How to Use the Target Invoice Template for Efficient Billing

Managing finances efficiently is crucial for any business or freelancer. One of the most important tasks in maintaining smooth operations is ensuring that payment requests are clear, professional, and easy to process. A well-structured billing document can save time, reduce errors, and enhance client relationships.

With the right format, you can automate and simplify the entire procedure, making it quicker to create and send requests for payment. By customizing the layout to suit your needs, you can ensure that all the necessary information is included, which in turn helps clients understand what they’re paying for and when to expect payment.

In this guide, we will explore how to create and personalize a billing document that fits your business model, from freelancers to larger enterprises. You’ll learn how to organize essential details, select the best features, and ensure that your financial transactions run smoothly.

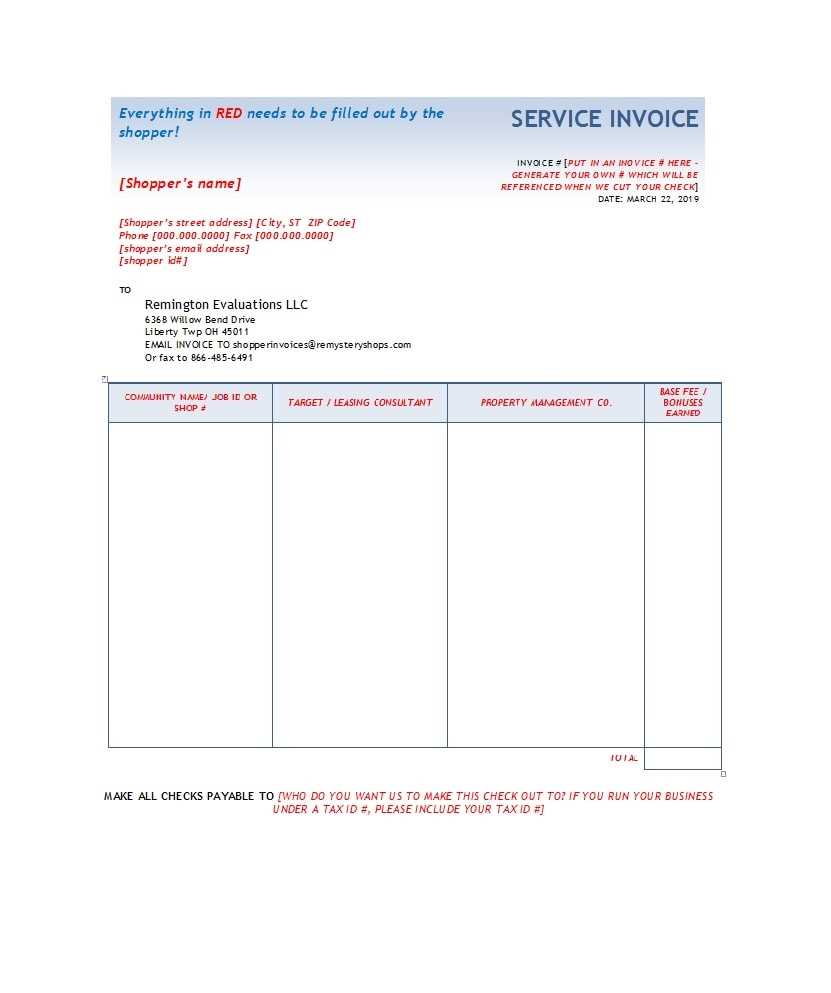

Understanding the Target Invoice Template

Having an organized and efficient billing structure is essential for any business or freelancer. The right document can streamline the process, ensuring that every necessary detail is included and easy to understand for both the sender and the recipient. This structure helps avoid confusion and minimizes the chance of mistakes during payment processing.

The document in question is designed to meet specific needs, allowing you to input essential information such as payment terms, services provided, and the amount due in a straightforward manner. By using a pre-designed format, you can save time while maintaining a professional appearance for every transaction.

Key Elements of the Document

The key elements typically include sections for client information, a breakdown of services or products, payment details, and any applicable taxes or discounts. These are arranged in a clear, easy-to-follow layout that ensures all necessary data is included without overwhelming the reader.

Why It Works for Small Businesses

This structured format is particularly beneficial for small businesses and independent professionals who need a simple yet effective way to manage payments. By using this pre-made solution, they can focus on their work without spending too much time on administrative tasks like creating documents from scratch.

Why Choose a Target Invoice Template

Opting for a pre-designed billing document offers numerous advantages, especially when it comes to saving time and maintaining consistency across your financial records. A carefully structured format simplifies the process, ensuring all the required details are present without the need to create each document from scratch.

One of the main reasons to use such a solution is the efficiency it brings. By utilizing an already organized layout, you can quickly generate documents for clients or customers, speeding up the payment cycle. Additionally, these documents are typically customizable, allowing you to align them with your business needs while keeping a professional appearance.

Another key benefit is the reliability that comes with using a proven structure. By choosing a widely accepted format, you reduce the risk of errors or omissions in your billing, helping to ensure clarity and avoid misunderstandings with clients. The structure ensures that all necessary information is consistently included, which can improve communication and client trust.

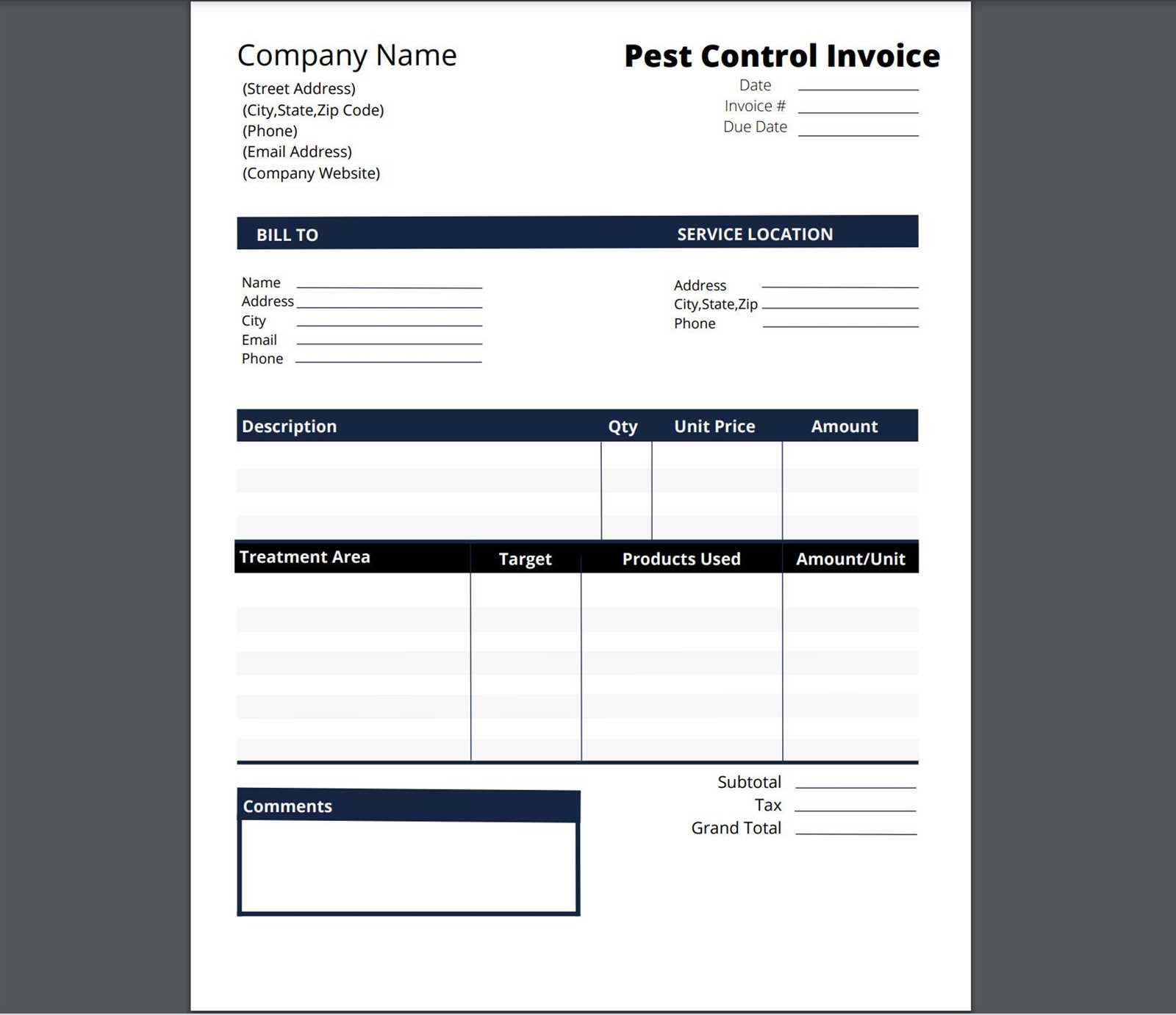

Key Features of the Template

When it comes to generating billing documents, certain features make a format stand out in terms of functionality and ease of use. The best designs prioritize simplicity, clarity, and flexibility, allowing users to quickly create professional-looking statements while maintaining all the necessary details.

A well-designed billing document typically includes customizable sections for your client’s information, a breakdown of products or services, payment terms, and totals. The ability to personalize these elements ensures that the format can be adapted to suit various business models, from freelancers to larger companies.

Customizable Layout and Sections

One of the most valuable features is the option to tailor the layout and content. You can easily modify headers, adjust font styles, and add specific fields that reflect your unique billing needs. Whether you need to include additional details like project milestones or tax calculations, a flexible structure makes it possible to do so without hassle.

Clear and Organized Data Presentation

The simplicity of the design ensures that all the critical information is presented in a clean, organized manner. Important details such as due dates, amounts owed, and payment methods are clearly outlined, making it easy for your clients to understand their obligations. This clarity helps avoid confusion and expedites the payment process.

How to Customize the Template

Customizing a billing document is essential for tailoring it to your specific business needs. With the right format, you can easily modify sections to include the relevant details, reflect your brand, and match your company’s requirements. The customization process is usually straightforward, allowing you to quickly adjust elements like fonts, colors, and the arrangement of sections.

Modifying the Basic Structure

The first step in customizing your document is adjusting the basic structure. Depending on your needs, you may want to add or remove sections, change the order of information, or include additional fields. Most formats allow you to easily swap out placeholders with actual data, such as customer names, dates, and amounts.

Personalizing Appearance and Branding

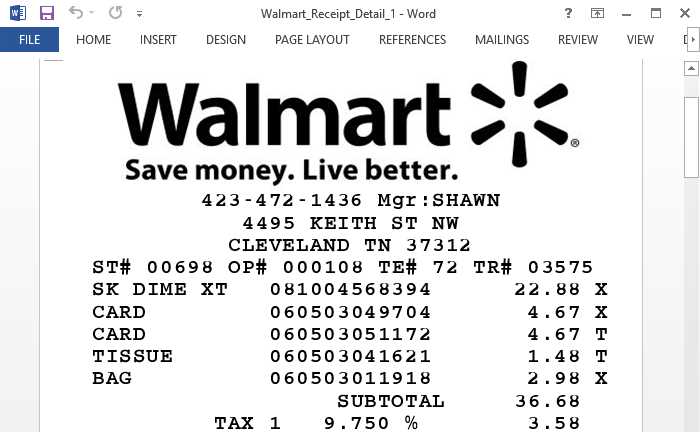

Beyond layout changes, personalizing the look of your document is an important step in establishing your brand identity. Adding your company logo, adjusting font styles, and selecting brand colors can all be done to ensure that the document reflects your business’s unique image. Below is an example of how this might appear in a customized layout:

| Section | Customization Options |

|---|---|

| Header | Logo, company name, contact information |

| Itemization | Service descriptions, pricing, discounts |

| Footer | Payment terms, thank you message, additional notes |

With these adjustments, you can ensure that your document n

Using the Template for Small Businesses

For small businesses, efficient and clear documentation is key to maintaining professionalism and ensuring smooth financial transactions. A well-structured document for billing helps streamline administrative tasks, minimize errors, and improve cash flow. By utilizing a pre-designed structure for your payment requests, you can focus more on growing your business rather than spending time on formatting and layout concerns.

Benefits for Small Business Owners

Adopting a ready-made billing document brings several advantages for small business owners:

- Time-saving: It eliminates the need for creating documents from scratch each time a payment is due.

- Professional appearance: A polished design enhances your brand image and shows customers that you are organized.

- Consistency: Using a standardized format ensures uniformity across all financial communications.

- Customization: Many pre-designed forms are flexible, allowing you to add your logo, adjust color schemes, and modify fields according to your specific needs.

How to Use Effectively

For optimal results, small businesses should follow these best practices when utilizing pre-made billing structures:

- Fill in all relevant details: Always ensure that client information, service descriptions, and payment terms are accurate and complete.

- Ensure clarity: Use simple and clear language to avoid misunderstandings. Clearly outline payment due dates and amounts.

- Keep records: Maintain a copy of each document sent out for future reference and potential follow-up.

- Review regularly: Update your document if your business processes or services change, or if legal requirements evolve.

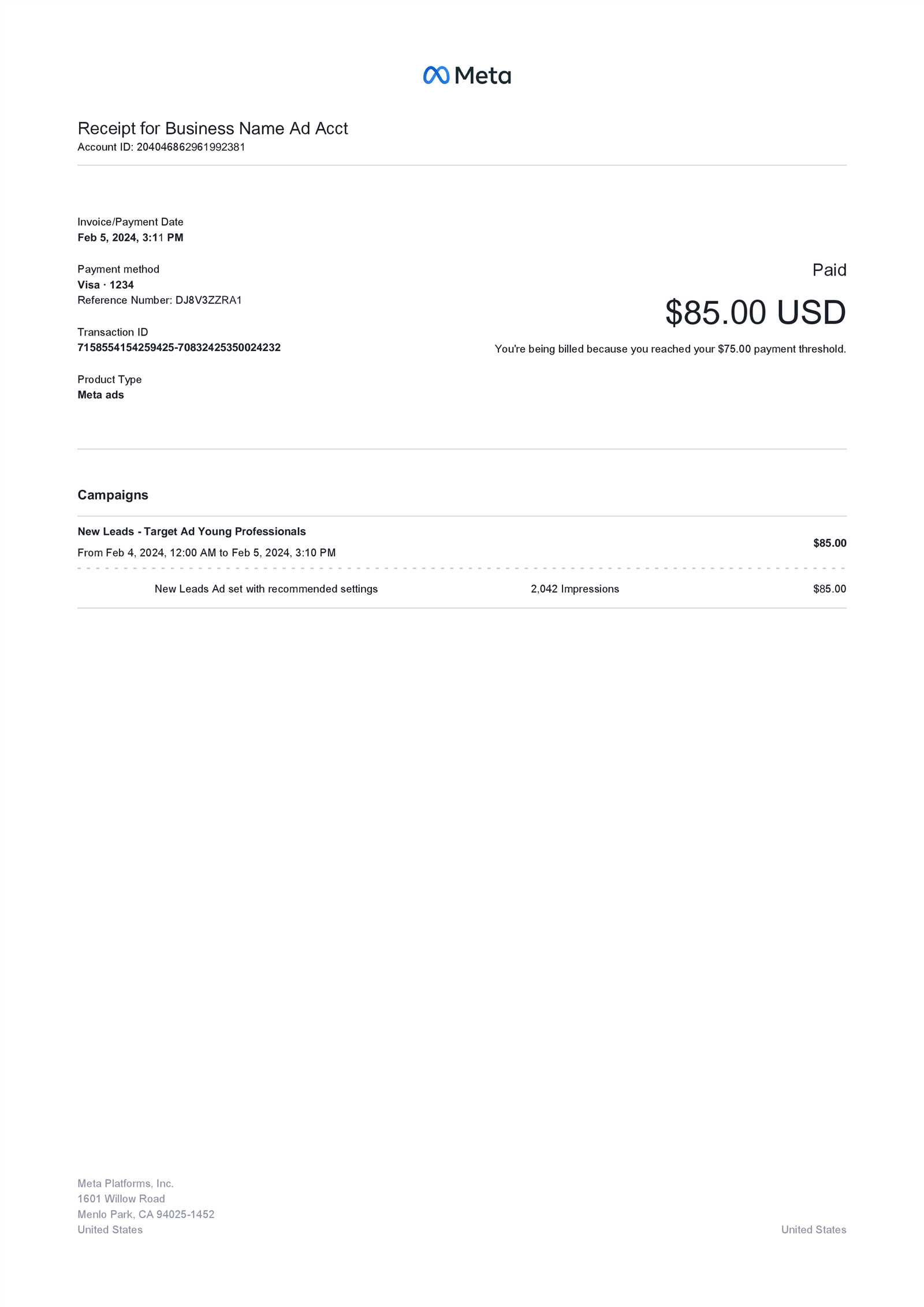

Target Invoice Template for Freelancers

For freelancers, maintaining a professional and organized approach to billing is essential for smooth business operations. A structured document for payment requests not only ensures clarity in transactions but also helps build trust with clients. With the right format, freelancers can streamline their workflow, save time, and reduce the risk of errors when requesting compensation for their services.

Why Freelancers Should Use a Structured Document

Having a standardized format for payment requests offers several key benefits to freelancers:

- Efficiency: A predefined structure reduces the time spent on formatting each payment request, allowing freelancers to focus on their work.

- Professionalism: Presenting a well-organized document helps establish a professional image, making clients more likely to pay on time.

- Clarity: A clear breakdown of services, rates, and deadlines eliminates confusion and reduces disputes.

Essential Elements of a Payment Request for Freelancers

When creating a payment document, freelancers should ensure it includes all the key information necessary for both parties to understand the terms. Here’s an example structure:

| Item Description | Quantity | Rate | Total |

|---|---|---|---|

| Design Services | 5 hours | $50/hr | $250 |

| Consultation | 2 hours | $75/hr | $150 |

| Total Amount Due | $400 | ||

This simple structure provides an easy-to-read summary of services rendered, along with the payment amount due. Including clear payment terms, such as due dates and preferred payment methods, ensures that both parties are on the same page.

Common Mistakes to Avoid

Creating a clear and professional payment request document is crucial for ensuring timely and accurate payments. However, many individuals and businesses make avoidable errors when preparing these documents, which can lead to confusion, delays, or even disputes. Recognizing and preventing these mistakes can make a significant difference in maintaining smooth financial interactions with clients.

Key Mistakes to Watch Out For

- Incomplete Client Information: Always double-check that the client’s name, address, and contact details are accurate. Missing or incorrect information can cause delays and confusion.

- Vague Service Descriptions: Ensure each service or product is clearly described. Vague or overly broad descriptions can lead to misunderstandings or disagreements about what was delivered.

- Incorrect Payment Terms: Clearly state the due date, late fees, and any other relevant payment terms. Failing to include this information can result in delayed payments or misunderstandings with clients.

- Missing Payment Method Details: Always specify the methods through which you accept payments (bank transfer, PayPal, etc.). Leaving this out can lead to clients not knowing how to pay.

- Forgetting to Include a Unique Reference Number: A reference number for each payment request helps you track transactions and prevents confusion, especially if you work with multiple clients.

How to Avoid These Mistakes

To avoid these common pitfalls, consider the following best practices:

- Double-check all information: Always review your document for accuracy before sending it to your client.

- Be specific: Break down services or products in detail to avoid ambiguity.

- Set clear expectations: Include all relevant payment terms and conditions to ensure both parties are aligned.

- Use software tools: Consider using professional software or platforms designed for billing to help minimize errors.

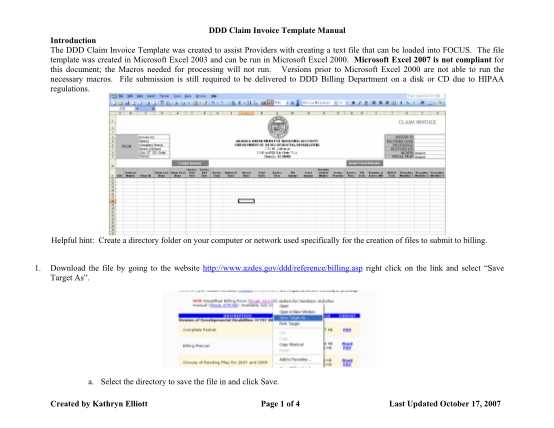

How to Download the Target Template

Obtaining a ready-made document for billing or payment requests is a straightforward process, and it can save a significant amount of time for small businesses and freelancers. By downloading a well-structured format, you can immediately start customizing it for your specific needs. The steps are simple, and many platforms provide free or paid options that suit various business types. Here’s how you can get started.

Steps to Download the Payment Request Format

Follow these simple steps to download and begin using a standardized document for your transactions:

- Choose a Platform: Many websites and online tools offer customizable formats. Popular platforms include Google Docs, Microsoft Office, and specialized invoicing software websites.

- Search for the Document: Use relevant keywords like “billing document,” “payment request,” or “business payment form” in the search bar of your chosen platform.

- Select the Right Version: Choose the version that best fits your needs, whether it’s a simple format for freelancers or a more detailed one for businesses.

- Download the File: Click the “Download” button, ensuring the file type is compatible with your software (PDF, DOCX, XLSX, etc.).

- Save to Your Device: Store the document in an easily accessible folder on your computer or cloud storage to ensure you can access it whenever needed.

Customizing Your Document

Once you’ve downloaded the document, it’s time to tailor it to your business or freelance needs:

- Update Business Information: Make

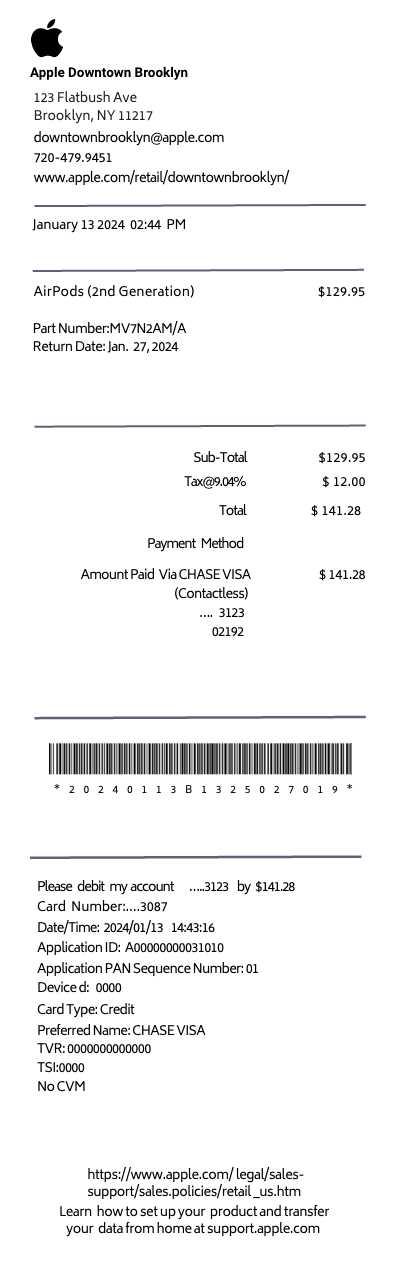

Benefits of Digital Invoicing with Target

Switching to a digital system for creating and sending payment requests offers numerous advantages for businesses of all sizes. By using electronic formats, businesses can simplify their administrative tasks, reduce human errors, and streamline their financial processes. Additionally, digital payment requests are faster, more secure, and easier to manage compared to traditional paper-based methods.

Key Advantages of Going Digital

Using digital solutions for payment requests can bring several benefits to your business operations:

- Faster Processing: Digital formats allow for quicker creation, sending, and receiving of payment requests. Clients can receive their documents immediately, speeding up the overall payment cycle.

- Improved Accuracy: Automated calculations and pre-set fields reduce the likelihood of errors, ensuring that the amounts and terms are accurate every time.

- Environmental Impact: By eliminating paper usage, digital payment documents contribute to a more sustainable, eco-friendly business model.

- Better Organization: Digital records are easy to store, search, and retrieve, making it simpler to track payments and maintain accurate financial records.

- Enhanced Security: With encrypted documents and secure delivery methods, digital solutions offer better protection against loss, theft, or unauthorized access compared to paper-based systems.

Additional Features for Efficiency

Many digital platforms offer additional tools and features that can further enhance the invoicing process:

- Automated Reminders: Set automatic reminders for clients who have

Target Template vs Other Invoice Tools

When it comes to managing financial documents, there are many options available for businesses and freelancers. Some prefer using pre-designed formats, while others opt for specialized software or platforms with more advanced features. Choosing the right tool depends on the specific needs of your business, such as the level of customization required, the ease of use, and the integration with other systems.

Comparison of Pre-designed Formats vs Specialized Software

Here are some key differences between using a pre-designed document format and more advanced invoicing software or tools:

- Ease of Use: Pre-designed formats are simple to use, requiring minimal technical skills. You just fill in the fields and send the document. In contrast, invoicing software can have a steeper learning curve but offers more advanced features and automation.

- Customization: While pre-designed formats can be adjusted to some extent, specialized software provides a higher degree of customization, allowing you to create invoices with personalized branding, client management features, and custom payment terms.

- Integration: Many invoicing platforms integrate seamlessly with accounting and financial software, helping businesses track expenses, generate reports, and manage taxes more efficiently. Pre-designed formats do not have this capability and often require manual entry into accounting systems.

- Cost: Pre-designed formats are usually free or available for a low cost, while invoicing software may have a subscription or one-time fee. The choice between these options often comes down to your business’s budget and requirements.

- Automation: Specialized invoicing tools often come with automated features, such as recurring billing, automatic reminders for overdue payments, and real-time tracking. Pre-designed formats, however, require manual effort

Step-by-Step Guide to Create a Payment Request

Creating a clear and accurate payment request is essential for ensuring timely payments and maintaining professionalism. Whether you are a freelancer, small business owner, or service provider, following a systematic approach will help you craft a document that is both functional and professional. Here is a step-by-step guide to help you prepare a payment document that covers all necessary details.

Step 1: Include Your Business Information

Start by adding your business name, address, phone number, and email at the top of the document. This ensures that your client knows who the payment request is from and can contact you easily if there are any questions.

- Business name and logo

- Contact details

- Tax or registration number (if applicable)

Step 2: Add Client Information

Next, include the recipient’s details. Make sure to include the client’s full name or business name, address, and contact information. This ensures the request is directed to the correct individual or company.

- Client’s name or company name

- Step-by-Step Guide to Create a Payment Request

Creating a clear and accurate payment request is essential for ensuring timely payments and maintaining professionalism. Whether you are a freelancer, small business owner, or service provider, following a systematic approach will help you craft a document that is both functional and professional. Here is a step-by-step guide to help you prepare a payment document that covers all necessary details.

Step 1: Include Your Business Information

Start by adding your business name, address, phone number, and email at the top of the document. This ensures that your client knows who the payment request is from and can contact you easily if there are any questions.

- Business name and logo

- Contact details

- Tax or registration number (if applicable)

Step 2: Add Client Information

Next, include the recipient’s details. Make sure to include the client’s full name or business name, address, and contact information. This ensures the request is directed to the correct individual or company.

- Client’s name or company name

- Client’s address and contact information

Step 3: Assign a Unique Reference Number

Give the document a unique reference number for tracking purposes. This can be a sequential number or a custom code that helps you keep track of all your requests efficiently. It’s important for organizing and referencing payments in the future.

Step 4: List the Services or Products Provided

Clearly outline the products or services provided, including quantities, rates, and any relevant details. If you offer multiple services, break them down into separate line items for clarity.

- Description of each service or product

- Quantity or hours worked

- Rate per item or service

- Total cost per item or service

Step 5: Specify Payment Terms

Define the payment terms, such as the total amount due, payment methods accepted, and the due date. Be clear about late fees or penalties if the payment is not received on time.

- Total amount due

- Accepted payment methods

- Payment due date

- Late fees or penalties (if applicable)

Step 6: Add Any Additional Notes

If necessary, include any special terms, notes, or instructions for your client. This could include refund policies, discounts, or project completion dates.

Step 7: Send the Document

Once you’ve double-checked all the information, save the document in a secure format (such as PDF) and send it to your client via email or your preferred method of communication.

By following these steps, you can create a professional payment request that ensures clear communication and smooth financial transactions with your clients.

Saving Time with the Template

For businesses and freelancers, time is a precious resource. Streamlining administrative tasks, such as creating payment documents, can free up valuable time that can be better spent on core activities like serving clients or growing the business. Using a pre-designed structure for financial documents can significantly reduce the time spent on repetitive tasks, ensuring both efficiency and accuracy.

How a Pre-designed Document Helps Save Time

Here are some ways a structured format can help you save time and improve your workflow:

- Quick Setup: A pre-made format eliminates the need to design a new document each time. You only need to input the relevant details, such as client information, services provided, and payment amounts.

- Consistency: By using the same format every time, you avoid spending time making design choices or adjusting layouts. Consistent documents save time in the long run by reducing the risk of errors or confusion.

- Automation Features: Many pre-designed structures allow you to save commonly used information, such as your business name or standard payment terms, which can be automatically filled in for each new document.

- Faster Review Process: A clear, standardized layout makes it easier to quickly review and send documents without missing critical details or spending too much time on formatting.

Additional Time-Saving Tips

To maximize your efficiency when using pre-designed formats, consider these additional tips:

- Save Templates: Keep multiple versions of your documents for different types of clients or services. This way, you can quickly select the most appropriate one and customize it as needed.

- Use Pre-filled Information: Many digital platforms let you store and pre-fill client details, reducing the need to enter the same information repeatedly.

- Send Documents Electronically: Avoid delays by sending your documents through email or other digital methods. This ensures that your client receives the document instantly, speeding up the payment process.

By incorporating these strategies into your routine, you can save valuable time and focus on more important tasks, while maintaining a high level of professionalism in your financial communications.

How to Integrate Payments into the Template

Integrating payment options directly into your billing documents can streamline the process for both you and your clients. By offering clear payment instructions and multiple payment methods, you make it easier for clients to settle their bills on time. Adding payment integration features into your financial documents can help reduce friction in the payment process and improve cash flow.

Steps to Include Payment Methods in Your Document

Here are the steps to effectively integrate payment options into your document:

- List Accepted Payment Methods: Clearly state the payment methods you accept. These may include bank transfers, credit cards, PayPal, or other digital payment systems. Make sure to specify any necessary details, such as account numbers or payment links.

- Provide Payment Instructions: Include detailed instructions on how to make a payment. For example, provide your bank’s routing number for wire transfers or a direct link to a PayPal account for online payments.

- Set Payment Terms: Clearly mention payment due dates, any early payment discounts, or late fees. This ensures that clients are fully aware of when and how payments should be made.

- Include QR Codes or Payment Links: For even greater convenience, you can integrate QR codes or direct payment links. These can be scanned by clients or clicked directly, making it as easy as possible for them to complete the payment.

Benefits of Payment Integration

Integrating payment options directly into your documents brings several key benefits:

- Faster Payments: Clients can pay instantly, reducing delays and improving your cash flow.

- Reduced Errors: With all payment information in one place, there’s less chance of errors or misunderstandings about how payments should be made.

- Convenience for Clients: Offering multiple payment methods and clear instructions makes it easier for clients to pay in the way t

Best Practices for Invoice Management

Efficient handling of billing documents is crucial for maintaining smooth financial operations within any organization. A well-structured approach ensures timely payments, reduces errors, and fosters better relationships with clients and suppliers. By following a set of established practices, businesses can streamline their financial workflows and avoid common pitfalls that lead to delays or misunderstandings.

Organize and Standardize Document Formats

One of the most important aspects of managing billing records is consistency. Using a clear, organized structure for all financial documents ensures that both the issuing and receiving parties can quickly understand the details. Standardizing essential elements–such as dates, amounts, payment terms, and contact information–helps prevent confusion and speeds up the review process. Additionally, adopting uniform naming conventions and categorization systems for each document type helps maintain order in your record-keeping system.

Implement a Timely Follow-Up System

To ensure that all payments are received on time, businesses should establish a proactive follow-up process. Set reminders for approaching deadlines, and keep track of overdue payments. Automated notifications or email reminders to clients about upcoming or past due payments can help maintain cash flow and reduce late fees. Consistent follow-up, paired with clear communication, can significantly enhance the efficiency of payment collection and improve overall financial health.

Maintaining Professionalism with Invoices

Professionalism in financial communications plays a vital role in how a business is perceived by clients and partners. Clear, accurate, and respectful handling of billing documents is essential for building trust and ensuring that business relationships remain strong. By maintaining a high level of professionalism, companies can avoid disputes, minimize misunderstandings, and ensure that payments are processed efficiently and on time.

Key Elements of Professional Billing Documents

To maintain a professional appearance, it is crucial to include specific information in every billing document. The following elements should always be present:

- Clear identification of the company or individual issuing the document.

- Accurate and detailed list of services or products provided, including quantities, descriptions, and rates.

- Precise payment terms, such as due dates, accepted payment methods, and any late fees or discounts for early payment.

- Contact details for inquiries or disputes, making it easy for clients to reach out if they have questions.

- A professional tone in the wording, avoiding any ambiguity or overly casual language.

Timeliness and Consistency

In addition to the format and content of billing documents, the timing and consistency of their issuance are equally important. Following these practices can enhance professionalism:

- Issue documents promptly after completing a transaction or service delivery.

- Ensure consistency in the format and layout of all financial records to present a cohesive brand image.

- Stick to agreed-upon payment terms to show reliability and respect for your client’s business practices.

- Keep record

Tips for Efficient Billing with Target

Effective management of billing processes can significantly improve cash flow and client satisfaction. By adopting streamlined practices and leveraging appropriate tools, businesses can ensure faster payments, reduce errors, and avoid unnecessary complications. Implementing these strategies helps optimize the entire financial workflow, from initial documentation to final payment collection.

Here are some practical tips for enhancing efficiency in the billing process:

- Automate recurring charges to reduce manual input and minimize the risk of missing payments.

- Ensure all documentation is clear, detailed, and error-free to prevent delays or confusion from clients.

- Set up automatic reminders for clients about upcoming due dates to encourage timely payments.

- Utilize digital tools for easy tracking of all issued documents, making it simpler to follow up when needed.

- Maintain a consistent format and structure across all documents to improve readability and professionalism.

By focusing on clarity, organization, and timely follow-ups, businesses can create a smoother and more efficient billing process that benefits both parties involved.