How to Use a Summary Invoice Template for Efficient Billing

Managing billing processes effectively is crucial for any business. Having a clear and organized way to present payment details ensures both the sender and receiver are on the same page. This can help avoid confusion, reduce errors, and speed up transactions.

One of the best ways to streamline this process is by using structured formats designed for documenting payments. These formats offer a professional appearance while making it easier to manage financial records. Whether for freelance work, service providers, or larger companies, these formats are adaptable to various needs.

In this guide, we’ll explore how to use a structured document for listing charges, breaking down costs, and providing necessary payment information. You’ll learn how to create a clear and concise layout that works for both small and large-scale transactions. Effective communication of payment details can save time and prevent delays in receiving payments. Having a well-organized format is essential to maintaining smooth financial operations.

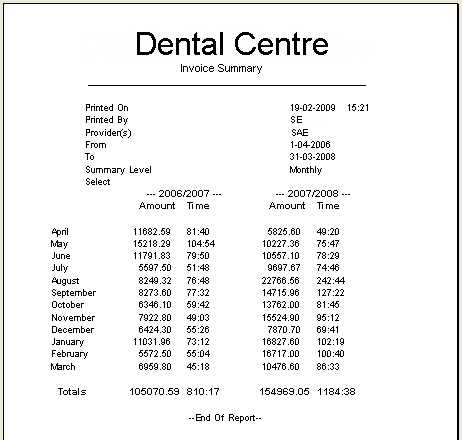

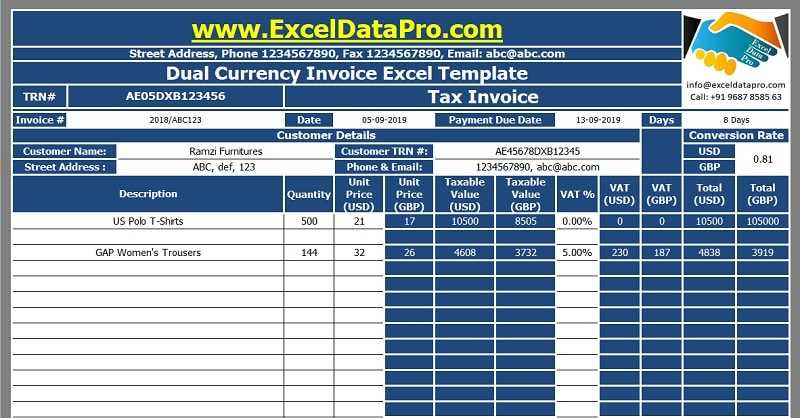

Summary Invoice Template Overview

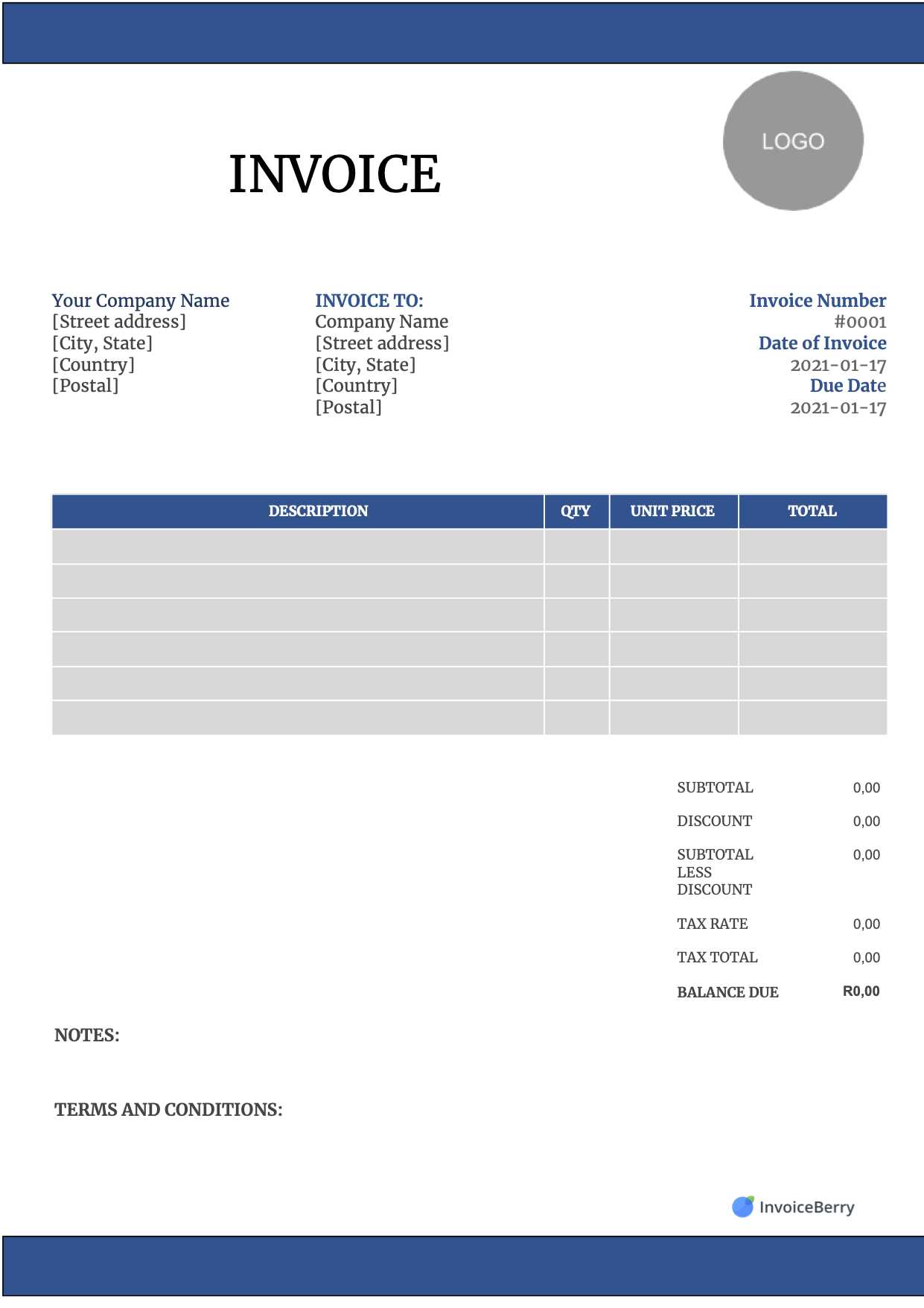

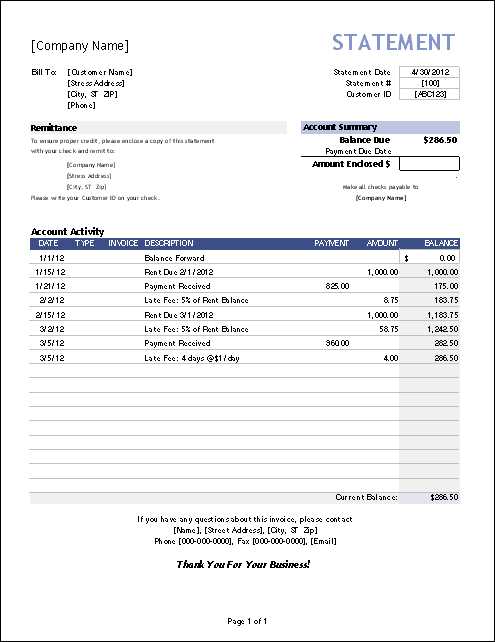

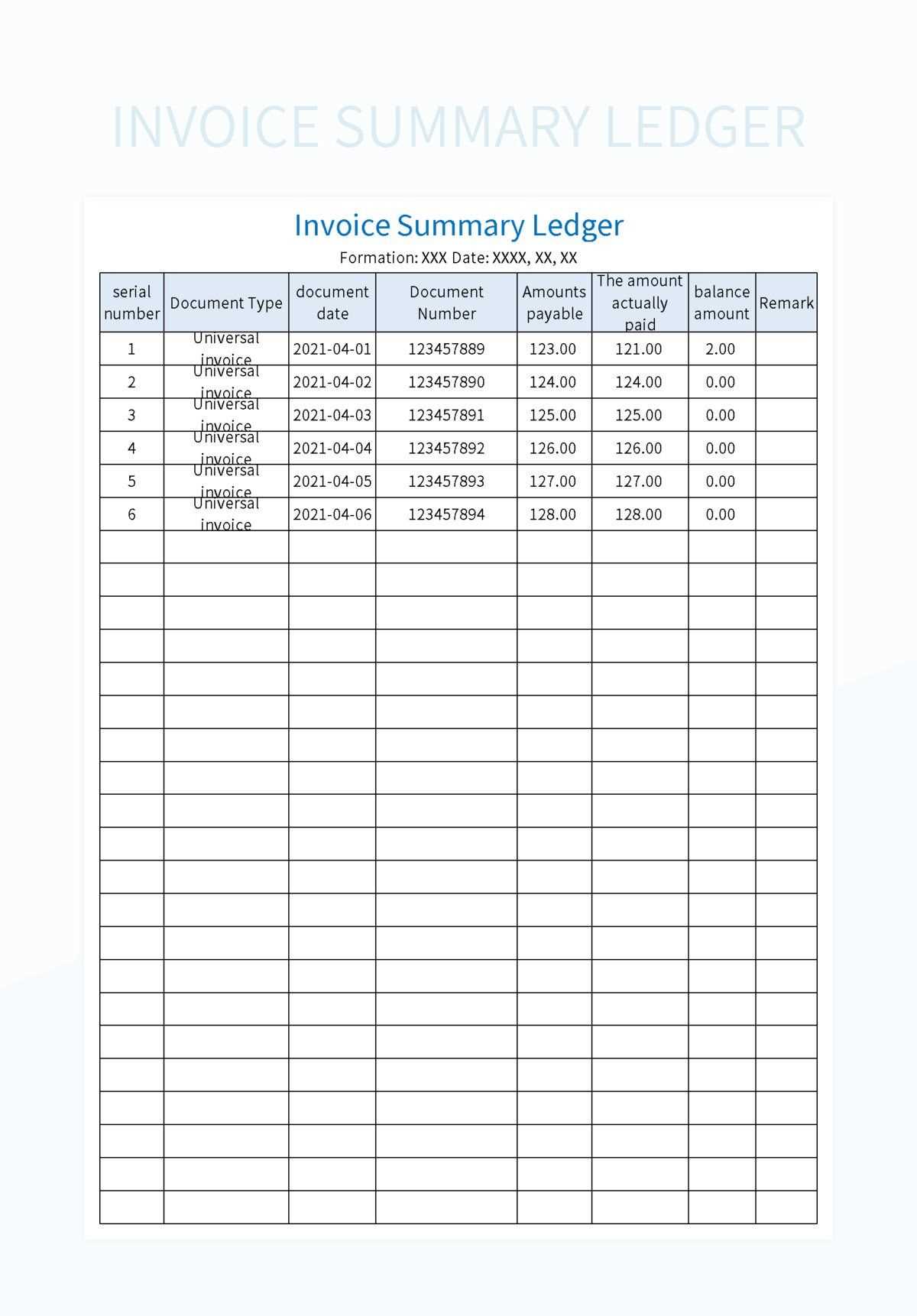

Organizing payment records effectively is a fundamental part of any business transaction. A well-structured document helps clearly outline charges, making it easier to track finances and communicate with clients. Such documents offer a simple yet professional way to present all necessary payment details in one place.

These documents are typically used by businesses and freelancers to list services provided or goods sold, as well as associated costs. The main purpose is to summarize the financial details in an easy-to-read format that benefits both the issuer and the recipient.

Key Elements of a Billing Document

Effective payment documentation includes essential details such as service descriptions, quantities, rates, and total amounts. Additionally, incorporating payment terms and due dates helps ensure smooth processing of transactions.

Why Structured Formats Matter

A well-organized format reduces confusion and ensures that all relevant information is included. It can save time, prevent errors, and help maintain professionalism in financial communications.

| Service | Description | Amount |

|---|---|---|

| Consulting | Hourly consulting fee for business analysis | $150 |

| Design | Graphic design services for website | $500 |

| Total | $650 |

Why Use a Summary Invoice Template

Using an organized document for billing is essential for efficient business operations. This structured format helps present all necessary details in a clear, concise manner, ensuring that both parties involved understand the financial aspects of the transaction. There are several reasons why this approach is beneficial for both small and large businesses.

- Time-saving: Pre-designed formats eliminate the need for manually structuring each document, saving time on every transaction.

- Professional appearance: A polished format helps maintain a professional image, making it easier to gain trust and credibility with clients.

- Accuracy: Clearly defined sections ensure that all payment details are included, reducing the likelihood of errors.

- Efficiency in record-keeping: By using consistent formats, businesses can keep better track of financial documents, aiding in future references or audits.

In addition to these advantages, using a pre-made structure reduces the chance of overlooking important details. Whether tracking multiple charges or providing a summary of services, this method ensures that every aspect is covered with minimal effort.

- Customizability: Most formats are easily adaptable to suit specific business needs or client requirements.

- Client clarity: A structured layout makes it easier for clients to understand the payment details, which can help avoid disputes or confusion.

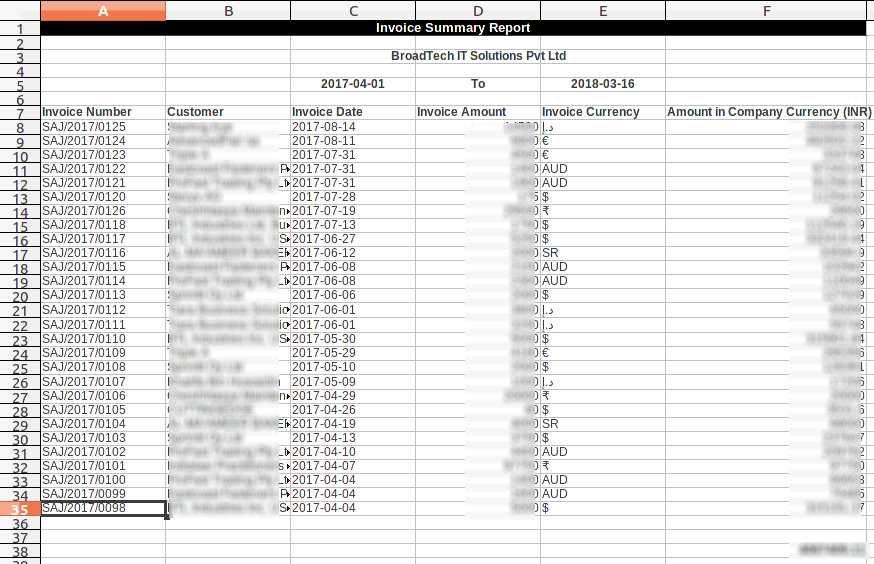

Key Features of a Summary Invoice

An effective billing document should contain key elements that clearly outline the details of a transaction. These elements are designed to ensure both the sender and the recipient understand the costs involved, payment terms, and any relevant notes. The following features are essential for an organized and professional document.

Essential Information for Clarity

Every document should include basic information such as the business name, contact details, and payment information. Additionally, a breakdown of services or goods provided, along with their corresponding costs, is crucial for transparency.

Structured Breakdown of Charges

A well-organized document includes a clear structure to present the charges. This may involve listing each service or item, the quantity, unit cost, and total amount, making it easy to see the final sum.

| Service | Description | Amount |

|---|---|---|

| Consulting | Strategic business analysis for growth | $200 |

| Design | Website redesign services | $450 |

| Total | $650 |

Additional features such as payment terms, due dates, and tax information can further enhance the document’s usefulness. Including these elements ensures all necessary details are accounted for and clearly communicated.

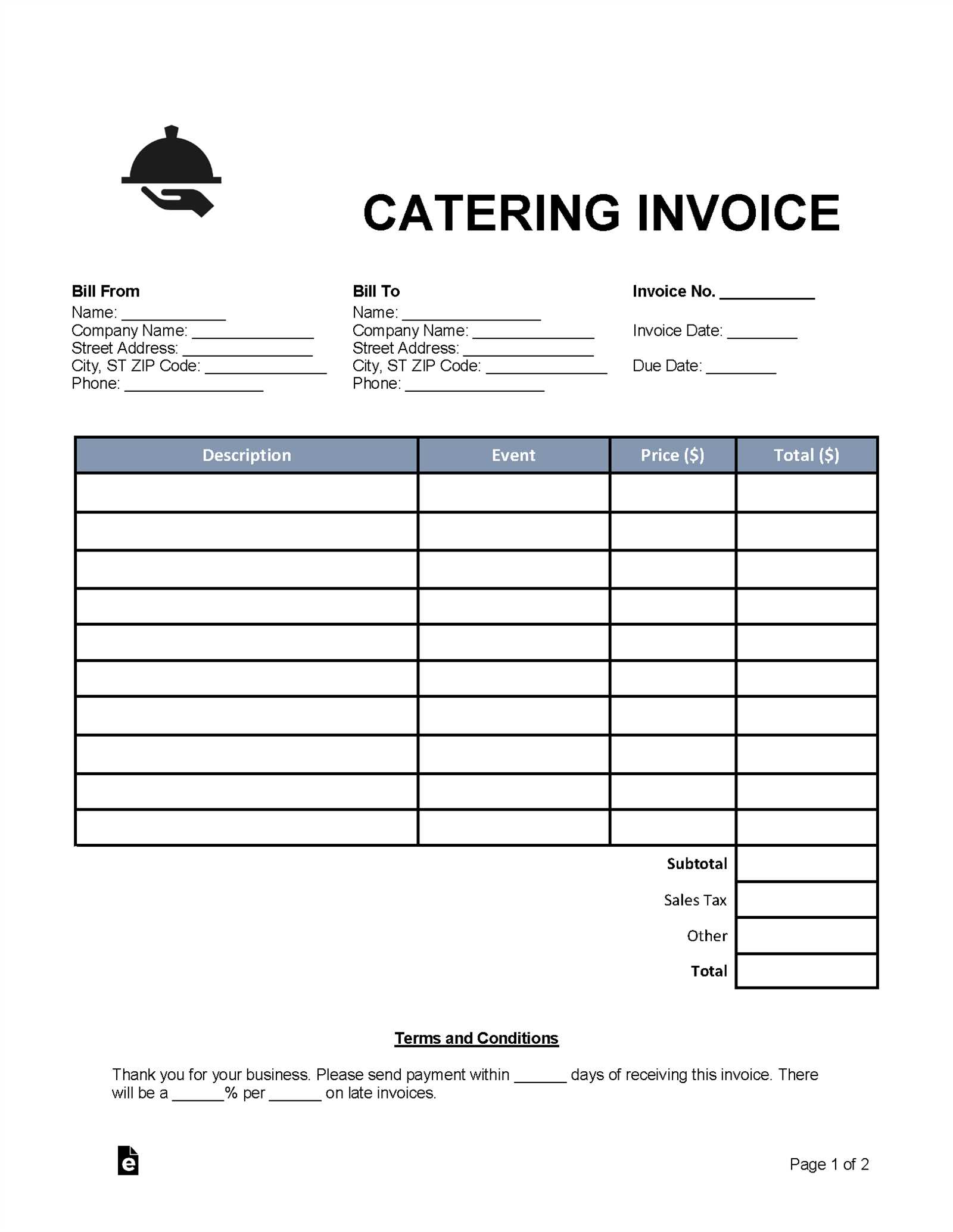

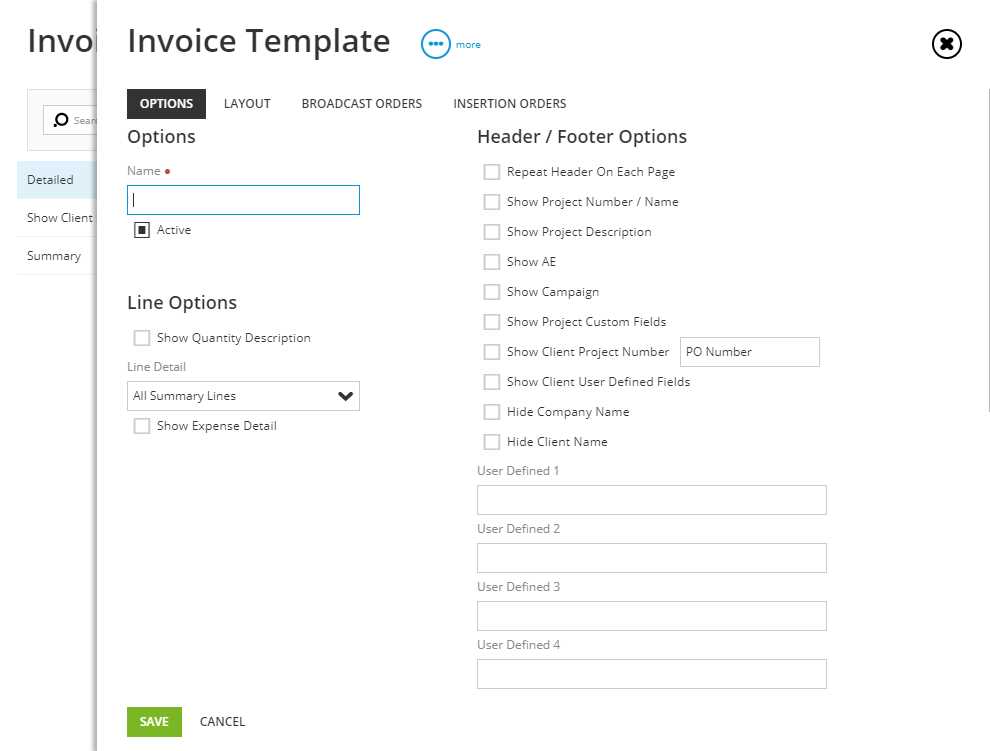

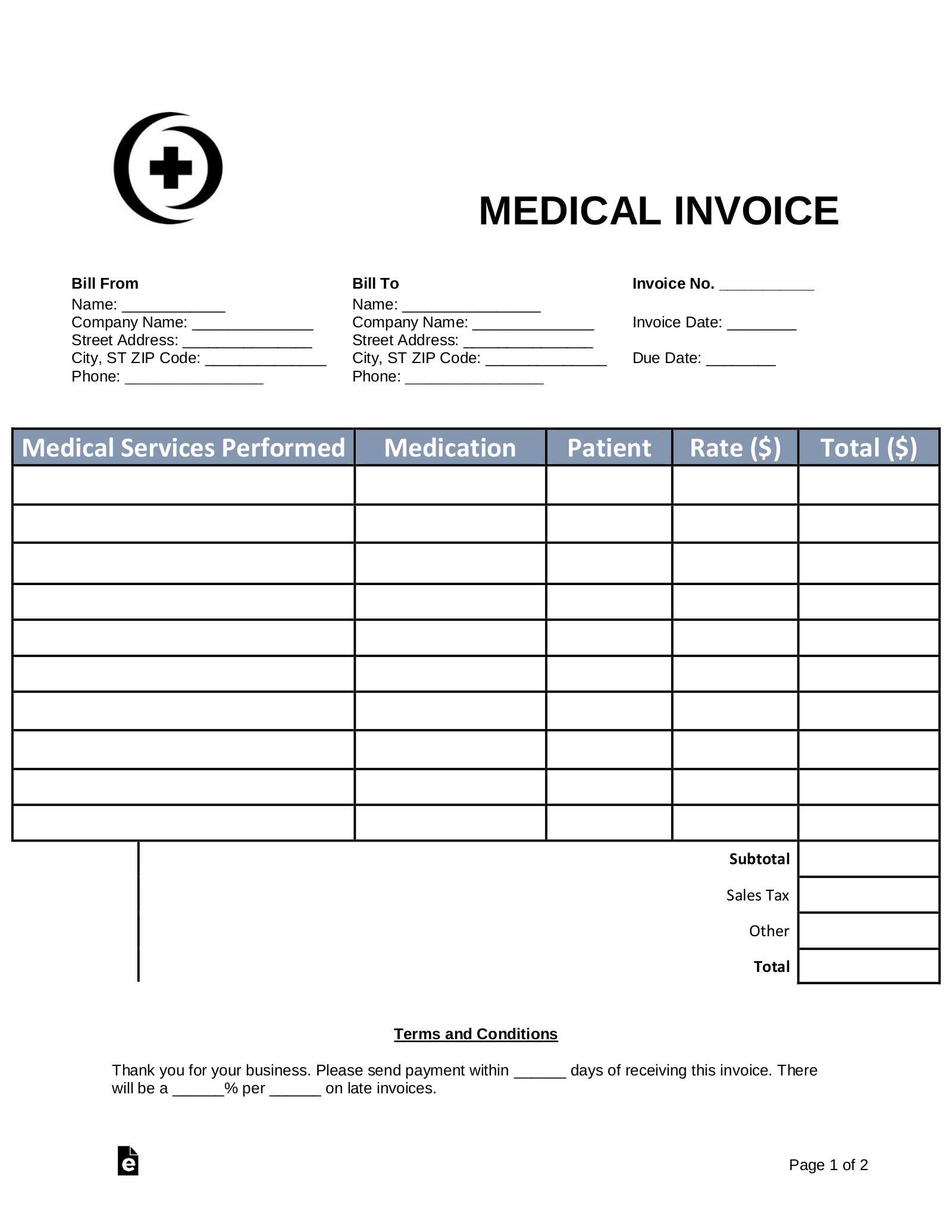

How to Customize a Summary Invoice

Creating a document that reflects your business’s unique identity can make a positive impression on clients while maintaining clarity in billing. Customization allows you to adapt the format to suit specific needs, ensuring all relevant details are effectively communicated.

Adjusting Layout and Design

To make the document visually appealing, start by adjusting the layout to include your business logo, colors, and fonts that align with your brand’s identity. A personalized design not only enhances readability but also reinforces your brand image with each interaction.

Consider rearranging sections to highlight key areas such as contact details, payment terms, or special notes. Using bold headings and clear fonts helps make these sections stand out, ensuring that clients quickly locate essential information.

Adding Custom Fields

Custom fields allow for greater flexibility, enablin

Benefits of Streamlined Billing with Templates

Utilizing a structured document for billing simplifies the financial process, making it faster and easier to manage payments. This approach benefits businesses by reducing administrative tasks and ensuring that payment information is both accurate and accessible. Streamlined formats enhance efficiency, allowing companies to focus on core activities rather than paperwork.

Increased Efficiency and Time Savings

A pre-designed format removes the need to create each document from scratch, saving valuable time. With ready-to-use sections for all essential details, filling out the information becomes a quick process, which is especially helpful for businesses managing multiple transactions. This not only improves workflow but also reduces the chance of errors.

Enhanced Professionalism and Client Satisfaction

Professional, uniform billing documents contribute to a positive business image. Clients appreciate clear, well-organized information that is easy to read and understand. By offering a structur

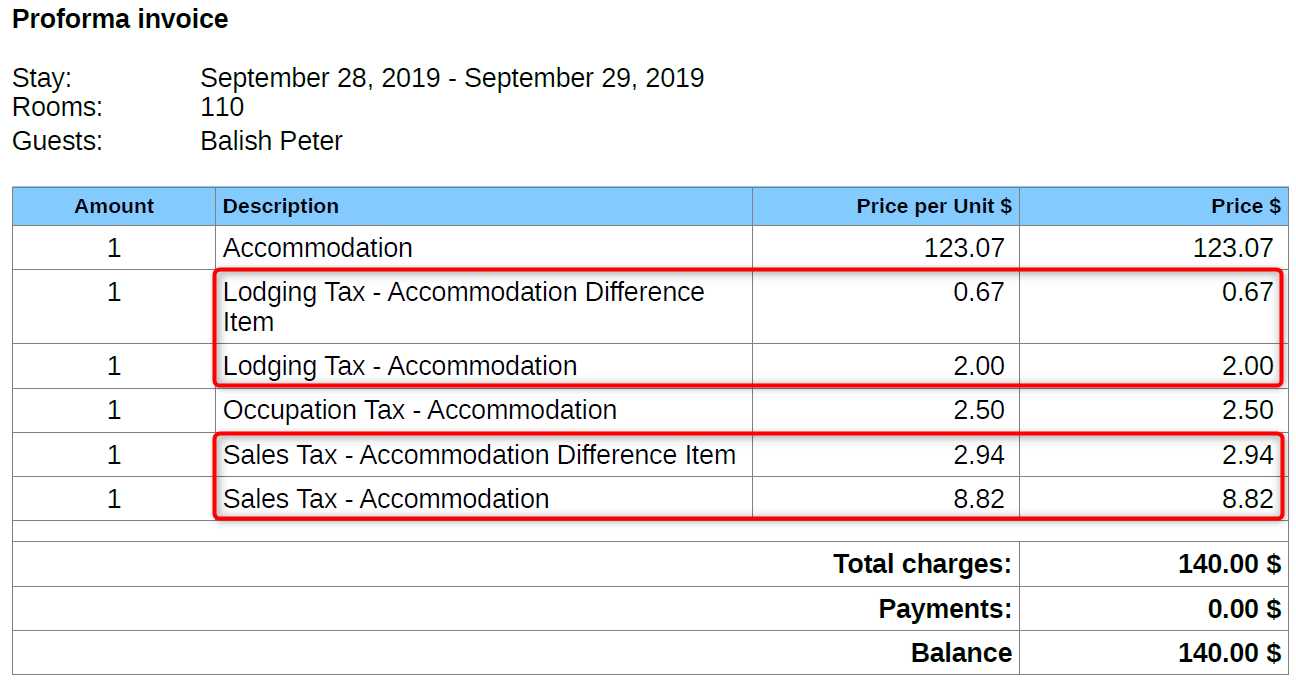

How to Avoid Common Invoice Errors

Maintaining accuracy in billing documents is essential for building trust and ensuring timely payments. Errors, even small ones, can lead to confusion, delays, and potential disputes with clients. By paying close attention to key areas, businesses can avoid common mistakes and improve the overall efficiency of their financial processes.

Double-Check All Details

Before sending any document, carefully review each section to ensure that all information is accurate. Verify names, addresses, payment terms, and any associated dates. Mistakes in these areas can cause issues with payments or lead to misunderstandings. Additionally, confirming quantities, rates, and totals is essential for maintaining accuracy.

Clear and Consistent Formatting

Using a consistent layout helps prevent errors. Make sure that all sections are easy to read and that each field has adequate space for necessary information. Consistent formatting not only reduces the chance of omissions but also makes the docume

Best Practices for Creating Invoices

Establishing a professional and efficient process for billing is crucial for maintaining financial clarity and fostering trust with clients. By following certain guidelines, businesses can enhance the readability and effectiveness of their documents, reducing the likelihood of errors and ensuring timely payments.

Include Essential Information

Each billing document should contain clear, essential details to avoid any ambiguity. Include items such as contact information, payment terms, and a detailed breakdown of services or products. Providing a structured layout with these key points will help clients easily understand the charges and payment requirements.

Organize Charges and Payment Details

Arranging charges in a logical order and providing clear payment instructions can help avoid client confusion. Present each service or item separately to show transparency in pricing.

| Section | Details to Include | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Client

Choosing the Right Template for Your BusinessFinding a format that aligns with your business needs can simplify the billing process and improve your professional image. The ideal layout should reflect your company’s operations while ensuring clarity and ease of use for both you and your clients. Here are some factors to consider when selecting the best format.

|