Student Invoice Template for Simple Billing and Payment Management

Managing payments and keeping track of financial transactions is a crucial task for anyone providing educational services. Having a well-structured method for documenting charges ensures clear communication with clients and helps avoid misunderstandings. By utilizing organized billing documents, both service providers and recipients can stay on top of payment schedules and amounts due.

Customizable billing documents offer flexibility and can be easily tailored to suit various needs. Whether you’re working with individuals or groups, a clear and professional approach to charging is essential for maintaining trust and efficiency. These documents help outline services rendered, payment terms, and due dates, ensuring both parties are aligned.

Utilizing a structured approach to financial tracking not only saves time but also contributes to a more professional appearance. With the right tools, managing transactions can become a smooth and seamless part of the administrative process.

Student Invoice Template Guide

Creating clear and organized billing documents is essential for anyone offering educational services. These records serve as a formal way to outline the charges for services rendered and to ensure that both parties understand the financial expectations. A well-designed billing structure helps facilitate smooth transactions and promotes transparency between the provider and the client.

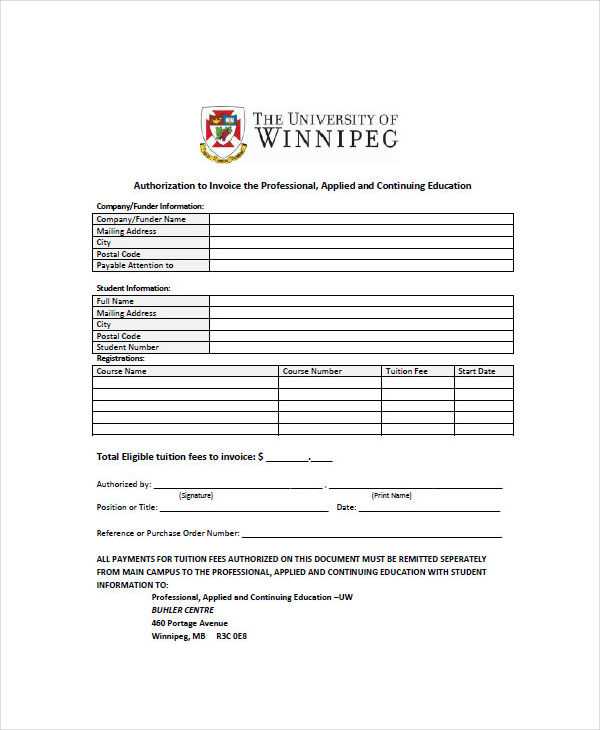

To create an effective billing document, it is important to include key details such as the services provided, the payment amount, the payment due date, and any additional terms. Customizable formats make it easy to adjust the layout and content, ensuring that each document meets specific needs while maintaining professionalism.

Simple yet detailed records offer a solution for both parties to track payments, manage outstanding balances, and maintain financial clarity. With the right approach, these documents not only simplify the administrative side of providing services but also help to establish trust and accountability with clients.

What is a Student Invoice Template

A well-structured billing document serves as an essential tool for individuals or organizations that provide educational or tutoring services. It acts as a record to outline the charges for the services offered, ensuring that both the service provider and the recipient are aligned on the financial terms. Such documents include critical information such as payment amounts, deadlines, and service details.

Typically, these records follow a specific format, making it easier for both parties to understand and process the information efficiently. A standardized format can save time and effort, allowing service providers to focus on their work rather than worrying about the complexities of billing.

| Details | Description |

|---|---|

| Service Provided | Clear description of the work or courses rendered. |

| Amount Due | Total cost for the services delivered. |

| Due Date | The specific date by which payment should be made. |

| Payment Method | Details about how payment can be made (e.g., bank transfer, PayPal). |

These documents not only ensure clarity but also promote professionalism in financial exchanges, helping to maintain positive relationships between service providers and clients.

Benefits of Using a Student Invoice

Utilizing a well-organized billing document provides numerous advantages for both service providers and clients. It ensures that all financial transactions are clearly outlined, minimizing misunderstandings and promoting trust. These records help track payments, manage outstanding balances, and maintain financial order throughout the entire process.

Improved Organization

By using structured records, service providers can easily manage multiple clients and payments without confusion. Customizable formats allow for quick adjustments and consistent documentation, saving time on administrative tasks. This level of organization leads to fewer errors and more efficient business operations.

Professionalism and Clarity

Presenting a polished and clear billing document helps build credibility and demonstrates professionalism. It establishes transparent terms for both the provider and the recipient, making it easier to resolve any disputes if they arise. This level of clarity ensures that both parties understand the expectations and obligations involved in the financial exchange.

Overall, using these tools enhances communication, fosters positive relationships, and supports timely payments, making financial management a smoother experience for all parties involved.

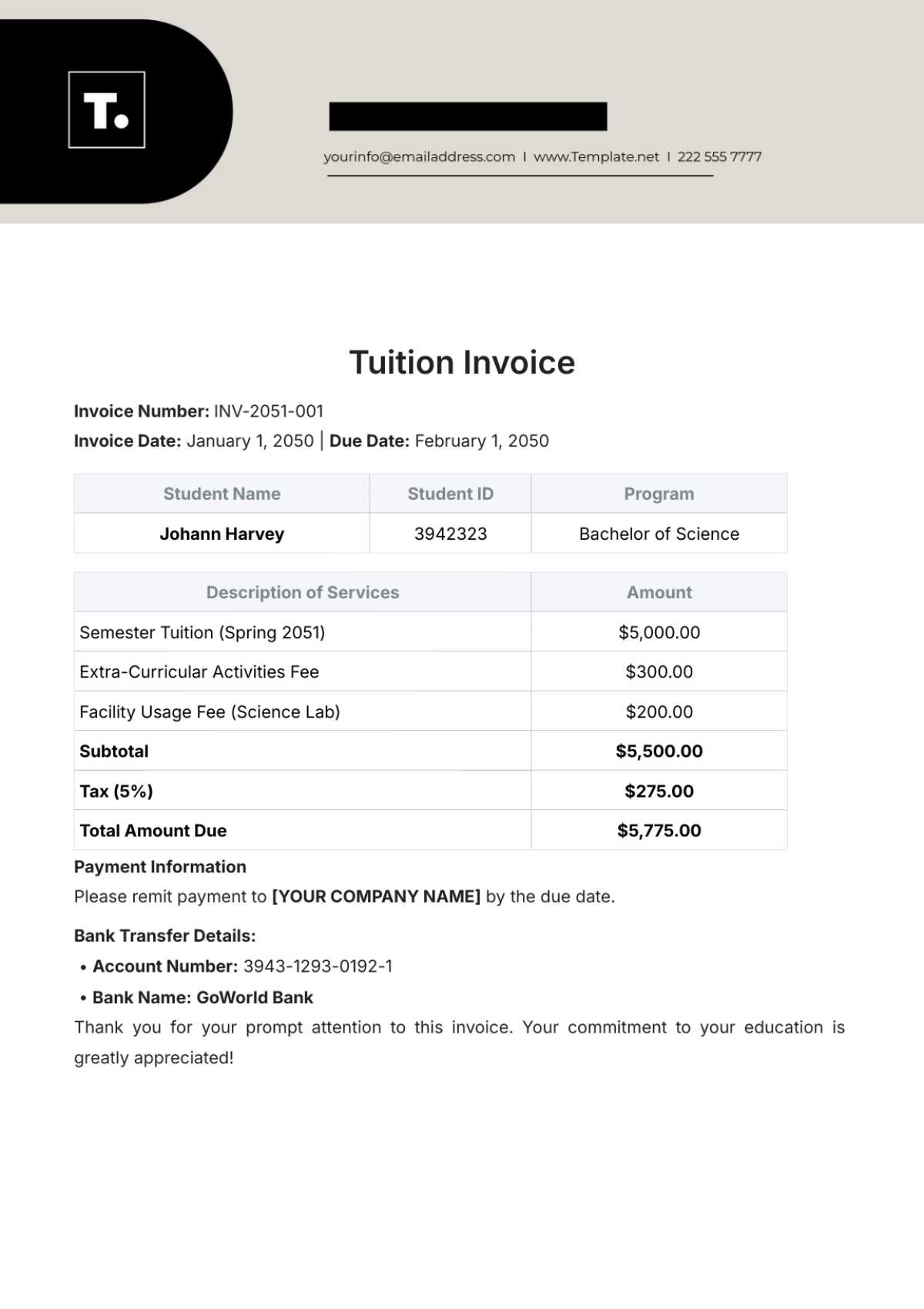

How to Create a Student Invoice

Creating an organized billing document is a straightforward process that helps ensure all financial details are communicated clearly. By including the right information and following a consistent format, you can avoid confusion and maintain professionalism. Here’s a step-by-step guide to creating a well-structured record for services rendered.

Step 1: Include Essential Information

Start by listing key details such as the service provided, the amount due, and the due date. It’s also important to include contact information for both the service provider and the recipient, as well as any relevant terms or conditions. These elements form the foundation of your document and help ensure both parties are aligned on expectations.

Step 2: Use a Clear and Readable Format

Choose a layout that is easy to read and professional. Break the document into sections like services rendered, total amount due, and payment instructions. You may also include any additional notes that help clarify payment methods, deadlines, or penalties for late payments. A well-organized document makes it easier to track and follow up on payments.

By carefully including all necessary details and following a logical structure, you can create a reliable and efficient billing document that benefits both the provider and the client.

Essential Information for a Student Invoice

To ensure clear communication and avoid misunderstandings, it is important to include all the necessary details when creating a billing record. A well-structured document should provide both the provider and the recipient with key information related to the services, payment terms, and deadlines. This clarity helps both parties stay organized and aligned throughout the financial transaction.

Key details to include:

- Contact Information: Include the full name, address, and contact details for both the provider and the recipient.

- Description of Services: Clearly outline the work completed or services provided, including dates or hours worked if applicable.

- Amount Due: Specify the total amount to be paid for the services rendered, including any applicable taxes or fees.

- Due Date: Clearly state the date by which the payment must be made to avoid any late fees or complications.

- Payment Instructions: Provide clear guidance on how the payment should be made, such as bank transfer, online payment system, or check.

Including all this information in a clear, organized format ensures that both parties are fully aware of their financial obligations and responsibilities, fostering professionalism and trust.

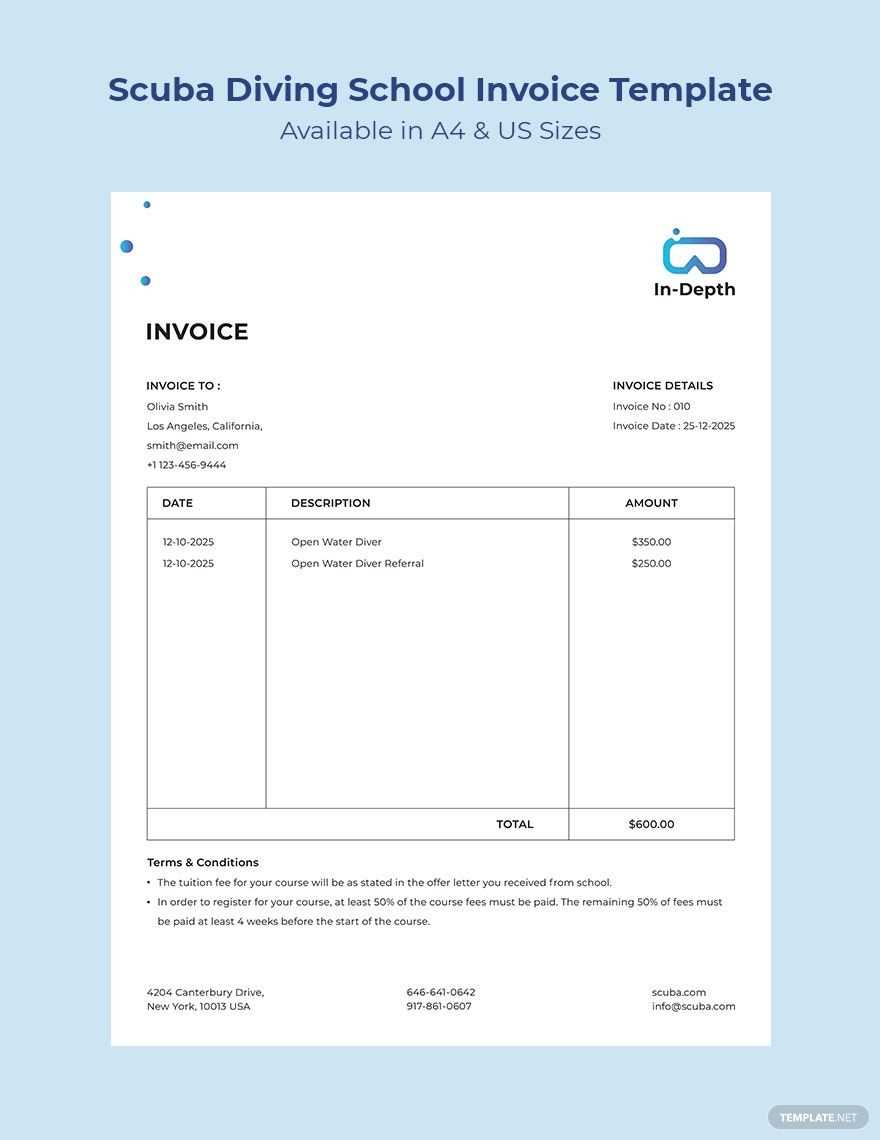

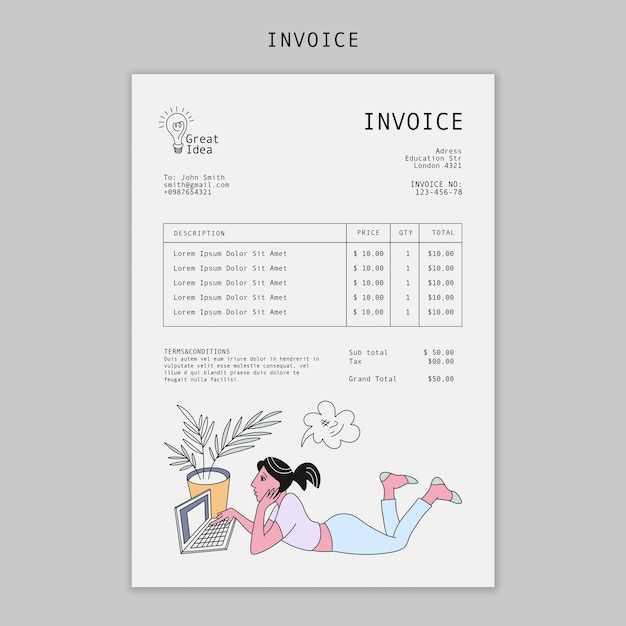

Customizing Your Student Invoice Template

Tailoring a billing document to suit your specific needs can significantly improve both its functionality and appearance. Customization allows you to add or remove sections, adjust the layout, and highlight important information. A personalized approach ensures that your records are not only effective but also reflect your unique style or business requirements.

When customizing your billing record, consider the following key elements:

- Design and Layout: Choose a clean, easy-to-read format. Consider adding your logo, using distinct headings, and keeping the sections well-spaced for clarity.

- Service Details: Adjust the section for describing services rendered, depending on the complexity. You can add multiple line items, descriptions, or specific dates if necessary.

- Payment Instructions: Tailor this section to your preferred payment methods, such as online payment portals or bank transfer details. Be clear and concise about the steps needed to complete the payment.

- Terms and Conditions: If applicable, include specific terms such as late fees, payment deadlines, or other policies that help protect both parties.

- Additional Notes: Add any other information that may be relevant to your clients, such as thank-you messages or upcoming service availability.

By adjusting these elements, you create a document that not only serves its functional purpose but also aligns with your personal or business branding and client communication style.

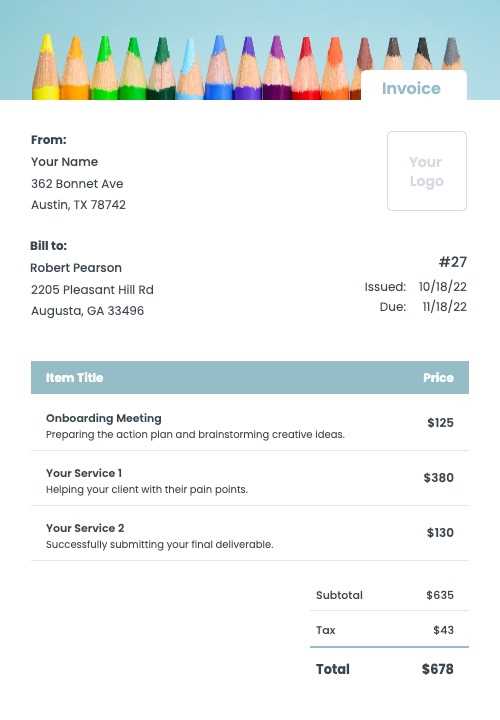

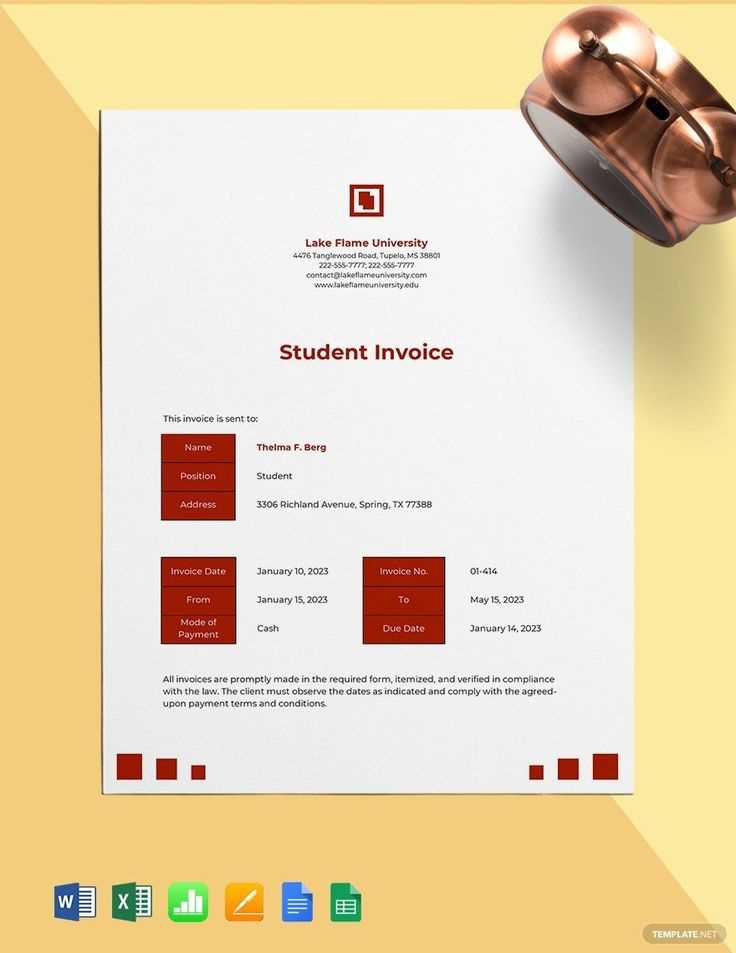

Free Student Invoice Templates to Use

There are many resources available online offering free and customizable billing documents. These resources are designed to save time and effort, allowing service providers to easily generate professional records without starting from scratch. Whether you’re working on a one-time project or need a long-term solution, these free options offer flexibility and convenience.

Online Platforms Offering Free Templates

Several websites offer downloadable or editable billing records that can be tailored to meet your specific needs. These platforms often provide both basic and advanced versions, allowing you to choose a layout that best suits your business style. Some even offer integrated tools for tracking payments and sending reminders, making the entire process smoother.

Benefits of Using Free Templates

By using these free resources, you can:

- Save time: No need to design your own document from scratch.

- Maintain professionalism: Choose from a variety of polished, ready-made formats.

- Ensure accuracy: Templates are structured to include all essential elements, reducing the risk of missing important details.

- Flexibility: Many templates allow for easy customization to match your service offerings and payment methods.

Using free templates not only streamlines the billing process but also ensures that all financial transactions are documented clearly and professionally.

Why Use Templates for Student Billing

Utilizing pre-designed documents for billing purposes offers numerous advantages, especially for individuals or organizations providing educational services. These ready-made formats streamline the process, ensuring consistency and reducing the likelihood of errors. Templates can simplify record keeping, improve professionalism, and save valuable time, allowing you to focus more on providing services.

Efficiency and Consistency

Using a standardized document ensures that all necessary information is included, making the billing process faster and more reliable. These records follow a clear structure, which reduces the chances of leaving out important details such as payment terms or service descriptions.

Professional Appearance

With a pre-designed document, you can present a polished and professional look to your clients, enhancing trust and improving your business image. These formats are designed to be both functional and aesthetically pleasing, reflecting your attention to detail.

| Advantages | Description |

|---|---|

| Time-Saving | Pre-made documents reduce the time spent creating billing records from scratch. |

| Accurate Records | Templates ensure that all relevant information is captured correctly every time. |

| Customizable | These documents can be easily adapted to suit specific service offerings or payment terms. |

By using these ready-to-use documents, you can ensure a smooth and organized billing process, which contributes to the overall efficiency of your business operations.

How to Send Student Invoices

Effectively delivering billing records is an essential part of maintaining clear communication with clients. The method of sending these documents can impact how promptly payments are made and whether any misunderstandings arise. By selecting the right approach and ensuring the recipient has all the necessary details, you can streamline the entire process.

Choosing the Right Delivery Method

There are several options available for sending billing documents, each suited to different needs. You can choose to send them via email, postal mail, or through online payment platforms. While email is the most common and fastest method, using online payment systems can also simplify the payment process by integrating it with the billing record.

Important Steps Before Sending

Before sending the document, verify that all the necessary details are included and accurate. Double-check the payment amount, due date, and recipient contact information to avoid any potential issues. If you’re sending a digital version, consider saving it as a PDF to preserve formatting and prevent accidental alterations.

Once ready, ensure the document is clearly named (e.g., “Billing Record for [Service]”) and send it through your chosen method, providing clear instructions for payment.

By following these steps, you can ensure a smooth transaction process and minimize delays in receiving payments.

Managing Payments with Student Invoices

Efficiently managing payments is crucial for maintaining smooth financial operations. By keeping track of outstanding balances, payment dates, and terms, you ensure that no payments are missed and clients are aware of their obligations. Proper management of these records also helps in resolving any payment-related issues quickly and effectively.

Tracking Payment Status

It is important to keep track of whether payments have been made, are pending, or overdue. One way to do this is by using a digital system or spreadsheet to monitor the payment status for each client. This allows you to easily follow up on outstanding payments and ensure that no one falls behind.

Setting Payment Terms

Clearly outlining the payment terms in the billing document is essential for both parties. Specify the payment methods, due dates, and any late fees that may apply. By being transparent about terms from the beginning, you reduce the chances of confusion and ensure that clients know exactly what is expected of them.

Managing payments effectively involves more than just sending a document–it requires keeping detailed records and ensuring both clarity and consistency throughout the process.

Common Mistakes in Student Invoices

While preparing billing records, it’s easy to overlook important details that could cause confusion or delays in payment. Making sure that all essential information is included and correctly formatted is crucial. Common mistakes can lead to misunderstandings, missed payments, and frustration for both parties.

Frequent Errors to Avoid

- Incorrect Payment Details: Always double-check payment methods, bank account numbers, or online payment details. Mistakes in these areas can cause delays in receiving payments.

- Missing Due Dates: Ensure that the due date is clearly stated and easy to find. Lack of this information may cause unnecessary delays and confusion regarding when payment is expected.

- Ambiguous Descriptions of Services: Provide clear and detailed descriptions for each service provided. Vague or unclear entries may cause clients to question the charges.

- Omitting Taxes or Fees: If applicable, don’t forget to include taxes or additional fees. These should be clearly listed to avoid discrepancies later.

- Failure to Include Contact Information: Make sure your contact details are up-to-date and visible. Clients should have a way to reach out for questions or clarifications.

How to Prevent These Mistakes

To avoid these common mistakes, it’s best to carefully review each document before sending it. Utilize checklists or software tools designed to ensure all required information is included. Regularly updating your billing process and paying attention to detail will help maintain professionalism and efficiency.

By being thorough and proactive, you can avoid these errors and ensure a smooth and professional transaction process.

Tracking Payments with Invoice Templates

Managing and monitoring payments is essential for ensuring that all financial obligations are met on time. By using pre-designed records, you can efficiently track which payments have been received, which are pending, and which are overdue. This level of organization helps prevent confusion and delays in transactions.

| Payment Status | Action |

|---|---|

| Pending | Send a reminder email or a follow-up call to encourage timely payment. |

| Paid | Mark as paid and confirm receipt with the client to maintain transparency. |

| Overdue | Implement a late fee policy or contact the client to resolve the delay. |

Tracking payments becomes easier with organized records. Including columns for payment dates, amounts, and payment methods helps ensure that all transactions are properly documented. This allows for quick reference when following up or generating financial reports.

By using a consistent format for payment tracking, you can stay on top of your financial records and ensure that all payments are processed smoothly.

Integrating Student Invoices with Accounting Tools

Connecting billing records to accounting software is a powerful way to streamline financial processes and improve accuracy. By automating data transfer, you reduce the chance of human error and simplify tasks such as tracking payments, generating financial reports, and managing taxes. Integration ensures that your billing system works in harmony with your accounting tools, saving time and effort.

Key Benefits of Integration

- Time-Saving Automation: Automatically sync billing information with accounting software, eliminating manual data entry and reducing errors.

- Accurate Financial Reports: Generate detailed financial statements and reports with up-to-date information pulled directly from your billing system.

- Improved Tax Management: Keep track of taxes on each transaction, ensuring that all applicable tax rates are correctly applied and documented.

- Seamless Payment Tracking: Monitor payments in real-time, making it easy to see which transactions are pending, completed, or overdue.

How to Integrate Billing with Accounting Tools

- Choose an accounting tool that supports integration with your preferred billing platform.

- Set up automatic syncing between your billing system and accounting software for real-time updates.

- Ensure that each transaction is categorized properly to help you track expenses, payments, and revenue accurately.

- Regularly update both systems to ensure compatibility and prevent data discrepancies.

By integrating billing records with accounting tools, you create a more efficient, error-free process that saves time and enhances financial oversight.

Improving Efficiency with Billing Records

Enhancing the efficiency of billing and payment tracking is essential for streamlining financial workflows. By using well-organized and automated systems, you can significantly reduce time spent on manual tasks, prevent errors, and maintain accuracy in your financial documentation. This process ensures a smoother experience for both service providers and clients, minimizing delays and miscommunication.

Key Strategies for Efficiency

- Automation: Implementing automated billing solutions can save time by reducing manual data entry and automatically sending reminders for payments.

- Standardized Formats: Using consistent formats for billing records ensures all necessary information is included, making it easier to track and manage transactions.

- Cloud Integration: Leveraging cloud-based systems allows for real-time updates and easier access to billing records, reducing the risk of lost or misplaced documents.

- Regular Reviews: Periodically reviewing and updating your billing system helps identify inefficiencies and areas for improvement, ensuring the process remains streamlined.

Benefits of Efficient Billing Practices

- Time Savings: Automated systems reduce the time spent on administrative tasks, freeing up time for other important activities.

- Reduced Errors: Standardized formats and automated processes minimize the risk of human error in calculations and data entry.

- Faster Payments: Clear and efficient systems lead to quicker payment processing, ensuring timely compensation for services rendered.

- Better Organization: Improved documentation and tracking make it easier to manage finances and prepare for audits or tax reporting.

By optimizing the billing process, you can create a more efficient, reliable, and time-saving system that benefits both providers and clients alike.

Legal Aspects of Billing Records

Understanding the legal considerations involved in creating and managing billing records is essential for ensuring compliance with local laws and regulations. Whether you’re providing educational services, freelance work, or any other type of service, it’s important to ensure that the financial documents you issue meet legal requirements. This helps protect both the service provider and the recipient in case of disputes or audits.

Essential Legal Information

- Clear Payment Terms: Include specific details about payment due dates, late fees, and accepted payment methods. This protects both parties and ensures there are no misunderstandings.

- Legal Language: Use proper legal language to avoid ambiguity. Phrases like “payable upon receipt” or “late payment fee” should be clearly defined.

- Tax Compliance: Ensure that the correct taxes are applied based on local regulations. Including tax details is crucial for compliance and proper financial reporting.

- Identification Information: Your document should include both your business or personal details (name, contact, and tax ID number) and the recipient’s information.

How to Ensure Legal Compliance

- Familiarize yourself with the local laws regarding financial documentation to ensure that your records are fully compliant with regulations.

- Use accurate accounting software or billing platforms that generate legally sound documents based on your jurisdiction’s requirements.

- Review each document before sending to ensure that it contains all the necessary legal and financial details required by law.

- Consult with a legal or financial expert to verify that your billing practices align with applicable laws and protect your business interests.

By taking these legal aspects into account, you can ensure that your financial records are both accurate and compliant, preventing potential legal issues down the road.

Best Practices for Billing Records

Creating accurate and professional billing documents is key to ensuring smooth financial transactions. By following best practices, service providers can maintain clear communication with clients, avoid disputes, and promote timely payments. Below are some essential practices to consider when preparing billing records.

Clear and Concise Information

- Detailed Descriptions: Always include a thorough description of the services or products provided, with clear breakdowns of pricing, quantities, and any applicable discounts.

- Accurate Contact Information: Ensure that both your business and the recipient’s contact details are accurate. This includes names, addresses, email addresses, and phone numbers.

- Due Dates and Payment Terms: Clearly state the payment due date, late fees, and any early payment discounts. This helps set expectations and ensures timely payments.

- Itemized Costs: Always itemize costs separately. This transparency helps clients understand what they are being charged for and reduces the risk of confusion.

Consistency and Professionalism

- Uniform Design: Use a consistent format and professional design for all billing records. This can enhance your brand image and ensure that your records are easy to understand.

- Regular Issuance: Establish a routine for issuing billing documents, whether weekly, monthly, or per project. Consistency can help maintain cash flow and avoid late payments.

- Follow-Up Communications: If payment deadlines are approaching or overdue, send polite reminders. Maintain professionalism when communicating with clients about payments.

By adhering to these best practices, you can streamline the billing process, reduce errors, and foster strong professional relationships with clients.