Subcontractor Invoice Template UK for Easy and Accurate Billing

When working on projects for clients or companies, having a streamlined method for requesting payment is crucial. Clear and professional documentation ensures that both parties understand the agreed terms, reducing the risk of confusion and payment delays. This is where an effective billing structure becomes indispensable for contractors in the UK.

In this guide, we’ll explore how to create and manage professional financial documents that help contractors get paid promptly and accurately. By following a few simple steps, you can ensure that your requests for compensation meet legal requirements and industry standards, making the entire process smoother for everyone involved.

From formatting your documents to understanding legal obligations, we will walk you through the essentials that make an effective billing request. Whether you are new to freelance work or looking to improve your current system, mastering these techniques will help maintain professionalism and promote timely payments.

Subcontractor Invoice Template UK Explained

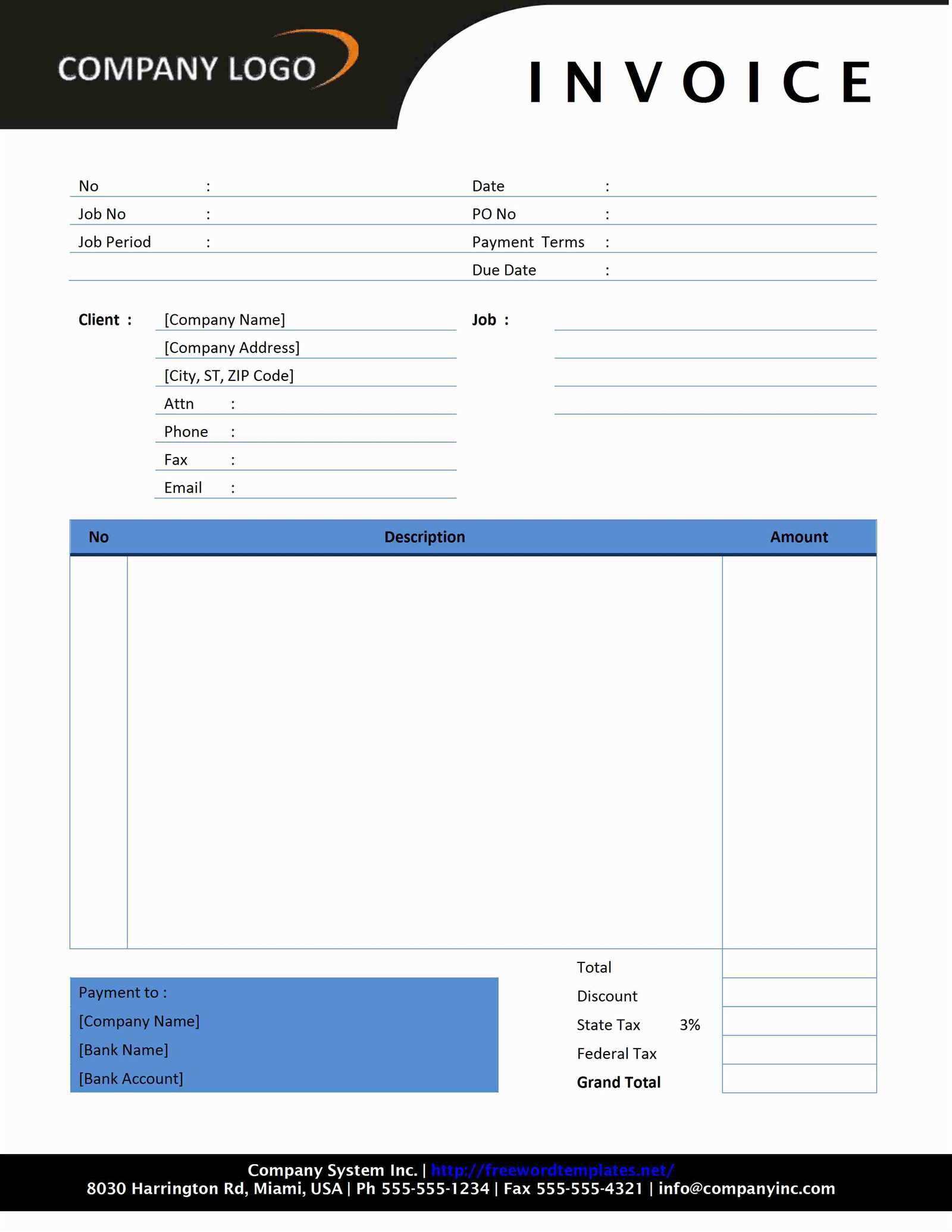

When working on a project, one of the key aspects of managing finances is creating clear and detailed payment requests. Having a well-structured document to outline the work completed, the agreed-upon fees, and the terms of payment is essential for both contractors and clients. This document not only helps maintain transparency but also ensures that both parties are aligned when it comes to expectations and deliverables.

The purpose of a billing document is to clearly communicate what services were provided, how much is owed, and when the payment is due. This is essential in ensuring timely compensation and avoiding any potential disputes down the line. In the UK, certain elements should always be included to meet legal standards and to help the process go smoothly.

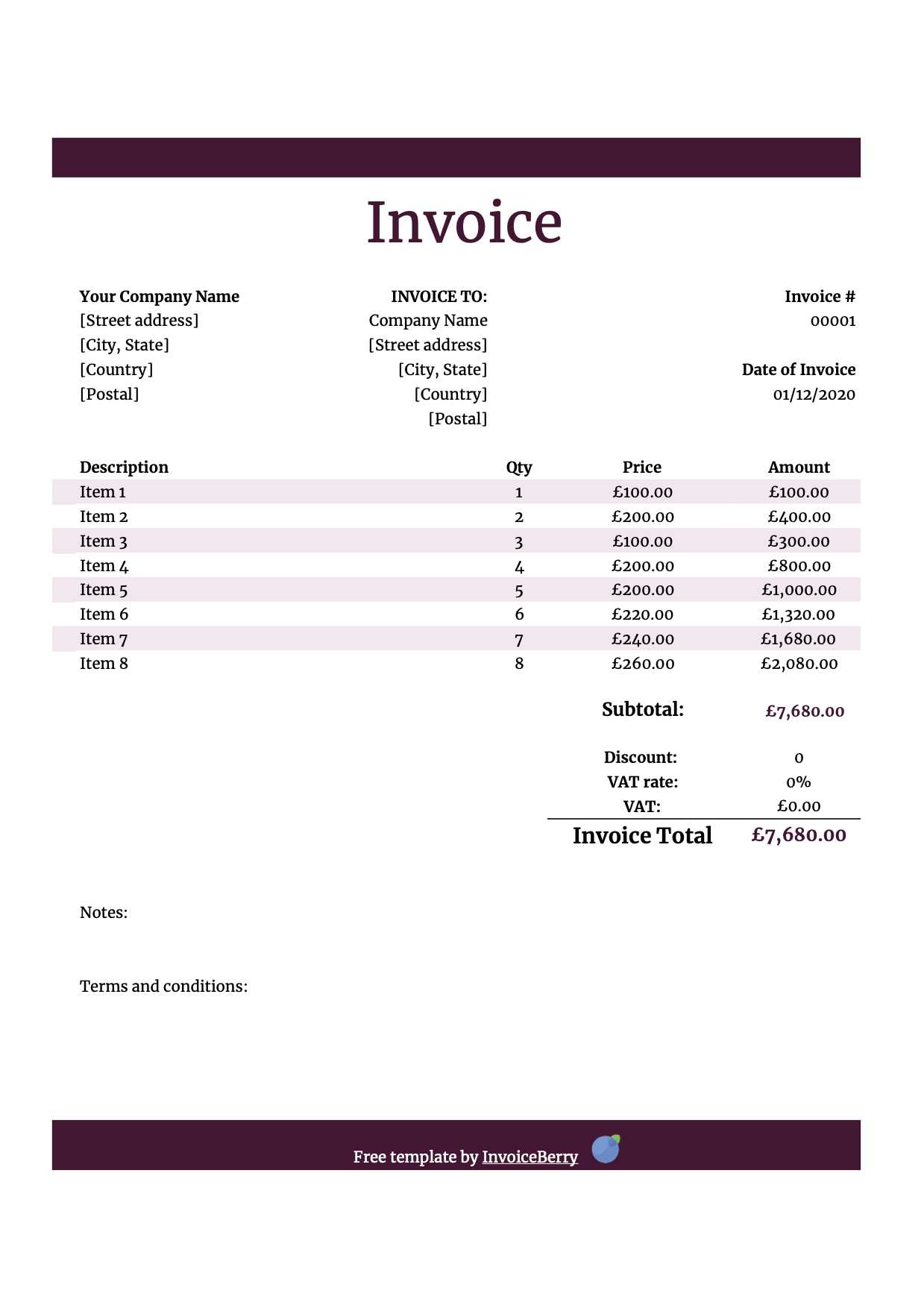

Here are the key components to include when creating a professional billing request:

- Business Information: Include the contractor’s and the client’s contact details, including names, addresses, and phone numbers.

- Service Description: A detailed list of the work carried out, broken down into individual tasks or phases of the project.

- Payment Terms: Clearly state the agreed amount, payment methods, and due date. This helps ensure that there are no misunderstandings.

- Legal and Tax Information: Include VAT details if applicable, as well as any other tax-related information required by UK law.

- Unique Reference Number: Assign a unique number to each document for easy tracking and future reference.

Creating a structured document with these elements will not only help you get paid faster but also maintain a professional relationship with your clients. It serves as both a record of completed work and a legally binding request for compensation. In the next sections, we will look at how to customize these documents and explore software tools to make the process easier.

Why You Need a Subcontractor Invoice

When providing services to clients, it is essential to have a formal way to request payment. A clear, detailed document serves as the official record of work completed and the amount due, helping both the service provider and the client stay on the same page. Without such a document, the payment process can become disorganized and may lead to misunderstandings or delays.

Having a properly structured billing document is not only a matter of professionalism but also a legal necessity in many cases. It ensures that all terms are documented, making it easier to resolve disputes and maintain transparency. Below are some of the key reasons why having a well-designed billing record is crucial for anyone offering services:

- Clear Communication: It outlines exactly what services were provided, the cost for each service, and the payment schedule, leaving no room for confusion.

- Timely Payments: A formal payment request helps expedite the payment process, ensuring you are compensated promptly for your work.

- Legal Protection: This document serves as proof of the agreed terms and protects you in case of any disputes over payment.

- Professionalism: Providing a structured and detailed payment request reflects well on your business, building trust with clients.

- Tax Compliance: It helps you stay compliant with tax regulations by clearly outlining any applicable VAT or tax deductions.

- Record Keeping: Proper documentation allows for easy tracking of past work and payments, simplifying accounting and future tax filings.

Whether you’re a freelancer or part of a larger contracting team, having a well-organized document to request payment is an essential part of running a successful business. It ensures that all parties are aware of what has been agreed upon, minimizing confusion and facilitating smooth transactions.

Key Features of an Effective Template

For a payment request document to be effective, it must be clear, professional, and comprehensive. The goal is to provide all the necessary information in an organized manner, ensuring that both the service provider and the client are aligned. An effective document helps prevent misunderstandings, streamlines the payment process, and ensures legal compliance.

Essential Components

To create a well-structured payment request, certain elements should always be included. These key components ensure that the document is complete and legally sound:

- Service Description: A clear breakdown of the work done, including dates, hours, and individual tasks or milestones.

- Payment Terms: Details of the agreed fee, payment methods, and the due date. This section should also include any late payment penalties if applicable.

- Business Information: Contact details of both the service provider and the client, including names, addresses, and phone numbers.

- Legal Requirements: Include any tax-related information, such as VAT registration numbers, to ensure compliance with UK regulations.

- Unique Reference Number: Assigning a reference number for each document helps track payments and simplifies future communication.

Design and Formatting Tips

In addition to including the right information, the overall design and layout of the document are also important. A clean, easy-to-read format ensures that the recipient can quickly find the relevant details without confusion. Consider the following:

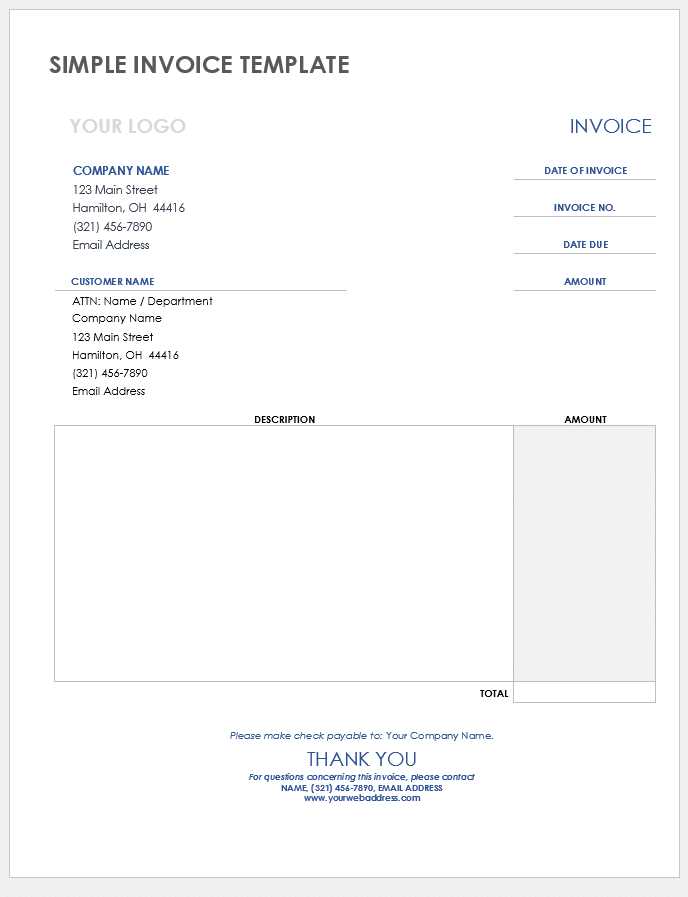

- Clarity: Use headings, bullet points, and bold text to make the document easy to navigate.

- Consistency: Maintain a consistent font style and size throughout the document to ensure a professional appearance.

- Branding: Incorporate your logo or business name at the top of the document to reinforce your identity.

By incorporating these features, you can create a well-organized and effective document that not only facilitates smooth transactions but also enhances your professional image.

How to Customize Your Invoice Template

Personalizing a payment request document is essential to reflect your unique business needs and professional identity. Customization not only ensures that all relevant details are included, but it also helps make the document more user-friendly for both you and your clients. Tailoring your billing document can increase efficiency, streamline communication, and enhance your brand presence.

Here are several steps to help you customize your payment request document effectively:

- Choose a Design: Select a layout that matches your brand’s style. Whether you prefer a clean, minimalist design or a more detailed approach, make sure the structure is easy to read and navigate.

- Include Your Branding: Add your company’s logo, colors, and contact information at the top of the document. This reinforces your brand identity and creates a professional appearance.

- Adjust the Sections: Tailor the sections based on the type of work you do. For example, if you provide multiple services, make sure each one is listed with a clear breakdown of hours, rates, and costs.

- Update Payment Terms: If your payment terms are unique (such as discounts for early payments or late fees for overdue amounts), ensure that they are clearly stated and easy to understand.

- Add Your Business Details: Always include your business registration number, tax identification, and VAT number (if applicable). This information not only ensures compliance with UK regulations but also adds legitimacy to your request.

By customizing your billing documents, you can make them more effective, professional, and aligned with your business’s specific requirements. A well-designed and personalized payment request can help strengthen your client relationships and ensure smooth, timely payments.

Step-by-Step Guide to Creating Invoices

Creating a detailed and accurate payment request is crucial for ensuring timely compensation for your work. A well-crafted document serves as both a record of the services provided and a clear outline of the agreed-upon payment terms. Follow this step-by-step guide to ensure your billing documents are professional and comprehensive.

- Step 1: Add Your Business Details

Start by including your business name, address, and contact information at the top of the document. This helps the client identify the source of the request and makes the document look professional.

- Step 2: Include Client Information

Provide the full name or business name of the client, along with their contact details. This ensures the request is properly directed and avoids any confusion.

- Step 3: Assign a Unique Reference Number

Every request should have a unique reference number for easy tracking and future communication. This is particularly helpful for both parties to keep a record of past transactions.

- Step 4: List the Services Provided

Clearly describe the work completed, breaking it down into individual tasks, hours worked, or milestones. Be as specific as possible to avoid misunderstandings.

- Step 5: Specify the Total Amount Due

List the amount due for each service or task, along with any taxes or fees that may apply. Ensure that the total amount at the bottom reflects all charges and deductions.

- Step 6: Outline Payment Terms

State the payment methods you accept, the due date, and any penalties for late payments. This sets clear expectations for both parties.

- Step 7: Include Legal and Tax Information

Add any necessary legal details, such as your business registration number, tax ID, and VAT information. This is essential for compliance and helps maintain transparency.

- Step 8: Review and Finalize

Before sending the document, double-check all information for accuracy. Verify that the amounts are correct, all services are listed, and payment terms are clearly stated.

By following these steps, you can ensure that your payment request is clear, professional, and legally sound. A well-organized document not only facilitates smooth transactions but also strengthens your professional image and client relationships.

Understanding Legal Requirements for UK Invoices

When creating a payment request document, it is essential to adhere to the legal standards set by UK authorities. These regulations ensure that both the service provider and the client have clear, enforceable terms, which help avoid any future disputes or legal issues. Understanding the key legal requirements will ensure that your document is compliant and protects both parties’ interests.

Essential Legal Information

In the UK, certain details are required to be included in any formal payment request, especially for tax purposes. Below are the key elements that should be part of your document to meet legal and tax compliance:

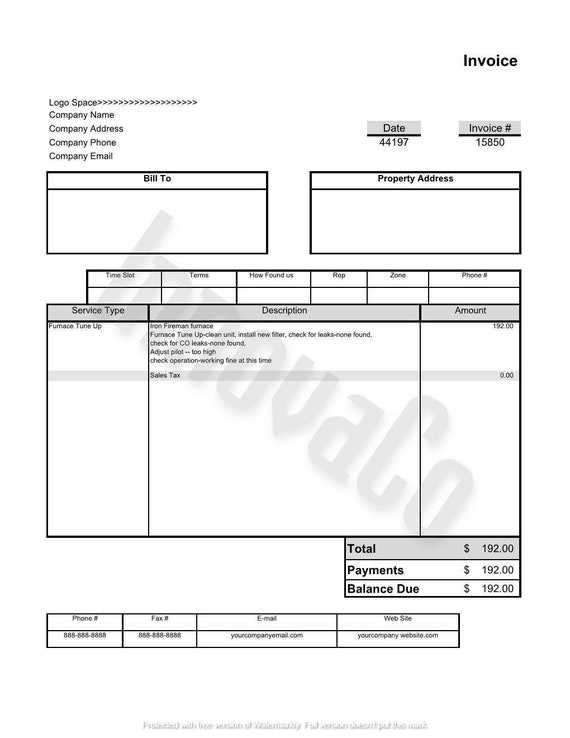

- Business Identification: Always include your business name, address, and contact information, along with your registration number if applicable.

- Client Information: The name, address, and contact details of the client receiving the services should be listed clearly.

- VAT Details: If your business is VAT-registered, you must include your VAT number on the document. This is required by law for VAT-exempt and VAT-liable transactions.

- Tax Breakdown: If applicable, show the amount of VAT charged for each service and the total VAT. Be clear about the rates used, especially if different services are subject to different rates.

- Unique Reference Number: Every payment request should have a unique reference number for tracking purposes. This is important for both bookkeeping and potential audits.

- Payment Terms: Clearly specify the payment due date, and any penalties for late payments if agreed upon in the contract.

Additional Compliance Considerations

Beyond the essential details, there are other aspects that can impact the legal standing of your document:

- Clear Description of Services: The services provided must be described accurately and in sufficient detail. This helps avoid misunderstandings about what has been delivered and the agreed-upon compensation.

- Record Keeping: Under UK law, businesses are required to keep records of financial documents for a minimum of six years. Proper record keeping can help with tax filings and legal disputes.

- Electronic Documents: If submitting payment requests electronically, ensure that they meet the same legal standards as paper documents, including the correct information and formats for VAT compliance.

By understanding and following these legal requirements, you can ensure that your payment request documents are both compliant and professionally presented, reducing the risk of issues with clients or tax authorities.

Common Mistakes in Subcontractor Invoices

Even with a well-structured payment request, mistakes can happen that may cause delays or confusion. Whether it’s missing details, incorrect calculations, or vague descriptions, errors in your billing document can lead to disputes, payment delays, or even legal complications. Understanding the common pitfalls can help you avoid these issues and ensure a smooth transaction process.

Frequent Errors to Avoid

Below are some of the most common mistakes that can occur when creating a billing document, along with tips on how to prevent them:

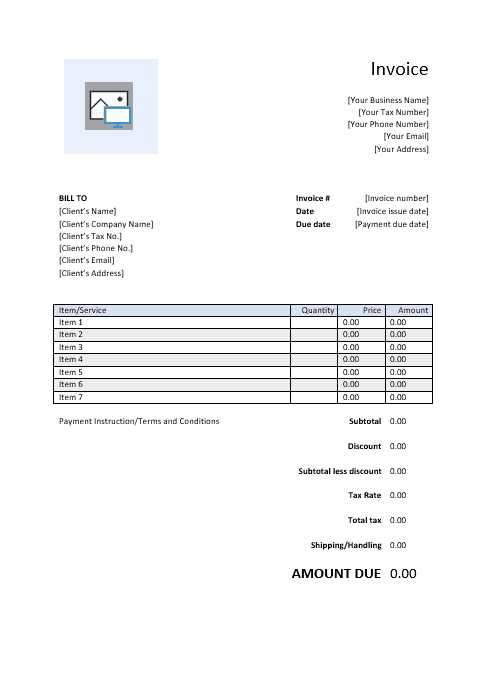

| Common Mistake | Impact | How to Avoid | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing Client Details | Confusion over who the payment request is for, leading to delays. | Always ensure the client’s name, address, and contact information are included. | ||||||||||||||||||||||||||||||||||

| Incorrect Amounts | Undercharging or overcharging the client, leading to disputes. | Double-check the services provided and the agreed-upon rates before finalizing. | ||||||||||||||||||||||||||||||||||

| Unclear Service Descriptions | Ambiguity about what work was done, making it difficult for the client to process payment. | Be specific about each task or service, and include dates, hours, or quantities as necessary. | ||||||||||||||||||||||||||||||||||

| Failure to Include Payment Terms | Confusion over due dates and payment methods, leading to delays. | Clearly state the payment deadline, acceptable methods, and any late fees. | ||||||||||||||||||||||||||||||||||

| Not Including Tax Details | Non-compliance with tax regulations and potential legal consequences. | If

How to Avoid Payment Delays with InvoicesLate payments can significantly impact your cash flow and create unnecessary tension between you and your clients. One of the main reasons payments are delayed is due to unclear or incomplete billing documents. To ensure timely payments, it’s crucial to avoid common mistakes and follow best practices when requesting compensation. By being proactive and thorough, you can help prevent delays and ensure smooth financial transactions. Here are several strategies to help you minimize the risk of delayed payments:

By implementing these practices, you can reduce the likelihood of delayed payments and maintain strong, positive relationships with your clients. Timely payments are essential for the financial health of your business, and a well-prepared and organized payment request plays a key role in achieving this goal. Top Software for Subcontractor InvoicesManaging payment requests can be time-consuming, especially if you’re dealing with multiple clients or complex billing structures. Fortunately, there are several software tools available that can help streamline the process, making it easier to create, send, and track payment requests. These tools not only save time but also ensure accuracy and professionalism in your documents. Below are some of the top software solutions designed to simplify the billing process for service providers. Here are some of the best software options to help manage your payment requests:

By using the right software, you can automate many aspects of the payment process, reduce human error, and improve your overall efficiency. These tools help you create clear, professional documents that streamline the billing process and make managing your finances much easier. How to Format Your Subcontractor InvoiceWhen creating a payment request document, proper formatting is essential to ensure that all necessary details are clear and easy to read. A well-organized layout not only reflects professionalism but also helps prevent errors and confusion. By following a structured format, you can make sure that all important information is included and presented in a way that is both comprehensive and accessible to your client. Here are some key tips for formatting your payment request document effectively:

By following these formatting guidelines, you can ensure that your payment request documents are professional, organized, and easy to understand. A well-formatted document not only speeds up the payment process but also enhances your business’s credibility and efficiency. How VAT Affects Your Subcontractor InvoiceValue Added Tax (VAT) is a critical component of the financial transactions for businesses in the UK. Understanding how VAT works and how it should be applied to your billing documents is essential for both compliance and maintaining transparency with your clients. If your business is VAT-registered, you need to accurately calculate and report VAT on your payment request documents. Failing to do so could lead to complications with tax authorities or disputes with clients. Here’s a breakdown of how VAT can affect your billing process:

By properly incorporating VAT into your payment request documents, you ensure that your billing complies with UK tax laws and avoids misunderstandings with your clients. It’s essential to stay updated on VAT regulations and apply them consistently to your business transactions. Digital vs. Paper Invoices for SubcontractorsWhen it comes to requesting payment for services rendered, businesses have the option of using either digital or paper-based documents. Each method has its own set of advantages and challenges, depending on the needs of the business and the client. Understanding the differences between digital and paper formats can help you make an informed decision on which approach to use for your financial transactions. Advantages of Digital Payment Requests

Digital billing has gained significant popularity due to its convenience, speed, and eco-friendliness. Some of the key benefits of using digital documents include:

Advantages of Paper-Based Payment RequestsWhile digital documents are becoming more common, some businesses and clients may still prefer traditional paper-based payment requests. Here are some reasons why paper documents might still be a preferred option:

While both methods have their benefits, the decision ultimately depends on the needs of your business and the preferences of your clients. Digital formats are generally more efficient and environmentally friendly, but paper-based requests may still be necessary for ce Best Practices for Subcontractor Invoice ManagementEffective management of payment requests is essential to maintaining smooth cash flow and ensuring timely compensation for work completed. Having a well-structured approach to handling these documents can prevent delays, reduce errors, and improve your professional relationships with clients. By following a few key practices, you can streamline the entire process and avoid common pitfalls that can lead to payment issues. Key Strategies for Efficient Payment Request ManagementImplementing efficient systems for managing your payment requests can help you stay organized and ensure you never miss a payment. Here are some best practices to consider:

Managing Multiple Clients EffectivelyWhen working with multiple clients, managing each payment request can become complex. Here’s how to keep things under control:

By following these best practices, you can improve your payment reque When to Send Your Payment Request

Knowing the right time to send a payment request is crucial for maintaining good cash flow and ensuring timely payment for your services. Sending it too early may cause confusion, while sending it too late can delay your earnings. Understanding the best time to submit your request depends on several factors, including the nature of your work, the agreement with your client, and the payment terms you’ve established. Factors to Consider When Sending Payment RequestsSeveral elements should guide your decision on when to submit a payment request:

Best Practices for Timing Your Payment RequestsTo avoid delays and ensure that payments are made promptly, follow these guidelines for sending your payment requests:

By understanding the right time to send your payment request and following these best practices, you can help ensure timely payments and maintain a healthy cash flow for your business. How to Handle Disputed Payment RequestsDisputes over payment requests are an unfortunate but common occurrence in business transactions. Whether due to discrepancies in the amount owed, disagreements over terms, or misunderstandings about the scope of work, it is essential to approach these issues calmly and professionally. Effectively managing disputes can help maintain a positive relationship with your clients and resolve issues without unnecessary delays or complications. Here are some steps you can take to address and resolve payment request disputes:

If a resolution is not reached through direct communication, consider involving a neutral third party or legal assistance. However, most disputes can be resolved with clear communication, professional conduct, and proper documentation. Addressing issues promptly and effectively ensures that your business continues to operate smoothly while maintaining trust with your clients. Why Timely Billing is Crucial for BusinessSending payment requests on time is not just a routine task–it’s a key component in maintaining the financial health of your business. Timely billing ensures that cash flow remains steady, which is essential for covering operational costs, investing in growth, and keeping good relationships with clients. Failure to issue payment requests promptly can lead to delayed payments, financial strain, and even damage to your business reputation. The Importance of Prompt Payment RequestsTimely billing has several significant advantages that can directly impact your business’s success:

Best Practices for Timely BillingHere are some tips to help you ensure that your payment requests are always sent on time:

By prioritizing ti |