Software Development Invoice Template Word for Easy and Professional Billing

In any technology-based field, ensuring that payments are processed smoothly and professionally is essential for maintaining good client relationships. One of the most important steps in the financial side of a project is preparing accurate and clear billing documents. These documents not only help streamline the payment process but also reflect your professionalism as a contractor or service provider.

For many, using a ready-made document format can simplify the entire process. With the right layout, you can easily outline the services provided, specify payment terms, and ensure all required details are included. Customizing these formats according to your specific needs can save time, reduce errors, and help you maintain consistency across multiple projects.

By choosing an adaptable format, you can create a tailored document that works best for your business, whether you are working on small tasks or large-scale initiatives. This approach can be especially beneficial for those handling multiple clients, as it ensures that all financial exchanges are handled efficiently and professionally.

Why Use a Billing Document Format

Creating a professional document to track services rendered and payments due is essential for any business, especially in the tech industry. A structured format makes it easier to ensure all necessary information is included and presented clearly. By using a pre-designed format, you save time, avoid common mistakes, and ensure a consistent look for all your transactions.

Efficiency and Time-Saving

When you’re working on multiple projects, managing payments and client records can become overwhelming. Using a ready-made structure allows you to quickly create accurate documents without having to start from scratch each time. This helps free up valuable time for focusing on other aspects of your work.

- Streamlined document creation

- Consistency across all billing records

- Prevention of common errors and omissions

Professionalism and Trust

Clients appreciate clear and well-organized payment documents. A polished layout not only makes it easier for clients to understand the billing details but also reinforces your professionalism. Consistently using a structured format helps build trust and encourages prompt payment.

- Clear presentation of services and costs

- Helps establish credibility with clients

- Minimizes confusion over payment terms

Benefits of Document Formats for Developers

Using a pre-designed structure for billing allows tech professionals to handle payments more efficiently, ensuring that all necessary details are included in a clear, easy-to-read format. For those who need to manage multiple projects, these formats are a valuable tool for maintaining organization and professionalism. They provide an effective way to manage the administrative side of the business without wasting time on formatting or creating documents from scratch.

Time Efficiency

By utilizing a ready-made document structure, developers can focus on their core tasks while quickly generating professional documents for clients. This not only saves valuable time but also reduces the mental load of figuring out the layout and content for each new project.

- Quick document creation without formatting concerns

- Streamlined process for regular use

- Less time spent on administrative tasks

Consistency and Professionalism

Consistent use of a structured format helps maintain a high level of professionalism in all client communications. A polished, organized document reinforces your reputation as a reliable and detail-oriented provider. Clients will appreciate the clarity and organization of the billing details, leading to improved trust and quicker payments.

-

How to Create a Custom Billing Document

Creating a personalized billing document that reflects your specific needs is simple and straightforward. By using a flexible document editor, you can design a layout that matches your business style while including all the necessary components. Customizing your billing format allows you to maintain consistency and professionalism across all transactions.

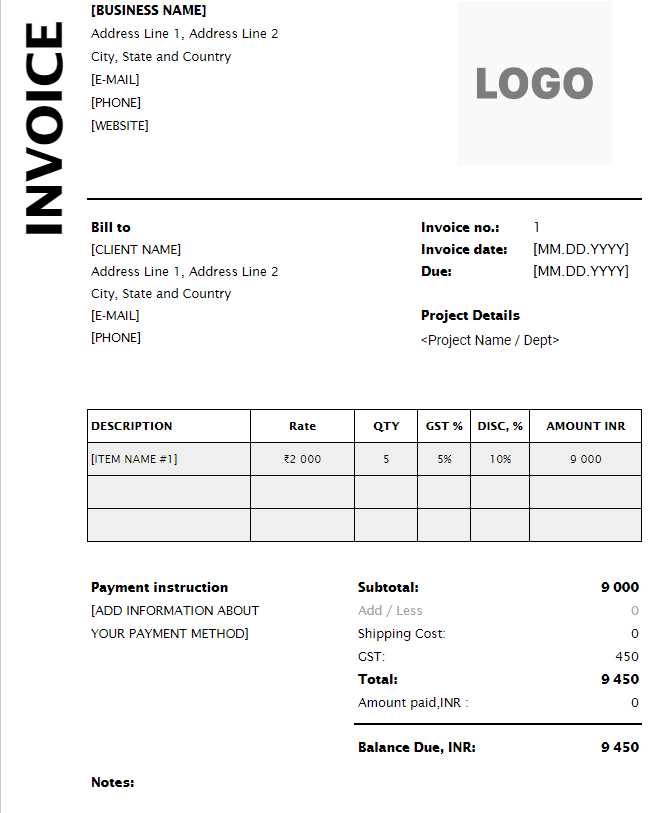

Step-by-Step Guide to Customize Your Document

Follow these steps to create a customized billing document that works for you:

- Open the document editor and start a new blank document.

- Insert a header with your business name, contact information, and logo, if applicable.

- Include the client’s details: name, address, and contact info.

- Add a unique reference number for the transaction to keep track of different projects.

- List the services provided, detailing the tasks completed, hours worked, and the corresponding rates.

- Specify the total amount due, including any taxes or additional fees, and the payment terms (e.g., due date, late fees).

- Include your payment information or instructions on how the client should make the payment.

Personalizing Your Document for Your Business

Personalization goes beyond just adding your contact details. You can adjust the layout, font style, and color scheme to match your brand’s identity. This helps present a more cohesive image to clients while maintaining clarity and ease of understanding.

- Use consistent f

Essential Elements of a Billing Document

A well-crafted billing document is key to ensuring clear communication between you and your clients. It should include all necessary details to avoid confusion and ensure smooth payment processing. Having the right elements in place will not only help you maintain a professional image but also make the financial exchange straightforward and efficient.

Here are the key components to include in every billing document:

- Business Information: Include your business name, contact details, and logo. This provides the recipient with a clear point of contact.

- Client Information: Add the client’s name, address, and any other relevant contact details to ensure the document is properly addressed.

- Document Number: Assign a unique reference number to each billing document. This helps with tracking and organizing transactions.

- Service Description: Provide a detailed breakdown of the services or work completed, including specific tasks, hours worked, and rates charged.

- Amount Due: Clearly state the total amount owed, breaking it down into subtotals, taxes, and any additional fees.

- Payment Terms: Include the due date, accepted payment methods, and any late payment penalties if applicable.

- Additional Notes: If necessary, add any relevant notes or terms and conditions that might clarify aspects of the work or payment terms.

Including all of these elements in your billing document ensures that the client has all the information they need to process the payment quickly

Best Practices for Professional Invoicing

Ensuring that your billing process is clear, consistent, and professional is essential for maintaining good relationships with clients. Proper documentation not only facilitates smoother transactions but also helps to avoid misunderstandings regarding payments. Adopting a few key practices can enhance the effectiveness of your financial communication and reinforce the professionalism of your business.

- Clear and Detailed Information: Make sure all necessary details are included, such as the full names of both parties, address information, services provided, agreed-upon fees, and payment terms. This reduces any confusion and helps avoid disputes.

- Use Structured Layouts: A well-organized document is easier to read and process. Consider using clear sections and bullet points to break down services, rates, and totals. Keep the design simple and professional, using standard fonts and formatting.

- Include Payment Terms: Specify when the payment is due, any late fees, and available payment methods. Clear terms help manage client expectations and encourage prompt payment.

- Maintain Consistency: Regularly update and follow a consistent approach in how you present your billing documents. This adds a layer of professionalism and can improve your brand’s recognition.

- Use Proper Numbering: Assign a unique number to each transaction to help you track payments efficiently. A sequential numbering system is a good practice for organizing your financial records.

- Timely Issuance: Ensure that you send your statements promptly after completing a job or service. This establishes reliability and encourages quicker processing on the client’s part.

- Offer Multiple Payment Options: The easier it is for clients to pay, the faster you will receive your funds. Include multiple methods of payment, such as bank transfers, online payment portals, and checks.

- Follow Up Politely: If payments are delayed, send friendly reminders to keep the conversation professional. A well-written follow-up can often resolve minor delays without tension.

By applying these best practices, you create a transparent and professional financial process that reflects positively on your business and supports healthy client relationships.

How Word Templates Save Time on Billing

Creating and sending out accurate financial documents can be a time-consuming process, especially when starting from scratch each time. However, utilizing pre-designed layouts for your payment requests can streamline the entire workflow. With the right structure in place, you can eliminate repetitive tasks and focus on customizing only the necessary details for each client. This not only saves time but also reduces the potential for errors.

Consistency and Efficiency

When you use a predefined structure for your payment requests, you ensure that all the essential components are always included. This consistency makes it faster to fill in specific details like the services rendered, client information, and amounts due. With less time spent on organizing the layout, you can dedicate more focus to reviewing the accuracy of the figures.

Quick Customization

Prebuilt formats allow for easy adjustments. Once you’ve set up a basic design, you can simply update the project or service details, rates, and payment terms. This quick customization is far more efficient than designing a new document every time, especially when you have recurring clients or projects with similar parameters.

- Time-saving: No need to recreate the structure for each new request.

- Consistency: The same format every time helps avoid mistakes.

- Easy adjustments: You can modify just the key details without reformatting.

Using structured formats for your payment requests helps you complete tasks faster while maintaining a professional appearance. With these tools, the billing process becomes quicker, more organized, and less prone to errors.

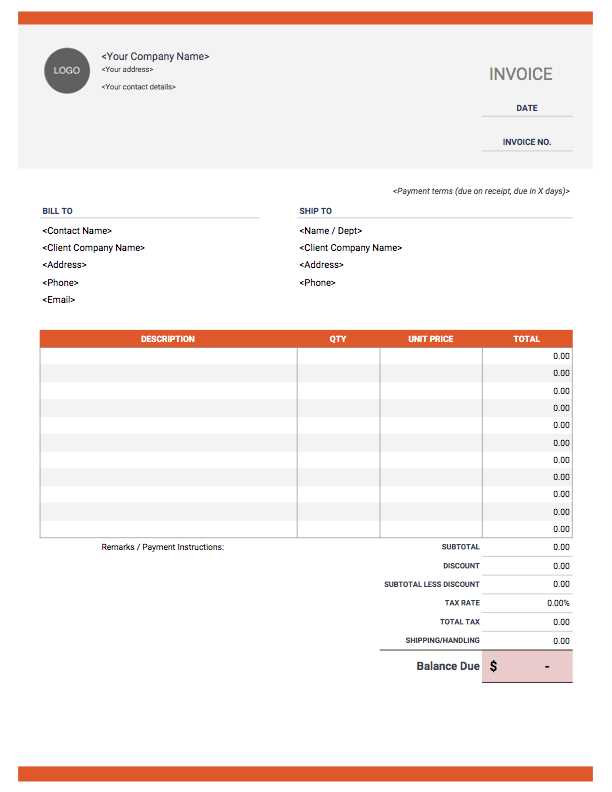

Free vs Paid Billing Document Layouts

When choosing a layout for your billing statements, businesses often face the decision of whether to use a free or paid option. Each approach has its pros and cons, depending on your specific needs, the volume of work, and the level of customization you require. Understanding the differences between these two types can help you make an informed decision that saves you time and ensures a professional result.

Free Options

Free layouts are widely available and can be a good starting point for small businesses or individuals with limited budgets. They provide basic functionality and can cover common billing scenarios. However, free designs may lack advanced features, customization options, and some design flexibility. They may also include limitations in terms of file formats or require additional software to function properly.

Paid Options

Paid solutions offer more advanced features, such as customization, branding, and integration with accounting tools. These layouts are often more polished and tailored to specific industries, providing a higher level of professionalism. While they come with a price, the investment can result in more time saved, better client satisfaction, and enhanced financial organization.

Feature Free Options Paid Options Customization Limited High Professional Design Basic Polished Customizing Your Billing Document Layout Personalizing your payment request format is essential for reflecting your business identity and ensuring clear communication with clients. By adjusting certain elements, you can make the document more professional, tailored to your brand, and aligned with the specific requirements of each project. Customizing the structure is simple and can save time while adding a personal touch to each transaction.

Key Elements to Customize

When adapting your document layout, there are several key components that you can modify to suit your needs. These include the design, branding, content structure, and layout details. Customization ensures that the document is consistent with your business style while providing all necessary information in a clear and easily accessible format.

Element Customization Options Header Logo, company name, contact details Client Information Client name, address, and contact details Service Description Detailed breakdown of tasks, hours worked, and rates Payment Terms Due date, payment methods, late fees, discounts Footer Additional notes, thank you message, business What to Include in Your Billing Statement

To ensure clarity and avoid any confusion, it’s essential to include all necessary details in your payment request. A well-structured document provides the client with everything they need to understand the charges and make timely payments. This includes both the specifics of the service provided and the terms under which payment is expected.

Here are the key components you should always include:

- Business and Client Information: Include your company name, contact information, and logo, as well as the client’s name and details. This establishes clarity on who is invoicing and who is being billed.

- Unique Reference Number: Assign a unique identifier to each request for easy tracking and reference. This helps both you and the client keep records organized.

- Detailed Service Description: Clearly describe the products or services provided, including any dates and the time spent on each task, if applicable. This transparency ensures the client understands exactly what they are paying for.

- Breakdown of Costs: List the cost of each service or product individually, including any applicable taxes or discounts. This helps avoid confusion about the pricing structure.

- Total Amount Due: Clearly display the total amount to be paid, so there is no ambiguity about the final figure.

- Payment Terms: Specify the payment due date, acceptable payment methods, and any late fees or penalties for overdue payments. This sets clear expectations for both parties.

- Additional Notes: Add any extra information, such as a thank you message, specific instructions for payment, or any other business-related notes that may be helpful to the client.

Common Mistakes to Avoid in Billing Statements

When creating payment requests, small errors can lead to misunderstandings, delays, and even damaged client relationships. It’s important to ensure that all details are accurate and clear. By recognizing and avoiding common mistakes, you can make the billing process smoother and more professional for both you and your clients.

Incorrect or Missing Information

One of the most common issues is incomplete or inaccurate details. Missing client contact information, wrong service descriptions, or incorrect amounts can cause confusion and delays in payment. Always double-check that all fields are filled out correctly, including your business information, client details, and the services provided.

Ambiguous Payment Terms

Another frequent mistake is failing to clearly state the payment terms. Without specifying the due date, payment methods, and any late fees, you risk leaving room for confusion about when and how the payment should be made. Be sure to include these details clearly so that both parties are on the same page and avoid disputes later on.

- Common Errors to Watch Out For:

- Missing client or business contact details

- Incorrect breakdown of costs

- Failure to specify due dates or payment methods

- Ambiguous or missing service descriptions

- Not including late payment penalties or discounts

By paying attention to these common mistakes and ensuring that every detail is correct, you can present a polished, professional do

Automating Billing Document Generation

Generating billing statements manually can be time-consuming, especially when dealing with large volumes of transactions. By automating the process, you can streamline your workflow, reduce the chance of errors, and save valuable time. Automation allows for quick generation of payment requests while maintaining consistency and professionalism across all documents.

Benefits of Automation

Automating the creation of your billing documents provides several advantages. It reduces manual input, ensuring that each document is created based on pre-set criteria, which in turn speeds up the entire process. Automation also ensures consistency in format, so that all your payment requests look the same, helping to maintain a professional appearance. Additionally, automation can integrate with other business tools like accounting systems, which simplifies record keeping and financial tracking.

Setting Up Automation

To automate the creation of billing statements, you can use built-in features of your document software. Many programs allow you to create templates with placeholders for client names, service details, dates, and costs. By linking these placeholders to external data sources, such as spreadsheets or databases, the program can automatically populate the necessary fields. You can also create macros or use specialized plugins to handle repetitive tasks, reducing the time spent on each document.

- Key Features for Automation:

- Templates with dynamic fields

- Integration with databases or spreadsheets

- Macros for repetitive tasks

- Customizable reminders and payment tracking

By setting up an automated system, you not only reduce manual labor but also ensure that each billing statement is accurate, consistent, and timely.

Legal Considerations for Billing Statements

When creating payment requests, it’s crucial to understand the legal implications involved. An accurate and well-structured document not only ensures prompt payment but also protects both parties in case of disputes. By adhering to certain legal requirements, you ensure that your financial documents comply with industry standards and local laws, which can help avoid complications down the line.

Key Legal Elements to Include

There are several key pieces of information that should be included in each payment request to meet legal requirements. These elements help ensure that the document is legally enforceable and clear in its terms.

- Identification of the Parties: Clearly list both the service provider’s and the client’s full names or business names, along with addresses and contact details.

- Accurate Dates: Include the date the service was completed and the date the payment is due. These details help establish the time frame for the transaction and prevent confusion.

- Service Description: Provide a detailed description of the work done, including any milestones or deliverables. This helps to avoid misunderstandings and provides clarity in case of disputes.

- Payment Terms: Specify the total amount due, payment methods, and any penalties for late payments. Clearly outline the conditions under which payments are expected and how overdue amounts will be handled.

- Tax Information: Depending on the jurisdiction, you may need to include tax details such as VAT or sales tax. Ensure that the document complies with local tax laws to avoid any legal issues.

Compliance with Local Laws

Tips for Accurate Time Tracking and Billing

Accurate time tracking is crucial for ensuring that clients are billed fairly and that you are compensated properly for your work. Whether you are charging by the hour or on a project basis, it is important to track time meticulously and translate those hours into an accurate, clear statement. Efficient time management and accurate recording can save time, reduce errors, and improve client relationships.

Effective Time Tracking Practices

To ensure precision in your billing, it is essential to implement reliable time-tracking practices. The following tips can help you stay organized and keep an accurate record of your work hours:

- Track Time Daily: Avoid waiting until the end of the week to log your hours. Track your time daily to reduce the risk of forgetting important details.

- Use Time-Tracking Tools: Leverage apps or software that automatically log the hours you spend on tasks. These tools can help ensure accuracy and prevent manual errors.

- Break Down Tasks: For complex projects, break down tasks into smaller, more manageable units. Track time for each task separately to ensure precise billing for every element of the work.

- Record Breaks: Don’t forget to log breaks. If you’re billing by the hour, be sure to account for any time spent away from work to avoid overcharging.

- Review Your Logs Regularly: Regularly check your time entries to ensure they match the work you’ve completed. This will help you stay on top of discrepancies before they become problems.

How to Handle International Invoicing for Software Projects

When managing projects across borders, it’s crucial to ensure that financial transactions are handled smoothly and transparently. Dealing with clients from various countries introduces complexities such as currency differences, tax regulations, and legal requirements. Properly addressing these elements is essential to avoid misunderstandings and delays in payments, while also maintaining compliance with international standards.

One of the first considerations is the choice of currency for payment. It’s important to agree on whether payments will be made in the client’s local currency or in a universally accepted one like USD or EUR. This decision can impact the final amount due, depending on exchange rates. In addition, it’s recommended to clearly outline the exchange rate policy in the agreement to avoid disputes later.

Next, understanding tax implications is key. Different regions have specific rules about Value Added Tax (VAT), Goods and Services Tax (GST), or other local taxes that may apply. Depending on the country, either the client or the service provider may be responsible for the tax payment, so it’s vital to clarify this aspect beforehand. Not doing so can lead to unexpected costs or delays in receiving the payment.

Legal aspects also play a significant role. Jurisdictions vary in terms of contract enforcement and the protection of payment rights. It’s advisable to include clear terms about how disputes will be resolved, such as specifying an arbitration process or selecting a neutral country’s laws to govern the agreement. This can save time and effort if any payment-related issues arise.

Clear Communication is another essential aspect. Ensuring that both parties are on the same page regarding the structure and due dates of payments will minimize the chances of confusion. This includes setting out milestones, payment deadlines, and potential penalties for late payments in the initial contract.

Lastly, consider the use of digital platforms for efficient tracking and processing of transactions. Automated systems can help manage different currencies and tax rates, making the invoicing process much more efficient and reducing the possibility of errors.

Choosing the Right Invoice Template for Your Needs

Selecting the appropriate document format for billing can significantly impact the efficiency and professionalism of your financial transactions. The right structure helps convey necessary details clearly, reduces the chance of errors, and ensures that your clients can process payments smoothly. Depending on the nature of your business, project size, and client expectations, the design and content of this document may vary.

One key factor to consider is simplicity versus detail. For straightforward projects with few items or services, a minimalist design with basic information like dates, amounts, and services rendered might be sufficient. On the other hand, larger or ongoing projects may require more detailed breakdowns, including milestones, hours worked, or separate categories of charges.

Customization is another critical element. You may need a format that allows for easy modification to fit various client needs. Flexibility in adjusting payment terms, adding or removing fields, and including specific references to contracts or agreements is important for maintaining clarity and accuracy.

Branding is also an aspect to consider. While functionality is crucial, ensuring that your billing documents align with your company’s image can reinforce professionalism and trust. This might include incorporating your logo, using brand colors, or maintaining a specific font style. A polished document adds credibility and can leave a lasting impression.

Additionally, it’s wise to think about the delivery method. If you are working with clients from different parts of the world, having a format that’s compatible with electronic systems and can be easily shared via email or a client portal is essential. Consider choosing a design that can be seamlessly exported to various file formats like PDF for easy sharing and printing.

Finally, always ensure that your chosen document format complies with local legal and t