Software Sales Invoice Template for Simple and Accurate Billing

Effective financial management is essential for any business, especially when it comes to handling transactions and ensuring timely payments. One of the most important tools for managing this process is a well-structured document that records the details of each transaction. Whether you’re dealing with clients or customers, having a reliable system for tracking payments is crucial for maintaining cash flow and avoiding errors.

By using a structured format to document sales and services rendered, businesses can streamline their operations and keep a clear record of financial exchanges. This method not only saves time but also reduces the risk of missing important information, which can lead to disputes or payment delays.

In this guide, we will explore how to create and use a professional billing document, focusing on how to customize and adapt it to your business needs. We will also highlight best practices for ensuring accuracy and compliance, helping you avoid common pitfalls and improve your overall invoicing process.

Understanding Software Sales Invoices

When businesses engage in transactions with clients, it’s crucial to document the exchange of goods or services clearly and professionally. These records ensure that both parties are aligned on the terms and amount due, helping avoid misunderstandings and delays. A well-crafted billing document provides transparency and is essential for accurate record-keeping and financial planning.

In essence, a billing document serves as both a request for payment and a record of the transaction. It typically includes details about the products or services provided, along with the total amount owed, payment terms, and other necessary information. This document helps businesses track what has been sold, what is owed, and when payment is expected.

Key Elements of a Billing Document

- Business Information: Includes your company’s name, contact details, and any relevant identifiers (e.g., tax number or account number).

- Client Details: Includes the customer’s name, address, and contact information.

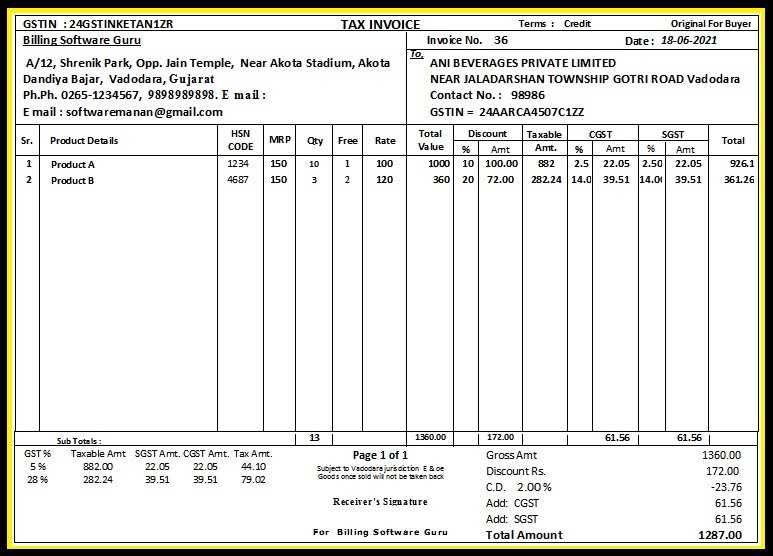

- Description of Goods or Services: A detailed list of the products or services provided, including quantities, prices, and any applicable discounts.

- Total Amount Due: The total sum owed by the client, including taxes, shipping, or additional fees.

- Payment Terms: Specifies when payment is due, late fees (if applicable), and the accepted payment methods.

- Unique Identification Number: Helps track the document for future reference or record-keeping purposes.

The Role of Professional Billing Documents

Having a standardized way to record transactions not only helps with financial accuracy but also strengthens a company’s professionalism. Well-designed billing documents demonstrate to clients that the business is organized and serious about its operations. Moreover, they serve as legal documentation in case of disputes and can be vital for tax and auditing purposes.

Ultimately, understanding the essential components of a proper billing record will help you create documents that are both functional and effective in managing your business’s financial needs.

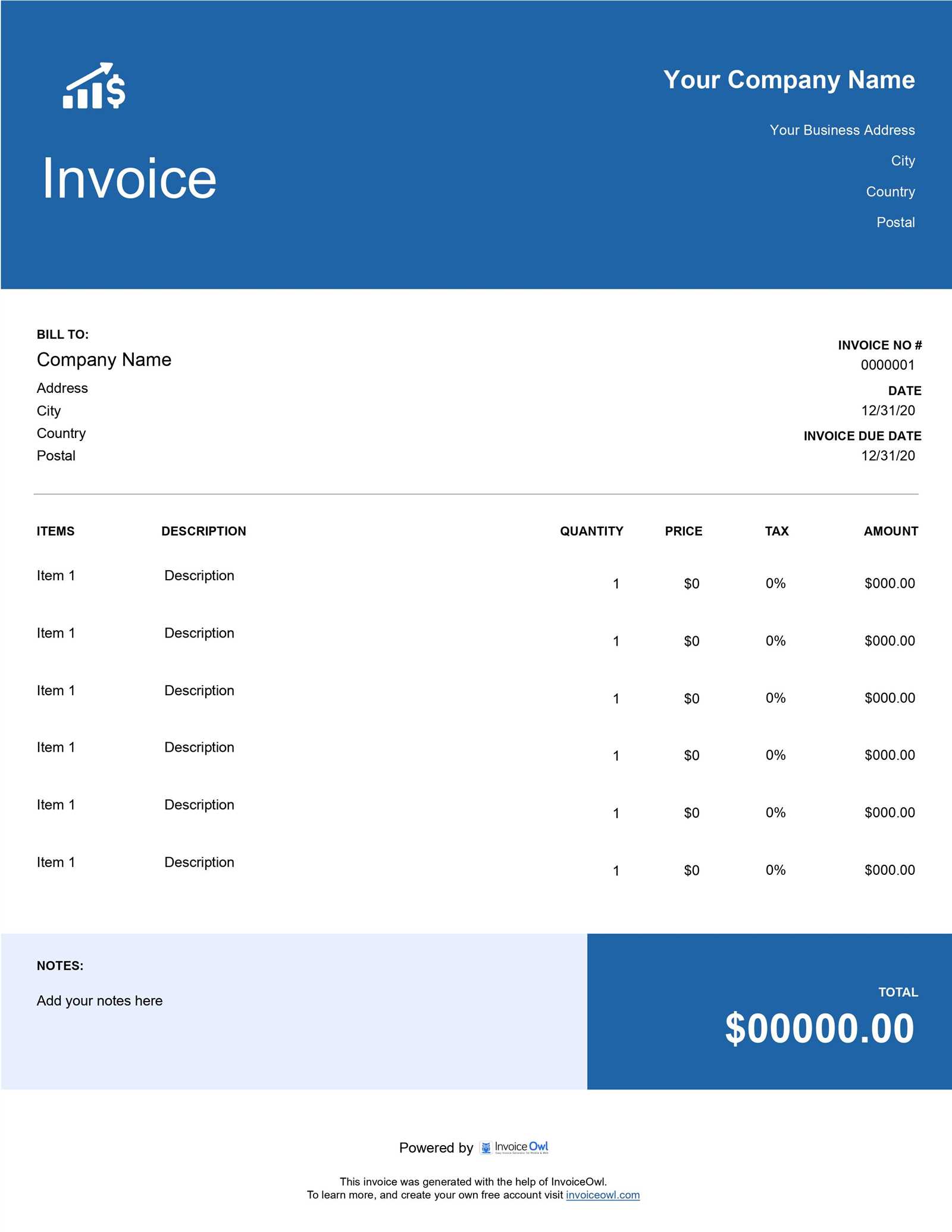

What Is a Sales Invoice Template?

A billing document format is a pre-designed layout that businesses use to record and request payment for the products or services provided to customers. It simplifies the process of creating accurate and consistent records by offering a standardized structure. This format ensures that all the necessary details are included, making it easier for both the business and the client to understand the terms of the transaction.

Rather than creating a new document from scratch each time a payment request needs to be issued, this structured layout allows businesses to quickly fill in the relevant information. It serves as a guide to ensure all critical elements–such as the products, prices, payment terms, and due dates–are consistently documented in a professional and organized manner.

By using a standardized billing format, companies can save time, reduce errors, and maintain a clear and accurate record of their transactions. This not only streamlines the payment process but also helps with financial tracking, improving overall business efficiency.

Why Use a Billing Document?

Using a well-structured payment request form is essential for businesses to maintain clear and organized financial records. This document serves as an official record of the goods or services provided and ensures both parties agree on the terms of the transaction. Without it, businesses risk confusion, delayed payments, and potential disputes with clients or customers.

Here are some of the key reasons why having a standardized billing form is beneficial:

- Accuracy: A consistent format reduces the risk of errors, ensuring that all necessary details–such as pricing, payment terms, and due dates–are accurately recorded.

- Efficiency: With a pre-designed structure, businesses can quickly create and send requests, saving valuable time in the payment process.

- Professionalism: A clear, organized document enhances the business’s credibility and demonstrates a high level of professionalism to clients.

- Legal Protection: This document serves as proof of the agreement and transaction, which can be important in case of disputes or audits.

- Financial Tracking: It helps businesses track payments, monitor outstanding balances, and maintain accurate records for accounting purposes.

Incorporating a standardized method for documenting transactions can streamline operations, ensure transparency, and support smoother interactions between businesses and their clients. It is an essential tool for maintaining financial stability and ensuring timely payments.

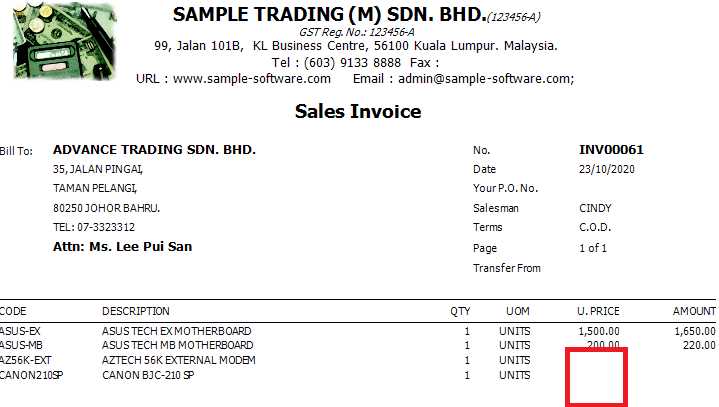

Key Components of a Billing Document

A well-crafted payment request form is composed of several essential elements that ensure clarity and accuracy. These components work together to provide a comprehensive record of the transaction, making it easier for both the business and the customer to understand the details of the agreement. Understanding these key sections is crucial to creating a professional and effective document.

Essential Details to Include

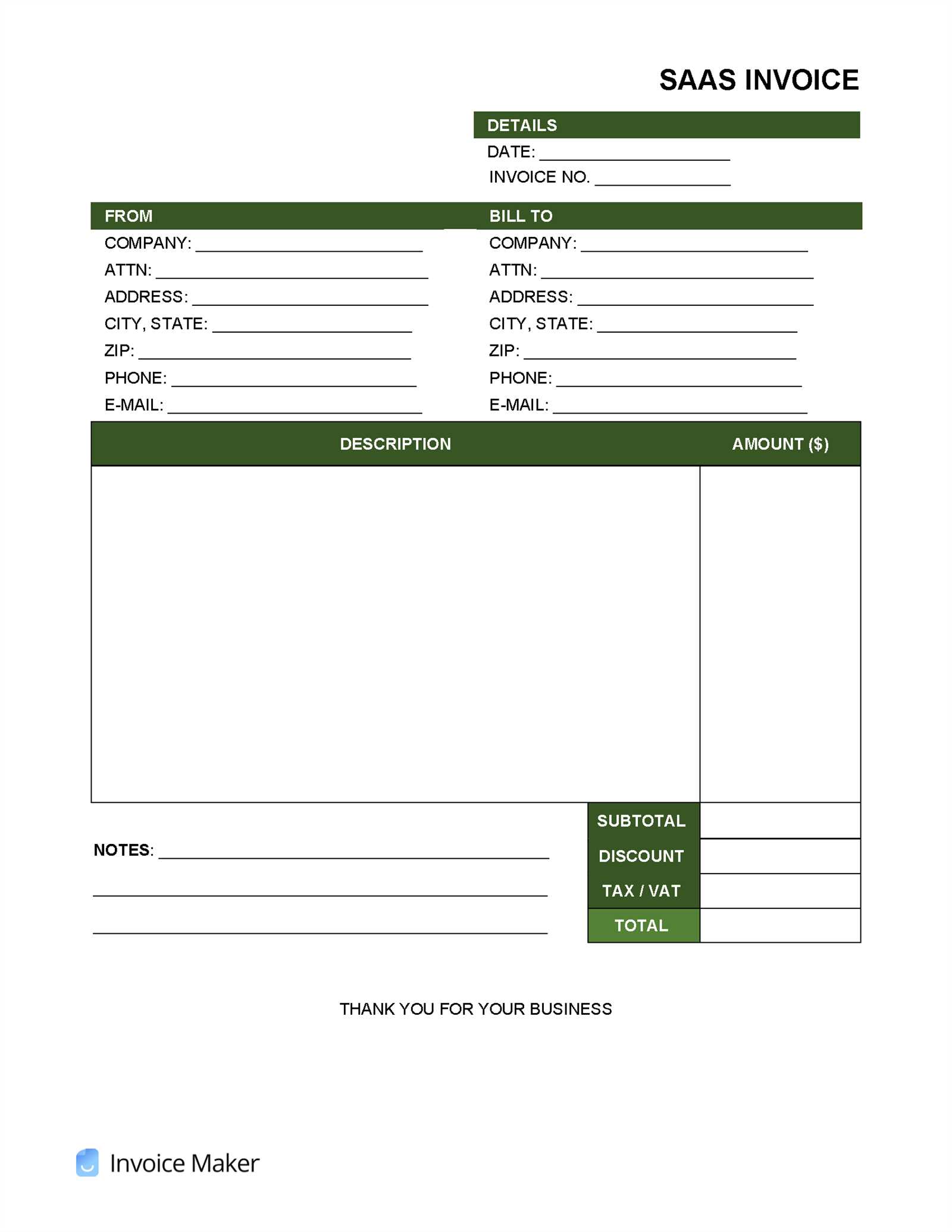

- Business Information: The company’s name, address, contact details, and identification numbers (e.g., tax or registration number).

- Client Information: The customer’s name, address, and other contact details to ensure proper identification.

- Transaction Description: A detailed list of the items or services provided, including quantity, unit price, and a brief description of each.

- Dates: The issue date of the document, as well as any relevant deadlines or payment due dates.

- Total Amount Due: The full amount owed, including any taxes, discounts, or additional fees applied to the transaction.

- Payment Instructions: Clearly outlined payment methods, terms, and deadlines to ensure the client knows how and when to settle the amount.

Optional Elements for Better Tracking

- Unique Reference Number: An identification number for easy tracking and reference to specific transactions.

- Terms and Conditions: Any additional clauses or agreements regarding late fees, refunds, or warranties that apply to the transaction.

By including these key components, businesses can create clear, effective payment requests that help facilitate smooth financial transactions and maintain transparency with their clients.

How to Create a Billing Document

Creating a professional payment request form is a straightforward process, but it requires attention to detail to ensure all relevant information is included. A well-organized document not only helps you maintain accurate records but also makes it easier for your clients to understand the terms of the transaction. Here’s a step-by-step guide to crafting a comprehensive billing document.

Step-by-Step Process

Follow these simple steps to create an effective payment request:

- Start with Business and Client Information: At the top of the document, include your company’s details and the customer’s contact information. This helps identify both parties and adds a professional touch.

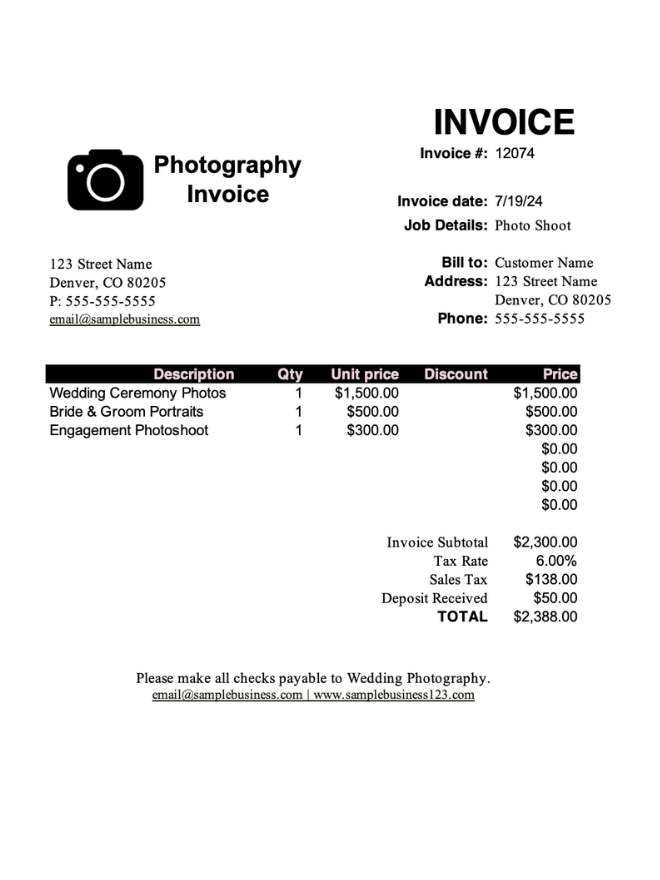

- Describe the Transaction: List the items or services provided, along with quantities, prices, and any applicable discounts or taxes. Be clear and concise to avoid confusion.

- Specify Payment Terms: Clearly state the total amount due, payment methods accepted, and the payment due date. This section is crucial for avoiding delays or misunderstandings.

- Assign a Unique Reference Number: This number helps both parties easily track the transaction and is particularly useful for record-keeping and follow-ups.

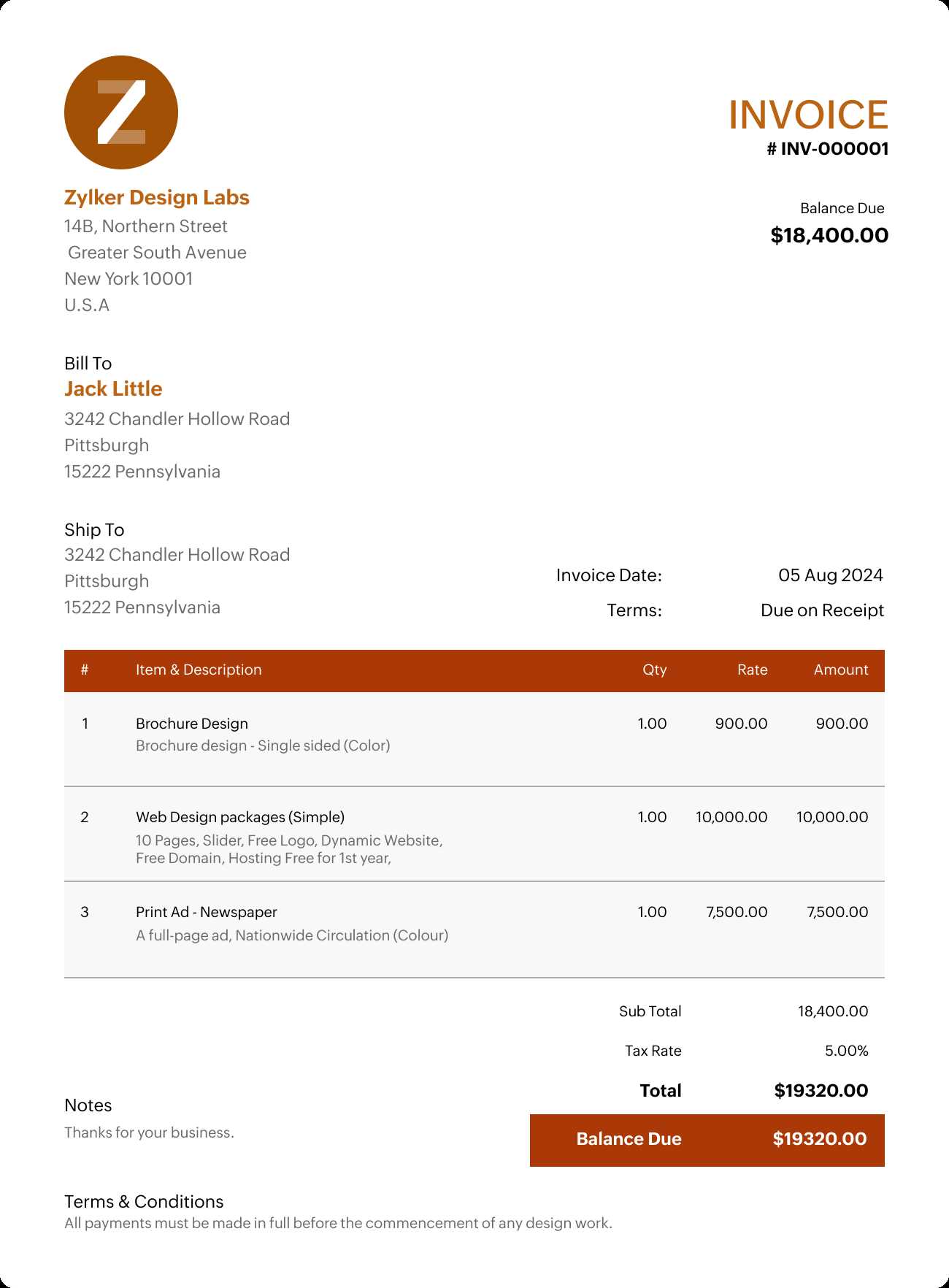

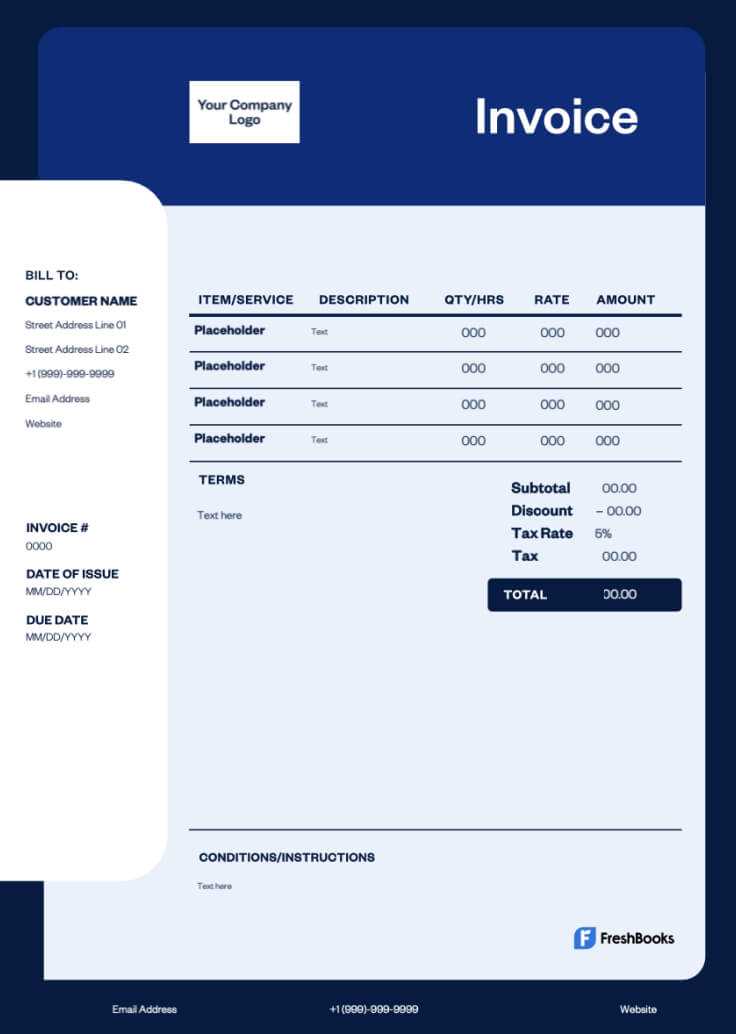

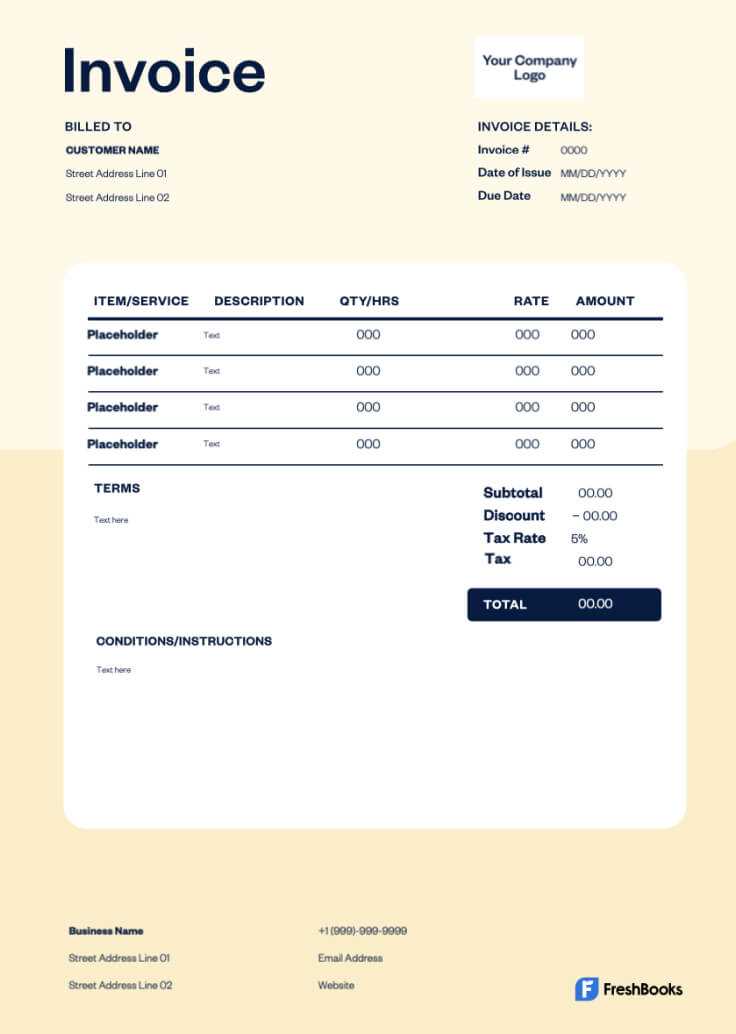

Example of a Billing Document Layout

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Service | 1 | $1000 | $1000 |

| SEO Optimization | 1 | $500 | $500 |

| Discount | – | -$100 | |

| Total Amount Due | $1400 | ||

Once you’ve included these key sections, review the document for accuracy and consistency. Double-check the amounts, dates, and client information to avoid mistakes. When the document is complete, it can be sent to the client as a formal request for payment.

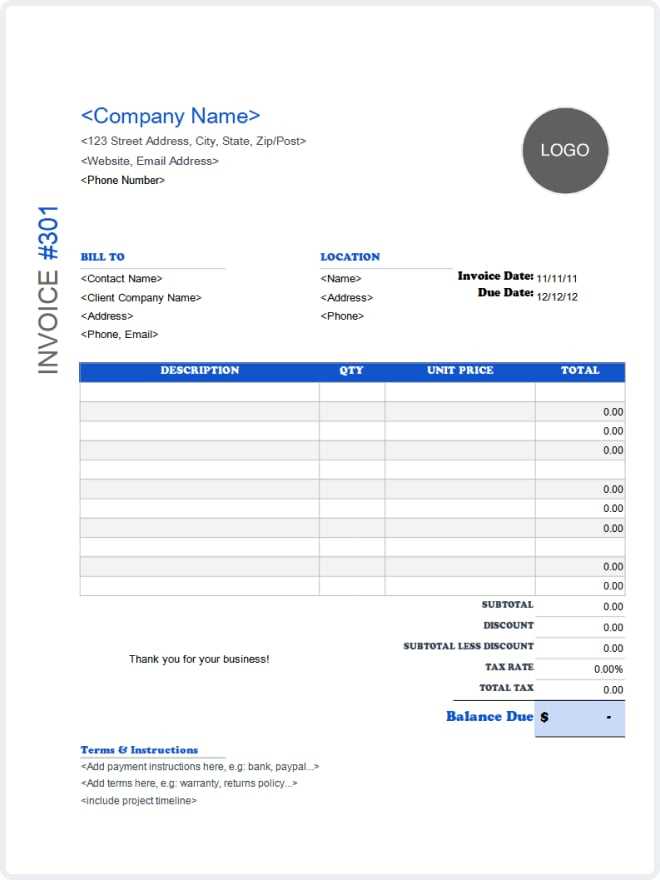

Choosing the Right Billing Document Format

Selecting the right format for creating payment requests is crucial for ensuring your documents are clear, professional, and functional. The right choice can save time, reduce errors, and help maintain consistent communication with clients. When deciding on the best layout, it’s important to consider factors like business needs, ease of use, and customization options.

Factors to Consider When Choosing a Format

- Business Type: Different businesses may require different styles of documents. A service-based business may need a simpler format, while product-based companies may require more detailed breakdowns of goods or quantities.

- Ease of Use: Choose a format that allows you to quickly generate documents with minimal effort. Templates that are easy to customize and fill in will improve efficiency.

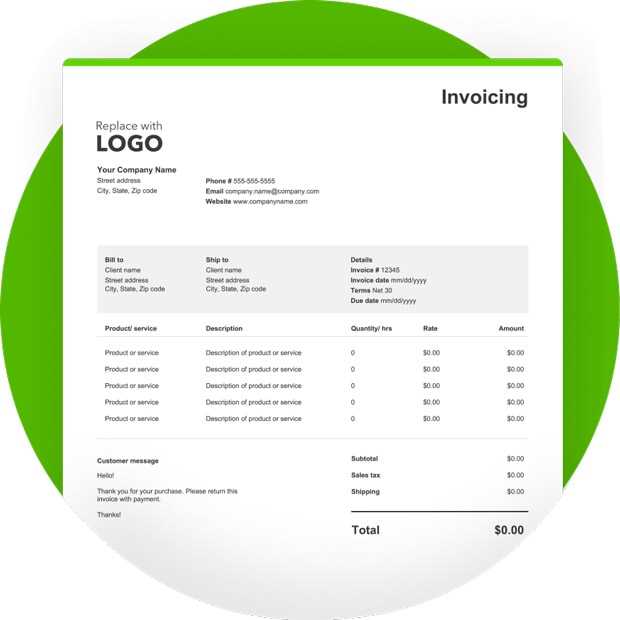

- Customization Options: Ensure the format can be easily adapted to fit your branding, with space for your company logo, color scheme, and specific terms.

- Compatibility with Other Systems: If you use accounting or payment software, ensure the chosen format can integrate smoothly with these tools for seamless tracking and processing.

Additional Features to Look For

- Automated Calculations: Choose a layout that automatically calculates totals, taxes, and discounts to reduce human error and speed up the process.

- Clear Payment Instructions: The format should make it easy to specify payment methods, due dates, and any late fees or penalties.

- Professional Appearance: The layout should be clean, with well-organized sections and readable fonts to enhance your business’s credibility.

By carefully selecting the right document format, you can ensure that your payment requests are effective, professional, and aligned with your business needs.

Benefits of Customizable Billing Documents

Having a flexible structure for creating payment requests offers numerous advantages, particularly for businesses that need to adjust their forms to meet specific needs. A customizable layout allows you to tailor each document to reflect the nature of the transaction and the preferences of your clients. This flexibility can significantly improve efficiency and professionalism while providing a more personalized approach to financial documentation.

Key Advantages of Customizable Formats

- Brand Consistency: Customizable documents allow you to add your company logo, colors, and other branding elements. This ensures a consistent professional appearance across all business communications.

- Flexibility in Design: You can easily adjust the layout to suit different types of transactions, whether you’re billing for services, products, or a combination of both. This adaptability helps ensure all necessary details are included.

- Scalability: As your business grows or diversifies, you can update your document layout to reflect new services, pricing models, or terms, without needing to start from scratch.

Efficiency and Accuracy

- Reduced Errors: Customizable formats often come with automated features like calculation tools, reducing the likelihood of manual errors in pricing, taxes, or totals.

- Time-Saving: With a pre-built structure that you can modify for each transaction, you save valuable time by not having to recreate documents every time you need to send a payment request.

- Easy Updates: As regulations or business requirements change, you can quickly adjust the document to meet new standards without a complicated overhaul.

Overall, the flexibility of a customizable billing format allows you to streamline your processes, enhance client satisfaction, and maintain a professional image while meeting the unique demands of your business.

Ensuring Accurate Billing Information

Accurate documentation of financial transactions is crucial for maintaining smooth business operations and positive client relationships. Any error in the details–whether it’s in the pricing, quantities, or payment terms–can lead to confusion, delays in payments, or even disputes. Ensuring that all information is correct not only enhances professionalism but also helps in maintaining transparent and efficient financial processes.

Steps to Ensure Accuracy

- Double-Check Client Information: Always verify that the customer’s name, address, and contact details are correct to avoid sending the document to the wrong recipient.

- Review Transaction Details: Carefully list each product or service, along with the correct quantity and agreed-upon price. This prevents misunderstandings regarding what was provided.

- Accurate Calculations: Ensure that all totals, taxes, and discounts are calculated correctly. A small mistake here can cause discrepancies in payment amounts.

- Check Payment Terms: Clearly specify the payment due date, accepted methods, and any applicable late fees to avoid confusion about the financial terms.

Tools to Help Maintain Accuracy

- Automated Calculations: Using digital forms with built-in calculation tools can help reduce human error by automatically computing totals and taxes.

- Standardized Formats: Using a consistent layout for all documents ensures that all necessary details are included and easy to review.

- Proofreading: Before sending any request, always proofread the document for spelling or grammatical errors, as well as numerical mistakes.

By following these steps and using the right tools, you can avoid mistakes and maintain a high level of accuracy in your payment requests, which contributes to faster payments and stronger client trust.

Automating Billing Document Generation for Efficiency

In today’s fast-paced business environment, streamlining administrative tasks is essential to saving time and reducing human error. Automating the process of creating payment requests not only speeds up the workflow but also ensures consistency across all documents. By integrating automation tools, businesses can eliminate repetitive manual work and focus more on core operations while maintaining accurate financial records.

Benefits of Automation

- Time Savings: Automating the document creation process allows you to generate payment requests in just a few clicks, cutting down on the time spent manually entering information.

- Consistency and Accuracy: Automated systems help ensure that each document follows the same format and includes all the necessary details, reducing the risk of mistakes.

- Improved Cash Flow: With automation, payment requests are generated and sent out more quickly, which can lead to faster payments and improved financial management.

- Reduced Administrative Costs: By cutting down on manual labor, automation minimizes the need for administrative staff to handle routine tasks, lowering operational costs.

Tools for Automating the Process

- Accounting Software: Many modern accounting platforms come with built-in tools that automatically generate payment requests based on transaction data entered into the system.

- Customizable Automation Platforms: Tools that allow for deeper customization can generate documents that automatically populate fields such as client information, product details, and payment terms.

- Recurring Billing Systems: For businesses with subscription models, automated systems can schedule and generate documents on a regular basis, reducing the need for manual input each time.

Incorporating automation into the document creation process helps businesses become more efficient, accurate, and responsive, ultimately leading to smoother financial operations and stronger client relationships.

Managing Payment Terms in Billing Documents

Setting clear and transparent payment terms is essential for both businesses and clients to avoid misunderstandings and ensure smooth financial transactions. The terms outlined in the payment request document define when the payment is due, how it should be made, and any penalties for late payments. Well-managed terms contribute to timely payments and maintain a professional relationship between the parties involved.

To effectively manage payment terms, it’s important to consider several factors that affect cash flow, client relationships, and legal protection. These terms should be clearly communicated on every billing document, ensuring that clients fully understand their obligations and the consequences of not meeting them.

Common Payment Terms to Include

- Due Date: Clearly specify when payment is expected. Common terms include “net 30,” “net 45,” or “due upon receipt.” These terms indicate the number of days after the document issue date that payment is due.

- Late Payment Penalties: If applicable, include terms for late fees or interest charges. For example, you may charge a percentage of the total due for each week the payment is overdue.

- Payment Methods: Specify the acceptable methods for payment, whether it’s bank transfer, credit card, online payment system, or check. This ensures that both parties know how the transaction will be processed.

- Early Payment Discounts: Offer incentives for clients to pay early, such as a small discount on the total amount. For example, “2% discount if paid within 10 days.”

Best Practices for Payment Terms

- Consistency: Use the same terms across all documents to avoid confusion. This establishes clear expectations and makes payment tracking easier.

- Clarity: Ensure the payment terms are easy to understand and free from jargon. This helps avoid disputes and delays caused by misunderstandings.

- Review Periodically: Regularly assess your payment terms to ensure they align with your business needs and client expectations. Adjust as needed based on market conditions or client feedback.

Effectively managing payment terms not only improves cash flow but also establishes a sense of professionalism, fostering trust with clients and ensuring the smooth operation of business transactions.

Tracking Transactions with Billing Documents

Effectively tracking business transactions is essential for maintaining organized financial records and ensuring that all payments are processed correctly. A well-organized payment request form not only serves as a record for both the business and the customer but also provides key insights into revenue, outstanding balances, and payment trends. By using a consistent system, businesses can monitor their cash flow and identify areas for improvement.

Tracking each transaction allows companies to stay on top of payments, recognize patterns, and make informed decisions. A structured approach to recording these transactions ensures that every detail is documented, making it easier to identify discrepancies and manage customer relationships more efficiently.

Key Benefits of Tracking Transactions

- Accurate Financial Overview: Keeping track of all transactions provides a clear view of your revenue and expenses, helping to manage cash flow and make strategic decisions for business growth.

- Outstanding Payment Management: By maintaining detailed records, you can quickly identify unpaid balances and follow up with clients to ensure timely payment.

- Improved Client Relations: Regular tracking allows you to spot any payment issues early and resolve them promptly, fostering positive relationships with clients.

- Tax and Reporting Compliance: Detailed records of transactions make it easier to prepare accurate financial statements and meet tax requirements, reducing the risk of errors during audits.

Best Practices for Effective Tracking

- Use Unique Reference Numbers: Assign a unique identifier to each document to easily locate and track specific transactions in your records.

- Update Records Regularly: Make sure all completed transactions are promptly recorded, allowing for up-to-date tracking of your financial status.

- Integrate with Accounting Software: Use digital tools to automate the tracking process and integrate the data with your accounting systems for better accuracy and reporting.

By systematically tracking each transaction, businesses can improve their financial operations, reduce administrative workload, and ensure more effective management of payments and client interactions.

Common Mistakes in Billing Document Creation

Creating accurate and professional payment request forms is crucial for smooth business operations, but it’s easy to make errors that can lead to confusion, delayed payments, or even disputes with clients. These mistakes are often simple oversights, but they can have a significant impact on the financial health of a business. Understanding and avoiding common pitfalls can help improve the accuracy and efficiency of the billing process.

Frequent Errors in Billing Documents

- Incorrect or Missing Client Details: Failing to include the correct client name, address, or contact information can cause documents to be sent to the wrong recipient, delaying payment.

- Missing or Incorrect Dates: Not including the correct issue or due date can lead to confusion about when the payment is expected, which may result in delayed payments.

- Calculation Errors: Simple mistakes in adding up totals, applying discounts, or calculating taxes can lead to inaccurate amounts being billed, causing issues for both parties.

- Unclear Payment Terms: If payment instructions, due dates, or late fees are not clearly outlined, it can create uncertainty about the terms of the transaction and lead to misunderstandings.

- Failure to Include Unique Reference Numbers: Not assigning a unique identifier to each document makes it difficult to track payments and follow up on unpaid balances.

- Not Using Consistent Formatting: Using inconsistent fonts, layouts, or formatting can make the document look unprofessional and difficult to read, which may cause clients to overlook important details.

How to Avoid These Mistakes

- Double-Check Information: Always verify client details, dates, and amounts before finalizing any document. A thorough review reduces the risk of errors.

- Use Automation Tools: Utilize tools that automatically calculate totals, apply taxes, and ensure consistency in document formatting to minimize human error.

- Clearly Define Payment Terms: Make sure payment terms, such as due dates, accepted methods, and late fees, are clearly stated and easy to understand.

- Implement a Standardized Format: Create and use a standardized format for all payment documents, ensuring consistency and professionalism across all transactions.

By recognizing these common mistakes and implementing best practices, businesses can improve their document creation process, ensuring that payment requests are accurate, clear, and efficient.

Document Formatting for Professionalism

Properly formatted billing documents convey a sense of professionalism and reliability. The way you present financial information can greatly impact how clients perceive your business. A well-organized, easy-to-read layout ensures that all the important details are highlighted and helps clients understand the terms of the transaction clearly. Investing time in document design reflects positively on your company’s credibility and fosters trust with clients.

Formatting your payment documents with attention to detail can also prevent misunderstandings and make it easier for clients to process payments on time. Clear organization, consistent styling, and appropriate section headings create a smooth flow of information that enhances the customer experience.

Key Elements for a Professional Document

- Clean Layout: Keep the design simple and uncluttered. Use white space effectively to separate sections, making the document visually appealing and easy to follow.

- Consistent Fonts and Styles: Stick to one or two easy-to-read fonts throughout the document. Use bold or italics sparingly to highlight key information such as totals or payment terms.

- Clear Sections: Organize the content into clear, logical sections–such as contact information, itemized list, totals, and payment instructions–so clients can quickly find what they need.

- Accurate Alignment: Ensure that numbers, especially totals and quantities, are properly aligned in columns. This improves readability and reduces the risk of mistakes when reviewing the document.

Tips for Enhancing Professionalism

- Branding: Include your company’s logo, business name, and contact details at the top to reinforce your brand’s identity and make the document look official.

- Well-Defined Payment Terms: Make sure your payment instructions, due date, and any penalties for late payments are clearly highlighted and easy to understand.

- Use High-Quality Materials: If sending physical copies, choose quality paper and printing materials to ensure your documents look polished and professional.

By focusing on document formatting, you can elevate the professionalism of your business communications and improve the overall client experience. Clear, well-organized documents not only help clients understand the terms but also strengthen your brand’s reputation.

Integrating Billing Documents with Accounting Tools

Seamlessly linking financial records with accounting systems streamlines business operations and ensures accurate tracking of payments. By automating the transfer of data from billing forms to accounting software, businesses can reduce the time spent on manual data entry, eliminate errors, and improve overall efficiency. This integration creates a unified approach to financial management, providing a comprehensive view of income, expenses, and cash flow.

Integration not only simplifies bookkeeping but also enhances reporting, making it easier to prepare financial statements and track outstanding payments. With a direct connection between payment requests and accounting tools, businesses can stay organized and ensure that financial information is always up to date.

Benefits of Integration

- Increased Accuracy: By automating the data transfer between billing documents and accounting software, businesses reduce the risk of human error, ensuring accurate financial records.

- Time Efficiency: Automating the process saves valuable time that would otherwise be spent manually inputting payment details into accounting systems, allowing staff to focus on other critical tasks.

- Real-Time Data Sync: Integration allows for real-time synchronization between billing and accounting platforms, providing an up-to-date view of financial transactions.

- Improved Reporting: With integrated systems, generating financial reports becomes easier, enabling businesses to quickly assess their financial position and make informed decisions.

How to Integrate Billing Documents with Accounting Tools

- Select Compatible Tools: Ensure the billing software or platform you use is compatible with your accounting tool to enable seamless data transfer.

- Automate Data Entry: Set up automatic data transfer from your billing documents to your accounting system. This can often be done by linking the two platforms directly or using an integration service.

- Monitor Integration: Regularly review the integration setup to ensure that data is being accurately transferred and no discrepancies are occurring between the two systems.

Integrating billing documents with accounting tools not only saves time but also improves accuracy and financial oversight. By automating the flow of information, businesses can streamline their financial operations and focus on growing their company.

Legal Considerations in Billing Documents

When creating financial documents for transactions, it is important to understand the legal requirements and implications that come with them. These documents are not only tools for managing payments but also legally binding agreements between the business and the client. Ensuring that all legal elements are included and accurate is essential for protecting both parties’ rights and avoiding potential disputes or legal issues.

Each region and industry may have specific regulations regarding the content and format of such documents. Complying with these requirements ensures that your transactions are transparent and that you are meeting your legal obligations. Key considerations include terms of payment, taxes, and any disclaimers or clauses that must be included to avoid complications down the line.

Essential Legal Elements to Include

- Payment Terms: Clearly state the payment due date, applicable late fees, and penalties for overdue payments. This helps prevent misunderstandings regarding payment deadlines.

- Tax Information: Include the appropriate sales tax or value-added tax (VAT) based on local regulations. Failing to do so could result in fines or legal trouble.

- Business Identification: Ensure that your company’s name, business registration number, and contact details are clearly visible. This ensures the document is recognized as legitimate and can be traced back to your business.

- Contractual Clauses: If applicable, include terms and conditions that outline the legal rights of both parties, including any warranties, return policies, or service agreements.

- Dispute Resolution: It’s important to include information about how disputes will be handled, such as whether arbitration or legal action will be required in case of non-payment or contractual breaches.

Best Practices for Legal Compliance

- Consult Legal Experts: To ensure full legal compliance, it’s recommended to consult with a legal professional to review your documents, especially if you operate in different jurisdictions.

- Keep Accurate Records: Always retain copies of these documents for your records. This can help resolve any future disputes and may be needed in case of audits.

- Stay Updated on Regulations: Laws and tax rates change frequently. Ensure that your billing process stays up-to-date with current regulations to avoid any unintentional violations.

By paying attention to the legal aspects of your billing process, you protect your business from potential risks and ensure that your financial tr

Tips for Maintaining Financial Records

Accurate and organized financial records are the backbone of any successful business. Proper record-keeping ensures that you can track your income, monitor expenses, and comply with tax regulations. Without effective management of financial documents, you risk facing discrepancies, missing payments, or encountering legal issues. Implementing a structured approach to maintain your records is essential for long-term business stability.

By keeping track of all financial transactions, businesses can gain valuable insights into their financial health and make informed decisions. Consistent record maintenance also makes it easier to prepare for audits, manage cash flow, and avoid errors in tax filings.

Best Practices for Managing Financial Documents

- Keep Everything Organized: Create a clear system for categorizing and storing receipts, bills, and payment records. This can be done manually or using digital tools. Proper organization saves time and reduces the risk of losing critical documents.

- Maintain Consistency: Ensure that you record every transaction consistently. This means entering every payment, purchase, or refund in a timely manner. Consistent entries help keep records accurate and up-to-date.

- Back Up Records Regularly: Whether you use physical files or digital systems, make sure to back up your financial records. Digital backups can be stored on cloud services, while physical documents should be stored in a safe, organized space.

- Monitor Cash Flow: Regularly review your financial documents to monitor cash flow. Keep track of incoming and outgoing payments, so you can identify any irregularities or trends that need attention.

- Use Accounting Software: Leverage digital tools to automate and streamline the record-keeping process. Accounting software can reduce manual errors, generate reports, and help you stay on top of finances more efficiently.

Tips for Compliance and Tax Readiness

- Stay Updated on Tax Laws: Regularly review any changes to tax regulations in your region. Understanding the latest requirements ensures that you can stay compliant whe

Optimizing Your Billing Workflow

Streamlining the process of creating and managing payment requests can greatly enhance business efficiency and improve cash flow. By optimizing your billing workflow, you can reduce the time spent on administrative tasks, minimize errors, and ensure that all necessary steps are completed on time. An efficient workflow ensures that your team spends less time on manual processes and more time focusing on growing the business.

Improving the flow of payment requests from creation to payment collection can lead to faster processing and better customer satisfaction. When the process is simple and consistent, clients are more likely to make timely payments, and your business operations become smoother overall.

Steps to Streamline Your Billing Process

- Automate Repetitive Tasks: Use tools to automate recurring tasks like generating and sending payment requests, tracking payment statuses, and setting reminders for overdue payments. Automation minimizes manual effort and reduces the likelihood of errors.

- Use Pre-Designed Formats: Standardize your payment documents by using predefined formats for consistency. This ensures that every document is clear, professional, and contains all necessary details without having to recreate the layout each time.

- Integrate with Financial Systems: Connect your billing platform with accounting software to automatically update records and track payments. Integration improves data accuracy and saves time on manual entry.

- Set Clear Payment Terms: Clearly outline payment terms, including due dates, late fees, and accepted payment methods, to avoid misunderstandings and ensure clients know what is expected of them from the outset.

Maximizing Efficiency through Regular Reviews

- Analyze Your Workflow: Regularly review your billing process to identify bottlenecks or inefficiencies. Look for areas where time is wasted or where improvements could be made.

- Get Feedback from Clients: Ask clients about their experience with the payment process. Their feedback can provide insights into how the process can be made more convenient and user-friendly.

- Improve Communication: Keep clients informed about their payment statuses and any changes to terms or deadlines. Clear communication reduces confusion and helps ensure timely payments.

By optimizing your billing process, you can not only save time but also ensure that your business runs more efficiently and maintains better relationships with clients. A smooth, efficient workflow leads to faster payments, better organiz