Free Studio Invoice Template for Easy and Professional Billing

Managing payments and ensuring clients are billed accurately is a crucial part of running any creative business. When it comes to organizing charges for services, having a reliable and efficient system in place can save time and reduce the chances of errors. Using a standardized form for requesting payment can simplify the process and help you maintain professionalism in your financial dealings.

Customizable billing formats allow you to streamline your workflow and keep everything in one place. They provide an easy way to include all necessary details, such as work performed, rates, and deadlines, while maintaining clarity. This can help establish trust and prevent any misunderstandings with clients.

Whether you’re a freelancer, small business owner, or part of a larger creative agency, having access to ready-to-use, customizable documents ensures that you always present a polished and consistent approach to managing financial transactions. These resources allow you to focus more on your craft while staying on top of your financial responsibilities.

Why You Need a Billing Document Format

Having a structured approach to requesting payment is essential for any business, especially when dealing with clients in creative fields. A clear, organized format helps ensure that all the necessary information is included, minimizing the risk of errors or confusion. Without such a tool, managing financial transactions becomes time-consuming and prone to mistakes.

Using a pre-designed form allows you to save valuable time by eliminating the need to create documents from scratch for each client. With a ready-made solution, you can quickly fill in the required details, ensuring accuracy and consistency across all your payments. This method not only increases efficiency but also improves the overall professionalism of your business.

Another key advantage is that a well-structured document sets clear expectations for your clients. By outlining the work completed, payment terms, and deadlines in a consistent way, you foster transparency and trust. This helps reduce misunderstandings and ensures that both parties are on the same page regarding financial obligations.

Ultimately, having a reliable format at your disposal streamlines the billing process, freeing up time to focus on what matters most: your creative work. It helps maintain a smooth workflow, allowing you to stay organized and professional while building strong relationships with clients.

How to Customize Your Billing Document

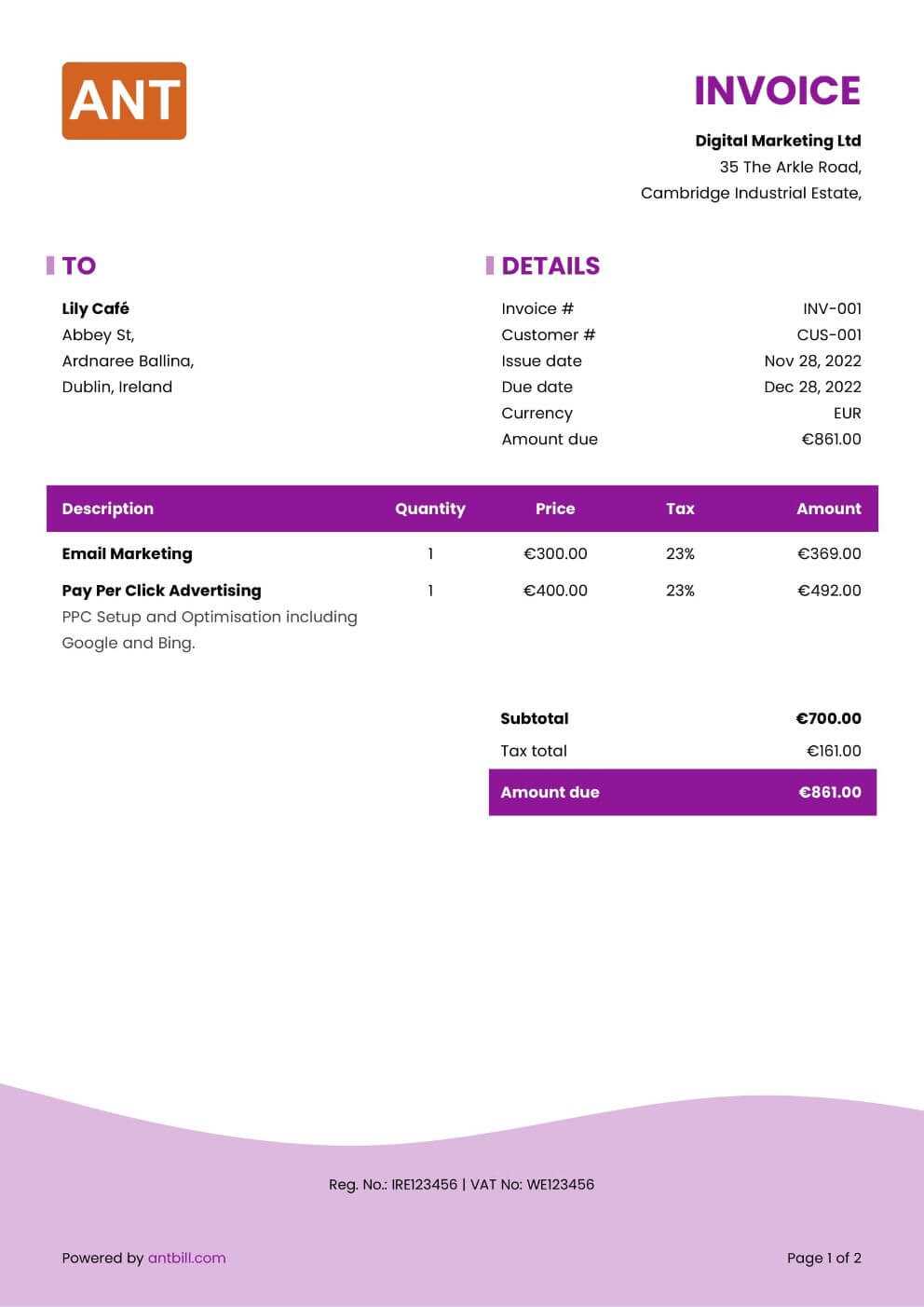

Customizing a billing document is essential for ensuring that it aligns with your brand and meets the specific needs of your clients. By adjusting the layout, content, and style, you can create a professional-looking record that reflects your business’s identity and facilitates clear communication. Customization makes it easier to manage financial transactions while enhancing the overall client experience.

Adjusting the Layout and Structure

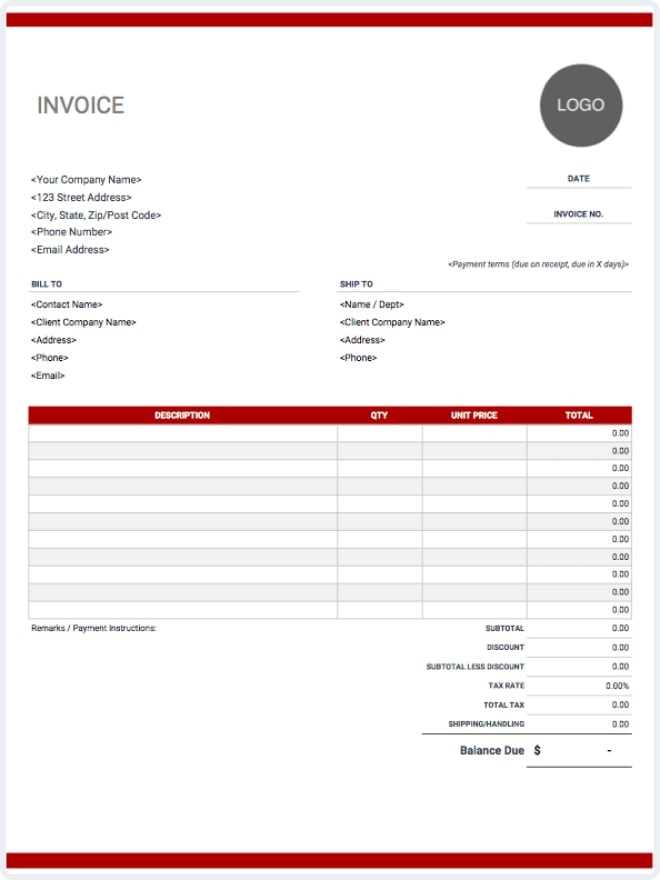

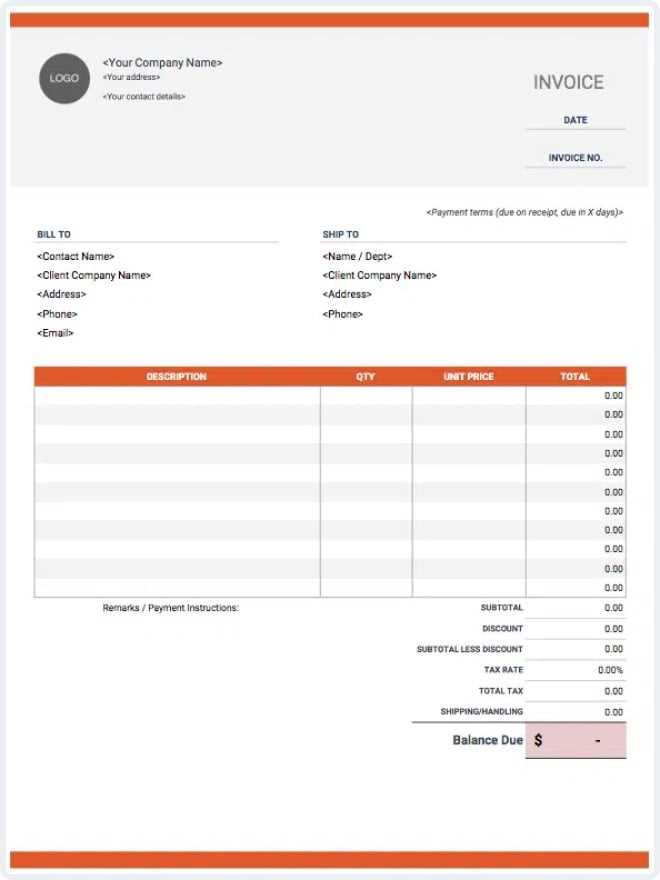

The first step in customization is deciding on the overall structure of your document. You can modify sections, reorder items, or add new fields based on the nature of your work. Common details to include are the client’s name, description of services, payment terms, and total cost. Make sure the layout is clean and easy to follow, with sufficient space between sections.

Adding Your Brand Identity

To make the document truly your own, incorporate elements of your brand identity, such as your business logo, color scheme, and font style. Adding these personal touches not only makes your document visually appealing but also reinforces brand recognition. This small adjustment can elevate your business’s professional image and leave a lasting impression on clients.

By making these changes, you can ensure that every transaction reflects the unique aspects of your business while remaining clear and easy to understand. Customization allows you to stay organized and maintain a consistent, professional approach to your financial dealings.

Top Features of a Billing Document

A well-designed billing document should offer both clarity and functionality. It serves not only as a record of completed work but also as a professional tool that ensures timely payments. A great document format includes specific elements that contribute to smooth financial transactions and client trust. These features make it easier to manage payments while maintaining a high standard of professionalism.

Key Elements to Include

- Client Information: Clear identification of the client, including their name, address, and contact details, is essential for accurate record-keeping.

- Description of Services: A concise breakdown of the work done, including any applicable project milestones or deliverables, ensures both parties are aligned on what has been completed.

- Payment Terms: Clearly outlining the payment due date, late fees, and accepted payment methods helps avoid confusion or disputes later on.

- Itemized Costs: A detailed list of charges for each service or product provided allows clients to understand exactly what they are paying for.

- Total Amount Due: A final, clearly marked total amount makes it easy for clients to see their financial obligation at a glance.

Additional Useful Features

- Tax Information: Including tax rates or exemptions ensures legal compliance and avoids potential issues with authorities.

- Due Date & Payment Instructions: Providing an exact due date and payment instructions gives clients clear guidance on how and when to pay.

- Customizable Sections: The ability to modify sections, add notes, or include promotional discounts helps tailor the document to each unique transaction.

- Professional Design: A clean, aesthetically pleasing format enhances the document’s readability and helps leave a good impression on clients.

By incorporating these key features, a billing document not only facilitates smooth transactions but also strengthens your business’s professional image, ensuring clients feel confident in their financial dealings with you.

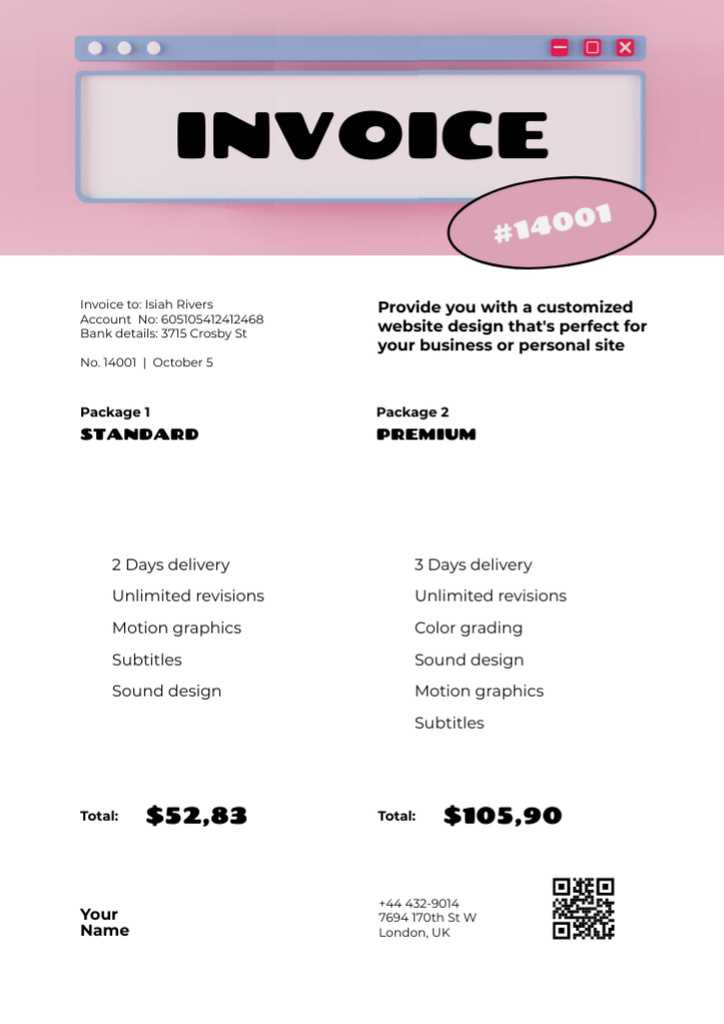

Best Formats for Billing Documents

Choosing the right format for your billing records is crucial for ensuring that your financial transactions are clear, professional, and easy to process. The format should be simple, easy to navigate, and compatible with the way you manage your business. Whether you prefer digital or paper records, selecting a format that suits both your workflow and client needs will streamline the billing process and help avoid any confusion.

There are a variety of formats available, each with its own advantages depending on your preferences and the specific requirements of your clients. Below is a comparison of some of the most commonly used formats:

| Format Type | Advantages | Best For |

|---|---|---|

| Universal compatibility, professional appearance, easy to send and store electronically | Freelancers, small businesses, digital creatives | |

| Excel/Spreadsheet | Easy to edit, calculate totals automatically, and track payments | Businesses requiring detailed calculations or multiple clients |

| Word/Docs | Highly customizable, easy to add detailed notes or descriptions | Creative professionals who need flexibility and simplicity |

| Online Platforms | Automated features, integrates with accounting software, real-time updates | Businesses with high volume or clients requiring automated processes |

Each format offers its own set of tools to make managing financial records easier. Choosing the right one depends on your business needs, the complexity of your billing system, and your client preferences. For those who prefer a simple and secure approach, PDF documents work well. If you need more dynamic features such as calculations and data analysis, a spreadsheet might be the best fit. Online platforms, on the other hand, are ideal for larger operations seeking automated processes and integrations with other systems.

How to Create Professional Billing Documents Quickly

Creating a polished and accurate billing document doesn’t have to be a time-consuming task. With the right approach, you can quickly generate professional records that reflect your business’s quality and efficiency. By streamlining the process and using the right tools, you can focus more on your work and less on administrative tasks. Here are several tips to help you generate high-quality records in no time.

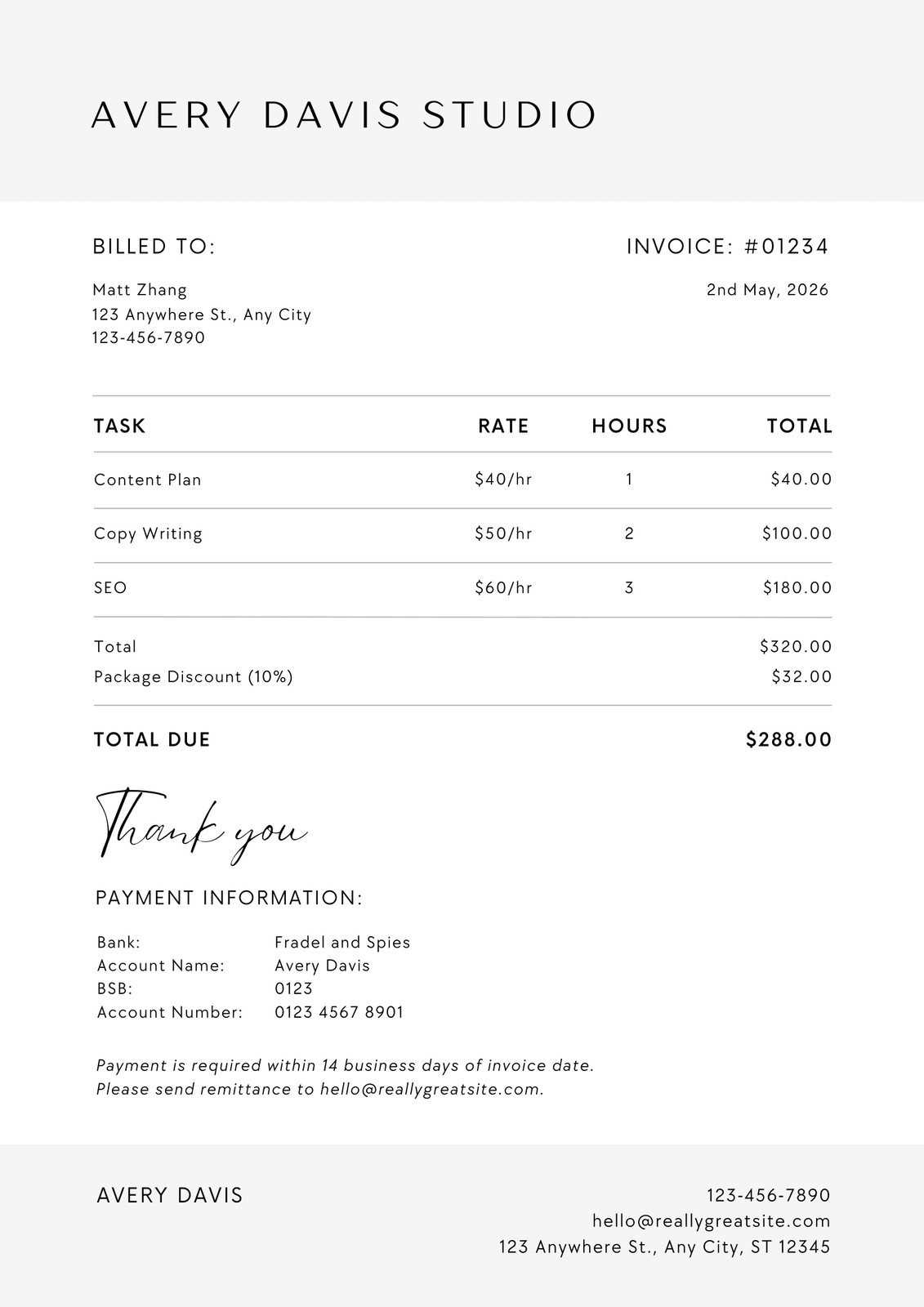

1. Use Pre-designed Formats: The fastest way to create a professional document is by starting with a ready-made format. Choose a customizable document that you can easily adjust with your business details and client information. These formats already include necessary sections, such as service descriptions, payment terms, and total amounts due, reducing the need for manual setup.

2. Automate Calculations: If your billing involves complex calculations or multiple services, use a spreadsheet or software that can automatically calculate totals, taxes, and discounts. This reduces human error and speeds up the process. You can simply input the service details, and the system will handle the rest.

3. Pre-fill Common Information: For frequent clients, set up templates where you can save their details, such as name, address, and payment terms. This allows you to generate a new document in seconds without having to input the same information over and over again.

4. Choose Digital Tools: Online tools and software are incredibly helpful for quickly creating and sending documents. Many platforms allow you to create and send professional records with just a few clicks. They also integrate with payment systems, so clients can easily pay their bills directly through the document.

5. Review and Personalize: While speed is important, take a moment to ensure the document is complete and reflects the specifics of the transaction. Adding a personal note or adjusting the tone to fit your brand can make a big difference in how your clients perceive your professionalism.

By following these simple steps, you can efficiently produce high-quality billing records while saving valuable time. Whether you’re handling a few clients or managing a large volume of work, these strategies will help you stay organized and maintain a professional image in all your financial dealings.

Essential Information for Billing Documents

To ensure smooth transactions and avoid any misunderstandings, it is important to include all the necessary details in your billing documents. The information you provide helps both you and your client stay organized and clear about the services rendered and the payments due. Properly structured documents not only simplify the payment process but also reflect your professionalism.

Key Details to Include

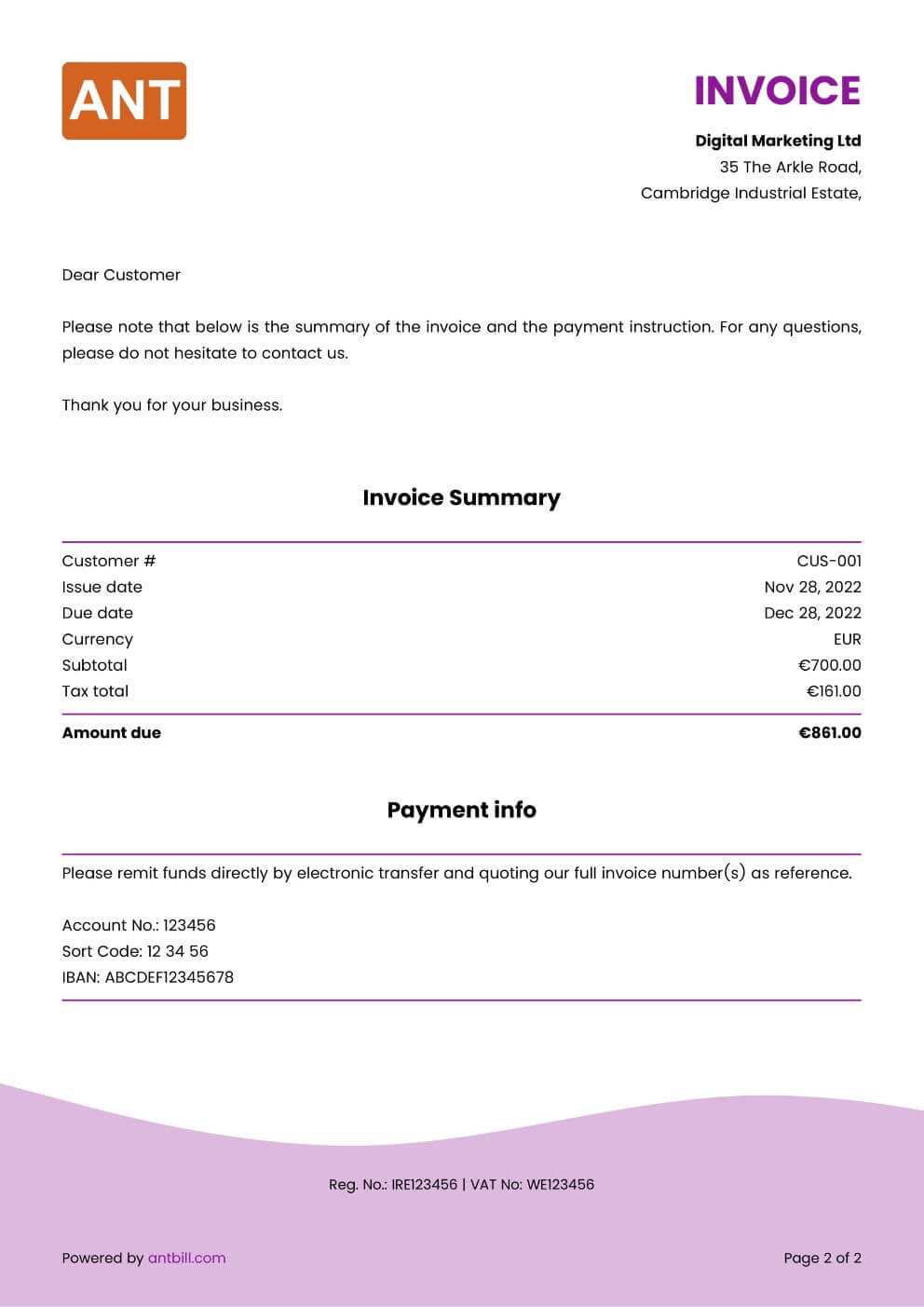

- Client’s Information: Always include the full name, address, and contact details of the client. This ensures that there is no confusion about who is responsible for the payment.

- Description of Services: Provide a detailed list of the work completed. This should include specific tasks, milestones, or products delivered, so the client can easily match the charges with the work performed.

- Dates: Include the date the work was completed and the payment due date. This helps set clear expectations for both parties and prevents delays in payment.

- Payment Terms: Clearly outline the payment method, due date, and any penalties for late payments. This helps avoid disputes and ensures the client understands the terms from the beginning.

- Amount Due: Provide an itemized breakdown of costs and the total amount due. This ensures transparency and helps the client understand exactly what they are paying for.

Additional Information to Consider

- Tax Information: If applicable, include tax rates or exemptions, along with the total tax amount, to stay compliant with regulations.

- Unique Identifiers: Adding an invoice or reference number helps both you and your client track the transaction more easily. It’s especially useful for larger businesses or recurring clients.

- Notes or Special Instructions: If there are any additional instructions or special offers, include them at the bottom of the document to keep the client informed.

Incorporating these essential details into your billing documents will help maintain clear communication, reduce the chance of errors, and ensure prompt payments. Whether you’re handling a single transaction or multiple clients, having this information organized in your document is key to a smooth and efficient billing process.

Benefits of Using a Billing Format

Using a pre-designed billing format offers a range of advantages that can significantly streamline the financial side of your business. With a structured document, you can avoid common errors, ensure consistency, and save valuable time. These formats provide an efficient way to keep track of transactions while maintaining a professional image, which is crucial for building trust with clients.

Time and Efficiency

- Speed: A pre-designed structure eliminates the need to start from scratch each time, allowing you to fill in the details quickly and efficiently.

- Consistency: Using the same layout for all your transactions ensures consistency, making it easier for both you and your clients to understand the details every time.

- Reduces Errors: With a structured format, you’re less likely to miss important information or make mistakes, especially when calculating totals or inputting client details.

Professionalism and Accuracy

- Polished Appearance: A well-organized document gives your business a professional image, helping to build credibility and trust with your clients.

- Clear Communication: When all necessary details are clearly laid out, there’s less room for confusion. Clients can easily see what they are being charged for and when the payment is due.

- Customizable for Your Needs: Pre-designed formats are often highly customizable, allowing you to adjust the layout, content, and branding elements to reflect your business style.

Ultimately, using a structured billing document helps you stay organized, save time, and present a polished image to your clients. It’s an easy way to improve your business operations and ensure you receive timely payments, all while maintaining professionalism in every transaction.

Choosing the Right Billing Document Format

Selecting the right format for your billing records is crucial to ensure smooth transactions and maintain a professional appearance. The right structure will make it easier to present your services, calculate totals, and communicate payment details clearly to your clients. Whether you’re a freelancer or a small business owner, choosing a format that suits your workflow and the specific needs of your clients will streamline the billing process and help you stay organized.

Factors to Consider

- Business Type: The nature of your work may influence the best format for your records. For example, creative professionals might benefit from a more flexible format that allows for detailed project descriptions, while service-based businesses may need something simpler and focused on hourly rates.

- Customization Options: Look for a format that offers customization options. You should be able to adjust the layout, add your branding, and tailor the content to each client or project.

- Ease of Use: The format should be user-friendly and allow you to quickly input information without unnecessary steps. Templates with auto-fill features or integrated calculation tools can save you time and reduce the chance of errors.

Choosing Between Digital or Physical Formats

- Digital Formats: If you prefer a faster, more efficient way to create and send documents, digital formats such as PDFs or online billing platforms are ideal. They allow for easy distribution and archiving, and some even integrate with payment gateways for seamless transactions.

- Physical Formats: If you need hard copies for specific clients or legal purposes, choose a format that is simple to print and still looks professional on paper. A well-organized, clear document will help reinforce the trust clients have in your business.

Ultimately, the right format for your billing documents depends on your unique business needs and the level of customization you require. By choosing wisely, you can ensure a smooth, professional experience for both you and your clients every time you send a payment request.

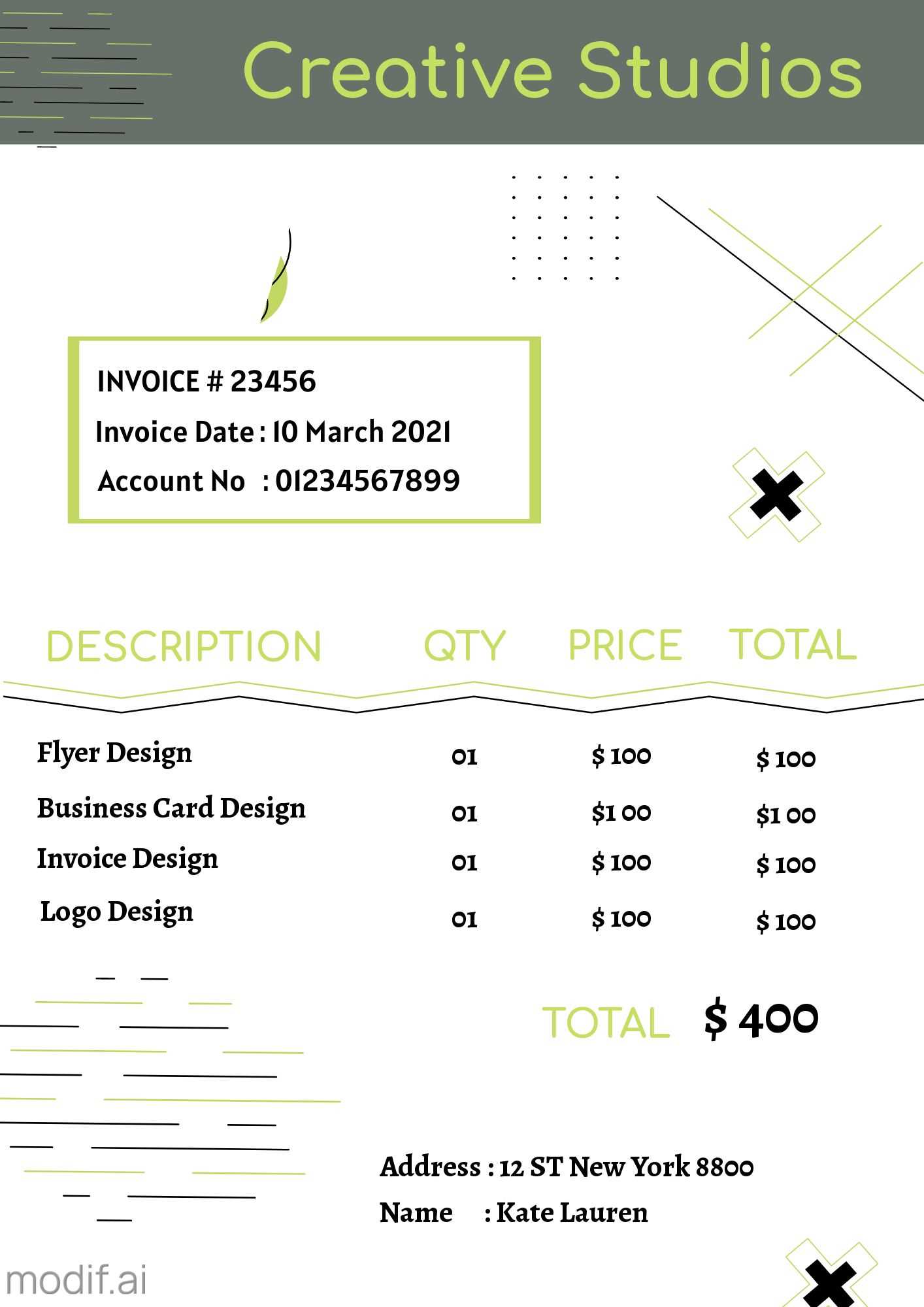

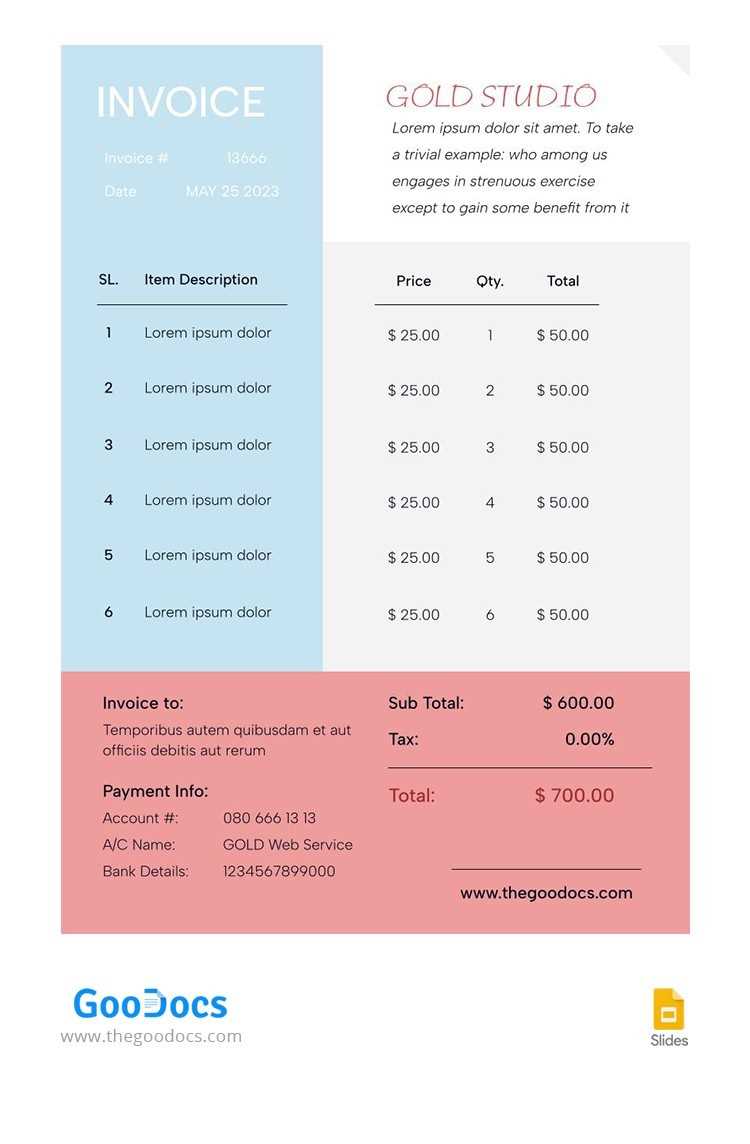

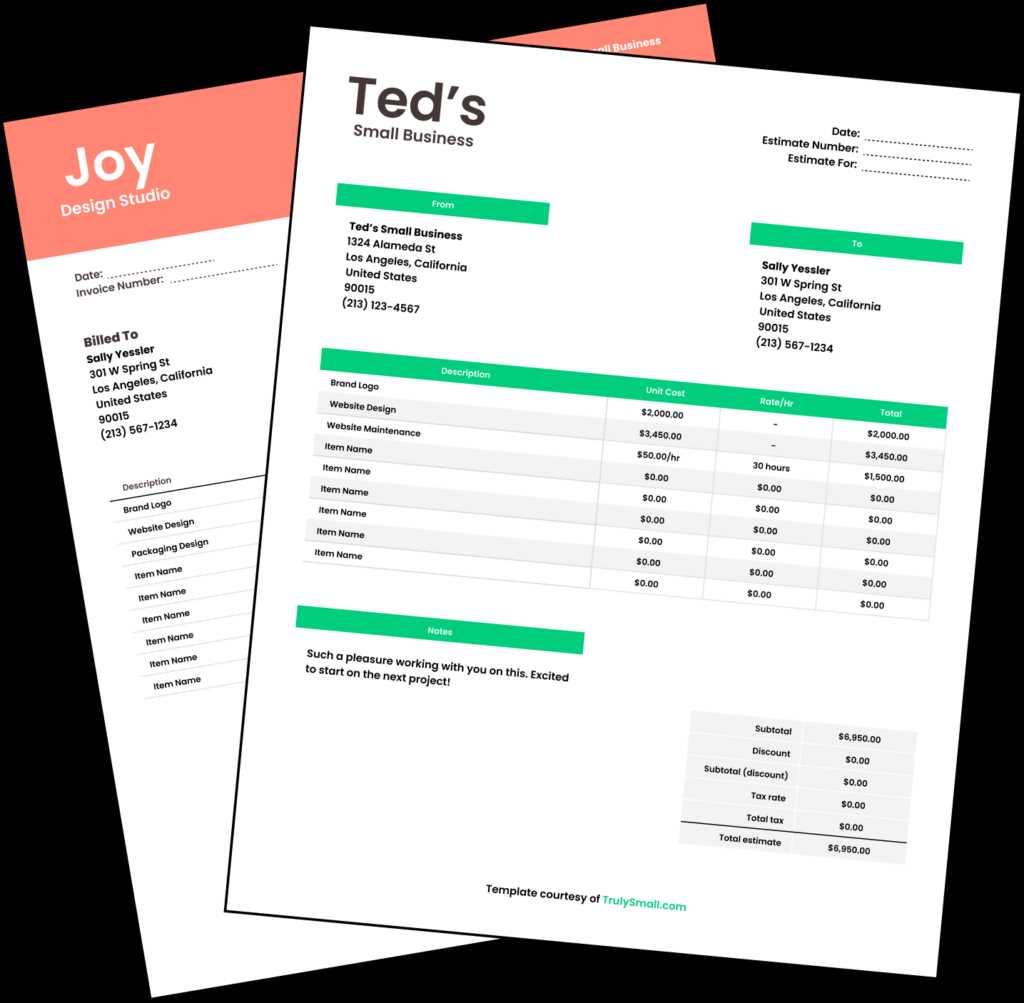

Free Billing Document Formats to Download

For businesses looking to streamline their payment requests, downloading a ready-made format can save significant time and effort. These free resources are designed to help you quickly generate professional documents without the need for creating one from scratch. Whether you need a simple layout or a more detailed structure, there are plenty of options available to suit various business types.

Where to Find Free Resources

- Online Platforms: Many websites offer free downloadable formats, often with customizable fields to suit your business needs. These are great for quick use and often come in popular formats like PDFs or Excel sheets.

- Accounting Software: Some accounting software offers free basic document formats as part of their free plans or trial versions. These can be a great option for businesses that want an all-in-one solution for managing finances.

- Business Resource Websites: There are many sites dedicated to providing free templates for various business needs. These often include specialized formats for different industries, such as creative services, consulting, or retail.

Types of Free Formats Available

- Simple Billing Documents: Basic, easy-to-fill formats that include sections for client details, service descriptions, payment terms, and totals.

- Detailed Records: These formats may include additional sections for tracking hours worked, expenses, taxes, and payment schedules, making them suitable for businesses with more complex billing needs.

- Branded Templates: Some downloadable formats allow you to add your company logo and colors, creating a personalized, professional look for your documents.

Downloading these free resources allows you to avoid the hassle of starting from scratch and ensures that you have the necessary details to create accurate and professional billing records. By taking advantage of these tools, you can save time and present your business in a more organized manner.

How to Add Taxes and Discounts

Incorporating taxes and discounts into your billing documents is an essential part of managing financial transactions. These adjustments help ensure that the final amount is accurate, reflecting both applicable taxes and any promotional offers or negotiated reductions. Adding these elements correctly not only helps with compliance but also provides transparency to your clients, making the process more efficient and professional.

1. Calculating Taxes: Depending on your location and the nature of your services, taxes may need to be added to the total amount due. The first step is to determine the applicable tax rate–whether it’s sales tax, VAT, or another type of levy. Once you know the rate, you can calculate the tax by multiplying the subtotal by the tax percentage.

Example: If the subtotal of your services is $500 and the tax rate is 10%, the tax would be $50 (500 x 0.10). The total amount due would then be $550.

2. Applying Discounts: Discounts can be applied either as a percentage or a fixed amount off the total. To apply a discount, subtract the discount value from the subtotal before calculating any taxes. This ensures that the tax is calculated on the reduced amount, which is more accurate and reflects the agreed-upon discount.

Example: If your subtotal is $500 and you offer a 20% discount, the discount amount is $100 (500 x 0.20), making the new subtotal $400. If taxes are applied at 10%, the tax is calculated on the $400, bringing the total to $440 ($400 + $40 tax).

3. Including Both on the Document: When adding taxes and discounts, it’s important to show both clearly on the billing record. Include a line item for the discount, noting the amount or percentage, and another line for the tax, specifying the rate. This breakdown provides transparency and ensures the client understands how the final total was calculated.

By accurately adding taxes and discounts, you can maintain fairness and professionalism in your transactions. It also helps clients understand the final cost clearly, making the entire process smoother and reducing the risk of confusion or disputes.

Common Mistakes in Billing Documents

When creating billing records, even small mistakes can lead to confusion, delays in payment, or misunderstandings with clients. These errors may seem minor, but they can have a significant impact on the smooth operation of your business. Avoiding common pitfalls ensures that your documents are clear, accurate, and professional, helping to maintain positive relationships with your clients.

Frequently Made Errors

- Incorrect Client Details: One of the most common mistakes is failing to input accurate client information, such as the name, address, or contact details. This can cause delays or confusion, especially if the client needs to reconcile the document with their own records.

- Missing Payment Terms: Not specifying payment terms can create uncertainty about when payment is due or the methods of payment accepted. This lack of clarity can lead to missed deadlines or delayed payments.

- Omitting or Miscalculating Taxes: Failing to add the correct tax rate, or neglecting to include taxes altogether, can lead to complications. Ensure that tax calculations are accurate and clearly stated to avoid misunderstandings with clients or tax authorities.

- Ambiguous Descriptions: Vague or overly general descriptions of the services rendered can cause confusion about what the client is actually paying for. Always provide clear, specific details to avoid any potential disputes.

How to Avoid These Mistakes

- Double-check all information: Before finalizing any document, take a moment to review all client details, service descriptions, and payment terms.

- Use a checklist: Create a checklist of necessary components–such as client information, service descriptions, taxes, and payment terms–before generating the document to ensure nothing is overlooked.

- Use a structured format: A well-organized, consistent format minimizes the risk of missing key elements and ensures that important information is easy to spot.

By being mindful of these common mistakes, you can create more reliable and professional billing records. Ensuring accuracy and clarity in your documents helps maintain trust and efficiency in your business transactions.

How to Ensure Accurate Billing

Ensuring accuracy in billing is essential for maintaining a professional relationship with clients and ensuring that your business receives timely payments. A small mistake, whether it’s a miscalculation, a missing detail, or incorrect terms, can cause confusion and delay payment. By following a few simple steps and adopting a careful approach, you can guarantee that your billing documents are clear, correct, and easy to understand.

1. Double-Check Client Details

It’s crucial to verify that the client’s name, contact information, and address are correct. An incorrect detail can cause the document to be sent to the wrong recipient or delay the processing of payments. Always ensure the information is up to date before finalizing the document.

2. Be Specific with Descriptions

When listing the services or products provided, be as detailed as possible. A vague description can lead to misunderstandings or disputes about what is being paid for. Break down complex services into clear, easy-to-understand items, including quantity, rate, and total amount.

3. Use Automatic Calculations

Whenever possible, use software or digital tools that automatically calculate totals, taxes, and discounts. This reduces the risk of human error and ensures that the numbers match the services provided. Using a consistent format will also make it easier to identify errors if they do occur.

4. Review Payment Terms

Clarify the payment method, due date, and any late fees in the document. Clearly stating these terms upfront avoids confusion and helps ensure timely payment. Be sure to use precise language regarding late fees and discounts, if applicable.

5. Implement a Consistent System

Develop a standardized process for creating billing documents. Using the same format every time ensures that you don’t overlook any essential details. A consistent structure also allows both you and your clients to quickly recognize and verify key information.

Best Practices for Accurate Billing

- Keep track of all services and products provided in an organized way to avoid forgetting any details.

- Always ensure the correct tax rates are applied, taking into account any regional or business-specific requirements.

- Make use of professional billing software or online platforms to automate and streamline the p

Managing Payments with Billing Documents

Efficient payment management is crucial for maintaining healthy cash flow and strong client relationships. Properly managing your payment requests ensures you get paid on time, reduces disputes, and keeps your financial records accurate. By using well-structured payment records, you can create clear expectations with clients and streamline the entire process from issuing the request to receiving the payment.

Key Steps in Managing Payments

- Set Clear Payment Terms: Always outline payment terms in the document, including due dates, acceptable payment methods, and any late fees. This transparency helps clients understand when and how to pay.

- Follow Up on Outstanding Payments: Track due dates and follow up on overdue payments in a timely manner. Polite but firm reminders help ensure clients don’t forget about outstanding balances.

- Offer Multiple Payment Methods: Allow clients to pay via various methods such as bank transfer, credit card, or online payment platforms. The more flexible you are, the easier it is for clients to pay promptly.

- Keep Detailed Records: Maintain a clear record of all payments, including partial payments, to avoid confusion. This can be easily tracked using a payment management system or an organized spreadsheet.

Example Payment Breakdown

Below is an example of how to track payments effectively in your billing records:

Service Amount Paid Outstanding Consultation $500 $500 $0 Design Work $700 $400 $300 Project Management $300 $300 $0 Total $1500 $1200 $300 In this example, the client has partially paid for the design work, with $300 still outstanding. By keeping track of these details, you can quick

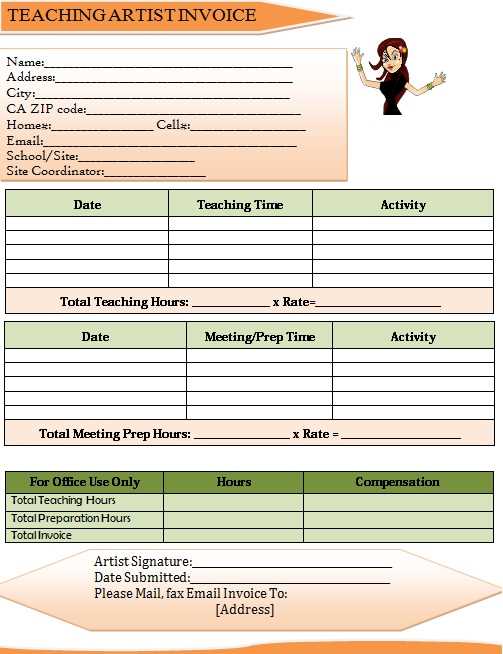

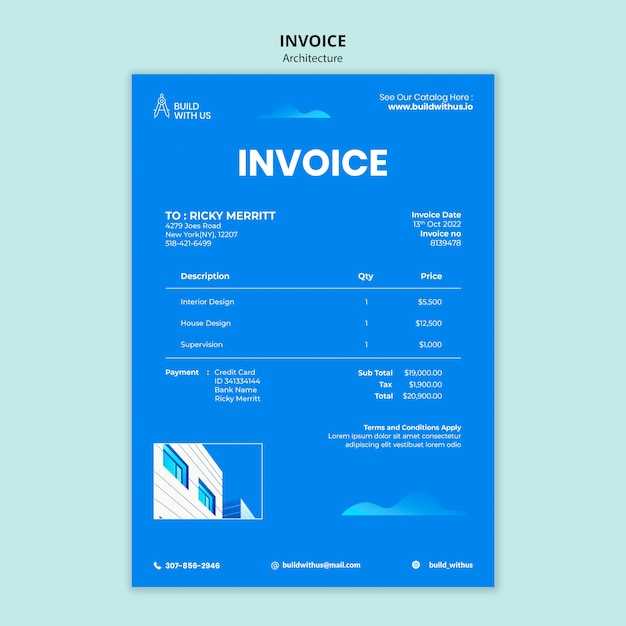

Billing Documents for Different Business Types

Each business operates differently, and the needs for payment records can vary significantly depending on the type of services offered. Whether you are providing creative work, consulting, or technical services, tailoring your payment records to reflect the specifics of your industry is essential. Different types of businesses often require distinct formats to accurately capture the details of their transactions and ensure both clarity and professionalism in financial dealings.

Creative and Artistic Services

For businesses offering creative or artistic services, such as design, photography, or video production, payment records need to clearly outline the scope of the project, the hours worked, or the deliverables provided. These records should also include any licensing fees, rights transfers, or additional services such as revisions or consultation hours.

- Itemized Service Descriptions: Clearly break down the work done, such as number of hours, type of service, and specific deliverables.

- Licensing and Rights: If applicable, include any licensing fees or intellectual property rights transfers.

- Revisions and Additional Charges: Make sure to list any additional work or changes requested by the client and their associated costs.

Consulting and Professional Services

For consulting or other professional services, billing records need to reflect the scope of advisory work provided, with an emphasis on time spent, hourly rates, and any expenses incurred. Payment requests in these sectors often include detailed descriptions of the services rendered, such as research, planning, or strategy development, to ensure both parties are aligned on the value delivered.

- Time-Based Billing: If billing by the hour, include a breakdown of the time spent on each task or project phase.

- Expense Reimbursement: If applicable, include a section for reimbursable expenses, such as travel or materials.

- Clear Payment Terms: Specify payment terms, including rates, due dates, and any penalties for late payments.

Technical or Product-Based Services

For businesses offering technical or product-based services, such as software development, engineering, or construction, payment records typically need to include detailed lists of products, services, and any milestone-based payments. It’s important to break down the costs clearly for each stage of a project, especially if it spans multiple phases or includes different products or deliverables.

- Milestone Payments: Clearly define payment schedules based on project phases or deliverable completion.

- Product Breakdown: For businesses selling physical or digital products, include detailed descriptions of each item or service sold.

- Warranty and Support: If applicable, include any ongoing support or warranty details in the billing document.

Understanding the unique needs of your business type allows you to create payment records that not only streamline the payment process but also ensure both parties are on the same page about the work comple

Automating Billing for Efficiency

Automation can greatly enhance the efficiency of managing payment requests, saving time, reducing errors, and improving cash flow. By using automated systems for generating and sending payment records, businesses can streamline the process and ensure that billing is consistent, accurate, and timely. Automation tools can handle repetitive tasks such as calculations, record-keeping, and reminders, allowing business owners to focus more on their core operations.

1. Time-Saving Automation

Automating the creation of payment records eliminates the need to manually input data for each client. By setting up a system that automatically pulls information from your customer database and project management tools, you can generate accurate and consistent billing documents with minimal effort. This not only saves time but also minimizes human error.

2. Consistency and Accuracy

Automation ensures that all necessary details, such as payment terms, tax rates, and service descriptions, are included every time. This consistency reduces the risk of forgetting key elements that could lead to misunderstandings or disputes. Additionally, automatic calculations for taxes, discounts, and totals ensure that numbers are always correct.

3. Streamlined Reminders

One of the most beneficial aspects of automation is the ability to send reminders to clients about upcoming or overdue payments. Automated systems can be programmed to send emails or notifications on a scheduled basis, reducing the need for manual follow-ups. This helps ensure that payments are made on time, improving your cash flow and reducing administrative work.

Tools for Automating Billing

There are several tools and platforms available that can help automate the process of managing billing records. Some popular options include:

- Accounting Software: Tools like QuickBooks, FreshBooks, and Xero allow you to automate billing, send payment reminders, and generate reports on payment statuses.

- Payment Platforms: Platforms such as PayPal, Stripe, and Square offer automated invoicing features that integrate with your business website, making it easy to send and receive payments.

- CRM Systems: Customer relationship management tools, such as HubSpot or Zoho, can store client information and automatically generate billing records based on data from ongoing projects or contracts.

By adopting automation, businesses can not only speed up the billing process but also improve overall efficiency, reduce errors, and enhance the customer experience. Whether you’re a freelancer, a small business owner, or running a larger operation, automating your payment requests can help save valu

How to Track Outstanding Payments

Effectively tracking unpaid bills is crucial for maintaining a steady cash flow and avoiding potential financial issues. Keeping a clear record of all pending payments ensures that you can follow up with clients promptly and avoid delays. By organizing and regularly reviewing your records, you can stay on top of outstanding balances and take timely action when needed.

1. Keep Detailed Records

Accurate record-keeping is the foundation of tracking unpaid balances. Ensure that every payment request includes the correct details such as client information, services rendered, amounts due, and payment terms. This allows you to quickly identify which clients have outstanding balances and the total amount owed.

2. Use a Payment Management System

A dedicated payment management system or software can help streamline the process of tracking unpaid balances. Many tools provide features like automated payment reminders, overdue alerts, and detailed reports to help you monitor your cash flow. These systems can also generate up-to-date status reports on which payments have been made and which are pending.

3. Regularly Review Your Records

Regularly checking your financial records ensures that no payment goes unnoticed. At the end of each week or month, take the time to go through all outstanding amounts and check whether any payments have been received or are overdue. This proactive approach prevents issues from piling up.

Example of Tracking Outstanding Payments

Here’s an example of how to track outstanding payments in a structured way:

Client Amount Due Due Date Status John Doe $500 2024-09-30 Paid Jane Smith $750 2024-10-10 Outstanding ACME Corp. $1200 2024-09-25 Outstanding Total Outstanding $1950 In this example, you can quickly identify which clients have unpaid balances and their corresponding amoun