Self Employed Invoice Template for Easy and Professional Billing

When working independently, it’s crucial to present clients with clear and professional payment requests. Properly structured billing documents not only ensure timely payments but also reflect your credibility and attention to detail. Having an efficient way to create these documents can save you time and reduce the risk of errors.

Designing the right format for your payment requests can make all the difference. The right structure provides clarity on services rendered, amounts due, and deadlines. This simple yet effective tool will help streamline your financial operations, keeping everything organized and easy to manage.

Whether you’re a freelancer or a consultant, being able to generate well-structured documents quickly is essential. It helps avoid confusion and minimizes the back-and-forth with clients, ensuring a smooth transaction process every time.

Why You Need an Invoice Template

When working independently, having a consistent method of generating billing documents is essential for smooth transactions. A well-organized structure for your payment requests helps ensure all critical details are included and clear, reducing the chances of confusion or delay in receiving payment. By utilizing an efficient format, you can easily manage your financial records and avoid any unnecessary complications with clients.

Streamlining Your Workflow

By using a pre-designed document structure, you can save valuable time. Instead of creating a new billing request from scratch every time, you simply fill in the relevant details. This streamlined process not only boosts productivity but also ensures that your documents maintain a professional appearance, helping to establish trust with clients.

Consistency and Accuracy

Using a standard layout guarantees that all necessary information is consistently included in every payment request. It minimizes the risk of missing important details such as payment terms, itemized services, or due dates. This level of consistency is vital for maintaining professionalism and avoiding misunderstandings with clients.

| Benefit | Explanation |

|---|---|

| Efficiency | Quickly generate accurate documents without starting from scratch each time. |

| Professionalism | A clean, consistent layout reinforces your image as a reliable business partner. |

| Clarity | Ensure all necessary details are included, reducing confusion for clients. |

| Organization | Easily track outstanding payments and keep records organized for future reference. |

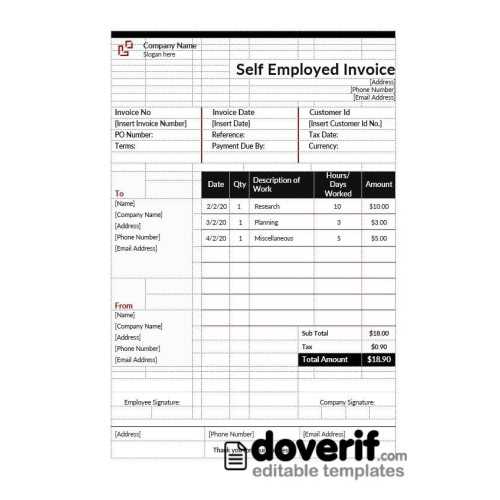

Choosing the Best Invoice Format

Selecting the right structure for your billing documents is crucial to maintaining professionalism and ensuring smooth transactions. The layout you choose should be both functional and visually appealing, making it easy for clients to understand the details of the services provided and the payment required. An effective format ensures all the necessary information is clearly presented, leaving no room for confusion or error.

Consider Your Business Type when deciding on a format. For simple one-time projects, a basic structure might be sufficient. However, if you’re dealing with ongoing contracts or multiple clients, you may need a more complex layout that can accommodate varying terms and details for each project.

Flexibility and customization are also important factors. You should be able to adjust your document based on the specific needs of each client, whether it’s adding discounts, tax details, or specific payment instructions. The ability to modify a layout quickly without compromising clarity will save you time and effort.

Lastly, make sure the format aligns with your branding. Including your logo, contact details, and a consistent design will enhance your business’s professional image. A well-structured billing document reflects your attention to detail and commitment to quality, which can lead to stronger client relationships and faster payments.

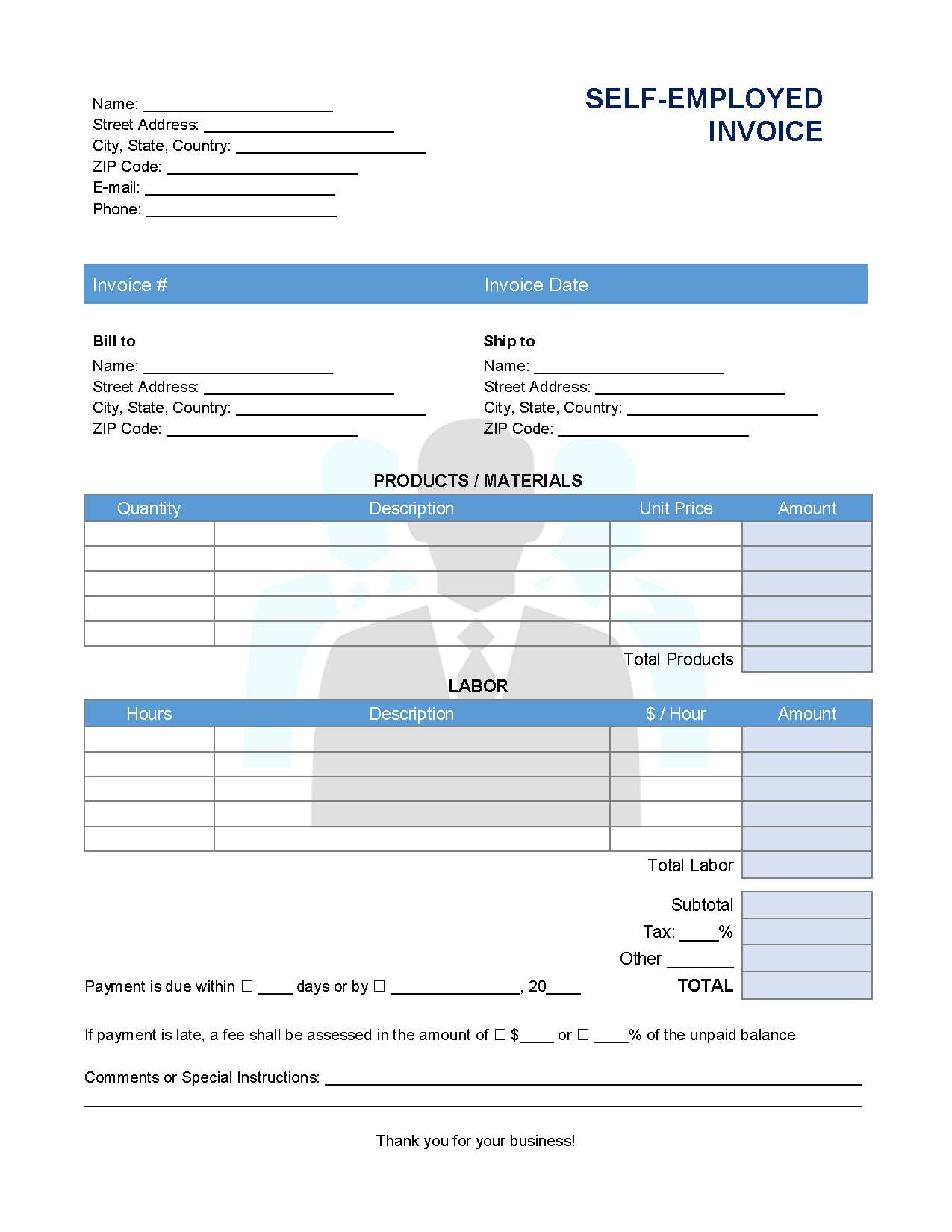

Key Elements of a Billing Document

When creating a payment request, it’s essential to include specific information that ensures clarity and avoids any potential confusion. The key components of such a document not only detail the services rendered but also set clear expectations regarding payment terms, helping to streamline the transaction process. Including all necessary elements in a clear, concise manner is critical for both you and your client.

Important Details to Include

- Your Business Information: Include your name, address, phone number, and email. This makes it easy for clients to contact you if needed.

- Client Information: Clearly state the client’s name and address to avoid any mix-ups.

- Unique Document Number: A unique identifier helps you track each request easily and organize records.

- Detailed Description of Services: Clearly outline what you’ve done, specifying the work performed, hours worked, or items provided.

- Payment Terms: Specify due dates and accepted payment methods, such as bank transfer, check, or online payments.

- Total Amount Due: Include a breakdown of the charges and the total payment required, ensuring no hidden fees or confusion.

Optional Yet Beneficial Elements

- Discounts or Credits: If you offer discounts, clearly note them to show transparency in pricing.

- Late Payment Fees: Include details on penalties for late payments, if applicable, to encourage timely settlement.

- Additional Notes: This section can be used to add custom instructions, thank-you notes, or any other important information.

Including all of these elements in your document will ensure that your request is clear, complete, and professional, reducing the chances of misunderstan

How to Customize Your Billing Document

Personalizing your billing requests allows you to tailor them to your business needs while maintaining a professional appearance. Customization not only reflects your brand identity but also makes it easier to communicate important details such as payment terms, services rendered, and any special instructions. A well-designed document can help foster trust and ensure timely payments.

Start with Your Branding by incorporating your logo, business colors, and contact details. This gives your documents a polished, cohesive look that aligns with your overall branding strategy. Include elements like your business name, email, phone number, and website to make it easy for clients to reach you if needed.

Adjust the Layout to fit the unique needs of your projects. If your work is project-based, you might want to include sections for different phases or milestones. For recurring services, consider adding a space for subscription details or payment frequency. Tailoring the structure ensures that the document remains useful and relevant, regardless of the type of work you perform.

Additionally, personalize the language to make it sound more aligned with your tone and communication style. Whether you prefer a formal approach or a more friendly, conversational tone, adjusting the wording helps to create a stronger connection with your clients.

Finally, always leave room for flexibility in your terms and conditions. You may need to adjust payment due dates, provide discounts, or add specific instructions depending on the client or project. Make sure your layout allows for easy changes while still keeping everything organized and clear.

Free vs Paid Invoice Templates

When choosing a layout for your billing documents, one of the first decisions you’ll face is whether to go with a free or paid version. Each option comes with its own set of advantages and trade-offs, depending on the complexity of your needs, your budget, and how much customization you require. Understanding the differences can help you make an informed choice that best suits your business.

Free Options are typically basic, offering essential features for generating billing documents without any upfront cost. These layouts are often easy to use and suitable for small businesses or freelancers just starting out. However, while free solutions are functional, they might come with limitations such as fewer customization options, fewer design choices, or mandatory branding from the service provider.

Paid Options provide more advanced features, including a greater range of professional designs, the ability to fully customize the layout, and integration with accounting software. These versions are ideal for businesses looking for more flexibility and who need additional functionalities such as automated reminders or recurring billing. The downside is the cost, which can range from a one-time fee to monthly or annual subscriptions.

When comparing these two, think about your specific business needs. If you’re just starting out or only need a simple document for occasional use, a free solution may be sufficient. However, if you’re dealing with multiple clients, ongoing projects, or require more tailored documents, investing in a paid service might be worth the cost.

Benefits of Using an Invoice Template

Using a pre-designed format for creating payment requests offers several advantages that can save time, improve organization, and enhance professionalism. These structured documents ensure that all necessary details are included in a clear and consistent manner, reducing the risk of errors and misunderstandings. With a standardized approach, you can focus more on the work at hand, while the billing process becomes faster and more efficient.

| Benefit | Description |

|---|---|

| Time Savings | Quickly generate professional documents without starting from scratch each time. |

| Consistency | Maintain a uniform format across all client communications, reducing confusion. |

| Professional Appearance | Present a polished, business-like image to clients, building trust and credibility. |

| Customization | Easily adjust the structure to meet specific client needs or project requirements. |

| Legal Compliance | Ensure you include all necessary information required by law, avoiding potential issues. |

Incorporating a ready-made structure into your workflow not only streamlines the process but also helps ensure that your documents remain organized and up to date. This can ultimately lead to smoother transactions and better relationships with clients.

How to Add Tax Information to Invoices

Including tax details in your billing documents is essential for compliance and transparency. Not only does it help ensure that you meet legal requirements, but it also provides clients with clear information about the amount they owe and the breakdown of charges. Properly including tax information also prevents misunderstandings and ensures a smooth transaction process.

The key is to make sure that your tax rates, calculations, and any relevant tax identification numbers are clearly presented in the document. Depending on your location and the nature of your business, the tax rate may vary, so it’s important to keep these details accurate and updated.

| Tax Detail | Explanation |

|---|---|

| Tax Identification Number (TIN) | Include your unique tax ID number, if applicable, to verify your business for tax purposes. |

| Applicable Tax Rate | Clearly indicate the tax percentage applied to the total amount of the services or goods provided. |

| Tax Breakdown | Show a separate line for tax charges to ensure clients see how much they are paying for taxes. |

| Exemptions or Discounts | If certain items or services are tax-exempt or discounted, specify these details in the document. |

By clearly displaying tax-related information in your billing documents, you ensure that both you and your clients have a transparent understanding of the amounts involved. This not only helps with record-keeping but also maintains professionalism in your business transactions.

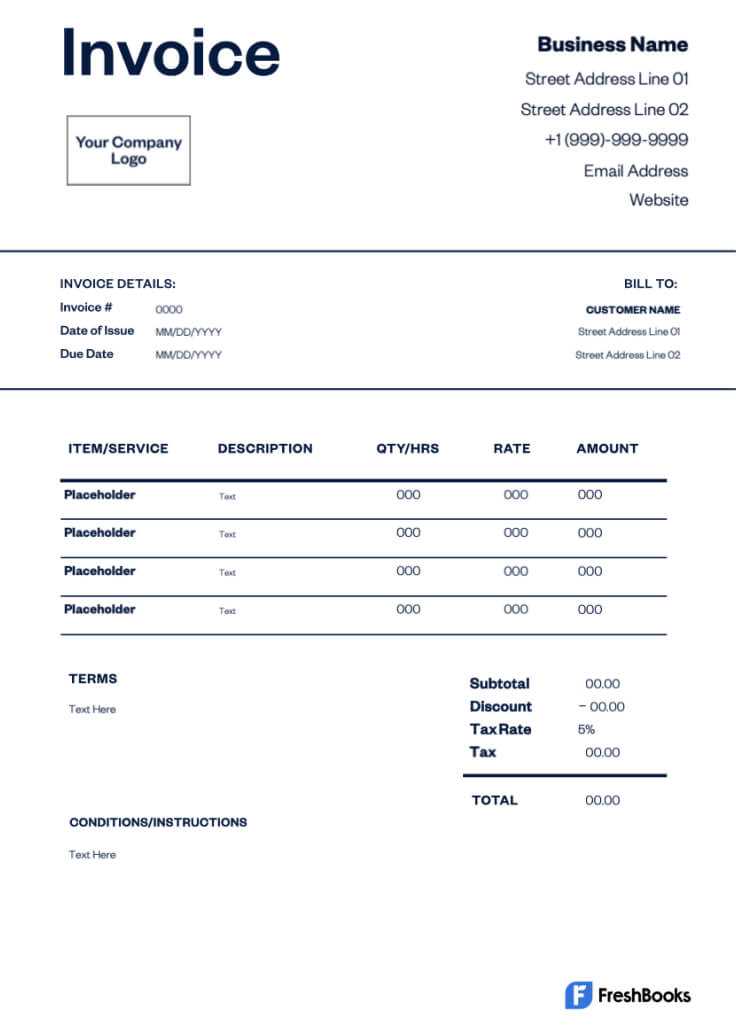

Incorporating Your Branding on Invoices

Adding your brand identity to billing documents is an effective way to reinforce your business image and maintain consistency across all client communications. When clients receive a payment request that reflects your brand, it not only looks more professional but also helps to establish trust and recognition. Customizing the design of your document ensures that every interaction with your clients aligns with the visual identity you’ve worked to create.

There are several key elements to consider when adding your branding to billing documents:

- Logo: Include your business logo at the top of the document, ensuring it’s prominently displayed. This helps clients easily recognize your brand.

- Business Name: Your business name should be clear and easy to read, typically placed near the top alongside your logo.

- Color Scheme: Use your brand’s colors throughout the document to create a cohesive look that aligns with your marketing materials.

- Font Style: Choose fonts that reflect your brand’s personality. Whether it’s modern, classic, or playful, make sure the font is legible and professional.

- Contact Information: Include your business’s contact details such as email, phone number, and website to make it easy for clients to reach you.

Incorporating these elements into your payment requests doesn’t just enhance their appearance; it also contributes to brand recognition, reminding clients of who you are and what your business stands for. By keeping your documents aligned with your overall branding strategy, you present a unified and professional image that builds credibility over time.

Managing Multiple Clients with One Template

When you work with several clients, maintaining consistency in your billing documents is essential. Using a standardized structure allows you to efficiently manage different clients while keeping all the necessary details organized. You can tailor each document to suit the specific needs of each client without having to create something from scratch each time. This approach simplifies your workflow and ensures that you don’t overlook important information.

One of the biggest advantages of using a consistent format is the ability to quickly adapt it for different clients. With a single layout, you can easily update the client name, project details, amounts, and payment terms. This flexibility saves you time and reduces the chances of making errors when working with multiple projects or clients simultaneously.

Customizing for Each Client involves adding specific details like services rendered, personalized messages, or even unique discounts. The structure remains the same, but the content changes based on the client’s requirements, ensuring that each request is both accurate and relevant.

By using a single layout for all clients, you can also track payments more easily. Since all your documents follow the same format, it’s simpler to store and retrieve them, helping you stay on top of outstanding payments and record keeping. This consistency contributes to better organization and more efficient financial management.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s easy to overlook certain details, especially when you’re managing multiple clients or projects. However, small mistakes can lead to confusion, delayed payments, or even damage to your professional reputation. By being aware of common errors and knowing how to avoid them, you can ensure that your payment requests are accurate, clear, and effective.

| Mistake | Explanation |

|---|---|

| Incorrect or Missing Contact Information | Always ensure that your contact details are correct and up to date. Missing information can delay payments or cause communication problems. |

| Unclear Payment Terms | Clearly specify the payment due date, accepted methods, and any late fees. Vague terms can lead to misunderstandings and late payments. |

| Missing or Incorrect Tax Details | Double-check tax rates, calculations, and your tax identification number. Errors in tax information can cause complications with your client or local authorities. |

| Not Itemizing Services | Failing to break down services or goods provided can confuse your client and lead to disputes over charges. Always provide detailed descriptions. |

| Omitting a Unique Invoice Number | Each request should have a unique reference number to help you and your client track payments and avoid confusion in the future. |

By being mindful of these common mistakes, you can create professional, accurate, and easy-to-understand payment requests that will improve your chances of getting paid on time and maintaining positive relationships with clients.

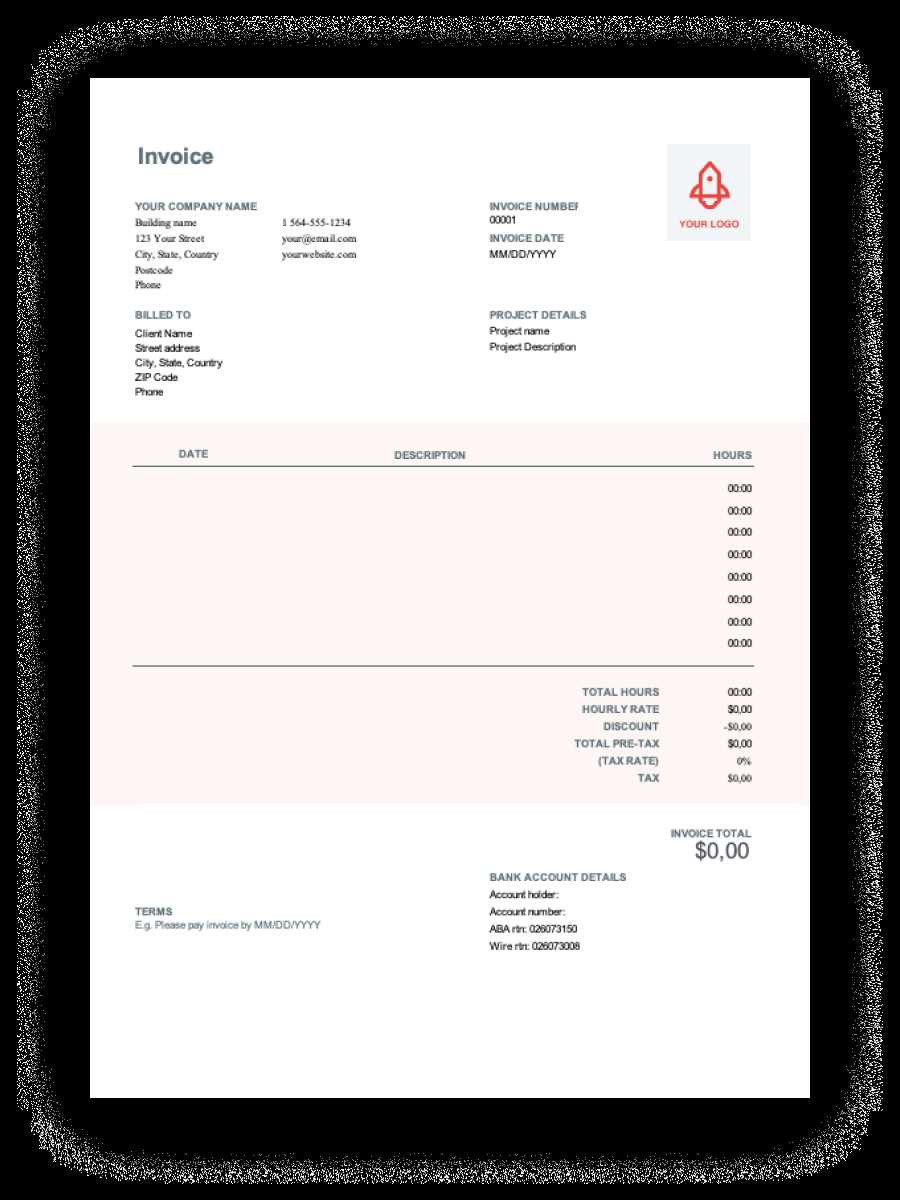

How to Calculate Invoice Totals Accurately

Calculating the total amount due for a payment request requires attention to detail. It’s crucial to include all charges, taxes, and any applicable discounts to ensure accuracy. A well-calculated total not only helps in maintaining transparency but also prevents disputes or confusion with clients. This section outlines the key steps to ensure that your totals are correct every time you send a payment request.

Step-by-Step Calculation

To accurately calculate the total, follow these basic steps:

- List all Services or Products: Include each item, with a brief description and the associated cost. If applicable, include the number of units or hours worked.

- Calculate Subtotals: Multiply the quantity of each item or service by its rate to find the subtotal for each line item.

- Add Taxes: Apply the appropriate tax rate to the subtotal. Make sure you use the correct local or national tax rate depending on your business location.

- Apply Discounts or Adjustments: If you offer a discount, subtract it from the subtotal or apply it after tax calculation, depending on your pricing structure.

- Calculate the Total: Add up all subtotals, taxes, and adjustments to find the final total amount due.

Example Breakdown

| Description | Amount |

|---|---|

| Service 1 (5 hours @ $50/hour) | $250 |

| Service 2 (3 hours @ $75/hour) | $225 |

| Subtotal | $475 |

| Tax (10%) | $47.50 |

| Discount (5%) | -$23.75 |

| Total Due | $498.75 |

Following these steps will help ensure that all charges are accurately calculated and that your client understands the breakdown of costs. Keeping calculations clear and transparent builds trust and helps avoid delays or confusion when it’s time to process payment.

Sending and Tracking Invoices Efficiently

Efficiently managing payment requests is essential for maintaining smooth business operations and ensuring timely payments. Sending them promptly and keeping track of their status helps you stay organized and reduces the chances of overlooking overdue payments. By streamlining the process, you can focus more on your work while ensuring that financial transactions are handled seamlessly.

Methods for Sending Payment Requests

There are several ways to send your billing documents, each offering its own set of advantages:

- Email: The most common method for sending payment requests, as it is fast and allows you to easily attach documents. You can also include a personalized message, which can help maintain good client relationships.

- Online Payment Platforms: Services like PayPal or Stripe allow you to send payment requests directly through their platform. These services often include tracking tools and automatic reminders, making it easier to manage payments.

- Postal Mail: For clients who prefer traditional methods or when an official printed copy is required, sending physical copies may be necessary, though it is slower and often less efficient.

Tracking and Managing Payments

Once you’ve sent your payment request, it’s important to keep track of its status to ensure it’s processed on time:

- Use Tracking Tools: Many online platforms provide tools to track the status of your payment requests. You can see if the client has received or viewed the document, and whether payment has been made.

- Set Payment Reminders: Automated reminders can help you follow up on outstanding payments without having to manually keep track of due dates. Many invoicing systems or online payment platforms offer this feature.

- Maintain Organized Records: Keep a log of all sent documents, including their due dates, amounts, and payment status. This can be done with simple spreadsheets or with dedicated accounting software for more advanced tracking.

By adopting a systematic approach to both sending and tracking your billing documents, you can stay on top of your finances, avoid overdue payments, and ensure that your cash flow remains steady and predictable.

Legal Requirements for Self Employed Invoices

When issuing billing documents, it’s essential to ensure that they meet all legal and tax requirements in your jurisdiction. Failing to comply with these regulations could result in delays, penalties, or complications with tax authorities. Understanding the mandatory details and formatting can help you maintain professionalism and stay compliant with the law.

Here are the key legal requirements you should include when preparing payment requests:

- Business Information: Always include your full legal business name, address, and contact information. If applicable, include your business registration number or tax ID (TIN).

- Client Information: The recipient’s name and address should also be clearly displayed, especially for formal transactions or legal purposes.

- Unique Reference Number: Each document must have a unique identifier to distinguish it from others. This is essential for record-keeping and tax purposes.

- Clear Description of Services: A detailed description of the products or services provided, including quantities and rates. This transparency helps prevent disputes and ensures that both parties understand the charges.

- Payment Terms: Specify the payment due date, the total amount due, and any applicable late fees for overdue payments. This helps establish clear expectations for both parties.

- Tax Information: If applicable, you must include the relevant tax rate and the amount of tax charged. Also, make sure to provide your tax identification number if required by local tax laws.

- Currency: Indicate the currency used for the transaction, especially if dealing with international clients.

Complying with these legal requirements not only ensures that your payment requests are legitimate but also protects your business in case of disputes or audits. By adhering to local laws, you demonstrate professionalism and help facilitate smoother transactions with your clients.

Invoice Template Software Options

Using specialized software for creating and managing payment requests can significantly streamline your billing process. These tools not only save time but also offer features that help ensure accuracy, compliance, and professionalism in your documents. With a range of options available, you can choose the software that best suits your needs and business structure.

Here are some popular software options to consider:

- QuickBooks: This well-known accounting software offers comprehensive invoicing features that allow you to create customized payment requests, track payments, and manage finances in one place. It’s especially useful for businesses that need detailed accounting features.

- FreshBooks: FreshBooks is a cloud-based tool designed for small businesses and freelancers. It provides easy-to-use invoicing capabilities along with time tracking, project management, and expense tracking features, making it ideal for service-based businesses.

- Wave: A free, cloud-based option that offers professional-looking payment request designs. Wave is great for freelancers and small business owners looking for an easy solution without a subscription fee. It also includes features for accounting and receipts.

- Zoho Invoice: This software allows you to create customized documents and automate follow-up reminders. It also integrates with Zoho’s suite of tools for project management and time tracking, providing a seamless experience for businesses of all sizes.

- Invoicely: A flexible and user-friendly tool for creating professional billing documents. Invoicely offers both free and paid plans, with options for unlimited invoices and clients on the premium plans. It’s ideal for those who need to send recurring requests or work with international clients.

Each of these software options comes with its own set of features, so it’s important to consider your business’s unique needs when selecting the right tool. Whether you need advanced accounting capabilities, easy customization, or simple invoicing, there’s a solution that can make your billing process more efficient and professional.

How to Set Payment Terms in Invoices

Setting clear and specific payment terms is an essential aspect of managing business transactions. Well-defined terms help avoid misunderstandings between you and your clients, ensure that payments are made on time, and allow you to maintain a steady cash flow. Whether you’re providing goods or services, clearly outlining when and how payment should be made protects both parties involved.

Key Elements to Include in Payment Terms

When setting payment terms, you need to specify several key elements to ensure clarity and avoid confusion:

- Payment Due Date: Clearly state the date by which the payment should be made. Typical terms include “Net 30” (payment due in 30 days), “Net 15,” or immediate payment (“Due on Receipt”).

- Accepted Payment Methods: Indicate which methods of payment are acceptable, such as bank transfer, credit card, PayPal, or checks.

- Late Fees: Specify any penalties for late payments. For example, a common practice is to charge a percentage of the total due each month after the payment due date.

- Discounts for Early Payment: Offering discounts for early settlement of bills can encourage clients to pay ahead of schedule. For example, a “2/10, Net 30” term offers a 2% discount if payment is made within 10 days.

- Currency: Indicate the currency in which payment should be made, especially if you’re dealing with international clients.

Example Payment Terms

| Description | Amount |

|---|---|

| Goods purchased (10 units) | $500 |

| Discount for early payment (2%) | -$10 |

| Subtotal | $490 |

| Due Date: 30 days from issue | Due by: [Date] |

| Late Fee: 5% per month | After [Due Date] |

Including detailed payment terms not only helps ensure that you get paid on time but also protects your business financially. It also builds a level of professionalism and trust with your clients, making the payment process smoother for both parties.

Creating Recurring Invoices for Clients

When you have clients who require regular billing, setting up recurring payment requests can save time and ensure consistency in your cash flow. Recurring transactions are common in businesses that offer subscription-based services, maintenance contracts, or ongoing consulting. Automating this process helps reduce administrative work and minimizes the risk of missed payments.

Here’s how to create effective recurring payment requests:

Setting Up Recurring Billing

To set up a recurring billing cycle, you need to determine the frequency and structure of the payments. This includes deciding on:

- Billing Frequency: Define how often the client will be billed–weekly, monthly, quarterly, or annually.

- Service Duration: Decide whether the recurring charge will continue indefinitely, for a fixed period, or until canceled by either party.

- Amount and Terms: Clarify the amount due each time, whether it includes taxes, discounts, or other adjustments. Clearly state the due date for each cycle (e.g., the 1st of every month).

Automating the Process

Many invoicing platforms allow you to automate recurring payments, which can be particularly helpful for businesses that deal with numerous clients. By automating the process, you can:

- Reduce Manual Work: Avoid the need to manually create each billing request by setting up the recurring cycle once.

- Ensure Timeliness: Automate reminders and notifications to clients when a payment is due, reducing the risk of late payments.

- Increase Client Retention: Clients appreciate the convenience of automated billing. This can lead to better customer retention and smoother relationships.

When setting up recurring payments, it’s crucial to keep clients informed about the billing schedule. You should clearly communicate when charges will occur and ensure that they can easily update their payment details if needed. This transparency builds trust and minimizes disputes over payments.