Download Free Standard Invoice Template for Easy and Professional Billing

Creating a well-organized payment request is crucial for any business or freelancer. A clear and detailed document not only ensures smooth financial transactions but also helps maintain professional relationships with clients. Whether you are just starting your business or looking to streamline your processes, using a pre-designed structure can save time and reduce errors.

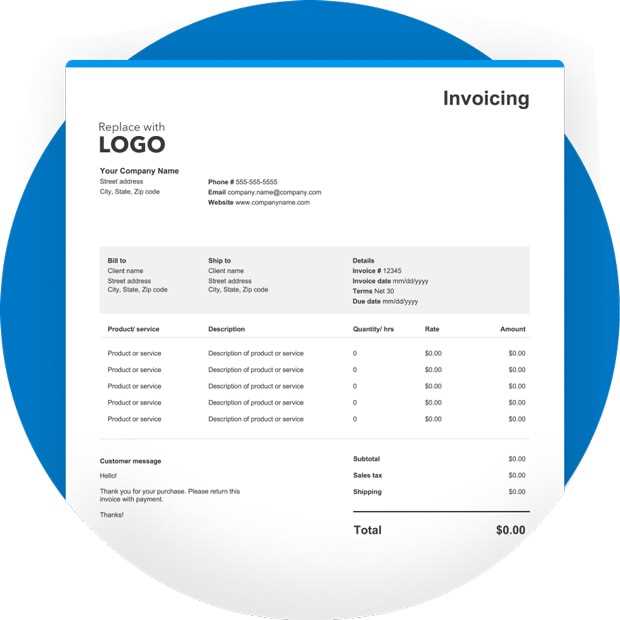

Customizable billing forms are widely available and offer the flexibility to suit different industries and business models. These documents are easy to personalize with your logo, contact details, and specific payment terms. By utilizing a structured format, you can present your charges in a concise and transparent way, making it easier for clients to understand and process payments quickly.

In this guide, we will explore the key components and benefits of using such a document. From customizing content to understanding essential fields, you’ll learn how to create an effective and professional request for payment that stands out to clients and ensures timely compensation.

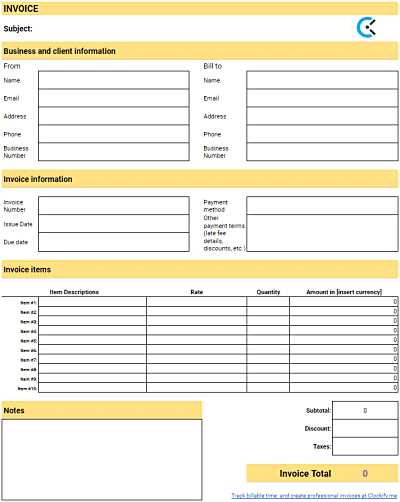

What is a Standard Invoice Template

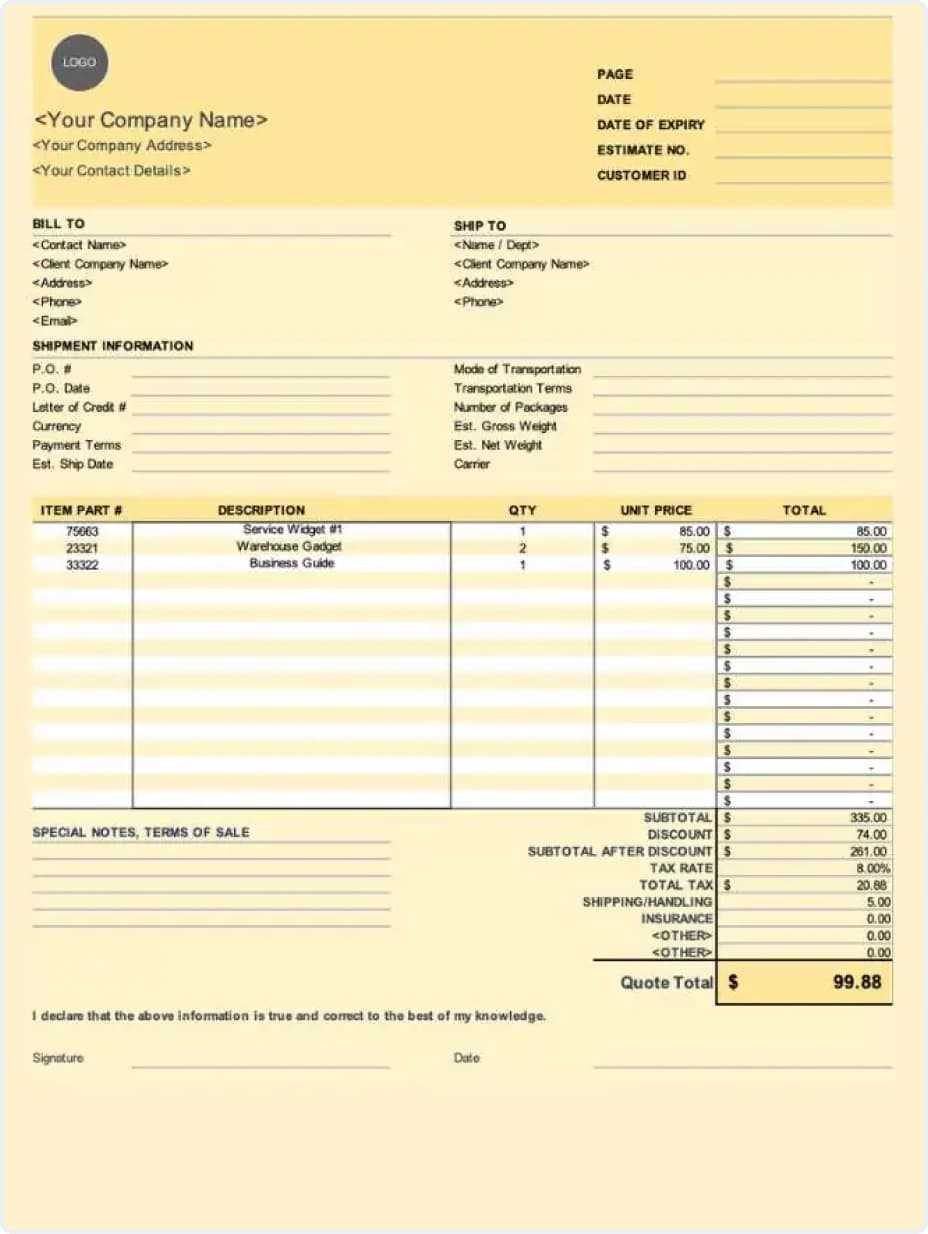

At its core, a well-structured document used for requesting payment serves as a formal agreement between businesses and clients. It outlines the services or products provided, the corresponding costs, and the terms for payment. This type of document ensures both parties are clear on the financial exchange and serves as a record for accounting purposes.

Such a document typically includes key details such as the seller’s contact information, a unique reference number, a breakdown of charges, and the due date for payment. The goal is to create a clear, concise, and professional record that can be easily customized based on specific transactions and business needs.

Using pre-designed structures helps to maintain consistency and efficiency in financial transactions. By adopting a set format, businesses can avoid missing critical information and ensure every document is presented in a uniform and professional manner.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for billing offers numerous advantages, especially for small businesses and freelancers. By relying on a consistent format, you can save time, reduce errors, and enhance the professionalism of your financial communications. Below are some of the key benefits of using a structured form for payment requests:

- Time Efficiency: With a ready-made layout, you can quickly input transaction details without starting from scratch each time.

- Consistency: A uniform format ensures all payment requests are clear and follow the same structure, which helps avoid confusion for clients.

- Professionalism: Using a polished, organized document increases your business credibility and leaves a positive impression with clients.

- Error Reduction: Predefined fields and sections reduce the likelihood of missing important information or making costly mistakes.

- Customization: You can easily adjust the content to fit specific needs, such as adding discounts, taxes, or payment terms.

- Record-Keeping: These documents serve as important records for both parties, aiding in accounting and tax reporting.

Incorporating such a structure into your workflow not only simplifies the billing process but also improves financial management for your business.

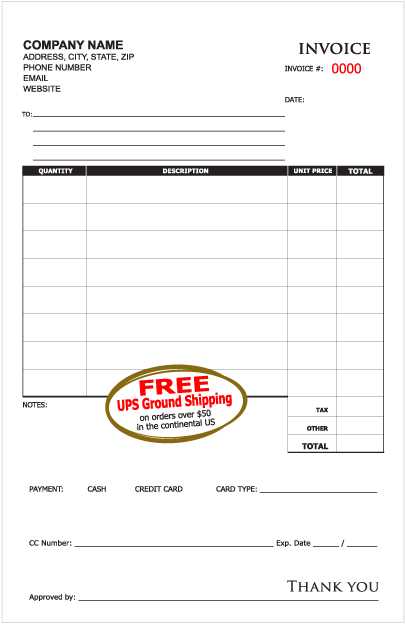

How to Customize Your Billing Document

Personalizing a billing document is essential for making it align with your brand and specific business needs. Customization ensures that every payment request is tailored to reflect the unique details of a transaction and presents a professional image. Below are the key steps to effectively adjust the structure for your requirements:

- Add Your Business Information: Include your business name, logo, contact details, and any other relevant information to make the document clearly identify your company.

- Adjust the Layout: Modify the design to suit your style. You can adjust fonts, colors, and spacing to match your brand identity.

- Modify the Itemization: Ensure that each product or service is listed clearly, including descriptions, quantities, prices, and any applicable taxes or discounts.

- Set Payment Terms: Specify due dates, accepted payment methods, and any late fees or conditions for your clients to follow.

- Include Custom Fields: If necessary, add extra sections like purchase order numbers, project references, or special instructions that are relevant to your business or clients.

- Review Legal Compliance: Make sure your document meets the local legal requirements, such as including tax identification numbers or VAT information if required by law.

By taking the time to personalize each document, you create a clear, professional, and effective request for payment that reflects your unique business practices and client expectations.

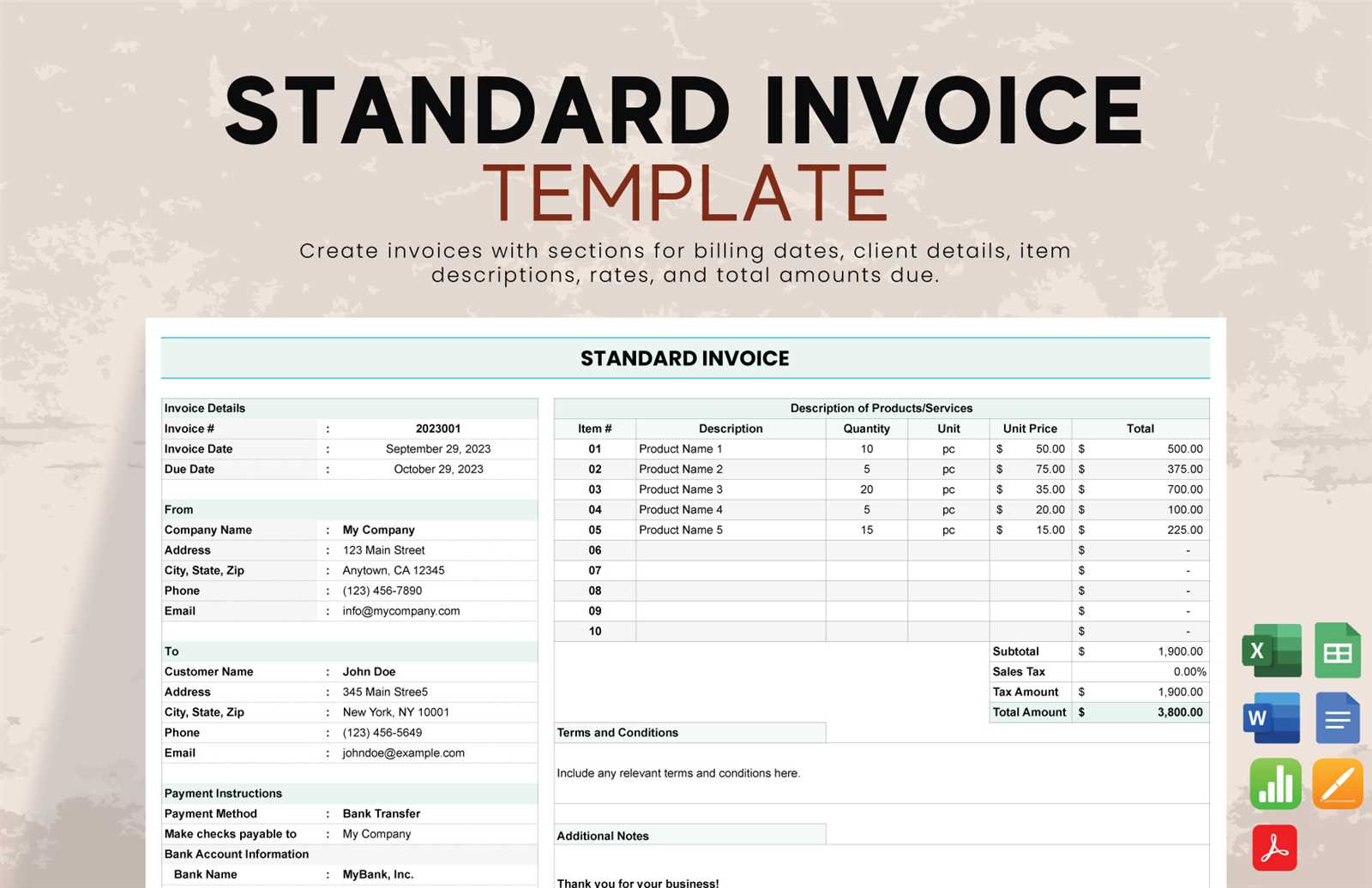

Key Elements of a Professional Invoice

A well-organized payment request document is essential for ensuring clear communication and smooth transactions between businesses and clients. It must include specific components that provide all the necessary details, such as what is being charged, when payment is due, and how it can be made. Below are the key elements that should be present in any professional billing record:

1. Contact Information

Both the business and the client should be clearly identified with their respective contact details. This includes the business name, address, phone number, and email, as well as the client’s name, address, and other relevant contact information. This helps prevent confusion and ensures that the document can be easily traced back to the correct parties.

2. Unique Reference Number and Date

Each document should have a unique identifier or reference number for easy tracking. Along with this, the date the document is issued and the payment due date should be clearly indicated. This ensures there is no ambiguity about when the payment is expected.

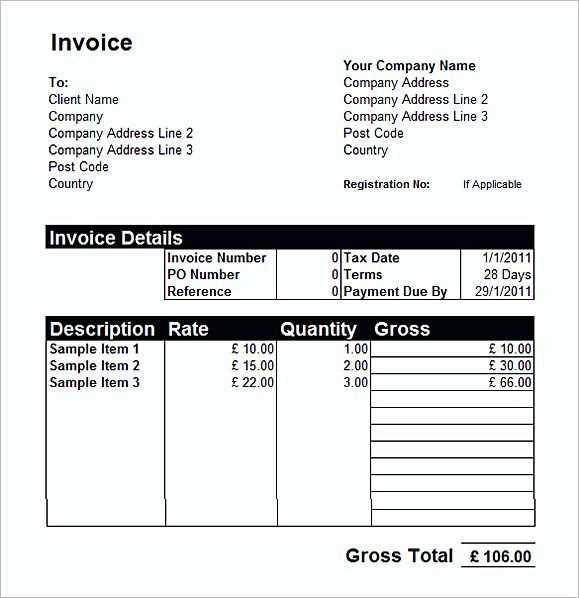

3. Detailed List of Products or Services

A comprehensive breakdown of the items being billed should be included, with clear descriptions, quantities, rates, and total costs for each item or service provided. This section is crucial for transparency and helps avoid any disputes about the charges.

4. Payment Terms and Methods

Clearly outline the payment terms, such as due dates, accepted payment methods (e.g., bank transfer, credit card), and any late fees or early payment discounts. This section helps the client understand how and when to make the payment and what to expect if they miss the deadline.

5. Tax Information

If applicable, include tax details such as VAT or sales tax. Provide the relevant tax rates and amounts, ensuring full compliance with local tax regulations.

Including these key elements ensures that your billing documents are professional, clear, and legally sound, promoting timely payments and positive business relationships.

Where to Find Free Billing Documents

Finding a ready-made, customizable document for requesting payment can be a time-saver for any business. Fortunately, there are various sources online where you can download free, professional-looking structures that suit your needs. Below are some of the most reliable places to find such documents:

1. Online Template Providers

Many websites offer free downloadable options for business documents, including payment request formats. Popular sites like Canva, Microsoft Office, and Google Docs provide a wide range of choices that are fully customizable. These platforms often feature templates designed to meet various business needs, from freelancers to large corporations.

2. Freelance and Business Websites

Freelance platforms like Upwork, Fiverr, and business sites like Zoho or FreshBooks also offer free billing structures. These sites cater to small businesses and individual entrepreneurs, providing tools and documents designed for ease of use and professional presentation.

By exploring these platforms, you can easily find a format that aligns with your branding and business requirements, and tailor it to suit your specific transactions.

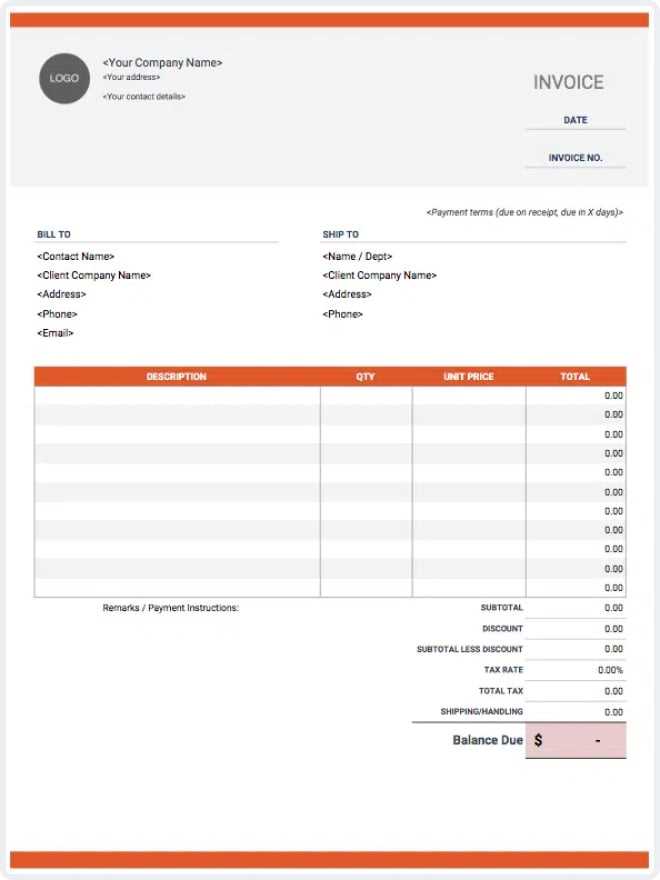

Choosing the Right Billing Format

When selecting a format for your payment request, it’s important to choose one that aligns with your business needs and the expectations of your clients. The right structure can improve your workflow, reduce mistakes, and ensure you present a professional image. Below are key factors to consider when choosing the best format for your business:

1. Consider Your Business Type

The format you choose should reflect the nature of your business. For example:

- Freelancers: Simple, clear documents with sections for services, rates, and payment terms are typically sufficient.

- Small businesses: A more detailed document might be necessary, including tax calculations, discounts, and multiple product/service lines.

- Large enterprises: More complex formats with additional sections for purchase order numbers, multiple payment options, and legal terms may be required.

2. Evaluate Your Client’s Preferences

Understanding your client’s expectations can guide your choice of structure. Some may prefer a minimalist format, while others might require detailed breakdowns. Consider the following:

- Corporate clients: Often prefer detailed and formal documents with comprehensive information.

- Freelance or creative clients: May be more flexible, preferring a clean, easy-to-read format with fewer details.

By tailoring your document to both your business needs and client preferences, you can ensure that it not only looks professional but also meets the specific requirements of each transaction.

How to Add Taxes and Discounts

Incorporating taxes and discounts into your payment request is essential for ensuring accurate billing and maintaining transparency with your clients. Properly calculating these amounts and displaying them clearly on the document prevents confusion and fosters trust. Below are steps to add both taxes and discounts to your financial documents:

1. Adding Taxes

Taxes are typically added as a percentage of the total amount for goods or services provided. To calculate this, you multiply the subtotal by the applicable tax rate. Make sure to include the tax rate and the total tax amount to ensure clarity for the client.

| Item Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Service/Product Name | $100.00 | 10% | $10.00 |

In this example, a 10% tax rate has been applied to a $100.00 service, resulting in $10.00 in taxes.

2. Applying Discounts

Discounts can be subtracted from the total amount before taxes are applied, or in some cases, after tax. Discounts can be percentage-based or flat amounts. Be sure to clearly state the discount and calculate it accurately to avoid any misunderstandings.

| Item Description | Original Amount | Discount | Amount After Discount |

|---|---|---|---|

| Service/Product Name | $150.00 | 15% | $127.50 |

In this example, a 15% discount on a $150.00 item reduces the total to $127.50. Always display the discount clearly so that the client knows exactly how much was subtracted from the original amount.

By carefully calculating and displaying both taxes and discounts, you can ensure your billing is accurate and transparent, ultimately leading to smoother financial transactions.

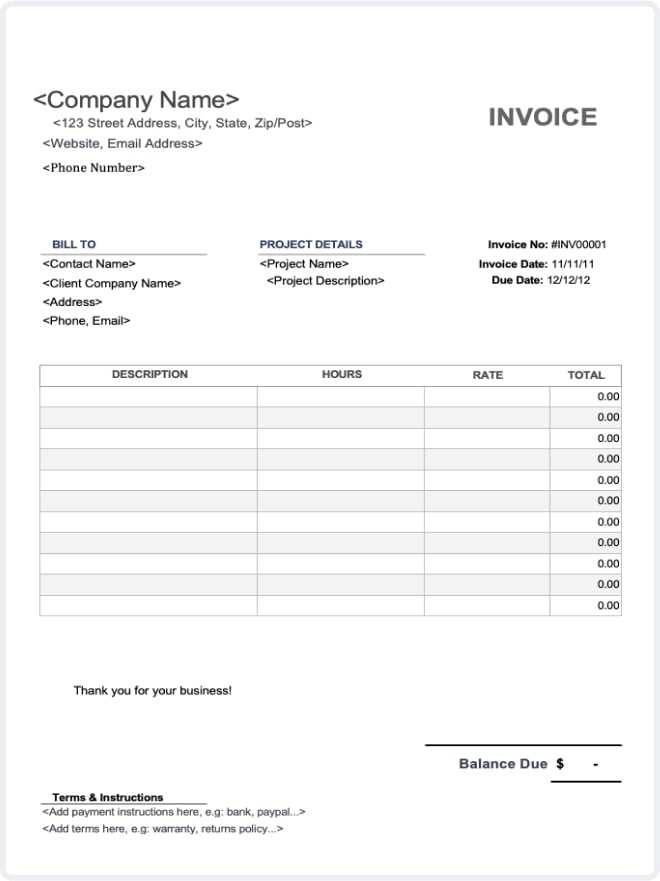

Using Billing Documents for Small Businesses

For small businesses, maintaining an organized and professional system for requesting payment is essential. Using a pre-designed structure allows entrepreneurs to save time, ensure accuracy, and present a consistent image to clients. With a ready-made layout, small business owners can focus more on their core operations rather than spending time creating documents from scratch.

1. Streamlining the Billing Process

Using a preformatted structure simplifies the process of generating payment requests, allowing small business owners to send out professional documents quickly. This reduces the chances of errors, such as missing information or incorrect totals, and helps ensure a faster turnaround for payments.

2. Customizing for Your Business Needs

Ready-to-use structures can be easily customized to suit your specific business needs. Whether you are providing products, services, or both, you can tailor the layout to include relevant fields such as product descriptions, project details, or hourly rates. Personalizing the document also allows you to include your logo and branding, helping to reinforce your company’s professional image.

By adopting such an approach, small businesses can stay organized, save time on administrative tasks, and improve cash flow management, all while presenting a polished and consistent image to clients.

Common Mistakes in Billing Document Creation

Creating a payment request may seem straightforward, but there are several common errors that can lead to confusion, delays, or disputes. By understanding these pitfalls and addressing them early, businesses can ensure smoother transactions and maintain professionalism. Below are some of the most frequent mistakes made during the billing process:

1. Missing or Incorrect Information

One of the most common issues is leaving out important details or providing incorrect information. This can delay payments and damage the professional image of your business. Key mistakes to avoid include:

- Missing contact details: Not including your business name, address, and phone number can make it difficult for clients to reach you with questions or issues.

- Incorrect dates: Ensure that the issue date and payment due date are correct. Errors here can confuse your client and delay payment.

- Wrong amounts or calculations: Always double-check the totals and ensure the amounts are accurate, including taxes and discounts.

2. Lack of Clear Payment Terms

Vague or missing payment terms can cause confusion for clients and delay payments. It’s important to clearly state the expected payment method, due date, and any late fees or discounts for early payment. Without these details, clients may be unsure of how or when to pay.

- Unclear payment methods: Specify if you accept bank transfers, credit cards, or other methods to avoid delays.

- Omitting late fees or penalties: If applicable, ensure that any late fees are clearly outlined, so clients know the consequences of delayed payments.

- Not stating the due date: Clearly state when payment is due to avoid misunderstandings and unnecessary delays.

By addressing these common mistakes and ensuring that every detail is clear and accurate, businesses can create more effective, professional payment requests that encourage timely payments and reduce the risk of disputes.

How to Save Time with Pre-Formatted Documents

Using pre-designed billing documents can significantly reduce the time spent on administrative tasks. Instead of starting from scratch each time you need to create a payment request, a ready-made structure allows you to simply fill in the relevant details. This not only speeds up the process but also ensures consistency and reduces the risk of errors. Here’s how utilizing such structures can save you valuable time:

- Faster Document Creation: By filling in fields instead of designing a new document each time, you can generate a payment request in minutes rather than hours.

- Reduced Errors: Pre-built formats have clear sections and calculations, which help prevent common mistakes like missing information or incorrect totals.

- Consistency Across Documents: Using the same structure for every transaction ensures a uniform look, making it easier to track and organize your records.

- Easy Customization: Ready-made formats can be quickly adjusted to reflect specific details, such as client information or services provided, saving you from reformatting every time.

- Streamlined Processes: Once you’ve set up your structure, sending out requests becomes a simple task, allowing you to focus on more important business matters.

By adopting pre-designed documents, businesses can handle billing more efficiently, freeing up time to focus on growth and client relationships.

Best Software for Creating Billing Documents

Choosing the right software for generating payment requests can greatly simplify your workflow, increase efficiency, and help maintain consistency in your financial records. With various options available, it’s important to select a tool that meets the unique needs of your business, whether you’re a freelancer, a small business owner, or part of a larger enterprise. Here are some of the best software solutions for creating professional payment requests:

1. FreshBooks

FreshBooks is a popular choice among small business owners and freelancers. It allows you to create customized payment requests quickly, track payments, and even send reminders for overdue payments.

- User-friendly interface: Intuitive and easy to navigate, even for beginners.

- Time tracking: Ideal for service-based businesses that bill clients based on time.

- Cloud-based: Access your documents from anywhere, anytime.

2. Zoho Invoice

Zoho Invoice offers a range of features that help businesses create professional documents, track expenses, and manage payments. It’s known for its flexibility and customization options.

- Automation: Automatically send recurring payment requests to clients.

- Custom branding: Add your logo and choose colors that reflect your business.

- Multi-currency support: Great for businesses with international clients.

3. QuickBooks Online

QuickBooks Online is one of the most well-known accounting software tools, offering robust features for managing finances, including generating payment requests. It’s perfect for businesses that require comprehensive accounting tools in addition to billing.

- Integrated accounting: Track your income and expenses alongside billing tasks.

- Customizable documents: Easily tailor payment requests to meet your needs.

- Payment tracking: Monitor your payment status in real-time.

4. Invoice Ninja

Invoice Ninja is an excellent option for freelancers and small businesses that need a free yet powerful tool for creating payment requests and managing projects.

- Free plan available: Great for small businesses on a tight budget.

- Multiple payment gateways: Accept payments through PayPal, Stripe, and others.

- Client management: Organize your client information and communication easily.

By using the right software, you can streamline the process of creating and managing your billing documents, ultimately saving time and reducing errors in your financial transactions.

Understanding Billing Numbering Systems

A well-organized numbering system for payment requests is essential for tracking transactions and maintaining accurate records. It helps both businesses and clients quickly reference specific documents, reduces the risk of confusion, and ensures that every request is unique. In this section, we’ll explore the importance of a good numbering system and different methods you can use to organize your billing records.

The numbering system you choose should be simple, sequential, and easy to track. It’s important to avoid duplication and ensure that each document has a unique identifier. This makes it easier to refer to a specific record when discussing payments, resolving disputes, or organizing financial data. A well-structured system also supports better record-keeping and can streamline processes for both internal use and tax reporting.

There are several approaches to numbering your payment documents, each with its own advantages. The method you select will depend on your business needs, the volume of transactions, and how detailed you want your record-keeping to be.

How to Track Payments with Billing Documents

Tracking payments is a crucial part of managing finances for any business. Having a clear system for monitoring which payments have been received and which are still outstanding helps ensure steady cash flow and avoids confusion. A well-organized approach allows you to stay on top of client transactions and efficiently manage your accounts receivable.

By using the right tools and practices, you can easily track payments and keep your financial records in order. Here are some effective ways to monitor payments using your billing documents:

1. Include Payment Status on Each Document

- Mark as Paid: Clearly indicate when a payment has been received to avoid any confusion. This can be done with a simple checkbox or a “Paid” stamp on the document.

- Outstanding Balance: Include the remaining balance if the payment is partial or if the due date has not yet arrived. This helps both you and the client keep track of the amount owed.

- Due Date: Always list the due date on the document to remind clients of when payment is expected.

2. Use Payment Tracking Software

- Automatic Updates: Some accounting software automatically updates the payment status when a payment is received, saving you time on manual tracking.

- Invoice History: Keep a detailed history of all transactions in one place, so you can easily reference previous payments or overdue amounts.

- Payment Reminders: Set up automatic reminders for clients with outstanding balances. This ensures payments are received on time and helps avoid late fees.

3. Create a Payment Log

- Record Payments: Maintain a log that tracks all incoming payments by date, amount, and payment method. This will help you reconcile accounts and detect any discrepancies.

- Track Client Payments: Organize your records by client, so you can quickly see which clients have paid and which still owe you money.

By implementing these practices, you can simplify the process of tracking payments, stay organized, and reduce the risk of missed or delayed payments. This level of organization can help your business run more smoothly and improve your financial management overall.

Ensuring Legal Compliance in Billing Documents

Ensuring that your payment requests are legally compliant is essential for maintaining the integrity of your business and avoiding potential disputes or legal issues. A legally compliant payment request not only serves as proof of transaction but also ensures that both parties adhere to the requirements set forth by relevant authorities. It is important to include specific details and follow guidelines based on the laws of your region or industry.

1. Include Required Information

Most jurisdictions require certain details to be included in all official billing documents. Here are the key elements to ensure your documents are compliant:

- Business Information: Your company name, address, and contact details must be clearly stated. This provides transparency and helps clients know who they are transacting with.

- Tax Identification Number: If applicable, include your business’s tax ID number or VAT number. This is particularly important for tax reporting purposes.

- Client Details: The client’s name, address, and contact information should be present, ensuring clarity in who the payment is intended for.

- Unique Document Number: Each payment request should have a unique identification number for tracking and legal purposes.

2. Follow Tax and Financial Regulations

It is crucial that your billing documents comply with tax laws and other financial regulations. Here’s how to ensure you meet these requirements:

- Tax Rates: Clearly display the applicable tax rate, whether it’s sales tax, VAT, or any other form of tax, and calculate the tax amount correctly.

- Payment Terms: Make sure to include any legally required payment terms, such as due dates, late fees, and discounts for early payment, depending on local laws.

- Currency and Amounts: Ensure that the currency is clearly stated, and the amounts are correct according to your country’s financial regulations.

3. Retain Records for Legal Purposes

In many cases, businesses are legally required to keep copies of payment requests for a set number of years. Here are a few best practices:

- Document Retention: Maintain copies of all payment requests for the period required by local tax or business laws. Digital records are often acceptable, but they must be easily accessible and properly organized.

- Compliance Audits: Conduct regular audits to ensure your billing documents meet all legal standards and remain up to date with any changes in tax or business law.

By making sure your payment requests are legally compliant, you can minimize the risk of legal issues, reduce potential disputes, and foster trust with your clients. Regularly review your processes to ensure you stay in line with changing laws and regulations.

Tips for Getting Paid Faster with Billing Documents

Getting paid promptly is essential for maintaining healthy cash flow and keeping your business running smoothly. While a well-prepared payment request can help, there are several strategies you can implement to encourage quicker payments. By adopting some simple but effective practices, you can reduce delays and ensure your clients prioritize settling their bills on time.

1. Set Clear Payment Terms

Setting clear, transparent payment terms from the beginning helps avoid confusion and reduces the likelihood of delayed payments. Here’s how to define your payment expectations:

- Specify Due Dates: Clearly state when payments are due, and avoid vague terms like “Payable upon receipt.”

- Late Fees: Include penalties for overdue payments to encourage clients to pay on time.

- Early Payment Discounts: Offer a discount for clients who pay early as an incentive to pay faster.

2. Make Payment Easy for Your Clients

Providing multiple, convenient payment options can encourage faster transactions. If clients have flexibility in how they pay, they’re more likely to settle the bill quickly. Here are a few ways to make the payment process easier:

- Accept Various Payment Methods: Include options like credit/debit cards, bank transfers, or online payment platforms (PayPal, Stripe, etc.).

- Automate Recurring Billing: If you have regular clients, set up automated billing to streamline the payment process.

3. Send Payment Requests Promptly and Follow Up

Sending your payment request as soon as the service is rendered or the product is delivered sets the tone for timely payment. Here’s how you can improve your chances of being paid quickly:

- Immediate Delivery: Don’t wait too long to send the request; the sooner you send it, the sooner your client can process it.

- Friendly Reminders: If payment is overdue, send a polite reminder. Sometimes clients simply forget, and a gentle follow-up can resolve the issue.

4. Use Clear and Professional Documents

Clarity and professionalism in your billing documents can lead to quicker payments. A well-structured document that’s easy to read and understand is more likely to get processed swiftly. Pay attention to the following:

| Tip | Description |

|---|---|

| Simple Layout | Ensure your document has a clean design with easy-to-find payment details such as the amount due and payment instructions. |

| Detailed Information | Include all necessary details like the client’s name, your company’s name, the services/products rendered, and clear payment instructions. |