How to Create a Professional Template Invoice Email for Your Business

Sending clear and professional payment requests is essential for maintaining smooth financial operations in any business. Effective communication not only ensures timely payments but also reflects your brand’s professionalism. Using a consistent structure for your payment communications helps your clients easily understand the details and respond accordingly.

There are several ways to craft an organized and well-received payment request. By focusing on clarity, tone, and design, you can create a communication that conveys all necessary information while fostering positive client relationships. Including important details such as the amount owed, due date, and payment instructions ensures that your message is both effective and actionable.

In this article, we’ll explore key strategies for creating impactful payment notices, offering practical tips and examples. Whether you’re sending a friendly reminder or a more formal notification, the approach you take can significantly influence how quickly you receive payment and how your business is perceived by clients.

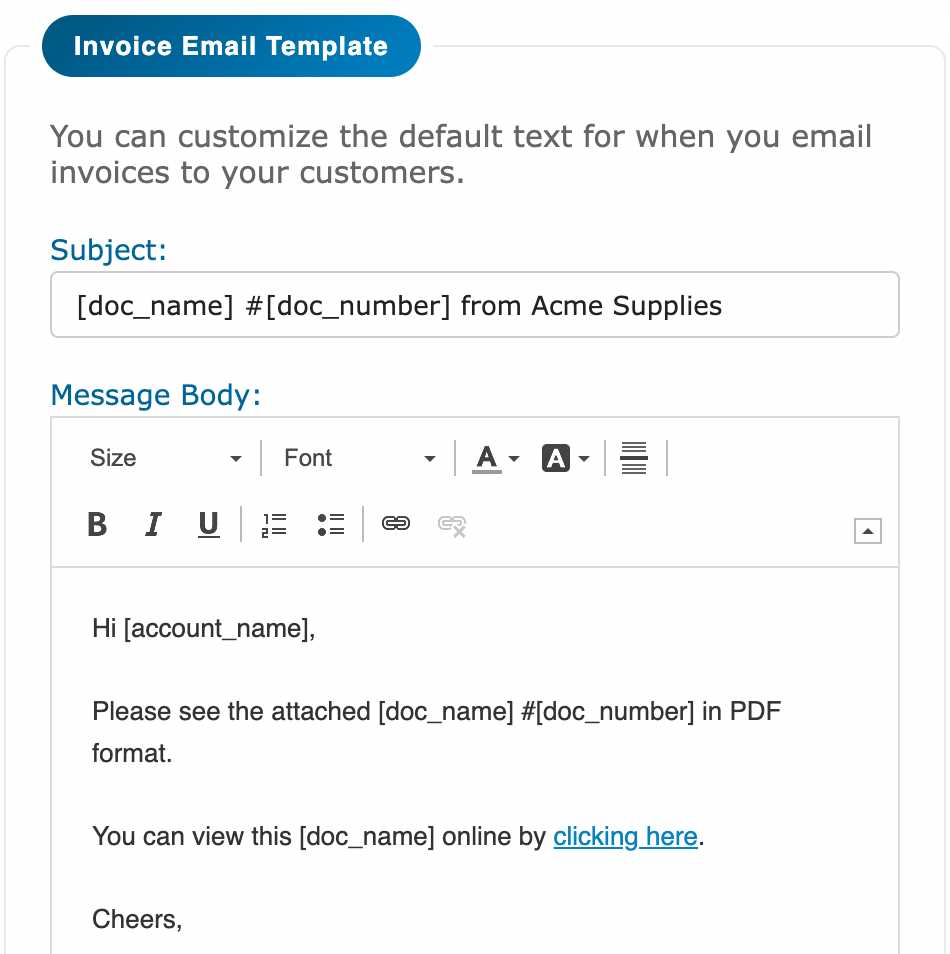

What is an Invoice Email Template

An organized, pre-designed structure for sending payment requests is a vital tool for businesses. This approach allows companies to streamline their communication process, ensuring that all necessary details are included while maintaining a professional tone. Using such a structure not only saves time but also ensures consistency across all communications with clients.

Typically, this format includes the essential information required for clients to understand the payment request clearly and take action without confusion. It may feature standard fields like payment amount, due date, and a clear call to action, making the process simple for both parties involved.

| Section | Description |

|---|---|

| Subject Line | Brief, clear indication of the payment request purpose |

| Greeting | Personalized greeting to establish rapport with the recipient |

| Details | Clear breakdown of the payment amount and terms |

| Payment Instructions | Step-by-step guide on how to complete the payment |

| Closing | Friendly, professional sign-off to encourage a timely response |

By using this organized format, businesses can ensure that all relevant details are effectively communicated, minimizing the risk of misunderstandings and delays.

Benefits of Using Template Invoice Emails

Using a pre-structured format for sending payment requests offers numerous advantages for businesses. It simplifies the process, reduces errors, and helps maintain a professional image. These benefits contribute to a more efficient workflow and a stronger relationship with clients.

- Time-saving – Pre-designed formats eliminate the need to start from scratch each time, allowing you to focus on other important tasks.

- Consistency – Ensures that each communication is uniform, presenting the same professional tone and structure for all clients.

- Accuracy – Standardized fields reduce the risk of missing critical details, ensuring all necessary information is included in every communication.

- Improved Client Experience – Clients appreciate clear, easy-to-understand requests that allow them to take action quickly.

- Professional Image – A polished and organized approach helps convey credibility, reinforcing trust between you and your clients.

- Easy Customization – While the structure remains consistent, you can easily tailor the message to meet specific needs, ensuring it feels personal.

- Automation Potential – Many businesses automate this process, sending pre-built payment requests at regular intervals or based on certain triggers.

By utilizing a standardized format, businesses can streamline their operations, enhance client relationships, and ensure timely payments with minimal effort.

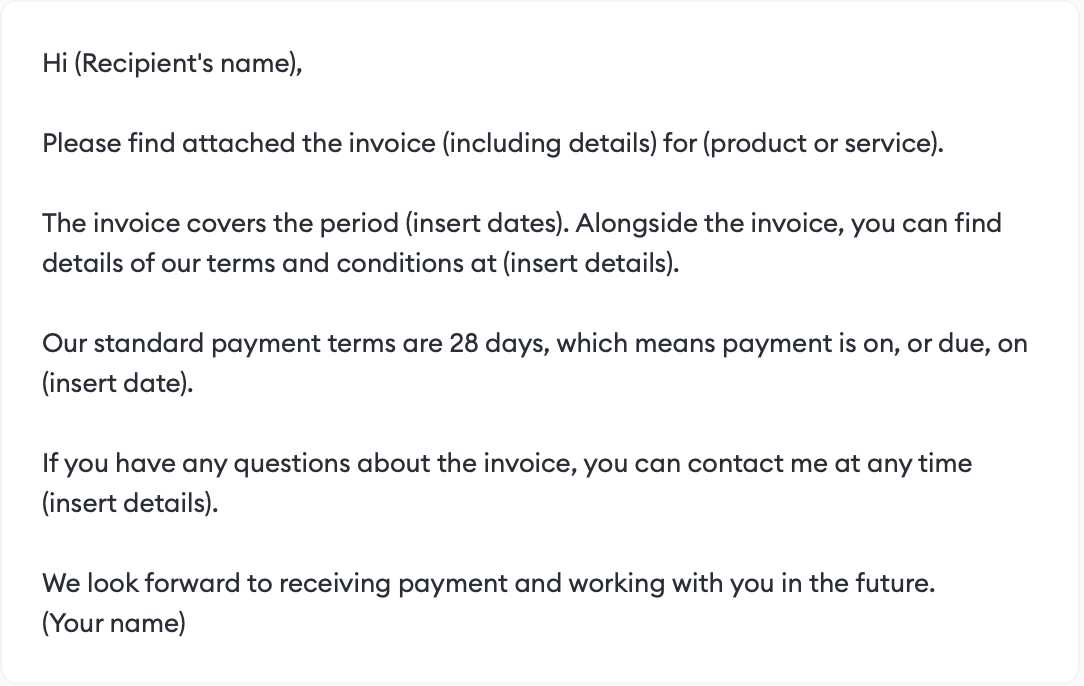

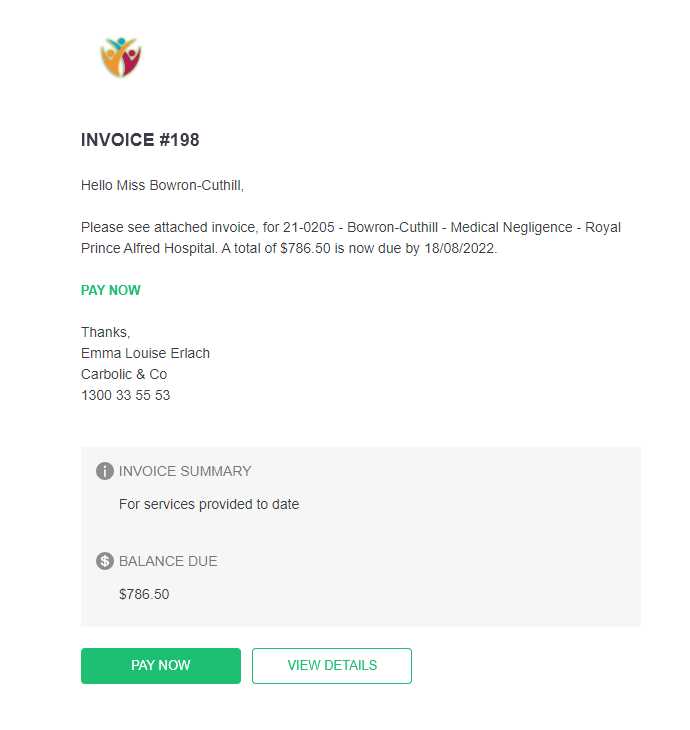

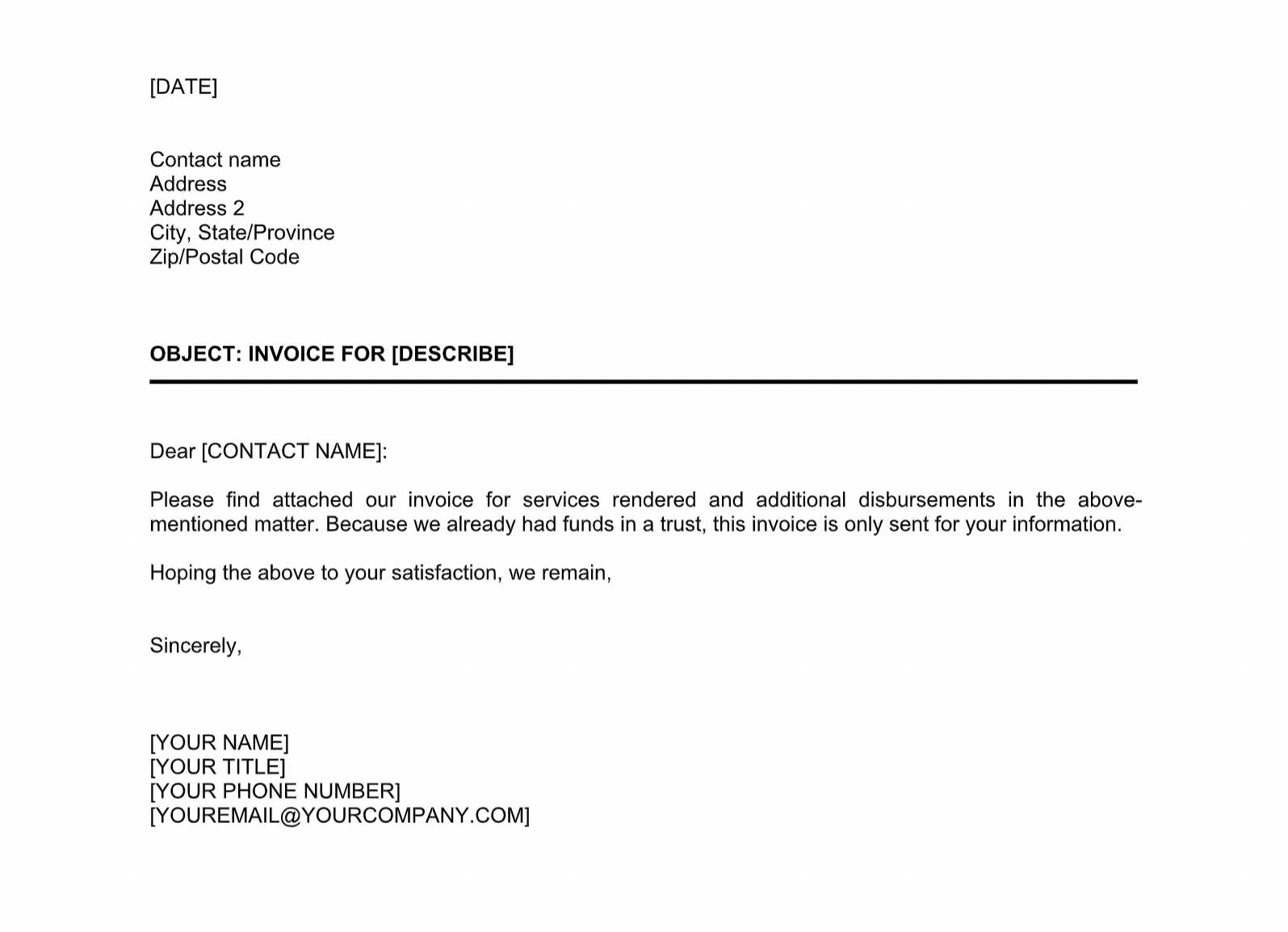

Key Elements of an Invoice Email

To ensure that your payment requests are clear and professional, it’s important to include certain essential components in every message. These elements help clients understand the specifics of the payment, making it easier for them to act promptly. A well-structured request not only speeds up processing but also strengthens your business’s reputation for professionalism.

- Clear Subject Line – A concise, informative subject line that immediately tells the recipient the purpose of the message.

- Personalized Greeting – A friendly, professional salutation that addresses the recipient by name, creating a sense of connection.

- Detailed Payment Breakdown – Clear information about the amount owed, including any relevant dates, services provided, or products delivered.

- Payment Terms – Explicit instructions regarding the due date, accepted payment methods, and any penalties for late payments.

- Call to Action – A direct, polite request for the recipient to complete the payment, with an easy way to take action.

- Contact Information – Clear details on how the client can reach you for any questions or concerns related to the payment.

- Professional Sign-off – A courteous closing that reinforces the relationship and invites further communication if necessary.

By incorporating these essential elements, you ensure that your payment requests are not only effective but also maintain a high standard of professionalism, encouraging prompt action from your clients.

How to Write a Clear Invoice Email

To ensure that your payment request is easily understood, it’s important to communicate all necessary details in a straightforward and organized manner. A well-written message reduces confusion and promotes timely action. Keeping the content clear, concise, and professional is key to a positive client experience.

Here are some essential steps to follow when crafting a clear payment request:

| Step | Action |

|---|---|

| 1. Use a Concise Subject Line | Make sure the subject line directly reflects the purpose of the message, such as “Payment Due for [Service/Product Name]”. |

| 2. Address the Recipient | Personalize the greeting by using the recipient’s name, which helps establish a professional connection. |

| 3. Provide Payment Details | Clearly outline the amount due, the due date, and any other important details about the transaction. |

| 4. Specify Payment Methods | List the accepted methods of payment and any necessary instructions for completing the transaction. |

| 5. Add a Call to Action | Politely encourage the recipient to complete the payment and include clear steps on how to do so. |

| 6. Provide Contact Information | Include your contact details in case the recipient has questions or needs clarification. |

| 7. Close Professionally | End with a courteous and professional sign-off, reinforcing your availability for further communication. |

By following these steps, you’ll craft a message that is not only easy to read but also encourages prompt action from your client, ensuring smooth transactions for your business.

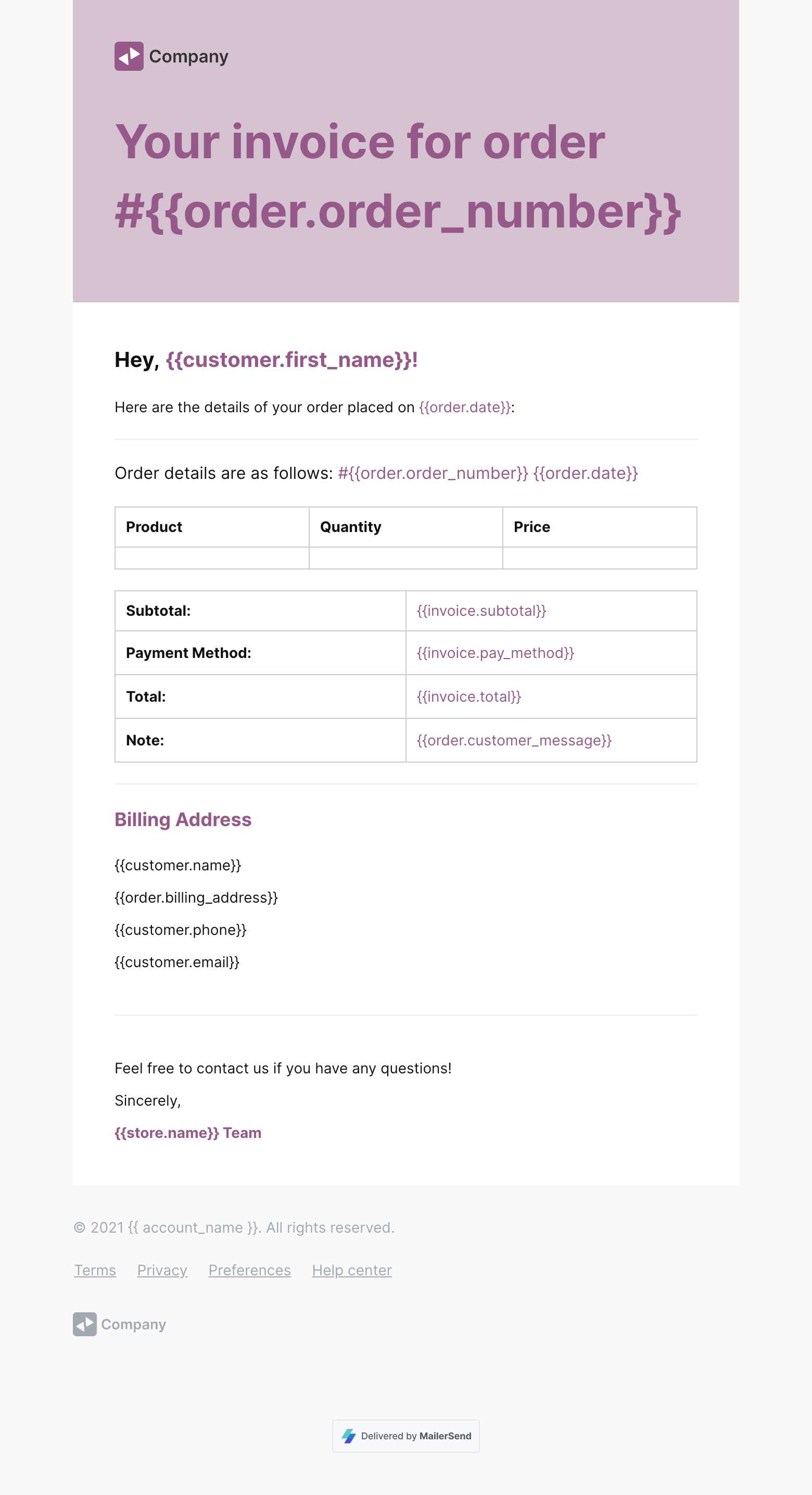

Best Practices for Invoice Email Design

When sending payment requests, the visual presentation of your message plays a crucial role in ensuring that your communication is clear, professional, and easy to read. A well-designed layout enhances the recipient’s experience and encourages prompt action. By following key design principles, you can make your message stand out while maintaining a polished, business-like appearance.

Key Design Elements for Effective Communication

- Clean and Simple Layout – Avoid cluttered designs. A straightforward, well-spaced layout allows recipients to focus on the most important details without distraction.

- Consistent Branding – Incorporate your company’s logo, colors, and fonts to reinforce brand recognition and trustworthiness.

- Readable Font Sizes – Ensure that text is easy to read, with a font size that’s large enough for both mobile and desktop views.

- Logical Information Flow – Organize content in a logical sequence: start with the recipient’s greeting, followed by payment details, instructions, and a clear call to action.

- Whitespace – Use whitespace effectively to separate sections and prevent the message from feeling overwhelming. This enhances readability and clarity.

Optimizing for User Experience

- Mobile-Friendly Design – Since many clients access their messages on mobile devices, ensure your payment request is responsive and easy to read on smaller screens.

- Use of Bullet Points – Break down complex information into bullet points or numbered lists to make key details stand out, such as payment amounts, due dates, and instructions.

- Actionable Links – Include clickable links for easy payment options or contact information, ensuring that clients can act quickly.

- Professional Imagery – If using images or icons, make sure they are relevant, high-quality, and professional, avoiding anything too flashy or distracting.

By following these design principles, you can enhance the impact of your payment request, making it easier for clients to understand and act upon. A well-crafted layout not only improves the clarity of your message but also strengthens your professional reputation.

How to Personalize Your Invoice Emails

Personalization in payment requests goes beyond simply addressing the recipient by name. It involves tailoring your communication to create a more engaging and professional experience for your client. Personalizing your payment reminders can build stronger relationships, improve response rates, and show your clients that you care about their specific needs.

Key Steps for Personalization

- Use the Client’s Name – Always address your recipient by their full name or preferred title. This creates a more personal touch and sets a professional tone.

- Reference Past Interactions – Mention previous transactions or services provided to remind the client of the value you bring and make the request feel more relevant.

- Adjust the Tone – Modify the language based on the client’s history with your business. A long-term client may appreciate a more casual tone, while a new client might benefit from a more formal approach.

- Include Specific Details – Customize the content to reflect the exact services or products the client has received, ensuring that the payment request is relevant and clear.

- Offer Personalized Payment Options – If your clients prefer specific methods of payment or have set terms, make sure to acknowledge and offer these options in your request.

Best Practices for Effective Personalization

- Use Custom Variables – If possible, automate the inclusion of personalized data such as the client’s previous purchases, outstanding amounts, or unique discounts they may qualify for.

- Express Gratitude – Acknowledge your client’s continued business and express appreciation for their partnership. This can make the payment request feel more like a continuation of a positive relationship.

- Set the Right Expectations – Be clear about deadlines or next steps while ensuring that your message is approachable and not overly demanding.

- Follow Up with a Personalized Reminder – If payment is not received by the due date, consider sending a gentle, personalized reminder, offering assistance if needed or providing a simple way for the client to reach out for support.

By taking the time to customize your payment requests, you not only improve the chances of receiving timely payments but also build stronger, more trusting relationships with your clients.

Common Mistakes in Invoice Emails

When sending payment requests, even small mistakes can cause confusion and delay payments. It’s important to avoid common pitfalls that can negatively impact the clarity and professionalism of your communication. By understanding and addressing these errors, you can ensure a smoother, more efficient process for both you and your clients.

- Vague Subject Lines – A subject line that lacks clarity may cause your message to be overlooked or ignored. Always ensure your subject directly reflects the purpose of the communication, such as “Payment Due for [Service/Product].”

- Missing Payment Details – Failing to include key information such as the payment amount, due date, and description of services or products can lead to confusion and delays. Ensure all necessary data is easily visible.

- Unclear Payment Instructions – If your payment methods or instructions are not clearly explained, clients may struggle to complete the transaction. Always include simple, step-by-step guidance on how they can make the payment.

- Lack of Personalization – Sending generic messages can make clients feel less valued. Personalizing your communication by addressing the client by name or referencing past transactions helps build a stronger relationship.

- Too Much Technical Jargon – Using complex terminology or overly technical language can confuse clients, especially those who may not be familiar with your industry. Keep the message simple and easy to understand.

- Unprofessional Tone – A tone that is too casual or too aggressive can damage your professional image. Ensure that your message remains polite, courteous, and respectful.

- Failure to Proofread – Spelling and grammar errors can undermine your professionalism. Always proofread your message before sending to ensure it is error-free.

- Not Following Up – Neglecting to follow up on overdue payments or not sending reminders can result in delayed transactions. Be sure to set reminders for yourself and your clients.

Avoiding these common mistakes ensures that your payment requests are clear, professional, and effective, ultimately leading to quicker payments and stronger client relationships.

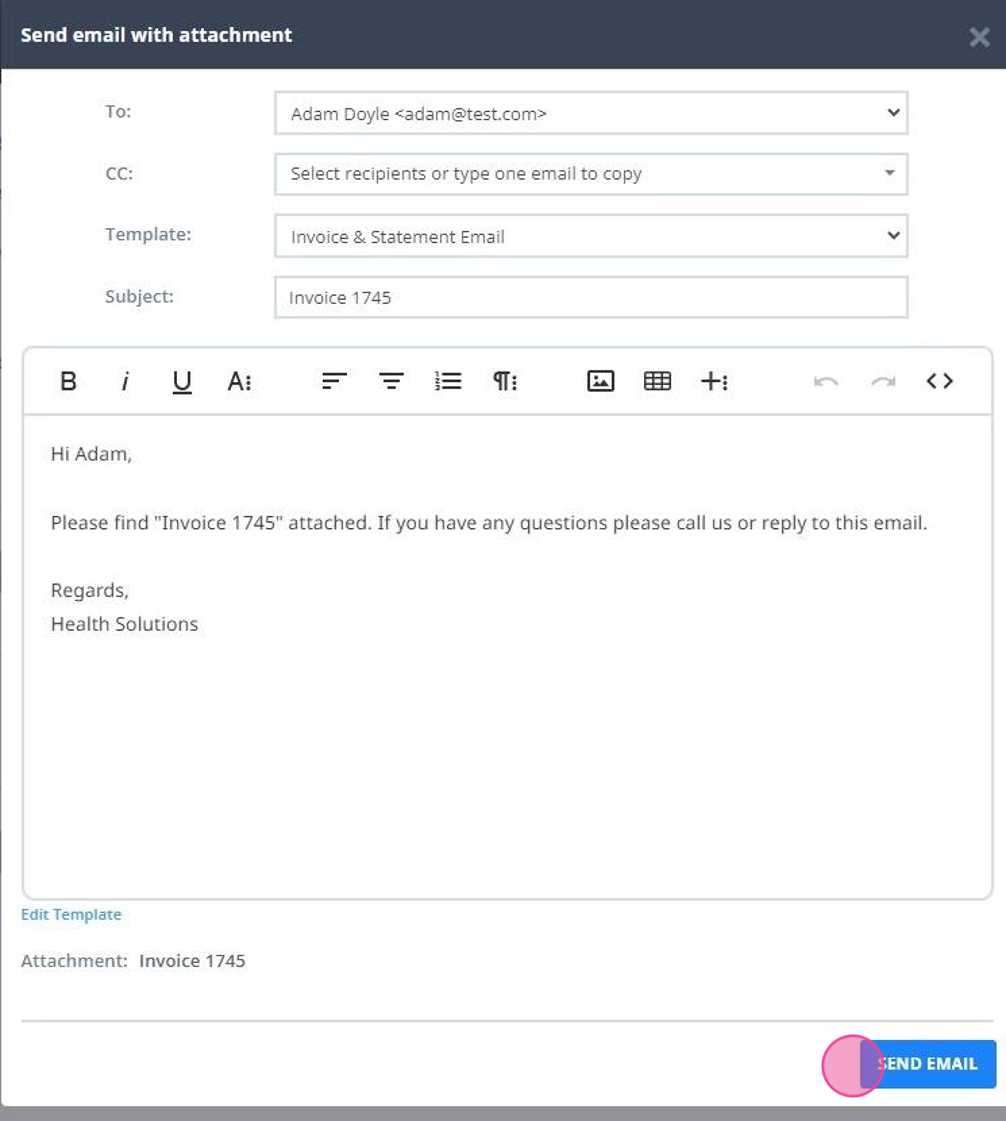

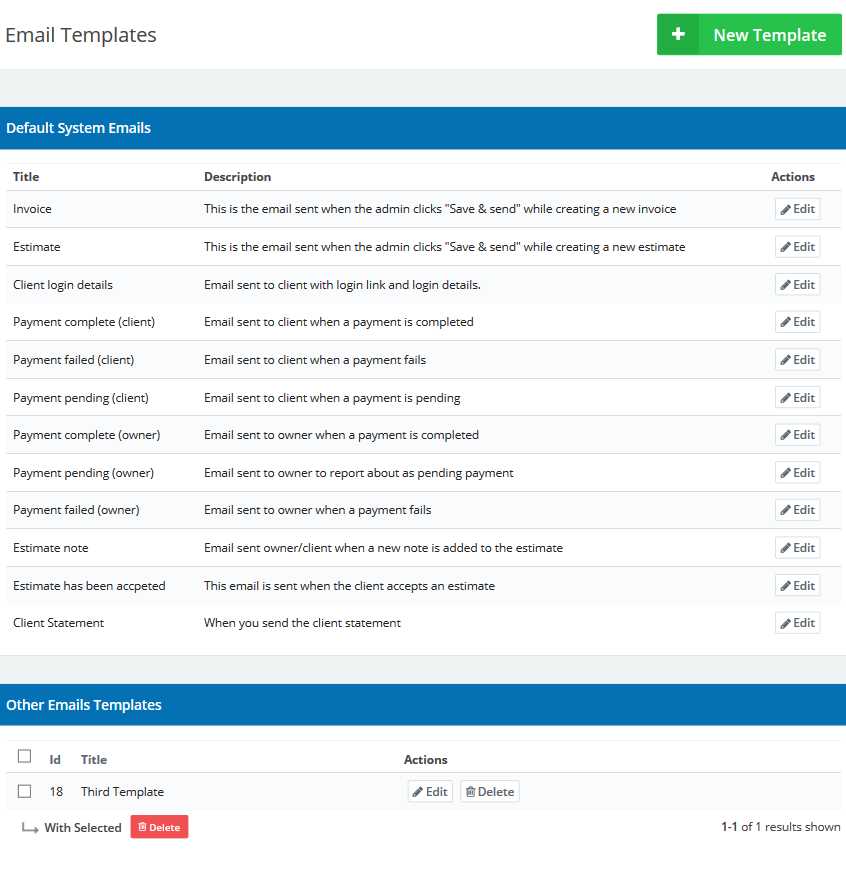

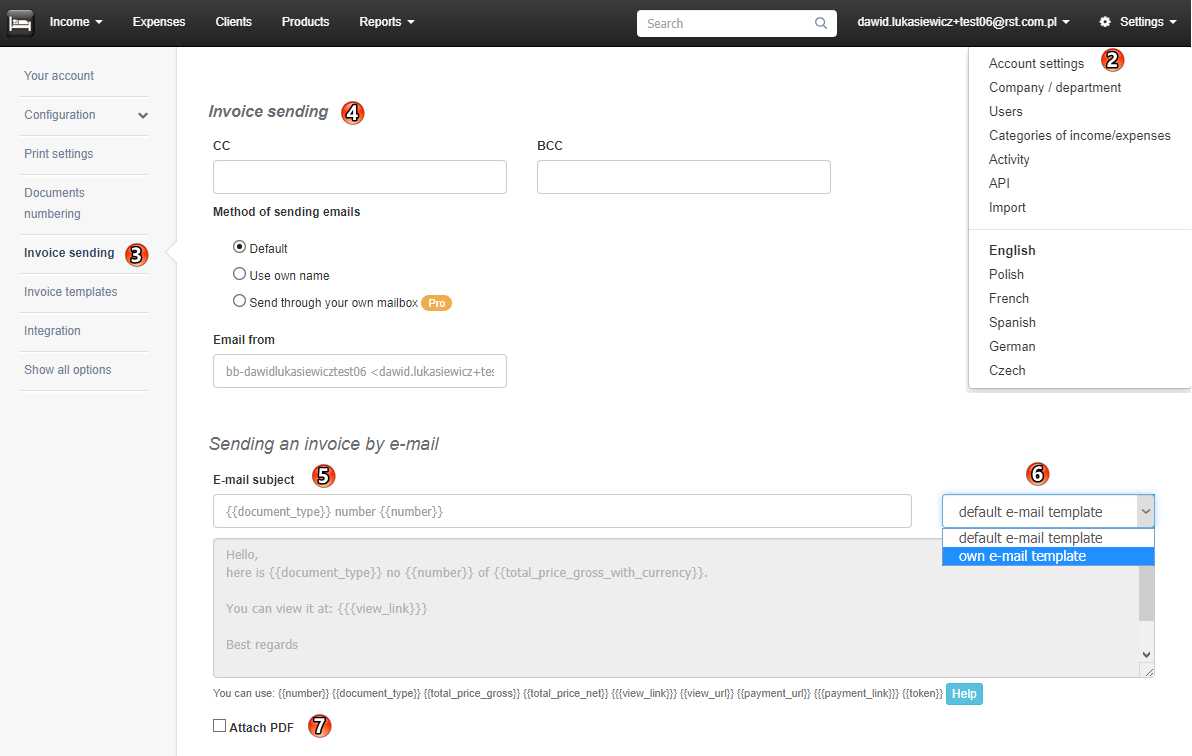

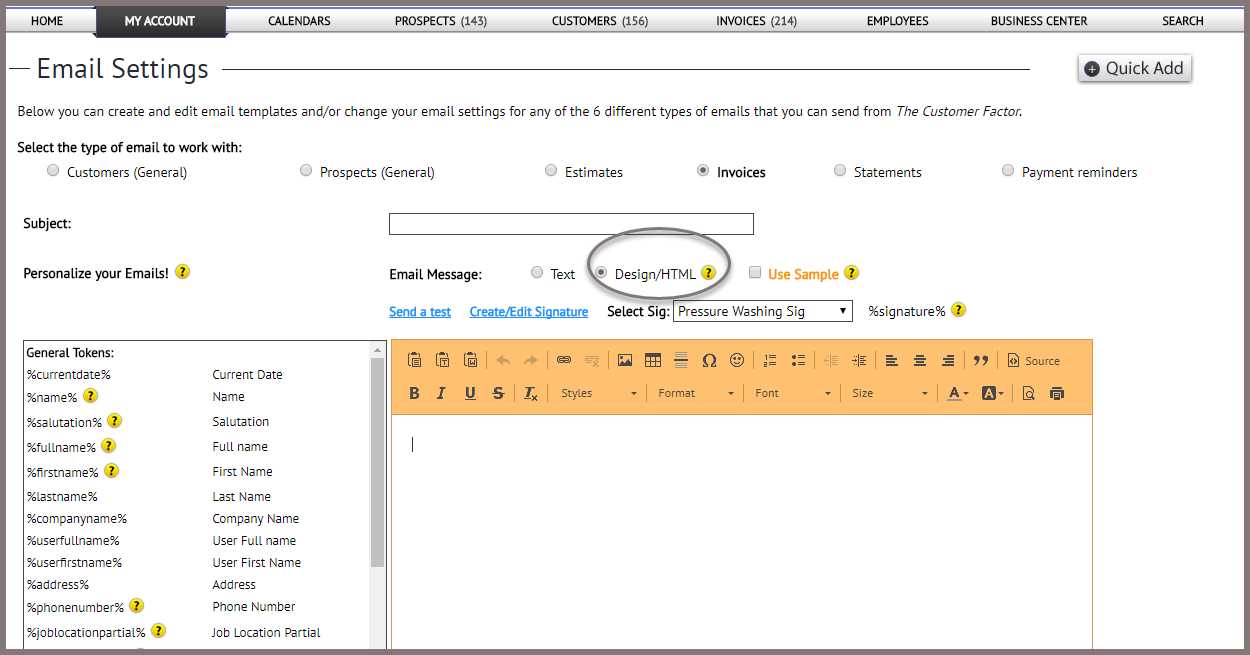

How to Automate Invoice Emails

Automating payment requests is an excellent way to save time, reduce manual effort, and ensure consistency in your communications. By setting up an automated system, you can send reminders and payment requests at the right time without having to manually create and send each message. This streamlines your billing process, improves efficiency, and helps prevent missed payments.

Steps to Set Up Automation

- Choose the Right Automation Tool – Select a tool or software that integrates with your accounting or customer management system. Popular options include cloud-based invoicing software that allows you to schedule automatic messages.

- Set Clear Triggers – Determine the events that will trigger your automated messages. For example, you can set up reminders to be sent a few days before the payment due date or immediately after a transaction is completed.

- Customize the Message – Even with automation, it’s important to customize your message templates to reflect your brand voice and include all the necessary payment details. Ensure each automated message contains the correct payment amount, due date, and instructions.

- Test the System – Before fully implementing automation, test the system with a few clients to ensure that the messages are sent correctly and contain the right information.

- Monitor and Adjust – Once automation is in place, regularly review the results and adjust the timing, content, or frequency of the messages based on feedback and performance.

Benefits of Automating Payment Requests

- Consistency – Automated messages ensure that every client receives the same level of communication, reducing the risk of errors or omissions.

- Efficiency – Automation frees up time for other tasks, allowing you to focus on more important aspects of your business.

- Timely Reminders – Automated systems can send reminders precisely when needed, helping to reduce the chances of late payments.

- Improved Cash Flow – With consistent and timely requests, you are more likely to receive payments on time, improving your overall cash flow.

By automating your payment requests, you can streamline your operations, reduce administrative burden, and ensure more efficient communication with your clients.

Choosing the Right Invoice Template Style

Selecting the right design for your payment requests is essential in presenting a professional and clear message to your clients. The style of your request reflects your business image and plays a role in how seriously your clients take the communication. A well-chosen layout not only makes the details easier to read but also helps create a positive, lasting impression.

Factors to Consider When Choosing a Style

- Brand Consistency – Your design should align with your business’s branding. Use consistent colors, fonts, and logo placement to reinforce your company’s identity.

- Client Type – Consider your audience. A corporate client may appreciate a more formal, minimalist design, while a creative client might enjoy a more colorful and dynamic layout.

- Clarity and Simplicity – The most effective designs are those that prioritize clarity. Keep the layout simple, organized, and easy to read so clients can quickly find the key payment details.

- Customization – Ensure the design allows for personalization. You may need to adjust the layout depending on the specific details of the transaction or client preferences.

- Mobile Optimization – Many clients may view your message on mobile devices, so it’s essential that your design looks good on both desktop and mobile screens.

Popular Design Styles for Payment Requests

| Design Style | Best For |

|---|---|

| Minimalist | Businesses looking for clean, simple, and professional communication. Often used by consultants, freelancers, and law firms. |

| Creative | Small businesses in creative industries, such as graphic design, photography, and advertising, who want to showcase their unique style. |

| Corporate | Large businesses or corporations that need a formal and polished look. Often used for high-value contracts and recurring billing. |

| Modern | Companies looking for a fresh, current design that incorporates trends like bold typography, vibrant colors, and unique layouts. |

Choosing the right style for your payment request is an important decision that affects how your clients perceive your business. By considering your brand, audience, and communication needs, you can select a design that enhances the clarity and professionalism of your requests while strengthening your brand image.

Legal Considerations for Invoice Emails

When sending payment requests, it’s crucial to ensure that your communications are not only clear and professional but also compliant with applicable laws and regulations. Understanding the legal aspects of these communications can help protect your business and ensure that your clients are informed of their obligations. This section covers important legal considerations that should be taken into account when crafting your requests for payment.

Key Legal Elements to Include

- Accurate Payment Information – Ensure that all payment details are correct, including amounts due, deadlines, and terms. Incorrect information could lead to legal disputes or confusion.

- Clear Payment Terms – Clearly outline payment terms, including due dates, interest on late payments, and any potential penalties. This sets expectations for the client and can protect you if payments are delayed.

- Tax Information – Depending on your location and business type, it may be necessary to include tax details, such as VAT or sales tax. This is especially important for businesses that are required to collect taxes on their services or goods.

- Business Identification – Include your legal business name, registration number (if applicable), and other necessary identification details. This ensures transparency and is a requirement in many jurisdictions.

- Dispute Resolution Clause – In the event of a disagreement over a payment, it’s advisable to include a clause that explains how disputes will be handled, whether through mediation, arbitration, or legal proceedings.

Important Legal Considerations for International Transactions

- Currency and Exchange Rates – For international transactions, clearly state the currency in which payment is due, and be aware of exchange rates or additional fees that may apply.

- International Taxes and Compliance – Understand the tax laws and compliance requirements in both your country and the client’s location, especially when dealing with cross-border transactions.

- Legal Jurisdiction – Specify which country’s laws will govern the contract in case of legal disputes. This is particularly important when working with clients in different countries.

By considering these legal factors, you can avoid potential legal issues and ensure that your payment requests are in full compliance with relevant regulations. Always consult with a legal expert if you are unsure about the requirements for your specific situation or location.

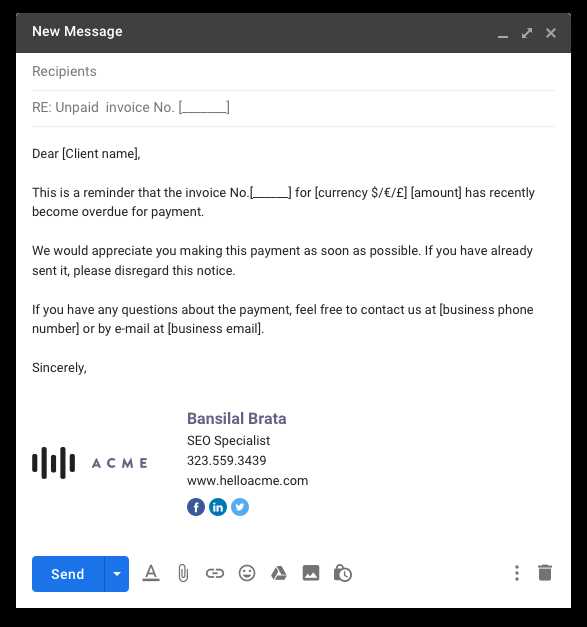

How to Handle Late Payments in Emails

Late payments can be frustrating, but addressing them in a professional and respectful manner is crucial for maintaining positive relationships with your clients while ensuring timely compensation. When a payment is overdue, your communication should be clear, polite, and firm, outlining the necessary steps for resolution. In this section, we’ll explore strategies for handling late payments and crafting messages that encourage prompt action.

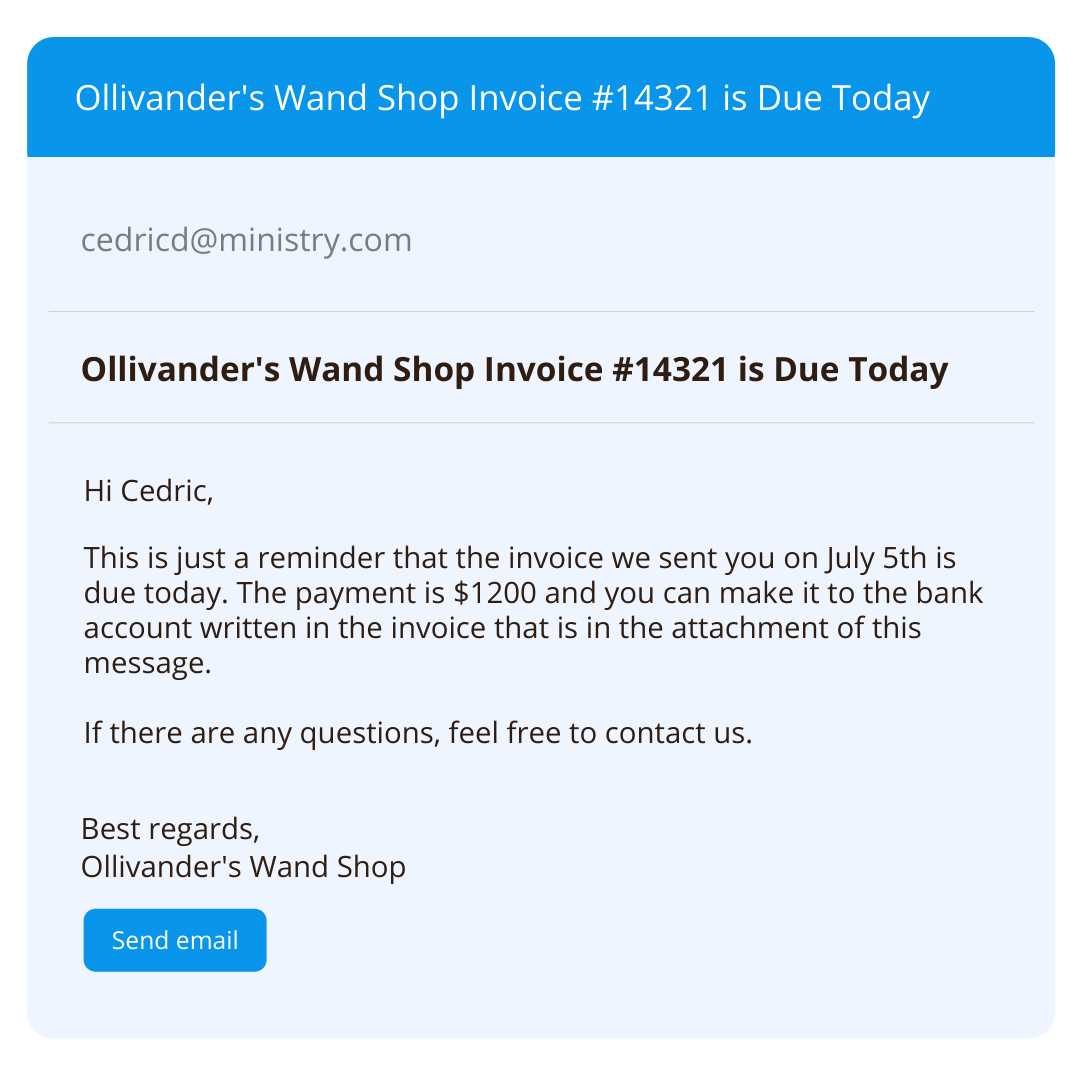

Steps for Addressing Late Payments

- Send a Friendly Reminder – If the payment is only a few days late, send a courteous reminder. Express understanding but clearly state that the payment is due. Use a polite tone and offer assistance if the client is facing any difficulties.

- Specify the Amount Due – Clearly list the amount that remains unpaid, the original due date, and any late fees (if applicable). This helps avoid confusion and makes it easy for the client to take immediate action.

- Offer Payment Options – Provide multiple payment methods or offer flexibility in case the client is facing challenges with the payment process. This can demonstrate goodwill and encourage quicker resolution.

- State the Consequences – Politely mention any consequences of continued non-payment, such as service interruption or additional late fees. Be firm but professional in communicating the impact of further delays.

- Maintain Professionalism – Throughout the process, always maintain a respectful and professional tone. Even if a client is repeatedly late, your communication should remain courteous to preserve the relationship.

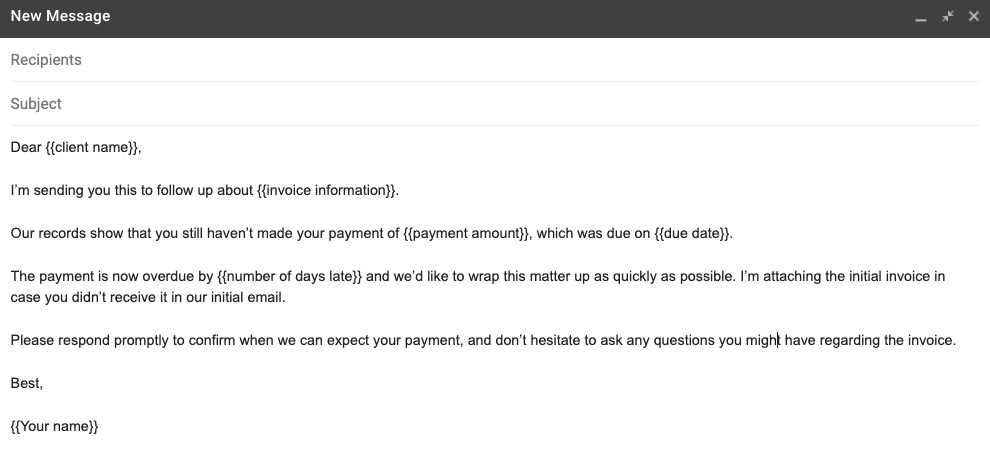

How to Follow Up After the First Reminder

- Escalate with a Second Reminder – If the payment is still not received after your first reminder, send a second, more urgent message. This message should reiterate the due date, the outstanding amount, and a request for immediate payment.

- Set a New Deadline – Provide a new, firm deadline for payment and express the need for prompt resolution. This helps create a sense of urgency without sounding overly aggressive.

- Offer to Discuss Payment Plans – If the client is genuinely unable to pay the full amount, consider offering a payment plan. This shows flexibility and a willingness to work with the client to find a solution.

- Consider Legal Action as a Last Resort – If all else fails and the payment is still overdue, you may need to inform the client about the possibility of legal action. However, this should only be mentioned after several attempts to resolve the issue amicably.

By handling late payments professionally, you can maintain a positive relationship with your clients while also protecting your business interests. Clear, polite communication is key to resolving

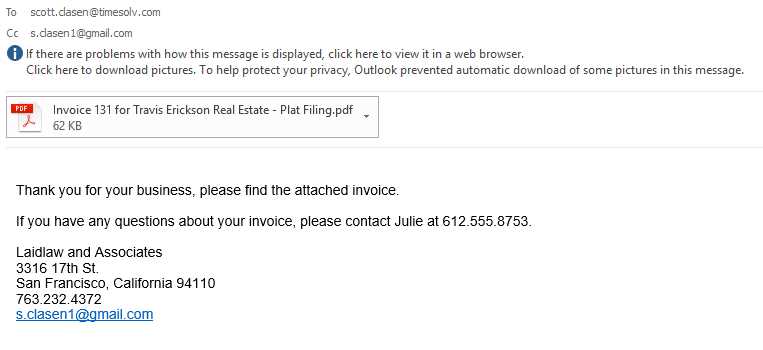

How to Add Payment Instructions to Emails

Including clear and detailed payment instructions in your communications is essential for ensuring that your clients can easily complete their transactions. Ambiguous or incomplete instructions can lead to confusion, delays, and frustration. By providing precise steps and multiple payment options, you help streamline the process and reduce the likelihood of missed or incorrect payments.

Steps for Writing Clear Payment Instructions

- State the Amount Due – Begin by clearly stating the amount that needs to be paid. This ensures that the recipient understands the exact sum and avoids any confusion about the total.

- List Available Payment Methods – Offer a range of payment options, such as credit cards, bank transfers, or online payment services like PayPal or Stripe. Provide the necessary details for each method (e.g., account numbers, links to payment platforms, etc.).

- Provide Account Information – If a bank transfer is one of the payment methods, include the bank name, account number, and any other required information, such as SWIFT or IBAN codes for international transfers.

- Explain How to Pay – Clearly describe the steps for each payment method. For example, if the client is paying through an online platform, explain how to navigate to the payment page and complete the transaction.

- Include a Due Date – Let the client know by when the payment should be made. This sets clear expectations and encourages prompt action. If necessary, mention any late fees that may apply for payments received after the due date.

Additional Tips for Effective Payment Instructions

- Keep it Simple – Avoid overly technical language. Use straightforward instructions to ensure that clients of all backgrounds can easily understand the payment process.

- Highlight Key Information – Use bold text or bullet points to draw attention to important details, such as the total amount due or the payment deadline.

- Offer Assistance – Include a line inviting the recipient to reach out if they encounter any problems or have questions about the payment process. This adds a level of customer service and can improve client satisfaction.

- Test the Payment Process – Before sending out payment instructions to clients, test the process yourself to ensure that all links and information are correct and that the transaction can be completed without issues.

By providing clear, organized, and easy-to-follow payment instructions, you make it easier for your clients to settle their accounts promptly. This not only improves your cash flow but also enhances your professional reputation.

Using Invoice Templates for Different Clients

Customizing your payment requests based on the type of client you are dealing with can enhance the professionalism of your communication and ensure the process runs smoothly. Each client may have different expectations, preferences, and business practices, and tailoring your request can lead to better relationships and prompt payments. Whether you’re working with individuals, small businesses, or large corporations, adapting your format and approach can be beneficial for both parties.

For example, individual clients may appreciate a simple and straightforward design, with clear payment instructions and minimal details. On the other hand, larger organizations may require more formal, structured requests that include detailed descriptions of services, tax information, and contractual terms. Understanding the specific needs of each client and adjusting your format accordingly ensures that the payment request is clear, accurate, and well-received.

By offering personalized communication for different clients, you help build trust and credibility, increasing the likelihood of timely payments and long-term business relationships.

Integrating Invoice Emails with Accounting Software

Streamlining your financial processes by connecting your payment request communications with accounting software can significantly improve efficiency and accuracy. Integration allows for automatic generation of payment reminders, faster billing cycles, and better tracking of outstanding amounts, all while reducing the potential for human error. By linking your client communication system with your accounting platform, you create a seamless flow of data that makes managing finances easier and more effective.

Benefits of Integration

- Time Savings – Automatically generated communications reduce the need for manual creation of payment requests, freeing up time for other tasks.

- Improved Accuracy – Direct integration between systems ensures that all financial data, such as amounts due and due dates, are correct and consistent.

- Real-Time Tracking – Integration allows for instant updates on payments, helping you monitor the status of transactions and better manage cash flow.

- Enhanced Reporting – By using integrated tools, you can generate detailed reports that combine both communication logs and financial data, providing deeper insights into your business’s financial health.

How to Integrate Systems

| Step | Action |

|---|---|

| 1. Choose Software | Select accounting software that offers integration with your preferred communication platform, such as QuickBooks, Xero, or FreshBooks. |

| 2. Link Accounts | Connect your accounting software with your client management or communication system. Many platforms offer direct integration options or third-party tools to facilitate this. |

| 3. Automate Data Sync | Set up automatic syncing between the two platforms. This ensures that all client details, amounts due, and other relevant information are updated in real time. |

| 4. Test the System | Before fully relying on the integration, test it with a few transactions to ensure that all data is flowing correctly between systems and that payment reminders are being sent as expected. |

| 5. Monitor and Adjust | Regularly check the integration’s performance and make adjustments as necessary to ensure it’s operating smoothly and meeting your business needs. |

Integrating your financial communications with accounting software is a smart way to optimize your billing process. By reducing manual work and enhancing accuracy, you can save time, reduce errors, and better manage your business’s finances.

How to Follow Up on Unpaid Invoices

Following up on unpaid bills is a critical part of maintaining a healthy cash flow. A polite and professional reminder can often resolve the issue quickly, while also preserving a positive relationship with the client. It’s important to approach the situation with clarity and tact, outlining the specifics of the unpaid amount while offering assistance if needed. By following a consistent and structured approach, you can encourage prompt payment without damaging your client relationships.

Steps for Following Up on Unpaid Bills

| Step | Action |

|---|---|

| 1. Send a Friendly Reminder | If the payment is only slightly overdue, send a gentle reminder. Politely ask if they’ve had the chance to review the outstanding balance and provide the necessary payment details again. |

| 2. Confirm Payment Terms | Clearly reiterate the payment due date and any agreed-upon terms, such as early payment discounts or late fees. This ensures both parties are on the same page regarding expectations. |

| 3. Highlight the Impact | Explain the consequences of continued non-payment, such as service suspension or additional charges, if applicable. Make sure to communicate this politely but firmly. |

| 4. Offer Flexible Payment Options | If the client is struggling to pay, consider offering different payment methods or a payment plan. Flexibility can help resolve the issue without escalating the situation. |

| 5. Escalate if Necessary | If the issue persists, consider sending a more direct message, possibly with a firm deadline for payment. Be clear about any steps you may take if the balance is not cleared within that time frame. |

| 6. Consider Legal Action | If the payment remains unpaid after several attempts, consult with a legal professional to explore options such as sending a formal demand letter or taking the matter to court. |

By following these steps, you can improve the chances of getting paid on time while maintaining a professional approach. Always ensure that communication remains polite and respectful, and tailor your follow-up messages to the specific situation of the client. This approach will help you manage overdue payments effectively and preserve strong client relationships.

How to Track Invoice Email Open Rates

Tracking the effectiveness of your communication is essential for understanding client engagement and ensuring that your payment reminders are being received. Knowing when and if a client opens your payment request message allows you to gauge the success of your outreach and follow up accordingly. By monitoring open rates, you can identify any potential issues with delivery, timing, or content, and optimize your future communications for better results.

To track how often clients open your messages, you can use specialized tools that provide detailed analytics, including open rates, click-through rates, and response times. These tools can help you determine the best time to send messages, the most effective subject lines, and the level of engagement with the content of your payment requests. Additionally, by tracking open rates, you can quickly follow up with clients who may have missed the message or are not responding to your initial communication.

Utilizing open rate tracking ensures that you can refine your communication strategy and take proactive steps to address any overdue payments, ultimately improving your cash flow management.