Simple Invoice Template for Services Rendered

Creating clear and professional billing documents is crucial for freelancers and small business owners. These documents serve as a formal request for payment and reflect the value of the work done. A well-structured billing statement ensures both clarity and timely payments, contributing to a smooth financial workflow.

Whether you are just starting or have years of experience, having a standard way to present charges can save time and reduce errors. A well-designed document can include necessary details like the work description, pricing, and due dates, making it easy for clients to understand and settle their bills promptly.

In this article, we will explore how you can efficiently craft such documents, ensuring they meet all the necessary legal and professional standards. We will guide you through the essential components to include, and how to customize your forms to fit your specific needs, all while maintaining a professional appearance.

Why Use a Simple Invoice Template

Having a standardized document to request payment is essential for any professional. By using a structured approach to billing, you ensure that all necessary information is presented clearly, helping to avoid confusion and delays in payments. A well-organized statement not only makes the payment process smoother but also enhances your professional image.

Efficiency and Time-Saving

One of the key reasons for adopting a consistent billing format is the efficiency it brings. With a pre-designed layout, you no longer need to start from scratch with every transaction. Instead, you can quickly fill in the details, allowing you to focus more on your work rather than administrative tasks. This can save you hours each month, which adds up significantly over time.

Improved Accuracy and Clarity

When you rely on a consistent structure, you minimize the chances of leaving out crucial details or making errors. A well-organized document ensures that every essential aspect–such as the work description, amount due, and payment terms–is included, reducing misunderstandings with clients. This level of clarity fosters trust and ensures that you are compensated fairly for your efforts.

Benefits of Streamlined Invoicing for Services

Efficient billing processes can transform the way businesses manage payments. By adopting a well-organized approach, you can reduce administrative tasks, enhance accuracy, and speed up the payment cycle. This leads to better cash flow and fewer misunderstandings between you and your clients.

Faster Payment Processing

When your billing system is clear and consistent, clients can quickly review and process payments. With all the necessary details in one place, such as charges, payment terms, and deadlines, it minimizes delays and accelerates the settlement process. The more straightforward the format, the faster clients can act, resulting in improved financial management for your business.

Reduced Errors and Miscommunications

A streamlined system ensures that all information is properly organized, reducing the likelihood of mistakes. When clients receive clear, easy-to-read documents, there is less chance of misinterpretation or confusion regarding what is being billed. This improves trust and minimizes disputes, making the entire financial relationship more transparent and reliable.

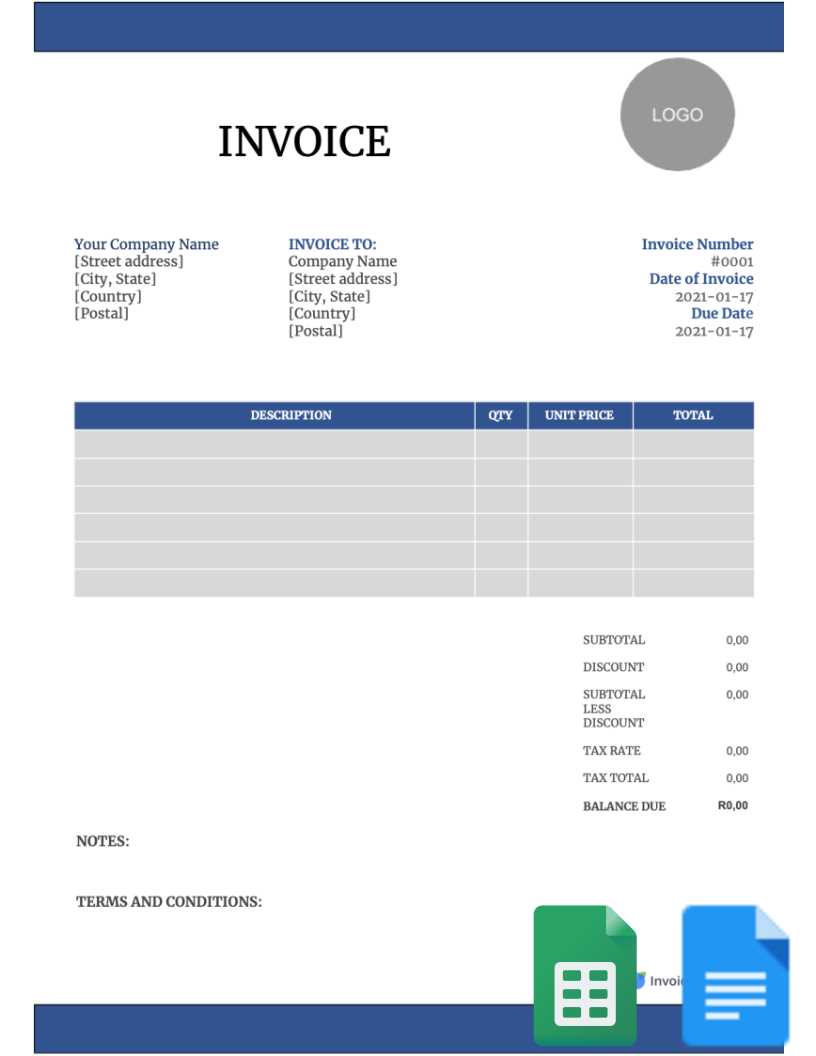

How to Create a Basic Invoice

Creating a professional billing document doesn’t have to be complicated. By following a few key steps, you can easily prepare a clear, accurate request for payment. A well-organized statement will ensure your clients understand exactly what they are being charged for and how to make a payment.

Essential Components of a Billing Document

To craft a basic payment request, be sure to include the following information:

- Your business details: Include your name, address, and contact information.

- Client information: Provide the client’s name, address, and contact details.

- Unique reference number: Assign a number to each request for easy tracking and reference.

- Clear description of work: Specify what was done, along with any relevant dates.

- Pricing breakdown: Include itemized charges and total cost.

- Payment terms: Clearly state when payment is due and any penalties for late payments.

Steps to Create the Document

- Start by gathering all relevant details, such as your business information and the client’s contact info.

- Write a brief description of the work completed or products provided.

- List the charges in a clear, organized format, ensuring each item is accounted for.

- Include payment instructions and the deadline for when the amount should be settled.

- Double-check all the information to ensure accuracy before sending it to the client.

Essential Elements in a Service Invoice

To create a comprehensive payment request, certain details must be included to ensure clarity and avoid confusion. Each component plays a key role in providing a professional document that is easy to understand and meets both legal and business requirements.

The most important aspects of any billing document are the business and client information, a breakdown of the charges, and clear payment terms. These elements ensure that both parties are on the same page regarding the work completed and the amounts owed, making the entire process smoother.

In addition to these basics, it’s essential to include unique identifiers, such as a reference number, to keep track of the transaction. The document should also specify the payment methods available, allowing the client to choose the most convenient option. Clear, precise wording is crucial to avoid any misunderstandings or disputes after submission.

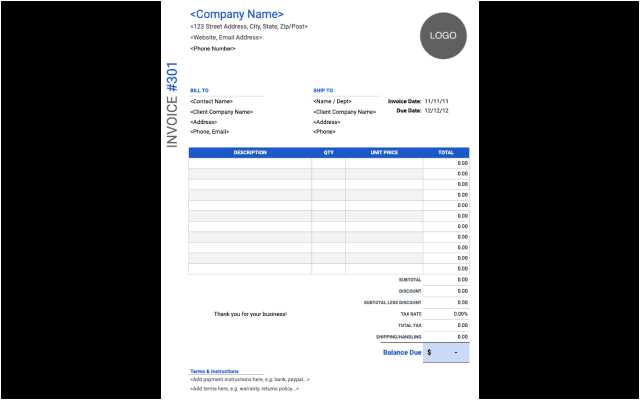

Choosing the Right Invoice Format

Selecting the appropriate format for your billing document is crucial to ensure it is both professional and functional. The right structure not only helps you present your charges clearly but also makes it easier for clients to understand and process payments promptly. A well-chosen layout can also save you time and avoid errors in future transactions.

There are several formats available, depending on your needs. Some may be more detailed and designed for larger projects, while others are simpler and more suited to smaller, one-time transactions. Choosing the right approach will depend on the nature of the work and the expectations of your clients.

| Format Type | Best For | Advantages |

|---|---|---|

| Basic Layout | One-time projects or small businesses | Quick to fill out, easy to read |

| Itemized Format | Long-term contracts or detailed work | Clear breakdown of each charge, helps avoid disputes |

| Online Format | Freelancers or digital businesses | Can be sent electronically, saves time and resources |

Ultimately, the goal is to find a style that works best for you and your clients, ensuring all necessary information is included in an easy-to-understand manner.

Customizing Your Invoice for Clients

Adapting your billing documents to meet the specific needs of each client can enhance both the professionalism and effectiveness of your financial communication. By tailoring your documents, you create a more personalized experience, which can improve your business relationships and ensure that all necessary details are included in a way that suits each individual client.

Customization goes beyond just adding the client’s name. It can include adjusting the payment terms, highlighting specific work or products, and even altering the layout to match the preferences or industry standards of your client. Doing so can ensure that your request for payment aligns with their expectations, which may help you receive payments more promptly.

Key Areas to Personalize:

- Client contact details: Ensure the correct name, address, and other contact information are used.

- Billing terms: Adjust payment deadlines, early payment discounts, or late fees as per the agreement.

- Work details: Clearly outline the scope of the project or work completed to avoid any confusion.

- Design layout: Some clients may prefer a more formal or informal layout, so consider this when setting up your document.

Taking the time to personalize your billing requests demonstrates a high level of professionalism and attention to detail that clients will appreciate.

Free Invoice Templates for Service Providers

Many professionals and small business owners often seek ways to streamline their billing process without the need to invest in expensive software or tools. Fortunately, there are a variety of free resources available that allow you to create effective and professional payment requests with minimal effort. These resources are designed to be user-friendly and customizable, making them ideal for freelancers and independent contractors.

Using free billing forms can help save both time and money, ensuring that you present a polished, organized request while keeping costs low. Whether you prefer a basic layout or something more detailed, there are options available that can suit your needs.

Benefits of Free Resources:

- No upfront costs: Many online platforms offer free downloads with no hidden fees.

- Ease of use: Templates are typically easy to customize, even for those with minimal design experience.

- Variety of formats: Choose from different styles, from basic layouts to more complex structures depending on your requirements.

By using these free options, you can simplify your billing process, increase your efficiency, and maintain a professional appearance without additional expenses.

How Templates Save Time and Effort

Using pre-designed forms can significantly reduce the amount of time spent on administrative tasks. Instead of starting from scratch every time a payment request is needed, these ready-made structures allow you to quickly fill in necessary details and send them to clients. This streamlined process minimizes the chances of errors and makes your workflow more efficient.

Quick and Easy Setup

By relying on a pre-structured document, you eliminate the need to design each new request manually. This can be especially helpful for busy professionals who need to handle multiple clients or projects simultaneously. The consistency in format helps you stay organized, and you only need to update specific information for each transaction.

Consistency and Professionalism

Using a standard layout ensures that all documents sent to clients look professional and are easy to read. A uniform approach helps build trust and ensures that all important details, such as payment terms and amounts, are clearly outlined every time. This consistency saves time, as you don’t have to worry about formatting or missing important sections.

In the long run, this method reduces the effort required to handle payment requests, allowing you to focus on growing your business.

Why Invoices Are Crucial for Business

Having a formal system for requesting payment is essential for any business to maintain financial stability and ensure that compensation is received on time. Without a clear, organized document outlining the amount due, payment terms, and work completed, businesses can experience delays in cash flow and even legal complications.

In addition to securing timely payments, these documents also play a critical role in accounting and tax reporting. By keeping track of each transaction, business owners can ensure that all revenue is accurately recorded, making it easier to file taxes and manage finances efficiently.

- Clear communication: Helps ensure clients understand the charges and terms, preventing misunderstandings.

- Professional appearance: Demonstrates legitimacy and fosters trust between the business and the client.

- Legal protection: Acts as an official record of the transaction, useful for resolving disputes.

- Financial tracking: Simplifies accounting by providing detailed documentation of all transactions.

Ultimately, without a proper system to document transactions, businesses risk losing revenue and damaging client relationships.

Legal Importance of Service Invoices

Proper documentation of financial transactions is not only a best practice but also a legal requirement in many jurisdictions. A well-drafted payment request serves as an official record that can protect both businesses and clients in case of disputes or legal challenges. This document can act as evidence of the terms agreed upon and the work completed, which is vital for ensuring accountability.

In the event of a legal issue, these documents can be presented as proof of the transaction, including the amount due, the agreed-upon payment terms, and the date the work was performed. Without such a record, it can be difficult to resolve payment disagreements or demonstrate compliance with contractual obligations.

Key Legal Benefits:

- Proof of transaction: Acts as tangible evidence that a business transaction took place.

- Clear terms: Ensures both parties are on the same page regarding payment terms, reducing the risk of disputes.

- Compliance with tax laws: Facilitates accurate reporting and supports tax filings by documenting income.

Without proper records, businesses may face difficulties in enforcing contracts or even defending themselves in legal proceedings.

Improving Cash Flow with Invoices

Maintaining a steady flow of income is critical to the success of any business. Timely and accurate payment requests play a significant role in ensuring that cash inflows are consistent and predictable. By effectively managing these requests, businesses can reduce the risk of late payments and improve overall financial stability.

Ensuring Timely Payments

Sending out payment requests promptly after work completion helps avoid unnecessary delays. The sooner you issue a request, the sooner you can expect to receive payment, which in turn allows you to cover business expenses and reinvest in growth opportunities.

Clear Terms and Reminders

Clear payment terms within the request document can encourage clients to pay on time. Including due dates, late fees, and early payment discounts can incentivize faster payments. Additionally, sending gentle reminders before the due date can reduce the chances of missed or delayed payments.

Efficient financial management through well-structured payment requests can significantly boost a business’s cash flow, helping to avoid disruptions and maintain smooth operations.

How to Avoid Invoice Mistakes

Ensuring accuracy in payment requests is essential for maintaining a smooth and professional relationship with clients. Mistakes in these documents can lead to delays, confusion, and even disputes. By being thorough and organized, you can avoid common errors that may cause problems down the line.

One of the most important steps is double-checking all figures, including amounts, tax rates, and totals. It’s also critical to ensure that the correct client details and payment terms are included. Even small mistakes, such as incorrect dates or missing information, can cause unnecessary complications.

Tips to Avoid Mistakes:

- Double-check the details: Verify client information, dates, and amounts before sending.

- Use consistent formats: Stick to a clear and standard structure for all your billing documents.

- Proofread your document: Read through your request carefully to spot any errors before submitting it.

By taking the time to ensure accuracy, you help maintain professionalism and minimize the risk of payment delays or misunderstandings.

How to Track Payments with Invoices

Efficiently tracking payments is key to maintaining healthy cash flow and staying organized in business operations. A well-structured payment request can serve as a tool to not only document transactions but also to keep track of which payments have been made and which are still pending. By monitoring these records, you can ensure timely follow-ups and reduce the chances of missed or forgotten payments.

Organizing Payment Records

It’s important to create a system where you can easily match payments with corresponding requests. This can be done by assigning unique reference numbers to each document, making it easier to track the status of each payment. This also helps in case there are disputes, as you’ll be able to provide clear records of when the payment was due and what was agreed upon.

Tracking Payment Status

- Mark paid requests: Clearly indicate when a payment has been received by marking the document or updating a payment tracking system.

- Monitor overdue amounts: Set reminders for any overdue payments and follow up promptly to maintain cash flow.

- Use accounting software: Integrating payment tracking into your software can automate the process, ensuring you never miss a payment.

By staying proactive and organized, you can ensure that payments are tracked accurately and follow-ups are handled in a timely manner. This helps to maintain financial stability and client satisfaction.

Common Invoice Terms Explained

Understanding the terminology used in payment requests is essential for both businesses and clients. These terms help clarify the expectations, conditions, and obligations involved in financial transactions. Familiarity with the common phrases used can prevent misunderstandings and ensure smooth business operations.

Below are some of the most frequently used terms and their meanings:

- Due Date: The date by which the payment must be made. Missing this date may result in penalties or interest charges.

- Payment Terms: The conditions under which payment is expected, such as the due date, discounts for early payment, or penalties for late payment.

- Subtotal: The total amount for the items or work completed before any taxes or additional charges are applied.

- Tax Rate: The percentage of tax applied to the subtotal, based on local regulations and business practices.

- Total Amount Due: The final amount to be paid after taxes, discounts, and any other adjustments.

Knowing these terms will help you navigate payment requests with confidence, ensuring clear communication and reducing the risk of errors or confusion.

Setting Payment Terms on Your Invoice

Establishing clear payment expectations is crucial for maintaining healthy financial practices in your business. Setting payment terms helps both parties understand when the payment is due, how it should be made, and any consequences for late payments. These terms are essential for reducing confusion and ensuring prompt payments.

Key Considerations for Payment Terms

- Due Date: Define when payment should be made. Common options include “Net 30,” which means payment is due 30 days after the transaction date, or specific dates like the 15th of each month.

- Late Fees: Clearly state any penalties for overdue payments. For example, you can charge a fixed fee or a percentage of the total amount due for each day the payment is late.

- Early Payment Discounts: Offer a discount for early payment to encourage clients to pay sooner. A common discount is 2% off if the payment is made within 10 days.

- Accepted Payment Methods: Specify the methods you accept, such as bank transfer, credit card, or online payment platforms like PayPal.

Having clearly defined payment terms helps ensure that both parties are on the same page, promoting trust and reducing payment delays.

Designing a Professional Invoice Template

Creating a well-structured and visually appealing document for billing is essential to project professionalism and enhance credibility. A clean, organized layout not only ensures clarity but also reflects positively on your business. It helps clients easily understand the details of the transaction while also conveying your attention to detail and business standards.

Key Design Elements

- Clear Branding: Include your business logo, name, and contact details at the top of the document. This makes your billing more recognizable and professional.

- Readable Fonts: Choose legible fonts that are easy on the eyes. Avoid overly stylized fonts that may make the document harder to read.

- Section Organization: Separate different parts of the document with headings or lines. This helps to organize information such as the description of goods or tasks, payment terms, and total amounts.

Consistency and Functionality

- Consistent Layout: Use a consistent layout across all your documents. This helps clients easily recognize your branding and also reduces confusion.

- Space Utilization: Balance the amount of information displayed with sufficient white space. Crowding the document with too much text can make it overwhelming for the reader.

By incorporating these design principles, you create a document that not only looks professional but also serves its functional purpose of clearly communicating billing information.