Solicitors Invoice Template for Simplified Billing and Accurate Record Keeping

Managing client charges efficiently is essential for any legal professional aiming to maintain clarity and trust with clients. A well-organized approach to financial documentation not only simplifies payment processes but also enhances transparency in client relationships. Legal professionals require structured tools to streamline this aspect of their practice and ensure all details are clear and professional.

Incorporating structured billing documents tailored to legal services can save valuable time while providing clients with clear, detailed records. By organizing and automating financial summaries, legal experts can reduce manual workload, avoid common mistakes, and deliver precise financial breakdowns with ease.

Utilizing adaptable financial documentation formats allows for a personalized approach to each client’s needs, reinforcing clarity and trust. From defining service charges to tracking payments, an efficient document setup can play a vital role in maintaining consistent cash flow and strong client satisfaction.

Solicitors Invoice Template for Professional Billing

Efficiently managing financial records is crucial for maintaining a smooth workflow in any legal practice. By implementing structured, standardized documents, legal professionals can provide clients with clear, accurate summaries of services, which strengthens trust and streamlines the payment process.

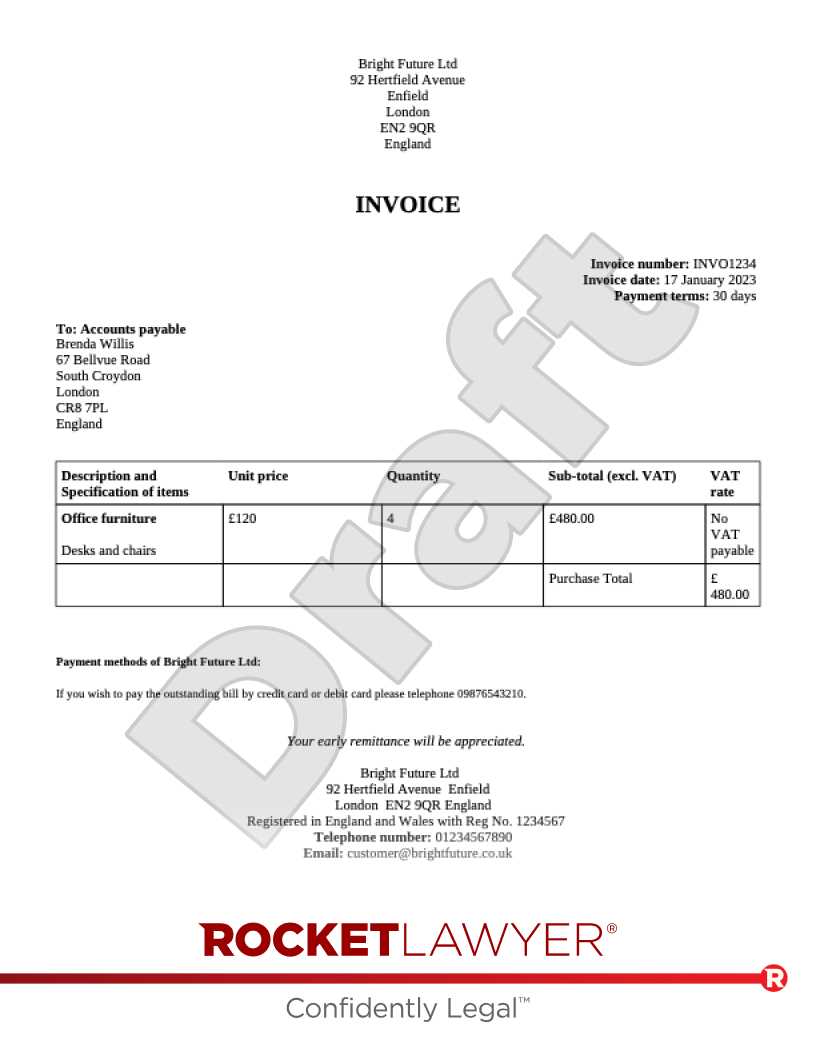

To maximize clarity and professionalism in billing, consider including the following elements in your document:

- Client Information: Ensure that each document includes comprehensive client details, such as full name, address, and contact information, to avoid any confusion and maintain accuracy.

- Service Descriptions: Clearly outline each service provided, with descriptions that give clients an exact understanding of the charges. This transparency helps build trust and justifies costs.

- Time and Fees: Indicate the time spent on each task, along with hourly or flat rates. Accurate time tracking helps clients see the value of each service.

- Payment Terms: Include clear payment instructions, deadlines, and preferred methods to ensure timely transactions. Specific ter

Benefits of Using a Legal Invoice Template

Structured financial documents play a pivotal role in the success of any legal practice by providing clarity and consistency in billing processes. Adopting a standardized format for client charges can significantly enhance both the client experience and internal efficiency.

Key advantages of implementing a reliable billing structure include:

- Improved Accuracy: Using a predefined format minimizes errors, ensuring that all essential details are included and reducing the chance of miscommunication with clients.

- Time Efficiency: With a ready-to-use format, legal professionals can save valuable time by avoiding repetitive tasks, allowing for quicker preparation and delivery of financial summaries.

- Enhanced Professionalism: A consistent, polished layout reflects a

How to Customize Your Invoice for Clients

Tailoring financial documents to suit individual client needs can make a significant difference in how services are received and appreciated. A personalized approach ensures clarity, reinforces trust, and allows clients to fully understand the value they are receiving from their legal services.

Here are key steps to customize your billing format effectively:

Include Client-Specific Details: Start by incorporating personalized information, such as the client’s full name, case reference, and specific contact information. Adding these details demonstrates attentiveness and helps avoid any potential mix-ups.

Break Down Services Provided: Clearly outline each task completed, along with corresponding costs. A detailed breakdown not only highlights the scope of work but also reinforces the transparency of the billing process, giving clients a comprehensiv

Essential Elements in a Solicitor Invoice

A well-structured billing document is crucial for maintaining clarity and professionalism in client relationships. By including all essential details, legal professionals can ensure clients understand the charges and feel confident in the accuracy of the financial summary provided.

Client Information: Begin with complete details of the client, including their full name, address, and contact information. This ensures that the document is directed to the correct recipient and reduces the likelihood of any confusion.

Service Descriptions: Clearly describe each service provided, detailing the specific tasks or consultations performed. This transparency allows clients to see the value they are receiving and justifies the associated costs.

Time and Fee Breakdown: Include a breakdown of time spent on each task, alongside the r

Streamlining Billing with Digital Templates

Embracing digital formats for billing processes can significantly increase efficiency and accuracy. By moving away from manual documentation and utilizing organized digital formats, legal professionals can simplify their workflow and reduce the time spent on administrative tasks.

Here are some key ways digital formats help streamline the billing process:

- Quick Customization: Digital formats make it easy to personalize each document for individual clients, allowing for quick adjustments to details like client names, services rendered, and payment terms.

- Automated Calculations: With built-in formulas, digital formats can automatically calculate totals, taxes, and other charges, reducing the risk of errors and ensuring accurate totals for clients.

- Easy Record Keeping: Digital files are simple to organiz

Tips for Accurate and Clear Invoices

Creating precise and transparent financial documents is essential to maintain professional relationships and ensure clients understand the charges for services rendered. By following a few key strategies, professionals can ensure their billing records are both accurate and easy to comprehend.

Ensure Clear Descriptions

Clearly define each service or task performed, with sufficient details to avoid confusion. The more specific you are about the work completed, the easier it will be for clients to understand the value they are receiving.

Double-Check Calculations

Accurate calculations are crucial to prevent discrepancies. Before finalizing your document, verify that all totals, rates, and taxes have been correctly applied to avoid any billing disputes later.

Service Hourly Rate Time Spent Total Consultation $150 2 hours $300 Research $120 3 hours $360 Total $660 Incorporating these steps into your billing process will help maintain professionalism, improve client satisfaction, and avoid misunderstandings regarding payments.

How to Organize Payment Terms Effectively

Establishing clear and well-structured payment terms is vital for maintaining smooth financial transactions with clients. Clear terms help set expectations and ensure both parties are aware of their responsibilities, reducing the risk of disputes and delayed payments.

Key Elements to Include

When outlining payment terms, be sure to cover the following elements:

- Payment Due Date: Specify the exact date by which the payment should be made to avoid confusion and ensure timely settlement.

- Accepted Payment Methods: Clearly state the methods of payment you accept (e.g., bank transfer, credit card, checks) to facilitate ease for clients.

- Late Payment Penalties: Define any penalties for overdue payments, such as interest charges, to encourage clients to pay on time.

- Discounts for Early Payment: Offer incentives for early payments to encourage clients to settle bills before the due date.

- Installment Options: If applicable, provide the option for clients to pay in installments and clearly outline the installment schedule.

Communicating Payment Terms Effectively

Once the payment terms are decided, it’s essential to communicate them clearly with clients. Consider the following methods:

- Include in Contracts: Always include payment terms in the contract or agreement to avoid any ambiguity.

- Highlight in Billing Documents: Ensure the payment terms are easily visible on any financial document you send, whether it’s a bill, statement, or reminder.

- Discuss Directly: If necessary, review the terms with clients before starting any work to ensure mutual understanding.

By organizing payment terms effectively and communicating them clearly, professionals can foster good relationships with clients while ensuring consistent and timely payments.

Design Tips for a Professional Invoice

Creating a visually appealing and well-organized financial document is essential for establishing professionalism and ensuring clarity. A clean and structured layout not only helps clients understand their charges but also reflects the quality of services provided. Here are some design tips to enhance the presentation of your billing documents.

Keep the Layout Simple and Clear

A cluttered document can confuse clients. Use a straightforward layout with clearly defined sections to make it easy to follow. The essential information such as service descriptions, costs, and due dates should be prominent and easy to find.

Use Consistent Branding

Incorporating your logo, brand colors, and fonts helps maintain a cohesive professional image. Ensure that the design elements align with your overall brand identity, which reinforces trust and professionalism.

Ensure Readable Fonts and Sizes

Choose legible fonts with an appropriate size for easy reading. Avoid overly stylized fonts that may make the document difficult to read. Prioritize clarity over decoration.

Organize Information with Tables

Using tables to display itemized charges, services, and totals makes the document more structured. This improves readability and helps clients quickly identify individual costs and the overall amount due.

Leave Room for Notes or Special Instructions

Including a section for notes or additional instructions can add a personal touch and provide clients with any extra information they may need. This could include payment methods, terms, or a message of thanks.

By following these design tips, you can create billing documents that not only look professional but also enhance the client’s experience and understanding of the services rendered.

Best Practices for Transparent Legal Billing

Maintaining transparency in financial documentation is crucial for fostering trust between legal professionals and their clients. Clear communication of fees, charges, and terms ensures that clients understand exactly what they are paying for and why. Implementing transparent billing practices is essential for avoiding misunderstandings and disputes, ultimately leading to stronger client relationships.

Provide Clear Descriptions of Services

Each service provided should be clearly described to avoid confusion. Break down tasks into specific actions with corresponding fees. This approach allows clients to understand the time and resources involved in each step of the process, making them feel more confident in their financial commitment.

Itemize Charges and Costs

Detailing all charges, including hourly rates, administrative costs, and any other expenses, helps eliminate surprises. Clients should be able to see exactly what they are paying for, down to the smallest detail. This itemization provides a clear breakdown of the financial aspects of the work performed.

Service Description Hours/Units Rate Total Consultation 2 hours $150/hour $300 Document Review 1.5 hours $120/hour $180 Filing Fee 1 $50 $50 By itemizing all services and expenses, clients are fully aware of the costs associated with each step of the legal process, leading to a more transparent and satisfactory experience.

Establish Clear Payment Terms

Clearly outline the payment terms, including deadlines, methods of payment, and any potential penalties for late payments. Having these terms in writing ensures that there is no ambiguity about when and how payments are expected, protecting both the client and the legal professional.

Following these best practices for transparent billing ensures clarity, builds trust, and helps maintain strong professional relationships with clients.

Creating an Invoice Template in Excel

Designing a professional billing document in Excel is an efficient way to streamline the financial aspect of your business. Using Excel to create a structured and customizable billing layout allows you to keep track of all charges, payment terms, and client information in a clear and organized manner. This method is both cost-effective and adaptable to various needs, enabling easy modifications as your business requirements evolve.

Setting Up the Structure

Start by creating a clean, simple layout with all the necessary fields. Key elements to include are the business name, client information, a description of services, payment terms, and a total amount due. Excel provides the flexibility to arrange these fields in an organized way, ensuring everything is easy to read and understand.

Using Formulas for Automation

Excel’s built-in formulas can help automate calculations, saving time and reducing the risk of errors. Use formulas for summing up totals, calculating tax rates, or applying discounts. This automation ensures that all calculations are accurate and up to date without needing manual input for each billing cycle.

Service Description Hours Rate Amount Initial Consultation 2 $100 $200 Research and Analysis 3 $120 $360 Final Report 1 $150 $150 Total $710 With this layout, you can easily input data and see the total amount due automatically calculated based on your hourly rates and hours worked. Excel also allows you to format the document to suit your business branding, making it not only functional but also visually professional.

How to Include Hourly Rates and Fees

When creating a billing document, it is crucial to clearly outline the hourly rates and associated fees for services provided. By providing transparent and accurate details about your charges, clients will have a clear understanding of what they are paying for. Including these details properly ensures that both parties are aligned on expectations and avoids confusion or disputes.

Setting Up Hourly Charges

To set up hourly charges effectively, begin by listing each service performed and the corresponding hourly rate. You can break down the tasks into specific categories, each with its own rate. For example:

- Consultation: $150 per hour

- Research and analysis: $120 per hour

- Writing and drafting: $100 per hour

It is important to make sure that each service is clearly identified with the number of hours spent on it, as this will allow clients to see exactly what they are being billed for.

Additional Fees and Charges

Besides hourly rates, there may be additional fees for special services or costs incurred during the work. These could include:

- Administrative fees: $50 per document

- Travel expenses: $0.50 per mile

- Overnight delivery fees: $20

Make sure to list any extra charges clearly and explain the reason for these fees. This helps the client understand why they are being added to the total cost of services rendered.

By clearly outlining both hourly rates and any additional fees in your billing document, you create a transparent and professional approach that promotes trust and clarity with your clients.

Managing Invoices for Multiple Clients

Effectively managing billing records for numerous clients can be a challenge, especially when there are varying rates, terms, and services involved. To ensure accuracy and efficiency, it is essential to implement a system that tracks each client’s billing details individually while maintaining a comprehensive overview. By organizing each account meticulously, you can avoid errors and streamline the process.

One of the most important practices is to maintain separate records for each client, noting all relevant details such as service descriptions, charges, and due dates. This prevents confusion and helps in providing clear and transparent documents for clients when payment time arrives.

Creating a Client-Based System

To manage multiple accounts effectively, create individual records for each client. You can organize this information in a digital file or a cloud-based system for easy access. Each record should include:

- Client’s name and contact information

- Description of the services provided

- Applicable rates and payment terms

- Dates of service rendered

- Any additional charges or expenses

Automating the Process

When handling a large number of clients, consider using automated software or tools that can generate billing documents for you. These systems allow you to input the necessary information and generate professional documents with minimal effort. Some systems also offer:

- Automatic reminders for payment due dates

- Customizable service descriptions and rates

- Trackable payment statuses

By leveraging automation, you can save time and reduce the chance of errors, ensuring that each client’s record remains up-to-date and consistent.

Common Mistakes in Legal Billing

Managing client accounts and ensuring that all charges are accurately reflected can be a complex task. Even with careful attention to detail, some common errors tend to arise during the billing process. These mistakes can lead to misunderstandings, delayed payments, and a negative client experience. Recognizing these pitfalls and taking steps to avoid them is crucial for maintaining professionalism and trust with your clients.

Common Billing Errors to Avoid

Below are some of the most frequent mistakes that occur in legal billing:

- Missing or Incorrect Client Information: Failing to include accurate client details, such as contact information or case-specific data, can delay payments and create confusion.

- Inconsistent Rates: Using varying rates without proper documentation or communication can lead to disputes. Ensure that your rates are clearly defined and agreed upon upfront.

- Failure to Itemize Services: Not providing a detailed breakdown of services rendered can cause clients to question the legitimacy of the charges. Each service should be listed with a clear description and associated fee.

- Omitting Payment Terms: Not specifying payment deadlines, late fees, or accepted payment methods can result in missed payments. It is essential to outline these terms clearly.

- Not Tracking Billable Hours Accurately: Inaccurate timekeeping is one of the most common issues. Ensure that every hour worked is recorded properly, using a reliable tracking system.

Preventing Billing Mistakes

By taking a proactive approach to billing, you can minimize the occurrence of these errors. Here are some strategies to help:

- Keep comprehensive records of client communications, agreements, and the scope of work.

- Regularly review and update your billing system to reflect any changes in rates or services.

- Implement automated billing tools that reduce human error and enhance accuracy.

- Ensure that each bill is reviewed for completeness before sending it to the client.

By avoiding these common mistakes, you can enhance the clarity of your billing process and improve your relationship with clients.

Ensuring Compliance in Invoice Formatting

Properly structuring and presenting billing statements is essential for adhering to legal and financial regulations. A well-organized document not only ensures that all required details are included but also reflects professionalism and transparency. Understanding the regulatory requirements and formatting standards is crucial for maintaining compliance and preventing errors that could lead to disputes or delays in payment.

Essential Information Compliance Consideration Client Information Ensure that the client’s full name, address, and contact information are clearly listed. This is often required for legal and tax purposes. Date of Issuance The date on which the statement is issued should be included to establish payment deadlines and timelines for services rendered. Detailed Breakdown of Services Include a clear description of the services provided with associated charges, ensuring that it aligns with any prior agreements or contracts. Payment Terms Specify payment methods, deadlines, and any late fees to ensure clarity regarding the expected timeline and financial obligations. Tax Information Ensure that applicable taxes are properly calculated and clearly stated, in accordance with local laws and regulations. By adhering to these requirements, you ensure that your billing statements meet compliance standards while also fostering transparency and trust with clients. Regularly reviewing and updating your documents in line with any changes in laws or industry standards will help maintain accuracy and legal compliance.

Why Invoice Templates Save Time

Utilizing pre-designed billing documents can significantly reduce the amount of time spent on creating custom statements from scratch. These ready-made structures allow you to quickly input necessary details without having to worry about formatting or ensuring all essential information is included. By streamlining the process, you can focus more on your work while ensuring that all documents are clear and consistent.

Efficiency in Repetition

Having a consistent format means that you don’t need to reformat or adjust each document individually. Simply filling in new client or project information saves time, eliminating the need for repetitive formatting steps.

Consistency Across Documents

A standardized approach helps avoid errors and ensures that every billing statement looks professional and includes all required fields. This consistency is not only time-saving but also promotes credibility and trust with clients.

Faster Turnaround Times

With a pre-set structure, you can generate documents in a fraction of the time compared to starting from scratch each time. This quick turnaround allows for faster billing cycles and improves cash flow management.

How to Track Payments

Efficiently monitoring payments is crucial for maintaining healthy cash flow and ensuring that all financial transactions are accurately recorded. Implementing a clear system for tracking each payment can help avoid misunderstandings and provide a comprehensive view of the financial status of your business.

Use a Payment Log

Keeping a detailed log of all incoming payments is essential. Record the date, amount, client name, and payment method for each transaction. This log will serve as a reference for any future discrepancies or inquiries.

Set Up Payment Reminders

Automate reminders to notify clients when payments are due. This proactive approach can help reduce delays and encourage timely payments, ensuring that your accounts are always up to date.

Reconcile Regularly

Regularly compare your payment records with your bank statements or payment processor reports. This reconciliation process ensures that there are no discrepancies and helps you maintain accurate financial records.