How to Use Tally Invoice Template for Easy and Professional Billing

Managing financial transactions is a crucial task for any business, whether small or large. Having a reliable and efficient system for generating documents that track payments, products, and services can save time and prevent errors. The right solution can automate many aspects of this process, ensuring accuracy and consistency across all records.

Customizable tools that allow you to create detailed, professional records are essential for keeping your operations running smoothly. These tools not only help generate documents quickly but also offer flexibility in adapting to different business needs. With such systems, you can ensure that each record reflects your specific requirements while maintaining a high level of professionalism.

Whether you are a freelancer, entrepreneur, or run a larger organization, having a streamlined approach to documentation will improve efficiency, reduce administrative overhead, and make financial management more accessible. By utilizing smart, user-friendly solutions, you can stay on top of your financial obligations and focus on growing your business.

Understanding Tally Invoice Template

Effective document creation plays a pivotal role in ensuring smooth financial transactions. By using an automated solution for generating business records, you can avoid manual errors and speed up the process of keeping track of payments, goods, and services provided. These solutions allow for quick customization and provide consistency across multiple documents, making them an essential tool for business management.

One of the key advantages of such systems is the ability to tailor documents to your business’s specific needs. With customizable fields and sections, you can easily adjust layouts to reflect company branding or specific regulatory requirements. These solutions are designed to ensure accuracy and maintain a professional appearance in every generated record.

Key Features

- Simple customization options for different business needs

- Ability to automatically calculate taxes and discounts

- Professional design for a consistent business image

- Easy tracking of payments and products

- Support for multiple currencies and languages

Why Use an Automated Solution?

- Reduces time spent on manual document creation

- Minimizes human error

- Improves overall business efficiency

- Ensures proper record-keeping for financial reporting

By integrating an automated solution into your daily operations, you can save time, reduce errors, and maintain a professional approach to managing financial documents. Whether for simple transactions or complex billing scenarios, these systems streamline the process, ensuring accuracy and consistency across all documents.

Benefits of Using Tally Invoice

Using automated solutions for creating business records offers numerous advantages that can significantly improve efficiency and accuracy. These tools simplify the process of generating financial documents, allowing businesses to save time while ensuring consistency in every record. Whether you are managing a small business or a large enterprise, implementing such systems can streamline operations and reduce administrative overhead.

One of the primary benefits is the time-saving aspect. With pre-designed layouts and automated calculations, the need for manual data entry is minimized. This allows employees to focus on more strategic tasks while ensuring that all records are generated quickly and accurately. Additionally, the flexibility to customize templates ensures that the documents meet the specific needs of your business and industry.

Key Advantages

- Increased efficiency through automated processes

- Consistency across all documents, reducing the risk of errors

- Customization options to tailor documents to specific business needs

- Tax and discount calculations automatically applied to each record

- Professional appearance for a more polished business image

How It Improves Accuracy

- Minimized manual errors with automated data input

- Reliable calculation of taxes and fees based on current rates

- Standardized format that ensures consistency in every record

Incorporating such a solution into your business processes allows for greater control over financial documentation and better management of business operations. This not only reduces the likelihood of mistakes but also promotes a more professional and organized workflow across teams.

How to Download Tally Invoice Template

Getting started with an automated solution for creating business records is simple and can be done in just a few steps. By downloading a customizable document creation tool, businesses can quickly generate professional and accurate financial documents. This process is designed to be user-friendly, ensuring that even those with minimal technical experience can easily integrate the system into their workflow.

To begin using the document creation system, you first need to download the required file from a trusted source. Once downloaded, you can customize it according to your business requirements. Here’s a step-by-step guide to help you through the process:

Steps to Download

- Visit a reputable website that offers customizable business record solutions.

- Locate the specific section or page for financial record templates or document creation tools.

- Select the appropriate version of the document generator that suits your business needs.

- Click the download link to save the file to your computer or device.

- Open the downloaded file and follow the instructions to customize it to your preferences.

Things to Consider

- Ensure that the source of the download is secure and trustworthy.

- Check for compatibility with your accounting or business software.

- Look for templates that allow customization to match your branding or legal requirements.

Once downloaded, you can start creating accurate and professional records with minimal effort. These solutions offer the flexibility to adapt to your business’s specific needs while ensuring efficiency in your financial documentation processes.

Customizing Your Tally Invoice Design

Personalizing the design of your business documents allows you to align them with your brand identity while also ensuring they meet specific operational or legal requirements. A well-designed financial document not only reflects professionalism but also makes it easier for clients to understand the details of transactions. Customization options typically include adjusting the layout, adding company logos, and modifying fields to suit your unique needs.

By modifying key elements such as color schemes, fonts, and sections, you can create documents that are both visually appealing and functional. This helps in maintaining a consistent brand image across all communications with clients and partners. Below are the steps you can follow to customize your document design:

Steps for Customization

- Open the document creation tool or software that you downloaded.

- Locate the settings or customization menu where you can edit the layout.

- Adjust the color scheme to match your business branding or preferences.

- Add your company logo and any other relevant brand elements to the design.

- Modify the fields (e.g., business name, address, tax details) to reflect your specific business information.

- Ensure the layout is clean and easy to read, making use of proper spacing and alignment.

- Save your custom design and preview it to ensure everything is formatted correctly.

Things to Keep in Mind

- Ensure your document is clear and easy to navigate, with all necessary information prominently displayed.

- Use professional fonts and avoid over-complicating the design with unnecessary elements.

- Check that the design works well both on-screen and when printed.

- Ensure compliance with any local regulations regarding the appearance or content of business records.

Customizing your document design gives you the flexibility to create professional-looking records that match your brand’s identity while also serving the practical needs of your business. By taking a few simple steps, you can enhance the look and feel of your financial documents, making them more effective in communicating important details to your clients and partners.

Key Features of Tally Invoice Template

When choosing a system for creating business records, it’s important to consider the features that will help streamline your processes and improve accuracy. The right solution can automate many of the time-consuming tasks involved in generating professional documents, from calculating taxes to tracking payments. Below are some key aspects that make these document creation tools highly effective for business management.

One of the most valuable features is the ability to automate complex calculations, such as tax rates, discounts, and total amounts. This ensures that every document is error-free and consistent. Another major benefit is the customization options, allowing you to adjust layouts, fields, and branding elements to suit your specific business needs. Additionally, these systems are designed to integrate with your accounting software, making data management seamless and more efficient.

- Automatic calculations: Calculates totals, taxes, and discounts with minimal input.

- Customizable layout: Allows you to adjust the structure and design to match your business style and legal requirements.

- Professional appearance: Generates clean, clear, and visually appealing documents that convey professionalism.

- Multi-currency support: Accommodates transactions in different currencies, making it ideal for global business.

- Easy integration: Seamlessly integrates with accounting software for better financial tracking and reporting.

- Custom fields: Allows you to add unique fields for tracking additional information, such as order numbers or delivery dates.

These features make business document creation faster, more accurate, and highly adaptable to different industries and business models. By leveraging such tools, you can maintain a high standard of professionalism and operational efficiency in your financial documentation processes.

Creating Invoices in Tally Software

Generating business records using specialized software is a highly efficient way to ensure accuracy and consistency in your documentation. This process eliminates the need for manual data entry and allows you to automate many aspects of record creation, such as tax calculations, payment tracking, and itemized lists. By using a dedicated software solution, you can streamline your workflow and reduce the risk of errors that often occur with manual processes.

The process of generating documents within the software typically involves selecting the right format, entering transaction details, and customizing fields to suit your specific needs. The software provides an easy-to-navigate interface that guides you through these steps, allowing you to create professional records in just a few clicks. Below are the key steps to follow when generating financial documents within the system:

Step-by-Step Guide

- Open the software and navigate to the “Create Document” section.

- Choose the appropriate document type (e.g., sales, purchase, or service record).

- Enter essential business details such as client information, products, services, and prices.

- Include tax rates and discounts as necessary. The software will automatically apply these values to the total.

- Review the document for accuracy and make any final adjustments, such as adding custom fields or notes.

- Save the document, and if necessary, generate a PDF or print a hard copy.

Customizing Your Document

- Field Adjustments: Modify fields to include specific information such as reference numbers or order dates.

- Branding Elements: Add your company logo, address, and contact information for a professional touch.

- Automated Calculations: Ensure that taxes, totals, and discounts are calculated automatically for greater accuracy.

By following these steps, you can create detailed and professional records quickly and easily, while also maintaining the flexibility to adjust them to meet your specific business needs. This process helps you save time, avoid manual errors, and improve your financial documentation efficiency.

Setting Up Tax Rates in Tally

Configuring tax rates correctly within your business document creation software is essential for ensuring that all transactions are processed accurately. By setting up tax rates in the system, you can automate calculations for different tax categories and ensure that the correct amounts are applied to every record. This helps to eliminate manual errors and saves valuable time, allowing you to focus on other aspects of your business.

Most software solutions provide a simple interface for configuring tax rates, allowing you to define various types of taxes–such as sales tax, value-added tax (VAT), or service tax–and apply them across different types of records. Setting this up correctly ensures that you are always in compliance with local regulations and that your financial documents are accurate and complete.

Steps to Set Up Tax Rates

- Navigate to the “Tax Settings” or “Tax Configuration” section in the software.

- Choose the tax type you need to set up (e.g., sales tax, VAT, GST).

- Enter the applicable tax percentage for each category. For example, if your sales tax rate is 10%, enter 10% in the appropriate field.

- Specify whether the tax should be applied to products, services, or both.

- If your business operates in multiple regions, configure the tax rates based on different geographic locations, if applicable.

- Save the settings to apply the tax rates across all future records.

Things to Keep in Mind

- Compliance: Ensure that the tax rates match the current regulations in your region to avoid legal issues.

- Multiple Tax Types: If applicable, set up multiple tax categories (e.g., federal tax, state tax) to be applied to different transactions.

- Automatic Calculations: Check that the software is correctly applying the tax rates to all relevant fields in your records.

Once the tax rates are configured, the system will automatically calculate and apply the correct amounts to each document, reducing the risk of mistakes and ensuring that you remain compliant with tax laws. This automation not only saves time but also adds a layer of accuracy and professionalism to your financial documents.

Saving and Printing Tally Invoices

Once your business documents are generated, the next step is to save and print them for record-keeping or sharing with clients. The ability to store these records digitally ensures easy access and prevents the loss of important information. Printing these documents allows you to provide physical copies for transactions or other administrative purposes. This process is straightforward, with several options for both saving and printing that enhance flexibility and convenience.

Most document creation software offers various formats for saving your records, such as PDF or Excel, to ensure compatibility across different devices and platforms. The software also allows you to print directly from the program, with options to customize the layout for physical copies. Below are the steps you should follow to save and print your records efficiently:

Saving Your Documents

- After creating the document, review it for accuracy.

- Click the “Save” or “Export” option to store the file on your computer or cloud storage.

- Select the desired format, such as PDF or Excel, for easy sharing or future reference.

- Choose the location on your device or cloud storage where you want to store the file.

- Click “Save” to complete the process.

Printing Your Documents

- Open the saved document or select “Print” from within the software.

- Choose your preferred printer from the available options.

- Customize print settings such as paper size, margins, and orientation.

- Click “Print” to generate a physical copy.

By following these simple steps, you can easily save and print your business documents. Whether you need digital copies for your records or physical ones for client meetings, this process allows you to efficiently manage all aspects of document creation, storage, and distribution.

Integrating Tally Invoice with Accounting

Seamlessly connecting your business documentation system with your accounting software can greatly enhance financial management. By integrating the tools used to generate records with your accounting platform, you can automate data transfer, reduce manual entries, and ensure consistency across financial statements. This integration allows for better tracking of payments, revenues, taxes, and other important financial metrics, making it easier to maintain accurate records and streamline your business operations.

Most modern accounting software solutions support integration with document creation systems, allowing data from generated records to flow directly into your accounts. This eliminates the need for duplicate data entry, reducing the risk of errors and saving time. The integration process is typically straightforward, involving setting up sync features and mapping relevant fields between the two systems. Below are the steps to integrate your document creation system with accounting software:

Steps to Integrate

- Open your accounting software and navigate to the integration or settings section.

- Find the option to link or sync with your document management tool.

- Follow the on-screen instructions to authenticate the connection between the two platforms.

- Map key fields (such as client name, product details, amounts, and tax rates) from the document system to the accounting software.

- Enable automatic syncing to ensure that all records are updated in real-time.

- Test the integration by generating a sample record and confirming that it appears in the accounting system.

Benefits of Integration

- Reduced manual data entry: Automatically transfers data from your documents to the accounting system, saving time and reducing errors.

- Improved financial tracking: Ensures that all transactions are accurately recorded and easily accessible for reporting.

- Real-time updates: Provides up-to-date information across both systems, enhancing decision-making capabilities.

- Better compliance: Helps maintain consistent tax calculations and ensures that financial data aligns with regulatory requirements.

Integrating your document generation system with accounting software offers numerous advantages, including enhanced accuracy, reduced administrative workload, and smoother overall operations. By taking advantage of this integration, you can ensure that your financial records are consistently up to date and properly accounted for.

Common Issues with Tally Invoices

While generating business documents through automated systems offers numerous benefits, users often encounter certain challenges that can affect accuracy or efficiency. These issues can range from technical problems, such as software glitches, to configuration errors that lead to incorrect data on the generated records. Understanding and addressing these common problems will help improve the document creation process and ensure smoother operations.

Below are some of the most frequently encountered issues when creating financial records with automated systems, along with tips on how to resolve them:

Common Problems

- Incorrect Tax Calculations: One of the most common issues is inaccurate tax application. This often occurs when tax rates are not correctly set up or updated in the system. To avoid this, regularly review and update tax configurations to ensure they are aligned with current regulations.

- Missing Data Fields: Sometimes, key details such as customer information, transaction dates, or item descriptions may be missing from the document. This can happen if certain fields are left blank or if customizations to the document layout are improperly configured. Double-check your settings and make sure all relevant fields are included.

- Layout Problems: Document formatting issues, such as misalignment of text, images, or columns, can affect the professionalism of your records. Ensure that the layout settings are properly adjusted and that any logos or headers are placed correctly. Preview the document before finalizing it to catch any formatting issues.

- Duplicate Records: In some cases, you may accidentally generate duplicate records for the same transaction. This usually happens due to incorrect data entry or system glitches. Make sure to cross-check the data before saving or printing the record, and use the software’s “duplicate check” feature if available.

- Software Compatibility Issues: If the software is not compatible with your operating system or other business tools, it can lead to performance issues, such as slow processing or failure to save documents. Ensure that your software is regularly updated and compatible with your other tools, and consider reaching out to support if issues persist.

How to Resolve These Issues

- Update System Settings: Regularly check and update your tax rates, company information, and other system configurations to avoid errors in calculations and document fields.

- Test Documents Before Finalizing: Always preview your generated records to ensure that the layout and content appear as expected before saving or printing.

- Use Error-Checking Features: Take advantage of built-in error detection tools that can identify missing or inconsistent data fields.

- Regular Backups: Backup your documents frequently to prevent data loss and to resolve issues with duplicate records or software crashes.

By being aware of these common challenges and taking proactive measures to address them, you can ensure a smoother and more efficient document creation process. Regularly reviewing settings, testing outputs, and leveraging support resources will help keep your business operations running smoothly and your financial records accurate.

How to Add Products and Services

Adding products and services to your business records is a fundamental task that allows you to track the details of each transaction. Whether you are selling physical goods or offering services, the ability to quickly add items to your documents ensures that the transaction details are accurate and complete. Most software platforms provide simple steps to add, edit, and organize products and services within your system.

Incorporating items into your records involves specifying the name, description, quantity, price, and any applicable taxes or discounts. By setting up your product and service catalog within the system, you can streamline the process, reduce the risk of manual errors, and enhance the overall efficiency of your business operations.

Steps to Add Products and Services

- Access the “Products” or “Items” section in the software.

- Select the option to “Add New Item” or “Create New Product.”

- Enter the name of the product or service, along with a detailed description, if necessary.

- Specify the unit of measurement (e.g., each, kg, hours) and the price per unit.

- Set the applicable tax rate or discount for the product or service, if required.

- Save the item, and ensure it is added to your inventory or product catalog within the system.

Organizing Your Catalog

- Categorization: Group similar products or services into categories to make it easier to search and add items.

- Pricing Adjustments: Set up tiered pricing for bulk orders or add seasonal discounts that apply automatically.

- Stock Management: If your software supports inventory management, track stock levels and set alerts for low inventory.

Once added, these products and services can be easily included in your records for each transaction, saving time and improving consistency. By keeping your catalog up to date, you ensure that every document generated reflects accurate, current information, which contributes to a more efficient business workflow and helps maintain client satisfaction.

Managing Discounts and Payments in Tally

Effectively managing discounts and payment details is essential for maintaining accurate financial records and ensuring smooth business operations. When processing transactions, you may need to apply discounts to products or services and track payments in various forms, such as cash, credit, or digital transfers. Having the ability to automatically calculate and apply these adjustments within your system ensures that each document reflects the correct amounts and is updated in real time.

By configuring the system to manage discounts and payments, you can eliminate the need for manual calculations and reduce the chances of errors. This feature not only helps with maintaining financial accuracy but also streamlines the process for both businesses and customers. Below, we cover how to manage discounts and payment details effectively in your system.

Managing Discounts

- Access the “Discounts” or “Pricing” section in your software.

- Select the product or service to which you wish to apply a discount.

- Choose the type of discount (percentage or fixed amount) and enter the discount value.

- If applicable, set conditions for the discount, such as minimum purchase requirements or expiration dates.

- Review the transaction to ensure the discount is applied correctly, and save the record.

Tracking Payments

- Payment Methods: Specify the payment method for each transaction, whether it is cash, credit card, bank transfer, or digital payment.

- Partial Payments: If the customer makes a partial payment, record the amount received and track the balance due.

- Payment Date: Ensure that payment dates are recorded accurately, especially for credit-based transactions.

- Payment Receipt: Generate receipts or confirmations for payments made, ensuring both parties have a record of the transaction.

By efficiently managing discounts and payments in your system, you ensure that your financial records remain consistent and up to date. This allows you to quickly assess outstanding balances, monitor cash flow, and generate accurate reports without manual intervention. Additionally, clear and transparent records help improve customer trust and satisfaction.

Best Practices for Invoice Management

Effective management of business documents is crucial for maintaining financial accuracy and streamlining operations. By following best practices for handling sales records, companies can ensure timely payments, avoid errors, and stay organized. Proper management involves not only creating and sending documents but also tracking payments, maintaining records, and adhering to legal or regulatory requirements. Implementing these practices will help businesses avoid common pitfalls and improve overall efficiency.

Below are some key best practices for managing business documents that can lead to smoother processes and better financial oversight:

- Maintain Accurate and Up-to-Date Information: Always ensure that customer details, product/service descriptions, and payment terms are accurate before generating records. Regularly update your system with any changes to client information or pricing structures.

- Implement Clear Payment Terms: Clearly state payment due dates, late fees, and accepted payment methods in all records. This helps to avoid confusion and ensures that clients know when and how to pay.

- Automate Document Generation: Use automated systems to create records, as this reduces the chance of human error and speeds up the process. Ensure your software can handle recurring billing for clients who subscribe to regular services.

- Send Documents Promptly: After generating a document, send it to the client as soon as possible. Delays can affect payment timelines and reduce cash flow. Make use of digital formats such as PDFs for quick and secure delivery.

- Track Payments and Outstanding Balances: Regularly monitor payments to ensure they align with your documents. Keep track of overdue amounts and follow up with clients on pending payments. Use software features to flag overdue records automatically.

- Organize and Archive Records: Store all business documents systematically for easy retrieval. Maintain digital backups and ensure that records are easily searchable by client name, date, or other key identifiers.

- Regularly Review Reports: Analyze financial reports to identify any discrepancies or trends in payments. Regularly reviewing reports allows you to address any issues early and helps in planning for future financial needs.

By following these best practices, businesses can improve their record-keeping efficiency, enhance cash flow management, and maintain better relationships with clients. Proper invoice management not only helps with day-to-day operations but also sets the foundation for long-term financial success.

How Tally Improves Billing Efficiency

Efficient billing is essential for maintaining smooth cash flow and minimizing administrative overhead in any business. By automating and streamlining the process of creating and managing financial records, businesses can save time, reduce errors, and improve accuracy in their accounting. A well-integrated system can enhance productivity by simplifying tasks such as calculating totals, applying taxes, managing discounts, and tracking payments. This results in faster document generation, quicker payments, and fewer discrepancies in financial records.

The use of a reliable software solution can significantly boost billing efficiency, ensuring that transactions are completed accurately and promptly. With automated features and centralized data management, businesses can maintain better control over their billing processes and financial reporting.

Streamlined Record Creation

One of the key ways an automated system enhances billing efficiency is through the simplification of record creation. Instead of manually entering transaction details for every sale or service, users can easily input essential data once, with the system automatically calculating totals, taxes, and applicable discounts. This reduces the time spent on each transaction and ensures that every document is accurate and consistent.

Faster Payment Tracking

Another benefit is the ability to track payments in real time. Automated systems can immediately update the status of each transaction as payments are made, allowing businesses to stay on top of outstanding balances. This enables businesses to send timely reminders and follow-ups for overdue payments, improving cash flow management and reducing the time spent on manual reconciliation.

By reducing manual work and automating key billing processes, companies can increase operational efficiency, reduce human error, and focus more on customer satisfaction. These advantages ultimately lead to a more streamlined and effective billing system that supports long-term business growth.

Exporting Tally Invoices to PDF

Exporting business documents to a PDF format is an essential feature for many companies, as it allows for easy sharing, printing, and archiving. PDF files are universally accessible, ensuring that recipients can view and print documents without compatibility issues. Whether you need to send records to clients, store them for future reference, or create hard copies, exporting documents in PDF format helps maintain consistency and professionalism in all transactions.

This process is quick and simple, requiring just a few steps to convert a document into a secure, uneditable format. The ability to export documents to PDF ensures that all business records are easily accessible and can be stored or shared with confidence.

Steps to Export Documents to PDF

- Open the document you wish to export within the software.

- Select the option to “Export” or “Save As” from the menu.

- Choose PDF as the desired file format from the list of options.

- Specify the destination folder where the file will be saved.

- Click “Save” or “Export” to complete the process.

Benefits of PDF Export

- Universal Accessibility: PDFs can be opened on nearly any device or operating system without requiring special software.

- Security: PDF files can be password protected, preventing unauthorized access or editing.

- Easy Sharing: PDFs can be easily emailed or uploaded, ensuring quick and efficient document sharing.

- Professional Appearance: Exported PDFs maintain consistent formatting and are often seen as more formal and official in business communications.

By regularly exporting documents to PDF, businesses can ensure that their financial records are professionally presented, easily shareable, and securely stored. This simple process enhances document management and supports a smooth workflow for both internal and external purposes.

Ensuring Accuracy with Tally Invoice Templates

Maintaining precision in business records is vital for both financial clarity and customer trust. Using predefined document formats and automated tools helps businesses minimize errors, streamline their processes, and ensure that all transaction details are consistently accurate. These systems automatically calculate totals, taxes, and discounts, making sure every aspect of a record is correct without the need for manual intervention.

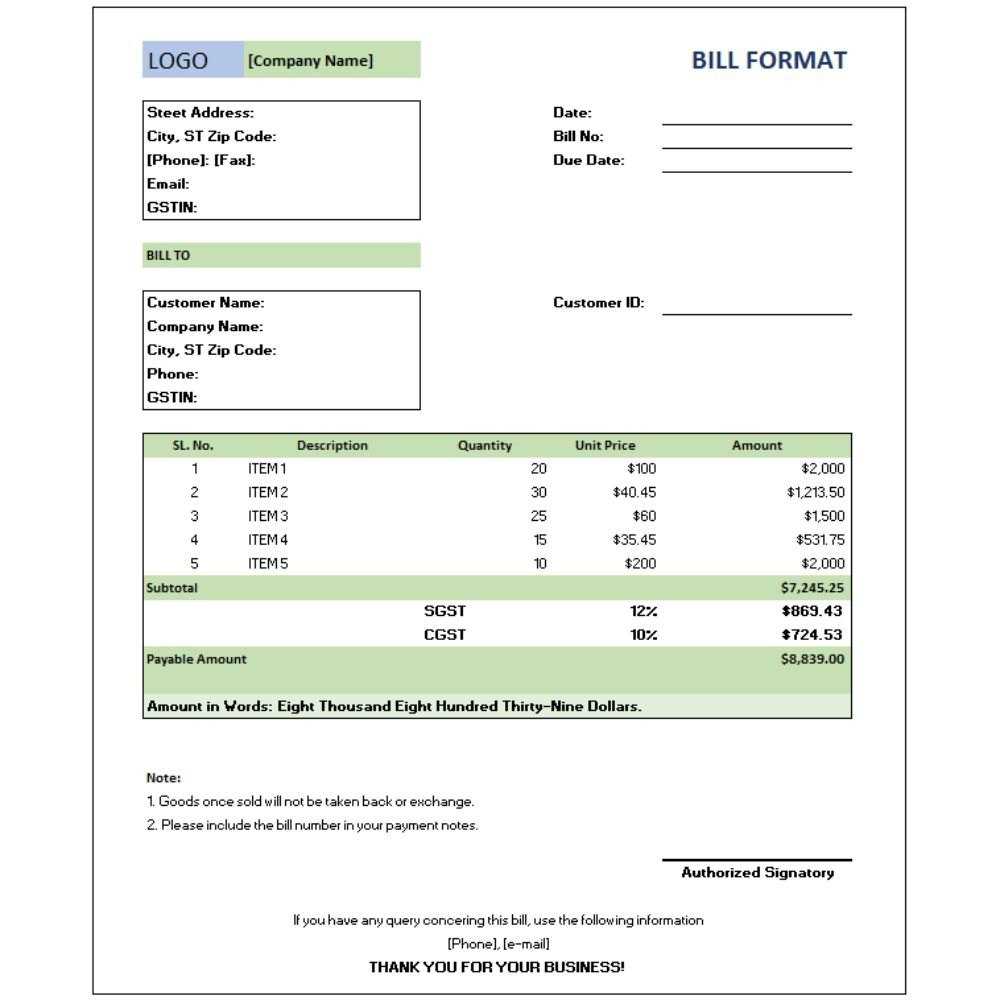

To ensure accuracy in your records, it’s essential to rely on structured formats that automatically incorporate the necessary calculations and prevent common mistakes. Below is an example of how using automated templates can help maintain accuracy in transaction documents:

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 3 | $50.00 | $150.00 |

| Service B | 2 | $30.00 | $60.00 |

| Total | $210.00 |

In this example, the automated system ensures that totals are accurately calculated and presented, while eliminating the risk of human error in manual entries. Additionally, once the details are confirmed, the data is instantly updated across the system, maintaining consistency in all related records.

Using such structured, automated systems allows businesses to focus on growth and customer relationships, rather than worrying about the accuracy of basic transaction details. As a result, businesses can rely on their documentation tools to create professional, accurate records every time.