Download Free Invoice Templates for Your Business

Efficient financial management is essential for any business, and having the right tools can significantly streamline this process. Access to complimentary documents designed for billing can greatly enhance productivity and professionalism. By utilizing these resources, businesses can ensure accuracy and clarity in their financial transactions.

These documents not only simplify the payment process but also contribute to maintaining a positive relationship with clients. Customizable formats allow businesses to reflect their brand identity while ensuring all necessary information is clearly presented. With a variety of options available, companies can easily find a solution that meets their specific needs.

In this guide, we will explore various resources available for creating effective billing documents. From design tips to practical advice on usage, our aim is to provide valuable insights that will help you manage your financial transactions with ease and confidence.

Free Invoice Template Benefits

Utilizing complimentary billing documents offers numerous advantages for businesses of all sizes. These resources simplify the process of requesting payments while ensuring that all necessary details are clearly communicated. By using pre-designed options, companies can save time and focus on their core operations.

One of the primary benefits is the cost-effectiveness of accessing these resources without any financial commitment. This allows businesses to allocate funds to other essential areas, such as marketing or product development. Moreover, free billing documents often come with a variety of designs, enabling organizations to choose a format that aligns with their branding.

Another significant advantage is the professional appearance that well-crafted documents provide. Clients appreciate clear and organized requests for payment, which can enhance trust and improve the overall business relationship. Additionally, having these documents readily available helps to maintain consistency in billing practices, which is vital for accurate record-keeping.

Incorporating these resources can lead to increased efficiency in the financial management process. By streamlining the billing experience, businesses can reduce the likelihood of errors and ensure timely payments. Overall, using free resources for billing is a smart choice for any organization aiming to optimize its financial operations.

How to Create an Invoice

Crafting a billing document is a crucial task for any business seeking to maintain effective financial operations. A well-structured request for payment not only aids in collecting dues but also helps establish a professional image. Following a clear process ensures that all necessary information is included and presented in an organized manner.

Essential Information to Include

When designing your billing document, it is vital to include specific details to ensure clarity. Start with your company name and contact information at the top, followed by the recipient’s name and address. Clearly state the services or products provided, including quantities and prices. A unique reference number can also help in tracking the transaction.

Designing the Document

Next, focus on the layout and aesthetics of your document. Choose a clean and professional format that aligns with your brand identity. Utilize sections to separate different parts of the document, such as item descriptions, totals, and payment instructions. Incorporating your logo can enhance brand recognition, making your billing request more personalized.

Finally, review the document thoroughly before sending it out. Ensuring accuracy in all details is essential for preventing disputes and fostering a positive relationship with clients. By following these steps, you can create an effective billing document that facilitates prompt payment and reflects professionalism.

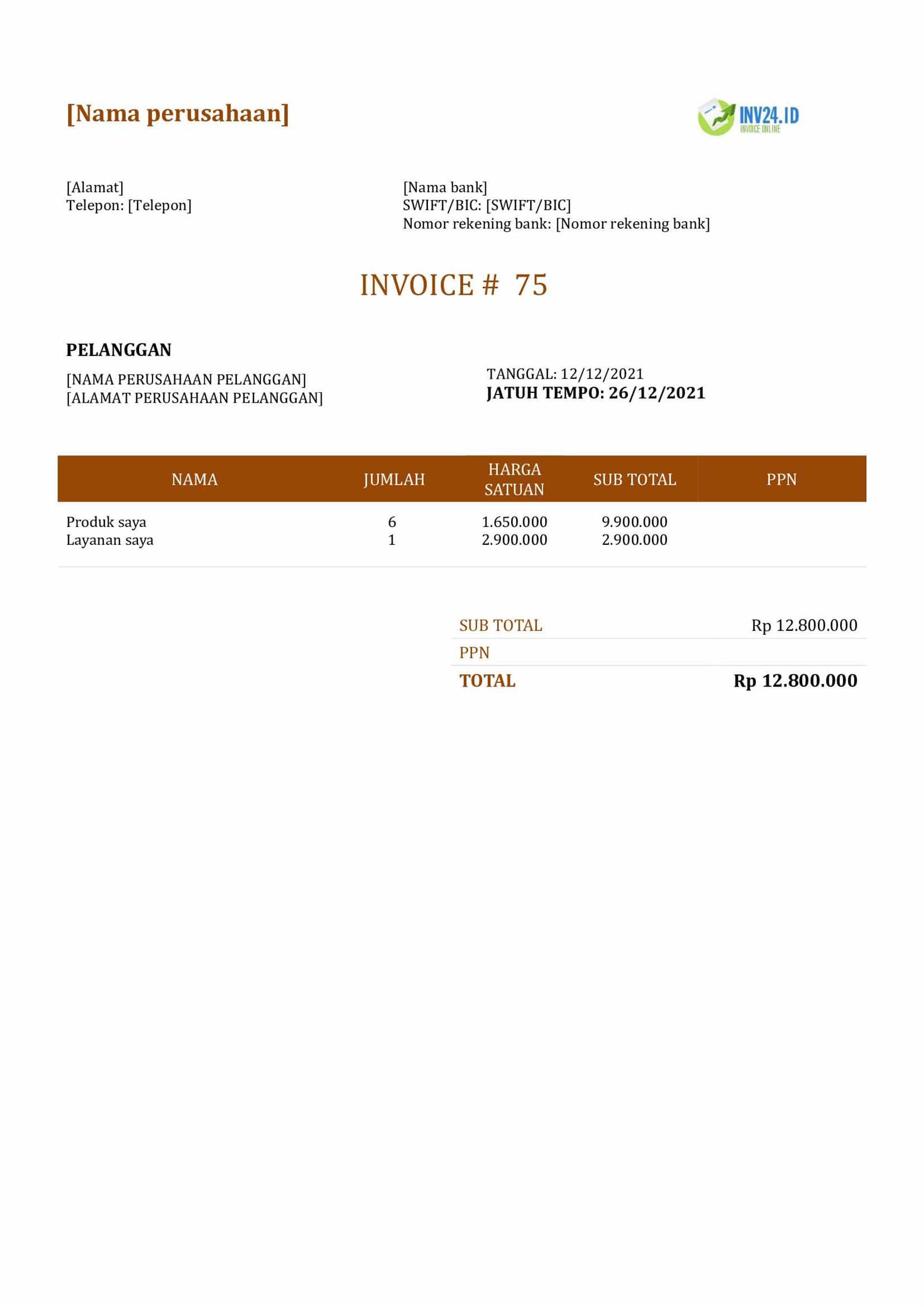

Essential Elements of Invoices

Creating a comprehensive billing document requires careful attention to specific components that ensure clarity and professionalism. Including the right elements not only facilitates a smooth payment process but also reinforces your brand’s credibility. Understanding these essential parts is crucial for effective communication with clients.

Key Components to Consider

There are several critical elements that should always be present in any billing request. Below is a table summarizing these essential components:

| Element | Description |

|---|---|

| Business Information | Your company name, logo, and contact details. |

| Client Details | Recipient’s name, address, and contact information. |

| Date | The date when the document is issued. |

| Unique Reference Number | A specific identifier for tracking purposes. |

| Description of Goods/Services | Clear details of the products or services provided. |

| Total Amount Due | The complete sum owed by the client. |

| Payment Instructions | Guidelines on how the client can settle the amount. |

Importance of Accurate Information

Including accurate information is paramount in ensuring that clients understand what they are being billed for. This transparency helps to minimize disputes and fosters trust between you and your customers. By incorporating these essential elements, you can create a well-organized billing document that enhances your professional image and streamlines the payment process.

Customizing Your Invoice Template

Tailoring your billing documents to reflect your brand can significantly enhance your professional image and improve client relationships. Personalization not only makes your requests for payment visually appealing but also helps in establishing a recognizable identity in the marketplace. By customizing various aspects of these documents, you can ensure that they resonate with your target audience.

Key Customization Options

There are several areas where you can personalize your billing documents. The table below outlines important aspects to consider when making adjustments:

| Customization Aspect | Description |

|---|---|

| Branding | Incorporate your logo and brand colors to create a cohesive look. |

| Fonts and Styles | Choose fonts that align with your brand identity for readability and professionalism. |

| Layout | Adjust the arrangement of sections to suit your preferences and improve clarity. |

| Personalized Messages | Add custom greetings or notes to enhance client interaction. |

| Payment Terms | Clearly outline your payment policies, including deadlines and methods accepted. |

Benefits of Customization

Customizing your billing documents not only enhances your brand visibility but also conveys professionalism and attention to detail. When clients receive personalized requests for payment, they are more likely to engage positively, leading to faster payment cycles and improved customer satisfaction. By investing time in this aspect, you can create effective and memorable billing experiences that reflect your business values.

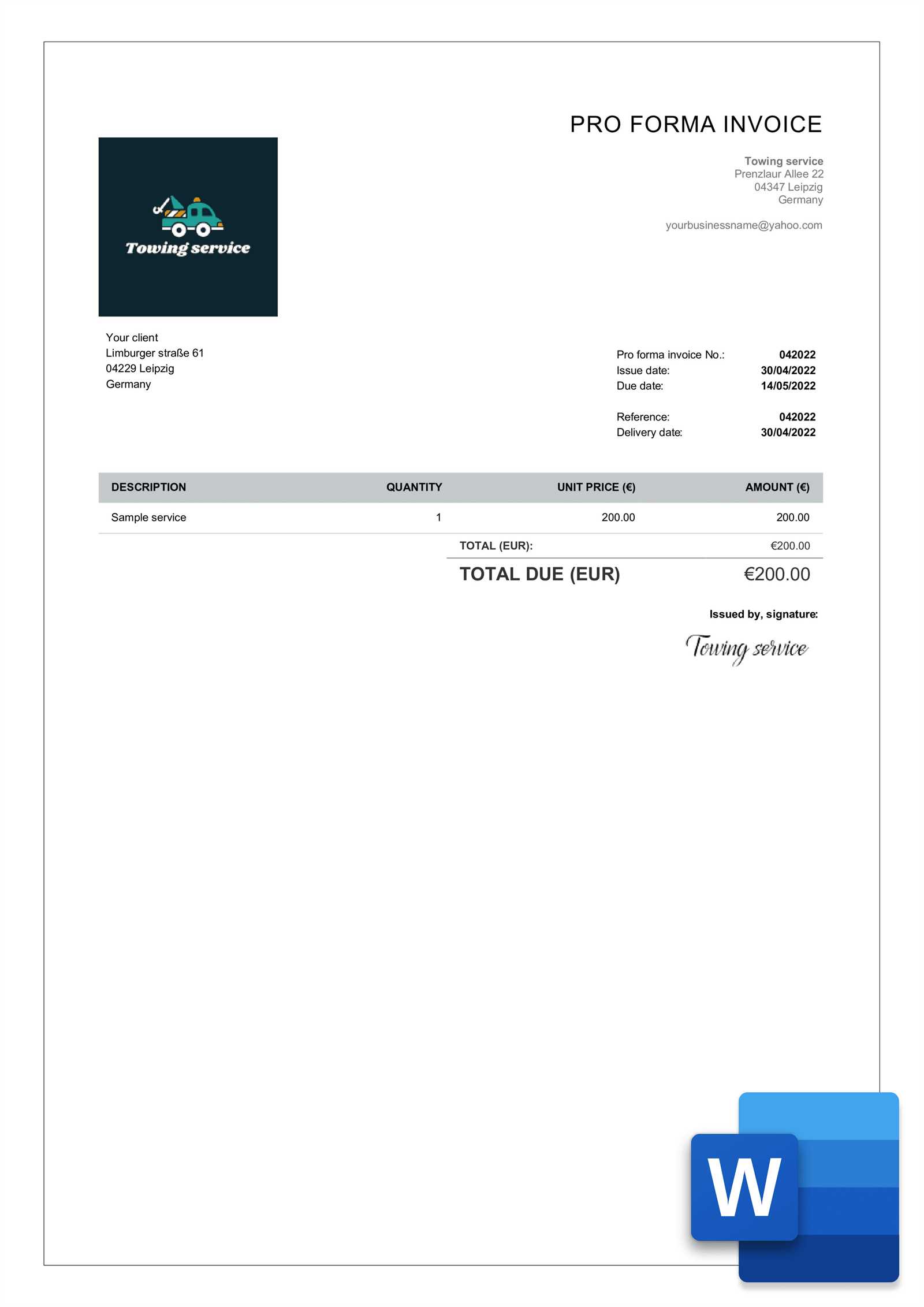

Choosing the Right Format

Selecting the appropriate format for your billing documents is essential for ensuring clarity and ease of use. The right layout not only enhances readability but also facilitates efficient communication with clients regarding payments. With various options available, understanding the strengths of each format can help you make an informed decision that best fits your business needs.

One popular choice is the PDF format, which preserves the document’s layout and ensures that it appears the same across different devices. This format is ideal for sending finalized requests, as it maintains professionalism and prevents unauthorized alterations. Additionally, PDFs can be easily printed, making them convenient for clients who prefer physical copies.

Another option is the Word document format, which allows for easy editing and customization. This is particularly useful for businesses that need to make frequent changes to their billing requests or want to personalize each document. However, it’s important to consider that Word documents may not maintain the same level of formatting consistency when opened on different systems.

Lastly, online invoicing tools provide a modern solution, enabling businesses to create and send requests directly through a web interface. These tools often come with additional features, such as automated reminders and tracking capabilities, which can streamline the billing process significantly. However, it’s crucial to ensure that the platform you choose aligns with your specific requirements and workflow.

Ultimately, the format you select should align with your business practices and client preferences. By considering the advantages and limitations of each option, you can choose a format that not only enhances the billing experience but also fosters positive relationships with your clients.

Tips for Professional Invoices

Creating high-quality billing documents is essential for maintaining professionalism and ensuring timely payments. By incorporating specific best practices, you can enhance the effectiveness of your requests for payment and leave a positive impression on your clients. Here are several tips to consider when preparing these important documents.

Ensure Clarity and Detail

One of the key elements of an effective billing document is clarity. Be sure to include detailed descriptions of the goods or services provided, along with their corresponding prices. Using clear headings and a logical layout will help clients easily understand what they are being charged for. Additionally, consider breaking down costs into line items, as this provides transparency and reduces the likelihood of disputes.

Maintain Consistency in Design

Consistency in design not only enhances the professional appearance of your billing documents but also reinforces your brand identity. Use the same fonts, colors, and layout style across all your billing documents to create a cohesive look. This consistency helps clients recognize your brand immediately, fostering trust and reliability.

Furthermore, make sure to include essential information such as your business name, logo, contact details, and payment instructions. This information should be prominently displayed to ensure that clients can easily reach out with questions or concerns.

By applying these tips, you can create professional billing documents that reflect your business values and facilitate smoother transactions. Taking the time to produce well-crafted requests for payment will not only improve your client relationships but also encourage prompt payments, benefiting your overall business operations.

Online Tools for Invoice Design

In the digital age, utilizing online tools for creating billing documents has become increasingly popular. These platforms offer user-friendly interfaces and a variety of customizable options, allowing businesses to craft professional-looking requests for payment with ease. By leveraging these resources, you can save time and enhance the overall quality of your documents.

One notable option is Canva, a versatile design tool that provides a range of customizable templates. With its drag-and-drop functionality, you can easily add your branding elements, adjust layouts, and modify text to suit your needs. This flexibility makes it a popular choice for many entrepreneurs and small businesses.

Another excellent resource is Invoice Ninja, which combines invoicing features with design capabilities. This platform not only allows you to create visually appealing requests for payment but also integrates tracking and payment processing options. This comprehensive approach simplifies the entire billing process, making it more efficient for both you and your clients.

Zoho Invoice is also worth mentioning, offering a suite of tools for managing billing and payments. Its design capabilities allow you to create professional documents while automating recurring billing and payment reminders. This can significantly reduce the administrative burden, allowing you to focus more on your core business activities.

Overall, these online tools empower businesses to create customized and visually appealing billing documents. By choosing the right platform, you can enhance your professional image and streamline the payment process, ultimately contributing to the success of your business.

Common Mistakes to Avoid

When preparing billing documents, avoiding common pitfalls is essential to ensure professionalism and clarity. Making small errors can lead to misunderstandings, delays in payments, and even damage your reputation. By being aware of these frequent mistakes, you can enhance the quality of your requests for payment and foster better relationships with your clients.

Inaccurate Information

One of the most critical errors is providing inaccurate or incomplete information. Ensure that all details, including client names, addresses, dates, and amounts due, are correct. Double-checking these elements can prevent confusion and disputes later on. Additionally, failing to include essential terms of service or payment instructions may lead to delays in receiving payments.

Neglecting Follow-Up

Another common oversight is not following up on sent billing documents. It’s important to establish a system for tracking when requests for payment are sent and to schedule reminders for follow-ups. Clients may forget about outstanding amounts, so a gentle reminder can prompt timely payments and demonstrate your professionalism.

By steering clear of these mistakes, you can create more effective billing documents that enhance your credibility and promote smoother transactions. Taking the time to review and refine your requests for payment will ultimately lead to better outcomes for your business.

Integrating Invoices with Software

Integrating billing documents with various software solutions can significantly enhance the efficiency of financial processes for businesses. By streamlining the creation, management, and tracking of payment requests, organizations can save time and reduce the likelihood of errors. Effective integration allows for a seamless flow of information between different platforms, ensuring that all financial data is organized and easily accessible.

Many accounting and financial management tools offer integration capabilities that allow users to automatically generate requests for payment based on transactions recorded in the system. This automation not only minimizes manual entry but also ensures consistency and accuracy in all financial documents. Popular software solutions such as QuickBooks, FreshBooks, and Xero provide features that allow for easy integration, enabling businesses to connect their billing processes with broader financial management tasks.

Additionally, integrating billing documents with customer relationship management (CRM) systems can enhance customer interactions. By linking financial data with client profiles, businesses can provide a more personalized experience, such as tailoring payment requests based on client history and preferences. This level of integration fosters stronger relationships and can lead to higher customer satisfaction.

Overall, integrating billing documents with relevant software not only streamlines operations but also contributes to improved accuracy and customer engagement. Embracing these technological solutions can help businesses focus on growth while maintaining effective financial management.

Tracking Payments and Invoices

Effectively monitoring requests for payment and corresponding transactions is crucial for maintaining financial health within a business. Establishing a robust tracking system helps organizations stay on top of their cash flow, ensuring timely collections and minimizing outstanding amounts. With a clear overview of what has been paid and what is still pending, businesses can make informed decisions and manage their resources efficiently.

Utilizing Software Solutions

Many modern accounting applications come equipped with features that facilitate tracking financial documents and payments. These tools can automate the process, providing real-time updates on the status of each request for payment. By utilizing such software, businesses can generate reports that highlight outstanding amounts and payment histories, enabling better cash flow management. Additionally, notifications can be set up to remind users of overdue payments, helping to ensure timely follow-ups.

Establishing a Payment Schedule

Another effective strategy for tracking transactions is to create a structured payment schedule. By clearly communicating due dates and expectations with clients, businesses can foster a culture of punctuality in payments. This not only helps in tracking what is owed but also reinforces the importance of timely settlements. Keeping detailed records of all interactions related to payments can also prove beneficial in case of disputes or inquiries.

In summary, diligent tracking of financial requests and their corresponding payments is essential for a business’s success. By leveraging technology and establishing clear communication with clients, organizations can enhance their financial management processes and improve overall cash flow.

Legal Requirements for Invoices

In many countries, businesses are required to meet specific legal standards when issuing financial documents for transactions. These guidelines are essential for ensuring transparency, accountability, and compliance with tax laws. Understanding and following the required elements for these records helps avoid legal complications and ensures smooth business operations, especially during audits or reviews by tax authorities.

Mandatory Information

There are several key elements that must be included when creating financial documents for payments. These typically include the business’s name, contact details, and tax identification number, as well as the customer’s information. Additionally, the document should include the transaction date, a clear description of the goods or services provided, and the total amount due, including taxes. Providing a unique identifier for each record also helps track transactions effectively and ensures proper referencing in legal matters.

Tax Compliance

Complying with tax regulations is another critical aspect. Depending on the jurisdiction, certain taxes must be clearly outlined, including the tax rate applied to the total amount and the tax amount itself. This ensures that both parties are aware of the tax obligations and helps in maintaining proper records for reporting to tax authorities. Some regions also require businesses to include a breakdown of taxes, which is necessary for accurate tax filings.

In conclusion, adhering to legal requirements when creating these records is essential for avoiding penalties and ensuring proper documentation for both the business and its clients. By following the mandated guidelines, companies can maintain transparency and ensure they are compliant with relevant laws and tax regulations.

Storing and Organizing Invoices

Efficiently managing financial records is crucial for any business. Proper organization of transaction documentation ensures easy access, reduces the risk of errors, and simplifies the process during audits or tax reporting. Whether you choose to keep physical copies or store them digitally, having a reliable system for managing these documents is essential for maintaining order and compliance.

Choosing the Right Storage Method

When it comes to storing records, businesses have two main options: physical storage or digital storage. Physical records require secure filing systems, such as cabinets or folders, where each document is clearly labeled and categorized. On the other hand, digital storage offers convenience and space-saving benefits. Using cloud storage or secure document management systems allows businesses to access their files remotely, while ensuring that sensitive data remains protected with encryption.

Organizing Financial Documents

Properly organizing these records helps ensure they are easy to locate when needed. A consistent filing system, such as categorizing by date, customer, or project, can significantly improve efficiency. Digital tools allow for easy tagging, keyword searches, and automated categorization. It’s important to ensure that each record is uniquely identifiable, such as by using sequential numbering or clear references to related transactions.

In conclusion, the key to effective organization lies in consistency. Whether using physical or digital storage methods, it is crucial to maintain a well-structured system to avoid confusion and ensure easy retrieval when needed for audits, reporting, or other business needs.

Importance of Invoice Templates

Having a consistent and well-structured document for billing is essential for businesses of all sizes. It streamlines the process, reduces the chances of errors, and ensures that all necessary information is captured. When used correctly, such a format helps improve professionalism and helps businesses maintain a solid financial record, which is vital for managing cash flow and handling payments efficiently.

Enhancing Professionalism

Using a standardized format for creating payment requests helps businesses maintain a professional image. A polished document not only reflects the company’s attention to detail but also builds trust with clients. Clear presentation of information, such as business details, payment terms, and itemized services, contributes to a more transparent relationship between the provider and the customer.

Time and Efficiency Savings

By utilizing pre-designed layouts, businesses can save time when generating payment requests. The repetitive task of manually writing out each bill can be time-consuming. With a pre-arranged structure, all that’s needed is to fill in the specific details for each transaction. This allows businesses to focus on more important tasks, such as client interaction or product/service development.

In summary, using a consistent billing method supports both operational efficiency and professionalism. It helps businesses maintain accurate records, ensures timely payments, and provides a positive experience for customers. It’s a small investment of time that can lead to big rewards in terms of organization and financial management.

Updating Your Invoice Design

Regularly refreshing the design of your billing documents is crucial for maintaining a modern and professional appearance. An outdated or hard-to-read layout can create confusion and reflect poorly on your business. Updating the format ensures that your documents remain clear, appealing, and aligned with your brand’s image. This is especially important as customer expectations evolve, and businesses seek to stay competitive.

Improving Readability and User Experience

One of the primary reasons for redesigning your billing structure is to enhance readability. A clean, easy-to-follow format makes it simpler for clients to understand the details of the charges. Key information such as payment terms, item descriptions, and totals should be easily identifiable at a glance. Avoiding clutter and using appropriate spacing can significantly improve the overall user experience.

Aligning with Brand Identity

Another important aspect of updating your billing documents is aligning the design with your brand’s identity. Incorporating consistent colors, fonts, and logos reinforces your business image and strengthens recognition. Customizing your documents to reflect your business style can leave a lasting impression on clients, showing that you pay attention to detail in every aspect of your operations.

In conclusion, regularly updating the design of your billing documents is an essential part of presenting a professional image and maintaining efficient operations. A well-structured and visually appealing document helps build trust with clients and improves communication, making the billing process smoother for both parties.

Sharing Invoices with Clients

Effectively sharing your billing documents with clients is crucial for maintaining smooth business operations and ensuring prompt payments. Whether it’s through email, physical mail, or a client portal, choosing the right method of delivery can enhance communication and speed up the payment process. Making sure that the document is easy to access, clear, and well-presented fosters trust and professionalism.

Digital Delivery Methods

In today’s digital age, electronic distribution is often the most efficient way to share billing documents. Sending files via email ensures that clients receive them immediately, reducing the chances of delays. You can use various formats such as PDF, which maintains the formatting and ensures that the document looks consistent across different devices. Additionally, using cloud-based systems or client portals allows clients to access their documents at any time, making the process even more convenient.

Physical Delivery Methods

While digital methods are popular, there are still situations where sending a hard copy of the billing document may be necessary. This could be due to client preferences or legal requirements in certain industries. In these cases, it’s essential to ensure that the document is printed clearly, and securely mailed to avoid any issues with lost or delayed delivery.

In conclusion, selecting the appropriate method to share your billing documents with clients is key to ensuring a smooth transaction. Offering multiple options, whether digital or physical, increases the chances of prompt payments and maintains a positive relationship with your clients.

Using Invoices for Record Keeping

Maintaining accurate records of transactions is essential for any business. Proper documentation allows you to track financial activities, manage cash flow, and ensure compliance with tax regulations. These records not only provide insight into the financial health of a business but also serve as proof of transactions in case of disputes or audits.

Benefits of Keeping Records

- Financial Tracking: Helps monitor incoming and outgoing payments, making it easier to manage cash flow and financial planning.

- Tax Compliance: Proper documentation ensures that all required information is available when filing taxes, reducing the risk of errors and penalties.

- Dispute Resolution: Having a clear record of each transaction can be invaluable in resolving disagreements with clients or suppliers.

- Audit Preparation: Keeping detailed records makes it easier to provide necessary documentation during financial audits.

Best Practices for Organizing Records

- Use Consistent Formats: Always use a standardized format for documenting transactions, making it easier to track and find specific records.

- Store Records Securely: Whether using digital or physical storage, ensure that records are kept in a secure location to protect sensitive financial data.

- Keep Records for the Required Period: Be aware of local laws regarding how long business records must be retained, and ensure that you follow these guidelines.

- Regularly Update Your Records: Review and update your records regularly to ensure that they are accurate and reflect the most current financial information.

By integrating a proper system for keeping transaction records, businesses can benefit from better financial control, transparency, and protection against legal and tax issues.