Simple Printable Blank Invoice Template for Easy Billing

When managing business transactions, having an organized and efficient method for generating payment requests is crucial. Whether you’re a freelancer, small business owner, or working in a large corporation, having a standardized format for your financial communications can save time and reduce errors. In this guide, we will explore how to craft an effective document for requesting payment that fits your needs and ensures clarity with clients.

Efficient financial documentation is more than just a tool–it’s a way to present your services in a professional manner. By using well-structured forms, you ensure that important details such as payment terms, service descriptions, and total amounts due are clear and easily accessible. A clear format helps avoid confusion and can foster trust between you and your clients.

We will also discuss the various options available for customizing these documents to suit your business style. With easy-to-use solutions, you can create a personalized structure without the need for advanced software or design skills. This ensures that every transaction is handled smoothly and professionally, from start to finish.

Why Use a Printable Invoice Template

Having a standardized format for billing makes it easier to manage financial transactions and maintain consistency in your business practices. By using a structured document, you ensure that all relevant information is included and presented clearly, reducing the chances of errors or misunderstandings. This approach helps streamline the payment process, both for you and your clients, making it easier to track sales, services rendered, and payments received.

Utilizing a pre-designed document can save valuable time and effort. Instead of starting from scratch each time you need to request payment, a ready-made layout provides a quick and efficient solution. It allows you to focus on the important aspects of the transaction, such as adjusting amounts or including specific details, without worrying about the formatting or structure.

Additionally, a well-organized document reflects professionalism and attention to detail. It signals to your clients that you take your business seriously and that you are committed to maintaining clear, organized records. Whether you’re managing a small freelance business or handling large-scale transactions, using a structured format ensures a smooth and professional experience for both parties.

Benefits of Customizable Invoice Templates

Customizable billing formats offer numerous advantages for businesses, allowing greater flexibility and personalization in financial communications. Instead of relying on a rigid structure, these formats can be adjusted to meet the unique needs of different clients, industries, or services. This adaptability helps ensure that each document is tailored to reflect the specific details of the transaction, making it both professional and accurate.

Enhanced Professionalism

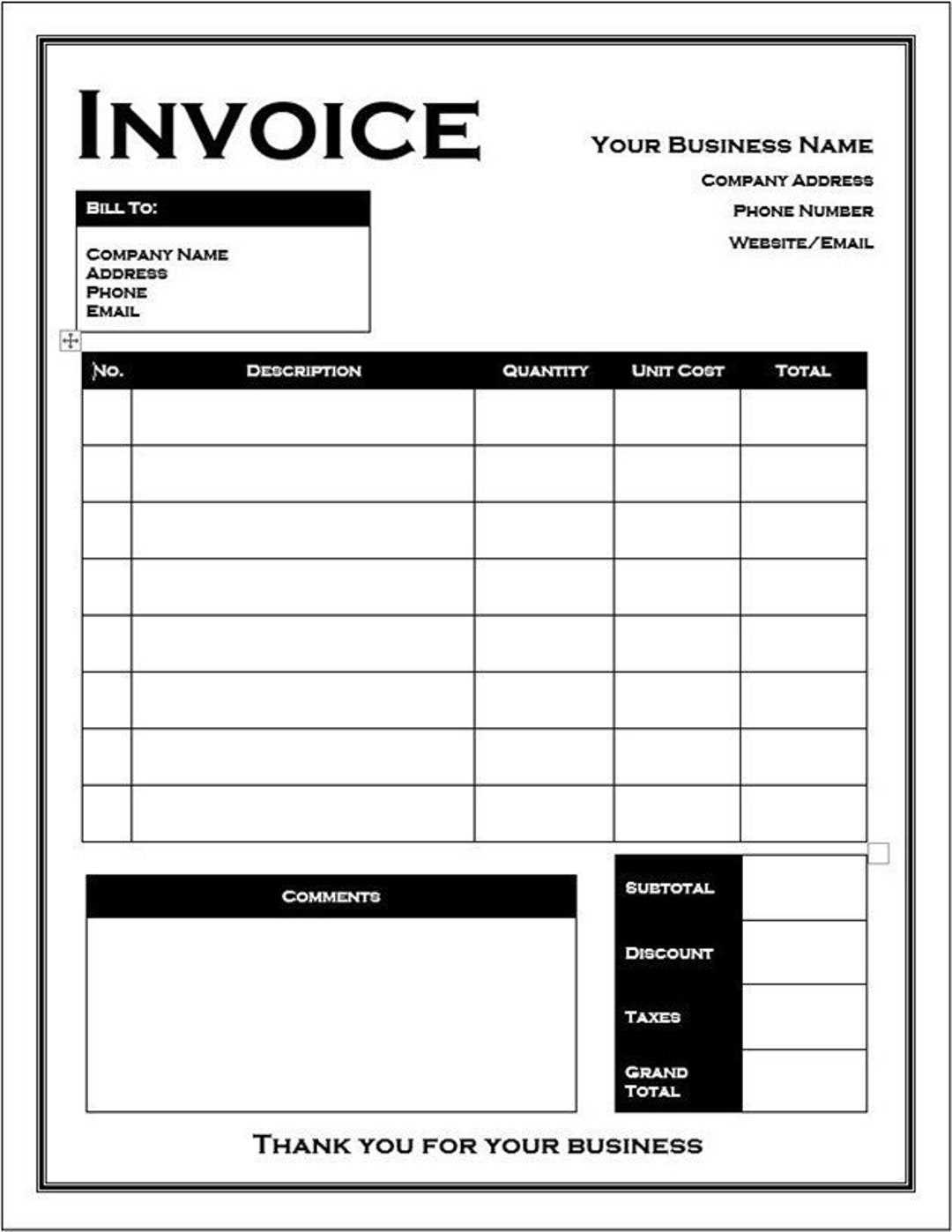

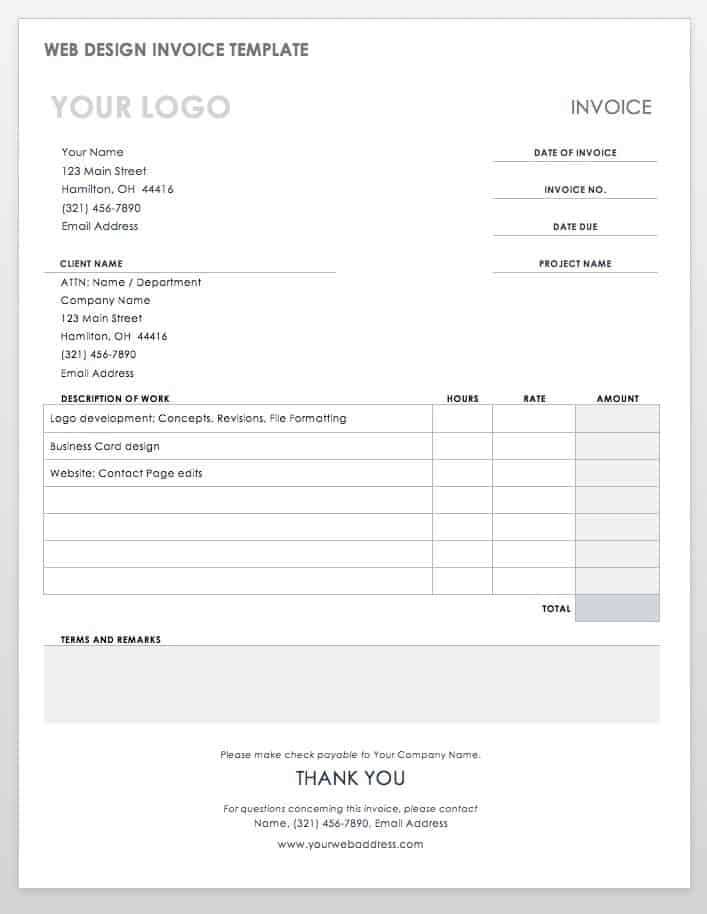

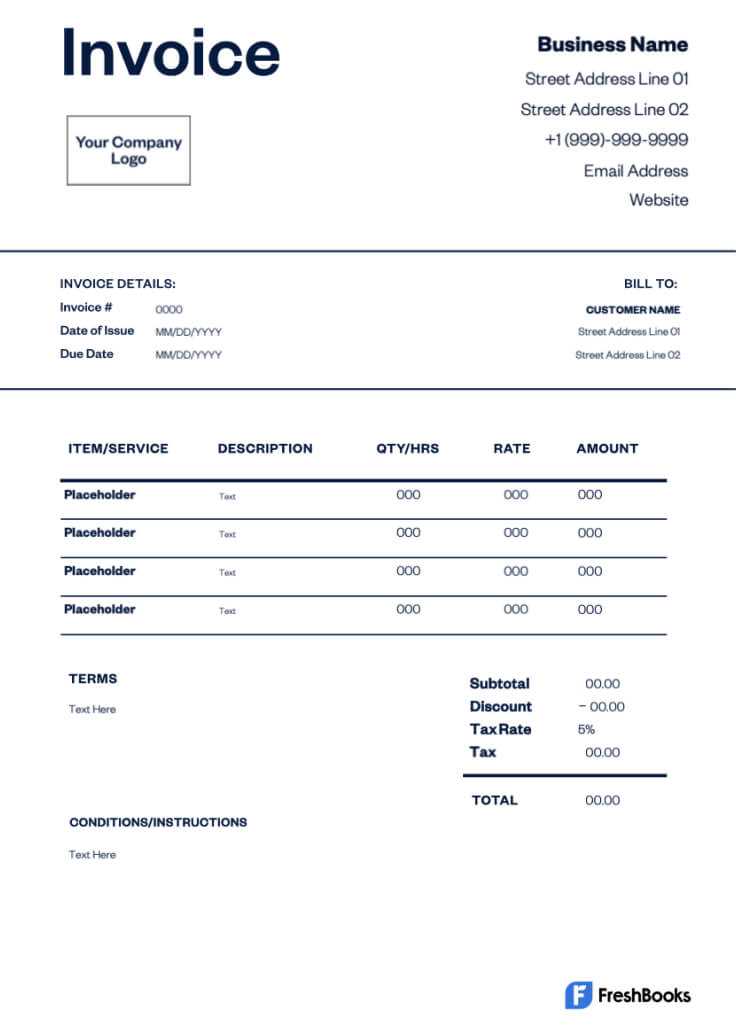

One of the key benefits of using a customizable structure is the ability to present a polished, professional appearance. By modifying the design, you can incorporate your company’s branding elements, such as logos and color schemes, which enhances your company’s image and fosters trust with clients. A well-designed document reflects a level of professionalism that can distinguish your business from competitors.

Increased Efficiency

Another significant advantage is the time-saving aspect. Instead of recreating the same document each time, a customizable format allows for quick adjustments to suit individual transactions. Whether you’re adjusting pricing, adding specific details, or changing payment terms, having a flexible structure reduces the time spent on administrative tasks, allowing you to focus on growing your business.

How to Create a Simple Invoice

Creating a clear and concise billing document is essential for maintaining an organized record of transactions and ensuring prompt payments. The process can be straightforward if you follow a few key steps, focusing on the most important information your client needs. A well-structured document will help eliminate confusion and make it easier for both parties to understand the terms of the agreement.

Step 1: Include Essential Information

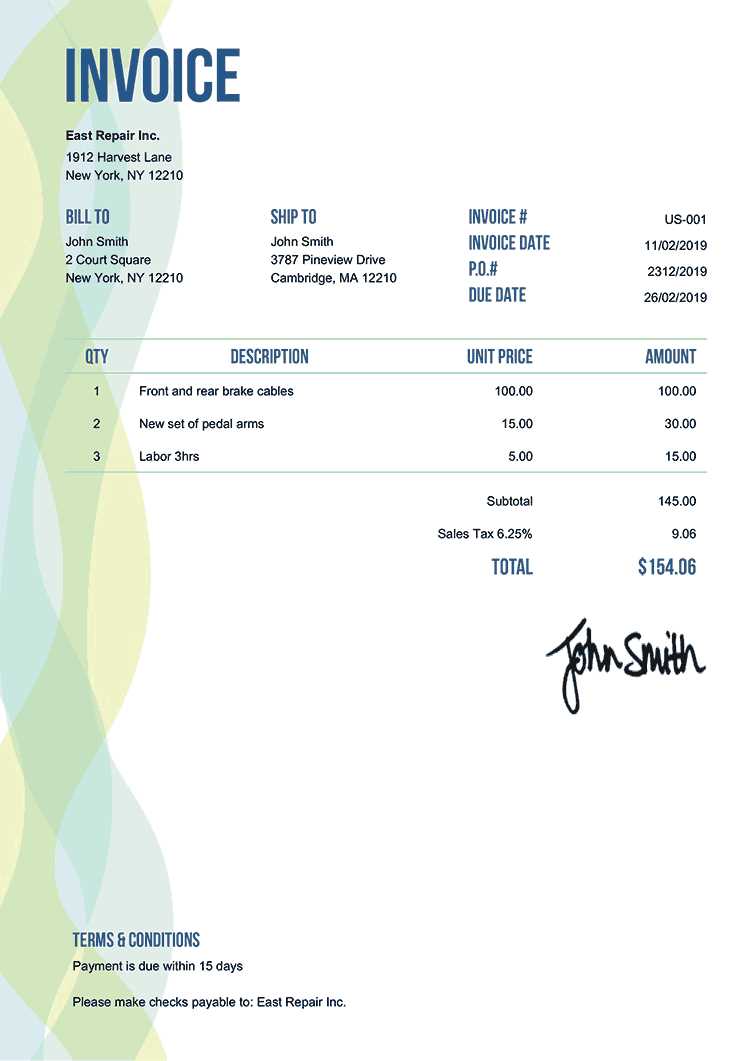

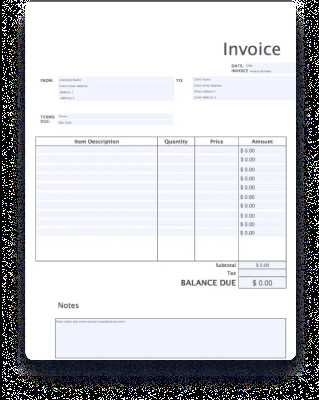

The first step in crafting a payment request is to ensure that all necessary details are included. Start by adding your business name, address, and contact information at the top. Then, include the client’s details, such as their name, company, and contact information. Clearly state the date and any relevant reference numbers that can help identify the transaction.

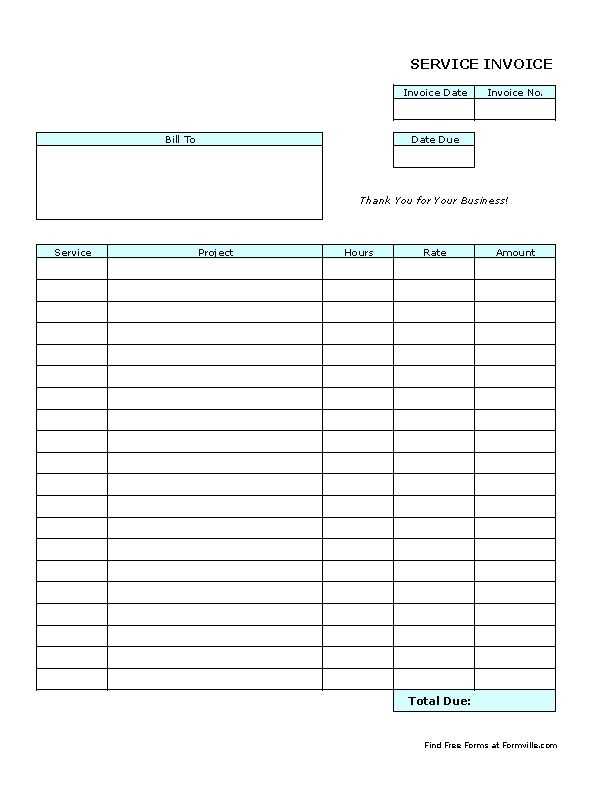

Step 2: List Services or Products

Next, list the services rendered or products provided along with the corresponding costs. Be specific about each item, providing a brief description if needed. Break down the charges in an easy-to-read format, showing the quantity, unit price, and total for each. This level of detail ensures transparency and makes it easier for your client to verify the charges. Accurate calculations are crucial to avoid any potential disputes.

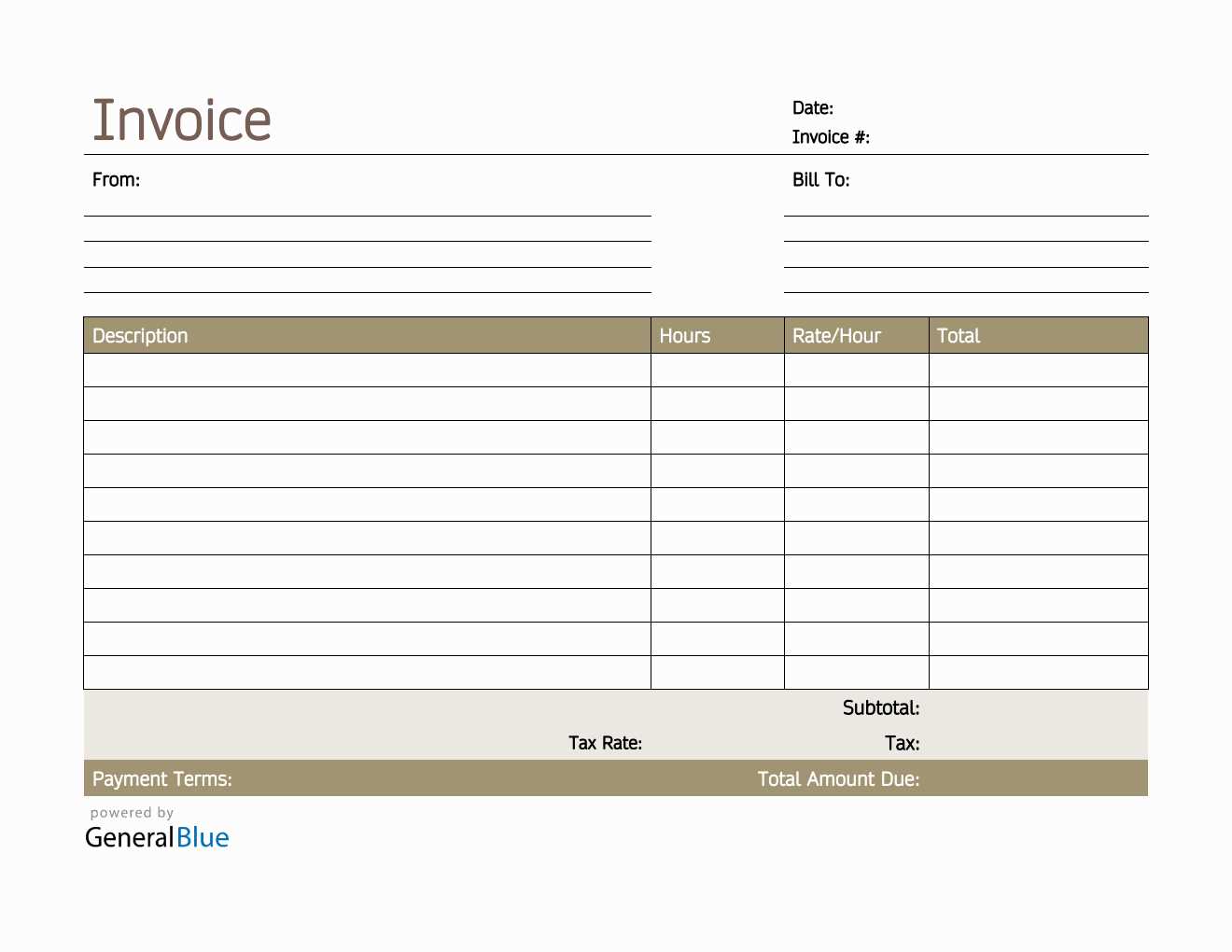

Key Elements in an Invoice Template

When creating a billing document, there are several critical components that should always be included to ensure clarity and prevent misunderstandings. These elements provide a clear structure, making it easier for both the business and the client to process the transaction. Below are the essential sections that every well-constructed document should contain.

| Element | Description | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Information | Your company’s name, address, and contact details should be prominently displayed at the top. | |||||||||||||

| Client Information | Include the client’s name, company, and contact details to ensure the document is directed to the correct party. | |||||||||||||

| Transaction Date | Clearly state the date the transaction took place or when the payment is due. | |||||||||||||

| Unique Identifier | Assign a unique reference number to the document for easy tracking and future reference. | |||||||||||||

| List of Products/Services | Detail each item or service provided, along with the unit price, quantity, and total cost. | |||||||||||||

| Payment Terms | Specify the payment due date and any terms or conditions associated with late payments or early discounts. | |||||||||||||

Total Amount

Where to Find Blank Invoice TemplatesThere are various places where you can find ready-made documents to help streamline the billing process. Whether you’re looking for a free option or a more advanced solution, many resources are available online, offering a range of designs and formats to suit your needs. Below are some of the best places to find these ready-to-use layouts. 1. Online Websites and MarketplacesNumerous websites offer free or paid layouts for generating payment requests. These resources often allow you to download a customizable structure that you can fill in with your own details. Some of the most popular platforms include:

2. Accounting and Finance SoftwareFor those who need more robust features, many accounting software solutions include customizable options for creating professional billing documents. These tools typically integrate with other business functions, such as invoicing, reporting, and payment tracking. Some options include:

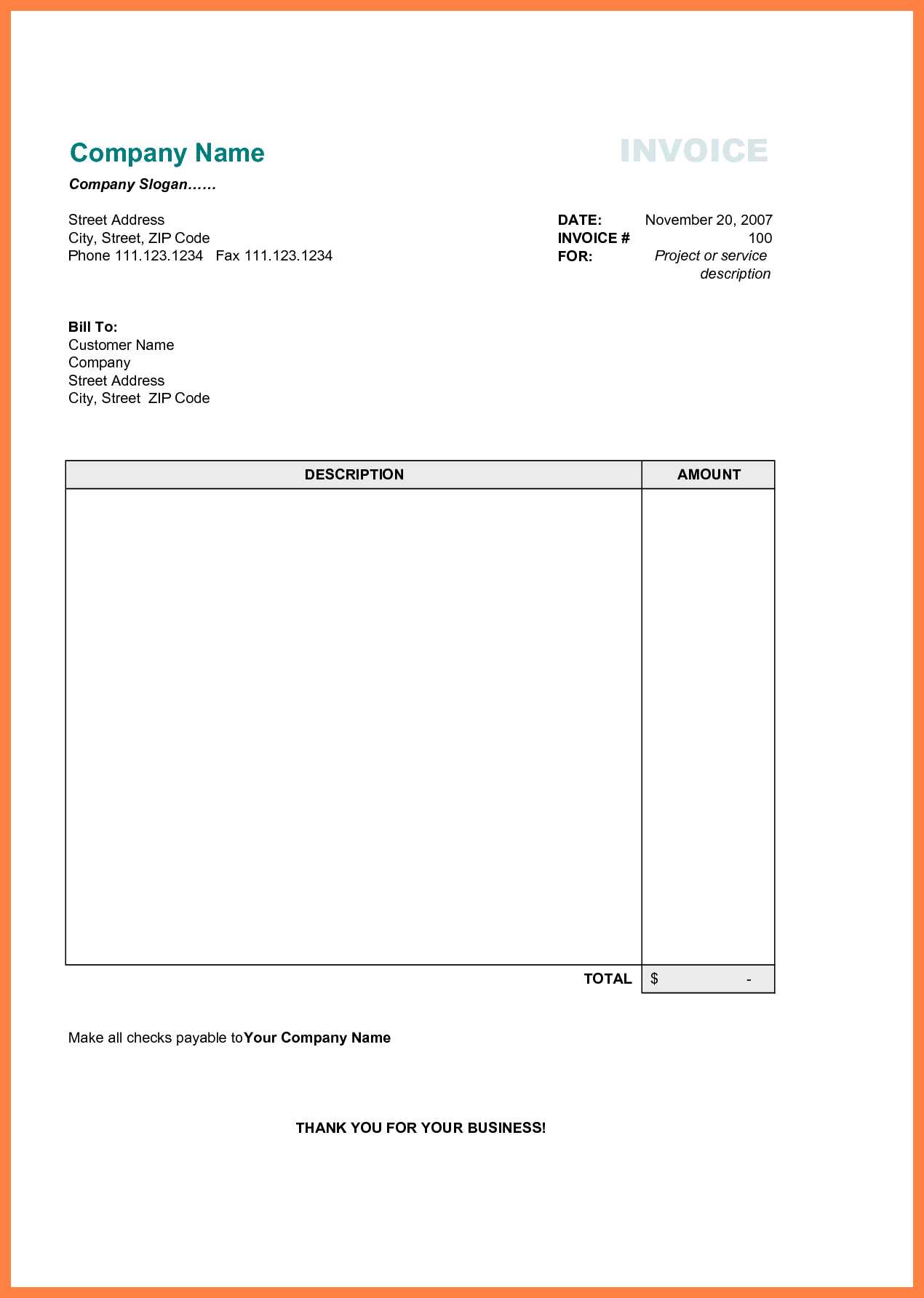

By exploring these platforms, you can easily find the right structure for your business, savin How to Fill Out an Invoice FormCompleting a billing document accurately is crucial for ensuring clear communication with your clients and for maintaining proper financial records. Each section of the document must be filled in with specific details to avoid confusion and ensure timely payments. Below are some important steps to follow when filling out a payment request form. Step 1: Enter Your Business and Client DetailsAt the top of the document, begin by entering your company’s name, address, and contact information. Follow this by entering the client’s details, including their name, company, and relevant contact info. Ensure that both parties’ addresses and contact numbers are correct to avoid any delivery or communication issues. Step 2: List Services or Products ProvidedNext, clearly list the services or goods provided, along with their respective quantities and unit prices. For each item, include a brief description if necessary, so the client knows exactly what they are being charged for. This section should be well-organized, with each line showing the amount due for each item. Finally, calculate the total cost for each service or product and ensure that the sums are accurate. After this, include the payment terms, such as the due date and any applicable taxes or discounts. Don’t forget to check the final total to ensure it reflects the correct amount due. A well-completed document helps prevent misunderstandings and ensures that both parties are on the same page. Types of Invoice Templates AvailableThere are various styles of billing documents, each designed to meet different business needs and preferences. The structure and design of each document can vary based on factors such as the nature of the services provided, the size of the business, and the level of detail required. Understanding the different options available can help you select the best format for your specific situation. 1. Basic FormatThis type is ideal for small businesses or freelancers who need to send straightforward payment requests. It typically includes essential information like the client’s details, a list of services rendered, and the total amount due. 2. Detailed FormatFor larger projects or services that require more explanation, a detailed layout may be more suitable. This format often includes itemized lists, terms and conditions, and payment instructions, making it easier for both parties to understand the agreement.

|