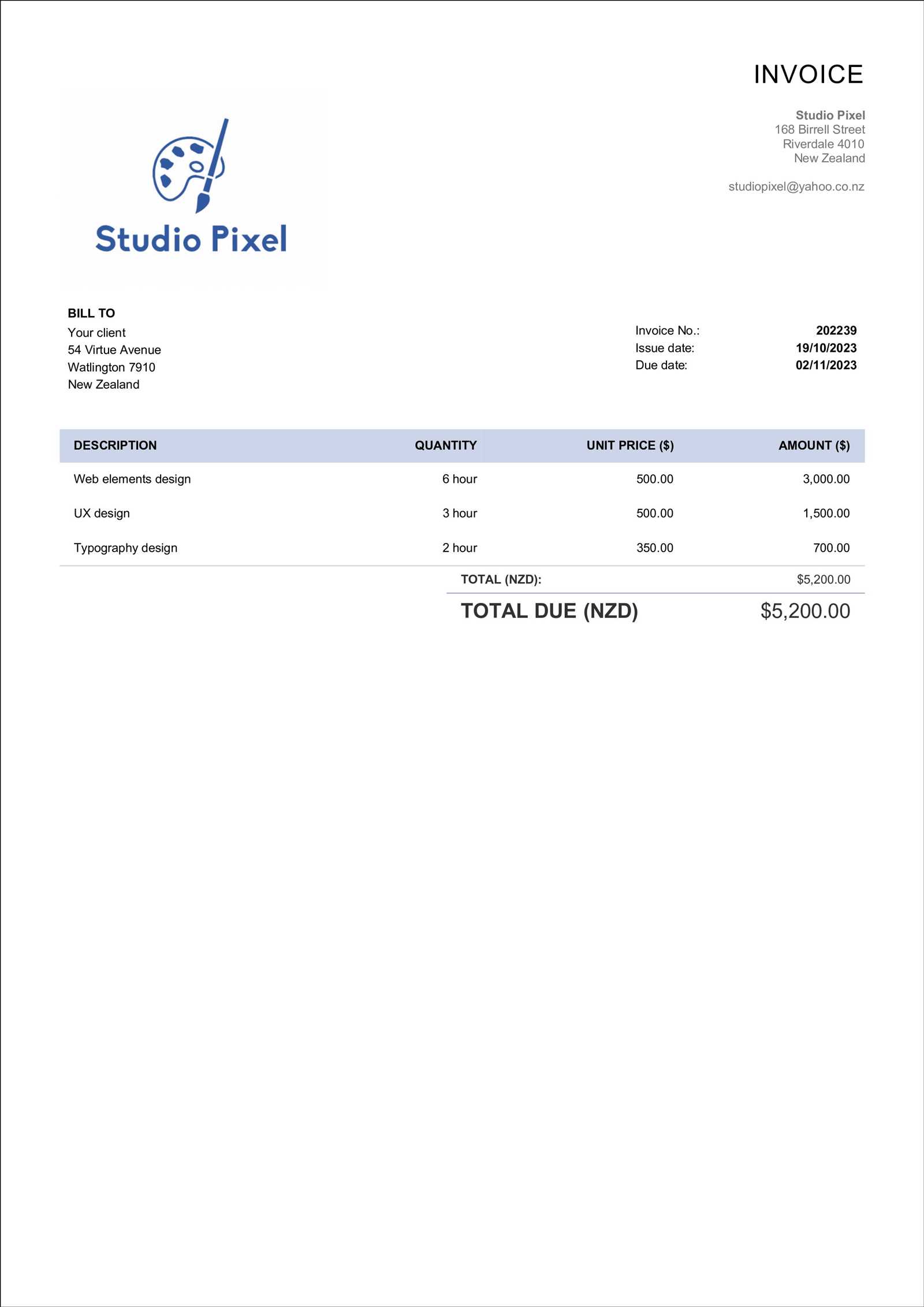

Template Invoice NZ for Simple and Efficient Billing

Managing payments and financial transactions efficiently is essential for any business. In New Zealand, having a standardized document to request payment can help businesses maintain a professional image and ensure clarity in their financial dealings. Whether you are a freelancer, small business owner, or large company, using a well-structured document for this purpose can save time and reduce errors.

Customizable payment requests play a significant role in simplifying the process of billing clients. With the right tools, these documents can be easily tailored to suit your specific business needs, ensuring accuracy and consistency in every transaction.

Creating a smooth workflow for handling payments starts with having an organized approach. The right documentation ensures both you and your clients are on the same page regarding amounts, services rendered, and payment due dates. This clarity fosters trust and reduces the chances of misunderstandings down the line.

Template Invoice NZ: A Complete Guide

In New Zealand, businesses of all sizes rely on standardized documents to ensure smooth financial transactions with clients. These documents serve as formal requests for payment, detailing the amount owed, the services provided, and the terms of payment. Understanding how to create and use such documents effectively can streamline business operations, enhance professionalism, and reduce the chances of errors.

Why Standardized Payment Documents Matter

Utilizing a consistent format for payment requests helps maintain clarity and transparency in financial interactions. By ensuring that each document contains the necessary details, you can avoid confusion, late payments, and disputes. A well-structured request for payment not only looks professional but also makes it easier for clients to process and fulfill their obligations.

Customizing Your Payment Request for Your Business

Adapting payment requests to suit the unique needs of your business is essential for efficiency. You can include specific sections that align with your services, pricing structure, and payment terms. Personalizing these documents can also help reinforce your brand identity, making each transaction feel more connected to your business.

Benefits of Using Template Invoices

Using a standardized approach to creating payment requests brings several advantages to businesses. By employing pre-designed formats, businesses can ensure consistency, save time, and reduce the likelihood of mistakes. These well-structured documents streamline the process of requesting payments, making financial transactions smoother and more efficient.

One of the key benefits of utilizing a structured format is the time efficiency it offers. Instead of creating a new payment request from scratch each time, you can easily fill in the necessary details, allowing for faster billing and a more organized workflow.

| Benefit | Description |

|---|---|

| Consistency | Standardized formats ensure every payment request looks professional and includes the necessary information, reducing errors. |

| Time Savings | Quickly generate new documents with pre-filled sections, speeding up the billing process. |

| Branding | Personalized templates can help reinforce your brand’s identity, offering a more cohesive client experience. |

| Clarity | Clear, structured documents prevent misunderstandings between you and your clients regarding amounts owed and terms. |

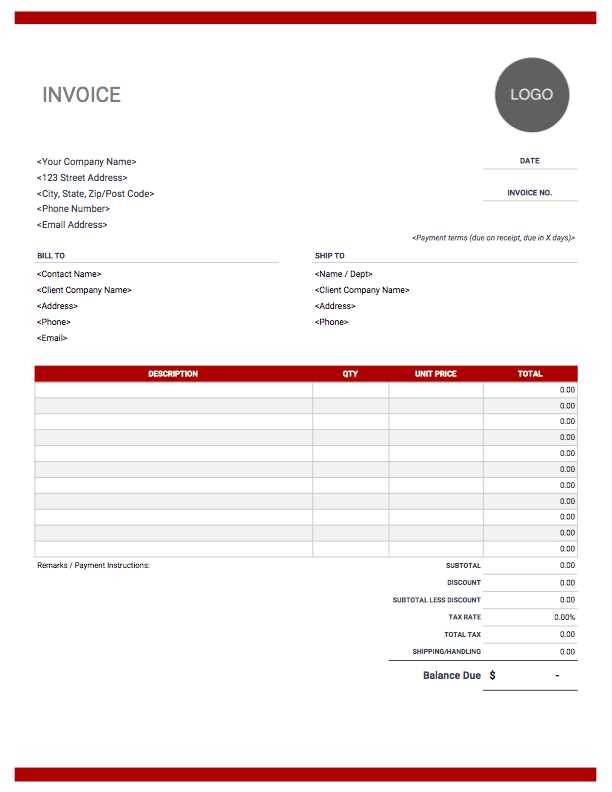

How to Create Your Own Invoice Template

Creating a personalized document for requesting payment can help streamline your billing process and present a professional image to clients. With the right structure, you can easily customize it to reflect your business’s specific needs and branding. Designing this type of document from scratch gives you full control over its content and layout, ensuring it includes all the necessary details for clear communication with your clients.

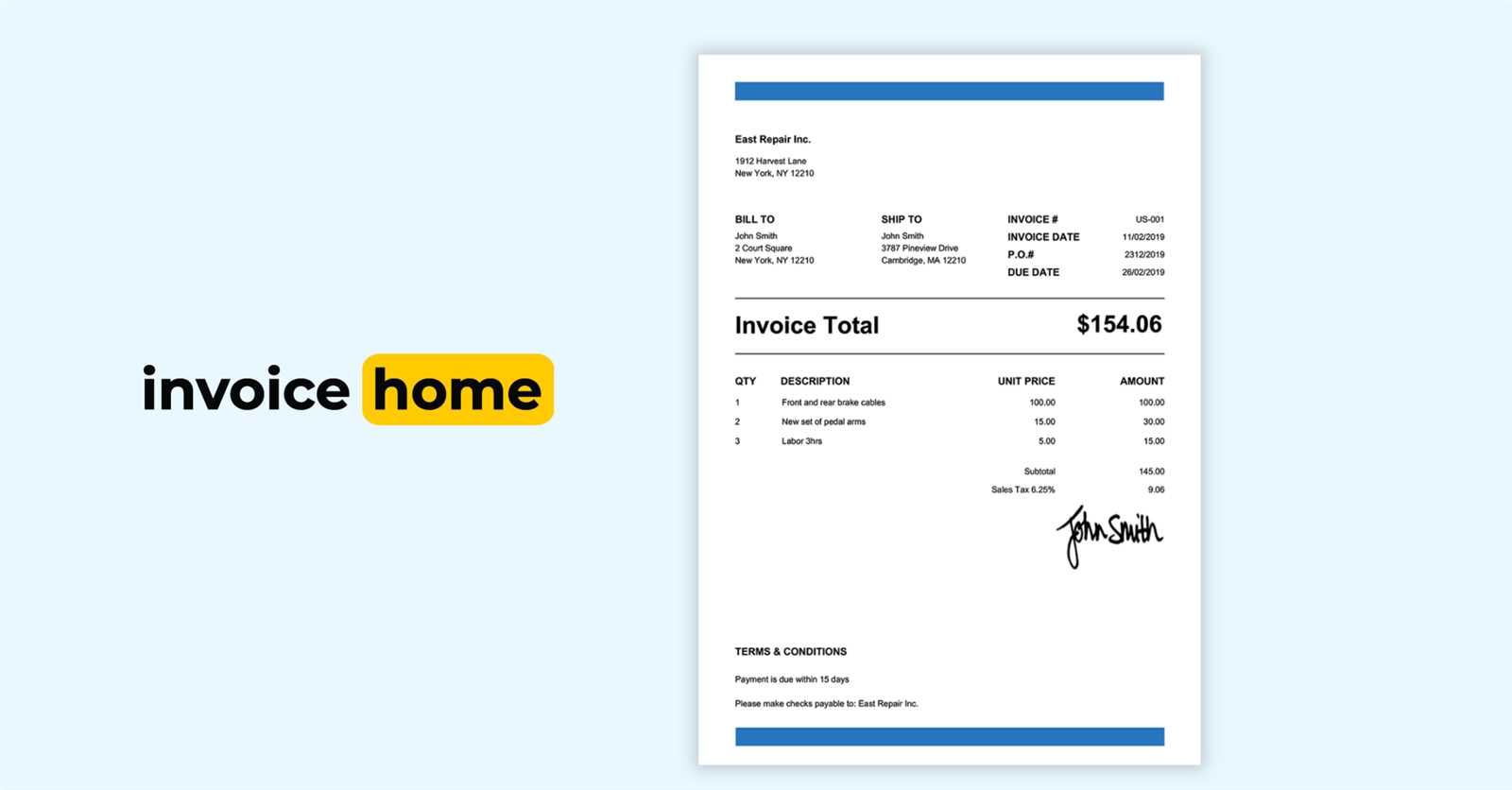

Essential Elements to Include

When building your payment request document, there are several key components to ensure it meets legal and professional standards. These elements will help clarify the terms of the transaction and ensure both you and your client understand the payment details.

- Business Information – Include your company name, address, phone number, and email.

- Client Details – Make sure to add your client’s name and contact information for clarity.

- Payment Terms – Specify the due date and any applicable late fees or discounts for early payment.

- List of Services – Clearly describe the products or services provided, including quantities and rates.

- Total Amount Due – Summarize the total charges, including taxes and additional fees.

Design and Layout Tips

The design of your document can impact its effectiveness. While the content is important, a clean, easy-to-read layout will make your document more professional and user-friendly. Keep these points in mind when designing:

- Use Clear Fonts – Choose readable fonts that are easy to scan, such as Arial or Helvetica.

- Maintain Consistent Formatting – Ensure alignment and spacing are uniform throughout to create a polished look.

- Include Your Branding – Incorporate your logo and business colors to strengthen your brand identity.

- Leave Space for Notes – Add a section for additional comments, terms, or messages to clients.

Choosing the Right Invoice Format

Selecting the proper layout for your payment requests is crucial to ensure clarity and professionalism in your business dealings. The format you choose will influence how easily clients can understand the details of the transaction, making it easier for them to process payments promptly. Whether you’re dealing with local clients or international ones, the right structure can save time, reduce errors, and prevent misunderstandings.

Factors to Consider When Selecting a Format

There are several important factors to think about when choosing the best design for your payment request document. Each of these factors will affect how well your document serves its purpose and fits your business style.

- Business Type – Different industries may require specific details, so choose a format that accommodates your services.

- Client Needs – If you often deal with international clients, ensure the format includes space for currency conversions and tax rates.

- Legal Requirements – Make sure your format adheres to local legal standards, such as GST inclusion or tax number listings in New Zealand.

- Customization Options – Opt for a format that allows you to add or remove fields depending on the specific job or service provided.

Popular Formats for Payment Requests

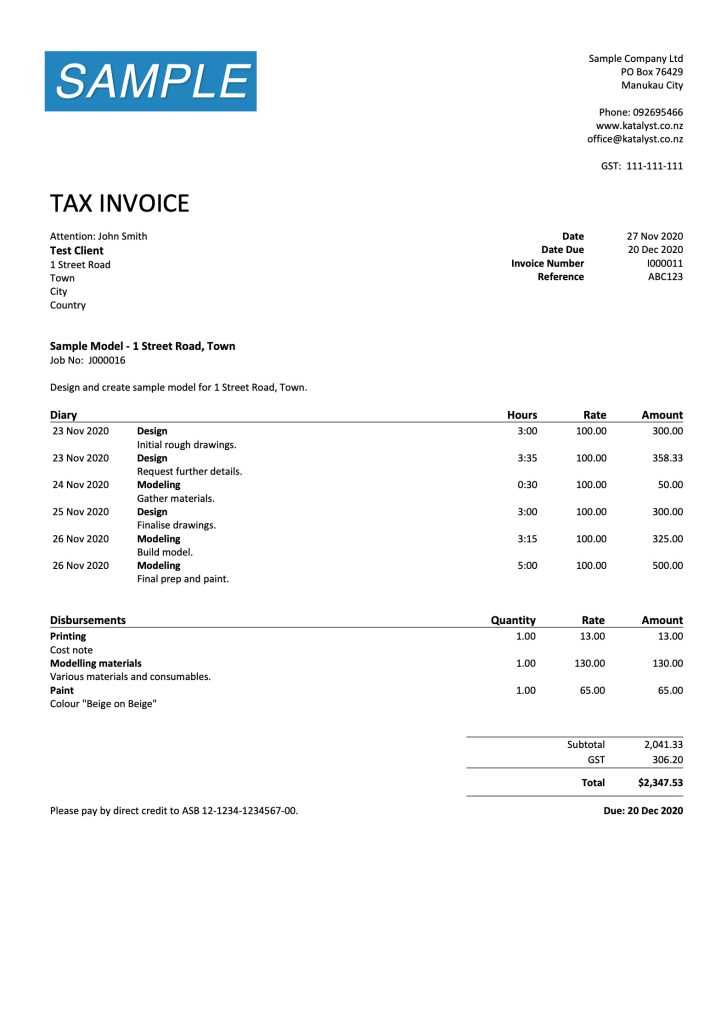

Several formats are commonly used, each with its strengths and particular use cases. Choosing one depends on your specific business needs and the level of detail you wish to include in your payment requests.

- Simplified Format – Best for small businesses and freelancers who offer standard services or products with clear pricing.

- Detailed Format – Ideal for businesses that provide complex services or products that require a breakdown of charges.

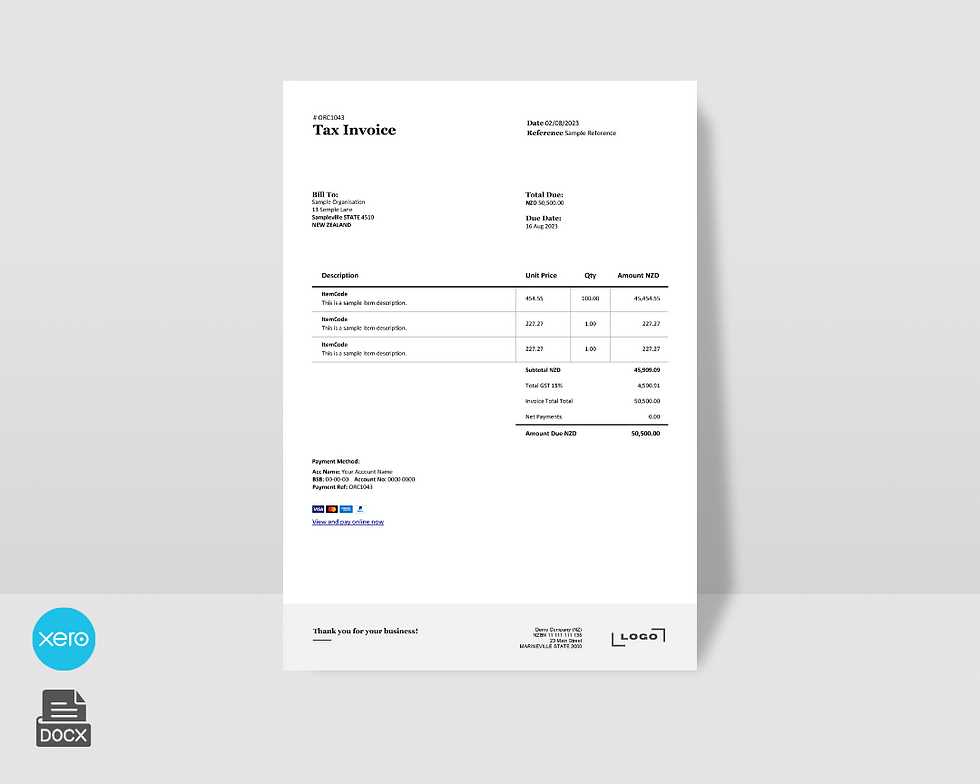

- Online Format – A digital layout, often integrated with accounting software, which can automate the creation and sending of payment requests.

Legal Requirements for Invoices in NZ

In New Zealand, businesses are required to follow certain legal guidelines when creating documents to request payment. These legal requirements ensure that transactions are transparent and that businesses comply with tax laws, providing both the business and the client with a clear record of the exchange. Understanding these regulations is essential for maintaining professionalism and avoiding potential issues with tax authorities.

Each payment request document must include specific information to meet legal standards. Failing to include these details could lead to delays in payment processing or complications during tax reporting.

| Required Information | Description |

|---|---|

| GST Number | If your business is registered for Goods and Services Tax (GST), you must include your GST number on all payment requests. |

| Taxable Amount | The document should clearly indicate the taxable amount and the applicable GST if your business charges this tax. |

| Issue Date | Every document must have an issue date, showing when the payment request was created. |

| Payment Due Date | Clearly specify the date by which the payment is due, including any late fees if applicable. |

| Business Information | Include the full name, contact details, and address of your business. |

| Client Information | Include the name and contact information of the client receiving the payment request. |

Top Tools for Customizing Invoices

Customizing payment request documents is a key step for businesses to maintain a professional appearance and streamline their billing process. With the right tools, you can quickly adjust these documents to suit your business’s unique needs, ensuring clarity, accuracy, and branding consistency. Various software solutions make it easy to create, personalize, and manage these documents, whether you’re a small business owner or part of a larger company.

From simple drag-and-drop tools to advanced software with built-in financial features, there are a wide variety of options to choose from. These tools help you design payment requests that align with your brand, include essential details, and are easy to update as your business evolves.

Free Invoice Templates for New Zealand

For businesses in New Zealand, there are a variety of free resources available to help create professional payment request documents. These tools allow you to easily generate customized forms that meet local regulations and include all the necessary details for a clear and efficient billing process. With free options readily accessible, businesses of all sizes can maintain consistency and professionalism without incurring additional costs.

Free resources typically offer simple, easy-to-use platforms for creating well-organized documents, whether you’re a freelancer, small business owner, or part of a larger company. Many of these tools allow for quick modifications, such as adding your branding, adjusting payment terms, or customizing the layout.

By using these no-cost solutions, you can ensure that your payment requests are both compliant with New Zealand’s legal requirements and aligned with your business’s unique needs, all while saving valuable time and resources. These tools are perfect for those who need a quick solution without the complexity of paid software.

How to Save Time with Templates

Using pre-designed structures for payment requests can significantly reduce the time spent on administrative tasks. These tools allow you to quickly generate professional documents without having to manually input repetitive information each time. By streamlining the creation process, businesses can focus more on their core activities while ensuring consistency and accuracy in their transactions.

By utilizing ready-made formats, you can eliminate the need to start from scratch every time a payment needs to be requested. These structures allow for easy customization, saving time on the formatting and layout, and ensuring that essential details are always included.

| Time-Saving Benefit | Description |

|---|---|

| Quick Document Creation | Pre-filled fields allow you to rapidly generate accurate payment requests, reducing manual input time. |

| Consistent Format | With standardized designs, every document follows the same professional structure, eliminating the need to rethink formatting. |

| Reduced Errors | Built-in fields reduce the chance of missing or incorrect details, ensuring your payment requests are always accurate. |

| Easy Updates | Templates can be quickly updated to reflect new rates, services, or tax rules without having to redesign the document. |

Common Mistakes to Avoid in Invoices

When creating payment request documents, it’s essential to avoid common errors that could lead to delays in payment or confusion for both you and your clients. Small mistakes, such as missing information or incorrect calculations, can create misunderstandings, leading to trust issues or unnecessary follow-ups. By being aware of the typical pitfalls, businesses can ensure smooth transactions and maintain a professional reputation.

Common Errors to Watch Out For

There are several frequent mistakes that businesses often make when preparing documents to request payment. These errors can result in complications during the billing process, which can delay payments or affect client relationships.

| Mistake | How to Avoid It |

|---|---|

| Missing Contact Details | Ensure both your business and the client’s contact details are clearly listed to prevent any confusion. |

| Incorrect Amount | Double-check your calculations and make sure the total matches the agreed-upon amount. |

| Omitting Payment Terms | Clearly state payment due dates, and include any applicable late fees to avoid misunderstandings. |

| Not Including Tax Details | If taxes apply, include them clearly and ensure they are calculated accurately. |

Other Key Considerations

Beyond the most common mistakes, it’s important to regularly review your processes to ensure your payment request documents stay clear, professional, and compliant with any relevant regulations. Regular checks can prevent small errors from becoming larger issues.

Understanding Invoice Terms and Components

When creating a document to request payment, understanding its key terms and components is crucial for ensuring that all necessary information is included. A well-structured document not only ensures clarity for both parties but also helps to avoid misunderstandings that could delay the payment process. Knowing what should be included and how to organize the content is an important part of effective financial communication.

Key Components to Include

Each payment request should include several essential elements to ensure it is both comprehensive and legally compliant. These components help to provide a clear record of the transaction and set expectations for both the business and the client.

- Header Information: Include your business name, logo, contact details, and any relevant registration numbers.

- Client Information: Clearly state the client’s name, address, and contact information.

- Issue Date: The date when the document was created and issued.

- Payment Due Date: Specify when the payment is expected, along with any late fees for overdue payments.

- Description of Goods/Services: Provide a detailed description of the products or services being billed, including quantities and unit prices.

- Payment Amount: Clearly show the total amount due, including applicable taxes or discounts.

- GST Information: For businesses registered for GST, include the GST number and the tax amount applicable.

Important Terms to Understand

In addition to the components of a payment request, there are a few important terms that are commonly used in financial documentation. Familiarity with these terms will help ensure that both businesses and clients understand their obligations clearly.

- Due Date: The date by which payment must be made. Late payments often incur fees or interest.

- Net Terms: The number of days a client has to pay after receiving the request (e.g., Net 30, which means payment is due 30 days after issue).

- Discounts: Some documents offer early payment discounts, which should be clearly noted to encourage prompt payment.

How to Invoice Clients Professionally

Creating a professional payment request document is an essential skill for maintaining strong business relationships and ensuring timely payments. A well-structured request communicates professionalism and clarity, which helps build trust with clients. It is crucial to ensure that all necessary details are included and that the document is formatted in a way that is easy for clients to understand and process.

Key Steps for Professional Billing

To ensure your payment request documents reflect professionalism, follow these key steps:

- Clear Layout: Keep the document clean and easy to read. Use headings, bold text, and a simple font to highlight important information.

- Accurate Details: Double-check that all client information, payment amounts, and due dates are correct to avoid confusion or delays.

- Include Terms: Specify payment terms such as net payment periods (e.g., Net 30), early payment discounts, and any late fees to set clear expectations.

- Timeliness: Send the request promptly after the service is provided or goods are delivered to ensure timely payment.

Building Trust with Clients

To build trust with your clients, it’s important to maintain professionalism throughout the entire billing process. Clear, timely, and accurate payment requests not only help ensure you receive payment on time but also reflect your business’s commitment to quality service and transparency.

- Personalized Communication: Address the client by name and include any specific details relevant to their transaction.

- Follow-Up: If payment is overdue, send a polite reminder. Professional follow-up can help maintain positive client relationships while encouraging prompt payment.

Best Practices for Invoice Design

When creating a payment request document, the design plays a crucial role in ensuring clarity and professionalism. A well-organized and visually appealing layout helps your clients quickly find the information they need, reducing the likelihood of misunderstandings or delays. Adopting best practices for design can improve your business’s image and streamline the payment process.

Clear and Consistent Layout: Use a consistent layout throughout your documents. A well-structured design with clearly defined sections for contact information, payment details, and transaction summaries makes it easier for clients to understand the content at a glance. Avoid clutter, and leave enough white space to give the document a clean and organized look.

Highlight Key Information: Ensure that the most important details stand out. This includes the total amount due, payment terms, and the due date. Use bold or larger font sizes for these elements to make them easily noticeable. This will help clients quickly identify the crucial points and prioritize the payment accordingly.

Brand Consistency: Incorporating your brand’s logo, colors, and font styles into the document design helps reinforce your business identity. A consistent and professional appearance will create a sense of trust and reliability with your clients.

Use of Clear Typography: Choose fonts that are easy to read and professional-looking. Avoid using overly decorative fonts or text sizes that are too small. The goal is to ensure that all information is legible without straining the reader’s eyes.

Ensure Mobile Compatibility: In today’s digital world, many clients access documents on their mobile devices. Design your payment requests to be mobile-friendly by using a responsive layout or a simple, straightforward design that adapts well to different screen sizes.

Integrating Payment Options into Templates

Incorporating multiple payment methods into your payment request documents can greatly enhance the convenience for clients, leading to faster processing and a smoother transaction experience. Offering various payment options ensures that clients can select the method most convenient for them, which can help improve cash flow and reduce the chances of delayed payments.

Payment Methods to Include

It’s essential to provide clear, accessible payment options for your clients. The following methods should be considered:

- Bank Transfers: Providing your bank account details allows clients to make direct deposits. Ensure that your bank’s name, account number, and sort code are included.

- Credit/Debit Cards: Offering online payment through a secure gateway makes it easy for clients to pay instantly using their preferred card.

- Online Payment Platforms: Include options like PayPal or Stripe for international clients or those who prefer digital payment solutions.

- Cheque Payments: Though less common, providing your mailing address for cheque payments might still be useful for certain clients.

Clear Payment Instructions

To avoid confusion, it is vital to offer detailed instructions for each payment method. Include all necessary information, such as payment references, links, or account details. This ensures that clients can quickly and easily make payments without any additional communication or back-and-forth.

Example of Payment Integration

| Payment Method | Details |

|---|---|

| Bank Transfer | Account Number: 12345678 Bank Name: ABC Bank Sort Code: 00-00-00 |

| Credit/Debit Card | Visit www.example.com/pay to make a secure payment |

| PayPal | Send payment to [email protected] |

By clearly outlining payment options and instructions, you make the process easier for your clients, improving their experience and increasing the likelihood of prompt payment.

Tips for Sending Invoices on Time

Timely payment requests are crucial for maintaining steady cash flow and fostering positive relationships with clients. Sending them promptly not only ensures that you get paid on time, but also portrays your business as organized and professional. Here are some effective strategies to help you send payment requests without delays.

Plan and Set Reminders

Planning ahead and setting reminders are essential steps in ensuring your payment requests are sent on time. Consider using a digital calendar or project management tool to track payment due dates. By setting automatic reminders, you can stay ahead of your billing cycle.

- Use Calendar Tools: Set up a recurring event for sending payment requests and reminders in advance.

- Automate with Software: Use invoicing software that sends reminders or automatic payment requests on your behalf.

Streamline the Process

Keep your payment request process efficient by having all necessary details ready ahead of time. This includes client contact information, services or products provided, and payment terms. The quicker you can prepare and send the request, the more likely you are to meet deadlines.

- Keep Records Organized: Maintain a database or spreadsheet with key details of each project or service rendered.

- Use Predefined Formats: Create reusable formats for different types of payment requests to reduce preparation time.

By staying organized, automating reminders, and planning ahead, you can improve your chances of sending payment requests on time, ensuring timely payments and fostering good business practices.

Tracking Payments with Invoice Templates

Efficiently tracking payments is crucial for maintaining financial stability in any business. By using clear, structured documents for payment requests, you can easily monitor when payments are made, ensuring no due amounts are overlooked. This not only helps you stay on top of your finances but also ensures a professional approach to managing outstanding balances.

Utilizing Payment Status Columns

Including a payment status section in your documents allows you to track whether payments have been completed, partially paid, or are still outstanding. This feature helps both you and your clients stay informed about the status of each transaction.

- Completed: Indicate when payment has been successfully received.

- Partially Paid: Mark when a payment has been made but the balance remains.

- Outstanding: Show when the full payment has not yet been received, helping you track overdue amounts.

Automating Payment Reminders

By using software or digital tools, you can automate reminders for overdue payments. These reminders can be sent to clients automatically based on your terms, ensuring no payments are forgotten or delayed.

- Automatic Alerts: Set up automated notifications to remind clients of overdue payments.

- Recurring Reminders: Send periodic follow-ups for outstanding balances after a specific number of days.

Tracking payments efficiently not only improves cash flow but also enhances client relationships by ensuring transparency and reducing the chances of misunderstandings.

Customizing Your Invoice for Branding

Personalizing your payment requests is a great way to enhance your brand identity and create a professional impression. By customizing the design and content of your documents, you can showcase your company’s unique style while making the transaction process smoother and more consistent with your overall branding. A well-designed document can also increase brand recognition and help you stand out to clients.

Incorporating Brand Elements

Including specific brand elements in your payment requests will help maintain consistency across all business communications. These elements can include your company logo, colors, fonts, and other visual features that represent your business’s personality.

- Logo: Place your logo prominently at the top or in the header to strengthen brand identity.

- Brand Colors: Use your company’s primary colors for headings, borders, and background to make the document feel more aligned with your brand.

- Custom Fonts: Choose fonts that reflect your brand’s style to enhance the professionalism of your document.

Standardizing Contact Information

Ensure that your contact details, such as email, phone number, and website, are consistently displayed across all documents. This helps clients easily reach you, reinforces your professionalism, and aligns with your brand’s messaging.

| Contact Detail | Example |

|---|---|

| Email Address | [email protected] |

| Phone Number | +64 21 123 4567 |

| Website | www.yourcompany.com |

Customizing your payment requests with consistent brand elements not only makes them more professional but also fosters trust and recognition with clients.