Free Small Business Invoice Template Excel for Simple and Professional Billing

Managing financial transactions and ensuring timely payments is a critical part of any operation. For those handling their own accounting or working with limited resources, having an efficient way to track and organize charges is essential. Fortunately, simple yet powerful solutions are available to help with this task, allowing users to easily create, customize, and manage their payment records. With the right resources, maintaining clarity and professionalism becomes less time-consuming and more accurate.

Whether you’re a freelancer, a consultant, or running a smaller operation, utilizing well-designed software or tools can dramatically improve your workflow. With just a few clicks, you can generate polished documents that include all the necessary details for successful transactions. These solutions also offer flexibility, allowing you to adjust fields as your needs evolve. As a result, you’ll save time and reduce the risk of errors, all while maintaining a level of professionalism that your clients will appreciate.

By integrating these practical resources into your routine, you can focus on growing your efforts instead of worrying about administrative tasks. A well-organized payment system not only streamlines your day-to-day activities but also gives you a clear overview of your financial health. Whether for quick adjustments or long-term tracking, these tools offer a simple approach to managing your monetary exchanges with ease and confidence.

Why Use an Invoice Template for Small Businesses

Maintaining clear and consistent records is vital when managing financial transactions. For those operating independently or with smaller teams, using an organized system to generate payment requests can greatly simplify accounting tasks. By relying on pre-designed formats, entrepreneurs can avoid confusion, ensure accuracy, and speed up the process of tracking incoming payments. A well-structured document helps ensure that every transaction is recorded properly and provides a professional appearance for clients.

Using ready-made forms not only saves valuable time but also reduces the risk of making costly errors. Instead of spending time manually creating billing documents from scratch, you can use a standardized format that already includes key fields, such as service descriptions, payment terms, and contact information. This makes the entire process more efficient and reliable, leaving more time to focus on other important areas of your operation.

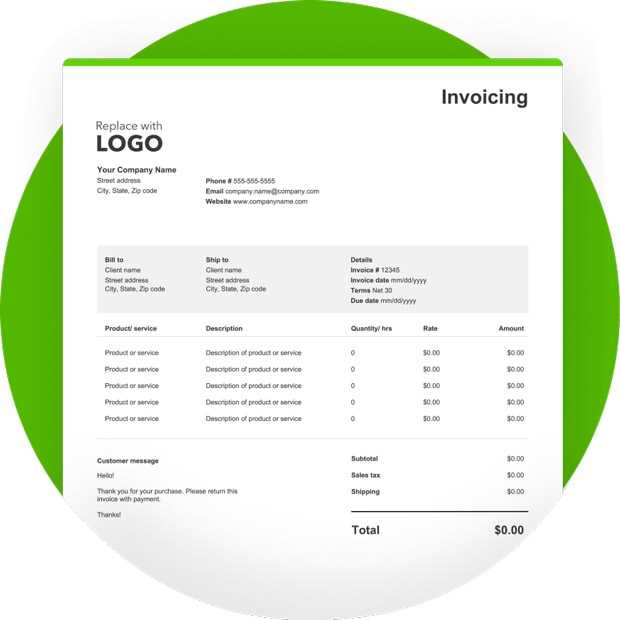

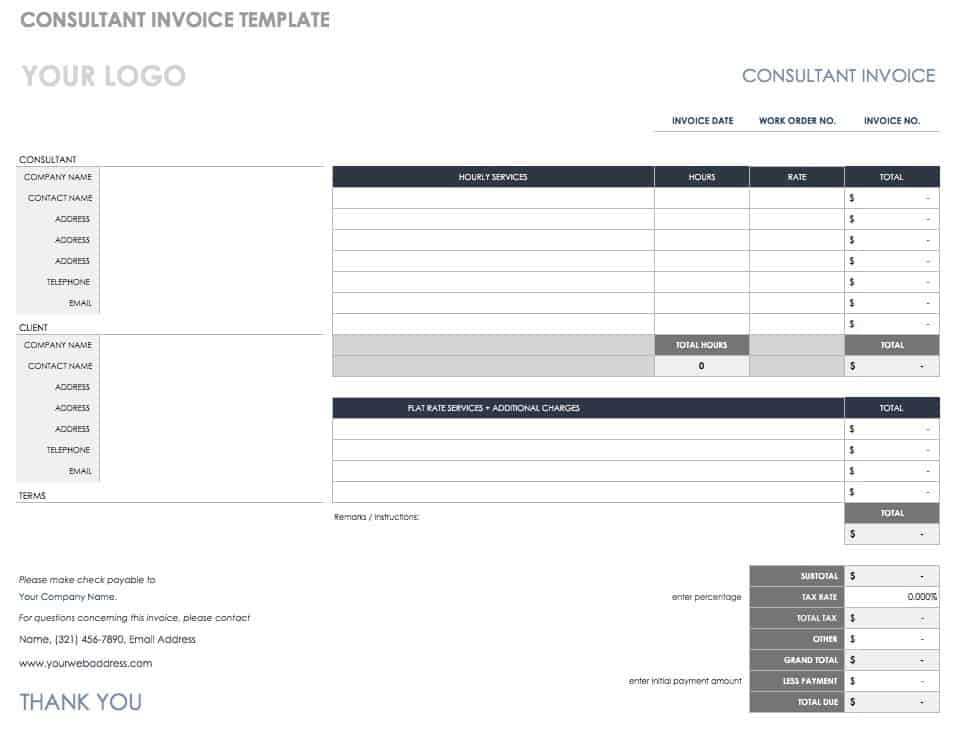

Below is an example of how such a format might look, ensuring that every essential detail is included:

| Description | Amount | Due Date | Client Information |

|---|---|---|---|

| Consulting Service | $500 | December 1, 2024 | John Doe |

| Design Work | $300 | December 15, 2024 | Jane Smith |

By utilizing this kind of structure, businesses can ensure that each document is clear, accurate, and easily customizable, helping to streamline financial processes and avoid administrative burdens.

Benefits of Excel for Invoicing Tasks

Using spreadsheet software for generating payment documents offers significant advantages. It combines flexibility, ease of use, and powerful functions that streamline administrative processes. Instead of relying on manual calculations and formatting, this tool provides automated solutions that save time and reduce errors. Whether it’s for creating multiple records or tracking payments, spreadsheets offer features that support effective financial management.

Here are some key benefits of using spreadsheet programs for managing payment requests:

- Customization: You can design each document to suit your specific needs, adjusting the layout, colors, and fields to match your workflow.

- Accuracy: Built-in formulas and functions ensure that calculations, such as totals and taxes, are performed automatically, minimizing the risk of mistakes.

- Efficiency: Reuse and modify existing sheets for new projects, saving time by eliminating the need to start from scratch each time.

- Tracking: Keep an organized record of all transactions, including due dates and payment statuses, which allows for easy monitoring of outstanding balances.

- Cost-Effective: Unlike specialized invoicing software, this tool is often free or comes bundled with other office software, making it an affordable option for many.

Furthermore, you can integrate advanced features such as pivot tables for summarizing financial data or create charts to visualize cash flow. With these capabilities, spreadsheet programs provide both simplicity for basic tasks and powerful tools for detailed analysis, making them an excellent choice for those looking to manage their financial records more efficiently.

How to Create an Invoice in Excel

Creating a payment request document from scratch may seem like a daunting task, but with the right tools and a step-by-step approach, the process can be simple and quick. By using a spreadsheet program, you can easily generate customized records that are both professional and efficient. This method allows you to track and manage your transactions with ease, ensuring that every detail is properly documented and calculated.

Follow these steps to create a payment record in a spreadsheet:

- Set Up Your Header: Start by adding your contact details at the top of the document. This includes your name or company name, address, phone number, and email. Also, include the client’s details for clarity.

- Add the Date and Unique Number: Insert the date of issue and assign a unique reference number for tracking purposes. This helps with record keeping and ensures that you can quickly identify the document later.

- List the Services or Products: Create a table with columns for the description of services or products provided, quantities, unit prices, and totals. This will allow you to easily calculate the cost of each item or service.

- Include Payment Terms: Be sure to add any relevant terms, such as the payment due date, accepted methods of payment, and late fees, if applicable. This information sets clear expectations with your clients.

- Calculate Totals: Use built-in functions to sum the total amount due, including any applicable taxes or discounts. You can also add a grand total at the bottom of the document for quick reference.

- Finalize the Document: Ensure all sections are complete, and format the document for clarity. Use bold text for headings and appropriate spacing to make the document easy to read.

Once your document is ready, save it and send it to your client. You can easily modify or reuse the same layout for future transactions, ensuring consistency and saving time.

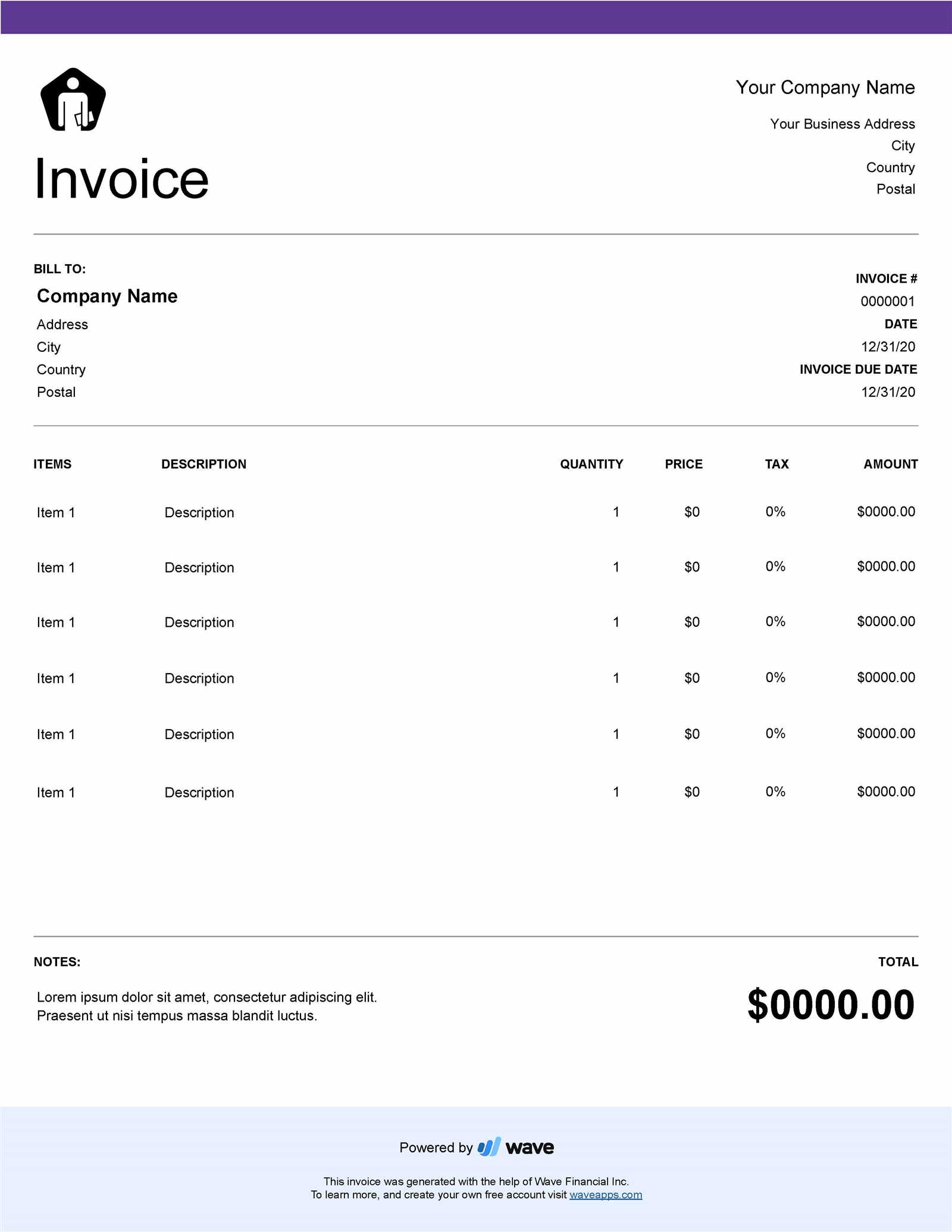

Customizing Your Small Business Invoice

Every organization has unique needs, and customizing your payment request documents ensures that they reflect your specific services, brand identity, and client relationships. Personalizing these documents not only helps convey professionalism but also allows you to tailor the layout and information to suit your workflow. By adjusting certain elements, you can create a consistent format that enhances both the appearance and functionality of your financial records.

Here are some key elements to focus on when personalizing your payment documents:

- Branding: Incorporate your logo, colors, and fonts to make your documents instantly recognizable. This adds a professional touch and helps reinforce your brand’s identity.

- Contact Information: Ensure your contact details, including email, phone number, and website, are clearly displayed. This makes it easy for clients to reach you with any questions or concerns.

- Service Descriptions: Provide clear, detailed descriptions of the work or products provided. You can customize the categories and columns based on the types of services you offer, helping clients understand the charges more easily.

- Payment Terms: Tailor the payment terms to reflect your preferred conditions. Whether you offer early payment discounts or specific due dates, include this information prominently to avoid any confusion.

- Tax and Discount Fields: If applicable, add fields for taxes and discounts to ensure accuracy in calculations. Customize these sections to match the applicable rates for your region or industry.

By making these adjustments, you create a more efficient system for tracking payments, which also improves the client experience. A personalized document provides all the necessary details in an easy-to-read format, encouraging prompt payment and reinforcing your professional reputation.

Common Invoice Mistakes to Avoid

Even minor errors in your payment documents can lead to confusion, delayed payments, and a lack of professionalism. It’s essential to ensure that every detail is accurate and clearly presented to avoid misunderstandings. By being aware of the most common mistakes, you can improve your financial processes and maintain strong relationships with clients.

Here are some frequent errors to watch out for when preparing payment requests:

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s contact details are correct. Missing email addresses, incorrect phone numbers, or outdated information can cause communication issues and payment delays.

- Unclear Payment Terms: Failing to specify payment deadlines, methods, or penalties for late payments can lead to confusion. Make sure your terms are clearly outlined so there are no misunderstandings about when and how payment is expected.

- Not Including a Unique Reference Number: A unique identifier for each transaction makes it easier to track payments and resolve any discrepancies. Without this, it can be challenging to match payments to their respective documents.

- Errors in Calculations: Manual errors in adding up totals or applying tax rates can cause discrepancies. Ensure that all formulas or totals are correct, especially when taxes, discounts, or other adjustments are involved.

- Inconsistent Format or Layout: A disorganized or inconsistent layout can make the document harder to read and create a less professional impression. Keep the design simple and consistent, using clear headings and enough spacing to highlight important details.

- Omitting Necessary Details: Always include all relevant information such as service descriptions, quantities, unit prices, and totals. Leaving out key elements can delay the payment process and may result in clients questioning the charges.

By taking care to avoid these mistakes, you ensure that your financial records are clear, accurate, and professional, leading to smoother transactions and stronger client trust.

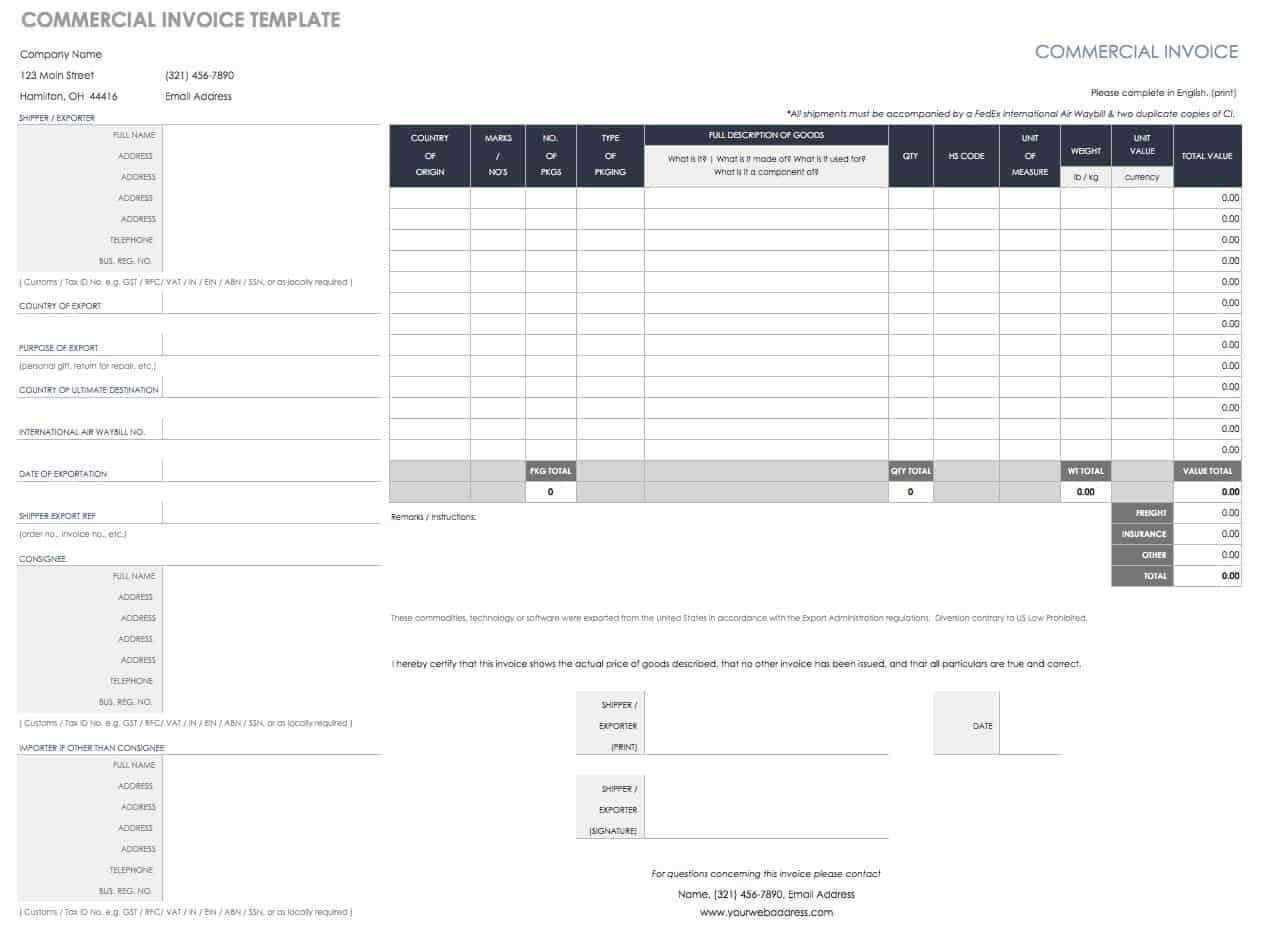

Essential Information for Accurate Invoices

To ensure smooth transactions and avoid delays, it’s crucial to include all necessary details in your payment documents. Each element serves a specific purpose, providing both clarity for your client and a record of the transaction for your own financial tracking. Missing any key information can lead to confusion, disputes, or payment delays. By organizing your documents effectively, you create a clear agreement between you and your client, setting expectations and protecting both parties.

Key Elements to Include

Here are the essential components that must be included in every payment record:

- Contact Information: Always include your company name (or personal name if you’re a freelancer), address, email, and phone number. Additionally, make sure the client’s contact details are listed to avoid any confusion.

- Unique Reference Number: Assign a unique identifier to each transaction to easily track and refer to payments. This helps both parties keep records organized.

- Date of Issue and Due Date: Clearly display the date when the document was issued and the deadline by which the payment should be made. This sets clear expectations for both parties.

- Detailed Description of Goods or Services: List each item or service provided, with enough detail to ensure that the client understands what they are being charged for. Include quantities, unit prices, and any other relevant information.

- Payment Terms: Specify any terms, such as discounts for early payment or penalties for late payments. This section clarifies the conditions under which the payment is due and how it should be made.

Additional Considerations

- Tax Information: If applicable, include a breakdown of any taxes or VAT that apply to the amount being charged. Ensure these are clearly marked to avoid confusion.

- Total Amount Due: Provide a final total at the bottom of the document, summing up all items, taxes, and applicable discounts. This makes it easy for clients to know the exact amount owed.

By including these critical details, you can ensure that your payment documents are both clear and professional, reducing the risk of errors and helping to maintain positive client relationships.

Automating Invoice Generation with Excel

Manually creating payment documents can be time-consuming and prone to errors, especially when dealing with multiple clients and recurring transactions. Automating the generation of these records can significantly streamline the process, saving time and reducing the risk of mistakes. By setting up automated functions, you can quickly generate accurate and consistent payment requests, allowing you to focus on other important aspects of your work.

Excel provides several tools and functions that make automation easy, including formulas, data validation, and pre-set calculations. With a few simple adjustments, you can create a system that automatically fills in certain fields, updates totals, and even generates new records based on input data. For example, by setting up a basic template that pulls client information from a separate list, you can automatically populate client names, addresses, and transaction details with minimal effort.

Additionally, Excel allows for the use of macros, which can record a series of actions and then execute them with a single click. This feature is particularly useful for tasks that require repetitive actions, such as applying the same format or recalculating totals across multiple documents. Once set up, automation tools can save valuable time, reduce the chance of human error, and help ensure that every document is consistent and professional.

How to Track Payments with Excel Templates

Keeping track of payments is essential for maintaining cash flow and staying organized. When handling multiple transactions, manually recording each payment can quickly become overwhelming. Using a well-structured system within a spreadsheet allows you to easily monitor which payments have been made, which are overdue, and what the outstanding balances are. This method provides a clear overview of your financial situation and helps ensure you don’t miss any critical transactions.

To effectively track payments, you can set up a dedicated worksheet that includes key details such as client names, due dates, amounts due, and payment status. As payments are made, you can update the status to reflect whether the amount is paid, pending, or overdue. By incorporating formulas, you can automatically calculate totals, apply discounts, and even track outstanding balances. Using conditional formatting, you can highlight overdue payments, making them easy to spot at a glance.

Additionally, you can use separate sheets or tabs to track payments by month or client, enabling you to quickly assess the status of any transaction. Creating a summary sheet that compiles this data into one place makes it easier to track overall performance and identify trends, such as frequent late payments. With a few simple steps, a spreadsheet can become a powerful tool for managing and tracking payments efficiently, reducing the time spent on manual record-keeping.

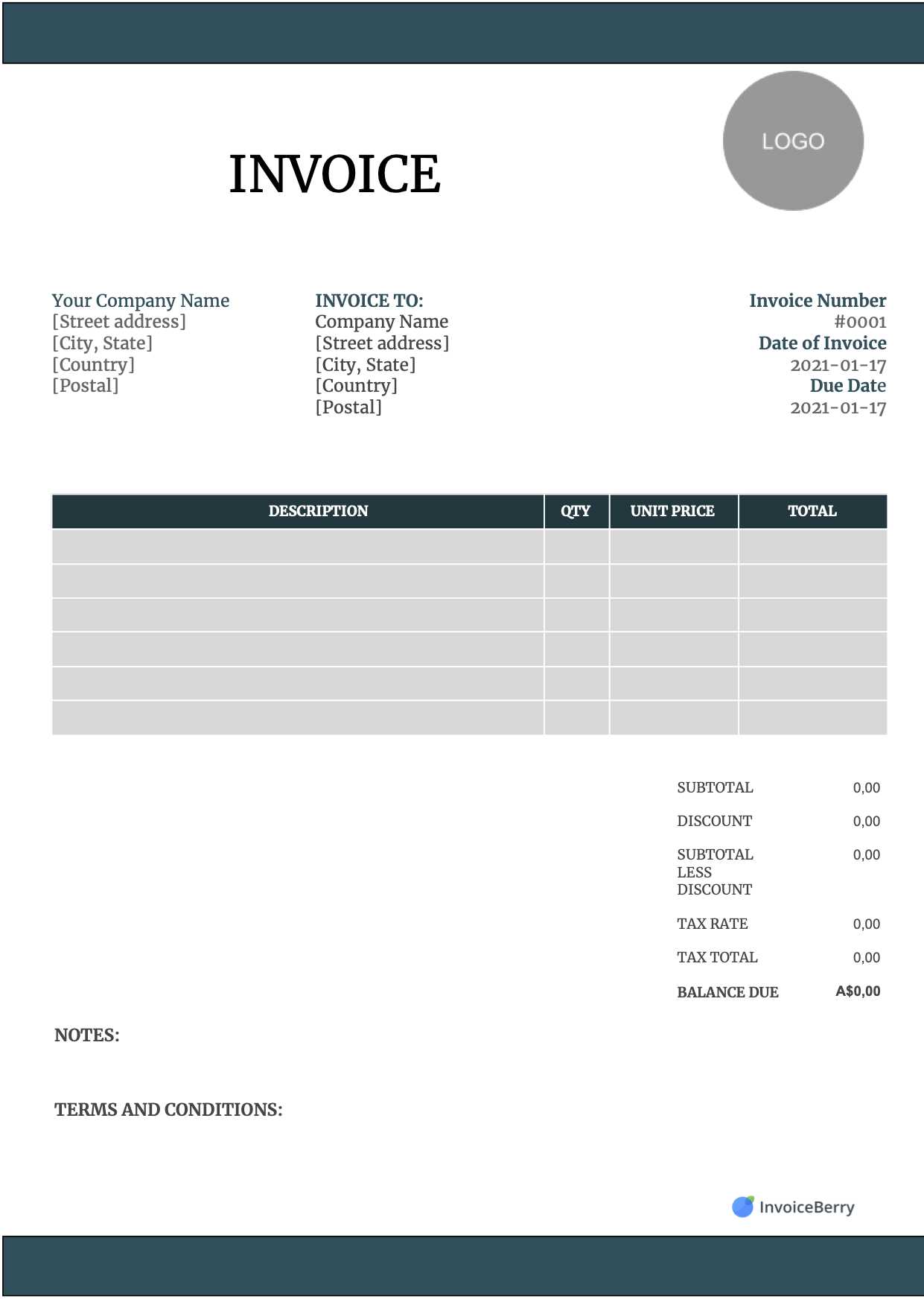

Free Invoice Templates Available

For those who need a quick and professional way to create payment documents without the hassle of starting from scratch, there are many free resources available online. These pre-made forms are designed to save time and ensure accuracy, providing a structured format that you can easily customize to suit your needs. Whether you’re just starting out or need a simple solution for everyday transactions, these free tools can help you stay organized and look professional in the eyes of your clients.

Here are some of the key features of free resources you can find:

- Pre-Designed Layouts: Many free forms come with a ready-to-use format that you can quickly fill in with your own details. These layouts often include essential fields such as item descriptions, amounts, and payment terms.

- Customizable Fields: These documents are fully customizable, allowing you to adjust details such as payment methods, due dates, or any other specific information related to your transactions.

- Variety of Styles: From basic designs to more advanced options with your branding elements, there is a wide range of styles to choose from, ensuring you can find one that suits your preferences and needs.

- Easy to Use: Most templates are user-friendly, making it simple for anyone, even with little experience, to create and send payment requests without any complicated software or design skills.

- Free Access: These forms are available for download at no cost, which makes them a great option for those looking to streamline their financial processes without investing in expensive software.

These resources can be an excellent starting point for anyone who wants to stay organized and present a professional image, especially when time or budget is a constraint. Simply download a free template, customize it with your details, and you’re ready to send out accurate and professional payment requests.

Designing Professional Invoices with Excel

Creating well-organized and polished payment documents is an essential part of presenting a professional image to your clients. A clean, structured layout not only ensures clarity but also builds trust, as clients are more likely to pay attention to and act upon a clear, easy-to-read request. Using spreadsheet software allows for flexibility and control, enabling you to design documents that are both functional and visually appealing.

When designing a payment record, it’s important to focus on both aesthetics and practicality. A professional layout should clearly highlight the most important details–such as amounts due, due dates, and contact information–while maintaining a simple and uncluttered appearance. Here’s a basic structure that you can use to create an effective document:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 10 hours | $50/hour | $500 |

| Website Design | 1 | $1000 | $1000 |

| Total | $1500 |

In this example, a simple table format clearly lists the services provided, quantities, and total costs. You can further enhance the design by including your logo, adjusting the color scheme to match your branding, and using bold text for headers and totals. The goal is to keep it clean and easy to navigate while ensuring that all the key details are prominently displayed.

In addition to the layout, consider using built-in functions to calculate totals, apply tax rates, and track payments. This makes the process of generating new documents faster and reduces the risk of calculation errors. The flexibility of spreadsheet software also allows for future adjustments, so as your needs grow, your payment documents can evolve with you.

How to Manage Multiple Invoices Efficiently

When handling a large volume of payment requests, staying organized is key to ensuring smooth operations and maintaining accurate financial records. Managing multiple transactions can be overwhelming without a proper system in place. By using structured processes and tools, you can track each document efficiently, reduce the chances of errors, and save valuable time. Whether you’re dealing with a few or many clients, a systematic approach will help you stay on top of payments and ensure nothing slips through the cracks.

Organizing and Tracking Payments

Here are several strategies for managing multiple transactions effectively:

- Use a Centralized Record System: Keep all payment documents in one place, whether in digital folders or on a spreadsheet. This allows you to easily access, review, and update records as needed.

- Number and Categorize Documents: Assign each transaction a unique number or code for quick reference. You can also categorize them by client, date, or project to simplify sorting and tracking.

- Set Payment Reminders: Use reminders to track due dates and follow up with clients when payments are nearing or past due. Many spreadsheet tools offer automatic date-based reminders.

- Implement a Color-Coding System: Use colors to visually track the status of each document–green for paid, yellow for pending, and red for overdue. This can help you quickly identify which transactions need attention.

Leveraging Technology for Efficiency

In addition to organizing your documents manually, consider using tools that can automate and streamline the process:

- Automated Calculations: Set up formulas to automatically calculate totals, taxes, and discounts. This reduces manual errors and speeds up the process of creating new documents.

- Use Templates for Consistency: Save time by using pre-designed formats for each new transaction. Customizable templates ensure that each document follows the same structure and includes all necessary details.

- Track Payment Status: Use separate columns or tabs to mark each document’s payment status (e.g., paid, pending, overdue). This will allow you to keep an eye on what has been processed and what needs further attention.

By organizing your payment records, setting clear deadlines, and utilizing digital tools, you can efficiently manage a large volume of documents and ensure timely payments without the risk of missing important details.

Integrating Payment Methods into Invoices

Providing clients with clear, accessible payment options is essential for ensuring that transactions are completed smoothly and promptly. By integrating various payment methods directly into your payment documents, you make it easier for clients to pay in their preferred way, which can speed up the payment process and reduce the chances of delays. Including this information also helps maintain a professional image, showing that you’re well-prepared to accommodate a variety of payment preferences.

When integrating payment options, it’s important to provide all the necessary details to avoid confusion. This may include account numbers, payment links, or instructions for alternative payment methods. Here is a sample layout to consider for including payment methods on your documents:

| Payment Method | Details |

|---|---|

| Bank Transfer | Account Number: 123456789 Bank: ABC Bank Routing Number: 987654321 |

| Credit/Debit Card | Visit [Payment Portal Link] to pay with your card securely. |

| PayPal | Send payments to: [email protected] |

| Cheque | Make cheque payable to: [Your Name/Company Name]. Send to [Address]. |

By including clear and concise payment methods like this, you provide clients with easy access to the options available. This ensures that no matter their preferred way to pay, the necessary information is right in front of them, helping to reduce delays and improve overall payment efficiency.

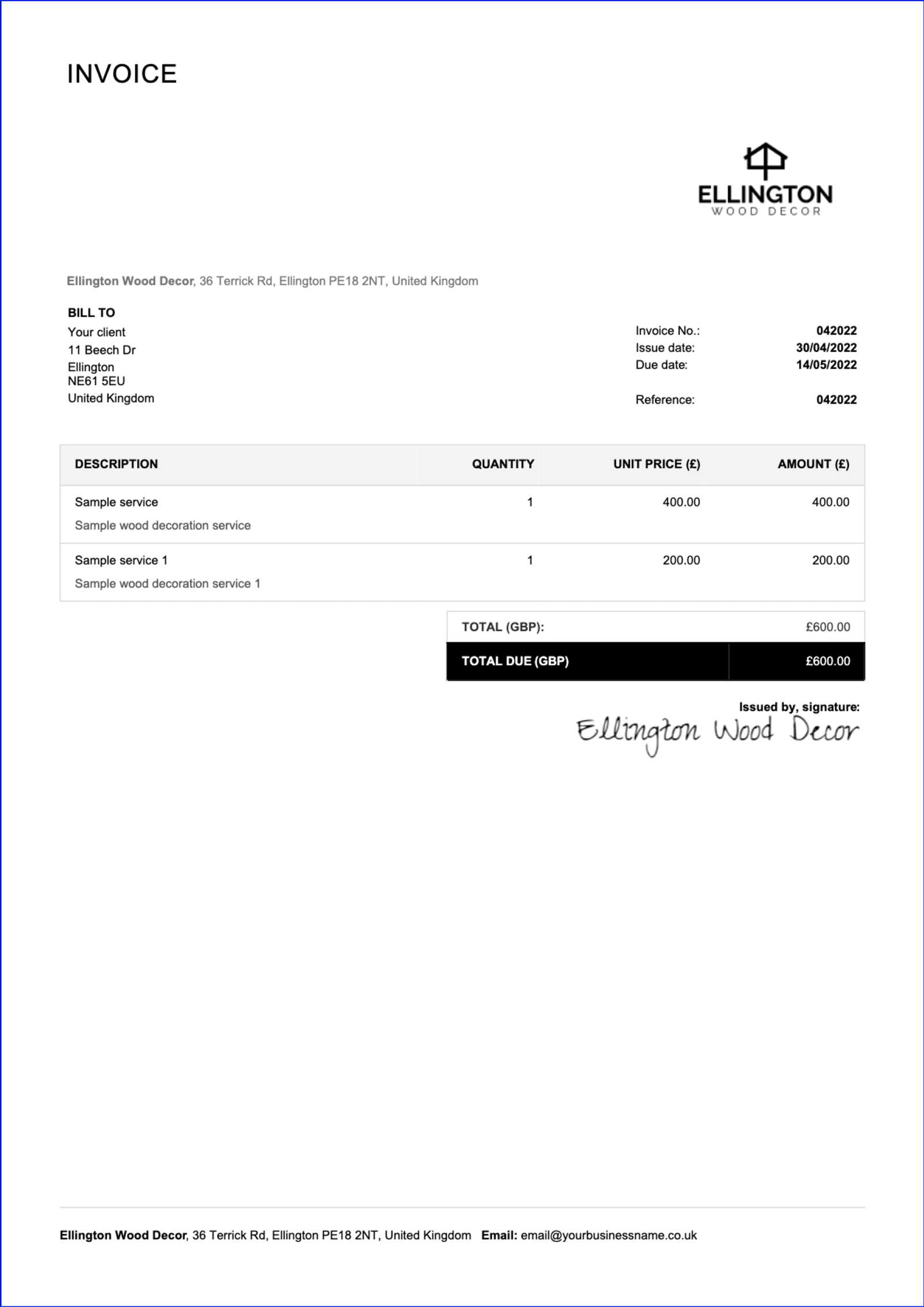

Invoice Templates for Freelancers and Contractors

Freelancers and independent contractors often juggle multiple clients and projects, making it essential to have a system in place for managing payment requests. A well-organized document is crucial for maintaining a professional image and ensuring timely payments. Having a pre-designed format for each project or client can help streamline the process, making it easier to track earnings and manage administrative tasks effectively.

For freelancers and contractors, it’s important that these payment records include all the necessary details while remaining simple and clear. Below are some key features that should be included when creating a payment document:

- Client Details: Include the client’s name, address, and contact information. This ensures that both parties have a clear understanding of the transaction and prevents any mix-ups.

- Project Description: Clearly outline the work completed, including dates, services rendered, and any special terms or conditions. This gives the client transparency and reinforces the value of the work done.

- Payment Terms: Clearly state the agreed-upon payment terms, including the total amount due, the due date, and any late fees if applicable. This prevents confusion and sets clear expectations.

- Hourly Rate or Flat Fee: If the payment is based on hours worked, include the hourly rate and the total number of hours worked. For fixed-price projects, ensure that the total fee is outlined.

- Payment Methods: List available payment methods, such as bank transfers, online payment systems like PayPal, or checks, ensuring clients know how to send their payments easily.

For maximum efficiency, freelancers and contractors can use pre-designed documents that include these elements, allowing for easy customization and reducing the time spent creating new records for each client. Below are some suggestions for creating these documents:

- Customizable Design: Choose a format that can be easily adapted to different types of work. Templates with editable fields can save time when creating new documents.

- Clear and Concise Layout: Keep the design simple, ensuring that key information like amounts due, due dates, and payment instructions stand out. A cluttered document can lead to confusion.

- Professional Branding: Include your logo or personal brand elements to enhance your professional appearance and help clients recognize your work easily.

Using a structured and easy-to-fill-out system helps ensure that freelancers and contractors can focus on their work rather than worrying about administrative tasks. By using pre-made, customizable formats, managing payments becomes more efficient and stress-free.

Ensuring Tax Compliance with Invoices

Proper documentation is essential for staying compliant with tax regulations, especially when handling payments and collecting funds. A well-prepared payment record not only helps you keep track of your income but also ensures that you meet the legal requirements for reporting taxes. Including the necessary tax-related information in your documents is crucial for both personal peace of mind and for any potential audits or inquiries by tax authorities.

Key Tax Information to Include

When preparing a payment document, make sure to include the following details to stay tax-compliant:

- Tax Identification Number (TIN): Include your tax identification number, whether it’s a personal number or a company ID, to ensure that your income can be properly attributed for tax purposes.

- Tax Rates: Specify the applicable tax rates for each item or service provided. This could include sales tax, VAT, or other region-specific taxes.

- Tax Amount: Clearly state the tax amount for each item and provide a total tax amount at the bottom of the document. This makes it easy to calculate the total due.

- Tax Exemptions (if applicable): If any items are exempt from taxes, list them separately and explain the reason for the exemption to avoid confusion or errors.

- Invoice Date and Payment Due Date: These are essential for calculating tax periods and ensuring that payments are processed within the appropriate tax timeframe.

Keeping Accurate Records

Maintaining accurate records is vital for tax reporting and compliance. To make sure your documents align with tax laws, consider these best practices:

- Store Copies of All Documents: Keep digital or physical copies of all payment records, as you may need them for tax filings or in case of a tax audit.

- Separate Tax and Non-Taxable Items: Clearly differentiate between taxable and non-taxable items on your payment record. This will make it easier when calculating totals and tax obligations.

- Regularly Update Your Records: Ensure that your records are up to date with any changes in tax rates or regulations. Set reminders to review tax laws periodically to stay compliant.

- Consult with a Tax Professional: If you are unsure about any tax-related details or requirements, it’s always a good idea to consult with a tax professional to avoid errors.

By including accurate tax information in your payment documents and keeping up-to-date records, you ensure compliance and make the tax process more manageable. This not only saves time during tax season but also reduces the likelihood of penalties or issues with tax authorities.

Using Excel for Invoice Reporting and Analytics

Tracking and analyzing payment records can significantly improve financial decision-making and help businesses identify trends, assess performance, and forecast future revenue. By utilizing spreadsheet software, you can create detailed reports that give a clear picture of your financial standing. With the right tools, you can generate insights that help optimize cash flow and identify areas for growth or improvement.

One of the primary benefits of using spreadsheet software for payment reporting is its ability to organize data, perform complex calculations, and generate visual reports like charts or graphs. Here’s how you can leverage spreadsheet tools for better tracking and analysis:

| Month | Total Amount Due | Total Paid | Outstanding Balance | Payment Status |

|---|---|---|---|---|

| January | $5000 | $4500 | $500 | Pending |

| February | $6000 | $6000 | $0 | Paid |

| March | $7000 | $3500 | $3500 | Pending |

With this data in a structured format, it’s easy to track performance over time and see trends emerge. For example, you can calculate the total amount due, total payments received, and outstanding balances at a glance. This information can help identify payment delays, forecast cash flow, and assess overall financial health.

Additionally, spreadsheet tools offer built-in features for advanced reporting and analysis, such as:

- Pivot Tables: Pivot tables allow you to summarize and analyze large amounts of data, making it easier to spot trends or group data by different categories like clients, services, or time periods.

- Charts and Graphs: You can visually represent payment data through bar charts, line graphs, or pie charts, which provide a more digestible and informative view of your financial status.

- Conditional Formatting: This feature lets you highlight specific cells based on conditions, such as overdue payments, helping you quickly identify potential issues in your records.

- Data Filtering: Filtering allows you to sort and view specific data sets, like all outstanding payments or payments from a particular client, making it easier to manage your finances.

By integrating reporting and analytics directly into your payment records, you can stay on top of your financial situation, make more informed decisions, and streamline your financial processes.