Download Free Stationery Invoice Template for Easy Billing

Efficient billing is a crucial part of any business operation, ensuring clear communication between service providers and clients. With the right tools, you can create organized and professional-looking financial records that reflect your brand’s identity. This not only improves customer relations but also streamlines the payment process.

Customizable documents offer flexibility, allowing you to easily adjust the layout, content, and style to fit your specific needs. Whether you are managing a small freelance business or handling larger corporate accounts, having a pre-designed structure can save you time and reduce the risk of errors.

In this guide, we will explore the essential elements of designing a professional billing form, what features to prioritize, and how to make the most of ready-made solutions. With these tools, you’ll be equipped to produce polished documents that convey professionalism and trustworthiness.

Stationery Invoice Template Overview

Creating a structured billing document is essential for maintaining professionalism and ensuring clear communication with clients. A well-organized form not only helps to itemize services or products provided but also streamlines the payment process, reducing misunderstandings and delays. Having a customizable layout allows businesses to tailor the appearance and content to their specific needs while retaining a professional standard.

Key Features of Effective Billing Documents

The most effective billing documents include essential details such as the business’s contact information, client’s details, a clear breakdown of products or services provided, and payment terms. An intuitive design with these elements makes it easy for both parties to understand the amount due and the services rendered. Additionally, incorporating your company’s logo and branding into the layout helps to reinforce your identity and adds a polished touch.

Why Customization Matters

Customization is crucial because it allows you to adjust the format to suit the nature of your business. Whether you are a freelancer or manage a larger organization, the ability to modify a billing document helps to align it with your brand’s look and feel. A personalized design can also ensure that you capture all the necessary information that is relevant to your specific industry or clientele, making the process smoother and more efficient.

Why Use a Professional Invoice Template

Utilizing a well-designed document for financial transactions is crucial for any business that values clarity and efficiency. A professional-looking form not only ensures that the details of the transaction are clearly presented but also promotes a sense of trust and reliability. When clients receive a well-organized and polished document, it enhances their confidence in your professionalism and your ability to manage your business effectively.

Enhanced Credibility and Brand Image

Presenting a clean and consistent billing document helps to reinforce your brand identity. By incorporating your company logo, color scheme, and fonts, you create a cohesive visual experience that aligns with the rest of your marketing materials. This small detail can significantly improve the perception of your business, making it appear more established and trustworthy to your clients.

Efficiency and Time Savings

One of the greatest advantages of using a pre-designed structure is the time saved on manual creation. With a professional format, you don’t have to start from scratch each time you need to send a new bill. The document is ready to be quickly customized with client-specific details, helping you stay organized and focus on growing your business.

Benefits of Customizable Invoice Formats

Using a flexible and adaptable billing document provides numerous advantages for businesses, from improved professionalism to better organization. Customizable designs allow you to adjust the document to meet your specific needs, ensuring that it aligns with your brand and business model. This level of control enhances both efficiency and consistency across your transactions.

Key Advantages of Customizable Billing Documents

- Tailored to Your Business Needs: Customizable formats let you add or remove sections based on your specific requirements, such as additional client information, detailed service descriptions, or custom payment terms.

- Consistency Across Documents: A consistent design across all your billing records creates a professional appearance and reinforces your brand identity.

- Increased Client Trust: A polished, well-organized document can help improve client relationships by presenting information in a clear, easy-to-understand manner.

- Time Efficiency: Once a document layout is set up, you can quickly reuse and modify it for future transactions, saving time on manual creation.

Enhancing Workflow and Efficiency

- Quick Updates: When you need to adjust terms, rates, or layout, a customizable format allows for easy updates without starting from scratch.

- Streamlined Record Keeping: Custom formats help maintain consistency in how records are organized, making it easier to track payments and manage financial data.

How to Create a Professional Billing Document

Creating a well-organized and clear billing document is essential for any business. A structured approach ensures that all relevant details are accurately presented, reducing confusion and helping both you and your clients track payments easily. By following a few simple steps, you can create a professional-looking form that aligns with your business needs and promotes your brand image.

Step 1: Include Essential Information

Start by adding the basic information that is crucial for any transaction. This includes:

- Your business details: Name, address, and contact information.

- Client’s details: Include the client’s name, address, and contact information.

- Unique reference number: Assign a unique ID or number to the document for easy tracking and future reference.

- Date of issue: Clearly state the date when the document is created or sent.

Step 2: Organize the Service or Product Information

List the products or services provided, including a brief description, quantity, unit price, and total cost. This helps the client clearly understand what they are being billed for. Be sure to use a clean layout with ample space between each item to avoid clutter.

- Service description: A concise explanation of the service provided.

- Quantity and pricing: Ensure that the unit cost and total amount are clearly stated.

- Payment terms: Specify the due date, any applicable late fees, and payment methods accepted.

Step 3: Design and Branding

To make your billing document look professional, integrate your company logo, brand colors, and fonts. This helps reinforce your business identity and provides a polished, cohesive appearance. Ensure that the document is easy to read by using a clear font and maintaining a simple layout.

Key Elements in an Invoice Template

When creating a document for requesting payment, it’s essential to include several crucial components to ensure clarity and professionalism. These elements are not only important for legal purposes but also contribute to a smooth transaction process. Whether you’re sending a bill for goods or services, understanding these parts will help streamline communication and minimize confusion.

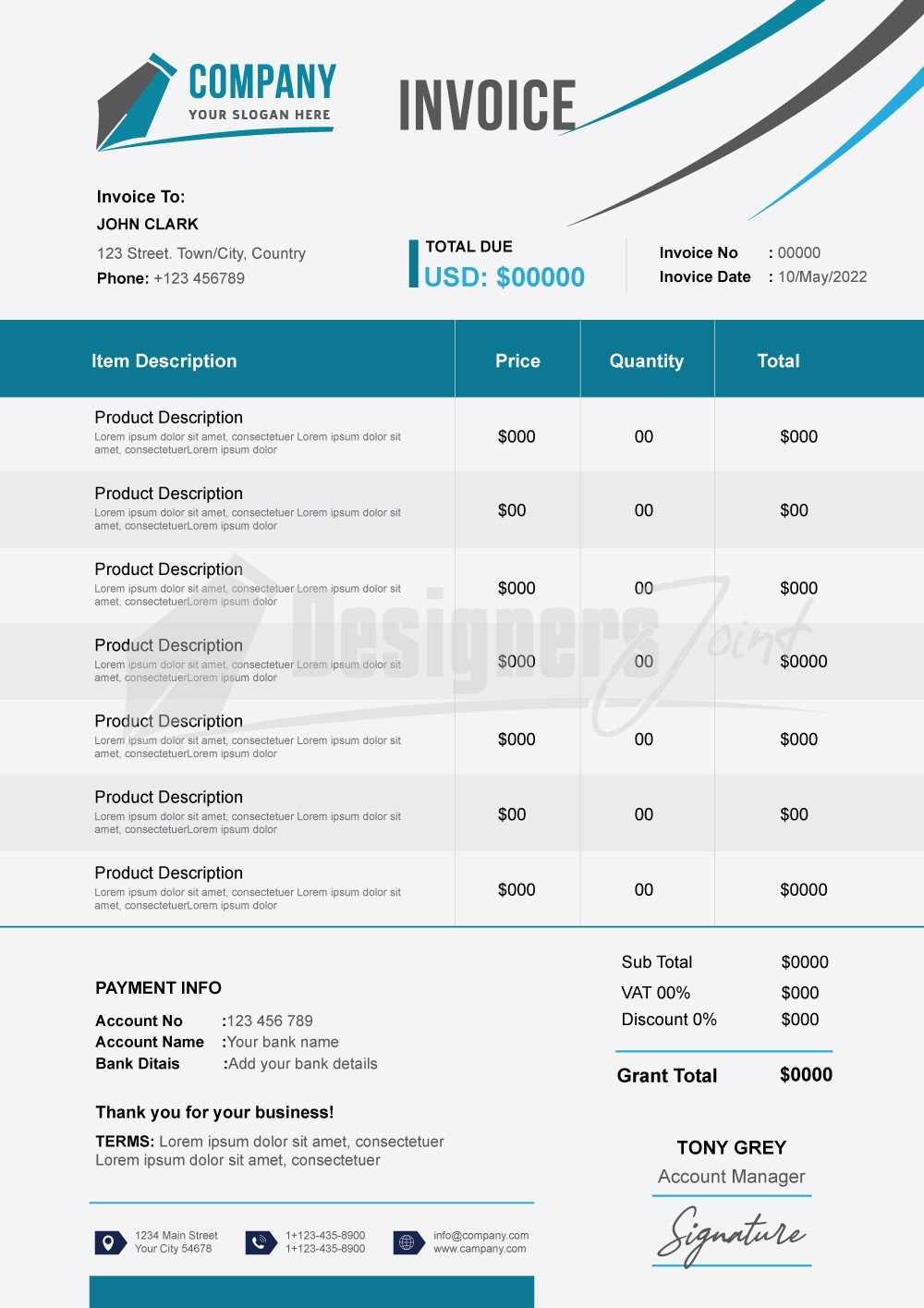

Contact Information is the first fundamental section. Clearly stating the names, addresses, and contact details of both the sender and recipient establishes accountability and makes it easier for either party to reach out if needed.

Unique Reference Number provides a simple method to track transactions and avoid any errors or confusion with future payments. This reference number should be easily identifiable and consistent across all correspondence.

Date marks the start of the transaction and is important for establishing payment deadlines. Both the issue date and any due dates should be visible to avoid misunderstandings.

Itemization of products or services being billed is essential. Each entry should be clear and concise, detailing quantities, descriptions, unit prices, and totals. This gives the recipient an accurate overview of what they are paying for.

Total Amount Due clearly displays the full sum expected, including any taxes or additional charges. A breakdown of how this total is calculated should always be present to enhance transparency.

Terms and Conditions outline the payment expectations and other important rules regarding late fees, payment methods, or refunds. These conditions are vital for legal protection and ensuring both parties agree on the transaction terms.

Free vs Paid Invoice Templates

When selecting a document format for billing purposes, businesses and freelancers often face the decision between using free or paid options. Each type comes with its advantages and potential drawbacks, depending on the needs and scale of the operation. Understanding these differences can help you choose the best solution for efficiency, branding, and professional presentation.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization available, limited design options | Advanced customization, fully customizable layouts and features |

| Design Quality | Simple, minimalistic designs, often generic | Premium, professional designs tailored for branding |

| Functionality | Basic fields, may lack advanced calculations or integrations | Advanced features like automated calculations, accounting software integrations |

| Support | Limited or no customer support | Dedicated support and regular updates |

| Cost | Free, but may include ads or restrictions | Requires a one-time fee or subscription |

Ultimately, the choice between free and paid formats depends on the specific needs of your business. Free options are suitable for small-scale operations with minimal requirements, while paid solutions are better for those seeking advanced features, customization, and professional-level designs.

Choosing the Right Template for Your Business

Selecting the right format for your billing documents is a critical decision for any business. The document should not only be functional but also align with your brand’s image and meet the specific needs of your clients. The right design can enhance professionalism, improve clarity, and streamline your financial processes. Understanding your business requirements is key to making an informed choice.

Consider Your Business Type

The nature of your business plays a significant role in determining which structure best suits your needs. Here are some factors to consider:

- Service-based businesses: Opt for simple, clear formats that highlight the details of services provided, time spent, or hourly rates.

- Product-based businesses: Choose designs that allow for easy itemization of multiple products, quantities, and prices.

- Freelancers and consultants: A more personalized or unique layout might be ideal to convey professionalism and creativity.

Features You Need

Different businesses may need different features in their documents. Consider these options when selecting a format:

- Custom Branding: Ensure the option allows you to incorporate your business logo, colors, and contact details.

- Itemization: For businesses with many products or services, choose a format that clearly separates individual items, quantities, and prices.

- Payment Terms: Make sure there is space to specify payment deadlines, late fees, or accepted payment methods.

- Automation: If you handle a high volume of transactions, look for formats that offer automatic calculations and integration with accounting tools.

Choosing the right option is about balancing your business’s functionality with a professional, streamlined design. Ensure that the chosen structure meets your needs today and adapts as your business grows.

How to Edit an Invoice Template

Editing a billing document is a straightforward process that allows you to personalize your document to fit your business needs. Whether you’re updating client information, adjusting pricing details, or modifying design elements, knowing how to make these changes efficiently is crucial for maintaining professional and accurate records. Below are the steps to help you quickly and easily adjust your document.

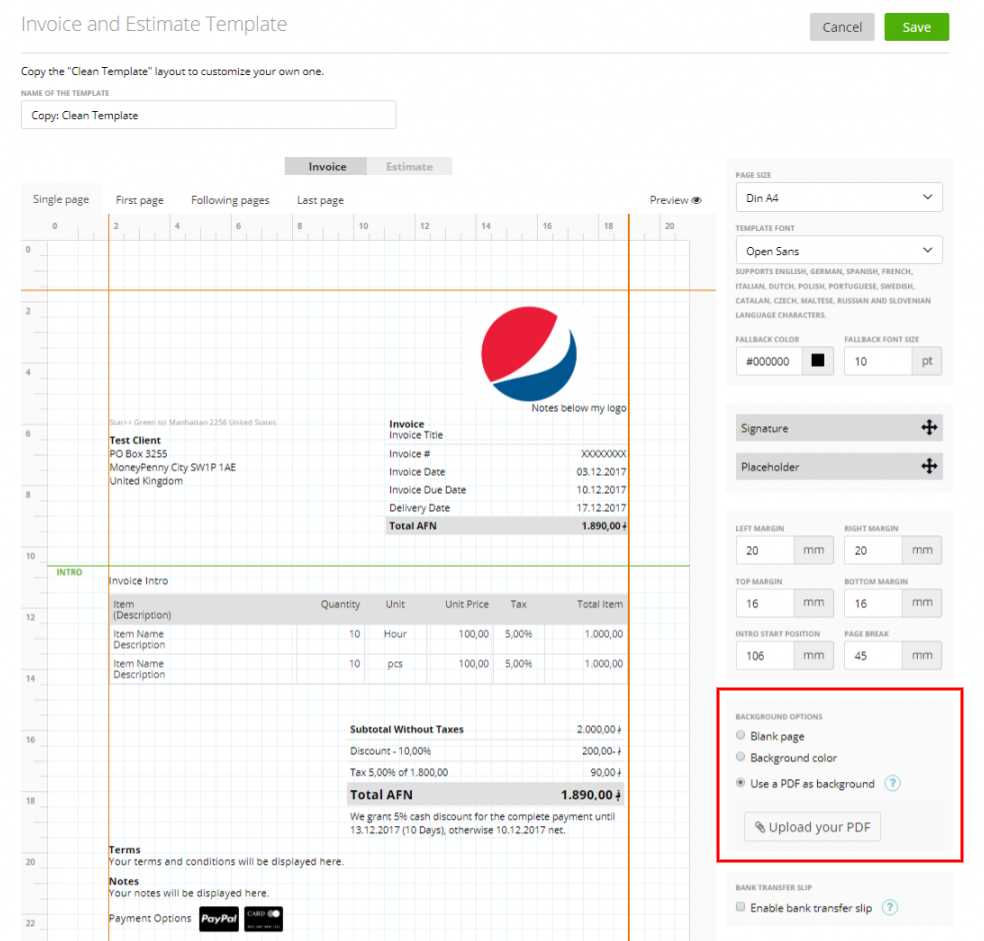

1. Choose the Right Software or Tool

To start editing, select the software or platform you will use. Most formats can be edited in popular word processing programs like Microsoft Word, Google Docs, or specialized accounting software. Choose the one that fits your level of expertise and allows you to make the necessary customizations:

- Word Processing Software: Ideal for simple adjustments such as text edits, logos, and colors.

- Accounting Tools: Best for more complex needs like automated calculations, tax calculations, and integration with other financial tools.

- Online Generators: Great for quick, cloud-based edits with pre-built designs.

2. Update Key Information

The next step is to update the details specific to the transaction or the client. This includes:

- Client Information: Edit the recipient’s name, address, and contact details as necessary.

- Services or Products: Adjust quantities, descriptions, and prices of goods or services provided.

- Payment Terms: Ensure the payment deadline, late fees, and accepted methods are accurate and reflect your current policies.

Additionally, you can personalize the design by adding your company logo, changing fonts, or modifying the layout. This helps reinforce your brand identity while keeping the format clean and professional.

3. Save and Export

After making all the necessary changes, save your document. It’s recommended to keep both the editable and exported versions. You can export the final version to a PDF to ensure the format remains intact across different devices and systems. For recurring use, save your edited version as a template for easy access in the future.

Editing a billing document allows you to keep your records accurate, professional, and aligned with your business needs. By following these simple steps, you ensure that your documents will reflect both your brand and your financial expectations.

Top Features to Look for in Templates

When selecting a document for billing or payment requests, certain features can significantly enhance its efficiency, clarity, and professional appearance. Choosing the right structure will not only help streamline the process but also ensure that all necessary information is accurately conveyed. Below are the top characteristics to look for when choosing a format for your business needs.

- Customizable Design: The ability to adjust the layout, colors, and fonts allows you to match the document with your brand’s identity. A well-branded document enhances professionalism and ensures recognition by your clients.

- Clear Itemization: A good structure should allow for clear separation of individual items or services, with corresponding quantities, rates, and totals. This feature minimizes confusion and improves transparency for your clients.

- Automated Calculations: Automation of totals, taxes, and discounts saves time and reduces the likelihood of errors. Look for structures that perform these calculations automatically based on the input data.

- Payment Terms Section: A dedicated area for payment conditions, including due dates, late fees, and acceptable methods, ensures clear communication about financial expectations and helps prevent misunderstandings.

- Contact Information Fields: Including space for both your company and client details is crucial. This should feature areas for names, addresses, and contact information, making it easy for both parties to stay in touch if necessary.

- Multi-Currency and Tax Support: If you work internationally or with different tax regions, a format that supports multiple currencies and automatic tax calculations is essential for maintaining accuracy and compliance.

- Professional Look and Feel: A clean, well-organized design with high-quality fonts and spacing conveys professionalism. Avoid clutter and choose a structure that balances functionality with aesthetics.

By selecting a document with these key features, you ensure that your financial communications are both efficient and effective, helping to foster trust with clients while streamlining your own administrative processes.

Common Mistakes in Invoice Creation

When preparing a document to request payment, it’s easy to overlook small details that can lead to confusion, delayed payments, or even disputes. Understanding common errors can help ensure that your financial documents are clear, accurate, and professional, ultimately improving the transaction process. Below are some of the most frequent mistakes that can occur during document preparation and how to avoid them.

| Error | Description | How to Avoid |

|---|---|---|

| Missing or Incorrect Client Details | Failure to include accurate client information, such as the name, address, or contact details, can lead to confusion and delays. | Always double-check the recipient’s details before sending the document. Ensure that the information is up-to-date and correct. |

| Unclear Payment Terms | Ambiguous or missing payment terms, such as due dates or late fees, can create misunderstandings between you and your client. | Clearly state payment deadlines, accepted methods, and any penalties for late payments to avoid confusion. |

| Incorrect Calculations | Errors in the totals, taxes, or discounts can cause distrust and delay payments. | Use automatic calculation features, double-check the math, and ensure all figures are correct before finalizing the document. |

| Omitting a Unique Reference Number | Without a unique reference number, it becomes difficult to track payments, especially if you handle multiple transactions. | Always include a unique identifier for each document to ensure easy tracking and management of transactions. |

| Lack of Professional Design | A cluttered or unprofessional layout can give a negative impression and affect the credibility of your business. | Use a clean, well-organized layout with consistent fonts and branding to convey professionalism and clarity. |

By being aware of these common mistakes and taking steps to avoid them, you can ensure that your documents are both effective and professional, leading to smoother transactions and stronger business relationships.

Ensuring Consistency with Your Branding

When creating billing documents, it is important to ensure that they reflect your brand’s identity and values. Consistency in design and presentation helps reinforce your business image, build trust with clients, and make your communications more memorable. By aligning your documents with your overall branding strategy, you can create a cohesive experience that enhances both professionalism and recognition.

To achieve this, start by incorporating your brand’s logo, colors, and fonts into the document design. Using the same visual elements found on your website, marketing materials, and social media profiles ensures a unified appearance across all platforms. Additionally, pay attention to the tone and language of the content–keeping it consistent with your brand’s voice is key to maintaining a professional image.

Furthermore, consistency extends to the structure of your documents. Regular use of the same format for all financial communications ensures that clients know what to expect and can easily navigate the information. This not only saves time but also contributes to a more organized and efficient process for both you and your clients.

By maintaining consistent branding throughout your documents, you strengthen your business’s identity and create a more seamless, professional experience for your clients.

How to Save Time with Templates

Using pre-designed formats for your business documents can drastically reduce the time spent on repetitive tasks. Instead of creating a new document from scratch every time you need to request payment or provide a financial summary, a reusable structure allows you to focus on the content while keeping the format consistent. This can streamline your administrative tasks, boost productivity, and reduce the risk of errors.

Benefits of Using Pre-Designed Formats

Here are some key ways pre-made designs help save time:

- Faster Setup: Instead of formatting each document individually, you can simply enter relevant details, such as client names, amounts, and services, and have everything automatically organized.

- Consistency: Using the same layout for all your documents ensures that every request has a professional appearance, making the process quicker and more efficient without needing to adjust the design each time.

- Automated Calculations: Many pre-designed documents include automatic calculations for totals, taxes, and discounts, saving you from doing the math manually.

- Easy Reuse: Once set up, you can save the document as a reusable file, making future edits much quicker and less time-consuming.

How to Maximize Efficiency

To get the most out of pre-designed formats, consider the following tips:

- Customize Once: Spend time customizing the design, adding your logo, and setting up the layout for your business. Once this is done, you won’t need to repeat it every time.

- Use Fields and Placeholders: Set up your format with placeholders for client names, payment details, and service descriptions. This will make it easier to quickly fill in the necessary information without reformatting.

- Save and Organize: Keep your most-used versions stored in a way that makes them easy to access and reuse, whether on your computer or in a cloud service.

By leveraging pre-designed formats, you can reduce the amount of time spent on document creation, leaving you with more time to focus on other essential aspects of your business.

Invoice Template Tools for Beginners

If you’re just starting out with managing billing or financial documents, using the right tools can make the process much easier and more efficient. For beginners, it’s important to find simple yet effective tools that allow you to create and customize documents without a steep learning curve. With the right resources, you can quickly generate professional-looking documents and focus on other aspects of your business.

Popular Tools for Beginners

Here are some user-friendly tools that are great for those who are new to creating financial documents:

- Google Docs: A free, easy-to-use option that allows you to create customizable documents with basic templates. It also offers cloud storage for easy access from any device.

- Microsoft Word: A classic choice, offering a variety of pre-designed formats and the flexibility to modify and save your own. Perfect for those who are already familiar with the software.

- Canva: Known for its design capabilities, Canva offers simple drag-and-drop tools and professional templates, making it ideal for users who want to create visually appealing documents quickly.

- Zoho Invoice: A cloud-based tool designed specifically for billing, offering customizable formats, automatic tax calculations, and easy client management–great for small businesses.

- Wave: A free online platform that allows you to create, send, and track documents. Wave also integrates with accounting features, making it a solid choice for beginners looking to streamline finances.

How to Choose the Right Tool

When selecting a tool for document creation, consider the following:

- Ease of Use: Choose a tool that fits your level of expertise. Look for platforms with an intuitive interface and pre-designed options that require minimal effort to modify.

- Customization: Ensure the tool allows you to make changes to fonts, colors, and layout so that you can align documents with your brand identity.

- Automation: If you’re handling a high volume of documents, choose tools with features like automated calculations or integrations with accounting software.

- Cost: Many tools offer free versions with basic functionality. Consider what features you need and whether you may need to upgrade in the future.

By using these beginner-friendly tools, you can quickly create, manage, and send professional documents, saving time while maintaining accuracy and professionalism in your financial processes.

How to Format Your Document Professionally

Creating a polished and well-organized document for financial transactions is crucial for making a positive impression on clients. The key to professionalism lies in clarity, structure, and attention to detail. Proper formatting not only ensures that all necessary information is included but also fosters trust and credibility with your audience.

Start by ensuring your document has a clear and logical layout. This includes using headings and subheadings for easy navigation and dividing the content into distinct sections. Clear organization allows recipients to quickly understand important details, such as payment terms, amounts due, and deadlines.

Another essential aspect is consistency in font style and size. Avoid using multiple fonts or sizes that can distract from the content. Instead, select one or two professional fonts, ensuring readability and a clean appearance. Additionally, make sure there is sufficient white space between sections to create a sense of balance and avoid a cluttered look.

Make sure to include all required details without overcrowding the document. This means highlighting essential elements like contact information, transaction references, and payment instructions clearly. A structured approach not only makes the document easy to read but also ensures that it conveys professionalism throughout.

Managing Document Formats for Multiple Clients

Handling various forms for different clients can be a challenge, especially when each one requires specific details or has unique preferences. It’s essential to keep everything organized and efficient, ensuring that all the necessary information is customized according to the client’s needs while maintaining consistency in appearance and structure.

One effective strategy is to create distinct versions of the document for each client, tailoring them to include relevant terms, payment instructions, and branding elements specific to the client. Using a centralized system for organizing these formats helps streamline the process. By keeping all documents clearly labeled and categorized, you can quickly find the right version for each client.

It’s also important to regularly review and update each version. Over time, the terms of business or payment methods might change, and keeping track of these updates is crucial for accuracy. Consider creating a master format that includes the most common elements, which can then be easily adjusted for each client. This will save time while ensuring that each document remains professional and up-to-date.

Utilizing digital tools and software that allow easy customization and storage of these files can significantly enhance your workflow. With the right system in place, managing multiple documents for various clients becomes an efficient, organized process that helps maintain professionalism across the board.

Best Practices for Document Follow-up

Following up on outstanding payments is an essential part of maintaining a healthy cash flow and ensuring that financial transactions are completed in a timely manner. A well-executed follow-up can foster good relationships with clients, while also safeguarding your business interests. However, it’s important to approach follow-ups in a professional and tactful way, balancing persistence with courtesy.

Here are some key practices to help guide your follow-up process:

| Timing | Send a reminder promptly but politely after the due date has passed. A gentle nudge within a few days of the deadline is often enough to prompt action. |

|---|---|

| Clarity | Ensure that your follow-up message clearly outlines the amount due, the original due date, and any relevant transaction details. This helps the client quickly understand what is owed and reduces confusion. |

| Multiple Channels | Consider using multiple communication methods–such as email, phone calls, or even text messages–depending on your relationship with the client. This increases the likelihood of reaching them in a timely manner. |

| Politeness | Keep your tone professional and respectful. Even when sending reminders, maintain a friendly attitude to preserve good relations and encourage prompt payment. |

| Follow-up Frequency | Set a schedule for follow-ups, but avoid bombarding your clients with multiple reminders. Space them out appropriately, with escalating levels of urgency as necessary. |

By adhering to these best practices, you can improve your chances of receiving payments on time and maintain positive business relationships with your clients. A methodical and considerate approach to follow-ups helps ensure that your business continues to run smoothly and efficiently.