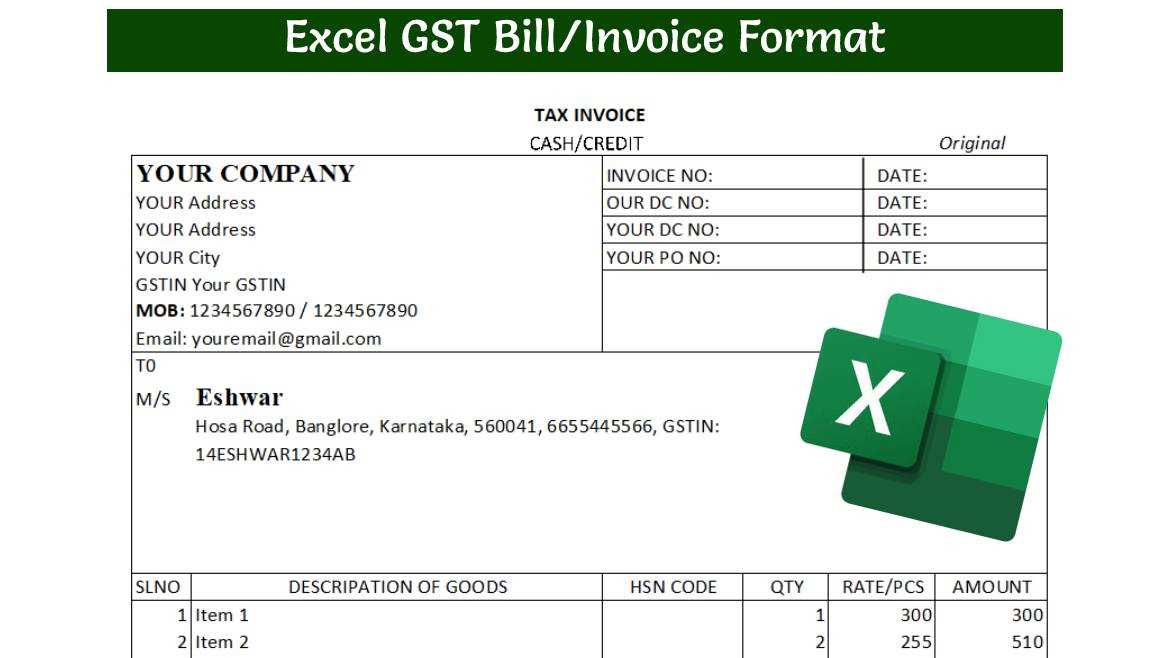

Download Free Tax Invoice Template in Excel Format

In today’s fast-paced business world, efficiency is key when it comes to managing financial documents. Whether you are a freelancer, small business owner, or part of a larger company, having a well-organized system for generating and managing financial records is essential. Using digital tools can simplify this process, ensuring accuracy and saving valuable time.

Digital document solutions provide an easy way to keep track of transactions, offering customizable formats that can be quickly adapted to your specific needs. These tools help eliminate the complexity of manually creating financial paperwork, making it easier to stay compliant with relevant regulations.

For those seeking to improve their workflow, leveraging a customizable format for financial records can bring tremendous value. With built-in formulas and automatic calculations, the process of documenting payments, taxes, and totals becomes more efficient. By using an organized digital format, businesses can enhance both their professionalism and productivity.

What is a Financial Record Format

A financial record format is a structured document used by businesses to detail the transactions between them and their clients. It serves as an official proof of purchase or service rendered, often including key information such as item descriptions, quantities, prices, and applicable charges. This format ensures both parties are on the same page regarding the terms of the agreement.

Digital solutions have made it easier to create and manage these records, offering customizable options that cater to different business needs. With a pre-designed structure, users can quickly input data and generate accurate records without the risk of errors or omissions. By utilizing automatic calculations, these formats ensure that all figures, including tax calculations, are precise and consistent.

For businesses looking to streamline their financial processes, a well-designed document format can simplify record-keeping, enhance professionalism, and improve overall efficiency. The flexibility of these formats allows them to be used across various industries and for different types of transactions, making them an indispensable tool for modern business operations.

Benefits of Using Spreadsheets for Financial Documents

Spreadsheets have become an invaluable tool for businesses when managing financial records. Their versatility and ease of use make them an ideal choice for organizing, calculating, and tracking payments. By utilizing built-in functions and formulas, businesses can reduce manual work and ensure accuracy in their financial documentation.

Automation is one of the key advantages of using spreadsheets. With just a few clicks, users can generate totals, apply tax rates, and calculate discounts automatically. This not only saves time but also minimizes human error, providing a more reliable and efficient way to create detailed financial records.

Another significant benefit is customizability. Spreadsheets allow users to design their documents to fit their specific needs, whether they need to include additional fields, adjust formats, or incorporate branding elements. This flexibility makes them suitable for a wide range of business types, from freelancers to large enterprises.

Lastly, spreadsheets offer easy data management. With features such as sorting, filtering, and searching, users can quickly find and organize any information they need. This is particularly useful when handling large volumes of financial data or when looking to track multiple transactions over time.

How to Create a Financial Document in a Spreadsheet

Creating a structured document to track business transactions can be done easily using a spreadsheet program. By following a few simple steps, you can quickly design a professional-looking record that includes all necessary information such as items, prices, and applicable charges. Here’s how you can create a well-organized document from scratch.

Step 1: Set Up Your Spreadsheet

- Open a new spreadsheet in your chosen program.

- Adjust the column widths to ensure ample space for data entry.

- Label your columns with appropriate headings, such as “Item Description,” “Quantity,” “Price,” “Total,” and “Tax Rate.”

Step 2: Input Data

- Begin entering the details of the transaction, including the names and quantities of products or services provided.

- For each item, input the price per unit, ensuring that it is clear and accurate.

- Use the formula function to calculate the total for each line item (e.g., multiply quantity by unit price).

Step 3: Add Calculations

- To calculate the total amount due, use formulas to sum the individual totals for each item.

- If necessary, apply any additional charges or discounts by adjusting the relevant cells.

- Ensure the tax rate is correctly applied to the total and calculate the final amount due.

Once you’ve completed these steps, your document will be ready to use, whether for personal record-keeping or client transactions. You can customize it further by adding branding elements such as your business logo, contact information, or any specific terms of service. The simplicity and flexibility of using a spreadsheet make it an efficient tool for creating and managing financial records.

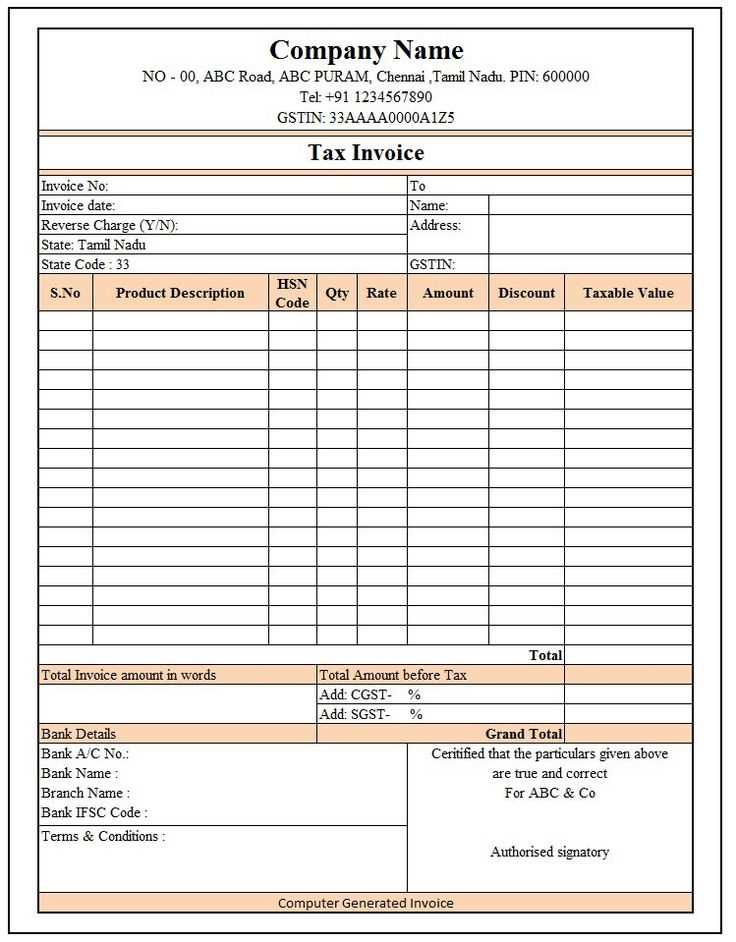

Key Features of a Financial Record Format

A well-designed financial document format provides essential features that help businesses create clear, accurate, and professional records. These key elements ensure that all relevant information is included and easily accessible, making the process of tracking transactions efficient and error-free. Below are some of the critical features to look for in an effective financial record format.

- Itemized List of Products or Services: A detailed breakdown of each product or service provided, including descriptions, quantities, and unit prices, is crucial for clarity and transparency.

- Automatic Calculations: Built-in formulas that automatically calculate totals, taxes, and discounts help to minimize errors and save time.

- Client and Business Information: Clearly displaying both the business and client’s contact details, including names, addresses, and phone numbers, ensures the document is professional and easy to reference.

- Tax and Other Charges: A section for including applicable tax rates, discounts, and additional fees is important for ensuring that all charges are properly accounted for.

- Clear Payment Instructions: Including clear payment terms, methods, and due dates ensures both parties understand the expectations and deadlines for completing the transaction.

- Customizable Layout: The ability to customize the layout to suit different business needs–whether by adding branding elements, adjusting the format, or including specific terms–enhances the flexibility and usability of the document.

These features work together to create a document that is both functional and professional. Whether you are managing small transactions or large contracts, having a structured format with these key elements helps businesses stay organized and ensure smooth financial operations.

Customizing Your Financial Document Format

Customizing your financial record layout allows you to tailor the document to meet your business’s unique needs and ensure consistency across all transactions. By adjusting various elements such as structure, design, and content, you can create a document that not only reflects your brand but also enhances clarity and professionalism. Below are some tips for personalizing your financial document format effectively.

- Adjusting the Layout: Modify the rows and columns to better organize the information, such as moving total amounts or payment terms to more prominent positions. You can also add additional sections to include more details, like project descriptions or special terms of sale.

- Branding and Design: Personalize the design by incorporating your business logo, colors, and fonts. This ensures that the document aligns with your company’s identity and gives a professional touch to every transaction.

- Custom Fields: Add custom fields that are relevant to your business, such as project numbers, client reference codes, or special notes about the product or service. This can help you track specific information that’s important for your records.

- Setting up Formulas: Excel allows you to set up automated calculations for subtotals, taxes, discounts, and final amounts. You can customize these formulas to suit different pricing models or offer conditional discounts depending on the transaction size.

- Creating Templates for Repeat Use: Once you’ve customized your document, save it as a reusable file for future use. This allows you to generate new documents quickly without having to redo the setup each time.

With these customization options, you can create a flexible and professional document that not only meets your business requirements but also improves the efficiency and accuracy of your financial management.

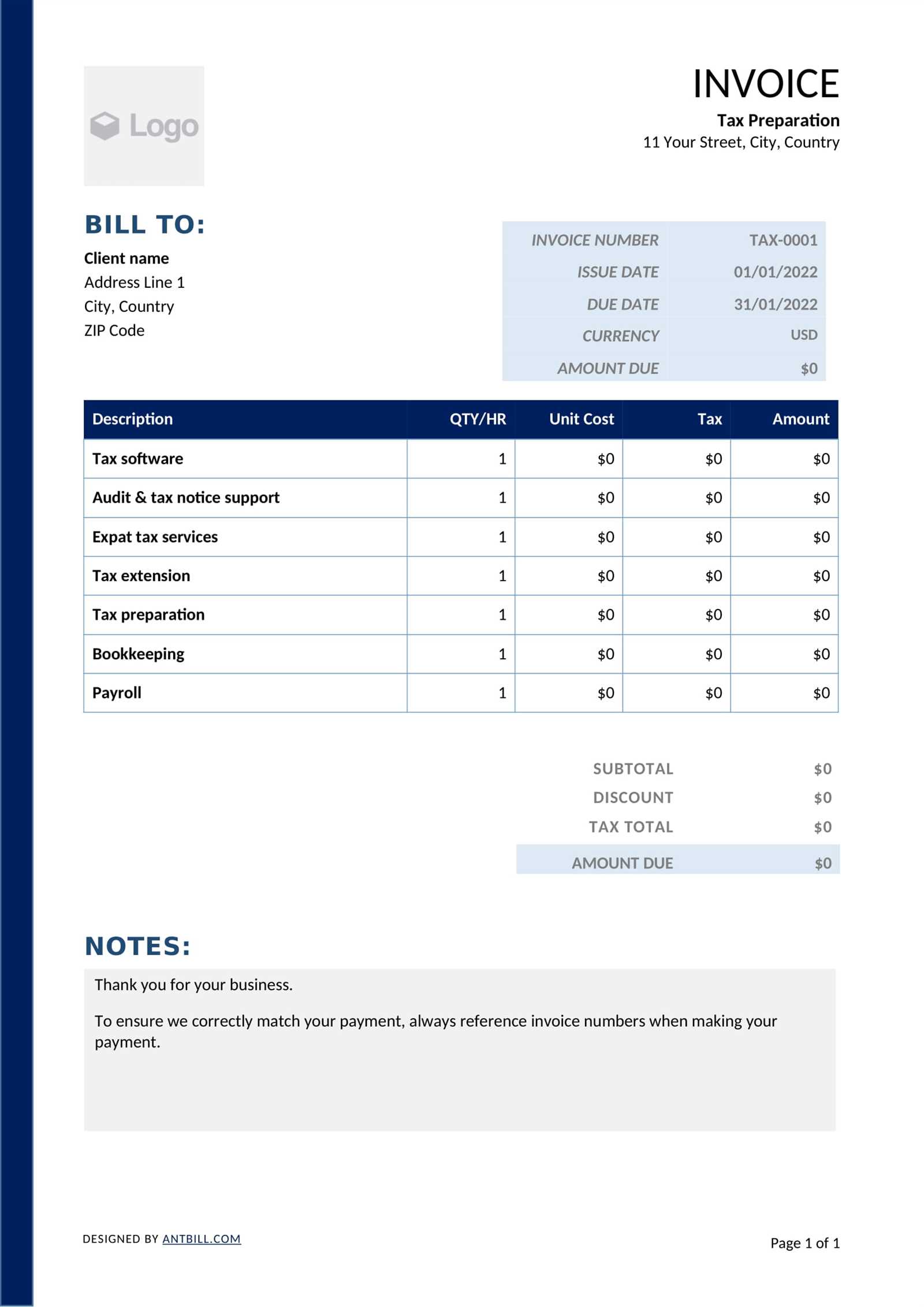

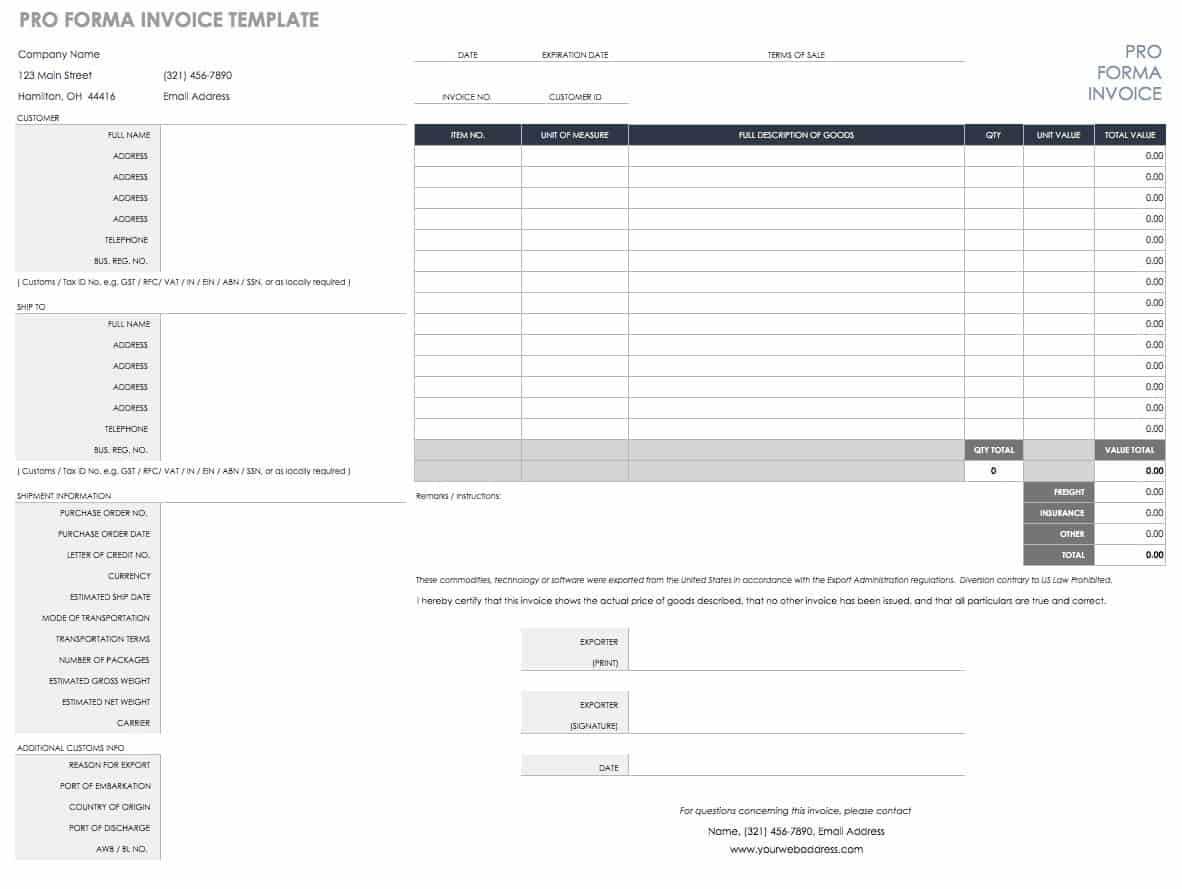

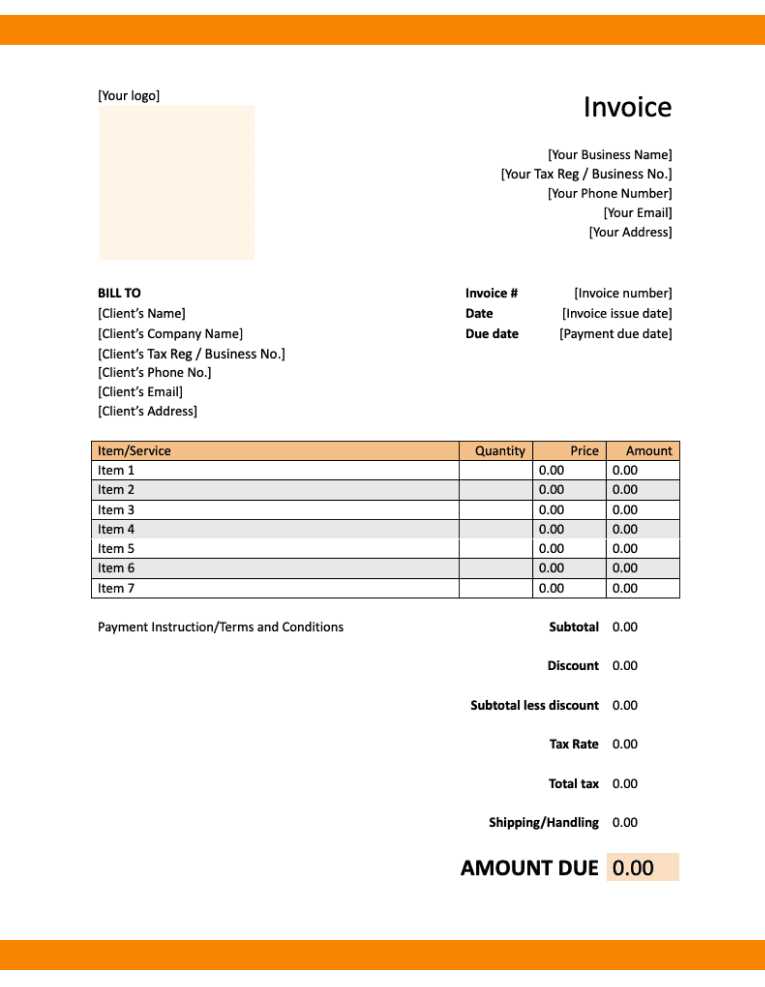

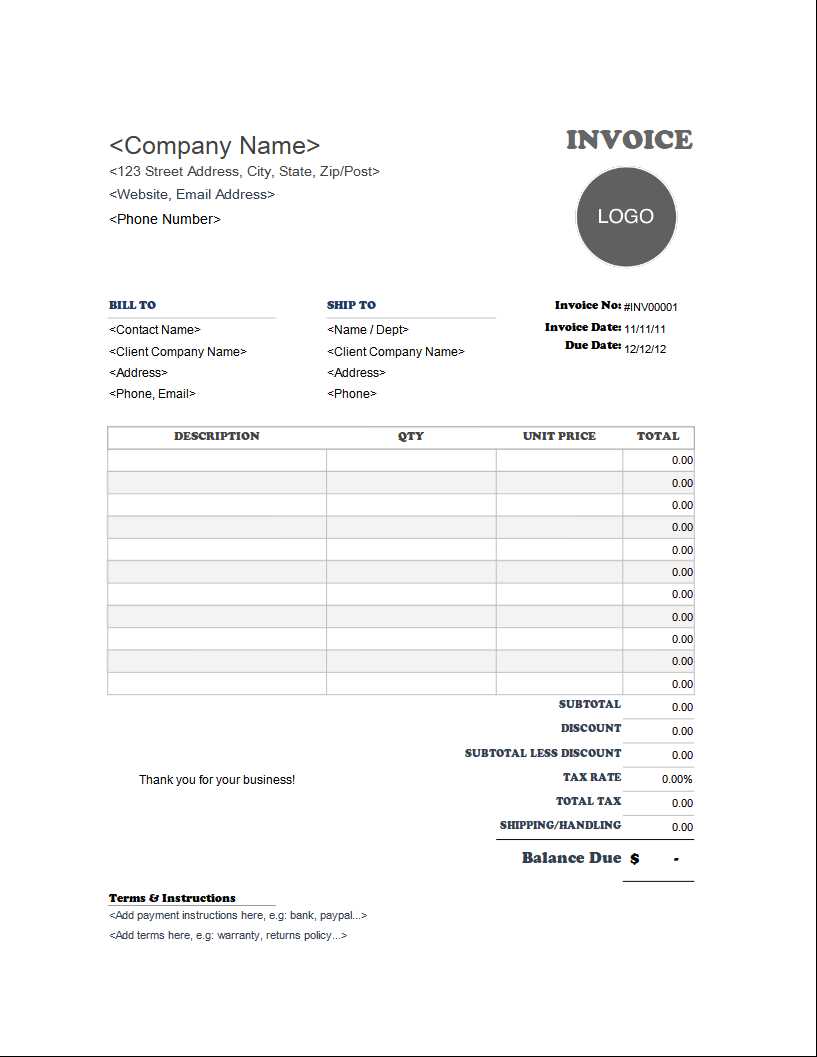

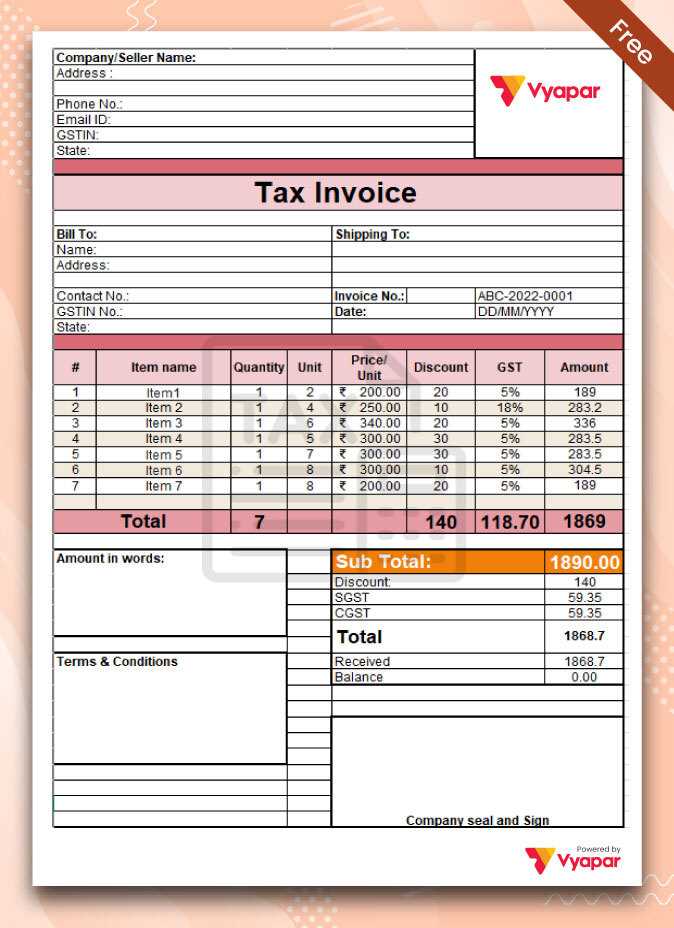

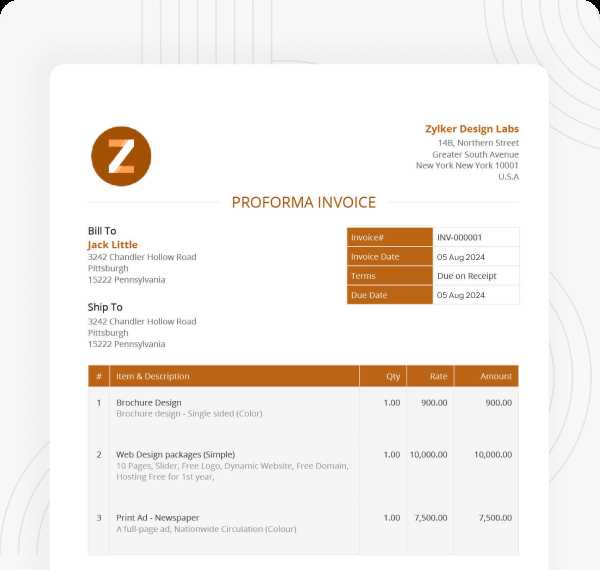

Free Financial Record Formats for Spreadsheets

Finding free, customizable formats for managing business transactions can save both time and effort. These ready-made solutions allow users to quickly create professional documents without needing to start from scratch. Whether you’re a freelancer, small business owner, or large enterprise, there are many options available that meet a variety of needs and preferences.

Where to Find Free Formats

Several online platforms offer free downloadable options that can be easily adapted to your business’s requirements. Websites such as Google Sheets, Microsoft Office, and Template.net feature a wide range of pre-designed options, from simple records to more complex designs. These formats often include built-in features like automatic calculations, customizable fields, and ready-to-use layouts.

Benefits of Using Free Formats

- Time Savings: Pre-designed formats eliminate the need to build your own from scratch, speeding up the document creation process.

- Customizability: Even free versions can be tailored to your specific needs, allowing you to adjust fields, fonts, and calculations.

- Professional Appearance: Ready-made formats often come with sleek designs and clear structures, helping you create well-organized documents that look polished and official.

By using free, pre-made formats, businesses can ensure that their financial documentation is both accurate and professional, without incurring additional costs. These templates help streamline administrative tasks and free up time for more important business activities.

Common Errors in Financial Records

While creating financial documents, there are several common mistakes that can lead to confusion, incorrect calculations, or even legal issues. Ensuring accuracy in every step is essential for maintaining professional standards and preventing unnecessary complications. Below are some of the most frequent errors businesses make when generating financial records.

1. Incorrect Calculations

One of the most common mistakes is miscalculating totals, taxes, or discounts. Errors in simple arithmetic can lead to discrepancies in the final amount owed or paid. Without proper formulas or checks in place, these errors can go unnoticed, causing issues with clients or regulatory authorities.

2. Missing or Inaccurate Information

- Client Details: Failing to include accurate or complete client information, such as names, addresses, and contact details, can create confusion and make it difficult to track transactions.

- Item Descriptions: Vague or incomplete descriptions of products or services can lead to misunderstandings or disputes about what was provided.

- Payment Terms: Missing or unclear payment terms can lead to late payments or confusion about deadlines.

3. Not Using Consistent Formats

Inconsistent formatting between documents, such as varying fonts, sizes, or column placements, can make financial records look unprofessional and harder to read. A consistent, clear layout helps improve readability and ensures that all necessary details are easily accessible.

4. Failing to Apply Proper Tax Rates

Incorrectly applying tax rates or forgetting to include them altogether can result in financial discrepancies. It’s important to ensure that the correct rate is applied based on location, product, or service type, and that any tax exemptions or discounts are properly accounted for.

By addressing these common errors, businesses can avoid costly mistakes and ensure that their financial documentation remains accurate and professional. Regularly reviewing documents before sending them out is crucial for maintaining smooth operations and a good relationship with clients.

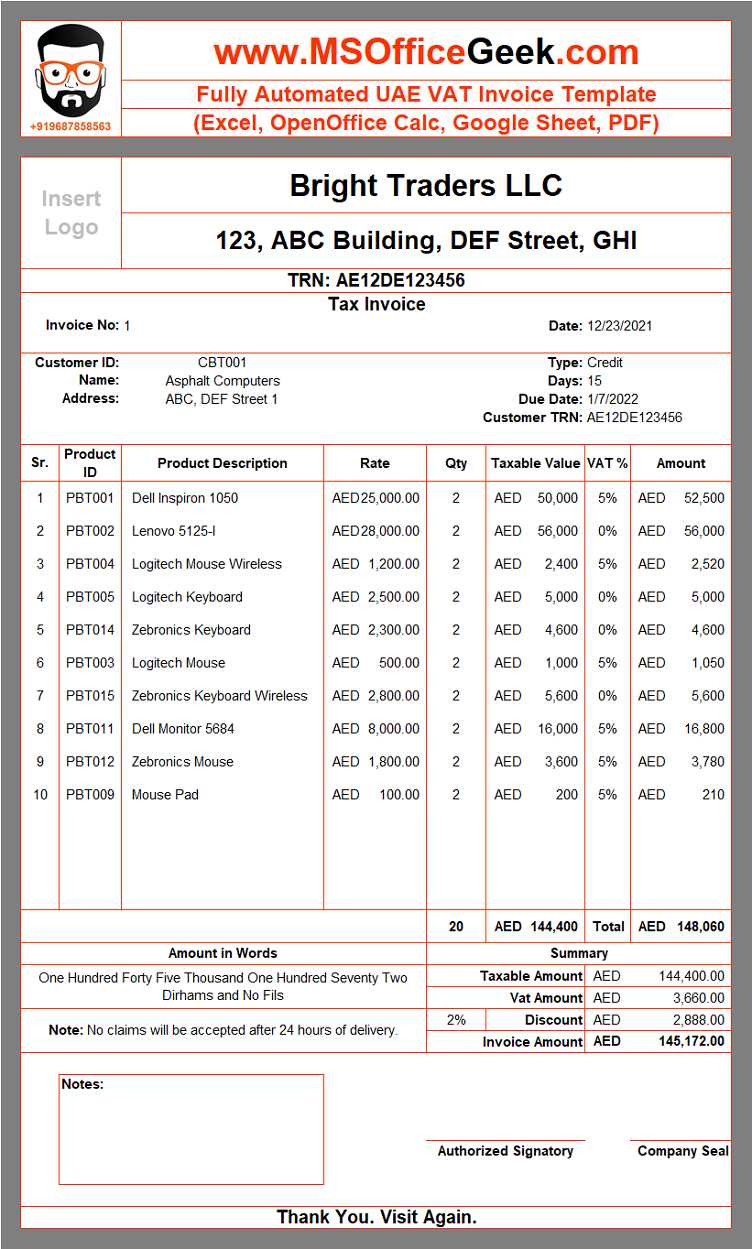

How to Add Tax Rates to Spreadsheet Documents

Adding tax rates to your financial documents is an essential step to ensure that your transactions are complete and compliant with local regulations. By incorporating automated tax calculations into your spreadsheet, you can save time and reduce the likelihood of errors. Below are simple steps to add and calculate tax rates within your financial record format.

Step 1: Set Up Your Columns

- Ensure you have columns for the item description, quantity, unit price, and total price for each product or service provided.

- Add a new column titled “Tax Rate” where you can enter the applicable percentage for each line item.

- Create another column labeled “Tax Amount” where the calculated tax value for each item will be displayed.

Step 2: Input the Tax Rate

- For each item, enter the applicable tax rate in the “Tax Rate” column. This could be a percentage, such as 5%, 10%, or any rate relevant to your region or industry.

- For products that are tax-exempt, you can leave the field blank or input a value of 0% to avoid any tax calculations.

Step 3: Apply a Formula for Tax Calculation

- In the “Tax Amount” column, use a formula to calculate the tax for each line item. For example, if the unit price is in column C and the tax rate is in column D, the formula in the “Tax Amount” column would be =C2*D2 (assuming row 2 is where the data starts).

- For the total tax amount across all items, use the SUM function to add up the values in the “Tax Amount” column.

Step 4: Calculate the Total Amount Due

- Finally, create a column labeled “Total Due” where you can calculate the final amount by adding the item price and the corresponding tax amount.

- Use the formula =C2+E2 (where C2 is the total price and E2 is the calculated tax amount) to determine the final price for each item.

By automating the tax calculation process in your spreadsheet, you ensure accuracy and consistency across all your financial records. This not only reduces the risk of mistakes but also streamlines the process of handling multiple transactions.

Managing Multiple Financial Records in Spreadsheets

When handling numerous transactions, managing multiple financial documents in a single spreadsheet can be a highly efficient way to stay organized. Rather than creating individual files for each record, consolidating them into one master document allows for better tracking and easier analysis. This method is especially helpful for businesses that need to monitor payments, outstanding amounts, or other details across several clients or projects.

Using a Master Spreadsheet

A master spreadsheet is a central file where all of your transactions are stored. You can organize your records into different sheets or tabs based on categories such as clients, time periods, or transaction types. Here’s how you can set up and manage multiple records in a single document:

| Client Name | Transaction Date | Item Description | Quantity | Unit Price | Total Amount | Paid | Outstanding |

|---|---|---|---|---|---|---|---|

| Client A | 01/15/2024 | Web Design | 1 | $500 | $500 | Yes | $0 |

| Client B | 01/16/2024 | SEO Services | 2 | $300 | $600 | No | $600 |

Tracking and Updating Records

To efficiently track multiple records, you can use sorting and filtering options available in most spreadsheet programs. These features allow you to quickly organize records by client name, date, or status. For example, you could filter to view only unpaid balances or transactions within a specific time frame.

- Sorting: Sort by date, client, or total amount to view specific entries in an organized manner.

- Filtering: Apply filters to narrow down the results, such as viewing only transactions that are marked as “paid” or “unpaid.”

- Conditional Formatting: Use color-coding or other visual cues to highlight important data, such as overdue payments or high-value transactions.

By centralizing your financial documents in a master spreadsheet, you can save time, improve data accuracy, and have a better overview of your business’s financial activities. This method is not only efficient but also helps in maintaining a clear, detailed record of every transaction.

Exporting Your Financial Record to PDF

Converting your financial document to a PDF format is an essential step when you need to share or store a finalized record. PDF files preserve the layout and formatting of your document, ensuring that it appears the same across all devices and platforms. This is particularly important when sending professional documents to clients, as PDFs provide a clean, uneditable format that is universally accepted.

To export your spreadsheet document to PDF, follow these steps:

- Step 1: Open your spreadsheet document and ensure that the layout is correct and ready for sharing.

- Step 2: Go to the “File” menu and select “Save As” or “Export” depending on the program you are using.

- Step 3: Choose “PDF” as the file format from the list of available options.

- Step 4: Adjust the settings to ensure that the document fits properly on the page. You can modify the margins, scale, or orientation if needed to make sure everything is visible and aligned.

- Step 5: Click “Save” or “Export” to convert the file to PDF.

Once saved as a PDF, your document is ready for distribution. Whether you’re sending it via email, uploading it to a portal, or simply archiving it for future reference, the PDF format ensures that your record will be viewed exactly as you intended, without any risk of formatting changes or accidental alterations.

How to Track Payments in Spreadsheets

Efficiently tracking payments is a key part of managing your business’s finances. By using a spreadsheet, you can easily record payments made, monitor outstanding balances, and ensure that all transactions are accounted for. This allows you to stay on top of your cash flow, follow up on overdue amounts, and maintain a clear record for financial reporting.

Here’s how you can set up a payment tracking system within your financial record sheet:

- Step 1: Create Essential Columns – Ensure you have columns for client names, transaction dates, amounts due, amounts paid, and the outstanding balance. This will help you track each payment and determine the remaining balance for each transaction.

- Step 2: Input Payment Data – Whenever a payment is made, enter the amount in the “Amount Paid” column. You can use a date field to record the payment date, so you have a clear record of when each transaction was completed.

- Step 3: Calculate Outstanding Balances – Use simple formulas to automatically update the outstanding balance. For example, subtract the “Amount Paid” from the “Amount Due” to determine the remaining amount. The formula would look like this: =Amount Due – Amount Paid.

- Step 4: Update Payment Status – Add a column titled “Payment Status” where you can mark whether the payment is complete, partial, or overdue. This will help you quickly assess the status of each transaction at a glance.

Example Table for Tracking Payments

| Client Name | Transaction Date | Amount Due | Amount Paid | Outstanding Balance | Payment Status |

|---|---|---|---|---|---|

| Client A | 01/15/2024 | $500 | $500 | $0 | Paid |

| Client B | 01/16/2024 | $600 | $300 | $300 | Partial |

By setting up these tracking mechanisms in your spreadsheet, you can quickly review payment statuses, ensure that outstanding balances are promptly addressed, and maintain accurate financial records. This system also makes it easier to send reminders or follow-ups for payments that are due or overdue.

Formulas for Accurate Financial Documents

When creating financial documents, using formulas can significantly improve accuracy and efficiency. Instead of manually calculating totals, taxes, or discounts, you can automate these processes using built-in spreadsheet formulas. This reduces the chances of errors and ensures consistency across all your documents.

Common Formulas for Financial Documents

- SUM: This is one of the most frequently used formulas to calculate the total amount for a list of items. For example, if you have individual item prices in cells B2 to B10, you can use =SUM(B2:B10) to calculate the total of all items.

- Multiplication for Quantity and Price: To calculate the total cost for a product or service, multiply the quantity by the unit price. The formula =B2*C2 (where B2 is the quantity and C2 is the unit price) will give the total cost for that item.

- Discounts: If you are applying a discount, you can use a formula like =B2-(B2*C3), where B2 is the total amount and C3 is the discount percentage (as a decimal, e.g., 0.10 for a 10% discount).

- Tax Calculation: To apply tax, use a formula like =B2*C3, where B2 is the total amount and C3 is the tax rate as a decimal (e.g., 0.08 for an 8% rate). This will calculate the amount of tax for that transaction.

- Total Amount Due: After applying discounts and taxes, you can calculate the final amount due using =B2+D2-E2, where B2 is the subtotal, D2 is the tax, and E2 is the discount amount.

Benefits of Using Formulas

- Accuracy: Using formulas ensures that calculations are precise and eliminates human error from manual computations.

- Efficiency: Formulas speed up the process of creating financial documents, allowing you to focus on other aspects of your business.

- Consistency: By using the same formulas across all records, you ensure that your documents follow a uniform structure, which is vital for reporting and analysis.

Incorporating these formulas into your financial documents can streamline your workflow, improve accuracy, and help you maintain professional, consistent records for your business.

Legal Requirements for Financial Records

When creating official financial documents, it’s crucial to adhere to the legal standards set by local regulations. These documents serve not only as proof of transaction but also as an important tool for tax reporting, financial auditing, and legal compliance. The information included in such records must meet certain requirements to ensure their validity in the eyes of the law.

In many jurisdictions, businesses are required to include specific details in their financial documents. This helps ensure transparency, prevent fraud, and maintain accurate records for both the business and the authorities. Below are some of the common legal requirements businesses must follow when preparing these official records:

- Clear Identification of the Parties Involved: The name, address, and contact details of both the service provider and the recipient must be clearly stated. This ensures that both parties are easily identifiable in case of disputes.

- Document Date: The date the document is created or the transaction takes place should be included. This is essential for determining when the transaction occurred and for future reference during audits or compliance checks.

- Detailed Description of Products or Services: The document must contain a clear and detailed description of the goods or services provided, including quantities, unit prices, and total amounts. This prevents ambiguity and ensures the recipient understands what they are being charged for.

- Legal Identification Numbers: Businesses are often required to include their registration number, tax identification number, or other relevant legal identifiers. This verifies the legitimacy of the business and ensures that the document is valid for financial and tax purposes.

- Payment Terms: The document should specify the payment terms, such as due dates, discounts for early payments, or penalties for late payments. This provides clarity on the financial obligations of both parties.

- Amount Breakdown: The total amount due should be clearly separated into its components, such as the cost of the product or service, applicable taxes, and any discounts or adjustments. This makes it easier to track payments and ensures full transparency in the transaction.

By ensuring that all these elements are included in financial records, businesses can avoid potential legal issues and maintain accurate documentation for their operations. This also helps build trust with clients and ensures that the documents are legally sound and can be used in case of audits or disputes.

Integrating Spreadsheets with Accounting Software

Connecting your financial documents with accounting software can streamline your workflow and improve accuracy in your financial tracking. By integrating spreadsheets with accounting tools, businesses can automate data transfers, reduce manual entry errors, and ensure that financial records are consistently updated across all platforms. This integration helps create a seamless flow of information, from invoicing and payment tracking to financial reporting and tax preparation.

There are several benefits to integrating spreadsheets with accounting software:

- Automated Data Transfer: Integration allows for automatic transfer of data between your spreadsheet and accounting software, reducing the need for repetitive data entry. For example, amounts entered in a spreadsheet can be automatically updated in your accounting system, ensuring accuracy.

- Real-Time Updates: With integration, both systems are updated in real-time. This means that any changes made in one platform will instantly reflect on the other, ensuring that your records are always current.

- Improved Accuracy: By eliminating manual data entry, integration reduces the chances of human error, ensuring that your financial records are accurate and consistent across all platforms.

- Time Savings: Integrating the two systems saves time by automating routine tasks, such as syncing payments, balances, and transaction histories. This allows you to focus on more strategic financial decisions.

- Better Reporting: With data flowing seamlessly between your spreadsheet and accounting software, generating reports becomes easier and more accurate. Whether you need profit and loss statements, balance sheets, or tax reports, the integration ensures that all information is in sync.

To integrate your spreadsheet with accounting software, there are typically two main approaches:

- Direct Integration: Many modern accounting platforms, like QuickBooks or Xero, offer built-in integrations with spreadsheets, allowing data to sync automatically with just a few clicks.

- Export and Import: If direct integration is not available, you can export your spreadsheet data into a compatible format (such as CSV or XML) and import it into your accounting software. While this process is manual, it still streamlines data transfer and reduces errors.

By integrating your spreadsheets with accounting software, you can enhance the efficiency, accuracy, and effectiveness of your financial management processes, ensuring that your business remains organized and compliant.

How to Save Time with Pre-designed Financial Documents

Creating financial records from scratch can be a time-consuming task, especially when it comes to formatting and ensuring all necessary details are included. Pre-designed documents are a great solution to streamline this process. By using a pre-made structure, you can quickly customize the necessary details and generate a professional-looking record in a fraction of the time.

Here are some ways you can save time by using pre-designed documents:

- Ready-to-Use Layouts: Pre-designed financial documents come with a structured layout that includes all the essential fields, such as item descriptions, quantities, prices, and payment terms. This eliminates the need for you to create these sections manually every time.

- Consistent Formatting: With pre-designed documents, formatting is already handled. This ensures that all your records look consistent and professional, saving you from spending extra time on design and layout adjustments.

- Quick Customization: Instead of typing out the same information repeatedly, you can easily input specific data (e.g., client name, product details, payment due dates) into predefined fields. This significantly reduces the time spent on each document.

- Automated Calculations: Many pre-designed documents come with built-in formulas for calculating totals, taxes, and discounts. This automation removes the need to manually perform calculations, ensuring accuracy and speeding up the process.

- Reuse Across Multiple Transactions: Once you have a pre-designed document, you can reuse it for multiple clients or transactions. Simply save the document as a new file and update the details, making the process even faster.

By incorporating pre-designed financial documents into your workflow, you not only save time but also reduce the risk of errors. This approach helps you focus on more important aspects of your business, while ensuring that your records remain professional and consistent.

Why Spreadsheets are Ideal for Financial Documents

Spreadsheets have become an essential tool for managing and organizing business finances. Their flexibility, ease of use, and powerful features make them an ideal choice for creating detailed financial records. Whether you’re generating receipts, tracking payments, or calculating totals, a well-structured spreadsheet can handle it all while providing accurate results quickly.

Key Advantages of Using Spreadsheets for Financial Records

- Customizable Layout: Spreadsheets allow you to design financial records that suit your specific business needs. You can add or remove columns, adjust the format, and create unique structures to match your preferred way of organizing information.

- Automation of Calculations: With built-in functions, spreadsheets can automatically calculate totals, taxes, discounts, and other important values. This saves time and ensures that your calculations are accurate, reducing the likelihood of human error.

- Real-Time Updates: When data changes, spreadsheets automatically update the information, ensuring that all figures are accurate and up-to-date without requiring manual intervention.

- Integration with Other Tools: Spreadsheets can easily be integrated with other business tools and accounting software. This enables seamless data transfer and reduces the need for double entry, further improving efficiency.

- Easy Record Keeping and Tracking: Spreadsheets provide an excellent way to store and track financial records over time. You can easily reference past transactions, keep detailed logs, and maintain historical records, which are vital for business analysis and compliance.

How Spreadsheets Simplify the Process

- Speed: Creating and modifying financial records in spreadsheets is fast. Once you have a basic format set up, you can quickly input new data, and the system will handle the calculations for you.

- Consistency: With spreadsheets, you can create uniform structures for all your financial records, ensuring consistency across all documents. This makes it easier to understand and compare data, whether for internal tracking or external reporting.

- Cost-Effective: Many people already use spreadsheet software as part of their daily business tasks, which means there’s no need for additional costly software to manage financial documentation.

For businesses of all sizes, spreadsheets offer an accessible, efficient, and reliable method for creating, managing, and storing financial records. Their flexibility and powerful features make them the perfect choice for handling various types of financial transactions with ease and accuracy.