Free Tax Invoice Template Australia Word Download

Managing finances efficiently is essential for every business. One crucial aspect of financial management is ensuring that all transactions are properly documented and presented. A well-organized and legally compliant billing system not only keeps your records accurate but also helps maintain a professional image with clients. Having a ready-made structure for generating official documents can save time and reduce the risk of errors.

By using a customizable structure, business owners can streamline the process of issuing payments and receipts, ensuring that they meet local regulations. A standardized format allows for clarity and consistency in all communications, whether you’re dealing with customers or other businesses. It can also make it easier for your clients to understand charges and make payments promptly.

Whether you’re a freelancer, a small business owner, or part of a larger company, having the right resources to create these important documents is key. With the right tools, you can focus on growing your business while handling administrative tasks more effectively. This guide will show you how to utilize accessible formats that cater to your specific needs and help you stay compliant with all relevant financial guidelines.

Tax Invoice Template Australia Word Overview

Creating professional billing documents is an essential task for businesses of all sizes. Using a structured format to generate receipts and payment requests ensures that all necessary details are included and presented clearly. This method not only simplifies the process but also guarantees consistency and accuracy in financial communications with clients and partners.

For businesses operating in specific regions, such as those subject to particular tax laws, having a compliant and customizable structure is crucial. Such formats are designed to meet legal requirements while allowing flexibility for businesses to adjust the content to their specific needs. These tools enable users to efficiently generate documentation that fulfills both administrative and regulatory demands.

Using editable formats that are easy to update and personalize can save valuable time and resources. They ensure that business owners and freelancers can focus on growing their operations without worrying about creating billing documents from scratch every time. In the following sections, we will explore the benefits and features of these ready-made structures, as well as how they contribute to streamlined business operations and improved professionalism.

Why Use a Tax Invoice Template

Having a pre-structured document for billing and financial transactions offers numerous advantages for businesses. It ensures that every required detail is captured accurately, helping to avoid errors and miscommunication. By relying on a standardized format, businesses can maintain consistency across all their communications, presenting a professional image to clients and partners alike.

Save Time and Effort

Manually creating these documents from scratch for each transaction can be time-consuming. By using an editable structure, the process is streamlined, allowing business owners and freelancers to quickly generate accurate documents without the need for redesigning them each time. This efficiency frees up time that can be better spent on growing the business or attending to other tasks.

Ensure Compliance and Accuracy

In regions with specific regulations, such as those governing financial transactions or business reporting, using a compliant structure ensures that all legal requirements are met. By incorporating the necessary elements into the document, businesses can avoid mistakes that could lead to fines or complications. A reliable format helps maintain accuracy in calculations and details, further ensuring proper adherence to local rules.

Consistency and professionalism are key when managing financial interactions. With a standardized format, businesses are more likely to present a polished and cohesive appearance to their clients, building trust and credibility in the process.

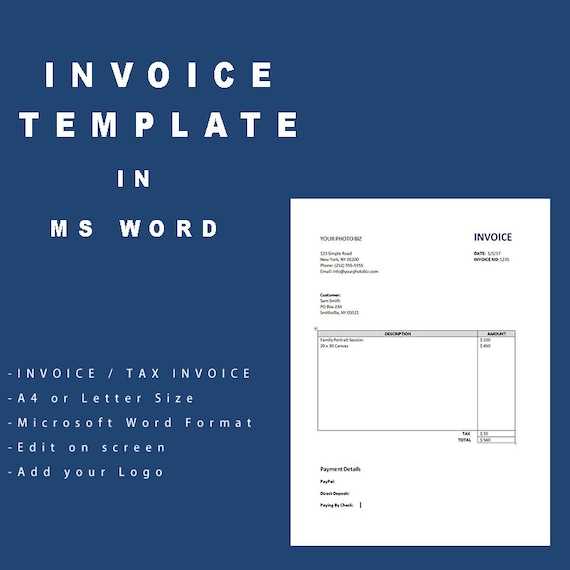

Benefits of Word Format for Invoices

Using a text-based document format for billing and payment requests offers several advantages, particularly in terms of flexibility and accessibility. This format allows for easy customization, enabling businesses to adjust layouts, fonts, and content as needed without technical expertise. Additionally, it is widely supported across various devices and platforms, making it a versatile choice for both small and large enterprises.

Easy Customization and Flexibility

The primary advantage of this format is its ease of customization. With simple editing tools, users can add their company logo, change fonts, or adjust the layout to fit their specific needs. Whether you’re a freelancer or a growing business, the ability to personalize the document makes a significant difference in maintaining a professional appearance while ensuring the document includes all necessary details.

Universal Compatibility and Accessibility

Another key benefit is the universal compatibility of text-based formats. Nearly every computer and operating system supports it, making it easy to create, edit, and share these documents across different platforms. This ensures that no matter the software or device your clients or colleagues use, they can easily view and process the document without compatibility issues.

Overall, the flexibility and widespread usability of text-based documents make them an excellent choice for businesses looking to streamline their billing process while maintaining professionalism and efficiency.

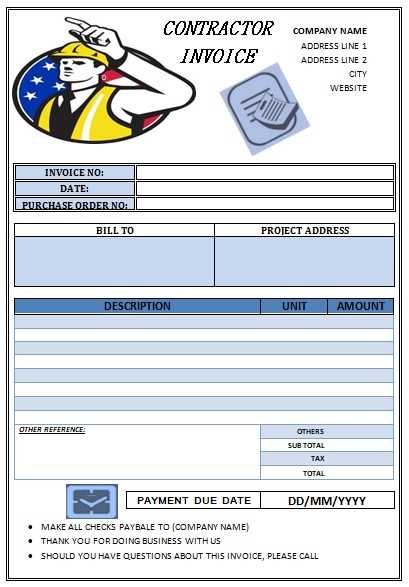

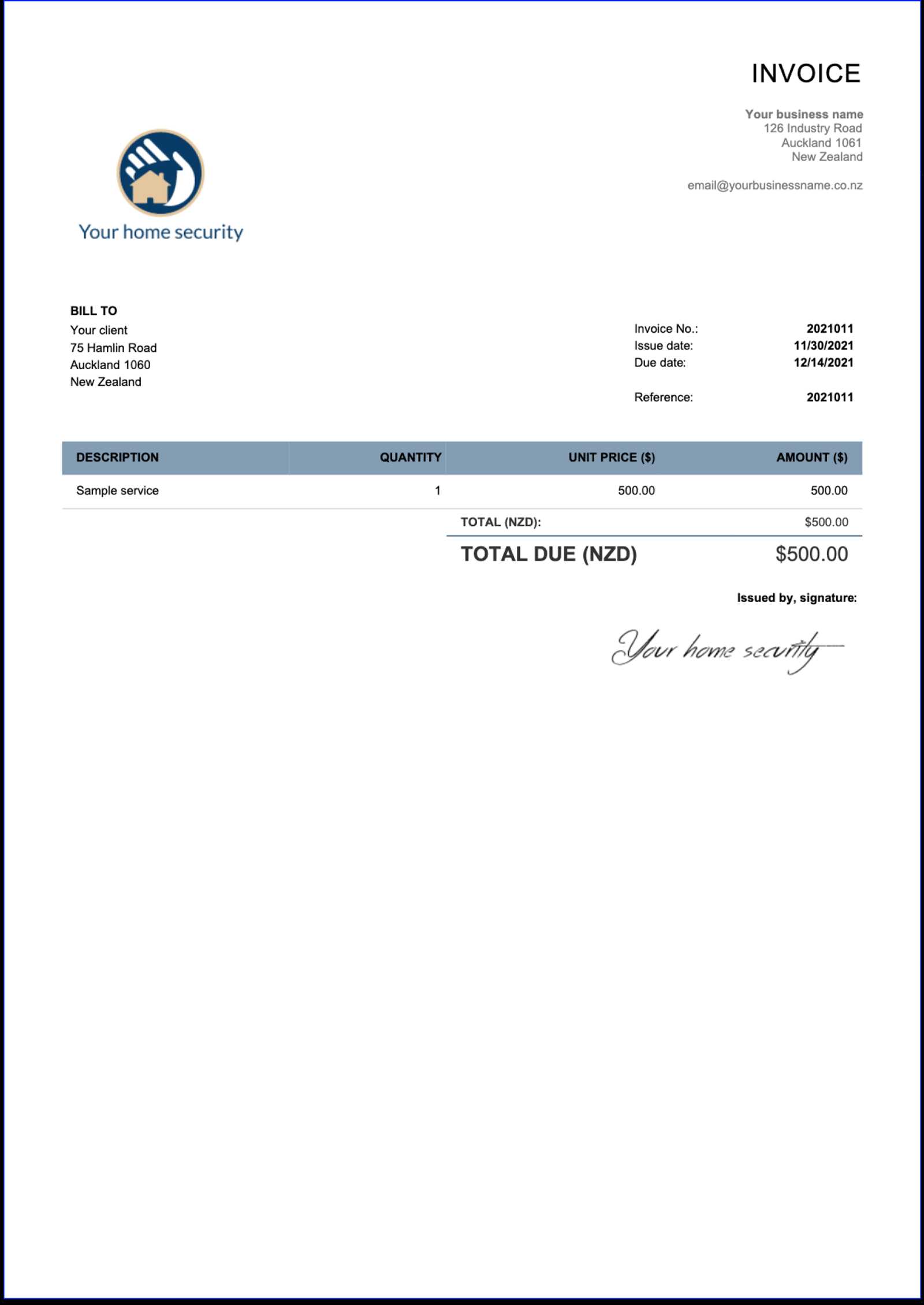

How to Create a Billing Document

Creating an effective payment request document involves ensuring that all essential details are clearly presented and easy to understand. A well-structured document not only reflects professionalism but also reduces the chances of confusion or errors between you and your clients. Following a few simple steps can help you generate an accurate and legally compliant request every time.

Step 1: Include Basic Information

The first step is to ensure that all the key information is included. This typically includes your business name, contact details, and the recipient’s information. Additionally, it’s important to add a unique reference number for tracking purposes and the date the document is issued. Make sure that all these details are clear and visible at the top of the document to avoid any ambiguity.

Step 2: Specify Services or Goods Provided

Next, outline the services or goods provided, including descriptions, quantities, and individual prices. It’s important to be as specific as possible, as this helps the recipient understand exactly what they are being charged for. If applicable, include any discounts, taxes, or additional fees in a separate section to keep everything transparent and easy to read.

Clarity and accuracy are crucial to ensure that both parties are on the same page regarding the amount owed. Taking time to properly format and organize the details of each transaction will help streamline the process and maintain positive client relationships.

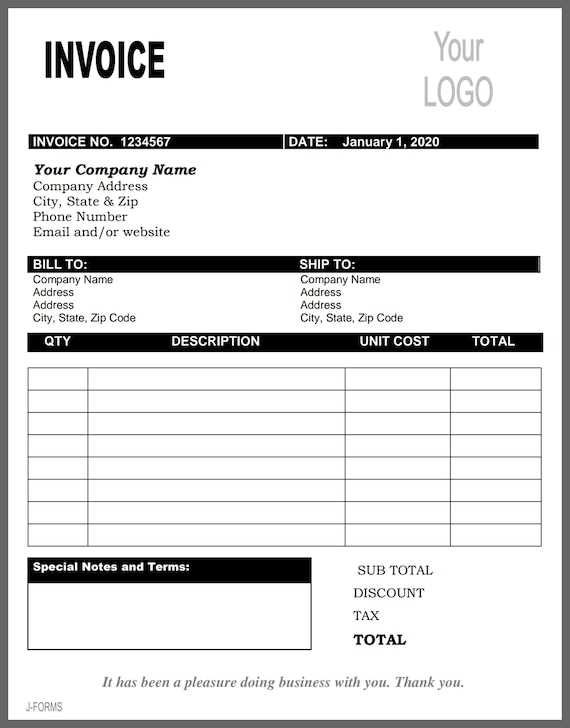

Essential Components of a Billing Document

When preparing a formal payment request, it is important to include specific information that ensures both clarity and compliance. A properly structured document should contain several key elements that not only provide a clear breakdown of charges but also ensure that the recipient has all the details they need to process the payment accurately. Understanding these essential components is crucial for creating effective and professional documents.

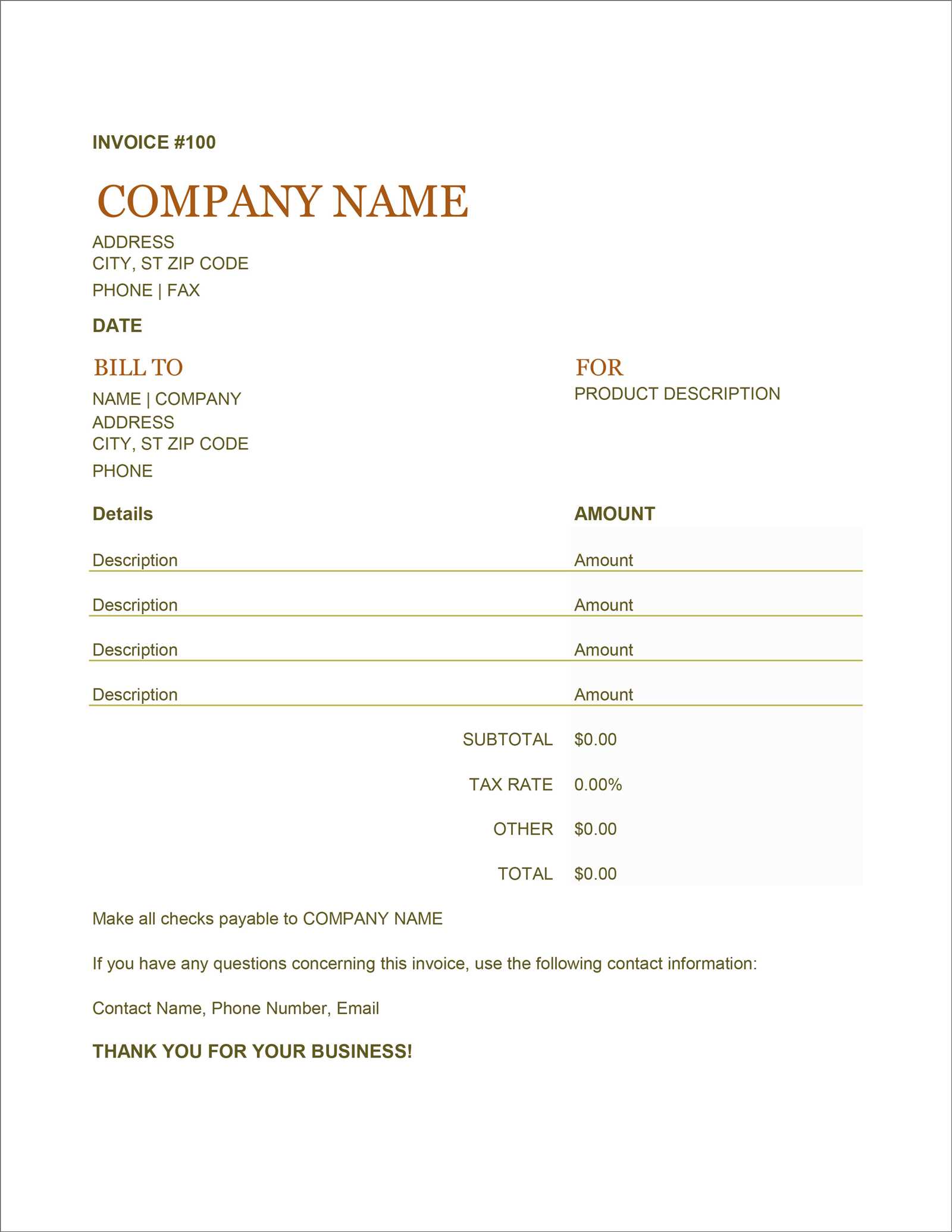

1. Business Information

The first essential element is your business details. This should include your company’s name, address, and contact information, such as phone numbers and email addresses. Having this information readily available ensures that the recipient knows how to contact you for any inquiries or clarifications regarding the transaction.

2. Recipient’s Information

Next, include the name and contact details of the person or business receiving the payment request. This establishes clarity regarding who is responsible for the payment and ensures that the document reaches the right party. Include their address, email, and any other necessary details for communication.

3. Unique Reference Number

A unique reference number is a key part of an organized system for tracking transactions. It allows both you and the recipient to refer to the specific transaction in case of any future questions or disputes. This number is especially useful for accounting purposes and helps you stay organized.

4. Detailed Breakdown of Goods or Services

Clearly list all the goods or services provided. Include descriptions, quantities, rates, and any applicable charges. Being specific about what was delivered or performed ensures transparency and helps prevent confusion or disputes later on.

5. Total Amount Due

Finally, the document must show the total amount due, including any taxes, fees, or discounts applied. This section should be easy to understand, with the amounts clearly separated to avoid errors. It is also important to include payment terms, such as the due date and available payment methods, to ensure prompt processing of the payment.

Including these essential components in your formal payment requests ensures that they are professional, clear, and legally sound. Properly detailing each aspect not only improves the chances of timely payment but also strengthens your business’s credibility.

Customizing Your Billing Document Format

Personalizing your payment request format can help make your business stand out and ensure that the document suits your specific needs. By adjusting certain elements like design, layout, and content, you can create a more professional and recognizable document that aligns with your brand’s identity. Customization not only enhances the look and feel but also allows you to streamline your documentation process according to your preferences.

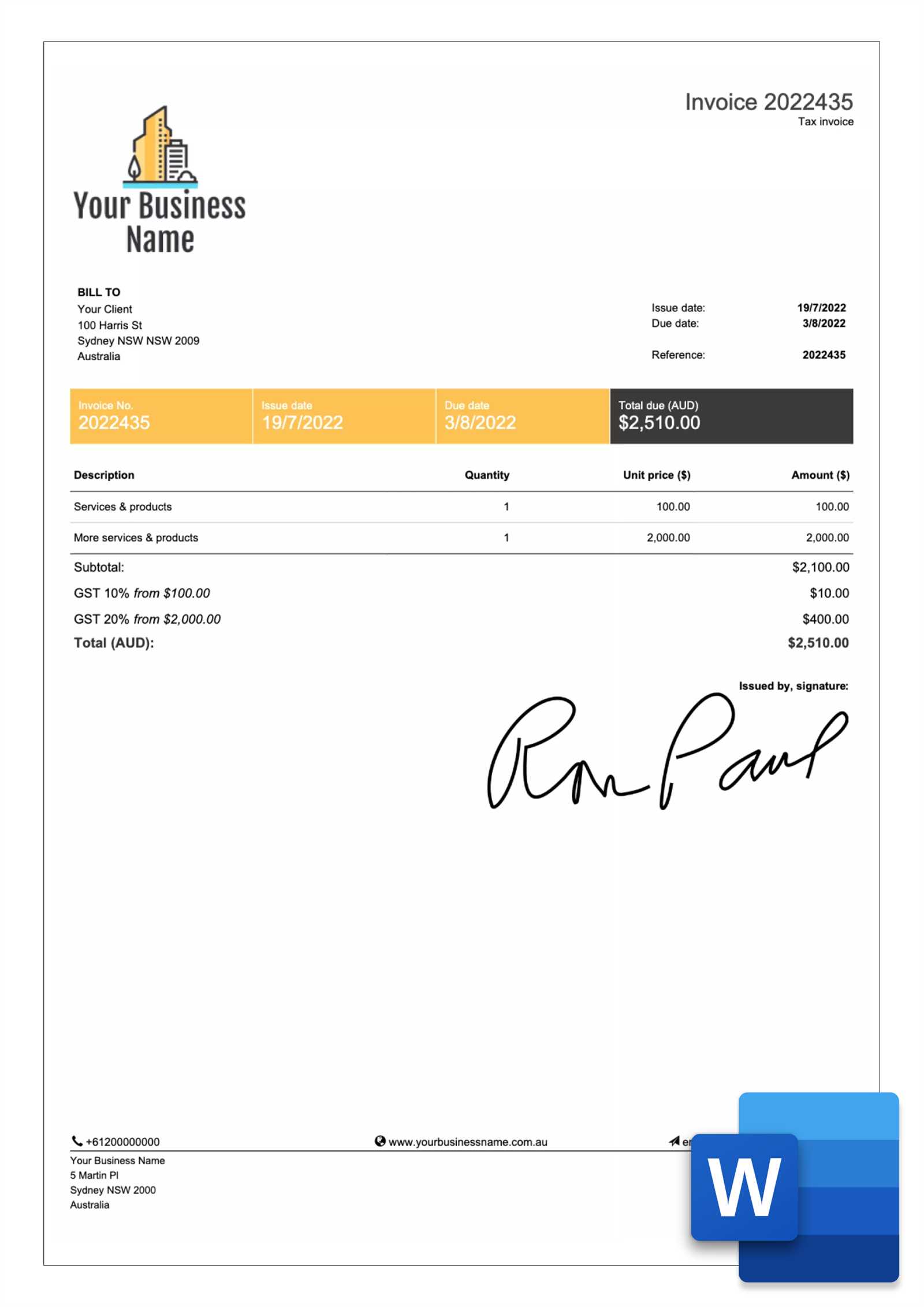

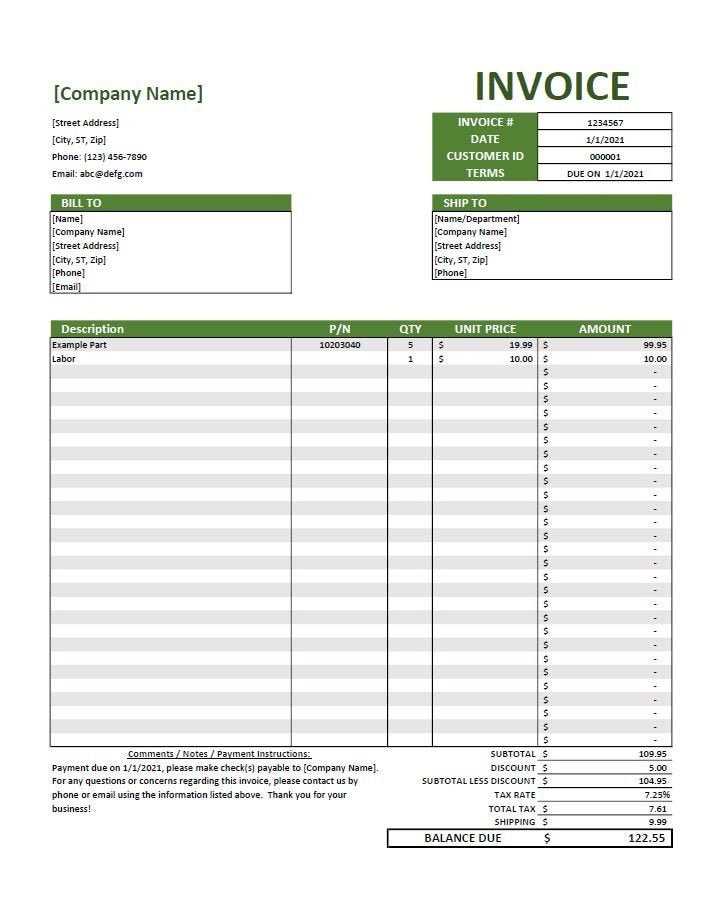

1. Adjusting the Layout and Design

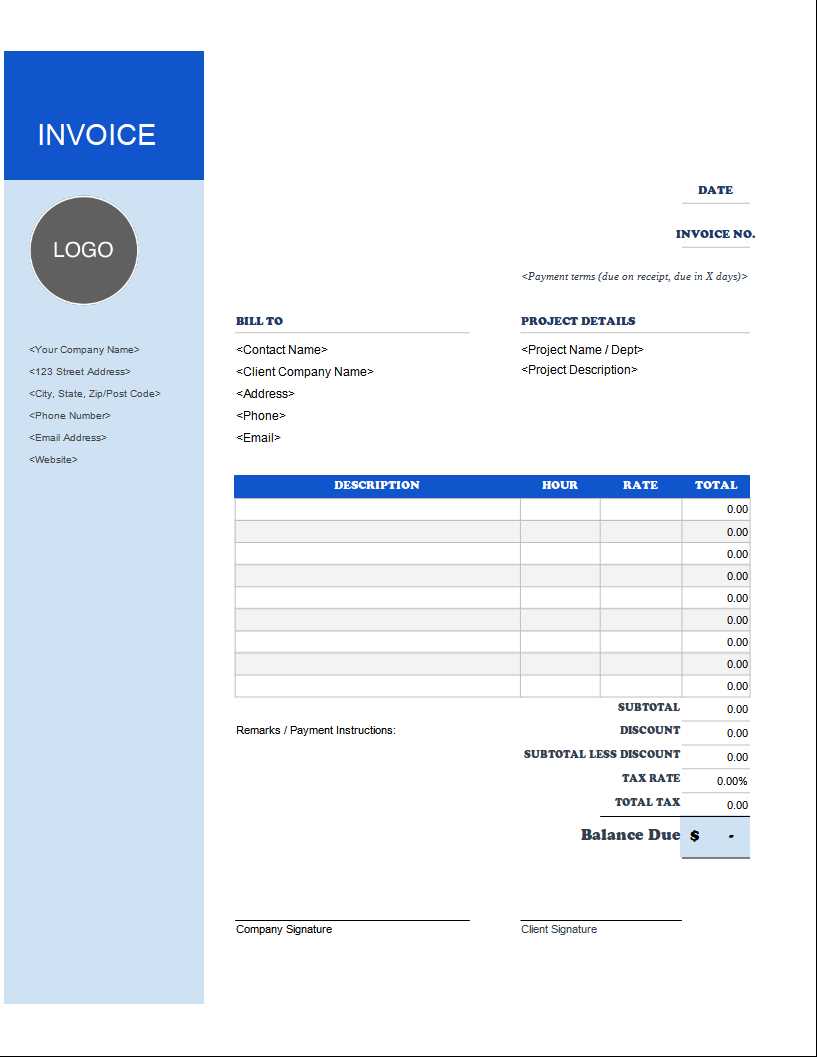

The layout of the document plays a significant role in making it visually appealing and easy to read. You can start by modifying the header section, where you can add your business logo, tagline, or any other branding elements. Below is a simple table format for organizing your content more clearly:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Example Service | 2 | $50.00 | $100.00 |

| Example Product | 5 | $20.00 | $100.00 |

2. Including Payment Terms and Instructions

Another key customization is to include clear payment instructions. You may want to specify payment methods, bank details, or any other relevant instructions. This section can be placed at the bottom of the document or in a prominent location where the recipient can easily find it. You can also customize the due date, late fees, or early payment discounts to fit your business policies.

By making these adjustments, your billing documents can reflect your brand’s professionalism and ensure smoother transactions with your clients. Customizing the format will help streamline your processes and improve the overall experience for both you and your recipients.

Common Mistakes to Avoid in Billing Documents

When preparing formal payment requests, it’s easy to overlook small details that can lead to confusion or delays in payments. Even minor mistakes can cause misunderstandings with clients or result in delayed transactions. By being aware of common errors and proactively addressing them, businesses can ensure smoother financial interactions and maintain a professional reputation.

1. Missing Key Details

One of the most common mistakes is failing to include essential information. This can range from missing the recipient’s contact details to omitting the transaction date. To avoid this, always double-check that your document includes the following:

| Essential Information | Example |

|---|---|

| Your business name and contact details | XYZ Ltd., 123 Main St, (123) 456-7890 |

| Recipient’s name and contact details | John Doe, 456 Elm St, [email protected] |

| Unique reference number | INV-12345 |

| Description of goods/services | Consulting services, 10 hours |

| Total amount due | $500.00 |

2. Incorrect Calculations

Another frequent issue is miscalculating the amounts, especially when including taxes, discounts, or additional fees. Even a small error in the math can cause confusion or disputes. Always use a reliable method to ensure the calculations are accurate, and clearly show the breakdown of charges for transparency.

It’s also important to check that the correct tax rates or service fees are applied based on your region or the type of service provided. Being transparent in these calculations can help prevent delays in payment and improve client trust.

By avoiding these common mistakes, businesses can reduce errors and ensure their billing process remains smooth, efficient, and professional. Taking the time to double-check every document c

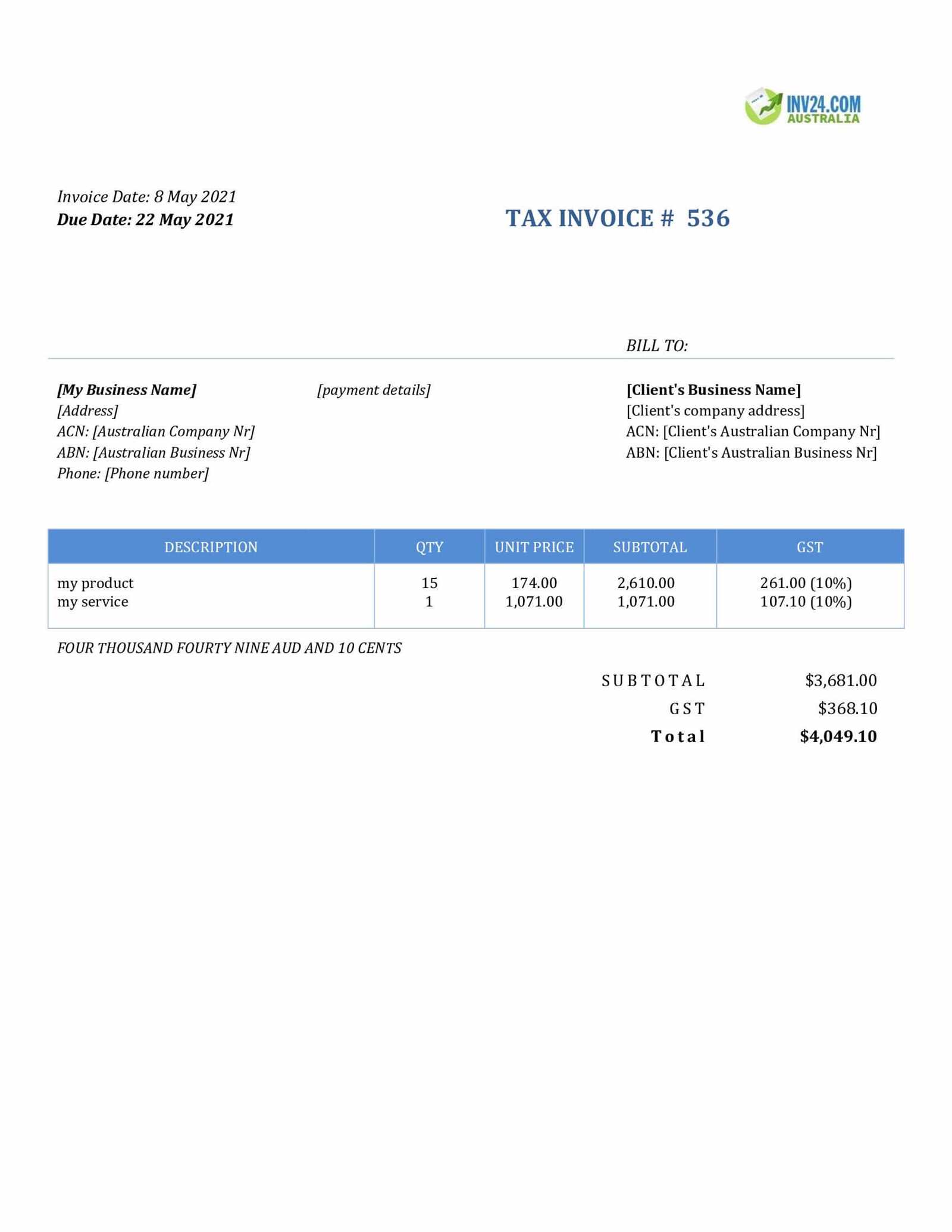

Ensuring Compliance with Australian Tax Law

Adhering to local financial regulations is essential for any business operating within a country. For businesses in Australia, understanding and following the legal requirements for financial documentation can help avoid potential issues with the authorities. By ensuring that all necessary components are included and properly formatted, you can remain compliant with the law and avoid unnecessary penalties.

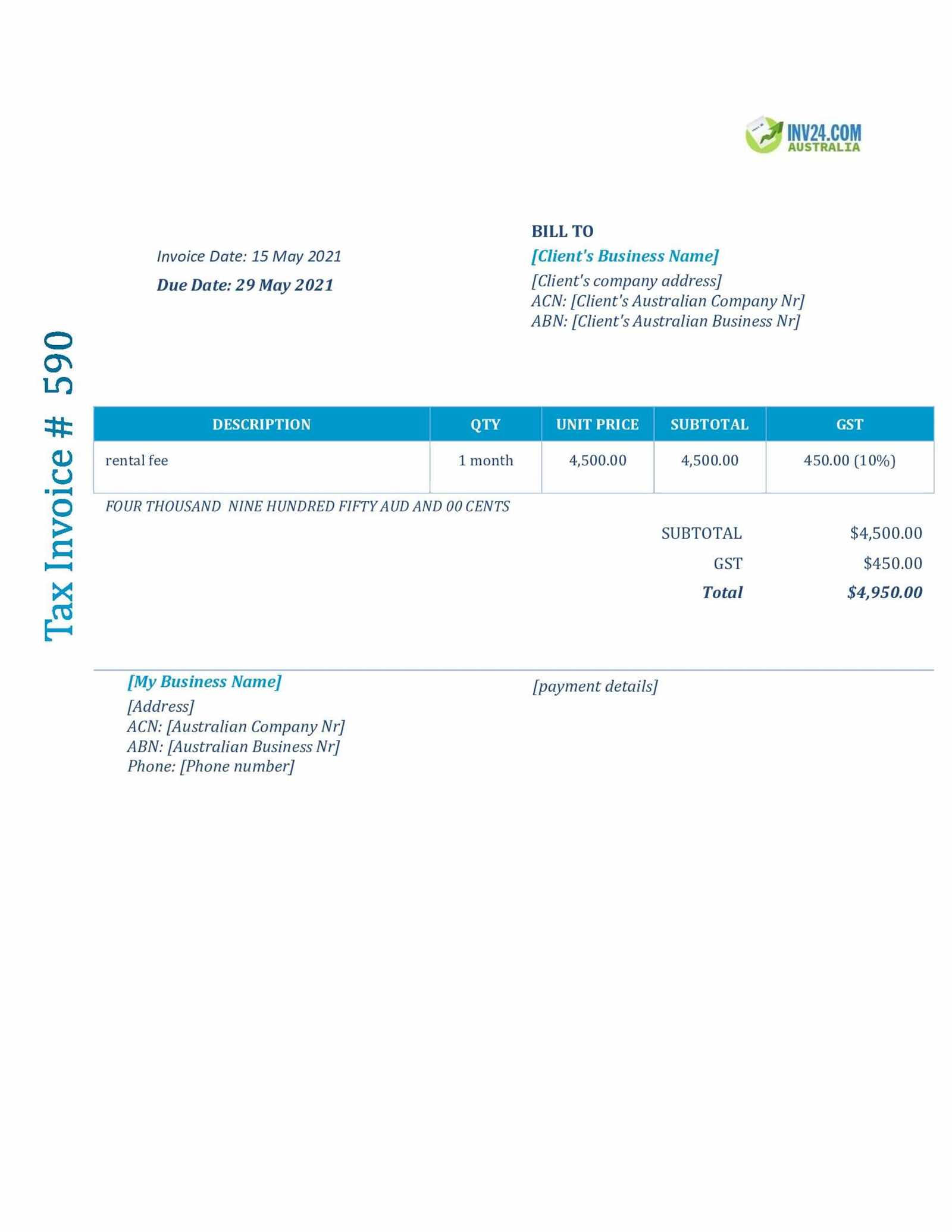

1. Include the Required Details

One of the key aspects of staying compliant is ensuring that all required information is included in your formal financial documents. In Australia, this typically includes your business’s registration details, the recipient’s details, a clear breakdown of the amount being charged, and the application of the correct Goods and Services Tax (GST) where applicable. Failure to include these details may lead to non-compliance and financial repercussions.

2. Apply the Correct GST Rate

In Australia, it is essential to apply the correct GST rate when preparing official documents related to financial transactions. Businesses that are registered for GST must include this on their documents, showing the correct percentage applied to the sale. Whether you are charging for goods, services, or both, ensuring the correct rate is applied will help avoid confusion and possible fines. Always stay updated with the latest rate set by the Australian government to ensure full compliance.

By paying close attention to these details, businesses can ensure that they meet all legal obligations and maintain a smooth financial operation. Understanding local regulations and properly applying them to your documentation processes is vital for long-term success and reputation.

How to Download Billing Document Templates

Accessing and downloading pre-made billing document formats can significantly streamline your administrative work. These formats offer a quick and easy way to create professional and compliant documents without the need to design them from scratch. Whether you are a freelancer, small business owner, or large company, these ready-made files can save you valuable time and effort.

Steps to Download a Billing Document Format

Follow these simple steps to find and download a ready-to-use format for your needs:

- Step 1: Choose a reliable source. Many websites offer free or paid options for downloading editable formats. Be sure to choose a reputable provider with positive reviews and clear usage terms.

- Step 2: Look for customization options. Some sites allow you to customize the document before downloading, enabling you to add your company logo, business name, or other personalized details.

- Step 3: Download the format. Once you’ve selected the appropriate document, click on the download link and save it to your computer. Make sure the format is compatible with the software you plan to use (e.g., Microsoft Office or Google Docs).

- Step 4: Open and edit. After downloading, open the file in your preferred software, make the necessary changes, and save the document for future use.

Where to Find Templates

There are several places online where you can find high-quality, free or affordable formats. Here are a few options:

- Official business resource websites

- Freelance platforms with downloadable resources

- Online document-sharing platforms, such as Google Docs and Microsoft Office templates

- Specialized accounting or financial software websites that offer downloadable files

By following these steps, you can easily find and download the right document format, making the process of creating professional billing requests more efficient and less time-consuming.

Top Features of a Good Template

A high-quality billing document structure is more than just a basic form to fill out; it should offer features that make creating and managing your financial documents simple, professional, and efficient. The best formats ensure clarity, customization, and legal compliance while also saving you time. Here are the key attributes that make a great document structure stand out.

1. Clear and Organized Layout

A well-designed format should be easy to read and navigate. A clear structure ensures that both you and the recipient can quickly identify important details, such as payment amounts, service descriptions, and due dates. Key features to look for include:

- Headings and subheadings for easy reference

- Logical flow that guides the reader through the document

- Whitespace to prevent overcrowding and enhance readability

2. Customization Options

Customization is essential for making the document align with your brand or specific business needs. A good structure should allow you to easily add or adjust:

- Your company logo and branding colors

- Contact information and other personal details

- Payment terms such as due dates or late fees

The ability to tailor these elements ensures that your document not only looks professional but also represents your business’s unique identity.

3. Compliance with Legal Requirements

A good structure should also ensure that it meets any legal or regulatory requirements for your region or industry. This includes:

- Including necessary details such as registration numbers or tax IDs

- Properly displaying the amount of applicable fees and taxes

- Offering clearly defined payment terms to avoid confusion

Ensuring compliance protects your business from potential legal issues and fosters trust with clients.

These are the core features that make a document format functional and user-friendly. By selecting a format with these attributes, you streamline the process of creating professional, efficient, and compliant

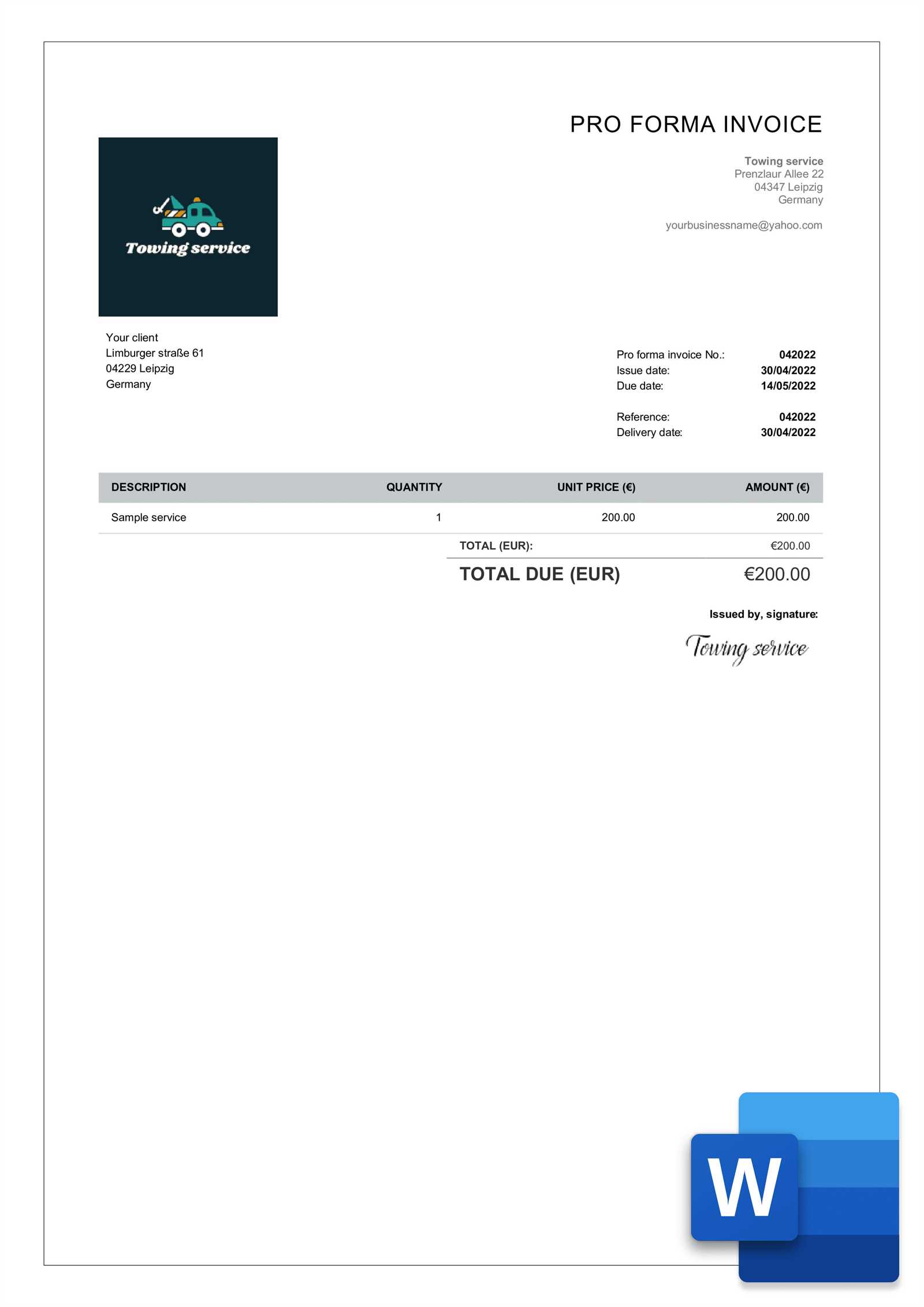

Understanding GST on Billing Documents

Goods and Services Tax (GST) is a significant component of the Australian financial system, affecting businesses of all sizes. When preparing formal financial documents, it’s crucial to understand how GST applies to your transactions, as it impacts the total amount due and ensures compliance with local regulations. Whether you’re a business owner or a contractor, understanding how to correctly apply GST will help avoid costly mistakes and ensure smooth financial operations.

What is GST and How Does it Work?

GST is a value-added tax applied to most goods, services, and other items sold or consumed within Australia. The tax is collected by businesses on behalf of the government and is typically included in the final sale price. It’s important to know whether or not you are required to charge GST, as this depends on your business registration status and the type of goods or services you provide.

If your business is registered for GST, you must include it in your pricing and list it clearly on all formal payment requests. If you’re not registered, GST is not applicable to your sales, and you do not need to charge it or include it in your financial documents.

How to Apply GST Correctly

To correctly apply GST, ensure the following key points are addressed in your formal payment documents:

- Ensure the GST rate is accurate – The standard rate in Australia is currently 10%, but this may change, so it’s important to verify the rate at the time of the transaction.

- Clearly state the GST amount – Include a breakdown of the GST charge, separate from the total price of goods or services.

- P

Tips for Organizing Your Billing Documents

Maintaining an organized system for your financial records is crucial for ensuring smooth operations and avoiding unnecessary complications. Whether you’re managing a small business or a freelance practice, keeping your documents in order not only helps with tracking payments but also ensures you stay compliant with regulations. Here are some key tips for organizing your billing paperwork effectively.

1. Implement a Numbering System

Using a consistent numbering system for your documents can make tracking and referencing much easier. Each document should have a unique reference number, which helps prevent confusion and allows you to quickly locate any specific entry. For example, a numbering system like “INV-001,” “INV-002,” and so on can help you stay organized and maintain a clear, chronological order.

2. Sort by Date or Client

Another effective organizational strategy is sorting your documents either by date or client. Both methods have their benefits:

- By date: This allows you to track outstanding payments and upcoming due dates more easily. It’s helpful for keeping a running record of all transactions within a specific timeframe.

- By client: Sorting by client can be beneficial if you manage multiple ongoing projects. This makes it easier to monitor the history of transactions with each client.

3. Use Digital Tools for Better Tracking

In addition to manual filing, consider using accounting or document management software to keep everything organized digitally. These tools can automatically track payments, send reminders, and generate reports, reducing the need for paper files. Most software allows you to categorize and filter your documents quickly, making them accessible at any time.

4. Keep Backup Copies

It’s important to keep a backup of all your documents, whether in physical form or digital. For digital backups, ensure they are stored securely and that you have a proper cloud or external storage system in place. This precaution helps prevent loss due to hardware failure or other unexpected events.

By applying these strategies, you can ensure that your billing process is efficient, organized, and transparent. An organized system not only reduces stress but also improves your ability to track payments and manage finances more effectively.

Using Templates for Small Businesses

For small businesses, managing administrative tasks efficiently is key to maintaining smooth operations and focusing on growth. One of the simplest ways to streamline processes like creating formal financial documents is by using pre-designed formats. These ready-made structures save time, improve accuracy, and help maintain a professional appearance for all your business transactions.

Benefits of Using Pre-Designed Formats

Here are some of the key advantages that small businesses can experience by using pre-designed structures for their financial records:

- Time Savings: Pre-made documents save you the time it would take to design one from scratch. You can quickly fill in the necessary details and move on to other tasks.

- Consistency: Using the same format ensures that all your financial documents look uniform, which enhances your business’s professionalism.

- Customization: Many templates allow for easy customization, so you can tailor them to reflect your business’s unique branding and needs.

- Compliance: High-quality pre-designed formats often come with features that help ensure compliance with local regulations, making it easier to stay on top of legal requirements.

How to Choose the Right Format for Your Business

When selecting a format, consider the following factors to ensure it aligns with your business needs:

- Industry-Specific Requirements: Some industries may require additional details or specific layout features. Choose a format that can accommodate these needs.

- Ease of Use: The format should be user-friendly and easy to navigate, especially if you’re not tech-savvy. Look for one that simplifies the process of entering information.

- Compatibility: Ensure that the format is compatible with the software or tools you currently use, such as Microsoft Office, Google Docs, or accounting software.

Using pre-designed structures can significantly reduce the burden of paperwork for small business owners. With the right tool, administrative tasks become much more manageable, allowing you to focus more on growing your business.

Saving Time with Billing Document Templates

Managing financial paperwork can be time-consuming, especially for small businesses and freelancers. However, by using pre-designed formats for your payment requests, you can drastically reduce the time spent on administrative tasks. These ready-made structures allow you to focus on the important aspects of your business while automating the creation of professional-looking documents.

How Pre-Designed Documents Streamline the Process

Using ready-made formats eliminates the need to start from scratch every time you need to send a payment request. Here’s how they help save time:

- Quick Setup: Simply open the format, fill in the necessary details, and you’re ready to send it. This quick process eliminates the hours spent designing or formatting documents manually.

- Consistency: Pre-designed formats ensure uniformity in all your financial records, saving you from having to reformat or adjust each document individually.

- Reduced Errors: By relying on a consistent format, you minimize the chance of forgetting important details or making formatting mistakes, which can lead to additional time spent fixing errors.

Maximizing Efficiency for Your Business

Time is a valuable resource for any business, and using pre-made structures frees up more of it for core activities like customer service, marketing, or product development. The time you save can be better invested in growing your business, improving services, or expanding your client base.

Incorporating these time-saving tools into your daily operations allows you to handle your finances more efficiently, leading to better productivity and overall business success.

Free vs Paid Billing Document Templates

When it comes to choosing the right format for your financial documents, one of the main decisions you’ll face is whether to use a free or paid option. Both come with their own set of advantages and drawbacks. Understanding these differences can help you make a more informed choice based on your business needs, budget, and the level of customization you’re looking for.

Free Billing Document Formats

Free formats are a popular choice for businesses just starting out or for those who have a tight budget. They can often be found on various websites or offered as part of free business tools. However, these documents typically come with certain limitations:

- Basic Features: Free formats usually offer essential fields but may lack advanced customization options or specialized features.

- Limited Support: Support options for free formats are often limited, leaving you on your own if you encounter issues or need help with customization.

- Standard Designs: Free formats often have generic designs and may not reflect your business branding as effectively as paid options.

Paid Billing Document Formats

Paid formats, on the other hand, come with enhanced features and more professional designs. They are typically provided by software companies, professional service providers, or specialized businesses. Here are some benefits:

- Advanced Customization: Paid options often allow for more detailed customization, letting you incorporate branding, logos, and specific client information with ease.

- Professional Designs: These formats tend to have a more polished and professional look, which can make

How to Send Billing Documents in Australia

Sending formal payment requests is an essential part of running a business, and doing so correctly ensures timely payments and legal compliance. In Australia, there are specific guidelines and practices to follow when sending financial documents to clients. By adhering to these steps, you can streamline the process and avoid unnecessary delays or complications.

1. Ensure Proper Documentation

Before sending a payment request, ensure that the document is properly filled out with all the required information. This includes clear details about the transaction, such as the amount, description of goods or services, and the applicable tax. Also, include your business details, including your registration number if required, to meet legal standards. Double-checking this information will help prevent disputes or delays.

2. Choose the Right Delivery Method

There are various ways to deliver your formal payment requests to clients, and selecting the right method is essential for ensuring that the document is received promptly. In Australia, the most common methods include:

- Email: Sending payment documents via email is the most common method for businesses today. It’s fast, cost-effective, and easily trackable. Ensure the document is in a widely accepted format such as PDF for easy viewing and downloading.

- Postal Mail: While less common in the digital age, some businesses may prefer to send formal payment requests via post. This method can be used for clients who prefer physical copies or when email is not an option.

Using both methods allows you to cater to different client preferences while ensuring a smooth payment process.

3. Include Clear Payment Terms

To avoid confusion, it is important to clearly state your payment terms on the document. This includes the due date for payment, available payment methods (such as bank transfer, credit card, or online payment systems), and any penalties for late payments. Be transparent about your terms to prevent any misunderstandings down the line.

By following these steps, you can ensure that your formal payment requests are sent efficiently and professionally, helping you maintain a positive relationship with your clients and ensuring timely payments.