Simple Proforma Invoice Template Excel for Easy Invoice Creation

Efficient documentation is crucial for any business, especially when it comes to transactions and client communications. Whether you’re a freelancer, a small business owner, or part of a larger organization, using the right tools can help you stay organized and professional. A well-organized financial record helps streamline processes, reduce errors, and ensure timely payments.

For those who prefer to handle their records digitally, there are numerous solutions available that simplify the process of creating formal documents. These tools allow users to quickly generate structured and clear documents that can be easily customized for any need. They provide a straightforward way to communicate the details of a sale or service, ensuring that both parties are on the same page.

By incorporating these user-friendly tools into your workflow, you can enhance your productivity and improve overall communication with clients. In this article, we explore how these essential documents can be easily crafted and tailored for specific business needs, saving you time and effort in the long run.

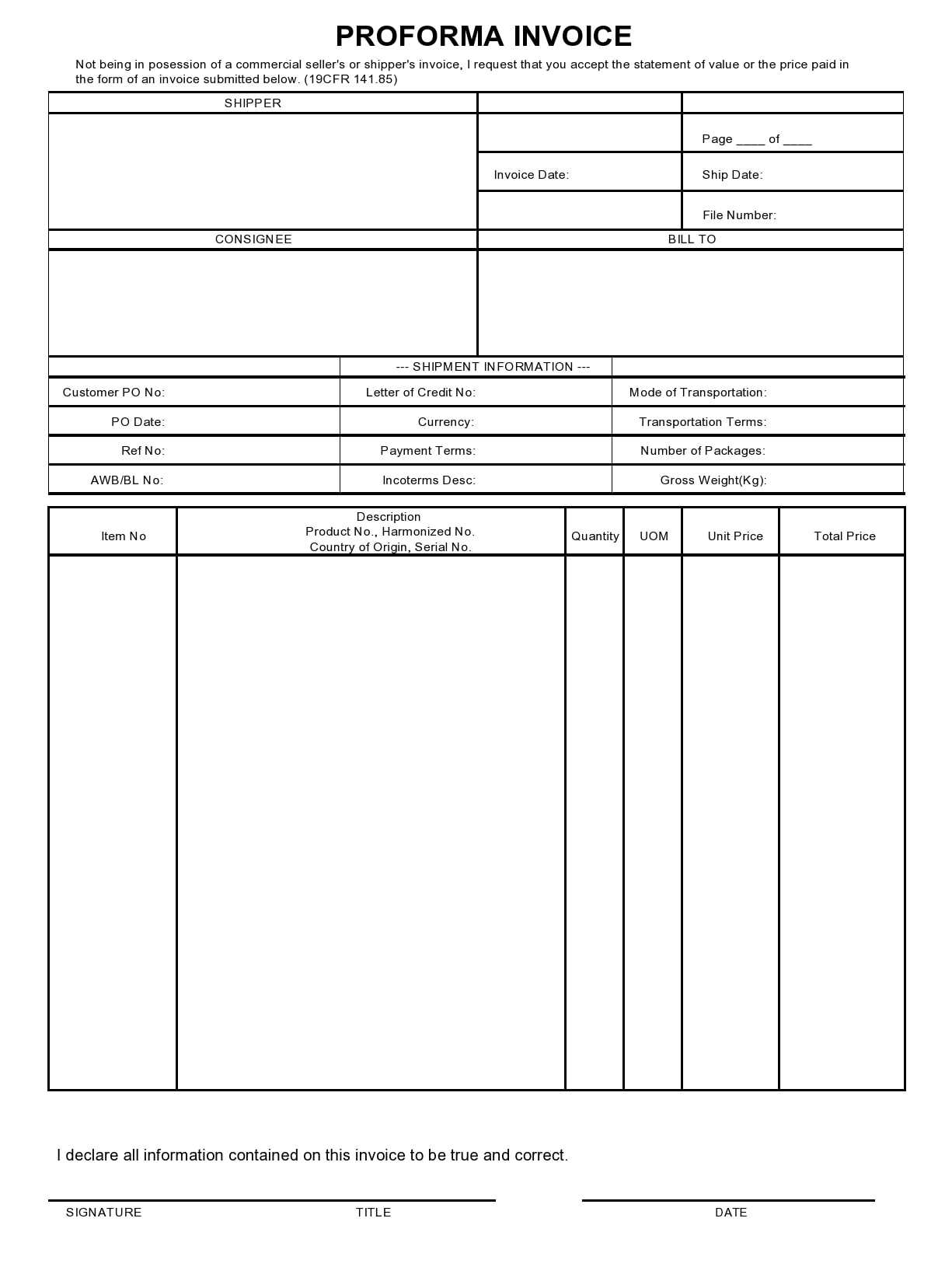

Why Use a Proforma Invoice Template

Having a structured document for outlining the terms of a transaction before it is finalized can greatly benefit both buyers and sellers. Such documents provide clarity, reduce misunderstandings, and set clear expectations on both sides. Using a pre-designed format allows you to easily fill in the necessary details without having to worry about creating a new layout each time, saving time and effort.

Save Time and Effort

One of the main advantages of using a ready-made document structure is the time it saves. Instead of starting from scratch, a pre-built format allows you to quickly input relevant data such as item descriptions, quantities, and prices. This streamlined process can be especially helpful when managing multiple transactions or dealing with tight deadlines.

Ensure Consistency and Professionalism

Consistency in documentation is key to maintaining a professional image. By using a standard format, you ensure that every transaction is presented in a clear and uniform manner. This consistency not only boosts your credibility but also makes it easier for clients to understand the details of your agreements. A professional appearance can lead to stronger relationships and a higher likelihood of repeat business.

Benefits of Excel for Invoice Templates

Using digital tools for financial documentation offers numerous advantages, particularly when it comes to organizing and managing important details. One such tool is a widely-used spreadsheet software, which provides powerful features that make creating and managing documents straightforward and efficient. These tools allow for flexibility, customization, and automation, making them ideal for business needs.

Customization and Flexibility

With spreadsheet software, users can easily modify their documents to suit specific needs. Whether you need to adjust the layout, add more fields, or change formulas, the software offers full control over the design and content. Key benefits include:

- Personalization: Tailor the format to your specific business requirements.

- Adaptability: Quickly update information as prices, quantities, or terms change.

- Scalability: Easily add new rows or sections to accommodate multiple products or services.

Time Efficiency and Automation

Spreadsheets significantly reduce the time spent on creating and updating documents. By utilizing built-in formulas and functions, repetitive tasks such as calculations can be automated, ensuring accuracy and saving time. For example:

- Automatic Calculations: Easily calculate totals, taxes, and discounts with pre-set formulas.

- Data Organization: Sort and filter entries to better track transactions or payments.

- Time-saving Features: Use templates or previously saved versions to quickly generate new documents without starting from scratch.

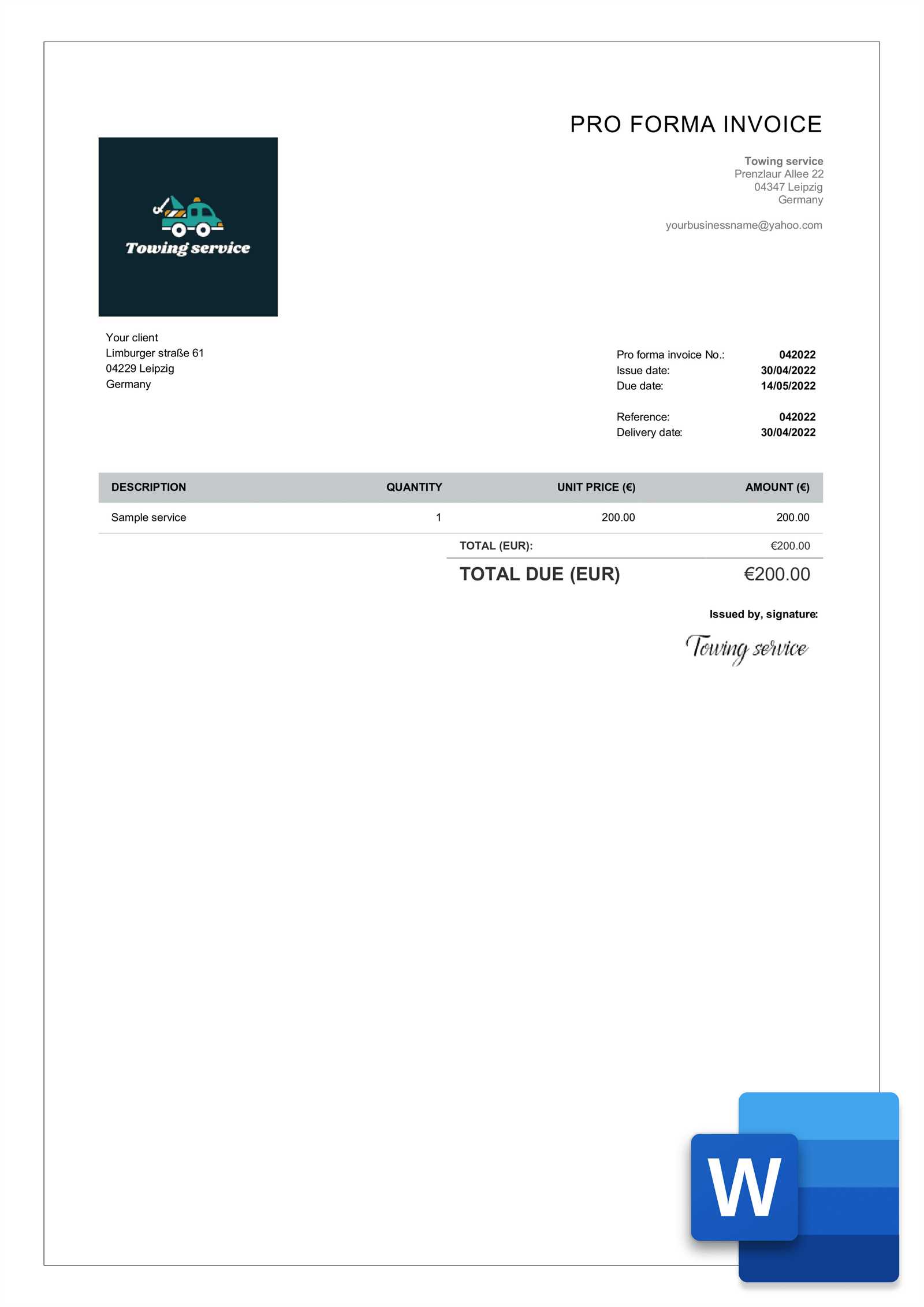

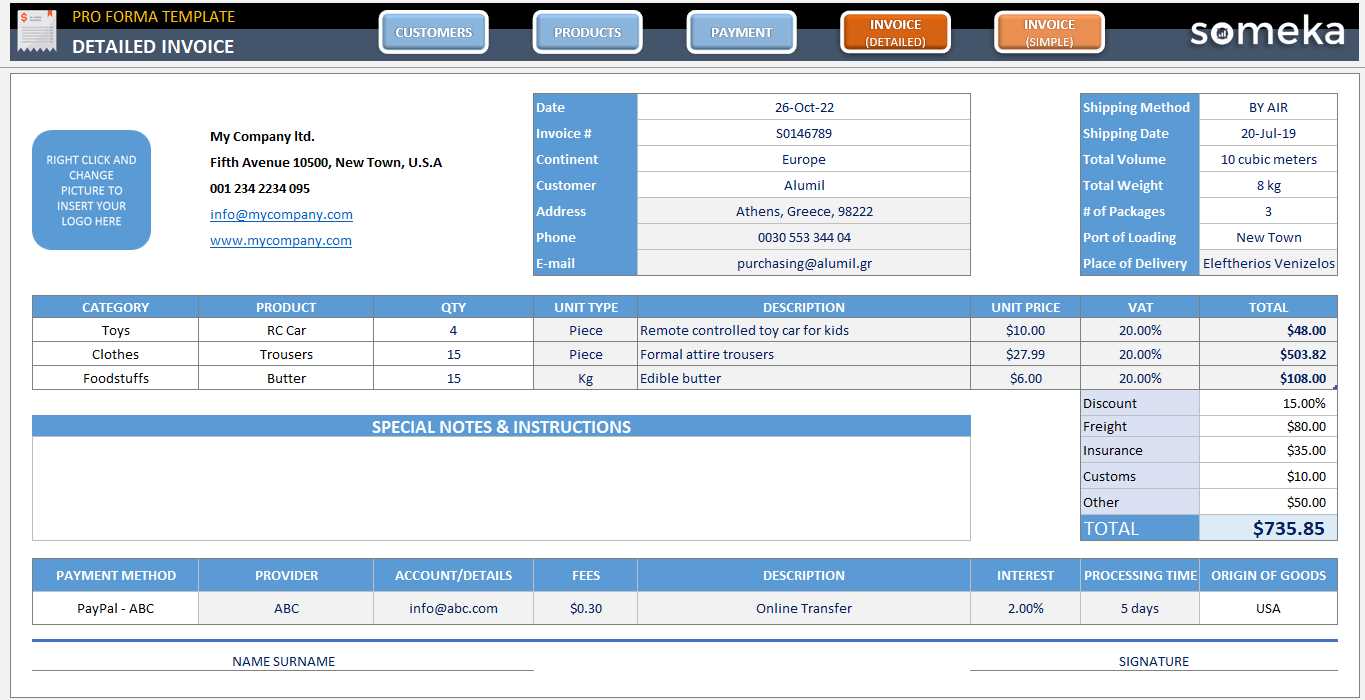

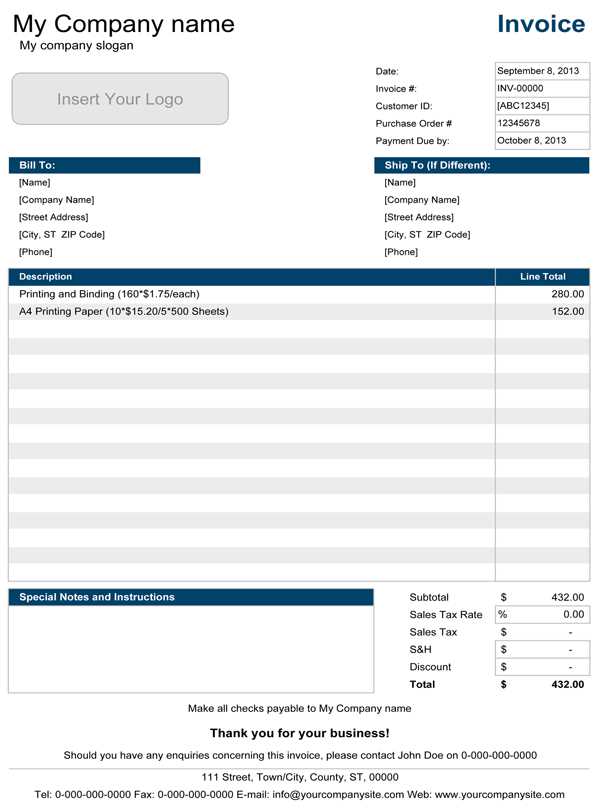

How to Create a Proforma Invoice

Creating a formal document that outlines the terms of a transaction is a simple yet important task for any business. This document helps establish expectations between the seller and the buyer before the final transaction takes place. By including all necessary details, such as products or services, quantities, pricing, and delivery terms, you can ensure clarity and avoid any future misunderstandings.

Step-by-Step Process for Creating the Document

Follow these basic steps to craft a well-structured document that will serve your business needs:

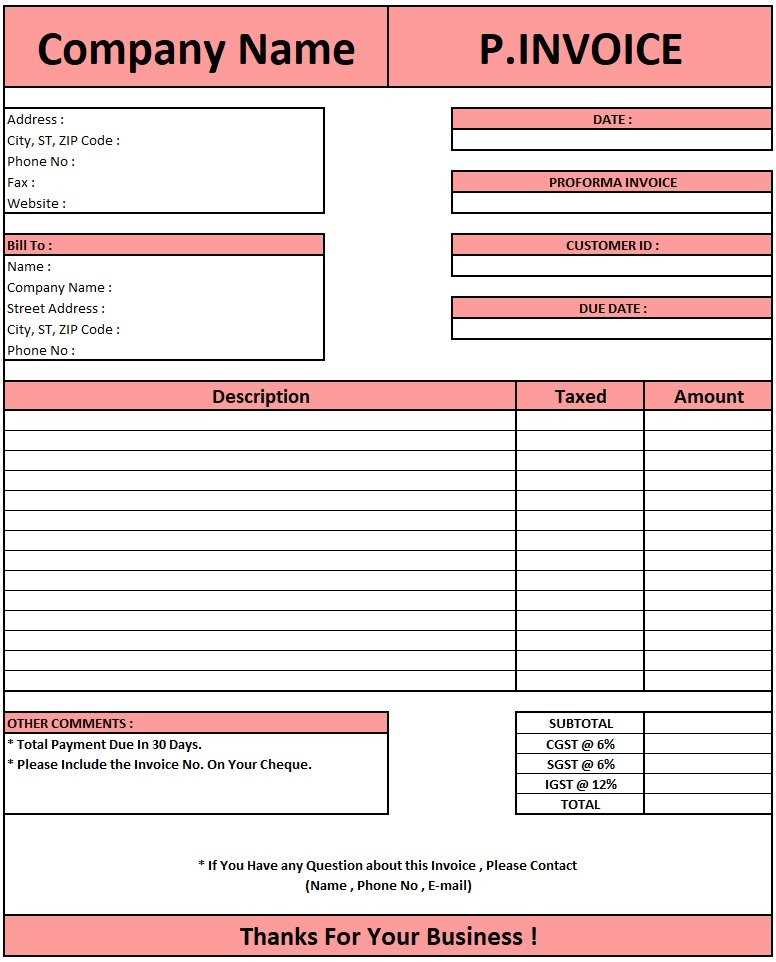

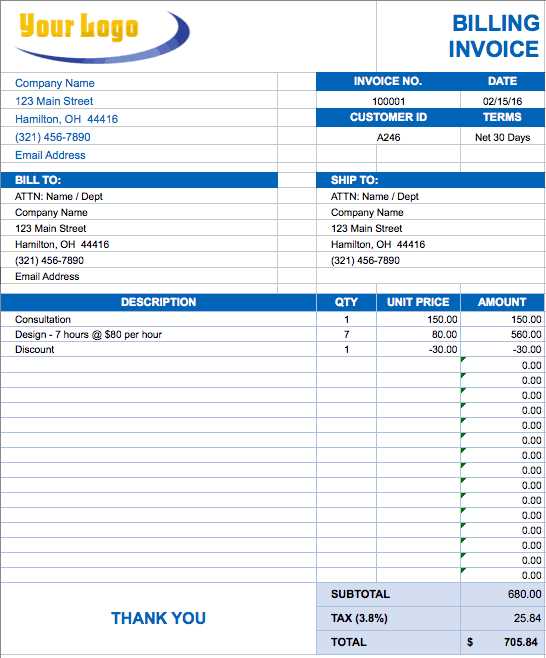

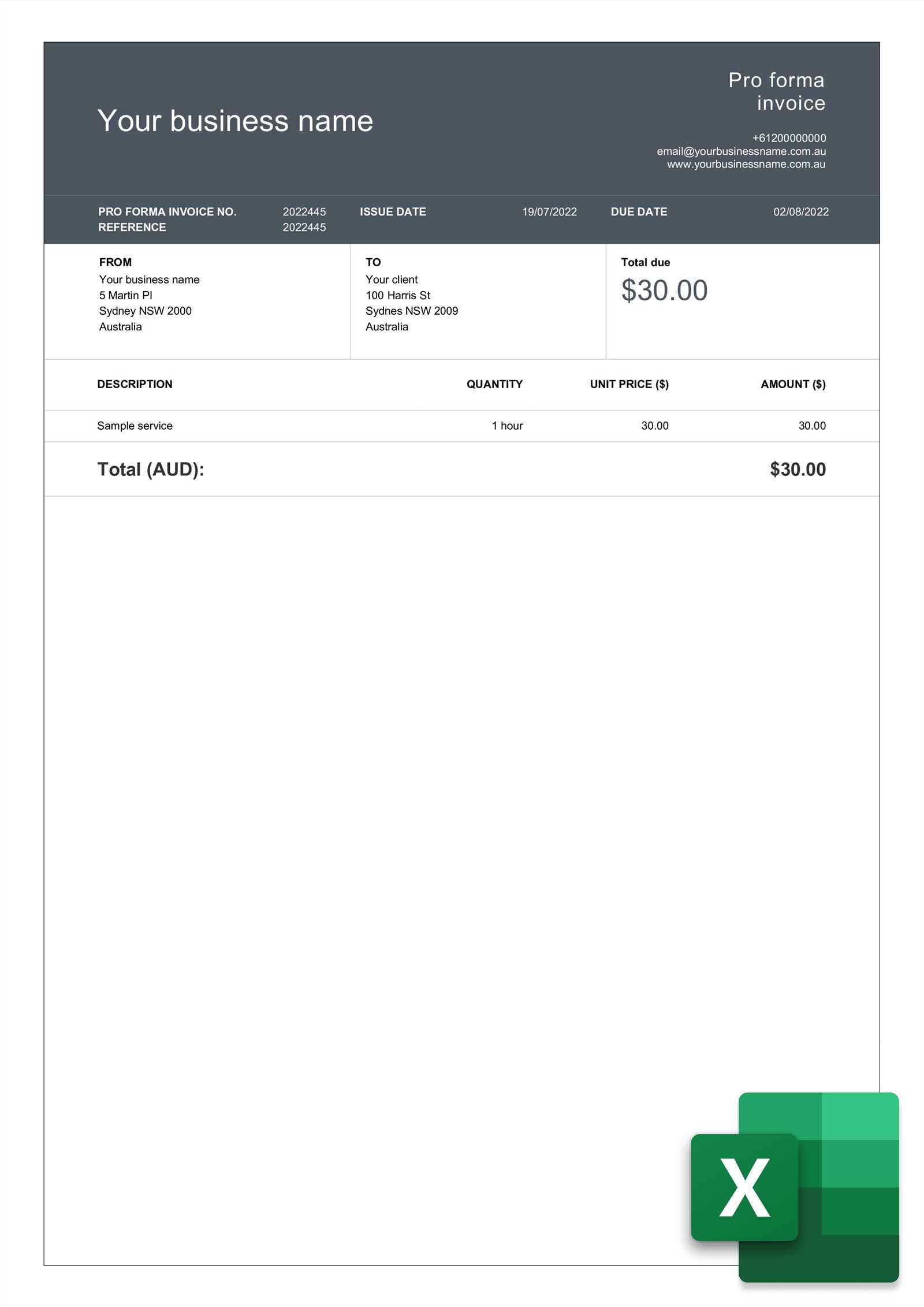

- Header Section: Start by including your business name, logo, contact information, and the recipient’s details.

- Transaction Information: Include a unique reference number, the date of issue, and payment terms.

- List of Products or Services: Describe each item or service, including quantities, unit prices, and total amounts.

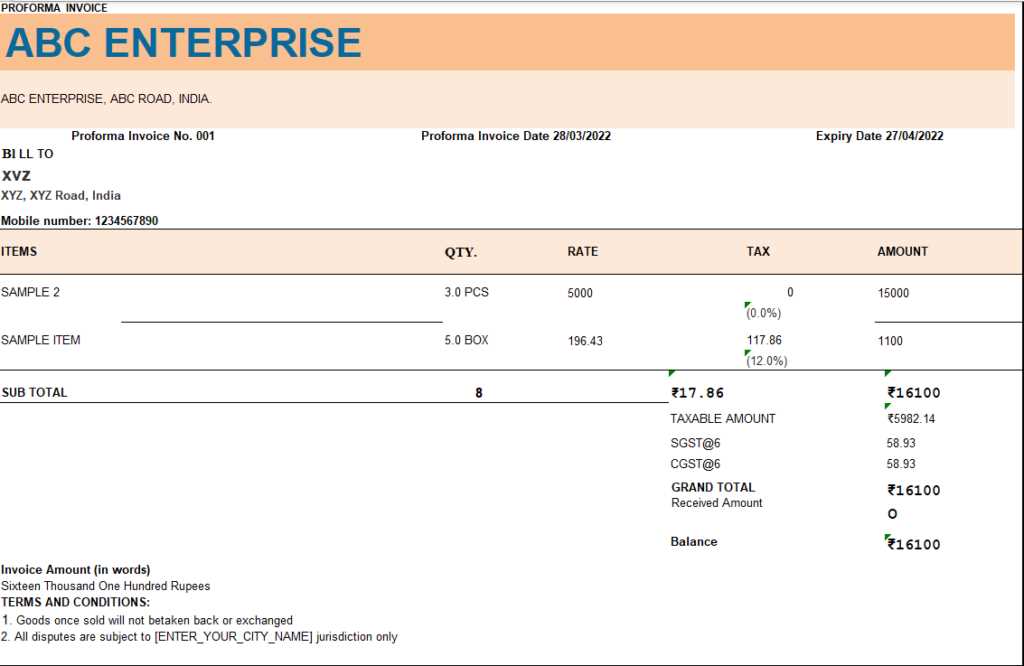

- Calculation of Total: Include the subtotal, taxes, discounts (if any), and the grand total.

- Terms and Conditions: Clearly define delivery dates, shipping costs, and other important contractual details.

Tips for Efficiency and Accuracy

To ensure that the document is both professional and accurate, here are some key tips:

- Double-check Calculations: Verify that all totals, taxes, and discounts are correctly calculated.

- Clear Formatting: Use tables or grids to present data in a clean, easy-to-read manner.

- Consistent Language: Use clear and concise language to avoid confusion.

- Save and Reuse: Once created, save the document as a template for future transactions.

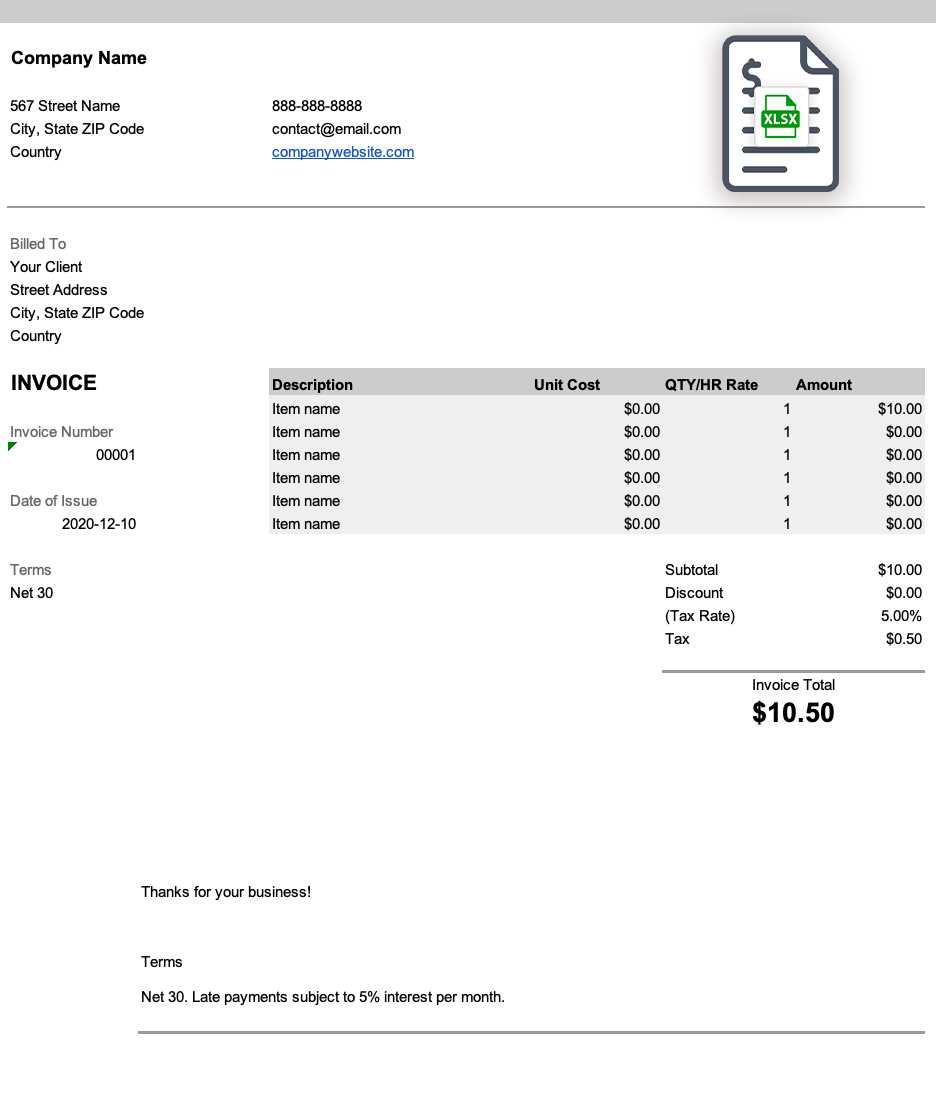

Step-by-Step Guide to Excel Templates

Creating structured documents in digital form is an efficient way to handle business transactions. Spreadsheet software provides a versatile platform to create customized forms that can be adapted to various business needs. This guide will take you through the process of building a functional, organized document using the features available in such programs, allowing you to streamline your workflow and reduce manual errors.

Setting Up the Document

The first step in creating your document is to establish the basic structure. Follow these guidelines:

- Open a New File: Start by creating a new workbook to begin your design.

- Create Header Rows: Label the top rows with categories such as “Item Description,” “Quantity,” “Price,” and “Total Amount.”

- Use Proper Columns: Set up columns for each type of information you need to display, ensuring the layout is easy to read and logical.

Customizing Your Layout

Now that you have the basic setup, it’s time to make the document more functional and tailored to your needs:

- Format Cells: Use cell formatting to adjust the appearance of the text, numbers, and borders for better readability.

- Add Formulas: Input formulas to automatically calculate totals, taxes, or discounts based on the entered data.

- Insert Predefined Data: If applicable, include dropdown menus or predefined data to speed up data entry.

Once you’ve set up the structure and customized the layout, your document is ready to be used for multiple transactions, and you can save it for future use.

Essential Elements of a Proforma Invoice

When creating a formal document to outline the terms of a transaction, certain key details must be included to ensure clarity and avoid misunderstandings. A well-structured document serves as an official outline of the transaction before the final sale or service is executed. It should provide both parties with all necessary information, setting clear expectations on price, delivery, and terms.

Key Information to Include

To ensure your document is both informative and professional, make sure to include the following essential elements:

- Business Information: Include your company name, logo, contact details, and any relevant registration information.

- Client Information: Provide the customer’s name, address, and contact information to ensure proper identification.

- Document Number: Assign a unique reference number to each document for easy tracking and organization.

- Issue Date: State the date the document is created, so both parties are aware of when the terms were agreed upon.

Transaction Details

Next, ensure the body of the document clearly outlines the specifics of the transaction:

- Product or Service Description: Provide clear details about the items or services being offered, including quantities and unit prices.

- Total Calculation: Show the subtotal, taxes, discounts, and any other additional charges, along with the final amount due.

- Payment Terms: Outline the payment method, due date, and any applicable penalties for late payments.

- Delivery Terms: Include the expected delivery date, shipping costs, and responsibilities regarding logistics.

By including these key elements, your document will not only look professional but will also help maintain clear communication and establish a solid foundation for a successful transaction.

Customizing Your Invoice Template

Tailoring a document to meet the specific needs of your business is an essential step in ensuring clarity and professionalism. Customizing the layout and content allows you to present your offerings in a way that aligns with your brand while also ensuring that all necessary details are included for your clients. Whether you need to adjust the design or add new fields, personalization can enhance both the usability and appearance of your document.

When personalizing your document, focus on elements that can improve both form and function:

- Branding Elements: Incorporate your company logo, colors, and fonts to make the document instantly recognizable as your business’s official document.

- Flexible Layout: Adjust the structure to suit your needs, such as rearranging sections or adding extra columns for more detailed product descriptions or payment information.

- Additional Fields: Add custom fields for special discounts, terms and conditions, or specific delivery instructions that are relevant to your transactions.

Customizing your document not only makes it more visually appealing but also ensures that it meets your business’s unique requirements. This personal touch can help reinforce your professional image and improve the experience for your clients.

How Excel Templates Save Time

Using a pre-designed structure for creating business documents can significantly reduce the amount of time spent on administrative tasks. These ready-made solutions allow you to bypass the need to design and format each document from scratch, giving you more time to focus on other important aspects of your business. By automating common processes and providing a clear structure, such tools streamline document creation and ensure greater efficiency.

Here are some key ways that these tools save time:

- Pre-set Structure: With a pre-arranged layout, you only need to input the specific data, such as quantities and prices, instead of spending time on formatting and arranging elements.

- Automated Calculations: Built-in formulas can instantly calculate totals, taxes, and discounts, eliminating manual work and reducing the risk of errors.

- Reusable Format: Once you have created a customized document, you can reuse the same structure for future transactions, allowing for fast and consistent document generation.

By cutting down on repetitive tasks and minimizing the risk of mistakes, using these tools leads to more productive workdays and faster turnaround times for your business transactions.

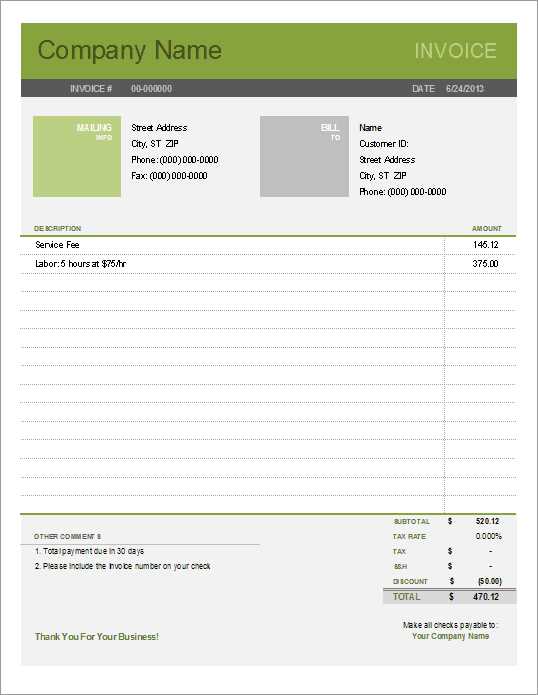

Best Practices for Invoice Formatting

Proper formatting of business documents is crucial for ensuring clarity, accuracy, and professionalism. A well-organized document helps to avoid confusion, facilitates better communication with clients, and ensures that all important details are easily accessible. Following best practices when arranging your document can improve its effectiveness and create a positive impression on recipients.

Key Formatting Tips

Here are some essential guidelines to follow when creating your documents:

- Use Clear Headings: Ensure that each section of the document is clearly labeled, such as “Item Details,” “Amount Due,” and “Payment Terms.” This allows for easy navigation and quick reference.

- Maintain Consistency: Stick to a consistent font, size, and color scheme throughout the document. This creates a polished, uniform appearance and enhances readability.

- Keep It Simple: Avoid clutter by limiting the use of unnecessary design elements. Use space effectively to make the document easy to read without overwhelming the recipient.

- Organize Information Logically: Present details in a clear order. Group related information together and separate different sections, such as item descriptions and pricing, for better clarity.

Optimizing for Readability

To further improve the usability of your document, consider the following:

- Use Tables for Data: When listing items or services, use tables to ensure the data is neatly aligned. This allows clients to easily compare quantities, prices, and totals at a glance.

- Highlight Important Information: Make key details stand out, such as the total amount due or the payment due date, by using bold or larger text to draw attention to them.

- Include Visual Breaks: Use lines or spaces between sections to visually separate different parts of the document, preventing it from looking too crowded.

By following these best practices, you ensure that your documents are clear, professional, and effective in communicating important information to your clients.

Key Features to Look for in Templates

When selecting a digital document layout for business use, it’s important to choose a solution that offers both functionality and ease of use. A well-designed layout should help you organize information clearly and ensure that your documents are consistent and professional. The right features can save you time, improve accuracy, and streamline your workflow, making it easier to generate multiple documents with minimal effort.

Essential Features for Efficiency

Here are the key attributes to look for in a pre-designed document structure:

- Customizable Fields: Ensure that the layout allows for easy modifications, such as adding or removing rows, changing labels, and adjusting data input areas to fit your specific needs.

- Automated Calculations: Choose a layout that includes built-in formulas for automatically calculating totals, taxes, discounts, or shipping costs. This helps reduce manual errors and speeds up document preparation.

- Clear Sectioning: The layout should be divided into clear sections, such as item lists, totals, and payment terms, so that each piece of information is easily accessible and readable.

- Predefined Fields: Look for a structure that comes with predefined fields for common transaction details like dates, addresses, and amounts. This minimizes the amount of data entry needed.

Usability and Design

In addition to functionality, the design of the document should contribute to its ease of use and professionalism:

- Simple, Intuitive Layout: The document should be easy to navigate, with a user-friendly design that doesn’t require complex adjustments or formatting skills.

- Professional Aesthetic: The layout should have a clean and consistent design, using fonts, colors, and spacing that reflect your brand and make the document look polished.

- Responsive Design: Ensure that the layout is compatible with various devices and screen sizes, making it easy to view, edit, and share across platforms.

By selecting a solution with these essential features, you can ensure that your documents are efficient, error-free, and presentable, helping you save time while maintaining a high level of professionalism.

Free vs Paid Proforma Invoice Templates

When selecting a digital document structure for your business, you’ll often face the choice between free and paid options. Both have their advantages and limitations, and the decision depends largely on the specific needs of your business. While free solutions may provide basic functionality, paid options often come with additional features that can enhance the usability, customization, and overall professionalism of the document.

Advantages of Free Solutions

Free layouts can be a great starting point, especially for small businesses or individuals who are just getting started. Some of the benefits include:

- No Cost: The most obvious benefit is that you don’t need to spend any money to access the document structure.

- Quick Setup: Free layouts are usually easy to download and implement, requiring minimal setup.

- Simplicity: For those who need a basic structure without unnecessary features, free layouts often provide a straightforward, easy-to-use solution.

Advantages of Paid Solutions

While free options can be sufficient for simple needs, paid layouts offer more advanced features and benefits, including:

- Customization: Paid options typically allow for greater flexibility in adjusting the document to match your specific business requirements, from adding custom fields to creating a unique design.

- Advanced Features: These may include automated calculations, pre-set data fields, or integration with other business tools, streamlining the entire process and reducing manual work.

- Professional Design: Paid solutions often come with more polished designs that can help enhance your brand image and make a stronger impression on clients.

- Customer Support: With paid options, you typically have access to customer service in case you encounter any issues or need assistance with customization.

Ultimately, the choice between free and paid layouts depends on the scale of your business, the level of customization you need, and the resources you’re willing to invest. If your needs are basic and you’re looking to save on costs, free solutions can work well. However, if you require more advanced features, greater flexibility, and enhanced design options, a paid layout may be the better choice for your business.

Why Excel is Ideal for Invoices

When it comes to creating and managing business documents, particularly those that involve calculations, a flexible and easy-to-use platform is essential. Spreadsheet software offers an efficient solution, combining powerful functionality with an intuitive interface. This makes it an excellent choice for generating accurate and professional documents that require detailed data entry, automatic calculations, and easy customization.

Key Benefits of Using Spreadsheet Software

Here are some of the main reasons why spreadsheet software is a top choice for creating business documents:

- Ease of Use: Spreadsheet programs are user-friendly and don’t require advanced technical skills. Even beginners can quickly get the hang of creating and customizing documents.

- Built-In Calculations: With the ability to use formulas, you can automate calculations for totals, taxes, and discounts. This reduces the likelihood of errors and saves time on manual calculations.

- Customization: The platform offers great flexibility. You can easily adjust the layout, modify fields, and personalize the design to suit your business’s specific needs and branding.

- Data Organization: Spreadsheets allow for easy organization of large amounts of data, making it simple to track transactions, manage records, and update documents as needed.

Integration and Accessibility

Another advantage is that spreadsheets can easily integrate with other tools or platforms your business may use. Whether it’s linking to an inventory management system, syncing with accounting software, or exporting data to other formats, spreadsheet software provides seamless functionality. Additionally, these documents can be accessed, edited, and shared across various devices and locations, enhancing collaboration and ensuring that important details are always up to date.

By leveraging these advantages, spreadsheet software allows businesses to create efficient, professional, and accurate documents that meet their operational needs.

Common Mistakes in Invoice Creation

When creating business documents that outline transactions, it’s easy to make mistakes that can lead to confusion, delayed payments, or even legal issues. These errors are often due to oversight or lack of attention to detail, but they can be easily avoided by being aware of common pitfalls. Addressing these mistakes not only ensures accuracy but also promotes professionalism and trust with your clients.

Common Errors to Watch Out For

Here are some of the most frequent mistakes businesses make when creating transaction documents:

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Incorrect or Missing Contact Information | Leads to confusion or delays in communication with clients. | Ensure all details, including names, addresses, and contact numbers, are accurate and up-to-date. |

| Failure to Include Payment Terms | Clients may not be aware of due dates or payment conditions, resulting in missed payments. | Clearly state payment deadlines, methods, and any penalties for late payments. |

| Miscalculations | Can cause discrepancies in the final amount due and lead to trust issues with clients. | Use built-in formulas or double-check all figures to ensure accuracy in totals, taxes, and discounts. |

| Unclear Descriptions of Goods or Services | Confusion over what is being charged for and potentially disputes over payment. | Provide detailed descriptions of items or services, including quantities, specifications, and unit prices. |

| Omitting Document Number | Prevents easy reference and tracking of documents, complicating future correspondence. | Assign a unique reference number to each document for easy identification and tracking. |

By keeping an eye out for these common mistakes, you can ensure that your transaction documents are professional, accurate, and effective in communicating important details to your clients. Consistency and attention to detail are key to maintaining strong business relationships and avoiding unnecessary complications.

How to Manage Proforma Invoice Data

Efficiently handling and organizing business transaction data is crucial for maintaining smooth operations and ensuring accuracy. Proper data management helps streamline workflows, reduces errors, and improves communication with clients. By implementing effective practices, you can track key information and maintain an organized record of all your transactions for future reference.

Best Practices for Organizing Transaction Data

To manage your business data effectively, consider the following strategies:

- Centralized Storage: Store all relevant documents in one central location, such as a secure cloud storage service or a dedicated folder on your system. This makes it easier to find and reference data when needed.

- Use Consistent Naming Conventions: Label each document with a unique and consistent naming format that includes key details such as the client name, date, and document type. This improves searchability and prevents confusion.

- Track Changes and Updates: Regularly update your data, especially if any terms or amounts change. It’s also important to keep track of which documents have been sent and when payments are due or completed.

- Data Backup: Always back up your data in case of system failures or accidental loss. This ensures that you have access to your records at any time, even in the event of technical issues.

Automating Data Management

Using automated tools can simplify data management and help minimize human error:

- Integration with Accounting Software: Link your transaction records with accounting software to automatically update financial data, such as totals, taxes, and payment status. This helps maintain accuracy across all your financial records.

- Data Templates: Use pre-set document structures to quickly fill in required fields, reducing time spent on manual entry. Templates help ensure consistency across documents and minimize errors.

- Automated Reminders: Set up reminders for payment due dates or follow-up actions to keep track of overdue payments and ensure timely follow-through with clients.

By following these practices, you can efficiently manage your transaction data, reduce errors, and improve overall business operations. Proper data management is key to maintaining clear records and ensuring smooth business interactions with clients and partners.

How to Track Payments Using Excel

Tracking payments efficiently is crucial for maintaining a smooth cash flow and ensuring that all transactions are properly accounted for. By organizing payment data in a clear and structured manner, you can quickly identify which clients have paid, which invoices are outstanding, and what your current financial standing is. Spreadsheet software offers an excellent way to manage and track these payments with minimal effort and maximum accuracy.

Creating a Payment Tracking System

Here’s how to set up a simple and effective payment tracking system:

| Column Name | Description |

|---|---|

| Client Name | The name of the client or customer who made the payment. |

| Document Number | Reference number for the transaction, such as the order or service number. |

| Amount Due | The total amount that was initially requested from the client. |

| Amount Paid | The actual amount the client has paid towards the transaction. |

| Payment Date | The date the payment was made or received. |

| Payment Method | The method used for payment (e.g., bank transfer, check, cash, etc.). |

| Balance Due | The remaining amount that the client still owes, calculated automatically. |

With these columns, you can easily track the status of each transaction and know if there are any outstanding balances. To make the process even more efficient, you can use formulas to automatically calculate totals, balances, and other key figures.

Using Formulas for Better Tracking

Formulas can be incredibly helpful in managing payments. Here’s how you can use them:

- Balance Due Formula: You can use a formula like =Amount Due – Amount Paid to calculate the remaining balance automatically. This eliminates the need for manual calculations and reduces the risk of errors.

- Total Payments Formula: Use a

How to Share Your Proforma Invoice

Once you’ve created your business document outlining a transaction, it’s essential to share it with your client in a way that is both professional and efficient. Whether you’re sending it for approval or as part of the payment process, the method of sharing can influence how quickly your client responds and how easy it is for them to process the document. Choosing the right delivery method ensures clear communication and helps keep everything organized.

Popular Ways to Share Your Document

There are several methods you can use to share your business documents. Each method has its own advantages, depending on the client’s preferences and the nature of your relationship.

- Email: The most common method is sending the document via email. You can attach the file as a PDF or other format, and include a brief message explaining the contents. This ensures fast delivery and allows for easy storage on both ends.

- Cloud Storage Links: If the document is too large to email or you prefer not to send attachments, you can upload the file to a cloud storage platform (such as Google Drive, Dropbox, or OneDrive) and share a link. This is a great option for clients who may need to access the document multiple times or download it to their own systems.

- Direct Messaging or Business Platforms: Many businesses use platforms like Slack, Trello, or customer relationship management (CRM) tools to share important files. This can keep everything within a specific workflow and allow for easy communication alongside the document exchange.

- Fax or Postal Service: While less common today, faxing or mailing hard copies may still be preferred by some clients, especially in industries that require official, signed documentation. It’s important to confirm the method preferred by your client before sending.

Best Practices for Sharing Your Document

Regardless of the method you choose, there are a few best practices to follow:

- Clear File Naming: Use a consistent and professional naming convention for your document. Include key details like the client name, the date, and the document type (e.g., “ClientName_Transaction_Document_2024”). This makes it easier for your client to locate and identify the file.

- Include a Clear Subject Line: If sending via email, use a clear and concise subject line that highlights the purpose of the document, such as “Transaction Summary for Review” o

Tips for Automating Invoice Creation in Excel

Automating the creation of transaction records can save time, reduce human error, and ensure consistency across all your business documents. With the right tools and techniques, you can streamline the process of generating accurate and professional-looking transaction summaries. This approach not only makes your workflow more efficient but also helps in maintaining a high level of accuracy, even when dealing with large volumes of data.

Leveraging Built-In Features for Automation

There are several features within spreadsheet software that can help automate the creation and management of transaction records:

- Formulas and Functions: Utilize formulas to automatically calculate totals, taxes, discounts, and balances. For example, you can use

=SUM()to add up item prices, or=A2*B2to calculate the total cost based on quantity and unit price. - Data Validation: Set up drop-down lists and data validation rules to prevent incorrect entries. For example, a drop-down list for payment methods ensures that users select only valid options, reducing mistakes.

- Conditional Formatting: Use conditional formatting to highlight key data points, such as overdue payments or discounts, based on predefined criteria. This makes it easier to spot important information at a glance.

- Cell Referencing: By using absolute and relative references, you can automate the transfer of data between different sheets or sections of the document, ensuring that calculations remain accurate as you add new entries.

Setting Up Automation with Macros

Macros are an excellent tool for automating repetitive tasks. These are recorded actions that can be replayed to save time and effort. Here’s how you can use macros for invoice automation:

- Recording a Macro: In your spreadsheet software, record a sequence of actions, such as formatting cells, inserting specific text, or performing calculations. Once recorded, you can replay the macro with a single click to repeat those actions without having to do them manually.

- Automating Common Actions: Macros can be used to perform frequent tasks such as updating client information, applying payment terms, or creating a new transaction record based on a specific template or structure.

- Advanced Automation with VBA: For more advanced automation, use Visual Basic for Applications (VBA) to create custom scripts that can handle complex tasks, like automatically generating documents based on customer data or generating reports.

By combining built-in features with macros, you can significantly reduce the time spent on administrative tasks and ensure that your transaction records are always up to date and accurate.

- Formulas and Functions: Utilize formulas to automatically calculate totals, taxes, discounts, and balances. For example, you can use