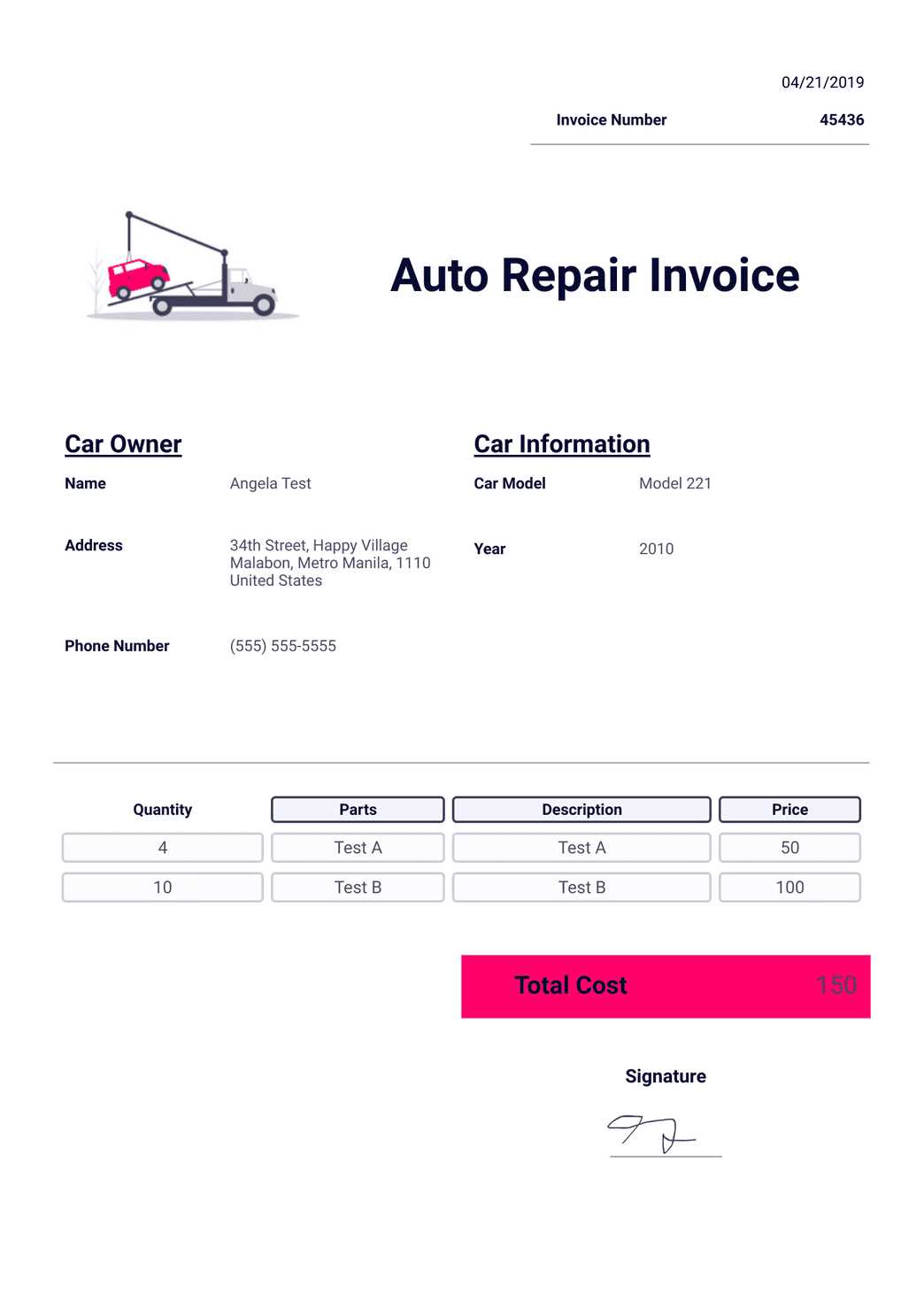

Small Engine Repair Invoice Template for Easy and Accurate Billing

When managing a business that involves mechanical work or technical services, having an organized and professional way to document transactions is essential. A well-structured billing document ensures clear communication between service providers and clients while promoting efficient payment processing. Such documents are key to maintaining accurate records and building trust with customers.

For businesses in the technical and mechanical repair industry, having the right tool to manage payments is crucial. The process of invoicing can be streamlined through customizable formats that suit specific needs. These tools help avoid errors, save time, and provide consistency across all financial exchanges. By creating a standardized approach, service providers can ensure that all necessary information is included while maintaining a professional appearance.

Whether you’re a mechanic, technician, or service provider, having a properly formatted document helps manage transactions seamlessly. Customizable solutions allow for easy adaptation to various types of jobs and customer requirements. This flexibility helps reduce the stress of managing finances and enhances the overall customer experience.

Why You Need a Service Billing Document

Maintaining proper documentation for the services you provide is a critical component of running a successful business. Clear, professional records help ensure that clients are billed accurately and that payment processes are streamlined. Without the right documentation, misunderstandings and payment delays can arise, which can impact your business’s cash flow and reputation.

Ensures Accurate Payment Collection

Using a structured document helps both you and your client clearly understand the cost of services rendered. It outlines all charges in detail, avoiding confusion about prices, fees, and taxes. By having a well-organized document, clients are more likely to pay on time and in full, reducing the likelihood of disputes.

Enhances Professionalism and Credibility

Providing a polished and comprehensive statement signals professionalism to your clients. It shows that you take your work seriously and have a system in place to manage financial matters efficiently. This can help build trust and encourage repeat business.

- Clear breakdown of costs and services provided

- Increased client satisfaction through transparency

- Improved cash flow and timely payments

- Less likelihood of miscommunication or errors

By adopting a consistent approach to documenting transactions, you also make it easier to track payments, analyze business performance, and prepare for taxes. This small but crucial tool serves as a foundation for a well-managed business operation.

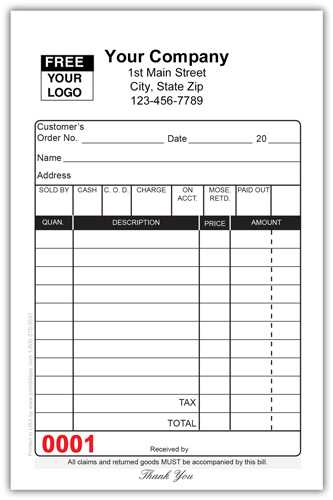

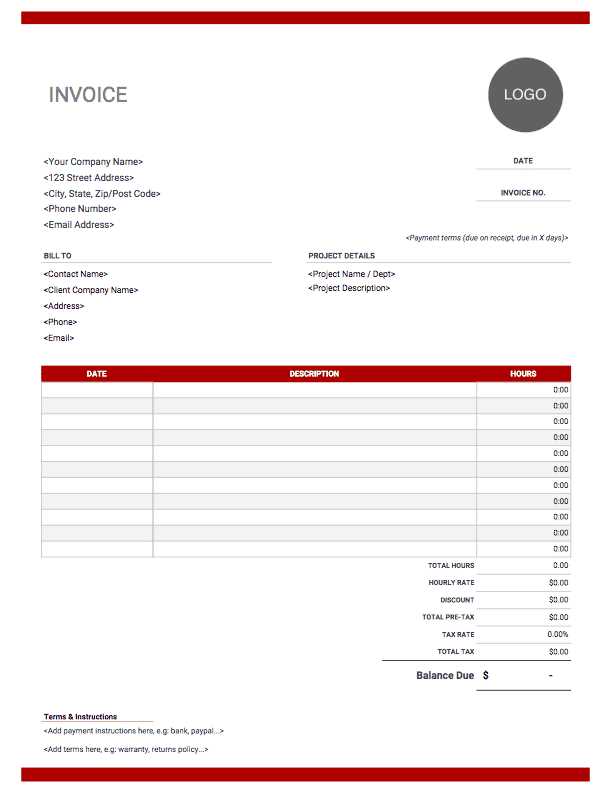

How to Create a Service Billing Document

Creating a professional and clear billing document requires attention to detail and a structured approach. The goal is to ensure that all necessary information is included, making it easy for both you and your client to understand the transaction. By following a simple process, you can create a document that is both accurate and easy to manage.

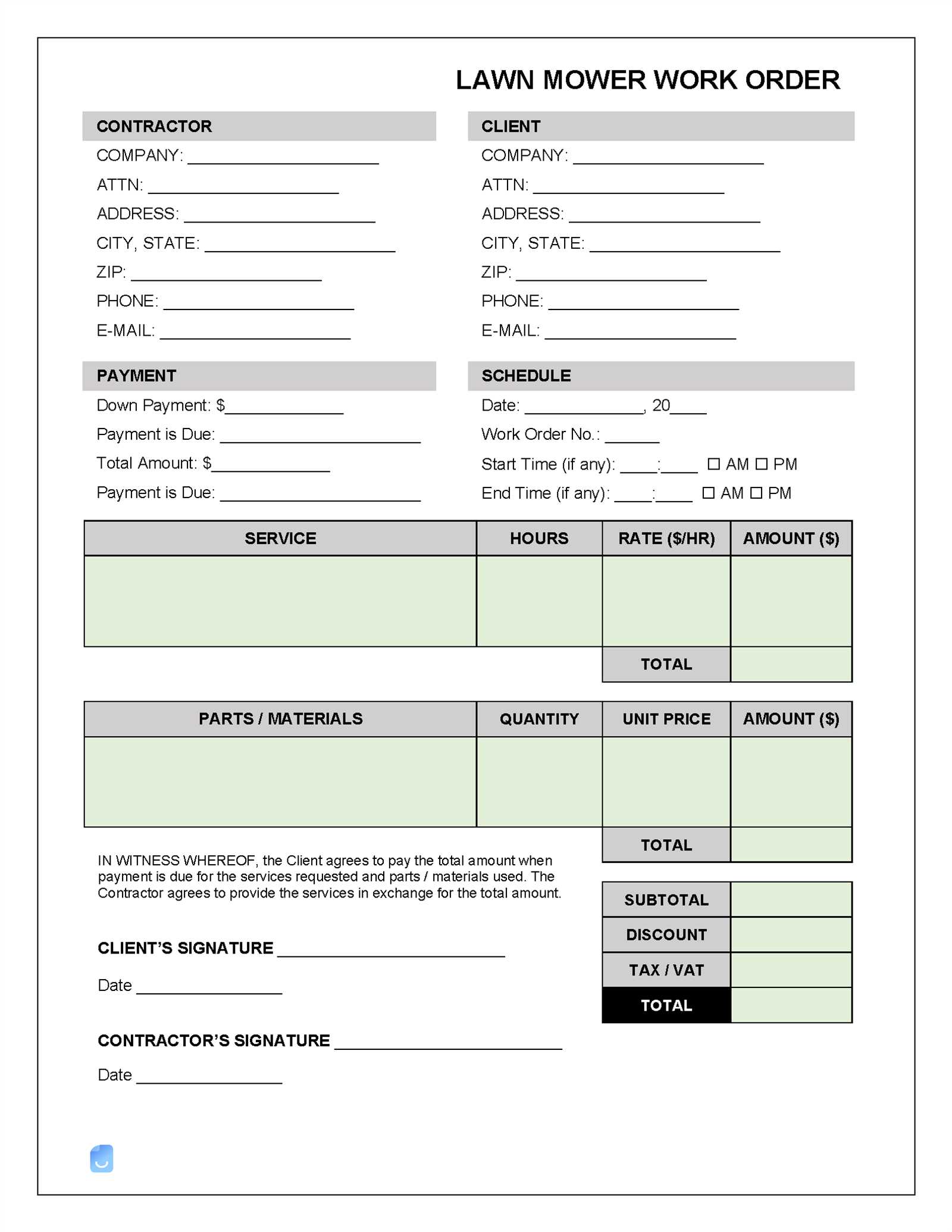

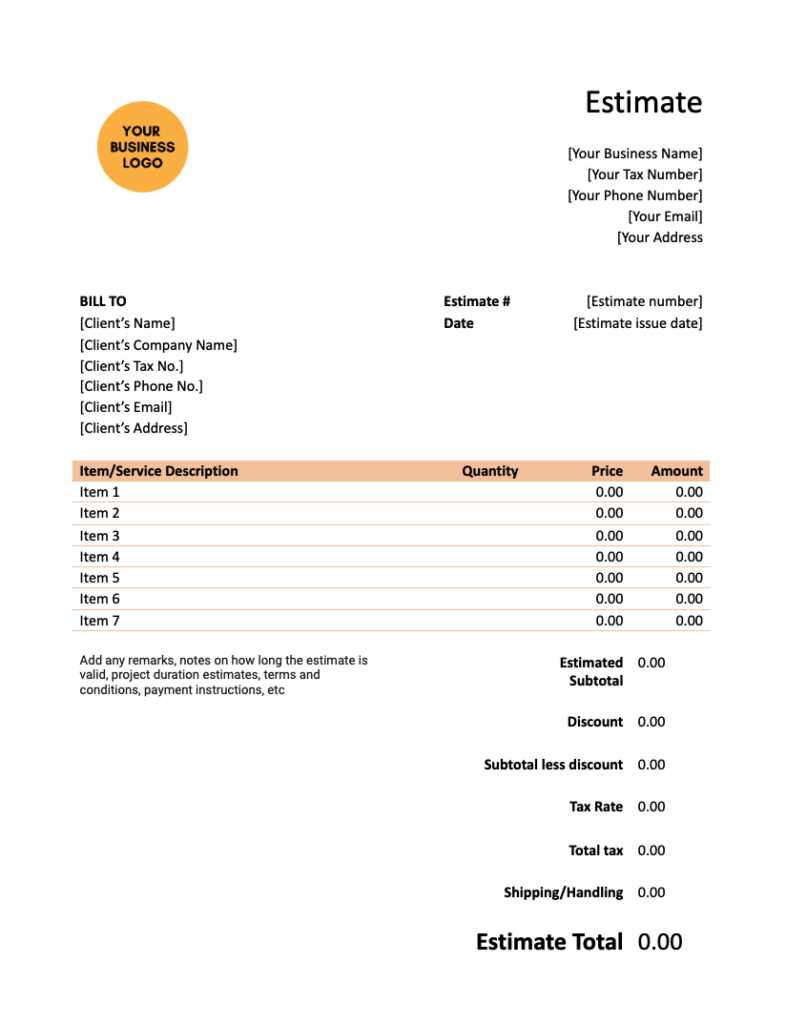

1. Start with Your Business Information

At the top of the document, include your business name, address, contact information, and any other relevant details. This establishes your identity and makes it easier for clients to reach you if needed.

2. Include Client Information

Next, add the customer’s name, address, and contact details. This ensures that the document is personalized and specific to the individual or business you are invoicing. This step is crucial for accurate record-keeping and communication.

3. List the Services Provided

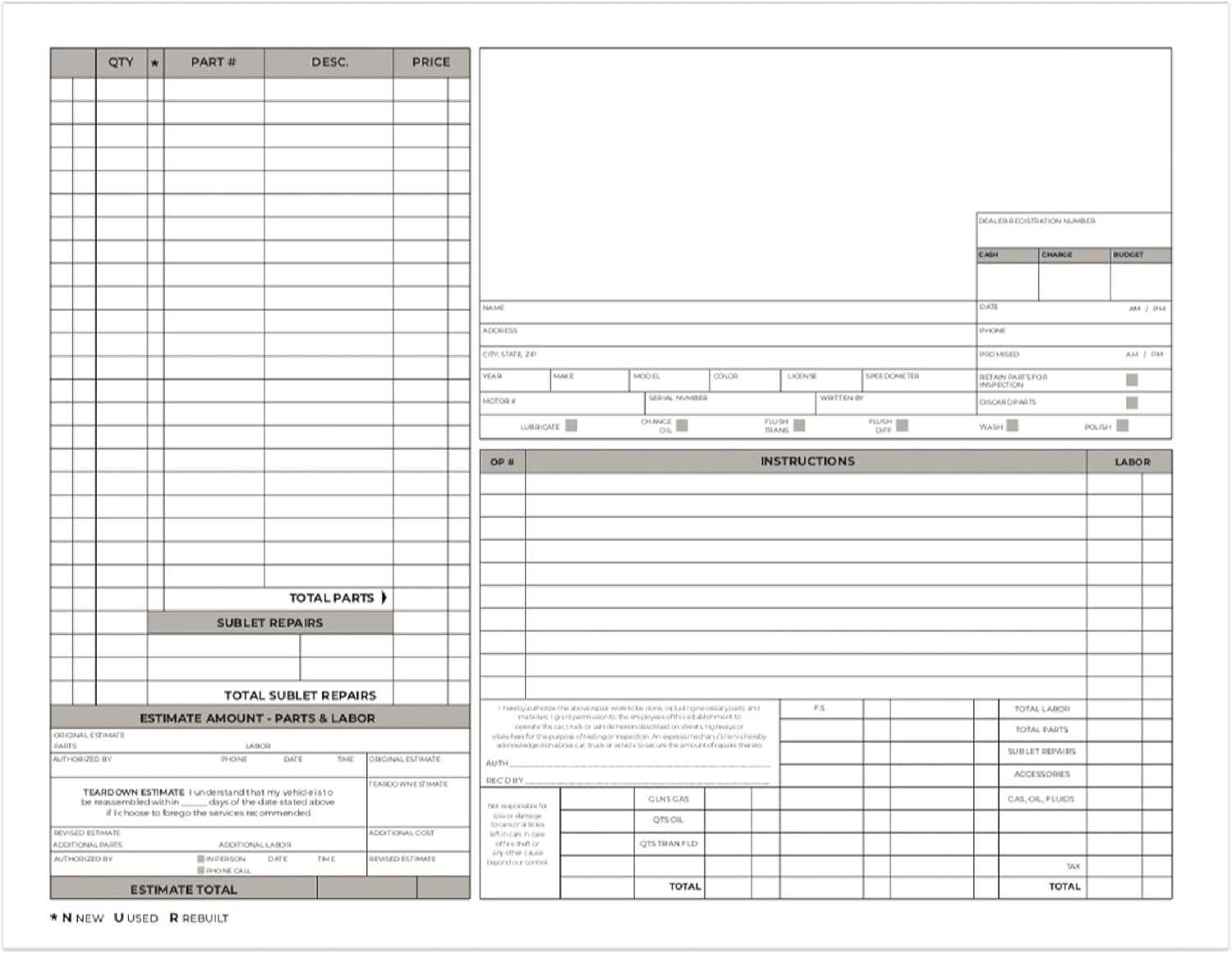

Clearly outline the services performed, including descriptions and quantities where applicable. Be specific about each task so the client understands exactly what they are being charged for. This helps avoid confusion and sets clear expectations for both parties.

4. Specify the Costs

Break down the pricing for each service or item, ensuring transparency in your billing. Include unit prices, the number of hours worked, or any additional charges, such as materials or travel fees. A clear cost breakdown prevents disputes and fosters trust.

5. Add Payment Terms

Clearly outline the payment terms, including due dates, late fees (if any), and acceptable payment methods. Being transparent about your terms helps encourage timely payments and sets clear expectations for the client.

6. Include a Total Amount

Ensure the total amount due is clearly visible. Double-check that all charges are accurately added up to avoid errors. A well-organized final figure makes it easier for clients to process payments quickly.

7. Review and Send

Before sending, review the document for any errors or missing information. Once finalized, send the billing document to your client in the agreed format–whether by email, post, or an online portal.

By following these steps, you create a clear and professional document that not only helps in collecting payment but also builds trust with your clients.

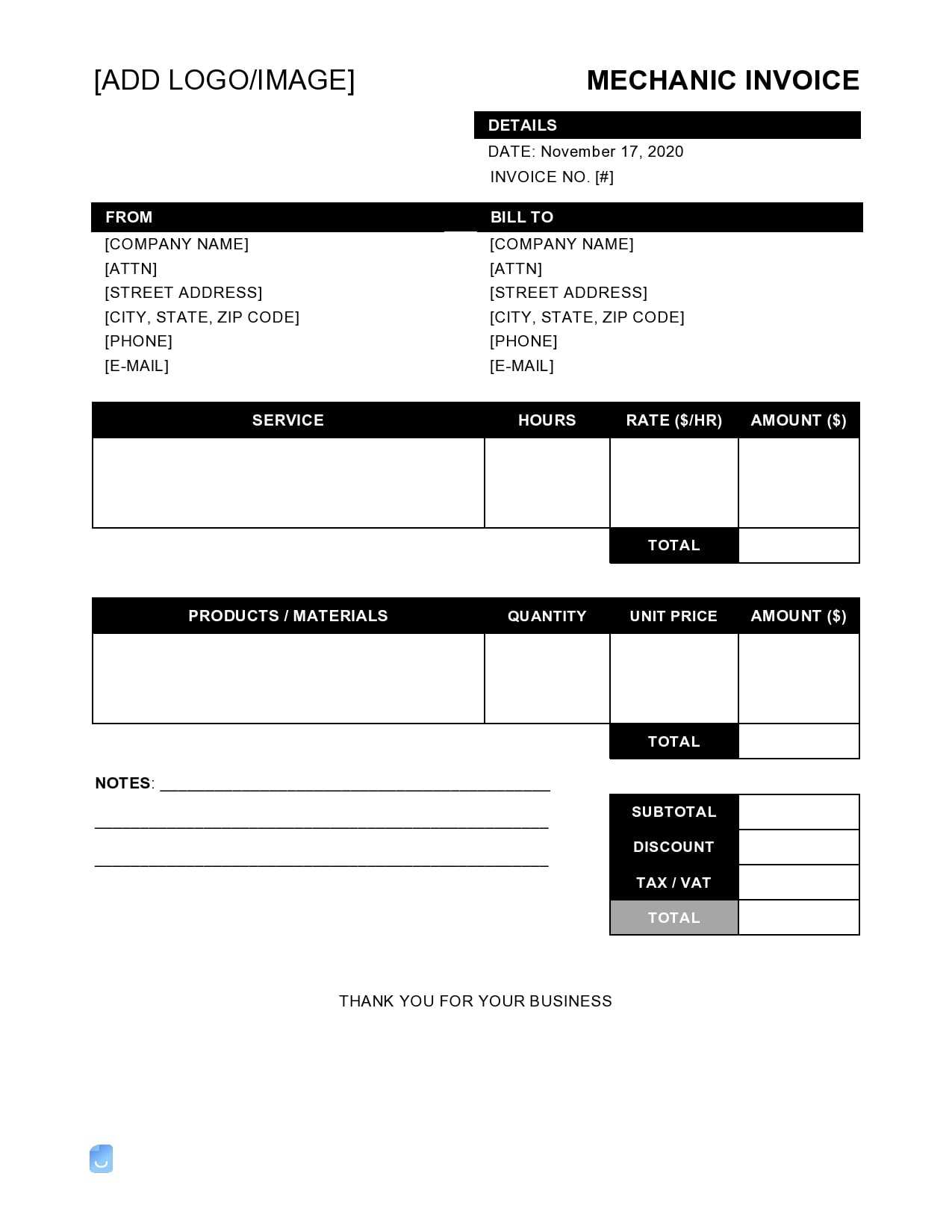

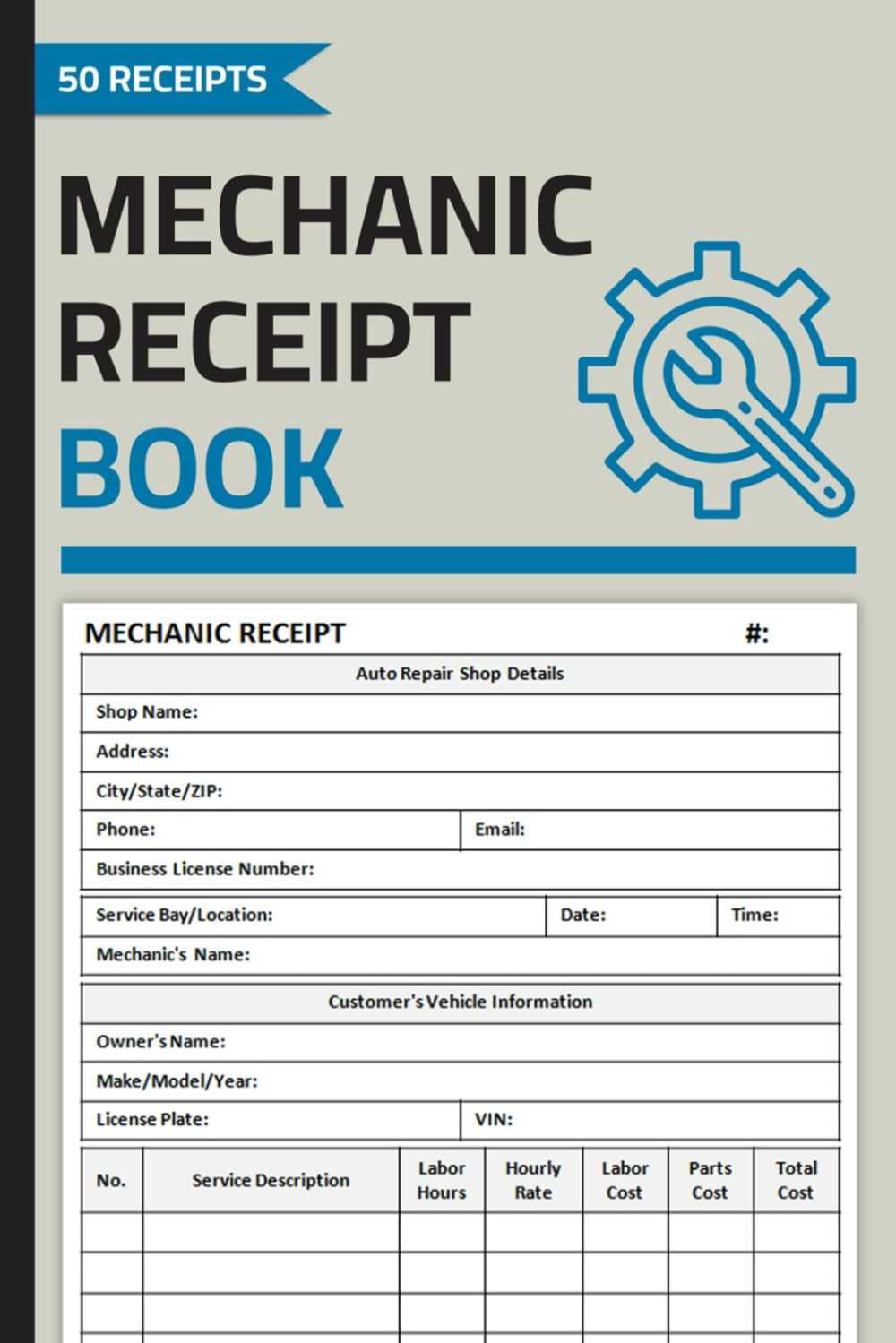

Key Elements of a Service Billing Document

For any business providing technical or mechanical services, having a well-structured billing document is essential. This document not only serves as a record of the work done but also ensures that both the service provider and the client are clear on the terms of payment. A properly designed document should include several critical components to maintain transparency and professionalism.

Essential Information to Include

To create a complete and clear billing document, ensure the following elements are included:

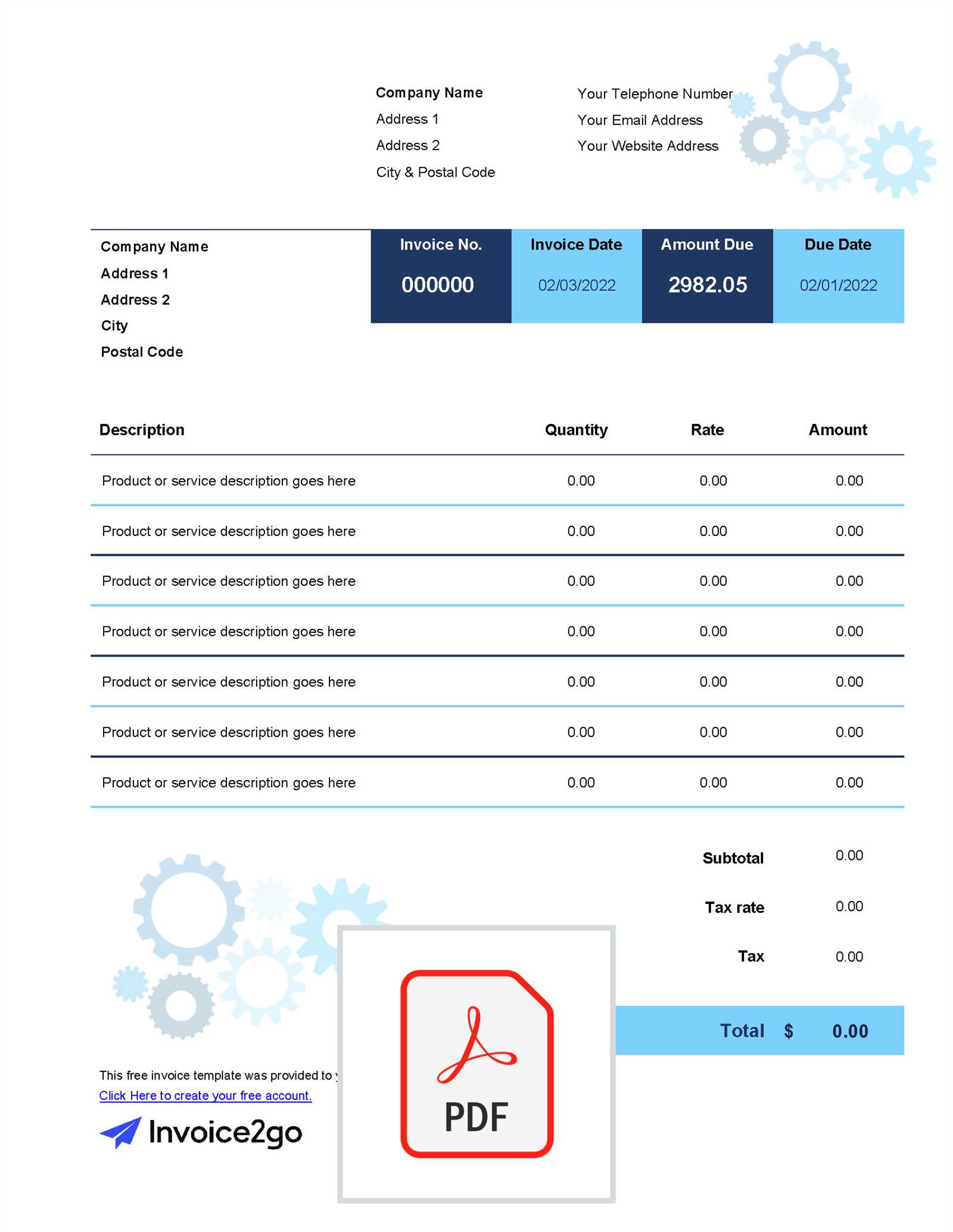

- Business Details: Your business name, address, contact information, and any relevant identification numbers (e.g., tax ID).

- Client Information: The name, address, and contact details of the person or company receiving the service.

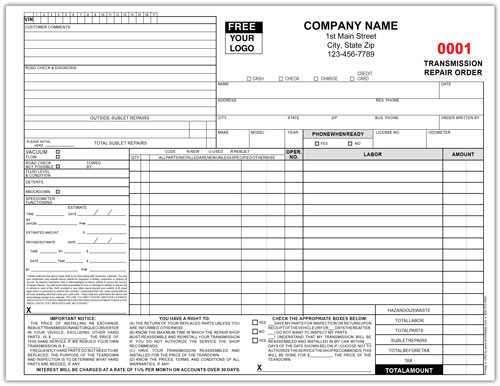

- Service Description: A detailed list of the tasks performed, with clear descriptions of each action or part replaced, if applicable.

- Costs Breakdown: Itemized charges for each service, labor hours, parts, and any other additional fees (e.g., travel or handling fees).

- Payment Terms: Clear payment instructions, including due dates, acceptable payment methods, and late fee policies.

Additional Key Considerations

While the above elements are necessary, there are other optional but important details to consider when drafting the document:

- Invoice Number: A unique reference number for each document helps keep records organized and simplifies tracking payments.

- Tax Information: If applicable, include any tax charges or exemptions for the work completed.

- Due Date: The date by which payment is expected. This helps prevent delays and provides a clear timeframe for your client.

By ensuring all of these elements are present and clearly outlined, you can create a professional and comprehensive document that fosters trust and facilitates prompt payments from your clients.

Benefits of Using a Billing Document Format

Utilizing a pre-designed structure for your billing process brings numerous advantages to both the service provider and the client. A standardized approach helps reduce errors, ensures consistency, and saves time, making the transaction smoother and more professional. By relying on a well-organized format, businesses can streamline administrative tasks and focus more on providing quality services.

Time and Efficiency Savings

One of the main benefits of using a predefined format is the amount of time saved during the billing process. Instead of manually creating a new document from scratch for each client, you can quickly input the relevant details and generate a complete document in minutes. This efficiency allows you to focus on other important aspects of your business.

- Faster document creation: Quickly generate accurate records without starting from zero.

- Less chance of mistakes: Reduces human error by using a consistent layout every time.

- Ready to use for each job: Easily adaptable to any new project or service without much effort.

Improved Professionalism and Consistency

A standardized document helps maintain a consistent appearance for your business. Clients appreciate receiving clear, organized documents that reflect the professionalism of the service provider. Having a uniform layout also helps reinforce your brand image and shows clients that you take all aspects of your business seriously.

- Branding: Consistent use of colors, logos, and styles can reinforce your company’s identity.

- Clear presentation: A well-structured document enhances readability and avoids confusion.

- Standardized communication: Clients know exactly what to expect with each transaction, improving trust.

By using a billing document format, you not only save valuable time but also present a professional image that can positively influence client relationships and promote timely payments.

Customizing Your Service Billing Document

Personalizing your billing document allows you to better align it with your business needs and create a more professional experience for your clients. A custom layout ensures that all necessary details are included, while also offering the flexibility to reflect your unique services, branding, and payment preferences. Customization is not just about aesthetics–it’s about tailoring the document to function more effectively for both you and your customers.

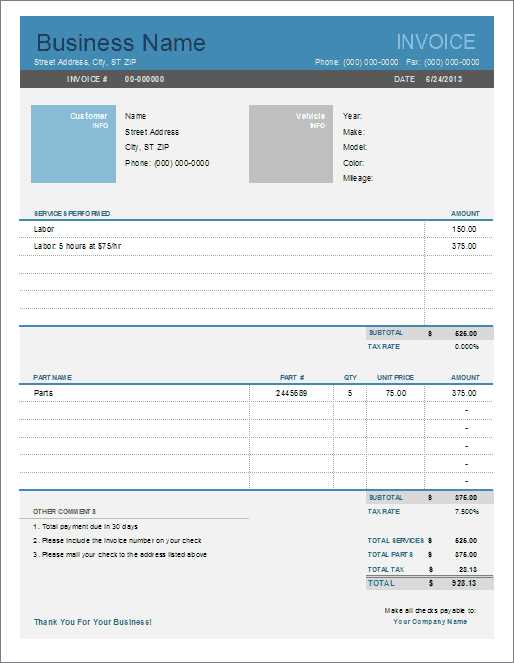

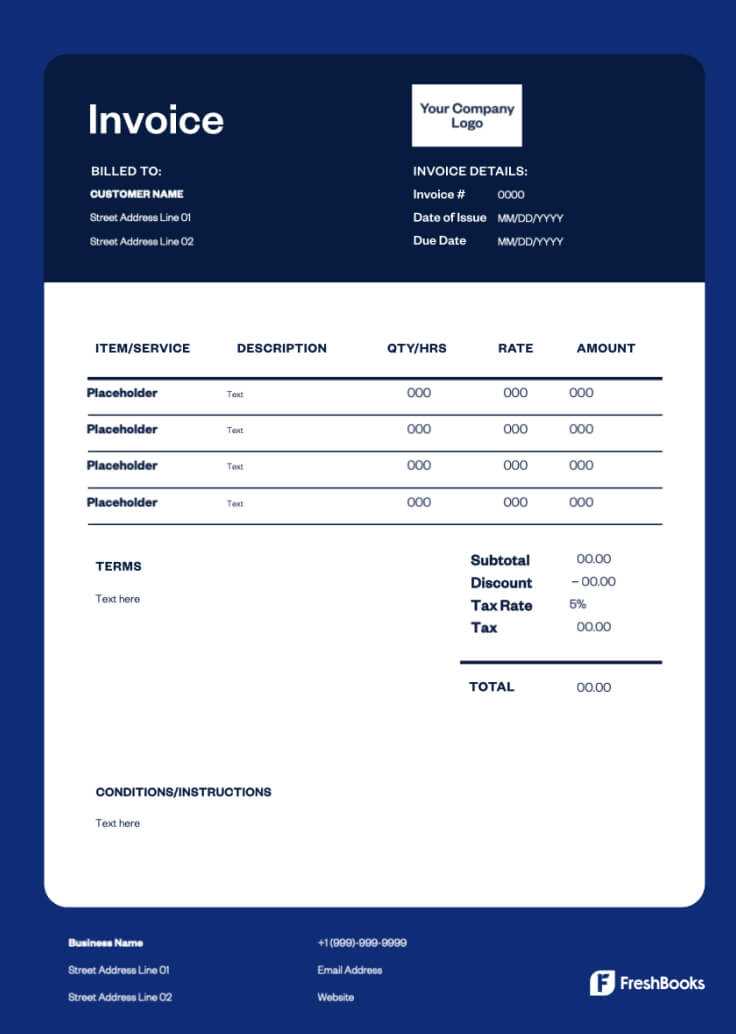

Adjusting Layout and Design

One of the first steps in customization is modifying the layout to suit your brand and the specific needs of your business. You can choose to highlight certain sections, such as the services provided or payment instructions, to make them more prominent. Additionally, you can use your company’s logo, colors, and fonts to give the document a cohesive look that matches your business identity.

- Branding: Incorporate your company’s logo and colors to reinforce your brand image.

- Headers and Footers: Use headers for clear section divisions and footers to include legal information or disclaimers.

- Fonts and Colors: Select fonts and colors that are easy to read and professional, avoiding overly bright or complex styles.

Tailoring the Content to Your Business

Customizing the content is equally important. Depending on the types of services you offer, you may want to add specific fields or categories for pricing, materials, or labor charges. You can also adjust payment terms or late fee policies to better suit your business practices. The flexibility of a personalized document allows you to include all the relevant details that will make the billing process more efficient.

- Service Categories: Create sections for different types of work, such as diagnostics, parts, or labor.

- Pricing Adjustments: Include fields for discounts, promotions, or special charges that may apply.

- Payment Instructions: Provide clear, customized payment methods that suit both you and your clients.

By customizing your billing document, you ensure that it not only looks professional but also meets the specific needs of your business, creating a smoother and more effective transaction process.

Choosing the Right Format for Your Business

Selecting the right document format for your business is essential for ensuring smooth transactions and professional communication with your clients. The format you choose should cater to the specific needs of your services, offer customization options, and be user-friendly for both you and your clients. A well-suited structure can help streamline the billing process, reduce errors, and maintain consistency across all transactions.

Considerations for Selecting a Suitable Layout

When choosing a layout, there are several factors to keep in mind to ensure it fits your business model. The format should be adaptable to different service types, provide enough space for detailed descriptions, and allow easy adjustments based on project complexity. Here are a few things to consider:

| Factor | Description | Example |

|---|---|---|

| Flexibility | Choose a layout that allows easy customization for varying service details and pricing. | Fields for labor, materials, and travel fees. |

| Clarity | The document should be easy to read and well-organized, preventing confusion for both you and the client. | Clear sections for services, costs, and payment instructions. |

| Branding Options | The format should allow for your company’s branding elements to be included, creating a professional look. | Logo, colors, and fonts that align with your brand. |

| Ease of Use | Choose a format that’s simple to fill out and doesn’t require a lot of time to complete. | Pre-filled fields for standard charges or service types. |

Adapting to Your Specific Industry Needs

Every business has its own unique requirements when it comes to documentation. If you offer a wide range of services or specialize in mo

Best Practices for Document Clarity

Creating a clear and concise billing document is crucial for ensuring smooth transactions and preventing misunderstandings with clients. A well-structured document that presents all necessary information in an easy-to-read format helps clients quickly understand charges and payment terms. By following a few best practices, you can enhance clarity and ensure that your documents are both professional and effective.

Organizing Key Information

The layout of your billing document should allow clients to quickly locate key details. A well-organized format with distinct sections for each component–such as services provided, costs, and payment terms–makes it easier to follow. Here are a few tips for maintaining clear organization:

- Use headings: Label each section clearly (e.g., “Services”, “Total Amount Due”, “Payment Terms”) so clients can easily navigate the document.

- Break it down: For complex services or pricing, break down charges into subcategories, such as labor, parts, and taxes.

- White space: Ensure adequate space between sections to avoid clutter and make the document easier to read.

Using Simple and Direct Language

Avoid using technical jargon or overly complex language in your billing documents. Instead, aim for clear, simple, and direct wording. This ensures that clients of all backgrounds can easily understand the document, regardless of their familiarity with the services you provide.

- Be concise: Use straightforward terms to describe the services performed and the costs associated with them.

- Avoid ambiguity: Be specific when listing charges. For example, instead of saying “miscellaneous charges,” specify the exact nature of the fee.

- Define terms: If you must use industry-specific terms, include brief definitions or explanations to avoid confusion.

Highlighting Important Details

Certain elements of your document should stand out to ensure that clients notice them. Key information, such as the total amount due, due date, and payment instructions, should be clearly visible to avoid any miscommunication.

- Bold or larger fonts: Use bold or larger fonts for the total amount due, making it the focal point of the document.

- Color coding: You can use subtle color accents to highlight important information, such as payment terms or late fees, but be careful not to overdo it.

- Section dividers: Use lines or boxes to separate sections, which helps to organize th

Common Mistakes in Service Billing Documents

Even with the best intentions, mistakes can easily occur when creating billing documents. These errors can lead to confusion, delayed payments, and even a negative impression of your business. Being aware of the most common mistakes can help you avoid them and create a more professional and effective document for your clients. Here are a few key pitfalls to watch out for when preparing your billing documents.

Missing or Incomplete Information

One of the most frequent mistakes is omitting essential details or leaving sections incomplete. This can make it difficult for the client to understand the charges, leading to delays or disputes. Always ensure that you include all the relevant information, such as a breakdown of services, prices, and payment terms.

- Missing client details: Failing to include the client’s name or contact information can create confusion, especially if multiple clients are being served.

- Omitting service descriptions: Not specifying what was done or what materials were used can lead to misunderstandings about the charges.

- Incomplete pricing: If any part of the cost is left unclear or unlisted, clients may question the total amount due.

Errors in Calculations

Mathematical errors, whether it’s in the calculation of labor hours, material costs, or taxes, are a common issue. Even a small mistake can lead to overcharging or undercharging, which might impact your business’s reputation. Double-check all calculations before sending the document to ensure accuracy.

- Incorrect totals: A simple miscalculation in the total amount due can cause problems when it’s time for payment.

- Unaccounted-for taxes or fees: Failing to add taxes or other charges like service fees can lead to discrepancies when clients make payments.

- Overlooking discounts: If you offer discounts or promotions, make sure they are applied correctly to avoid billing errors.

Unclear Payment Terms

Another frequent issue is not clearly outlining the payment terms. If the client is unsure about when or how to pay, it can lead to delays. Make sure your payment terms are clear and easy to understand, including the due date and acceptable payment methods.

- Ambiguous due dates: A vague or unclear due date can lead to late payments. Always specify when the payment is expected.

- Unspecified payment methods: If clients aren’t sure how they can pay, they may hesitate or delay payment. Always provide clear instructions on payment options.

- Lack of late fees or penalties: If you have a late fee policy, be sure to include it so clients are aware of the consequences of missing the payment deadline.

By avoiding these common mistakes, you can create billing documents that are clear, accurate, and professional, leading to smoother transactions and better relationships with your clients.

Tips for Accurate Billing in Service Work

Ensuring accuracy in billing is essential for maintaining trust and transparency with your clients. In service-based businesses, where costs can vary depending on time, materials, and labor, accurate and detailed documentation is key to avoiding misunderstandings and ensuring timely payments. By following a few simple tips, you can streamline your billing process and provide clear, reliable information to your clients.

Track Time and Materials Carefully

Accurate tracking of the time spent on each task and the materials used is one of the most important aspects of creating an accurate billing document. Without proper documentation, it’s easy to overlook or miscalculate the resources required for a particular job.

- Log labor hours: Keep a detailed record of the time spent on each task. Consider using time tracking tools or apps to simplify this process.

- Itemize materials: List all materials used, including quantities, unit prices, and any other associated costs. This ensures complete transparency for the client.

- Account for extras: If any additional materials or services were needed unexpectedly, be sure to record and include them in the final billing document.

Be Transparent with Pricing

Clear and transparent pricing helps prevent disputes and builds trust with clients. Avoid using vague terms or rounding up prices. Instead, provide detailed pricing for every service, part, or action taken during the job.

- Breakdown costs: Clearly separate labor, parts, and any other charges. This makes it easier for clients to understand exactly what they’re paying for.

- Offer quotes beforehand: Whenever possible, provide a detailed quote in advance to manage client expectations regarding pricing.

- Clarify hourly rates: If you charge by the hour, ensure that your rate is clearly stated and that you have a clear record of hours worked.

Double-Check Your Work

Even if you’ve been meticulous, errors can still creep in. Before sending out any billing document, make sure to review it carefully for accuracy. Small mistakes can lead to larger problems, including delayed payments or client dissatisfaction.

- Revisit totals: Double-check all calculations, including the subtotal and final amount, to ensure there are no errors.

- Cross-r

How to Handle Payment Terms on Billing Documents

Establishing clear and precise payment terms is essential for maintaining healthy cash flow and reducing confusion in business transactions. A well-defined set of payment terms helps clients understand their obligations and the expectations surrounding the timing and method of payment. By addressing payment terms effectively in your billing documents, you can ensure that both you and your clients are on the same page, leading to smoother financial operations.

Key Components of Payment Terms

Payment terms should be easy to find and understand in the billing document. They typically include details such as the due date, accepted payment methods, and any penalties for late payments. Being transparent about these components upfront will help prevent misunderstandings.

Component Description Example Due Date The specific date by which payment should be made. “Payment is due within 30 days of service completion.” Accepted Payment Methods The types of payments you accept (e.g., credit cards, bank transfers, checks). “Payments can be made via credit card, PayPal, or bank transfer.” Late Fees Charges imposed if payment is not made on time. “A 5% late fee will be applied if payment is not received within 15 days of the due date.” Early Payment Discounts Discounts for clients who pay before the due date. “A 2% discount will be applied if payment is made within 10 days.” Best Practices for Clear Payment Terms

To ensure clarity and minimize confusion, here are some best practices for handling payment terms in your billing documents:

- Be specific: Avoid vague language. Clearly state the payment due date, the preferred methods of payment, and any late fees or discounts.

- Highlight the terms: Make payment terms stand out on the document, possibly by placing them in a separate section or using bold text.

- State penalties for late payments: Clearly define the consequences of late payments to motivate clients to pay on time.

- Offer flexibility: If possible, offer multiple payment methods to cater to clients’ preferences, making it easier for them to pay.

By including these key elements and following best practices, you can set clear expectations with your clients regarding payment and ensure a smoother transaction process. Well-communicated payment terms not only promote timely payments but also build trust and professionalism in your business relationships.

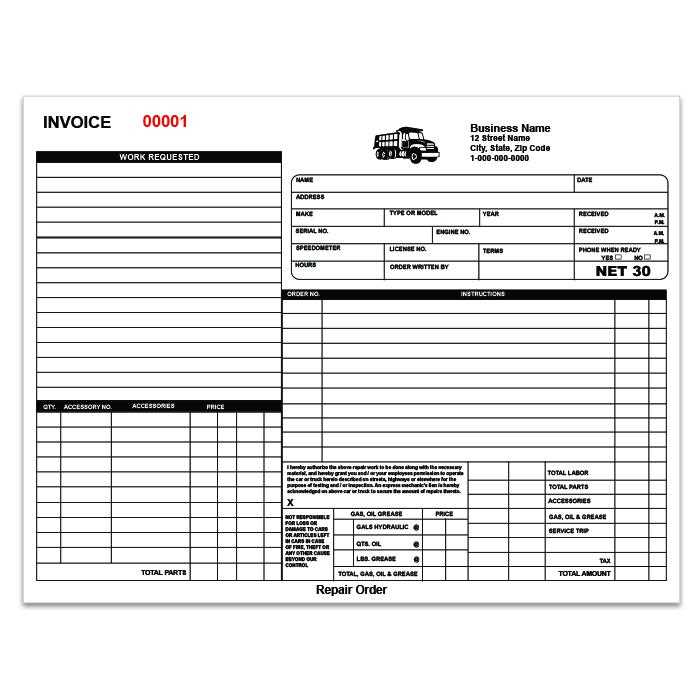

Billing Documents for Different Service Jobs

Different types of service jobs require different approaches when creating billing documents. Whether you are performing routine maintenance, dealing with an emergency fix, or handling a complex project, the structure of your documentation should reflect the nature of the work completed. Tailoring the document to suit each type of job can help ensure that all relevant information is captured and presented clearly, fostering professionalism and trust with your clients.

Routine Service Jobs

For regular maintenance or minor fixes, the billing document should be straightforward, focusing on a few key aspects such as the time spent and any parts used. This type of job often involves consistent tasks and pricing, so the document should highlight the scope of work and its predictability.

- Simple pricing: Clearly outline fixed costs for standard services.

- Time tracking: Include a clear breakdown of hours worked if applicable.

- Standard materials: List common parts or consumables used during the service.

Emergency or Urgent Jobs

Emergency or urgent work often requires quick turnaround and may involve additional charges due to time constraints or the complexity of the job. When creating a billing document for such jobs, it is important to outline the urgency of the work and any extra fees applied.

- Rush fees: Include any additional costs for urgent service or after-hours work.

- Clear deadlines: Specify the timing of the service and whether expedited delivery influenced the cost.

- Detailed explanation: Provide a breakdown of emergency-related tasks or complications that led to additional charges.

Complex or Extensive Service Jobs

For large or intricate projects, your billing document should be more detailed to account for the complexity and scope of the job. This may include multiple phases of work, special equipment used, or higher-skilled labor required. Clear documentation helps clients understand the breakdown of costs and ensures that no aspect of the service is overlooked.

- Project phases: Break down the service into different st

Tracking Payments with Service Billing Documents

Efficiently tracking payments is crucial for maintaining a smooth cash flow and ensuring that clients meet their financial obligations. By organizing and monitoring payment statuses, service providers can minimize delays, reduce errors, and maintain positive relationships with customers. A well-managed tracking system for payments helps both parties stay on the same page regarding what has been paid and what is still due.

Setting Up a Payment Tracking System

Before diving into tracking payments, it’s important to set up a system that’s easy to follow and update. This system can range from simple spreadsheets to more advanced accounting software, depending on the complexity of your business. The goal is to make sure that every transaction is documented and easy to retrieve when needed.

- Use unique reference numbers: Assign a unique identifier to each billing document to help track payments more efficiently.

- Record all payment details: Log the payment date, amount, method, and any reference number provided by the client.

- Update payment status: Regularly update the status of each job to reflect whether it has been fully paid, partially paid, or still outstanding.

Methods for Monitoring Payments

Once your system is in place, you can begin actively tracking payments. Whether you use digital tools or manual methods, it’s essential to ensure accuracy. Some popular methods for tracking payments include:

- Spreadsheets: Simple yet effective, spreadsheets can be customized to track payment dates, amounts, and outstanding balances. They are a good option for smaller businesses.

- Accounting software: Programs like QuickBooks or FreshBooks can automate many aspects of payment tracking, including sending reminders, calculating balances, and generating reports.

- Manual logs: For those who prefer a hands-on approach, keeping a physical log or binder with payment records can be effective, though it requires more time and attention.

Handling Unpaid or Late Payments

Late or missed payments can be a common issue in service-based businesses. Having a clear follow-up process is essential to address these situations quickly and professionally. Effective communication is key to resolving these issues and ensuring that clients understand the importance of timely payments.

- Send reminders: After the payment due date has passed, send a polite reminder to the client, either via email or a phone call.

- Provide clear terms: Be upfront about your late fee policies and ensure that they are stated clearly in your original documentation to avoid

Incorporating Taxes into Service Billing Documents

Including taxes in billing documents is an essential aspect of running a compliant and transparent business. Properly accounting for taxes ensures that your service transactions align with local laws and regulations, while also helping clients understand the full cost of services provided. Whether it’s sales tax, service tax, or other applicable charges, it is crucial to clearly reflect tax calculations in your billing statements.

Understanding Tax Rates and Categories

Before incorporating taxes into your documents, it’s important to understand the different types of taxes that may apply to your services. These can vary depending on your location and the nature of the work performed. Most regions impose sales taxes on services, and some might require specific rates for certain categories of work or materials used. Here are a few key tax categories to consider:

- Sales Tax: This is the most common tax applied to goods and services. The rate may differ by state, country, or region.

- Service Tax: Certain types of services may be subject to a special tax, which varies depending on local laws.

- Excise Tax: Some businesses may need to account for excise taxes, especially if specialized tools or equipment are involved in the service provided.

How to Include Taxes on Your Billing Statement

Accurate tax inclusion on your documents is crucial to ensure you charge clients the correct amount and remain compliant with tax regulations. Here’s how you can include taxes in a clear and understandable way:

- Identify the applicable tax rate: Research the relevant tax rate(s) for your services. Ensure that the correct rate is applied to the total cost of the service.

- Calculate the tax amount: Multiply the taxable amount by the tax rate to determine the tax amount. For example, if the service costs $100 and the tax rate is 10%, the tax amount would be $10.

- Show taxes as a separate line item: Clearly indicate the tax amount on your document as a distinct line item. This makes it easier for clients to see how much tax they are paying and ensures transparency.

- Include the total cost: After listing the tax, include the total cost, which is the sum of the service charges and the tax amount. This allows clients to see the full payment due at a glance.

Why Digital Billing Documents are More Efficient

In today’s fast-paced business world, adopting digital methods for managing billing and payments has become increasingly important. Digital billing documents streamline the entire process, offering speed, accuracy, and greater flexibility compared to traditional paper-based methods. With the right digital tools, businesses can enhance workflow, reduce errors, and improve client satisfaction–all while saving valuable time and resources.

Speed and Convenience

One of the most significant advantages of digital billing documents is the speed at which they can be generated, sent, and processed. Instead of waiting for paper invoices to be printed, mailed, and received, digital documents can be delivered instantly via email or through an online platform. This quick turnaround helps businesses get paid faster and reduces administrative delays.

- Instant delivery: Digital documents can be sent to clients immediately after completion, eliminating the time it takes for physical delivery.

- Immediate acknowledgment: Clients can quickly review and respond to digital invoices, facilitating faster payment processing.

- Automated reminders: Digital tools can automatically send payment reminders, reducing the need for manual follow-ups.

Cost-Effectiveness

Switching to digital billing reduces the costs associated with printing, paper, postage, and physical storage. These savings can add up over time, especially for businesses that deal with a high volume of transactions. Additionally, digital invoices can often be generated automatically, further reducing the need for manual labor and potential human error.

- Reduced material costs: There’s no need for paper, ink, or postage when billing clients digitally.

- Lower administrative overhead: Digital tools can automatically fill in recurring information, such as client details or service descriptions, saving valuable time for employees.

- Environmental benefits: By reducing paper usage, businesses contribute to sustainability efforts and cut down on waste.

Improved Accuracy and Organization

Digital billing documents are less prone to human error compared to manual entries on paper. With automated calculations, the chance of incorrect totals, tax miscalculations, or missing line items is minimized. Additionally, digital files can be easily stored, organized, and retrieved, allowing for a more efficient management system.

- Auto-calculation: Digital platforms automatically calculate totals, taxes, and discounts, reducing the chance of errors.

- Searchable records: Digital documents are easy to search and organize, making i

Legal Considerations for Service Billing Documents

When it comes to providing services and handling payments, there are several legal factors that businesses must consider to ensure compliance and avoid potential disputes. Proper documentation is not only vital for business operations but also serves as a safeguard in case of legal issues. Billing documents must clearly outline terms, conditions, and other essential details to meet legal requirements and protect both service providers and clients.

Clear Terms and Conditions

One of the most important aspects of legal compliance is the inclusion of clear terms and conditions on all service-related documents. These terms outline the expectations for both parties and can help prevent misunderstandings that might lead to legal issues later. Key elements to include are payment terms, deadlines, and the scope of services provided.

- Payment deadlines: Specify when payments are due and any penalties for late payments to avoid confusion or disputes.

- Scope of work: Clearly describe the services to be provided and any limitations to prevent claims of misrepresentation or unfulfilled services.

- Warranties or guarantees: Include information about any warranties or guarantees on the work completed, as well as the duration and limitations of such guarantees.

Tax Compliance and Rates

Depending on your location, taxes may be applicable to the services you provide. It is essential to ensure that your documents reflect the correct tax rates and comply with any relevant tax laws. Failing to include appropriate taxes or charging the wrong amount could result in fines or penalties.

- Sales tax: Ensure that sales tax is calculated correctly based on local or national tax rates, and include it as a separate line item in the billing document.

- Service-specific taxes: In some areas, specific services may have additional taxes. Research and understand which services are taxable in your region.

- Tax-exempt status: If your client is tax-exempt, make sure to properly document this to avoid charging unnecessary taxes.

Record Keeping and Documentation

Maintaining accurate and organized records is not only essential for financial management but also a legal requirement. Keeping well-organized billing records ensures that you can provide proof of transactions in the event of audits, disputes, or legal proceedings.

- Keep copies: Retain copies of all b