Therapist Invoice Template for Easy Billing

Managing financial transactions in a professional practice requires clear, accurate documentation. An efficient system for generating and tracking charges is essential for maintaining smooth operations and ensuring timely payments from clients. By using a structured approach, you can save time and avoid confusion, all while keeping your finances organized.

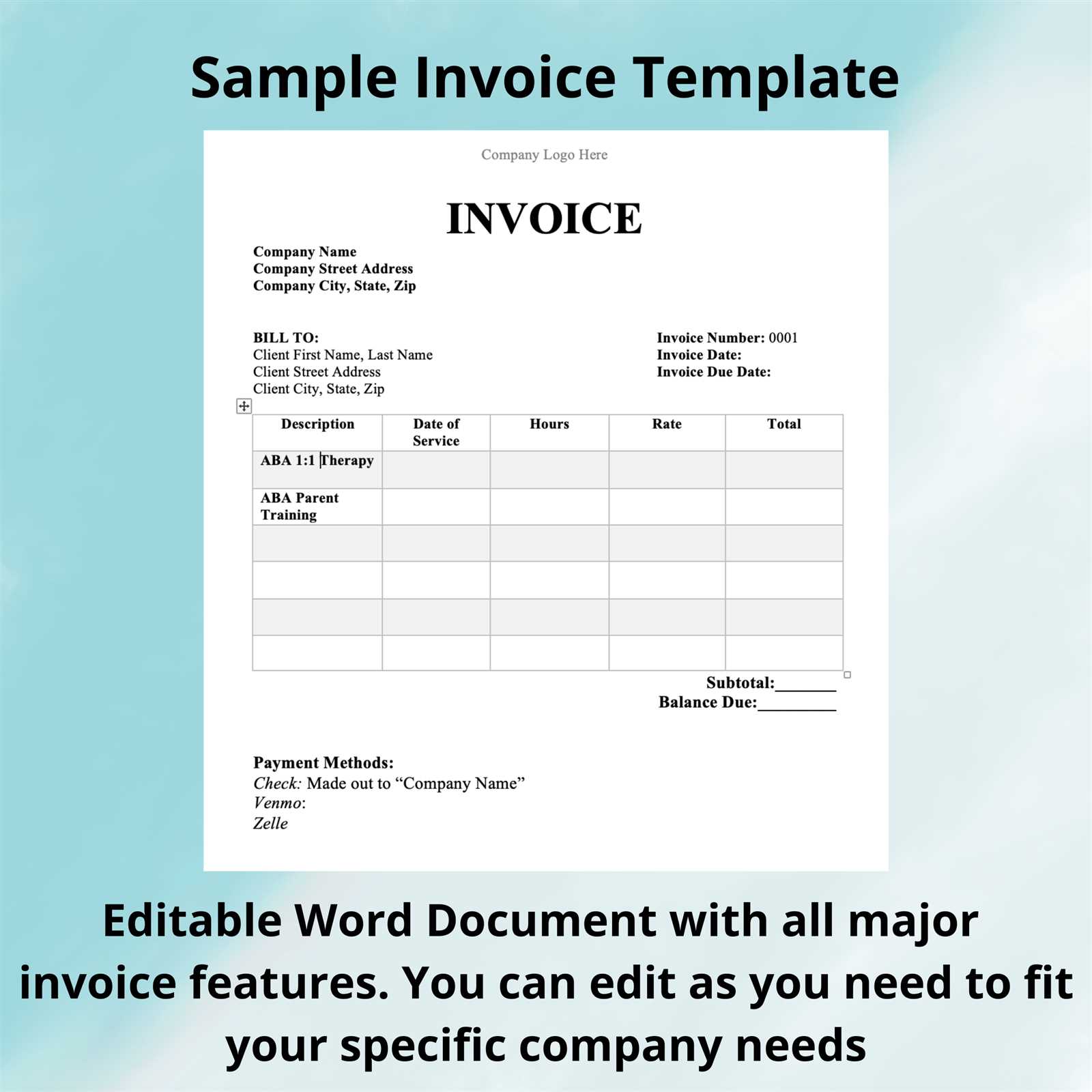

Setting up a well-designed billing document can greatly simplify this task. With the right tools, professionals can create a document that is both easy to understand for clients and comprehensive in covering all the necessary details. This ensures that payments are processed without unnecessary delays and helps maintain a positive relationship with clients.

Properly formatted financial records also serve as a helpful reference for bookkeeping and tax purposes. Using a customized format allows for greater flexibility, making it easier to adjust for specific services rendered or different payment terms. Whether you’re working independently or as part of a larger organization, adopting an organized system can lead to greater efficiency and peace of mind.

Therapist Invoice Template Overview

In any professional practice, the process of creating and managing payment records is essential for both administrative efficiency and financial clarity. A well-organized billing document ensures that services rendered are accurately recorded and that payment terms are clear, reducing the likelihood of misunderstandings. Understanding how to structure and personalize such a document is crucial for a smooth and professional transaction process.

Key Elements of a Well-Structured Billing Document

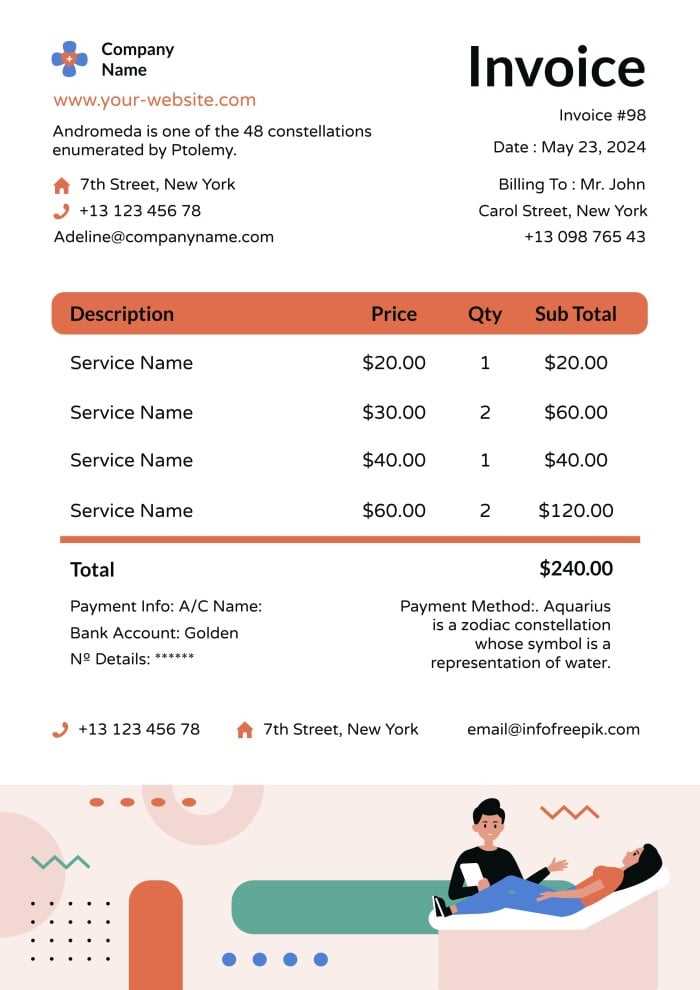

A comprehensive billing record should contain essential details that cover the specifics of the services provided. These details typically include information about the client, the nature of the service, the dates of service, and the agreed-upon payment terms. Below is an example of what these elements might look like:

| Section | Description |

|---|---|

| Client Information | Details such as the client’s name, address, and contact information. |

| Service Description | A brief summary of the work or service provided, including the date and time of the session. |

| Payment Amount | The total cost for the service, including any applicable taxes or discounts. |

| Payment Terms | Details of when and how the payment is due, including methods of payment accepted. |

Customizing the Document to Fit Your Needs

Adapting this document to suit specific practice requirements or client preferences is key to maintaining flexibility. Whether you’re working with a standard pricing model or offering specialized services, the layout of the billing record should reflect your unique needs. Additionally, many professionals prefer using digital formats that can be easily modified, saved, and sent directly to clients.

Why You Need an Invoice Template

Efficient financial management is crucial for any business, and having a consistent way to document charges and payments ensures smooth operations. A standardized billing record helps eliminate confusion, keeps transactions clear, and provides both the service provider and the client with accurate details. Utilizing a structured format makes the entire process more efficient, reducing the risk of errors and delays.

Whether you’re managing a small practice or a larger service-oriented business, using a structured document for recording financial exchanges allows you to stay organized. This tool not only improves professionalism but also helps maintain clear communication with clients about payment expectations.

| Benefit | Description |

|---|---|

| Consistency | Provides a uniform method for documenting services and payments, reducing mistakes. |

| Professionalism | A well-designed document boosts your business’s credibility and presents a polished image. |

| Efficiency | Speeds up the billing process and reduces administrative work by using pre-made structures. |

| Clarity | Clearly outlines the services provided, the amount due, and payment terms, preventing misunderstandings. |

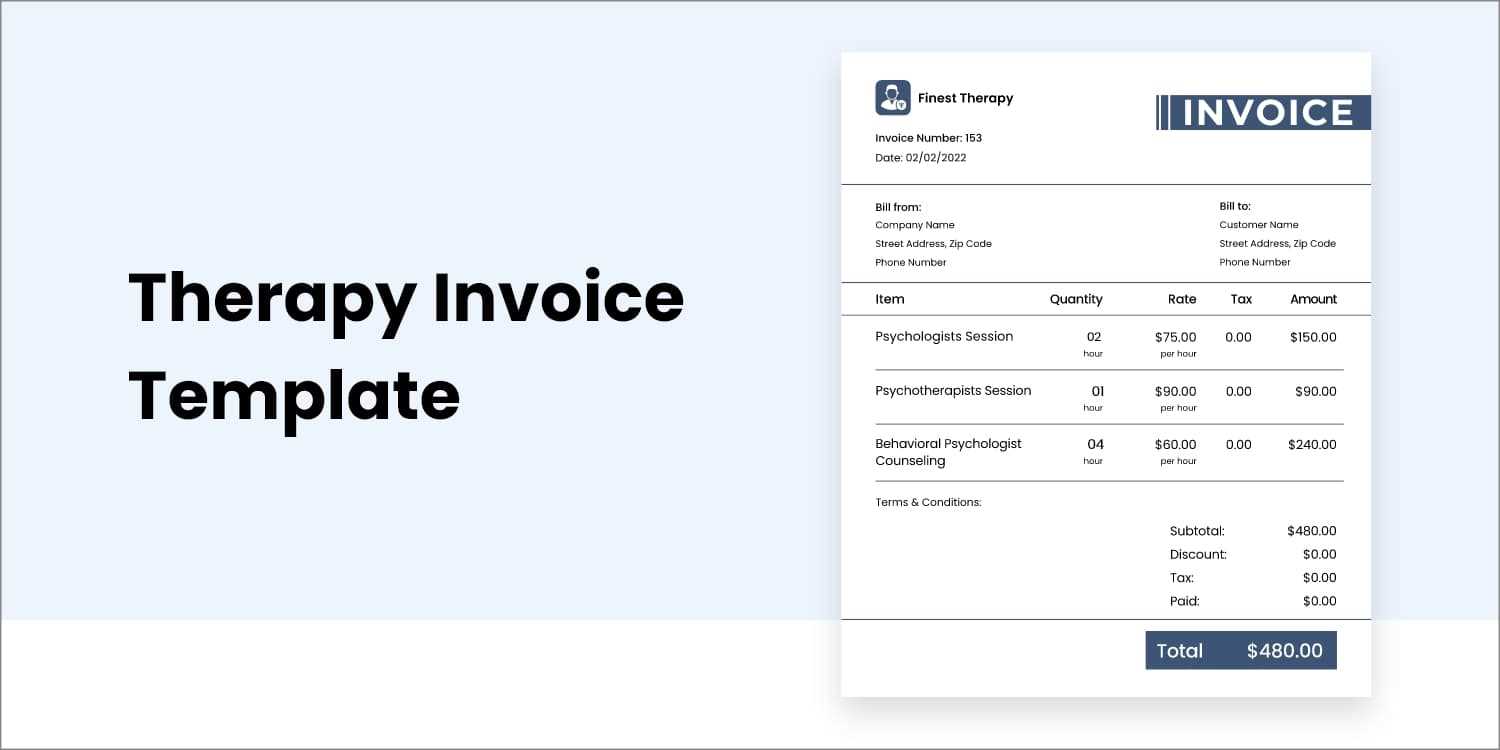

Key Components of a Therapist Invoice

A comprehensive financial document should include all the necessary information to ensure clarity and prevent confusion for both the service provider and the client. Essential details like contact information, a description of services, and payment terms must be clearly outlined to avoid any misunderstandings. The structure of the document should also support easy tracking and reference for future transactions.

To create an effective billing record, several key components must be included. These elements ensure that the document is complete, professional, and easy to understand for both parties involved in the transaction.

| Component | Description |

|---|---|

| Contact Information | Includes both the client’s and the service provider’s names, addresses, and contact details. |

| Service Description | A clear breakdown of the services provided, including dates, times, and any specific details about the session or treatment. |

| Payment Amount | The total cost of the services rendered, including any applicable taxes or additional charges. |

| Payment Terms | Details about when the payment is due, any late fees, and accepted payment methods (e.g., credit card, check, or online payment). |

| Unique Invoice Number | A unique reference number for tracking and organizing financial records. |

How to Customize Your Invoice

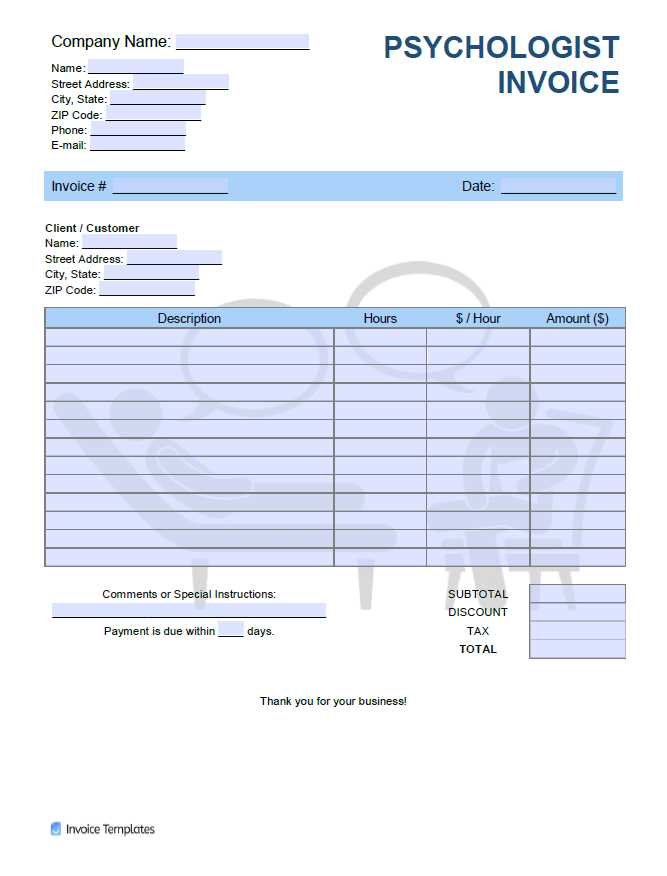

Personalizing a financial record allows you to tailor it to your unique business needs and client preferences. Customization ensures that the document is both practical and professional, reflecting your brand and providing essential details in a clear and concise format. Adjusting specific elements such as service descriptions, payment methods, and document layout can make the process smoother and more efficient for both you and your clients.

Adjusting the Layout and Design

When personalizing a billing document, one of the first aspects to consider is the overall design. While it is essential that the document is clear and easy to read, you can also integrate your branding elements, such as your logo, business name, or colors. This not only gives the document a professional appearance but also reinforces your business identity. A clean, organized design helps clients easily navigate the details, ensuring that no information is overlooked.

Customizing Payment Details

Another key customization is related to payment terms. You may choose to include different payment methods, offer discounts, or specify late payment fees. Additionally, depending on your business model, you can adjust how services are listed–whether as individual items or as a bundled package. Clearly outlining payment terms such as due dates and acceptable payment methods is essential to avoid confusion and delays.

Choosing the Right Invoice Format

Selecting the appropriate structure for documenting charges and payments is essential to ensure that your financial records are both efficient and professional. The format should be clear, easy to navigate, and customizable to suit the specifics of your business or services. Whether you prefer a digital or printed version, the goal is to make the transaction process as straightforward as possible for both you and your clients.

Digital vs. Paper Records

One of the first decisions you’ll need to make is whether to use a digital or paper format. Digital versions offer flexibility, allowing for easy editing, storage, and sharing via email or cloud-based systems. This format is particularly useful for quick turnaround times and can be easily integrated into accounting software. On the other hand, paper versions might be preferred by clients who prefer traditional methods or require a physical document for their records.

Choosing a Pre-made or Custom Format

Another consideration is whether to use a pre-made structure or create a custom design. Pre-made formats can save time, especially if you’re looking for something simple and straightforward. However, customizing the format to reflect your branding and specific needs can provide a more professional and tailored approach. Customizing the format allows you to include unique details or payment terms that best suit your practice and client base.

Digital vs Paper Therapist Invoices

When it comes to documenting financial transactions, choosing between digital or paper formats can significantly impact your workflow and the client experience. Both options have their advantages, and the right choice depends on your business preferences, the nature of your practice, and how you want to manage your records. Below is a comparison of the two formats to help you make an informed decision.

Advantages of Digital Records

Digital documents offer several benefits that can streamline your billing process:

- Efficiency: Digital records can be created, modified, and sent instantly, reducing the time spent on administrative tasks.

- Easy Storage: Storing records digitally saves physical space and makes it easy to organize and retrieve past transactions.

- Integration with Software: Many digital formats can be integrated with accounting software, making tracking and reporting easier.

- Environmentally Friendly: Going paperless reduces waste and is more sustainable.

- Accessibility: Digital documents can be accessed from anywhere, allowing for remote management of your financial records.

Advantages of Paper Records

Despite the rise of digital systems, there are still reasons why some businesses prefer to use paper documents:

- Client Preference: Some clients may prefer receiving a physical document, especially if they are not as comfortable with digital communication.

- Traditional Approach: Paper records offer a tangible, hard copy of the transaction, which can feel more personal or formal.

- No Need for Technology: Paper documents don’t require any technical setup or reliance on digital tools, making them simpler for those who prefer traditional methods.

- Security and Privacy: For those concerned about digital security, paper records offer an alternative where no online data is involved.

Ultimately, the decision between digital or paper records depends on your specific needs and preferences. Some businesses even choose to use a combination of both formats to cater to different clients and ensure efficiency in managing financial data.

Steps to Create an Invoice

Creating a professional billing document requires attention to detail and a clear structure. Whether you’re new to generating financial records or simply looking to improve your process, understanding the key steps involved can help ensure that you capture all necessary information. By following a straightforward process, you can create a clear, accurate document that reflects the services rendered and sets clear expectations for payment.

Here are the essential steps to create a comprehensive and effective billing document:

1. Include Your Contact Information

Start by adding your business or personal contact details at the top of the document. This includes your name or business name, address, phone number, and email. Clear contact information ensures that your client can easily reach you if there are any questions or issues regarding the transaction.

2. Add the Client’s Information

Next, include your client’s name and contact details. This helps to identify the recipient of the payment and ensures that there are no mix-ups when handling multiple clients. It’s also helpful to add any account or reference numbers if you maintain them for your records.

3. Detail the Services Rendered

Provide a description of the services provided. Be specific about what was done, including dates, times, and any relevant details. Breaking down the service descriptions makes it easier for clients to understand what they are being charged for.

4. Specify Payment Amounts

Clearly list the costs associated with each service. This may include base charges, taxes, or any additional fees that apply. It’s important to ensure transparency in pricing to avoid any confusion later on.

5. Set Payment Terms

Define when the payment is due and the accepted methods of payment. This section should also outline any penalties for late payments and if there are any discounts for early payment. Clear payment terms help ensure that both parties understand the expectations regarding settlement.

6. Include a Unique Reference Number

For tracking and organizational purposes, assign a unique number to the document. This can help you stay organized and make it easier to locate specific records in the future.

7. Review and Send

Before finalizing the document, double-check all the details for accuracy. Once you are sure everything is correct, send the document to your client through their preferred method–whether that’s via email, postal mail, or a digital payment system.

Common Mistakes to Avoid in Invoices

Creating an accurate and professional financial document is crucial for maintaining clear communication with clients and ensuring timely payments. However, there are several common mistakes that can cause confusion or delay in receiving payments. Recognizing and avoiding these pitfalls can help streamline your billing process and build trust with your clients.

1. Missing or Incorrect Contact Information

One of the most frequent mistakes is failing to include or inaccurately listing contact details. If your business or client’s information is incorrect or incomplete, it can lead to delays or complications in the payment process.

2. Unclear Payment Terms

Another issue is failing to clearly define payment terms. Whether it’s a due date, accepted payment methods, or late fees, unclear or missing terms can cause confusion and result in delayed payments.

| Mistake | Impact |

|---|---|

| Incorrect or Missing Contact Details | Can lead to miscommunication and payment delays |

| Vague Payment Terms | Creates confusion over payment deadlines or methods |

| Lack of Detailed Service Descriptions | Can cause clients to question the charges or request clarification |

| Errors in Pricing | Can result in overcharging or undercharging, leading to disputes |

3. Failing to Include Service Details

Leaving out specific information about the services provided can lead to confusion about what the client is paying for. Be sure to list all services rendered along with dates, hours, or session lengths to avoid misunderstandings.

4. Pricing Errors

Another common mistake is incorrect pricing. Whether it’s miscalculating the total or not including taxes, inaccurate charges can lead to disputes or a delay in payment. Always double-check the amounts and ensure that all additional fees are accounted for.

Setting Payment Terms for Clients

Establishing clear payment terms is a key component of maintaining a smooth financial relationship with your clients. By outlining when and how payments should be made, you ensure that both parties understand the expectations upfront. Proper payment terms not only help avoid misunderstandings but also contribute to timely payments, improving cash flow and reducing administrative work.

Types of Payment Terms

There are various ways to structure payment terms, depending on your preferences and the nature of your services. Common options include:

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days of the service date. |

| Due on Receipt | Payment is expected as soon as the client receives the document. |

| Installments | Payments are broken into smaller, scheduled amounts over a period of time. |

| Prepaid | Full payment is required before services are rendered. |

Choosing the Right Terms

It’s important to choose payment terms that align with your business model and your clients’ needs. For example, a “net 30” term might be more suitable for ongoing services, while a “due on receipt” term may work better for one-time consultations or sessions. Offering flexible payment options, such as installment plans or prepaid services, can also make it easier for clients to fulfill their obligations.

Clear, consistent payment terms not only enhance the professionalism of your business but also protect you from delayed payments, making sure you’re compensated in a timely manner for your work.

Legal Requirements for Therapist Invoices

When creating a billing document, it’s essential to be aware of the legal obligations that may apply to ensure that the document is compliant with local tax laws and business regulations. These requirements can vary depending on the region or country, but certain key elements are universally necessary to protect both the service provider and the client. Understanding these legal essentials can help you avoid potential issues, such as audits or disputes, and ensure that your financial records are in order.

Key Legal Elements to Include

In most cases, legal guidelines dictate that specific information must be included in any billing statement. Failure to meet these requirements can lead to problems with tax authorities or difficulty in enforcing payment. Below are some essential elements you should always include:

| Required Element | Description |

|---|---|

| Service Provider’s Information | Your business name, address, and tax identification number (TIN) or VAT number are often required by law for tax reporting purposes. |

| Client’s Information | Full name or business name of the client receiving the service, and sometimes their address or contact information. |

| Clear Payment Terms | Specify the due date, accepted methods of payment, and any late fees or interest charges to comply with contractual obligations. |

| Tax Information | Indicate applicable tax rates and clearly itemize tax amounts if your services are taxable under local laws. |

| Unique Reference Number | A unique document number is essential for record-keeping and auditing purposes. |

Regional Variations and Compliance

Legal requirements can vary depending on your location. For example, businesses in the European Union must adhere to specific VAT regulations, while in the U.S., state tax laws may differ from one jurisdiction to another. As a service provider, it is important to stay informed about local laws regarding financial documentation. Regularly reviewing local business regulations ensures that your billing practices remain compliant and that you avoid penalties or fines.

Always consider consulting a legal professional or accountant to ensure that your records are fully compliant with local and international requirements, especially when dealing with taxes or contracts.

Using Invoices for Insurance Claims

When seeking reimbursement from insurance providers, having a detailed and accurate financial document is essential. This document serves as proof of services rendered, making it a critical component in the claims process. Insurance companies require specific information to process claims efficiently, and ensuring that the billing statement meets these requirements can help facilitate smoother transactions and avoid delays.

Key Information for Insurance Claims

To ensure that your billing documents are accepted by insurance companies, it’s important to include the necessary details. The following elements are typically required when submitting a claim:

| Required Information | Description |

|---|---|

| Provider’s Full Name | Insurance companies need the name of the professional or business who provided the services. |

| Service Date | Indicate the exact date(s) when services were provided to the client to match with the insurance policy period. |

| Detailed Service Description | A clear breakdown of the services provided helps the insurance company understand what is being reimbursed. |

| Fees and Charges | Provide a clear breakdown of all charges and indicate any discounts or payments already made, if applicable. |

| Insurance Provider Information | Include the insurance provider’s details, including the policy number, to ensure proper submission and reimbursement. |

Best Practices for Submitting Claims

To streamline the claims process, make sure that your billing documents are accurate and compliant with the insurance provider’s requirements. Some best practices include:

- Reviewing insurance policy guidelines to ensure that the services are covered under the plan.

- Submitting all required documentation in a timely manner to avoid delays in reimbursement.

- Keeping a copy of all financial records for your own reference and in case the insurance company requires additional information.

By providing thorough and accurate financial records, you can enhance the chances of a successful claim, ensuring that clients or your business are reimbursed promptly and correctly.

Tracking Payments with Invoices

Properly managing and tracking payments is crucial for maintaining financial order and ensuring that your business operations run smoothly. When you issue a financial statement, it becomes a key tool for tracking what has been paid and what is still outstanding. This record allows both you and your clients to stay informed about financial transactions, helping to avoid confusion and delays.

To effectively track payments, it’s essential to ensure that each statement includes clear and accurate information. By organizing and updating these records regularly, you can easily monitor payment statuses, follow up on overdue amounts, and ensure that your financial records remain accurate. Tracking payments also helps in preparing for tax season, audits, or other financial reviews.

Here are a few strategies to enhance payment tracking:

- Label payments clearly: Make sure each document has a unique number, making it easy to reference when tracking the payment status.

- Include payment terms: Specify the due date and payment method to avoid confusion about when and how the payment is expected.

- Mark paid amounts: Indicate when payments are received and ensure that any partial payments are noted accordingly.

- Follow up on overdue amounts: Keep a record of overdue payments and send reminders to clients to ensure timely settlement.

By staying organized and keeping thorough records of payments, you can manage your business’s cash flow more effectively and reduce the likelihood of missed payments or billing errors.

How to Send Invoices to Clients

Efficiently delivering financial documents to clients is a key part of maintaining clear communication and ensuring timely payments. Whether through digital or physical means, the method you choose should be reliable, professional, and convenient for both you and the client. Sending these documents properly ensures that the recipient can review the details of the transaction and process the payment as expected.

Methods for Sending Financial Documents

There are several ways to send financial statements to clients, each with its advantages depending on the preferences of both parties. Here are the most common methods:

- Email: Sending electronic copies via email is one of the most efficient and eco-friendly methods. Ensure that the file is in a widely accepted format, such as PDF, so that it can be easily opened and stored by the client.

- Postal Mail: Some clients may prefer or require hard copies of financial records. In these cases, sending a printed version by postal mail ensures that all necessary documents are received in a formal, tangible format.

- Online Payment Systems: Many businesses and clients use digital platforms that integrate payment and billing features. Sending your statement through these systems can streamline the payment process, making it easier for clients to pay immediately upon receipt.

Best Practices for Sending Financial Documents

To ensure your financial statements are properly received and processed, consider the following tips:

- Confirm Contact Details: Before sending, double-check that you have the correct email address or postal address for the client to avoid delays.

- Attach Clear Instructions: Include a brief message with the document outlining any payment terms, due dates, and how the client can make the payment.

- Use Professional Language: Maintain a courteous and professional tone when sending your documents. This reinforces your business’s credibility and encourages prompt payment.

By choosing the right method and following best practices, you ensure that your financial records are delivered in a timely and professional manner, making the payment process smoother for both you and your clients.

How to Handle Late Payments

Managing overdue payments is an important aspect of maintaining a smooth cash flow and ensuring the financial stability of your business. Delays in payment can lead to disruptions in your operations, so it’s essential to address late payments promptly and professionally. Clear communication and a structured approach can help resolve payment issues without damaging client relationships.

Step 1: Send a Reminder

When a payment is overdue, the first step is to send a polite reminder. This can be done via email or phone, depending on your usual communication channels. Be sure to include the original payment terms, the due date, and the amount still owed. A friendly reminder can encourage clients to settle their debt without creating tension.

Step 2: Offer Flexible Payment Options

If a client is unable to make the full payment at once, consider offering flexible payment options. This might include allowing them to pay in installments or extending the due date. By accommodating clients’ financial situations, you increase the likelihood of receiving the payment while maintaining a positive relationship.

Best Practices for Handling Late Payments:

- Stay Professional: Always remain polite and professional when addressing late payments. Avoid becoming confrontational, as this can harm your business reputation.

- Implement Late Fees: If overdue payments are a recurring issue, consider adding a late fee policy. This helps incentivize timely payments and deters clients from delaying payments in the future.

- Set Clear Payment Terms: Be transparent about your payment terms from the beginning. Ensure that your clients are aware of due dates and the consequences of late payments before any transactions occur.

By taking these steps and staying proactive, you can manage late payments effectively while preserving a positive relationship with your clients. Clear expectations and consistent follow-ups are key to maintaining financial stability in your business.

Using Software for Billing Management

In today’s digital age, using software to manage billing can significantly simplify the administrative aspects of running a business. Billing software allows you to automate many tasks, such as generating receipts, tracking payments, and ensuring accuracy. These tools provide a more efficient and organized way to handle financial transactions, saving time and reducing errors.

Benefits of Using Billing Software

There are several advantages to using software for managing payments and billing details. Below are some key benefits:

- Automation: Automated invoicing eliminates the need for manual entry, ensuring quicker and more accurate processing.

- Time-Saving: Software allows you to create, send, and track bills in just a few clicks, which saves valuable time.

- Professional Appearance: Customize bills with your branding and maintain a professional image for your business.

- Payment Tracking: Easily track overdue payments and outstanding balances with built-in reminders and reports.

Features to Look for in Billing Software

When choosing billing software, consider the following features to meet your needs:

| Feature | Description |

|---|---|

| Customizable Templates | Ability to design and customize billing documents to reflect your business’s style. |

| Payment Gateway Integration | Integration with payment processors like PayPal or Stripe for easy online payments. |

| Recurring Billing | Set up recurring payments for clients with subscription-based services or long-term contracts. |

| Client Management | Store client information securely and track their payment history within the software. |

By using billing software, you can streamline financial tasks and enhance your overall operational efficiency. With various options available, choosing the right software tailored to your business needs can simplify the billing process and free up time to focus on what matters most–serving your clients.

Benefits of Professional Billing Design

A well-crafted billing document not only serves as a functional tool for recording transactions, but also plays a key role in how clients perceive your business. A professional design enhances clarity, builds trust, and communicates attention to detail. Whether you are offering services or products, presenting your financial documents with a polished appearance can create a lasting positive impression.

Improved Client Trust and Credibility

A clean and well-organized financial document reflects professionalism, which can foster trust with clients. When clients receive a properly designed bill, they are more likely to view your business as reliable and legitimate. A professional layout also ensures that all necessary information is presented clearly, making it easier for clients to understand the charges and payment terms.

Enhanced Brand Identity

By customizing your billing documents to align with your brand’s style, you can create a consistent experience across all client interactions. Including your logo, brand colors, and typography helps reinforce your brand identity, making your business instantly recognizable. This attention to detail can make a big difference in building brand loyalty and customer retention.

In addition, a professionally designed document is more likely to be taken seriously by clients. Whether it’s used for payment tracking, tax purposes, or insurance claims, a well-designed bill increases the likelihood that clients will view the document as legitimate and trustworthy.

Integrating Billing with Accounting Software

Integrating your financial documents with accounting software can significantly streamline your business operations. This process allows for automatic synchronization between your payments, records, and reports, saving you time and reducing the risk of errors. By linking your billing system with accounting tools, you can create a seamless workflow that ensures accuracy and efficiency in financial management.

Automated Data Entry

One of the main benefits of integrating your billing system with accounting software is the automation of data entry. When a new transaction occurs, the system can automatically update your records without the need for manual input. This reduces the time spent on administrative tasks and minimizes the likelihood of human error. With accurate and real-time data, you can ensure your financial records are always up-to-date.

Better Financial Reporting

By syncing your billing documents with your accounting software, you gain access to more detailed financial reports. The software can generate income statements, balance sheets, and tax reports that reflect the most current data. This integration not only improves the accuracy of your financial reporting but also provides valuable insights into your business’s financial health.

Moreover, integrating your billing system with accounting tools enhances transparency. It allows for better tracking of payments, outstanding balances, and other financial obligations, giving you a clearer overview of your cash flow. This can help you make more informed decisions and improve financial planning.