How to Tailor an Invoice Template for Your Business

Creating professional and effective financial documents is essential for any business. Whether you’re a freelancer or run a large company, having a well-organized and personalized billing system can make a significant difference in your workflow and client interactions. Customizing your billing structure not only ensures clarity but also reflects your brand identity.

By adjusting the format and design of your billing sheets, you can create a tool that meets both your operational needs and legal requirements. A clear, accurate, and well-organized document helps avoid misunderstandings, improves cash flow, and enhances the professionalism of your communications with clients and partners.

In this guide, we’ll explore how to adjust these important documents, focusing on elements like layout, information structure, and the integration of branding. Whether you’re starting from scratch or looking to refine your current approach, the goal is to ensure that every bill you send is efficient, clear, and aligned with your business standards.

Customizing Billing Documents for Your Business

Every business has unique needs when it comes to how it manages financial transactions. Creating a document that reflects your specific requirements, whether you’re a freelancer or a large corporation, is essential for smooth operations. A well-structured, personalized billing sheet not only keeps your business organized but also helps you maintain a professional image with your clients.

Key Considerations When Customizing

To create an efficient and functional financial document, several factors should be considered. These include clarity, completeness, and adaptability to your business model. Here are some of the most important elements to keep in mind:

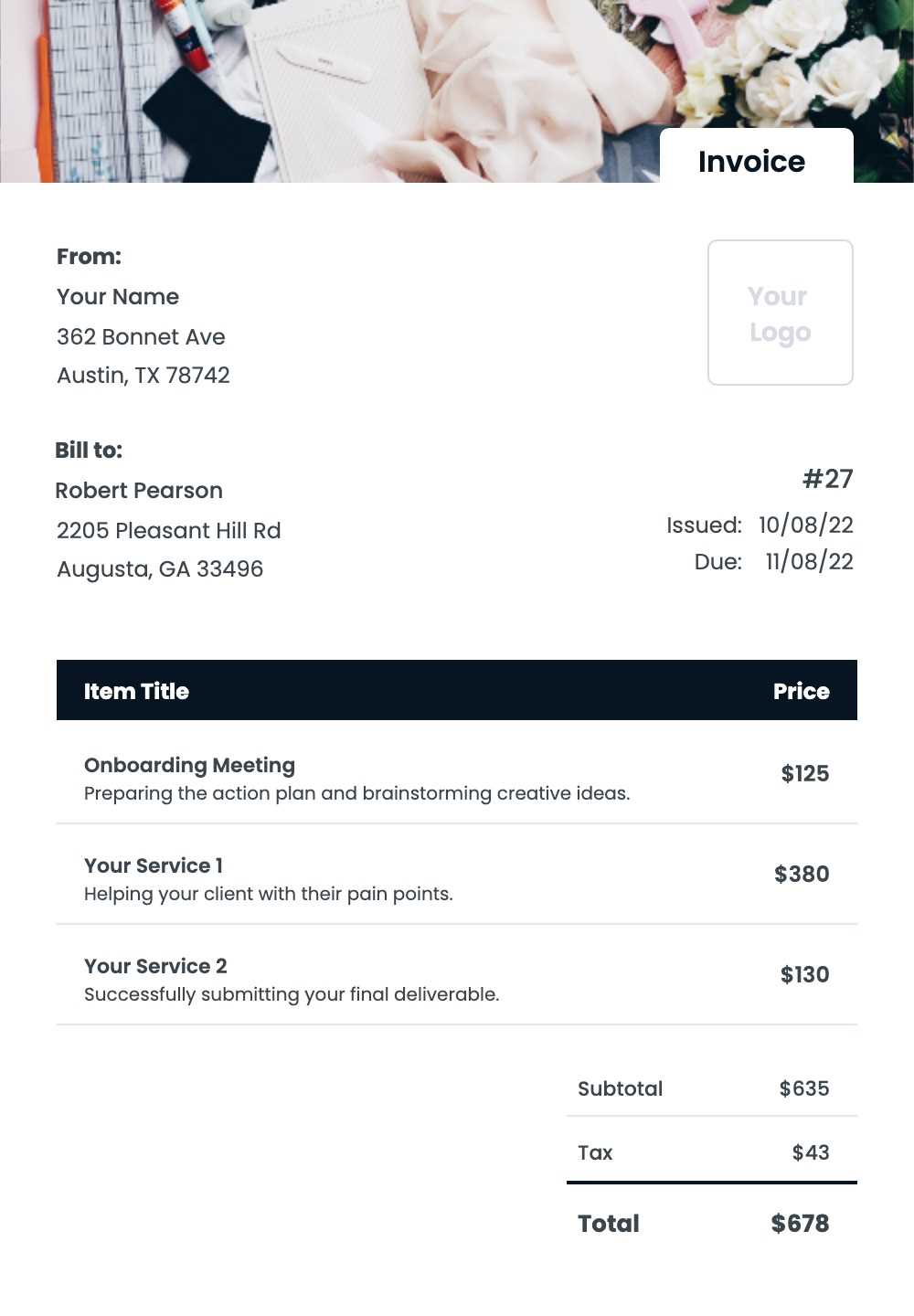

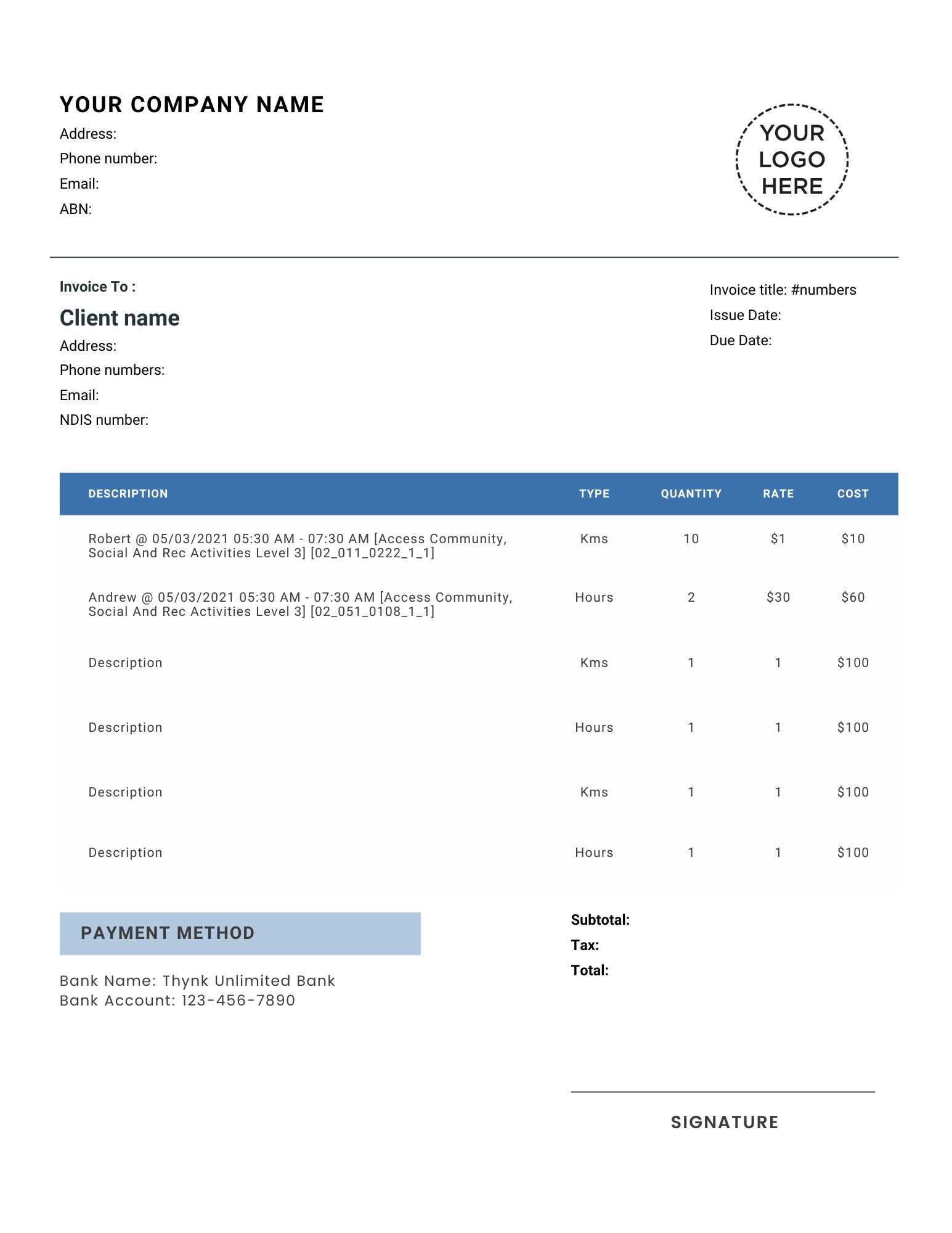

- Branding: Incorporate your logo, business name, and contact details to make the document uniquely yours.

- Layout: A clean and simple layout improves readability, ensuring all important information is easy to find.

- Payment Terms: Clearly outline payment deadlines and methods to avoid confusion.

- Legal Requirements: Make sure your document complies with any relevant tax or industry regulations.

- Adaptability: The structure should be flexible enough to accommodate varying project sizes or client needs.

Steps to Create the Perfect Document

Now that you understand the basics, follow these steps to build a document that works for your business:

- Choose the Right Software: Depending on your needs, choose software that allows for easy customization and integration with your accounting system.

- Define Required Information: Make a list of the mandatory fields your document must include, such as services provided, pricing, and client details.

- Design the Layout: Focus on a clean, straightforward layout with clear section headings to guide the reader through the document.

- Incorporate Your Brand: Customize colors, fonts, and logos to align the document with your business’s visual identity.

- Test and Refine: After creating your document, test it by sending it to a few clients to ensure everything is easy to understand and functions properly.

Why Customizing Billing Documents Matters

Creating personalized financial documents is not just about adding your company logo. It’s a strategic decision that can positively impact your workflow, client relationships, and overall business efficiency. A well-crafted document that suits your unique needs can help ensure clarity, avoid errors, and improve communication with clients.

Benefits of Customization

When you adapt your financial documents to your business’s specific requirements, you gain several advantages:

- Enhanced Professionalism: A polished, customized document shows clients that you take your business seriously and pay attention to detail.

- Improved Accuracy: Personalizing the structure ensures you include all the necessary details, reducing the risk of errors or omissions.

- Better Brand Recognition: Incorporating your business’s unique branding elements makes your documents stand out, fostering a more consistent and recognizable image.

- Increased Efficiency: Customizing the layout can help streamline your internal processes, saving time and reducing mistakes.

- Improved Client Trust: A clear, easy-to-understand document builds trust with clients, helping to avoid misunderstandings and ensuring smoother transactions.

How Customization Affects Client Relationships

Well-crafted documents are more than just administrative tools–they are a reflection of your business to your clients. When your documents are clear, professional, and tailored to the specific needs of your projects, clients are more likely to appreciate your attention to detail and feel confident in working with you. Here’s how it can impact your relationships:

- Clear Expectations: Clearly outlined payment terms and services reduce the likelihood of disputes.

- Better Communication: Custom documents make it easier to present information in a concise and understandable manner.

- Enhanced Customer Experience: When clients see that you’ve taken the time to personalize their experience, it leaves a lasting impression.

Key Elements of an Effective Billing Document

Creating an effective financial document is essential for smooth transactions and professional interactions. The right elements ensure clarity, prevent confusion, and guarantee that all necessary information is communicated. A well-structured document not only provides a record of the services rendered but also sets clear expectations for payment and helps maintain good client relations.

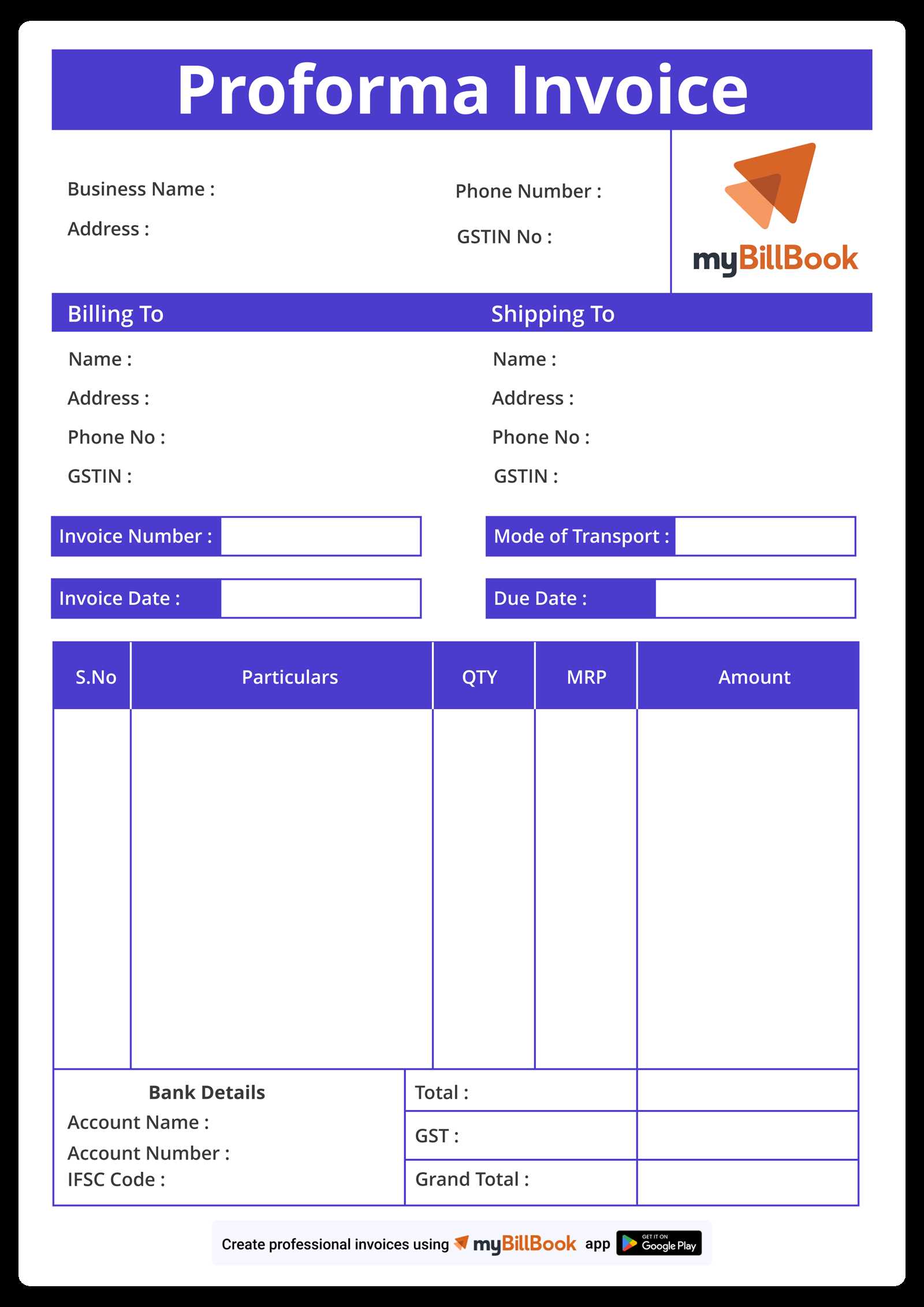

Essential Information to Include

For a billing document to be both functional and professional, it must contain specific details. Here are the key components that should always be included:

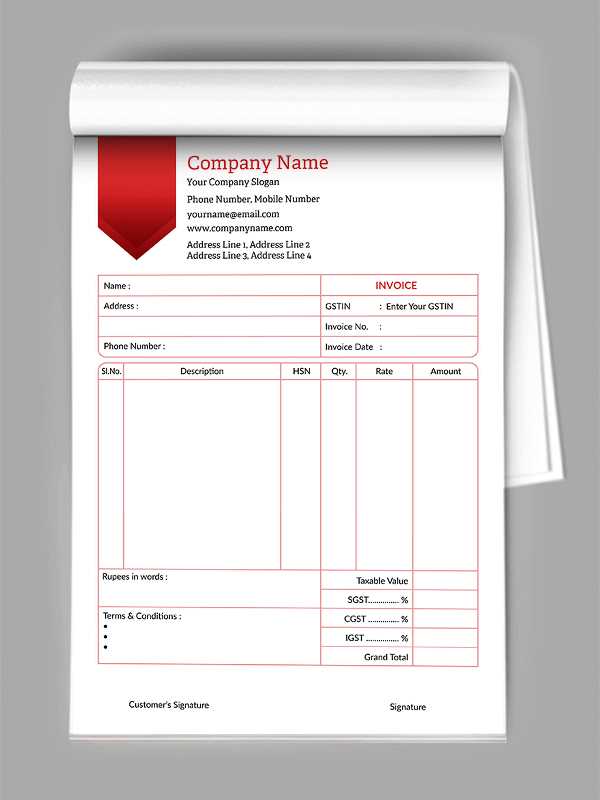

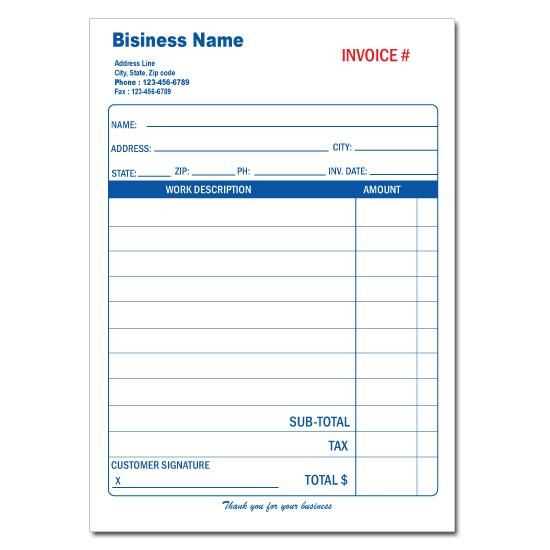

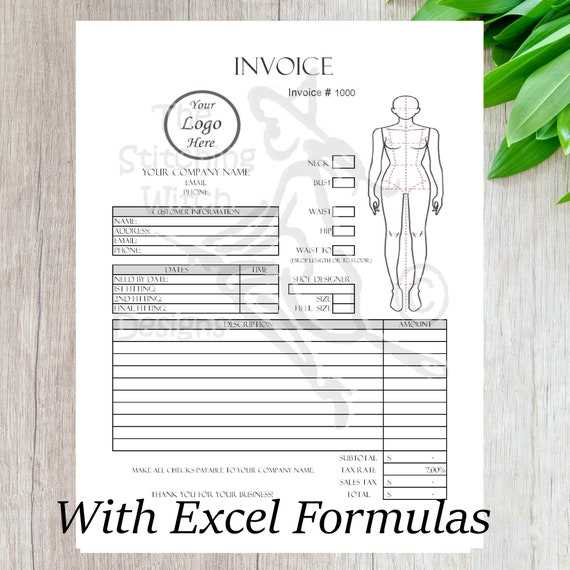

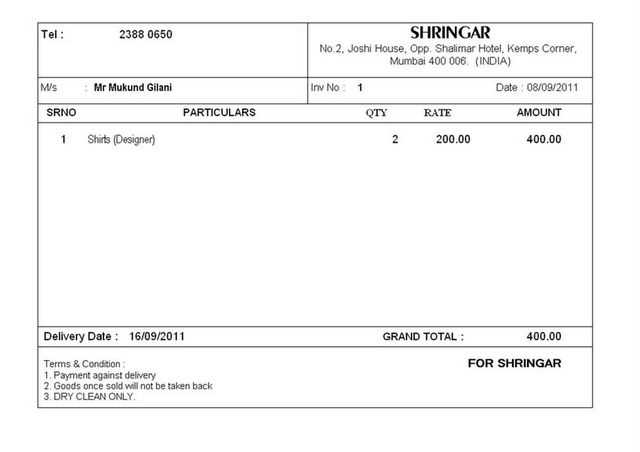

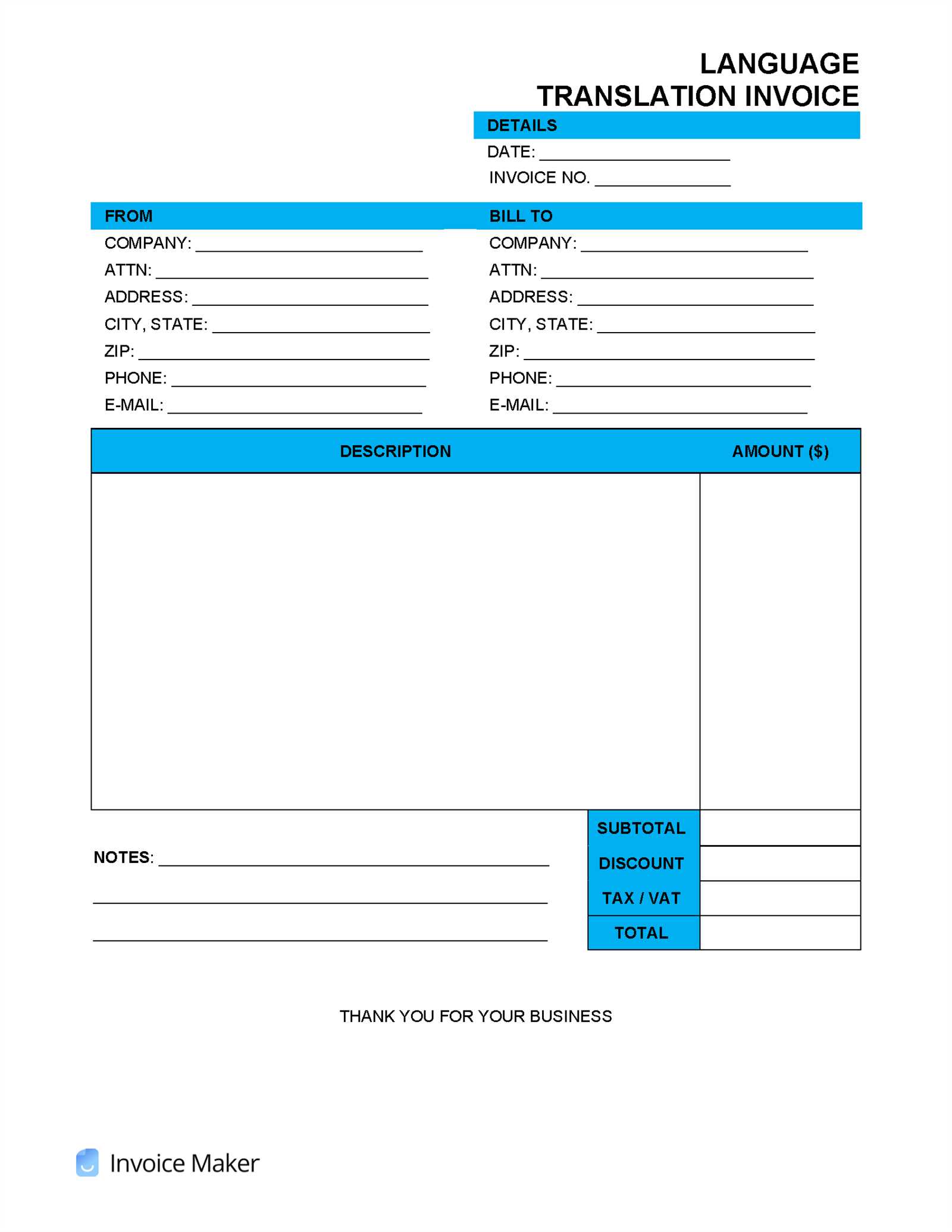

- Business Details: Include your business name, logo, address, phone number, and email to ensure easy identification.

- Client Information: Clearly state the client’s name, contact information, and billing address to avoid any confusion.

- Unique Reference Number: Assign a unique number to each document for easy tracking and referencing.

- Detailed List of Services: Itemize the products or services provided, including descriptions, quantities, and rates, to avoid misunderstandings.

- Total Amount Due: Clearly state the total amount owed, breaking down taxes, discounts, and any other charges to ensure transparency.

- Payment Terms: Specify the payment due date, late fees, and accepted payment methods to set clear expectations for the client.

- Legal and Tax Information: Depending on the region, it’s important to include applicable tax rates and any legal disclaimers to stay compliant with local regulations.

Formatting for Clarity and Professionalism

In addition to including the necessary information, the layout of the document plays a crucial role in how easily the recipient can understand it. A clean, logical structure allows clients to quickly find the details they need. Key formatting considerations include:

- Organized Sections: Group related information together, such as service details, amounts, and contact information, to enhance readability.

- Consistent Fonts and Spacing: Use legible fonts and proper spacing to avoid clutter and ensure the document is visually appealing.

- Clear Headings: Use bold headings and sections to direct the reader’s attention to important details, making it easy to find specific information quickly.

Choosing the Right Billing Document Format

Selecting the proper structure for your financial documents is a critical step in ensuring smooth transactions and effective communication with your clients. The right format helps organize information clearly, maintains professionalism, and reduces the likelihood of mistakes. Whether you’re handling a simple service or a complex project, the structure of your document should reflect the complexity of the work while remaining easy to understand.

Factors to Consider When Choosing a Format

When deciding on a layout for your financial document, it’s important to consider several factors that will affect both the appearance and functionality of the final product:

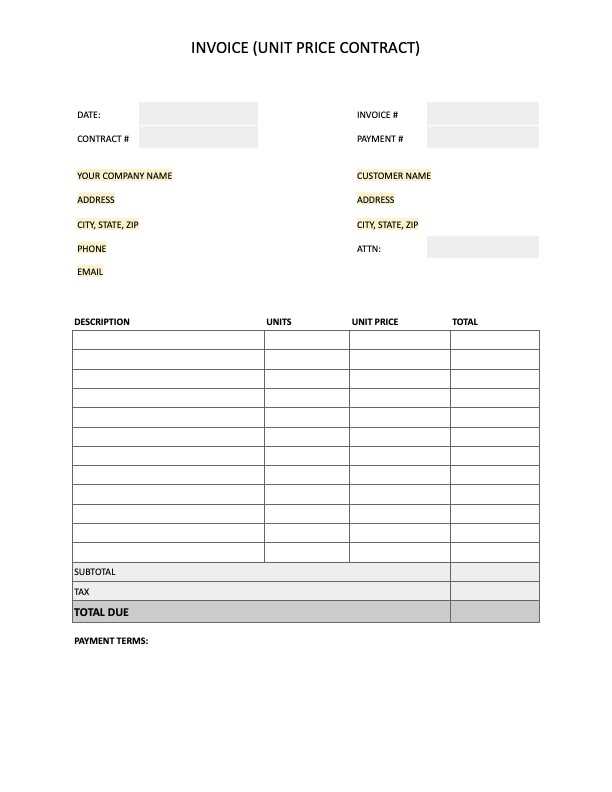

- Business Type: Different industries may require different structures. For example, service-based businesses may need to itemize hours worked, while product-based businesses may focus more on quantities and unit prices.

- Complexity of the Project: More detailed projects may need a format that accommodates itemized lists, additional notes, or multiple stages of billing.

- Client Preferences: Some clients may have specific formatting preferences or requirements. Adapting to these can improve client satisfaction and help ensure that the document is accepted without delay.

- Legal and Regulatory Requirements: Certain regions or industries may require specific document structures to comply with tax laws or business regulations.

Types of Document Formats to Consider

Here are some common formats to consider when creating your billing documents:

- Basic Format: A simple, no-frills structure is ideal for smaller projects or businesses with straightforward billing needs. This format typically includes a list of services or products, pricing, and payment terms.

- Itemized Format: For more complex transactions, an itemized format breaks down each service or product, providing details like hours worked, rates, and quantities. This is useful for larger projects or clients who require transparency.

- Recurring Billing Format: For businesses that offer subscriptions or ongoing services, a recurring billing format includes recurring payment schedules and subscription terms, making it easy to track payments over time.

- Customizable Format: Some businesses may need a highly flexible format that allows them to add or remove sections depending on the specific project. This format is ideal for businesses that offer a wide range of services or work with diverse client needs.

Ultimately, the format you choose should reflect your business’s needs and client expectations while being easy to read and use. The goal is to create a document that simplifies the payment process and avoids confusion for both parties.

How to Add Your Business Branding

Integrating your business’s unique identity into financial documents not only enhances their professional appearance but also reinforces your brand recognition with clients. Including branding elements, such as logos, colors, and fonts, creates consistency across all your communications and helps differentiate your business from competitors. A well-branded document conveys trust and attention to detail, which is crucial for maintaining strong client relationships.

Essential Branding Elements to Include

To effectively add your business branding, consider incorporating the following elements into your financial documents:

- Logo: Place your company logo prominently at the top of the document to ensure that your brand is immediately recognizable.

- Business Colors: Use your brand’s color palette for headings, borders, or backgrounds to maintain visual consistency.

- Typography: Choose fonts that reflect your brand’s style, ensuring they are easy to read while aligning with your overall aesthetic.

- Tagline or Slogan: If your business has a memorable slogan or tagline, consider including it at the bottom or in a footer to reinforce your messaging.

- Contact Information: Make sure your phone number, email, website, and social media profiles are clearly displayed to encourage communication.

Where to Place Branding Elements

Strategically placing branding elements throughout the document ensures they stand out without overwhelming the content. Below is an example of where to position key elements:

| Element | Placement |

|---|---|

| Logo | Top left or center for immediate visibility |

| Business Name | Near the logo, typically at the top or header |

| Colors | Used for headings, borders, and background accents |

| Typography | Used consistently for headings, body text, and details |

| Contact Information | Footer or a designated section at the bottom of the page |

Incorporating these elements in a balanced and cohesive way will ensure that your financial documents reflect your brand identity while remaining clear and professional for your clients.

Understanding Payment Terms on Billing Documents

Clear and precise payment terms are crucial for maintaining healthy business relationships and ensuring timely payments. Defining how and when a client is expected to settle an outstanding amount helps avoid confusion and delays. Properly outlined payment conditions contribute to smooth financial operations and reduce the risk of disputes or misunderstandings between you and your clients.

Common Payment Terms to Include

Different businesses have varying needs when it comes to payment agreements. However, there are some standard terms that are commonly used in financial documents. Below are the most important ones to include for clarity:

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due 30 days from the date of the document. |

| Net 60 | Payment is due 60 days from the document date, often used for larger projects or long-term agreements. |

| Due on Receipt | Payment is expected immediately upon receiving the document. |

| Late Fees | Additional charges applied if payment is not made within the specified time frame. |

| Early Payment Discount | A discount offered to clients who pay before the due date, often as an incentive to settle balances quickly. |

| Installments | Payments are broken into smaller, scheduled payments, typically used for larger projects. |

Why Payment Terms Matter

Establishing clear payment conditions benefits both you and your clients. When payment terms are outlined properly, clients know exactly what to expect and can plan accordingly. For businesses, having set terms ensures cash flow remains steady and reduces the time spent chasing overdue payments. Payment terms also help maintain professionalism and transparency, fostering trust with clients.

In addition, clearly stated conditions help avoid any legal or financial complications by outlining late fees or interest charges if payments are delayed. Always make sure that payment terms are easy to understand and agreed upon by both parties to avoid unnecessary issues.

Incorporating Tax Information Properly

Accurate and transparent tax information is an essential component of any financial document, ensuring compliance with local regulations and preventing potential legal issues. Properly displaying tax-related details not only helps your business stay compliant but also provides clients with clear insight into their financial obligations. This section will guide you on how to correctly include tax information in your billing sheets to avoid confusion and errors.

Types of Tax Information to Include

Depending on the location of your business and your clients, there are various types of taxes that may need to be reflected in your documents. Here are the most common tax details to include:

- Sales Tax: The amount of tax charged on products or services based on the applicable sales tax rate in your jurisdiction. Always specify the percentage and total amount separately.

- VAT (Value Added Tax): Common in many countries, this tax is added to the price of goods and services at each stage of production. Include both the rate and the total amount to ensure transparency.

- Service Tax: For businesses providing services, this tax may be applicable. It’s essential to clearly list it and differentiate it from the price of the service.

- Custom Duties: For international transactions, duties or import taxes may apply, which need to be specified in the billing document.

How to Format Tax Information

Proper formatting ensures that tax information is easy to understand for both you and your clients. Here are some tips on how to display tax details clearly:

- Separate Tax Amount: Clearly list the tax amount as a separate line item, either under the price list or as a distinct section labeled “Tax” or “VAT” to avoid confusion.

- Percentage and Total: Always mention the applicable tax rate (e.g., 10% VAT) and the total tax amount, so the client knows exactly what they are paying.

- Include Tax Identification Number (TIN): If required by local laws, include your business’s Tax Identification Number (TIN) for verification purposes.

By incorporating tax information properly, you ensure that all tax obligations are clearly communicated, minimizing the risk of disputes and ensuring smooth financial operations for both you and your clients.

Including Detailed Item Descriptions

Providing clear and detailed descriptions of the products or services provided is crucial for transparency and accuracy. When you include well-defined explanations for each item, it helps your clients understand exactly what they are being charged for and reduces the chance of confusion or disputes. A well-detailed list also demonstrates professionalism and ensures that all parties are on the same page regarding the scope of work or purchased items.

Why Item Descriptions Matter

Detailed descriptions are important for several reasons:

- Clarity: Clearly defined descriptions leave no room for ambiguity, ensuring the client understands the specific services or goods they are being billed for.

- Transparency: Breaking down each item or service with detailed information helps build trust with your clients, as they can see exactly what they are paying for.

- Dispute Prevention: Providing specifics reduces the likelihood of disagreements about pricing or services rendered, as everything is documented in detail.

- Tracking and Auditing: Detailed descriptions help both your business and your clients track expenses and easily refer to past transactions in case of audits or reviews.

What to Include in Item Descriptions

Each item listed in your financial document should include enough detail to make it clear. Here’s a breakdown of what to include in the descriptions:

- Service/Product Name: Use clear and concise names that accurately reflect what was provided. Avoid jargon or overly complex terms.

- Quantity: For physical products, specify the quantity of items. For services, indicate the hours or sessions worked.

- Unit Price: Clearly state the price per unit or rate for the service, so the client can see how the final total is calculated.

- Total Price: For each item or service, include the total cost, which is the unit price multiplied by the quantity or hours worked.

- Additional Information: If relevant, include any specifications, model numbers, or descriptions that further clarify what was provided (e.g., “Graphic design service for logo creation, 5 revisions included”).

By including detailed item descriptions, you not only improve clarity but also reinforce your business’s credibility and commitment to transparency. A well-documented list provides your clients with all the necessary information to understand the charges and make timely payments.

Setting Up Billing Numbering Systems

Establishing a clear and organized numbering system for your financial documents is essential for maintaining order and simplifying record-keeping. A well-structured numbering system helps you track payments, reference past transactions easily, and ensures that every document is uniquely identifiable. This is especially important for managing large volumes of transactions and for compliance with accounting and legal regulations.

Why a Numbering System is Important

Using a consistent numbering system provides several key benefits:

- Easy Organization: A systematic approach allows you to keep track of all your transactions in a logical and sequential manner, making it easier to locate specific records when needed.

- Improved Record Keeping: Unique identifiers prevent duplication and help ensure that each document is accounted for.

- Audit Compliance: For tax and audit purposes, a well-maintained numbering system helps establish a clear trail of transactions and simplifies financial reviews.

- Professionalism: A consistent numbering system signals to your clients that your business is organized and detail-oriented, enhancing your professional reputation.

How to Create a Numbering System

When setting up a numbering system for your financial documents, there are a few important considerations to ensure the system works effectively:

- Sequential Numbers: Use consecutive numbers for each document to maintain a simple and easy-to-track system (e.g., 001, 002, 003, etc.). This is the most common method for small businesses.

- Prefix or Suffix for Identification: Consider adding prefixes or suffixes that indicate the document type or business division (e.g., INV-001 for invoices or SO-001 for sales orders). This is especially helpful if you handle various types of transactions.

- Date-Based Numbering: Incorporating dates into your numbering system can help organize documents by time period (e.g., 2024-001, 2024-002). This method is useful for tracking documents within specific months or years.

- Client or Project Codes: If you work with multiple clients or have different projects, including client-specific or project-specific identifiers can be helpful (e.g., C001-001 for the first client’s first document).

- Automatic Numbering: Many accounting or invoicing software programs allow for automatic document numbering, ensuring there are no duplicates and minimizing human error.

By implementing a structured and consistent numbering system, you ensure that your financial records are organized, easy to reference, and prepared for any future audits or financial reviews. This simple step can significantly streamline your administrative process and improve your over

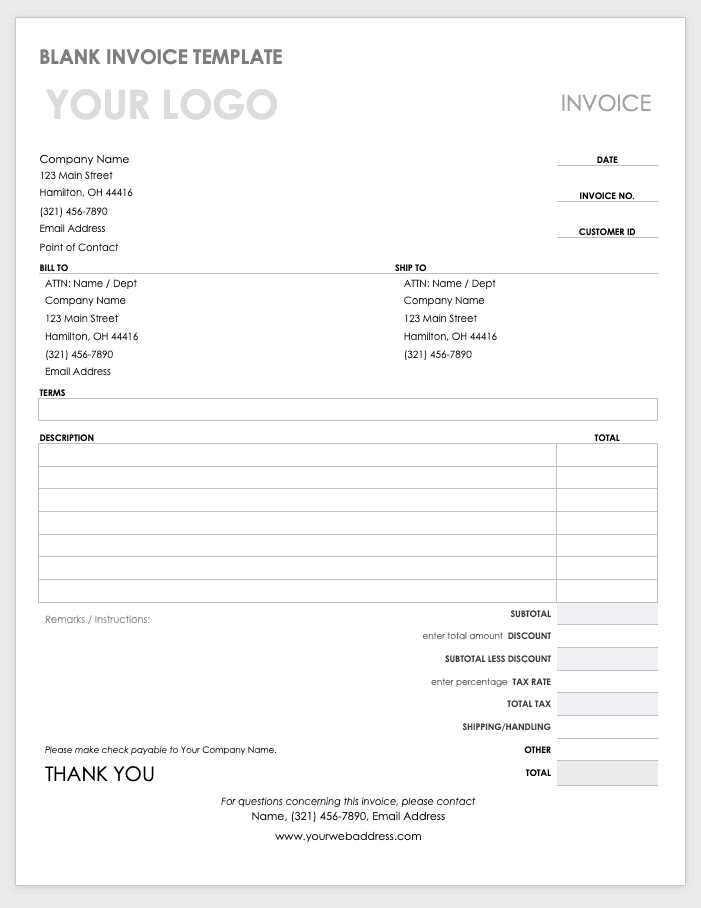

Adjusting Layout for Clarity and Readability

Creating a well-structured layout for your financial documents is essential to ensuring that all relevant information is easy to read and understand. A clear and organized design not only makes your documents look more professional but also minimizes the chances of errors or misunderstandings. When clients can quickly locate important details like the total amount due, payment terms, and descriptions of services or products, it leads to faster processing and payment.

Key Design Principles for Readable Documents

To enhance clarity and readability, there are several key design principles to follow:

- Whitespace: Proper use of whitespace around sections and between different blocks of information helps reduce visual clutter and makes the document easier to scan. Ensure that the page is not overcrowded with text or data.

- Clear Section Headers: Use bold or larger fonts to distinguish between different sections, such as “Billing Information,” “Item Details,” and “Payment Terms.” This will allow clients to quickly locate the information they need.

- Logical Flow: Arrange the information in a logical order that makes sense for your business process. Start with basic information (like client name and address), followed by the services/products, and then payment instructions.

- Consistent Alignment: Align text in a consistent manner, especially numbers and dates. For instance, align all monetary values to the right and item descriptions to the left to create a clean, uniform look.

- Readable Fonts: Choose fonts that are easy to read, such as sans-serif fonts for headings and a clean serif font for the body text. Avoid overly decorative fonts that can be hard to decipher.

Using Tables for Organized Data

Tables are an effective way to organize data in a structured and clear format. When listing items, services, or costs, using tables can break down the information into digestible chunks. Below is an example of how you can use a table to list the services provided:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation for project design | 3 hours | $100/hour | $300 |

| Website setup and maintenance | 1 project | $500 | $500 |

By clearly separating the details of each service or product into columns and rows, you make it easier for your clients to see what they are being billed for, reducing th

Design Tips for Professional Invoices

Creating a polished and professional design for your financial documents is crucial for presenting your business in the best possible light. A well-designed document reflects the quality of your services or products and can help you build trust with clients. Good design not only enhances the visual appeal but also improves readability, making it easier for clients to understand the details and pay promptly. Here are some essential design tips to ensure your documents look professional and function efficiently.

1. Keep It Simple and Clean

A cluttered design can make a document appear unprofessional and difficult to read. Aim for a clean, minimalist layout that focuses on key information. Use ample whitespace to separate sections and avoid overcrowding the page with too much text or unnecessary elements. A straightforward, easy-to-navigate design will not only look better but also make it easier for clients to find the relevant details.

- Limit the use of colors: Stick to your brand’s color palette to maintain consistency. Too many colors can distract from the core content.

- Use clear fonts: Choose legible, simple fonts such as sans-serif for headings and a clean serif font for the body text. Avoid using more than two fonts to maintain consistency.

2. Focus on Readability

The key to a professional-looking document is ensuring that it is easy to read. This involves more than just choosing the right fonts–it’s about organizing the content logically, using appropriate spacing, and highlighting the most important information.

- Highlight important details: Use bold or larger font sizes for critical information like the total amount due, due dates, and payment instructions.

- Use tables for clarity: When listing services, products, or charges, use tables to neatly organize data and ensure everything is easy to scan.

- Consistent alignment: Align text consistently–right-align numbers, left-align descriptions, and center headings for a more structured look.

3. Brand Consistency

Incorporating your business branding into your design not only makes your documents unique but also reinforces your brand’s identity. Use your logo, color scheme, and fonts to create a cohesive look that reflects your company’s style.

- Include your logo: Place your logo at the top of the document, where it’s visible and clearly associated with your business.

- Follow your brand guidelines: If your business has specific guidelines for colors, fonts, or logo placement, ensure they are adhered to in your document design.

By applying these design principles, you will create documents that not only look professional but are also user-friendly. This will enhance client relationships, improve communication, and ensure that your business is portrayed in

Creating a Mobile-Friendly Billing Document

With more people accessing business documents on their smartphones, ensuring that your financial records are mobile-friendly has become essential. A mobile-optimized document ensures that your clients can easily read, navigate, and respond to your billing details no matter where they are. By designing a layout that adjusts seamlessly to smaller screens, you can enhance the user experience, leading to quicker reviews and faster payments.

Why Mobile Optimization Matters

There are several reasons why optimizing your financial documents for mobile devices is important:

- Convenience: Clients can view and act on your documents anytime, anywhere, which makes it more likely they will pay promptly.

- Improved User Experience: A mobile-friendly design ensures that the information is clear, readable, and accessible, enhancing client satisfaction.

- Increased Accessibility: As more businesses and individuals rely on mobile devices, offering a document that’s easy to read on smaller screens helps you cater to a wider audience.

- Professional Appearance: A document that adapts well to both desktop and mobile screens demonstrates that your business is forward-thinking and aware of current technology trends.

Key Design Considerations for Mobile-Friendly Documents

Here are several design elements to focus on when creating a document that works well on mobile devices:

- Responsive Layout: Use a responsive design that adapts to different screen sizes. Avoid fixed-width layouts and ensure your document content adjusts fluidly to smaller screens.

- Simple Structure: Keep the layout simple and straightforward, with clear sections and minimal text. Long paragraphs or complex formatting can become difficult to read on small screens.

- Readable Fonts: Use larger font sizes (16px or higher) for easy reading on mobile devices. Choose sans-serif fonts that remain legible even at smaller sizes.

- Optimized Images: If you include logos or other images, make sure they are appropriately sized and compressed to avoid slowing down the document’s load time on mobile devices.

- Vertical Scrolling: Ensure the document is designed for vertical scrolling, as most mobile users interact with content by scrolling rather than zooming or panning.

By focusing on these key aspects, you can create a billing document that delivers a seamless and professional experience for clients viewing it on mobile devices. With this mobile-friendly approach, you increase the likelihood of faster payments and improve client satisfaction, demonstrating your attention to detail and commitment to convenience.

Legal Considerations for Document Customization

When customizing financial records for your business, it’s essential to ensure that they comply with relevant laws and regulations. While adjusting the design and layout of your documents can enhance professionalism and brand identity, failing to include legally required elements can result in compliance issues or disputes with clients. Understanding the legal requirements that govern business transactions is crucial to maintaining proper documentation and avoiding legal complications.

Key Legal Elements to Include

There are several important legal aspects to consider when customizing your documents to ensure they are both functional and compliant with regulations:

- Business Information: Most jurisdictions require that your business name, address, and tax identification number (TIN) be clearly stated. This ensures that the document is legally recognized and traceable to your business entity.

- Client Information: Include the name and contact details of your client, as well as any relevant client identifiers (such as account numbers) to ensure the document is properly attributed to the recipient.

- Itemized List of Goods/Services: Clearly describe the products or services provided, along with their quantities and prices. This helps prevent disputes over charges and provides clarity in case of an audit or legal review.

- Payment Terms: Clearly state the payment terms, including the due date and any late fees or penalties for overdue payments. This helps set expectations and prevents misunderstandings about when payment is due.

- Tax Information: Depending on your location, you may be required to include sales tax, VAT, or other applicable taxes on the document. Ensure that the appropriate tax rate is clearly stated, along with any other mandatory tax-related information.

Complying with Local Regulations

Different regions have varying legal requirements for business transactions, so it’s important to ensure that your documents meet the specific needs of the area in which your business operates. Below are some important compliance factors to keep in mind:

- Country/State-Specific Rules: Some countries or states have specific rules about what must be included in financial records, such as mandatory language or disclaimers, depending on the type of business.

- Currency and Language: If you do business internationally, it may be necessary to include the currency symbol and provide translations of the document for clients who speak different languages.

- Digital Signature Requirements: In some cases, legal documents may need to be signed electronically or include specific information for digital validity.

By understanding and following these legal requirements, you can ensure that your customized documents are not only professional but also legally compliant. This reduces the risk of disputes, enhances business transparency, and protects both you and your clients.

How to Handle International Billing

When dealing with clients across borders, it’s crucial to ensure that your financial documents are properly formatted to meet international standards and legal requirements. Each country may have its own set of rules regarding taxes, currencies, and payment methods, so it’s important to adapt your documents accordingly. Understanding how to handle these nuances can prevent delays, misunderstandings, and legal complications in cross-border transactions.

1. Currency and Payment Methods

One of the most significant differences when dealing with international clients is the use of different currencies. It’s essential to specify the currency in which payment is expected to avoid confusion or disputes. Additionally, understanding the preferred payment methods in different countries will help facilitate smoother transactions.

- Currency: Always specify the currency for international payments (e.g., USD, EUR, GBP). If dealing with clients from multiple countries, consider providing conversion rates or offering payment in their local currency.

- Payment Methods: Depending on the country, different payment methods may be preferred. International bank transfers, PayPal, credit cards, and even cryptocurrencies may be used. Make sure to include relevant payment details or options.

2. Tax and Legal Considerations

Different countries have different tax regulations, which may affect how you present your charges. You need to understand the tax requirements for your client’s location, such as VAT, GST, or other local taxes. Ensuring your document includes the correct tax details will keep you compliant and help avoid any confusion.

- Sales Tax or VAT: Many countries require businesses to include a tax identification number (TIN) and indicate whether VAT or other local taxes are applicable. Be sure to research the local tax laws of your client’s country.

- Tax Exemptions: In some cases, clients in specific regions may be exempt from certain taxes. Make sure to include any exemptions or tax breaks that apply to your transaction.

- Legal Compliance: Each country may have different legal requirements for documentation. For example, some countries may require the use of specific language or disclaimers in business communications. Ensure your document complies with local laws.

3. Language and Localization

When communicating with international clients, language barriers can be a challenge. Offering your documents in multiple languages can help improve understanding and foster better client relationships. Be sure to account for localization in terms of cultural preferences, measurements, or date formats as well.

- Translation: If your client speaks a different language, consider providing a translated version of the document. This shows respect for their language and ensures clear communication.

- Date Format: Different countries use different date formats. For example, the US uses MM/DD/YYYY, while many European countries use DD/MM/YYYY. Make sure to use the appropriate format for the clie

Integrating Billing Documents with Software

Integrating your financial documents with accounting or invoicing software can streamline your business operations and improve overall efficiency. By automating the creation and distribution of your records, you can reduce human error, save time, and ensure consistency across all your transactions. This integration allows for a more seamless workflow, connecting document creation, payment processing, and record keeping in one unified system.

Benefits of Software Integration

There are several advantages to integrating your billing documents with specialized software tools:

- Automation: Software can automatically generate and populate documents, saving you time and ensuring that the necessary fields are always filled correctly.

- Accuracy: By integrating with accounting or financial systems, the software can minimize errors related to calculations, taxes, and totals, leading to more accurate documents.

- Consistency: Integration ensures that all your records follow the same format and design, giving your business a professional and cohesive appearance.

- Data Synchronization: Your software can synchronize with customer databases, automatically populating client details such as name, address, and payment terms, reducing the need for manual entry.

- Time-Saving: By automating repetitive tasks such as document generation and sending, you can focus more on other important business activities.

Choosing the Right Software for Integration

When selecting software for integrating your financial documents, it’s essential to choose a solution that fits your business needs. Consider the following factors:

- Compatibility: Ensure the software is compatible with other tools you are using, such as CRM or accounting software, to streamline your entire workflow.

- Customization: Look for software that allows for customization to reflect your branding and the specific information you need in your records.

- Automation Features: Check that the software can automate key processes like calculations, data entry, and document delivery.

- Security: Your software should comply with data protection laws and ensure the security of sensitive client and financial information.

- Ease of Use: The software should be user-friendly, with a simple interface that allows you to create and manage documents without extensive training.

Integrating your billing documents with the right software not only enhances the accuracy and efficiency of your business operations but also provides a more seamless experience for your clients. By taking advantage of automation and synchronization, you can ensure that your financial transactions are processed smoothly and consistently, helping your business grow and operate more effectively.

Ensuring Billing Document Security and Privacy

When dealing with financial transactions, securing your business documents and protecting sensitive client information is of utmost importance. Ensuring that your documents are both safe from unauthorized access and compliant with privacy regulations not only helps to build trust with clients but also minimizes the risk of financial fraud or data breaches. Adopting robust security measures is critical in safeguarding both your business and your clients’ sensitive information.

Key Security Measures for Protecting Documents

To ensure the security of your financial records, it is important to implement several key measures:

- Encryption: Encrypt your documents to protect them from unauthorized access during transmission. This ensures that even if a document is intercepted, it cannot be read without the proper decryption key.

- Password Protection: Use strong, unique passwords to restrict access to your files. For additional protection, consider using two-factor authentication for users who handle sensitive documents.

- Access Control: Limit access to your financial documents to authorized personnel only. This reduces the risk of accidental or malicious data exposure.

- Secure Cloud Storage: Store your documents in a secure, encrypted cloud service with a reliable backup system. This ensures that your records are safe and accessible even in case of hardware failure.

- Audit Trails: Keep track of who accessed or modified your documents with audit trails. This provides a record of any changes made and helps identify potential security breaches.

Privacy Compliance and Best Practices

In addition to security, it is essential to ensure compliance with privacy laws and industry regulations that govern the handling of personal and financial information. Here are some best practices for maintaining privacy:

- Data Minimization: Only collect and retain the minimum amount of personal or financial data necessary for your transactions. Avoid storing unnecessary or outdated client information.

- GDPR and Data Protection Laws: If you operate in regions with strict data protection laws, such as the European Union’s GDPR, make sure your documents are compliant with local privacy regulations.

- Client Consent: Obtain explicit consent from clients to store and process their personal data, and inform them of their rights to access, correct, or delete their information when necessary.

- Secure Communication Channels: When sending sensitive documents, use encrypted email services or secure file-sharing platforms to ensure that the communication remains private.

By prioritizing the security and privacy of your financial documents, you help protect your clients’ sensitive data, comply with legal requirements, and maintain a strong reputation for trustworthiness in your business. Incorporating these security measures and privacy best practices will not only safeguard your operations but also enhance your clients’ confidence in your services.