Free Tax Invoice Template in Excel Format

Creating accurate financial records is essential for managing business transactions. Whether you’re dealing with clients or suppliers, having a structured and professional way to present charges and payments is crucial for smooth operations. Modern tools offer quick solutions to generate clear, organized records without the hassle of manual calculations or complex setups.

With the right format, you can efficiently manage various aspects of your financial exchanges. These tools allow for automatic calculations, tracking of amounts, and the ability to customize fields to meet specific business needs. Streamlining your financial documentation not only saves time but also reduces the chances of errors, making your business more efficient and reliable in handling transactions.

Many of these formats are designed to be flexible and adaptable, allowing businesses of all sizes to tailor them according to their specific requirements. From simple billing to more complex financial arrangements, the available options provide a clear path to improving organization and ensuring that all necessary details are captured for each exchange.

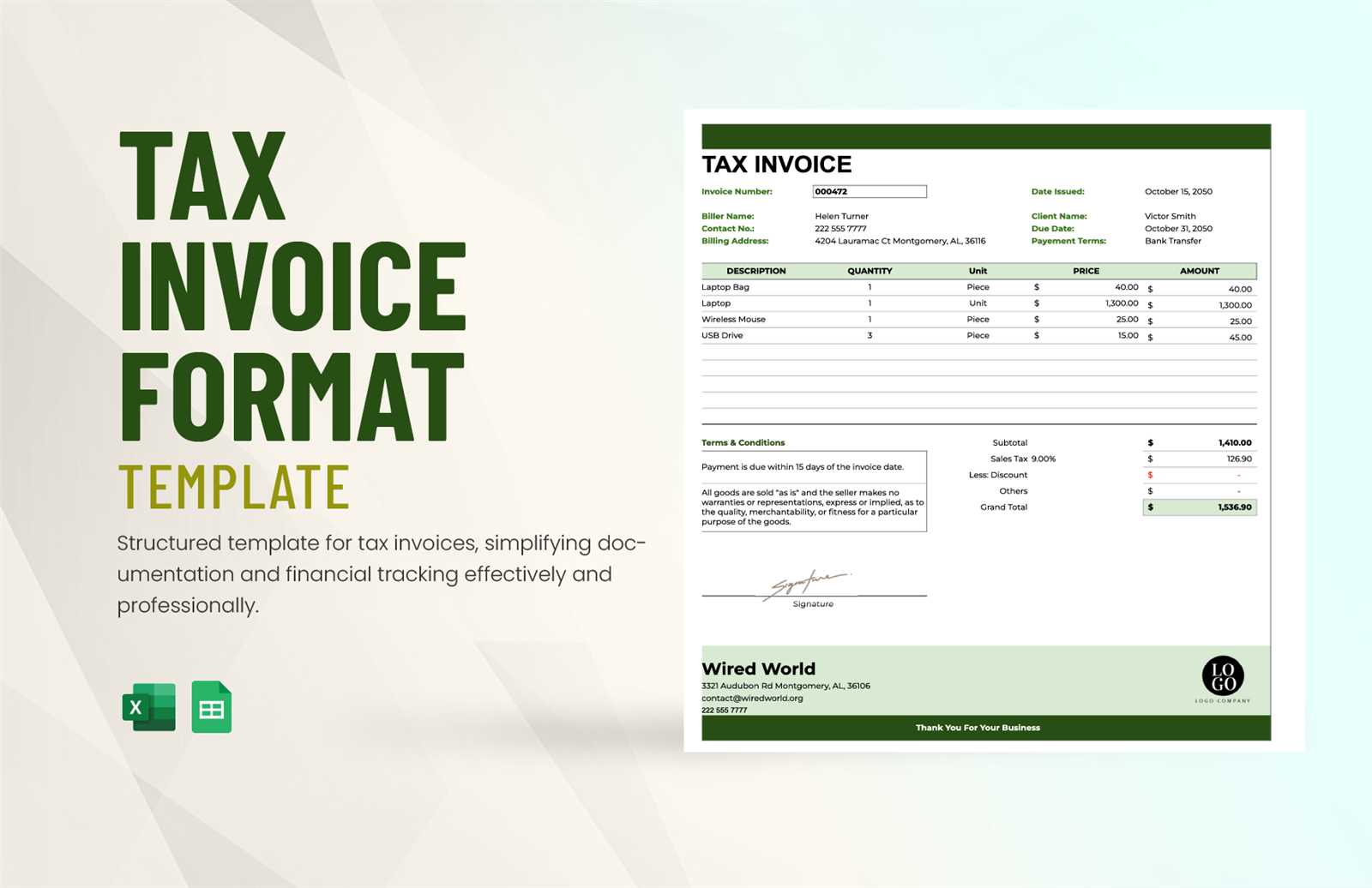

Free Tax Invoice Template in Excel

When it comes to managing financial records, having an organized and professional format can significantly simplify the process. Many businesses rely on digital tools to generate detailed financial documents that ensure accuracy, compliance, and ease of use. By using readily available tools, you can create a document that fits your specific needs without having to build everything from scratch.

One of the most effective ways to streamline this process is by using a simple, customizable document that allows for quick input and automated calculations. These documents are designed to be user-friendly, helping businesses keep track of payments and receipts in an efficient manner.

Here are some key reasons to use a customizable document format:

- Ease of Use: Templates are designed to be intuitive, requiring little to no technical expertise to manage.

- Customizability: Fields can be easily adjusted to match the details of any transaction, allowing you to create documents that suit your specific needs.

- Accuracy: Automated fields reduce the risk of errors, ensuring that all amounts, taxes, and totals are correctly calculated.

- Professional Appearance: A well-structured document gives a polished and professional impression to clients or partners.

With the right format, creating and managing your business transactions becomes a simple and efficient task. You can save time while ensuring that your financial records are accurate, organized, and ready for review at any moment.

Why Use an Excel Invoice Template?

Managing financial records effectively is essential for any business, and using the right tools can make this task much easier. With a digital format, you can streamline the process of documenting transactions, ensuring that all necessary details are included without the risk of missing important information. These formats are not only practical but also highly adaptable, making them a popular choice for businesses of all sizes.

Here are some of the main reasons why using a digital document format is beneficial:

| Advantage | Description |

|---|---|

| Time Efficiency | Automated calculations and pre-set fields reduce the time spent on manual entry and math, allowing you to complete documents faster. |

| Customizability | The format can be tailored to fit your unique business needs, with easy adjustments to fields and categories. |

| Professional Look | A well-structured document makes a positive impression on clients and partners, showcasing a high level of organization. |

| Accuracy | With built-in formulas and automated fields, you can reduce the likelihood of errors, ensuring correct totals and calculations. |

By using a structured document format, businesses can enhance their operations and focus on what truly matters–growing their business and managing client relationships with ease.

How to Customize Your Tax Invoice

Customizing your financial documents is essential to ensure that they meet your specific business needs and accurately reflect the details of each transaction. A personalized document can include all necessary information in a clear, organized format, making it easier for both you and your clients to understand the terms of the exchange.

Here are some steps to help you make adjustments to your document format:

- Add Your Business Details: Include your company name, contact information, and logo at the top to ensure that the document is easily recognizable as coming from your business.

- Modify Date and Reference Fields: Ensure that each document includes the correct date and any reference numbers that will help you or your clients track the transaction.

- Adjust the Item Descriptions: List the goods or services provided, along with their respective quantities and prices. This section can be customized to reflect your specific offerings.

- Include Custom Payment Terms: Add payment deadlines, methods, or other specific instructions related to the payment process that are relevant to the transaction.

- Tax and Discount Adjustments: Modify the tax fields or include any discounts that may apply to the transaction, ensuring the calculations are accurate and reflective of your pricing structure.

Customizing your financial document allows you to present a more professional and tailored approach to managing business exchanges. By making these adjustments, you ensure that both your records and your clients’ understanding are clear and precise.

Benefits of Using Excel for Invoices

Using a digital format to create financial documents offers a range of advantages, especially when it comes to managing details like calculations, formatting, and record-keeping. A flexible tool can streamline your workflow, saving time and reducing the risk of errors. With its wide range of functions, it provides a reliable solution for businesses of all sizes.

Enhanced Accuracy and Efficiency

One of the primary benefits of digital formats is the ability to automate calculations. With built-in formulas, you can easily calculate totals, taxes, and discounts, ensuring that your records are accurate every time. This eliminates the need for manual math, which reduces the chance of human error.

Customization and Flexibility

Another key advantage is the ability to personalize your documents to fit your business needs. You can easily modify fields, adjust layouts, and add custom elements, such as payment terms or item descriptions. This flexibility allows you to create documents that are both functional and tailored to your brand’s needs.

| Benefit | Details |

|---|---|

| Time-Saving | Automatic calculations and pre-set fields streamline the process, allowing you to generate documents quickly. |

| Professional Appearance | Templates allow you to create neat, consistent documents that reflect a polished business image. |

| Easy Record Keeping | Digital records are easy to store, search, and retrieve, improving the organization of your financial data. |

| Cost-Effective | No need to invest in expensive software; simple tools provide all the features needed to create professional documents. |

By using a flexible digital format, you can take full control over your financial documentation, ensuring both accuracy and ease of use while saving valuable time. These benefits make it an ideal choice for businesses looking to optimize their operations and keep their transactions organized.

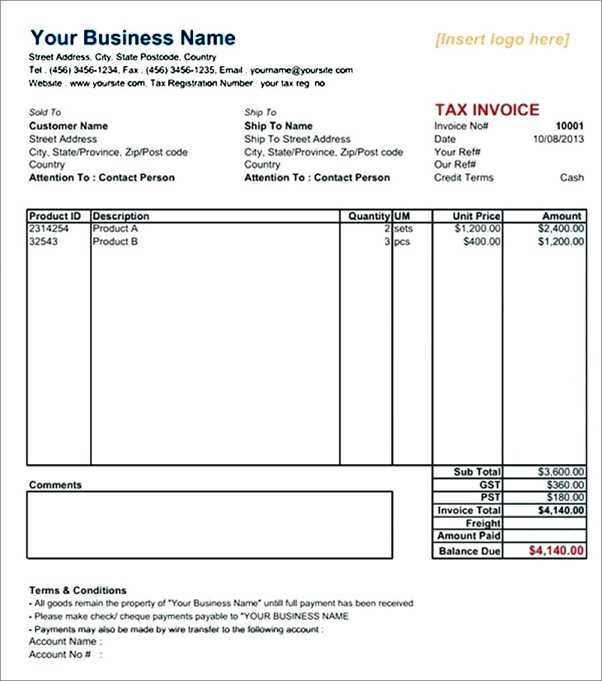

Key Features of a Tax Invoice

For any business, having a clear and well-structured document to record financial transactions is essential. This document should include specific details that not only reflect the nature of the transaction but also provide clarity and transparency to both parties involved. Certain key features are necessary to ensure that all essential information is captured correctly and comprehensively.

Essential Information to Include

There are a few critical elements that must be included to ensure a document is both complete and legally sound. These elements help provide clarity and ensure that all relevant details are captured for future reference or potential audits.

| Feature | Description |

|---|---|

| Business Details | Your company’s name, address, and contact information should be clearly visible to identify the sender of the document. |

| Transaction Date | The exact date when the transaction took place or when the document was issued. |

| Itemized List | Clearly list the goods or services provided, including quantities, unit prices, and a brief description. |

| Amounts and Totals | Include the total amount due, taxes, any discounts, and the final amount to be paid. |

| Payment Terms | Outline the agreed-upon payment terms, including due dates and accepted payment methods. |

Additional Customizations for Clarity

Beyond the basics, there may be additional customizations or features you may want to add depending on your specific needs. These might include unique reference numbers for tracking, custom fields for special terms, or specific formatting options that match your brand’s identity. All of these contribute to creating a professional and comprehensive document.

By incorporating these key features, businesses can create clear, effective documents that support smooth transactions and foster strong professional relationships with clients and partners.

How to Calculate Taxes in Excel

When managing business transactions, it’s essential to accurately calculate additional charges, such as government levies, on the total amounts. Using a digital format for this process allows you to automate these calculations, ensuring that the figures are consistent and error-free. With the right functions, you can quickly calculate charges, track amounts, and adjust them based on the varying rates that apply to different products or services.

To calculate these charges in a structured document, you can use simple formulas that apply the correct rate to the item price or total amount. The benefit of using a flexible format is that these calculations can be updated in real time as you modify the data, saving time and minimizing errors.

Here’s a step-by-step guide to calculating charges:

- Identify the rate: First, determine the applicable rate based on the product or service you’re offering. Rates can vary by category or location.

- Enter the amount: Input the cost of the item or service in the relevant cell.

- Apply the formula: Use a formula to multiply the cost by the rate. For example, if the rate is 10%, the formula would be =Amount * 0.10.

- Calculate total: Once the charge is calculated, you can add it to the total cost, adjusting the final amount accordingly.

By setting up these formulas in a digital format, you can easily manage calculations across different transactions, and the system will automatically adjust the results whenever the initial values are updated. This not only saves time but also ensures accuracy in your financial documents.

Step-by-Step Guide to Invoice Creation

Creating a well-structured document for billing purposes is essential for maintaining clear and accurate financial records. This process involves organizing relevant details in a way that ensures both the sender and receiver understand the terms of the transaction. Following a step-by-step approach can simplify this task, ensuring that no important information is overlooked and that all necessary fields are filled out correctly.

Step 1: Gather Essential Information

Before creating the document, collect all the details that need to be included. This includes your business name and contact information, the client’s details, and a list of the products or services provided. Make sure to have the correct pricing and payment terms ready for inclusion as well.

Step 2: Organize the Details

Start by organizing the information into a clear layout. At the top of the document, include your business details followed by the client’s information. Next, create a table to list the goods or services provided, including a description, quantity, unit price, and total cost for each item. Be sure to include any relevant taxes or additional charges in separate fields.

Finalizing the document: Once all the details are organized, double-check the total amount due, including any applicable taxes or adjustments. Clearly state the payment terms, including the due date and accepted methods of payment. Ensure that the document is easy to read and professional in appearance.

By following these simple steps, you can create a clear and effective billing document that accurately reflects your business transactions and promotes smooth financial operations.

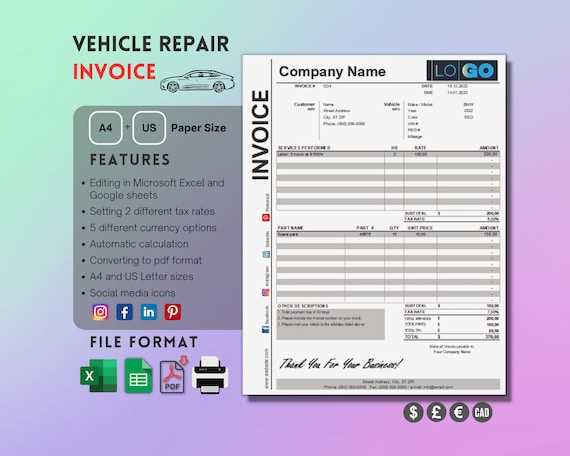

Download Free Excel Invoice Templates

For businesses looking to streamline the process of generating financial documents, having a ready-made structure can save time and effort. Many customizable structures are available online, allowing you to simply download and modify them to suit your specific needs. These ready-to-use formats can help ensure that all necessary fields are included while maintaining a professional and organized look for each transaction.

Advantages of Using Ready-Made Structures

Downloading a pre-designed structure can provide several benefits, including:

- Time Efficiency: Skip the need to design a document from scratch. These ready-made formats can be quickly downloaded and filled in with relevant details.

- Consistency: Using a standardized layout helps maintain consistency across all your documents, making it easier to track and organize transactions.

- Customization: Most of these files are customizable, allowing you to adjust the design, fields, and content to suit your business needs.

- Accuracy: Pre-designed formats ensure that you don’t miss any essential fields, reducing the chance of errors in the final document.

Where to Find Reliable Downloads

There are many reputable sources online that offer ready-to-use structures. Here are some suggestions:

- Official business websites or industry portals that provide downloadable files for professionals.

- Online resource libraries dedicated to small businesses or entrepreneurs.

- Software providers offering downloadable documents as part of their service packages.

By downloading a structured document, you can create professional records in no time, ensuring that your business stays organized and efficient.

Tips for Efficient Invoice Management

Managing financial records efficiently is essential for maintaining smooth operations within a business. Proper organization of transaction records ensures that payments are tracked accurately, deadlines are met, and business operations continue without disruption. Below are some tips to help you streamline the process of handling payment requests and ensure everything runs smoothly.

1. Organize Your Records

It’s important to maintain a well-organized system for storing and tracking all financial documents. This will help you quickly access any needed records and avoid confusion. Consider the following:

- Create a Filing System: Use folders, both digital and physical, to categorize records by client, date, or project.

- Maintain Consistency: Make sure every document is named and stored in a consistent manner, making it easier to find later.

- Utilize Cloud Storage: Store your documents online for easy access, backup, and sharing with stakeholders.

2. Set Clear Payment Terms

Ensure that both you and your clients are clear about when payments are due. This will help avoid confusion or delays in payment processing. Here are some ways to enforce this:

- Specify Due Dates: Always include a specific due date on each document, so both parties know when the payment is expected.

- Clarify Payment Methods: List all accepted payment methods to avoid confusion.

- Send Reminders: Send gentle reminders a few days before the due date to ensure timely payments.

3. Automate Repetitive Tasks

Automation can save you time and reduce errors. Consider these practices for automating your financial workflow:

- Set Up Recurring Reminders: Use scheduling tools to automatically remind clients of upcoming payments.

- Use Software for Tracking: Many accounting platforms can automatically track payments and generate documents based on your input.

- Integrate Payment Systems: Connect your online payment system with your record-keeping software to track payments automatically.

By implementing these tips, you can make managing financial documents simpler, more organized, and more efficient, ultimately improving your business operations and reducing the risk of late payments.

Common Mistakes When Creating Invoices

Generating financial documents can seem straightforward, but there are several common mistakes that businesses often make. These errors can lead to confusion, delayed payments, and potential misunderstandings with clients. By being aware of these pitfalls, you can ensure that your documents are clear, professional, and accurate, helping to maintain smooth financial transactions.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate contact details for both parties. This can delay communication and lead to payment issues. Make sure to:

- Double-check contact information: Ensure that both your business and the client’s details are correct, including address, phone number, and email.

- Provide clear payment instructions: Include details on how the client can pay (bank details, payment platforms, etc.).

2. Not Specifying Clear Payment Terms

Failure to define clear payment expectations can lead to confusion or disputes. It’s crucial to:

- State the due date: Always include a specific due date for the payment to avoid misunderstandings.

- Clarify late fees: If applicable, specify any late fees or penalties for overdue payments.

3. Incorrect or Missing Amounts

Another common mistake is errors in the total amounts. This can range from incorrect unit prices to adding up totals incorrectly. To avoid this:

- Double-check calculations: Always double-check all quantities, prices, and totals before finalizing the document.

- Break down the costs: Clearly separate each item or service with its price to make it easier for clients to understand the charges.

4. Lack of Professional Formatting

Professional appearance matters. Poor formatting can make your documents hard to read and create a negative impression. Consider these tips:

- Use a clear and organized layout: Ensure that the document is easy to read, with clear headers, organized information, and consistent fonts.

- Maintain a consistent style: Use the same design and structure for all documents to keep your business branding consistent.

5. Forgetting to Include Tax or Additional Charges

Sometimes, businesses overlook taxes or additional charges, leading to confusion later. It’s essential to:

- Clearly list all additional charges: If taxes or shipping fees apply, be sure to include them and show how they’re calculated.

- Specify tax rates: If applicable, include the tax rate used in the calculation to ensure transparency.

By avoiding these common mistakes, you can create clear, accurate, and professional financial documents that help ensure smooth transactions and reduce the chance

How to Save Time on Invoices

Managing financial records can be time-consuming, especially when it comes to creating, tracking, and sending documents. By adopting smart strategies and utilizing the right tools, you can significantly reduce the time spent on these tasks, allowing you to focus more on other important aspects of your business. Here are some effective ways to save time while managing your financial paperwork.

1. Automate Recurring Documents

If you regularly create similar documents for different clients or projects, automation can save a lot of time. Here’s how:

- Use predefined templates: Set up standard layouts and formats that you can quickly adapt to new transactions.

- Schedule automated reminders: Use software to automatically send reminders for upcoming payments or due dates.

- Utilize batch processing: If you have multiple documents to create, use tools that allow you to generate several at once.

2. Integrate Payment Systems

Connecting your financial records with payment platforms or accounting software can drastically reduce the time spent on managing documents. Consider the following steps:

- Sync payments with your records: Integrate your payment system so that transactions are automatically recorded without manual entry.

- Link invoicing tools with banking systems: Allow your financial tools to track payments and update records automatically once a payment is made.

- Offer online payment options: Clients can pay directly through links or platforms, reducing the need for follow-ups or manual processing.

3. Reduce Manual Entry with Software

Manual data entry can be tedious and time-consuming. By using specialized software, you can streamline the process. Here are some tips:

- Use data import features: Import client and transaction details directly into your financial documents instead of entering them manually.

- Leverage real-time updates: Use software that automatically updates your records as new information comes in.

- Save time on calculations: Use software that performs calculations for taxes, totals, and discounts automatically, minimizing human error.

By implementing these time-saving practices, you can significantly reduce the hours spent on managing financial paperwork, improve efficiency, and focus on growing your business.

Ensuring Tax Compliance with Templates

When creating financial documents, ensuring that they adhere to the correct legal and regulatory standards is essential. Compliance with local laws not only helps avoid penalties but also ensures that your business practices are transparent and trustworthy. Using structured and organized documents can significantly reduce the risk of errors and ensure that all necessary information is included for accurate reporting.

To stay compliant with regulations, it’s important to incorporate key elements that are required by law. These may include specific identification numbers, dates, detailed descriptions of goods or services, and applicable fees. Using pre-structured documents can assist in keeping track of these essential components and ensure that no crucial data is missed.

1. Include All Required Information

One of the most important steps in maintaining compliance is ensuring that all necessary details are present. Be sure to:

- List complete business details: Include your legal business name, registration number, and address, along with the client’s information.

- Specify detailed descriptions: Provide a clear breakdown of the products or services being provided, including quantities and pricing.

- Document payment terms: Clearly define payment methods, deadlines, and penalties for late payments.

2. Apply Correct Rates and Calculations

Accurate calculations are vital in staying within the bounds of compliance. Ensure that:

- Applicable rates are applied: Ensure that the correct rates are used for any applicable charges or fees, depending on the nature of the transaction.

- Amounts are clearly calculated: Use built-in functions to calculate total amounts, taxes, and discounts to reduce the chance of errors.

- Verify the totals: Double-check that all values add up correctly and match your accounting records.

By using carefully structured documents, you can simplify the process of ensuring that your business complies with relevant regulations and guidelines. This helps not only in avoiding costly mistakes but also in building trust with clients and authorities alike.

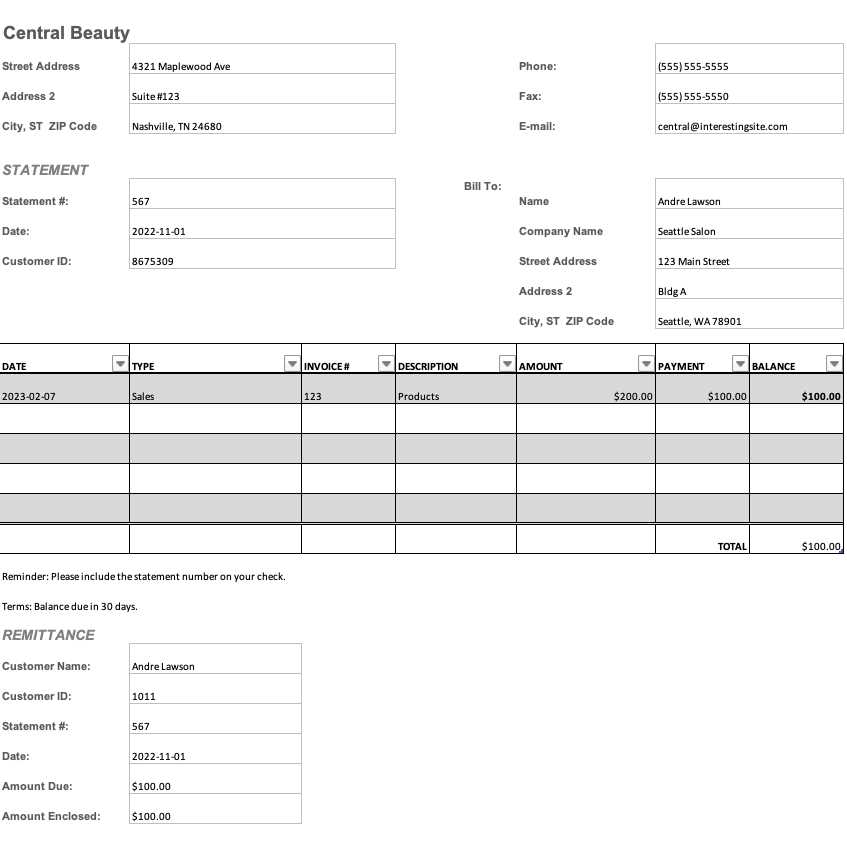

How to Track Payments with Excel

Keeping track of payments is a crucial aspect of managing finances. It ensures that you are aware of outstanding amounts, helps you maintain accurate records, and supports better cash flow management. With the right approach, you can easily monitor transactions, identify overdue payments, and maintain a clear overview of your business’s financial status.

Using structured tools like spreadsheets can simplify this task, providing a detailed and organized way to track incoming payments. Here’s how you can set up a system to track payments efficiently:

1. Create a Payment Tracking Sheet

Start by setting up a sheet dedicated to tracking payments. Include the following key columns:

- Invoice Number: Reference number for each transaction.

- Client Name: Name of the person or company making the payment.

- Amount Due: The total amount that was billed.

- Payment Received: Amount received for each transaction.

- Payment Date: The date when payment was made.

- Balance: The remaining amount due after partial payments.

2. Set Up Automatic Calculations

Using formulas can save you time and reduce errors. Implement formulas that will automatically calculate the balance and track payment status. For example:

- Balance Calculation: Use a simple subtraction formula (Amount Due – Payment Received) to calculate the outstanding balance.

- Payment Status: Apply a conditional formula to mark invoices as “Paid” or “Pending” based on whether the amount received equals the amount due.

- Summary Calculation: Sum the totals for all received payments to keep track of overall revenue.

3. Monitor Payment Trends

To ensure that you stay on top of your finances, it’s helpful to monitor payment trends over time. Here’s how you can do it:

- Track overdue payments: Highlight unpaid balances that exceed the payment terms to ensure you follow up with clients on time.

- Analyze payment frequency: Identify clients who pay regularly and those who delay payments, so you can tailor your approach accordingly.

- Generate reports: Use built-in functions to create monthly or quarterly reports to analyze your cash flow and adjust your business strategy if needed.

By implementing these steps, you can ensure that you are always aware of your financial standing and that no payment goes unnoticed. This approach helps streamline your accounting process and makes financial man

Customizing Fields for Different Needs

When creating a document for billing or financial tracking, it’s important to tailor the fields to fit the unique requirements of your business. Not every transaction is the same, and having customizable fields ensures that you capture all the necessary information without cluttering the form with irrelevant details. By adjusting the fields to suit specific needs, you can make the process more efficient and aligned with your company’s practices.

Here are some essential considerations when customizing fields:

1. Adjusting for Different Business Types

Depending on the nature of your business, the fields you need may vary. For example:

- Service-based businesses: You may want fields for service descriptions, hourly rates, or project milestones.

- Product-based businesses: You might need to list item numbers, quantities, and unit prices.

- Consultants and freelancers: You could add space for task details, project deadlines, and hourly or flat rates.

Customizing these fields makes it easier to keep track of what’s being sold or performed, ensuring your documents reflect the specifics of each transaction.

2. Adding Personalization for Clients

It’s also beneficial to personalize the document for each client. You can add fields for:

- Client’s Purchase Order Number: This helps to cross-reference transactions with their records.

- Special Payment Terms: If the client has custom payment conditions, adding a field for that ensures clarity.

- Notes Section: Include a space for any extra details that are specific to the client or the transaction.

This level of customization enhances the customer experience by providing clarity and fostering professional communication.

3. Adapting for Legal or Regional Requirements

In certain regions, businesses must comply with specific regulations or industry standards. Customizing fields can help ensure you’re meeting legal requirements by adding:

- Regulatory Numbers: Fields for business or tax identification numbers that may be required by law.

- Currency Information: If you deal with international clients, you may need to include fields for currency type and conversion rates.

- Legal Terms: Adding a section for terms and conditions, which is often necessary for contractual purposes.

By ensuring these fields are included, you protect your business from compliance issues and reduce the likelihood of disputes.

Customizing fields to meet your specific needs not only saves time but also ensures accuracy and professionalism in every

How to Avoid Formatting Errors

When creating a document for financial records or client communication, ensuring proper layout and organization is key. Formatting errors can lead to confusion, misinterpretation, and even mistakes in transactions. By following some simple guidelines, you can avoid common pitfalls and ensure your document looks professional and clear. Below are strategies to help you maintain consistent and accurate formatting in your files.

1. Set Consistent Number Formats

One of the most common mistakes is inconsistent number formatting. This can cause issues with readability, especially when dealing with prices, totals, or calculations. Ensure that:

- Currency: All monetary values are formatted correctly with the appropriate currency symbols and decimal places.

- Percentages: Use percentage formatting for values that represent ratios or rates to ensure accuracy in calculation.

- General Numbers: Standardize the number format to avoid discrepancies between whole numbers and decimals.

To apply consistent formatting, select the cells that need to be formatted, then choose the correct format from the toolbar or use the “Format Cells” option.

2. Use Alignment and Spacing Properly

Proper alignment and spacing help make the document easier to read. For example, all headers should be aligned to the left, and monetary values should be right-aligned for clarity. Follow these tips:

- Left-align text: Use left alignment for text-based fields such as names, descriptions, or addresses.

- Right-align numbers: Align numerical data to the right to ensure that all digits are correctly lined up, especially when dealing with long figures.

- Consistent Row Heights: Adjust row heights to avoid text being cut off or looking cramped.

By using proper alignment, you enhance the readability of the document and make sure everything is neatly organized.

3. Avoid Overcomplicating With Too Many Styles

While adding colors, borders, and different fonts can make your document look appealing, overdoing it can result in clutter and distract from the key information. To prevent this:

- Limit font styles: Stick to one or two font styles (e.g., Arial and Bold) to maintain consistency.

- Keep colors minimal: Use colors sparingly for headers or important information, but avoid making the entire document colorful.

- Be cautious with borders: Avoid overuse of borders as they can make your document look crowded.

By simplifying your layout, you make it easier for others to quickly understand the document’s key points.

4. Use Tables for Structured Data

For organized and structured presentation, especially when displaying multiple pieces of related data, using tables is essential. Tables allow you to arrange information clearly and logically, helping to avoid alignment issues. Here’s how to use them effectively:

| Column 1 | Column 2

Using Excel Invoices for Small BusinessManaging finances effectively is crucial for any small business, and having a well-organized system to track payments and services provided is key. One of the easiest and most cost-effective methods to handle client billing is by using spreadsheet software. This method helps small business owners create professional, accurate records without needing expensive software. Here’s why spreadsheets are a great tool for business owners to manage their payment requests. 1. Simplicity and CustomizationSpreadsheets provide a simple yet powerful way to manage billing. With just a few clicks, you can create documents that cater to your specific needs. Whether you are working with a few clients or handling a larger volume of transactions, the layout can be adjusted as required.

2. Cost-Effective SolutionFor small businesses, keeping overhead costs low is a priority. Using a spreadsheet system eliminates the need for subscription-based invoicing software or expensive tools. By simply utilizing the tools already available, you save both time and money.

By opting for a spreadsheet-based approach, businesses can keep their operations efficient without incurring additional expenses. 3. Accuracy and TrackingBeing able to track payments and outstanding balances is vital to maintaining a healthy cash flow. A spreadsheet system allows small business owners to manage and record all transactions in one place. This reduces the chances of error and ensures that all details are accurate.

In addition to being simple to use, spreadsheets provide powerful tools for ensuring your records are always up to date and precise. Overall, using spreadsheet tools for your business billing is an ideal solution for small business owners looking to streamline operations, save costs, and maintain organized records without any unnecessary complexity. |

|---|