Simple Invoice Template for UK Businesses

Managing financial transactions and keeping track of payments can be a time-consuming task for businesses. Having an organized and efficient system in place for documenting these transactions is essential to ensure smooth operations. Using a structured document that can be tailored to your needs offers a simple way to stay on top of your financial record-keeping.

For businesses in the UK, the right tool can streamline the entire billing process. A well-designed document not only ensures clarity for both parties but also helps maintain a professional image. Whether you’re a freelancer or a small company owner, having a flexible format can save time and reduce errors.

In this guide, we will explore various ways to set up such a document, focusing on key elements to include and offering tips on customization. By understanding how to create a functional and polished form, you can enhance your business’s financial workflow with minimal effort.

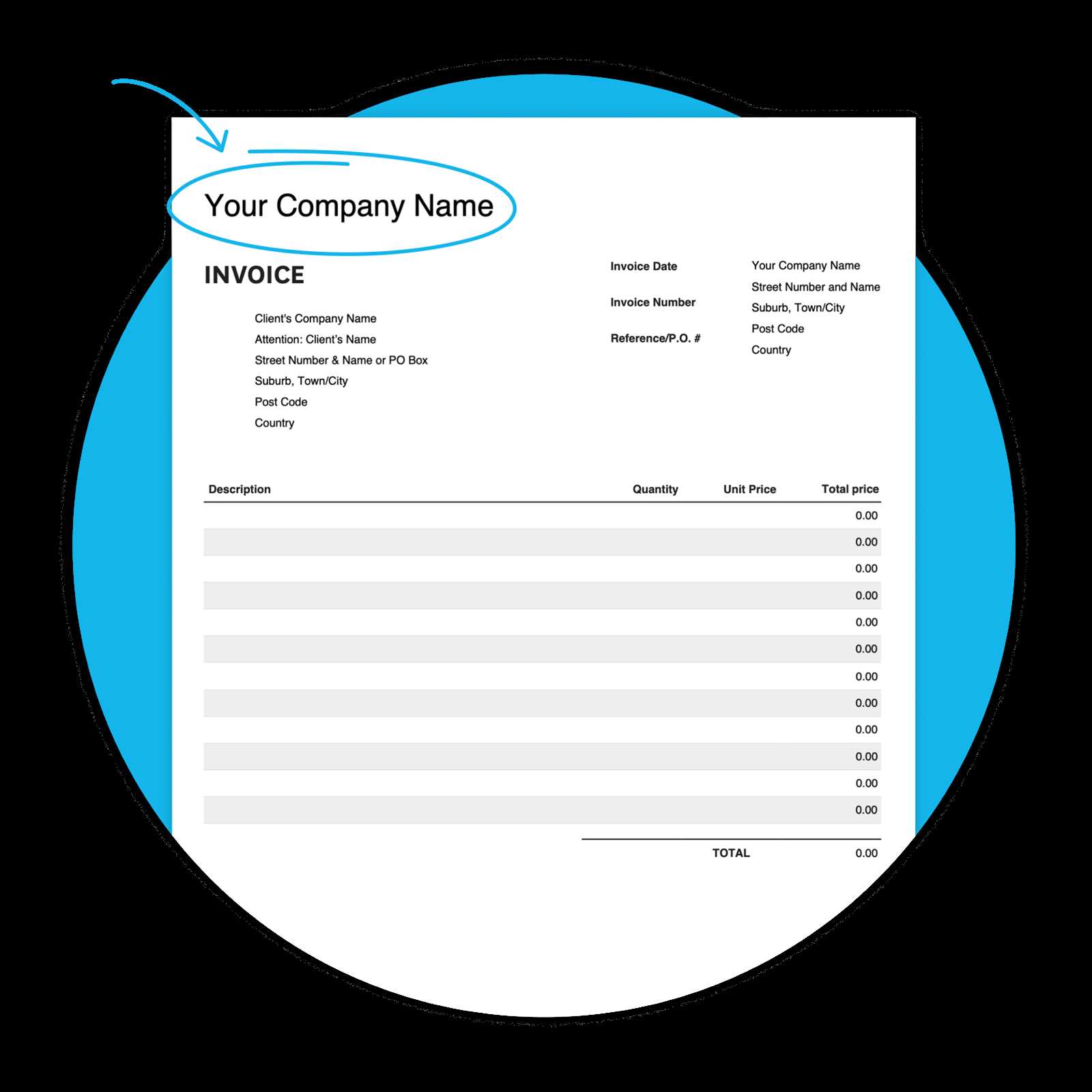

Simple Invoice Template UK

For UK businesses, having a well-organized document for tracking transactions is essential for smooth operations. Whether you’re billing clients for services rendered or products sold, a standardized method for documenting payments helps maintain order and professionalism. A customizable document that is easy to update and adapt ensures that all necessary details are captured while saving time.

Key Features to Include

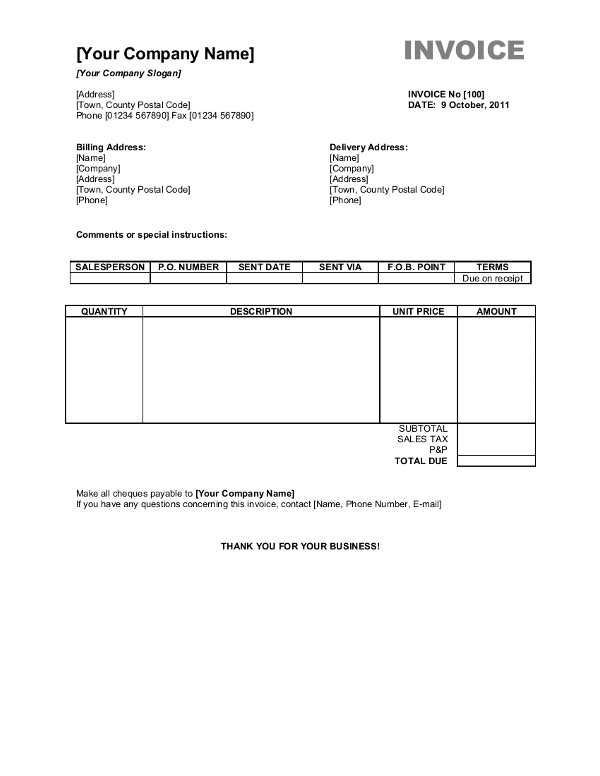

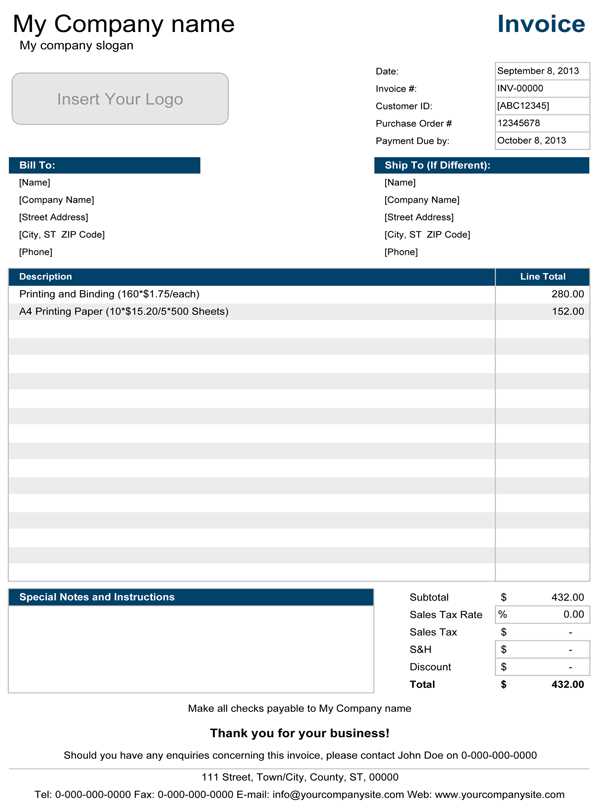

When creating a document for billing purposes, it’s important to include certain essential details that make the document clear and legally compliant. These include:

- Business Information: Include your business name, address, contact details, and VAT number if applicable.

- Client Information: Ensure the customer’s name, address, and contact information are listed accurately.

- Unique Reference Number: Assign a unique identifier to each transaction for easy tracking and future reference.

- Description of Goods/Services: Clearly outline what has been sold or the service provided, with itemized costs.

- Total Amount Due: Provide a clear breakdown of the total amount to be paid, including any applicable taxes.

- Payment Terms: Specify the payment due date and any penalties for late payments.

Why Choose a Customizable Format

Using a flexible structure for your billing documents allows you to make quick adjustments as your business needs change. It ensures consistency and helps present a professional image to clients. By adapting the layout to suit your specific requirements, you can efficiently manage your finances and keep track of outstanding payments. Customization options could include adding your logo, adjusting the layout, or incorporating additional fields as needed.

Why Use an Invoice Template

Adopting a standardized method for documenting payments and transactions offers numerous advantages for businesses. A structured form ensures consistency, reduces errors, and saves time, allowing you to focus on other important aspects of your operations. Using a pre-designed layout to record financial details not only improves efficiency but also maintains a professional appearance when dealing with clients.

Benefits of Using a Pre-Formatted Document

There are several key reasons to adopt a ready-made structure for billing purposes:

- Time-Saving: Using a predefined structure reduces the amount of time spent creating each new document from scratch.

- Accuracy: A consistent format ensures all necessary information is included, minimizing the risk of missing important details.

- Professionalism: A clean, well-organized format presents a polished image to clients and reflects well on your business.

- Ease of Customization: Templates can be tailored to meet specific business needs, such as adding or removing fields and adjusting the layout.

- Legal Compliance: Pre-designed formats often include all the required legal elements, ensuring your documents meet necessary regulations.

How Templates Enhance Workflow

By using a structured document for billing, you can automate and streamline your business processes. This leads to faster payment processing and easier tracking of transactions. Templates also help reduce errors in calculations, as many pre-made forms come with built-in fields for automatic calculations, ensuring accuracy every time you issue a bill.

Benefits of Customizable Invoice Formats

Having the ability to modify your billing documents allows businesses to meet their unique needs and improve the efficiency of their financial operations. A flexible structure enables easy adjustments to reflect changes in the business or client requirements. This customization leads to a more personalized experience, fostering a professional image while improving the accuracy and clarity of each transaction.

Why Customization is Important

There are several advantages to using a format that can be tailored to suit specific requirements:

- Branding Opportunities: Customizable layouts allow you to incorporate your business logo, colors, and fonts, creating a cohesive brand identity across all your documents.

- Adaptability to Business Changes: As your business evolves, you can easily update your billing format to reflect new products, services, or payment structures.

- Client-Specific Adjustments: Custom fields can be added to address the unique needs of each client, such as discounts, custom payment terms, or specific service descriptions.

- Enhanced Clarity: Tailoring the format lets you highlight the most important details in a way that suits your business style, making it easier for clients to understand the terms.

- Efficient Record-Keeping: A customizable design can include fields for tracking payment status, due dates, and other critical information, helping you stay organized.

How Customization Improves Workflow

By customizing your billing format, you streamline the entire process, from creation to tracking and payment. Personalized designs can integrate seamlessly into your workflow, reducing manual entry and the risk of errors. Furthermore, having the flexibility to make quick changes means you can easily adapt to new regulations, industry standards, or customer demands without needing to start over.

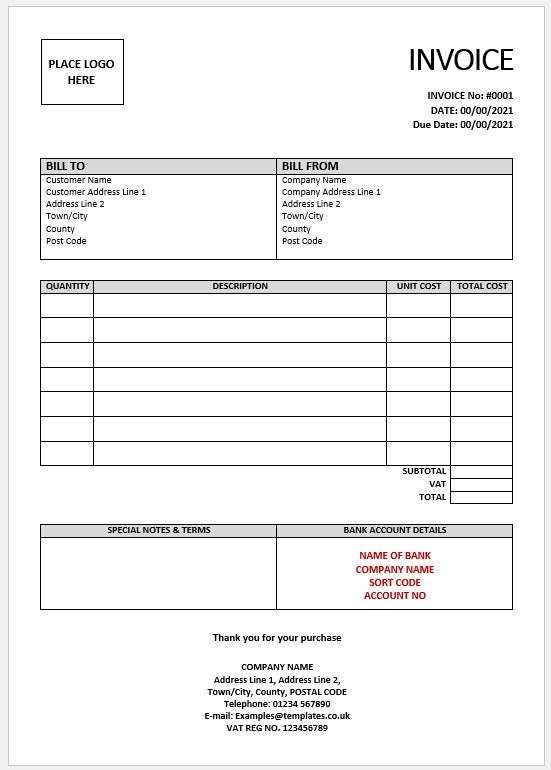

Essential Elements of an Invoice

To ensure clarity and professionalism, it’s crucial that a billing document includes all the necessary information. A well-structured document not only helps to maintain a smooth transaction process but also protects both parties in case of disputes. Including key details ensures that the recipient understands what is being charged and the terms of payment.

The following elements are essential for creating a clear and complete record:

- Business Information: Clearly display the company’s name, address, contact details, and VAT number if applicable. This allows the recipient to easily reach out if there are any questions regarding the transaction.

- Recipient Details: Include the client’s name, address, and contact information. This ensures the bill is properly addressed and facilitates communication if necessary.

- Unique Reference Number: Each document should have a unique identification number. This helps in tracking and organizing financial records.

- Detailed List of Goods/Services: Provide a description of the products or services delivered, including quantities, prices, and any applicable discounts. This breakdown ensures both parties agree on the details of the transaction.

- Total Amount Due: Clearly state the total sum to be paid, including taxes and any additional charges. It should be easy to identify the full amount the recipient owes.

- Payment Terms: Specify the due date for payment, and outline any late fees or penalties that may apply if payment is not received on time. This helps avoid confusion or misunderstandings.

- Payment Methods: Indicate the accepted payment methods and any necessary details, such as bank account numbers or online payment instructions.

By including these key elements, you ensure that the document serves both as a record for your business and a clear request for payment from your client.

How to Create an Invoice for UK

Creating a professional billing document for transactions in the UK requires careful attention to detail and an understanding of local regulations. By following a clear structure, you can ensure that both you and your clients have a complete and accurate record of the transaction. A well-prepared document helps streamline the payment process and reduces the likelihood of disputes.

Step-by-Step Guide to Creating a Billing Document

Follow these steps to craft a clear and legally compliant record for any business transaction:

- Include Your Business Information: List your business name, address, phone number, email, and VAT number if applicable. This ensures the recipient knows exactly who is sending the bill.

- Client’s Details: Include the full name, address, and contact information of the customer or business receiving the bill. This ensures that the document is properly addressed.

- Assign a Unique Reference Number: This helps both you and the recipient track the transaction easily. It’s essential for record-keeping purposes.

- Describe the Goods or Services: List each item or service provided, including the quantity, unit price, and total for each entry. This breakdown ensures both parties understand exactly what is being billed.

- Include Payment Terms: Clearly outline the payment due date and any late fees if applicable. Payment terms should be concise and easy to understand.

- Calculate the Total Amount: Sum up all the costs, including any taxes, discounts, or additional charges. Be transparent about the final amount due.

- Provide Payment Instructions: Specify the methods of payment accepted, such as bank transfers, credit card payments, or online platforms. Include relevant details like account numbers or payment links.

Important Considerations

When preparing a billing document for a UK-based transaction, make sure it complies with legal requirements, including VAT regulations if applicable. Double-check for accuracy, particularly in the payment details, to avoid any confusion or delays. A well-structured document not only reflects professionalism but also ensures a smooth payment process.

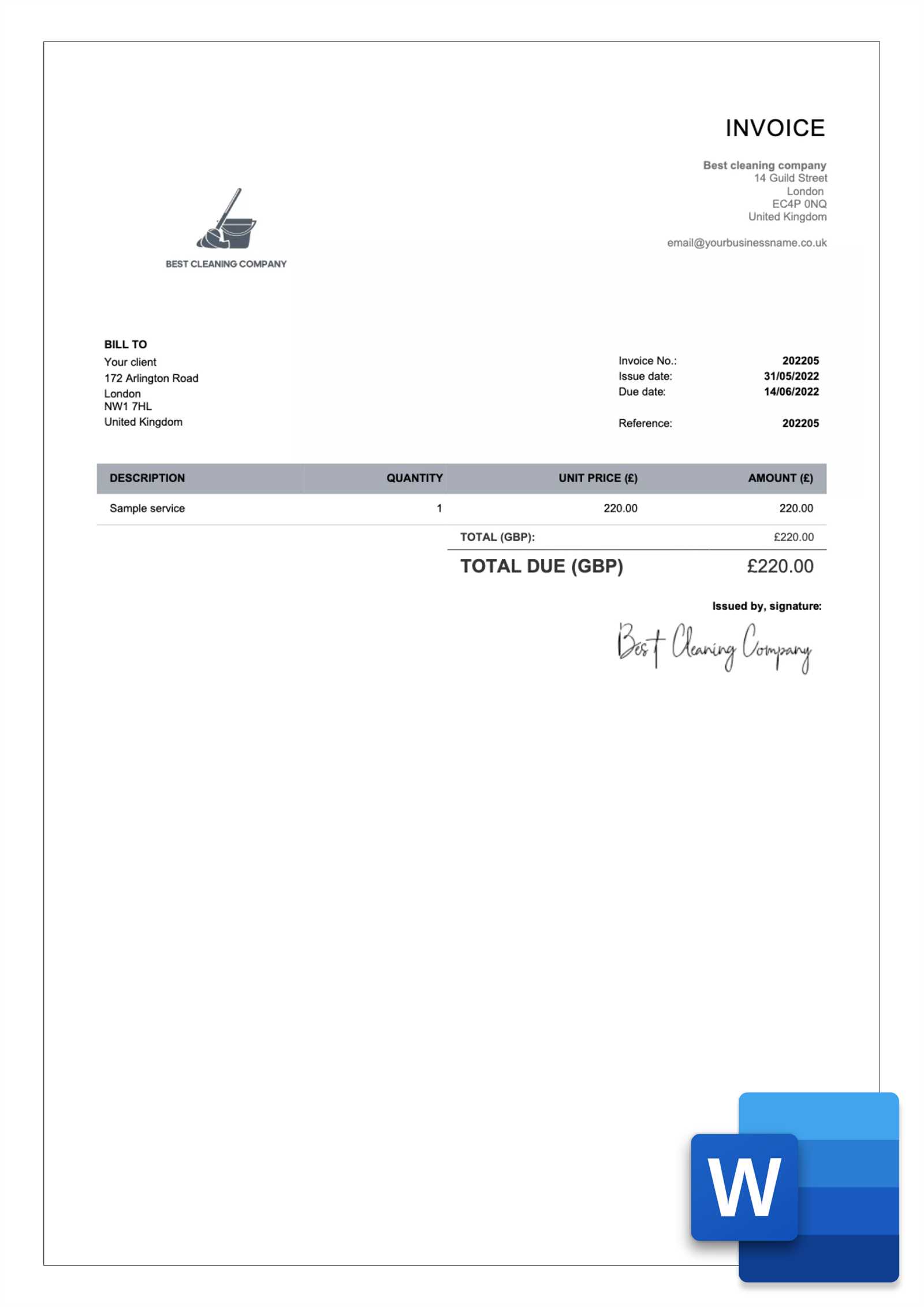

Free Invoice Templates for Small Businesses

For small businesses, finding an affordable and efficient solution for creating billing documents is essential. Thankfully, there are numerous free options available that provide ready-made structures designed to streamline the billing process. These resources are ideal for entrepreneurs and small business owners who need a quick, professional solution without the overhead of costly software or services.

Using a free, pre-designed structure allows small businesses to focus on what matters most – growing their business. These tools are often customizable, enabling you to adapt them to your specific needs while maintaining a consistent, professional appearance. Many options are designed with simplicity in mind, providing just the right balance of functionality and ease of use.

Advantages of Using Free Billing Documents

- Cost-Effective: Free resources eliminate the need for expensive software or subscriptions, making them ideal for businesses with limited budgets.

- Ease of Use: Most free billing documents are simple to use, with easy-to-fill fields that don’t require any technical expertise.

- Customization: Even free options often offer a degree of customization, allowing businesses to adjust the layout, add logos, and modify fields to suit specific needs.

- Time-Saving: Ready-made documents help businesses save time by providing a structured framework that eliminates the need for creating a new document from scratch.

Where to Find Free Resources

There are many reputable online platforms that offer free resources for small businesses. Websites dedicated to entrepreneurs often provide downloadable documents in various formats, such as Word, Excel, or PDF, so you can choose the one that fits your preferred workflow. Many of these platforms also offer tutorials and customer support to help you get started quickly.

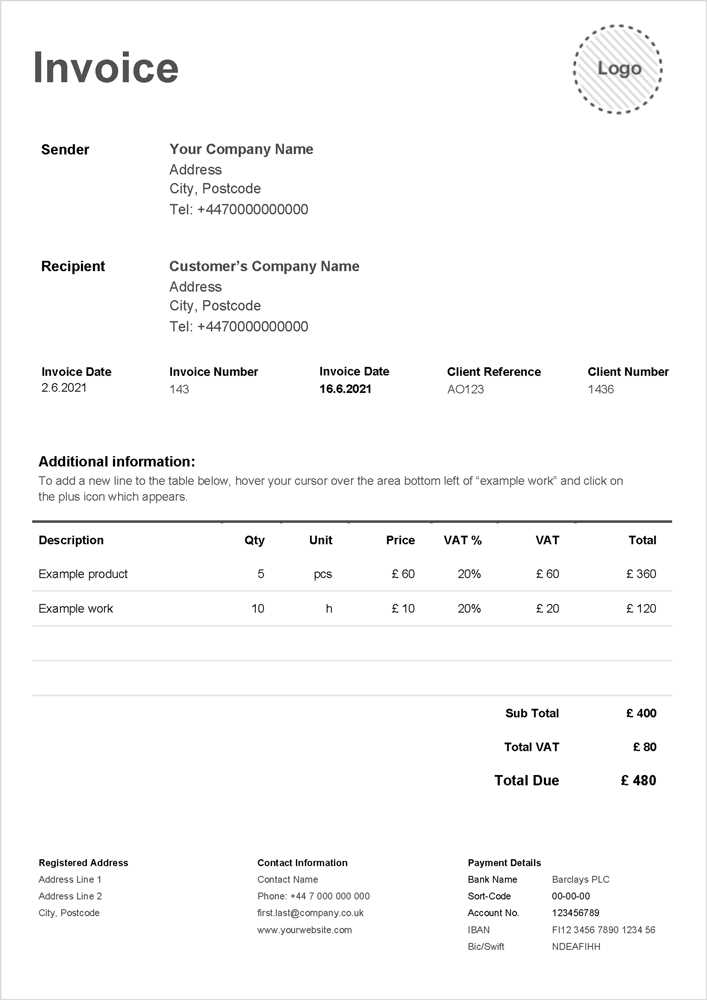

Managing VAT with Invoice Templates

Properly managing VAT (Value Added Tax) is a crucial aspect of running a business, especially for those operating in the UK. Accurate tax reporting ensures compliance with regulations and helps businesses avoid penalties. Using a structured document to manage VAT makes it easier to calculate, display, and track tax amounts, providing both clarity and efficiency in business operations.

To manage VAT correctly, it’s essential that the relevant tax information is included in each billing record. This includes specifying the VAT rate, breaking down taxable amounts, and clearly indicating the total VAT charged. Using a standardized format can simplify this process by automatically calculating taxes based on the pre-set rates.

Essential VAT Details for UK Businesses

When preparing a document that includes VAT, make sure to include the following key elements:

| Detail | Description |

|---|---|

| VAT Registration Number | Include your unique VAT number to comply with tax regulations. |

| Taxable Amount | Clearly separate the price before tax from the total amount, showing how much is taxable. |

| VAT Rate | Specify the VAT rate applied, such as the standard rate of 20% or a reduced rate, depending on the product or service. |

| Total VAT Charged | Include the total VAT amount on the bill, calculated based on the taxable amount and VAT rate. |

| Gross Total | The final total, including VAT, which is what the client will pay. |

By incorporating these essential details into your billing documents, you ensure that VAT is accurately tracked and communicated. This not only helps with legal compliance but also provides clients with a transparent breakdown of the taxes they are being charged.

How to Add Payment Terms to Invoices

Clearly outlining payment expectations is an important part of any business transaction. By setting clear payment terms, both parties understand the deadlines and conditions for settling the bill. Including these terms in your billing document ensures transparency and helps prevent misunderstandings.

When adding payment terms, make sure they are concise, easy to understand, and legally enforceable. Payment terms can vary depending on the nature of the transaction, but including the right details ensures that both you and your client are on the same page regarding deadlines, penalties, and acceptable payment methods.

Key Elements to Include in Payment Terms

- Due Date: Clearly specify the exact date by which payment must be received. For example, “Due within 30 days from the date of issue” or a specific calendar date.

- Late Payment Penalties: Indicate any fees that will apply if payment is not received by the due date, such as a fixed fee or interest rate (e.g., 2% per month).

- Accepted Payment Methods: List the methods you accept for payment, such as bank transfer, credit card, PayPal, or cheque, along with any necessary details (e.g., bank account number).

- Discounts for Early Payment: If applicable, offer a discount for prompt payment, such as “2% discount if paid within 10 days.” This encourages clients to pay earlier.

- Currency: State the currency in which payments should be made, especially important for international transactions (e.g., GBP, USD, EUR).

- Payment Instructions: Provide clear instructions on how and where to make the payment, ensuring your client has all the necessary details to settle the bill quickly.

By including these terms in your billing documents, you not only clarify payment expectations but also create a more professional image for your business. Clear payment terms protect both parties and streamline the financial side of your operations.

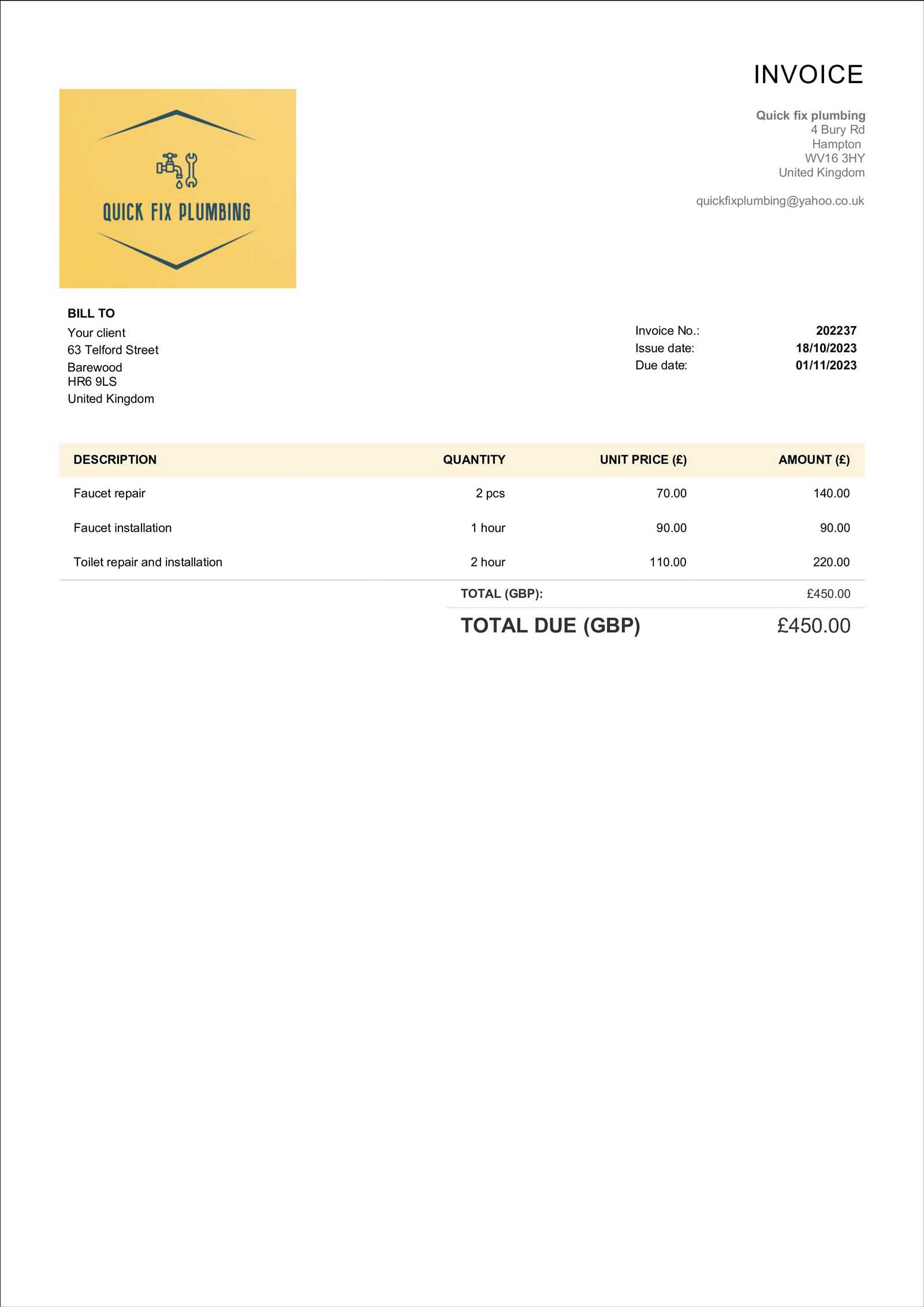

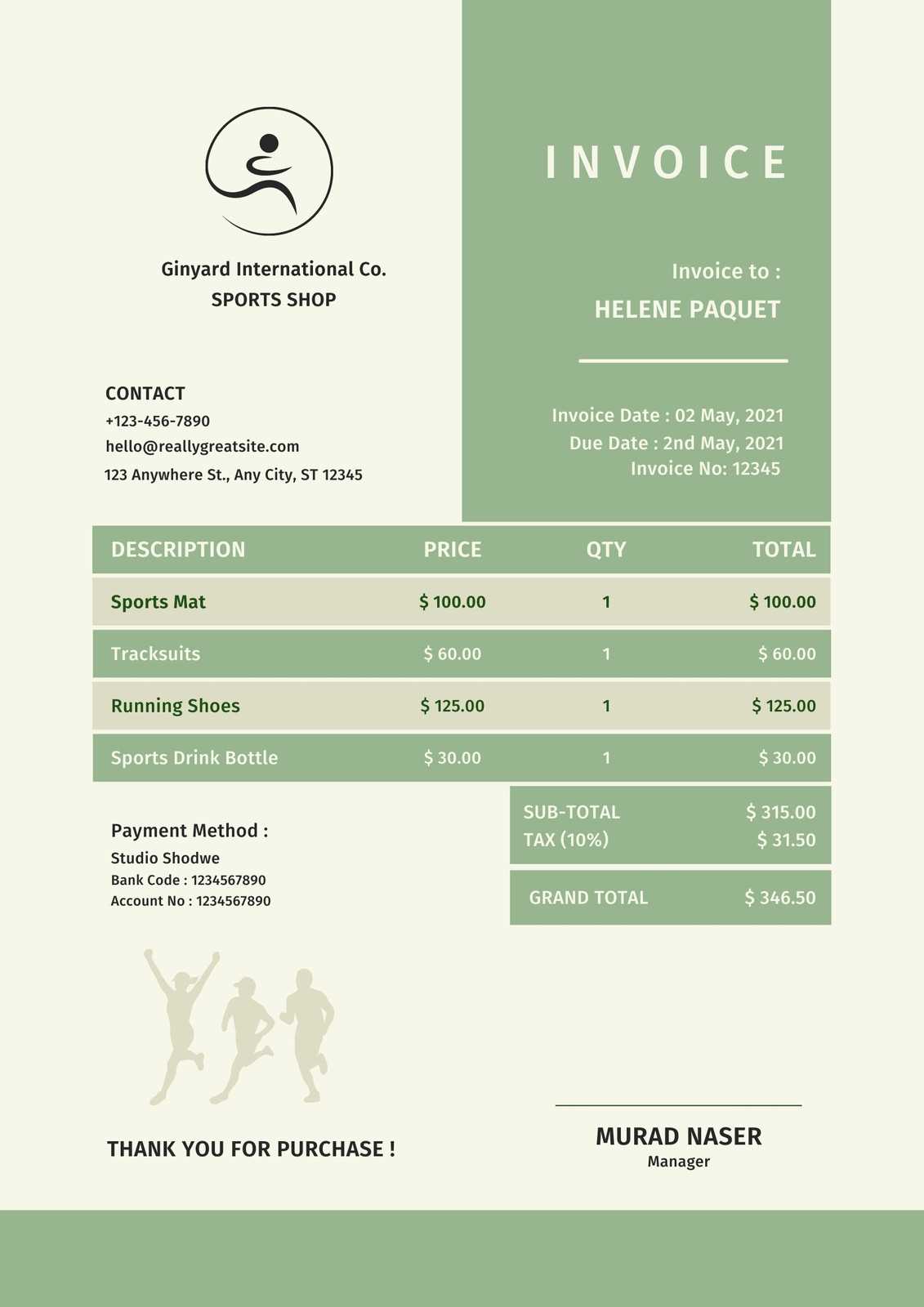

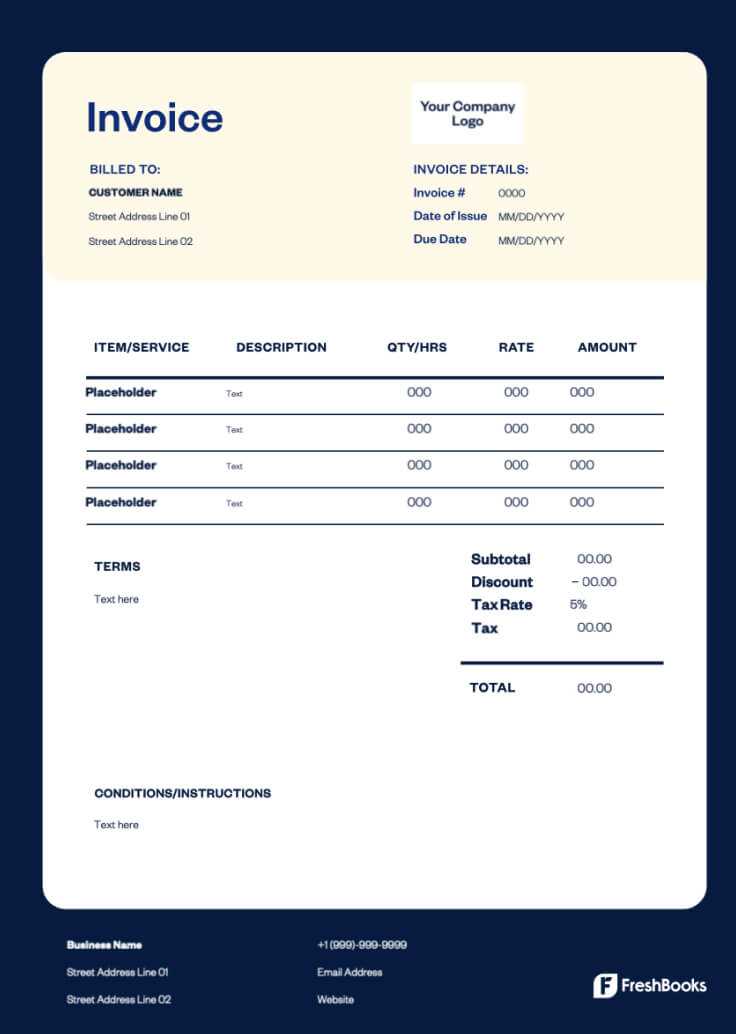

Customizing Your Invoice for Branding

Personalizing your billing documents is a powerful way to reinforce your brand identity and leave a lasting impression on your clients. Customization goes beyond adding a logo; it involves tailoring the design and content to reflect your company’s style, values, and professionalism. A well-branded document not only enhances recognition but also conveys trustworthiness and attention to detail.

By integrating key elements of your branding into your billing documents, you create a consistent experience for your clients. This makes your communications feel more cohesive and ensures that every aspect of your business, from marketing materials to financial documents, aligns with your brand’s identity.

How to Customize Your Billing Document

- Logo and Company Name: Place your business logo prominently at the top, along with your company name and contact information. This ensures your clients can easily identify the document as coming from your business.

- Brand Colors: Use your company’s brand colors throughout the document. This can include text, borders, or background colors to create a visually cohesive look that matches your overall branding.

- Font Style: Choose fonts that are consistent with your brand’s style guide. Avoid using too many different fonts to keep the document professional and easy to read.

- Custom Terms and Messaging: Personalize the text on the document by including a friendly note or message that reflects your brand’s tone and values. Whether it’s a thank you message or a brief brand statement, it adds a personal touch.

- Design Elements: Incorporate elements such as icons or design motifs that align with your brand’s aesthetic. Subtle details like these make the document feel more polished and aligned with your business’s image.

- Legal and Payment Information: Ensure that all legal disclaimers and payment details are clear, but you can also integrate them into the overall design to maintain a professional appearance without sacrificing functionality.

Customizing your billing documents isn’t just about making them look good–it’s about creating a memorable experience for your clients. With these branding elements, you elevate the professionalism of your communications, helping reinforce your brand identity at every touchpoint.

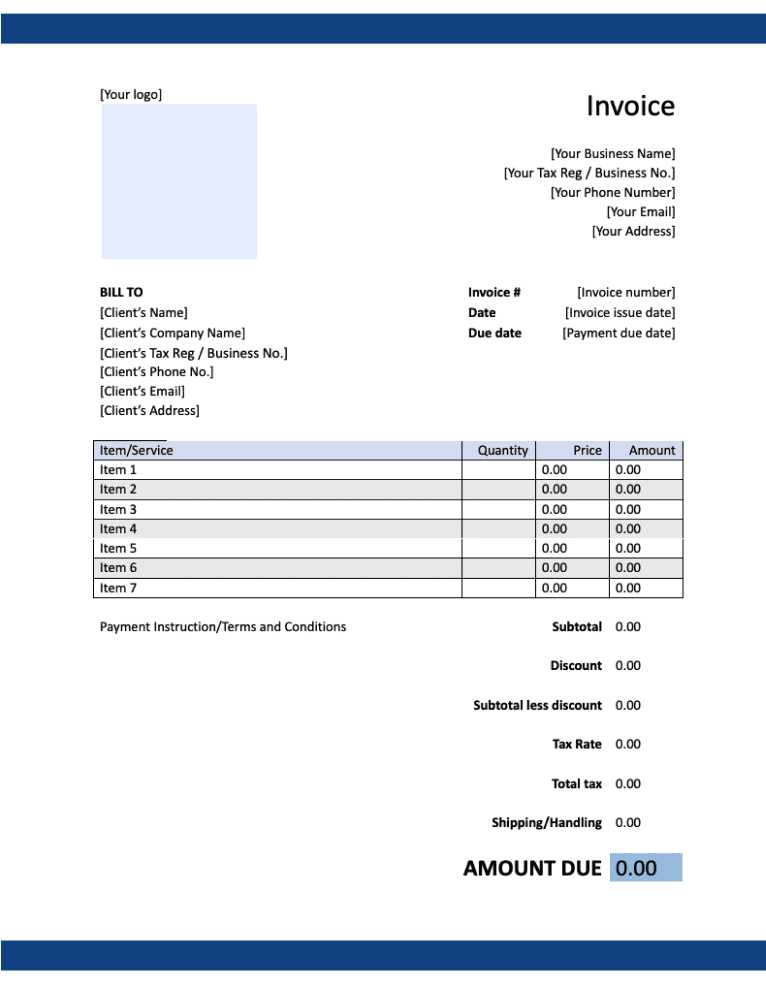

Choosing the Right Invoice Format

Selecting the right format for your billing document is crucial for ensuring clarity and professionalism. The format you choose can influence how quickly your clients process payments and how easy it is for both parties to review the transaction details. It’s important to consider your business needs, the type of products or services provided, and the preferences of your clients when deciding on the best structure.

There are various options available, from simple, straightforward layouts to more detailed designs that include additional sections for terms, conditions, and payment methods. The format should be easy to read and provide all the necessary information without overwhelming the recipient.

Factors to Consider When Choosing a Format

- Business Type: The format should reflect your business’s nature. A freelancer may require a more minimalist format, while a company with complex transactions might need a detailed document.

- Client Preferences: Some clients may prefer a more straightforward, no-frills document, while others may appreciate a more formal layout with clearly defined sections for taxes, discounts, and payment instructions.

- Legal Requirements: In the UK, certain details such as VAT registration number, payment terms, and the total amount owed must be clearly outlined, so choose a format that accommodates these legal obligations.

- Clarity: Ensure that the format is visually clear, with logical divisions between sections like itemized charges, payment terms, and due dates. This helps avoid confusion and speeds up the payment process.

Choosing Between Digital and Printed Formats

- Digital: Many businesses prefer digital formats, such as PDFs or online invoicing tools, due to their ease of use and quick delivery. Digital invoices can also be automatically generated and stored for easier tracking.

- Printed: For businesses that prefer more traditional methods, printed invoices still play a role. This format is often preferred for certain industries or when working with clients who do not use email or digital payment methods.

The right format ultimately depends on your business model and the needs of your clients. The key is to strike a balance between simplicity, professionalism, and functionality to ensure that your billing documents support smooth transactions and enhance your brand’s image.

Automating Invoicing with Templates

Automating your billing process is an efficient way to save time, reduce human error, and ensure that clients are billed promptly. By using pre-designed documents that can be easily customized for each transaction, businesses can streamline their financial operations. Automation also helps maintain consistency in the way transactions are recorded and communicated, contributing to better financial management.

Using automation for generating billing documents allows businesses to focus on other tasks, while ensuring that payment reminders and due dates are consistently met. This process can be further enhanced by integrating automated systems that create, send, and track bills without the need for manual intervention.

Benefits of Automating Billing

- Efficiency: Automating the process reduces the time spent manually entering data and customizing each document. This is especially valuable for businesses with a high volume of transactions.

- Accuracy: Pre-set details like company name, payment terms, and tax rates are automatically filled in, minimizing the risk of errors.

- Consistency: Automation ensures that all documents are created in the same format and include all necessary information, maintaining a professional image for your business.

- Faster Payments: Automated reminders and due date tracking can encourage clients to pay on time, improving cash flow.

- Tracking: Automated systems can keep track of outstanding payments, send overdue notices, and even generate reports, helping you stay on top of finances.

How to Set Up Automation

Setting up an automated system for generating and sending your billing documents requires choosing the right software that suits your business needs. Here’s a basic outline of how the process works:

| Step | Description |

|---|---|

| 1. Select Automation Tool | Choose an invoicing software that offers automation features, such as automatic creation, delivery, and reminders. |

| 2. Input Business Information | Enter all necessary details, including your business name, address, tax ID, and payment terms. |

| 3. Customize Document Layout | Adjust the layout to match your branding, ensuring that each document follows a consistent format. |

| 4. Set Up Payment Reminders | Configure automatic payment reminders and overdue notifications to encourage timely payments from clients. |

| 5. Integrate with Accounting | Link your invoicing system with accounting software for seamless financial tracking and reporting. |

By leveraging automated systems for your billing needs, you can significantly improve your workflow, reduce errors, and ultimately save valuable time. Whether you’re a small business or a large corporation, automating the billing process can help ensure that your finances rem

How to Track Payments Using Templates

Efficiently managing payment records is essential for maintaining healthy cash flow and ensuring that clients fulfill their financial obligations on time. Using pre-designed documents can simplify this process by offering a structured approach to recording payments and tracking outstanding balances. With the right setup, you can easily monitor which clients have paid, which are overdue, and which need follow-up.

By incorporating payment tracking features into your billing documents, businesses can reduce the risk of errors and ensure no payment goes unnoticed. Templates that include sections for payment status and due dates allow for clear documentation of the transaction history, making it easier to stay organized and ensure timely collections.

Key Sections for Payment Tracking

- Payment Status: Include a section to mark whether the payment has been completed, is pending, or is overdue. This provides a quick overview of the transaction status.

- Due Dates: Ensure that each document clearly displays the payment due date. Having a visible deadline encourages timely payments and allows you to track whether payments are overdue.

- Partial Payments: If applicable, track any partial payments that have been made. Including this information can help keep clients updated on the balance remaining.

- Payment Methods: Record how payments are made (e.g., bank transfer, cheque, online payment) to ensure accurate financial records.

Using a Payment Tracking System

Incorporating an automated system into your payment tracking process can save time and improve accuracy. Here is a basic example of how you can structure your payment tracking process:

| Step | Description |

|---|---|

| 1. Include Payment Information | Ensure that each billing document has sections for payment status, due date, and payment method. |

| 2. Update Payment Status | As soon as payment is received, update the status to reflect the completion of the transaction. |

| 3. Track Outstanding Balances | Regularly review your payment records to track any outstanding amounts and identify overdue payments. |

| 4. Send Payment Reminders | Automate reminders for overdue payments to encourage timely settlement. |

| 5. Generate Reports | Use the collected payment data to generate financial reports and analyze cash flow patterns. |

By integrating payment tracking into your billing process, you can maintain a clear and

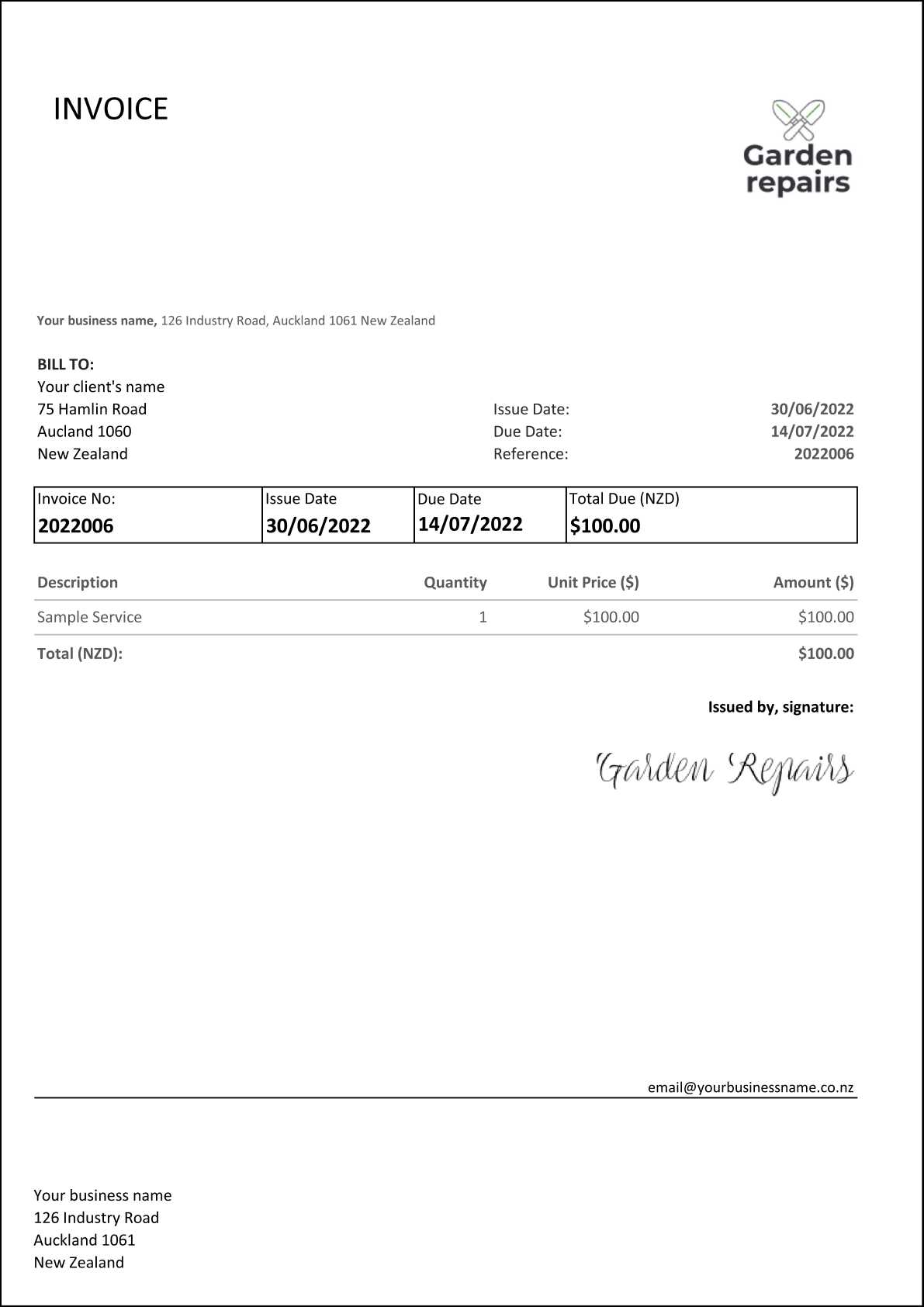

Invoice Templates for Freelancers in the UK

For freelancers in the UK, managing financial transactions efficiently is crucial to maintaining a steady flow of work and ensuring timely payments. Using standardized documents designed for billing helps streamline the process, keeping everything organized and professional. These tools are essential for freelancers who need to provide clear and accurate billing records to clients while staying compliant with UK tax regulations.

By utilizing structured documents, freelancers can easily outline the work done, payment due dates, and any applicable taxes or additional charges. This also provides a clear record for both the freelancer and the client, ensuring there is no confusion about payment expectations. Whether you are working on a project basis or providing ongoing services, having a reliable billing method is vital for keeping your business operations smooth and professional.

Key Features for Freelance Billing

- Work Description: Clearly define the services rendered or products delivered. This should include detailed descriptions to avoid any misunderstanding.

- Payment Terms: Specify the agreed-upon payment terms, such as deadlines, discounts for early payment, or penalties for late payment.

- Tax Information: Include VAT or other applicable taxes to ensure compliance with UK tax laws, depending on your business structure.

- Contact Details: Ensure your contact details, including your business name and registration number, are included for both professionalism and legal purposes.

- Client Information: Always include the client’s name, address, and any other pertinent details to ensure that the document is correctly addressed.

Customizing Documents for Freelance Needs

For UK freelancers, it’s important that the billing document reflects both the nature of the services and the specific arrangements with clients. Customizing your billing records based on the type of work and the client relationship allows you to maintain a consistent, professional appearance. Furthermore, keeping the format simple and easy to understand enhances the client experience and helps avoid delays in payment.

By personalizing these documents with your branding, including your logo and business colours, you can further solidify your professional image while making your billing process more efficient and organized. Freelancers who create custom documents that reflect their individual business practices and needs are more likely to build trust with clients and ensure smooth financial transactions.

How to Include Discounts on Invoices

Incorporating discounts into billing records is an effective way to offer value to clients while ensuring transparency in financial transactions. Whether it’s a seasonal promotion, bulk discount, or a special offer for repeat business, properly reflecting discounts on documents is essential to maintaining clear communication and preventing any misunderstandings about the total amount due.

To ensure that discounts are clearly communicated, it’s important to outline the discount percentage or amount in a dedicated section of the document. This helps clients understand exactly how much they are saving and reinforces the professionalism of your business. By including this information upfront, you show transparency and establish trust with your clients.

Steps to Include Discounts

- Specify the Discount Type: Clearly state whether the discount is a percentage of the total, a fixed amount, or applied after tax.

- Show Original Price: Always include the original price of the product or service before any discounts are applied. This helps demonstrate the value of the discount.

- Deduct the Discount: Subtract the discount amount from the original total, and clearly show the new, discounted amount due.

- Terms of Discount: If the discount is conditional (such as for early payment), make sure to specify any requirements or deadlines for the offer.

Example of Discount Calculation

| Description | Amount (£) |

|---|---|

| Original Price | 200.00 |

| Discount (10%) | -20.00 |

| Total Due | 180.00 |

By following these steps and clearly showing discounts, you ensure that clients understand the full breakdown of charges. This transparent approach helps build long-term, trust-based relationships with customers, encouraging repeat business and positive referrals.

What to Avoid in Invoice Templates

Creating well-structured billing documents is crucial for maintaining clear communication with clients and ensuring smooth financial transactions. However, certain mistakes can undermine the clarity and professionalism of your records. By being mindful of common pitfalls, you can create more effective documents that reduce confusion and prevent disputes.

It’s essential to avoid ambiguities and inconsistencies when preparing these records. Ensure all details, including the breakdown of services or goods provided, are clearly stated. Small errors or omissions can lead to misunderstandings or delays in payment. Furthermore, it’s important to ensure that each part of the document is well-organized and easy to read.

Common Mistakes to Avoid

- Unclear Payment Terms: Always specify the payment terms, including the due date and any late fees for overdue payments. Failing to provide this information can lead to delayed payments.

- Missing Contact Information: Ensure that both your details and the client’s contact information are included, so there are no issues with communication or payment processing.

- Incorrect Calculations: Double-check all calculations to avoid errors in total amounts, discounts, or taxes. Even small mistakes can damage your credibility.

- Lack of Breakdown of Charges: Provide a detailed list of what the client is being charged for, including quantities, unit prices, and total amounts. This helps prevent confusion and establishes transparency.

- Not Customizing for Client: Generic documents that lack a personal touch can feel impersonal and less professional. Tailor the content to each client’s needs and agreements.

Example of Clear Structure

| Description | Amount (£) |

|---|---|

| Product/Service Description | 150.00 |

| Discount (5%) | -7.50 |

| Sales Tax (20%) | 28.50 |

| Total Due | 171.00 |

By avoiding these common mistakes, you can create clear, professional records that help prevent payment delays and ensure that all transactions are processed smoothly. Attention to detail in your documents helps to build trust and maintain positive relationships with your clients.

Saving Time with Pre-made Invoice Templates

Using ready-made formats for billing documents can significantly reduce the time spent on administrative tasks. Instead of creating a new document from scratch for each transaction, these pre-built structures allow you to quickly fill in the necessary information and finalize your records. This streamlined approach saves time, reduces errors, and helps maintain consistency in your business operations.

For small businesses or freelancers, time is valuable, and automating or simplifying the invoicing process can lead to faster payments and fewer mistakes. By choosing a pre-designed layout that suits your needs, you can focus more on your core tasks while ensuring your financial documentation is accurate and professional.

Advantages of Using Pre-made Formats

- Faster Processing: Pre-made documents allow you to quickly input details like client names, amounts, and services provided, speeding up the creation process.

- Consistency: Using the same structure for every bill helps ensure consistency in your financial records and reinforces your brand’s professional image.

- Reduce Errors: Ready-made layouts often include built-in formulas or guidelines, which minimize the chances of mistakes in calculations.

- Easy Customization: Pre-built formats can be easily modified to include your logo, terms, or any other details specific to your business or client needs.

- Compliance with Standards: Many pre-designed formats are created with legal and tax regulations in mind, ensuring that your records comply with local rules.

How Pre-made Formats Can Save Time

- Standardized Fields: Most pre-built formats include fields for key information, such as due dates, descriptions, and payment terms, so you don’t need to manually type out every section each time.

- Automation Potential: Many digital formats can be integrated with accounting software, enabling automatic population of client details, payment status, and more.

- Reduced Setup Time: Instead of designing the layout from scratch or searching for the right structure, you can choose a pre-designed format that already meets your needs.

Overall, using pre-made billing layouts saves both time and effort. It allows you to focus on what truly matters–delivering great service while ensuring your financial records are clear, accurate, and professional.

Where to Find Invoice Templates Online

There are numerous online resources that offer ready-made structures for billing documents, making it easy for businesses and freelancers to create professional financial records without starting from scratch. Whether you’re looking for free options or premium services, the internet offers a wide range of customizable formats that suit different industries and business needs.

Many websites provide various designs that you can quickly download and modify to fit your branding. These formats often include essential fields like payment terms, descriptions, and tax information, ensuring your documentation is complete and compliant with local regulations.

Top Websites Offering Free Resources

- Microsoft Office Templates: Microsoft offers a variety of free templates in Word and Excel formats that can be customized to suit your business.

- Canva: Known for its design tools, Canva offers free and premium templates with creative designs, allowing you to tailor invoices with ease.

- Google Docs and Sheets: Google provides free templates that you can use and modify directly within Google Docs and Sheets, which can be stored and shared online.

- Invoice Generator: This simple tool generates customized bills for free based on your inputs and allows you to download them instantly in multiple formats.

Paid Services for More Features

- FreshBooks: FreshBooks is a popular accounting platform that offers a variety of customizable billing formats along with built-in financial management tools.

- Zoho Invoice: Zoho’s invoicing software offers customizable and automated invoice formats, especially beneficial for businesses looking for integrated solutions.

- QuickBooks: QuickBooks offers professional billing layouts with added features like payment tracking, reporting, and tax calculations.

By using online resources, businesses can save time while ensuring their financial documents look professional and meet regulatory requirements. Whether you choose a free option or a premium service, there are plenty of tools available to help you get started with minimal effort.