Trades and Home Service Invoice Template for Efficient Billing

Accurate billing plays a crucial role in maintaining smooth operations for contractors and skilled professionals. Whether you’re fixing homes, working on construction projects, or offering specialized expertise, having a structured document to request payment is essential. It not only ensures clarity but also helps manage finances effectively.

Creating a well-organized payment request document can simplify your financial processes and improve client satisfaction. By including key details such as the scope of work, payment terms, and deadlines, you can avoid misunderstandings and delays. A carefully crafted form can serve as a powerful tool for professionals to keep track of payments and maintain professionalism with their clients.

In this guide, we will explore how to design a document that meets all your needs, enhances transparency, and supports your business operations. With the right format, you can focus more on your craft while staying on top of your finances.

Understanding Billing Requests for Professionals

For any skilled expert working in the construction or repair industry, a formal document to request payment is a fundamental aspect of the business. These documents serve as a clear record of the services provided, ensuring both parties are on the same page regarding the work done and the agreed-upon cost. The goal is to create a seamless process for collecting payments, which is vital for maintaining a healthy cash flow.

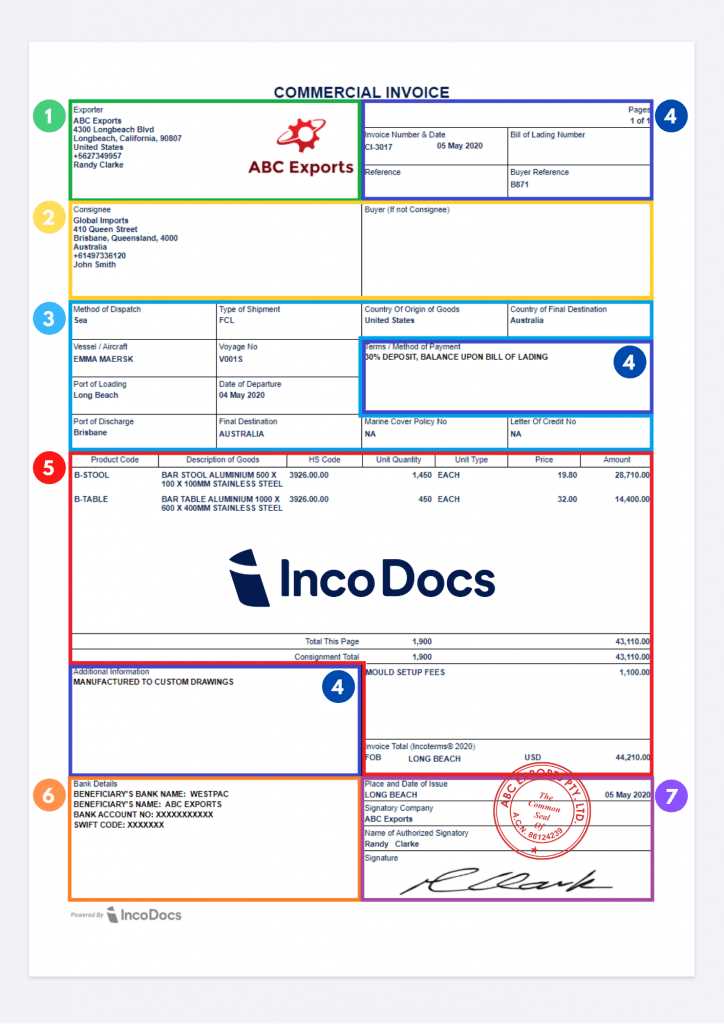

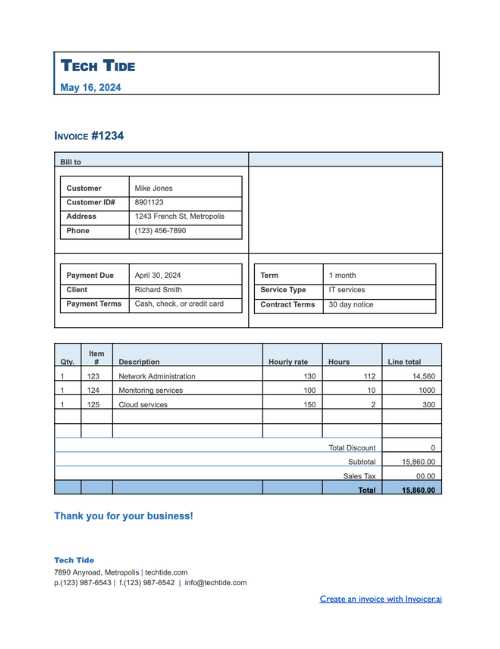

Key Information to Include

A well-organized request for payment includes several key pieces of information. It should outline the specific tasks performed, the rates applied, and any additional costs that may have arisen. Moreover, it must detail the total amount due, the payment terms, and the method of payment accepted. This document serves as an official record that protects both the provider and the client in case of disputes.

Why These Documents Matter

Having a structured method for outlining charges not only ensures payment but also enhances the professionalism of your business. A clear request for payment helps clients understand exactly what they are paying for, reducing confusion and fostering trust. Furthermore, timely billing can improve cash flow, enabling workers to invest in their businesses or pay for materials and labor without delay.

Why an Invoice Template is Essential

Having a pre-designed format for requesting payment is crucial for any professional in the construction, repair, or maintenance field. It not only ensures consistency but also saves valuable time. With a ready-to-use document, you eliminate the need to start from scratch with every new transaction, streamlining the billing process and minimizing the risk of errors.

One of the main advantages of using such a pre-made document is its ability to organize all necessary details in a clear, professional manner. By including all the essential components like job descriptions, rates, and total charges, the document can easily be customized for each individual project. This reduces confusion, helps avoid disputes, and makes the payment process more transparent.

Additionally, a well-structured format supports efficient record-keeping. It makes tracking payments and managing finances much simpler, especially when dealing with multiple clients and ongoing projects. This organizational benefit is essential for maintaining accurate financial records and improving overall business management.

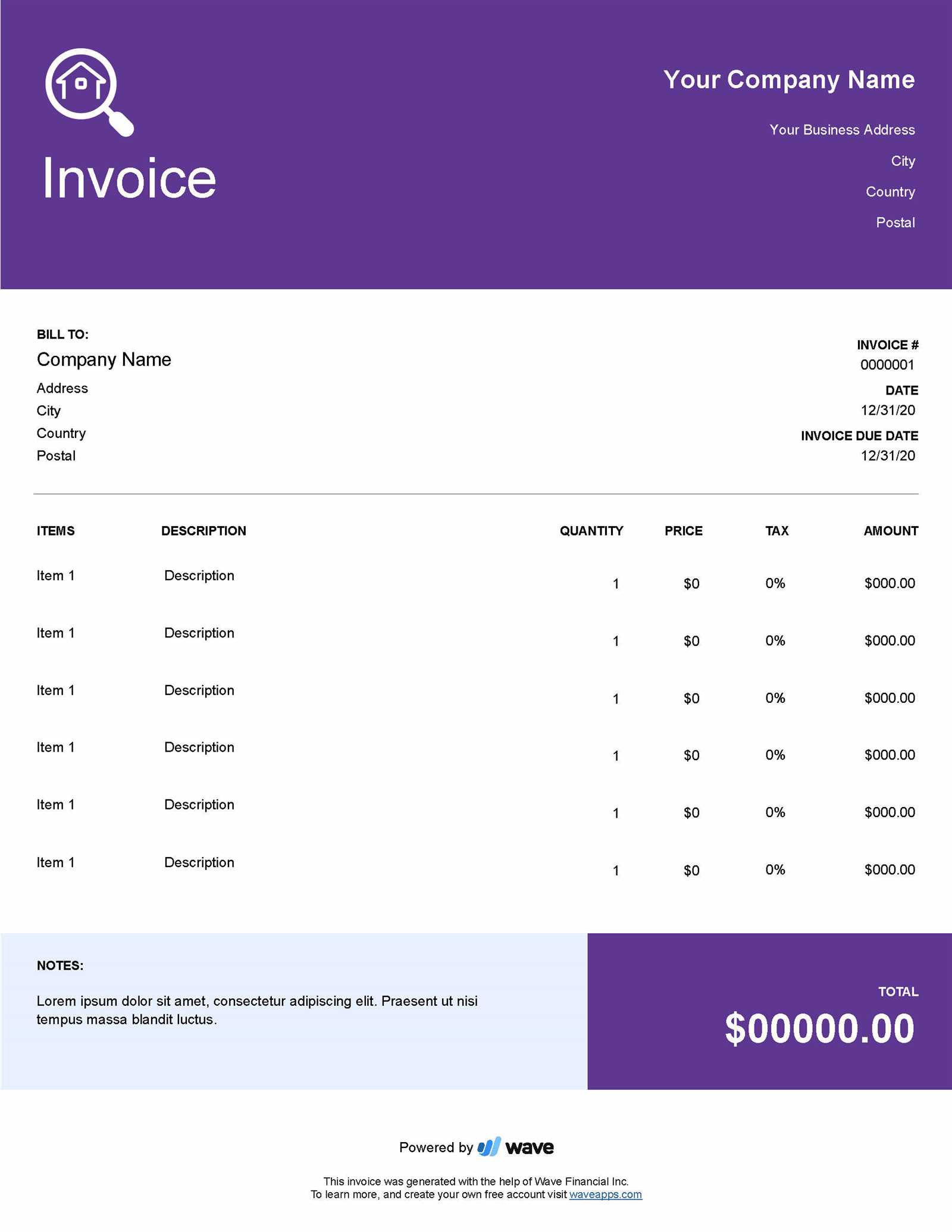

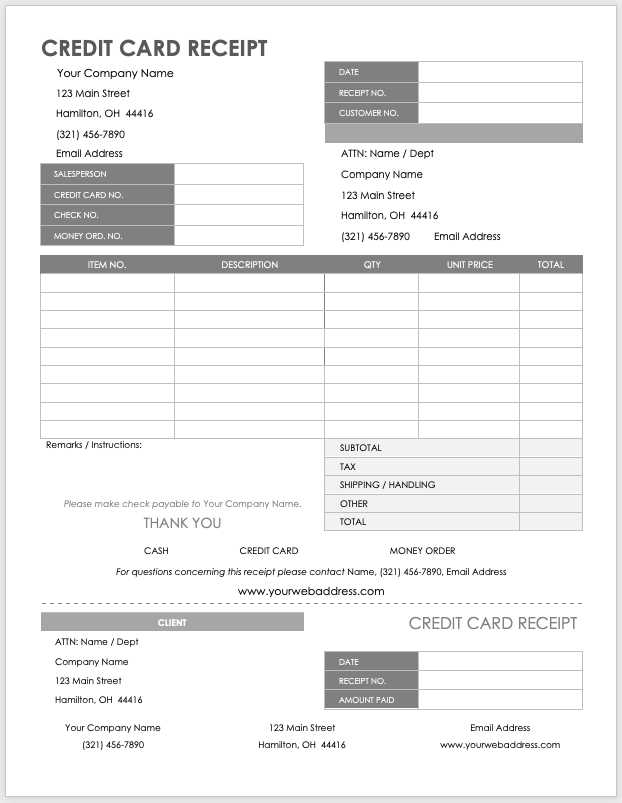

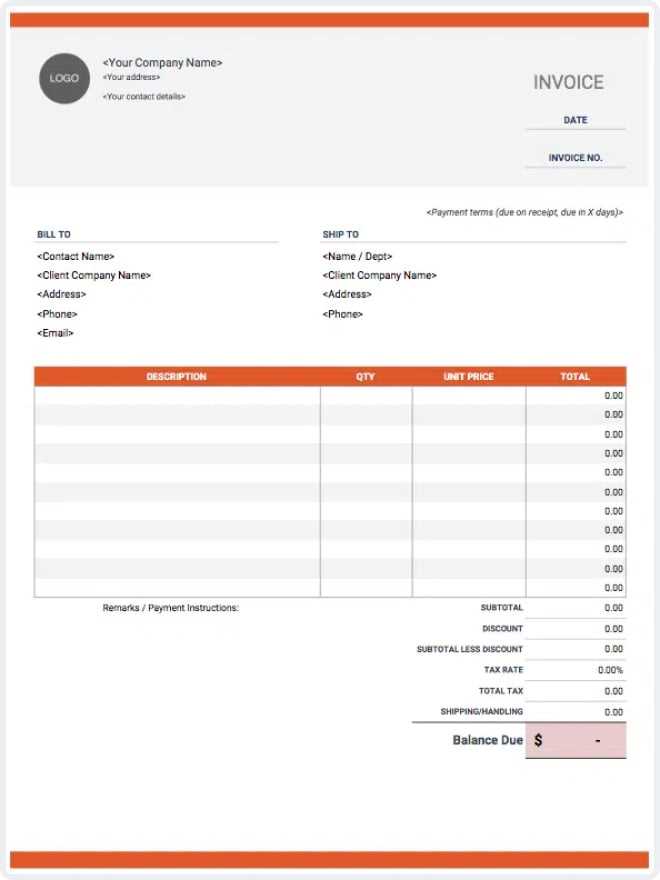

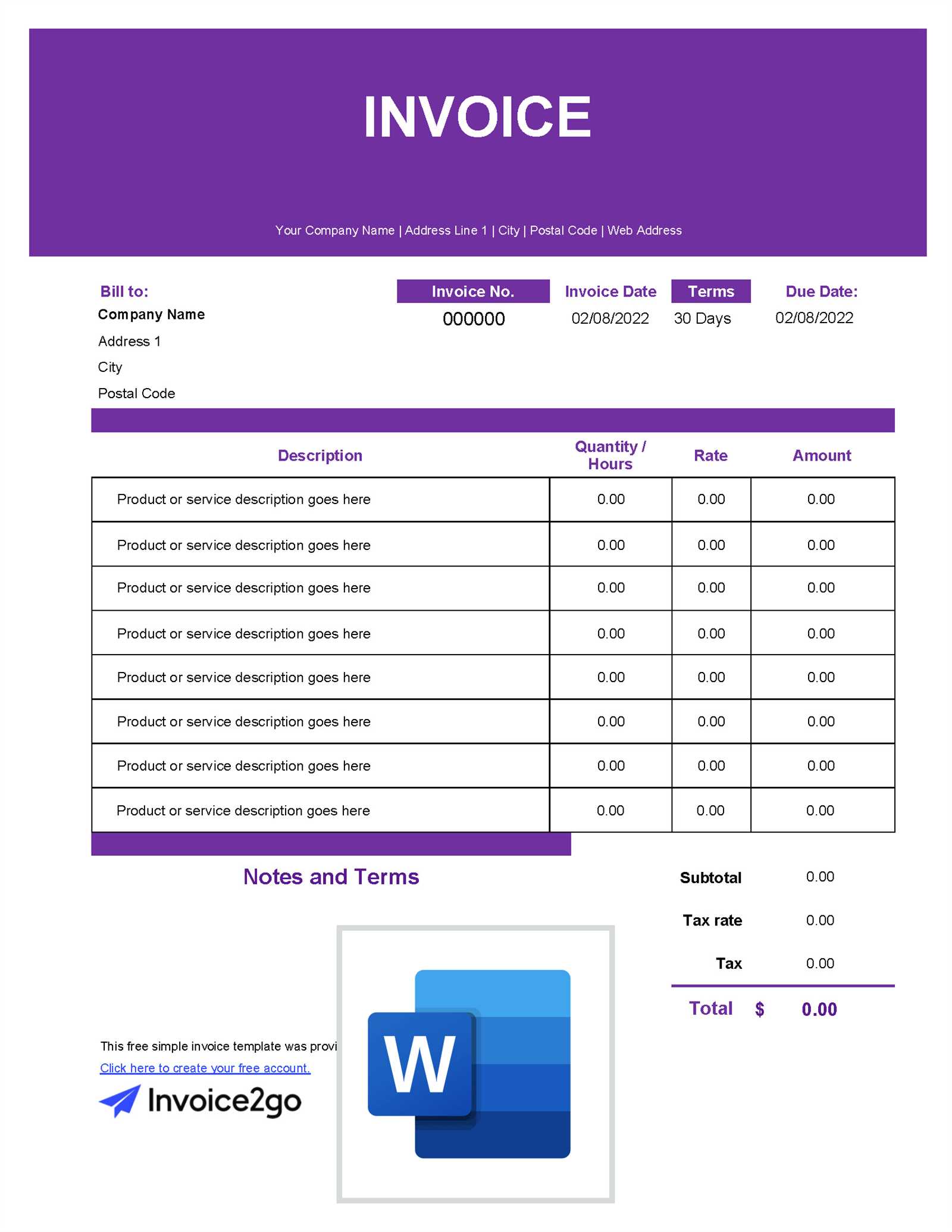

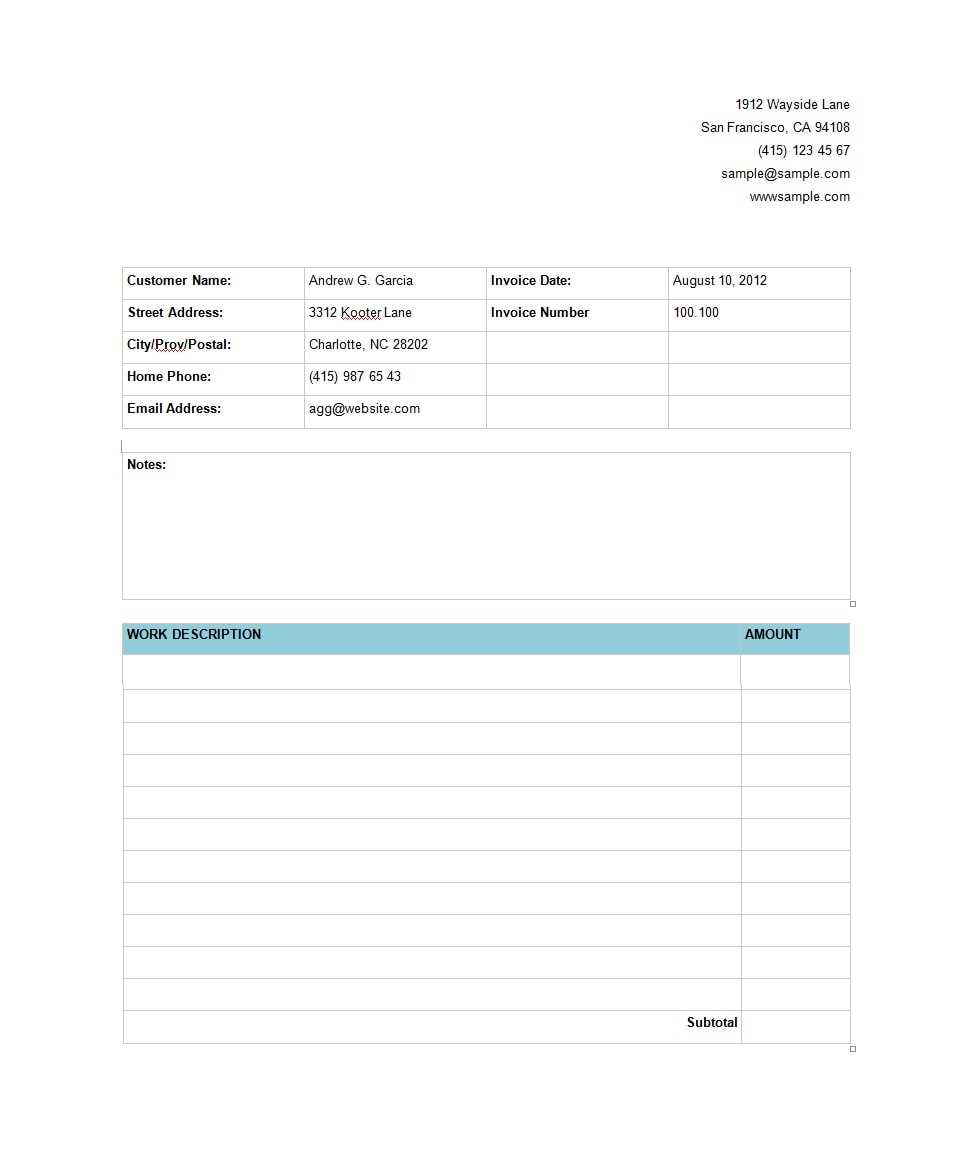

Key Elements of a Payment Request Document

To ensure clarity and prevent confusion, a well-structured payment request must include all relevant details. It’s essential to outline the work completed, the cost associated with each task, and any additional charges. By organizing the document logically, both the professional and the client can easily review and understand the amounts due.

Some of the most important components to include are the client’s information, such as their name and contact details, and the provider’s information, including the business name and address. Additionally, it should clearly state the date of the request and a unique reference number for tracking purposes. These elements help establish the document as an official record.

Equally important is the breakdown of work performed. This section should list each task separately, along with the respective cost, allowing for full transparency. Furthermore, a section for payment terms–such as due dates, accepted payment methods, and any late fees–should be clearly indicated to ensure prompt and correct payments.

How to Customize Your Payment Request Document

Customizing a payment request document is a straightforward process that ensures it reflects the unique nature of your work and business. Whether you’re working on a one-time project or maintaining long-term contracts, tailoring the document to your specific needs can streamline the billing process and enhance professionalism. The goal is to make sure that every important detail is clearly presented and aligned with your business style.

Adjusting Layout and Design

The first step in customization is choosing a layout that suits your business. The document should look professional and be easy to read. You can adjust font sizes, colors, and logo placement to match your branding. Many platforms allow for drag-and-drop editing, so you can quickly rearrange sections, such as contact information, task descriptions, and payment details, to ensure they are logically organized.

Incorporating Your Specific Information

Once the design is set, focus on the content. Start by adding your business name, logo, and any relevant certifications or licenses that might be important to the client. Be sure to include the necessary payment details, including the accepted methods, payment deadlines, and late fees if applicable. Make it clear which services were provided, along with the corresponding charges for each, to ensure transparency.

Customization should also extend to additional sections like discounts, taxes, or travel fees if they apply to your specific work. By tailoring each document to your projects, you help foster better communication and ensure your clients fully understand what they are paying for.

Choosing the Right Payment Request Format

Selecting the appropriate structure for your payment request is a critical step in ensuring both clarity and professionalism. The format you choose will influence how easily your clients can understand the charges and how smoothly the transaction process flows. It’s important to consider both the complexity of the work you do and the preferences of your clients when deciding on the layout.

Simple vs. Detailed Layout

A simple layout is ideal for smaller jobs or one-time tasks. It focuses on the essentials, such as the total amount due, brief descriptions of the work completed, and payment terms. This straightforward approach is easy for clients to review quickly and ensures fast payments.

For more complex projects or long-term contracts, a more detailed format may be necessary. This type of structure allows you to itemize every aspect of the work, list multiple stages of the project, and include additional costs like materials, permits, or taxes. Including these details ensures full transparency and reduces the likelihood of confusion or disputes.

Digital or Paper Format

Another important consideration is whether to use a digital or physical version of your payment request. Digital formats are easy to create, share, and store, while paper versions may be preferred by clients who are accustomed to traditional methods. Each option has its benefits, and the right choice depends on your business model and client preferences. Digital formats can also be integrated with accounting software, making it easier to manage payments and track outstanding balances.

Common Mistakes to Avoid in Payment Requests

When creating a document to request payment, small errors can lead to misunderstandings, delays, or even non-payment. It’s essential to ensure every detail is accurate and clearly communicated to avoid complications with your clients. Here are some common mistakes that can affect the effectiveness of your payment requests.

Missing Key Information

Omitting important details can cause confusion or force clients to contact you for clarification. Make sure your document includes:

- Client’s full name and contact details

- Detailed descriptions of the work performed

- Accurate cost breakdowns

- Clear payment terms and deadlines

Unclear Payment Terms

Ambiguities in the payment terms can lead to missed payments or disputes. Always specify:

- Exact due date

- Accepted payment methods (e.g., bank transfer, credit card)

- Any applicable late fees or interest charges for overdue payments

Inaccurate or Incomplete Pricing

Failing to list precise prices for each task or component of the project can lead to confusion. Ensure that:

- Each service or product is clearly itemized with an accurate cost

- Additional costs, such as taxes or materials, are included

- Discounts or promotional offers are clearly stated, if applicable

Errors in Contact Information

Incorrect contact details can delay payments or prevent clients from reaching out when necessary. Double-check that your business name, address, phone number, and email are correct before sending out the document.

Failure to Personalize

Using a generic, unbranded format may come across as unprofessional. Customizing your document with your business logo, colors, and a personalized touch not only makes it look more professional but also reinforces your brand image.

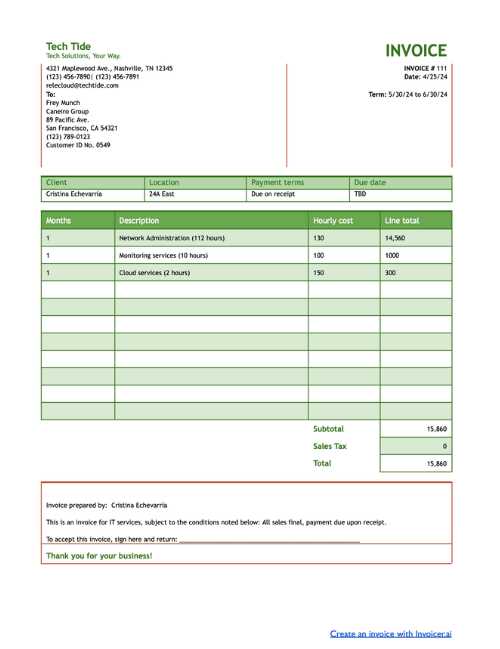

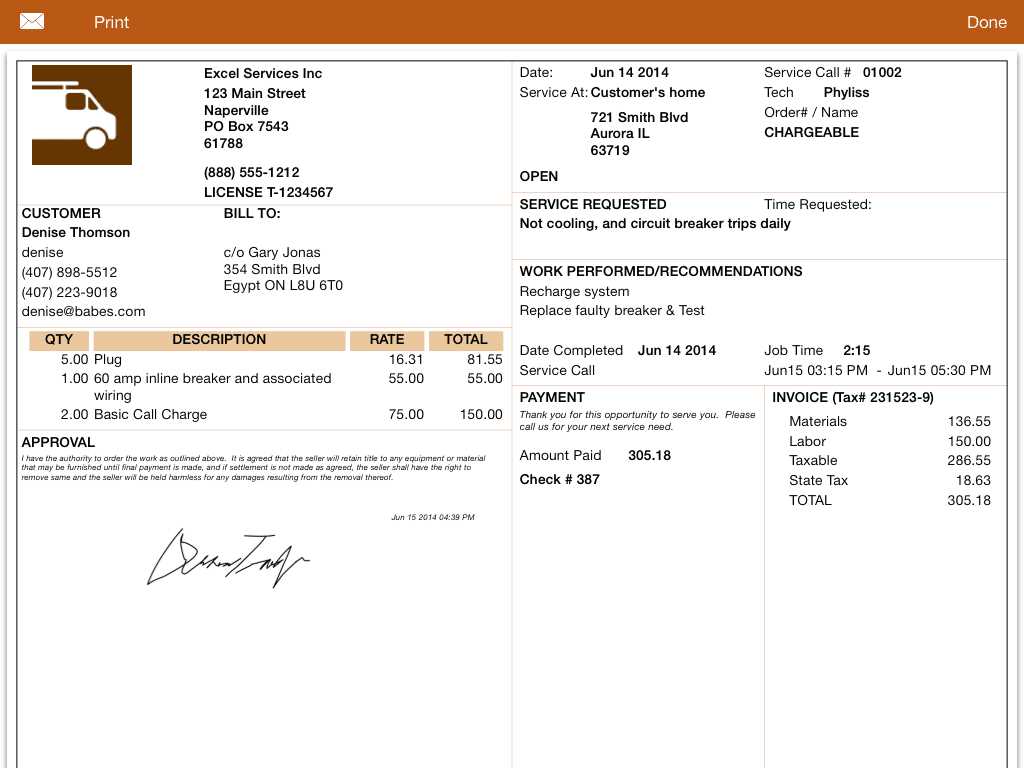

How to Itemize Work on Payment Requests

Itemizing the tasks or materials involved in a project is essential for providing transparency and clarity to your clients. Breaking down the work into individual line items ensures that both you and your client have a clear understanding of what is being paid for, and it helps prevent misunderstandings or disputes later on. A well-organized list of tasks allows for more accurate billing and promotes trust between you and your client.

Breaking Down Each Task or Product

Each item on your payment request should represent a distinct task or material used in the project. Be as specific as possible when describing the work completed. For example, instead of simply stating “plumbing work,” detail the specific tasks, such as “replacing kitchen sink” or “repairing broken pipe.” Include the amount of time spent on each task, if applicable, and the rate charged for that time or product. This level of detail helps clients understand exactly what they are paying for.

Including Additional Costs

In addition to the basic labor or product costs, you may have additional charges to include. Some common extra costs to consider are:

- Materials used for the job, such as paint, tools, or parts

- Travel or transportation fees for getting to the job site

- Consultation or design fees for planning or estimating the work

- Emergency or after-hours rates, if applicable

Be sure to itemize these additional charges separately to ensure clarity. Always state the cost for each additional service or material to avoid confusion.

Design Tips for a Professional Payment Request

Creating a visually appealing and easy-to-read document is crucial for making a strong professional impression. The layout and design elements of your payment request can influence how clients perceive your business. A clean, well-organized format not only improves readability but also ensures that all essential details are easily accessible, fostering trust and clarity.

Keep It Simple and Clean

A cluttered or overly complicated layout can confuse your clients and make it difficult for them to find the necessary information. Stick to a simple, streamlined design that prioritizes clarity. Use a basic font such as Arial or Times New Roman, with a font size that is easy to read (typically 10-12 pt). Keep the color scheme professional–neutral tones like black, grey, or navy work best–and use bold or underlined text to highlight important sections like payment due dates or amounts due.

Use Consistent Branding

Incorporating your business logo and brand colors is an excellent way to personalize the document and reinforce your company’s identity. Consistent branding helps your clients easily recognize your business, adding a sense of professionalism and credibility. Position your logo at the top of the page, and consider using your brand colors for headings, borders, or accents, but be careful not to overdo it. The goal is to make the document look polished, not distracting.

Organize the Information Logically

Ensure that the layout flows logically, with clear sections for each piece of information. A well-organized structure typically includes:

- Your business details (name, contact, address)

- Client information (name, address, contact)

- Breakdown of work completed

- Cost breakdown (tasks, materials, taxes)

- Payment terms (due date, methods, late fees)

Consider dividing the document into easily distinguishable sections using borders, lines, or shaded backgrounds for clarity. This will help the reader quickly navigate the content and find specific details without frustration.

How to Include Payment Terms Clearly

Clearly outlining payment expectations in your document is essential for ensuring timely and accurate payments. Misunderstandings about when and how to pay can lead to delays and frustration. A well-defined set of payment terms provides clarity and establishes professional boundaries, which helps build trust with clients.

Specify the Payment Due Date

One of the most important aspects of payment terms is setting a clear due date. The due date should be easy to find and prominently displayed on the document. Include a specific calendar date (e.g., “Due by April 15, 2024”) rather than a vague time frame (e.g., “Pay within 30 days”). This reduces any ambiguity and gives your client a clear deadline to meet.

Accepted Payment Methods

To avoid confusion, list all acceptable methods of payment. Be specific about whether you accept credit cards, bank transfers, checks, or digital payment systems (like PayPal or Venmo). For each method, consider including any necessary details such as:

- Bank account information for transfers

- PayPal email address

- Check payable to your business name

Late Payment Fees

Including late payment fees can help encourage prompt payment. Clearly state the percentage or flat fee you will charge if the payment is late, and specify when the fee will apply (e.g., “A 5% late fee will be added if payment is not received within 10 days after the due date”). This helps set clear expectations and protects your business from unnecessary delays.

Discounts for Early Payments

Offering an early payment discount can motivate clients to pay ahead of time. If applicable, include the terms of the discount clearly. For example:

- “A 2% discount applies if payment is made within 7 days of the issue date.”

Make sure the discount is prominently displayed, and explain how the discount will be calculated based on the total amount due.

When to Send a Payment Request

Timing is crucial when it comes to sending a payment request. Sending it too early or too late can lead to missed payments or strained relationships with clients. Knowing the right moment to issue a request can help ensure that you receive payments on time and maintain smooth business operations.

Immediately After Completing Work

For many types of projects, it’s best to send the payment request immediately after the work is completed. This ensures that the details of the project are fresh in both your mind and your client’s. It also avoids delays caused by forgetting the specifics of the work performed. If the project was completed successfully and on time, sending a payment request promptly reinforces professionalism and encourages timely payment.

At Milestone Completion

For larger projects that take time to complete, it’s a good idea to issue a request after each significant phase or milestone. For example, if you’re working on a long-term renovation or repair project, consider sending a request after completing key stages, such as the demolition phase or the final installation. This method helps keep cash flow steady and avoids waiting until the entire project is finished before receiving payment.

At Regular Intervals for Ongoing Contracts

If you have ongoing work with a client, such as maintenance contracts or subscription-based services, consider sending payment requests at regular intervals. This could be weekly, bi-weekly, or monthly, depending on your agreement. Regular billing helps both you and your client stay organized and ensures that payments are consistently made throughout the duration of the contract.

After Client Approval or Final Inspection

In cases where client approval or a final inspection is required before payment can be made, it’s important to send the request only after receiving that confirmation. This helps avoid misunderstandings and ensures that the client is satisfied with the work before committing to payment. Make sure the request includes a statement that the work has been completed to the client’s satisfaction, if applicable.

Tracking Payment Requests for Better Cash Flow

Efficiently tracking payment requests is essential for maintaining a healthy cash flow. By keeping a close eye on the status of your payments, you can prevent delays, avoid overdue balances, and ensure that your business stays financially stable. Proper tracking helps you stay organized and provides you with the information needed to follow up on unpaid amounts in a timely manner.

One of the most effective ways to track payments is by maintaining a record of all sent requests and their statuses. This could be done manually using spreadsheets or, preferably, with the help of accounting software that automatically updates the status of each request (e.g., “sent,” “paid,” “overdue”). Having all this data in one place allows you to quickly identify which payments are still pending and which clients may need to be reminded.

Another useful strategy is setting up automated reminders for clients as the due date approaches or once a payment becomes overdue. These reminders can be customized based on the payment terms you’ve established, ensuring that clients are aware of upcoming or late payments and can act accordingly. By staying proactive, you’ll reduce the chances of delays and late payments, which can severely impact cash flow.

In addition to reminders, reviewing your payment history regularly gives you valuable insights into your clients’ payment habits. If you notice that certain clients are consistently late, you can adjust your approach, perhaps requiring deposits or upfront payments for future work, or even renegotiating payment terms for better security.

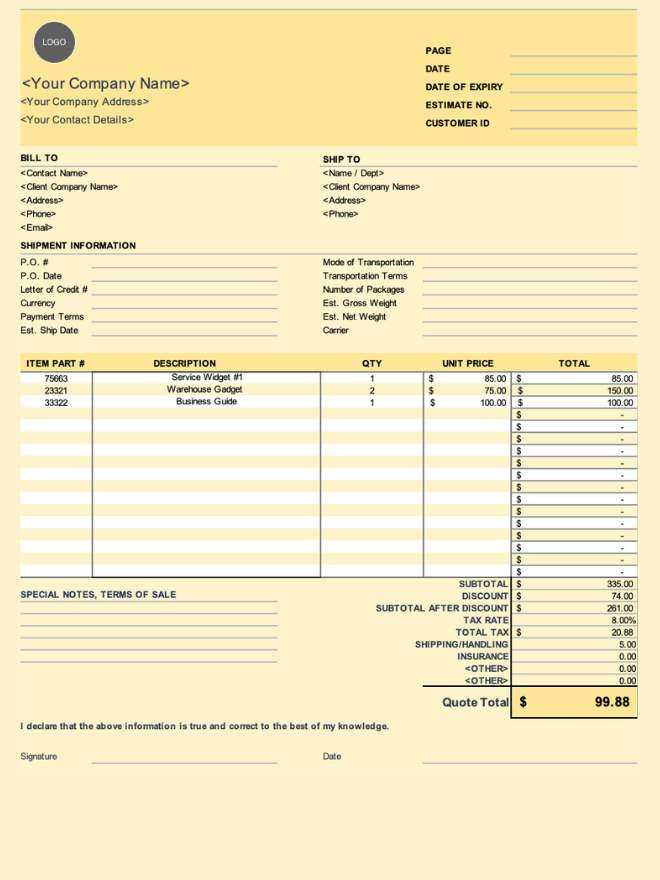

Legal Requirements for Payment Requests

When issuing a document to request payment, it’s important to comply with local regulations and legal standards. These requirements vary by country and jurisdiction but generally include certain mandatory details that ensure the document is valid and can be used for tax and legal purposes. Failing to include these key elements may result in disputes or delays in receiving payment.

Essential Information to Include

Regardless of your location, there are several details that should always be included to meet legal standards. These elements help protect both you and your client and ensure that the payment process is clear and official:

- Business Identification: Your business name, legal address, and contact information must be included, along with any relevant registration or license numbers.

- Client Information: Clearly state the client’s name, address, and contact details to avoid confusion, especially if the document needs to be presented in a legal context.

- Unique Reference Number: Each payment request should have a unique identification number, which allows you to track it for accounting and legal purposes.

- Description of Goods or Work Provided: A detailed list of tasks or products delivered, including quantities, prices, and applicable tax rates. This ensures transparency and proper documentation for both parties.

- Tax Identification Number: In some regions, your business or your client’s tax ID may need to be listed on the document for tax reporting purposes.

Tax and Legal Compliance

In many countries, tax laws require that businesses collect and document taxes on services or products provided. Depending on the nature of your work, this could include sales tax, VAT (Value Added Tax), or other local taxes. Be sure to include:

- Tax Rates: The appropriate tax rate applied to the work or materials provided should be clearly indicated, along with the total tax amount.

- Payment Terms: Include your payment terms, such as due dates, late fees, or discounts, to ensure both you and the client are on the same page regarding financial obligations.

Ensure that you are familiar with the specific legal requirements in your region and consult with an accountant or legal expert to ensure full compliance. Proper documentation not only protects your business but also helps you build credibility and trust with clients.

Creating a Reusable Payment Request Layout

Designing a customizable payment request layout that can be used repeatedly is a time-saving strategy for businesses. This type of layout ensures consistency across all documents and streamlines the process of issuing new requests. By establishing a template with fixed fields and adaptable sections, you can quickly generate professional-looking requests tailored to each client and project without starting from scratch every time.

Key Elements to Include

A reusable layout should contain all the essential sections that need to be filled in for each individual payment request. These sections should remain the same in structure, with certain fields left open for modification, such as the client’s details, specific services provided, and the total amount due. Below is a basic outline of what a standard layout should include:

| Section | Description |

|---|---|

| Business Information | Includes your business name, address, phone number, and email |

| Client Information | Fields for the client’s name, address, and contact information |

| Description of Work | A detailed list of tasks, products, or services provided, including pricing |

| Payment Terms | Specify the due date, accepted payment methods, and late fees if applicable |

| Amount Due | Total cost for the work performed, including taxes and additional fees |

Benefits of a Reusable Layout

Once your layout is designed, it can be used for multiple clients or projects, saving you significant time in the future. This ensures that your payment requests are consistent in style and content, making your business look more professional. Additionally, with a standardized approach, you reduce the risk of forgetting key details or making errors in the document.

Make sure your layout is flexible enough to adjust to the specifics of each new project while retaining the core structure. By doing so, you will streamline your billing process, enhance client satisfaction, and maintain better financial organization.

Digital vs. Paper Payment Requests: What’s Better?

When deciding how to issue payment requests, businesses often face the choice between digital or traditional paper methods. Each option has its own set of advantages and potential drawbacks. The decision depends on factors such as convenience, cost, speed, and environmental impact. Understanding the benefits of both methods can help you determine which works best for your business needs.

Advantages of Digital Payment Requests

Digital payment requests have become increasingly popular due to their speed, efficiency, and flexibility. Here are some key benefits:

- Speed: Sending a digital request can be done instantly, ensuring faster delivery and quicker client response times.

- Cost-Effective: Digital formats eliminate the need for paper, printing, and postage costs, making it a more affordable option in the long run.

- Convenience: You can easily track and store digital records, making it simple to follow up on unpaid requests or search for past transactions.

- Accessibility: Clients can receive and pay the request from anywhere, offering greater flexibility for both parties.

- Environmental Impact: Digital documents help reduce paper waste, contributing to a more eco-friendly approach to business.

Benefits of Paper Payment Requests

While digital methods are growing in popularity, there are still reasons some businesses prefer using paper requests. These advantages include:

- Personal Touch: A physical request may feel more personal and professional to some clients, helping to build stronger business relationships.

- Client Preference: Some clients may not be comfortable with digital systems and prefer receiving a physical copy for their records or payment processing.

- Legal Requirements: In some jurisdictions, physical records or signatures may be required for certain transactions or industries.

- No Technology Dependence: Paper requests don’t rely on internet access or electronic devices, making them more accessible for clients with limited access to technology.

Ultimately, the choice between digital and paper payment requests depends on your business’s goals, client preferences, and resources. For many modern businesses, a combination of both methods might be the best solution to accommodate all types of clients and situations.

How to Handle Late Payments on Payment Requests

Late payments can create challenges for businesses, disrupting cash flow and causing unnecessary stress. It’s essential to have a clear and professional strategy in place to handle overdue amounts. Addressing late payments promptly and efficiently can help protect your business without damaging client relationships. The key is to maintain professionalism while taking appropriate action to ensure timely compensation for your work.

Setting Clear Payment Terms

The first step to managing late payments is ensuring that your payment terms are clear from the beginning. Be transparent about due dates, penalties for delays, and preferred payment methods. When clients know exactly what to expect, they are more likely to respect the agreed-upon schedule. Clearly stated terms also give you a strong foundation for any follow-up communications regarding overdue amounts.

Steps to Take for Late Payments

If a payment becomes overdue, it’s important to follow a structured process for addressing the situation. Here are some effective steps to handle late payments:

- Initial Reminder: Send a polite reminder shortly after the due date passes. This could be a simple email or message acknowledging the missed payment and kindly requesting prompt payment.

- Second Follow-Up: If the payment remains unpaid after the first reminder, follow up again. This message should be more firm, reiterating the due date and specifying any late fees that may apply.

- Direct Communication: If payments are still not made, consider reaching out by phone. A direct conversation can clarify any issues and encourage quicker resolution.

- Late Fees: Ensure that late fees or interest charges are applied as stipulated in your terms. This serves as both a deterrent and a fair compensation for the delay.

- Formal Action: As a last resort, if payment is not made after multiple attempts, you may need to consider legal action or involve a collections agency. This should always be a final step after all other methods have been exhausted.

By addressing late payments professionally and consistently, you can maintain good client relationships while protecting your business’s financial health.

Benefits of Using an Invoice Generator

Using an automated tool to create payment requests offers a range of advantages for businesses. Rather than manually designing each document from scratch, an invoice generator can streamline the entire process, saving valuable time and reducing the likelihood of errors. These tools offer numerous features that improve both the efficiency and professionalism of your billing system.

One of the key benefits is the speed at which you can generate customized requests. With pre-designed formats and the ability to input specific client details, a generator allows you to create a document in just a few clicks. This eliminates the need for manually entering repetitive information, such as your business name, client information, and payment details.

Another significant advantage is the reduction of human error. With a template in place, the chances of missing critical information or making mathematical mistakes are greatly minimized. Invoice generators often come with built-in calculators, automatically summing totals and applying taxes or discounts as needed.

Additionally, an invoice generator often provides options for branding, allowing you to add your logo, business colors, and other elements that personalize each request. This gives your payment requests a polished, professional look, enhancing your business’s image and fostering trust with clients.

Many tools also allow for digital tracking, making it easier to monitor the status of requests, set reminders for overdue payments, and keep an organized record of transactions. These features help ensure timely follow-ups and better financial management overall.

Ultimately, using an invoice generator not only saves time and reduces errors but also ensures a smoother, more professional billing experience for both you and your clients.

Integrating Payment Requests with Accounting Software

Integrating payment requests with accounting software can greatly improve the efficiency of managing financial records. By automating the connection between billing and accounting systems, businesses can streamline their processes, reduce manual data entry, and ensure more accurate financial tracking. This integration helps to maintain up-to-date financial information and avoid discrepancies between payment records and accounting reports.

Advantages of Integration

Here are some key benefits that come with integrating payment requests into your accounting software:

- Automated Data Syncing: Automatically transfer payment data directly from the request to your accounting system, eliminating the need to manually enter figures, dates, and client details.

- Real-Time Updates: As soon as a payment request is issued or updated, the accounting system reflects the changes in real-time, keeping your financial records current and accurate.

- Improved Accuracy: Reduces the chances of errors from manual input, ensuring that your income, tax calculations, and balances are always correct.

- Time-Saving: By automating the process, you save valuable time that would otherwise be spent on data entry, allowing you to focus on growing your business.

- Better Financial Insights: Integration gives you easy access to detailed financial reports, helping you make informed decisions based on up-to-date data.

How to Integrate

Integrating payment requests with your accounting software typically involves linking the two platforms through a third-party app or direct API integration. Follow these steps to set up the integration:

- Select Compatible Software: Choose accounting software that supports integration with your payment request system, ensuring they are compatible with each other.

- Set Up Integration: Follow the instructions provided by both systems to connect them. This may involve granting access to your software accounts or installing specific plugins.

- Configure Preferences: Customize the integration settings according to your business needs, such as selecting which payment categories to sync or automating tax calculations.

- Test the System: Perform a test transaction to verify that the integration works as expected and all data is correctly synced across both platforms.

By integrating payment requests with your accounting software, you simplify financial management, improve accuracy, and ultimately make your billing system more efficient and effective.

Why Accurate Payment Requests Build Client Trust

Providing clients with precise and clear payment requests is essential for fostering trust and maintaining long-term relationships. When clients receive professional, well-organized documents, they feel confident in your business practices and are more likely to return for future projects. Accurate requests not only reflect your attention to detail but also show that you value transparency and fairness in your transactions.

Key Reasons Why Accuracy Matters

Here are several reasons why clear and correct payment requests play a crucial role in building trust with clients:

- Professionalism: An error-free document demonstrates that you are professional and take your business seriously. Clients are more likely to trust a business that provides clean, well-organized records.

- Transparency: When all charges are clearly outlined, clients feel assured that there are no hidden costs or confusing fees. Transparency helps avoid misunderstandings and builds a stronger relationship.

- Efficiency: A well-organized payment request makes it easier for clients to understand exactly what they are being billed for, leading to quicker payments and fewer queries.

- Reputation: Consistently accurate billing contributes to a strong reputation for reliability. Clients are more likely to recommend a business that handles financial matters with precision and honesty.

- Minimized Disputes: Mistakes or inconsistencies in payment requests can lead to disputes and delays. When your documents are accurate from the start, the chances of disagreements are greatly reduced.

Building Lasting Relationships

Accurate payment requests go beyond just completing a transaction. They are a reflection of how you manage your business and how much you value your clients. By providing clear, correct billing details, you create a foundation for mutual respect and long-lasting business relationships. This trust encourages clients to return for future work, knowing they will always receive reliable and professional service.