How to Create a Storage Invoice Template for Efficient Billing

For any business offering space rental or storage-related services, having a clear and organized billing process is essential. Managing payments, keeping track of customer transactions, and maintaining accurate records are all vital aspects of ensuring smooth operations and maintaining client trust. The use of a well-structured billing document can significantly simplify these tasks, reducing errors and enhancing professionalism.

By using a customizable billing document, you can easily adjust the details to suit the specific needs of your business. Whether you’re charging for short-term or long-term rentals, including extra fees, or offering discounts, a properly designed document will help you present the required information clearly and concisely. The right structure can also help you avoid mistakes, ensuring accurate amounts are charged and payments are tracked efficiently.

In this article, we’ll explore the key elements that make up an effective billing document for rental services. We will guide you through the essential components and offer practical tips for creating and managing these documents for your business. With the right tools and knowledge, you can streamline your billing process and focus on growing your operations.

Storage Billing Document Guide

When it comes to billing for rental or storage services, it’s crucial to have a reliable system in place to ensure clarity, accuracy, and efficiency. A well-organized document not only helps you communicate charges to your clients but also ensures that all necessary details are included for smooth financial tracking. This guide will walk you through the steps of creating a professional and effective document that meets the needs of both your business and your customers.

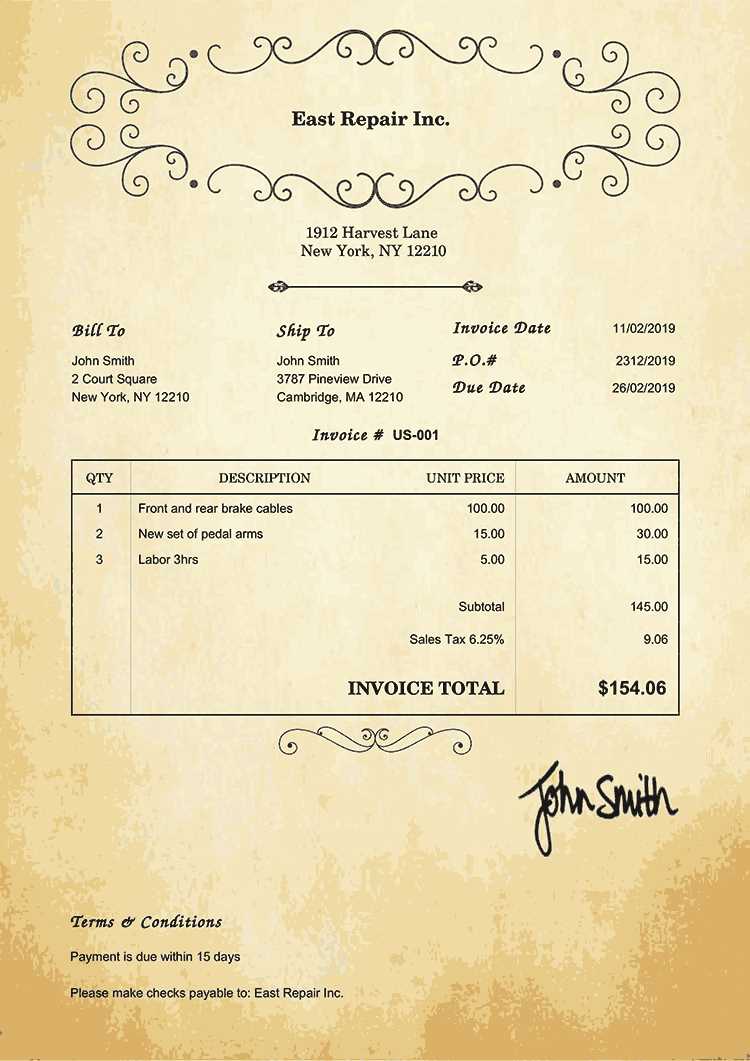

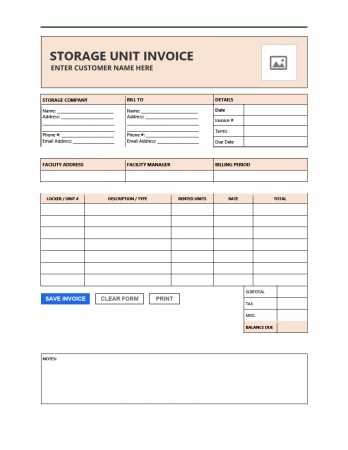

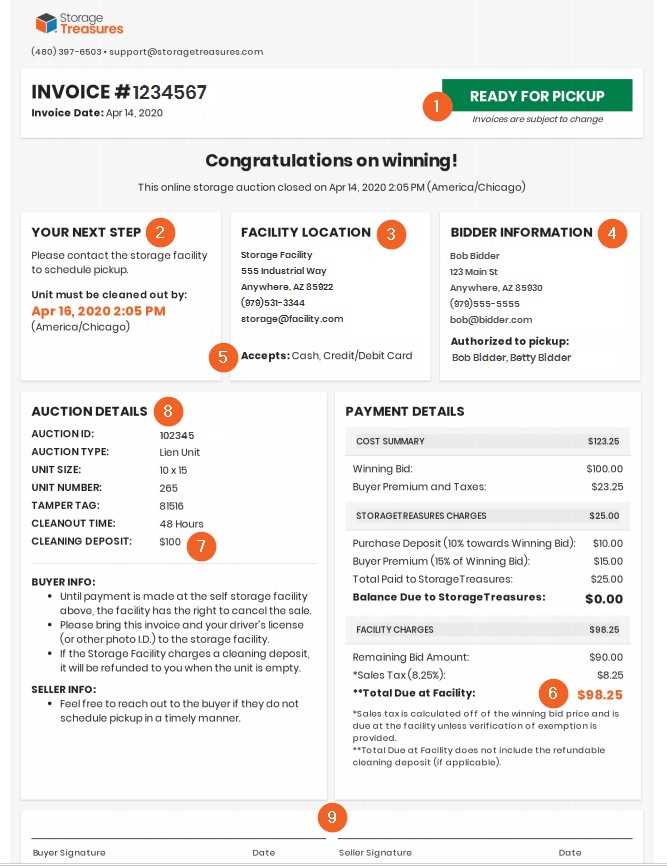

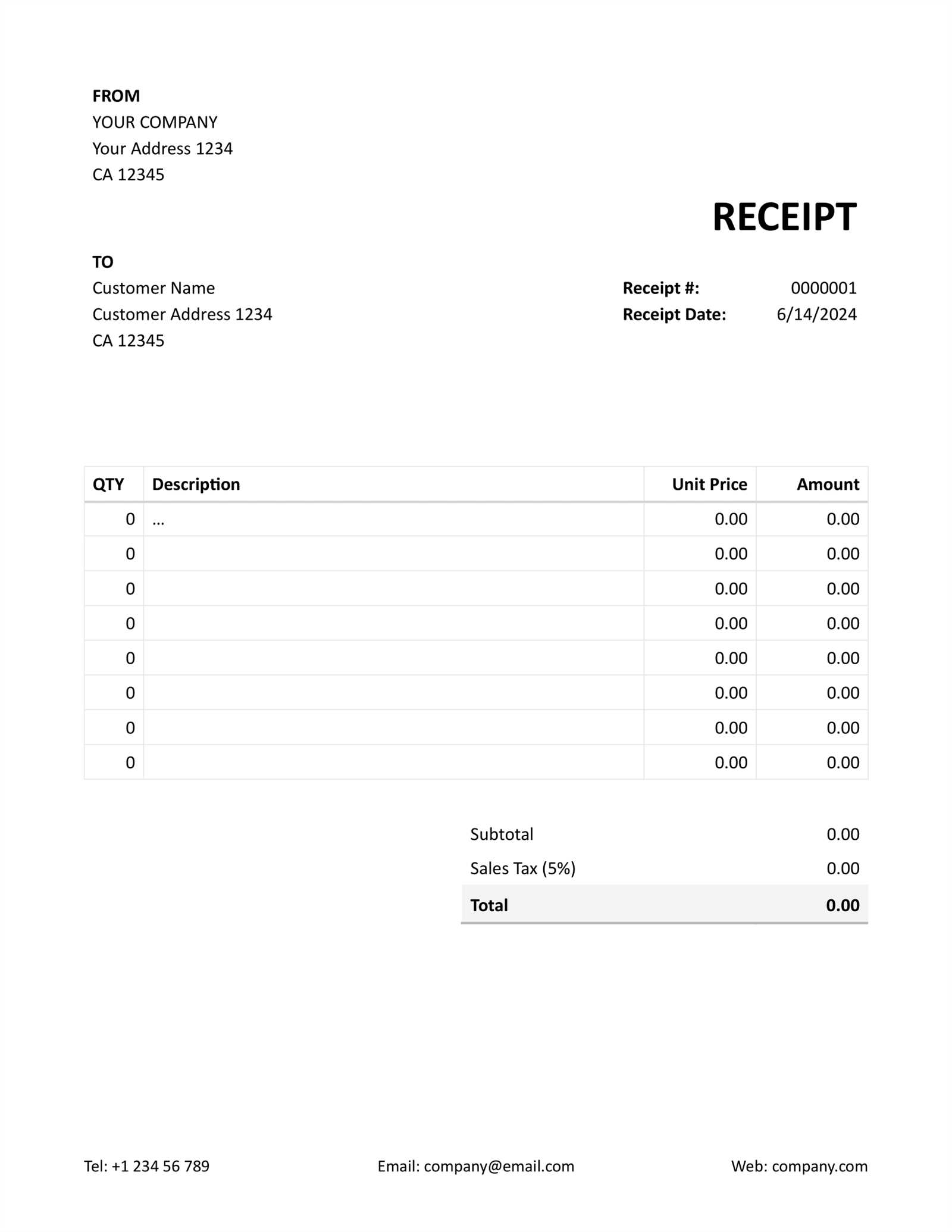

To create a functional billing document, start by considering the essential components that should always be included. These typically consist of the client’s name and contact details, service dates, description of the services provided, payment terms, and the final amount due. Additionally, customizing the layout of the document can make it more user-friendly, ensuring that all the important information stands out and is easy to read.

Understanding the importance of clear itemization can also be a game-changer. Whether you’re charging for space usage, additional services, or late fees, listing each charge separately helps customers understand exactly what they’re paying for. A transparent approach not only prevents disputes but also fosters trust and professionalism between you and your clients.

With the right format and detailed structure, your billing documents can be both an efficient tool for collecting payments and a way to maintain clear records for your business. By following these simple guidelines, you can create documents that are both functional and visually appealing, streamlining your financial processes and ensuring smoother client interactions.

Why You Need a Billing Document

When providing rental or space-related services, it is essential to have a clear method for requesting payment and tracking transactions. A well-structured billing document helps formalize the financial relationship between you and your customers, ensuring that both parties are on the same page regarding amounts due and services rendered. Having a professional, accurate record also protects your business and supports smooth operations.

Here are a few reasons why a proper billing document is indispensable for your business:

- Clarity and Transparency: A detailed document outlines all charges, ensuring that customers know exactly what they are paying for, including any additional fees or discounts.

- Legal Protection: A formal record of services rendered provides proof of the agreement, which can be important in case of disputes or audits.

- Professionalism: Providing a polished, standardized document shows your customers that you are organized and reliable, boosting their confidence in your services.

- Efficient Payment Tracking: A structured document makes it easier to monitor due dates and outstanding balances, helping you manage cash flow effectively.

- Tax Compliance: Proper documentation is essential for calculating and reporting taxes, ensuring your business stays compliant with local laws.

Having this kind of tool not only ensures that you are paid accurately and on time but also contributes to the overall efficiency of your business operations. By maintaining clear and organized records, you can avoid potential misunderstandings and streamline your financial processes.

Key Features of a Billing Document

Creating an effective billing document goes beyond simply listing amounts due. It requires including essential elements that provide clarity, transparency, and professionalism. These key components ensure that both the service provider and the customer have a mutual understanding of the transaction, helping to prevent misunderstandings and streamline the payment process.

Essential Information to Include

To ensure accuracy and completeness, your document should contain specific details that make the transaction clear. Key elements include:

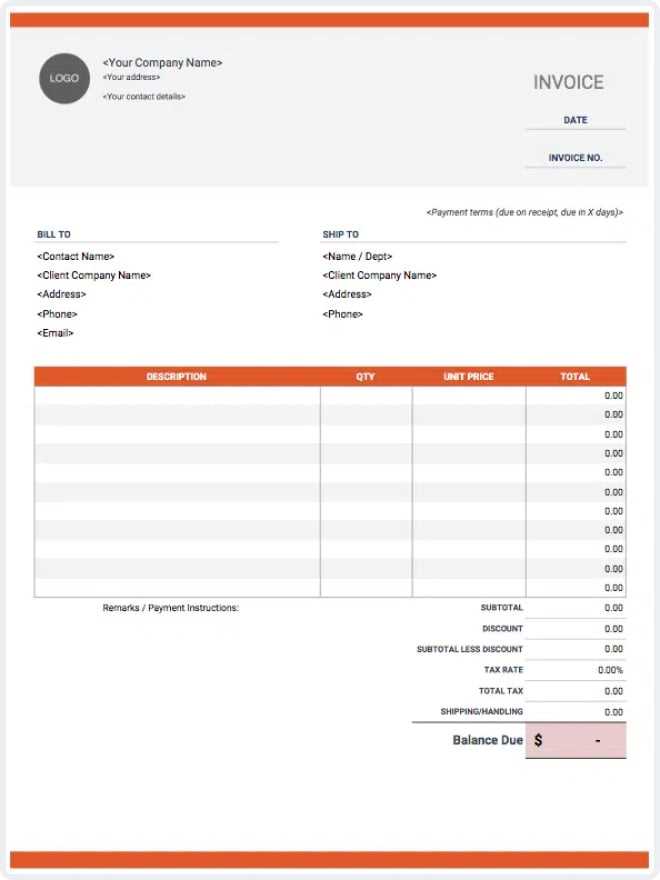

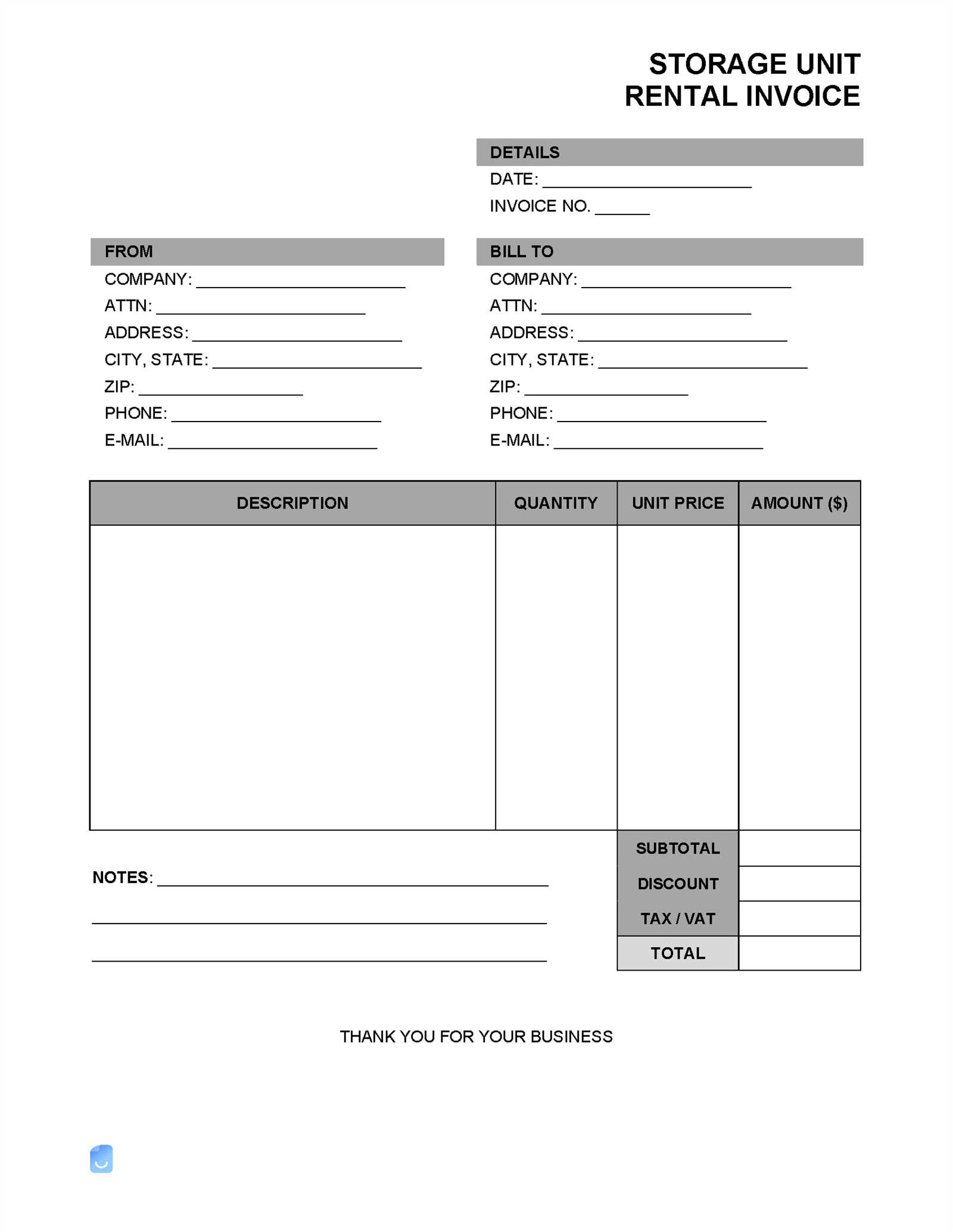

- Business Information: Include your company’s name, address, contact details, and logo for a professional appearance.

- Client Details: Clearly state the customer’s full name, address, and contact information to avoid confusion.

- Service Dates: Specify the start and end dates of the service period to give the customer a clear understanding of the timeframe.

- Services Provided: Detail each service or product provided, including any additional fees, so the customer knows exactly what they’re paying for.

- Total Amount Due: Clearly list the total balance to be paid, ensuring that any taxes, discounts, or adjustments are reflected.

Format and Structure for Clarity

The layout and design of your document play a crucial role in ensuring readability and understanding. A clean, organized format makes it easier for customers to quickly identify important information. Consider the following:

- Simple Layout: Keep the document well-organized with clearly defined sections, using headings and bullet points where appropriate.

- Itemized List: Break down charges into individual items or services, showing the price of each one, to make the document easy to review.

- Clear Payment Instructions: Include details on how and where the payment should be made, along with any deadlines or late fees.

By including these key features and structuring the document in a way that is easy to follow, you ensure that the billing process is efficient, accurate, and professional. This not only improves the client experience but also simplifies financial management for your business.

Choosing the Right Billing Format

Selecting the appropriate format for your billing documents is crucial to ensure efficiency and clarity in your financial communications. The right format will not only help organize the details of the transaction but also make it easier for both you and your clients to review the information. With multiple options available, it’s important to choose one that fits your business needs, is easy to understand, and aligns with your workflow.

There are several factors to consider when determining which format is best suited for your business:

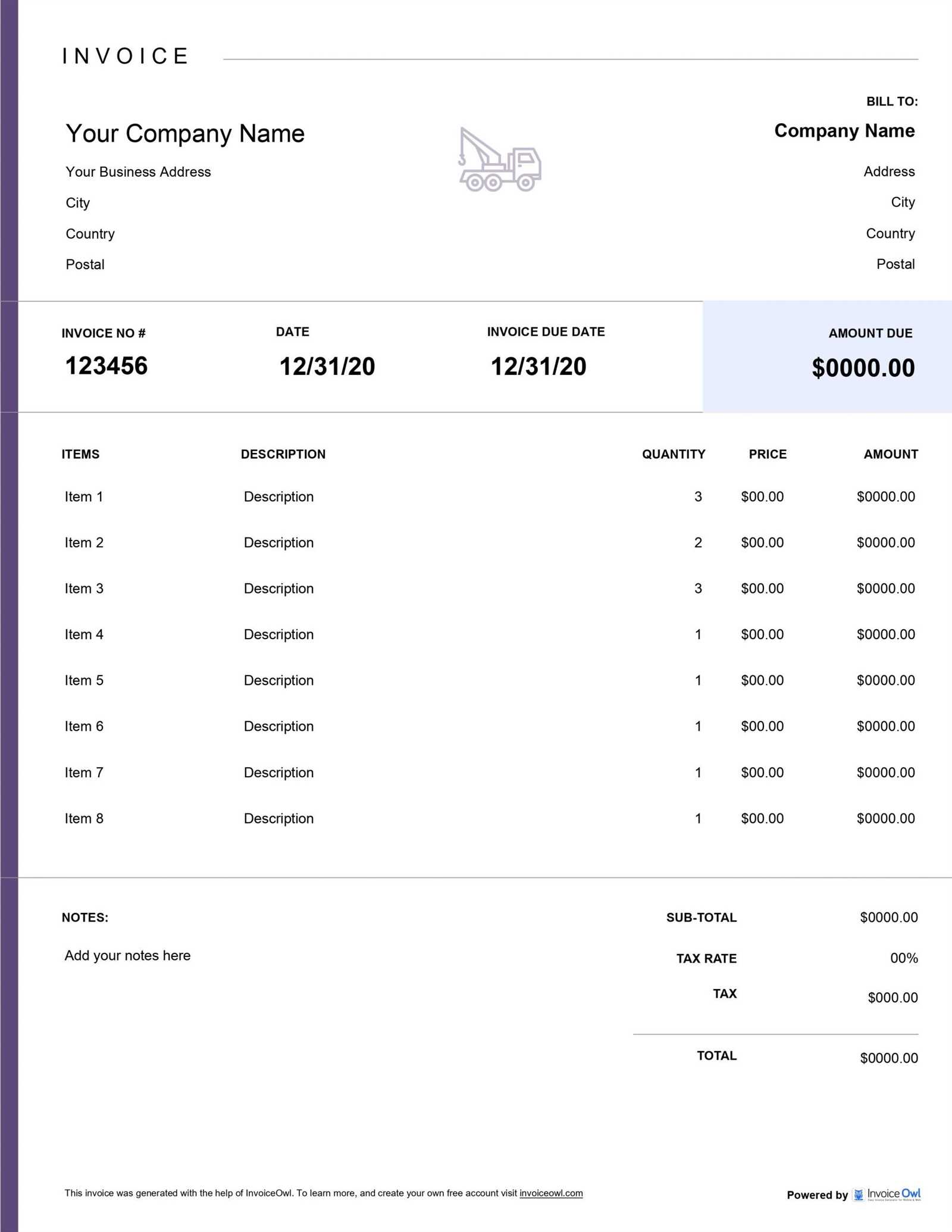

- Digital vs. Paper: Decide whether you want to send physical copies or digital documents. Digital formats, such as PDFs, are easier to store, share, and track, while paper invoices may be necessary for clients who prefer traditional methods.

- Pre-designed vs. Custom Formats: If you need a quick solution, pre-designed layouts are readily available and can be customized to some extent. However, if your business has unique billing requirements, designing a custom document may be a better choice.

- Simple vs. Detailed: If your services are straightforward, a simple, concise layout may be sufficient. For more complex offerings, such as multiple items or variable rates, a more detailed format will help avoid confusion and ensure transparency.

In addition to these considerations, the choice of format can impact the professionalism of your business. A well-organized document that is easy to read and understand gives your clients a positive impression and helps ensure timely payments.

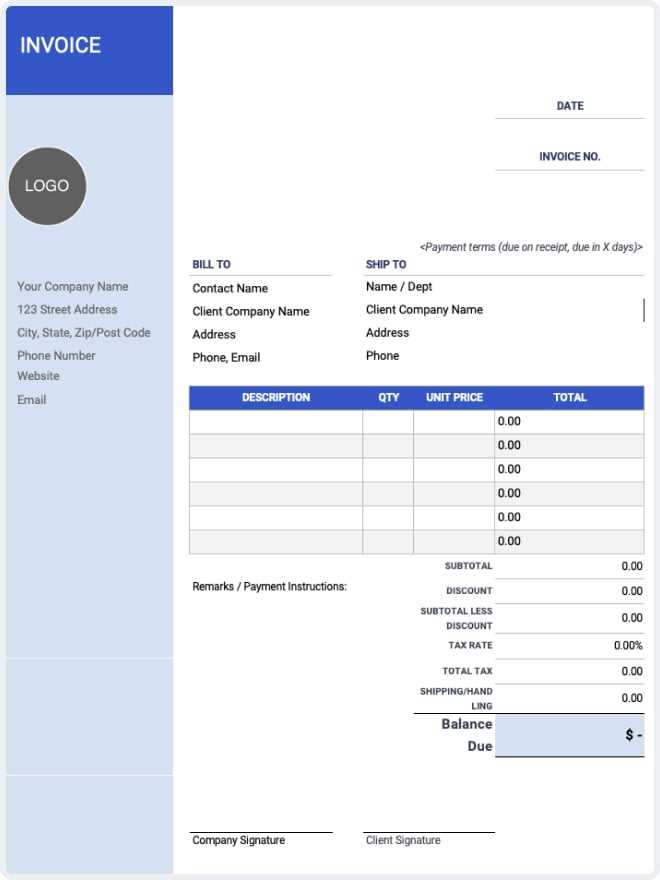

Essential Information for Billing Documents

Creating a clear and comprehensive billing document requires including specific details to ensure both the service provider and the client are aligned on the terms and amounts due. The more organized and complete the document, the less room there is for confusion or disputes. Below are the key elements that should always be included to ensure a smooth transaction and professional appearance.

Basic Components to Include

Each billing document should contain essential information that helps identify the transaction, both for the business and the customer. These are the primary details to include:

| Information | Description |

|---|---|

| Business Name and Contact Info | Ensure that your company name, address, phone number, and email are clearly visible for easy reference. |

| Customer Details | Include the client’s full name, address, and contact information for proper identification. |

| Unique Reference Number | Assign a unique number to each document to track and organize your transactions effectively. |

| Service Period | Clearly state the start and end dates of the service or rental period being billed. |

| Itemized Charges | List each service, product, or fee separately along with its associated cost. |

| Amount Due | Provide a final total, clearly showing any taxes, discounts, or additional charges included in the overall sum. |

Additional Considerations

While the above elements form the core of your document, there are other important details to consider for better clarity:

- Payment Terms: Include payment methods, due dates, and penalties for late payments.

- Notes and Special Instructions: If there are specific terms or conditions related to the charges, include them in a separate section.

- Tax Information: Ensure the document reflects applicable taxes, and provide a breakdown if necessary for transparency.

By including these critical elements, you ensure that your billing documents are clear, professional, and effective in communicating the necessary details to your clients.

Benefits of Using a Pre-designed Document

Utilizing a pre-designed document for billing or payment requests offers numerous advantages that can streamline your business processes. Instead of creating a new document from scratch each time, a structured format helps save time, reduce errors, and maintain consistency across all your transactions. Whether you are handling a few or hundreds of clients, using a standardized format can significantly improve efficiency and professionalism.

Here are some key benefits of using a pre-designed document:

- Time-saving: With a ready-made structure, you can quickly fill in the relevant details without having to design the layout or organize the information each time.

- Consistency: Using the same format for every transaction ensures uniformity, which enhances your brand image and helps clients easily understand the details of the agreement.

- Accuracy: A well-designed structure reduces the chances of missing critical information, such as payment terms or service descriptions, ensuring you charge the correct amounts.

- Professional Appearance: A polished and organized document gives your business a more professional look, which can positively impact client relations and trust.

- Customization Options: Many pre-designed formats allow for easy customization, so you can adjust them according to specific needs while still maintaining a consistent look.

By adopting a pre-designed document, you not only streamline the billing process but also improve your overall business operations, making it easier to manage customer relationships and financial records.

Common Mistakes to Avoid in Billing Documents

When creating payment requests or billing documents, small errors can lead to misunderstandings, payment delays, and even damage to your business’s reputation. Whether it’s an incorrect amount, missing information, or unclear terms, it’s important to ensure that every detail is accurate and well-presented. By being aware of common mistakes, you can avoid unnecessary issues and maintain professionalism with your clients.

Missing or Incorrect Information

One of the most frequent mistakes in billing documents is the omission of important details or the inclusion of inaccurate information. These errors can lead to confusion and disputes with clients. Common issues include:

- Incorrect Client Details: Always double-check the customer’s name, address, and contact information to ensure accuracy.

- Wrong Payment Amount: Double-check all figures, including taxes and discounts, to avoid charging the wrong amount.

- Omitting Service Dates: Clearly indicate the start and end dates for the services provided to prevent misunderstandings.

- Missing Reference Numbers: Without unique identifiers, it becomes difficult to track or match payments to specific services.

Unclear Payment Terms and Instructions

Vague or confusing payment instructions can delay payment and lead to frustration on both sides. To ensure smooth transactions, be clear and specific about:

- Payment Due Dates: Clearly state when the payment is due to avoid late payments.

- Late Fees: If there are penalties for late payments, include this information so clients know the consequences.

- Accepted Payment Methods: Specify whether you accept credit cards, bank transfers, or other payment methods to avoid confusion.

Avoiding these common mistakes will help you create billing documents that are accurate, professional, and efficient, fostering positive relationships with your clients and ensuring timely payments.

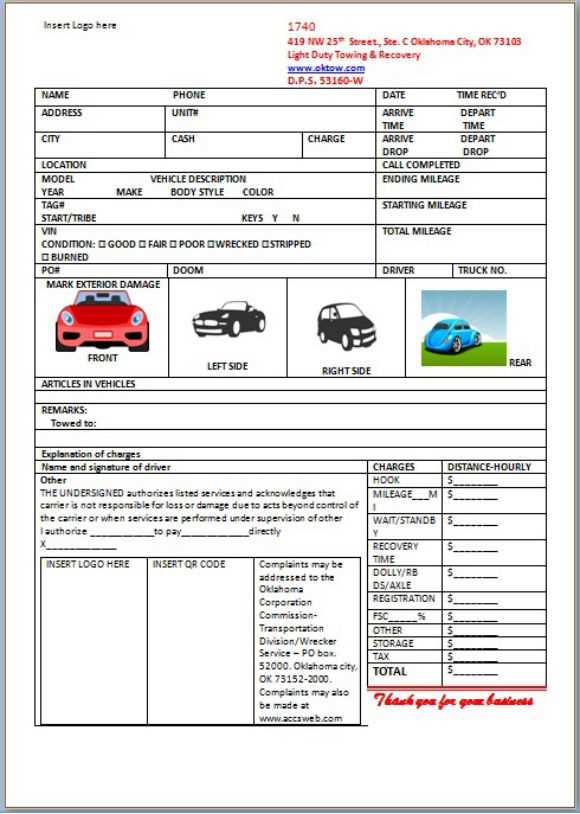

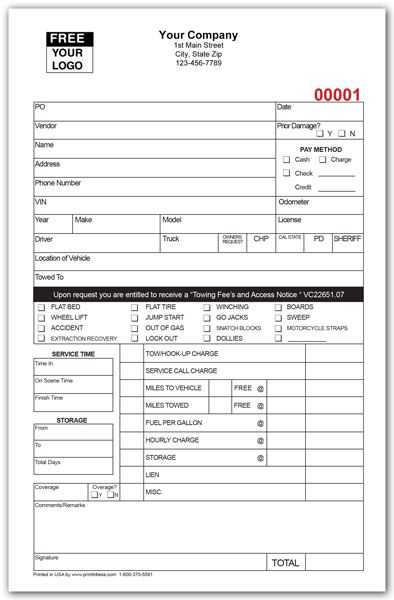

How to Calculate Storage Charges

Accurately calculating charges for rental or space usage is crucial for maintaining profitability and ensuring that clients are billed fairly. The key to calculating these charges is to consider all relevant factors, such as the size of the space, duration of use, any additional services provided, and any applicable taxes or fees. By establishing a clear pricing structure, you can avoid confusion and ensure both you and your clients understand the terms of payment.

Here are the main steps involved in calculating charges for space usage:

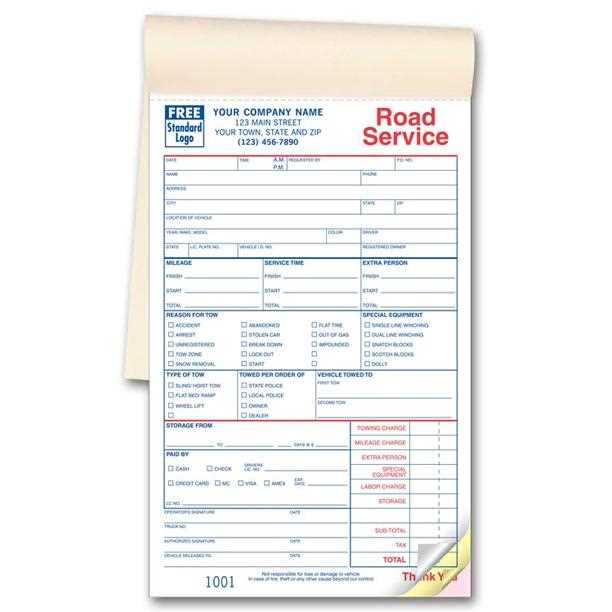

Step 1: Determine the Base Rate

Start by setting a base rate for the service, which could be determined by the size of the space or the amount of time it is rented. Common methods of calculating the base rate include:

- Per Square Foot/Unit: Charge based on the amount of space a client occupies. This is common in storage or rental businesses where space is the primary factor in pricing.

- Per Time Period: Charge a flat rate for a set period, such as per day, week, or month. This is often used for short-term rentals or services that are billed over a specific timeframe.

Step 2: Add Additional Fees

In addition to the base rate, you may need to include additional fees for services or circumstances that go beyond the standard offering. These can include:

- Access Fees: Charge extra if the customer requires frequent access to the rented space outside of normal business hours.

- Insurance: If you offer insurance options for the rented space, include the cost in the calculation.

- Late Fees: If the payment is not made on time, include any penalties or interest charges for overdue payments.

Step 3: Calculate Taxes and Discounts

Ensure that you account for any applicable taxes, such as sales tax, and apply any discounts if they are part of a promotion or agreement. This is important for compliance and accuracy in your final charge. Be sure to include these amounts clearly in the final calculation to avoid surprises for the client.

Once all factors have been considered, add them together to determine the final charge. Double-check your calculations to ensure that everything is accurate and transparent for both parties involved.

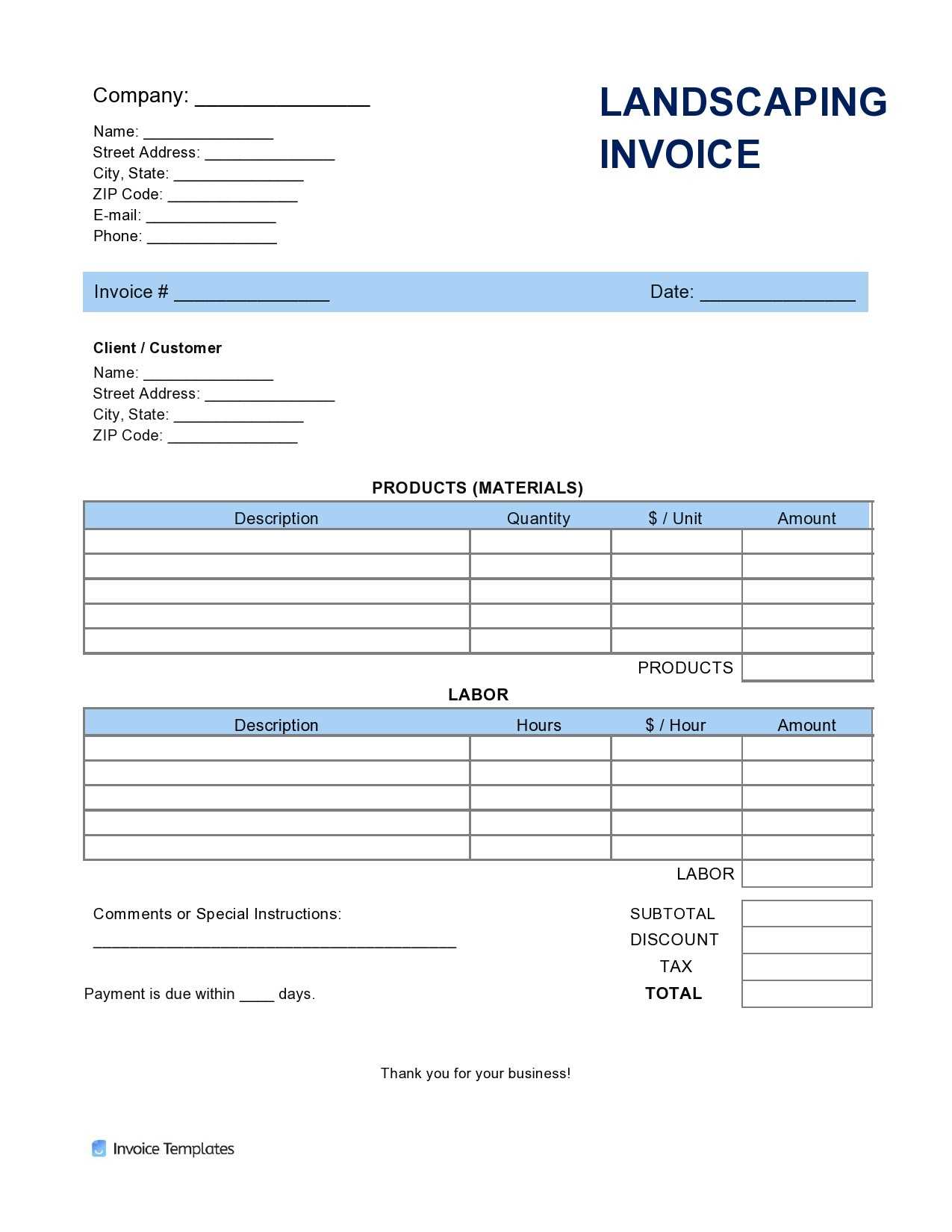

Including Taxes on Billing Documents

When calculating the total amount due for services rendered, it’s important to consider applicable taxes to ensure compliance with local regulations. Taxes can vary depending on your location, the type of service provided, and other factors, so it’s essential to properly include them in the final amount. Including taxes not only helps you avoid legal issues but also ensures transparency with your clients.

Understanding Different Types of Taxes

There are several types of taxes that could apply to your billing documents, depending on where you operate and the nature of your services. The most common types include:

- Sales Tax: This is a tax added to the sale of goods or services, typically calculated as a percentage of the total charge. It varies by region, so make sure to apply the correct rate based on your location.

- Value Added Tax (VAT): In some countries, VAT is levied on the value added at each stage of production or service. This can be a bit more complex, requiring you to track VAT paid at different stages.

- Local Taxes: Certain regions or municipalities may impose additional local taxes, such as city or state-specific levies. Be sure to research any taxes specific to your area of operation.

How to Include Taxes in Your Billing Document

Once you understand which taxes apply to your services, here’s how to correctly include them in your billing document:

- Calculate the Base Charge: Start with the amount for the services rendered, excluding taxes.

- Apply the Tax Rate: Multiply the base charge by the appropriate tax rate to determine the amount of tax owed.

- List the Tax Separately: Clearly show the tax amount on the billing document, separate from the base charge, to maintain transparency.

- Include the Total: After adding the tax, provide the final total that the client owes, including both the service charges and tax.

By following these steps, you can ensure that taxes are correctly applied and clearly communicated, fostering trust and compliance with

Adding Payment Terms to Your Billing Document

Clearly defining payment terms is essential for ensuring timely payments and avoiding misunderstandings with clients. Payment terms specify when and how the client should pay, as well as any penalties for late payments. By including clear and precise terms in your billing document, you provide your clients with all the information they need to make payments on time, and you help protect your business from delayed or missed payments.

Key Elements to Include in Payment Terms

Payment terms should cover several key points to ensure clarity. Below are the most important elements to include in your billing document:

| Element | Description |

|---|---|

| Due Date | Specify the exact date by which payment should be received. This helps avoid confusion and encourages clients to pay on time. |

| Payment Methods | Clearly state the acceptable forms of payment (e.g., credit card, bank transfer, cheque). This ensures that clients know how to complete the transaction. |

| Late Fees | Outline any fees that will be applied if payment is not received by the due date. These could be a flat fee or a percentage of the total amount due. |

| Early Payment Discounts | If you offer a discount for early payment, make sure to mention it in the payment terms to incentivize prompt payment. |

Additional Considerations for Payment Terms

In addition to the essential elements listed above, you may want to consider adding the following details to further clarify payment expectations:

- Grace Period: If you offer a short grace period for payments, specify the duration (e.g., “Payment is due within 30 days, with a 5-day grace period.”)

- Currency: If you work with international clients, be sure to state the currency in which the payment is expected to avoid confusion.

- Payment Plan Options: If your business offers payment installment plans, detail how these payments should be made (e.g., monthly payments or a deposit schedule).

By clearly stating payment terms in your billing document, you ensure that both parties understand the expectations and reduce the risk of delays or disputes. A well-defined payment policy contributes to smoother transactions and better financial management for your business.

Automating the Billing Process

Automating your billing process can save valuable time, reduce human error, and streamline financial operations. By implementing automated systems, you can ensure that invoices are generated, sent, and tracked with minimal manual effort, allowing you to focus on more strategic tasks. Automation also helps maintain consistency, ensuring that every transaction is handled in the same efficient manner.

Here are some key advantages of automating your billing process:

- Time Efficiency: Automating repetitive tasks such as generating billing documents, applying taxes, and sending reminders helps free up time for other important business functions.

- Reduced Errors: Automation eliminates the risk of manual mistakes such as incorrect calculations, missing details, or inconsistent formatting, ensuring greater accuracy in your documents.

- Consistency and Professionalism: By using automated systems, you can create uniform billing documents with a professional appearance, reinforcing your brand’s credibility.

- Faster Payment Collection: Automated reminders and due-date notifications can help ensure that clients are aware of upcoming payments and reduce the risk of late payments.

- Better Record Keeping: Automation tools can store all of your transaction data in an organized and easily accessible manner, making it simpler to track outstanding balances and generate reports.

To implement automation, consider using specialized software that integrates with your accounting system. Many tools offer customizable templates, recurring billing options, and automatic payment reminders, all of which can be tailored to suit your specific business needs.

By automating your billing system, you can improve your overall business efficiency, maintain better cash flow, and ensure a smoother experience for both you and your clients.

Best Tools for Creating Billing Documents

When it comes to generating professional billing documents, using the right tools can make all the difference. With the variety of available software, it’s important to choose one that not only fits your business needs but also simplifies the process of creating, sending, and managing your payment requests. Whether you need simple templates or more advanced features like recurring billing or payment tracking, the right tool can save you time and reduce errors.

Top Software for Efficient Billing

Below are some of the best tools for creating payment requests that streamline your process and ensure consistency:

- QuickBooks: Known for its comprehensive accounting features, QuickBooks offers customizable billing document creation, along with automatic tax calculations and payment tracking, making it a popular choice for businesses of all sizes.

- FreshBooks: FreshBooks provides an easy-to-use interface for creating and sending professional billing documents. It also offers features like automatic payment reminders and time-tracking, which can be helpful for service-based businesses.

- Zoho Invoice: A part of the Zoho suite, this tool offers a wide variety of templates and customization options. It also includes the ability to automate recurring billing and integrate with other business applications.

- Wave: Wave is a free accounting software that allows users to create and send billing documents. It’s especially ideal for freelancers and small businesses looking for a cost-effective solution with essential features.

- Invoice Ninja: Invoice Ninja provides an open-source platform with a lot of flexibility. You can customize the look of your documents, automate recurring billing, and even integrate payment gateways for online transactions.

Choosing the Right Tool for Your Business

The best tool for your business depends on the specific needs you have. For businesses looking for simple billing document creation, basic tools may suffice. However, if you require advanced features such as automated payment reminders, recurring billing, or in-depth reporting, more sophisticated software may be necessary. Make sure to evaluate the features, pricing, and ease of use before selecting a tool.

By investing in the right software, you can improve the efficiency of your billing process, reduce administrative work, and ensure that your clients receive clear and professional payment requests every time.

How to Manage Billing Records

Efficiently managing your billing records is crucial for maintaining accurate financial records, staying organized, and ensuring timely payments. By keeping detailed and well-organized records, you can easily track outstanding balances, monitor cash flow, and quickly resolve any discrepancies. Whether you’re using manual methods or automated systems, having a clear strategy for record-keeping can save time and prevent costly mistakes.

Here are some key steps to help you effectively manage your billing records:

1. Organize Your Records

It’s essential to keep all billing documents and payment information organized for easy access. Consider categorizing your records by date, client name, or service type. This will make it easier to locate past transactions when needed. You can organize records in a variety of ways:

- Digital Files: Store electronic records in cloud-based folders, ensuring they are properly labeled and easily searchable.

- Physical Copies: If you keep physical copies, use filing cabinets with clearly marked folders and keep them in chronological order for easy retrieval.

- Accounting Software: Utilize digital tools to automatically categorize, store, and retrieve records. Many accounting systems integrate with other tools to streamline this process.

2. Track Payments and Outstanding Balances

Regularly monitor and track payments to avoid missed or delayed payments. Use a system to record when each payment is made and compare it with the original amount due. This can be done manually with spreadsheets or through automated accounting software that provides real-time tracking of balances.

- Reconcile Accounts: Regularly reconcile your records to ensure that all payments are accounted for and that there are no discrepancies between your records and your bank statements.

- Set Up Payment Reminders: Implement automated reminders for clients with outstanding balances to ensure timely payment and reduce the risk of overdue accounts.

- Mark Payments as Received: Once a payment is made, immediately update your records to reflect the change, reducing the chance of confusion or missed payments.

3. Maintain Backup Copies

To prevent the loss of important records, always have a backup system in place. For digital files, consider using cloud storage or external drives to store copies. For physical records, keep duplicate copies in a secure location. This ensures you have access to your records in case of hardware failure, accidents, or other unforeseen issues.

By maintaining organized, up-to-date, and secure records, you can streamline your billing process, reduce the risk of errors, and ensure that your business stays on top of its financial obligations. The right system will help you save time, prevent confusion, and make better financial decisions moving forward.

Legal Considerations for Billing Documents

When creating and managing billing documents, it’s crucial to understand the legal requirements that apply to your business. These considerations help ensure that your documents are compliant with local laws, protect your rights, and clarify your responsibilities to clients. Failure to meet legal standards can lead to disputes, penalties, or even litigation. By addressing these key legal aspects, you can reduce risks and maintain a smooth and professional billing process.

Key Legal Aspects to Consider

Below are the most important legal factors to keep in mind when creating your billing documents:

- Clear Terms and Conditions: Always include a clear set of terms and conditions that outline payment expectations, deadlines, and consequences for late payments. These should be agreed upon by both parties before services are provided. Make sure that the client understands the agreement and acknowledges the terms in writing.

- Accurate Representation of Services: Ensure that your documents clearly detail the services rendered, including quantities, descriptions, and any applicable rates. Misrepresentation of services could lead to legal issues, especially if a client feels that they were overcharged or that services were not properly delivered.

- Applicable Taxes: Make sure to include the correct tax rates as required by local or national laws. Failure to apply the right taxes can result in penalties or legal action by tax authorities.

- Late Fees and Interest: If you include penalties for late payments, these fees must be reasonable and clearly stated in the billing document. Some jurisdictions may regulate the maximum allowable interest rates or late fees, so be sure to check local laws to avoid overcharging.

- Privacy and Data Protection: Protect your client’s personal and financial information. Be aware of privacy laws such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act) if you handle sensitive client data. Ensure that your document storage and transmission methods comply with relevant privacy regulations.

Maintaining Compliance

In order to stay compliant with legal requirements, it is important to regularly review and update your billing practices. Here are some tips to maintain compliance:

- Stay Informed: Regularly review changes in tax laws, labor laws, and other relevant regulations that may affect your billing documents.

- Consult Legal Experts: If you’re unsure about any legal aspect of your billing process, it’s wise to consult with a lawyer or legal advisor to ensure that your documents meet all requirements.

- Implement Standardized Practices: Create standardized templates and procedures that ensure all legal elements are consistently included in every document you send.

By addressing these legal considerations, you can protect your business, reduce the risk of disputes, and foster trust with your clients. Being proactive in managing your billing process with respect to the law will help you maintain professionalism and avoid unnecessa

How to Send Billing Documents Efficiently

Sending billing documents in a timely and organized manner is essential for maintaining smooth financial operations and ensuring prompt payments. An efficient process not only helps you stay on top of your accounts but also improves the overall client experience. By streamlining the way you deliver payment requests, you can save time, reduce errors, and accelerate cash flow.

Steps for Efficiently Sending Billing Documents

Here are some key steps to improve the efficiency of your billing distribution process:

- Automate Delivery: Use software that allows you to automatically send payment requests based on predefined schedules. Automating this process eliminates the need for manual data entry and reduces the likelihood of errors.

- Use Digital Methods: Sending billing documents electronically is faster and more secure than physical mail. Email, online portals, or accounting software platforms are great options for quick delivery and tracking.

- Ensure Accuracy Before Sending: Always double-check the details in the document, such as the client’s information, the correct amounts, and the due date. Mistakes at this stage can lead to delays and confusion.

- Set Clear Deadlines: Be specific about payment deadlines and ensure they are prominently displayed in your documents. Clear expectations help clients prioritize and reduce the risk of missed payments.

- Track Delivery and Confirmation: When using digital methods, make use of features that confirm delivery (such as read receipts or tracking numbers). This gives you peace of mind and helps you monitor the status of the document.

Best Practices for Follow-Up

Even with an efficient delivery system in place, it’s important to follow up on outstanding payments to ensure timely settlement. Here are some strategies to consider:

- Send Payment Reminders: Automate reminder emails for approaching due dates, as well as follow-up notices for overdue payments. Setting up a reminder schedule can improve on-time payment rates.

- Offer Multiple Payment Options: Make it easy for your clients to pay by offering a variety of payment methods, such as credit cards, bank transfers, or online payment systems like PayPal.

- Be Professional and Courteous: When sending reminders or following up on overdue payments, always maintain a professional and polite tone. This fosters a positive relationship with clients while encouraging timely payment.

By implementing these strategies, you can ensure that your billing process runs smoothly, payments are received promptly, and your business maintains positive client relationships.

Tracking Payments and Due Dates

Tracking payments and monitoring due dates is a crucial aspect of maintaining healthy cash flow and financial stability in any business. Keeping an organized record of which payments have been made and which are still outstanding helps to ensure timely collection, avoid late fees, and improve client relationships. A systematic approach can save time, reduce errors, and help you stay on top of your finances.

Here are some practical steps to effectively track payments and due dates:

1. Use a Payment Tracking System

Implementing a reliable payment tracking system is key. You can choose from manual spreadsheets or automated accounting software, depending on the scale of your business. A good tracking system should include the following:

- Client Information: The name, contact details, and payment history of each client.

- Service Details: Clear descriptions of the services provided and the amount due.

- Due Dates: Specific deadlines for payment and any agreed-upon terms.

- Payment Status: Mark whether a payment has been received, is pending, or overdue.

2. Monitor Due Dates Regularly

It is essential to track due dates closely to ensure you don’t miss any important deadlines. Set up a calendar or reminder system to alert you when payments are coming due. This will help you proactively reach out to clients before a payment becomes overdue.

| Client Name | Amount Due | Due Date | Status |

|---|---|---|---|

| John Doe | $200.00 | November 15, 2024 | Pending |

| Jane Smith | $350.00 | November 10, 2024 | Paid |

| Acme Corp | $500.00 | November 20, 2024 | Pending |

3. Send Reminders and Follow-Ups

Once the due date approaches or passes, it’s important to follow up with clients. Sending polite and professional reminders helps ensure that payments are made on time. Here are a few steps you can take:

- Early Reminders: Send a reminder a few days before the payment due date to give clients time to arrange payment.

- Overdue Follow-Ups: If the payment is overdue, follow up with a courteous but firm email or phone ca

Updating Your Billing Document Regularly

Maintaining up-to-date billing documents is vital for ensuring that your financial records remain accurate, professional, and legally compliant. Regular updates help you stay in line with changes in tax laws, business practices, or payment terms, while also improving the clarity and functionality of the documents you send to clients. By making adjustments as needed, you can ensure that each billing document reflects the most current information, reducing confusion and promoting timely payments.

Here are several reasons why you should update your billing documents regularly:

1. Ensure Compliance with Legal and Tax Changes

Tax rates, legal regulations, and industry standards often change, and it’s essential that your billing documents reflect these updates. For instance, new tax laws may require you to adjust the way taxes are calculated or listed. Regularly reviewing and updating your documents will ensure you stay compliant and avoid potential penalties.

2. Keep Contact and Payment Information Accurate

Client information, such as billing addresses, payment terms, and contacts, may change over time. Regular updates to your billing documents allow you to capture the most recent details, preventing delivery errors and ensuring that the correct person receives the payment request. This also helps avoid any potential issues related to late or missed payments.

3. Improve Clarity and Professionalism

As your business evolves, you may discover ways to make your billing documents clearer and more professional. Updating your documents with a cleaner layout, better fonts, or improved instructions for payment can improve your clients’ experience and minimize misunderstandings. Clear, easy-to-read documents also enhance your reputation as a reliable and professional business.

4. Add New Features and Functions

As your business grows, you may want to include additional details or features in your billing documents. For example, you might want to add sections for discounts, payment options, or additional charges. Regular updates give you the opportunity to integrate these new elements, making it easier to manage more complex transactions.

5. Stay Ahead of Technology

With the rapid growth of digital tools, billing documents can benefit from advancements in software and automation. Regularly updating your documents ensures that you are using the latest technology to streamline your processes. Whether it’s integrating with accounting software, offering online payment links, or automating reminders, staying current will make your billing system more efficient and effective.

Incorporating these updates into your billing documents will improve the overall efficiency of your business while maintaining professionalism and compliance. Regular revisions help you stay organized, minimize errors, and maintain strong relationships with clients by providing them with clear, accurate, and up-to-date documents.