Therapy Invoice Template for Simple and Efficient Billing

In the world of mental health services, professionals often face challenges beyond the scope of counseling. Managing payments and client accounts can become time-consuming and burdensome, especially for those who prioritize direct client care. A well-organized billing approach can alleviate this strain, allowing practitioners to focus more on what matters most – the wellbeing of their clients.

Organized billing solutions provide clarity and structure, essential for establishing trust and maintaining professional standards. By developing a straightforward approach to financial management, counselors and therapists can enhance their relationships with clients through transparent and efficient practices.

Whether you’re handling one-time sessions or ongoing support, having a reliable system in place for tracking payments ensures both peace of mind and a steady workflow. This article explores essential tips, tools, and insights to simplify your payment management and ensure that every client interaction remains focused and fulfilling.

Understanding the Basics of Therapy Invoices

For professionals in mental health and counseling, organizing and maintaining payment details is an essential part of managing a successful practice. A clear and structured approach to billing not only supports financial stability but also fosters trust and transparency with clients. To achieve this, practitioners must understand the essential elements of effective billing documents, ensuring each is thorough, accurate, and easy for clients to understand.

At the core of a well-prepared billing document is detailed client information, the session or service provided, and clear pricing. Including these elements promotes accountability and makes payment processes seamless. Here’s a breakdown of the key sections every mental health professional should include in their billing records:

| Section | Description |

|---|---|

| Client Information | Includes full name, contact details, and relevant identification numbers for secure and accurate records. |

| Service Details | Outlines the type of consultation or session, date of service, and duration to provide context for the charges. |

| Component | Description |

|---|---|

| Client Information | Ensure the client’s full name, contact details, and any identifying numbers are listed for proper identification and record-keeping. |

| Provider Information | Include the practitioner’s name, business name, address, phone number, and email for communication and reference. |

| Service Details | List the type of service provided, including session dates and duration. This provides a clear understanding of what was charged for. |

| Cost Breakdown | Itemize the costs associated with each service. This should include individual rates, discounts, and any additional fees that may apply. |

| Total Amount Due | Clearly state the final amount owed, ensuring the client knows exactly what they need to pay. |

| Payment Instructions | Provide clear information on how to submit payment, including accepted methods (e.g., bank transfer, credit card, online payment platforms). |

| Due Date | Specify the due date for payment to encourage timely submission of funds. |

| Late Fees | If applicable, include information on any late fees or penalties for overdue payments to set clear expectations. |

Incorporating these elements into every billing document ensures that clients have all the information they need to make timely payments and reduces the risk of financial misunderstandings.

Customizing Your Invoice to Suit Your Practice

Adapting your billing forms to reflect the specific needs of your practice is an important step in maintaining a professional image and streamlining the payment process. By customizing the layout, content, and features of your financial documents, you can ensure they meet both your operational requirements and client expectations. A personalized approach can help differentiate your practice and provide a more tailored experience for clients.

Here are several ways you can customize your billing documents to better suit your practice:

- Personalized Branding: Add your practice’s logo, color scheme, and branding elements to create a consistent and professional look that aligns with your overall business image.

- Flexible Payment Terms: Adjust the payment terms to suit your specific practice, whether you prefer to charge by session, offer package deals, or implement payment plans.

- Service Descriptions: Customize the service descriptions to reflect the specific types of sessions or treatments you offer. This helps clients understand what they are being charged for in detail.

- Payment Methods: Include a variety of payment methods that are most convenient for your clients, such as credit card, bank transfer, or online payment platforms.

- Custom Notes: Leave space for personalized notes, reminders, or instructions that may be relevant to the client, such as follow-up details or cancellations policies.

By making these adjustments, you create a billing system that not only meets your operational needs but also provides a smoother, more transparent experience for your clients.

Improving Cash Flow with Streamlined Billing

Efficient financial management is essential for any business, especially when it comes to maintaining healthy cash flow. Streamlining the billing process can significantly reduce delays in payments and help ensure that funds are collected promptly. By simplifying procedures and enhancing transparency, businesses can speed up the payment cycle, minimize administrative work, and improve overall cash flow.

Key Benefits of Streamlined Billing

Implementing a clear and efficient payment system offers several benefits for both practitioners and clients:

- Faster Payments: With a simplified and direct billing process, clients are more likely to submit payments on time, reducing the number of overdue accounts.

- Reduced Errors: Automated or well-organized billing forms help minimize mistakes in calculations or missing information, leading to fewer disputes and corrections.

- Enhanced Professionalism: A streamlined system conveys a sense of order and reliability, improving the perception of your business and fostering trust with clients.

Steps to Streamline Billing

To create a more efficient payment process, consider the following:

- Automate Bill Generation: Use tools that automatically generate and send payment requests, saving time and reducing the risk of human error.

- Set Clear Payment Terms: Establish straightforward terms that clearly define when and how payments are due to avoid confusion or delays.

- Offer Multiple Payment Options: Provide clients with flexible payment methods to make it easier for them to pay quickly.

By streamlining your financial processes, you can create a smoother experience for both yourself and your clients, ultimately leading to better cash flow and improved operational efficiency.

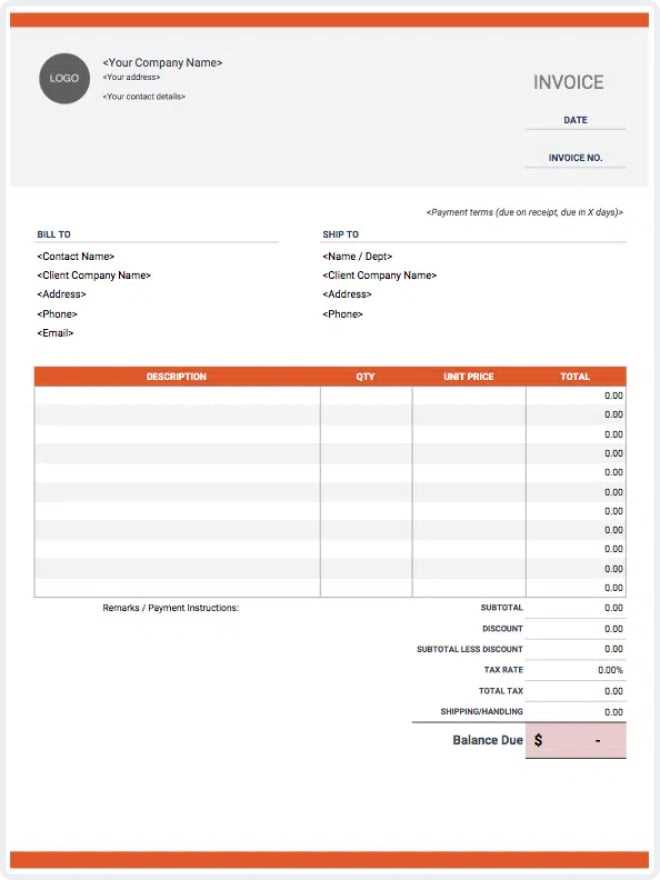

Top Free Billing Forms for Practitioners

Finding a suitable, cost-effective way to manage financial documents is essential for any professional. For those in the field of mental health and wellness, using a free, customizable billing form can be an efficient and affordable solution. These documents help maintain clear communication with clients and ensure that payment processes are handled smoothly.

Here are some of the best free billing forms available for professionals looking to streamline their payment procedures:

Recommended Free Billing Options

| Billing Form | Features |

|---|---|

| Basic Client Billing Form | Simple and clean design, ideal for straightforward sessions. Allows for easy customization of services and costs. |

| Detailed Service Billing Form | Includes sections for detailed descriptions of services provided, which is useful for clients who need clarity on what they are being charged for. |

| Payment Plan Billing Form | Designed for practitioners who offer installment payment options. This form allows clients to easily understand and track their payment schedules. |

| Online Payment Compatible Form | Integrates with online payment systems for easy processing of credit cards and other electronic payment methods. |

Where to Find Free Billing Forms

Several websites offer free downloadable forms that can be tailored to fit your specific needs. Look for options that provide flexibility in customization, ensuring that the forms you use align with your practice’s style and client needs. Many also offer additional features, such as online payment integration and automatic calculation of totals, making them a convenient choice for busy professionals.

Simple Steps to Create an Invoice

Creating a professional payment request doesn’t need to be complicated. By following a few straightforward steps, you can generate clear and accurate financial documents that keep transactions smooth and organized. A well-structured request helps ensure that clients understand the charges and reduces the chances of payment delays.

Step 1: Include Your Business Information

Start by adding your contact details at the top of the document. This should include:

- Your business name

- Address

- Phone number

- Email address

- Tax identification number (if applicable)

Step 2: List the Services Provided

Clearly describe each service or session that was provided, including the date of service and any relevant details. This ensures your client understands the charges for each item and helps with transparency. Use separate lines for each service to avoid confusion.

By following these simple steps, you can create a well-organized financial document that will facilitate timely payments and keep your accounting records up to date.

Understanding Client and Insurance Billing

Managing payments from both clients and insurance companies requires careful attention to detail and clear communication. It’s essential to understand how to structure financial documents so that both parties can easily process and settle payments. Whether dealing with private clients or third-party insurers, a solid billing structure ensures that funds are received promptly and accurately.

Billing Clients Directly

When working with private clients, it’s important to outline the agreed-upon charges clearly and provide easy-to-follow payment instructions. Here are the key steps for client billing:

- Provide Clear Details: List each service, including the date, description, and cost.

- State Payment Terms: Define when payments are due, any late fees, and available payment methods.

- Offer Flexibility: Allow clients to choose their preferred payment option, such as cash, credit card, or online payment methods.

Dealing with Insurance Companies

When billing insurance companies, additional documentation and specific codes are often required. This includes:

- Insurance Details: Include the client’s insurance provider, policy number, and group number.

- Medical Coding: Use the appropriate codes for services rendered, which can be crucial for reimbursement processing.

- Claim Submission: Make sure to submit claims according to the insurer’s specific guidelines and timelines to avoid delays.

Understanding these distinctions and creating accurate, detailed billing forms helps to ensure smooth transactions, whether you’re working with clients or insurance providers.

Common Mistakes to Avoid in Invoicing

When handling financial documentation, errors can lead to confusion, delays, and even payment disputes. It’s crucial to avoid common pitfalls that can hinder the smooth processing of payments. Ensuring accuracy and clarity in your billing records is key to maintaining a positive relationship with clients and ensuring timely compensation.

Overlooking Key Information

Failing to include essential details can lead to delays and misunderstandings. Ensure that all the necessary components are included:

- Service Dates: Always specify when the services were provided.

- Client Information: Double-check the correct name and contact details of your client.

- Payment Terms: Clearly state the payment due date, fees, and any applicable late charges.

Making Calculation Errors

Incorrect calculations can cause confusion and payment delays. To avoid this:

- Double-check totals: Verify the math before finalizing any document.

- Clear breakdown: Provide a detailed itemized list of charges to avoid discrepancies.

By avoiding these common mistakes, you can ensure a more efficient billing process and minimize the risk of delays or misunderstandings.

Managing Recurring Client Payments Efficiently

Managing regular payments from clients can be streamlined through effective systems and organization. By setting up clear payment schedules and using automated tools, you can ensure consistent cash flow while reducing administrative tasks. This process involves clear communication and reliable tracking to avoid delays or missed payments.

Establishing a Clear Payment Schedule

Having a defined payment schedule is crucial to ensure that clients are aware of when to expect charges. To make this process smoother:

- Set Fixed Dates: Choose a consistent day of the month for payments to be processed.

- Communicate Regularly: Send reminders or notifications before the payment is due.

- Offer Flexible Payment Methods: Provide various payment options, such as automatic bank transfers, credit card payments, or digital wallets.

Using Automated Payment Systems

Automating the billing process for recurring payments can save time and reduce human error. Here are some benefits:

- Reduced Administrative Burden: Automating payments means no need to manually process each transaction.

- Consistent Cash Flow: Clients’ payments will be collected automatically, ensuring timely revenue.

- Improved Tracking: With automated systems, tracking payments and generating reports becomes much easier.

By implementing these strategies, managing recurring payments can become an efficient and less time-consuming part of your practice.

Best Software for Therapy Invoicing

Choosing the right software can significantly enhance the efficiency of handling financial transactions for your practice. The right tool simplifies the billing process, allowing for accurate tracking, timely payments, and minimal administrative effort. Whether you’re managing a small clinic or a large practice, these software solutions can help streamline your financial operations.

1. QuickBooks

QuickBooks is one of the most popular choices for professionals looking to manage payments and generate billing documents. It offers a user-friendly interface, integrates with bank accounts, and automates many aspects of financial tracking, making it ideal for managing a steady flow of clients.

2. FreshBooks

FreshBooks is designed specifically for small businesses and independent professionals. It allows for quick invoice creation, recurring billing, and expense tracking, making it perfect for managing client accounts with ease and precision.

3. Xero

Xero is another excellent tool for managing finances, known for its comprehensive features that allow for creating detailed financial records. It’s suitable for practices that need an all-in-one solution for bookkeeping and billing.

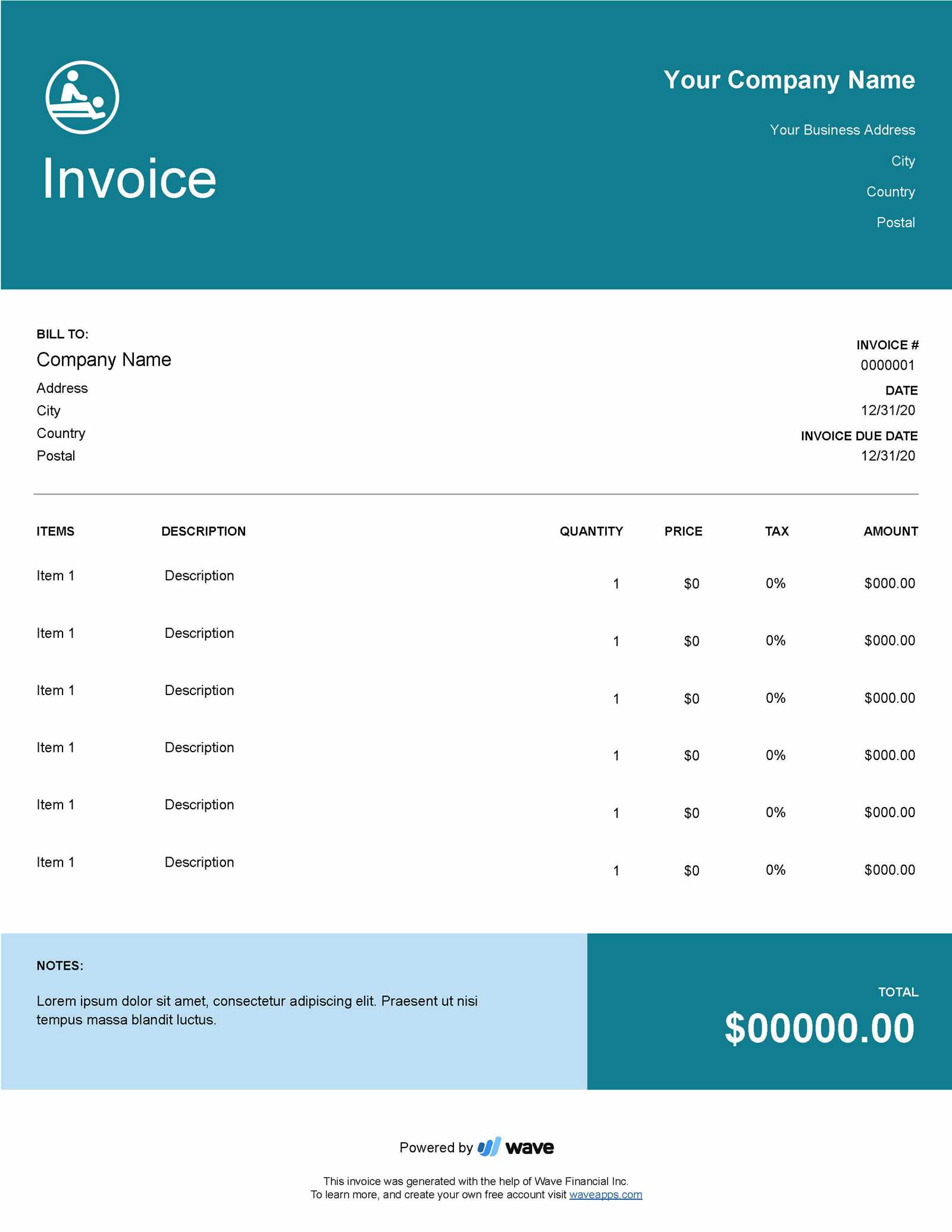

4. Wave

Wave offers free invoicing software that is highly rated by small businesses and independent practitioners. Its straightforward features help you create invoices, track payments, and manage finances efficiently without any upfront costs.

5. Zoho Invoice

Zoho Invoice provides an affordable and scalable option for professionals looking to automate their billing process. It offers custom branding options, time tracking, and payment reminders, making it ideal for practices of all sizes.

By investing in the right software, you can improve your billing system, enhance client satisfaction, and free up valuable time to focus on providing quality services.