How to Create a Template for Outstanding Invoices

Efficient management of financial transactions is essential for any business. One key aspect of maintaining smooth operations is ensuring that payment requests are clear, professional, and easy to process. Whether you’re a freelancer, small business owner, or part of a larger organization, having the right structure for your payment requests can save time and reduce errors.

Designing a well-organized document that clearly outlines the amount due, due date, and payment instructions is crucial. By using a structured format, you can help clients understand exactly what is expected, which in turn improves the likelihood of timely payment. A professional appearance adds credibility and strengthens business relationships.

Customizing these documents to fit your unique needs can make the billing process more efficient and effective. Incorporating specific terms, payment options, and additional details can ensure a smoother experience for both parties involved. In this article, we’ll explore how to create and refine your financial documents for improved results.

Understanding the Importance of Invoice Templates

Effective billing is a critical aspect of business operations, ensuring smooth financial transactions between a company and its clients. Without a standardized format, payment requests can become confusing or unprofessional, which may lead to delayed payments or misunderstandings. By utilizing a pre-designed structure, businesses can streamline this process and maintain clarity in all communications related to financial obligations.

Consistency in Professional Communication

Having a uniform approach to creating payment requests helps maintain a consistent and professional image. It provides both parties with a clear understanding of the terms, amount due, and payment instructions. A well-crafted document reflects positively on your business, fostering trust and credibility with your clients.

Improved Efficiency and Accuracy

Standardized documents minimize the chances of human error and omissions. By using a pre-set format, businesses ensure that all necessary information is included every time, reducing the time spent on drafting and editing. This consistency not only speeds up the billing process but also enhances accuracy, preventing costly mistakes that could affect cash flow.

Why Use a Template for Invoices

Having a pre-designed structure for billing ensures consistency and reduces the chances of missing crucial details. A standardized approach not only saves time but also helps businesses maintain a professional appearance in their financial dealings. Whether you handle a few transactions or manage hundreds, utilizing a well-organized layout is key to smooth operations and timely payments.

Time-Saving Benefits

Creating a new payment request from scratch each time can be time-consuming. By using a consistent format, much of the work is already done, allowing you to quickly fill in the necessary details. This leads to faster processing and less time spent on administrative tasks, freeing you up to focus on other aspects of your business.

Minimized Risk of Errors

With a predefined format, the likelihood of missing important information–such as payment terms, contact details, or due dates–is significantly reduced. By following a set structure, you ensure that all relevant data is included and presented clearly, which helps avoid confusion and disputes down the line.

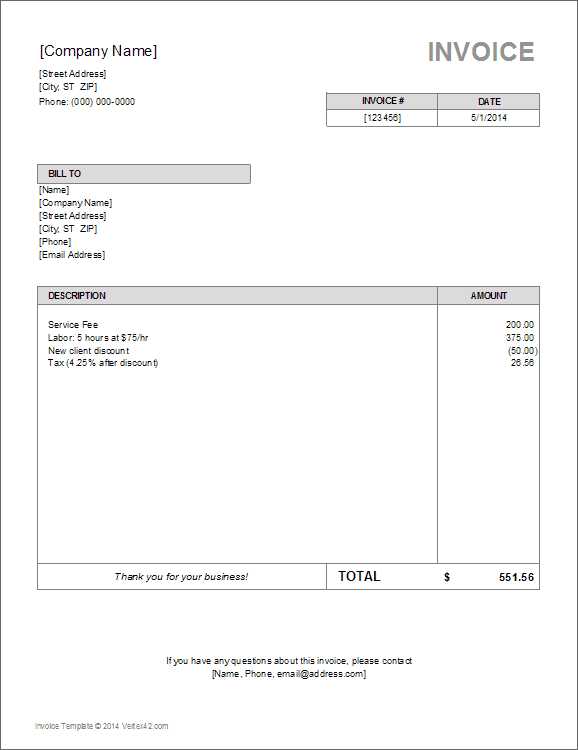

Key Elements of an Invoice Template

To ensure that payment requests are clear and effective, it is essential to include several key components. These elements not only provide necessary information but also help establish professionalism and clarity for the client. A well-organized document will minimize confusion and enhance the likelihood of prompt payment.

Essential Information to Include

The following details are crucial for creating a complete and understandable billing document:

- Business Details: Your company’s name, address, and contact information.

- Client Information: The recipient’s name, address, and any relevant contact details.

- Unique Identifier: A reference number to track the document and ensure it’s not confused with others.

- Payment Terms: Clear instructions regarding due dates, penalties for late payments, and acceptable payment methods.

- Breakdown of Charges: A list of services or products provided, with individual prices and any applicable taxes.

- Total Amount Due: The final amount, clearly outlined and easy to read.

Formatting Tips for Clarity

Proper organization and legibility are essential when creating financial documents. Consider these formatting suggestions to enhance readability:

- Use Clear Sections: Divide the document into logical sections, such as contact details, billing items, and payment instructions.

- Bold or Highlight Key Information: Make the total amount due, payment terms, and due date stand out to avoid confusion.

- Keep It Simple: Avoid clutter by focusing on essential details and keeping the design clean and professional.

How to Customize Your Invoice Template

Customizing your payment request document allows you to tailor it to your specific business needs. A personalized approach not only improves the document’s clarity but also enhances your brand’s professionalism. By adjusting various elements, you can ensure that the document aligns with your business’s identity and effectively communicates all necessary details to the client.

Here are a few key areas to focus on when customizing your billing document:

| Element | Customization Tip |

|---|---|

| Branding | Add your logo and adjust the color scheme to match your brand identity. |

| Contact Details | Ensure your business address, phone number, and email are up to date. |

| Payment Terms | Specify your preferred payment methods and any late payment penalties or discounts. |

| Item Descriptions | Modify the layout of product or service descriptions to suit your offerings. |

| Due Date | Clearly highlight the payment due date to avoid confusion. |

These adjustments ensure that your payment requests are not only functional but also align with your company’s image and client expectations. By making your documents distinctive and organized, you create a positive impression and help facilitate smooth transactions.

Common Mistakes to Avoid in Invoices

When creating payment requests, even small errors can lead to confusion, delays, or missed payments. Ensuring that all the information is accurate and clearly presented is key to maintaining professional relationships and efficient cash flow. Below are some common mistakes businesses make when preparing these documents and how to avoid them.

Missing or Incorrect Information

One of the most common mistakes is failing to include or incorrectly listing key details such as the amount due, payment terms, or client contact information. Always double-check the following:

- Client’s Name and Address: Ensure all recipient details are accurate to avoid confusion.

- Due Date: Be clear about the payment deadline and any applicable late fees.

- Itemized Charges: Ensure that all products or services are correctly listed with appropriate pricing.

Unclear Payment Instructions

Vague or missing payment instructions can cause delays. Clients need clear guidance on how to pay and which methods are acceptable. Always specify:

- Payment Methods: Indicate if payments are accepted by bank transfer, credit card, or online payment platforms.

- Banking Details: Provide complete and accurate payment information if relevant.

- Reference Information: Include any reference number or code that the client should use when making payment.

By avoiding these common errors, you can create clear, effective payment requests that minimize the risk of confusion and ensure timely payments.

Benefits of Professional Invoice Design

Having a well-designed payment request document not only improves clarity but also strengthens your brand’s image and credibility. A clean and organized layout ensures that essential details stand out, making it easier for clients to process payments promptly. A professional-looking document can also foster trust and reflect positively on your business operations.

Here are some key advantages of using a polished and structured design:

| Benefit | Explanation |

|---|---|

| Improved Brand Image | A professionally designed document reflects your business’s commitment to quality and attention to detail, creating a positive impression with clients. |

| Clear Communication | An organized layout ensures that the client can easily understand the payment amount, terms, and instructions, reducing the likelihood of misunderstandings. |

| Faster Payment Processing | Clear and visually appealing designs make it easy for clients to locate important information, such as due dates and payment options, which can speed up payment processing. |

| Minimized Errors | With a structured approach, you’re less likely to forget key details, ensuring that all necessary information is included and correctly formatted. |

| Increased Client Trust | When clients receive well-organized and polished documents, they are more likely to view your business as trustworthy and reliable, fostering long-term relationships. |

By investing time into creating a clear, professional design, you not only improve the billing process but also enhance the overall perception of your business, leading to better client interactions and smoother financial transactions.

Choosing the Right Invoice Software

Selecting the right software for generating payment requests can significantly impact the efficiency of your business operations. The right tool can streamline your billing process, improve accuracy, and save you time. However, with so many options available, it’s important to consider a variety of factors to ensure that the software aligns with your needs and business requirements.

Here are key considerations to keep in mind when choosing invoicing software:

- Ease of Use: Choose a platform that is intuitive and user-friendly, allowing you to create, send, and track requests without a steep learning curve.

- Customization Options: Ensure the software allows you to personalize payment documents, so they reflect your branding and business identity.

- Integration Capabilities: Look for software that integrates easily with your accounting, CRM, or other business systems to streamline processes and avoid duplication of data.

- Payment Gateway Support: Select a tool that enables easy integration with online payment methods, so your clients can pay quickly and conveniently.

- Automated Reminders: Consider software that sends automatic reminders for overdue payments to help you stay on top of outstanding balances.

- Reporting and Analytics: Choose a platform that provides insights into your payment history, outstanding amounts, and client behavior, which can help improve cash flow management.

By selecting invoicing software that meets these criteria, you can ensure that your payment request process is efficient, professional, and scalable as your business grows.

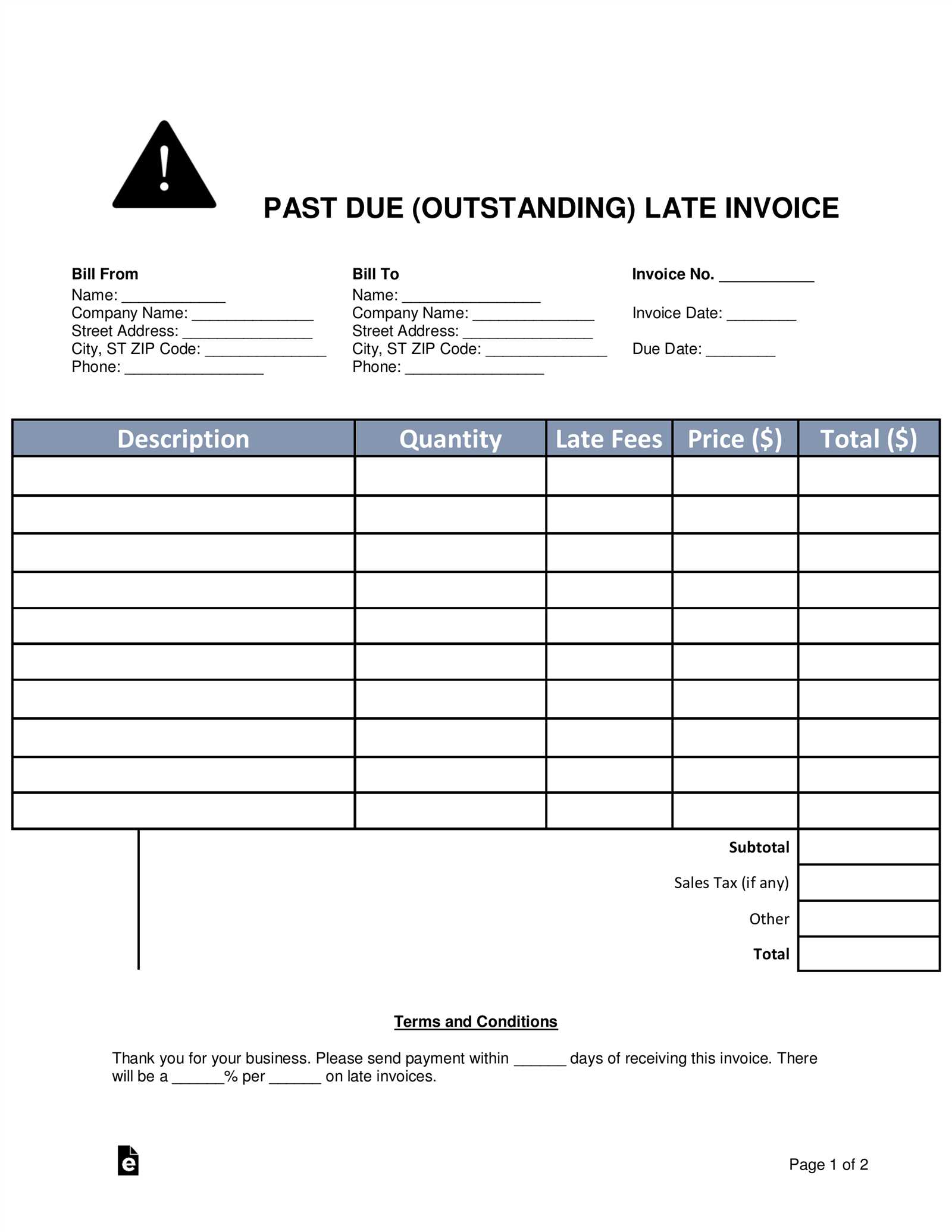

Legal Considerations for Outstanding Invoices

When dealing with unpaid balances, it’s important to be aware of the legal framework that governs payment requests. Understanding the legal obligations for both parties–businesses and clients–can help prevent disputes and ensure that all transactions are handled properly. From outlining payment terms to understanding collection practices, proper legal awareness ensures smoother financial operations and helps protect your business interests.

Key Legal Elements to Include

To minimize legal risks, it’s essential to include specific clauses and details in your payment requests. These elements not only clarify expectations but also ensure that you’re compliant with applicable laws:

| Legal Element | Purpose |

|---|---|

| Payment Terms | Clearly outline the payment deadline, late fees, and any applicable interest charges in case of delayed payments. |

| Service/Product Descriptions | Provide detailed descriptions to avoid disputes over the goods or services provided. |

| Jurisdiction Clause | Specify the legal jurisdiction that will handle disputes, in case of non-payment or disagreements. |

| Refund/Return Policy | Clarify the conditions under which refunds or returns are acceptable, if applicable to your services or products. |

Handling Non-Payment Legally

If payment isn’t received by the due date, there are several steps you can take while adhering to legal guidelines:

- Send Formal Reminders: Remind clients of their outstanding balance in a formal and polite manner, following the communication terms outlined in your agreement.

- Legal Action: If payment remains unpaid after multiple reminders, you may need to consider legal action, such as involving a collections agency or pursuing court proceedings, depending on the size of the debt and the terms in your agreement.

- Know Your Rights: Be familiar with debt collection laws in your jurisdiction to ensure you follow the correct procedures when pursuing unpaid balances.

By including clear legal terms and understanding your options in case of non-payment, you can protect your business and improve the chances of receiving timely payments.

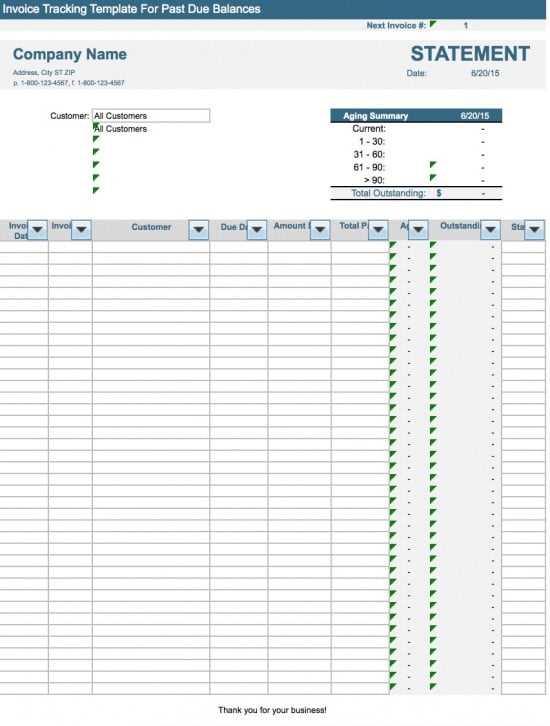

How to Organize Outstanding Invoice Records

Properly organizing unpaid payment requests is crucial for managing cash flow and ensuring that no transaction slips through the cracks. By creating an efficient system for tracking and managing pending balances, businesses can prioritize follow-ups, monitor payment status, and take timely action when necessary. An organized approach helps reduce errors, maintain accurate records, and improve overall financial management.

Setting Up a Record-Keeping System

To effectively track unpaid balances, businesses should implement a consistent record-keeping system. Here are key components to consider when setting up this system:

- Digital Tools: Utilize accounting software or spreadsheets to store and track payment records. This allows easy access and faster updates.

- Record Details: For each unpaid balance, ensure the record includes the client’s name, contact details, services or products provided, due date, amount owed, and any follow-up notes.

- Tracking Payment Status: Regularly update the status of each balance–whether it’s pending, overdue, or partially paid–to keep everything up to date.

Categorizing and Prioritizing Balances

Once payment records are established, categorizing and prioritizing them can help streamline follow-ups. Consider the following approaches:

- By Due Date: Organize records by due date to quickly identify overdue accounts and prioritize follow-ups.

- By Client: Group records by client to easily track the history of their payments and identify recurring issues.

- By Amount Due: Prioritize larger balances first to ensure that the most significant payments are addressed promptly.

By establishing a well-organized system and regularly updating records, businesses can maintain better control over their financial operations, improving both client relationships and cash flow management.

Setting Payment Terms in Invoice Templates

Clearly defining payment terms is crucial for both businesses and clients, as it sets expectations and helps avoid confusion regarding when and how payments should be made. Including detailed terms in payment requests ensures transparency, reduces disputes, and improves cash flow management. Establishing clear conditions also provides a framework for late fees or interest charges in case of delayed payments.

Essential Elements of Payment Terms

When setting payment terms, it’s important to include the following key elements to ensure clarity and avoid any misunderstandings:

- Due Date: Specify the exact date by which payment must be made. This is often set within a certain number of days from the date of issue (e.g., “Net 30” means payment is due 30 days after the request is issued).

- Accepted Payment Methods: Clearly outline the methods through which payments can be made (bank transfer, credit card, check, etc.).

- Late Payment Penalties: Specify any late fees or interest charges that will apply if the payment is not made by the due date.

- Discounts for Early Payment: Offer an incentive for early payment (e.g., “2% discount if paid within 10 days”).

How to Communicate Payment Terms Effectively

To ensure clients understand the payment terms, consider these best practices:

- Highlight Key Information: Bold or underline important details such as the due date, late fees, and payment methods to make them stand out.

- Be Clear and Concise: Avoid vague language and use simple, direct wording so there is no confusion about expectations.

- Include a Reminder: If the terms allow for payment reminders, mention this explicitly, letting the client know when they can expect to hear from you if payment is not received by the due date.

By setting clear, concise, and fair payment terms, businesses can build trust with their clients, improve payment timelines, and reduce the potential for late payments.

How to Track Unpaid Invoices Efficiently

Effectively managing unpaid payment requests is essential for maintaining healthy cash flow and ensuring timely collection. Without a proper system in place, it can be easy to overlook or forget about overdue balances, leading to delays in payment and potential issues with clients. By using a well-organized tracking system, you can monitor outstanding amounts, follow up on overdue payments, and keep everything in order for financial clarity.

Steps to Track Unpaid Balances

To track unpaid amounts efficiently, consider the following steps:

- Set Up a Centralized Tracking System: Use accounting software, spreadsheets, or a dedicated invoicing platform to centralize all unpaid records. This will allow you to easily access and update payment information.

- Monitor Payment Deadlines: Keep a close eye on due dates. Organize payment records by date to quickly identify overdue payments and take timely action.

- Review Records Regularly: Schedule regular reviews (weekly or bi-weekly) to ensure that any unpaid balances are noted and that follow-ups are completed on time.

Automating and Streamlining the Process

Automation can significantly improve the efficiency of your payment tracking system. Here are ways to streamline the process:

- Automated Reminders: Set up automatic payment reminders for clients as their due date approaches, and send follow-ups for overdue balances.

- Use Payment Status Indicators: Many accounting tools offer color-coded indicators to show the status of each balance (e.g., “paid,” “pending,” “overdue”). These visual cues make it easy to spot issues quickly.

- Invoice Scheduling: Consider scheduling invoices in advance or using recurring billing for clients with regular payments, reducing the need for manual tracking.

By implementing these strategies, you can stay on top of unpaid balances, improve your collection process, and ensure more consistent cash flow.

Automation Tools for Invoice Management

Managing payment requests manually can be time-consuming and error-prone. Automation tools can streamline the process, saving time and reducing the risk of mistakes. These tools help businesses generate, track, and follow up on payment records with minimal effort, improving efficiency and ensuring a more organized approach to managing financial transactions.

Key Features of Automation Tools

When selecting automation software for payment management, consider the following features:

- Automatic Billing: Set up recurring invoices for regular clients or services, reducing the need for manual entry each time.

- Payment Reminders: Automatically send reminders to clients before and after payment deadlines to ensure timely payments.

- Customizable Templates: Use pre-built, customizable templates that allow you to easily adjust each request based on your specific needs.

- Integration with Accounting Software: Sync payment records with accounting platforms for real-time tracking and seamless financial reporting.

- Multi-Payment Method Support: Offer clients a variety of payment options, such as credit card, bank transfer, or digital wallets, directly from the invoice.

Popular Automation Tools

Here are some popular tools designed to automate the management of payment records:

- QuickBooks: A widely used accounting software that offers automatic invoicing, payment tracking, and reminders for overdue amounts.

- FreshBooks: A cloud-based solution designed for small businesses that streamlines invoicing, time tracking, and payment reminders.

- Zoho Invoice: An easy-to-use platform that offers customizable templates, recurring billing, and automatic payment reminders.

- Invoicely: A simple invoicing tool that supports automatic billing, recurring invoices, and integrates with popular payment gateways.

By leveraging automation tools, businesses can save time, reduce administrative burden, and ensure timely payments, helping to maintain smoother cash flow and better client relationships.

Design Tips for Clear Invoices

Creating a clear and well-organized payment request is essential for ensuring that clients understand the details of the transaction without confusion. A professionally designed document not only helps clients quickly find the necessary information but also reflects positively on your business. An effective layout should focus on clarity, readability, and ease of navigation.

Here are some design tips to ensure your payment requests are both professional and easy to understand:

- Use a Simple and Clean Layout: Avoid clutter by using a clean and simple layout. Space out sections, use clear headings, and align text neatly. A well-organized structure helps clients focus on the essential details.

- Highlight Key Information: Ensure that critical elements like the due date, amount due, and payment instructions stand out. Use bold or larger font sizes for these sections to make them easy to spot.

- Include Clear Item Descriptions: For each service or product provided, include a brief but clear description. This ensures that the client knows exactly what they are being billed for.

- Keep Typography Legible: Choose easy-to-read fonts and ensure that font sizes are appropriate. Use headings for section titles and avoid using too many different font styles or sizes, which can be distracting.

- Incorporate Your Branding: Use your company’s logo, color scheme, and other branding elements to create a cohesive, professional look that represents your business identity.

- Leave Room for Additional Notes: Include space for any extra instructions, terms, or personalized messages. This can help clarify specific details or provide additional payment options to your clients.

By focusing on these design principles, you can create payment documents that not only look professional but are also easy for your clients to navigate and understand. This leads to faster processing, fewer misunderstandings, and better client relationships.

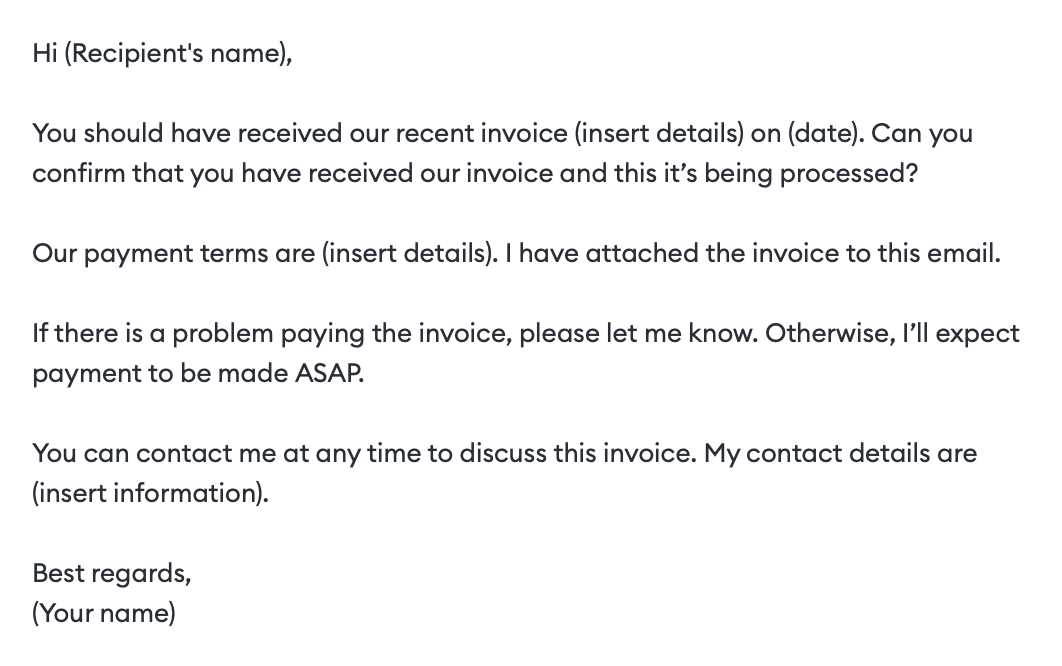

How to Handle Late Payments Effectively

Dealing with delayed payments is an inevitable part of running a business, but how you manage them can have a significant impact on your cash flow and client relationships. Timely follow-ups, clear communication, and a structured approach can help you handle late payments effectively, ensuring that your business remains financially stable while maintaining professionalism in client interactions.

Steps to Take When Payments Are Late

When a payment is overdue, it’s crucial to act promptly but tactfully. Here are steps to take to manage the situation effectively:

- Send a Friendly Reminder: Often, clients simply forget about due dates. Sending a polite, friendly reminder a few days after the due date can prompt immediate action.

- Check Payment Details: Double-check that all payment information provided is correct, including bank details or payment methods, to ensure there were no issues on your end.

- Send a Formal Follow-Up: If the payment is still pending after the initial reminder, send a more formal follow-up letter or email. This should include the original payment details, the new due date, and any applicable late fees.

- Offer Payment Plans: If a client is struggling financially, offering a structured payment plan or an extended deadline can help maintain a positive relationship while still securing payment over time.

Establishing Policies to Prevent Delays

To minimize the likelihood of late payments in the future, consider implementing clear payment policies and terms. Here’s how:

- Set Clear Terms Upfront: Always ensure that your payment terms are communicated clearly at the start of any project or transaction. This includes payment due dates, acceptable payment methods, and any penalties for late payments.

- Offer Early Payment Incentives: Encourage clients to pay early by offering a discount or another incentive, which can motivate quicker payments.

- Use Automatic Reminders: Utilize automated payment reminders to notify clients a few days before the due date and again if the payment is overdue.

- Enforce Late Fees: Clearly outline any late fees or interest charges in your payment terms and enforce them when necessary. A small fee can encourage timely payments.

By being proactive in handling late payments and setting clear expectations from the outset, you can reduce the occurrence of overdue amounts and maintain positive relationships with clients while safeguarding your cash flow.

Improving Cash Flow with Timely Invoices

Ensuring that payment requests are sent promptly and accurately is crucial to maintaining healthy cash flow. Delays in issuing or processing payment records can result in delayed payments, which in turn can create financial strain on your business. By establishing a system that prioritizes timely and efficient billing, you can improve cash flow and reduce the risk of overdue balances.

Here are several strategies to enhance your cash flow through prompt payment requests:

- Send Requests Immediately After Delivering Services: As soon as the work or product is delivered, send a payment request. This minimizes the time between the completion of the work and when payment is due.

- Set Clear Payment Terms: Clearly communicate payment expectations upfront, including due dates and penalties for late payments. By being transparent, you reduce the chance of misunderstandings and delays.

- Automate Billing: Use software that allows you to automate the billing process. Automated systems can send out requests on specific dates, ensuring that payments are requested promptly every time.

- Offer Multiple Payment Methods: Providing clients with several payment options–such as bank transfer, credit card, or online payment platforms–can make it easier for them to pay quickly.

- Incentivize Early Payments: Offering small discounts or perks for early payments can motivate clients to settle their balances faster, improving your cash flow.

By making it a priority to issue payment requests on time, businesses can enhance their liquidity, reduce late payment issues, and maintain financial stability. Establishing efficient billing practices is an essential component of long-term success.

How to Use Digital Payment Methods

In today’s digital age, accepting electronic payments has become essential for businesses of all sizes. Digital payment methods offer convenience, security, and speed, making it easier for clients to settle their balances and for businesses to receive payments quickly. By integrating digital payment options into your payment processes, you can streamline transactions, reduce administrative burdens, and improve cash flow.

Types of Digital Payment Methods

There are several digital payment methods available, each with its own set of advantages. Here are some of the most commonly used options:

- Credit and Debit Cards: Credit and debit cards are among the most popular digital payment methods. Most businesses can accept card payments through an online gateway, which ensures secure transactions and fast processing times.

- Bank Transfers: Direct bank transfers allow clients to pay directly from their bank account. This method is reliable and secure, particularly for larger payments, but it may take a few days to process.

- Mobile Payment Apps: Apps like PayPal, Venmo, and Stripe offer instant transactions and can be linked to both business and personal accounts. These are especially popular for smaller transactions and businesses that operate online.

- Cryptocurrency Payments: Cryptocurrencies like Bitcoin and Ethereum are becoming more accepted by businesses looking for a cutting-edge payment option. While adoption is still growing, crypto payments offer benefits like lower transaction fees and faster cross-border transactions.

How to Integrate Digital Payments into Your Process

To begin accepting digital payments, follow these steps:

- Choose a Payment Processor: Select a reliable payment processor that suits your business needs. Consider factors such as transaction fees, security, and compatibility with your existing systems.

- Integrate Payment Methods: Add payment buttons or links to your website, emails, or digital payment requests. Make sure these options are easy to find and use, so clients can make payments without hassle.

- Ensure Security: It is essential to protect sensitive financial data. Use encryption and comply with relevant security standards, such as PCI-DSS, to ensure safe transactions.

- Test Transactions: Before fully integrating a new payment method, run test transactions to ensure that everything functions smoothly and that clients can make payments without any issues.

By incorporating digital payment methods into your business, you can improve the speed and convenience of your payment processing, leading to better customer satisfaction and a more efficient cash flow management system.

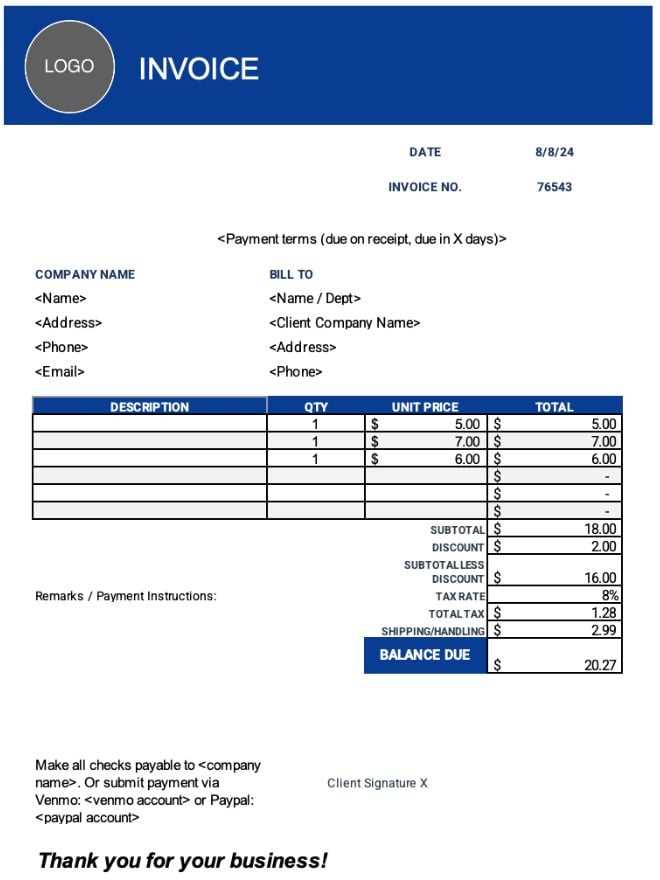

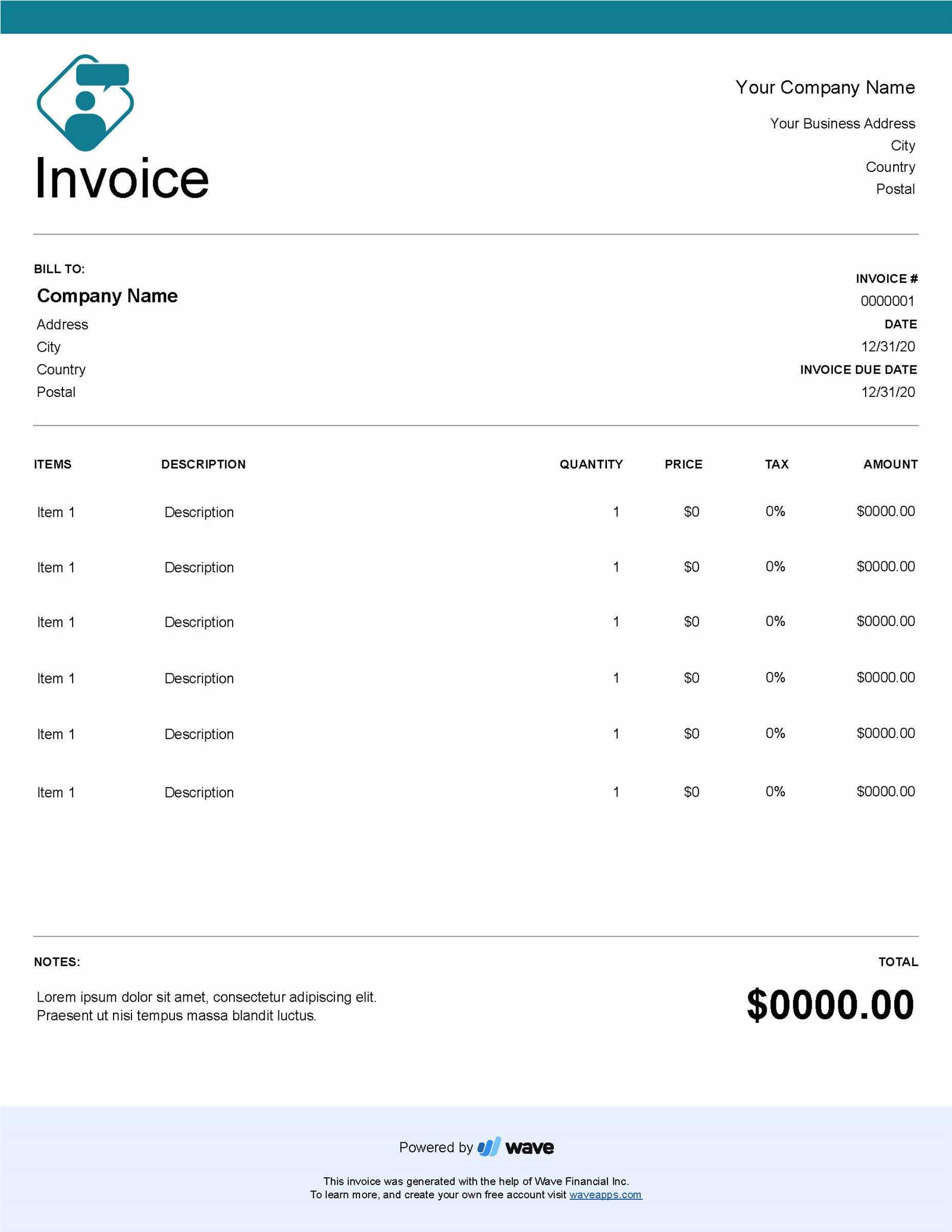

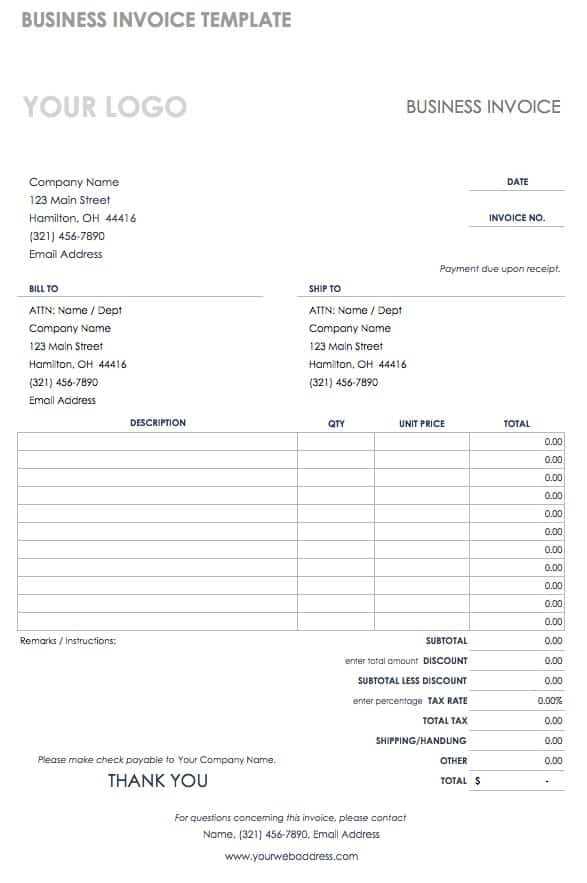

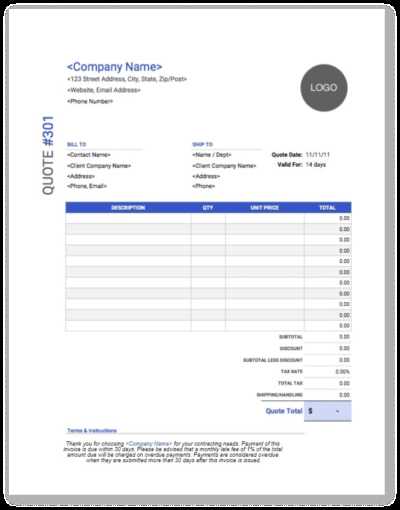

Examples of Outstanding Invoice Templates

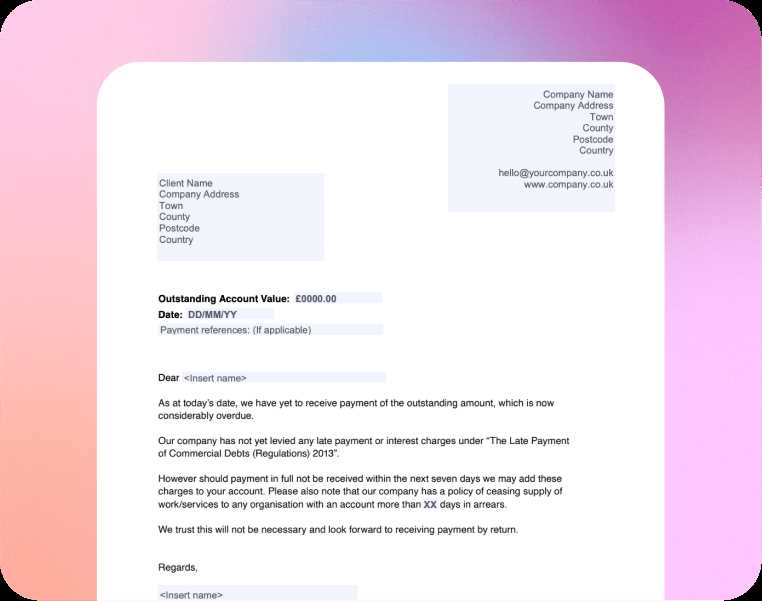

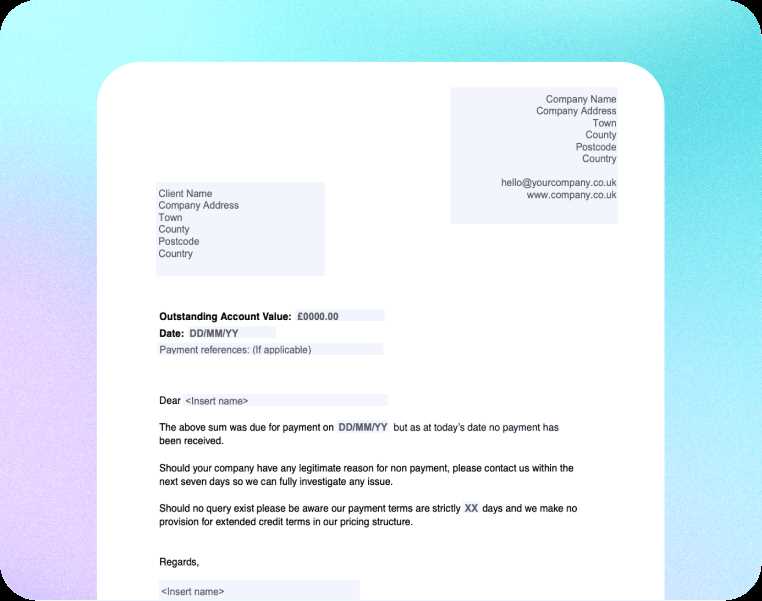

Having a structured and professional document for requesting payments is vital for any business. A well-designed form helps to clearly communicate the amount owed, the services or goods provided, and the payment terms. Here are a few examples of how you can organize a payment request effectively, ensuring clarity and easy navigation for your clients.

Simple Payment Request Format

This format is ideal for small businesses or freelancers who need a straightforward method of requesting payments. It focuses on key elements like client information, service description, payment due date, and the total amount owed.

- Client Information: Include the name, address, and contact details of the client.

- Business Details: Your company’s name, address, and contact info should be easy to find at the top.

- Invoice Number: A unique identifier for each request helps to track payments efficiently.

- Description of Goods/Services: Clear details of what was provided, including quantities and unit prices, if applicable.

- Amount Due: The total sum owed, including applicable taxes, fees, and any discounts.

- Payment Terms: The due date and acceptable payment methods.

Detailed Breakdown Format

A more detailed format works well for larger projects or ongoing services where the breakdown of each stage or item needs to be clear. This format provides transparency for both parties, reducing the chance of disputes over charges.

- Line Item Breakdown: A table or list that outlines each service or product, its quantity, rate, and total cost.

- Payment Milestones: If the work is completed in phases, include a section for partial payments due at each stage.

- Additional Costs: Clearly state any additional costs, such as shipping, handling, or late fees, if applicable.

- Notes or Special Terms: This section can include payment options, discounts for early payments, or a reminder about penalties for late payments.

By organizing payment requests in a clear, structured manner, businesses can streamline their billing process and ensure that all necessary information is readily available for their clients. This leads to smoother transactions and faster payments.

Ensuring Accurate Billing with Templates

Accurate billing is essential for maintaining healthy financial operations and good client relationships. When payment requests are clear, well-structured, and free of errors, it minimizes confusion and prevents disputes. Using a standardized format for creating these documents ensures that all necessary details are included and that the calculation of amounts due is precise.

One of the key advantages of a structured document is the ability to include every essential element consistently, reducing the likelihood of missing or incorrect information. This includes client details, service descriptions, payment due dates, and any applicable taxes or fees. By organizing your billing process in this way, you not only make it easier for clients to understand but also improve internal accuracy and efficiency.

Additionally, utilizing a template can help streamline the process by providing built-in fields that automatically calculate totals, taxes, and discounts. This removes the risk of human error and speeds up the time it takes to generate and send payment requests. As a result, businesses can ensure that they are always invoicing correctly, leading to quicker payments and smoother financial operations.