Download Simple Invoice Template PDF for Easy and Professional Billing

Efficient financial management starts with clear and organized documents that help businesses keep track of transactions. Whether you’re a freelancer, small business owner, or part of a larger organization, having access to ready-made formats for issuing payments is essential. These tools ensure professionalism and consistency across all your billing activities, making them a must-have for anyone who handles payments.

In this guide, we will explore how using a well-structured billing document can save time and reduce errors in your financial workflow. Instead of manually creating each one from scratch, a pre-designed document can be customized to suit your needs while maintaining a high level of professionalism. With just a few adjustments, you can have a polished statement ready for clients or partners in minutes.

Additionally, we will discuss the advantages of using digital formats for these records, focusing on their convenience and ease of sharing. Whether you’re dealing with local clients or managing international transactions, adopting these documents will simplify your accounting process and enhance your business operations.

What is a Basic Billing Document

A basic billing document is a standardized form used by businesses or individuals to request payment for goods or services provided. It typically includes key details about the transaction, such as the amount due, payment methods, and terms. These documents serve as a formal record of a transaction and are essential for maintaining financial accuracy and professionalism in any business.

These forms are designed to be simple yet comprehensive, ensuring that both the sender and the recipient have a clear understanding of the terms of the deal. By using a pre-made structure, businesses can streamline the process of issuing payment requests, reducing the need for manual work while ensuring all necessary information is included.

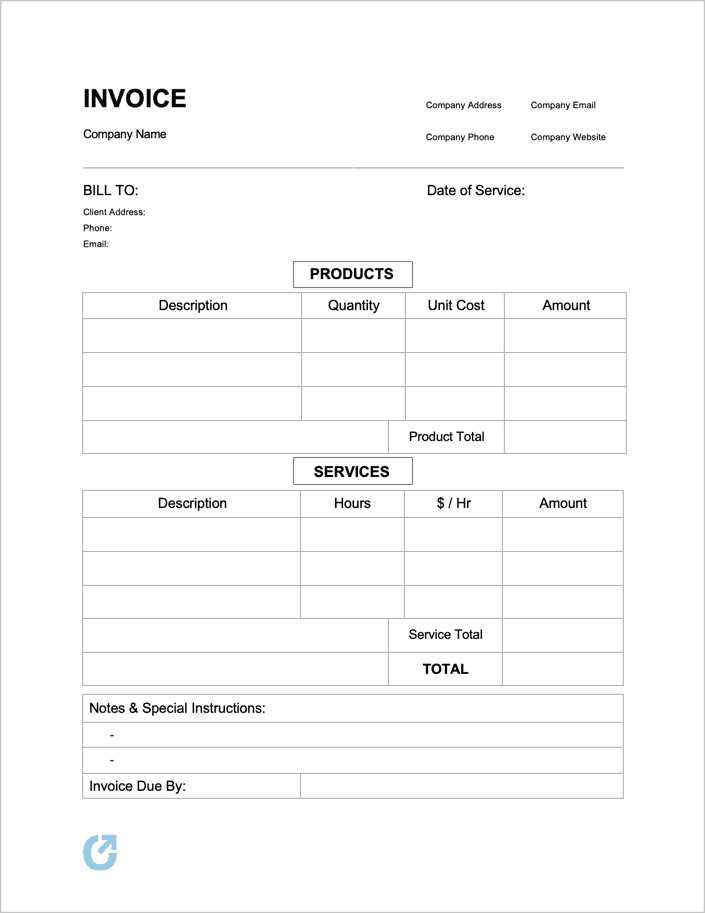

Key Components of a Billing Document

- Sender’s Information: Name, address, and contact details of the person or company issuing the request.

- Recipient’s Information: Details of the client or customer receiving the document.

- Description of Products or Services: A detailed breakdown of the items or services provided.

- Total Amount Due: The total sum that needs to be paid.

- Payment Instructions: Methods for completing the payment, such as bank transfer or online payment options.

- Due Date: The date by which the payment should be completed.

Why Use a Pre-Formatted Billing Document?

- Time Efficiency: A pre-designed form eliminates the need to create each document from scratch.

- Consistency: Using a standard format ensures that each request is clear and professional.

- Accuracy: Having a set structure reduces the risk of missing important details.

- Professionalism: A properly formatted document adds credibility to the payment process.

Benefits of Using a Billing Document Format

Using a pre-designed billing document format offers numerous advantages for businesses and freelancers alike. Instead of creating payment requests from scratch each time, these structured forms provide a quick and efficient way to ensure that all necessary details are included. Whether you’re sending a one-time request or handling ongoing transactions, relying on a standardized format can simplify your workflow and improve your overall efficiency.

One of the key benefits of using such a document is the reduction in errors. A clear structure helps ensure that all the essential information is correctly included, minimizing the risk of omissions or confusion. Additionally, these forms can save significant time, allowing you to focus on other important tasks rather than spending time formatting payment requests.

Key Advantages of Using Pre-Formatted Billing Documents

- Time Savings: Ready-made formats allow for quick customization and immediate use, eliminating the need to design each document from scratch.

- Consistency: Using the same format for every transaction creates uniformity, helping your business maintain a professional appearance.

- Reduced Risk of Mistakes: With a fixed layout, it’s easier to ensure that every essential piece of information is included, minimizing the chances of errors.

- Improved Organization: These forms help you keep accurate records of all transactions, making it easier to track payments and manage finances.

- Professional Appearance: A well-designed document gives clients the impression of a well-organized business, reinforcing trust and credibility.

- Easy Customization: Pre-designed forms can be easily adapted to fit specific needs, whether you’re dealing with different types of services or varying payment terms.

How Pre-Formatted Documents Enhance Efficiency

- Quick Edits: You can quickly update or modify any field without starting from scratch, making the billing process faster and more convenient.

- Multiple Formats: These forms can be saved and shared in a variety of formats, ensuring compatibility with different systems and clients.

- Better Record-Keeping: Digital versions of these documents can be easily stored, searched, and retrieved, making it simpler to keep track of past transactions and payments.

How to Customize Your Billing Document

Customizing a pre-made billing form allows you to personalize it to suit your specific needs and branding. By adjusting various elements of the document, you can ensure it aligns with your business identity and the nature of the services or products you offer. Making small modifications can greatly enhance the clarity and professionalism of the document, giving your clients a more polished experience.

To get started, you’ll need to focus on several key sections that can be easily personalized. These include the header, contact details, payment terms, and any additional notes or instructions. Customization doesn’t have to be complicated; with just a few changes, you can have a document that reflects your business’s unique requirements.

Steps to Personalize Your Billing Document

- Update Contact Information: Replace the placeholder information with your company’s name, address, phone number, and email address. This ensures that clients know how to reach you easily.

- Include Your Logo: Adding your company’s logo to the document’s header gives it a professional and branded look. Most formats allow you to upload or insert an image file for easy customization.

- Modify the Payment Terms: Adjust the payment due date, late fees, or any other terms based on the agreement with the client. Clearly state the payment method options (e.g., bank transfer, PayPal, etc.).

- Change the Currency: If you work with clients internationally, be sure to adjust the currency symbol and format to match the country’s standards.

- Personalize the Description Section: Customize the list of items or services to reflect what you’re actually billing for. You can add details such as quantities, rates, and descriptions that fit the specific transaction.

- Adjust Design Elements: Many formats allow you to change fonts, colors, and layout. Keep it simple and easy to read, but feel free to incorporate colors that match your brand’s style.

Additional Tips for Customization

- Use Consistent Branding: Ensure that your billing document matches your website, business cards, and other materials to maintain a consistent brand image.

- Include Custom Notes: You can add a section for notes or special instructions. This is especially useful if you need to provide specific details about the transaction or offer a thank-you message.

- Save as a Standard Document: Once you’ve customized your form, save it as a standard version so you can quickly use it again for future transactions without needing to start over.

Why Choose a Digital Document Format

When it comes to sending professional payment requests, selecting the right file format is crucial. A widely used format ensures that your document appears as intended, whether viewed on a computer, tablet, or smartphone. Opting for a universal digital format provides several benefits, including ease of sharing, security, and consistent formatting, regardless of the recipient’s device or software.

One of the main advantages of using this type of file is that it preserves the integrity of your document’s layout. Unlike editable file types, this format ensures that the design, fonts, and images remain intact, preventing any unintended alterations. This makes it especially valuable when sending important financial records or official communications.

Key Benefits of Using a Digital File Format

- Universal Compatibility: This file type can be opened on almost any device without requiring special software, making it easy for clients to access your document no matter their system.

- Consistent Appearance: The format preserves all visual elements, ensuring that your payment request looks the same to every recipient, no matter the platform or device they are using.

- Easy to Share: Digital documents are easy to attach to emails or upload to cloud services for quick and secure sharing with clients.

- Security Features: Many tools allow you to add passwords, restrict editing, or even encrypt the file, offering additional protection for sensitive financial information.

Why This Format is Ideal for Business Transactions

- Professional Image: Sending a well-structured, non-editable document helps maintain a professional appearance, ensuring that your financial communications are taken seriously.

- Easy Archiving: Digital files are easy to store and organize, allowing for better record-keeping and retrieval when needed for accounting or tax purposes.

- Environmentally Friendly: By using digital files, you eliminate the need for printing and physical mailing, which reduces paper waste and is more eco-conscious.

Free Invoice Templates for Small Businesses

Running a small business requires efficient management of financial transactions, and having the right documents to track sales and payments is crucial. Fortunately, there are numerous free resources available to help streamline the billing process. These resources offer professional designs and customizable features, making them ideal for entrepreneurs looking to maintain an organized record of their financial dealings.

- Easy to customize for specific business needs

- Professional designs that enhance credibility

- Ready-to-use formats for quick setup

- Helps with maintaining clear records for tax purposes

These tools allow small business owners to focus more on growing their operations, rather than spending valuable time creating documents from scratch. With just a few clicks, a customized form can be ready to send to clients, ensuring a seamless and professional experience. Whether you are selling products or offering services, these resources are an effective solution for all your billing needs.

How to Edit a PDF Invoice

Modifying a billing document after it has been finalized is a common task for many businesses. Whether you need to correct a mistake, update details, or add additional information, the process can be straightforward with the right tools. There are several methods to alter a document that is already in the popular format, depending on the software or online services you choose to use. Below is a guide to help you through the editing process.

Here are the steps involved in editing a standard billing file:

| Step | Description |

|---|---|

| 1. Open the File | Launch your editing software or use an online editor to open the document. Common programs for this task include Adobe Acrobat, Foxit, or even Google Docs for simpler edits. |

| 2. Select the Editing Tool | Most editors have an “Edit” or “Text” tool. Choose this option to enable the ability to alter text and other elements like dates or amounts. |

| 3. Modify the Content | Click on the text areas that need to be changed. You can add, delete, or adjust the content, such as customer names, payment amounts, or service descriptions. |

| 4. Save Changes | After editing, make sure to save the modified document. You can either overwrite the existing file or save a new copy to preserve the original version. |

| 5. Finalize the Document | Before sending the updated file, double-check all the details to ensure accuracy. Once satisfied, the file is ready to be shared with your client. |

By following these steps, you can quickly and easily update your document, keeping it accurate and professional for your business transactions.

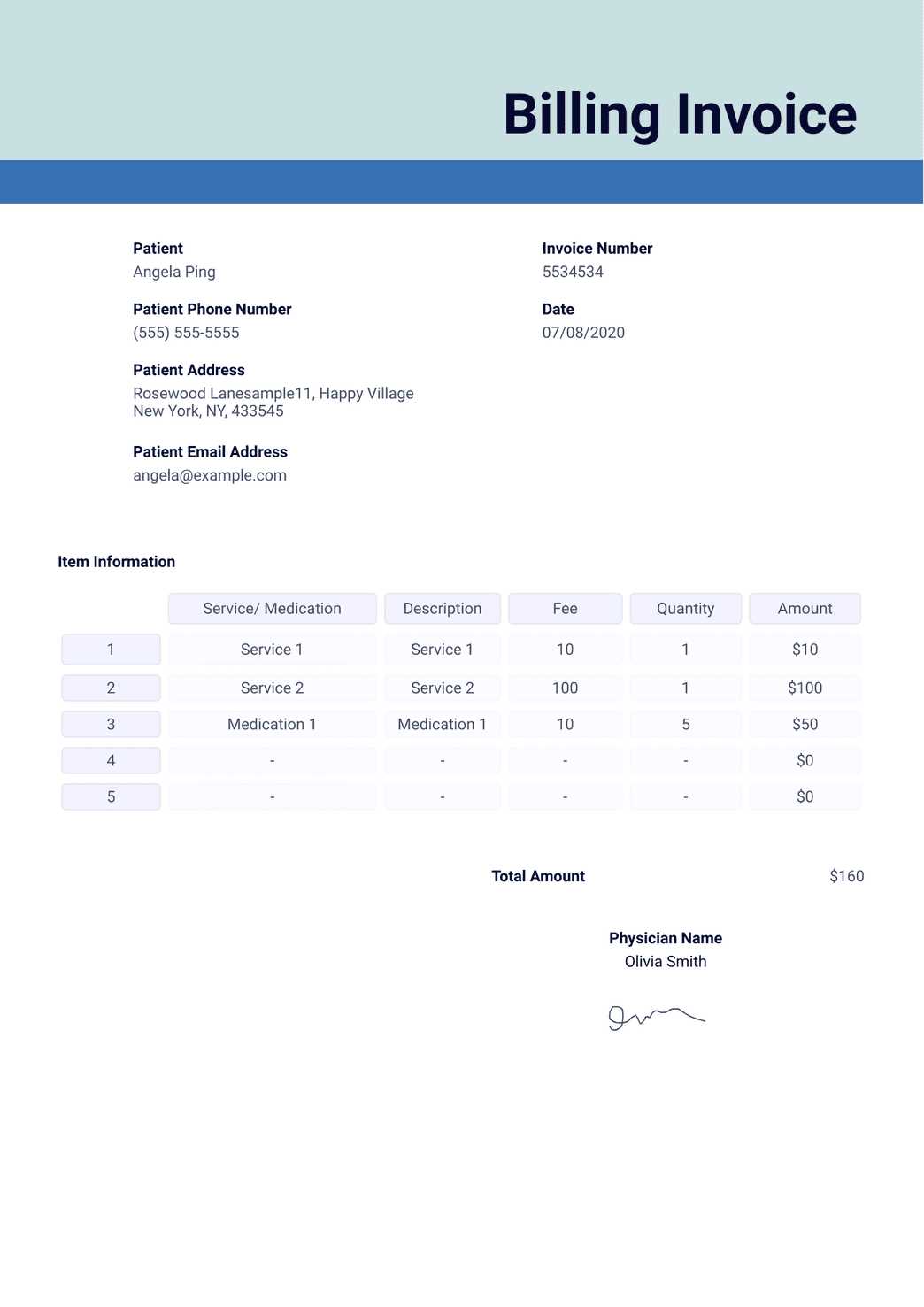

Key Elements of an Invoice

A well-structured billing document is essential for ensuring smooth financial transactions between businesses and their clients. It should contain specific details that clarify the terms of the transaction, provide a clear breakdown of costs, and facilitate easy payment processing. Understanding the key components that make up such a document is important for both accuracy and professionalism.

Essential Information for Clarity and Accuracy

When creating a billing statement, there are several key sections that must be included to ensure that the recipient has all the necessary information. These elements not only help avoid confusion but also ensure that both parties are on the same page regarding the transaction.

| Element | Description |

|---|---|

| Business Details | Include your business name, address, and contact information to ensure the client knows who is sending the document. |

| Client Information | List the recipient’s name, address, and contact details. This ensures the document reaches the correct party. |

| Document Number | Assign a unique number to each document for tracking purposes. This helps with organization and future reference. |

| Transaction Date | Include the date the service or product was delivered, or the date the document is being issued. |

| List of Products or Services | Provide a detailed list of what was sold, including descriptions, quantities, and unit prices for clarity. |

| Total Amount Due | Clearly state the total cost, including any taxes, fees, or discounts that apply. |

| Payment Terms | Specify the due date and any payment instructions, such as accepted payment methods and late fee policies. |

Why These Elements Matter

Each of these sections plays a vital role in maintaining transparency and fostering trust between businesses and clients. By including all necessary details, businesses can minimize disputes, expedite payments, and ensure proper record-keeping for financial reporting and taxes.

Creating a Professional Invoice Design

A well-designed billing document reflects the professionalism of your business and helps build trust with your clients. A clean and organized format not only enhances your credibility but also ensures that the recipient can quickly and easily understand the details of the transaction. A thoughtfully crafted layout can make a significant difference in how your documents are perceived and can streamline communication between you and your clients.

Here are some key design elements to consider when creating an effective and professional document:

- Branding: Incorporate your business logo, colors, and fonts to maintain consistency with your other materials. This helps reinforce your brand identity.

- Clear Structure: Organize the information in a logical and easy-to-follow manner. Use sections and headings to separate the different types of content, such as client details, payment terms, and transaction breakdowns.

- Typography: Choose readable fonts and sizes. Avoid using too many different fonts, which can clutter the document. Stick to one or two professional fonts to maintain a clean look.

- Whitespace: Don’t overcrowd the document with text or images. Adequate spacing between sections and lines of text improves readability and makes the content look more organized.

- Alignment: Ensure that text and elements are properly aligned. A left-aligned format is typically the most readable, but you can use centered headings or key figures to draw attention to important information.

- Color Scheme: Use a subtle and professional color palette. Too many bright colors can appear unprofessional, so stick to muted tones that complement your branding.

By paying attention to these elements, you can create a visually appealing and well-structured document that presents your business in the best possible light while facilitating a smooth payment process.

Common Invoice Mistakes to Avoid

Even small errors in your billing documents can lead to confusion, delays, and even lost revenue. It’s crucial to ensure that every detail is correct to maintain professionalism and ensure prompt payments. Below are some of the most common mistakes made when preparing such documents and how to avoid them to keep your business transactions smooth and efficient.

Incorrect or Missing Information

One of the most common errors is failing to include essential details or making mistakes in the information provided. This can cause delays and confusion, as clients may not know how to proceed with the payment or who to contact for further clarification. Be sure to check the following:

- Client Details: Ensure that the recipient’s name, address, and contact information are accurate.

- Business Information: Double-check that your business name, address, and phone number are correct, especially if the document will be used for future correspondence or tax purposes.

- Transaction Details: Verify that product or service descriptions, quantities, and unit prices are accurate and match the agreement made with your client.

Formatting and Organization Issues

Poor formatting can make your document difficult to read, which can result in misunderstandings. Proper alignment, spacing, and structure are key to ensuring that your content is easy to follow. Here are some points to keep in mind:

- Unclear Total: Always ensure that the total due is prominently displayed and easy to find. Avoid cluttering the document with unnecessary information.

- Inconsistent Layout: Use a consistent layout for all sections. Don’t mix fonts, colors, or alignments that could confuse the reader.

- Lack of Clear Payment Terms: Clearly outline the payment due date, method of payment, and any applicable late fees. This reduces the chance of payment delays.

By avoiding these common mistakes, you can ensure that your billing documents are both professional and effective in securing timely payments for your services or products.

How to Save Time with Invoice Templates

Creating financial documents from scratch for each transaction can be a time-consuming task. By using pre-designed forms that are easily customizable, you can streamline the process and focus on other important aspects of your business. These ready-made structures allow you to quickly input the necessary details without having to worry about layout, formatting, or repetitive tasks.

Here are some ways you can save time by using pre-built billing documents:

- Quick Customization: Pre-designed forms allow you to easily add or remove information, such as client details, product descriptions, and prices. This eliminates the need to create a new document from scratch every time.

- Consistency: Using the same layout for each transaction helps maintain a professional and uniform appearance. This consistency not only saves time but also ensures your documents are always clear and easy to understand.

- Automated Calculations: Many pre-designed forms come with built-in formulas that automatically calculate totals, taxes, and discounts. This reduces the chances of human error and speeds up the process.

- Easy Storage: By using the same structure for every document, you can quickly organize and store them, making it easier to track payments and manage records.

- Professional Appearance: Ready-made forms are often designed with a polished look in mind, which saves you the time spent on formatting and design. This ensures that your billing documents are both functional and visually appealing.

By incorporating these pre-designed tools into your workflow, you can significantly reduce the amount of time spent on financial paperwork and increase your overall efficiency, allowing you to focus more on growing your business.

Simple Invoice Template for Freelancers

Freelancers often juggle multiple projects for different clients, making it essential to have an efficient and professional way to request payment for their services. A straightforward document that clearly outlines the work done, the amount owed, and the payment terms can make this process easier and more organized. Using a pre-structured format allows freelancers to focus on their work rather than spending too much time on billing tasks.

Here is a basic structure that can be used to create a clean, functional document for freelancers:

| Section | Description |

|---|---|

| Freelancer’s Information | Include your full name, business name (if applicable), address, email, and phone number to ensure the client knows how to contact you. |

| Client Details | Provide the recipient’s name, company (if applicable), and contact information. This ensures clarity on who the payment is for. |

| Project Description | Briefly describe the work performed or services rendered. Include specific deliverables or milestones to ensure both parties are clear on the work completed. |

| Payment Breakdown | List individual costs for each service or item provided. If applicable, include hourly rates, project fees, or additional charges. |

| Total Amount Due | Clearly state the total amount owed, including any taxes, fees, or discounts that apply. |

| Payment Terms | Specify when the payment is due and any accepted methods (bank transfer, PayPal, etc.). It’s also helpful to include any late fees for overdue payments. |

This format helps freelancers maintain a consistent, organized way to request payment from clients. By using such a layout, you ensure that your documents are professional, easy to read, and complete, which can lead to faster payments and better client relationships.

How to Use Invoice Templates for Tax Filing

Accurate financial records are essential when it comes to filing taxes, especially for small business owners and freelancers. By using pre-designed documents that capture all relevant details of each transaction, you can ensure that your tax reporting is complete and precise. These ready-made formats not only save you time but also help you track income and expenses more effectively, which is crucial for minimizing errors and staying compliant with tax regulations.

Here are some ways to use pre-structured forms for tax filing:

- Tracking Income: Each time you complete a project or sale, use the form to record the amount received. This will serve as a reliable source of information when calculating total income for the year.

- Documenting Taxes Collected: If applicable, include any taxes collected from clients. Many forms come with a section for sales tax, which makes it easier to track and report these amounts at the end of the year.

- Expense Deduction Records: For businesses that incur expenses, use these documents to keep track of costs related to the services you provide. This will help when claiming deductions, such as materials, travel, or other business-related expenses.

- Organizing Financial Information: With consistent usage of the same format, your records become organized by client, date, and amount. This makes it easier to compile your financial data for tax preparation.

- Audit Preparation: If you ever face a tax audit, having detailed records of all transactions is invaluable. Well-maintained billing documents ensure that your income and tax filings are transparent and verifiable.

By using these pre-made tools to keep track of your financial activities throughout the year, you can simplify your tax filing process, reduce stress, and ensure that you’re fully prepared when it comes time to submit your taxes.

How to Track Payments with Invoices

Efficiently managing incoming payments is essential for any business. By using structured billing documents, you can clearly record each transaction and monitor payment status, which helps in managing cash flow and reducing the risk of missed or delayed payments. A well-organized system allows you to track who has paid, how much, and when, ensuring that your finances remain in order.

Here are some tips on how to track payments effectively:

- Assign Unique Document Numbers: Each billing document should have a unique reference number. This makes it easier to track specific transactions, especially when multiple clients or projects are involved.

- Include Payment Terms: Clearly state when the payment is due and outline any late fees. This provides both you and the client with a mutual understanding of payment expectations.

- Record Payment Dates: As soon as a payment is received, note the date of payment on the document. This helps you track the timeline of payments and ensures you know when funds were actually transferred.

- Monitor Partial Payments: If a client makes a partial payment, keep track of the remaining balance on the document. This ensures that both you and your client are aware of the outstanding amount.

- Use Payment Methods: Specify the method of payment used (e.g., bank transfer, check, online payment). Recording this information will help with future reconciliation and audits.

- Set Up a Payment Log: Maintain a separate payment log where you can list all received payments, including amounts, dates, and clients. This log provides a quick overview of your financial status and helps with bookkeeping.

By consistently using these strategies, you can keep a clear record of all payments and maintain better control over your financial transactions. Tracking payments not only helps in managing your day-to-day operations but also provides essential data for tax filing, forecasting, and overall business planning.

Invoice Template for International Clients

When working with clients across borders, having a well-organized document that outlines the terms of a transaction becomes essential. Whether you’re providing goods or services, clear communication regarding payment details, fees, and deadlines is crucial for maintaining professionalism and avoiding misunderstandings. This document helps streamline the process, ensuring that both parties are on the same page and that the payment process moves smoothly.

Key Elements for Global Transactions

When preparing this document for international clients, it’s important to include specific information that caters to cross-border dealings. The primary elements should consist of the recipient’s contact details, a breakdown of the products or services rendered, total amounts, as well as applicable taxes and shipping fees. Additionally, it’s necessary to indicate the currency in which the transaction will occur and any foreign exchange considerations, if applicable.

Currency, Payment Methods, and Legal Considerations

For international engagements, clearly specifying the currency used is vital to avoid confusion, especially when dealing with fluctuating exchange rates. It’s also important to provide multiple payment options that accommodate your client’s preferred method, whether it’s bank transfers, credit cards, or platforms like PayPal. Lastly, include any legal disclaimers or terms related to international contracts, such as VAT rates or import/export duties, to ensure compliance with local regulations.

Tip: Always double-check the recipient’s country-specific rules to prevent delays or complications in the payment process. By providing clear, detailed information, you can foster trust and maintain smooth relations with international clients.

Top Tools for Editing Invoice PDFs

When managing business documents, the ability to modify and update financial records is crucial. Whether it’s correcting details, adding new information, or adjusting formats, having the right tools can make a significant difference in efficiency and accuracy. Below are some of the most effective software and platforms that allow users to make quick and easy changes to their documents, ensuring everything is up to date before sending it to clients or partners.

Best Software for Editing Documents

There are various programs designed to help users edit, sign, and customize documents with ease. Here are some of the top options:

- Adobe Acrobat Pro DC – A powerful and widely-used tool for editing and modifying documents. It allows users to add text, images, and annotations, and also provides advanced features like optical character recognition (OCR) for scanned files.

- Foxit PhantomPDF – Known for its user-friendly interface, Foxit PhantomPDF offers comprehensive editing options, including the ability to change text, images, and layouts, as well as protect documents with encryption.

- Smallpdf – An online platform that provides a wide range of PDF-related tools, from editing and merging to converting files. Its ease of use makes it ideal for those who need a quick solution without downloading additional software.

- PDFescape – A free and web-based editor that allows users to modify text, images, and links, as well as add annotations and fillable fields. It’s a great option for basic document editing tasks.

Online Tools for Quick Modifications

If you prefer not to download software, online tools provide a great alternative for making fast edits to your documents. Here are some of the most popular choices:

- Sejda PDF Editor – This online tool lets you add text, images, and links, and also supports editing pages directly within your document. It’s available with both free and paid versions depending on the complexity of your needs.

- PDF Buddy – A simple, browser-based editor tha