Complete Guide to Using a Software Invoice Template for Efficient Billing

Managing financial transactions smoothly is crucial for any business. The process of creating clear, accurate documents for payments and services can save time and avoid confusion. With the right tools, billing can be automated, ensuring consistency and professionalism in every interaction with clients.

Customizable billing documents allow you to tailor each record according to specific client needs. These documents help streamline the process, allowing you to focus more on delivering quality service while maintaining organized financial records. By using predefined structures, you ensure all necessary details are included without the hassle of starting from scratch each time.

Effective billing tools not only simplify the creation of payment requests but also improve cash flow management. With features that cater to recurring charges, itemized lists, and easy payment tracking, businesses can avoid delays and errors that often occur with manual entry.

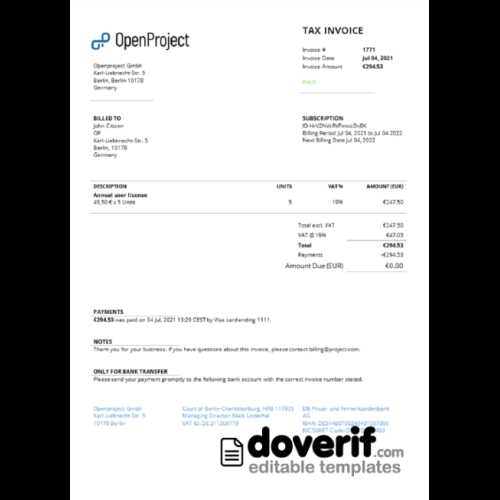

Software Invoice Template Overview

Creating clear and professional billing records is essential for businesses that wish to maintain organization and foster trust with clients. By using structured formats, companies can easily generate payment documents that contain all the necessary information in a consistent, easy-to-understand manner. This method reduces errors and ensures that every detail is covered, helping both the provider and the recipient stay on the same page.

Pre-designed billing structures allow businesses to save time and avoid starting from scratch with each new transaction. These formats include sections for contact details, payment terms, service descriptions, and totals, providing a comprehensive and standardized way to record charges. Additionally, customizable fields enable the inclusion of unique information, ensuring that each document meets the specific requirements of different clients.

By using such tools, businesses not only streamline their financial processes but also project a more professional image. Whether for one-time services or recurring payments, a well-structured document can facilitate faster transactions and clearer communication between both parties, leading to smoother operations and better client relationships.

Benefits of Using Invoice Templates

Using pre-designed structures for payment requests offers significant advantages for businesses looking to streamline their billing process. By eliminating the need to manually create documents from scratch each time, companies can save valuable time and reduce the risk of errors. These ready-made formats ensure that each payment record is consistent and includes all the necessary details.

Time efficiency is one of the most notable benefits. With customizable fields and a standard layout, businesses can quickly fill in the required information and generate a professional document. This not only speeds up the billing cycle but also frees up time for other essential tasks.

Accuracy and consistency are also improved by using structured formats. With clear sections for all required data, the chances of missing important details or making costly mistakes are minimized. Additionally, using these tools ensures that each document follows a uniform design, which enhances the professionalism and reliability of your business communications.

How to Create a Custom Invoice

Customizing billing documents allows businesses to ensure that each record reflects the unique details of a transaction. By following a few simple steps, you can create a document that meets your specific needs and presents a professional image to clients. The key is to incorporate essential elements while maintaining flexibility in the design.

Step 1: Include Basic Information

Start by adding your company’s contact details, including name, address, phone number, and email. Ensure that the recipient’s information is also clearly stated. This will help both parties stay organized and facilitate communication if needed. Don’t forget to include a unique reference number for each record to help with future tracking.

Step 2: Add Service Details

Next, list the products or services provided, along with clear descriptions and pricing. Make sure to break down costs if multiple items or services are involved. Including precise information such as quantity, rate, and total helps avoid confusion and allows clients to easily understand the charges.

Key Elements of a Software Invoice

When creating a billing document, certain components are essential to ensure clarity, accuracy, and professionalism. Each section should serve a specific purpose, from identifying the parties involved to detailing the transaction itself. Understanding what to include and how to format it can help avoid confusion and ensure that all necessary information is captured.

Basic contact information should always be at the top of the document, including both the business’s and the client’s name, address, and phone number. This ensures that both parties are clearly identified, and can easily refer back to the document if needed.

Transaction details are another critical section. This includes a list of the goods or services provided, along with a description of each item, quantity, unit price, and total cost. Breaking down the charges ensures transparency and helps the client understand exactly what they are being billed for.

Finally, payment terms such as the due date, late fees, and accepted payment methods should be clearly stated. This ensures that both parties understand the timeline for payment and any potential penalties for overdue amounts.

Choosing the Right Invoice Format

Selecting the proper structure for your billing documents is crucial for ensuring clarity and efficiency. The right format will not only enhance the presentation of your transactions but also help you maintain consistency across all your records. It’s important to choose a layout that suits your business needs, whether you’re dealing with simple one-time charges or complex recurring fees.

When deciding on the appropriate structure, consider the following factors:

| Factor | Considerations |

|---|---|

| Business Type | Choose a layout that reflects the complexity of your services, whether it’s a straightforward service or a multi-item project. |

| Customization | Ensure the format allows for flexibility in adding custom fields such as discounts, taxes, or specific project details. |

| Client Needs | Consider whether your clients require detailed breakdowns of charges or prefer a more simplified summary. |

| Branding | Choose a design that aligns with your company’s branding, ensuring a professional and cohesive look. |

Ultimately, the right format will depend on your specific business requirements and the preferences of your clients. A well-chosen structure not only makes your billing process smoother but also helps you maintain a professional relationship with your clients.

Free vs Paid Invoice Templates

When it comes to creating billing documents, businesses have the option to choose between free and paid formats. Both options come with their own set of advantages and limitations, and the best choice depends on your specific needs, budget, and the level of customization required. Understanding the differences can help you make an informed decision that will streamline your processes while maintaining professionalism.

Advantages of Free Formats

Free options are a great starting point for small businesses or freelancers with limited budgets. These formats often offer basic features that can handle the essential requirements of most transactions. They typically come with simple, straightforward designs that allow users to quickly fill in the necessary information and generate a document without any additional costs.

However, free formats may have limitations in terms of customization, functionality, and design flexibility. You may find fewer options for branding, and some features like automated calculations or recurring billing may not be available.

Benefits of Paid Formats

Paid solutions, on the other hand, often provide a higher level of sophistication. These can include advanced features such as the ability to automatically calculate totals, apply taxes, integrate with accounting software, and offer better customization options for branding. Paid options are often more polished, making them ideal for businesses looking to project a professional image consistently.

Paid formats also tend to be more secure and reliable, often offering customer support and regular updates. If you handle a high volume of transactions or need more tailored features, investing in a paid solution may be worthwhile in the long run.

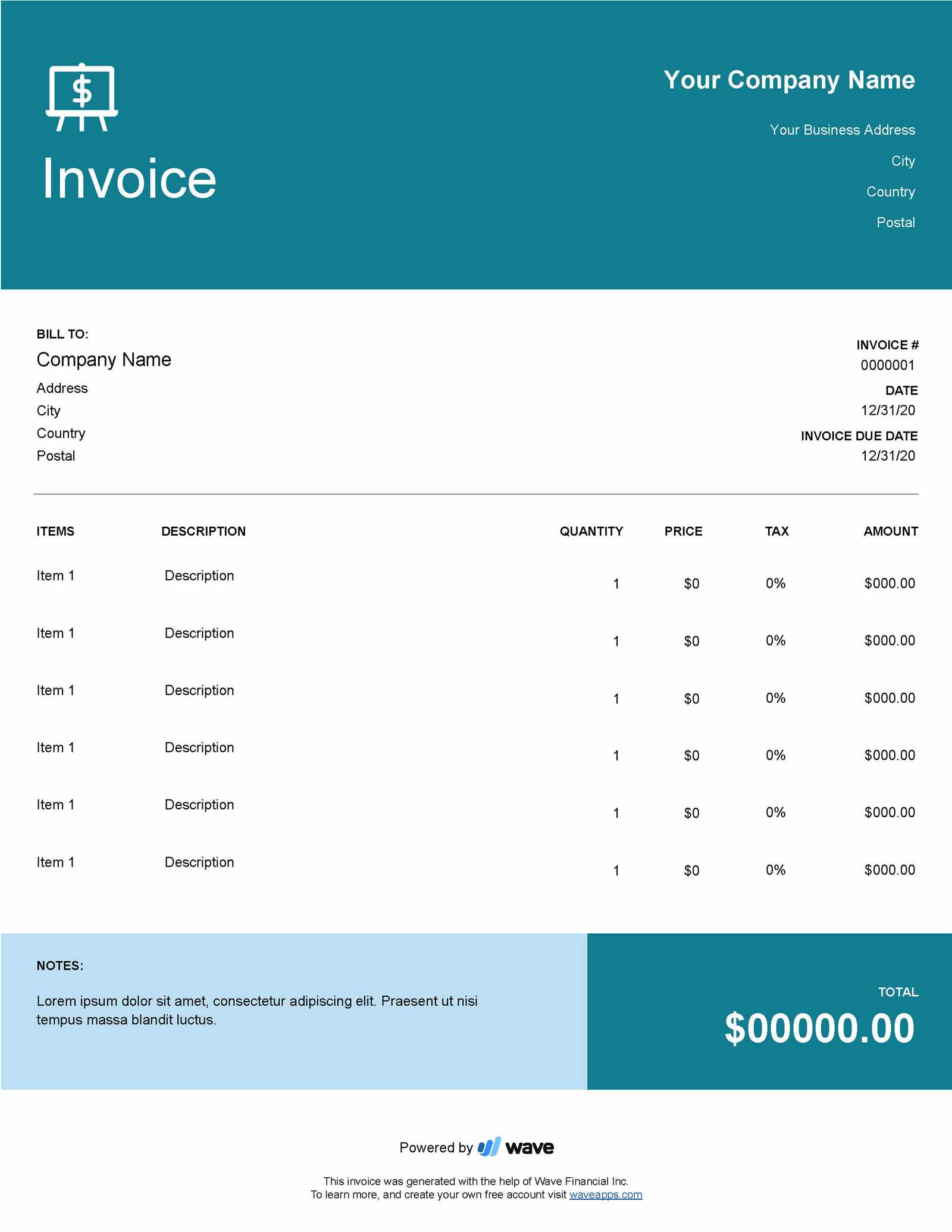

Best Software Invoice Tools Available

For businesses looking to streamline their billing process, using specialized tools can make a significant difference. These tools are designed to simplify the creation, management, and tracking of payment records, offering a range of features to suit different needs. Whether you’re a freelancer or part of a larger organization, choosing the right tool can save time, reduce errors, and improve professionalism.

Here are some of the best options currently available for creating efficient billing documents:

- FreshBooks – A popular choice for freelancers and small businesses, offering easy customization, automated reminders, and integration with accounting software.

- QuickBooks – Known for its robust features, QuickBooks provides an all-in-one solution for accounting and payment requests, with professional-looking templates and seamless integration with business accounts.

- Wave – A free tool that offers essential features for creating and managing billing documents, including the ability to track payments and send automatic reminders.

- Zoho Invoice – A flexible tool with various templates, recurring billing options, and integrations with other Zoho business apps.

- Invoicely – A user-friendly platform for businesses of all sizes, offering both free and paid plans with customizable features and multi-currency support.

Each of these tools provides unique features that can cater to various business needs. Consider factors such as pricing, customization options, and integrations when selecting the right one for your business.

How to Personalize Your Invoices

Personalizing your payment records helps reinforce your brand identity and builds a stronger relationship with your clients. Customization allows you to include your company’s unique features, from logos and color schemes to specific details that make your billing process more transparent and client-friendly. Tailoring each document can help ensure that your clients feel valued and can easily understand the charges.

Key Ways to Personalize Your Documents

- Include Your Branding: Add your company logo, business name, and brand colors to give the document a cohesive and professional look.

- Custom Descriptions: Tailor the description of products or services to match the language and terminology you use with clients.

- Payment Instructions: Customize your payment instructions with specific details, such as preferred methods or links to online payment portals.

- Client-Specific Notes: Include personalized notes or reminders, such as thank-you messages or special instructions for a particular client.

Advanced Customization Options

- Custom Fields: Add extra fields for specific needs like project codes, customer IDs, or discounts.

- Recurring Payments: Personalize documents for clients with ongoing agreements, setting up automatic charge intervals and custom payment terms.

- Unique Numbering System: Use a customized numbering system that makes sense for your business operations, whether it’s by project, client, or billing cycle.

By incorporating these personalized elements, you can make your payment documents not only more effective but also an integral part of your overall customer experience.

Managing Recurring Invoices with Templates

For businesses that offer subscription-based services or ongoing contracts, managing repeat billing can become a time-consuming task. Using pre-designed formats to handle recurring payments ensures that each transaction is consistent and timely, reducing the need for manual work every billing cycle. By automating and organizing the process, you can focus more on delivering value to your clients.

Setting up a structured system for regular charges can help maintain accuracy and ensure that all details, such as service periods and agreed-upon rates, are automatically included. This not only saves time but also enhances client satisfaction by providing clear and predictable billing schedules.

Additionally, recurring payment documents allow you to include important reminders about upcoming charges, discounts, or payment terms. This proactive approach can help reduce the risk of late payments and foster trust with your clients by keeping them informed of when and how to pay.

Common Mistakes in Invoice Design

Creating clear and professional payment documents is essential for smooth transactions and maintaining good client relationships. However, there are several common mistakes that can undermine the effectiveness of your billing records. These errors can cause confusion, delay payments, or even harm your professional image. Understanding what to avoid is the first step toward designing better, more efficient documents.

Frequent Errors to Avoid

- Missing Contact Information: Failing to include complete contact details for both the business and the client can lead to communication issues and delays.

- Unclear Descriptions: Vague or incomplete descriptions of products or services can confuse clients, potentially leading to disputes over charges.

- Inconsistent Formatting: Using inconsistent fonts, colors, or layouts can make the document look unprofessional and hard to read.

- Omitting Payment Terms: Not clearly stating payment terms, such as due dates and accepted methods, can create misunderstandings about when and how the client is expected to pay.

- Incorrect Calculations: Errors in totaling or applying taxes can undermine the credibility of the document and cause financial discrepancies.

How to Avoid These Mistakes

- Double-check information: Always verify contact details, payment terms, and service descriptions before sending any document.

- Standardize layout: Use a consistent and clean layout, with clear headings, spacing, and formatting that makes it easy to read.

- Use templates with built-in checks: Many tools and systems offer automatic calculations and predefined sections to ensure accuracy and reduce errors.

Avoiding these common mistakes will not only make your billing process smoother but also help present a more professional and trustworthy image to your clients.

How to Track Payments with Templates

Efficiently tracking payments is a critical part of managing your business’s financial health. By using structured formats for payment records, you can easily monitor the status of each transaction, identify overdue payments, and maintain accurate accounts. A well-organized system allows you to track outstanding balances and quickly follow up with clients when needed.

Steps to Effectively Track Payments

- Include Payment Status: Ensure that each document has a clear section to mark whether the payment has been received, is pending, or overdue.

- Use Unique Reference Numbers: Assign a unique identifier to each transaction to easily cross-reference payments and track their status in your records.

- Set Up Payment Reminders: Use your system to automatically send reminders for upcoming or overdue payments, helping clients stay on top of their obligations.

- Track Partial Payments: Make sure to note any partial payments and update the balance accordingly. This helps keep both parties informed of the remaining amount due.

Benefits of Tracking Payments with Structured Formats

- Improved Organization: Easily sort and filter payment records based on status, due date, or client, making it quicker to assess outstanding balances.

- Faster Follow-Ups: With a clear view of unpaid transactions, you can send timely reminders, reducing the chances of missed payments.

- Accurate Financial Reporting: Keeping a detailed log of all payments ensures your accounts remain up-to-date, which is vital for both financial analysis and tax reporting.

By integrating these tracking features into your payment documents, you’ll maintain better control over your cash flow and ensure a more streamlined and transparent financial process.

Invoice Template for Freelancers

For freelancers, having a professional and organized billing system is essential to maintaining a smooth and efficient business operation. Creating a payment record that clearly outlines services, payment terms, and contact information helps ensure timely payments and clear communication with clients. A well-designed structure allows freelancers to focus on their work without worrying about administrative issues.

Essential Elements for Freelance Billing

- Freelancer’s Contact Information: Always include your full name, business name (if applicable), phone number, and email address.

- Client’s Details: Include the client’s name or company name and their contact information for clarity.

- Service Description: Provide a detailed breakdown of the services rendered, including dates and hourly rates or project costs.

- Payment Terms: Specify payment due dates, acceptable payment methods, and any late fees that may apply.

- Unique Invoice Number: Assign a unique reference number to each billing document for tracking purposes.

Advantages of Using Structured Payment Records for Freelancers

- Time-Saving: With a pre-made structure, freelancers can quickly create and send out bills without starting from scratch each time.

- Professional Appearance: A consistent, well-organized document gives clients confidence in your business and promotes a professional image.

- Clear Payment Tracking: Freelancers can easily track payments, identify overdue balances, and manage their finances effectively.

By using a streamlined and detailed system for billing, freelancers can improve their workflow, reduce payment delays, and enhance client satisfaction.

Legal Considerations for Software Invoices

When creating payment documents, it is important to consider the legal aspects to ensure compliance with local laws and regulations. These documents not only serve as a record of transactions but also protect both the business and the client in case of disputes. Understanding the legal requirements, such as proper documentation and correct application of taxes, is essential for maintaining transparency and avoiding legal issues.

Accuracy and Transparency are key elements in ensuring that your documents meet legal standards. Each document should clearly outline the terms of the transaction, including the amount due, payment deadline, and any penalties for late payments. This protects both parties and ensures that there is no ambiguity regarding payment expectations.

Tax Compliance is another important factor to consider. Depending on the jurisdiction, certain types of services or products may require specific taxes to be applied. Always ensure that the correct tax rate is reflected in your documents to avoid issues with tax authorities. It’s also essential to keep accurate records of all transactions for tax reporting purposes.

Additionally, businesses should include a dispute resolution clause in their documents to outline how disagreements will be handled. This can help prevent costly legal battles by providing a clear process for resolving issues in a fair and efficient manner.

Automating Invoice Generation Process

Automating the process of creating billing documents can significantly streamline operations for businesses of all sizes. By using automated systems, you can reduce manual effort, minimize errors, and ensure timely, consistent billing without the need for repetitive tasks. This not only saves valuable time but also enhances the overall efficiency of the financial operations.

Automation tools can be set up to generate records based on predefined criteria, such as client details, service provided, and payment terms. With this setup, businesses can automatically produce and send out payment requests as soon as a job is completed or a payment cycle begins, eliminating the need for manual entry each time.

Integration with other systems is another key advantage of automation. By connecting your billing system with accounting software or customer management platforms, you can automatically update payment records, track outstanding balances, and even send reminders for overdue payments without lifting a finger. This seamless flow reduces the risk of errors and ensures that the business always has up-to-date financial information at hand.

In addition, automated solutions often allow for customization, so businesses can tailor the structure and content of their billing documents while benefiting from the time-saving automation features.

Design Tips for Professional Invoices

Creating a well-designed payment document is essential for maintaining a professional image and ensuring clear communication with your clients. A well-organized structure not only makes it easier for your clients to understand the details of the transaction but also improves the likelihood of prompt payments. The design of your payment request can reflect the quality of your work and the professionalism of your business.

Key Elements of a Professional Design

- Consistent Branding: Use your company logo, colors, and fonts to create a cohesive and recognizable look that aligns with your brand.

- Clear and Readable Layout: Organize the content in an easy-to-read format, with sufficient spacing and clear headings. This will make it easier for your client to find relevant information quickly.

- Accurate and Detailed Information: Always include the necessary details such as the service provided, cost breakdown, payment terms, and deadlines. A comprehensive breakdown prevents confusion and ensures that all parties are on the same page.

- Highlight Important Information: Use bold or larger text for key items such as the total amount due or payment deadline to make them stand out for quick reference.

Additional Design Considerations

- Avoid Overcrowding: Keep the document simple and clutter-free. Too much information or excessive decoration can make the document hard to read and may distract from the important details.

- Mobile-Friendly: As many people access documents from their phones, ensure your design is mobile-responsive and easy to view on smaller screens.

- Customizable Fields: Ensure that the document allows you to add or modify fields, such as discounts, tax rates, and service descriptions, to tailor it to each client or project.

A professional and well-structured document can leave a lasting impression and help establish a strong, reliable relationship with your clients. By focusing on design, you demonstrate attention to detail and a commitment to delivering quality services.

Integrating Templates with Accounting Software

Integrating billing documents with accounting systems can greatly simplify financial management for businesses. By syncing your payment records with an accounting platform, you can automate data entry, reduce errors, and ensure that all financial information is up-to-date. This integration helps streamline processes, saves time, and provides better oversight of your financial health.

When you connect your payment documents with accounting tools, key information such as transaction amounts, taxes, client details, and payment dates are automatically transferred to your accounting system. This eliminates the need for duplicate data entry, ensuring consistency across all records.

Key Benefits of Integration

- Time Efficiency: Automation reduces manual data input, saving you time and effort when reconciling accounts or preparing financial reports.

- Accuracy: Syncing payment documents with accounting software reduces human error and ensures accurate calculations and record-keeping.

- Better Financial Oversight: Real-time integration provides a clear view of your cash flow, outstanding payments, and financial status, helping you make informed decisions.

- Streamlined Reporting: Accounting software can generate reports directly from the integrated data, allowing you to track income, expenses, and tax liabilities with ease.

How Integration Works

Many accounting platforms offer features that allow you to import or link documents from external sources. Here’s a simple example of how integration might work:

| Action | Description |

|---|---|

| Data Sync | Payment records are automatically synced with the accounting system after being generated, reducing manual entry. |

| Automatic Updates | As payments are received or outstanding balances change, your accounting records are updated automatically. |

| Financial Reporting | The accounting system can generate up-to-date reports based on the integrated payment records, providing a comprehensive overview of your finances. |

By integrating your payment documentation with accounting software, you can ensure that your business operates more efficiently, with fewer errors and more accurate financial tracking.

How to Handle Late Payments with Invoices

Late payments are a common challenge for businesses, but with the right approach, they can be managed effectively. Addressing overdue transactions promptly and professionally ensures cash flow remains steady and helps maintain positive relationships with clients. Implementing clear payment terms and utilizing proper follow-up procedures can make the process smoother and reduce the likelihood of recurring delays.

Steps to Manage Late Payments

- Set Clear Payment Terms: Clearly state the payment due date, late fees, and any other relevant terms in your payment documents. Having clear terms helps avoid confusion and sets expectations from the start.

- Send a Friendly Reminder: If payment is not received by the due date, send a polite reminder email or message to the client, gently prompting them to fulfill the payment.

- Charge Late Fees: Consider implementing a late fee policy that is outlined in your terms and conditions. This adds an incentive for clients to pay on time and compensates for any inconvenience caused by the delay.

- Offer Payment Plans: If a client is facing financial difficulties, consider offering a payment plan to help them settle the outstanding balance in installments.

Best Practices for Preventing Late Payments

- Set Up Payment Reminders: Automate reminders to be sent before and after the due date to ensure clients are aware of upcoming or overdue payments.

- Provide Multiple Payment Options: Make it easy for clients to pay by offering a variety of payment methods such as credit cards, bank transfers, or online payment platforms.

- Establish a Relationship with Clients: Building trust and maintaining open communication can help prevent payment delays. A strong client relationship encourages timely payments and helps resolve any issues quickly.

By incorporating these practices into your billing process, you can minimize the impact of late payments and maintain healthy business operations.

Improving Client Communication with Invoices

Clear and effective communication with clients is essential for maintaining strong business relationships. When it comes to financial transactions, using well-structured payment records can significantly enhance the clarity of your communication, reduce misunderstandings, and promote trust. These documents not only outline the details of a transaction but also serve as a key tool for keeping clients informed and engaged throughout the payment process.

Key Strategies to Enhance Communication

- Clarity of Terms: Clearly define the payment terms, due dates, and any late fees. This ensures that the client knows exactly what to expect and helps avoid confusion or disputes later on.

- Detailed Descriptions: Provide a thorough breakdown of the services or products being billed. When clients can see a clear list of what they are paying for, they are more likely to feel satisfied with the transaction and less likely to ask for clarifications.

- Regular Updates: Keep clients informed about their payment status by sending reminders or updates. This can include gentle reminders for upcoming due dates or notifications when payments are received.

Best Practices for Client Engagement

- Personalized Communication: Add a personal touch by addressing clients by name and customizing the details to suit their specific needs or agreements. This makes clients feel valued and fosters a positive relationship.

- Professional Appearance: Maintain a consistent and professional format for your documents. A clean, well-organized design reflects your business’s attention to detail and enhances credibility.

- Offer Multiple Payment Methods: Make it easy for clients to pay by offering a variety of payment options. This flexibility shows that you understand their preferences and helps improve the chances of timely payment.

By using payment records as a tool for clear, consistent, and personalized communication, you not only make the payment process easier for your clients but also strengthen your business relationships and improve client satisfaction.