Free Taxi Invoice Template Excel for Easy Customization and Use

Managing payments for transportation services can quickly become overwhelming without the right tools. A well-organized document can help track charges, simplify calculations, and improve professionalism. Using a straightforward, customizable layout allows for easy management of financial details, ensuring clarity for both service providers and clients.

Efficiency is key when it comes to handling various client accounts. By utilizing a digital sheet, you can easily update rates, calculate totals, and adjust for additional costs, all while maintaining a consistent format. This approach also reduces the chance of errors and saves valuable time that would otherwise be spent on manual calculations or formatting.

Whether you are a small business owner or an independent contractor, having a personalized system for recording services provided and payments received can make a world of difference. With minimal effort, you can create a professional record that enhances your credibility and ensures timely payments from clients.

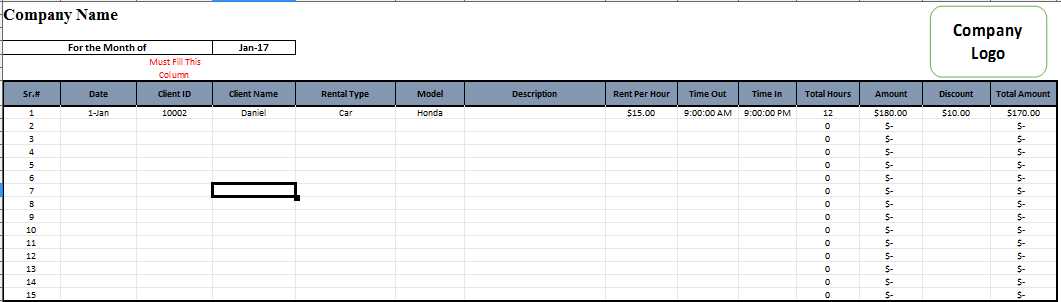

Taxi Invoice Template Excel Overview

When it comes to managing payment records for transportation services, using a customizable sheet can significantly improve the organization and efficiency of your billing process. A well-structured file allows for easy tracking of customer details, service charges, and any additional fees, all in one place. By setting up a straightforward system, service providers can maintain professionalism while saving time on manual calculations and paperwork.

Key Features of a Well-Designed Billing System

A good billing document should offer several essential features to meet the needs of service providers. It should be flexible, allowing for changes in rates, distances, or services. Additionally, a clear structure ensures that all necessary information is captured correctly, such as client details, trip summaries, and payment status. The following table highlights the main components that make up a reliable payment record document:

| Component | Purpose |

|---|---|

| Client Information | Ensures accurate identification of the customer and their contact details. |

| Service Description | Outlines the services provided, including the distance covered or time spent. |

| Charges and Fees | Details the rates applied, including any additional charges or discounts. |

| Payment Status | Tracks whether the amount has been paid or remains due. |

Benefits of Using a Customizable Sheet

By using a customizable system, service providers can adapt the document to their unique business needs. Whether it’s adjusting for fluctuating rates, adding special offers, or keeping track of multiple clients, this flexibility helps ensure that every transaction is accurately recorded. Additionally, having a clear and professional format improves communication with clients and enhances trust in the services offered.

Why Choose Excel for Taxi Invoices

Managing billing records through a digital sheet offers unmatched flexibility and precision for service providers. With a range of powerful features at your disposal, spreadsheets provide an efficient and cost-effective solution for keeping track of payments, services, and client details. Unlike traditional methods, this approach automates many tasks and minimizes the chances of errors, giving you more time to focus on your core business activities.

Here are some reasons why a spreadsheet system is ideal for managing payment records:

- Automation of Calculations – With built-in functions, you can automatically calculate totals, taxes, and discounts, saving time and reducing mistakes.

- Customizability – Easily adjust formats, rates, or fields to meet the specific needs of your services.

- Clear Structure – A well-organized layout ensures all essential details, such as dates, amounts, and client info, are easy to read and understand.

- Easy Tracking – Keep track of payments, outstanding balances, and service history, all in one place, for better financial oversight.

- Data Analysis – Quickly analyze income, expenses, or trends with built-in data tools like graphs and charts.

- Affordability – Most spreadsheet software comes at little to no cost, making it an accessible option for businesses of all sizes.

With these features, a spreadsheet solution allows for quick, accurate, and professional handling of all payment records. Whether you’re a small business or an independent contractor, the ease of use and customization options make it a smart choice for managing financial transactions.

Key Features of Taxi Invoice Templates

When creating a document to track payments for transportation services, certain features make the process easier and more efficient. A well-structured file not only helps you organize essential details, but it also ensures that all necessary information is captured accurately. From customer information to payment status, the right features can help streamline your workflow and improve the professionalism of your business records.

Here are some of the key components that make up a useful payment record sheet:

| Component | Description |

|---|---|

| Client Details | Captures customer name, address, and contact information for accurate records and communication. |

| Service Description | Summarizes the service provided, such as the trip route, duration, or distance covered, making it easy to understand the charges. |

| Charges Breakdown | Outlines all fees associated with the service, including base rates, additional charges, and taxes. |

| Payment Status | Indicates whether the customer has paid, or if payment is due, to prevent errors in tracking outstanding balances. |

| Customization Options | Allows for adjustments in rate, currency, and other variables to accommodate different clients or service conditions. |

Incorporating these features into a payment record document allows for efficient tracking, clearer communication with clients, and improved accuracy when handling financial transactions. With the right structure, it becomes easier to manage multiple clients and ensure timely payment processing, ultimately contributing to smoother business operations.

How to Download Free Templates

Finding a free, customizable file to manage payment records is an easy and effective way to streamline your billing process. Many resources online offer downloadable options that can be tailored to fit your specific needs. Whether you are looking for a simple layout or something more detailed, the internet provides a wide variety of solutions at no cost.

Here’s a step-by-step guide to download a free document to organize your payment details:

- Search for Free Resources – Begin by searching online for “free billing templates” or “free payment record sheets.” Numerous websites offer downloadable files with various layouts to choose from.

- Select the Right Format – Choose a format that works for your needs, such as a spreadsheet or a document. Make sure it is compatible with your software to ensure seamless use.

- Review and Customize – Before downloading, review the available options to make sure the layout contains all the fields you need. Some may include additional features like auto-calculation for totals or tax fields, which can save you time.

- Download the File – Once you’ve selected the right option, click the download link. The file will typically be in a .csv, .xls, or .doc format, which can be easily opened in most software programs.

- Modify for Your Business – After downloading, customize the document to reflect your unique pricing, services, and other business details. You can add or remove fields as necessary, ensuring that the record fits your workflow.

By following these simple steps, you can quickly access and implement a free document that suits your business needs. The flexibility of these resources makes them ideal for adapting to changes in your services or client requirements over time.

Benefits of Customizing Your Invoice

Customizing your billing record can significantly enhance the way you manage and present your financial transactions. A personalized document allows you to tailor the format, structure, and content to suit your specific business needs. This not only helps in maintaining professionalism but also ensures that all relevant information is clearly communicated to your clients.

Here are several advantages of customizing your payment record:

- Professional Appearance – A customized layout reflects your brand identity and enhances the credibility of your business, giving clients a polished and professional impression.

- Accurate Tracking – Tailoring your document ensures that all the necessary fields are included, such as payment status, service descriptions, and client details, making it easier to track outstanding balances and completed transactions.

- Improved Efficiency – By adding features like automatic calculations, you can save time and reduce errors, speeding up the billing process and minimizing manual work.

- Flexibility – Customizing allows you to adapt your billing structure as your business grows. Whether it’s adjusting for new services, changing rates, or offering discounts, a personalized record keeps you in control of your financial documentation.

- Better Client Communication – When your billing document is clear, comprehensive, and aligned with your services, it minimizes confusion and ensures better communication with clients, fostering trust and transparency.

Incorporating these benefits into your business operations ensures smoother financial management and enhances the overall client experience, contributing to the long-term success of your business.

Creating a Simple Billing Record in a Spreadsheet

Setting up a basic document to manage and track payments is straightforward and can save you time in the long run. A simple record-keeping system is all you need to start, especially if you’re looking for a way to organize your financial transactions without the complexity of advanced software. With just a few key components, you can create a professional, easy-to-use system that covers all the essential details of each transaction.

Follow these steps to create a simple billing document:

- Set Up the Layout – Start by creating a clean layout with headings for each section, such as client information, service description, charges, and payment status. This structure will help you quickly organize your data.

- Include Client Information – Add fields for customer details such as their name, address, and contact information. This ensures that you can easily reference the client for follow-up or future transactions.

- List Services Provided – Include a section to describe the services rendered, whether it’s the distance traveled, hours worked, or specific tasks completed. This is important for transparency and for the client to understand what they are being billed for.

- Specify Charges – Break down the costs clearly. Include base fees, any additional charges, taxes, and discounts. This will make it easier to calculate the total amount due and avoid misunderstandings.

- Add Payment Details – Provide space to track the payment status, including the total amount paid and the balance due. You can also include a due date for the payment, which will help you stay organized.

- Format for Clarity – Make sure the document is easy to read by using clear fonts, bold headings, and appropriate spacing between sections. This will help you maintain professionalism in all your transactions.

Once these components are set up, you can save the file and reuse it for future transactions. As your business grows, you can easily add more features or adjust the document to meet your evolving needs.

Using Spreadsheet Functions for Accurate Calculations

Accurate calculations are essential when managing financial records, especially when dealing with various charges and fees. Utilizing the built-in functions in a spreadsheet program can save you time and eliminate human errors. By automating calculations, you ensure that your records remain consistent, and you can focus more on providing quality service rather than worrying about math errors.

Essential Functions for Financial Calculations

Spreadsheets offer a wide range of functions that can help you accurately calculate totals, apply discounts, and handle taxes. Here are some of the most useful functions:

- SUM – Adds up values in a selected range of cells, perfect for totaling service fees or expenses.

- IF – This conditional function allows you to apply specific calculations based on set criteria, such as applying a discount for large payments.

- ROUND – Ensures your figures are rounded to the nearest decimal place, which is important for financial records.

- PRODUCT – Multiplies numbers together, such as calculating rates by distance or time.

- VLOOKUP – Allows you to search for and retrieve data from different parts of the sheet, useful for referencing customer details or service prices.

How to Automate Your Calculations

By setting up formulas for these functions, you can automate complex calculations and ensure accuracy. For instance, if you have a list of services provided with different rates, you can use the SUM function to automatically total the charges. Similarly, using IF statements can apply taxes or discounts based on specific conditions, making your billing system both efficient and error-free.

Using spreadsheet functions not only improves accuracy but also speeds up the process of managing payments. As your needs grow, you can customize these functions further to handle additional complexities such as multiple currencies or service categories.

Formatting Your Billing Record for Professionalism

Creating a polished and easy-to-read document is crucial for maintaining a professional image in your business dealings. A well-formatted financial document ensures clarity, prevents confusion, and demonstrates that you take your business seriously. By paying attention to details such as layout, fonts, and organization, you can make sure that your records are not only functional but also visually appealing and consistent with your brand identity.

Here are some key formatting tips to improve the professionalism of your payment records:

- Use Clear Headings – Divide your document into sections with clear, bold headings, such as “Client Details,” “Service Description,” and “Payment Summary.” This structure will make it easy for the reader to find specific information.

- Maintain Consistent Fonts – Choose a clean, easy-to-read font (such as Arial or Times New Roman) and use it consistently throughout the document. Avoid using too many different fonts or font sizes.

- Include Your Business Logo – Adding your logo at the top of the document can enhance your branding and make your payment record look more official.

- Use Tables for Clarity – Tables are an excellent way to present information in a neat and organized manner. Use them for breaking down charges, listing services, or showing payment status.

Below is an example of how to format your document using a simple table layout:

| Service Description | Rate | Amount |

|---|---|---|

| Basic Ride | $15.00 | $15.00 |

| Additional Time | $5.00 per hour | $10.00 |

| Discount | – | -$5.00 |

| Total | – | $20.00 |

By following these guidelines and using simple but effective formatting techniques, you can ensure that your financial records look professional and are easy for your clients to understand. A well-organized document not only reflects your attention to detail but also builds trust with your customers.

Adding Your Business Logo to the Template

Incorporating your business logo into your billing records can significantly enhance your professional image and brand recognition. A logo not only identifies your business but also adds a sense of legitimacy and trustworthiness to the document. By placing your logo in a prominent position, such as the top of the page, you create a cohesive and polished look for all your financial documents.

Steps to Add Your Logo

Here’s a simple guide to adding your logo to your document:

- Prepare the Logo – Make sure your logo is in a suitable file format, such as .PNG or .JPEG, and that it’s of high quality to avoid pixelation when inserted into the document.

- Insert the Logo – In your spreadsheet program, go to the header or top section of the document. Use the “Insert” menu to add an image, and select the file you want to include. Position it appropriately, usually in the upper left or center for visibility.

- Resize the Logo – Adjust the size of the logo so that it fits well without overpowering the other elements of the document. It should be large enough to be recognizable but not so large that it distracts from the rest of the information.

- Ensure Visibility and Alignment – Make sure the logo aligns properly with other elements, such as client details and payment summaries. Consistent alignment creates a balanced and professional layout.

Why Adding a Logo Matters

Including your logo helps reinforce your brand identity, ensuring that your clients immediately associate the document with your business. It also adds a level of professionalism that enhances the overall customer experience. A well-branded document can make a lasting impression and build trust, making clients more likely to return and recommend your services.

Incorporating your business logo into your financial records is a small but effective way to make your documents stand out and create a cohesive brand presence across all customer interactions.

Including Tax and Additional Fees on Billing Records

When preparing a billing record, it’s essential to account for all additional costs, including taxes and any other extra charges. Accurately including these elements ensures that your records reflect the full amount owed by your clients and helps avoid any misunderstandings or disputes. Additionally, clear breakdowns of such charges contribute to professionalism and transparency, which are key to maintaining strong customer relationships.

Calculating and Adding Tax

Taxes are a common part of any service transaction. Here’s how you can include them in your billing record:

- Determine the Tax Rate – Research and apply the appropriate tax rate for your region or industry. This could be a percentage of the total cost or a fixed rate, depending on local regulations.

- Apply the Tax to the Total – Multiply the total amount of the service by the tax rate. If the service is subject to multiple tax rates, calculate each tax separately and then add them together for the final amount.

- Show the Tax Breakdown – Clearly display the tax amount in a separate line item on the record so that clients can easily see how much they are being charged for tax. Transparency helps avoid confusion.

Including Additional Charges or Fees

In addition to taxes, you may need to include extra charges based on specific conditions, such as delivery fees, fuel surcharges, or other service-related costs. These fees should be added as separate line items to make the billing record clear and itemized:

- List All Additional Fees – If applicable, include fees for things like special services, waiting time, or distance traveled. Each fee should be clearly labeled and described.

- Ensure Consistent Formatting – Maintain a uniform format for listing additional charges. This makes it easier for clients to understand the reasons for extra costs and for you to track payments.

- Provide a Total – After adding the tax and any extra charges, include a final total that encompasses the full amount due. This should be clearly highlighted for ease of reference.

Including taxes and additional fees ensures that your billing records are accurate, transparent, and comprehensive. By clearly breaking down all costs, you show your clients that you are organized and honest, building trust and minimizing the chances of disputes.

How to Track Payments in a Spreadsheet

Keeping track of payments is crucial for managing your business’s cash flow and ensuring that all transactions are accounted for. Using a spreadsheet program to record and track payments can help you stay organized and prevent errors. By setting up a clear and efficient tracking system, you can easily monitor which clients have paid, which payments are pending, and the status of each transaction.

Setting Up Your Payment Tracking System

To effectively track payments, you need to create a structured system that includes all the relevant information. Start by setting up columns for the essential details of each transaction, such as the client name, service provided, amount due, amount paid, payment date, and payment status. Here’s how you can set it up:

| Client Name | Service Description | Amount Due | Amount Paid | Payment Date | Payment Status |

|---|---|---|---|---|---|

| John Doe | Ride from A to B | $30.00 | $30.00 | 2024-10-15 | Paid |

| Jane Smith | Ride from C to D | $50.00 | $25.00 | 2024-10-16 | Partial |

| Michael Brown | Ride from E to F | $40.00 | $0.00 | 2024-10-17 | Pending |

Using Functions to Monitor Payments

To streamline the tracking process and keep everything up to date, you can use various spreadsheet functions. For example:

- SUM – Automatically calculate the total amount due, total amount paid, or the outstanding balance by summing relevant columns.

- IF – Use this function to highlight specific rows or provide alerts when payments are overdue or partial payments have been made.

- Conditional Formatting – Apply color codes to payment statuses (e.g., green for “Paid,” yellow for “Partial,” red for “Pending”) to quickly visualize the status of each transaction.

By setting up your spreadsheet with clear categories and automating calculations, you can easily track the status of

Managing Multiple Billing Records with a Spreadsheet

When handling numerous financial transactions, it’s essential to have an efficient system for managing multiple records. A well-organized tracking system helps you keep all your payment details in one place, allowing for quick access and easy updates. Using a spreadsheet to manage a variety of records can streamline the process, making it easier to monitor each transaction and stay on top of outstanding balances.

Here are some strategies to effectively manage multiple billing records in a spreadsheet:

Setting Up a Centralized System

The first step is to create a master file that can store all the information about your transactions. In this file, you can have a dedicated section for each individual record, or you can use a single sheet with multiple rows, each representing a different transaction. Some key columns to include are:

| Client Name | Service Description | Amount Due | Amount Paid | Payment Status | Due Date |

|---|---|---|---|---|---|

| John Doe | Service A | $100.00 | $100.00 | Paid | 2024-10-10 |

| Jane Smith | Service B | $150.00 | $50.00 | Partial | 2024-10-12 |

| Michael Brown | Service C | $200.00 | $0.00 | Pending | 2024-10-15 |

Using Filters and Sorting

To manage large numbers of records, you can use built-in features like filtering and sorting to find specific details quickly. For example:

- Filter by Payment Status – Use the filter function to display only the records that are unpaid, partially paid, or fully settled. This allows you to focus on outstanding balances and follow up with clients as needed.

-

Common Mistakes to Avoid When Creating Billing Records

Creating clear and accurate financial records is essential for maintaining professionalism and ensuring smooth transactions with clients. However, even experienced individuals can make mistakes during the process. These errors can lead to confusion, delayed payments, and a lack of trust from clients. By understanding and avoiding common pitfalls, you can improve the accuracy and efficiency of your billing process.

Overlooking Essential Details

One of the most common mistakes when creating billing records is failing to include all the necessary information. Without complete details, clients may be unsure of what they are being charged for or when payments are due. Some important details to include are:

- Client Information: Ensure that client names, contact details, and addresses are correct.

- Accurate Service Descriptions: Clearly describe the services provided, including dates and specific tasks.

- Payment Terms: Clearly state payment due dates and any late fees or discounts.

Leaving out these critical details can lead to confusion and unnecessary follow-ups, wasting both time and resources.

Inaccurate Calculations

Another common mistake is making errors in calculations, which can result in incorrect billing amounts. Even small mistakes in the totals can create disputes with clients. To avoid this, make sure to:

- Double-Check Math: Always verify the math before finalizing the document, especially when dealing with discounts, taxes, or additional charges.

- Use Built-in Functions: Take advantage of spreadsheet formulas to automatically calculate totals and taxes. This minimizes the risk of human error.

- Check for Consistency: Ensure that all amounts, including discounts and extra fees, are consistent across the document.

Accurate calculations ensure that your clients are billed the correct amount and help maintain your reputation for reliability and professionalism.

Ignoring Branding and Formatting

Another error is neglecting the visual appeal and consistency of your financial records. Poor formatting can make it difficult for clients to read the document, potentially causing confusion or delays. To avoid this, consider the following:

- Consistent Branding: Include your business logo, use consistent fonts, and align text neatly to maintain a professional appearance.

- Clear Structure: Use headings, bul

Ensuring Legal Compliance in Billing Records

Maintaining legal compliance is crucial when managing financial transactions. It ensures that your business adheres to local, regional, or national regulations while minimizing the risk of disputes or penalties. Properly handling charges, taxes, and fees within your records helps you stay in line with legal standards and provides clarity to your clients. Understanding and implementing the required legal elements within your billing process is key to running a trustworthy business.

Key Legal Considerations for Billing

There are several legal factors to keep in mind when creating financial records. These considerations help ensure that all aspects of your billing process are compliant with relevant laws:

- Tax Compliance: Ensure that you are charging the correct tax rate based on your location or the client’s location. Different regions have different tax regulations, and failing to apply the correct rate could lead to fines.

- Accurate Service Descriptions: Provide clear, concise descriptions of the services rendered. Avoid vague terms to ensure transparency in case of legal scrutiny or audits.

- Payment Terms: Make sure your payment terms are clearly stated, including any late fees, discounts, or penalties. This ensures that clients understand the consequences of late payments and helps enforce fair business practices.

- Data Protection: If you store sensitive information, such as personal details or payment methods, ensure compliance with data protection regulations (e.g., GDPR, CCPA). Protecting your client’s privacy is not just a best practice but also a legal requirement.

How to Stay Compliant with Legal Requirements

To ensure your billing records remain legally sound, consider the following steps:

- Consult with a Legal Professional: When in doubt, seek advice from a legal expert familiar with business regulations in your industry. They can guide you through the specifics of tax laws, consumer protection, and other relevant legal requirements.

- Regularly Update Your Practices: Legal requirements change over time, so make it a point to stay informed about any changes in tax laws, payment regulations, or industry-specific standards.

- Use a Standardized Format: Implement a standardized format for all your billing records to ensure that they are clear and comprehensive. This reduces the chances of missing important information or violating regulations.

- Ensure Transparency with Clients: Provide clients with accurate, easily understandable documents. This helps avoid disputes and promotes trust between you and your clients, ensuring that your business practices are transparent.

By following these legal guidelines, you protect both your business and your clients while ensuring that all transactions are processed within the bounds of the law. Proper compliance also builds a reputation of reliability and professionalism, essential q

How to Automate Billing Record Generation in a Spreadsheet

Automating the creation of billing documents can save significant time and reduce human error. By setting up automatic processes in a spreadsheet, you can streamline the task of generating accurate financial records for each transaction. This method not only increases efficiency but also ensures consistency and eliminates the need to manually update every single detail for each new record.

Steps to Automate Your Billing Process

Here are a few steps to set up an automated system for generating financial records:

- Set Up a Master Data Sheet: Create a central data sheet where you will store all relevant information, such as client names, services rendered, amounts due, and payment status. This will be the source of data for generating your records.

- Use Formulas to Calculate Amounts: Implement formulas that automatically calculate totals, discounts, taxes, and balances. Functions such as SUM, IF, and VLOOKUP are particularly helpful in creating dynamic calculations.

- Link Data Across Sheets: If you use multiple sheets (e.g., one for client information, another for payment details), use cell references to link data across them. This will update relevant details automatically without having to manually enter information on each sheet.

- Automate Date and Number Generation: Use formulas to automatically generate unique billing numbers and populate the current date whenever you create a new record. This keeps your records organized and ensures that each entry is easily identifiable.

Advanced Automation Techniques

For even greater efficiency, consider using more advanced techniques:

- Use Macros: If you are comfortable with macros, you can automate the entire billing document creation process. A macro can pull data from your master sheet, fill out a formatted billing record, and even save it as a separate document with the client’s details.

- Integrate Drop-down Lists: By adding drop-down lists to your data entry fields, you can easily select client names, service types, and payment statuses, minimizing errors and making data entry faster.

- Conditional Formatting: Apply conditional formatting to highlight overdue payments or incomplete details. This can be automated to update in real-time as new records are added or payment statuses change.

By setting up these automated processes, you can ensure that your billing records are generated quickly and accurately, freeing up time for other important tasks while reducing the likelihood of mistakes. Automating your system also helps maintain consistency across all records, which is especially useful when managing large volumes of transactions.

Updating Your Billing System for Business Growth

As your business expands, so do your needs for more efficient and scalable financial processes. The system you use to generate financial records must evolve alongside your growth. Keeping your billing process adaptable ensures that you can handle increased volume, introduce new services, and cater to a broader customer base without compromising on accuracy or professionalism. Regularly updating your process can help you stay organized and continue offering excellent service as your business grows.

Adapting to Increased Volume

As your client base grows, your billing system should be able to handle a larger volume of transactions without becoming overwhelming. To achieve this:

- Expand Data Storage: Ensure your system can accommodate more clients and services. This may involve organizing your records into multiple sheets or utilizing a database to store and retrieve data more efficiently.

- Automate Routine Updates: Automate the generation of financial documents to reduce the amount of manual work required. Set up automatic calculations, due date updates, and new record generation to streamline your process.

- Introduce Client Categories: As your business diversifies, categorize your clients based on service types or contract terms. This can make it easier to apply tailored pricing, discounts, and payment terms.

Incorporating New Services and Pricing Models

As you add new services or update your pricing model, your billing process should reflect these changes seamlessly:

- Modify Service Descriptions: Update your records to clearly describe new services or packages. Be sure to include any associated costs or fees for transparent client communication.

- Adjust Pricing Structures: If you introduce tiered pricing or discounts for long-term clients, update your billing system to automatically apply these changes when generating financial records.

- Include Customizable Fields: If you offer a wider range of services or pricing options, consider adding customizable fields to your financial documents that allow for greater flexibility and accuracy.

By regularly updating your billing system, you ensure that it remains aligned with your business growth, allowing you to manage increased volume, new services, and evolving pricing structures without the need for complex manual updates. This adaptability is key to maintaining efficiency and professionalism as your business

Where to Find Advanced Billing Record Templates

When you need to upgrade your financial record-keeping system, finding a well-designed, advanced document layout can make all the difference. A sophisticated record generation format can help streamline the billing process, ensuring both accuracy and professionalism. Fortunately, there are numerous resources available online that offer customizable and feature-rich document formats to suit your needs.

Online Marketplaces and Resources

Here are several platforms where you can find high-quality, advanced document designs for your business:

- Microsoft Office Templates: The official Microsoft Office website offers a wide range of customizable financial document formats for businesses. These templates are easy to modify and come with predefined formulas for automatic calculations.

- Template Marketplaces: Websites like Template.net and Envato Elements provide professionally designed templates for a variety of business purposes, including billing. These sites often offer both free and paid options with advanced features such as integrated data analysis and automatic payment tracking.

- Google Sheets Template Gallery: Google Sheets also offers a selection of free templates for businesses. These templates are cloud-based, allowing for easy collaboration and access from anywhere, and can be customized to fit your specific requirements.

Free and Open-Source Resources

If you’re looking for a cost-effective solution, there are plenty of free and open-source resources available online. These templates may require a little more customization, but they can be a great starting point:

- Free Template Websites: Websites like Smartsheet and Vertex42 offer free downloadable templates, some of which include more advanced features such as automatic tax calculation, multi-currency support, and customizable sections.

- Open-Source Communities: Platforms such as GitHub sometimes host open-source templates created by the community. These resources are often highly customizable and may include additional functionality like integration with accounting software or cloud services.

Custom Design Services

If you’re looking for something more tailored to your specific needs, you can also commission custom design services. Many freelance designers specialize in creating personalized record formats that match your branding and business requirements. Here’s where to find them:

- Freelance Websites: Platforms like Upwork or

Managing financial records efficiently is crucial for maintaining a smooth business operation. A well-organized system allows you to track payments, avoid errors, and ensure timely collection. By implementing a few best practices, you can enhance the overall effectiveness of your record-keeping process, saving both time and effort while minimizing the risk of discrepancies.

1. Keep Your Data Organized

Organizing your data properly is the first step toward smooth financial record management. A clear and structured system helps you find the information you need quickly, reducing errors and improving workflow.

- Use Clear Categories: Divide your records into categories based on factors such as client type, service rendered, or payment status. This makes it easier to filter and analyze information.

- Maintain Separate Files: Keep different types of records in separate files, such as past due payments, completed transactions, and pending requests. This reduces clutter and ensures better organization.

- Use Descriptive Labels: Label your documents with client names, dates, and specific details about each transaction to make retrieval faster.

2. Automate Where Possible

Automation can save a significant amount of time and effort in managing financial documents. Setting up automated systems ensures consistency and reduces the chances of human error.

- Use Built-In Formulas: Leverage formulas for automatic calculations such as totals, taxes, and discounts. This ensures that your records are always accurate without manual intervention.

- Automate Reminders: Set up automated reminders for overdue payments. This will help you stay on top of pending collections without the need for manual follow-ups.

- Integrate Software Tools: Use accounting or record-keeping software that integrates with your existing tools. This allows for seamless tracking and reporting, minimizing manual data entry.

3. Regularly Review and Update Your Records

Regularly reviewing your records helps ensure that everything is accurate and up to date. Scheduled reviews prevent errors from accumulating and ensure that you don’t miss out on crucial updates.

- Set a Review Schedule: Set weekly or monthly reviews to ensure all financial documents are updated and all outstanding payments are tracked.

- Check for Duplicate Entries: Review records for any duplicate entries or inconsistencies. This will help keep your records clean and accurate.

- Update Contact Information: Make sure that client contact details and payment information are up-to-date to avoid delays or miscommunication.

By following these tips, you can optimize the management of your billing records, making the process more efficient, organized, and less prone to errors. An effective system will help you stay on top of your business finances and ensure smooth operations in the long run.