How to Create a Professional Solicitor Invoice Template

For legal experts, ensuring clear, precise, and professional billing is crucial for maintaining positive client relationships and streamlining financial operations. Having a structured and easy-to-use document for charging clients is essential to avoid confusion and potential disputes. A well-crafted billing statement helps maintain transparency and ensures that the terms of service are clearly understood by both parties.

Whether you’re a lawyer running a solo practice or working within a larger firm, a reliable system for creating and managing financial records is vital. With the right format, you can save time, reduce errors, and stay organized. This guide will explore how to create an effective billing structure that meets professional standards and adheres to the legal industry’s specific requirements.

Clear communication and accuracy are key elements when it comes to charging clients for services rendered. A properly formatted billing document can prevent misunderstandings and provide a clear breakdown of charges. Additionally, it serves as a valuable reference for both the professional and the client in future dealings.

Solicitor Invoice Template Overview

In any legal practice, managing financial documentation accurately and professionally is essential. A clear, structured billing document ensures that clients understand the charges for services rendered while also providing the legal professional with a reliable way to track payments. Whether you’re billing for consultations, court appearances, or other legal services, having a standardized document format is crucial for efficient financial management.

This section will explore the importance of using a well-organized document for charging clients, as well as the components that should be included to ensure completeness and clarity. A comprehensive billing format provides an essential framework that both clients and legal professionals can rely on for transparent and hassle-free transactions.

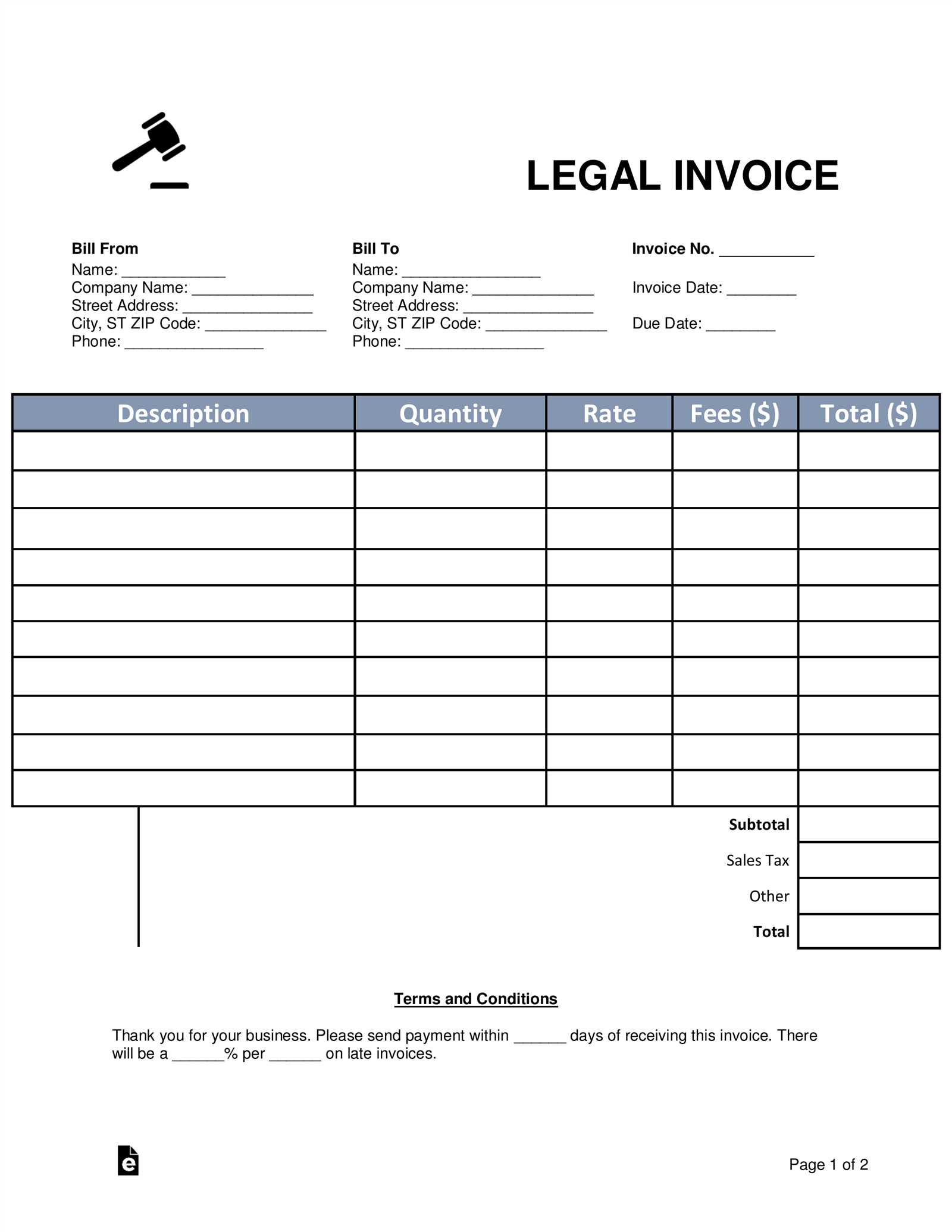

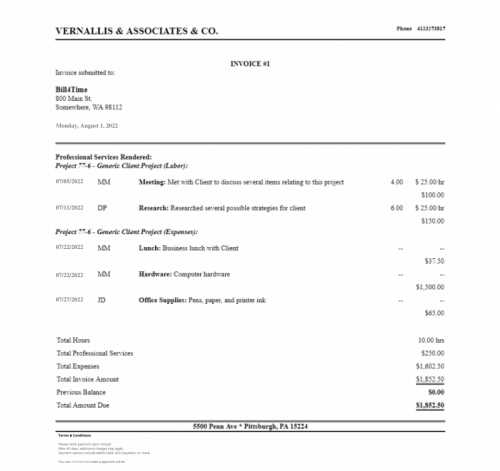

Key Features of a Legal Billing Document

- Client’s full name and contact information

- Detailed list of services provided, including dates and descriptions

- Accurate breakdown of charges, including hourly rates or flat fees

- Payment terms and conditions, such as due dates and penalties for late payments

- Methods for payment acceptance (e.g., bank transfer, credit card)

Why a Standardized Format Matters

Having a consistent structure for your financial records not only saves time but also reduces the risk of errors. With a standardized format, you can quickly generate accurate statements, ensuring that all necessary information is included and nothing is overlooked. It also enhances professionalism and fosters trust between you and your clients.

Importance of Using a Solicitor Invoice

Having a formal and structured document to outline charges for legal services is essential in maintaining transparency and professionalism in financial dealings. A well-organized record not only ensures that clients understand the exact nature of the services they are paying for but also helps legal professionals maintain proper accounting and avoid misunderstandings. Without a clear and comprehensive statement, there is a risk of confusion, delayed payments, or even disputes.

Using a standardized billing method provides a number of key benefits. It helps create consistency across all transactions, ensuring that nothing is overlooked. It also allows for easier tracking of outstanding payments and streamlines the process of managing client accounts. For legal professionals, this tool is indispensable in keeping business operations smooth and reducing administrative errors.

Efficient financial management is one of the primary reasons to adopt a formal billing document. By consistently using the same structure, it becomes easier to track revenue and expenses, as well as to prepare for tax filings or audits. Furthermore, such documents offer legal professionals a reliable reference for resolving any future billing disputes.

For clients, a clear and detailed billing statement provides peace of mind, knowing that they are being charged fairly and transparently. This helps to build trust and can even encourage repeat business and referrals.

Key Elements of a Solicitor Invoice

For any legal practice, creating a comprehensive financial document is crucial to ensure both the client and professional are on the same page regarding charges and payment expectations. A properly structured statement serves as a clear record of the services provided and ensures that all necessary information is included to avoid confusion. Each billing record should be complete, accurate, and easily understandable, making it vital to include certain key components.

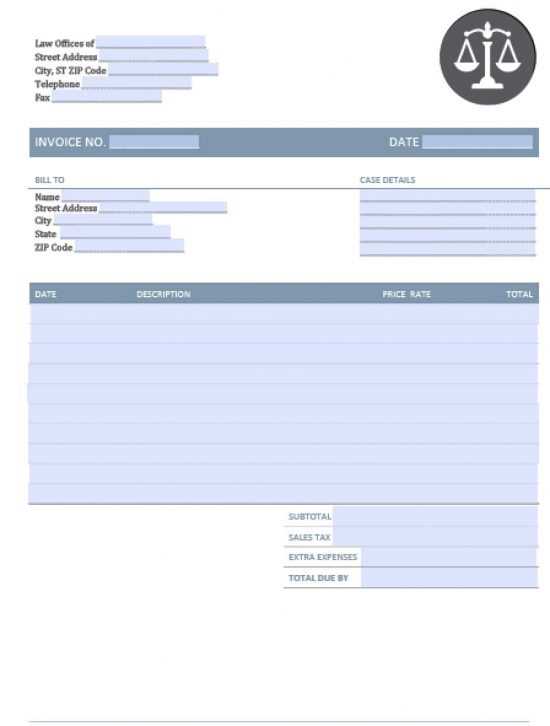

Essential Information to Include

- Client Details: Full name, address, and contact information of the client.

- Service Description: A clear and concise explanation of the services provided, including the dates and hours worked.

- Fee Structure: An itemized breakdown of charges, including hourly rates, flat fees, or other charges.

- Payment Terms: The due date for payment, any late fees, and available payment methods.

- Legal Professional’s Information: The name, address, and contact information of the individual or firm issuing the document.

Additional Considerations

- Tax Information: Any applicable taxes should be clearly stated, along with the total amount due after tax.

- Unique Reference Number: A reference number helps in tracking and organizing records, especially when handling multiple clients.

- Payment Instructions: Detailed instructions on how clients can pay, whether by bank transfer, cheque, or other methods.

By including these key elements, the document becomes not just a billing tool, but also a record that both the legal professional and the client can refer to in the future, ensuring clarity and preventing disputes.

How to Customize a Solicitor Invoice

Personalizing a billing document allows legal professionals to align their financial records with their specific business needs. Customization ensures that all relevant information is clearly displayed and tailored to the individual requirements of the client and the services provided. Whether you need to adjust the format, add specific details, or modify sections to match your practice, customizing your billing document makes it both functional and professional.

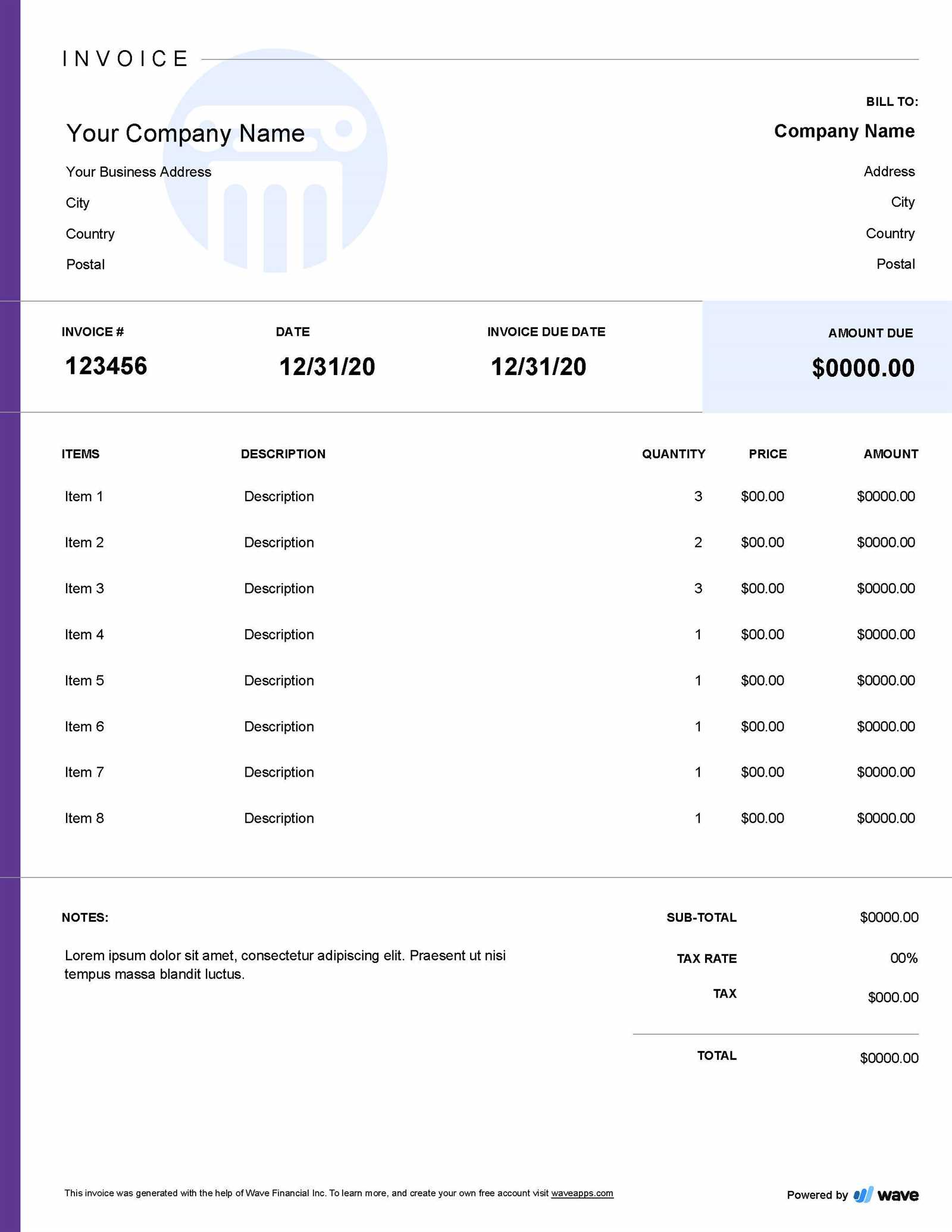

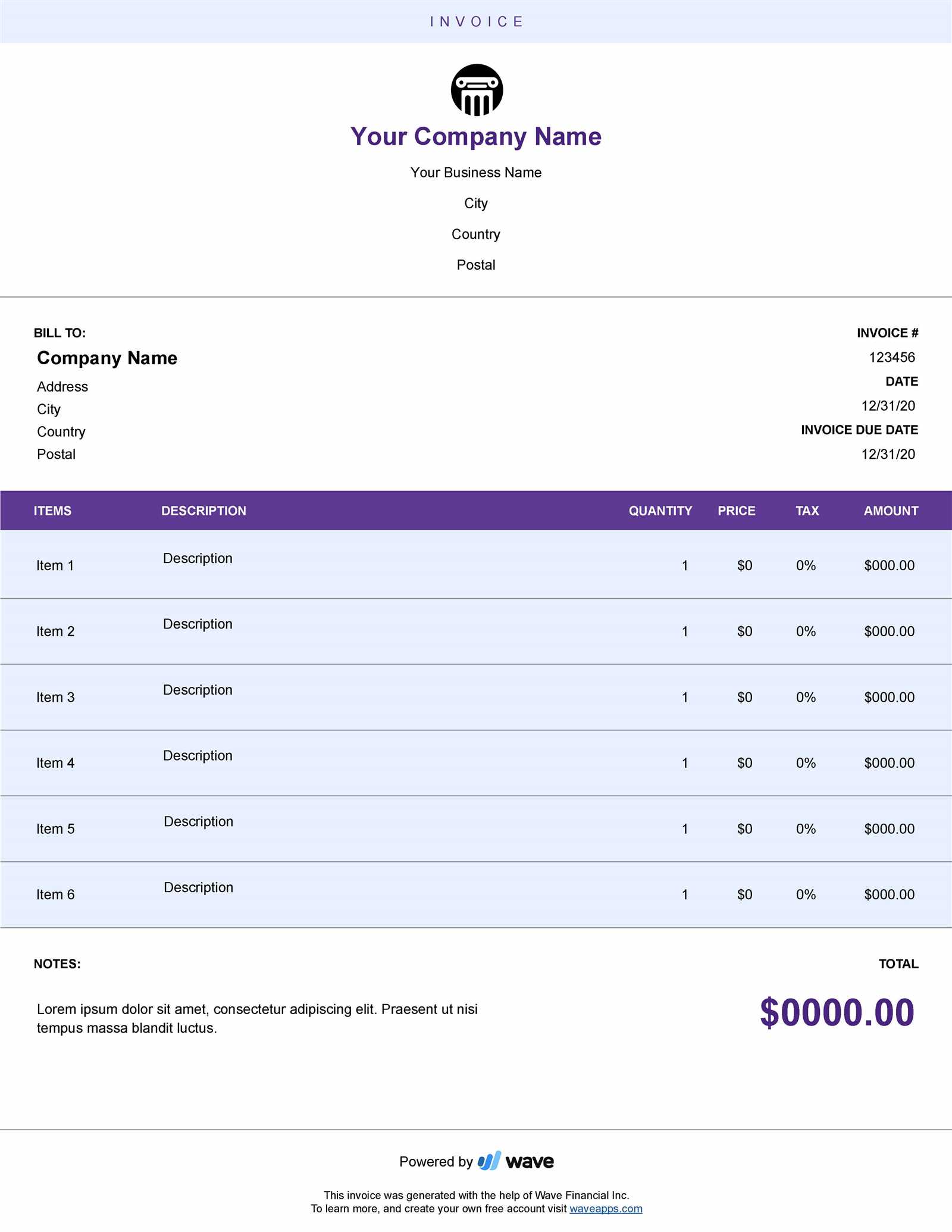

Steps to Personalize Your Billing Document

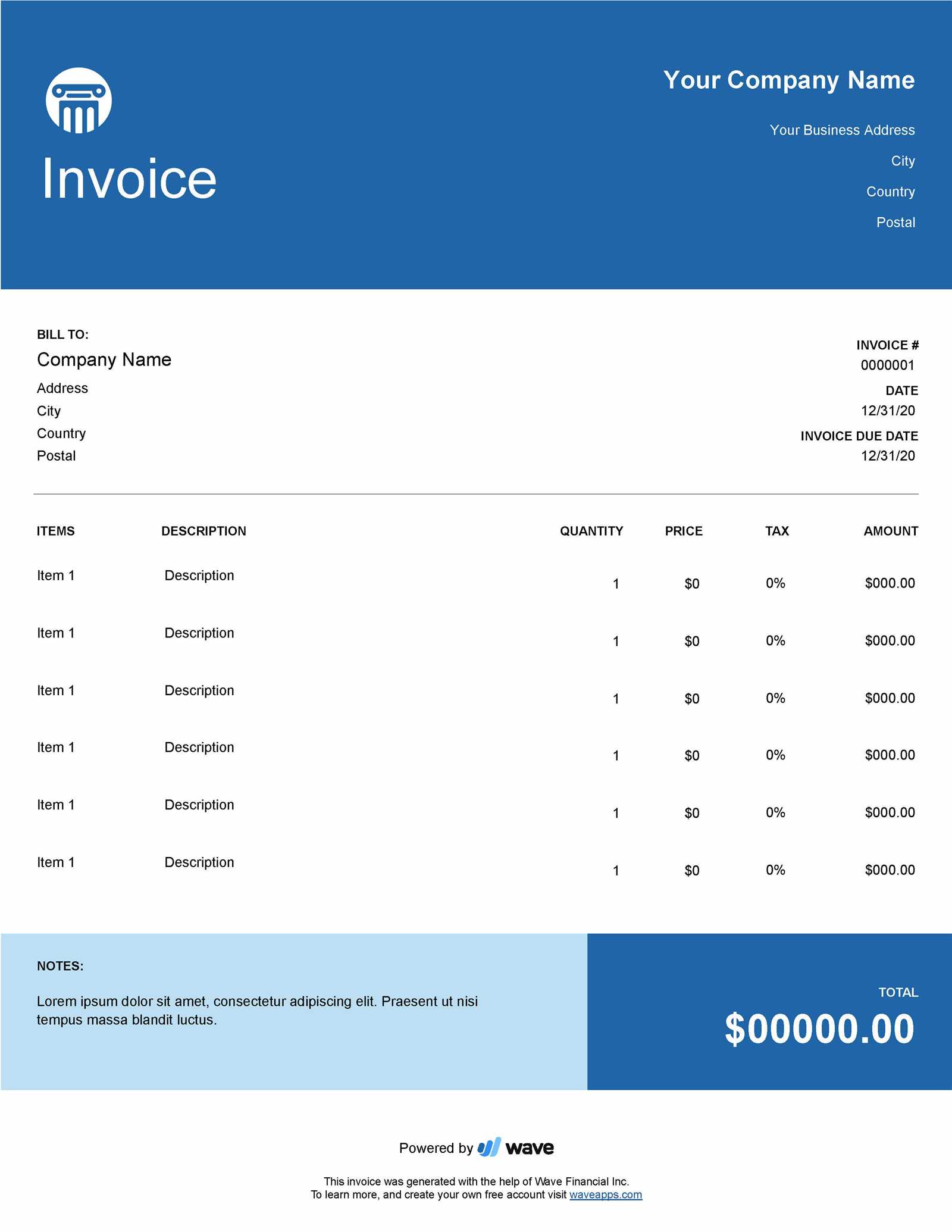

- Adjust the Layout: Choose a format that fits your brand and is easy for clients to read. This may include altering the font, colors, or positioning of sections.

- Add Company Branding: Include your firm’s logo, contact information, and any branding elements that reflect your professional identity.

- Customize Payment Terms: Adapt payment deadlines, late fees, and acceptable payment methods based on your business model and client agreements.

- Detail Service Descriptions: Tailor the descriptions of services provided to accurately reflect the unique nature of each task or consultation.

- Include Additional Charges: If there are additional fees such as administrative costs, photocopying, or court filing fees, ensure these are clearly outlined.

Advanced Customization Options

- Payment Instructions: Add specific instructions for making payments, including banking details or online payment links.

- Legal References: If necessary, include legal case references, contract numbers, or any other identifiers that might be relevant to the client.

- Tax Details: Adjust tax information based on the legal jurisdiction, ensuring that the correct rates are applied and calculated.

Customizing your billing records not only makes them more professional but also helps to ensure that all aspects of the transaction are transparent and clear to the client. A personalized document reflects your attention to detail and enhances the overall client experience.

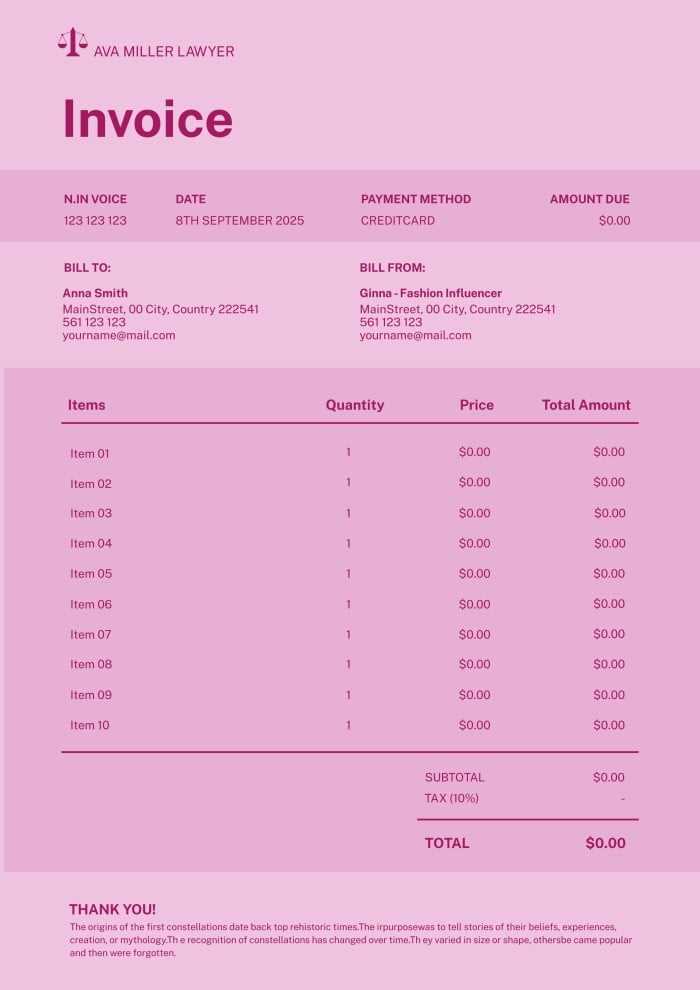

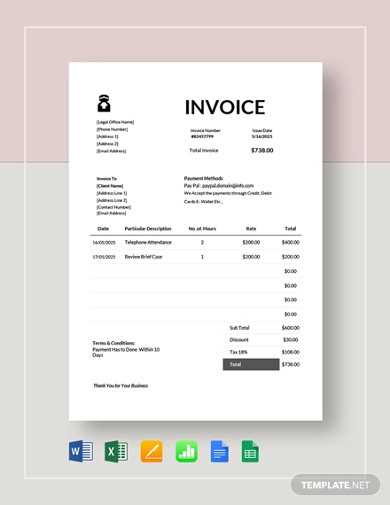

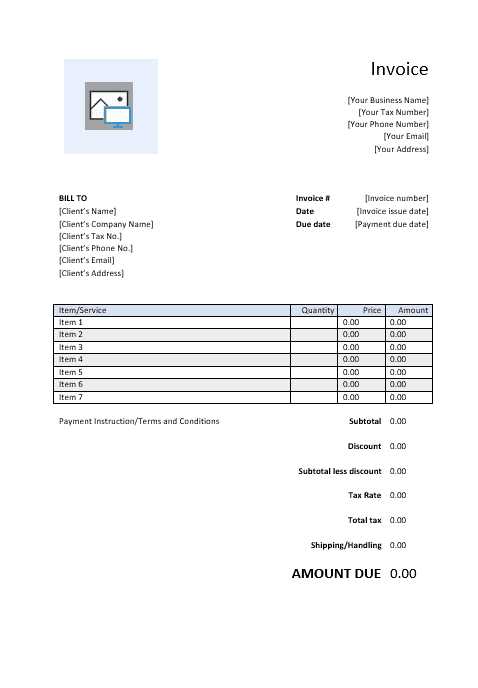

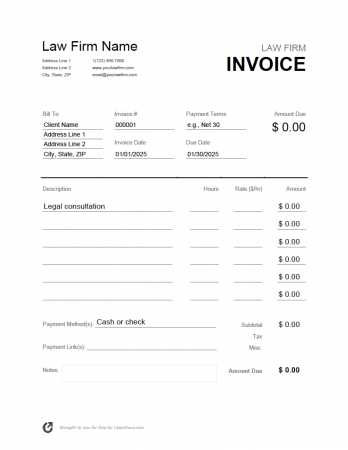

Free Templates for Solicitor Invoices

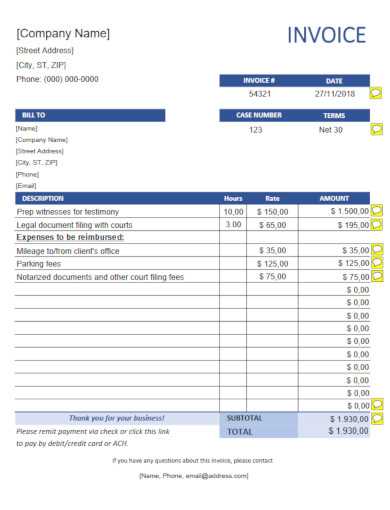

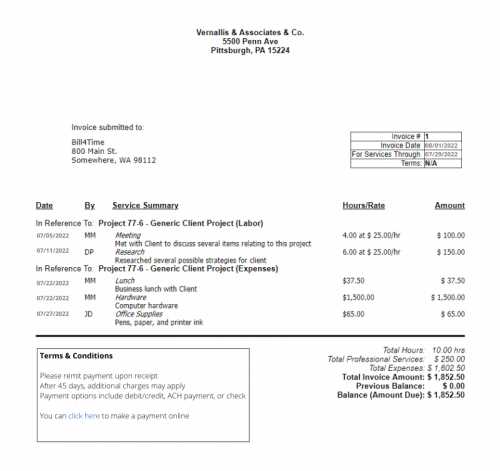

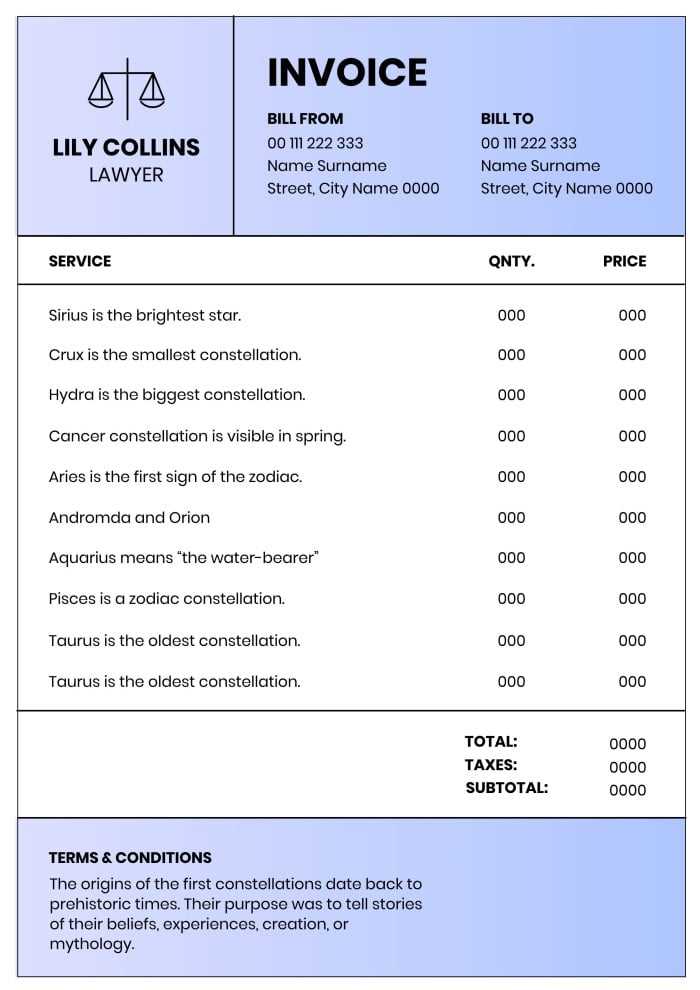

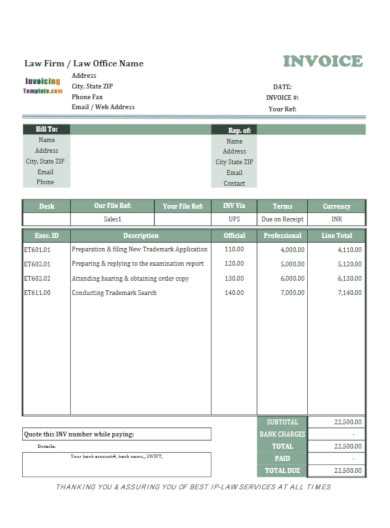

If you’re in the legal profession and need a way to manage billing efficiently, finding free resources to streamline the process can save valuable time. Whether you’re handling individual cases or offering ongoing services, having a structured document to track payments is essential. Free samples of billing forms can provide a straightforward solution to ensure transparency and clarity with clients while maintaining professionalism in your financial transactions.

Accessing these free resources allows legal professionals to focus on their work without getting bogged down by creating complex financial documents from scratch. These samples are typically pre-designed to cover all necessary fields, ensuring that no important details are missed, such as hourly rates, expenses, or due dates.

Using these free documents is a simple way to ensure that your billing process is accurate and up to standard, whether you’re dealing with consultations, contract work, or other services. With a variety of formats available, you can select the one that best fits your practice’s needs and customize it to suit your workflow.

Benefits of a Professional Invoice Template

Having a well-structured billing document offers numerous advantages, especially for those in service-oriented fields. It not only helps ensure that all relevant details are captured accurately, but also presents a polished and professional image to clients. By using a standardized form, you can minimize errors and make the payment process smoother for both parties.

Efficiency and Time-Saving

A professionally designed document significantly reduces the amount of time spent on administrative tasks. With predefined sections and fields, you can quickly fill in the necessary information, avoiding the need to manually create each bill from scratch. This efficiency allows you to focus more on your work, rather than on paperwork.

Improved Client Relations

Using a consistent and professional billing document builds trust with clients. It shows that you take your work seriously and are organized in managing financial matters. Clear, easy-to-read forms also help prevent misunderstandings and disputes, ensuring that your clients know exactly what they are being charged for and when payment is due.

Common Mistakes in Legal Invoices

When preparing financial documents for services rendered, it’s easy to make mistakes that can lead to confusion or delays in payment. Some errors may seem minor, but they can have a significant impact on how your clients perceive your professionalism. Ensuring that all details are correct and well-organized is essential for a smooth billing process.

Missing or Inaccurate Details

One of the most common mistakes is failing to include critical information or providing inaccurate details. This can result in payment delays or disputes. Some key elements that are often overlooked include:

- Client’s full name and contact information

- Clear description of services provided

- Accurate hourly rates or flat fees

- Payment terms and deadlines

Without these, clients may be confused about what they are paying for, leading to unnecessary follow-ups.

Unclear Billing Structure

Another frequent issue is an unclear billing structure. If the charges are not broken down properly, clients may struggle to understand the fees. To avoid this, consider the following:

- List services separately with corresponding fees

- Include detailed time entries, if applicable

- State any additional costs or disbursements clearly

Transparency in how fees are calculated helps build trust and prevents misunderstandings between you and your clients.

Best Practices for Legal Billing

Effective financial management is crucial for any professional offering services, particularly in law. Properly documenting fees and ensuring clarity in billing not only maintains trust with clients but also improves cash flow and reduces administrative errors. By adhering to best practices in financial documentation, you can ensure both efficiency and professionalism in your business operations.

Clear and Transparent Billing

One of the most important aspects of legal financial records is clarity. Clients should never be left guessing about the charges for services rendered. Here are some guidelines to follow:

- Provide a detailed breakdown of the work performed, including time spent and hourly rates (if applicable).

- Ensure that any additional costs, such as court fees or travel expenses, are clearly noted and explained.

- Include specific payment terms, such as due dates and penalties for late payments, to avoid confusion.

Timely and Consistent Billing

Sending bills on time is just as important as the content itself. Delayed or inconsistent billing can harm your relationship with clients and delay payments. Consider the following tips:

- Issue your financial documents regularly, whether weekly, bi-weekly, or monthly, depending on your agreement with clients.

- Ensure that all documents are sent promptly after the completion of a service or case milestone.

- Keep a consistent format for all billing documents to create familiarity and minimize errors.

How to Format Your Invoice Correctly

Properly formatting your billing document is essential for ensuring that all details are clear and easy to follow. A well-structured form not only facilitates quick payments but also enhances your professionalism in the eyes of clients. Whether you’re dealing with hourly rates, fixed fees, or additional costs, clear organization is key to minimizing errors and confusion.

Essential Components to Include

A correctly formatted billing document should contain several key elements. Missing or incomplete information can lead to delays or disputes. Make sure your document includes the following:

- Client Information: Include the full name and contact details of both the service provider and the client.

- Detailed Description: Break down the services provided, listing each task and its associated charge clearly.

- Payment Terms: State the payment due date, preferred payment methods, and any late fees.

- Unique Reference Number: Include a unique identifier for the document to help track payments and maintain proper records.

Tips for Clarity and Readability

In addition to the required details, the format should be visually clear and easy to read. Keep the following guidelines in mind:

- Use a clean and simple layout: Ensure there is enough white space around text to prevent the document from feeling cluttered.

- Use a consistent font and size: Opt for a professional, readable font (such as Arial or Times New Roman) and a size that is easy to read (usually 11 or 12 pt).

- Organize information logically: Group similar details together, such as all charges in one section, and any notes or terms at the bottom of the page.

Automating Solicitor Invoicing Process

Streamlining the billing process is a crucial step in improving efficiency and reducing administrative workload. By automating the generation and distribution of financial records, you can save valuable time, eliminate human errors, and ensure timely payments. Automation allows for consistent document formatting and faster processing, making it easier to manage multiple clients and projects simultaneously.

Benefits of Automation

Automating the financial record-keeping process offers several advantages for legal professionals:

- Time-saving: Automated systems can generate detailed documents in seconds, reducing the need for manual entry and calculations.

- Accuracy: Automation eliminates human errors, ensuring that all charges, rates, and client details are accurate.

- Consistency: By using predefined formats, automated systems help maintain a consistent appearance for all documents.

- Efficiency: Automated tools can send reminders, track payment status, and integrate with accounting software, reducing manual follow-up efforts.

How to Automate Your Billing Process

To successfully automate your financial documentation process, consider the following steps:

- Use invoicing software: Invest in billing software that allows you to create and send customized documents based on pre-set templates.

- Integrate with time-tracking tools: Combine automation with time-tracking software to capture hours worked, tasks completed, and rates charged without manual input.

- Set up automatic re

Tax Considerations for Legal Invoices

When preparing financial documents for services rendered, it is essential to account for relevant tax obligations. Correctly factoring in taxes not only ensures compliance with local tax laws but also prevents potential disputes or audits. Failure to properly account for tax details can lead to fines or complications with authorities. Understanding how taxes apply to your services and accurately reflecting them in your records is vital for both your practice and your clients.

Types of Taxes to Consider

Different types of taxes may apply depending on your jurisdiction, type of services offered, and the nature of your business. Common tax considerations include:

- Sales Tax: Some services are subject to sales tax, depending on local regulations. Ensure that you know whether your services fall under taxable categories.

- Value-Added Tax (VAT): In many countries, VAT applies to professional services. It’s important to include VAT rates and amounts where applicable.

- Withholding Tax: In certain situations, clients may be required to withhold a portion of the payment for tax purposes. Ensure this is clearly noted in your financial document.

How to Account for Taxes Properly

To avoid issues with tax authorities, follow these best practices when incorporating taxes into your billing process:

- Stay updated on tax rates: Tax laws and rates change over time, so it is important to stay informed about current regulations in your jurisdiction.

- Clearly display tax amounts: Always show the tax amount separately, so clients understand exactly what they are being charged for taxes in addition to the services provided.

- Ensure accurate documentation: Include all required tax registration numbers or other relevant details to maintain proper documentation for auditing purposes.

How to Handle Client Disputes Over Invoices

Client disagreements over financial documents can arise for various reasons, whether it’s due to perceived errors, misunderstandings, or differing expectations. Handling such disputes effectively is crucial for maintaining professional relationships and ensuring that payments are processed in a timely manner. Clear communication, prompt action, and a willingness to resolve issues fairly can prevent disputes from escalating.

Steps to Resolve Disputes

If a client raises a concern regarding a financial document, follow these steps to address the issue professionally:

- Listen carefully: Allow the client to explain their concerns fully without interruption, showing that you value their feedback.

- Review the document: Carefully go through the details in question, checking for any discrepancies or mistakes on your part.

- Clarify misunderstandings: Often, disputes arise from misunderstandings. Be sure to explain how the charges were calculated or why certain fees were included.

- Offer solutions: If an error is identified, provide an amended document or explain how the issue will be rectified. If the disagreement is about terms, negotiate a fair resolution.

Preventing Future Disputes

To minimize the chances of disputes in the future, implement the following practices:

- Be transparent: Clearly outline all fees, terms, and payment expectations upfront, and ensure that clients understand them from the beginning.

- Use detailed records: Maintain thorough documentation of services rendered and associated costs to back up your charges if any disputes arise.

- Follow up proactively: Reach out to clients before the payment due date to remind them of any outstanding amounts, making it easier to address issues early on.

Incorporating Payment Terms in Invoices

Clearly defined payment terms are essential for setting expectations and ensuring timely compensation for services provided. When these terms are included in financial documents, both the service provider and the client have a clear understanding of when and how payment should be made. Including detailed payment terms helps prevent misunderstandings and minimizes the likelihood of delayed payments.

Key Elements to Include

When incorporating payment terms into your financial documentation, it’s important to include the following elements to ensure clarity:

- Due Date: Specify the exact date by which the client is expected to make the payment. This eliminates any ambiguity and provides a clear deadline.

- Accepted Payment Methods: Clearly state which methods of payment are acceptable (e.g., bank transfer, credit card, check), so the client knows their options.

- Late Fees or Penalties: If applicable, mention any fees for overdue payments. This can help encourage timely payment and protect your cash flow.

- Discounts for Early Payment: If you offer any incentives for early settlement, such as a discount, make sure these are clearly outlined to encourage prompt payments.

Best Practices for Clarity

To ensure that your payment terms are easily understood, follow these best practices:

- Be specific: Avoid vague terms like “within 30 days.” Instead, specify the exact day or a fixed number of days from the date the service was completed.

- Highlight important details: Make payment terms stand out by placing them at the bottom of the document or in a separate section for easy reference.

- Use simple language: Avoid complicated legal jargon when describing payment terms to ensure that the client fully understands their obligations.

Using Online Tools for Invoice Creation

Online platforms provide a range of solutions for generating and organizing financial documents quickly and efficiently. These tools streamline the creation process, allowing users to focus on the content while automating formatting and calculations. This reduces time spent on paperwork and enhances accuracy, making it easier to keep financial records up to date.

Benefits of Digital Platforms

Digital tools for document preparation often include features like templates, calculation assistance, and customization options. They also provide easy access to past records and editing capabilities, which are invaluable for maintaining organized archives. Additionally, most platforms are user-friendly and require minimal setup, making them accessible to a wide range of professionals.

Comparison of Popular Online Tools

Platform Features Pricing Legal Compliance in Invoice Generation

Ensuring that financial documentation meets regulatory standards is essential for maintaining transparency and avoiding potential legal issues. Proper adherence to legal guidelines during the preparation process can protect both parties involved, supporting accurate record-keeping and fostering trust.

Mandatory Information for Compliance

Each financial document should include specific details to meet legal requirements. This generally involves clear identification of the service provider and client, a detailed list of provided services, and accurate calculations. Additionally, regulatory elements such as unique reference numbers, applicable taxes, and precise descriptions contribute to a legally sound document.

Record Retention and Accessibility

Maintaining a record of all issued documents is crucial for compliance and audit purposes. Most jurisdictions mandate that these records be kept for a specified number of years, readily accessible if needed. By following these regulations, service providers can demonstrate financial transparency

When to Send a Solicitor Invoice

Determining the optimal timing for issuing a billing document is key to ensuring a smooth financial workflow. By carefully planning when to finalize and send out these documents, professionals can improve client relations and maintain a steady income flow.

Consider the following common scenarios when it may be appropriate to send out a billing document:

- At the conclusion of a project or case, when all services have been rendered and a final statement can be prepared.

- Periodically during an ongoing project, especially for lengthy engagements, to ensure that payments are received incrementally for sustained progress.

- After significant milestones or phases within a project, allowing both parties to review and settle specific portions of the work.