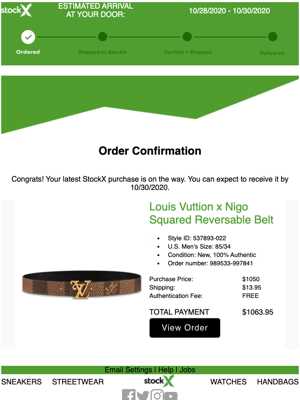

How to Use and Customize Stockx Invoice Template

When conducting business, having a clear and professional way to track payments and sales is essential. Whether you’re handling purchases or sales of goods, ensuring that all transaction details are properly documented helps streamline operations and keeps both parties on the same page.

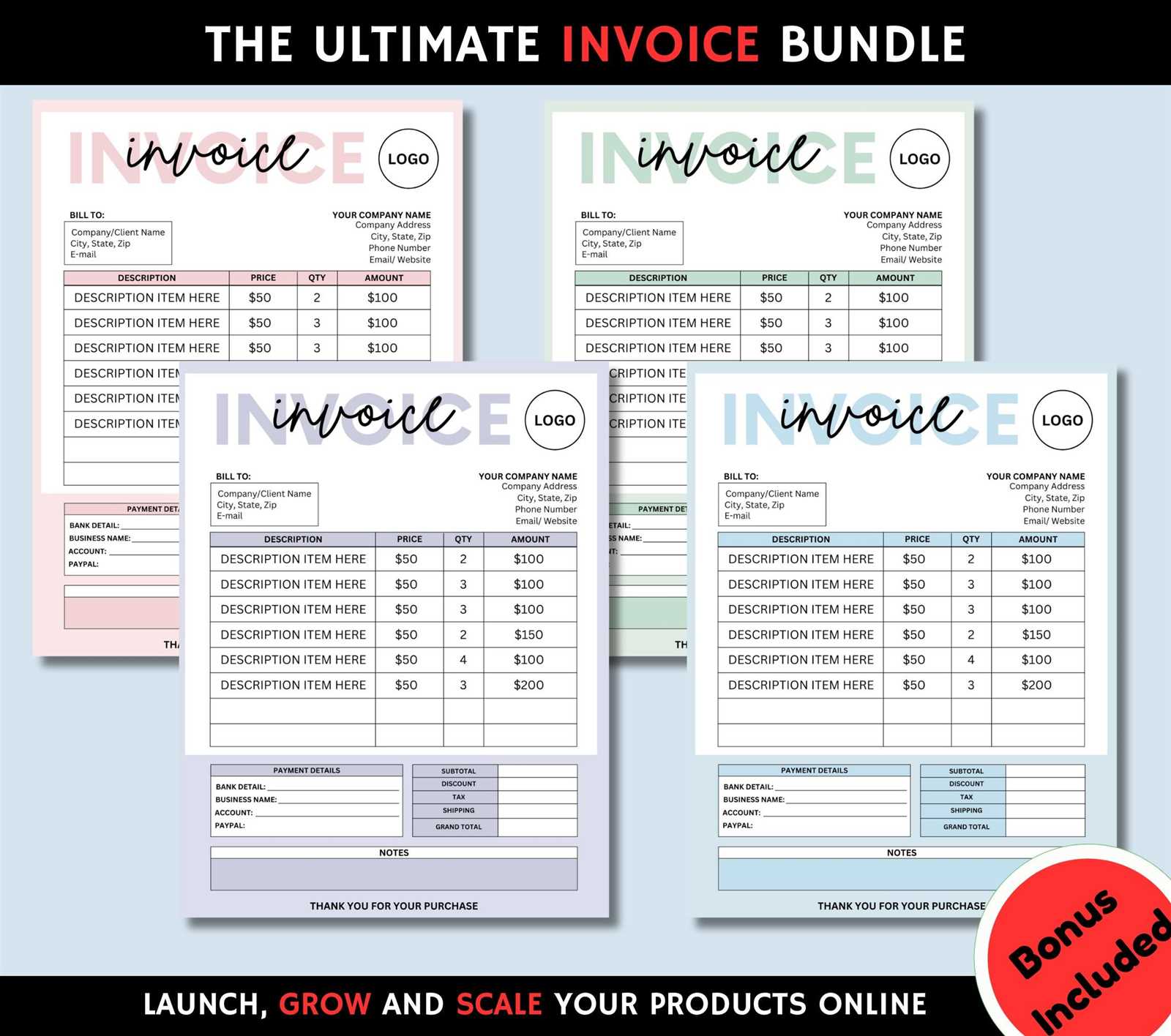

Customizable documents can be a useful tool for organizing transaction information. They allow for easy inclusion of important details such as the buyer’s information, item descriptions, dates, and amounts. This not only helps maintain transparency but also provides a formal record for future reference.

By using an adaptable form, you can save time and reduce errors. The ability to adjust fields and content ensures that each record is tailored to the specific needs of each exchange, offering flexibility without sacrificing professionalism. This simple yet powerful tool can be applied to various business contexts, improving both efficiency and accuracy.

Stockx Invoice Template Overview

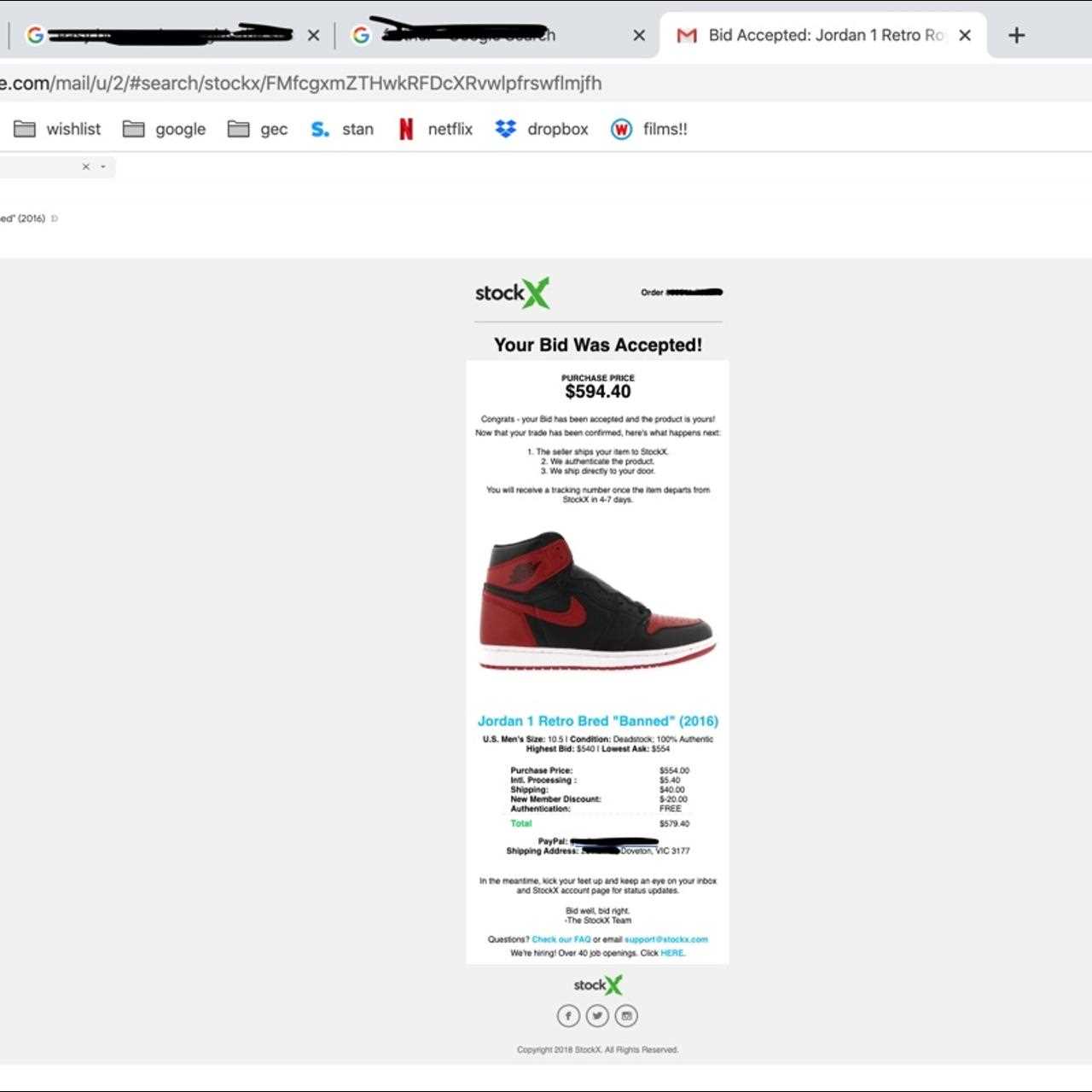

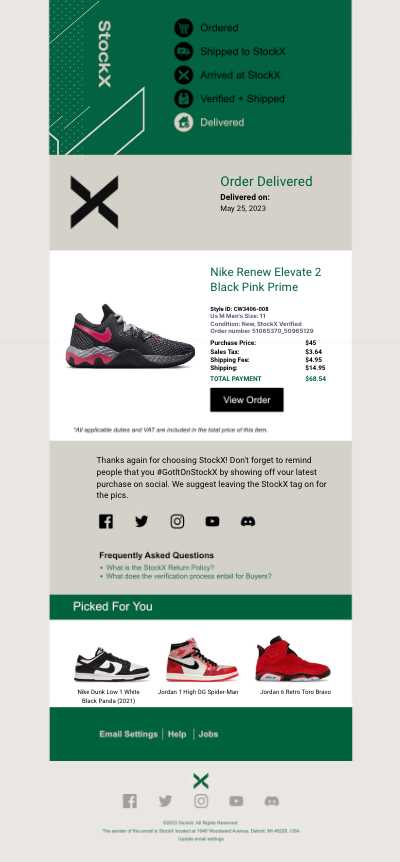

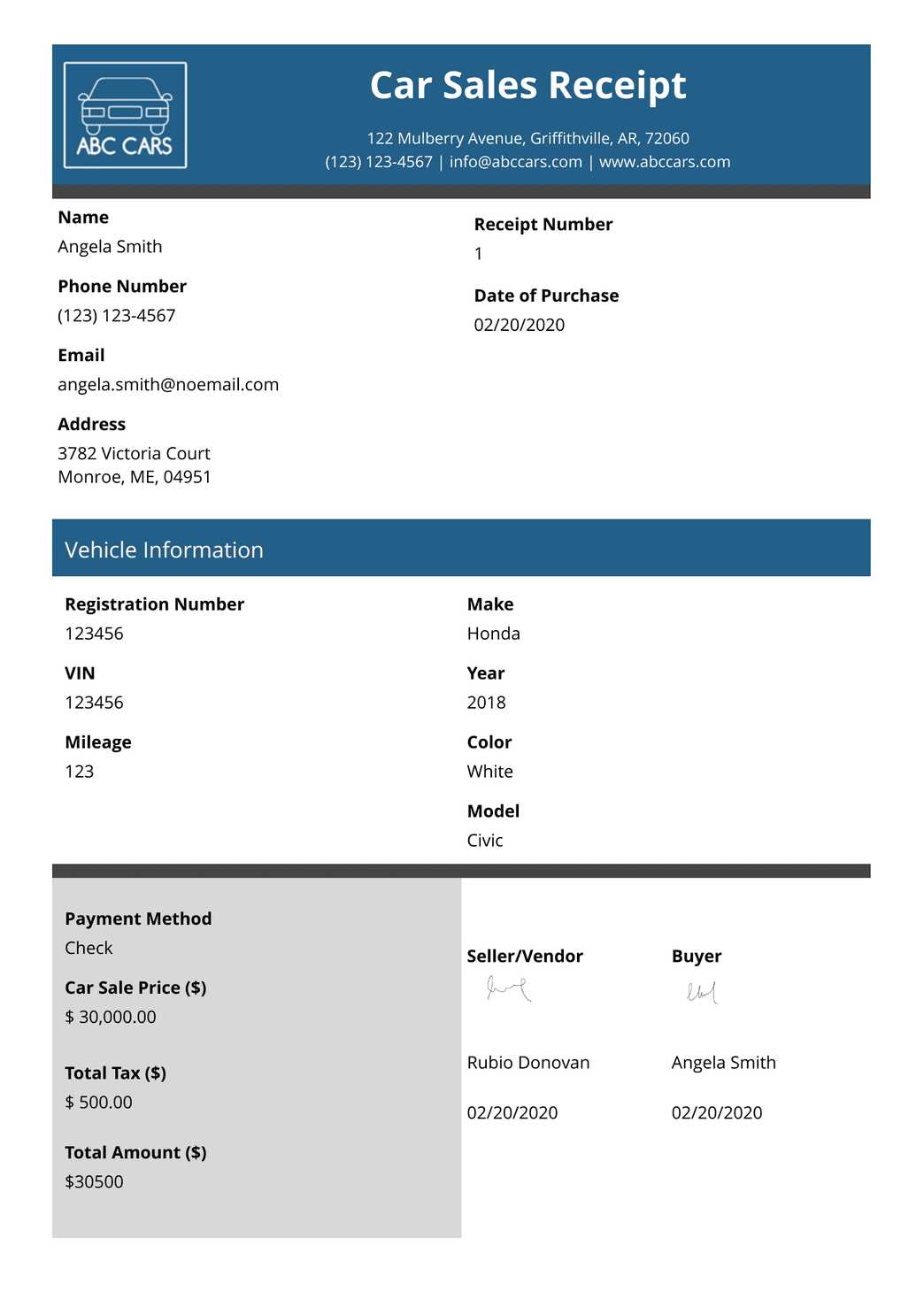

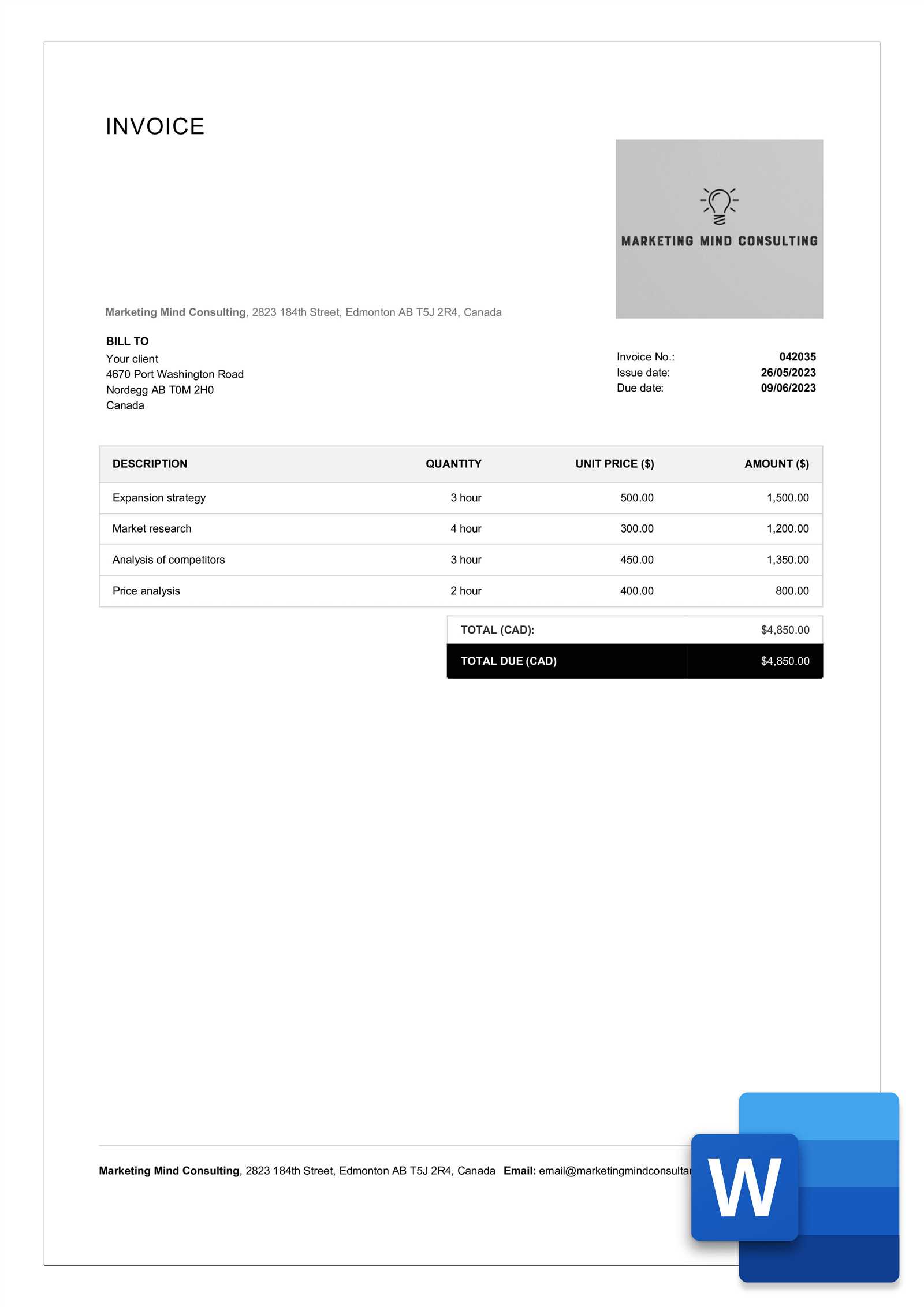

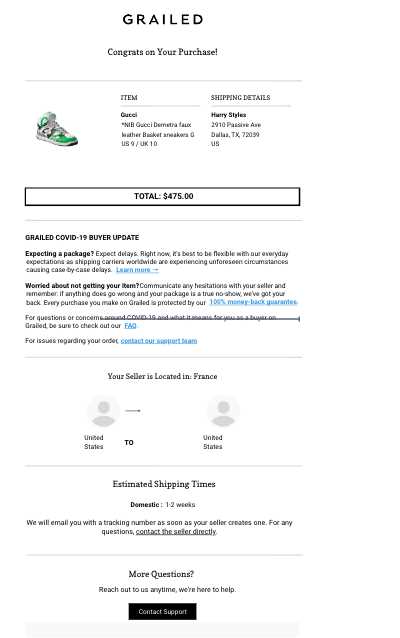

In the world of online sales, having a reliable document to record transactions is essential for maintaining accuracy and professionalism. This type of document serves as an official record of a sale, detailing the items purchased, the price, and the buyer’s information. It’s a tool that helps both parties stay organized and ensures smooth financial operations.

The structure of such documents is designed to be both simple and comprehensive. Each section is clearly defined, allowing users to easily input relevant information without confusion. From the buyer’s name to the item details and transaction totals, the form is intended to handle various types of exchanges and can be customized to fit different business needs.

Key Components of the Document

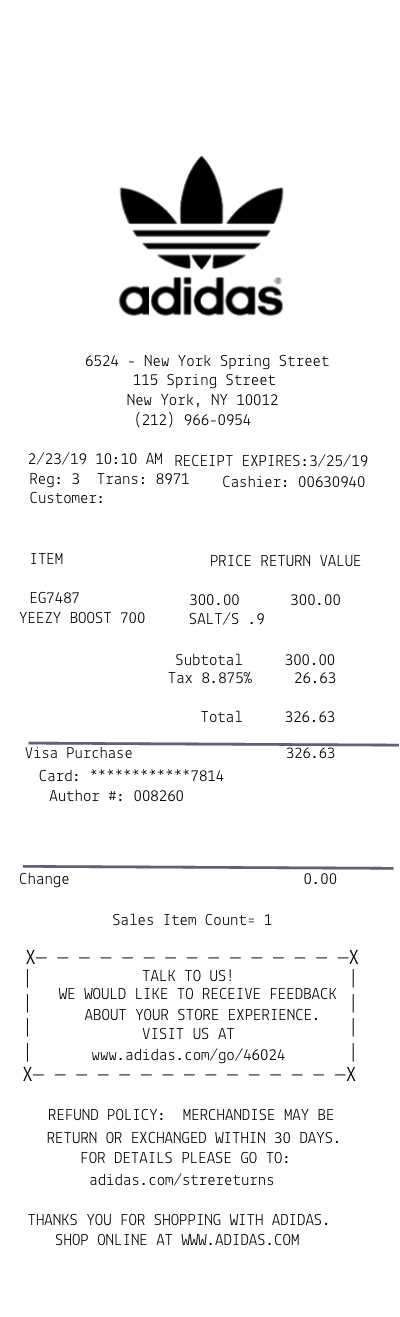

The document typically includes sections for the transaction date, seller and buyer contact information, item description, quantity, price per unit, and total cost. Some versions also offer space for additional notes or terms, providing further flexibility for users who need to communicate specific details.

Customizing for Specific Transactions

One of the advantages of using this form is its adaptability. Users can modify fields to match their particular requirements, ensuring that the document reflects the exact nature of each exchange. Whether you’re dealing with a one-time purchase or recurring transactions, customization options make it a versatile tool for many different scenarios.

Why Use a Template for Invoices

Using a pre-designed form for documenting transactions brings a high level of efficiency to the sales process. It allows businesses to standardize the way they record financial exchanges, saving time and reducing the risk of errors. Rather than starting from scratch every time, a structured document helps ensure consistency and professionalism across all transactions.

One of the key benefits of such forms is that they allow for quick customization without losing clarity. Instead of manually setting up a layout for each new deal, users can focus on adding relevant details, such as item descriptions and pricing, while the form’s design remains the same. This streamlined approach not only speeds up the process but also helps maintain accuracy and uniformity across all records.

Advantages of Using a Pre-Designed Document

Here are some key reasons why using this kind of form is beneficial:

| Benefit | Explanation |

|---|---|

| Time-saving | Ready-to-use layout means less time spent creating documents from scratch. |

| Consistency | Standardized format ensures every record looks professional and clear. |

| Customization | Fields can be easily adjusted to fit the specifics of any transaction. |

| Accuracy | Pre-set structure reduces the chances of missing or incorrect information. |

Efficient Financial Record Keeping

Having a consistent document makes it easier to manage and track financial records. By using the same structure for every sale, it becomes much simpler to organize and retrieve transaction information later. This is especially helpful when reviewing past sales or preparing for tax filings and audits. A uniform approach helps create a comprehensive record that can be easily referred to at any time.

Key Features of Stockx Invoice Templates

A well-designed form for transaction documentation offers several essential features that help ensure clarity and efficiency. These forms are crafted to be both easy to use and comprehensive, accommodating all necessary details while maintaining a professional appearance. Below are some of the key characteristics that make these documents valuable tools for businesses and individuals alike.

- Clear Structure: Each section is carefully organized, allowing for quick input of relevant information such as buyer details, item descriptions, prices, and dates.

- Customizable Fields: Users can modify fields to suit specific transaction types or personal preferences, ensuring the document is tailored to each unique exchange.

- Professional Design: The layout ensures that all information is presented neatly and clearly, enhancing the document’s credibility and making it easy to read.

- Easy to Edit: Whether it’s adjusting quantities, prices, or adding special terms, the document allows for easy modification, so it always reflects the current transaction details.

- Consistency: With a standardized format, every record maintains uniformity, simplifying the tracking and organizing of multiple transactions.

These features combine to make the form an indispensable tool for anyone involved in frequent buying and selling, offering a reliable method for keeping track of all transaction details.

Customizing Your Stockx Invoice

Personalizing a transaction document allows it to better reflect the specific needs of each sale or exchange. By customizing the layout, content, and design elements, you can ensure that the document matches your business style and includes all the necessary details. This flexibility not only improves the accuracy of records but also enhances the professionalism of your transactions.

The customization process involves adjusting several key sections, from adding company logos to modifying item descriptions and payment terms. Whether you need to include more detailed information or change the appearance for branding purposes, customizing the document ensures that each transaction is properly documented and aligned with your business practices.

Steps to Personalize the Document

Personalizing your transaction record is straightforward. First, you can add your company’s name and logo at the top of the form. Then, adjust the text fields to match the specifics of the sale, such as item quantity, pricing, and any applicable taxes or discounts. Additionally, there may be options to include payment terms or delivery instructions to make the document more informative.

Designing for Clarity and Professionalism

When customizing, it’s important to maintain a clear and professional appearance. Ensure that all key information is easy to read by selecting legible fonts and keeping sections neatly organized. The document’s layout should facilitate quick understanding, reducing any potential confusion for the buyer or seller.

How to Download the Template

Getting access to a ready-made form for recording transactions is a simple process. Most of these forms are available online, and downloading them is quick and straightforward. Whether you’re looking to save time or create a professional-looking document, obtaining this resource ensures that you have a reliable format for your business dealings.

To start, locate a trusted website offering the document. Once you find the form you need, simply look for a download button or link. Often, these files are available in formats such as PDF or Excel, making them easy to use and edit. After clicking the download link, the file will be saved to your device, ready for customization.

Remember to ensure that the source is reputable to avoid downloading malicious software. After downloading the file, you can open it on your computer and start adding the required details to suit your specific transactions.

Understanding the Template Layout

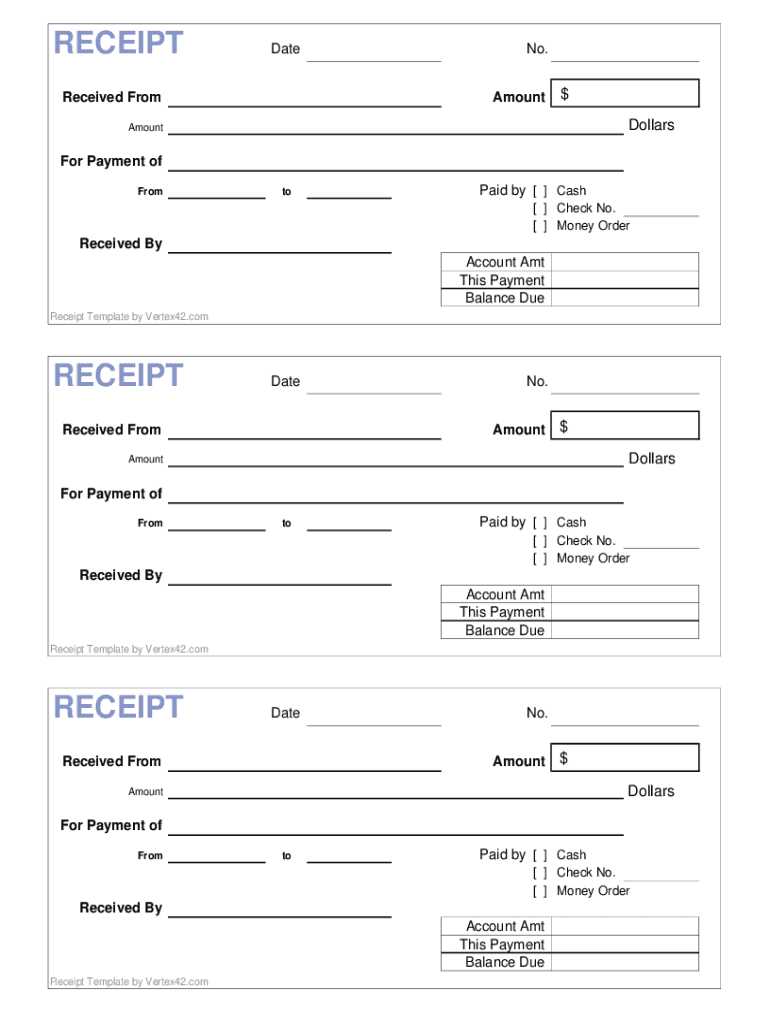

When using a structured document for recording transactions, understanding its layout is essential to ensure all information is captured accurately. The design of such forms is carefully planned to allow users to easily input the necessary details while maintaining clarity and professionalism. Each section is arranged in a logical order, guiding users through the process of completing the document without confusion.

The layout typically starts with basic information such as the date, buyer’s details, and seller’s contact information at the top. Below that, the main body of the form includes sections for item descriptions, quantities, prices, and totals. There may also be additional fields for payment terms, delivery instructions, or special notes, allowing for further customization.

By understanding the flow of the document, users can quickly navigate through and fill in the appropriate fields. This layout ensures that no essential information is overlooked while also providing a clean and organized look for professional use.

Steps to Fill Out the Invoice

Completing a transaction document requires filling out specific details to ensure accuracy and clarity. Each section of the form is designed to capture important information about the exchange, such as the buyer and seller details, item descriptions, and payment terms. Following a clear process helps avoid mistakes and ensures that the document is professional and easy to understand.

The first step is to fill in the basic information at the top of the document, including the date of the transaction, the names and contact details of both parties involved, and any reference numbers, if applicable. Next, proceed to the section where itemized details are listed, specifying the products, quantities, and individual prices. Be sure to calculate the total cost and include any additional charges, such as taxes or shipping fees, in the designated areas.

Lastly, review the document for any extra notes or terms that might need to be added, such as payment instructions, delivery methods, or special conditions. Once all fields are complete, ensure that the document is clear, accurate, and ready to be saved or shared with the other party.

Best Practices for Invoice Accuracy

Ensuring that a transaction record is accurate is crucial for maintaining trust and preventing misunderstandings between buyers and sellers. An error-free document not only reflects professionalism but also serves as an essential tool for record-keeping, taxation, and future reference. Adhering to best practices during the creation and review process helps avoid costly mistakes and ensures that all relevant information is correctly captured.

Double-Check Details Before Finalizing

One of the simplest yet most effective ways to ensure accuracy is to review all the information carefully before finalizing the document. Verify the buyer’s details, including their name, address, and contact information, to ensure that they match the records. Similarly, check the product or service descriptions, quantities, and pricing to confirm they reflect the actual transaction. Small discrepancies can lead to confusion or disputes, so it’s important to double-check everything.

Use Consistent and Clear Formatting

Consistency in formatting helps to avoid misinterpretation. Use a clear and professional font, and make sure that each section is neatly separated. This makes it easier to read and reduces the chance of overlooking crucial details. When it comes to calculations, ensure that totals, taxes, and discounts are added correctly, and double-check the math for accuracy.

By following these best practices, you can ensure that your transaction records are reliable and precise, fostering a smooth business relationship with your clients and maintaining a strong reputation for accuracy.

Common Mistakes to Avoid with Invoices

Creating a transaction document requires careful attention to detail to avoid errors that could lead to confusion or disputes. Mistakes in the document can not only create unnecessary delays in payment but also damage relationships with clients or business partners. By understanding common pitfalls, you can ensure that your records are accurate and professional.

Top Errors to Watch Out For

- Incorrect Contact Information: Always ensure that the buyer’s and seller’s names, addresses, and contact details are accurate. Even small errors in this section can cause confusion or delays.

- Wrong Item Descriptions: Double-check the descriptions, quantities, and unit prices for each product or service to avoid discrepancies that could lead to misunderstandings.

- Math Errors: Verify all calculations, including totals, taxes, and discounts. Incorrect arithmetic can cause issues and delay payment processing.

- Missing Payment Terms: Be sure to include clear payment instructions, such as due dates, accepted payment methods, and any penalties for late payments.

How to Prevent These Mistakes

- Proofread: Always review the document for any typos or inconsistencies before sending it out.

- Use Automation Tools: Consider using software or digital tools to generate transaction forms, which can reduce human error.

- Establish a Consistent Format: Having a standardized format for all transaction records can help prevent missing or incomplete information.

By being mindful of these common mistakes and taking steps to prevent them, you can ensure that your transaction documents remain professional and accurate, fostering trust and efficiency in business relationships.

How to Save and Print Your Invoice

After completing your transaction document, it’s essential to save it for future reference and print it when necessary. Properly storing a record ensures that you can easily retrieve it for bookkeeping, tax purposes, or follow-up communication. Printing the document provides a physical copy, which can be shared with clients or stored in your business files.

To save the document, ensure that it is in a file format that is easy to access, such as PDF or Excel. These formats are widely accepted and maintain the document’s layout and formatting across different devices. After selecting the desired format, click on the save option and choose a location on your device or cloud storage.

For printing, open the saved document and select the print option from your file menu. Make sure your printer is connected and properly configured. Before finalizing, check the document’s alignment and layout to ensure that all information is clear and readable on the printed page.

| Step | Action |

|---|---|

| 1 | Choose the file format (PDF, Excel, etc.) and save the document to your device or cloud storage. |

| 2 | Open the saved document and select the “Print” option. |

| 3 | Check document alignment and layout before printing to ensure clarity. |

By following these steps, you can easily save and print your transaction records whenever necessary, keeping your business operations organized and efficient.

Adding Additional Information on Invoices

Including supplementary details on transaction documents can provide clarity and help both parties understand the terms of the agreement more fully. Whether it’s adding payment terms, delivery instructions, or special notes, these extra pieces of information can prevent misunderstandings and foster a smoother business relationship. The ability to customize a record ensures that it meets specific needs while remaining clear and professional.

One common addition is payment terms, such as due dates or late fees, which ensure both the buyer and seller are on the same page regarding when and how payment should be made. You might also want to include any additional charges, such as shipping fees or taxes, in a separate section. For customized services or products, special instructions can be added to ensure that the expectations of both parties are met.

Delivery details are another crucial aspect that might need to be included, such as the shipping method, expected delivery dates, or tracking numbers. Including this information upfront reduces confusion and ensures a smooth transaction. Additionally, notes or special requests can be added to make the document more tailored to the specific nature of the business deal.

Exporting Templates for Different Platforms

When creating a transaction document, it is essential to ensure that it can be easily exported and used across various platforms. Different systems may require specific formats, so knowing how to export your records appropriately can make the process smoother and more efficient. Whether you’re working with accounting software, cloud storage services, or sending it via email, selecting the right export options ensures that the document maintains its integrity and can be easily shared or stored.

Common File Formats for Export

- PDF: A widely accepted format that preserves the layout and content across different devices.

- Excel: Ideal for users who need to perform calculations or further edits to the content.

- CSV: A text-based format often used for data importing into other platforms or systems.

- Word: Useful for more customizable documents that require text editing and formatting adjustments.

Steps to Export for Different Platforms

- Select the desired file format based on the platform you are using.

- Click on the “Export” or “Save As” option in your document editor.

- Choose the destination (e.g., cloud storage, local drive, email, etc.) where the document should be saved or sent.

- Confirm the file settings, ensuring that everything is properly formatted and aligned before exporting.

By understanding how to export your document for various platforms, you ensure that the information remains accessible and usable across different systems, saving you time and reducing potential errors during the process.

How to Use for International Transactions

When conducting cross-border transactions, it’s essential to ensure that all necessary information is clearly communicated and compliant with international standards. A well-prepared document helps prevent misunderstandings, ensures both parties are aligned, and facilitates smoother processing of payments, taxes, and delivery. Specific elements, such as currency, tax rates, and shipping terms, may need to be adjusted based on the country of the buyer and seller.

One of the primary aspects to consider is currency conversion. Clearly listing the currency used in the transaction and converting the amounts correctly is crucial to avoid confusion. Additionally, you may need to include international shipping details, customs declarations, and country-specific tax rates. Customizing the document for these specific needs helps maintain professionalism and avoids potential issues with customs or payments.

| Step | Action |

|---|---|

| 1 | Ensure that the currency is clearly stated and converted accurately based on the exchange rate. |

| 2 | Include shipping terms such as the shipping method, delivery timeframes, and tracking information. |

| 3 | Verify if there are any international taxes or tariffs that need to be added to the total amount. |

| 4 | Provide all necessary customs documentation or references if required for international shipments. |

By adjusting the relevant details for international transactions, you ensure that both parties have all the necessary information to complete the process smoothly, m

Legal Considerations in Invoice Creation

When creating transaction documents, it is essential to be aware of the legal requirements that ensure compliance and prevent disputes. Certain details must be accurately included to meet both local and international laws, including tax regulations, payment terms, and other contractual elements. Failure to incorporate the necessary legal elements can result in delayed payments, fines, or even legal action, making it vital for businesses to understand these considerations thoroughly.

For instance, it’s important to list the full names and addresses of both parties involved, include clear payment terms, and specify the applicable taxes or fees. Depending on the jurisdiction, specific language may be required to meet legal standards. This could include references to the applicable law governing the transaction or a statement regarding late fees or interest charges for overdue payments.

Common Legal Elements to Include

| Legal Element | Description |

|---|---|

| Payment Terms | Clearly outline when payments are due and any penalties for late payments. |

| Tax Information | Specify applicable tax rates and other fees, depending on the jurisdiction. |

| Jurisdiction | Indicate the governing law or location where disputes will be resolved. |

| Item Descriptions | Provide detailed descriptions of goods or services to avoid potential confusion. |

Why Legal Accuracy Matters

Ensuring that all required legal components are included reduces the likelihood of misunderstandings and ensures that your business practices remain compliant with regulations. Inaccuracies or missing details could lead to serious complications, including delayed transactions or disputes over terms. By taking the time to incorporate these legal elements, businesses not only protect themselves but also foster trust and professionalism with clients and partners.

Stockx Invoice Template vs Manual Creation

When preparing transaction documents, businesses have two primary options: using a pre-designed structure or creating one from scratch. Both approaches have their merits, but they also come with distinct advantages and challenges. Using a pre-designed structure can save time, ensure accuracy, and maintain consistency, while manual creation offers full flexibility but may lead to increased risk of errors or omissions.

Choosing between the two methods often depends on factors such as the volume of transactions, the complexity of the information required, and the business’s specific needs. A pre-designed structure is particularly useful for businesses with regular and standardized transactions, as it streamlines the process and reduces the chances of human error. On the other hand, manually crafting each document allows for more customization, which may be necessary for transactions that vary significantly from one to the next.

Advantages of Using a Pre-designed Structure

- Time Efficiency: Quickly generate documents without having to input all details each time.

- Consistency: Ensure that all documents follow the same format, making it easier for both parties to understand.

- Reduced Risk of Errors: Minimize human errors by automating some of the details.

Benefits of Manual Creation

- Full Customization: Tailor each document to the specific needs of the transaction.

- Flexibility: Adjust the layout or content based on the unique requirements of the client or situation.

- More Control: Manually reviewing every detail gives greater oversight over the final document.

While the automated method offers efficiency and consistency, manual creation provides more control and flexibility. Businesses must weigh these factors based on their own operational needs and the type of transactions they handle most frequently.

Integrating Templates with Accounting Software

Integrating pre-designed document formats with accounting software can significantly streamline financial workflows. By linking your transaction records to software tools, you can automate data entry, reduce errors, and ensure that all records are updated consistently across systems. This integration helps businesses maintain an organized and accurate financial ledger with minimal manual effort.

The integration process typically involves mapping fields from the document format to corresponding fields in the accounting software, allowing for seamless data transfer. This approach not only saves time but also ensures that financial statements and records are always aligned with the most up-to-date information. Moreover, automated synchronization between the two systems reduces the risk of discrepancies and ensures compliance with financial regulations.

Benefits of Integration

- Time Savings: Automate the transfer of transaction data directly from documents to accounting software.

- Accuracy: Reduce human errors by eliminating the need for manual data entry.

- Compliance: Ensure that financial records are consistent and comply with local accounting standards.

Steps to Integrate with Accounting Tools

- Select compatible software: Choose accounting software that allows for easy integration with your document system.

- Map fields: Define the key fields in the document format and match them with the corresponding fields in the accounting tool.

- Test and synchronize: Run test transactions to ensure that the integration works smoothly before fully deploying.

Once integrated, businesses can efficiently manage their financial records, improving both accuracy and workflow efficiency. This integration is especially beneficial for companies with high transaction volumes, as it simplifies reporting and enhances data consistency across platforms.

How to Share and Send Your Invoice

Once your financial document is ready, sharing it efficiently is crucial for maintaining smooth business operations. Whether you’re sending a transaction summary to a client or submitting records for your own accounting, ensuring the document reaches the right person in the right format is key to timely processing and payment.

There are various methods to share and send these documents, each suited to different needs and contexts. The most common approaches involve using email, cloud storage services, or direct uploads through customer portals. The format in which the document is shared–such as PDF, DOCX, or image file–can affect its readability and ease of access for the recipient.

Methods for Sharing Your Document

- Email: The simplest and most common method. Attach the document as a PDF or image and send it directly to the recipient’s email address.

- Cloud Storage: Use platforms like Google Drive or Dropbox to upload your document and share a link with the recipient. This method is ideal for large files or when you need to send multiple records.

- Customer Portals: Many platforms offer portals where clients can log in and download their documents directly, ensuring secure transmission and easy access to records.

Best Practices for Sending Documents

| Method | Pros | Cons |

|---|---|---|

| Fast and direct, widely used. | File size limits, potential for loss in spam filters. | |

| Cloud Storage | Easy to manage large files, secure sharing options. | Requires access to cloud accounts and internet connection. |

| Customer Portals | Highly secure, integrates well with automated workflows. | Can require user registration, may not be suitable for all clients. |

When sharing documents, it’s important to consider the recipient’s preferences and any confidentiality or privacy requirements that may apply. Always ensure that the method you choose is secure, especially when dealing with sensitive financial data.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for financial documents offers a range of advantages for both businesses and individuals. These ready-made layouts streamline the process of creating and managing important records, saving valuable time and reducing the potential for errors. By incorporating these structured designs, users can ensure that their documentation is not only consistent but also professional in appearance.

One of the key benefits of using these designs is the ability to simplify the record-keeping process. With everything already laid out, there is less room for mistakes, and users can focus more on the details that matter, such as transaction amounts and customer information. Additionally, the use of standardized formats can help enhance the efficiency of accounting and financial tracking tasks.

Key Advantages

- Consistency: Pre-designed documents help maintain uniformity across all records, ensuring a professional appearance and preventing confusion.

- Time Savings: Instead of starting from scratch, users can simply fill in relevant details, greatly reducing the time required for document preparation.

- Accuracy: The structured layout minimizes errors in data entry, ensuring that critical information is captured correctly and completely.

- Ease of Use: Even users without advanced technical knowledge can quickly create clear, well-organized documents, as the format is already set up for them.

- Customization: While the basic layout is provided, users can easily modify these documents to meet specific needs or preferences, making them versatile for various situations.

For businesses looking to streamline their financial operations, leveraging these ready-made formats can significantly reduce the time spent on administrative tasks, leading to greater productivity and more accurate financial records.