Free Excel Invoice Template for Easy and Professional Billing

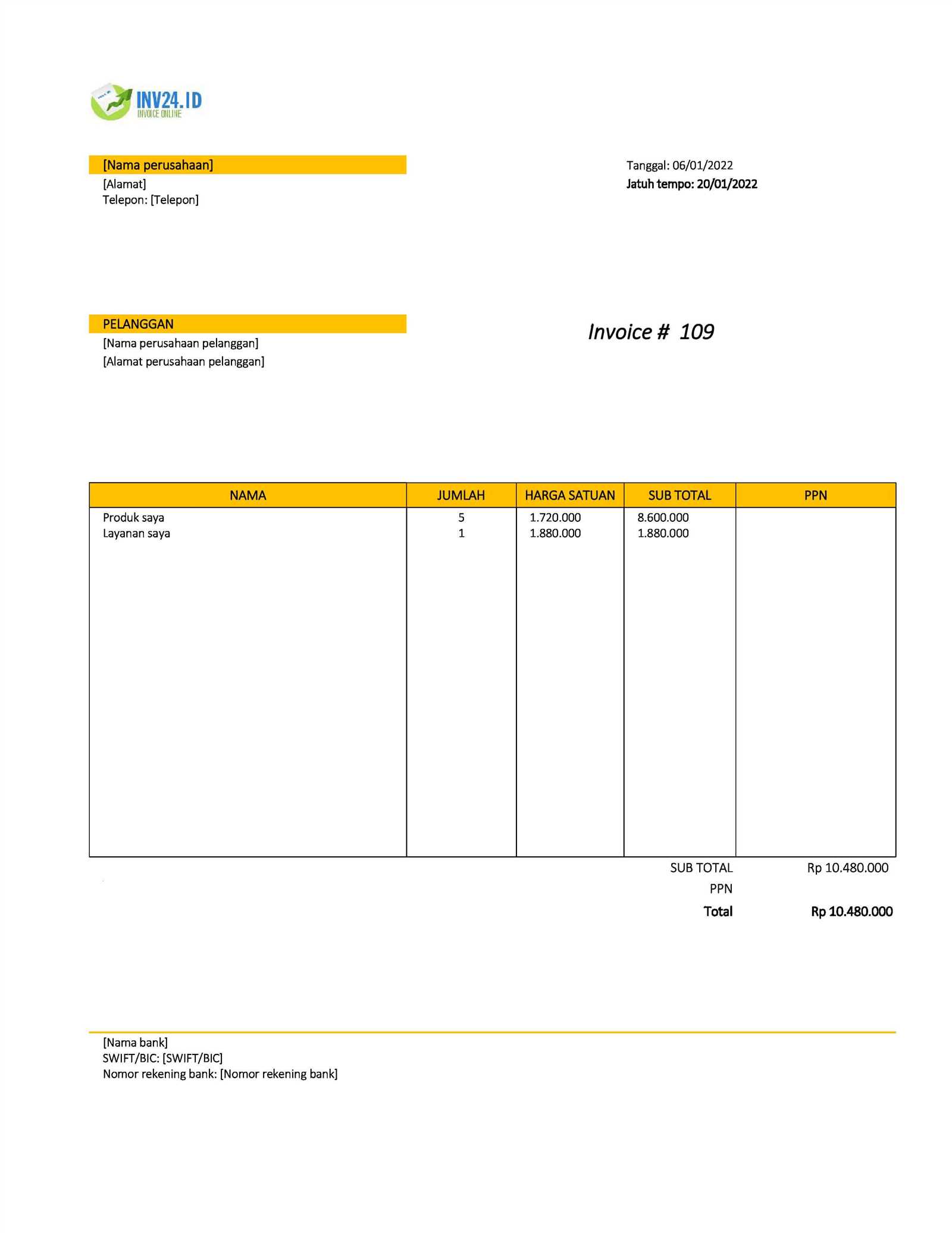

Managing financial transactions and maintaining professional documentation is essential for any business. Having a reliable way to generate structured records is crucial, whether you’re a freelancer, small business owner, or running a larger enterprise. Fortunately, there are simple, effective solutions available that allow you to create clean, organized financial documents quickly and at no cost.

With the right tools, you can produce professional-looking documents that help track payments, calculate totals, and ensure timely billing. These resources are designed to save you time while providing accuracy, allowing you to focus on other important aspects of your business. No prior experience in accounting or design is necessary to get started.

Accessing these free resources is easy, and customizing them to fit your specific needs is both straightforward and user-friendly. Whether you need to adjust the layout, add or remove fields, or include company branding, these solutions offer great flexibility. Discover how these free tools can streamline your financial workflow and improve your overall business efficiency.

Free Billing Solutions for Excel

Having an organized and professional way to generate financial documents is essential for businesses of all sizes. With the right tools, creating clear and accurate records is no longer a time-consuming or costly process. Free resources are available that enable you to produce high-quality documents quickly and with minimal effort.

These free resources offer various designs and layouts, all optimized to meet different business needs. From simple receipts to more detailed financial statements, you can find options that suit your workflow. The best part is that these tools are customizable, allowing you to adjust them to reflect your branding, payment terms, and other important details.

By using these free options, you can ensure that your business maintains a professional appearance while streamlining the billing process. Whether you’re managing a few clients or handling a larger volume, these resources make it easier to stay organized and efficient without investing in expensive software or services.

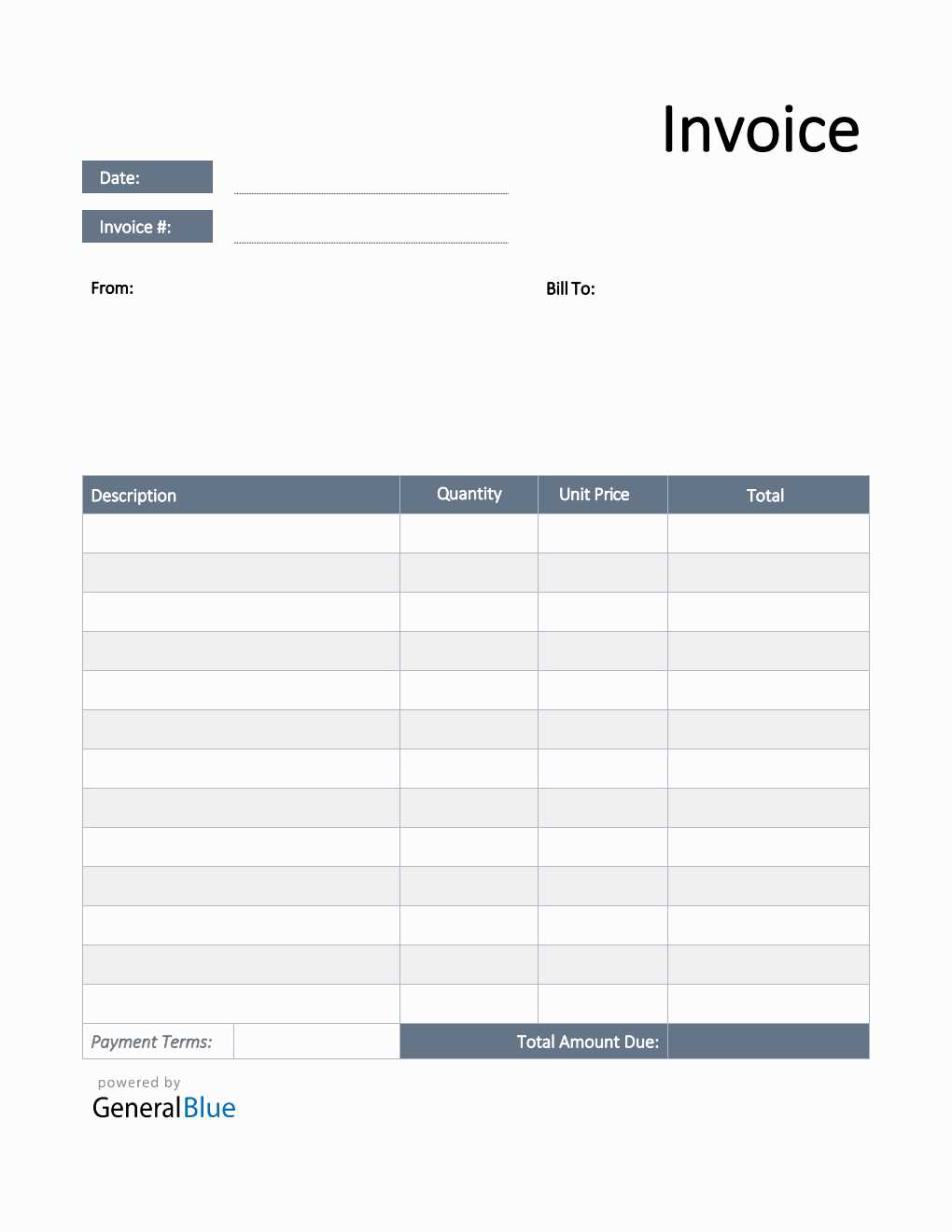

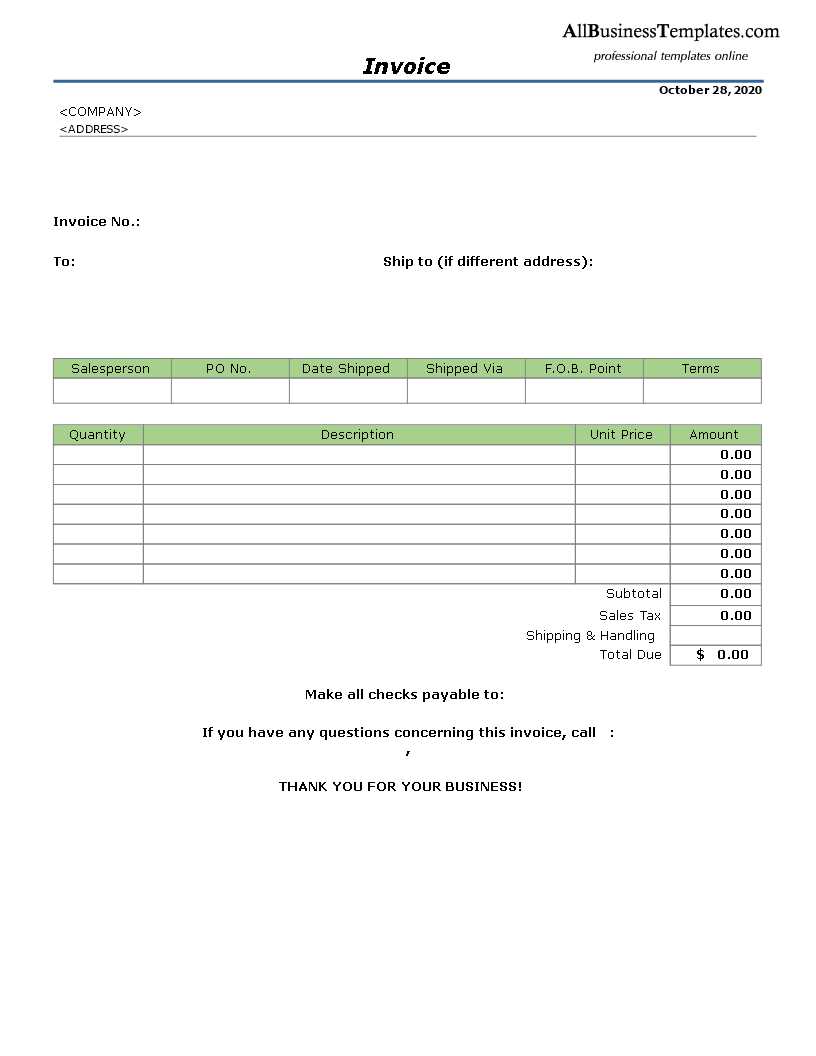

How to Use Excel Invoice Templates

Creating professional financial documents is easy with the right tools at your disposal. These tools help you structure all the necessary information such as client details, payment terms, and amounts owed. With customizable options, you can adjust each document to fit your specific needs and ensure clarity for both you and your clients.

Step-by-Step Process

To get started, open the document in your preferred spreadsheet application. You will typically find pre-set fields like the date, your business name, and recipient’s details. You can quickly edit these sections to include the relevant information for each transaction. Once the basic details are filled in, adjust the sections that pertain to the products or services provided, including pricing, quantities, and applicable taxes.

Personalizing and Saving Your Work

Customization is simple, as most resources allow you to change fonts, colors, and logos to align with your brand identity. Once you’ve completed a document, save it for future use or export it as a PDF for easy sharing with clients. By keeping a set structure, you can ensure consistency in your financial documents, making your business look more organized and professional.

Regularly updating your files with any new payment terms or changes in pricing is essential for keeping your business operations running smoothly and ensuring that all your transactions are properly documented.

Benefits of Using Billing Solutions

Utilizing pre-made structures for creating financial documents offers numerous advantages for businesses. These solutions not only streamline the creation of accurate and professional records but also help maintain consistency in your paperwork. By incorporating a standardized format, you ensure that every document follows the same layout and contains all the necessary details, saving you time and effort in the process.

- Time Efficiency: With a set structure, you can quickly fill in the required information without worrying about formatting or missing key sections. This allows you to focus more on other aspects of your business.

- Consistency: Using the same format for all your documents ensures they look professional and uniform, which is essential for building trust with clients.

- Cost Savings: Many free options available online eliminate the need for expensive software, allowing you to create professional documents without additional financial investment.

- Ease of Customization: These resources often come with customizable fields, letting you adjust the design, branding, and content to fit your business needs.

- Accuracy: Pre-built documents help reduce errors, as the necessary sections for pricing, taxes, and terms are already in place, minimizing the risk of omitting important details.

By incorporating these solutions into your daily operations, you can improve both the quality and speed of your financial documentation, leading to a more efficient and professional workflow.

Customizing Your Billing Document

Personalizing your financial documents is a simple yet powerful way to enhance professionalism and ensure that your branding is consistently represented. Customization allows you to adjust the layout, colors, fonts, and fields to match your specific business needs, making it easier for you and your clients to navigate the document. With just a few changes, you can make your records reflect the unique characteristics of your company.

Adjusting Layout and Design

One of the first things you can modify is the overall layout. You may want to move certain sections or resize columns to better suit the flow of information. Additionally, updating the color scheme and font style can help match the document with your company’s branding. Here’s a simple example of what you might customize:

| Field | Customization Option |

|---|---|

| Header | Change logo and company name, adjust font size |

| Item Description | Resize the text box for longer descriptions |

| Total Section | Highlight the total with a bold font or different background color |

Adding or Removing Fields

Another key area for customization is adjusting the fields. Depending on your business needs, you may want to add extra rows or remove irrelevant sections. If you often work with different payment terms or need to include specific notes, cust

Why Choose Excel for Invoicing

When it comes to managing billing and financial records, many businesses opt for digital solutions that offer flexibility, control, and simplicity. One of the most accessible and powerful tools available for creating and tracking payments is a spreadsheet program. These applications provide a versatile platform for organizing essential financial data and performing calculations quickly.

By using a spreadsheet, users can customize layouts and formulas, making it easy to create detailed and personalized documents without the need for specialized software. This adaptability allows individuals and small businesses to maintain professional records while avoiding the cost and complexity of other financial management tools.

Another key advantage is the ability to track and manage various payment details, such as due dates and amounts, all in one place. With built-in features like automatic summation and real-time data updates, it’s possible to streamline the process, reducing the chances of errors or omissions. Additionally, these platforms are widely available and compatible with various devices, making them accessible to a broad audience.

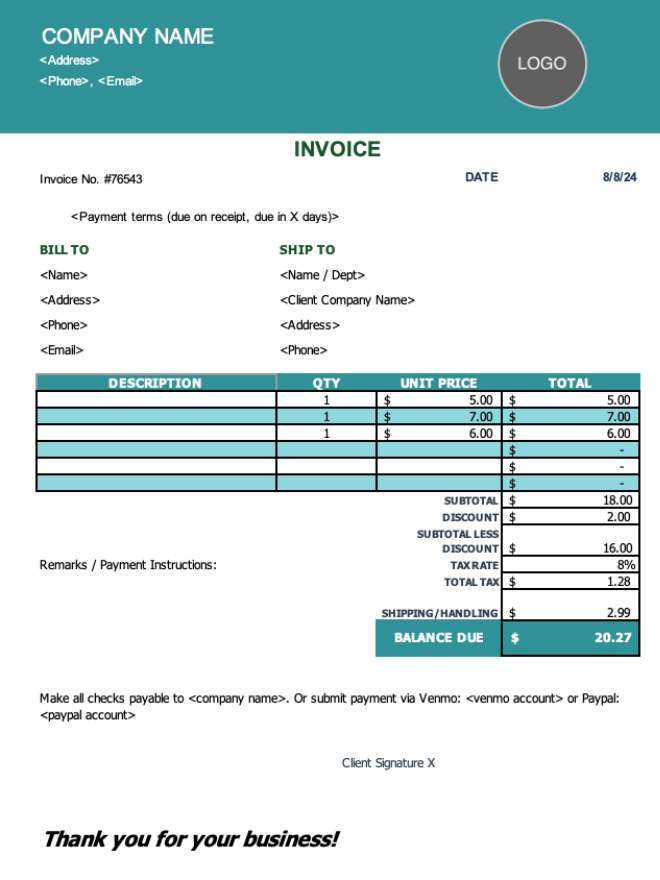

Top Features of Free Invoice Templates

Free billing documents often come with a variety of essential features designed to help individuals and businesses streamline their financial management. These tools are not only cost-effective but also offer functionality that simplifies the creation and tracking of transactions. Here are some key aspects that make these solutions popular among users:

- Customizable Layouts: Users can adjust the design and format to suit their specific needs, ensuring that the document reflects their business branding.

- Automatic Calculations: Built-in formulas help to automatically compute totals, taxes, and discounts, reducing the chances of human error.

- Clear and Organized Fields: Important sections, such as client information, product descriptions, and payment terms, are clearly marked, making it easy to fill in the required details.

- Tracking Capabilities: Many free solutions allow users to track due dates, payment statuses, and outstanding amounts, providing a clear overview of financial activities.

- Printable and Shareable: These documents can be easily printed or saved in digital formats, allowing for convenient sharing with clients and colleagues.

These features make free solutions a practical and efficient choice for businesses that need reliable, accessible, and user-friendly options for managing financial documentation.

How to Download Free Invoice Templates

Finding and downloading free financial document solutions is a straightforward process, thanks to the abundance of resources available online. Many websites offer a variety of formats, making it easy to find a suitable option that meets specific needs. Here’s a step-by-step guide to accessing these helpful tools:

Step 1: Search for Reliable Sources

Begin by searching for trusted websites that offer free downloadable documents. Popular platforms often feature a wide range of customizable options suitable for various business types. Make sure the site provides clear details on the features included in each document format.

Step 2: Select and Download the Document

Once you find the format that works best for your needs, click on the download button. Some websites may ask for your email or require you to create a free account, while others allow direct downloads. After downloading, open the file in your preferred software to begin using it immediately.

Tip: Always check for compatibility with your software before downloading to avoid any issues when opening the file.

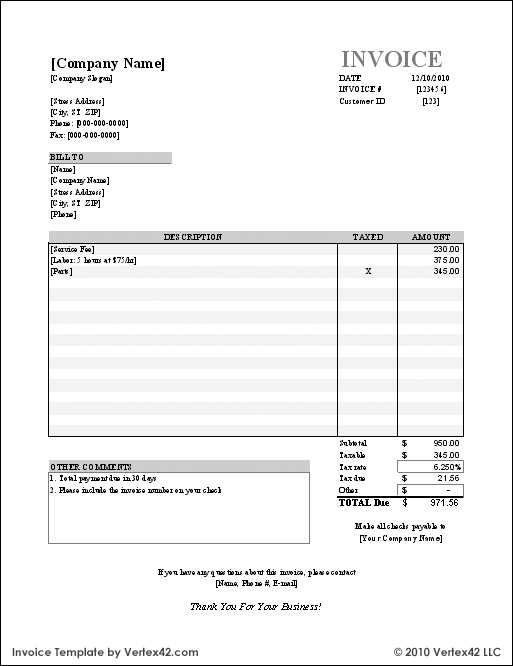

Creating Professional Invoices in Excel

Designing polished financial documents is essential for maintaining a professional image with clients. With the right tools, anyone can craft well-structured records that are clear, precise, and easy to manage. Using spreadsheet software allows for complete customization, making it simple to generate documents that are tailored to specific business needs.

The first step is to create a clear layout, ensuring that all the necessary information is presented in an organized manner. Key elements like contact details, product or service descriptions, payment terms, and totals should be easy to locate and understand. Utilize cell formatting options to emphasize important sections and ensure consistency throughout the document.

Tip: Make use of built-in functions such as automatic summation and tax calculation to minimize errors and save time.

By taking advantage of advanced features like tables, conditional formatting, and custom formulas, you can enhance the presentation and accuracy of each document, making it look more polished and professional.

Common Mistakes to Avoid in Invoices

When creating financial documents, accuracy is crucial to ensure timely payments and maintain professionalism. Even small errors can lead to confusion, delays, or disputes. Being mindful of common pitfalls can help you avoid complications and ensure smooth transactions with your clients.

One common mistake is failing to include all necessary details, such as correct contact information or a clear description of the products or services provided. Omitting these key elements can cause misunderstandings or delays in payment. Additionally, incorrect calculations, whether in totals or tax rates, can create discrepancies and lead to trust issues.

Another frequent issue is not clearly specifying payment terms. Vague or missing deadlines can result in late payments or confusion about when money is due. Finally, inconsistent formatting or poorly organized documents can appear unprofessional and may lead to errors when reviewing the records.

How to Calculate Taxes in Excel Invoices

Calculating taxes accurately is essential for maintaining compliance and ensuring that both parties agree on the total amount due. By using spreadsheet software, it becomes easy to apply the correct tax rates to your financial documents. Below is a guide to help you calculate taxes efficiently.

Step 1: Set Up the Tax Rate

Before calculating the tax, you’ll need to know the applicable tax rate. Enter the tax percentage in a separate cell, which will be referenced in the calculation.

Step 2: Apply the Formula

Once the tax rate is set, use the following formula to calculate the tax:

- Tax Amount: Amount x Tax Rate

- Total Amount: Amount + Tax Amount

For example, if the subtotal is $100 and the tax rate is 10%, the tax amount would be $10, and the total amount due would be $110.

Step 3: Automate for Multiple Items

If your document contains multiple products or services, apply the formula across different rows. Use the drag feature to copy the formula and calculate taxes for each line item automatically.

Invoice Templates for Small Businesses

For small business owners, managing financial records efficiently is crucial for maintaining cash flow and building professional relationships with clients. One of the easiest ways to ensure smooth transactions is by using simple yet effective billing documents that streamline the process. These solutions help you stay organized and present a polished image to your clients, all while saving time on manual calculations.

Here are some essential components to include in your billing documents for small businesses:

| Section | Description |

|---|---|

| Business Information | Include your company name, address, phone number, and email to ensure the client can reach you easily. |

| Client Details | Ensure the client’s name, address, and contact details are correctly listed for clarity and communication. |

| Itemized List | Provide clear descriptions of goods or services, quantities, and individual pricing for transparency. |

| Payment Terms | Clearly state due dates, payment methods, and any late fees to avoid misunderstandings. |

| Tax and Total | Calculate taxes and ensure totals are accurate, making it easy for the client to understand the final amount. |

By incorporating these elements into your billing system, you can ensure that your documents are both professional and easy for your clients to understand, helping to foster trust and maintain a smooth financial workflow.

How to Track Payments in Excel

Keeping track of payments is an essential part of managing your finances and ensuring timely cash flow. By using spreadsheet software, you can easily monitor received payments, outstanding balances, and payment due dates. This allows for efficient tracking and ensures that no payments are missed or overlooked.

Here are a few simple steps to effectively monitor payments:

- Create a Payment Tracking Table: Set up a table with columns for the client name, payment date, amount due, amount paid, and balance remaining.

- Use Formulas for Automatic Calculation: Apply formulas to calculate balances automatically as payments are received. This will help you maintain up-to-date records without manual calculation.

- Mark Paid Entries: Use color-coding or checkboxes to easily mark paid items. This provides a clear overview of which payments are still pending.

- Set Payment Reminders: Include a column for due dates and use conditional formatting to highlight overdue payments, making it easier to follow up with clients.

With these simple techniques, you can create a clear and organized system to track payments, ensuring that your financial records remain accurate and up to date.

Integrating Your Invoice with Accounting Tools

Efficient financial management becomes much easier when you connect your billing system with accounting software. By integrating your payment records with professional tools, you can automate various processes, reduce errors, and streamline your financial reporting. This allows for more accurate tracking of revenue and expenses while saving valuable time.

Step 1: Choose the Right Accounting Tools

To begin, select accounting software that suits your business needs. Many platforms offer seamless integration with billing systems, providing real-time updates on payments and balances. Popular tools can handle everything from tax calculations to profit analysis.

Step 2: Link Your Documents to the Accounting Software

After selecting your tool, you can connect your records by either importing documents directly or using automated synchronization features. Some tools allow you to link your financial records via API, while others may offer direct file uploads for easy integration.

- Automated Data Sync: Ensure that payment information flows automatically between your billing and accounting systems.

- Expense Tracking: Easily categorize payments and keep track of business expenses for tax purposes.

- Financial Reporting: Generate reports that reflect up-to-date payment statuses and overall business performance.

Integrating your billing system with accounting tools not only simplifies the management of financial documents but also improves overall business efficiency by automating tedious tasks and keeping your data consistent.

How to Save Time with Templates

Efficient document creation is key to saving valuable time in any business. By using pre-designed formats, you eliminate the need to start from scratch each time you need to generate a new document. This allows you to focus on other important tasks, ensuring smoother operations and faster turnarounds.

One way to streamline your workflow is by setting up reusable layouts that can be easily customized. With the right structure in place, you can simply input the necessary details, and the document will be ready in minutes.

- Consistent Format: Pre-built formats maintain consistency, ensuring that all documents are uniform and professional every time.

- Reduce Errors: With a ready-made structure, there’s less chance of missing important information or making formatting mistakes.

- Quick Customization: Templates allow for easy adjustments, letting you personalize details such as names, prices, and dates without redoing the entire document.

By utilizing these pre-structured solutions, you can boost your productivity, reduce repetitive work, and ensure that your documents are always accurate and timely.

Managing Multiple Invoices in Excel

Handling numerous billing documents can become overwhelming without a structured system in place. Whether you’re managing payments for different clients or processing multiple orders, organizing your financial records efficiently is key to maintaining accuracy and saving time. Spreadsheet software allows for easy management of multiple documents in one file, providing a clear overview of your transactions.

Here are a few strategies to help you efficiently manage a large number of billing records:

- Organize by Categories: Create separate sheets for each client, project, or month to keep everything organized. This prevents confusion and makes it easier to track individual payments.

- Use Filters and Sorting: Apply filters to columns such as due dates, amounts, or payment status. Sorting data based on these criteria helps you quickly find the information you need.

- Link Data Across Sheets: Use formulas to link data between multiple sheets, ensuring that totals and balances are automatically updated as new records are added.

- Track Payment Status: Maintain a column to mark whether a payment has been made or is still outstanding. Color coding or checkboxes can make this process visually clear.

By implementing these methods, you can ensure that your documents remain organized, easy to access, and up to date, no matter how many records you are managing.

Choosing the Best Template for Your Needs

When it comes to organizing your financial documents, choosing the right structure is essential. A well-suited layout can help you manage your records efficiently, ensuring that you have all the necessary details in place and can easily track payments and balances. The best solution depends on your business requirements, the complexity of your transactions, and the level of detail you need to include.

Consider Your Business Type

Different industries have unique needs when it comes to billing and record-keeping. For example, service-based businesses may require more detailed descriptions of the work performed, while product-based businesses might need a clearer breakdown of quantities and unit prices. Identifying what’s essential for your type of business will help you choose the most efficient format.

Key Features to Look For

When selecting a structure for your documents, make sure it includes the following important elements:

| Feature | Description |

|---|---|

| Clarity | Ensure the layout is easy to read and navigate, with clear sections for all relevant information. |

| Customization | Choose a design that allows you to personalize details such as client information, payment terms, and itemized lists. |

| Automation | Look for formats that include automated fields or formulas for calculating totals, taxes, and balances. |

| Compatibility | Ensure the format is compatible with your preferred software or tools for easy use and integration. |

By evaluating these features and considering your specific business needs, you can select a solution that streamlines your financial management and helps you stay organized.