product Deliveries: For physical goods, it’s essential to include descriptions, quantities, unit prices, and total costs for each product or item provided.

By tailoring the structure of your documents to the specific service provided, you help ensure that the information is clear and relevant to your clients, enhancing both professionalism and trust.

Legal Considerations for Training Invoices

When providing professional services or delivering goods, it is crucial to ensure that financial records meet all necessary legal requirements. These documents not only serve as a proof of transaction but also protect both parties by clearly outlining expectations, payment terms, and responsibilities. Adhering to the legal guidelines helps to avoid disputes, ensures compliance with tax regulations, and provides clarity in case of future audits or legal proceedings.

Key Legal Aspects to Consider

- Correct Identification of Parties: Always include full legal names, addresses, and business registration numbers for both the service provider and the client. This helps to establish clear ownership and accountability.

- Clear Payment Terms: Specify the due dates for payment, any applicable interest or late fees for overdue payments, and the acceptable payment methods. Make sure these terms are mutually agreed upon before starting the work.

- Tax Compliance: Ensure that all applicable taxes are included in the total charge, and mention tax registration numbers where necessary. Different regions may have varying rules on VAT, sales tax, and other applicable levies.

- Confidentiality and Privacy: If applicable, include confidentiality clauses that outline the protection of sensitive information. This is especially important when dealing with proprietary data or intellectual property.

Ensuring Transparency and Fairness

- Itemized Details: Always break down the charges by category, ensuring the client knows exactly what they are being billed for. This promotes fairness and reduces the risk of disputes.

- Contractual Agreement: If a formal contract exists between both parties, refer to it in the document. This provides additional legal protection and confirms that the terms have been agreed upon.

By including these key legal elements in your financial documents, you help protect both yourself and your clients while maintaining professionalism and ensuring compliance with all relevant regulations.