Simple Sales Invoice Template in Word for Easy and Professional Invoicing

Managing financial transactions and ensuring proper documentation is a crucial part of any business operation. Whether you are a freelancer, a small business owner, or a large corporation, having a structured and professional way to present your charges is essential for maintaining clear communication with clients. With the right tools, crafting professional billing documents can be done quickly and with minimal effort.

One of the most efficient ways to handle billing is by utilizing a digital format that allows for easy customization. This method ensures that you can personalize each document to reflect your business’s identity and meet your specific needs. A well-designed document helps avoid confusion, reduces errors, and streamlines the entire payment process.

In this guide, we will explore how you can leverage a versatile document layout that can be easily tailored to your requirements. You’ll learn how to use it for generating invoices, setting payment terms, and maintaining consistent documentation that supports smooth financial transactions with clients.

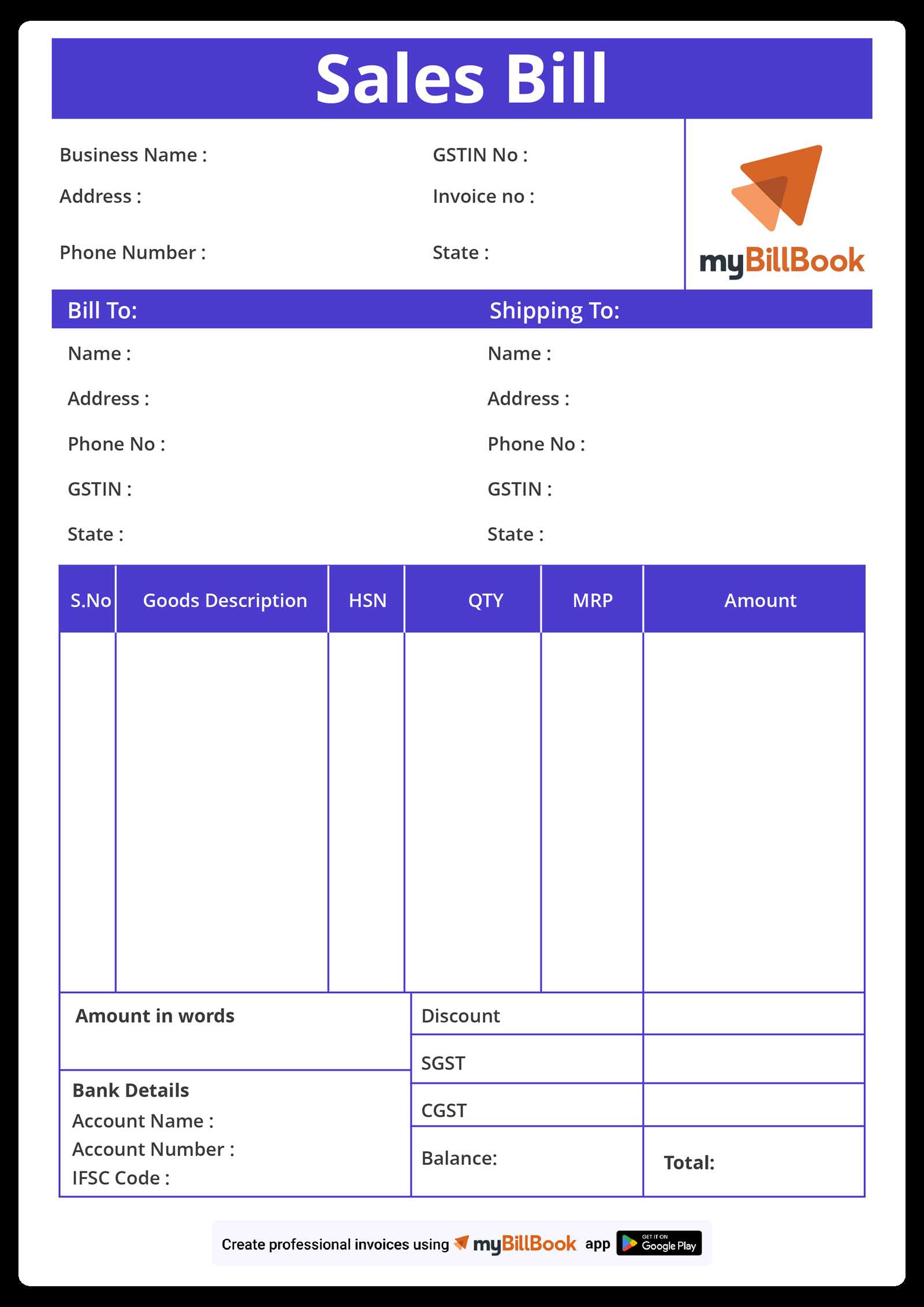

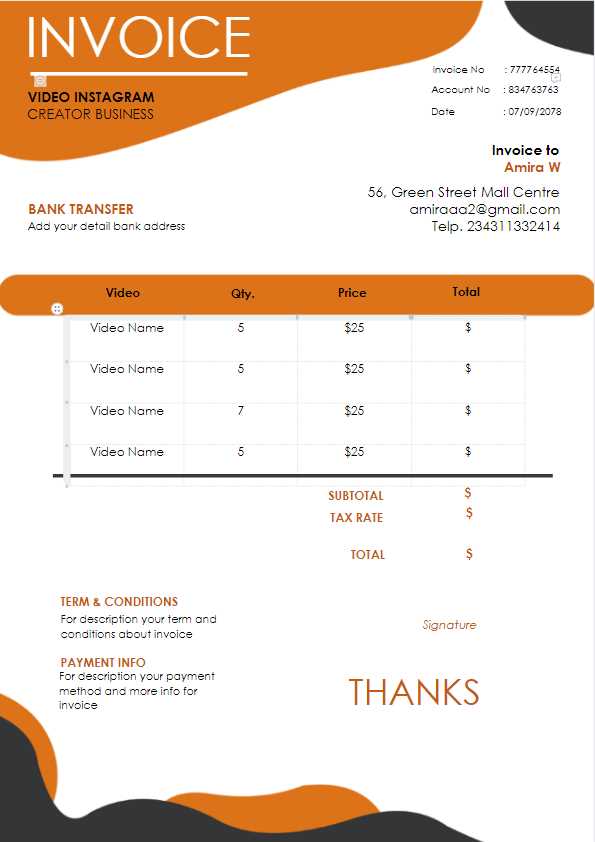

Simple Sales Invoice Template in Word

Creating effective billing documents is a fundamental task for businesses of all sizes. Whether you are providing services or selling goods, a well-structured document ensures clarity and professionalism in your transactions. Using a flexible document format allows you to quickly adapt the layout to your business’s specific needs while maintaining consistency in communication with clients.

By utilizing a straightforward layout in a word processing program, you can easily customize fields for client information, itemized lists, pricing, and payment terms. This approach saves time and helps streamline the entire invoicing process. It also reduces the likelihood of errors and ensures that all necessary details are included for a smooth transaction.

Benefits of Using a Customizable Document

One of the major advantages of using this approach is the ability to make adjustments for each client or project without starting from scratch. You can set default fields for your business details and include space for any additional notes or conditions. With this level of flexibility, every document will be uniquely tailored to each specific job while maintaining a consistent look and feel across your billing communications.

How to Customize Your Layout

To get started, simply open the layout in your preferred program and begin adjusting the fields. Enter your business information at the top, followed by your client’s name and contact details. Customize the itemized sections by adding product or service descriptions, quantities, and pricing. Make sure to include relevant terms such as payment due date and methods accepted. Finally, save the document as a template for future use, ensuring efficiency for upcoming projects or transactions.

Why Use a Sales Invoice Template?

Having a pre-designed structure for your billing documents provides numerous advantages for both efficiency and accuracy. By utilizing a ready-to-use format, you eliminate the need to recreate each document from scratch. This not only saves valuable time but also ensures that all essential information is consistently included, reducing the chance of missing critical details.

Additionally, a customizable layout can be tailored to suit your business needs, allowing you to easily incorporate specific elements such as payment terms, client information, and item descriptions. This level of organization enhances professionalism and builds trust with clients, as they can clearly see all relevant transaction details in a clear, organized manner.

Using a pre-structured document also minimizes errors. Since the format is already established, you simply need to input the necessary data, making it easier to spot mistakes and maintain accuracy. This is particularly helpful for businesses that need to generate numerous billing documents quickly and without oversight.

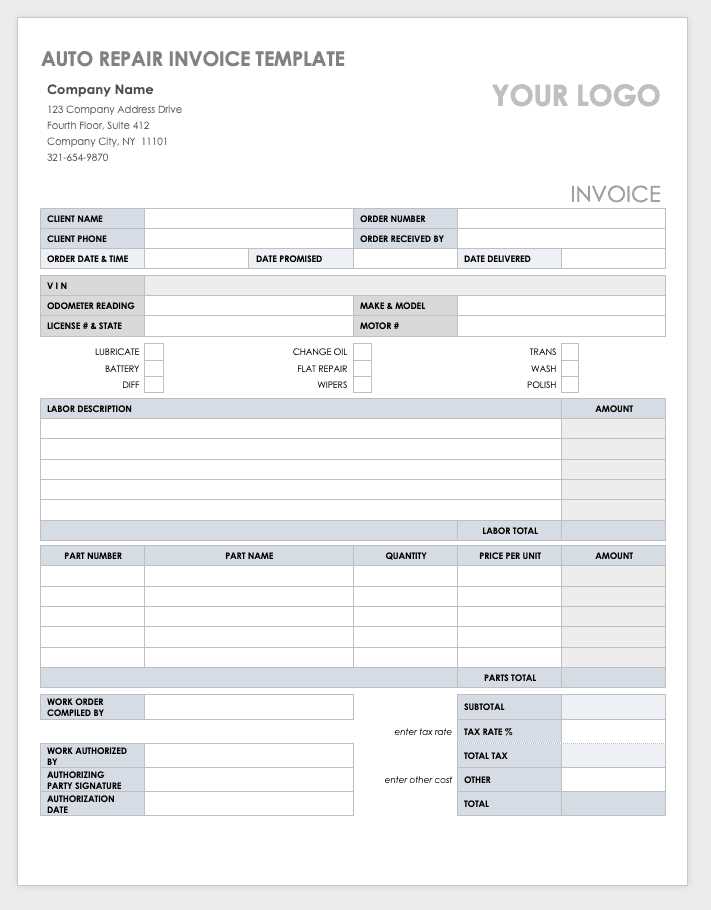

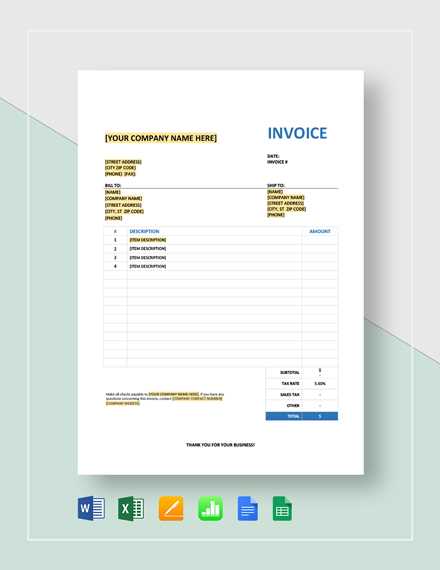

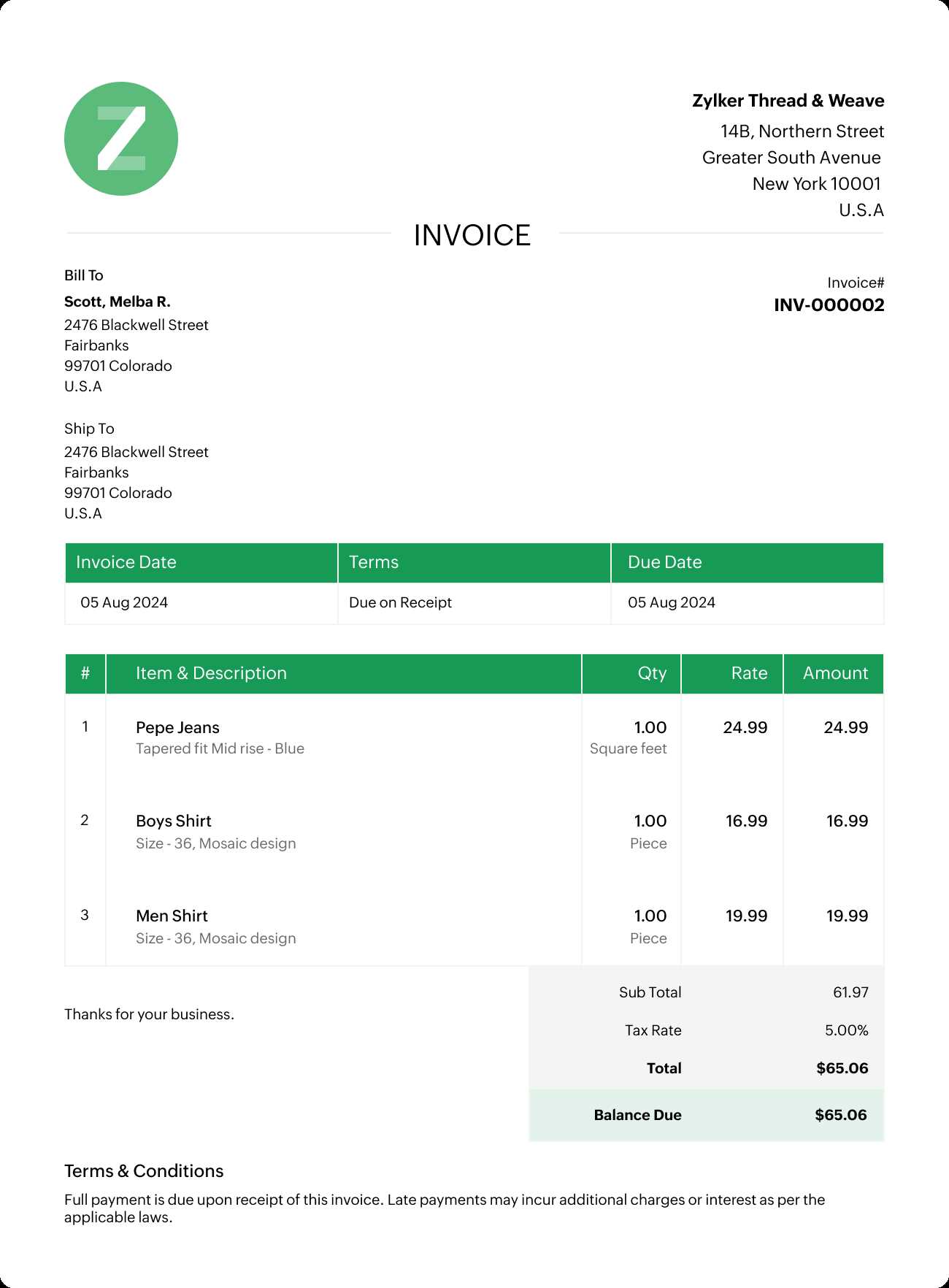

Key Features of an Invoice Template

When creating billing documents, there are several important components that ensure clarity, accuracy, and professionalism. A well-structured layout includes key elements that make it easy for both the business and the client to understand the terms of the transaction. These essential features help maintain consistency across all documents and reduce the chance of errors.

- Business Information: The document should clearly display your company name, address, contact details, and any other relevant identifiers like tax numbers or registration details.

- Client Details: It’s crucial to include the client’s full name, address, and any other necessary contact information to avoid confusion and ensure proper communication.

- Itemized List: An organized list of products or services provided, including descriptions, quantities, individual prices, and the total cost, helps clients understand exactly what they are being charged for.

- Payment Terms: Clear instructions on the payment method, due date, and any late fees or discounts are important to avoid misunderstandings and ensure timely payments.

- Unique Identification Number: Assigning each document a unique reference number allows for easy tracking and record-keeping.

- Invoice Date and Due Date: Including both the date the document is created and the date by which payment is due helps set clear expectations.

These elements, when combined, provide an efficient and professional document that not only supports your business but also fosters trust and transparency with your clients.

How to Customize a Word Template

Customizing a billing document layout allows you to tailor it to your specific business needs while maintaining a professional appearance. Adjusting the structure ensures that the document reflects your brand identity and meets your clients’ expectations. With just a few modifications, you can easily create personalized documents for each transaction.

To start, open the layout in your preferred text processing software. Begin by entering your company’s information, such as your business name, address, and contact details. This ensures consistency and makes your documents easily recognizable to clients. Next, update the client’s details, including their name, address, and any other pertinent contact information.

Once the basic information is set, focus on the content of the document. Modify the sections that list the services or products offered, ensuring that each item is accurately described with the correct quantity and price. You can also adjust the layout to suit the style of your business by changing fonts, colors, or the overall design. This customization step gives your documents a unique look while maintaining professionalism.

Finally, review the document to make sure that payment terms, due dates, and other important instructions are clear and accurate. Save the modified version for future use, so that you can quickly generate new documents as needed without having to re-enter the same details each time.

Benefits of Using Word for Invoices

Utilizing a word processing program for creating billing documents offers several key advantages. One of the main benefits is flexibility. The software allows for easy customization, enabling you to adjust the layout, design, and content to fit your business requirements. Whether you need to make small changes to the formatting or add specific client details, the process is straightforward and quick.

Another major benefit is the accessibility and familiarity of the program. Most users are already comfortable with word processors, which reduces the learning curve associated with other more specialized software. This ease of use allows you to generate and edit documents without needing extensive technical knowledge or training.

Consistency is another significant advantage. By creating a standard format for all your billing documents, you ensure that each document looks professional and follows a uniform style. This not only improves your company’s branding but also builds trust with clients, who can easily recognize your communications.

Finally, using a word processing tool makes it simple to save, share, and store your billing records. You can easily convert the document into different formats, such as PDF, for secure sharing with clients. Additionally, saving your documents in digital form ensures that they can be retrieved and referred to at any time, streamlining your business operations.

Creating Professional Invoices Quickly

Generating high-quality billing documents in a timely manner is essential for maintaining smooth business operations. The ability to produce professional and accurate records without delays ensures that payments are processed efficiently and clients remain satisfied. By using a structured layout, you can streamline the creation of each document and avoid unnecessary time spent on formatting.

One of the most effective ways to speed up the process is by utilizing a pre-designed structure. With a clear layout in place, all you need to do is fill in specific details for each transaction, such as client information, itemized lists, and total costs. This approach significantly reduces the amount of manual work required, allowing you to generate new documents quickly and consistently.

Customization options also play a role in expediting the process. By saving a base version of the layout with default business information and common terms, you can avoid having to re-enter repetitive data. This setup ensures that each document is ready for quick adjustments while maintaining a professional format across all records.

Moreover, using a flexible program allows you to make rapid adjustments to suit each client’s needs, whether it’s updating payment terms or adding special instructions. This adaptability ensures that your documents are both accurate and tailored to each specific situation, helping you maintain a high level of professionalism while minimizing the time spent on administrative tasks.

How to Add Client Details in Word

Including accurate client information in your billing documents is crucial for ensuring clear communication and proper record-keeping. By adding essential contact details such as the client’s name, address, and phone number, you make it easier for both parties to stay in touch and resolve any potential issues regarding the transaction. Customizing each document with the correct information is a straightforward process that can be completed in just a few steps.

Entering Basic Client Information

Start by placing the client’s name at the top of the document, directly below the header or business name. This is typically followed by the client’s full address, including street, city, and postal code. You may also want to add their phone number or email address, which allows for quick follow-up if necessary. These details should be clearly visible and easy to locate on the document.

Formatting for Consistency

To maintain a professional and organized look, align the client’s contact information in a consistent manner. You can use bullet points or separate the fields with lines for clarity. If you are dealing with multiple clients, consider saving this setup as part of your standard layout, so you can quickly update the relevant sections for each new document.

Remember, keeping the client’s information accurate and neatly presented not only reflects well on your business but also helps ensure that the document serves its intended purpose–facilitating clear, error-free communication.

Including Product or Service Information

One of the most important aspects of any billing document is providing a clear and detailed breakdown of the products or services being offered. This section ensures that both the business and the client are aligned on what is being provided, helping to avoid misunderstandings or disputes. Including precise descriptions, quantities, and prices allows clients to easily verify the charges and understand exactly what they are paying for.

Organizing Product or Service Details

To present this information effectively, structure it in a clear and organized manner. You can create a table or a list with the following key details:

- Item Description: A clear, concise explanation of the product or service being provided.

- Quantity: The number of items or services being charged for.

- Unit Price: The price for each individual item or service.

- Total Cost: The total cost for each line item, calculated by multiplying the quantity by the unit price.

Ensuring Clarity and Accuracy

Make sure to double-check each entry for accuracy. The clearer and more accurate the descriptions are, the easier it will be for clients to understand the charges. If there are any additional notes or special conditions related to a specific product or service, include them as well to provide complete transparency.

By including detailed, itemized information, you create a professional and comprehensive document that reflects well on your business and builds trust with your clients.

Adjusting Payment Terms on an Invoice

Clearly stating payment terms in your billing documents is essential for ensuring timely payments and avoiding misunderstandings. Payment terms define the rules surrounding when and how a client is expected to pay, and they can vary depending on the agreement between both parties. By adjusting these terms to meet the specific needs of each transaction, you can help streamline the process and ensure smoother financial operations.

Key Payment Term Elements to Adjust

When setting payment terms, consider the following elements to customize:

- Due Date: Specify when payment is due, such as “30 days from the issue date” or a specific calendar date. This helps set clear expectations for both parties.

- Late Fees: Indicate any penalties for overdue payments, such as a percentage of the total amount due for each day or week the payment is delayed.

- Accepted Payment Methods: List the methods through which clients can pay, such as credit cards, bank transfers, checks, or online payment systems.

- Discounts for Early Payment: Offer incentives for clients who pay before the due date, like a small percentage off the total amount.

Where to Place Payment Terms in the Document

It is crucial to position payment terms clearly within the document so that they are easily visible to your client. Typically, payment terms are placed towards the bottom of the page, but can also be included just after the itemized list of goods or services. Wherever you place them, ensure that they stand out and are easy to read. This helps to avoid confusion and ensures that your client is fully aware of the terms before processing payment.

Adjusting payment terms according

How to Format Your Invoice for Clarity

Formatting your billing documents for maximum clarity is crucial to ensure that both you and your client are on the same page. A well-structured layout not only improves the readability of the document but also helps to avoid confusion about the terms of the transaction. By using clear headings, organized sections, and consistent formatting, you can present all the necessary information in an easy-to-understand way.

Key Elements for Clear Formatting

Here are some important aspects to consider when formatting your document:

- Use Headings: Make sure each section of the document is clearly labeled. For example, include headings such as “Client Details”, “Product List”, and “Payment Terms” to make the document easy to navigate.

- Organize Information Logically: Present data in a logical order. Start with your business information, then move on to the client’s details, followed by the list of products or services, and end with payment terms and due date.

- Clear Itemization: When listing products or services, use bullet points or tables to break down the information. This makes it easier for clients to see what they’re being charged for, including quantities, prices, and totals.

- Use Consistent Fonts and Sizes: Stick to one or two professional fonts, with varying sizes to differentiate headings and body text. Consistency is key to readability.

- Leave Adequate Space: Avoid overcrowding the page. Use sufficient spacing between sections and text blocks to give the document a clean and uncluttered look.

Why Consistency Matters

Maintaining consistent formatting throughout the document not only enhances readability but also ensures a professional appearance. This consistency builds trust with your clients, as they will recognize that your business pays attention to detail and values clear communication. Moreover, standardized formats make it easier for you to generate new documents quickly while maintaining a uniform look across all your records.

By following these simple formatting tips, you can ensure that your documents are clear, professional, and easy for clients to understand. Proper formatting makes a lasting impr

Saving and Sharing Your Invoice in Word

Once you have completed your billing document, it’s essential to save it in a format that is easy to access and share. Properly saving your document ensures that you can quickly retrieve it for future reference or make updates as needed. Additionally, sharing the document securely and efficiently helps facilitate timely payments and maintains professional communication with your clients.

Saving Your Document for Easy Access

To ensure that you can easily find your document later, follow these simple steps:

- Save with a Descriptive Name: Give the file a unique name that includes relevant information, such as the client’s name and the date of the transaction (e.g., “JohnDoe_Invoice_2024-11-05”). This makes it easy to search and retrieve when needed.

- Use Folders for Organization: Organize your documents into clearly labeled folders based on clients, project names, or dates. This will keep everything well-organized and reduce the time spent searching for past records.

- Back Up Your Files: Store your documents in a cloud-based service or an external hard drive to prevent data loss. Regular backups will ensure that your business information is safe and accessible at all times.

Sharing Your Document Securely

Sharing your billing documents with clients should be done in a way that maintains professionalism and ensures data security. Consider these options:

- Email as PDF: Convert your document into a PDF before sharing it. PDFs are widely accessible and prevent accidental editing. Attach the file to an email along with a brief message to your client.

- Cloud Sharing: If you prefer not to send attachments, you can upload the file to a cloud service (e.g., Google Drive, Dropbox) an

Common Mistakes to Avoid in Invoices

Creating billing documents requires attention to detail, as even small errors can lead to confusion, delays, or missed payments. By being aware of common mistakes and proactively avoiding them, you can ensure that your documents are clear, accurate, and professional. This not only helps maintain a smooth workflow but also builds trust with your clients.

Common Errors to Watch For

- Incorrect or Missing Client Information: Double-check that the client’s name, address, and contact details are accurate. An incorrect address or name can delay delivery and cause confusion when clients review the charges.

- Unclear Payment Terms: Failing to clearly specify when payment is due or the accepted methods can lead to misunderstandings. Always include precise payment instructions to avoid late payments or missed deadlines.

- Omitting Line Item Details: Leaving out descriptions or quantities for products and services can result in confusion. Ensure that each item or service is clearly listed with the appropriate price, quantity, and total cost.

- Math Errors: Simple calculation mistakes can lead to discrepancies between the billed amount and the total due. Always double-check your math, especially when adding taxes, discounts, or additional fees.

- Failure to Include Unique Reference Number: Not including an invoice number or reference code can make it difficult for both you and your client to track the transaction. Assign a unique identifier for each billing document for easy future reference.

- Using an Unprofessional Design: A cluttered or difficult-to-read layout can negatively impact the perception of your business. Keep the design simple, organized, and easy to follow to ensure that the document looks professional.

How to Prevent These Mistakes

To avoid these common errors, take the time to carefully review each billing document before sending it out. It may also be helpful to create a checklist of key elements to ensure consistency across all your documents. Additionally, using a standard format or layout for your billing documents can minimize the chances of overlooking critical information.

By paying attention to these details and taking steps to prevent mistakes, you can streamline the billing process, build better relationships with your clients, and maintain a higher level of professionalism in your business operations.

How to Track Invoice Payments

Tracking payments for your billing documents is an essential part of managing your cash flow and ensuring that your business remains financially stable. By keeping accurate records of all transactions, you can easily identify which payments have been received and which are still outstanding. This process not only helps you stay organized but also minimizes the risk of errors and missed payments.

Steps for Tracking Payments

Here are some simple yet effective steps for keeping track of payments:

- Assign Unique Numbers: Always include a unique reference number for each billing document. This makes it easy to identify and track specific transactions in your records or payment systems.

- Create a Payment Log: Maintain a detailed log or spreadsheet where you record each payment received. Include the invoice number, payment date, amount, and method of payment (e.g., bank transfer, check, online payment).

- Set Payment Due Dates: Include clear due dates on your billing documents, and mark these dates in your payment log. This allows you to follow up with clients if payments are overdue.

- Monitor Overdue Payments: Use reminders or automated systems to track outstanding payments. Set a system in place to send follow-up messages to clients with overdue balances.

Tools for Efficient Payment Tracking

Using software tools can help streamline the payment tracking process. Consider the following options:

- Accounting Software: Many accounting programs (e.g., QuickBooks, Xero) have built-in features for tracking payments, sending reminders, and generating reports. These tools automatically update your records as payments are made, reducing manual tracking.

- Spreadsheets: If you prefer a more hands-on approach, you can create a payment tracker in Excel or Google Sheets. Organize the columns to track the client, payment method, date, and outstanding balance.

- Cloud Storage: Store your billing records and payment logs in a secure cloud-based system. This allows you to access

Using Templates for Multiple Invoices

When managing a high volume of billing documents, efficiency becomes key. Using a pre-designed structure allows you to create consistent, professional records in a fraction of the time. This approach eliminates the need to start from scratch with each new transaction, saving you effort and ensuring uniformity across all documents.

Benefits of Using a Pre-Formatted Structure

Using a standard structure for all your billing records brings several advantages:

- Time Efficiency: You don’t have to format each document individually, reducing the time spent on repetitive tasks.

- Consistency: A uniform design ensures that all your documents look professional and contain the necessary information, minimizing the risk of errors.

- Easy Updates: Once you have a set structure, updating or modifying it to reflect changes, such as new payment terms or product offerings, becomes quick and simple.

How to Use a Pre-Formatted Structure Effectively

To take full advantage of this method, follow these guidelines:

- Personalize Each Document: Even though the structure is the same, make sure each record includes the unique details of the client and transaction, such as their name, address, and the list of products or services.

- Maintain Version Control: Save each billing document with a clear and unique name, such as including the client’s name and the date, to avoid confusion later on.

- Automate When Possible: If your system allows, automate the population of client details and product/service descriptions to speed up the process even further.

Using a consistent structure across multiple records not only boosts your productivity but also helps create a more organized and professional approach to managing your business’s financial documentation. This method ensures that every transaction is properly documented, leaving little room for errors and misunderstandings.

How to Secure Your Invoice Documents

Protecting your billing documents is essential to prevent unauthorized access, tampering, or loss of sensitive information. Whether you store these records digitally or in physical form, securing them ensures that both your business and your clients’ data remain confidential and safe. Adopting the right security measures is critical to maintaining trust and safeguarding your financial records.

Digital Security Measures

If you manage your billing documents electronically, here are some effective steps to protect them:

- Use Strong Passwords: Always password-protect your files, especially when sending them over email or storing them in shared folders. Ensure your passwords are complex and unique to each document or system.

- Encrypt Your Files: Encryption adds an extra layer of security, making it difficult for unauthorized users to access or read your documents. Many software tools offer built-in encryption features.

- Enable Two-Factor Authentication: Use two-factor authentication (2FA) for any platforms where you store or access your billing records. This adds an additional level of protection beyond just your password.

- Backup Your Documents Regularly: Keep a backup of your documents in a secure cloud service or external hard drive. Regular backups prevent loss in case of technical failure or data corruption.

- Limit Access: If multiple people have access to your billing records, make sure only authorized individuals can view or edit them. Set permissions and restrict access to sensitive files whenever possible.

Physical Security Measures

If you maintain physical copies of your records, consider these steps to keep them safe:

- Store Documents in a Locked Location: Use file cabinets or safes with strong locks to keep your documents protected from theft or unauthorized access.

- Shred Sensitive Documents: When it’s time to discard old records, always shred them to prevent anyone from accessing sensitive financial information.

- Monitor Access: Keep track of who has access to your physical r

Where to Find Free Invoice Templates

If you’re looking for an easy way to create professional billing documents without having to design them from scratch, free pre-designed formats are a great solution. These structures can save you time and effort while ensuring that your records are complete and well-organized. Many resources are available online, offering a variety of styles to suit different business needs.

Online Sources for Free Templates

There are numerous websites that offer free billing document designs, ranging from basic to more detailed formats. Some of the most reliable sources include:

- Microsoft Office Templates: The official Microsoft Office website provides a range of free document formats, including those for invoicing. These are easy to download and can be edited in popular software like Microsoft Office or Google Docs.

- Google Docs: Google offers free editable formats through its Docs platform. These can be accessed directly via your Google Drive, customized, and shared with clients quickly.

- Invoice Generator Websites: Websites like Invoice Generator and Invoiced provide free, user-friendly tools for creating and sending billing documents. These tools often allow you to download documents in various formats like PDF, making them easy to share.

- Online Marketplaces: Platforms such as Etsy or Creative Market sometimes offer free or low-cost formats, often with additional customization options to suit your branding.

Customization and Adaptation

Once you’ve selected a pre-designed structure, it’s important to adapt it to fit your specific needs. Customize the fields to include all relevant information, such as your business name, client details, payment terms, and a clear breakdown of the products or services provided. Most platforms allow you to modify text, adjust layouts, and even change colors or fonts to match your company’s branding.

Using free online resources can streamline the billing process, providing you with easy-to-use and professional-looking documents without the need for additional s

Alternatives to Word for Invoices

While word processing software is a popular choice for creating billing documents, it’s not the only option available. Many businesses turn to specialized tools and platforms that streamline the process, offer more customization, and help automate certain aspects of invoicing. These alternatives can save time, reduce errors, and enhance the overall efficiency of managing payments.

Online Tools and Invoice Generators

Online platforms designed specifically for creating and managing billing records can be an excellent alternative. These tools often provide pre-built designs, easy customization, and additional features that are not available in standard word processors:

- Invoice Generators: Websites like Invoice Simple and Invoice Ninja allow users to quickly generate professional documents. These tools typically provide free or low-cost options, and some include features like automated reminders, tax calculations, and client management.

- Cloud-Based Software: Services such as FreshBooks or Zoho Invoice offer comprehensive billing solutions with tracking, reporting, and integration with payment gateways. These platforms make it easy to create, send, and monitor invoices in real-time, all from a secure cloud environment.

- Accounting Platforms: Tools like QuickBooks and Xero go beyond just generating billing documents. They offer full accounting capabilities, including expense tracking, payroll, and financial reporting, which can be helpful for businesses looking for an all-in-one solution.

Spreadsheet Applications

Another alternative to word processors is using spreadsheet software, such as Google Sheets or Microsoft Excel. These tools provide greater flexibility in organizing and customizing your billing documents:

- Customizable Layout: Spreadsheets offer full control over your document’s design, allowing you to structure your billing information exactly as needed. You can create reusable templates with formulas to automatically calculate totals, taxes, and discounts.

- Data Management: Since spreadsheet applications allow for easy data manipulation, they are a good choice for businesses that need to handle a large number of clients or tr