Best Template for Billing Invoice to Simplify Your Invoicing Process

Managing financial transactions efficiently is crucial for any business. Proper documentation ensures transparency, smooth communication, and timely payments. Whether you’re a freelancer, a small business owner, or a large corporation, having a structured way to request payment is essential for maintaining cash flow and professionalism.

One of the simplest and most effective ways to do this is by using a pre-designed format that organizes all the necessary details. This tool not only saves time but also helps reduce errors, ensuring your documents are clear, consistent, and easy to understand for clients. With just a few adjustments, you can tailor it to your specific needs, regardless of your industry.

Adopting such a system offers more than just convenience. It helps build trust with customers by presenting a polished, standardized approach to financial interactions. Moreover, automating and customizing these records can make your workflow more efficient, leaving you with more time to focus on growing your business.

What is a Billing Invoice Template

When managing business transactions, it’s important to have a standardized way of requesting payment. This system provides a structured format that allows you to clearly present the amount due, along with the relevant details of the services or goods provided. The goal is to make the entire process smooth, professional, and easy to understand for both parties involved.

At its core, this format is a pre-designed document that contains all the necessary fields for capturing key financial information. It can be customized to reflect your brand and the specifics of each transaction. By using this format, businesses can save time and ensure consistency in their financial dealings.

Why is it important? It reduces the risk of errors, minimizes confusion, and helps establish a professional reputation with clients. With all the essential details in one place, you can quickly issue clear and accurate payment requests, making the entire process more efficient and reliable.

Why Use a Billing Invoice Template

Having a pre-designed structure to request payments is essential for businesses of all sizes. It helps to ensure that every detail is included and that the document is both clear and professional. By relying on a standardized format, companies can save time, reduce errors, and present a polished image to their clients.

Time Efficiency

Creating payment requests from scratch for every transaction can be time-consuming. With a ready-made structure, you can quickly input the relevant details without having to format the document each time. This leads to faster processing and fewer delays in getting paid.

Professional Appearance

Using a consistent design gives your company a polished, trustworthy look. A well-structured document conveys professionalism and helps establish credibility with clients. It also ensures that all necessary information is presented in an easy-to-read format.

- Reduces Errors: A standardized structure minimizes the chances of leaving out important information or making mistakes.

- Ensures Consistency: Each payment request looks the same, making it easier for clients to understand your terms and details.

- Improves Cash Flow: Quick and clear requests lead to faster payments, helping you maintain a steady cash flow.

In summary, relying on a set format for payment requests streamlines your administrative tasks, improves the clarity of your communication, and enhances your company’s reputation. It allows you to focus more on your business, knowing that the financial details are being handled efficiently and professionally.

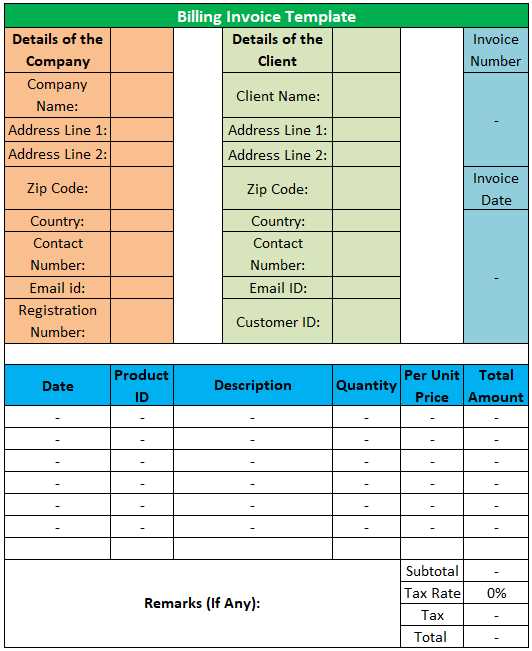

Key Features of an Effective Invoice

An efficient payment request document should have certain essential elements to ensure clarity, accuracy, and professionalism. A well-structured document not only serves as a formal request for funds but also acts as a record of the transaction, protecting both the business and the client. By including all necessary details, you can avoid confusion and facilitate faster payments.

Clear and Accurate Information

The most important feature of any payment request is accuracy. The document must clearly state the amount due, the services or goods provided, and any other relevant information such as payment terms and deadlines. This ensures there is no ambiguity about the transaction and reduces the chance of disputes.

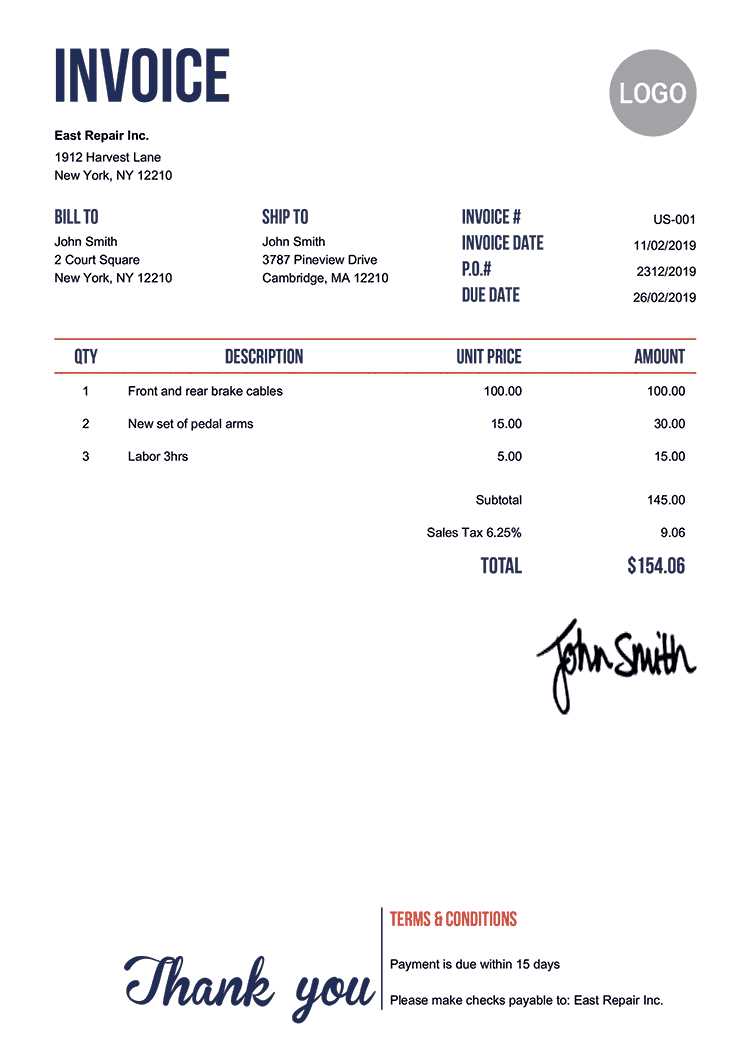

Professional Design and Layout

The design should be clean, easy to read, and well-organized. Using a professional layout makes a good impression and reflects positively on your business. Important details, such as the payment amount and due date, should be highlighted to ensure they are not overlooked.

- Contact Information: Both the business and client contact details should be clearly visible.

- Unique Identification Number: Assigning a reference number to each document makes it easier to track payments and maintain records.

- Payment Instructions: Be sure to include clear instructions on how the client can make the payment, such as bank account details or online payment links.

- Due Date: Clearly state the payment deadline to set clear expectations and avoid delays.

By incorporating these key elements, your document will not only be functional but also help streamline your financial processes. A clear, professional request fosters trust and improves the likelihood of timely payments, benefiting both you and your clients.

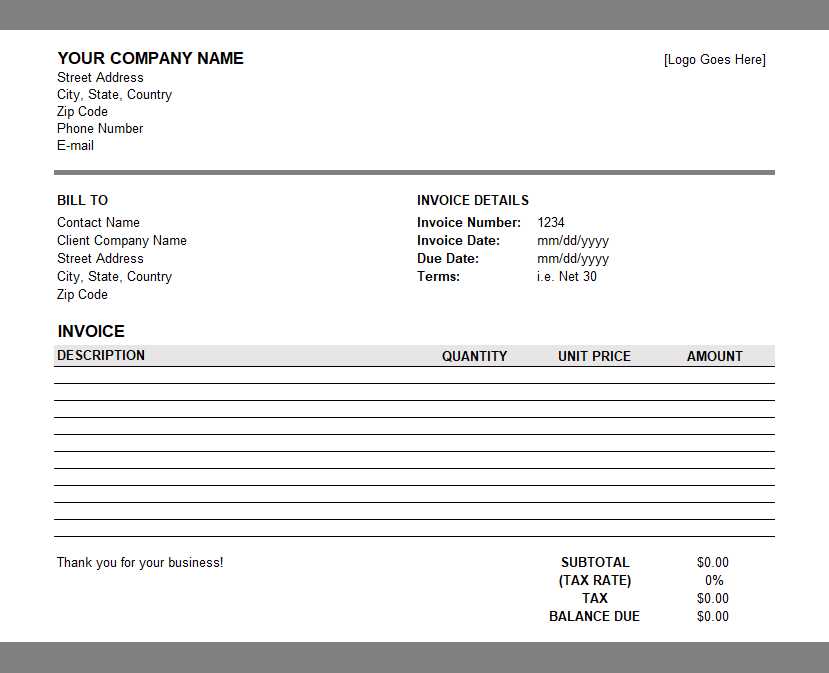

How to Create a Billing Invoice

Creating a clear and professional payment request document is essential for ensuring smooth financial transactions. The process involves gathering key details, structuring the content in a way that is easy to understand, and ensuring that the necessary information is presented clearly. Whether you are a freelancer or running a business, knowing how to construct this document is crucial for maintaining proper cash flow.

Step 1: Collect the Required Information

Before creating the document, gather all the information you need. This includes the following:

- Client Details: Name, address, and contact information of the person or company being billed.

- Your Business Information: Your business name, address, and contact information.

- Description of Services or Products: A clear breakdown of what was provided, along with the corresponding prices.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees if applicable.

Step 2: Structure the Document

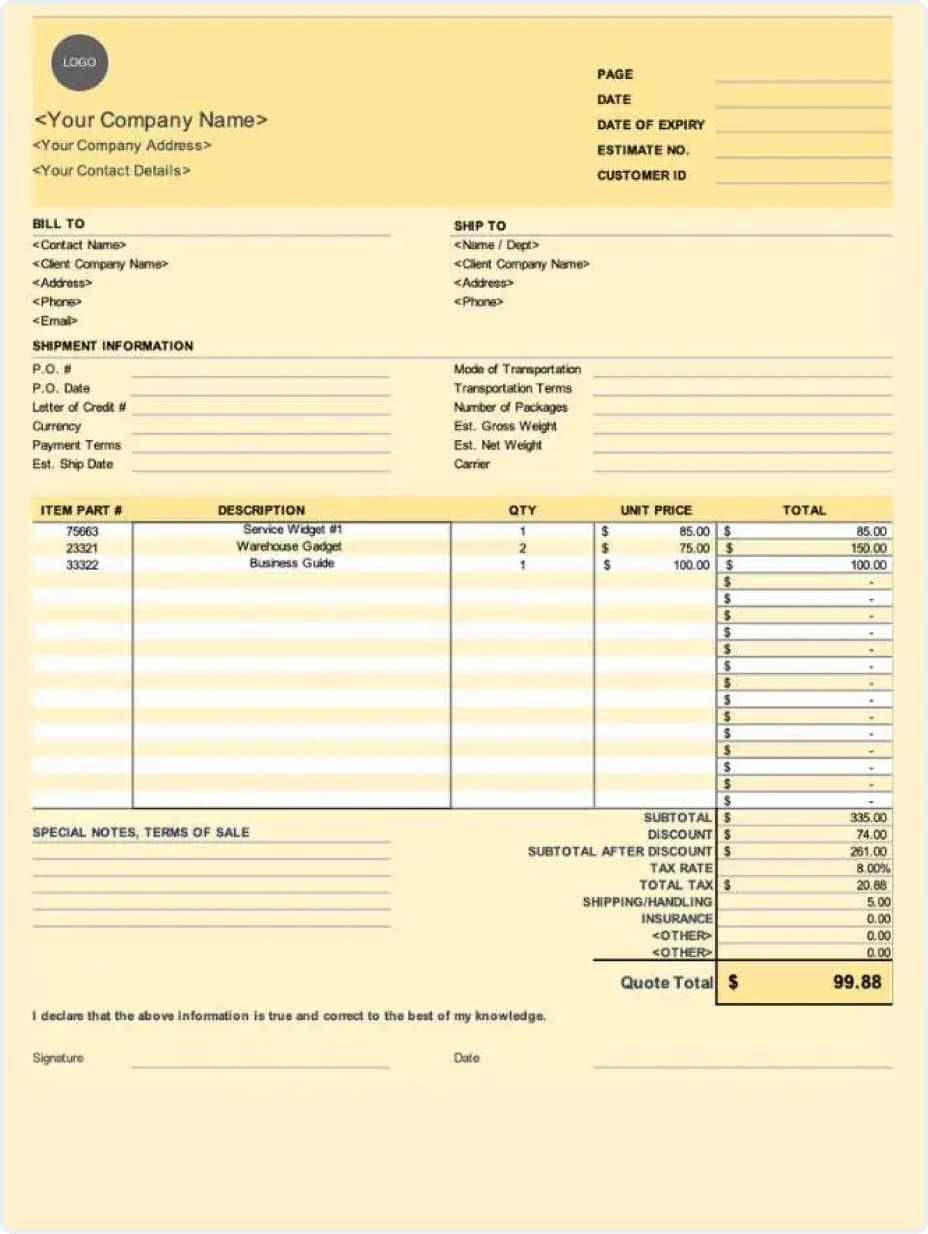

The document should be organized in a way that makes it easy to navigate. Begin by placing your business details at the top, followed by the client’s information. Include a unique reference number to track the transaction and add a clear date for when the payment request was issued. The itemized list of services or products should be next, followed by the total amount due and the payment terms.

Step 3: Review and Send

Once the document is complete, review it carefully to ensure accuracy. Double-check the amounts, dates, and any payment instructions. Once everything is correct, send the document through the most suitable method, whether by email, postal mail, or an online invoicing platform.

By following these steps, you can create a well-organized and professional payment request document that ensures all necessary details are included and helps streamline your financial processes.

Benefits of Customizing Your Invoice Template

Personalizing your payment request document offers numerous advantages that can help your business stand out and ensure a smooth financial process. By tailoring the format to your specific needs, you can enhance communication with clients, reinforce your brand identity, and create a more streamlined experience for both parties.

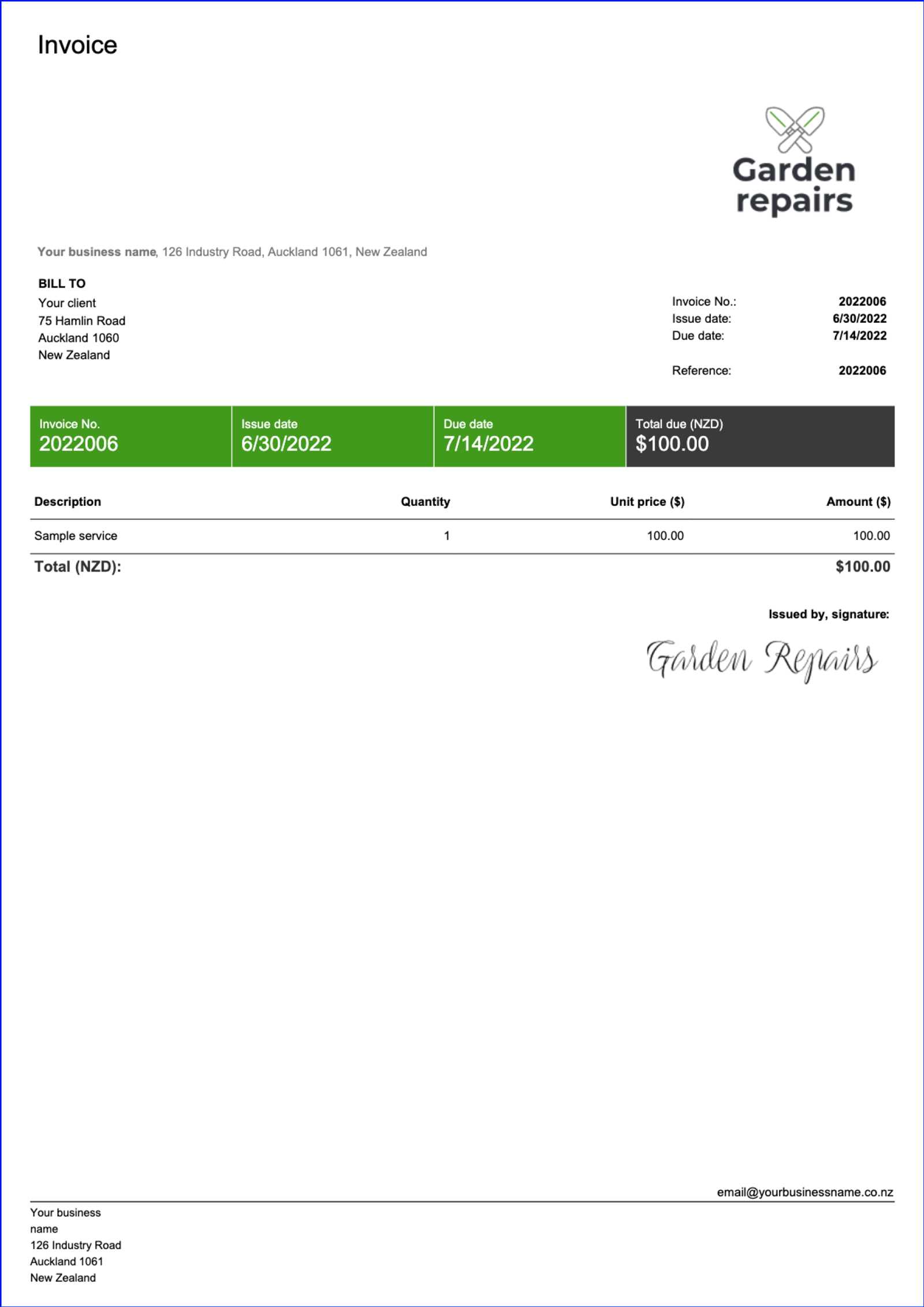

Improved Professional Image

Customizing the structure of your payment request gives you the opportunity to reflect your business’s branding. By including your company logo, specific colors, and fonts, you present a cohesive and professional appearance that helps reinforce your business identity. This small touch can build trust with clients and make your communications appear more polished.

Better Organization and Clarity

When you customize your document, you can structure it in a way that best suits your business operations. Whether you need to break down services in more detail or highlight certain fees, customization allows you to prioritize the most important information, making the document easier to read and understand for your clients.

- Faster Processing: With a personalized format, you can include standard information that stays consistent, saving time on each transaction.

- Tailored Payment Terms: You can add specific terms that apply to your business, such as early payment discounts, late fees, or installment options.

- Enhanced Client Experience: By adjusting the document to fit your clients’ needs, you provide a better user experience, making them more likely to engage with your business again.

In conclusion, customizing your request documents not only improves your professional image but also makes the process more efficient and clear for both you and your clients. It’s a simple step that can have a significant impact on your business’s overall financial operations and customer relations.

Choosing the Right Template for Your Business

Selecting the right structure for your payment request documents is crucial to maintaining efficiency, professionalism, and clarity in your financial communications. The right design ensures you provide all necessary information, making it easier for clients to process payments and for your business to track transactions.

Consider Your Business Type

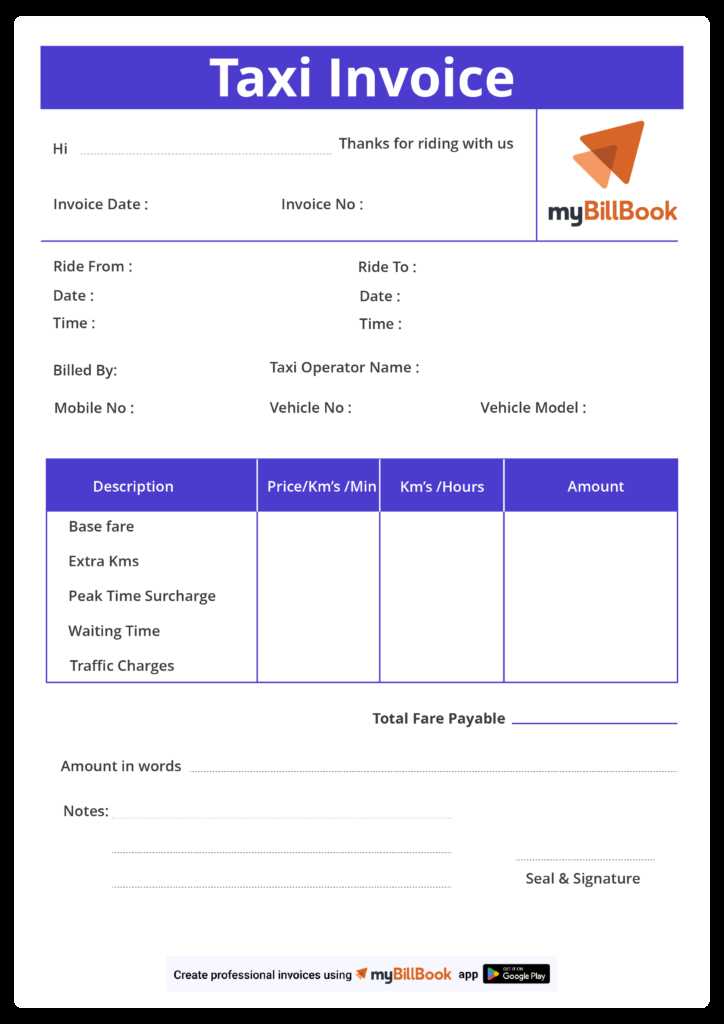

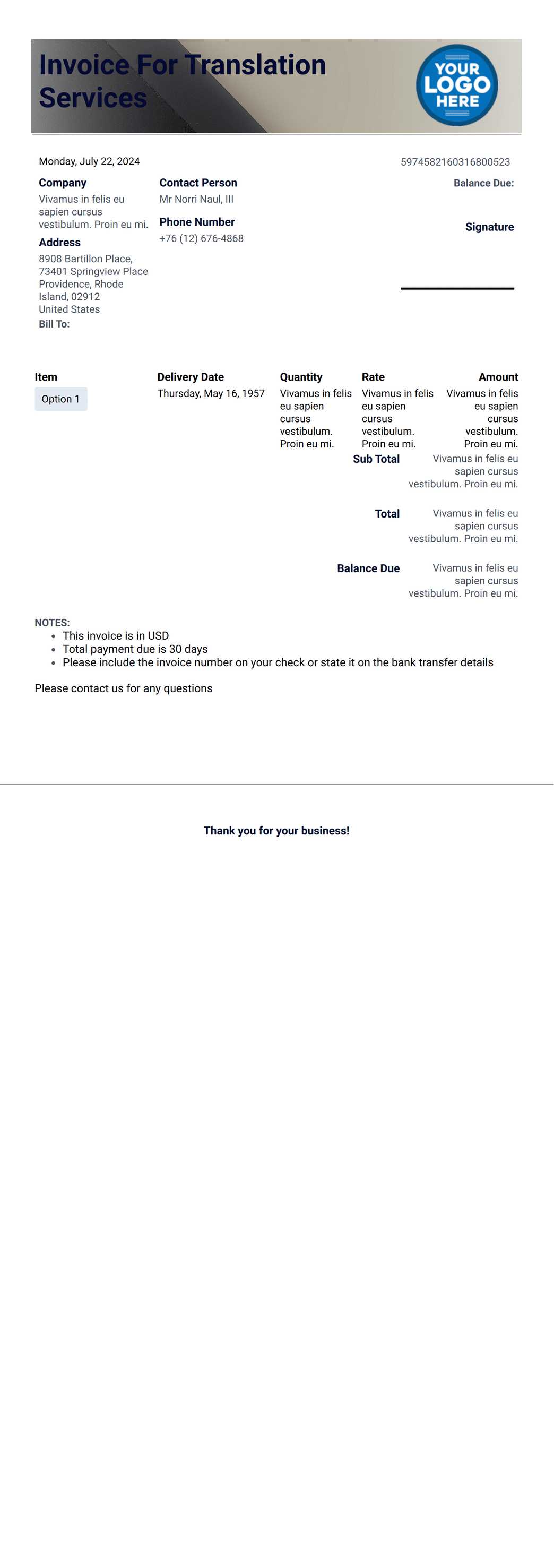

The first step in choosing the right format is to consider the nature of your business. Different industries may have different requirements, and it’s important to tailor the document accordingly. For example:

- Freelancers and Contractors: A simple, clean design with clear service descriptions and payment terms may be sufficient.

- Retailers: An itemized list of products or services, with corresponding prices and quantities, is typically necessary.

- Service-Based Businesses: Detailed breakdowns of hours worked, rates, and additional fees are often required.

Key Features to Look For

When selecting a format, make sure it includes the essential elements your business needs. Look for the following:

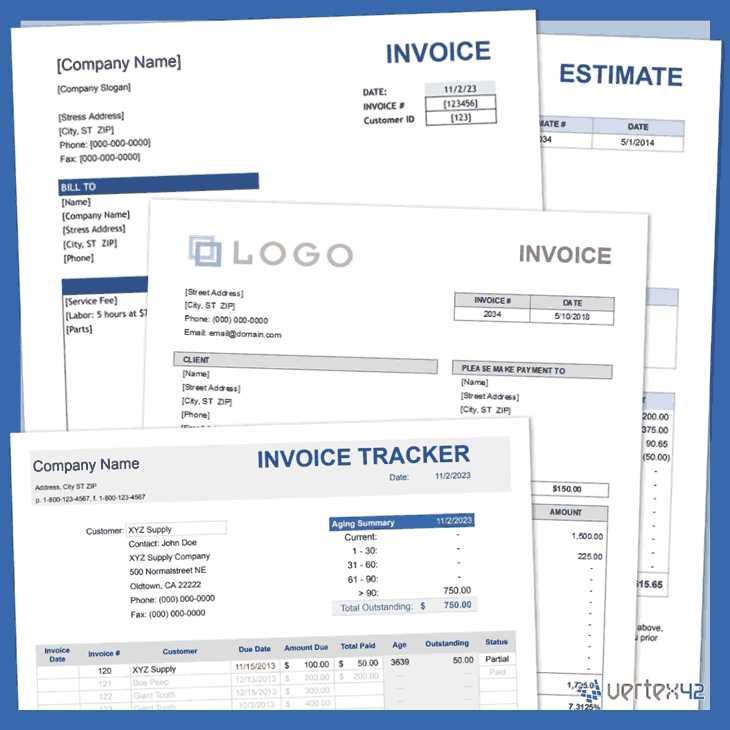

- Customization Options: Choose a structure that allows you to modify the document to fit your branding, such as adding logos or adjusting colors.

- Itemized Listings: Make sure the design allows you to clearly list all services, products, or hours worked, along with their prices.

- Payment Methods: Ensure it provides space to clearly state the payment options you accept, such as bank transfers, credit cards, or online platforms.

- Due Dates and Terms: It should have a place to specify deadlines, late fees, and other payment conditions.

By understanding your business needs and the specific features you require, you can select a structure that will save you time, reduce errors, and create a consistent experience for your clients.

Free vs Paid Invoice Templates

When it comes to creating payment request documents, businesses often face the decision between using a free or a paid structure. Both options have their advantages and limitations, and the right choice depends on your business’s needs, budget, and level of customization required. Understanding the differences between the two can help you make an informed decision that supports both your operational efficiency and professional image.

Advantages of Free Options

Free designs are an attractive option for businesses that are just starting out or those that need a simple and cost-effective solution. Here are some key benefits:

- Cost-Effective: As the name suggests, these documents are available at no cost, making them ideal for businesses with limited budgets.

- Quick Setup: Free structures are usually simple to use and can be accessed immediately, allowing you to start creating payment requests right away.

- Basic Features: While they may lack advanced customization, many free options still cover all the essential fields needed for a professional document.

Benefits of Paid Options

Paid designs, on the other hand, offer additional features and flexibility that can better serve more established businesses or those with specific needs. Here are the advantages:

- Customization: Paid options typically offer more advanced customization, allowing you to incorporate your branding, adjust layouts, and tailor the document to your exact preferences.

- Additional Features: These formats often include extra tools like automated calculations, recurring payment options, and integration with accounting software.

- Professional Design: A paid document often provides a more polished and modern look, which can help reinforce your business’s professionalism and credibility.

In summary, free designs may be a good starting point, but as your business grows and your needs become more complex, investing in a paid option can offer greater flexibility, enhanced features, and a more professional presentation. Choose the option that aligns best with your goals, ensuring it supports both your operational needs and your business image.

How to Format Your Billing Invoice

Proper formatting is essential when creating a payment request document. A well-organized layout ensures that all key details are easily accessible and clearly presented, making it easier for your client to understand the charges and pay promptly. Formatting is not just about aesthetics–it’s about efficiency and clarity in communication.

Essential Components to Include

Your document should always include specific sections to ensure it is complete and functional. The key components are:

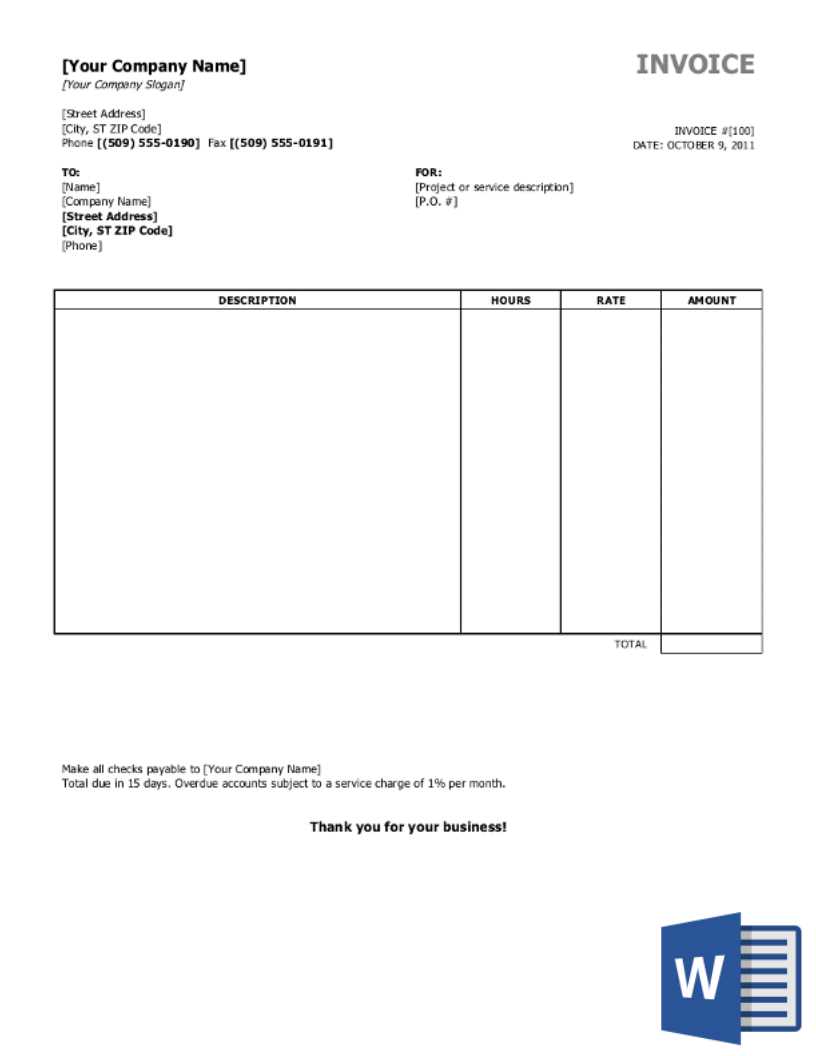

- Header: At the top, include your business name, logo, and contact information. This makes the document easily identifiable and provides the client with your details for future reference.

- Client Information: Below the header, list the client’s name, address, and contact information. This ensures there is no confusion about who the payment is coming from.

- Unique Reference Number: Assign a unique number to each document to help track payments and manage your records effectively.

- Details of Services or Products: Itemize what was provided, including descriptions, quantities, unit prices, and totals. This provides transparency and reduces the likelihood of disputes.

- Amount Due: Clearly display the total amount due, with any taxes or discounts applied, to make it easy for the client to see exactly what they owe.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees or discounts for early payments.

Design Tips for Clarity

A well-structured layout not only looks professional but also aids in clarity. Consider the following design tips:

- Use Headings: Break the document into sections with clear headings to guide the reader’s eyes.

- Consistent Font Style: Use a clean, professional font and ensure consistency throughout the document.

- Whitespace:

Common Mistakes to Avoid in Invoicing

Creating payment request documents may seem straightforward, but there are several common mistakes businesses often make that can lead to confusion, delayed payments, or even disputes. By understanding these pitfalls, you can ensure your documents are clear, professional, and effective in securing timely payment.

Missing or Incorrect Information

One of the most frequent errors is leaving out essential details or providing inaccurate information. This can create misunderstandings and complicate the payment process. Here are key elements that should never be overlooked:

- Client’s Contact Details: Always ensure you have the correct name, address, and contact information for the recipient of the payment.

- Service/Product Breakdown: A detailed list of what was provided, including quantities and prices, should be included to avoid confusion.

- Payment Terms: Clearly state the due date, payment methods, and any late fees to avoid delays and disputes.

Inconsistent or Unclear Formatting

Another common mistake is poor formatting. A cluttered or disorganized document can make it difficult for clients to quickly understand the key information. To avoid this:

- Ensure Readability: Use clean fonts, adequate spacing, and clear headings to make your document easy to read.

- Highlight Important Information: Bold or underline the total amount due and due date to draw attention to these critical details.

- Stay Consistent: Make sure the layout is consistent across all documents to create a professional, standardized appearance.

By avoiding these common mistakes, you can ensure that your payment requests are professional, accurate, and clear. This helps build trust with clients and accelerates the payment process, ultimately supporting the financial health of your business.

Essential Elements to Include in an Invoice

Creating a clear and complete payment request document is crucial for both your business and your clients. It ensures that all necessary information is provided in an organized manner, reducing the chances of confusion or delays in payment. There are several key components that every payment request should include to be both effective and professional.

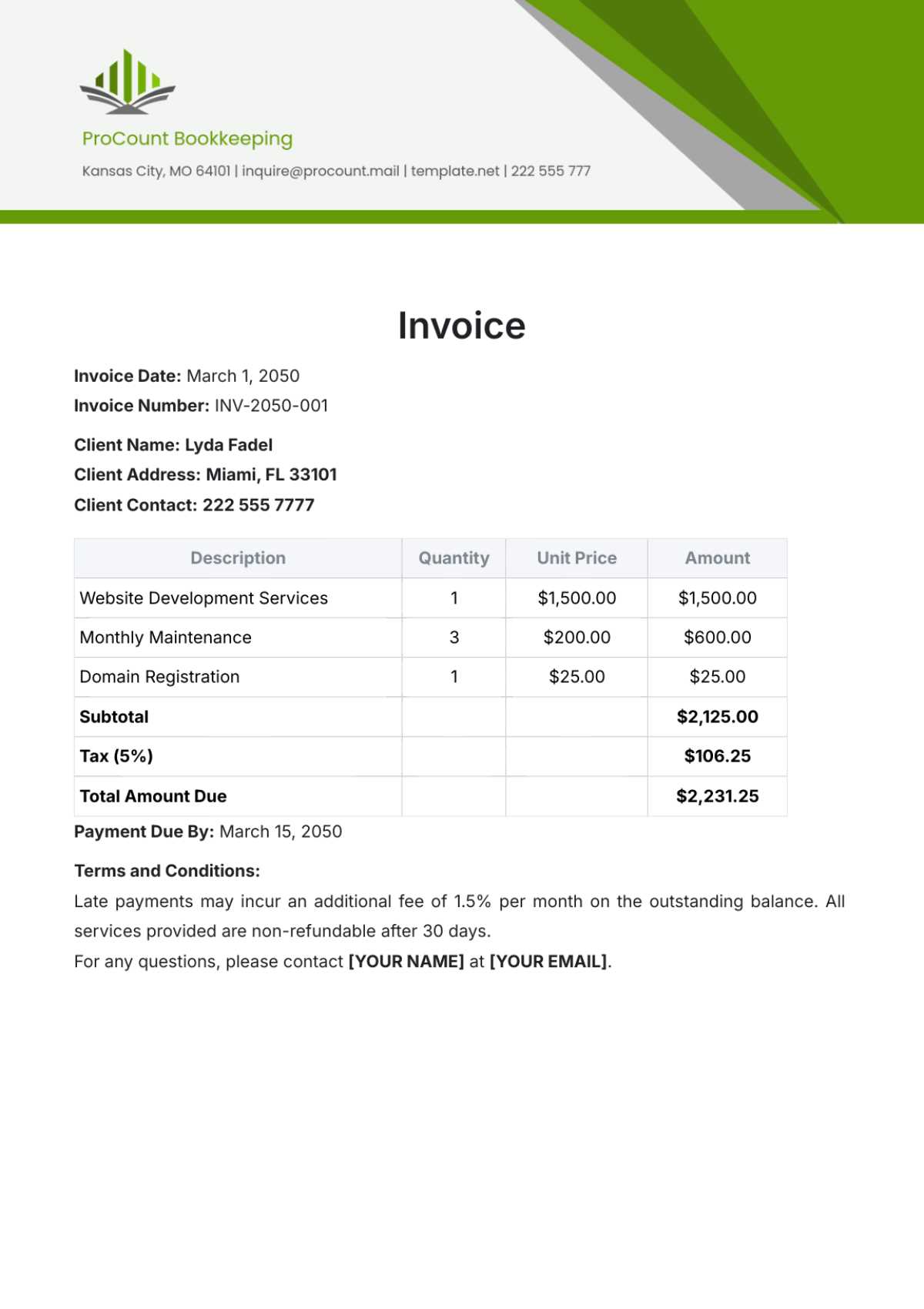

1. Business and Client Information

The first step is to clearly identify the parties involved in the transaction. Include your business name, logo, address, phone number, and email. Likewise, make sure your client’s name, address, and contact details are listed. This information establishes the legitimacy of the request and makes it easy to follow up if needed.

2. Detailed List of Goods or Services

One of the most critical sections of any payment request is the detailed description of what was provided. Include:

- Item Descriptions: Clearly describe each service or product you provided.

- Quantities: Indicate the amount or number of units delivered.

- Unit Prices: Specify the cost per unit for products or the rate for services.

- Subtotal: Provide the subtotal for each item or service line, before taxes or additional charges.

3. Total Amount Due

At the end of the document, clearly list the total amount due. This should include any taxes, discounts, or additional fees added to the subtotal. It’s important to make this figure easy to locate and emphasize it so clients can quickly see the total cost of the transaction.

4. Payment Terms and Conditions

Always specify the payment terms to ensure clarity regarding due dates, accepted payment methods, and any penalties for late payments. If you are offering early payment discounts or installment options, these should also be outlined here. Be clear about when the payment is expected and how it should be made to avoid confusion.

Including these essential components ensures that your payment request documents are thorough, professional, and easy to understand. Clear communication of these details not only facilitates quicker payments but also helps build a stronger business relationship with your clients.

How to Send an Invoice Correctly

Sending a payment request document is just as important as creating it. How you deliver the document can influence the speed of payment, the professionalism of your business, and the client’s overall experience. Ensuring that you send it in the correct manner and at the right time can prevent delays and misunderstandings, helping you maintain smooth cash flow.

Choose the Right Delivery Method

There are several ways to send your payment request, and the best method depends on your business relationship with the client. The most common options are:

- Email: This is the fastest and most efficient way to send documents. Make sure to attach the file in a widely accepted format like PDF to preserve the layout and prevent any issues with accessibility.

- Postal Mail: If your client prefers physical copies, mailing the document via regular or certified post is a good option. Ensure the document is printed clearly and included in a secure envelope to prevent damage.

- Online Payment Platforms: Many businesses use online platforms to send and track payment requests. These systems often allow for easy payment processing and can automatically notify both you and your client when the document is viewed.

Timing and Follow-Up

Sending your document at the right time is essential. Aim to send it shortly after the service or product has been delivered, while the transaction is still fresh in your client’s mind. Avoid delays in sending the document, as this can lead to payment delays as well. Also, consider these tips:

- Confirm Receipt: When sending via email, request a read receipt or follow up to ensure the client has received the document.

- Set Clear Deadlines: Always specify the payment due date clearly on the document and in any communications.

- Send a Reminder: If the payment deadline is approaching or has passed, send a polite reminder email to keep the payment on the c

Tracking Payments Using Invoice Templates

Effective tracking of payments is crucial for any business, as it ensures smooth cash flow and helps avoid overdue accounts. By using the right format for your payment requests, you can easily monitor the status of each transaction. This practice not only helps you stay organized but also ensures you can promptly follow up on unpaid amounts.

One of the simplest ways to keep track of payments is by maintaining a record of all issued documents and their payment statuses. Here’s how you can structure your record-keeping:

Document Number Client Name Amount Due Due Date Payment Status Payment Date 00123 John Doe $500 2024-11-15 How to Handle Late Payments on Invoices

Late payments are a common challenge for businesses of all sizes. When clients miss payment deadlines, it can disrupt cash flow and create unnecessary stress. However, handling overdue payments professionally and efficiently is key to maintaining healthy business relationships while ensuring you receive the money you’re owed.

1. Review the Terms and Check the Client’s History

Before taking any action, it’s essential to review the payment terms you agreed upon. Make sure the due date has passed and check for any special agreements regarding payment flexibility. Also, assess the client’s payment history–if this is a rare occurrence, a gentle reminder may be all that is needed.

2. Send a Polite Reminder

Start by sending a polite reminder email or letter, gently informing the client that the payment is overdue. A friendly tone can go a long way in maintaining a positive relationship. Key points to include in your reminder:

- Reference the Outstanding Amount: Clearly state the amount owed and the original due date.

- Reiterate Payment Methods: Remind the client of the available ways to settle the balance.

- Include a New Deadline: Politely request a revised payment date or prompt them to pay as soon as possible.

3. Offer Payment Solutions

If the client is facing financial difficulties, consider offering flexible payment options to resolve the issue. This might include:

- Installment Plans: Allowing the client to pay in smaller, more manageable amounts over time.

- Discount for Early Payment: Offering a small discount to encourage quicker settlement.

- Payment Extension: Providing an extension on the due date, if feasible, to accommodate the client’s situation.

4. Charge Late Fees

If your original agreement includes penalties for late payments, it may be time to enforce them. A reasonable late fee can serve as a deterrent to prevent future delays. Be sure to communicate any additional charges clearly, so the client understands the impact of not paying on time.

5. Seek Professional Help If Necessary

If repeated attempts to secure payment have been unsuccessful, it may be necessary to involve a collections agency or take legal action. Before pursuing these options, weigh the potential costs against the benefits, as this could damage your relationship

Legal Requirements for Billing Invoices

When creating a payment request document, it’s essential to ensure that it complies with the legal requirements in your country or region. These documents are not only critical for securing payments but also serve as legal records in case of disputes or audits. Understanding what must be included can help protect your business and ensure transparency with clients.

1. Clear Identification of the Parties Involved

Each payment request should clearly identify both the seller and the buyer. This typically includes the following details:

- Your Business Name and Address: Your company’s full legal name, business address, and contact information.

- Client Information: The name, address, and contact details of the person or company you are billing.

2. Unique Reference Number

To ensure clarity and for record-keeping purposes, each document should have a unique reference number. This allows both parties to easily track payments and resolve any issues related to the transaction. The number should be sequential and avoid duplication to maintain consistency in your record-keeping system.

3. Description of Goods or Services Provided

For the document to be legally valid, it must include a detailed breakdown of the goods or services provided. The description should be specific and unambiguous to prevent any confusion. Common requirements include:

- Itemized List: A clear description of each product or service, including quantities, unit prices, and applicable taxes.

- Dates of Delivery or Service: When the goods or services were provided should also be included to show when the transaction took place.

4. Total Amount Due

It is essential to state the total amount owed, including any taxes, shipping fees, and discounts. The document should indicate the net amount due, as well as a breakdown of individual charges to avoid ambiguity. If VAT (Value Added Tax) or other taxes apply, they must be listed separately.

5. Payment Terms

The document should clearly outline the terms of payment, including the due date, any late fees or penalties, and the payment methods you accept. This section should also indicate the consequences of late or missed payments, such as interest charges or the suspension of services.

6. Tax Identification Numbers

In many jurisdictions, businesses are required to include their tax identification number (TIN) or VAT number on any official payment request document. This is particularly important for transactions that involve tax reporting, as it allows authorities to track sales and taxes accurately.

7. Legal Language or Notices

In some cases, you may need to include specific legal language or disclaimers related to payment terms, returns, or refunds. These are typically based on local regulations and may vary by industry. It’s advisable to consult with a legal professional to ensure that you comply with all relevant laws and regulations.

By adhering to these legal require

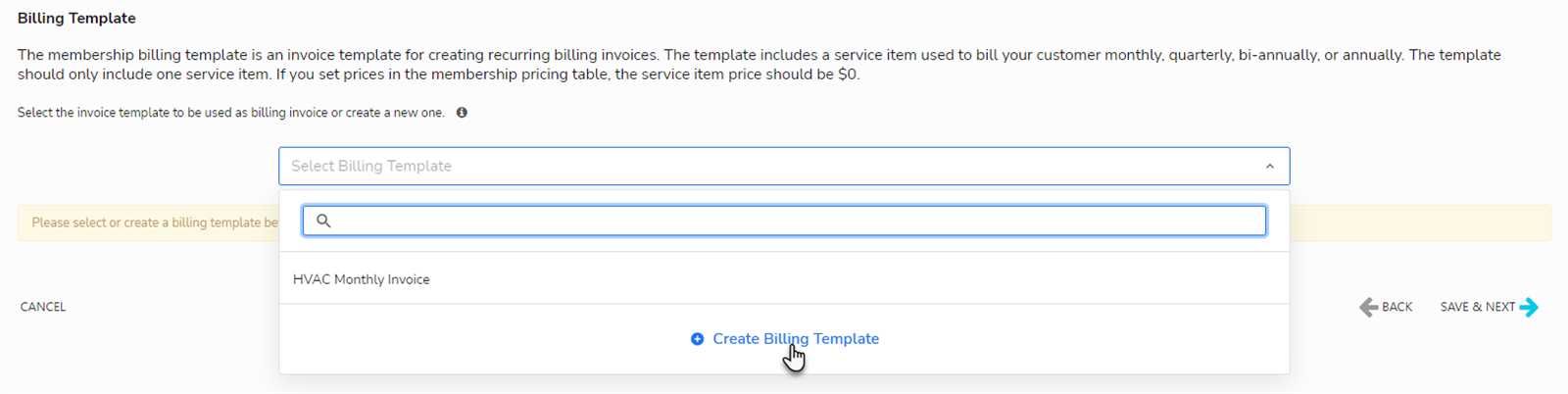

How to Automate Invoice Creation

Creating payment request documents manually can be time-consuming and prone to errors, especially as your business grows. Automating this process helps streamline your workflow, reduces human mistakes, and saves valuable time. By using automation tools, you can generate professional and accurate documents at the click of a button, ensuring faster payments and better efficiency.

1. Choose the Right Software

The first step to automating your payment document creation is selecting the right software. There are many tools available that offer customizable features to suit your business needs. Some popular options include:

- Accounting Software: Programs like QuickBooks, Xero, or FreshBooks can automatically generate documents based on your data and transactions.

- Dedicated Invoicing Platforms: Tools like Zoho Invoice or Invoice Ninja are designed specifically for creating and sending payment requests, with features such as recurring billing and client management.

- Cloud-Based Tools: Google Sheets or Microsoft Excel can also be set up to create documents using formulas and integration with other tools like Zapier for additional automation.

2. Integrate with Your Business Systems

To maximize automation, integrate your payment request system with other software platforms you use in your business. For example:

- CRM Integration: Linking your Customer Relationship Management (CRM) system with your invoicing software ensures that client details are automatically populated in your documents, reducing data entry errors.

- Payment Gateways: Integration with payment systems like PayPal or Stripe can automatically update payment statuses and track transactions.

- Accounting Integration: Sync your invoicing system with your accounting software to automatically record payments, taxes, and expenses.

3. Set Up Recurring Billing

If your business offers subscription-based products or services, automation can significantly simp

Best Software for Invoice Templates

Choosing the right software to generate and manage payment documents can greatly enhance your business operations. The best tools help you automate the creation process, offer customizable designs, and ensure compliance with legal standards. With the right software, you can quickly produce professional and accurate documents that streamline your financial processes and reduce errors.

1. QuickBooks

QuickBooks is one of the most widely used accounting platforms, offering robust features for managing both finances and payment requests. With QuickBooks, you can create customized documents, track payments, and even integrate with your bank account for seamless financial management. Key features include:

- Customizable Templates: You can easily personalize documents to match your brand, with the ability to include logos, colors, and payment terms.

- Recurring Invoicing: Automatically generate and send payment requests for regular transactions or subscriptions.

- Comprehensive Reports: Generate financial reports that integrate data from your payment requests and other business activities.

2. FreshBooks

FreshBooks is an intuitive accounting software designed with small businesses in mind. It offers a simple user interface and powerful invoicing features, ideal for freelancers and service-based businesses. Highlights include:

- Pre-designed and Customizable Forms: Choose from a variety of professional templates, or modify them to suit your needs.

- Time Tracking Integration: If you bill clients based on time worked, FreshBooks allows you to easily track and add hours directly to your payment requests.

- Client Portal: Clients can view and pay outstanding amounts directly from the document, improving efficiency and payment turnaround time.

3. Zoho Invoice

Zoho Invoice offers a variety of templates and customization options, making it a great choice for businesses that want flexibility and control over their payment requests. Features include:

- Multi-currency Support: Zoho allows you to bill clients in different currencies, making it perfect for international businesses.

- Automation Features: Set up recurring payments and automated reminders for overdue amounts to ensure timely collections.

- Detailed Analytics: Track payment histories, client behaviors, and other metrics to improve your financial strategies.

4. Wave

Wave is a free accounting software that includes a powerful invoicing tool, ideal for small businesses and startups. While it offers fewer features than some paid options, it provides solid functionality for generating professional documents without the cost. Key features of Wave include:

- Simple Interface: Create and send professional payment documents with ease, even without accounting experience.

- Receipt Scanning: Upload receipts and automatically categorize expenses for streamlined financial management.

- Integration with Bank Accounts: Sync your Wave account with your business bank account to automatically track transactions and payments.

5. Invoice Ninja

Invoice Ninja is a versatile and affordable solution for creating and managing payment documents. With its wide range of customization options, it’s suitable for freelancers, small businesses, and larger companies alike. Features include:

- Multiple Payment Options: Clients can pay directly through integrated payment gateways like PayPal, Stripe, and others.

- Mobile App: Invoice Ninja offers a mobile app for easy document creation and management on the go.

- Advanced Reporting: Access detailed reports on payments, taxes, and client history, helping you stay organized and informed.

With these software options, you can streamline the process of creating, sending, and tracking payment requests, while also ensuring that your business remains organized and compliant. By choosing the right tool, you’ll be able to focus more on your core business and less on administrative tasks.