Smart Invoice Template for Streamlined Billing

Managing billing processes efficiently is essential for maintaining a professional image and ensuring timely payments. With the right approach, creating well-structured documents becomes faster, simpler, and more accurate. By adopting digital solutions, businesses can focus on growth while reducing administrative burden.

Automated document creation has revolutionized how businesses handle transactions. These solutions allow users to generate customized forms quickly, ensuring all the necessary details are included and reducing the chance of human error. As a result, companies can enhance their operational efficiency and keep their finances in order.

In this guide, we explore various tools that help create professional-looking forms tailored to individual needs. Whether you’re a small business owner, freelancer, or part of a larger organization, these innovative systems can save valuable time and effort in managing financial records.

Smart Document Solution Overview

Efficient document creation tools have become essential for modern businesses, enabling seamless management of financial records and communication. These advanced systems are designed to simplify the process of generating professional forms that are tailored to specific needs. By leveraging these tools, users can ensure accuracy, consistency, and speed in their financial interactions.

With these automated systems, users can easily create customized forms that include all necessary details, from payment terms to contact information. This eliminates the need for manual data entry, reducing the risk of errors and improving the overall efficiency of business operations. Whether you are a freelancer or part of a large company, using an intuitive solution for generating documents helps streamline administrative tasks.

Automation and flexibility are key features of these systems, allowing for easy customization without the need for complex software. Users can focus on the details that matter most, while the platform ensures that every document maintains a professional appearance and meets industry standards.

Why Use a Smart Document Solution

In today’s fast-paced business environment, automating key tasks like creating billing forms can save significant time and effort. Relying on advanced systems that streamline the creation and management of essential documents enhances overall productivity. These tools are designed to simplify administrative work, reduce errors, and ensure accuracy in every transaction.

By using an automated solution, businesses can focus on their core activities, leaving the time-consuming task of document creation to a reliable platform. This approach also helps maintain consistency across all forms, ensuring that every document produced adheres to the same high standards.

Benefits of Using an Automated System

| Benefit | Description |

|---|---|

| Time Efficiency | Automates the document creation process, saving valuable time for other tasks. |

| Accuracy | Reduces human error by standardizing the document format and content. |

| Customization | Provides the flexibility to tailor documents to specific needs and preferences. |

| Professional Appearance | Ensures each document looks polished and well-organized, enhancing your business image. |

How It Improves Financial Operations

With the right system in place, generating detailed forms becomes faster and more reliable. Payment tracking and invoicing become smoother processes, with automatic updates reflecting changes in transaction details. By reducing manual input, these solutions also minimize the chance of missing or inaccurate information.

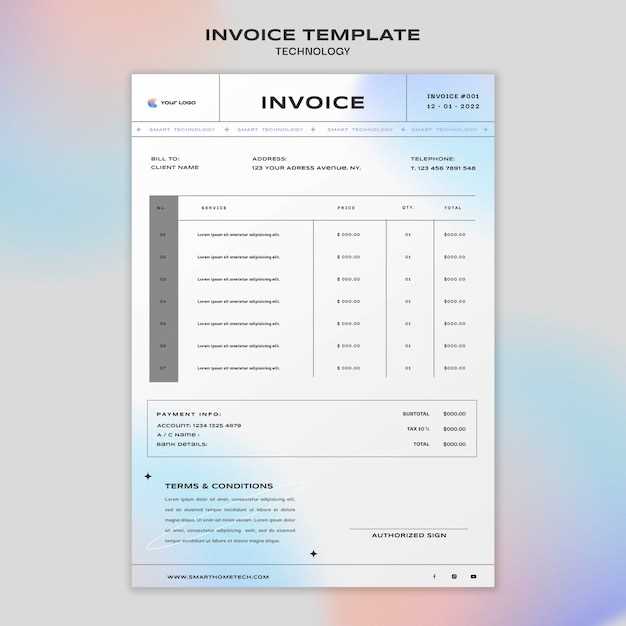

How to Customize Your Document

Personalizing your business forms is essential for creating a professional image and ensuring they meet your specific needs. Customization allows you to tailor the design, content, and layout to reflect your brand and the details of each transaction. By following a few simple steps, you can create documents that align with your business requirements while maintaining clarity and consistency.

Here are the key elements you can customize when using an advanced document system:

- Layout Design: Adjust the overall structure to fit your preferences, including header placement, footer details, and section organization.

- Company Information: Insert your business name, logo, contact details, and other relevant information to ensure your documents reflect your brand identity.

- Field Customization: Tailor the fields to include only the necessary information, such as service descriptions, quantities, and prices.

- Currency and Tax Rates: Select the appropriate currency and tax information based on your location and industry standards.

- Color Scheme and Fonts: Choose colors and fonts that align with your brand guidelines, making your forms look more cohesive and professional.

Once these elements are configured, you can save your settings for future use, ensuring consistency across all forms. By regularly updating and customizing your documents, you can enhance both efficiency and accuracy in your business operations.

Integrating Payment Methods Easily

One of the most important features of modern business documents is the ability to integrate payment methods seamlessly. This functionality allows businesses to provide clients with multiple, secure options to complete transactions directly from the document. By offering various payment gateways, you not only enhance the convenience for your customers but also streamline the entire billing process.

Incorporating payment options into your business forms reduces the likelihood of delays and simplifies the transaction flow. With just a few clicks, clients can process payments through their preferred methods, such as credit cards, bank transfers, or online wallets. Below are some of the key benefits of integrating payment solutions:

Benefits of Payment Integration

- Speed: Payments can be processed instantly, reducing the time spent waiting for funds to clear.

- Convenience: Clients can choose their preferred payment method, making the process more flexible.

- Accuracy: Direct integration ensures that payment amounts are correctly reflected in your financial records.

- Security: Secure payment gateways protect both your business and customers from fraud and unauthorized transactions.

How to Integrate Payment Systems

To integrate payment methods effectively, follow these simple steps:

- Choose a reliable payment gateway that suits your business model and customer preferences.

- Enable the gateway integration in your document management system, following the provided guidelines or API documentation.

- Ensure your documents include clear instructions on how clients can proceed with payments.

- Test the integration to ensure transactions are processed smoothly and securely.

By integrating payment systems directly into your business forms, you not only enhance user experience but also reduce administrative tasks associated with manual payment tracking. This leads to a more efficient workflow and helps build stronger customer trust.

Benefits of Automated Billing Systems

Automation in document creation and billing processes has become a game-changer for businesses. By using automated systems, companies can significantly reduce manual effort, improve accuracy, and streamline their entire financial workflow. These tools help businesses stay organized and ensure that every detail is handled consistently, leading to more efficient operations and greater customer satisfaction.

Here are some key advantages of adopting an automated billing system:

- Time-Saving: Automating repetitive tasks, such as data entry, calculations, and document generation, saves valuable time that can be better spent on core business activities.

- Reduced Errors: By eliminating manual input, the risk of human errors is minimized, ensuring that all details, including amounts and dates, are accurate.

- Consistency: Every document generated follows a consistent format, ensuring that your business looks professional and organized in all interactions.

- Faster Payment Processing: Automated systems can trigger payment reminders and send forms immediately, speeding up the billing cycle and reducing delays in payments.

- Better Financial Tracking: With automatic updates and logs, tracking payments and outstanding balances becomes much easier, providing clearer insights into financial performance.

By utilizing an automated solution, businesses can not only improve operational efficiency but also enhance customer relationships by providing timely, accurate, and professional-looking documents. The result is a more seamless and productive workflow for both clients and teams.

Saving Time with Digital Billing Systems

Digital solutions for creating and managing business documents are transforming how companies handle administrative tasks. By shifting from paper-based to electronic systems, businesses can significantly reduce the time spent on generating, sending, and processing records. These tools enable quick customization and automated processes, allowing for faster turnaround times and improved workflow efficiency.

Here are some ways digital solutions help save valuable time:

- Instant Generation: Digital systems allow users to create professional forms in seconds, eliminating the need for manual writing or formatting.

- Automated Delivery: Rather than physically mailing documents or manually emailing them, digital platforms can automatically send out forms to recipients, ensuring they are received promptly.

- Real-Time Updates: Any changes made to documents are instantly reflected, so there’s no need to manually track updates or revisions.

- Faster Payments: Automated reminders and direct payment links can speed up the time it takes to receive funds, improving cash flow.

- Reduced Follow-Ups: Automated systems can send reminders and updates, reducing the need for constant follow-up communication.

By embracing digital systems, businesses can not only speed up their internal processes but also improve client satisfaction by providing faster, more reliable service. This shift towards automation and efficiency leads to better use of time and resources for everyone involved.

Automated Billing for Small Businesses

For small businesses, managing financial tasks efficiently is crucial to maintaining smooth operations. Leveraging automated systems for creating and processing business forms not only saves time but also ensures accuracy and consistency across all documents. By utilizing an advanced solution tailored for smaller enterprises, businesses can streamline billing, reduce human error, and free up valuable time for growth and development.

Here’s how automated systems can benefit small businesses:

| Benefit | Description |

|---|---|

| Cost Efficiency | Automating the billing process reduces the need for manual input and paperwork, cutting down operational costs. |

| Time Saving | Speed up document creation and payment processing, allowing for faster turnaround times and improved cash flow. |

| Consistency | Standardized formats ensure that every document looks professional and contains the same crucial information. |

| Improved Accuracy | Automation eliminates errors from manual calculations or data entry, reducing discrepancies in billing. |

| Easy Tracking | Automated systems offer easy tracking of payments, outstanding balances, and document history, making financial management simpler. |

By adopting automated systems, small businesses can focus more on their core services and customer satisfaction, rather than being bogged down with administrative tasks. These systems provide the tools necessary to maintain professionalism and efficiency, ensuring business growth and long-term success.

Creating Professional Documents Quickly

For any business, creating professional forms quickly and accurately is essential to maintaining a smooth workflow and building a strong client relationship. By using modern tools that automate much of the document creation process, companies can generate clear, well-designed records in no time. This efficiency allows businesses to focus on what matters most, like providing excellent service and building their brand.

Key Steps for Fast Document Creation

Here are some crucial steps that can help you create polished and professional documents without unnecessary delays:

- Use Pre-designed Layouts: With built-in templates, you can easily select a layout that suits your business needs, saving time on design work.

- Automate Data Entry: Using automated tools to fill in client details, services, and amounts reduces the time spent entering information manually.

- Customize Essential Fields: Tailor the fields for each transaction to include relevant details, such as payment terms, service descriptions, and contact information.

- Save and Reuse Settings: Once you’ve customized your documents, save your settings for future use, enabling you to generate similar records instantly.

Advantages of Quick Document Creation

By streamlining the document creation process, businesses benefit from:

- Increased Efficiency: Generate professional forms in a fraction of the time it would take to do so manually.

- Improved Accuracy: Automation reduces the risk of errors, ensuring that every document is consistent and error-free.

- Better Client Relationships: Timely, polished documents reflect professionalism and help you establish trust with clients.

With the right tools, creating high-quality forms doesn’t have to be a time-consuming task. By utilizing automated systems, businesses can focus more on serving clients and less on administrative work.

Common Mistakes to Avoid

When generating business documents, small errors can have a significant impact on client relations and payment processes. Even though digital tools can simplify the task, certain mistakes can still slip through the cracks if not carefully addressed. Recognizing and avoiding these common pitfalls ensures that all your documents are accurate, professional, and efficient.

Common Errors to Watch Out For

| Mistake | Consequence | Solution |

|---|---|---|

| Incorrect Client Information | Sending documents with the wrong name or address can delay payments and cause confusion. | Double-check contact details before generating each document. |

| Missing Payment Terms | Clients may not know when or how to pay, leading to delayed payments. | Always include clear payment due dates and instructions. |

| Feature | Description |

|---|---|

| Payment Status Tracking | Real-time updates on whether a payment is pending, completed, or overdue, helping businesses stay organized. |

| Automated Reminders | Automatic notifications for overdue payments, reducing the need for manual follow-ups and minimizing delays. |

| Integrated Payment Links | Direct links to payment portals in your documents, making it easier for clients to complete transactions quickly. |

| Detailed Payment History | A detailed log of each payment, including date, amount, and method, to easily track past transactions. |

| Customizable Payment Terms | Flexible payment terms tailored to each client’s needs, allowing for better control over payment schedules. |

By using digital forms that track payments effectively, businesses can simplify the billing process, reduce administrative work, and ensure timely payments. This level of efficiency can help maintain a steady cash flow and promote better financial planning.

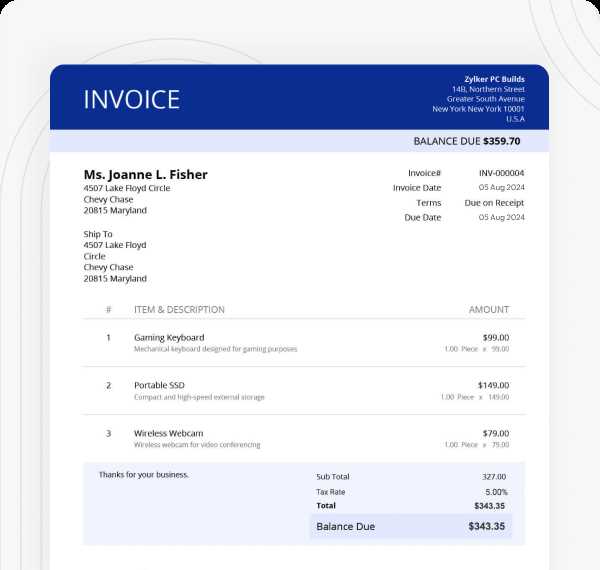

Choosing the Right Document Format

Selecting the appropriate format for your business documents is essential for clear communication and streamlined financial processes. The right format ensures that all necessary details are included and easily understood by your clients, making it simpler to manage payments and avoid misunderstandings. Choosing between different types of formats can depend on your industry, business size, and specific needs.

Key Considerations When Choosing a Format

Here are some important factors to consider when selecting a document format:

- Clarity: The layout should be simple and easy to read, ensuring that all essential information is clearly visible.

- Customization: Choose a format that allows you to tailor the content to your specific needs, whether it’s adding custom fields or adjusting payment terms.

- Automation: A format that integrates with payment systems and other business tools will save time and reduce the risk of human error.

- Consistency: Stick to a consistent format across all documents to maintain professionalism and ensure that clients know what to expect every time.

Types of Formats to Consider

There are various types of formats available, each suited to different business models and client expectations:

- Basic Layouts: These are simple, no-frills documents with essential details like amounts, dates, and services rendered.

- Professional Designs: More polished formats with branded elements, such as logos, headers, and custom colors, provide a more formal touch.

- Online Formats: Digital forms that can be sent via email or integrated with payment gateways for faster transactions and easier record-keeping.

By selecting the right format for your documents, you ensure that your business operations run smoothly, your clients are well-informed, and the financial process is as efficient as possible.

Reducing Errors in Billing Documents

Minimizing errors in financial documents is crucial for maintaining accurate records and ensuring smooth transactions with clients. Simple mistakes in figures, dates, or service descriptions can lead to delays in payments, confusion, and a lack of trust between businesses and their customers. By implementing certain practices, businesses can significantly reduce the likelihood of errors and enhance the efficiency of their billing processes.

Best Practices to Minimize Mistakes

Here are some effective strategies to avoid common errors in financial documents:

- Double-checking Details: Always verify the information entered, such as amounts, services provided, and client details. A quick review can catch most simple errors.

- Automating Calculations: Use digital tools that automatically calculate totals, taxes, and discounts to minimize human error.

- Standardizing Information: Use standardized formats for recurring fields, such as service descriptions, payment terms, and client addresses, to ensure consistency.

- Integrating Payment Tracking: Systems that automatically track payments can help identify discrepancies between what’s owed and what’s been paid, preventing underpayment or overpayment errors.

Tools for Error-Free Billing

Several digital solutions can help automate the process and reduce the risk of mistakes:

- Billing Software: Tools that provide pre-designed forms with automated fields help minimize manual input errors.

- Online Payment Platforms: Integration with payment gateways ensures that amounts are accurate and reduces discrepancies between invoiced and received payments.

- Cloud Storage: Storing billing documents in the cloud enables easy access to previous records, making it simpler to track and compare information.

By leveraging technology and following best practices, businesses can reduce errors in their billing processes, leading to smoother operations and stronger client relationships.

How Intelligent Documents Improve Accuracy

Using well-structured digital forms significantly enhances the precision of financial paperwork by reducing human error. When essential details such as amounts, dates, and service descriptions are automatically populated or validated, the risk of mistakes is minimized. These advanced solutions not only save time but also ensure that all information is consistently accurate, which is critical for both businesses and their clients.

Key Ways to Improve Accuracy with Advanced Forms

- Automated Calculations: Forms that automatically calculate totals, taxes, and discounts reduce the chances of errors in arithmetic and ensure that the final amounts are always correct.

- Pre-Set Fields: By providing predefined fields for recurring information, businesses eliminate the need to re-enter repetitive data, reducing the likelihood of inconsistencies.

- Error Alerts: Some systems highlight missing or inconsistent information, prompting users to correct potential mistakes before submitting the document.

- Standardized Layouts: Consistent design and structure ensure that all required fields are included, making it harder to overlook or omit important information.

Benefits of Enhanced Accuracy

- Fewer Disputes: Accurate forms lead to fewer misunderstandings between businesses and clients regarding amounts owed or services rendered.

- Streamlined Payments: When the details are correct from the start, payments are processed faster, reducing delays and improving cash flow.

- Improved Professionalism: Accurate and consistent documents create a positive impression and convey a higher level of professionalism to clients.

By utilizing advanced document solutions, businesses can ensure greater accuracy in their financial paperwork, ultimately improving operational efficiency and customer satisfaction.

Billing Documents for Freelancers

Freelancers often face unique challenges when managing their business finances, and creating professional, consistent billing documents is one of the key tasks they need to address. Properly formatted financial documents not only ensure timely payments but also help freelancers maintain a professional image with clients. By using efficient tools, freelancers can streamline their billing process, reduce administrative tasks, and ensure accuracy in every transaction.

Customizable billing forms allow freelancers to include all the necessary details, such as service descriptions, payment terms, and personal branding elements like logos and contact information. These forms also enable freelancers to quickly generate documents for different clients, ensuring consistency across their work without wasting time on manual entries.

Additionally, by incorporating automated calculations and predefined fields, freelancers can focus on their core work while the system handles the math, minimizing the risk of errors. This flexibility and efficiency are especially beneficial for freelancers managing multiple projects and clients simultaneously.

Best Practices for Document Design

When creating financial documents for your business, it is essential to ensure that the design is clear, professional, and easy for clients to understand. The layout and visual elements play a significant role in how your clients perceive your professionalism and the accuracy of your services. A well-organized design helps in communicating key details effectively, ensuring smooth transactions and reducing confusion.

Here are some best practices to consider when designing your financial documents:

- Consistency is Key: Maintain a consistent format across all your documents. This includes using the same fonts, colors, and logos, which helps reinforce your brand and makes your documents easily recognizable.

- Clear Structure: Ensure that the most important information, such as service descriptions, amounts, and due dates, is easily accessible. Use headings, bullet points, and tables to organize details and make the document more readable.

- Legible Fonts: Choose clean and professional fonts that are easy to read. Avoid overly decorative or complex fonts, as they can make the document harder to understand.

- Highlight Key Information: Make sure that critical details, like payment terms and due dates, stand out. You can achieve this by using bold text, larger font sizes, or different colors to draw attention to these areas.

- Include Your Branding: Add your logo, business name, and contact information in prominent places, such as the header or footer, to reinforce your brand identity and make it easy for clients to contact you.

By following these design principles, you can create financial documents that not only look professional but also function effectively, ensuring that all the necessary information is clearly communicated and easy to process for your clients.

Comparing Billing Software Options

When it comes to managing billing and financial documentation, choosing the right software is essential for ensuring efficiency and accuracy. With numerous tools available, it can be overwhelming to decide which one best suits your business needs. Each software option offers unique features, so understanding these differences can help you make an informed choice.

Here are some key factors to consider when comparing billing software:

- Ease of Use: Look for software that has an intuitive interface and is easy to navigate. You want a platform that doesn’t require a steep learning curve, allowing you to focus on your work, not the tool itself.

- Customization: The ability to customize your financial documents is crucial. Some software options offer more flexibility in design and layout, allowing you to add branding elements, adjust fields, and tailor the structure to suit your needs.

- Automation: Many billing solutions include automated features, such as recurring billing, tax calculations, and payment reminders. These automation options can save you time and reduce human error.

- Integration: Choose software that integrates with your existing tools, such as accounting software or payment platforms. Seamless integration ensures that your financial data is accurately transferred between systems.

- Customer Support: Reliable customer support is essential when dealing with financial tools. Look for software that offers prompt assistance, whether it’s through chat, email, or phone support, in case you run into any issues.

- Pricing: Consider the pricing structure of each tool. Some software options offer free plans with basic features, while others may have monthly or annual subscription fees. Make sure the tool aligns with your budget and provides value for the features it offers.

By evaluating these factors, you can select the best software that streamlines your billing process, improves accuracy, and supports the growth of your business.

Security Features in Advanced Billing Systems

In today’s digital age, safeguarding financial documents is of utmost importance. With increasing concerns over data breaches and fraud, it is essential that businesses use systems that provide robust security measures. Many modern billing systems are equipped with advanced security features designed to protect both sensitive client information and business data from unauthorized access and malicious activities.

Key Security Measures

When choosing a billing solution, it’s crucial to look for the following security features:

- Encryption: Data encryption ensures that all sensitive information, including payment details and client addresses, is securely transmitted and stored. This helps prevent unauthorized access to the data during communication or when stored in the system.

- Two-Factor Authentication (2FA): Adding an extra layer of security through two-factor authentication helps protect accounts from unauthorized access. By requiring a second form of verification, such as a one-time password or authentication app, businesses can minimize the risk of fraud.

- Access Control: Restricting access to sensitive data within the system is essential. With role-based access control, businesses can assign specific permissions to users, ensuring that only authorized individuals can view or modify critical financial information.

- Secure Payment Gateways: A reliable billing system integrates with secure payment gateways that comply with the highest industry standards, such as PCI DSS (Payment Card Industry Data Security Standard). These gateways ensure that all payment transactions are processed securely.

- Audit Logs: Tracking user activities within the system is an important security feature. Audit logs allow businesses to monitor who accessed what information and when, which helps identify any suspicious activities or breaches.

Why These Features Matter

These security measures play a significant role in protecting businesses from financial loss and reputational damage. By ensuring that sensitive data is encrypted, access is controlled, and transactions are secure, businesses can confidently manage their financial operations without the fear of data breaches or fraud.