Tile Invoice Template for Efficient and Professional Billing

In the world of construction and home improvement, clear and accurate billing is essential for maintaining professional relationships and ensuring timely payments. Creating a detailed document that outlines the work completed, the cost of materials, and the labor involved helps avoid misunderstandings and fosters trust between service providers and clients. A well-structured billing document not only ensures clarity but also contributes to better financial management.

For contractors, having a reliable and customizable document format can significantly streamline the payment process. Instead of creating a new form for every project, using a pre-designed structure allows for quick updates and eliminates the need to start from scratch. Whether you are a small business owner or a large contractor, adopting an efficient system for generating professional records can save time and reduce errors.

Customizable forms offer flexibility to adapt to various project types and customer requirements, making them a valuable tool for anyone in the construction or renovation industry. By incorporating key details like labor costs, material pricing, and payment terms, these documents can ensure that both parties have a clear understanding of the financial aspects of the job.

Billing Document Overview

A well-designed billing document is an essential tool for professionals in the construction industry. It serves as a formal record of the services rendered, materials supplied, and the agreed-upon costs. Such documents help ensure both clarity and transparency in transactions, offering a structured format that can be easily understood by both parties involved. By standardizing this process, businesses can maintain consistency and professionalism, regardless of the project’s size or complexity.

Key Features of a Well-Structured Billing Record

To make sure the document is clear, comprehensive, and professional, it is important to include the following details:

- Client Information: Include the client’s name, address, and contact details.

- Service Breakdown: A detailed list of the work performed, including any special requirements or customizations.

- Cost Calculation: Clear breakdowns of labor costs, material expenses, and any additional charges.

- Payment Terms: Define due dates, payment methods, and any late fees if applicable.

- Dates: Include both the project completion date and the payment due date.

Why Use a Standardized Format

Using a standardized format offers numerous advantages for businesses:

- Efficiency: Reduces the time spent creating new documents for each project.

- Accuracy: Ensures that all necessary details are included, preventing omissions and errors.

- Professionalism: Reflects well on your business and builds trust with clients.

- Consistency: Helps maintain uniformity in your billing process, making it easier to manage finances.

Benefits of Using a Billing Document

Adopting a standardized billing document offers numerous advantages to businesses, especially those in the construction and home improvement sectors. By streamlining the billing process, professionals can enhance their efficiency, improve client relationships, and ensure financial accuracy. A well-structured document provides clarity and helps avoid disputes, making it an essential tool for managing both small and large-scale projects.

Time-saving: With a pre-designed structure, professionals no longer need to create a new document for every project. Instead, they can easily customize an existing format, saving valuable time and reducing administrative work. This efficiency frees up more time for actual work and client interaction.

Enhanced Accuracy: Using a consistent format ensures that all essential details are captured, minimizing the risk of errors. Clear breakdowns of costs, materials, and labor prevent misunderstandings and help ensure that both parties are on the same page when it comes to financial expectations.

Professionalism: A polished, well-organized billing document reflects positively on a business. It demonstrates attention to detail and fosters trust between contractors and clients. By presenting a professional appearance, businesses can create a lasting positive impression and enhance their reputation.

Better Cash Flow Management: Accurate and timely billing helps ensure that payments are received on schedule. Clear payment terms and due dates facilitate smoother transactions, reducing the likelihood of delayed payments and improving cash flow.

Customizability: The flexibility to tailor the document to specific project needs means that businesses can adapt it for various job types, whether residential, commercial, or specialized services. This adaptability ensures that the document remains relevant and effective for all kinds of work.

How to Customize a Billing Document

Customizing a billing document is essential to ensure that it aligns with your business needs and the specific requirements of each project. By modifying the format to include relevant details, you can create a clear, professional record that accurately reflects the scope of work and agreed-upon terms. Personalizing the structure will also enhance the client’s experience and ensure smooth transactions.

Steps for Customization

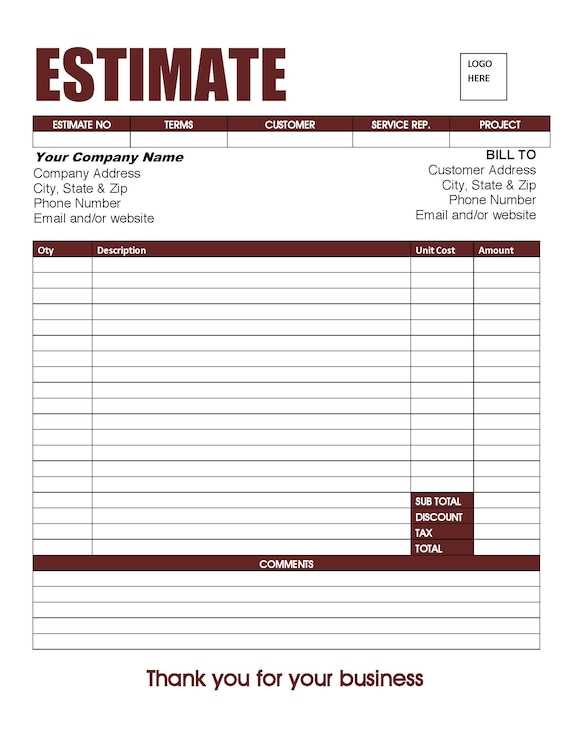

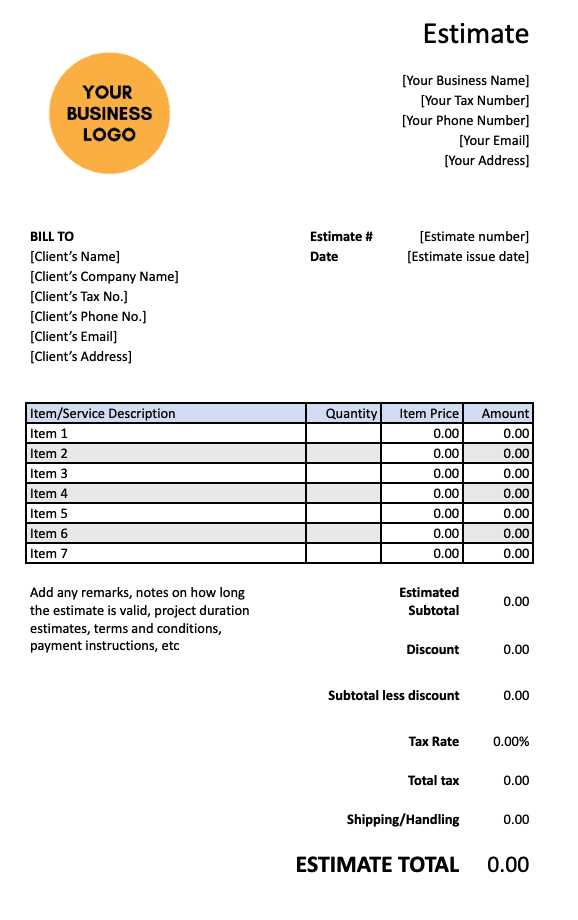

Follow these steps to easily tailor the document for different projects:

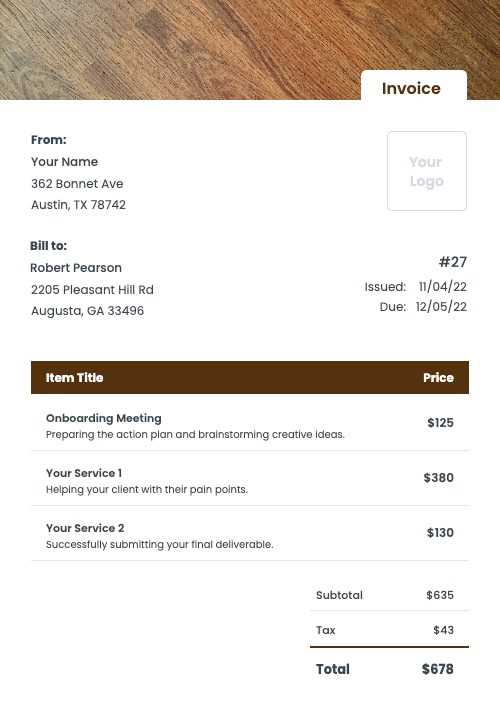

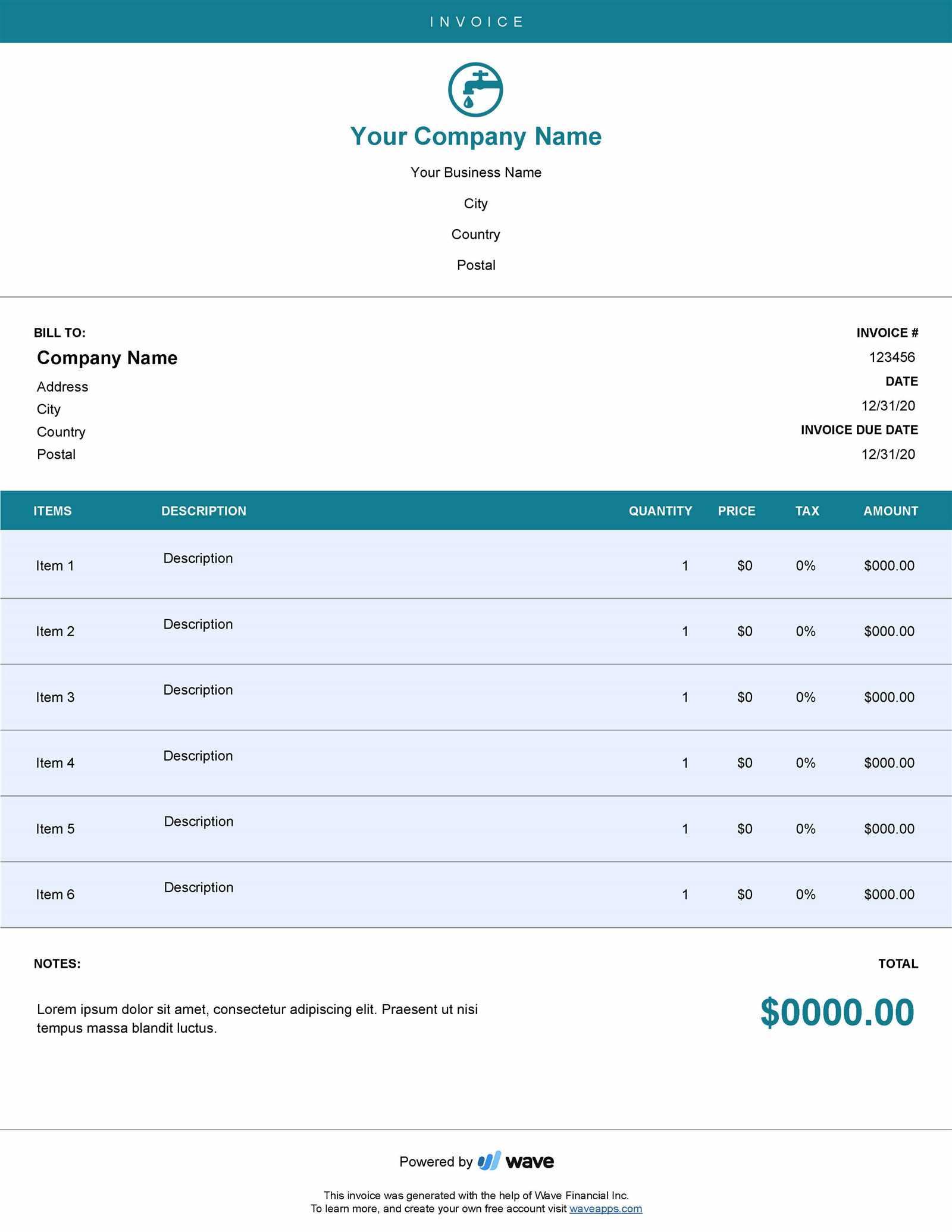

- Insert Business Information: Include your company name, logo, address, and contact details at the top of the document. This helps establish brand identity and makes the document easily traceable.

- Adjust the Client Section: Replace placeholder text with the client’s information. This should include their name, address, and contact information to ensure proper record-keeping.

- Customize Service Descriptions: Modify the list of services or work completed. Be specific about what was done, such as installations, repairs, or custom projects. Providing detailed descriptions helps prevent confusion later.

- Update Cost Breakdown: Customize the pricing section by adding the correct cost for labor, materials, and any additional fees. You can also adjust for discounts, taxes, and other factors specific to the project.

- Set Payment Terms: Clearly define payment conditions, such as the due date, accepted methods of payment, and any penalties for late payments. This section ensures that both parties understand the financial agreement.

- Add Any Special Instructions: Include any additional terms or special instructions, such as warranties, delivery schedules, or project-specific details that could impact payment or future work.

Tools for Easy Customization

There are various tools and software available to make the process of customizing a billing document easier:

- Spreadsheet Programs: Programs like Microsoft Excel or Google Sheets allow you to create, modify, and save documents in a structured format. They are flexible and easy to use for basic customizations.

- Online Platforms: Websites like Canva, Zoho, and FreshBooks offer easy-to-use templates with drag-and-drop features. These platforms allow for quick customization without the need for design expertise.

- Accounting Software: Many accounting tools come with built-in billing document generators. These tools often integrate with your financial records, making it easier to update and send documents directly from the software.

Essential Elements in Billing Documents

To create a clear and effective billing document, it is crucial to include all necessary details that both the service provider and the client need to understand the financial aspects of a project. A well-structured document not only ensures transparency but also helps prevent disputes and delays in payments. By including the right elements, businesses can maintain professionalism and provide clients with the information they need to make timely payments.

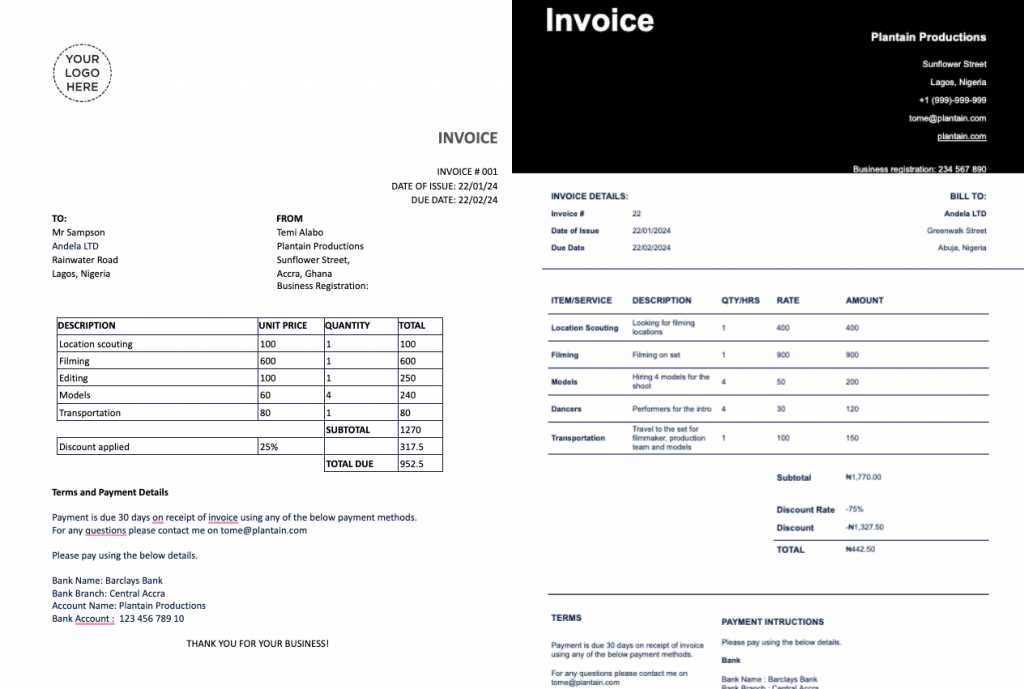

Client and Service Provider Information: One of the most important components of any billing document is the identification of both parties. This includes the service provider’s name, address, and contact information, as well as the client’s name, address, and relevant details. Having this information clearly displayed at the top helps to establish a formal relationship and makes the document easy to reference.

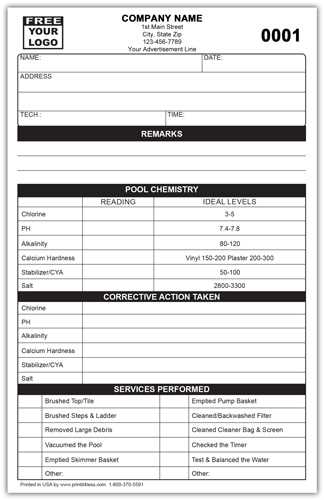

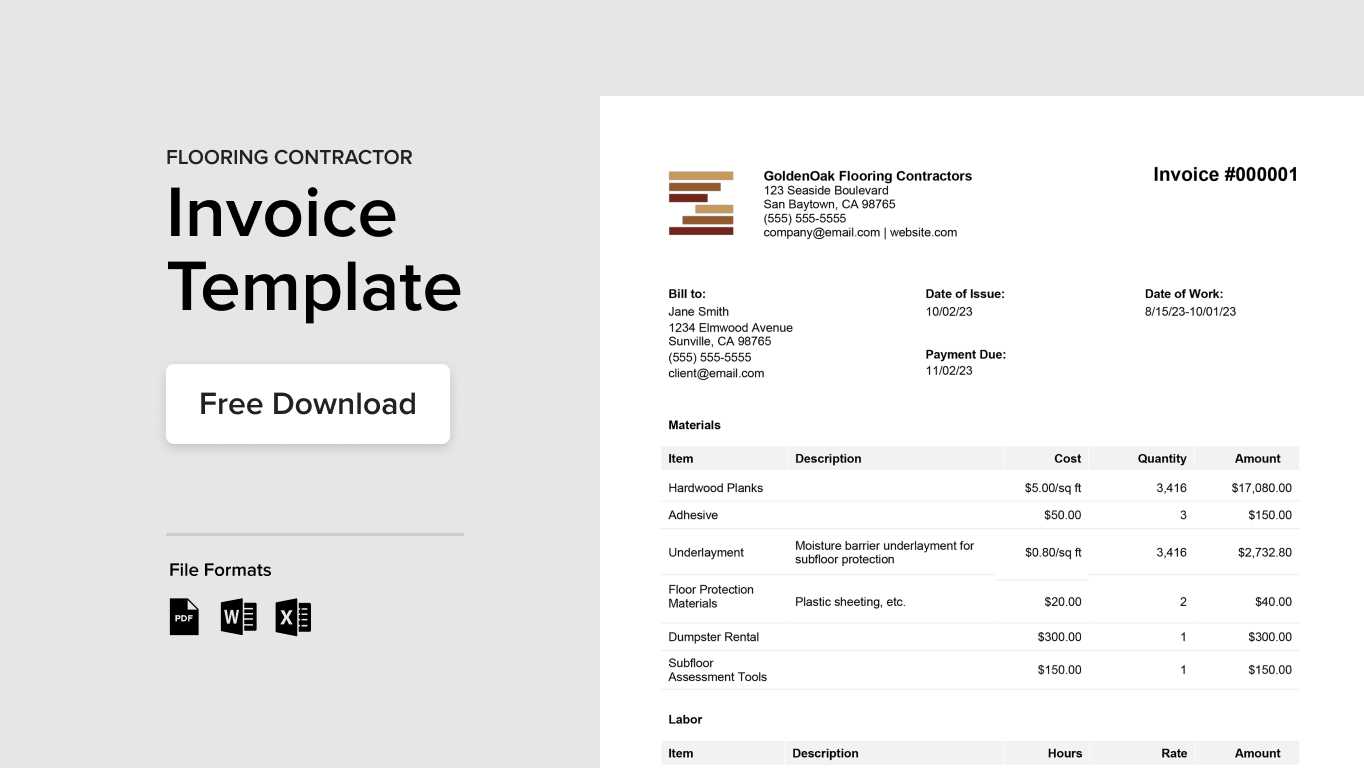

Clear Description of Services: A detailed breakdown of the work performed is essential. This section should specify exactly what services were provided, including any special requirements or adjustments made during the project. Being specific about the scope of work prevents misunderstandings and clarifies the expectations of both parties.

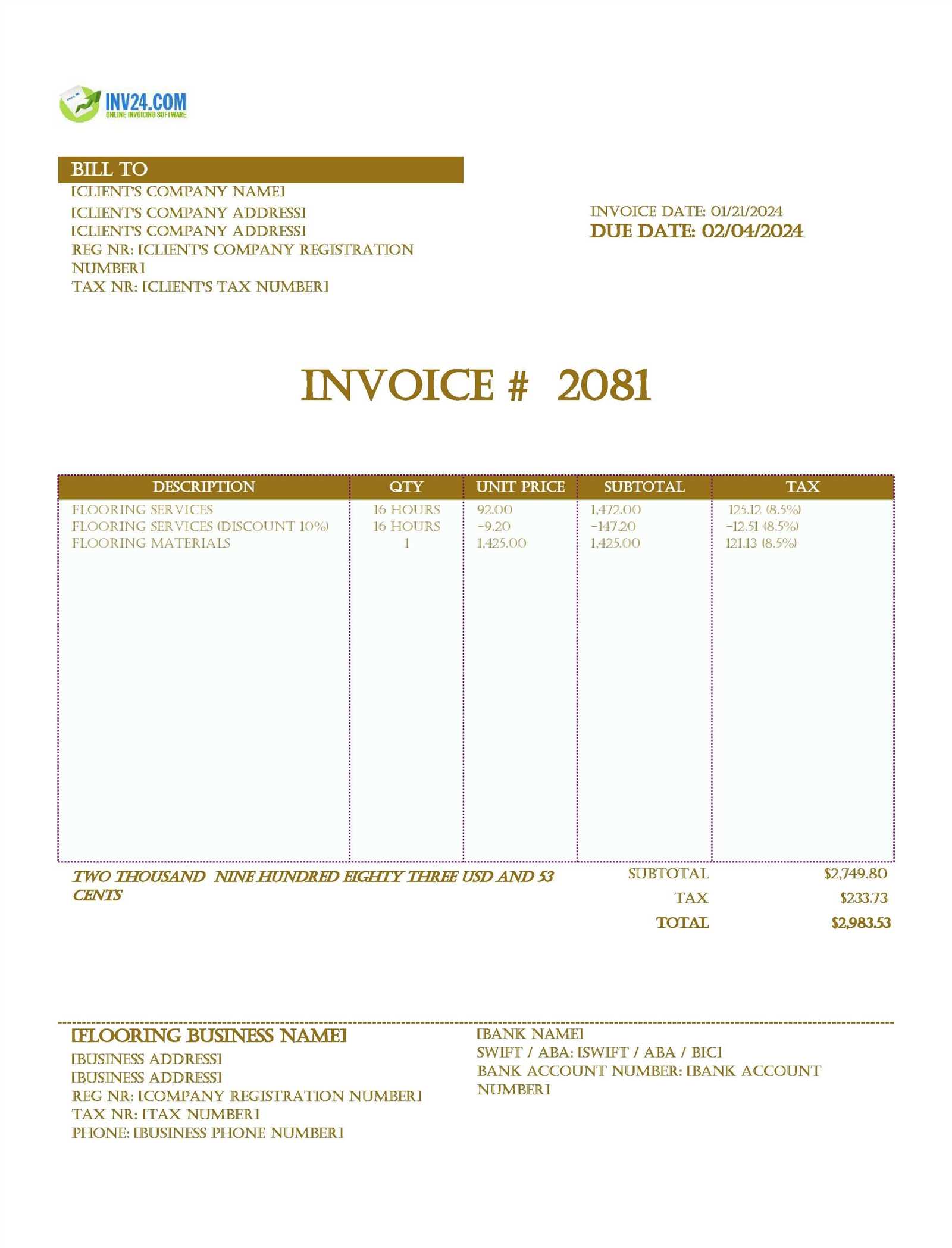

Cost Breakdown: Another critical element is a detailed list of charges. This should include individual pricing for materials, labor, and any additional fees. By itemizing the costs, both the client and the service provider can see exactly what is being paid for, which fosters transparency and trust. Additionally, this breakdown should account for any taxes, discounts, or other adjustments that may affect the total price.

Payment Terms: Defining payment conditions is crucial to avoid delays. This section should clearly state the due date, acceptable payment methods, and any penalties for late payments. Providing this information upfront helps set clear expectations and encourages timely settlements.

Project and Document Dates: Including important dates, such as the project completion date and the document’s issuance date, helps keep records organized and accurate. These dates also help both parties track when the work was completed and when payment is due.

Additional Terms or Notes: Depending on the nature of the project, additional terms might be necessary. This could include warranties, specific instructions for payment, or agreements related to future work. Including these details ensures that both parties are aware of any ongoing obligations or conditions.

Free Billing Documents Available Online

Finding a reliable and professional format for billing is easier than ever thanks to the availability of free resources online. Many websites offer customizable forms that can be downloaded and used without any cost, allowing businesses to streamline their billing process without investing in expensive software or custom designs. These free documents are perfect for both small businesses and independent contractors looking for a simple, effective way to manage their financial records.

Where to Find Free Resources

There are several online platforms offering free, customizable documents that are ready to be used or adapted for specific business needs. Here are some of the best places to start:

- Google Docs: Google’s suite of office tools offers free templates for billing documents that can be customized for any type of work or service. Easy to edit and share, Google Docs allows quick adjustments and updates to your files.

- Microsoft Word Online: Microsoft’s free online version of Word offers a variety of pre-made forms that can be tailored to different types of projects, from residential services to larger construction jobs.

- Canva: Known for its simple design tools, Canva offers a range of customizable document formats that include options for billing. These documents are easy to personalize and include design elements to create professional-looking records.

- Zoho: Zoho provides free billing document options, particularly for small businesses. Their platform offers an easy-to-use interface for customizing documents and automatically populating details from your database.

Advantages of Using Free Documents

Utilizing free resources for creating billing records offers multiple benefits for businesses:

- Cost-Effective: No need to pay for expensive software or hire a designer. Free resources provide essential features without the financial commitment.

- Customizable: Most free documents are fully customizable, allowing businesses to modify fields and adjust layouts to suit specific needs.

- Time-Saving: These resources help streamline the process of creating professional billing documents, saving valuable time that can be spent on other important tasks.

- Easy Access: Many of these platforms are cloud-based, meaning documents can be accessed from anywhere, shared instantly, and updated in real time.

Creating Professional Billing Documents

Producing a polished and professional billing document is crucial for any business that wants to maintain credibility and streamline financial transactions. A well-crafted document reflects the quality of the services provided and helps to build trust with clients. By focusing on clarity, structure, and accuracy, businesses can ensure that both parties understand the terms and prevent any misunderstandings that might delay payment.

1. Use a Clean, Organized Layout: A professional billing document should be easy to read and well-organized. Avoid clutter by using clear headings, ample spacing, and a logical flow of information. This includes sections like client information, service description, cost breakdown, and payment terms. Consistency in font and design also contributes to the overall professional appearance.

2. Provide Detailed Descriptions: Being specific about the work performed helps the client understand exactly what they are paying for. For example, instead of just listing “service charges,” break it down into individual tasks such as “installation of flooring” or “material cost for grout.” This level of detail shows transparency and professionalism.

3. Include Accurate Pricing: Ensure that the cost breakdown is clear and accurate. List all charges, including labor, materials, and any additional fees. If applicable, include tax rates and discounts. A detailed pricing structure reduces confusion and ensures that the client is fully aware of the financial commitment.

4. Set Clear Payment Terms: Clearly outline payment expectations, including the due date, accepted payment methods, and any late fees for overdue payments. Having these details upfront reduces the chances of disputes and ensures that clients know when and how to pay.

5. Customize for Each Project: Each project is unique, and so should be the billing document. Customize the content to match the specific details of the job, whether it’s a small renovation or a large construction project. This personalization helps clients feel like their needs are being addressed and enhances the professionalism of the document.

6. Use Professional Branding: Incorporating your business’s branding, such as logo, color scheme, and fonts, adds a personal touch that reinforces your company’s identity. A branded document not only looks more professional but also helps clients recognize your business more easily.

Billing Document for Small Businesses

For small businesses, having a streamlined and efficient method for generating financial records is essential for maintaining cash flow and ensuring timely payments. A professional billing document tailored to the specific needs of small businesses can help reduce administrative overhead and improve financial tracking. By utilizing a standardized format, small business owners can focus more on their work and less on paperwork.

Simplicity and Clarity: One of the key advantages for small businesses is the ability to create a simple, straightforward record that clearly outlines the services provided and the costs involved. A no-frills document helps to maintain transparency with clients, reducing the likelihood of confusion and ensuring quick resolution of any payment issues.

Cost-Effective Solutions: Small businesses often operate on tighter budgets, so using a free or low-cost solution for creating billing records is essential. There are numerous online platforms that offer customizable forms at no cost, allowing small businesses to generate professional documents without the need for expensive accounting software or hiring a designer.

Quick Customization: The ability to quickly adapt the billing document to suit each specific job is crucial. Whether it’s a one-time service or an ongoing project, a customizable document allows for easy updates to include varying prices, quantities, and service descriptions. This flexibility saves time and ensures accuracy with every transaction.

Professional Appearance: Even for small businesses, presenting a polished, professional image is important. By using a standardized, cleanly designed format, you send a message to your clients that you are organized and reliable. This not only boosts your credibility but also helps establish trust and encourages prompt payments.

Improved Tracking and Record-Keeping: With a consistent format, small businesses can more easily track payments and outstanding balances. Detailed records also make tax preparation and financial reporting more manageable. By maintaining a well-organized system for billing, small businesses can ensure smooth operations and avoid unnecessary delays or mistakes.

Best Practices for Billing

Creating clear and professional billing documents is crucial for businesses in maintaining good financial health and fostering strong client relationships. Following best practices ensures accuracy, transparency, and prompt payments, while also preventing potential disputes. By implementing simple yet effective strategies, businesses can streamline their billing processes and ensure smooth financial transactions.

Here are some best practices to keep in mind when creating your billing records:

| Best Practice | Description |

|---|---|

| Clarity in Descriptions | Be as detailed as possible when describing the work performed. Include specific tasks, materials used, and the time spent on each part of the job to provide full transparency. |

| Accurate Pricing | Ensure that the prices listed are correct and match the agreed-upon terms. Clearly separate costs for labor, materials, and any additional fees. |

| Consistent Formatting | Maintain a uniform layout for all billing documents. A consistent format makes it easier for both clients and your team to review and track payments. |

| Timely Issuance | Send your billing documents promptly after the job is completed. The sooner you issue the document, the faster you will receive payment, helping to maintain cash flow. |

| Clear Payment Terms | Outline payment due dates, accepted methods of payment, and late fees clearly. Setting expectations upfront helps avoid misunderstandings and ensures timely payments. |

| Follow-up Reminders | Don’t hesitate to follow up with clients if payments are delayed. A polite reminder can help ensure that you receive payment on time without causing friction. |

By incorporating these best practices, businesses can improve their billing process, enhance professionalism, and build stronger client relationships, ultimately contributing to long-term success.

How to Format Billing Documents Correctly

Properly formatting a billing document is essential for ensuring clarity and professionalism. A well-organized record not only makes it easier for clients to understand the charges but also improves the efficiency of your business’s financial management. Correct formatting ensures that all necessary information is presented logically, reducing the chances of errors or confusion. Here’s how to structure a billing document to achieve a polished, easy-to-read result.

Start with the basics: the document should have a clear title at the top, such as “Billing Statement” or “Payment Request,” followed by the service provider’s and client’s contact details. This makes the document instantly recognizable and helps with tracking and reference. Additionally, organizing the content into distinct sections such as service descriptions, costs, and payment terms ensures that everything is easy to find and review.

Be sure to use a professional font and maintain consistent spacing and alignment throughout. Avoid overloading the document with too much text or unnecessary information. A clean, minimalist approach with relevant sections will allow the recipient to quickly understand the charges and take action accordingly.

Lastly, make sure that your document is easily editable. This way, it can be customized for different projects and clients while maintaining a consistent format across all billing records.

Common Mistakes in Billing

When creating billing documents, even small errors can lead to confusion, payment delays, or misunderstandings with clients. Ensuring that your billing records are accurate and complete is crucial for maintaining professionalism and smooth business operations. Below are some of the most common mistakes businesses make when preparing financial records and how to avoid them.

1. Incomplete Client Information: One of the most frequent errors is failing to include all necessary details about the client, such as their full name, address, and contact information. Inaccurate or missing details can cause delays in processing payments or create confusion if multiple clients are involved. Always double-check the client’s contact information to ensure accuracy.

2. Lack of Detailed Descriptions: Providing vague descriptions of services or products can lead to misunderstandings. A common mistake is listing “service charge” without specifying what the charge includes. To avoid confusion, break down the services into specific tasks or products, explaining what was done and how it contributes to the overall cost.

3. Errors in Pricing: Incorrect pricing or failing to update prices can cause discrepancies between the agreed amount and what is listed in the document. Always ensure that the prices reflect the correct rate, any additional costs are accounted for, and that taxes or discounts are properly applied. Reviewing all pricing before issuing the document is crucial to avoid financial discrepancies.

4. Missing Payment Terms: Not including clear payment terms is a significant mistake. If the document does not specify due dates, payment methods, or late fees, clients may not know when and how to pay, which could delay the process. Always define the due date, acceptable payment methods, and consequences for late payments to avoid confusion.

5. Incorrect Formatting: Poor formatting, such as crowded text, inconsistent fonts, or unclear sections, can make the document hard to read. A professional document should be easy to navigate, with clear headings, organized sections, and sufficient white space. Simple formatting mistakes can affect the professionalism of your document and make it harder for clients to process the information.

6. Forgetting to Include a Reference Number: Without a reference or document number, tracking and organizing records becomes challenging. This can cause delays when referring back to previous records. Always assign a unique reference number to each document for easy identification and f

How to Save Time with Pre-Designed Forms

Using pre-designed forms can significantly speed up the process of generating professional documents, eliminating the need to start from scratch each time. By utilizing ready-made layouts, businesses can focus more on the specifics of the service or project and less on the administrative tasks. These forms provide structure and consistency, making it easier to complete records quickly and accurately.

1. Reduce Manual Data Entry: Pre-designed forms come with many of the necessary fields already set up, such as service descriptions, pricing, and client details. Instead of entering the same information repeatedly, you can simply fill in the blanks or adjust the relevant sections. This minimizes the time spent on redundant data entry and reduces the risk of errors.

2. Consistent Professional Appearance: Using pre-made forms ensures that every document you issue maintains a professional and uniform appearance. This consistency saves time spent on design decisions and formatting, which allows you to concentrate on the content. Your clients will appreciate the polished look, and it helps to reinforce your brand’s image.

3. Easy Customization for Different Projects: Pre-designed forms are flexible, allowing you to quickly modify them to suit the specifics of each new job. Whether you’re adding new items, adjusting pricing, or including custom notes, the structure is already in place. This means you don’t have to worry about starting from scratch or creating a new document each time, speeding up your workflow.

4. Save Time on Calculations: Many pre-made forms include built-in fields for taxes, discounts, and total calculations. By having these formulas ready, you can save time on manual calculations and ensure that the final amount is accurate every time.

5. Streamlined Record Keeping: Using a standardized form also makes it easier to track past documents and organize records. With each document formatted consistently, you can quickly locate and compare previous entries, which can help with future financial planning and tax preparation.

By adopting pre-designed forms, businesses can save time, improve accuracy, and present a more professional image to clients, all while reducing the administrative burden of creating documents from scratch.

Choosing the Right Billing Document Design

Selecting the right design for your financial records is crucial for ensuring that your documents are not only functional but also align with your brand and convey professionalism. A well-designed document helps streamline communication with clients, minimizes confusion, and promotes timely payments. The right design can make a significant difference in how your business is perceived and can improve efficiency in your administrative processes.

Key Considerations When Choosing a Design

- Clarity and Simplicity: The design should prioritize clarity, ensuring that all relevant information–such as services, costs, and payment terms–are easy to read and understand. A clean, minimalist layout with clear headings and ample spacing will help clients quickly review the details.

- Consistency with Branding: Choose a design that complements your business’s branding. Including your logo, colors, and consistent fonts helps maintain a professional and cohesive look across all your business communications.

- Customizability: The design should be flexible enough to accommodate different types of projects or services. A good design will allow you to easily adjust the content without compromising the overall layout.

- Mobile-Friendly Format: With many clients accessing documents from mobile devices, it’s important to select a design that is easy to read and navigate on both desktops and smartphones.

- Space for Details: Ensure that the design offers enough space to include specific information for each job, such as itemized services, quantities, rates, and payment terms.

Types of Designs to Consider

- Modern and Sleek: If you want a contemporary look, choose a design that incorporates clean lines, bold typography, and plenty of white space. This style is perfect for businesses looking to convey a sense of efficiency and sophistication.

- Traditional and Formal: For a more classic feel, opt for a design with a more structured layout, using serif fonts and formal language. This can work well for industries that value tradition and professionalism.

- Creative and Custom: If your business thrives on creativity, consider a more dynamic design that allows for some customization, such as adding images or custom graphics. This can help you stand out and show your personality while still maintaining professionalism.

Choosing the right design ultimately depends on the image you want to project and the type of work you do. A professional, clear, and well-structured document can enhance your business’s reputation and improve client satisfaction.

Tips for Clear and Accurate Billing Records

Creating clear and accurate financial documents is essential for maintaining smooth business operations and ensuring prompt payments. A well-structured document not only helps clients understand the charges but also reduces the chances of disputes or delays. To achieve this, it’s important to follow best practices that focus on accuracy, clarity, and professionalism. Here are some tips to help you create billing records that are easy to understand and error-free.

Key Tips for Accuracy

- Double-check Client Information: Always verify that the client’s name, address, and contact details are accurate. Mistakes in this information can lead to delayed payments or confusion.

- Itemize Services or Products: Instead of grouping multiple services together under a generic heading, break down each task or product separately. Include descriptions, quantities, and rates so the client understands exactly what they are paying for.

- Verify Pricing and Discounts: Ensure that the prices are up to date and reflect the agreed-upon terms. If there are discounts or special offers, make sure they are clearly noted along with the corresponding calculations.

- Include Applicable Taxes: If taxes are applicable, ensure they are correctly calculated and clearly listed in the document. Specify the tax rate and the total amount of tax applied to avoid confusion.

Tips for Clarity and Organization

- Use Clear Headings and Sections: Organize the document with clear headings for each section (e.g., services, costs, payment terms). This makes it easier for the client to navigate through the information.

- Include Payment Terms: Specify the payment due date, accepted payment methods, and any late fees for overdue payments. Be transparent about the terms to prevent misunderstandings.

- Maintain Consistent Formatting: Keep fonts, spacing, and alignment consistent throughout the document. A neat, organized layout improves readability and conveys professionalism.

- Provide Contact Information: Always include your business contact details so the client knows who to reach out to if they have any questions about the document or payment.

By following these tips, you can ensure that your billing records are not only clear and accurate but also enhance your professionalism and improve client satisfaction. Clear communication through well-structured documents fosters trust and helps to maintain positive relationships with your clients.

Legal Requirements for Billing Records

When creating financial documents for your business, it’s crucial to ensure they meet legal standards and comply with local regulations. Depending on your location and the nature of your business, there may be specific legal requirements that you must adhere to in order to avoid fines, disputes, or even legal action. Understanding and implementing these requirements helps protect both your business and your clients, ensuring transparency and reducing the risk of errors or omissions.

Essential Legal Elements to Include

- Business Information: Your document should include the full legal name of your business, contact details (such as address and phone number), and any relevant registration numbers (e.g., tax identification number, VAT number). This information ensures that the document is legally traceable to your business.

- Client Information: Including the client’s full name and contact details is essential. This establishes a clear record of the transaction and makes it easier to resolve any issues that may arise later.

- Clear Breakdown of Services or Products: Legally, you are required to provide a clear description of the services or products provided. This helps avoid confusion and ensures that the client understands exactly what they are being charged for.

- Amount Due and Payment Terms: The document must clearly state the total amount owed, including any applicable taxes. Additionally, payment terms should be outlined, including the due date, acceptable payment methods, and any late fees for overdue payments.

- Tax Information: If applicable, your document must show the correct tax rates and amounts for the services or products provided. Different regions have varying tax laws, so it’s important to stay up to date with the correct tax information for your business.

- Unique Reference Number: In many jurisdictions, it is a legal requirement to assign a unique identification number to each billing document. This reference number helps track the transaction and simplifies accounting and auditing processes.

Compliance with Local Regulations

- Stay Updated with Tax Laws: Ensure that the tax rates you apply are up-to-date with local government regulations. This includes sales tax, VAT, and other applicable taxes. Failure to apply the correct tax rates can result in penalties.

- Follow Industry-Specific Rules: Certain industries may have specific invoicing requirements based on the type of work or products sold. Make sure to research and adhere to any specialized regulations that apply to your business.

- Record-Keeping for Audits: Keep detailed records of all financial documents as they may be required during audits. In some regions, businesses are lega

Billing Document Software Options

Choosing the right software for generating professional financial records can streamline your workflow, save time, and improve accuracy. With the wide variety of tools available, businesses of all sizes can find a solution that fits their needs. These programs typically offer customizable features, automated calculations, and easy integration with other business systems, helping you create error-free and polished records in minutes.

Here are some popular software options that can help you create well-organized financial records quickly and efficiently:

- QuickBooks: A widely used accounting software that provides easy-to-use templates for financial documents. QuickBooks allows you to customize records, manage taxes, and track payments. It also integrates with other accounting tools and provides detailed financial reporting.

- FreshBooks: Ideal for freelancers and small businesses, FreshBooks offers simple, professional-looking templates and automated billing features. It also includes time tracking, project management, and expense tracking tools, making it a well-rounded solution for service-based businesses.

- Zoho Invoice: Zoho Invoice is a cloud-based tool designed for small businesses and freelancers. It offers customizable layouts, automatic reminders, and easy online payment options. It also provides multi-currency support, making it a good choice for international businesses.

- Wave: Wave is a free accounting software that includes invoice creation tools along with expense tracking and financial reporting. Its user-friendly interface makes it easy to generate and send records to clients, and it’s particularly useful for small businesses with limited budgets.

- Xero: Xero is an accounting software with a focus on small businesses. It allows for the creation of detailed billing records, and features automatic bank feeds, tax calculations, and customizable templates. It’s particularly strong in its integration with various third-party apps.

When choosing software, it’s important to consider the size and complexity of your business, as well as any additional features you may need, such as tax calculations, recurring billing, or client management tools. Many software options offer free trials, allowing you to test the functionality before committing to a subscription. By selecting the right tool, you can save time, reduce errors, and present professional, easy-to-understand records to your clients.

Tracking Payments with Billing Records

Efficiently tracking payments is essential for maintaining a smooth cash flow and ensuring that all outstanding amounts are settled on time. By properly managing and monitoring financial documents, businesses can keep track of which clients have paid, which payments are still pending, and when to follow up on overdue accounts. Having a clear system for payment tracking minimizes errors and provides better insight into your business’s financial health.

Methods for Tracking Payments

- Mark Payments as Received: Once a payment is received, immediately update your records to reflect this. Many software options allow you to mark payments as “paid” and automatically update the remaining balance, ensuring that you always have an accurate record.

- Set Payment Reminders: Many accounting systems include features for setting up automatic payment reminders. This helps you follow up with clients before a payment becomes overdue, reducing the chances of missed payments.

- Monitor Payment Status Regularly: Regularly reviewing your records will help you stay on top of which payments have been completed and which are still pending. This proactive approach can help prevent overdue invoices from slipping through the cracks.

- Use Payment Tracking Software: Payment tracking software often includes features like invoice number tracking, payment status updates, and real-time notifications. This can make it much easier to monitor multiple transactions at once and prevent mistakes.

Best Practices for Managing Payments

- Include Clear Payment Terms: Always state clear terms, including due dates, late fees, and accepted payment methods. By setting expectations upfront, you reduce the likelihood of misunderstandings and make it easier to track when payments are due.

- Organize Payment Records by Client: Keep detailed payment records for each client, including the amounts paid, dates of payment, and any outstanding balances. This will make it easy to follow up on unpaid amounts and maintain accurate financial records.

- Provide Multiple Payment Options: Offering various payment methods, such as bank transfers, credit cards, and online payment systems, can help ensure faster payments. This increases the likelihood of clients paying on time, allowing you to track payments more efficiently.

- Generate Reports for Better Insights: Many accounting systems allow you to generate detailed payment reports, showing outstanding amounts, paid invoices, and payment trends. Regularly reviewing these reports helps you manage cash flow and make informed business decisions.

By implementing a systematic approach to tracking payments, businesses can ensure that they stay on top of their finances, reduce overdue payments, and maintain better relationships with clients. Effective payment tracking also provides clarity and transparency, which can help foster trust and encourage timely payments.

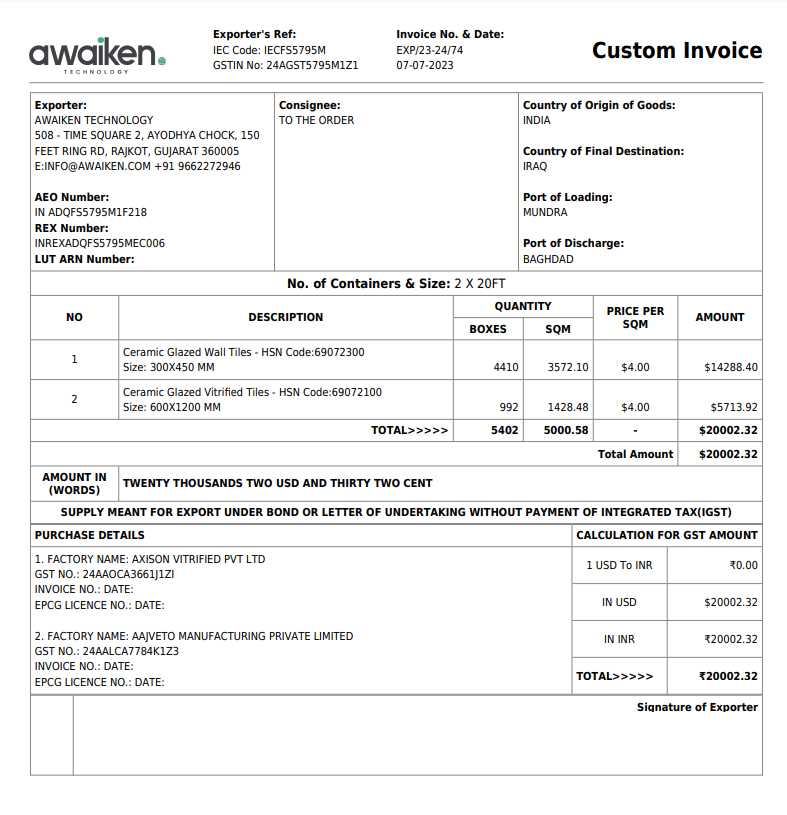

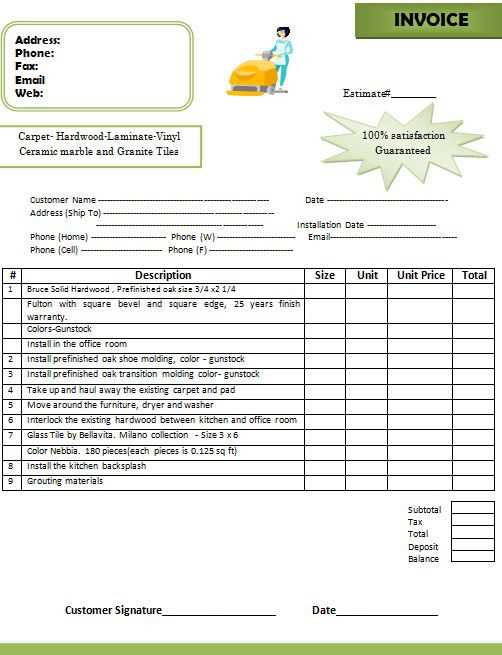

Billing Documents for Tile Contractors

For contractors in the tiling industry, having well-structured financial documents is key to ensuring clear communication with clients and receiving timely payments. These records should not only outline the services provided but also help in tracking project costs, labor, and materials efficiently. A professional-looking document helps in presenting a business’s work and ensures that both parties are on the same page when it comes to pricing and payment expectations.

When preparing a financial record, it’s important to include all necessary details specific to the contracting work. Here are some elements to consider when creating a billing document for your business:

- Clear Itemization: List all services, materials, and labor charges separately to avoid confusion. This ensures the client understands exactly what they are paying for and helps with cost transparency.

- Project Descriptions: Provide a concise description of the work completed, including the type of project, location, and specific tasks performed. This gives the client clarity and serves as a reminder of the services provided.

- Accurate Costing: Ensure that all rates for labor, materials, and additional fees are accurately reflected. Double-check these figures to prevent any errors that could lead to disputes or delayed payments.

- Payment Terms: Outline the payment schedule, due dates, and any applicable late fees. Be specific about payment methods, such as checks, bank transfers, or online payment systems.

- Visual Appeal: A clean, professional document can enhance the perception of your business. Customizable templates designed for contractors can help you easily create consistent and professional-looking records.

By incorporating these key elements into your billing records, you ensure that clients are well-informed about the details of the project and the charges. This approach not only helps reduce confusion but also fosters a more organized, efficient workflow for your contracting business.

How to Send and Follow Up on Billing Records

Sending financial documents to clients and ensuring timely payment is a crucial part of any business. However, the process doesn’t end once the document is sent. Effective follow-up is equally important to ensure that payments are made on time and any potential issues are addressed before they escalate. A well-organized system for sending and following up on records not only ensures steady cash flow but also strengthens client relationships.

Steps to Send Professional Billing Documents

- Choose the Right Delivery Method: Consider your client’s preferences when deciding how to send the billing document. Common methods include email, physical mail, or using an online payment platform. Email is usually the fastest and most efficient method, especially for clients in different locations.

- Double-Check for Accuracy: Before sending, review the document thoroughly to ensure all information is correct, including amounts, dates, and client details. Any errors can lead to delays or confusion, so take the