Sole Trader Invoice Template for Efficient Billing and Professional Invoicing

As a freelancer or small business owner, one of the most important tasks is ensuring clear and professional communication with clients. Properly formatted financial statements are not just about getting paid on time but also about maintaining a trustworthy image. Using a well-structured billing document is an essential part of managing payments and keeping your business running smoothly.

While the process of generating invoices can seem straightforward, having a consistent and customizable layout can save time and avoid confusion. By using a ready-made document structure, you can focus more on your work while ensuring that all the necessary information is included. This helps streamline the payment process and reduces the chances of disputes with clients.

In this guide, we’ll explore the key aspects of creating and personalizing a billing document, offering useful advice on how to simplify this often tedious task. Whether you’re just starting out or are looking to improve your current system, the right approach can make all the difference in how quickly and efficiently you receive payments.

Sole Trader Invoice Template Guide

For independent business owners and freelancers, creating clear and professional billing documents is crucial to ensure timely payments and avoid misunderstandings. Having a standardized format for these documents not only simplifies the process but also presents a polished and trustworthy image to your clients. This guide will walk you through the essential elements of crafting effective financial statements for your business.

Key Components of a Well-Structured Document

A well-organized document should include several important pieces of information that make it easy for clients to understand and process your payment request. Here are the critical components to include:

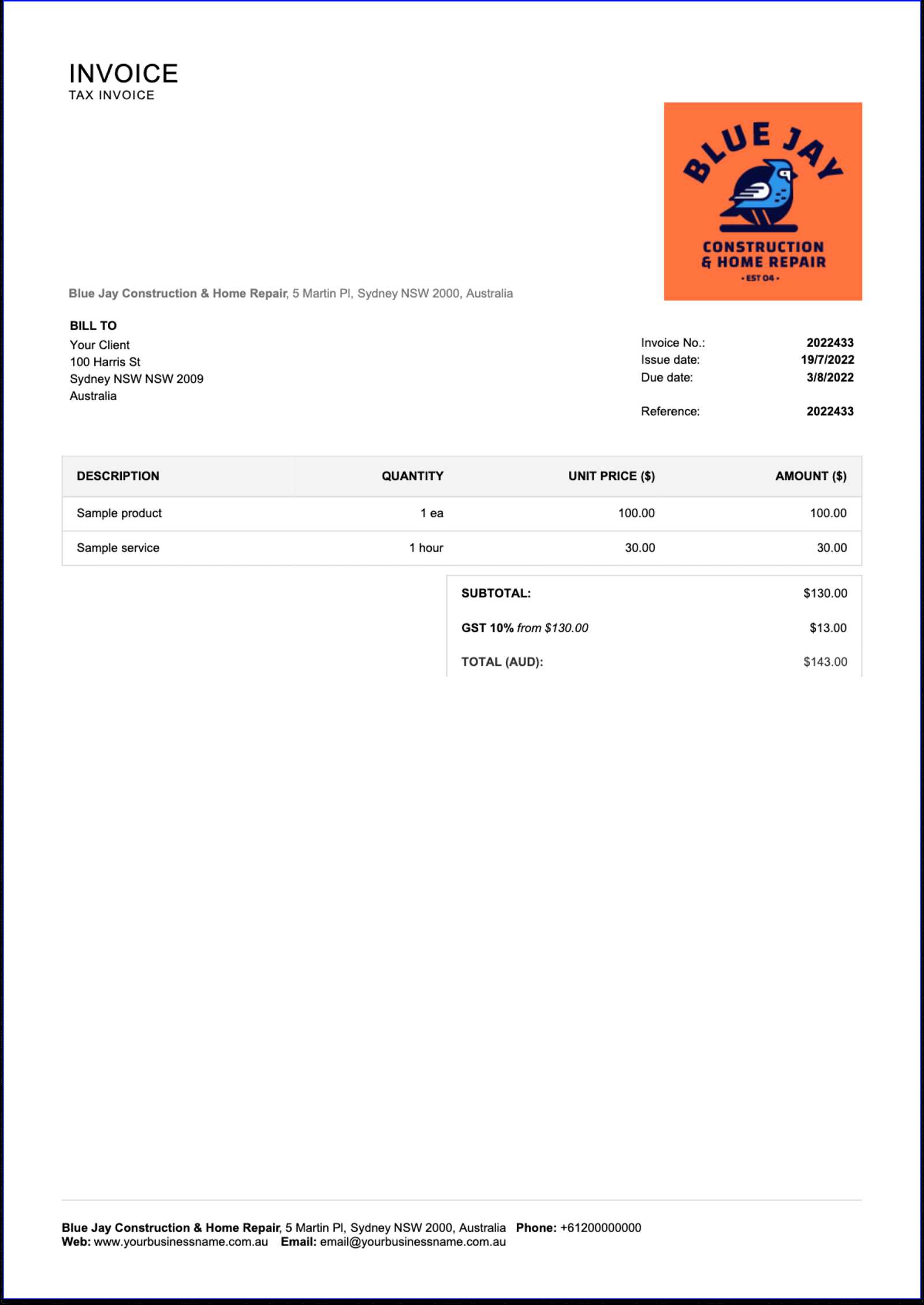

- Business Information: Your name, address, contact details, and business registration number if applicable.

- Client Details: Full name, business name (if relevant), and contact information of the person or company you’re invoicing.

- Document Number: A unique reference number for easy tracking and organization.

- Date of Issue: The date when the document is generated and sent to the client.

- List of Services or Products: A detailed description of what you are billing for, including quantities, rates, and any applicable discounts.

- Payment Terms: Clear instructions on how and when the payment should be made (e.g., due date, payment methods).

- Total Amount Due: The final sum the client needs to pay, including taxes if applicable.

- Late Payment Fees: If applicable, specify any penalties for overdue payments.

How to Customize Your Billing Documents

Customizing your financial documents to suit your business needs can make a significant difference in how efficient and professional your processes are. Here are some tips on making your billing format unique:

- Branding: Include your company logo, colors,

Why You Need an Invoice Template

For small business owners and freelancers, creating consistent and clear billing documents is essential for maintaining professionalism and ensuring timely payments. Without a structured approach, the process of generating financial statements can become confusing and lead to mistakes. A well-designed format not only simplifies this task but also adds a layer of credibility to your operations, helping to build trust with clients.

Time-Saving Efficiency

One of the biggest advantages of using a standardized format for your financial documents is the time saved. Instead of starting from scratch each time you need to bill a client, you can quickly fill in the necessary details and send out the document. This helps you focus on your core business activities while ensuring accuracy and consistency in your communications.

Improved Professionalism

A polished and well-organized billing document creates a professional image for your business. Clients are more likely to take you seriously and feel confident in your services when they receive clear, formal financial statements. Moreover, a standardized format ensures that you never miss any essential details, such as payment terms, due dates, or tax information, which could lead to delays or disputes.

In addition to improving efficiency and professionalism, having a consistent format helps you stay organized. It makes it easier to track payments, handle disputes, and keep your accounting records in order. With all the necessary information pre-arranged in a familiar structure, you can quickly review past transactions and ensure everything is in place when tax season comes around.

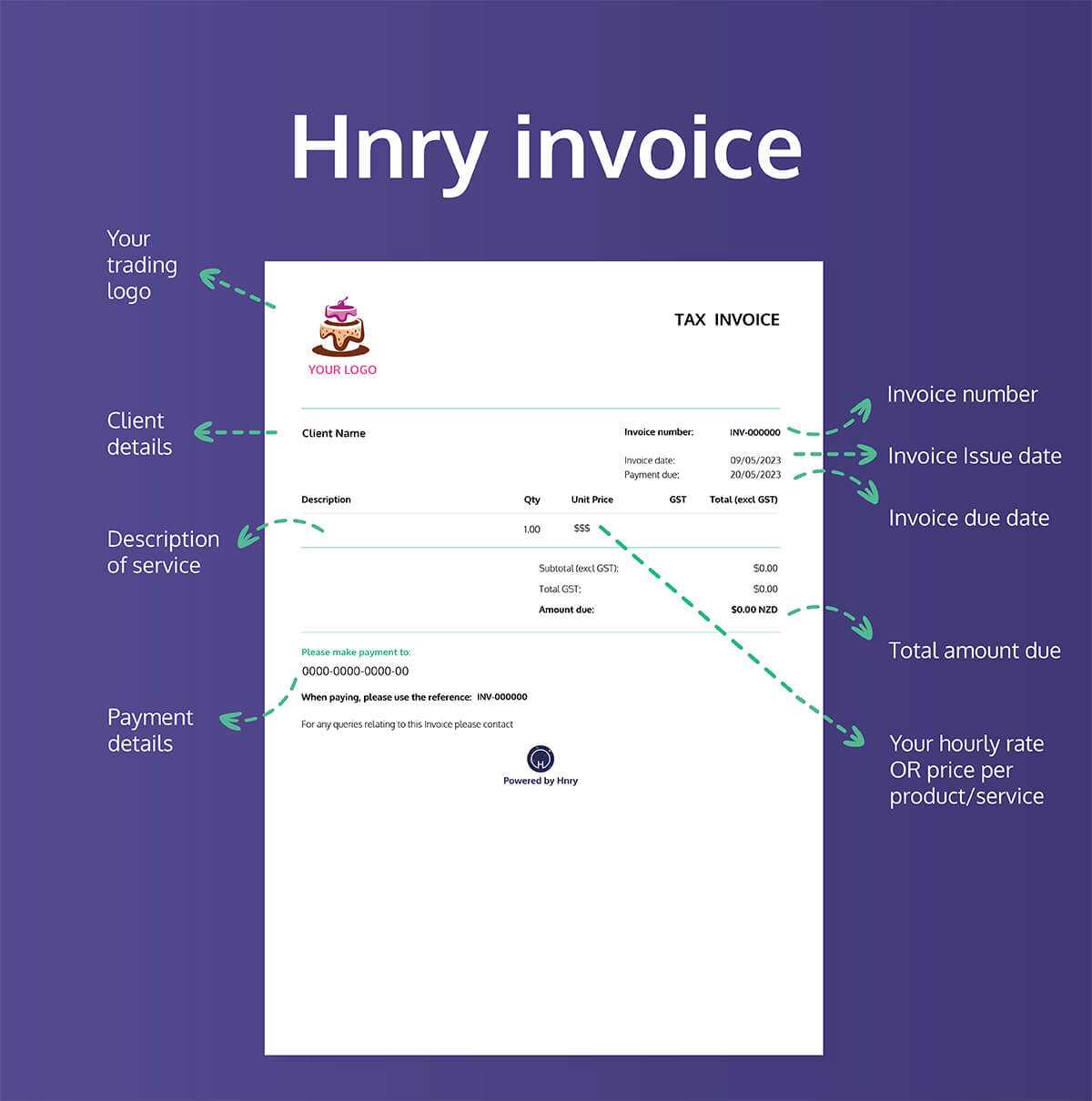

Key Elements of an Invoice

A well-structured billing document is essential for clear communication between business owners and clients. It provides all the necessary information for the client to understand what they are being charged for and ensures that the payment process runs smoothly. There are several key components that should be included to make sure the document is complete, professional, and legally compliant.

Below are the primary elements that every billing document should contain:

- Business Information: This includes the name of your business, address, contact details, and business registration number (if applicable). Providing this ensures clients know exactly who they are dealing with.

- Client Information: Clearly include the client’s name, business name (if applicable), and address. This allows the client to verify their information and ensures the document is tailored specifically to them.

- Document Number: Assigning a unique reference number to each document makes it easier to track and manage past transactions, especially for accounting purposes.

- Issue Date: The date when the document is issued should be clearly visible. This marks the beginning of the payment term and ensures there is no confusion about when the payment is due.

- Description of Goods or Services: A detailed breakdown of what the client is being billed for. Include a clear description of the products or services, quantities, individual prices, and any relevant discounts or adjustments.

- Payment Terms: State clearly the payment method(s) accepted, payment due date, and any specific instructions on how the client should complete the transaction.

- Amount Due: The total amount the client needs to pay, which includes any taxes or additional charges. Ensure this is clearly separated from other information for easy identification.

- Late Payment Fees: If applicable, outline any penalties for overdue payments, such as interest rates or flat fees, to encourage timely settlement.

Including all of these elements in your document ensures that your client has all the necessary information to make a payment promptly and accurately. It also helps you maintain a professional image and ke

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your specific business needs while maintaining a professional appearance. Personalization not only enhances your brand’s identity but also ensures that all necessary details are clear and aligned with your unique workflow. Whether you are including special payment instructions, adding your logo, or specifying additional terms, customizing your document helps streamline communication with clients.

Here are some ways to customize your billing documents effectively:

Customization Element How to Customize Business Branding Incorporate your company logo, brand colors, and fonts to ensure the document reflects your business identity. Client-Specific Details Personalize the document by adding your client’s name, their company details, or custom notes to create a more tailored experience. Payment Instructions Clearly indicate accepted payment methods (bank transfer, PayPal, etc.), and include any relevant account details or payment links. Payment Terms Modify the due date, late fees, or discounts based on each client or project’s unique requirements. Additional Charges Add extra fields for any applicable taxes, shipping fees, or miscellaneous charges that may apply to the service or product provided. By customizing each element to fit your specific business needs, you create a more seamless and personalized billing process for your clients. This not only reflects professionalism but also makes it easier for clients to

Common Mistakes to Avoid

When creating billing documents, small mistakes can cause confusion, delays, or even disputes with clients. It’s crucial to ensure that each document is accurate, complete, and clear. Avoiding common pitfalls can make the payment process smoother and maintain a professional relationship with your clients.

Here are some common errors to watch out for when preparing your billing documents:

- Omitting Important Information: Failing to include key details such as your business name, the client’s information, or a unique reference number can lead to confusion and delays in payment.

- Incorrect Payment Terms: Not specifying clear payment instructions, due dates, or accepted payment methods can cause misunderstandings about when and how payments should be made.

- Unclear Descriptions: Vague or insufficient descriptions of goods or services may leave clients unsure about what they are paying for. Always provide detailed breakdowns of your work or products.

- Missing Tax Information: Not including tax rates or other charges can lead to clients misunderstanding the final amount due. Make sure to list any applicable taxes or fees clearly.

- Overlooking Late Fees: If your terms include late payment penalties, ensure they are clearly stated and easy to find. Clients should be aware of any consequences for overdue payments from the start.

- Inconsistent Formatting: Inconsistent fonts, colors, or layouts can make your document look unprofessional. Stick to a clean, consistent format for better readability and clarity.

- Not Keeping Records: Failing to track past transactions or generate unique reference numbers for each billing document can complicate your financial recordkeeping. Ensure you keep proper documentation for future reference and tax purposes.

By being mindful of these common mistakes and taking the time to review your billing documents before sending them, you can avoid unnecessary complications and maintain a smooth, professional payment process.

Benefits of Using an Invoice Template

Utilizing a pre-designed document format can offer significant advantages for small business owners and freelancers. By adopting a standardized structure, you save time, increase accuracy, and present a more professional image to your clients. In addition to simplifying the billing process, it ensures consistency and helps you stay organized, making your business operations more efficient.

Here are the key benefits of using a structured format for your financial documents:

- Time Efficiency: With a pre-designed layout, you can quickly generate billing documents without needing to start from scratch each time. This speeds up the invoicing process and lets you focus on more important aspects of your business.

- Improved Accuracy: A consistent format reduces the chances of forgetting critical details, such as the client’s information, payment terms, or service descriptions. You are less likely to overlook important aspects, ensuring the document is complete and correct.

- Professional Appearance: Using a polished, well-structured document enhances your credibility and leaves a positive impression on your clients. A professional format can also improve trust and encourage quicker payments.

- Consistency: With a standardized design, every billing document you send will follow the same layout, making it easier for both you and your clients to review and track past transactions.

- Easy Customization: Pre-designed documents are flexible and can be easily modified to suit your specific needs. You can quickly update details like payment methods, due dates, and charges for different clients or projects.

- Better Financial Organization: By maintaining consistent records with a standardized structure, it’s easier to track your income and manage your accounting. It also simplifies the process when preparing tax filings or reviewing your business finances.

- Enhanced Legal Protection: A formal document that clearly outlines payment terms, services, and fees provides legal protection in case of disputes. It ensures both parties are aware of their obligations and helps prevent misunderstandings.

By incorporating a pre-designed structure into your business workflow, you can ensure that billing is more efficient, accurate, and professional. This approach not only improves the client experience but also helps you stay organized and on top of your financial records.

Choosing the Right Template for Your Business

Selecting the right format for your billing documents is a crucial step in ensuring that your business runs smoothly. Whether you’re a freelancer or managing a small enterprise, the document you use to request payment should reflect your brand, suit your workflow, and be easy for clients to understand. The right structure will not only help you stay organized but also facilitate faster payments and fewer misunderstandings.

Factors to Consider When Choosing a Format

When choosing a format for your business, there are several key factors to consider in order to find the most suitable option:

Factor Why It Matters Business Size A larger business may need a more detailed structure to track multiple clients and invoices, while a smaller operation can benefit from a simpler, more straightforward layout. Client Preferences Consider the preferences of your clients. Some may prefer a detailed breakdown, while others may prefer a quicker, more concise document. Services or Products If you offer a wide range of services or products, it’s important to choose a structure that allows for easy customization of descriptions, quantities, and prices. Branding Your format should reflect your business identity. Customizable designs can help ensure that your documents align with your brand’s visual identity, including logos, fonts, and color schemes. Ease of Use Select a format that is easy for you to fill out and send, whether you’re creating it manually or using software to automate the process. Types of Formats to Consider

Creating Invoices for Freelancers

As a freelancer, managing your own finances and ensuring timely payments is a crucial part of running your business. One of the most important tasks is generating clear and professional payment requests for your clients. These documents not only serve as a formal request for payment but also provide a record of the services you’ve provided, helping both you and your clients stay organized. Creating accurate and detailed payment requests can help you maintain a professional image and avoid misunderstandings about the terms of your work.

Here’s how to create effective payment requests for freelance work:

- Include All Necessary Details: Make sure your document includes key information such as your name or business name, client details, payment amount, a breakdown of the work done, and payment terms. This ensures that both you and your client are on the same page regarding the services rendered and the amount due.

- Clearly Define the Payment Terms: Specify the payment method, due date, and any late fees that may apply. It’s essential to communicate your expectations clearly to avoid delays or disputes.

- Provide a Detailed Breakdown: Freelancers often work on multiple projects or services for different clients. Providing a breakdown of the tasks you completed, along with the corresponding rates or hours worked, can make it easier for clients to understand the costs involved and ensure transparency.

- Set Your Rates Clearly: Whether you charge hourly or per project, clearly list your rates and any applicable discounts. This helps prevent confusion and reinforces your professionalism.

- Track Your Documents: Numbering each request and including the date allows for easy tracking and future reference. This is particularly important for freelancers who work with multiple clients or have recurring projects.

- Maintain Consistency: Use a consistent format and layout for each payment request to create a professional appearance and ensure all essential details are always included.

By following these guidelines, you can create well-organized, professional documents that streamline the payment process, minimize confusion, and help you maintain strong relationships with clients. Clear, effective payment requests are key to ensuring you get paid promptly and that your business runs smoothly.

How to Add Tax Information Correctly

For businesses of all sizes, properly adding tax details to payment requests is essential for compliance with local laws and for ensuring smooth transactions. Including accurate tax information not only helps you stay on the right side of regulations but also makes it easier for clients to understand the final amount due. Whether you’re working with sales tax, VAT, or other applicable duties, it’s crucial to correctly calculate, display, and explain these amounts to avoid confusion or delays in payments.

Here are the key steps to ensure you’re adding tax details correctly:

- Understand Applicable Tax Rates: Different regions and industries may have varying tax rates. Be sure to know the tax rate that applies to your business and ensure it’s up-to-date. This includes understanding whether you need to charge sales tax, VAT, or any other regional or industry-specific duties.

- Include a Tax Breakdown: It’s important to break down the tax amount separately from the total amount due. Show the base price of the goods or services provided, the tax rate applied, and the total tax amount. This makes it easy for clients to see exactly what they’re being charged for and ensures transparency.

- Display Tax Identification Numbers: If required in your jurisdiction, include your tax ID or VAT number on your document. This helps verify your business and ensures that clients know you are a legitimate, registered entity.

- Ensure Correct Calculation: Always double-check your tax calculations before finalizing the document. An error in tax rates or amounts can lead to confusion, disputes, or even legal issues. Consider using software or tools to help automate this process and reduce human error.

- Clarify Exemptions: If your goods or services are exempt from tax or qualify for special tax treatment, make sure to clearly indicate this on your document. This ensures that both you and your client are on the same page regarding tax obligations.

- Consider International Clients: If you’re working with clients from different countries, be aware of their local tax regulations. Some regions may require you to apply foreign tax rates or withhold taxes for cross-border transactions. Always clarify which tax rules apply to avoid complications.

By following these steps, you ensure that the tax information on your payment requests is accurate, clear, and legally compliant. Properly adding tax details not only protects your busin

Ensuring Professionalism in Invoicing

Maintaining a professional approach to billing is essential for building trust and ensuring smooth business operations. A well-structured and clear payment request not only reflects your attention to detail but also reinforces your credibility with clients. The professionalism of your documents can influence your business reputation and, ultimately, your cash flow. It’s important to present yourself and your services in the best light possible by ensuring that each payment request is accurate, polished, and easy to understand.

Here are some key ways to ensure professionalism when preparing billing documents:

- Use a Consistent Format: Stick to a clear, organized structure for all your billing documents. This includes consistent fonts, layout, and style. A uniform approach makes your documents easy to read and reinforces your business’s professionalism.

- Double-Check for Accuracy: Before sending out any billing documents, always review the details carefully. Ensure that the client’s information, payment amount, services rendered, and tax rates are correct. Mistakes in the document can cause delays, confusion, and erode your professional image.

- Incorporate Your Branding: Personalize your billing documents by adding your logo, business name, and contact details. This helps reinforce your brand’s identity and gives a polished, professional touch to your communications.

- Be Clear and Transparent: Make sure all details, including pricing, payment terms, and due dates, are clearly stated. Avoid any ambiguity that could lead to misunderstandings. Transparency builds trust and helps maintain positive client relationships.

- Set Professional Payment Terms: Clearly define your payment terms, such as accepted methods of payment, due dates, and any late fees. Having well-defined terms ensures both you and your client know what to expect and helps reduce payment delays.

- Follow Up Professionally: If a payment is overdue, follow up with a polite reminder. A professional tone in communications ensures that your relationship with the client remains positive, even when dealing with late payments.

- Maintain a Digital Record: Keep a digital copy of every payment request sent out. This helps with organization and ensures that you have a record in case any questions or disputes arise in the future.

By adopting these practices, you can ensure that your billing process is efficient, professional, and free from errors. A polished approach to managing payments not only improves cash flow but also strengthens your reputation as a reliable, trustworthy business.

Tips for Quick Invoice Payments

Receiving timely payments is crucial for maintaining cash flow and ensuring the smooth operation of your business. The faster you get paid, the more efficiently you can reinvest in your work and sustain your operations. However, getting prompt payments requires more than just sending a request–it’s about setting clear expectations, offering convenient payment methods, and ensuring your clients have everything they need to settle their accounts without delays.

Here are some practical tips to help speed up the payment process:

Clear Payment Terms

One of the easiest ways to ensure timely payments is by setting and communicating clear payment terms upfront. This helps eliminate any confusion and gives your clients a concrete understanding of when and how they should pay.

Tip Why It Helps Set a Clear Due Date Make sure the due date is specified and visible on your payment request. This creates a sense of urgency and sets expectations for when the payment should be made. Specify Accepted Payment Methods List the payment options you accept (e.g., bank transfer, credit card, PayPal) to avoid any confusion or delays related to payment method selection. Outline Late Fees Make clients aware of any late fees or interest charges for overdue payments. This can motivate clients to pay on time to avoid extra costs. Make Payment Easy for Clients

Offer clients simple, convenient ways to pay you. The easier you make the process, the more likely they are to pay promptly.

- Provide Multiple Payment Options: The more payment methods you offer, the more likely clients are to choose one that’s most convenient for them. Consider accepting online payments, bank transfers, credit cards, or even mobile payments, depending on your client base.

- Send Automatic Payment Reminders: Set up automatic reminders for clien

Formatting Your Document for Clarity

One of the keys to ensuring that clients pay promptly and without confusion is presenting your payment request in a clear and organized manner. A well-structured document allows your clients to quickly understand what they are being charged for, the total amount due, and the payment terms. Proper formatting can reduce misunderstandings and prevent delays, making the payment process smoother for both you and your clients.

Here are some essential tips for formatting your billing documents for clarity:

- Use a Clear and Readable Layout: Keep the layout simple and easy to follow. Group related information together, such as your contact details, client’s information, service descriptions, and payment terms. This will allow your clients to find specific details quickly.

- Break Down the Costs: Itemize each service or product provided with its respective cost. This provides transparency and ensures your client can clearly see the breakdown of charges, helping avoid disputes.

- Highlight Key Information: Make sure the most important information, such as the total amount due and the due date, is easy to locate. You can bold or underline these details to make them stand out.

- Use Consistent Fonts and Spacing: Stick to professional fonts like Arial or Times New Roman and ensure the text is well-spaced. Avoid cluttering the document with too many different font styles or sizes, as it can be overwhelming and detract from the document’s readability.

- Include a Unique Reference Number: Each payment request should have a unique reference or document number to help both you and your client track the transaction. This also helps if you need to follow up on a specific request or provide a record for tax purposes.

- Incorporate Clear Payment Terms: Clearly list the payment terms, including the due date, accepted methods of payment, and any late fees that may apply. The easier it is for clients to understand how to pay you, the faster you will receive payment.

- Ensure Accurate Contact Details: Include your business name, address, email, and phone number at the top or bottom of the document so clients know how to contact you if there are any issues or questions.

By following these formatting guidelines, you ensure that your payment requests are

Best Software for Invoice Creation

Creating and managing billing documents manually can be time-consuming and prone to error. Fortunately, there are numerous software solutions that streamline the process, making it quicker and more efficient. These tools not only help you generate professional-looking documents but also assist in tracking payments, managing client details, and ensuring tax compliance. Whether you’re a freelancer, a small business owner, or a large enterprise, selecting the right software for generating payment requests can save you time and enhance the professionalism of your business.

Here are some of the top software options to consider for creating and managing your payment documents:

1. FreshBooks

Best for: Freelancers and small businesses looking for an all-in-one solution.

- FreshBooks allows you to easily create and customize payment requests, track time, and manage client billing.

- It features automated reminders, recurring billing, and integrates with various payment gateways to make receiving payments easier.

- With its user-friendly interface, you can quickly set up and manage your documents with little effort.

2. QuickBooks

Best for: Small to medium-sized businesses needing detailed accounting features.

- QuickBooks offers comprehensive invoicing tools, as well as expense tracking, financial reporting, and tax calculations.

- The software integrates seamlessly with bank accounts and payment processors, simplifying the entire billing and payment process.

- QuickBooks also provides the option for recurring invoices and automated follow-ups for overdue payments.

3. Zoho Invoice

Best for: Businesses looking for a customizable and cost-effective invoicing solution.

- Zoho Invoice offers a free plan for small businesses, allowing them to create customized documents, track payments, and send automated reminders.

- The software provides detailed reporting features, allowing you to monitor income, expenses, and client activity.

- With multi-currency support and integration with various payment gateways, Zoho Invoice is ideal for businesses with international clients.

4. Wave

Best for: Small businesses or solopreneurs who need a free solution.

- Wave offers free invoicing and accounting features, making it a great option for startups and freelancers.

- It supports online payments, expense tracking, and custom templates for your payment requests.

- Wave is a simple, no-fuss tool for creating clean and professional documents without a steep learning curve.

5. Xero

Best for: Growing businesses that need advanced invoicing and accounting features.

- Xero offers a comprehensive suite of invoicing tools, including automatic recurring billing, payment tracking, and integration with third-party apps.

- It also allows you to add tax details and apply different payment terms, making it a versatile option for businesses in various industries.

- Xero’s user-friendly interface and cloud-based platform make it easy to access your billing documents from anywhere.

Choosing the right software depends on the size of your business, your specific needs, and the features you require. With the options listed above, you can streamline the billing process, stay organized, and improve your business operations, all while saving time and reducing errors.

How to Track Payments Using Templates

Effectively managing payments is crucial to ensuring a smooth cash flow for your business. One of the most efficient ways to track incoming payments is by using well-structured documents. These records not only help you keep track of outstanding balances but also provide an organized overview of transactions and ensure timely follow-ups on overdue payments. By leveraging customizable documents for tracking, you can easily monitor the status of each payment and reduce the risk of missed or delayed payments.

Here’s how you can use organized documents to track payments more efficiently:

1. Include a Payment Status Column

One of the most straightforward ways to track payments is by adding a “Payment Status” section to your records. This column will allow you to categorize each payment as “Pending,” “Paid,” or “Overdue.” It provides a quick visual reference, helping you stay on top of which payments have been completed and which still need attention.

- Pending: Payments that have been issued but not yet received.

- Paid: Payments that have been successfully processed and cleared.

- Overdue: Payments that have missed the due date and need to be followed up on.

2. Use Automated Payment Reminders

Many digital billing solutions and customizable documents offer features that automate the process of sending reminders. By integrating these tools into your workflow, you can set up automatic reminders to notify clients about upcoming or overdue payments. This reduces the time spent manually chasing payments and helps keep your records up-to-date without extra effort.

- Set Reminders: Schedule reminders for clients a few days before the due date to prompt them to make the payment on time.

- Late Payment Notices: Automate follow-up emails for overdue payments to maintain professionalism while encouraging prompt payment.

By utilizing these tracking methods, you can streamline your payment management process, ensure that no payment slips through the cracks, and keep your cash flow healthy and predictable.

What to Include in a Payment Reminder

Sending a payment reminder is an essential step in ensuring timely payments from clients. A well-crafted reminder helps maintain professionalism while gently prompting the client to settle their outstanding balance. It’s important that a reminder is clear, concise, and courteous, providing all the necessary information to avoid confusion and ensure swift action.

When drafting a payment reminder, here are the key elements to include:

1. Clear Reference to the Original Request

Your reminder should begin with a reference to the original payment request or transaction. This helps the client easily identify the bill you are referring to, avoiding any misunderstandings. Include the unique document number or reference code along with the date it was issued.

- Reference Number: Include the unique code or number associated with the payment request.

- Original Due Date: Mention the due date from the initial payment request to highlight the overdue status.

2. A Polite Request for Payment

Maintain a polite and professional tone when requesting payment. A friendly, respectful approach increases the likelihood of a prompt response and helps preserve a positive relationship with the client.

- Payment Reminder Language: Use phrases such as “This is a gentle reminder,” or “We would appreciate your prompt attention to this matter.”

- Acknowledge Possible Delays: Acknowledge that sometimes delays happen, and express understanding if the client has experienced any issues, offering assistance if needed.

3. Updated Payment Details

Ensure that your client has all the necessary payment details readily available. This includes the amount due, accepted payment methods, and instructions on how to complete the payment. If any changes have occurred since the original request (e.g., a new bank account), include these updates in your reminder.

- Amount Due: Clearly state the outstanding balance, including any late fees if applicable.

- How to Manage Multiple Clients’ Payment Requests

Managing payments from multiple clients can quickly become overwhelming without a clear system in place. Whether you’re handling a handful of clients or a large portfolio, it’s crucial to stay organized to ensure that no payment is missed and every transaction is tracked accurately. By using a structured approach, you can streamline the billing process, keep track of due dates, and reduce the likelihood of errors or delays in payments.

Here are some effective strategies to manage multiple clients’ payment requests:

1. Use a Centralized System

The first step in managing multiple clients is to use a centralized system to keep all payment details in one place. Whether it’s an online tool or a digital spreadsheet, having everything in a single location helps you quickly access and monitor outstanding balances. This system can track key information like the client’s name, amount due, due dates, and payment status.

Client Name Amount Due Due Date Payment Status Client A $500 November 15 Pending Client B $750 November 20 Paid Client C $300 November 10 Overdue 2. Set Reminders and Alerts

Set up automatic reminders or alerts for when payments are due or overdue. Many digital tools offer features that allow you to schedule reminders ahead of time, or you can manually set alerts in your calendar. Automated reminders can help ensure that you never forget to follow up on a payment, making it easier to stay on top of multiple clients at once.

- Automated Email Reminders: Set up emails that are automatically sent to clients a few days before their due date.

- Customizable Follow-ups: Customize follow-up emails to remind clients of overdue payments, including any late fees that may apply.

3. Keep Detailed Records of Each Client’s Payment History

Maintain a detailed record of each client’s paymen

Creating an Invoice for International Clients

When working with international clients, it’s essential to consider additional details to ensure smooth cross-border transactions. Aside from the usual billing information, creating a document that is clear and legally sound for international clients involves understanding currency conversions, taxes, and potential language differences. Properly structuring this document will not only facilitate faster payments but also help avoid misunderstandings and delays.

Here are key elements to consider when preparing a billing document for clients in other countries:

1. Include Currency and Payment Method Information

One of the most important factors when dealing with international clients is specifying the currency in which the payment should be made. Clearly state the currency (e.g., USD, EUR, GBP) to avoid confusion. Additionally, mention the acceptable methods for payment, such as bank transfers, PayPal, or credit card payments, and ensure these methods are accessible to the client from their location.

- Currency: Ensure that the currency is clearly specified and the correct exchange rate is applied if necessary.

- Payment Methods: List the available payment options, and check if any fees apply to international transactions.

2. Address Taxes and Duties

International transactions may involve additional taxes or duties, depending on the nature of the work and the countries involved. It is important to specify whether the prices include VAT or if any extra charges are applicable. Additionally, make sure to include your tax identification number, if required, and any other necessary tax information relevant to cross-border business.

- Value-Added Tax (VAT): Specify if VAT is applicable and whether it is included in the total amount or needs to be added separately.

- Customs Duties: If shipping goods internationally, ensure customs duties and import/export fees are clearly mentioned, outlining who is responsible for paying them.

By clearly addressing these points, you can ensure a seamless and transparent payment process for both you and your international clients. Additionally, always check the specific tax regulations or payment requirements for each country to avoid complications during the payment process.

Legal Considerations When Invoicing

When creating billing documents for clients, it’s important to keep in mind various legal aspects that govern such transactions. Properly managing these legal requirements ensures that both parties understand their rights and obligations, helping to avoid potential disputes. Key legal elements can vary based on location, industry, and the nature of the work, but certain general principles apply to most business arrangements.

Here are the main legal considerations to keep in mind when preparing your payment requests:

1. Clear Payment Terms

Always specify clear payment terms in your request. This includes the payment due date, accepted payment methods, and any late fees or interest charges that may apply if payment is not made on time. Establishing these terms upfront helps prevent misunderstandings and ensures that both you and your client are on the same page.

- Due Date: Clearly state when the payment is due to avoid confusion or delays.

- Late Fees: Include information on penalties or interest charges for overdue payments if applicable.

- Payment Methods: Specify acceptable payment methods (bank transfer, credit card, etc.) and any fees associated with each.

2. Tax and Regulatory Compliance

Ensure that your payment requests comply with the tax laws in your region or country. Depending on your business structure, you may be required to charge VAT or other local taxes. Be sure to include the correct tax rates and tax identification numbers, as well as comply with invoicing regulations, especially for international clients.

- Tax Numbers: Include your VAT or tax registration number if required by local law.

- Applicable Taxes: Specify any taxes, such as VAT or sales tax, that apply to the total amount, and make it clear whether they are included in the total price or should be added separately.

- International Compliance: If working with clients from other countries, familiarize yourself with the tax rules in those countries, such as whether you need to charge taxes and at what rate.

3. Business Identification Information

In many jurisdictions, businesses are required to include certain identifying information on payment documents. This can include the business’s legal name, registration number, and contact details. Providing this information helps verify the legitimacy of your business and can protect both you and your clients in case of any legal disputes.

- Business Name: Include the official name of your business or the entity you operate under.

- Business Registration Number: If applicable, provide your business’s registration number or equivalent identifier.

- Cont