Tax Invoice Template Excel for Australia Customizable and Easy to Use

For businesses and freelancers, managing financial transactions accurately and efficiently is crucial. One of the essential tools for this process is a well-structured billing document that meets all necessary legal and business requirements. By utilizing a structured system, companies can ensure they stay organized and comply with relevant regulations while maintaining professionalism in their dealings.

With the right tools, generating these essential records becomes simple and streamlined. Using customizable spreadsheets allows for easy creation and adjustment of these documents, ensuring that every piece of required information is included. This system helps avoid errors, reduces time spent on administrative tasks, and ensures consistency across all records.

In this guide, we will explore how to leverage digital solutions to create and manage these records efficiently. You will discover how a flexible, user-friendly format can simplify your financial workflows, allowing you to focus more on growing your business and less on paperwork.

Why Use an Excel Tax Invoice Template

For businesses of all sizes, managing billing and record-keeping is a critical task. The key to efficient and accurate documentation lies in having a well-organized system that allows for easy generation of business records. Digital tools, especially spreadsheet-based formats, offer a flexible and accessible solution to streamline the process.

Advantages of Using a Digital Spreadsheet for Billing

Using a spreadsheet for your financial documents provides a range of benefits that can save time and reduce errors. Some of the key advantages include:

- Customizability: Easily adjust fields and layout to match your specific needs or branding.

- Efficiency: Quickly populate necessary details without needing to manually input repetitive data.

- Flexibility: Easily edit and update information across multiple records in a matter of minutes.

- Consistency: Maintain uniformity in all your business paperwork, ensuring professional presentation every time.

How Spreadsheets Simplify Financial Management

When it comes to managing finances, spreadsheets are a powerful tool. They offer easy data entry, automatic calculations, and the ability to store information securely in one place. By using a pre-designed format, you can:

- Track payments and balances in real-time.

- Ensure compliance with legal requirements by including all necessary details.

- Generate reports with just a few clicks, reducing manual work and increasing productivity.

In summary, using a spreadsheet for business records offers significant time-saving and organizational advantages, making it an essential tool for businesses aiming to keep their financial processes efficient and professional.

Understanding Billing Documents in Australia

In any business transaction, proper documentation plays a crucial role in maintaining transparency, ensuring compliance, and preventing future disputes. For businesses operating in Australia, certain standards must be met when preparing financial records for goods and services provided. These documents must adhere to specific guidelines set by the local authorities to ensure accuracy and legitimacy in financial reporting.

When preparing these records, it’s essential to include all necessary details to meet both legal and business requirements. This helps ensure that your records are not only professionally presented but also compliant with regulatory standards, particularly when it comes to taxation and reporting purposes.

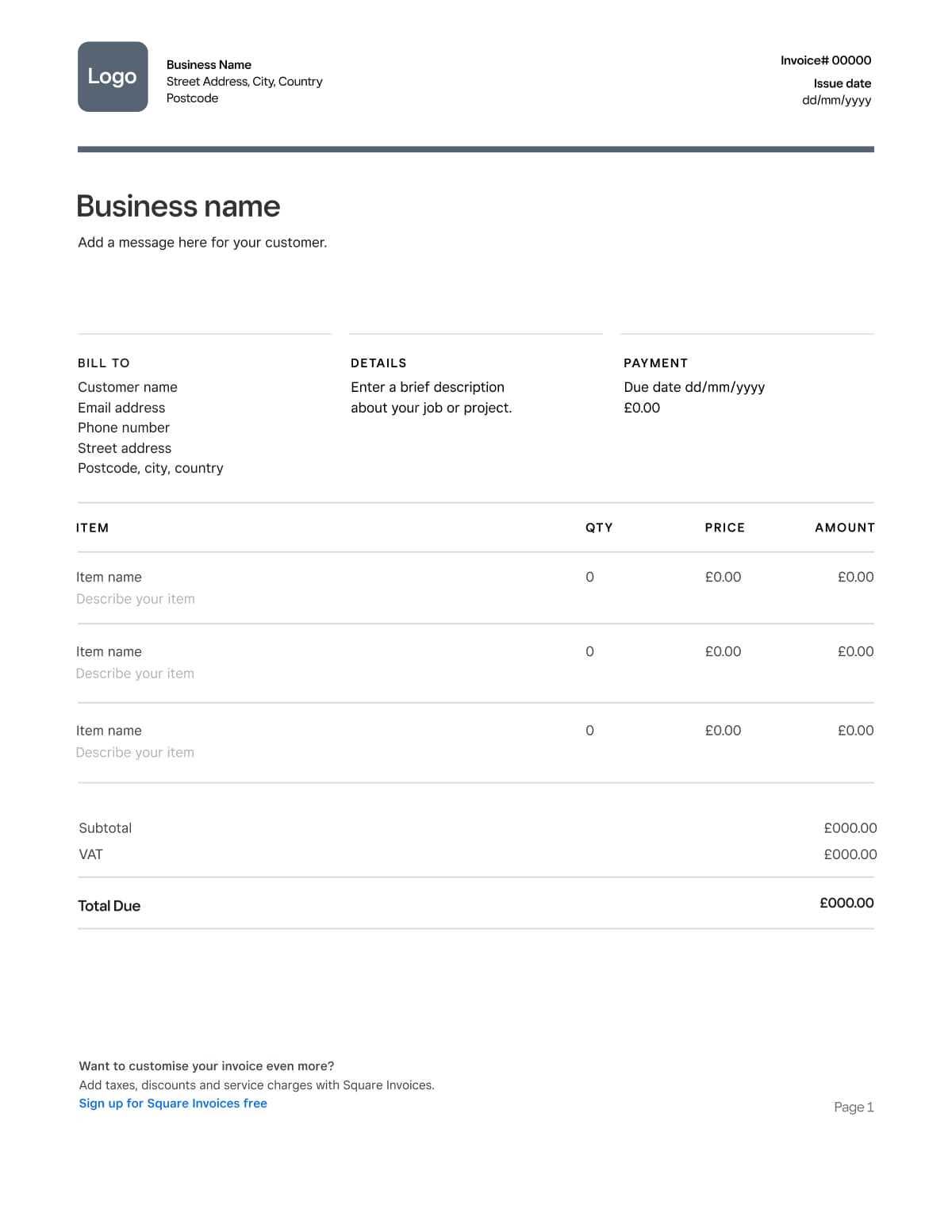

Key Information to Include

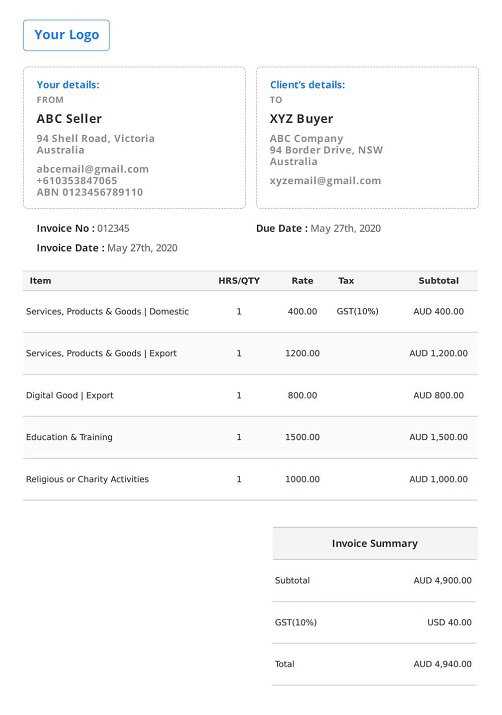

A well-prepared business document should contain all the required fields to avoid confusion or errors. Below are the primary components that should always be included:

- Business Name and Contact Details: Clear identification of the company issuing the document.

- Customer Information: Name and contact details of the person or company receiving the goods or services.

- Description of Goods or Services: A detailed breakdown of what was provided, including quantities and prices.

- Amount Due: Total cost including any relevant charges, such as delivery fees or discounts.

- Date of Transaction: The date when the transaction occurred or when the goods/services were delivered.

- Unique Reference Number: A sequential reference for each document to keep track of business records efficiently.

- Compliance Information: Specific details that ensure the document meets all legal and regulatory obligations.

Why Compliance is Crucial

Compliance with local regulations is essential for businesses, particularly when it comes to financial documentation. These documents must meet government requirements to ensure that businesses are reporting accurately and that customers are not overcharged. Non-compliance can lead to penalties, disputes, or delays in payments. By including all the necessary details and following the guidelines, businesses help safeguard their operations and build trust with clients.

Benefits of Customizable Billing Documents

Having the ability to adjust your financial records to suit specific needs provides significant advantages for businesses of all sizes. Customization ensures that your documentation can align with both your branding and the unique requirements of your business, leading to increased efficiency and a more professional presentation. The flexibility to modify various sections allows for seamless integration into your existing workflow, which ultimately saves time and reduces errors.

Customizable business records provide several key benefits that can enhance your overall financial management:

| Benefit | Description |

|---|---|

| Personalized Branding | Customizing layout, logo, and colors to reflect your company’s identity helps maintain consistency across all communications. |

| Flexible Layout | Modify fields, sections, and design to match your specific business needs or industry standards. |

| Ease of Use | Simple to adjust and update, reducing the complexity of creating new documents for different transactions. |

| Accurate Record-Keeping | Automatic population of fields ensures that relevant details are included, reducing manual data entry errors. |

| Time Efficiency | Quickly generate new documents for recurring transactions, reducing the time spent on administrative tasks. |

By utilizing fully customizable records, businesses can improve both the speed and accuracy of their documentation process, making it a valuable tool for streamlining operations and maintaining professionalism in all client interactions.

How to Create a Billing Document in a Spreadsheet

Creating a professional financial document using a digital spreadsheet can be done quickly and easily by following a few straightforward steps. With the right structure in place, you can ensure that every detail is captured accurately, and the document meets all necessary business requirements. This process helps streamline the creation of records, making it a useful tool for businesses of all sizes.

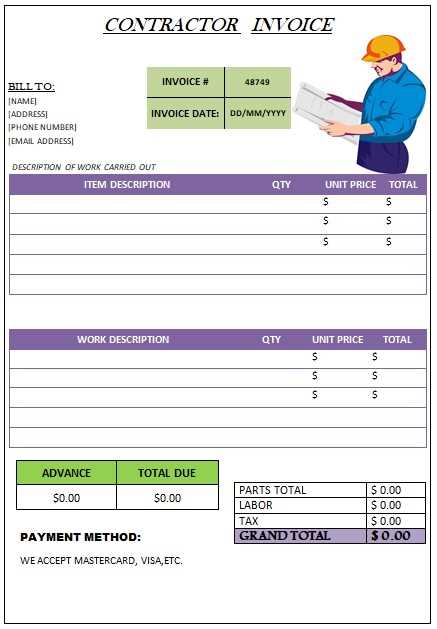

Here’s a step-by-step guide to help you create a detailed billing document in a spreadsheet:

- Open a New Spreadsheet: Start by opening a new blank file in your preferred spreadsheet application.

- Set Up the Header: At the top of the document, include your business name, logo, contact details, and the date of the transaction. This provides clear identification and ensures that clients know who the document is from.

- Add Client Information: Include the name and contact details of the client receiving the goods or services. This will help avoid confusion and ensure proper record-keeping.

- Provide a Detailed Description: In the next section, list the goods or services provided. Be as specific as possible, including quantities, prices, and any relevant discounts or charges.

- Calculate Totals: Include a formula to automatically calculate the total amount due, factoring in any taxes, discounts, or additional fees. This step will help ensure accuracy and save time on manual calculations.

- Include Payment Terms: Clearly state the payment due date and any specific terms, such as late fees or discounts for early payments, to avoid misunderstandings.

- Assign a Unique Number: Give each document a unique reference number. This helps you track records and maintain organization, especially for accounting or audit purposes.

By following these steps, you can create a polished and professional financial document every time. With the flexibility to adjust fields and layouts, you can ensure that each record is tailored to your business needs while remaining compliant with legal and operational requirements.

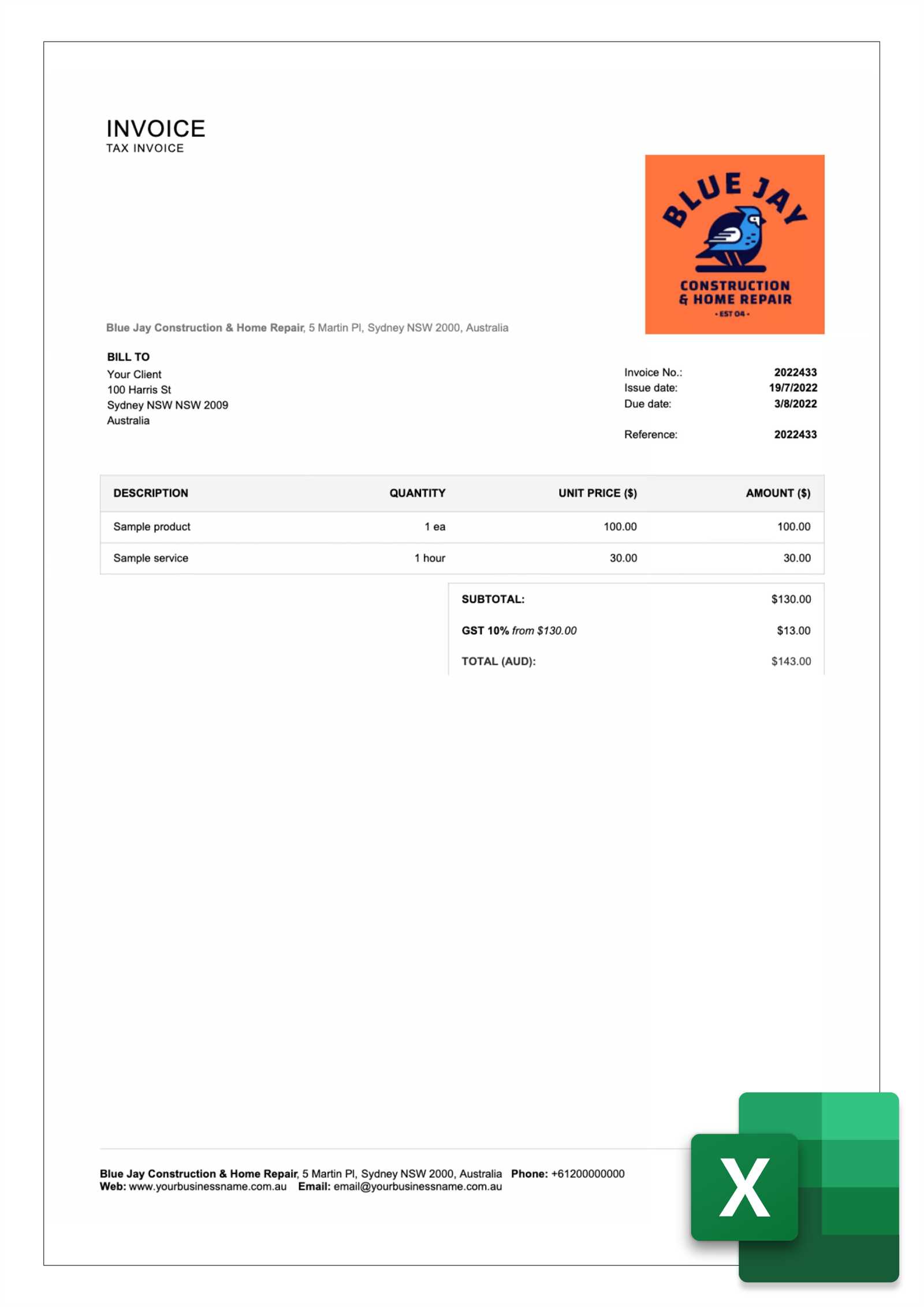

Key Components of a Billing Document in Australia

For a business document to be considered valid and compliant in Australia, it must include certain essential information. These components not only ensure that the document meets legal requirements but also provide clear and detailed records for both the seller and the buyer. Understanding what needs to be included is crucial for smooth business transactions and to avoid any potential issues down the line.

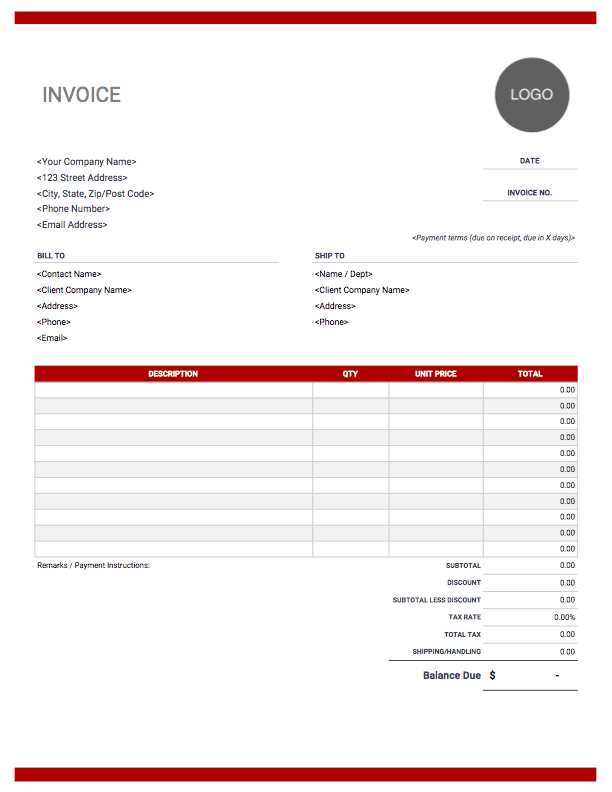

Below are the key elements that must be present in a proper business record:

- Business Identification: The document must clearly state the name and contact details of the business issuing it. This helps identify the provider of the goods or services.

- Client Information: The name, address, and contact information of the customer or client receiving the goods or services must be included to avoid confusion and ensure accurate records.

- Unique Document Number: A reference number for each record is essential for tracking and organizing transactions. This unique identifier helps distinguish one document from another in your system.

- Date of Transaction: The date the transaction took place or when the goods/services were delivered must be specified, as this impacts payment terms and legal timelines.

- Description of Goods or Services: Provide a clear and detailed description of what was provided, including the quantity, unit price, and any additional charges or discounts.

- Total Amount Due: The total cost, including any applicable charges, should be calculated and clearly stated. This is the amount the client is expected to pay.

- GST Information: If applicable, the document should indicate whether GST (Goods and Services Tax) is included in the price or calculated separately, in accordance with local tax laws.

- Payment Terms: Clearly mention the payment due date, along with any early payment discounts or late fees to ensure both parties are aware of the terms.

Including these components ensures that your business records are professional, accurate, and compliant with Australian standards, helping you maintain smooth transactions and reduce the risk of disputes.

Simple Steps to Fill Out Your Billing Document

Filling out a professional business document is straightforward when you follow a clear process. By systematically entering the required information, you can ensure that your record is complete, accurate, and ready for submission. Below are the simple steps to guide you through the process of filling out these essential records.

Here’s a step-by-step breakdown to help you complete your business documents efficiently:

| Step | Description |

|---|---|

| 1. Add Your Business Details | Include your business name, address, contact details, and logo at the top of the document for easy identification. |

| 2. Enter Customer Information | Fill in the name and contact details of the client, ensuring accuracy to avoid confusion. |

| 3. Provide a Detailed Description | List the goods or services provided, including quantities, prices, and any special notes or details that apply. |

| 4. Calculate Total Amount | Sum up the costs, including any taxes, fees, or discounts, to arrive at the total amount owed. |

| 5. Set Payment Terms | Clearly state the payment due date and any terms, such as late fees or discounts for early payment. |

| 6. Assign a Unique Reference Number | Generate a unique number for the document to help with future reference and record-keeping. |

By following these steps, you can quickly create a complete and professional business document that meets all your needs. Whether you’re working with a new client or maintaining an ongoing relationship, a well-filled document will help ensure smooth transactions and accurate record-keeping.

Free Billing Document Templates for Australia

For businesses looking to streamline their financial record-keeping, free customizable formats are a great resource. These ready-made documents can be downloaded and adjusted to fit your specific business needs. They are especially useful for those who want to avoid the time-consuming task of creating a new document from scratch every time they need one.

Using a pre-designed document format provides a simple and professional solution for managing transactions while ensuring compliance with local guidelines. These free formats typically come with all the essential fields already included, so you can quickly and easily create accurate records with minimal effort.

Benefits of Using Free Formats

Opting for a free downloadable document provides several advantages:

- Cost-Effective: No need to invest in expensive software or tools; free formats are available for anyone to use.

- Time-Saving: With a ready-made structure, you can complete your business records in a fraction of the time.

- Customizable: Easily adapt fields to suit your business needs, whether you want to add new sections or adjust existing ones.

- Compliance-Friendly: These formats are designed to meet local requirements, ensuring your documents comply with legal standards.

Where to Find Free Templates

There are various online platforms where you can access free downloadable business document formats, including:

- Business websites offering free resources and templates.

- Government or regulatory authority websites with compliance-ready documents.

- Online document sharing platforms like Google Docs, where you can customize and store templates easily.

By using these free resources, you can maintain accurate, professional, and legally compliant records without having to spend unnecessary time or money on creating documents from scratch.

Common Mistakes to Avoid When Creating Billing Documents

Creating accurate and professional business documents is crucial for maintaining smooth transactions and proper record-keeping. However, it’s easy to overlook certain details when preparing them, which can lead to mistakes that cause delays or confusion. Being aware of common errors can help you ensure your records are precise and compliant.

Here are some frequent mistakes to avoid when filling out your business documents:

- Incorrect or Missing Client Information: Failing to include the correct name, address, or contact details for your customer can lead to misunderstandings or delays in payment. Always double-check these details before finalizing the document.

- Omitting or Miscalculating Amounts: Failing to accurately calculate the total amount due or forgetting to include additional fees or discounts can create confusion. Always use reliable formulas or double-check your figures.

- Lack of a Unique Reference Number: Not including a unique document number can make it difficult to track transactions, leading to confusion or difficulties when managing your records. Assign a unique reference number to each document.

- Missing or Incorrect Date: Without a clear transaction date or delivery date, it can be difficult to determine when payment is due. Ensure that the date is correct and clearly visible.

- Failure to Include Payment Terms: Not specifying clear payment terms, such as the due date, late fees, or discounts, can lead to misunderstandings with clients. Always include this vital information.

- Ignoring Legal Requirements: Certain details are required by law in some regions, such as tax registration numbers or specific compliance notes. Make sure you’re familiar with local regulations to avoid legal issues.

By avoiding these common mistakes, you can ensure that your business records are clear, accurate, and professional, leading to smoother transactions and fewer disputes with clients.

How Excel Simplifies Document Management

Managing business records efficiently is essential for maintaining smooth operations. The right tools can make the process much easier, and one such tool is spreadsheet software. By using this versatile application, businesses can quickly create, organize, and track financial documents, reducing time spent on administrative tasks and improving overall productivity.

Here are a few ways in which spreadsheet programs simplify the management of business records:

- Automated Calculations: By using formulas, you can automatically calculate totals, taxes, and discounts. This reduces the risk of errors and ensures that all figures are accurate and up-to-date.

- Data Organization: Spreadsheets allow for easy sorting and filtering of data, so you can quickly find and review past transactions or group records based on specific criteria.

- Template Use: Pre-built formats offer a structure for creating records quickly. With just a few modifications, you can tailor the document to your needs, ensuring consistency across all business transactions.

- Tracking and Reporting: Spreadsheets can be used to generate reports, helping businesses track outstanding payments, client history, and overall financial health. This provides valuable insights into cash flow and business performance.

- Cloud Storage and Access: Many spreadsheet tools offer cloud-based storage, allowing you to access your documents from anywhere, on any device. This flexibility makes managing your records more convenient and ensures they are securely backed up.

Overall, spreadsheet programs make managing business records easier and more efficient, helping you stay organized, save time, and ensure accuracy across all your financial documents.

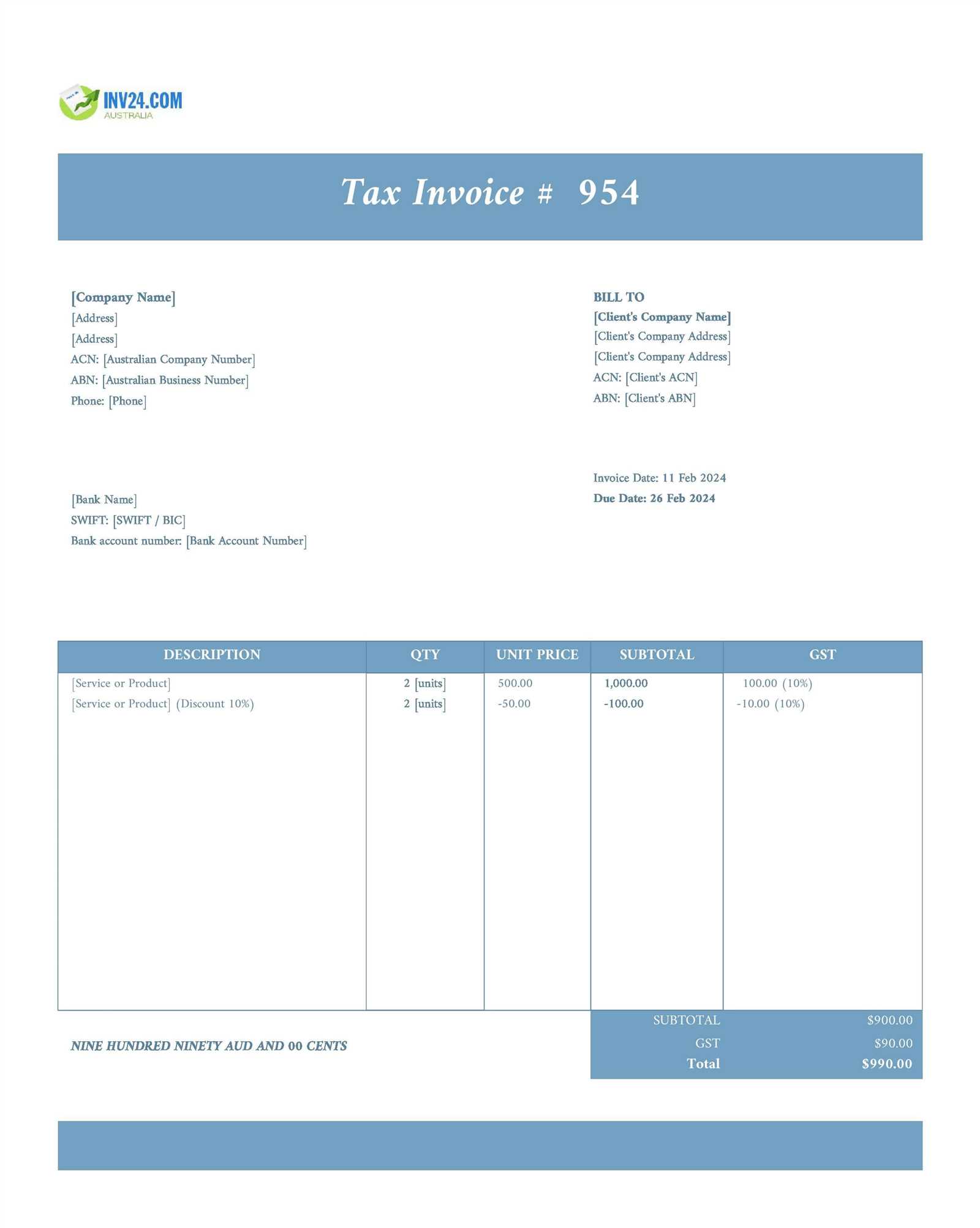

Ensure GST Compliance with Billing Documents

For businesses in regions that require Goods and Services Tax (GST) reporting, ensuring your financial records are compliant is essential. This includes accurately displaying GST on the relevant business documents, so both you and your customers are clear about the amounts being paid and owed. Compliance not only avoids legal issues but also helps maintain transparency in transactions.

To ensure that your records are GST-compliant, it’s important to include certain key details and adhere to the correct format. Below are the crucial steps to take:

- Display GST Clearly: Your document must clearly show the amount of GST being charged. This includes showing the GST as a separate line item, so it’s easy for both you and the client to identify.

- GST Registration Number: Ensure that your GST registration number is included on each document. This confirms that your business is registered for GST and meets legal obligations.

- Accurate GST Calculation: The GST amount should be correctly calculated based on the total cost of the goods or services provided. It’s essential to ensure the right percentage is applied to avoid discrepancies.

- Indicate Whether GST Is Included: Specify whether the GST is included in the total price or if it is added separately. This helps customers understand the full cost and ensures that no confusion arises.

- Issue a Compliant Record: To ensure compliance with regulations, only issue records that meet the requirements set by local authorities. If your business deals with GST, make sure the documents are formatted correctly and include all mandatory details.

By following these steps, you can ensure that your business is in full compliance with GST regulations. This not only helps avoid potential fines or penalties but also contributes to maintaining trust and professionalism in your

How to Add Payment Terms to Billing Documents

Including clear and concise payment terms in your business documents is crucial for setting expectations and ensuring timely payments. By outlining when and how payments should be made, you can avoid misunderstandings and maintain positive relationships with clients. Payment terms provide both parties with a mutual understanding of deadlines, fees, and any discounts that may apply.

Here are some essential steps to ensure that payment terms are properly included in your records:

- State the Due Date: Clearly mention the payment due date, such as “Due in 30 days from the date of issue” or a specific date (e.g., “Due by December 15, 2024”). This gives your clients a clear timeframe for making the payment.

- Include Late Fees: If applicable, specify any late payment charges. For example, you can mention “A 2% late fee will be applied to overdue amounts after 30 days.” This encourages timely payment and helps cover potential administrative costs.

- Offer Early Payment Discounts: If you provide discounts for early payment, be sure to outline these terms. For example, “A 5% discount will be applied for payments made within 10 days.” This motivates clients to pay sooner and improves your cash flow.

- Specify Accepted Payment Methods: Clearly list the payment methods you accept, such as bank transfers, credit cards, or checks. This ensures that your clients know how to proceed with payment without confusion.

- Set Partial Payment Terms: If you allow clients to make partial payments, include this option in the terms. For instance, “50% deposit required upon order, with the remaining balance due upon delivery.” This provides flexibility for larger transactions while ensuring you receive a portion of the payment upfront.

By clearly outlining these payment terms, you can avoid confusion and ensure that your business receives payments in a timely manner. It also helps maintain transparency with your clients and fosters trust in your business dealings.

Customizing Document Fields for Your Business

Every business has unique needs, and your financial records should reflect that. By customizing the fields in your business documents, you can tailor them to better suit your specific operations and make the process of managing transactions more efficient. Custom fields help ensure that the information relevant to your business is always included, leading to clearer communication with clients and better internal record-keeping.

Here’s how you can customize the key fields to align with your business requirements:

| Field | Customization Tips |

|---|---|

| Business Name and Contact Info | Ensure that your business name, phone number, email, and website are included for easy identification and communication. Consider adding a company logo for branding. |

| Client Information | Customize the client’s details section to include their account number or project reference. This makes it easier to track specific orders or projects for repeat clients. |

| Service/Product Descriptions | Include custom fields for specific services or product categories that your business offers. You can use dropdown lists or checkboxes to streamline this section. |

| Discounts and Special Offers | If your business offers frequent discounts or promotions, create fields to automatically calculate these offers based on the customer or product type. |

| Payment Instructions | Modify payment instructions to include your preferred payment methods and banking details. If you allow partial payments or deposits, create a section to specify these terms. |

| Legal or Compliance Information | For industries with specific regulatory requirements, include any mandatory legal disclaimers, terms, or compliance notes relevant to your field. |

By customizing these fields, you can create documents that better reflect the needs of your business, improve customer relationships, and ensure smoother transactions. Customization allows you to manage your financial records more effectively, saving time and reducing the chances of errors.

Save Time with Pre-built Billing Formats

Running a business involves countless tasks, and managing financial records is one of the most time-consuming. However, by using pre-designed formats, you can eliminate the need to create documents from scratch each time. These ready-to-use formats allow you to quickly input your details and generate professional, accurate records in a fraction of the time.

Here are the key reasons why pre-built formats save you time and effort:

- Predefined Structure: These formats come with all the essential fields already included, such as client details, product/service descriptions, amounts, and payment terms. You won’t have to worry about manually adding each section every time.

- Consistency: Using a standard format ensures consistency across all your documents. This helps maintain professionalism and prevents mistakes, especially when you’re managing multiple transactions or clients.

- Reduced Risk of Errors: With pre-built fields and formulas, you reduce the chances of miscalculating totals or missing key information. This improves accuracy and reduces the need for revisions.

- Easy Customization: Pre-built formats are customizable, allowing you to adapt them to your specific needs. Whether you need to add a discount, update payment terms, or adjust the design, these formats can be easily modified.

- Quick Turnaround: Pre-designed formats save time on every document creation. You simply fill in the necessary details, and your business record is ready in minutes, freeing up time for other important tasks.

By using these pre-made resources, you can streamline your record-keeping process, minimize administrative work, and focus more on running and growing your business.

Tracking Payments Using Spreadsheet Records

Managing cash flow and monitoring payments are essential tasks for any business. Keeping track of outstanding payments, received funds, and overdue balances can be a challenge without the proper tools. By utilizing a spreadsheet, you can streamline the process and gain better control over your financial transactions.

Spreadsheets provide a flexible and efficient way to track payments, ensuring you never lose sight of pending amounts or past transactions. By setting up a clear tracking system, you can stay on top of your accounts and ensure that payments are collected in a timely manner.

Setting Up a Payment Tracking System

To efficiently track payments, follow these steps:

- Set Up a Payment Status Column: Create a column to mark the payment status, such as “Paid,” “Pending,” or “Overdue.” This makes it easy to see the status of each transaction at a glance.

- Use Conditional Formatting: Highlight overdue payments in red or mark completed payments in green. This visually helps you focus on pending tasks without manually reviewing each entry.

- Record Payment Dates: Include a column for the payment date to track when the payment was made. This allows you to manage deadlines more efficiently and helps with reconciling accounts.

- Track Partial Payments: If you accept partial payments, create a column that notes the amount paid so far and the remaining balance due. This ensures that you always know how much is still owed.

- Automate Totals: Use formulas to automatically calculate totals, such as the sum of amounts paid and the remaining balances. This saves time and minimizes the chance for errors in calculations.

Benefits of Using Spreadsheets for Payment Tracking

Spreadsheets offer several advantages when it comes to payment tracking:

- Organization: With all your payment data in one place, you can easily track progress and manage client accounts.

- Real-Time Updates: You can instantly update the status of payments and see the changes reflected across your entire record.

- Customizable: Spreadsheets allow you to create a tracking system that fits your business needs, adding or removing fields as necessary.

- Ease of Access: Cloud-based spreadsheets can be accessed from anywhere, allowing you to check payment statuses on the go.

By using a spreadsheet to track payments, you can improve the accuracy and efficiency of your payment management process, ensuring that your business remains financially organized and on top of all incoming funds.

Why Spreadsheet Software is Ideal for Financial Records

When it comes to managing financial documents, many businesses rely on flexible and powerful tools to ensure accuracy and efficiency. Spreadsheet software offers a range of features that make it the ideal solution for creating, customizing, and tracking financial records. Its ability to streamline calculations, store large amounts of data, and adapt to specific needs makes it a top choice for companies of all sizes.

Here’s why spreadsheet software is so well-suited for managing financial documents:

Key Benefits of Using Spreadsheet Software

- Automated Calculations: One of the standout features of spreadsheet software is its ability to perform calculations automatically. Whether it’s adding up totals, applying tax rates, or calculating discounts, built-in formulas ensure accuracy and reduce the risk of human error.

- Customization: Spreadsheet tools allow businesses to tailor documents to their specific needs. You can adjust the layout, add or remove fields, and insert customized categories, all while keeping the document organized and professional.

- Data Organization: With built-in sorting and filtering options, spreadsheet software makes it easy to organize financial records by client, date, amount, or any other relevant factor. This helps businesses quickly find the information they need and track outstanding balances.

- Real-Time Updates: Spreadsheet documents can be easily updated in real-time. Whether you’re adding a new transaction or making changes to an existing record, updates are reflected immediately, keeping your financial data current.

- Templates and Pre-Built Features: Many spreadsheet programs offer pre-designed templates and features that make the document creation process faster. These templates often include standard fields for common business transactions, which saves time on formatting and organization.

- Security and Backup: Spreadsheet files can be securely stored and backed up on cloud-based platforms, ensuring that your data is protected and can be accessed from anywhere at any time.

How Spreadsheet Software Improves Efficiency

Spreadsheet software can significantly improve efficiency by reducing the time spent manually managing financial records. With features like autofill, drag-and-drop cell organization, and pre-calculated formulas, businesses can focus on more strategic tasks, while the tool handles the administrative workload.

By providing a flexible, customizable, and easy-to-use platform, spreadsheet software ensures that financial record-keeping is not only more organized but also more accurate and less time-consuming. This makes it an indispensable tool for businesses looking to maintain proper financial tracking and reporting.

Using Spreadsheet Software for Multiple Billing Documents

When managing a large number of financial transactions, businesses often need an efficient way to create and track numerous records at once. Spreadsheet software provides a powerful platform to handle multiple billing documents simultaneously, helping streamline the process, save time, and maintain consistency. By organizing your records in a single file, you can easily access, update, and analyze all your transactions in one place.

Here’s how spreadsheet software can help when dealing with multiple billing records:

Efficient Data Management

- Batch Creation: With spreadsheets, you can create multiple documents by copying and pasting pre-designed structures for each transaction. This eliminates the need to start from scratch every time you need to generate a new record.

- Bulk Updates: If you need to update or modify specific information (e.g., payment terms, amounts), changes can be made across multiple entries simultaneously, reducing manual input and minimizing errors.

- Quick Sorting and Filtering: Spreadsheets allow you to sort and filter your documents based on various criteria such as date, client, or amount, making it easier to access specific transactions without having to search through numerous files.

- Integrated Calculations: Using formulas, you can calculate totals, taxes, or discounts automatically for large volumes of transactions, saving significant time and ensuring consistency across all records.

Benefits of Using Spreadsheet Software for Multiple Documents

- Centralized Record-Keeping: With all your transactions in a single file, you can track and manage them more efficiently. This centralized approach simplifies accounting processes and ensures that all data is in one easily accessible place.

- Customization for Different Needs: Spreadsheet programs allow you to customize each document to fit different client or project needs. You can adjust fields, add new information, or even create different templates for various services.

- Time-Saving Features: Spreadsheet software offers powerful features like autofill, drag-and-drop, and automatic date entry, which help save time when handling large volumes of transactions.

- Record History and Tracking: By maintaining everything within a single document, you can easily track past records, identify trends, and review payment histories, all of which are important for business reporting and decision-making.

Whether you need to manage a handful of records or hundreds, spreadsheet software is a versatile and efficient tool that allows you to easily create, tr