Free Template for Invoice for Services and How to Use It

When managing any type of business, maintaining clear and accurate payment records is crucial. One of the best ways to ensure this is through the use of well-structured financial documents that help outline the work completed and the amount due. These documents not only serve as a formal request for payment but also protect both parties by providing a clear record of the transaction.

Creating a consistent and professional-looking document is essential for building trust with clients and ensuring prompt payments. Whether you are a freelancer, small business owner, or large company, having a ready-to-use format saves valuable time and reduces the likelihood of errors. With the right approach, you can present your billing information in a way that reflects the professionalism of your business.

Customizable options allow you to easily adapt your documents to fit your unique needs. By using a pre-designed structure, you can focus more on your core work and less on administrative tasks, making it easier to maintain a smooth cash flow and keep clients satisfied.

Why Use an Invoice Format for Billing

Handling financial transactions efficiently is vital to the success of any business. Having a structured document to request payment ensures that both you and your clients are on the same page regarding the details of the work completed and the amount owed. Instead of starting from scratch every time, using a ready-made structure can save time and reduce errors in your accounting process.

Key Advantages of Using a Pre-Designed Structure

- Consistency: A consistent format helps reinforce your professional image and ensures all necessary details are included in each request for payment.

- Time-saving: Having a ready-to-use format allows you to quickly fill in specific details, cutting down on the time spent creating a new document from the ground up.

- Minimizing Errors: A clear layout reduces the likelihood of missing important information, such as payment terms, due dates, or contact details.

- Clear Communication: Using a predefined structure makes it easier for your clients to understand the breakdown of the charges, fostering transparency and trust.

How a Pre-Formatted Billing Document Helps in Professionalism

When you use a well-designed layout, it signals to your clients that you take your business seriously. A clear, professional-looking document can enhance your reputation and help create long-term relationships with clients, as it reflects your attention to detail and commitment to organization. In addition, it simplifies the process for both parties, ensuring timely payments and reducing confusion.

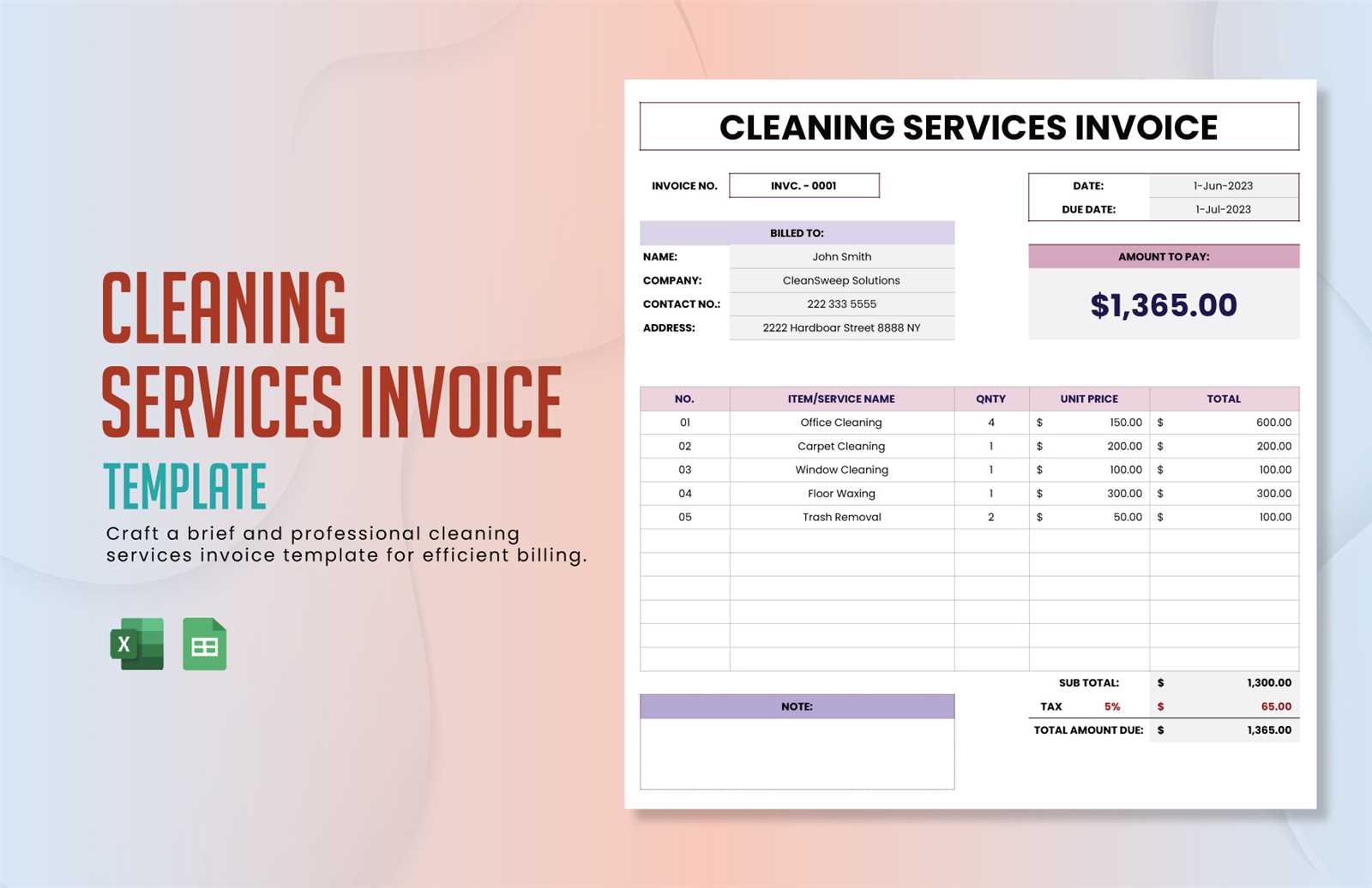

Benefits of Using Service Invoice Templates

Adopting a structured approach to billing can significantly streamline the administrative tasks involved in running a business. By relying on pre-designed formats, you can avoid the hassle of creating a new document every time you need to request payment. These ready-made options simplify the process, allowing you to focus more on your core work rather than the intricacies of document creation.

Efficiency and Time Savings: One of the biggest advantages is the amount of time saved. With a pre-set structure, you only need to input specific details like client information and work performed, which reduces the effort required to create each document from scratch. This can make your invoicing process much faster, freeing up time for other important tasks.

Accuracy and Consistency: A standardized approach ensures that every bill looks the same and includes all essential details, such as payment terms, descriptions of the work, and total amounts. This consistency helps avoid errors, such as forgetting to include key information, which could delay payment or lead to misunderstandings.

Professional Image: Using a polished and professional format conveys to your clients that you are organized and detail-oriented. This can help build trust, especially for new clients who may be hesitant to do business without clear, formal records of transactions. A well-structured document reflects the quality of your work and your commitment to professionalism.

Customizability: Many pre-made formats allow you to adjust the design and layout to match your branding and specific needs. Whether you want to add your logo, adjust payment terms, or modify the format, having flexibility ensures that you maintain consistency with your business’s unique style.

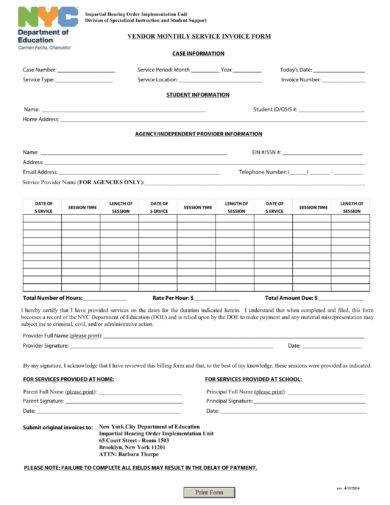

How to Create an Invoice for Services

Creating a well-structured document to request payment is essential for maintaining a smooth business operation. This document ensures clarity between you and your client, outlining the work completed and the amount due. Following a straightforward approach will help you include all necessary details and avoid confusion.

Steps to Craft a Payment Request

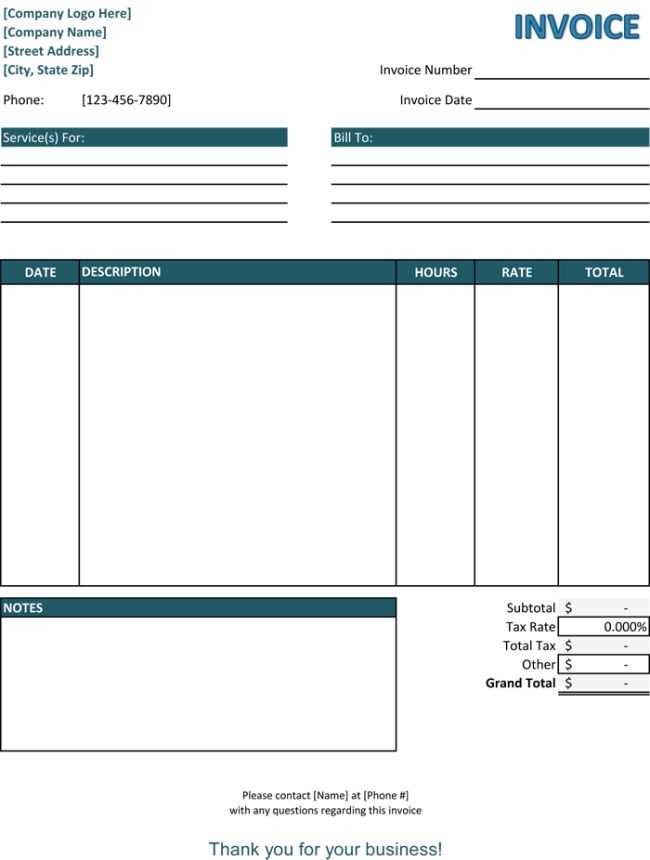

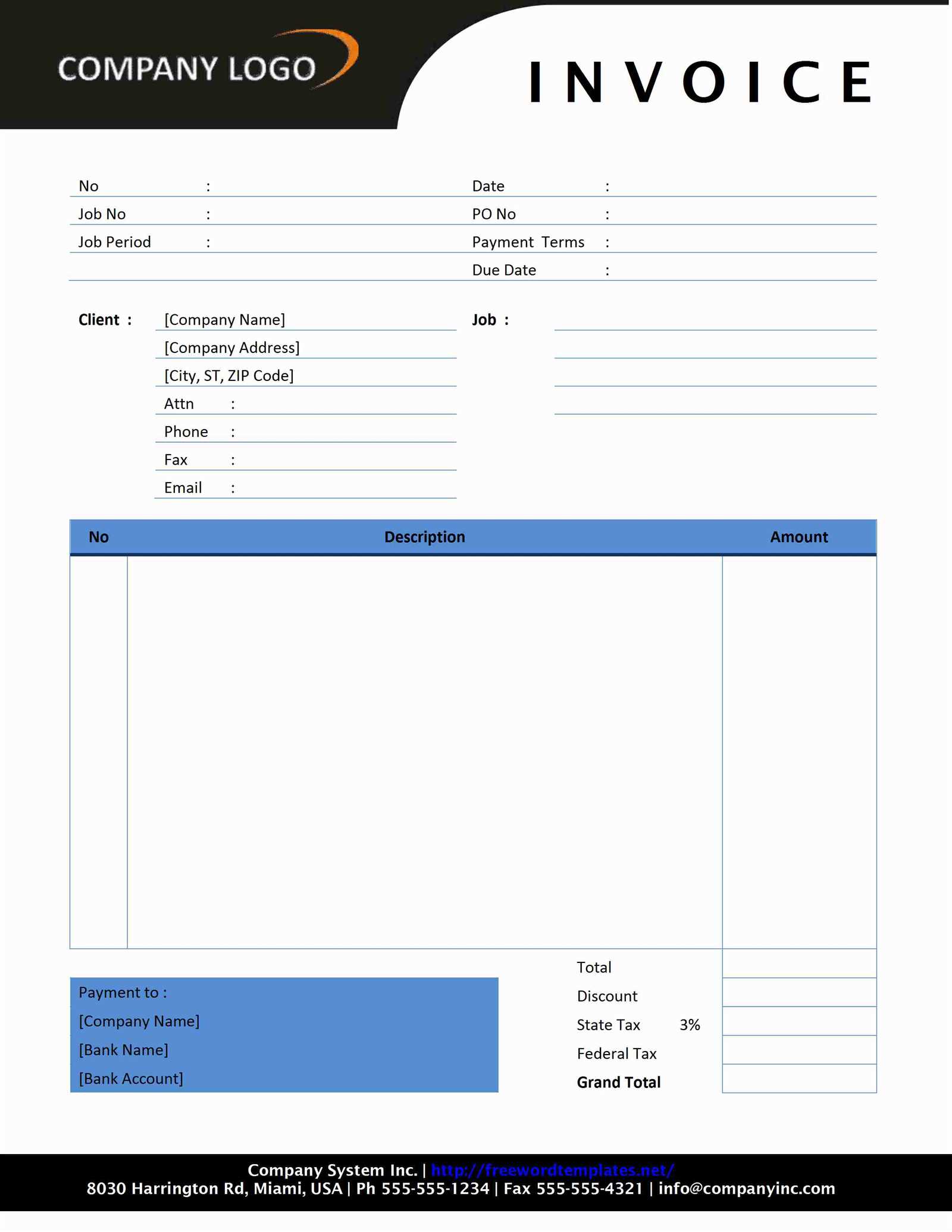

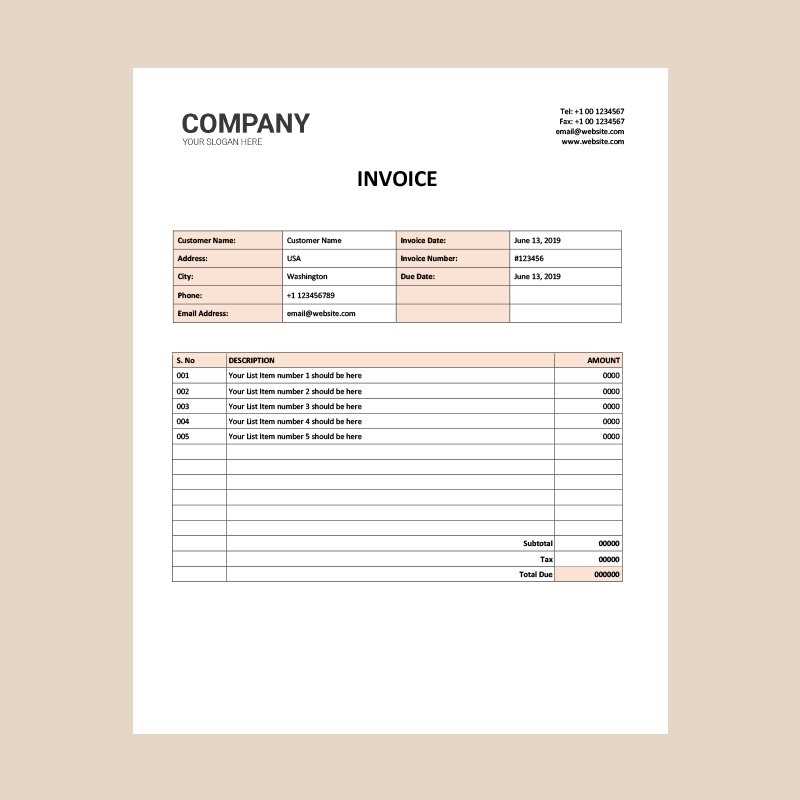

- Start with Your Business Information: Include your business name, address, phone number, and email address at the top of the document. This makes it easy for the client to contact you if needed.

- Client Details: Include the client’s name, company (if applicable), address, and contact information. This ensures that the document is tailored to the correct party.

- Unique Document Number: Assign a unique number to each document for easier tracking and reference. This also helps keep your records organized.

- Dates: Clearly mention the date of issue and the due date for payment. This helps your client know when to expect the payment and avoid late fees.

- Itemize the Work: List the specific tasks or deliverables, along with their respective charges. Be clear about what is being charged to avoid confusion.

- Payment Terms: Include details about payment methods, such as bank transfer, check, or online payment systems, and any applicable late fees or discounts.

- Total Amount: Clearly state the total amount due, ensuring that it includes taxes, if applicable.

Finishing Touches

- Review for Accuracy: Double-check that all details are correct, including pricing, client information, and dates.

- Send in a Timely Manner: Send the completed document as soon as possible to avoid delays in receiving payment.

- Keep a Copy: Always save a copy of the document for your own records, which helps with bookkeeping and tracking payments.

Essential Information in a Service Invoice

When requesting payment for work completed, it’s crucial to provide all necessary details in a clear and organized manner. A well-constructed document not only ensures that your client understands the charges but also serves as a formal record of the transaction. Including the right information helps avoid disputes and facilitates timely payment.

Key Elements to Include

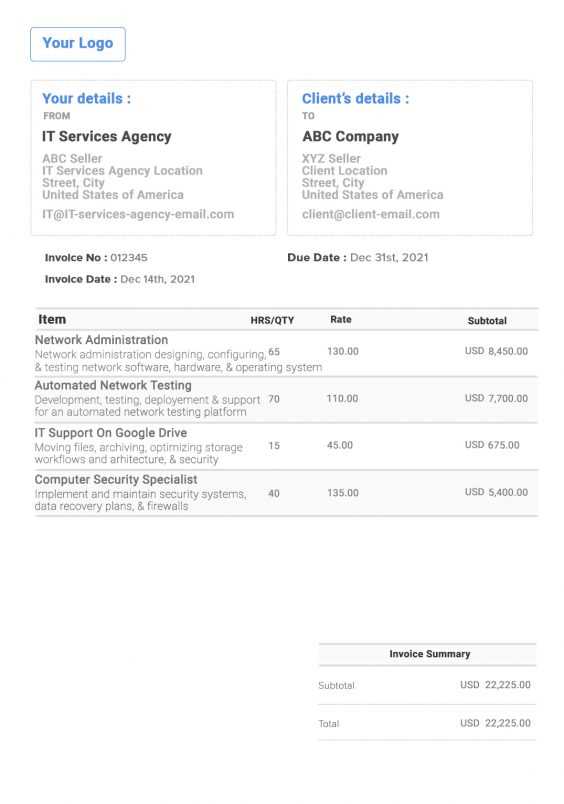

- Your Business Details: Clearly display your business name, contact information, and address. This helps the client identify the source of the document and contact you if needed.

- Client Information: Ensure you list the client’s full name, company (if applicable), and address. This helps verify who is responsible for payment.

- Unique Document Number: Assign a unique reference number to each document for easy tracking and record-keeping. This is especially important for accounting purposes.

- Issue and Due Dates: Include both the date the document was issued and the payment due date. This gives your client a clear timeline and helps you track overdue payments.

- Detailed Description of Work: List all tasks or products delivered, along with their individual costs. This provides transparency and ensures that the client understands exactly what they are paying for.

- Total Amount Due: Clearly state the total amount payable, including any applicable taxes or additional charges. This is essential to avoid confusion and disputes.

Additional Information to Consider

- Payment Methods: Specify the acceptable methods of payment, such as bank transfers, online payment systems, or checks, to make it easy for the client to pay.

- Late Payment Terms: If applicable, mention any late fees or interest charges for overdue payments. This can help encourage timely settlements.

- Notes or Special Instructions: Include any additional details or reminders, such as discounts for early payment or specific payment instructions.

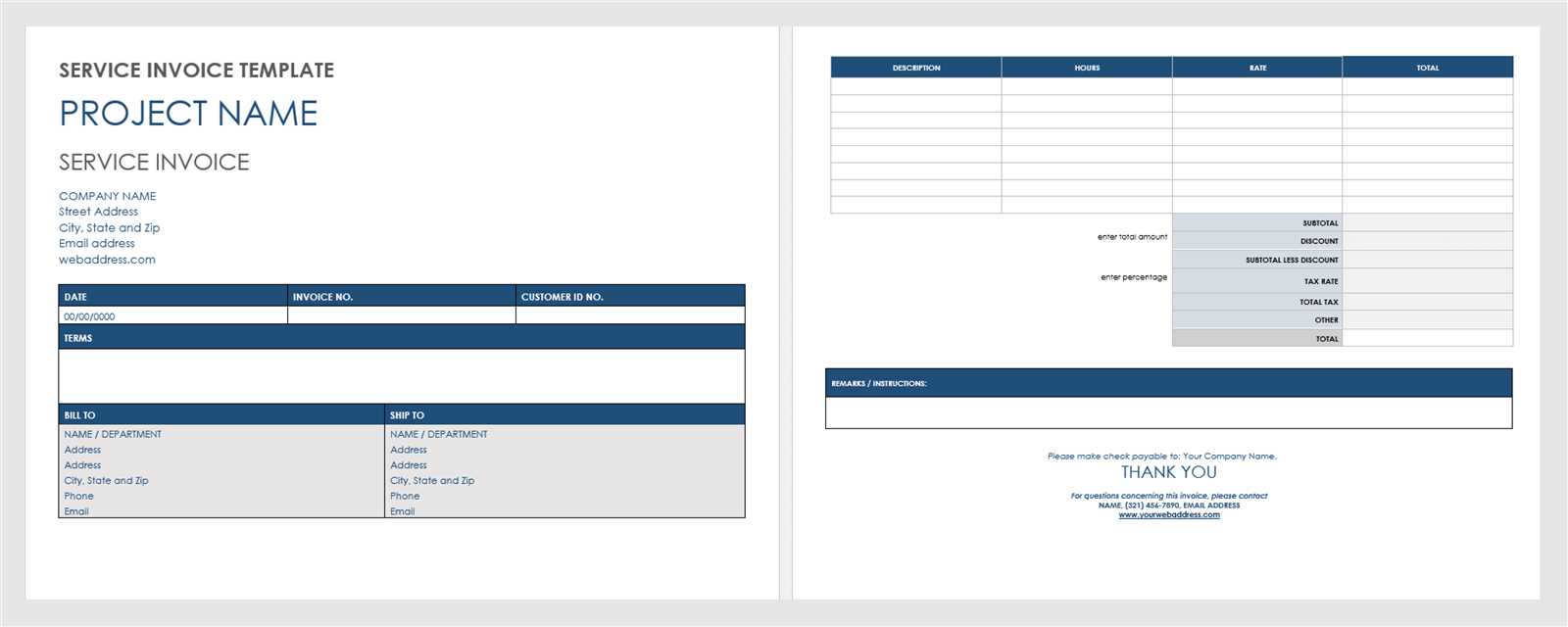

Customizing Your Service Invoice Template

Adapting your payment request document to reflect your business’s unique identity can enhance professionalism and improve client communication. By adjusting the design and structure, you ensure that your documents align with your brand and meet specific needs. Customization allows you to create a more polished and personalized experience for your clients, while still maintaining consistency across all transactions.

Key Areas to Customize

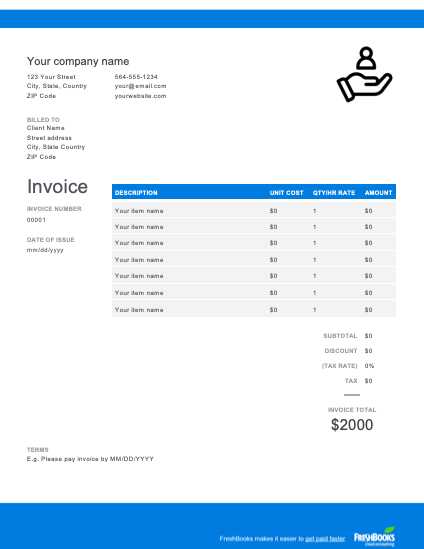

- Branding and Logo: Adding your logo and using your brand’s color scheme makes the document instantly recognizable and reflects the professionalism of your business.

- Contact Information: Customize the header to include your company’s contact details, such as phone number, email, and website, making it easy for clients to reach out if needed.

- Payment Terms and Conditions: Adjust payment terms to suit your business practices. Include information on accepted payment methods, due dates, and any applicable late fees or discounts.

- Layout and Design: Organize the sections in a way that suits your workflow. For example, you might want to adjust the space for item descriptions or total amounts, depending on the nature of the work or services provided.

- Notes or Special Instructions: If there are any specific instructions, such as project milestones or delivery dates, include these areas for additional clarity.

Tips for Effective Customization

- Keep It Professional: While customizing, ensure the design remains clear and easy to read. Avoid unnecessary clutter, which can distract from the important details.

- Maintain Consistency: Use consistent fonts, colors, and formatting to ensure your billing documents are uniform and professional-looking across all transactions.

- Stay User-Friendly: Make sure the customized document remains simple and easy to understand for your clients. Avoid over-complicating sections or including unnecessary information.

Choosing the Right Format for Your Business

Selecting the right format to request payments is crucial for ensuring that your transactions are smooth and professional. The format you choose should reflect your business type, the services you provide, and the preferences of your clients. A well-chosen design will make the billing process more efficient, promote clear communication, and enhance your professional image.

Factors to Consider When Selecting a Format

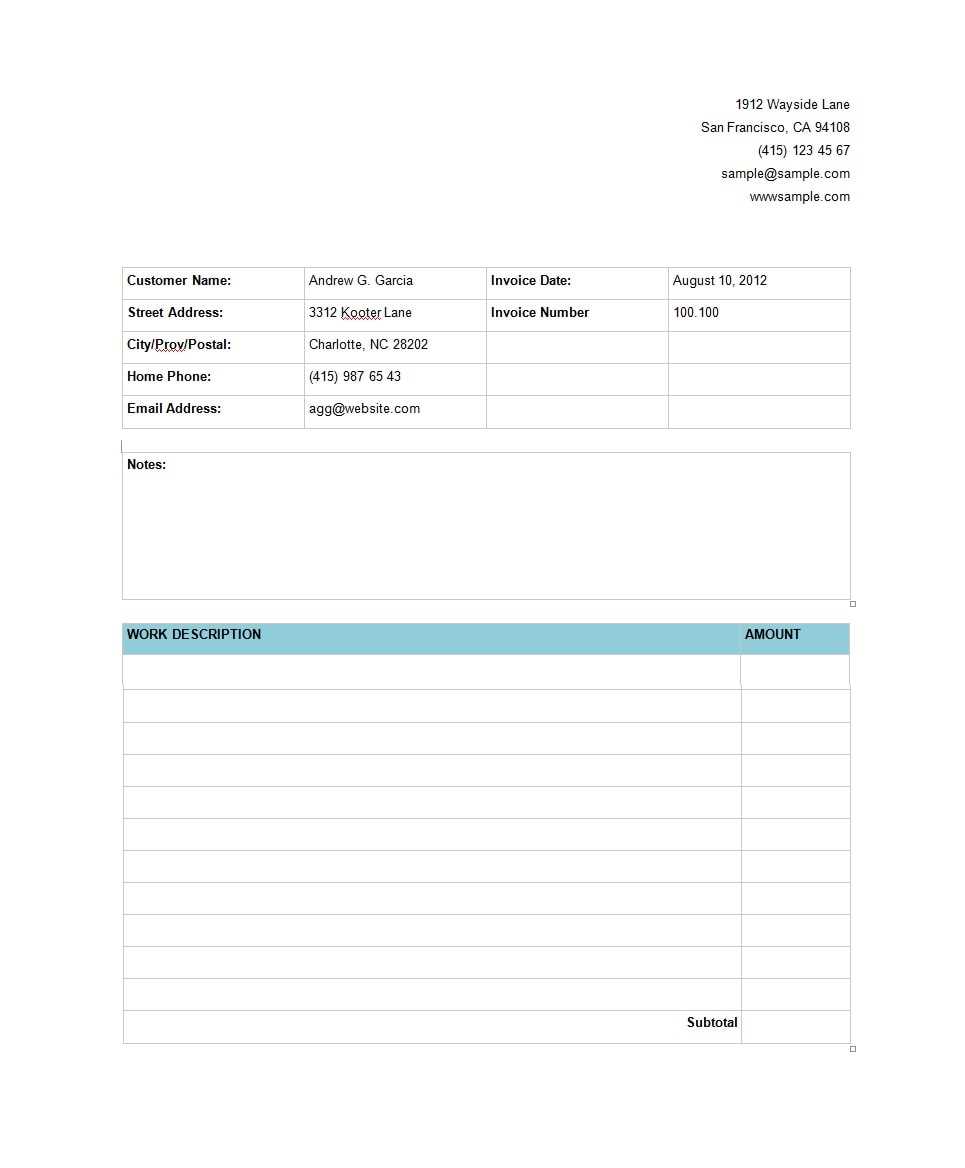

- Business Type: Different businesses may have different needs. For example, freelancers may require a simple design, while larger companies may prefer a more detailed and comprehensive layout to account for multiple departments or complex pricing structures.

- Client Preferences: Understand your client’s expectations and preferences. Some clients may prefer a minimalist layout, while others might appreciate more detailed descriptions of services and charges. Customizing the format based on client needs can improve client satisfaction.

- Professionalism and Clarity: Choose a design that enhances professionalism and ensures clarity. A clean and well-organized layout prevents confusion and makes it easier for clients to process the payment quickly.

- Customizability: Look for options that allow you to adjust and personalize the layout, so it aligns with your brand and business needs. The ability to modify the content, design, and structure will ensure the document stays flexible as your business evolves.

- Payment Terms and Details: The right format should accommodate all necessary details, including payment methods, due dates, and terms. Ensure that these sections are easy to find and understand to avoid delays in payment.

Common Format Options

- Basic Layouts: Simple and straightforward formats work well for smaller businesses or independent contractors who need quick and efficient billing.

- Detailed Designs: More elaborate layouts with itemized charges and extra sections are ideal for businesses offering complex or long-term projects that require a breakdown of services.

- Online Formats: Digital versions that allow easy editing, emailing, and integration with payment systems are a great choice for businesses aiming to streamline the billing process.

Free vs Paid Invoice Templates

When it comes to choosing the right format for your billing needs, one of the primary decisions is whether to go for a free option or invest in a paid version. Both have their advantages and drawbacks, and selecting the right one depends on your business requirements, budget, and the level of customization you need. Understanding the key differences between these two options can help you make a more informed choice.

Advantages of Free Formats

- Cost-Effective: The biggest benefit of free options is, of course, that they are completely free. They are an excellent choice for small businesses or freelancers who are just starting out and need to keep costs low.

- Quick Setup: Free options are often easy to download and use immediately. They typically offer basic features that are straightforward and intuitive.

- Basic Functionality: While they may lack advanced features, free formats are usually sufficient for businesses that have straightforward billing needs, such as providing basic descriptions and amounts for a small range of products or tasks.

Benefits of Paid Formats

- Customization Options: Paid options tend to offer more flexibility in terms of design and layout. You can often adjust the document’s appearance, add branding elements, and customize the structure to better reflect your business’s needs.

- Advanced Features: Paid formats often include additional features, such as the ability to track payments, add tax calculations, or integrate with accounting software. These can save time and reduce errors in your billing process.

- Professional Appearance: Many paid formats are designed with a higher level of sophistication, offering a polished and professional look that can help your business stand out and make a strong impression on clients.

- Customer Support: With paid options, you often get access to customer support or help resources, which can be valuable if you encounter any issues or need guidance while using the format.

Which Option is Right for You?

If you have simple billing needs and are just starting out, a free format might be the perfect solution. However, if your business is growing or you require more advanced features, investing in a paid version could be worth the cost. Ultimately, your choice will depend on the complexity of your billing system, the level of customization you need, and your available budget.

Common Mistakes to Avoid in Service Invoices

When creating a document to request payment, it’s essential to ensure that all details are accurate and complete. Simple mistakes can lead to confusion, delayed payments, or disputes with clients. Understanding the most common errors and how to avoid them will help streamline your billing process and maintain a professional image.

Frequent Errors to Watch Out For

| Mistake | Consequences | How to Avoid |

|---|---|---|

| Missing Client Information | Confusion about who the payment is for, delays in processing | Ensure all client details, including name, address, and contact information, are accurate |

| Incorrect Payment Amount | Delays in payment, dissatisfaction, disputes | Double-check the total amount due and ensure the correct quantities and rates are listed |

| Unclear Payment Terms | Late payments, misunderstandings about due dates or late fees | Clearly state the payment due date, methods, and any applicable penalties for overdue payments |

| Omitting Dates | Unclear timeline, confusion about when work was completed | Always include both the issue date and the due date to avoid ambiguity |

| Overcomplicated Layout | Client confusion, delays in processing payment | Keep the design clean and straightforward, focusing on key details like the total amount due and payment terms |

Tips for Clear and Accurate Billing

- Be Clear and Concise: Use simple language to explain the work done and the costs associated with it. Avoid jargon or overly complex explanations.

- Double-Check Calculations: Ensure all charges, taxes, and discounts are accurate and total correctly before sending.

- Maintain Consistency: Use the same format for each request for payment. Consistent formatting makes it easier for clients to process your documents quickly.

- Proofread Before Sending: A quick review can help catch any missing information or typographical errors that could lead to confusion.

Digital vs Paper Invoices for Services

When it comes to requesting payment, businesses have two main options: sending physical documents or utilizing digital formats. Each approach has its benefits and challenges, depending on your preferences, the nature of your business, and your client’s needs. Understanding the advantages and limitations of both methods can help you choose the one that best suits your workflow and goals.

Advantages of Digital Billing

- Speed and Efficiency: Digital documents can be created, sent, and received almost instantly. This allows for quicker processing and payment, helping to improve cash flow.

- Cost-Effective: By eliminating paper, printing, and postage costs, digital documents are much more affordable, especially for businesses that need to send many billing requests.

- Eco-Friendly: Using electronic formats reduces your carbon footprint, helping to promote sustainability and reduce waste from paper and ink.

- Automation and Integration: Many digital formats allow for automatic reminders, payment tracking, and integration with accounting software, saving you time and reducing the chances of errors.

Benefits of Paper Billing

- Personal Touch: Physical documents can feel more personal, and some clients may prefer receiving a paper bill as part of their overall customer experience.

- Higher Perceived Formality: A physical request for payment may feel more official to some clients, especially in industries that value traditional methods of business communication.

- Access to Clients Without Digital Access: Paper bills are ideal for clients who may not have access to or prefer not to use digital communication tools.

- Reliability: Paper documents do not rely on the client’s internet access or email system. There is no risk of technical issues causing delivery failures.

Choosing the Right Method for Your Business

The decision between digital and paper formats largely depends on your business model and the preferences of your clientele. Digital formats are ideal for businesses looking for speed, efficiency, and cost savings, while paper bills may be more suitable for clients who value personal interaction or for businesses in industries where physical documentation is standard. Whatever you choose, ensure that the method you use aligns with your workflow and supports timely, accurate payments.

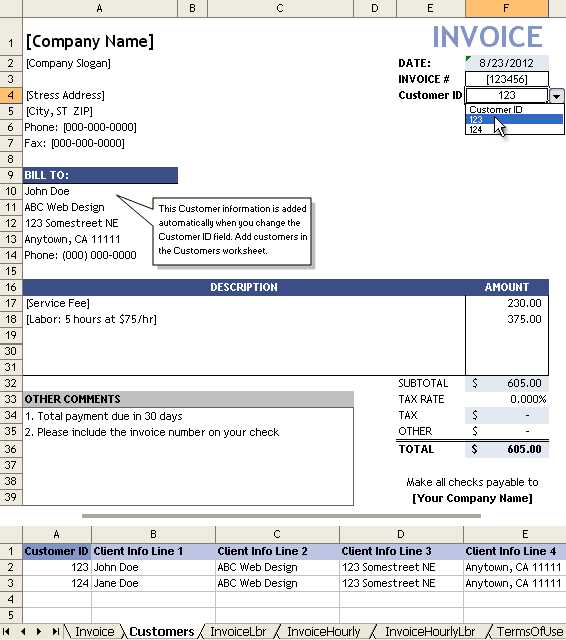

How to Edit and Save Invoice Templates

Customizing and saving your payment request documents is a key step in streamlining your billing process. Editing these documents allows you to reflect your business needs, whether you’re adding a logo, adjusting payment terms, or modifying layout elements. Understanding how to edit these files and save them efficiently ensures that your documents are always ready for use when needed.

Steps to Edit Your Document

- Select the Right Software: Choose a software or platform that supports easy document editing. Popular options include word processors like Microsoft Word, spreadsheet tools like Excel, or online platforms that offer customizable forms.

- Personalize Your Design: Adjust fonts, colors, and layout to match your business branding. Make sure your business name, address, and other essential details are displayed prominently.

- Add or Modify Fields: Customize sections such as item descriptions, payment terms, and taxes to suit your business. Be sure to include all necessary information, such as payment due dates and methods of payment.

- Check for Consistency: Ensure that your format remains consistent across all documents. This includes using the same font sizes, spacing, and section order every time you create a new request for payment.

How to Save and Reuse Your Document

- Save Your Document in Multiple Formats: After editing, save your file in a format that is easy to share and access. Common file formats include PDF, Word (.docx), or Excel (.xlsx). PDF is especially useful as it preserves formatting when sharing electronically.

- Store in a Centralized Location: Create a folder on your computer or cloud storage where you can keep all versions of your payment request files. This way, you can quickly access and update your documents as needed.

- Use Version Control: When making updates or changes, save new versions of your document with clear naming conventions (e.g., “Invoice_2024_v2”). This helps you track changes and ensures you are using the latest version when generating new requests.

- Automate Future Use: If you frequently use the same layout and details, consider using automation tools or software that allow you to save templates and quickly fill in the specific information for each new transaction.

Tracking Payments with Your Invoice Template

Effectively tracking payments is a crucial part of managing your finances and ensuring timely receipts. By integrating payment tracking into your billing documents, you can keep a close eye on outstanding amounts, due dates, and payment statuses. This process helps to prevent overdue payments and ensures that all transactions are properly recorded.

How to Add Payment Tracking to Your Document

- Include a Payment Status Section: Add a clearly marked section in your document to indicate whether the payment is “Paid”, “Pending”, or “Overdue.” This helps both you and your clients keep track of the payment’s progress at a glance.

- List Payment Due Dates: Ensure that each document has a clearly visible due date. This will help you monitor when payments should be made and allow clients to understand when their payment is expected.

- Track Partial Payments: If clients make partial payments, update the payment status and show the remaining balance due. This transparency helps avoid confusion and keeps your records accurate.

- Add a Payment Record Section: Include a section where you can record payment details, such as the date the payment was received, the payment method, and any reference numbers. This allows for easy future reference.

Benefits of Tracking Payments

- Improved Cash Flow: By monitoring payments, you can spot overdue amounts early, reducing the chances of delayed payments that could affect your cash flow.

- Clear Communication: A detailed payment tracking section helps communicate directly with clients about their outstanding balances, preventing misunderstandings and ensuring smooth transactions.

- Better Financial Management: Keeping accurate records of paid and unpaid amounts aids in budgeting and financial planning, ensuring you have a clear view of your business’s revenue.

How to Use Templates for Recurring Services

When providing ongoing work or regular assistance to clients, it’s essential to have an efficient way to request payments consistently. Utilizing pre-designed formats for repeating tasks can save time and reduce the likelihood of errors. These formats allow you to quickly customize and send out payment requests, ensuring you maintain a smooth billing cycle for your recurring engagements.

By adapting a format to your regular tasks, you can eliminate the need to start from scratch with every billing cycle. This approach helps maintain consistency in how you charge for ongoing work and keeps clients informed of their payment responsibilities. Whether it’s monthly, quarterly, or another recurring schedule, a streamlined process can significantly improve your business operations.

Additionally, using a predefined structure for recurring work allows you to focus on the substance of your relationships with clients, rather than spending time organizing the same details repeatedly. With the right format in place, you can stay on top of payments and avoid delays, ensuring a steady flow of revenue for your business.

Incorporating Taxes in Service Invoices

When requesting payment for work completed, it is essential to accurately include taxes to comply with local regulations and ensure that you are charging clients the correct amount. Adding taxes to your billing documents ensures that both you and your clients are clear on the total amount due, and it helps maintain legal and financial transparency.

Steps to Add Taxes to Your Billing Document

- Identify Applicable Taxes: Depending on your location and the nature of your work, different tax rates may apply. Common examples include sales tax, VAT, or service tax. Research the relevant tax laws in your jurisdiction to ensure accuracy.

- Calculate Tax Amount: Once you have the tax rate, apply it to the total amount for the work provided. For instance, if the tax rate is 10%, simply multiply the subtotal by 0.10 to calculate the tax to be added.

- Clearly Label Tax Information: It’s important to clearly indicate the tax amount on the payment request. You can list the tax as a separate line item, showing the rate and amount, so the client can easily see the breakdown.

- Include Tax Identification Number: If required by law, include your business’s tax ID number on the document to help ensure compliance with tax regulations.

Why Proper Tax Inclusion Matters

- Compliance with Legal Requirements: Ensuring that the correct taxes are included on your billing document helps you meet legal obligations and avoid penalties for non-compliance.

- Transparency with Clients: Breaking down the total cost, including taxes, ensures that clients understand exactly what they are being charged for, which helps avoid disputes or confusion.

- Accurate Financial Records: Including taxes in your billing documents provides a clear financial record for your business, which is essential for tax reporting and audits.

Legal Requirements for Service Invoices

When requesting payment for completed work, it’s important to ensure that your documents comply with legal standards. Failure to meet these requirements could result in fines or complications with tax authorities. There are several essential pieces of information that need to be included in order to meet legal obligations and maintain a transparent business operation.

Key Legal Elements to Include

- Business Details: Include your company name, address, and tax identification number (TIN) or VAT number if applicable. This ensures that the transaction is clearly associated with your business.

- Client Information: The name and address of the person or business you are charging must be listed on the document. This helps clarify who the payment is intended for.

- Unique Identification Number: Each request for payment should have a unique reference number for easy tracking and identification. This is particularly useful in case of disputes or audits.

- Clear Payment Terms: Specify the payment due date, acceptable methods of payment, and any late fees or interest that may apply if payment is delayed.

- Itemized List of Work: Provide a detailed description of the work completed, including dates, rates, and quantities, to ensure both parties agree on the scope of work and the corresponding charges.

- Tax Information: Depending on your jurisdiction, taxes may need to be added to the total amount due. Make sure to include the applicable tax rate and the total tax amount in your document.

Why Legal Compliance Matters

- Avoiding Penalties: