TNT Proforma Invoice Template for Easy Customization and Use

Managing international shipments and payments can be complex, especially when it comes to ensuring all necessary details are clearly communicated between parties. A well-structured document that outlines the terms of a transaction before it’s finalized can save time, reduce errors, and help avoid misunderstandings. In many cases, businesses rely on a specific type of document to serve this purpose, providing a preliminary overview of key details like product description, pricing, and shipping terms.

By using a standardized version of this document, businesses can easily customize it to fit their specific needs, ensuring that all critical information is captured and presented in a clear and professional manner. This process not only helps in maintaining accuracy but also fosters trust between the buyer and seller. In this article, we will explore the advantages of using such a document format and how it can be adapted to suit different business requirements.

Understanding the core components and how to customize it for specific situations is key to maximizing its usefulness in daily operations. Whether you’re a small business owner or part of a larger organization, mastering this essential document will enhance your operational efficiency and streamline your financial transactions.

What is a Shipping and Payment Preliminary Document

A shipping and payment preliminary document is a formal record used in international trade to outline the details of a transaction before the final sale is completed. It serves as a non-binding agreement between the buyer and seller, offering an initial overview of the goods or services involved, their pricing, and the terms of delivery. This document plays a crucial role in helping both parties understand the expected costs, timelines, and requirements for the shipment, without any immediate financial commitment.

Businesses commonly use this type of record for customs and administrative purposes, allowing both parties to agree on the terms prior to finalizing the deal. The key idea behind this document is to ensure transparency and accuracy in international trade. Some of the main benefits include:

- Providing a clear summary of the goods or services being exchanged

- Ensuring that both parties agree on the pricing and shipping terms

- Serving as a reference for customs clearance and international regulations

- Facilitating smoother communication and preventing misunderstandings

Although not a binding contract, it helps set the groundwork for the eventual finalization of the deal. Once the terms are agreed upon, the transaction can proceed smoothly, with both parties having a shared understanding of the key details involved. This preliminary record is especially important when dealing with international shipments, where different countries may have varying requirements and regulations.

Why Use a Preliminary Document Format

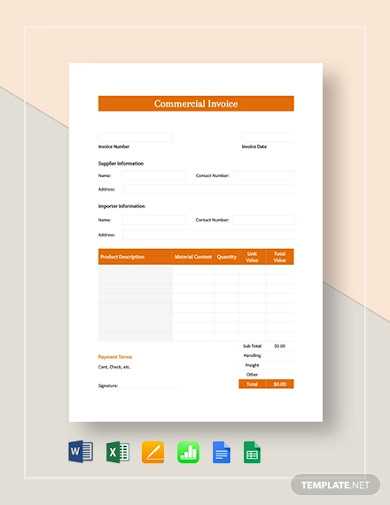

Utilizing a standardized format for creating a preliminary document in business transactions can offer significant advantages, particularly when dealing with international trade. This format provides a structured way to present key transaction details clearly, reducing the chances of misunderstandings between buyers and sellers. By relying on a pre-made format, businesses can save time, ensure consistency, and maintain accuracy across multiple transactions.

Here are some of the key reasons why using such a structured document format is beneficial:

- Consistency and Professionalism: A well-organized format ensures that all the necessary details are included, providing a professional and consistent look for every transaction.

- Time-Saving: By using a ready-to-go document, businesses can avoid the time-consuming task of creating a new record from scratch for every transaction.

- Improved Accuracy: With a template, key fields are pre-set, reducing the chances of omitting essential information or making errors in the details provided.

- Simplified Communication: Having a clear, standardized format helps both parties understand the terms of the deal quickly, which is especially important when communicating across borders.

- Customizable for Specific Needs: Though based on a standard format, these documents can be easily adjusted to fit the unique requirements of any particular transaction.

Using this type of document format not only streamlines the transaction process but also helps prevent potential delays or issues related to unclear documentation, particularly when dealing with customs or international shipping requirements. By adopting a standardized approach, businesses can increase their operational efficiency while maintaining a high level of accuracy and professionalism.

Benefits of Shipping and Payment Preliminary Document Format

Using a structured document format for detailing the terms of a transaction offers multiple advantages for businesses engaged in international trade. This type of document ensures that both parties clearly understand the specifics of the deal, helping to avoid misunderstandings and simplifying administrative processes. It can be easily customized for each transaction, yet maintains a consistent, professional appearance that fosters trust and efficiency.

Enhanced Clarity and Transparency

One of the primary benefits of adopting this type of structured document is the clarity it brings to every aspect of the transaction. Both the buyer and the seller can quickly reference all relevant details such as pricing, delivery terms, and product descriptions. This transparency eliminates any confusion or ambiguity that might arise during the negotiation process, allowing both parties to agree on the terms with confidence. Clear documentation is especially important when shipping internationally, as it helps to avoid potential delays at customs or complications due to incomplete or inaccurate information.

Streamlined Process and Reduced Errors

Using a standardized format also significantly reduces the likelihood of errors. With pre-defined fields and a clear structure, businesses are less likely to overlook critical details, ensuring that the document contains all necessary information. This consistency speeds up the preparation and review process, making it easier to manage multiple transactions efficiently. Furthermore, it simplifies internal workflows by creating a straightforward system for both invoicing and shipping documentation.

By leveraging a reliable and structured format, businesses not only improve their operational efficiency but also enhance customer satisfaction by providing clear, accurate, and timely documentation for each transaction. Whether it’s for compliance, logistics, or communication, the benefits of using this approach are clear and substantial.

How to Download Shipping and Payment Preliminary Document

Downloading a structured format for your shipping and payment details is a straightforward process, but it’s important to follow the right steps to ensure you’re getting the most up-to-date and accurate version of the document. Many service providers and platforms offer these documents for free, allowing businesses to quickly customize them according to their specific needs. Whether you’re new to using this format or are familiar with it, downloading it can be done in a few simple steps.

Step 1: Choose a Reliable Source

The first step is to find a trustworthy source from which to download the document. Ensure that the platform you are using is reputable, especially if you plan to use the document for international transactions or shipping. Official company websites, logistics service providers, or trusted online platforms usually offer the most reliable versions of these records. Always make sure the document is compatible with your region’s regulations and business requirements.

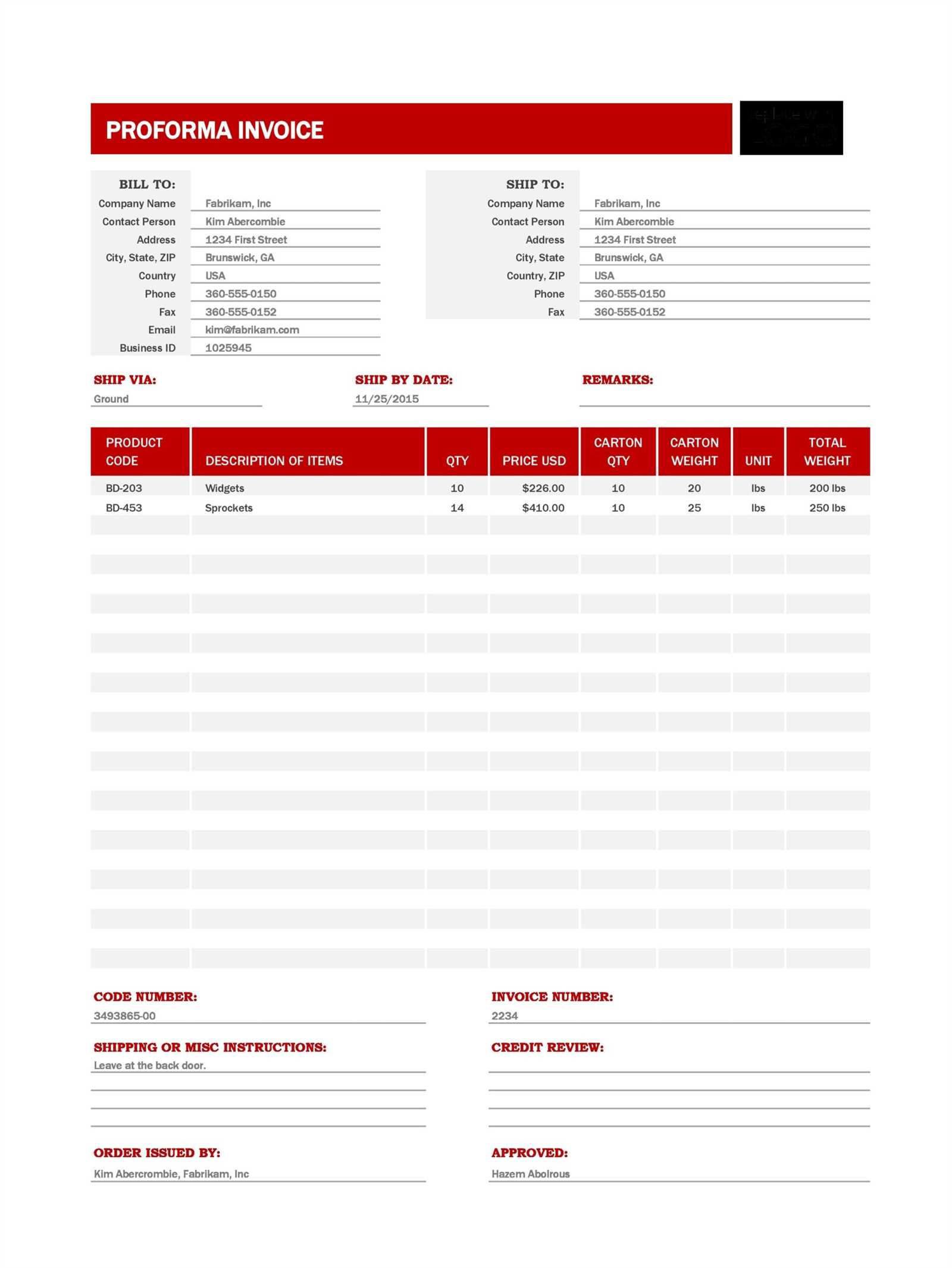

Step 2: Download and Customize the Document

Once you’ve located the right source, downloading the document is usually as simple as clicking a download link or button. After downloading the file, open it in your preferred editing software (such as Microsoft Word, Excel, or Google Docs). You can then customize the document by adding specific transaction details like product descriptions, prices, shipping terms, and payment instructions. Ensure that all required fields are filled out accurately to avoid any issues with the transaction.

Once you’ve completed these steps, your document will be ready for use. Always save a copy for your records, and ensure that the version you send to the other party reflects any changes made.

Step-by-Step Guide to Customizing Document Formats

Customizing a structured document format for your transaction details is an essential skill to ensure that all relevant information is accurately conveyed. By tailoring the fields and sections to match your specific needs, you can create a clear and professional document that meets the requirements of both parties involved. This guide will take you through the steps to modify the document, making it more efficient and aligned with your business processes.

Step 1: Open the Document and Review the Structure

Start by opening the downloaded document in your preferred editing software, such as Microsoft Word or Google Docs. The first thing you should do is review the overall structure of the document. Make sure it includes all the necessary sections, such as sender and receiver details, product descriptions, pricing, and shipping terms. Ensure that the format follows a logical flow, which will make it easy for both parties to understand the key details of the transaction. If any section is missing, you can easily add it using the available tools in your editor.

Step 2: Customize Fields and Add Transaction Details

Once you’ve reviewed the structure, it’s time to customize the document with your specific transaction details. Begin by adding the following information:

- Seller and Buyer Information: Fill in the name, address, and contact details for both parties involved in the transaction.

- Product Descriptions: Provide a clear description of the goods or services being exchanged, including quantities, unit prices, and total amounts.

- Shipping Information: Include the agreed delivery method, expected arrival date, and any special instructions related to the shipment.

- Payment Terms: Specify the payment conditions, including methods, deadlines, and any deposits or prepayments required.

By ensuring that all these fields are correctly filled out, you provide a transparent overview of the transaction, helping to avoid any confusion or disputes later. You can also make any adjustments to the formatting, such as changing font styles or colors to match your brand’s look and feel.

After completing these steps, save your customized document and ensure it is ready for use in future transactions or sent to the relevant parties for review. Customizing your documents in this way streamlines your operations and promotes clarity throughout your business dealings.

Common Mistakes When Creating Shipping and Payment Documents

Creating a structured document for international transactions may seem straightforward, but there are several common errors that can lead to confusion, delays, or even financial discrepancies. Whether it’s omitting important details, misunderstanding the terms, or not properly formatting the document, these mistakes can affect the clarity of the transaction and hinder smooth business operations. In this section, we will highlight some of the most frequent errors to avoid when preparing these documents.

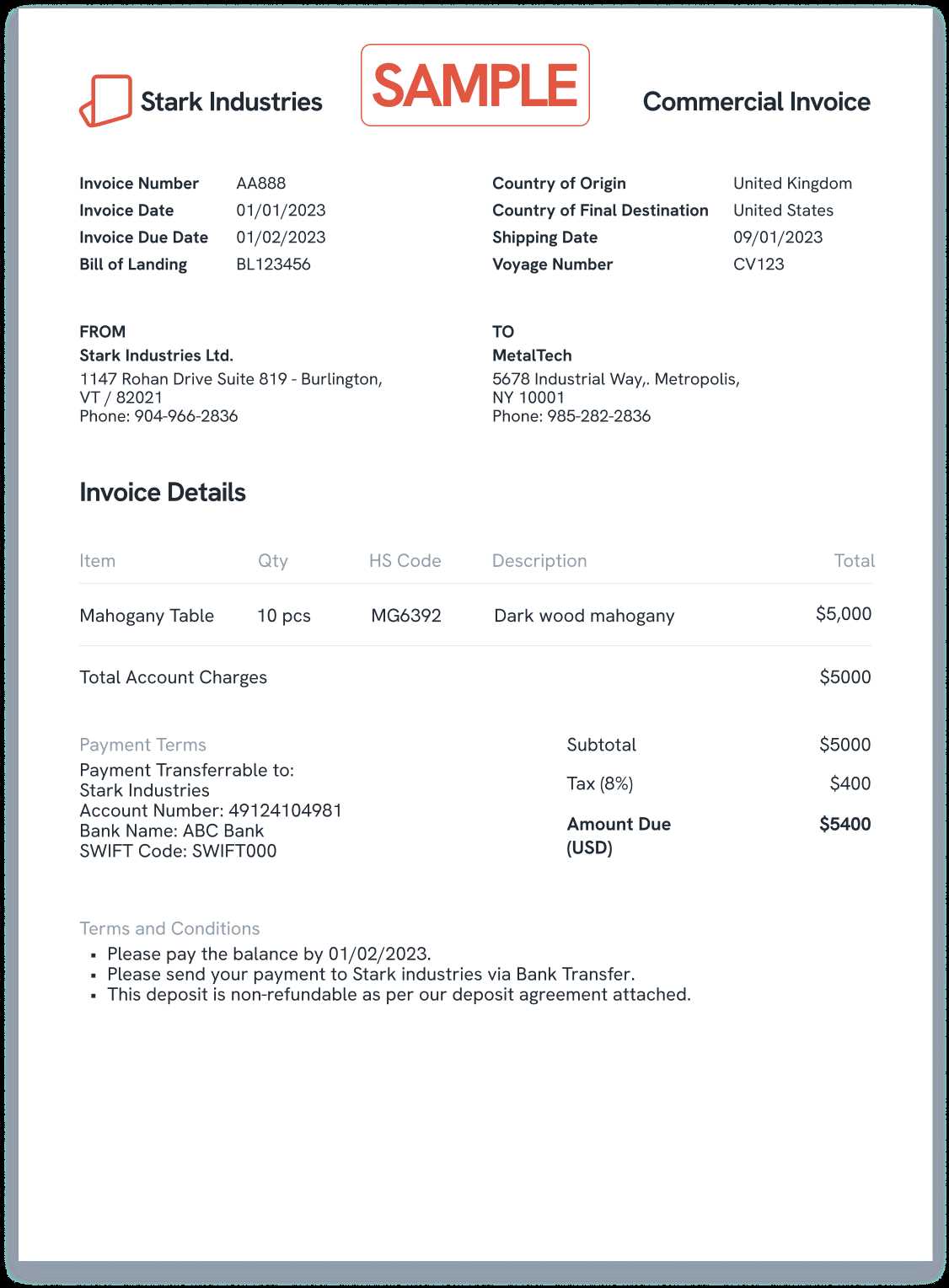

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Missing or Incorrect Contact Information | Delays in communication and shipment. | Double-check all buyer and seller details to ensure they are accurate and complete. |

| Incorrect Product Descriptions | Discrepancies at customs or with the buyer. | Provide clear, detailed descriptions including quantities, specifications, and serial numbers. |

| Inaccurate Pricing or Currency Issues | Confusion over the total cost and payment expectations. | Ensure that all prices are listed correctly, including taxes, and specify the currency used. |

| Omitting Shipping Details | Delays or complications with delivery. | Include the shipping method, expected delivery date, and any special instructions. |

| Failure to Mention Payment Terms | Payment disputes or missed deadlines. | Clearly outline payment terms, including due dates, methods, and deposit requirements. |

| Not Including Legal or Regulatory Information | Complications with customs clearance. | Make sure to include any legal or regulatory information required by the countries involved. |

By avoiding these common mistakes, businesses can ensure that their documents are accurate, clear, and compliant with international regulations. Taking the time to carefully review the details before sending the document can save time and prevent costly errors down the line.

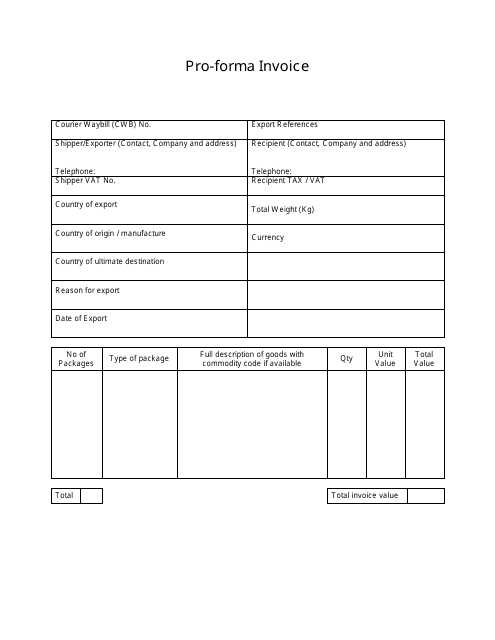

Essential Elements of Shipping and Payment Preliminary Document

When preparing a formal document for an international transaction, it’s essential to include certain key elements that ensure all parties are clear on the terms of the deal. These components not only provide a detailed overview of the transaction but also help in streamlining the shipping, customs clearance, and payment processes. A well-organized document will contain the necessary details to prevent confusion and ensure smooth business operations from start to finish.

Key Information About the Transaction

One of the most important aspects of a transaction document is clearly stating all relevant information about the transaction. This includes:

- Buyer and Seller Details: Full names, addresses, and contact information for both parties involved in the deal.

- Product Information: A detailed description of the items being exchanged, including quantities, unit prices, and any specific product identifiers like model numbers or serial codes.

- Delivery Terms: The agreed-upon method of shipment, the expected delivery date, and any special instructions related to handling or customs clearance.

Payment and Legal Information

In addition to transaction details, it’s crucial to include all relevant payment and legal information to avoid any future issues:

- Payment Terms: Specify the payment methods, due dates, and any prepayment or deposit conditions that were agreed upon.

- Legal and Regulatory Information: Include any legal disclaimers, tax details, or information required for customs compliance, particularly when dealing with international shipments.

By ensuring that these essential elements are included, businesses can avoid misunderstandings and create a smooth pathway for completing the transaction. Clear and accurate documentation is vital for maintaining professionalism and ensuring both parties are on the same page.

How to Add Shipping Details in the Document

Including shipping details in a transaction document is essential for ensuring that both parties understand the terms of delivery. Clear shipping information helps avoid confusion and potential delays, especially when dealing with international shipments. By adding the correct shipping details, you can ensure that the recipient knows exactly when and how to expect their goods. Below is a step-by-step guide on how to properly include this information in your document.

Step 1: Identify Key Shipping Information

When adding shipping details, it is important to include the following key pieces of information:

- Shipping Method: Specify how the goods will be delivered (e.g., air freight, sea freight, courier, etc.).

- Shipping Address: Provide the complete delivery address, including any special instructions for the delivery.

- Delivery Date: Include the expected arrival date or timeframe for the shipment to reach its destination.

- Tracking Information: If available, include tracking numbers or other relevant details for monitoring the shipment’s progress.

- Shipping Costs: Indicate whether the buyer or seller is responsible for shipping fees and specify the amounts if necessary.

Step 2: Format the Shipping Section

Once you have gathered all the relevant shipping details, the next step is to format them clearly in the document. A structured layout can help ensure that nothing is overlooked. Below is an example of how to organize the shipping information in a table format:

| Shipping Method | Air Freight |

|---|---|

| Shipping Address | 1234 Business St., City, Country |

| Expected Delivery Date | October 20, 2024 |

| Tracking Number | ABC123XYZ |

| Shipping Cost | Paid by Buyer – $50 |

By organizing the shipping details in a clear and accessible manner, you ensure that both parties are aligned on delivery expectations. This also helps in tracking and resolving any potential issues related to shipping or delivery once the transaction is complete.

How Standardized Document Formats Improve Accuracy

Using a standardized document format for financial transactions significantly enhances accuracy, ensuring that all required information is included and correctly presented. This approach reduces the likelihood of errors that can arise from manual document creation, which can lead to delays, disputes, or misunderstandings between parties. By adopting a structured format, businesses can streamline the process and increase the reliability of their records.

Here are some ways in which using a predefined format improves the accuracy of transaction documentation:

- Predefined Fields: The format includes set fields for critical information such as product details, pricing, and payment terms. This eliminates the risk of forgetting key details or entering incorrect data.

- Consistency Across Documents: By using the same structure for all transactions, businesses maintain consistency, making it easier to compare records and reduce discrepancies.

- Automated Calculations: Many predefined formats come with built-in formulas for calculating totals, taxes, and shipping costs, ensuring that these figures are accurate and up to date.

- Clear Segmentation: The document format is typically divided into sections, which makes it easier to review and verify each part of the transaction. This reduces the chance of overlooking important details.

- Reduced Human Error: With a structured format, the need for manual data entry is minimized, reducing the possibility of typos, incorrect figures, or misplaced information.

By relying on a standardized format, businesses can ensure that each transaction is documented accurately, improving operational efficiency and minimizing the potential for costly mistakes. This approach not only supports financial accuracy but also fosters trust and transparency with clients and partners.

Best Practices for Using Preliminary Transaction Documents

Using a structured document for detailing transaction terms is an essential part of international business. To ensure smooth operations and avoid common mistakes, it is crucial to follow best practices when preparing these documents. By adhering to established guidelines, businesses can create clear, accurate records that help streamline communication, facilitate payment processing, and prevent misunderstandings between buyers and sellers.

Ensure Accuracy and Clarity

One of the most important best practices is to provide accurate and clear information throughout the document. This includes specifying:

- Product Details: Be specific about the goods or services being sold, including quantities, specifications, and any unique identifiers like serial numbers or model numbers.

- Payment Terms: Outline the agreed-upon payment methods, deadlines, and any deposit or advance requirements.

- Shipping Information: Provide clear details on how the items will be shipped, including delivery dates, shipping methods, and tracking numbers (if available).

- Prices and Fees: List unit prices, taxes, discounts, and total amounts to ensure both parties are aligned on financial terms.

Maintain Consistency and Professionalism

Consistency in document formatting helps maintain professionalism and reduces the chances of errors or confusion. Here are some tips for maintaining consistency:

- Use a Standardized Format: Always use a consistent layout and structure for each document. This makes it easier for both parties to quickly locate the necessary information.

- Check for Errors: Always review the document carefully before sending it to avoid any typos, discrepancies, or missing information that could lead to misunderstandings.

- Provide Clear Headings: Organize sections with clear headings, such as “Product Description,” “Payment Terms,” and “Shipping Information,” to improve readability and make the document easier to navigate.

By following these best practices, businesses can ensure that their preliminary transaction documents are professional, clear, and accurate, ultimately leading to more successful and efficient business dealings.

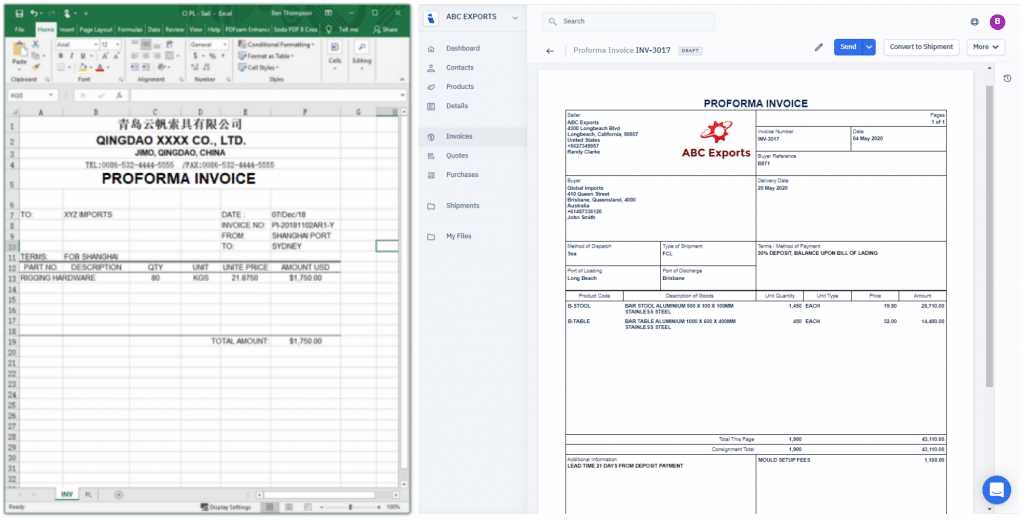

Integrating Standardized Documents with Other Tools

Integrating structured documents with various business tools can streamline workflows, improve data accuracy, and save valuable time. By linking these documents with other software platforms, such as accounting systems, customer relationship management (CRM) software, or inventory management tools, businesses can automate key processes, reduce manual entry errors, and enhance operational efficiency. Below, we will explore how integrating these documents with other tools can benefit your business.

Key Benefits of Integration

Integrating structured documents with external tools brings several advantages:

- Automation of Data Entry: Automatically populate fields such as pricing, product descriptions, and customer details from external systems, reducing manual entry errors and speeding up document creation.

- Improved Accuracy: Integration with inventory and order management systems ensures that product information is always up-to-date, reducing the risk of incorrect data being included in the document.

- Time Savings: Automating the flow of data between systems eliminates the need for repeated data entry, allowing staff to focus on more important tasks.

- Centralized Information: By linking documents with CRM and financial tools, all transaction-related information is stored in one central location, making it easier to track and manage.

How to Integrate with Other Tools

Integrating these documents with your existing business tools can be done in several ways:

- Use of API Integrations: Many modern business tools offer API access that allows for seamless data exchange between systems. By setting up these integrations, you can automatically pull customer, product, and payment details into your transaction documents.

- Link with Accounting Software: Integrating with accounting platforms like QuickBooks or Xero ensures that your transaction documents are automatically recorded for financial reporting and tax purposes.

- Inventory and Shipping Software: Syncing with inventory management or shipping software helps track the availability of goods, calculate shipping costs, and provide real-time tracking information for each transaction.

- Customer Relationship Management (CRM) Tools: By linking documents to CRM systems, you can easily access customer history, update contact information, and track sales progress, all from within your document management system.

By integrating your documents with these tools, you can achieve greater efficiency and accuracy across all business processes, making transactions smoother and more transparent for both your team and your customers.

Key Differences Between Preliminary and Final Transaction Documents

When handling international business transactions, it’s important to understand the difference between a preliminary document and a final transaction record. Although both serve as formal records of a sale, they are used in different contexts and for different purposes. Understanding these distinctions ensures that businesses comply with legal requirements and that transactions are processed smoothly without confusion.

Purpose and Use

One of the main differences between the two types of documents is their purpose:

- Preliminary Document: This document is typically used as a draft or a quotation, providing an overview of the sale before any actual goods or services are provided. It is often sent to the buyer for review and approval, but it does not require payment or serve as an official request for payment.

- Final Transaction Document: This document is used after goods have been shipped or services rendered. It serves as an official request for payment, and it includes final pricing, taxes, and payment instructions. It is legally binding and typically accompanies the goods during shipping.

Legal and Financial Implications

Another significant difference lies in the legal and financial implications of each document:

- Preliminary Document: While useful for providing detailed terms, this document is not legally binding in the same way a final transaction document is. It is often used to estimate costs or outline proposed terms, but it does not trigger the same legal obligations as a final record.

- Final Transaction Document: This document is legally binding and confirms the agreed-upon terms of the sale. It acts as a proof of transaction and is used for customs clearance, tax reporting, and payment processing. It is an official request for payment that the buyer is expected to settle.

Understanding these key differences helps businesses choose the correct document type for each stage of a transaction, ensuring compliance with legal standards and providing clarity in communication between buyers and sellers.

How Standardized Document Formats Help Streamline Operations

Using structured and standardized documents plays a crucial role in enhancing operational efficiency within businesses. By adopting a consistent format for transaction-related records, companies can automate workflows, reduce manual errors, and improve communication between departments. This streamlined approach leads to faster processing times, fewer mistakes, and a more organized workflow, making it easier to manage transactions and administrative tasks.

Key Benefits of Standardized Formats

Structured documents provide a range of advantages that contribute to a more efficient operation:

- Reduced Time Spent on Document Creation: With predefined fields and sections, employees spend less time drafting documents from scratch, allowing them to focus on more valuable tasks.

- Minimized Errors: Standardization reduces the risk of missing or incorrect data entries. By using a fixed format, businesses ensure that all essential details are included and accurate.

- Faster Processing: Automated data population and easy-to-read layouts enable quicker review, approval, and processing of documents, reducing delays in the transaction cycle.

- Consistency Across Documents: A uniform approach ensures that every transaction document looks the same, which improves clarity and simplifies document tracking.

- Better Integration with Other Systems: Standardized documents can easily integrate with accounting, inventory, and shipping software, automating tasks such as billing, inventory updates, and order tracking.

Improved Collaboration and Communication

Adopting structured documents not only improves internal workflows but also enhances communication with external parties:

- Clear Communication with Customers: When customers receive standardized documents, they can quickly identify and verify the details of the transaction, leading to fewer misunderstandings.

- Simplified Training for New Employees: New staff members can easily learn how to create and manage documents when there is a consistent structure in place.

- Enhanced Customer Service: With streamlined processes, businesses can respond to customer inquiries

Tips for Ensuring Compliance with Standardized Document Formats

Ensuring compliance with legal and regulatory requirements is essential when creating formal transaction documents. By using a standardized format, businesses can avoid costly errors and ensure that their documents meet both internal and external requirements. Adhering to the proper guidelines helps maintain accuracy, transparency, and accountability, while also fostering trust with clients and partners.

Key Tips for Compliance

Here are some important tips to ensure that your documents are fully compliant with applicable laws and best practices:

- Follow Legal Requirements: Make sure that all required legal information is included in the document, such as tax identification numbers, business registration details, and specific terms required by local or international laws.

- Include All Necessary Information: Ensure that all relevant details, such as product descriptions, pricing, shipping terms, and payment methods, are clearly listed and consistent with the agreed-upon terms.

- Verify Tax and Regulatory Compliance: Double-check that the tax rates and fees listed in the document align with local regulations. For international transactions, ensure that customs duties and other import/export requirements are properly accounted for.

- Use Accurate Currency and Payment Terms: Always specify the currency in which payment will be made and the agreed payment terms (e.g., payment due dates, method of payment, and any applicable penalties for late payments).

- Ensure Consistent Formatting: Consistent formatting across all documents ensures clarity and prevents any confusion. Ensure that the document layout is professional and follows standard conventions for ease of understanding.

- Review for Accuracy: Before finalizing any document, perform a thorough review to check for any errors or omissions. This includes verifying product descriptions, quantities, prices, and shipping details.

Stay Up to Date with Changes

Legal and regulatory requirements can change over time, so it’s crucial to stay informed about the latest updates that may affect the content of your documents:

- Monitor Local Laws: Regularly review changes in local tax laws, import/export regulations, and other relevant policies to ensure that your documents remain compliant with evolving requirements.

- Update Templates Regularly: Keep your document formats up to date by periodically revisiting your templates to incorporate any legal or regulatory changes that may impact your transactions.

- Consult Legal Experts: If you are unsure about specific requirements or need clarification on complex regulations, consult with a legal expert to ensure full compliance with applicable laws.

By adhering to these best practices, businesses can create documents that meet legal requirements, reduce the risk of errors, and ensure a smoother and more compliant transaction process.

Why Standardized Document Formats Are Trusted Worldwide

Standardized document formats have become a trusted tool for businesses around the world, offering consistency, reliability, and clarity in transactions. These formats help ensure that essential information is presented in a uniform way, making it easier for companies to communicate, track, and process deals, regardless of location. Their widespread adoption stems from their ability to reduce errors, streamline workflows, and meet international standards, leading to more efficient business operations globally.

Key Reasons for Global Trust

Several factors contribute to the widespread trust and use of standardized documents in international trade and business:

- Consistency and Professionalism: A uniform structure provides a sense of professionalism and reliability, helping businesses maintain a consistent image across transactions and interactions with clients worldwide.

- Clear Communication: These formats simplify the process of communication between parties, ensuring that all critical details such as prices, shipping methods, and payment terms are easy to understand and clearly presented.

- Compliance with International Standards: Standardized formats help businesses comply with international trade regulations, ensuring that all essential elements are included and formatted in accordance with global norms.

- Reduced Risk of Errors: The use of pre-defined fields and consistent structure minimizes the chances of missing or incorrect information, which can lead to misunderstandings, delays, or financial losses.

- Easy Integration with Other Systems: These formats are designed to be compatible with other business tools such as accounting software, shipping platforms, and customer relationship management systems, allowing for seamless data exchange and processing.

Widespread Adoption Across Industries

The versatility and reliability of standardized formats have made them a preferred choice across various industries, including manufacturing, retail, logistics, and finance. Businesses in these sectors trust these documents to:

- Streamline Administrative Processes: By eliminating the need for custom document creation for every transaction, businesses can save valuable time and focus on core activities.

- Facilitate Faster Payments: Clear and consistent documents ensure that payment terms are well understood, making it easier for businesses to collect payments in a timely manner.

- Improve Transparency: The consistency of these documents enhances transparency in transactions, helping both parties understand the terms of the deal and reducing the risk of disputes.

As businesses continue to operate in an increasingly globalized environment, the use of standardized formats remains essential to facilitating smooth and efficient international trade.

Frequently Asked Questions About Transaction Documents

When dealing with formal transaction records, many businesses and individuals have common questions regarding their use, format, and purpose. These documents serve as vital tools in ensuring the smooth flow of goods and services between parties, providing clarity on terms and expectations. Below are some of the most frequently asked questions to help you better understand these important documents.

What is the Purpose of This Document?

The main purpose of this type of document is to provide a preliminary overview of a transaction before any payment is made or goods are delivered. It outlines key details such as the nature of the transaction, estimated costs, and expected delivery timelines. It serves as a formal proposal that allows both parties to review the terms before proceeding with the actual exchange of goods or services.

Do I Need to Pay Upon Receipt of This Document?

No, this document is not a request for immediate payment. It is typically used for informational purposes, providing a detailed breakdown of the anticipated charges and the terms of the transaction. Payment is usually requested after the goods or services have been confirmed, shipped, or delivered, depending on the specific agreement.

How Can I Customize the Document for My Business?

Customizing the document to suit your business needs is easy. You can modify the fields to include your company logo, payment terms, shipping instructions, or any other specific details required for your transactions. Many businesses choose to use pre-made formats or digital tools that allow for easy editing and updating of these documents, ensuring they remain consistent and professional.

Is This Document Legally Binding?

This document is not legally binding in the same way a final transaction document (such as a receipt or commercial bill) is. However, it does establish the terms and conditions that both parties agree to at the start of the transaction. Once the goods or services are delivered and payment is made, a legally binding document may be created to confirm the completion of the transaction.

Can This Document Be Used for International Transactions?

Yes, this document is commonly used for international transactions as it provides a clear outline of the expected costs, terms, and delivery details. However, depending on the country, certain additional information, such as customs details or tax rates, may need to be included for the document to be accepted by customs authorities or other regulatory bodies.

If you have further questions or need assistance in preparing this document for your transactions, it is always advisable to consult with an expert in international trade or accounting.